THE

NOTEBOOK VICTORIA SCHOLAR’S TAKE ON TODAY’S BIGGEST BUSINESS STORIES P13

NOTEBOOK VICTORIA SCHOLAR’S TAKE ON TODAY’S BIGGEST BUSINESS STORIES P13

CHARLIE

VENTURE capital investors are bracing for a “real toughy” of a year ahead as further rate hikes from the Bank of England choke off the flow of cash into the sector, analysts have warned. UK venture investment plunged 25 per cent to $31bn (£24bn) last year as soaring inflation and rising interest rates roiled markets and ramped up the cost of cash.

Investors and analysts had been hoping for a rebound in the second half of this year but the resurgence looks set to be scuppered by a period of longer interest rate pain in the UK.

Henry Whorwood, head of research at investment analysis firm Beauhurst, said the latest hike by the Bank of England would force VC fund’s big investors –their LPs –to shift their cash elsewhere.

ON

“This will take a while to trickle through to GPs [venture fund managers] as a whole, although they’ll all be well aware of it looming, and GPs raising [money] will be feeling it at the moment,” he told City A.M.

Whorwood added that the sector would rely on private equity funds pouring in but it “could be a real toughy” of a year if they choose to sit on their cash.

London suffered a shallower drop-off than many European capitals last year amid a wider global slowdown in start-up funding. The capital retained its top spot in Europe with $22bn in funding, more than double the $11bn bagged by second place Paris, according to Dealroom.

However, analysts at Pitchbook City A.M. that VC deal activity in the UK and Ireland in the first half of the

year was tracking at 52 per cent below 2022 levels and would “remain muted” until at least December.

The higher cost of cash has already forced some high profile firms globally to suffer major ‘down rounds’ over the past year, with Klarna among the big name firms to suffer a major valuation cut.

Michael Moore [pictured], CEO of the British Venture Capital Association, told City A.M. that interest rates this year will “have an impact across the economy” but the sector would weather the storm.

“Private capital funds are patient investors and often have the flexibility to ride out short to medium-term uncertainty, but we need to ensure the conditions for investment are right,” he said.

“As times get tougher, reforms to pensions, certainty on tax incentives for research and venture investment become even more important.”

HSBC IS abandoning Canary Wharf to return to the Square Mile, ditching its skyscraper in E14 in favour of a smaller office back in the City.

The bank left its Poultry HQ for the Canary Wharf location some twenty years ago, and will not be moving out until 2026.

HSBC has been on the lookout for a smaller space since the emergence of

with CEO Noel Quinn a notable public proponent of more flexible working.

The move will be seen as a blow to the Docklands hub, though the Canary Wharf Group is already engaged in a reinvention of the area away from a purely financial hub to a mixed-use development.

The HSBC tower itself is owned by Qatar’s sovereign wealth fund, who bought it for £1.1bn in 2014.

THE UK’s entertainment and media market is expected to hit revenues of £100bn by 2027, according to PwC’s latest forecast.

The accounting firm's Global Entertainment & Media (E&M) Outlook 2023-2027 also expects the

UK to cling onto its top position in Europe as the leading E&M market over the next four years.

The E&M Outlook predicted the main influences driving the revenue will be internet advertising, virtual and augmented reality, and home and mobile internet spending.

Digital advertising, particularly

internet advertising, is expected to capture the majority of advertising revenue, while TV advertising faces more challenging circumstances.

Traditional parts of the entertainment and media industry are also set for a rebound. Cinema and out-of-home advertising are expected to

return to pre-Covid revenue levels, indicating postpandemic recovery and

Partner at PwC Strategy& Dan Bunyan said “the internet advertising sector remains highly dynamic”.

Expenditure is shifting towards emerging channels like retail media and gaming, as brands reevaluate for the “most fruitful” ways of engaging online audiences, Bunyan said.

IT’s no surprise that many see HSBC’s decision to leave Canary Wharf as some kind of harbinger of doom for E14’s occasionally maligned forest of skyscrapers. But HSBC –with CEO Noel Quinn a strong advocate of ‘modern’ workforces and the firm increasingly focused on Asia –may tell us a bit more about the bank than the Docklands. The truth is, despite the obvious difficulties of a new working world and a pandemic, Canary

OBITUARY

Wharf is an increasingly attractive place to work, and live. Wandering around the once lessthan-vibrant district is something of a revelation. The decision to lean into retail and hospitality is paying off, with office workers and visitors alike stopping for a

lunchtime drink, watching tennis on the big screen. Street food popups are thriving. Green space, at a premium in the Square Mile at least, is thriving; new pedestrian walkways and even wild swimming areas are opening up the waterfront; and there’s even the opportunity to beat your boss at mini golf.

The credit for all of this must go to Shobi Khan, CEO of the Canary Wharf Group, and the firm’s investors, Brookfield and the

Qataris. With a long-term vision for ‘Canary Wharf 3.0’, they have given Khan the space to pursue real progress in residential and life sciences, as well as deliver on the promise of more retail. It has one of the highest occupancy rates of any shopping hub in the country; it has no problem shifting residential units, or renting those they own directly. Like any urban development, Canary Wharf has taken a few years to develop a

HARRY MARKOWITZ (1927-2023) The US Nobel Prize-winning economist passed away on 22 June. He was regarded as one of the guiding lights of modern finance.

DOMINIC MCGRATH

BEN WALLACE has appeared to further play down his prospects of emerging as Nato chief in the future, after ruling himself out of the race to replace Jens Stoltenberg.

The defence secretary had already ruled himself out of the running to replace the outgoing Nato secretary general, telling The Economist last week “it’s not going to happen” and there are “a lot of unresolved issues in Nato”.

There had been speculation Wallace could emerge as a leading contender to take on the key defence job.

Earlier in the month, US President Joe Biden said he would support a Nato leader from the UK when he met with Rishi Sunak at the White House.

Biden had indicated that Wallace was a “very qualified individual”, but it “remains to be seen” who will get the job.

But speaking at the Rusi conference yesterday, the defence secretary seemed to suggest that a switch to Nato was not on the horizon in the short or even medium-term.

Giving a very brief answer, he said: “I am not going to be doing it this year, next year or the year after. It is for

Speaking about the events in Russia over the weekend, Wallace said the most important aspect of Yevgeny Prigozhin’s challenge to the Moscow leadership was that he “directly challenged the narrative for war”.

Wallace said it was important the “Russian people get to hear the truth and Prigozhin’s words did that”. He went on to warn: “We shouldn’t necessarily over-credit the destabilisation, that somehow this is a massive derailment of the Kremlin”.

The Wagner Group, he said, was now “spent, done, dissipated”.

personality –but it is, undoubtedly, getting there. But if commercial realities are in part driving this transformation, so is the changing world of work. For all the stress of what goes on inside the offices, the Wharf now feels like a place that takes ‘wellbeing’ seriously. In a world in which more and more employees want to work for companies that think about such things, Canary Wharf is onto something –with or without HSBC.

THE GUARDIAN

PLANS TO CLOSE MOST UK RAILWAY TICKET OFFICES TO KICK OFF ‘IN WEEKS’

A process to shut nearly all of Britain’s railway station ticket offices could begin as early as next week, the RMT union has warned. Almost 1,000 offices are believed to be targeted for closure.

THE FINANCIAL TIMES

GOLDMAN SACHS TO NAME FORMER TRADING BOSS TOM MONTAG FOR BOARD SEAT Goldman Sachs plans to nominate Tom Montag, a former partner at the Wall Street firm’s trading division and until recently a top executive at Bank of America, to its board of directors.

THE TELEGRAPH

JUST STOP OIL CALLED ‘OUT OF CONTROL’ AFTER PROTEST NEAR HOSPITAL Just Stop Oil has been described as “completely out of control” and “irresponsible” after staging a protest close to the entrance of London’s King’s College Hospital on Monday.

LUCY KENNINGHAM

BIG FOUR accountancy KPMG last night announced a fresh round of layoffs, with plans to cut five per cent of its US workforce.

In an internal message seen by City A.M., US chair and CEO Paul Knopp said KPMG “do not make the decision lightly”, and it was due to “economic headwinds, coupled with historically low attrition”.

The Big Four firm will be reducing its headcount by approximately five per cent between now and later this summer.

Employees in Audit, Tax and Digital Nexus who were laid off were notified yesterday. Affected staff in other departments will find out in the near future.

The firm previously slashed two per cent of US-based jobs in February.

Ernst & Young’s US division and Deloitte are both also reported to have slashed jobs this year.

A spokesman for KPMG said: “We remain confident in our growth prospects as we continue to compete and win in the marketplace.”

JACK

INVESTORS are sweating over Britain’s inflation problem running out of control and the Bank of England being unable to solve it any time soon, exclusive research for City A.M. has revealed.

More than a year of raging prices has eroded confidence in policymakers’ ability to ease the cost of living crisis.

Some 56 per cent of UK retail investors think scorching inflation is now entrenched in the economy, according to analysis by broker HYCM.

The survey indicates traders are not yet convinced that Bank governor Andrew Bailey and the rest of the Monetary Policy Committee’s (MPC) actions to bring down inflation will work.

Last week, they raised borrowing costs 50 basis points to five per cent, a move that blindsided City money managers who thought the MPC would opt for a smaller 25 basis point increase.

Despite the Bank’s efforts, inflation

has remained stubbornly high in the UK and is comfortably the highest in the rich world.

Yael Selfin, chief economist at KPMG UK, told City A.M. the Bank will need to keep lifting rates until “there are more concrete signs of moderation in domestic price setting behaviour”.

Financial markets now think Bailey and co are on course to hoist borrowing to costs to a peak of more than six per cent.

HYCM’s research found market participants are worried about the value of their assets tumbling in such a scenario, with 43 per cent of the 914 retail investors surveyed calling for the Bank to stop raising rates now.

The Bank of England declined to comment.

A Treasury spokesperson said: “We fully support the Bank of England as they take difficult decisions to return inflation to the two per cent target.

“The IMF say our response to inflation has been decisive.”

JESS JONES

THE UK’s battered economy could get a much-needed £31bn boost from the widespread adoption of generative AI, a new KPMG report has found. The report says generative AI has the potential to increase UK productivity by 1.2 per cent –the same as an extra economic output of £31bn a year –because AI could carry out 2.5 per cent

GUY TAYLOR

ASTON MARTIN has announced a deal with US electric vehicle (EV) manufacturer Lucid Group to build ‘ultra-luxury’ EVs, as it ditches elements of a previous 2020 agreement with Mercedez Benz.

The firm said it would issue £182m

THE RICHEST households in Britain are the only group to have undergone a living standards improvement over the last year, while poorer families are being whacked by energy and food bills, according to new research.

Top earners in the UK have seen a post-bill weekly income increase of 2.1 per cent over the year to May.

That compares to falls in all other income groups, with the poorest families suffering a 30 per cent drop in discretionary income, meaning they couldn’t cover basic bills.

Middle-income Brits also absorbed a 23.3 per cent hit to their weekly disposable incomes, down to £60.

of tasks, leaving workers more time to be productive elsewhere.

KPMG’s report also recognises the need for a “high degree of caution” from regulators and policymakers due to the potential for “highly uncertain” wider social and economic implications of AI. The report also discovered four in 10 jobs can expect some impact from generative AI.

The numbers, pulled together by Asda and the Centre for Business and Economics Research, illustrate the unequal experiences of Brits during the cost of living crisis.

“Continually weak spending power is the result of elevated and sticky inflation,” the survey said.

It also flagged food and housing inflation as key factors.

Wages are up 7.2 per cent, but the Bank of England last week said the highest rises were in the financial and professional services sectors.

worth of shares and cash payments, in exchange for electric batteries and powertrain components, with US startup Lucid becoming a 3.7 per cent shareholder.

Aston Martin is looking to launch its first EV by 2025. Chairman Lawrence Stroll

said the agreement was a “game changer for the future of EV-led growth”.

Major stakeholders Yew Tree Consortium, Mercedez-Benz (who represent 48.1 per cent of share capital) and Hangzhou-based Geely have all backed the deal with Lucid. The carmaker’s shares have soared this year, following a number of changes to its shareholder structure.

NICHOLAS EARL

SUPPLIERS have a duty to help businesses stay afloat through easing the conditions of their energy bills, a senior executive at EDF Energy has argued.

Philippe Commaret, managing director of customers at the Big Six supplier, told City A.M. it has offered small and medium businesses softer terms on new contracts because markets remain volatile, despite this year’s decline in gas prices.

“It was our duty, as one of the largest suppliers of electricity, to continue to provide energy to those customers when their contract was terminating,” he said.

The French state-backed firm has offered support including so-called ‘blend and extend’ options to 100,000 small and medium businesses.

This is where companies needing new contracts are offered lengthened terms but with lower monthly costs to help ease energy bills, with gas

prices still around double pre-crisis trading levels.

Unlike households, businesses are not supported with a price cap and have to sign long-term contracts for their energy usage.

EDF has offered contract extensions of up to three years, taking as much as half off of the upfront monthly energy costs.

The suppliers’ customers include businesses with very tight margins such as high street shops which are already dealing with pressures such as higher wholesale costs for products and pricier tenancy agreements.

Tom McTague, national chair of the Federation of Small BusiCity A.M. earlier this month that the ‘blend and extend’ option was “vital” to many businesses’ survival, with over 90,000 businesses at risk of closing, downsizing or restructuring without support.

Philippe Commaret, senior exec at EDF

CHARLIE CONCHIE

BOSSES at Scottish Mortgage Investment Trust are today set to face down shareholders after a “painful” year in which it has been rocked by a boardroom spat and a plunge in its share price.

The London-listed fund, which built a name for stellar returns with an innovation-focused investment strategy, has seen its value crater by over 58 per cent since a November 2021 peak.

Shareholders will now weigh in on the troubles today at the fund’s annual general meeting in Edinburgh.

“The fund managers will be bracing for some tough questions from its shareholders given it reported a share price loss of 33.5 per cent in its latest annual results” said Kyle Caldwell, analyst at Interactive Investor. Caldwell told City A.M. that investors will be looking for answers over why the firm has not seen its share price improve in 2023 despite its exposure to AI-adjacent firms, as

well as what is being done to tackle its wide discount on the value of its portfolio which is sitting at over 20 per cent.

A Scottish Mortgage Investment Trust spokesperson has mounted a defence today, however, telling City A.M. that the decline in value of many of the its holdings has been “driven by macroeconomic concerns, geopolitics and the ongoing shockwaves from Covid-19”. All votes at the meeting are expected to pass today.

Scottish Mortgage shareholders will be hoping for answers at the firm’s annual general meeting in Edinburgh todayWe need to talk about those people who feel confident about their retirement savings. But 1 in 3 of them are actually facing a savings gap of £100,000 or more.

LAURA MCGUIRE

PRIMARK owner Associated British Foods (ABF) has credited warm weather and a revamp of the website for a 13 per cent rise in sales.

The retail giant said like-forlike sales grew seven per cent in the third quarter due to “higher average selling prices” and inflation, as cash-strapped Brits tightened their belts.

The fashion brand, which has some 400 sites worldwide, reached sales of £1.99bn as it worked on improving its website for customers in mainland Europe and the US and continued to trial click-and-collect services.

Despite refusing to offer home-delivery services, Primark has continued to outperform competitors such as Asos, who posted a loss of

£87.4m in its latest financial results.

“Primark has continued to trade in line with our expectations, with summer ranges performing well as the season started in our markets. As well as seasonal clothing and accessories, sales in health and beauty products were strong. Sales in our flagship city centre stores have continued to be good,” ABF said.

AB Foods, which also owns curry brand Patak’s also reported a 13 per cent rise in grocery sales to £1.05bn, as an increase in commodity costs helped hike revenues.

The sugar-to-clothing retail group reported total sales of £4.7bn for the quarter up 16 per cent, revealing it expects the group’s adjusted operating profit for the full year to be “moderately ahead of last year”.

Savills said it had seen an uptick in property deals in the West End

LAURA MCGUIRE

LONDON’s West End property investment market saw a jump in transactions in the second quarter of this year, new data has revealed. Real estate advisor Savills said 24 deals were completed in the second quarter to date, compared to 14 deals in total across the first quarter.

It predicted that investment volumes for the second quarter will

GUY TAYLOR

PROPOSALS that would have entitled passengers to claim compensation for delayed flights have been scrapped from initial consumer protection reforms, the government has confirmed.

The proposals would have enabled passengers to claim compensation on domestic flights that arrived over an hour late. But the Department for Transport confirmed today it would need to “undertake further work” before the rules could be changed.

CHARLIE CONCHIE

THE INVESTMENT fund chaired by former chancellor George Osborne has built up its stake in retail tech firm Ocado, new company filings have revealed.

In a London Stock Exchange filing, Lingotto Investment Management, run by the billionaire Italian Agnelli family, revealed it has increased its stake in the FTSE 100 retail firm to five per cent. News of Lingotto’s stake comes after

shares in Ocado spiked 30 per cent last week following rumours of an £8-ashare takeover by Amazon.

Ocado and Amazon declined to comment on the rumours.

Prior to last week’s surge, Ocado’s share price had slumped as its retail business racked up losses.

Lingotto’s move on the firm comes after Osborne and veteran fund manager James Anderson were parachuted in to oversee the firm’s $3bn in assets earlier this year.

reach around £900m.

Paul Cockburn, head of the West End team at Savills, said it was “reassuring that against the backdrop of economic uncertainty and rising rates, we’ve seen a flurry of presummer activity”.

“Despite questions and negative comments around the future of the office, its clear many specialist investors disagree and some are now seeing this as a buying opportunity.”

Ex-transport secretary Grant Shapps had previously made plans to scrap EU rules allowing passengers to claim £220 payouts for delays greater than three hours, but nothing for any less. The government had intended on replacing this system with one that linked compensation payouts to the cost of travel, thereby allowing passengers to claim some return on flights delayed between one to three hours.

However, it has now said it will undertake further work on compensation following feedback. The announcement comes as part of host of new proposals published today, which aim to introduce stricter punishments for airlines’ poor service.

thephoenixgroup.com/living-longer

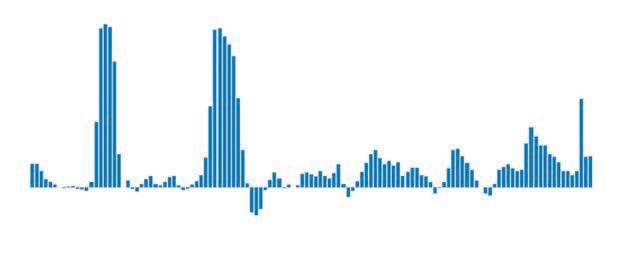

SUPERMARKETS slashing the prices of kitchen staples such as bread, milk and cheese has helped ease food inflation in a welcome boost for shoppers.

Food inflation fell to 14.6 per cent in June, down from 15.4 per cent in May, according to fresh figures from the British Retail Consortium (BRC). The decline marks the second consecutive monthly fall as the rate of food price increases starts to come down. As supply issues eased, fresh food inflation also slowed in June at 15.7 per cent, down from 17.2 per cent in May. This is below the three-month average rate of 16.8 per cent.

Separate figures from the ONS also show that the cost of basic food items have been on a slow but steady decline over the past three months – with price inflation on goods such as milk, cheese and eggs falling from 29.7 per cent in

March to 27.4 per cent in May.

“If the current situation continues, food inflation should drop to single digits later this year. However, it is imperative that government does not hamper this progress by introducing costly new policies,” BRC chief executive Helen Dickinson said.

‘Big Four’ grocery stores have had increasing pressure placed on them to keep prices as low as possible for consumers, with all major supermarkets introducing major price cuts on products. Sainsbury’s yesterday unveiled £15m of price cuts across essentials such as rice and pasta. It also pledged to continue slashing prices on essential products throughout the summer.

The move comes ahead of Chancellor Jeremy’s Hunt meeting with the Competition and Markets Authority on Wednesday to examine whether or not supermarkets have exploited inflation by raising prices.

CHRIS DORRELL

PROPOSED restrictions on postBrexit trade will pile costs onto consumers, representatives of the UK’s fresh produce industry has warned.

2020202120222023

Source: Shop Price Index, British Retail Consortium –NeilsenIQ

NEWS THAT food inflation is falling off the back of supermarkets cutting prices is welcome.

This data will likely be at the forefront of Chancellor Jeremy Hunt’s mind as he heads to meet with the Competition and Markets Authority, and the watchdogs for energy, water and communications on Wednesday to discuss the cost of living crisis. Hunt has also confirmed that ministers are talking to the food industry about “potential measures to ease the pressure on consumers”.

The government has previously discussed the idea of voluntary price

limits for basic food items –an opt-in scheme that requires shops to charge the lowest possible price for essentials such as bread and milk. But with prices gradually coming down, the government should avoid heavy-handed intervention.

The BRC has repeatedly hit back against the claim that supermarkets are profiteering, arguing that prices will eventually come down. It appears it is slowly being proven right.

LAURA MCGUIREThe Fresh Produce Consortium (FPC) warned that an extra £10m from import charges would have to be passed on to consumers, further fuelling food inflation.

In a letter to the government, seen by The Guardian, the FPC argued the government’s policy was an “outdated and highly inefficient border solution which fails to meet the needs of a modern progressive industry”.

Extra checks on fresh foods would “materially contribute towards consumer inflation, business oncosts, food waste and carbon emissions,” it said.

Among the proposals, the government wants to introduce a £43 charge for each consignment, payable from January next year. This would risk exacerbating an already challenging outlook for food prices, the group said.

GUY TAYLOR

LOGISTICS tech group Shift, which is making a swoop for delivery firm Tuffnells, has said it is eyeing up further acquisitions in the near future, with multiple deals on the horizon.

Shift’s founder Jacob Corlett told City A.M. the company had “multiple deals in the pipeline”.

“We’re in discussions with different parties of different shapes and sizes,” he said. “Watch this space.”

Shift, which was established in 2017, yesterday confirmed it had struck a deal with administrators at Interpath Advisory to purchase the Tuffnells brand after the company entered into administration earlier this month, leading to 2,000 staff being made redundant.

Shift is now in ongoing talks to try and secure many of Tuffnells’s 33 depots.

A number of other companies – the names of which have

ONE OF the UK’s future lithium producers is at risk of collapse, unless it secures a £10m financing deal by the end of next month.

Cornish Lithium has warned investors in its latest annual report that the company needs the cash injection to “ensure the business can meet its financial commitments”.

It was forecasting the start of production from 2026, but now the firm is scrambling for cash - exposing

its depleted reserves in its accounts signed off earlier this month.

Cornish Lithium, which posted a £6.6m loss in 2022, also revealed that, even if it secures the £10m, it needs medium to long-term support to avoid “mitigations” which will “reduce planned spending”.

The minerals specialist was expected to be at the centre of the UK’s electric vehicle ambitions, with the government needing to power domestic production of electric cars and batteries with a reliable

supply of lithium.

Cornish Lithium chairman Ian Cockerill blamed the lack of subsidy support for the company’s difficulties, accusing the government of failing to match the investment conditions offered in the US and EU.

“The lack of an industrial strategy has left the UK at a significant disadvantage in the race to build electric vehicles,” he said in the accounts.

The government has been approached for comment.

not yet been revealed – are also seeking a deal for the depots, and City A.M. understands that the talks are expected to conclude within days.

The deal would mark Shift’s biggest acquisition since buying European home move platform Movinga in April.

“We didn’t expect to be doing this only two months after Movinga,” Corlett said.

The founder said he would like to rehire as many Tuffnells employees that were made redundant as possible, adding that Shift has already “had 700 Tuffnells employees reach out to us about employment”.

But Cortlett cautioned that the firm “can’t guarantee that we’ll employ a single Tuffnells employee” until a deal surrounding the depots is confirmed.

“The picture is becoming clearer by the day. So you know, by this time tomorrow, and the day after, it’ll be further along, we’ll know which sites are opening, we’ll know what type of roles will become available,” Corlett said.

PETE SCHROEDER

BIG US lenders are expected to show they have ample capital to weather any fresh turmoil in the banking sector during this week’s Federal Reserve health checks, although resulting investor payouts are likely to dip slightly, analysts said. The central bank will tomorrow

release the results of its bank “stress tests”, which assess how much capital banks would need to withstand a severe economic downturn.

The 2023 tests come in the wake of this year’s banking crisis in which Silicon Valley Bank and two other lenders failed.

“Dividends should be secure, and banks should have excess capital to

return to shareholders under most circumstances, even if at a slower pace than in the past,” Wells Fargo said in a recent note.

The industry has performed well in recent years, although the Fed has faced criticism after the spring bank failures for not probing bank weaknesses for rising rates in prior tests.

BITCOIN has climbed to its highest level in over a year in recent days as top financial firms including Blackrock double down on their commitment to crypto.

The cryptocurrency, which last year plunged to 70 per cent below its November 2021 peak, climbed above $31,000 over the weekend for the first time since June last year.

More than $1 trillion was wiped from the value of the crypto market in

2022 after a string of high-profile implosions, such as the collapse of crypto exchange FTX, and rising interest rates battered the market. But the price of Bitcoin has now surged over 82 per cent since the beginning of the year.

Simon Peters, Etoro crypto analyst, said “Blackrock’s attempt to launch a Bitcoin exchange-traded fund” was a drivers of last week’s rally. Blackrock has been among the biggest names to have thrown its weight behind crypto.

The world’s biggest asset manager previously struck a deal with Coinbase to allow its clients to access crypto trading. While some firms have reined in their engagement with the space amidst a sell-off, Peters said that a recent move by Mastercard to expand its presence in the crypto market has bolstered confidence among investors. Yesterday, Bitcoin settled at $30,334. The price of cryptocurrency Ether has also risen since the start of the year, jumping 45 per cent.

JESS JONES

THE ANNUAL report investigating national security risks posed by the Chinese telecoms company Huawei has remained unpublished for nearly two years, raising concerns about government transparency.

According to The Telegraph, the decision to shelve the publication of the Huawei Cyber Security Evaluation Centre (HCSEC) report was made by the then-culture secretary, Nadine Dorries.

CINEWORLD yesterday said it is set to file for administration and suspend trading on the London Stock Exchange next month as part of a major bankruptcy restructuring plan.

In a statement yesterday, the cinema firm said its proposed restructuring would involve calling in administrators and could release approximately

$4.53bn (£3.56bn) of its funded indebtedness, a rights offering to raise $800m and the provision of $1.46bn in new debt financing.

Bosses said administrators would shift all its assets into the ownership of a wholly-owned subsidiary called Crown. A newly incorporated company controlled by the group’s lenders will become the sole owner of Crown, with Cineworld Group ceasing to have any interest in

Crown or the rest of the group.

“The proposed restructuring, when implemented, will transform the group’s balance sheet and provide it with significant additional liquidity to fund its long-term strategy,” Cineworld said.

The firm said that as a consequence of its administration, the trading of its shares on the London Stock Exchange’s main market for listed securities will be suspended next month.

Shareholders are set to be wiped out by the arrangements, with the firm confirming it would “not provide for any recovery for holders of Cineworld’s existing equity interests”.

Cinemas will remain open.

Cineworld said: “The group and its brands around the world –including Regal, Cinema City, Picturehouse and Planet –are continuing to welcome customers to cinemas as usual.”

Since 2021, the HCSEC report, which analyses potential risks to the UK’s national infrastructure from Huawei, has not been made public. The HCSEC board has been overseeing the report since 2010. It aims to analyse any risks to the UK’s national infrastructure by the foreign manufacturing giant, particularly from its software. While the watchdog’s work continues in Banbury where it is based, it remains unclear if ongoing reports are being produced.

This revelation has prompted concerns about transparency in Westminster. One source told The Telegraph former ministers had “let Huawei off the hook”.

Former Tory leader Sir Iain Duncan Smith has raised questions as to why the reports are not being released. Neither the Department for Science, Innovation and Technology nor Huawei immediately responded to City A.M.’s request for comment.

JESS JONES

VODAFONE and Three UK have dismissed concerns about their merger threatening national security after facing criticism from MPs and trade bodies over Three’s ties to China. Three UK is owned entirely by Hong Kong-based CK Hutchinson Holdings, which has provoked MPs and trade bodies to flag their concerns that the

telecoms company’s links to China may endanger national security.

Commenting on the news, Vodafone told City A.M. they “don’t believe there should be any security concerns”.

Three declined to comment but the firm’s UK boss Robert Finnegan previously told The Times he did not see “any concerns at all” as the telecoms company already has operations in the UK.

“It’s a regulated industry and we work very closely with the national security bureaus,” he added.

CK Hutchinson did not respond to City A.M.’s request for comment.

A cross-party group of MPs has raised concerns about the merger, backed by former Tory leader Sir Iain Duncan-Smith.

Britain’s competition watchdog is investigating the proposed merger.

THE UK’s electric dreams are at risk of running flat, with London-listed battery maker AMTE Power yet to update shareholders on its race to raise funds ahead of a key deadline next month.

The country’s only homegrown battery cell maker warned investors on 15 June they were at risk of being wiped out unless the company secures fresh financing, with cash reserves running on empty as it looks to bring products to market.

“Should the company be unable to secure additional funding, the prospects for recovery of value, if any, by shareholders would be uncertain,” it said.

Since then, there have been no announcements over funding. With AMTE Power confirming a four-week deadline to secure the funds, the deadline could come as soon as 12 July – placing a ticking clock under the company’s negotiations with investors.

The London-listed company’s shares have plummeted since the announcement, dropping from 51p per share to 6p per share in the course of just 11 days.

It now faces a nervous wait to see if the government or private investors will step in to offer more funds for what could be a vital cog in the UK’s early-stage electric vehicle industry.

The Scottish Highlands-based firm specialises in lithium-ion and sodium-ion cells used in high performance electric vehicle batteries and long-duration energy storage.

It previously unveiled plans for a gigafactory at the former Michelin tyre plant in Dundee, which hopes to create more than 200 jobs by the end of the decade.

To sustain operations, AMTE Power drew down a £580,000 loan facility from Highlands and Islands Enterprise in March and £1m from its convertible loan facility with Arena Investors in April.

Highlands and Islands Enterprise, a government development fund, told City

A.M. the company’s Thurso base was a “great asset” for the region and confirmed it was still in talks with AMTE Power over its financial plight.

The government declined to answer whether it would intervene to provide support to the company.

The PLANNING ACTS and the Orders and Regulations made thereunder

This notice gives details of applications registered by the Department of The Built Environment

Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

61 - 65 Holborn Viaduct, London, EC1A 2FD

22/01243/FULMAJ

Application under Section 73 of the Town and Country Planning Act 1990 (as amended) of planning permission 21/00781/FULMAJ (dated 02.09.2022) for the variation of condition 63 (approved drawings) to facilitate amendments to the approved scheme including but not limited to: alterations to the Snow Hill elevation and building line; changes to external facing materials; amendment to internal layouts to provide additional purpose built student accommodation; changes to the layout of the cultural and community space; and other ancillary works (RECONSULTATION DUE TO DESIGN AMENDMENTS AND SUBMISSION OF ADDITIONAL INFORMATION).

1 Ropemaker Street, London, EC2Y 9AW

23/00482/FULL

Temporary installation of sculptures for a temporary period between 29th May 2023 to 31st September 2023.

Alder Castle House, 10 Noble Street, London, EC2V 7JX

23/00535/FULL

Alterations to the main entrance; creation of new terraces; public realm improvements and other associated works.

The Mansion House, Court, Mansion House Street, London, EC4N 8BH

23/00555/LBC

IOG HAS cancelled its North Sea expansion projects in a bid to boost its balance sheet, enabling its share price to show slight signs of recovery yesterday.

Shares in the troubled oil and gas operator yesterday closed up 24 per cent yesterday, having started the week at just 4.6p per share.

Siemens shares have been in freefall since it scrapped its profit outlook last week

CHRISTOPH STEITZ

SIEMENS Energy shares fell for a second consecutive session yesterday, hit by a raft of target price cuts and rating downgrades in the wake of deeper-than-expected problems at its wind turbine division that emerged last week. Its share price fell to the bottom of Germany’s blue-chip index, taking the group’s loss in market valuation to €7.4bn (£6.4bn) since it scrapped its profit outlook late on Thursday.

“We are now waiting for the full results of the analysis before drawing any further conclusions,” a spokesperson for the company said in response to a query from Reuters. Citi cut the company to “neutral” from “buy” while Jefferies downgraded to “hold” from “buy”, following the group’s withdrawal of its 2023 profit guidance and the more than €1bn it says it will cost to fix the issues. Citi analysts said investor confidence had been “severely impacted”.

It comes after the oil company yesterday announced it had scrapped a contract for the Shelf Drilling Perseverance jack-up rig and suspended attempts to drill at the Kelham and Goddard prospects.

Despite the uptick in shareholder sentiment, IOG remains 70 per cent down in trading compared to its position at the start of the year on the FTSE AIM All-Share.

Rupert Newall, chief executive, revealed the firm has “been assessing next steps for the business very carefully”.

“Mindful of current gas market and balance sheet risks, we have decided to pause drilling activity for now in order to maximise near-term cash flow,” he said.

IOG has not ruled out drilling the wells by next March, which are part of its Saturn Energy Hub in the North Sea and are being explored in partnership with Cal Energy Resources.

Chef’s Shower Room, Staff Rest Room and The Lodge of Mansion House.

39 Threadneedle Street, London, EC2R 8AU

23/00587/LBC

Removal of external signage and branding.

20 Black Friars Lane, London, EC4V 6EB

23/00591/FULL

External and internal works comprising of: (i) the construction of a glazed link extension to the Bell Tower; (ii) elevational alterations to the Bell Tower; (iii) refurbishment of the existing of hard and soft landscaping; (iv) creation of a new pedestrian entrance off Black Friars Lane; (v) the provision of cycle paring and end of trip facilities; (vi) installation of replacement plant at roof level; (vii) and all associated works.

71 Fenchurch Street, London, EC3M 4BR

23/00606/LBC

Removal of 4 no. roof lights and associated solar

15 Mincing Lane, London, EC3R 7BD

23/00621/FULL

Creation of external seating area to side elevation (Plantation Lane) with two retractable awnings and planters.

Department of the Built Environment, North Wing, Guildhall, Basinghall Street, London EC2, between 09.30 and 16.30. Representations must be made within 21 days of the date of this newspaper online or in writing to PLNComments@ EC2P 2EJ. In the event that an appeal against a decision of the Council proceeds by way of the expedited procedure, any representations made about the application will be passed to the Secretary of State and there will be no opportunity to make further representations.

NICHOLAS EARL

COAL PRICES climbed to record levels last year driven by rising demand across Asia, according to a new report on global energy trends.

The Energy Institute’s latest annual survey showed consumption of the world’s most polluting energy source increased four per cent year-on-year in India and one per cent in China, enough to ramp up global production seven per cent over 2022.

Overall, generation soared to a

record high of 175 extrajoules, with 95 per cent of the demand growth coming from China, India and Indonesia. This caused prices to spike on the spot markets at $294 per tonne in Europe and $225 per tonne in Japan – rising 145 per cent and 45 per cent over 2021 respectively.

While coal consumption declined across Europe (3.1 per cent) and North America (6.8 per cent), this was insufficient to stave off a seven per cent hike in global production.

By contrast, renewables met just 7.5

per cent of the world’s energy demand last year – with the growth rate slowing to 14 per cent, compared to a 16 per cent boost in 2021.

The authors of the report – which is published in partnership with KPMG and consultancy Kearney –warned more needs to be done for the world to meet its climate goals.

Simon Virley, vice chair and head of energy at KPMG UK, said the report should act as a “clarion call for governments to inject more urgency into the energy transition”.

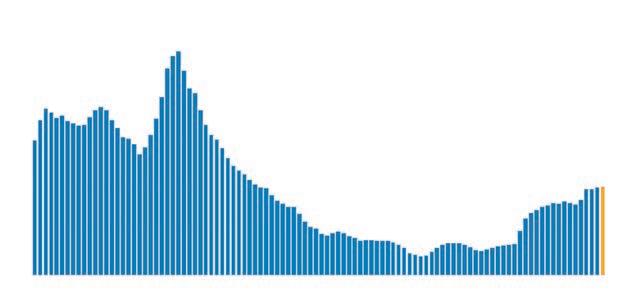

HERE’s a fun fact. If everyone in the UK worked for a year and gave all their earnings to the Treasury, the government could nearly repay the country’s more than £2.5 trillion debt pile.

Alright, that’s oversimplifying the equation. But it does illustrate a principle in economics that often gets lost in the deluge of headlines warning of the UK’s unsustainable debt stock.

Analysis from the Office for National Statistics released last week found the amount of money the UK has to repay investors is now (just about) greater than the amount of cash it generates from making goods and services each year.

In econ jargon, its debt-to-GDP ratio has topped 100 per cent –the first time that threshold has been breached since 1961.

The rate of change in that figure over the last 15 years has been staggering. Between the late 1980s and late 2000s, it barely moved away from 35 per cent or so.

In 2009, after the government stepped in to save the UK’s largest banks and was in the process of stepping up welfare payments amid the ensuing economic downturn, it leapt to more than 50 per cent.

Since then, it has doubled. You’d be hard pressed to find another leading economic indicator that has undergone such a huge rate of change in such a small amount of time.

It is also a reflection of the turbulence that has buffeted the UK economy over the same period.

Banking bailouts drained the Treasury’s coffers, as did the support packages to prevent a decline in activity following the retrenchment of lenders during the credit crunch.

Even now, Brexit has yet to deliver the promised benefits to household living standards and trade.

And the Covid-19 pandemic engineered the biggest fall in GDP since the Great Depression (maybe even longer). Emergency measures such as the furlough scheme turbocharged government spending at a time of nosediving tax revenues.

Last year’s energy crisis again forced lawmakers to intervene to avert a living standards catastrophe.

The sum total of these economic shocks and necessary government responses has been to force borrowing and, consequently, debt sharply higher.

But it’s not the stock that we should be worrying about. Instead, according to traditional economic thought, it’s whether the economy is growing at a slower rate than the debt pile (subscribers to modern monetary theory would contest that claim).

According to the ONS’s estimates (which are often revised), that is what’s happening right now.

All signs point to sustained pressure on the public finances in the coming years, initially emanating from the much higher interest rates the government is servicing on its debt.

A big chunk of the UK’s liabilities are tied to

Diverging from the mean here. A break from the usual wrap of an interesting piece of research published recently. I’ve just picked up Mikhail Bulgakov’s The Master and Margarita for the first time since my late teens for a second read. If you haven’t thumbed through it before, then take a break from the daily grind of bond yields, inflation and interest rates and put it straight to the top of your summer reading list. You won’t regret it. Back to form next week.

the retail price index, an old measure of inflation that has jumped over the last year or so. This, compounded by the Bank of England raising official borrowing costs quickly and steeply, is poised to send “central government debt interest costs to well over £100bn a year all the way through the next five years,” according to Sanjay Raja, a senior economist at Deutsche Bank.

“The looming additional burdens linked to

report over the weekend.

Crimped public finances present the greatest risk to the Conservatives losing the next general election, which must be held by January 2025 at the latest, though it’ll probably be in the autumn of 2024.

Chancellor Jeremy Hunt and Prime Minister Rishi Sunak are certain to try to reach for tax cuts to win over voters. Given their commitment to fiscal balance, spending cuts would likely countenance such a move.

Hunt was estimated by the Office for Budget Responsibility in March to have the slimmest headroom of any Chancellor against his fiscal rules since 2010.

Pressures on the public finances since those calculations have actually amplified, limiting his space to loosen policy further.

Labour faces a similar bind, and shadow chancellor Rachel Reeves recently watered down a commitment to spend £28bn a year on renewable energy as her plans rubbed up against fiscal reality.

Expect both parties to table a pretty unambitious economic agenda during the election campaign. Right now, that is the exact opposite of what Britain needs to reverse its economic fortunes.

CHRIS DORRELL

FEARS of insolvency are receding among UK firms despite recent data showing liquidations hit a four-year high in May.

According to new research from Evelyn Partners, 32 per cent of UK businesses believe there is a risk they will become insolvent in the next 12

months, down on the 47 per cent of firms that thought there was a risk of default back in September.

The rosier outlook comes even as insolvencies reached a four-year high just weeks ago. Official figures showed that there had been a 40 per cent surge in insolvencies year on year with over 2,500 firms declared insolvent in May. Almost all (99 per cent) of these

firms had revenue of less than £1m.

In contrast, the 500 business owners surveyed by Evelyn Partners had revenue of over £5m, pointing to a stronger outlook for medium-sized businesses.

Evelyn Partners partner Claire Burden said: “It is encouraging that business confidence remains stable, and survival prospects have improved.”

City A.M.’s economics editor Jack Barnett takes a deep dive into the state of the economy in his weekly columnConfidence among UK businesses appears to be improving, according to new research

Let’s all hand our cash over to the Treasury to repay the UK’s £2.5 trillion debt pileLAURA MCGUIRE

(MLC), creating trendy homes from derelict warehouses and former factories.

His ‘Big Apple’ influences can also be seen in his luxury real estate firm The Lakes by Yoo –bringing a Hamptons-style city escape to the Cotswolds. The idea is to give cash-rich Londoners a break from the hustle and bustle.

NEW YORK and London have a lot of similarities –a fastpaced lifestyle, diverse population and bustling financial centre.

To that we can perhaps add a shared aesthetic of urban living, with 'loft-style' Manhattan living now all the rage. And the man responsible for that might well be property entrepreneur and developer John Hitchcox.

In the 1990s, Hitchcox brought quintessential New York loft living to London, cofounding the Manhattan Loft Corporation

Homes in the 850-acre private woodland sell for upwards of £810,000 and celebrities such as Kate Moss and Jade Jaguar are also reported to have pads at the exclusive estate.

“The community is thriving,” Hitchcox tells City A.M. There's even a classic car club.

Business appears to be thriving, too.

“We've had 10 per cent annual property price growth at the lake since we started [in 2007]. It's been really strong financially and everyone who's bought has made money,” he shares.

“We sell about 20 houses a year, whether they're completed or their plot sales, so it's pretty steady and the value of the estate is

undermentioned streets will make several Orders on 6 July 2023 under Section 14(1) of the Road

Carlisle Avenue (Entire Length) & Northumberland Alley (Entire Length) ---- Utility Works

Carthusian Street (Entire Length) & Charterhouse Square (Hayne Street to Carthusian Street) ----

Utility Works

Charterhouse Square (Hayne Street - Carthusian Street) ---- Utility Works

Crutched Friars India Street

---- Resurfacing Works

Eldon Street Mobile Crane

Fore Street

Lothbury Utility Works

Mansion House Place (Entire Length) ---- COL Scheme Works

Prince’s Street COL Scheme Works

Prince’s Street COL Scheme Works

Star Alley Building Site

Walbrook COL Scheme Works

27 June 2023

just under £1bn now,” he adds.

But away from the rural idyll, Hitchcox is not only keen to transform how Londoners escape the city but also how they operate inside it.

Hitchcox’s capital market firm Yoo Capital has pumped £3bn of investment into London with his latest project including the redevelopment of

the Olympia, a landmark events venue in Hammersmith.

The rejuvenation of the exhibition halls includes a new live music venue, a theatre, two hotels, a slew of restaurants and bars, 550,000 sq ft of creative offices and 2.5 acres of gardens and public space –all set to open in 2025 and costing £1.5bn.

“It’s probably the largest public project in Europe at the moment. We expect to attract 12m visitors a year,” he said.

Hitchcox is excited about the venture, viewing it as a chance to exhibit the skills he learned overseas in the US decades ago to his home city of London and also sink his teeth into a project which has “very little residential”.

He said: “[It’s] more about supporting the fabric and the trajectory of London, which is the most successful city on the planet by a long way.”

Some of Yoo Capital’s other projects include a £5.4m transformation of Shepherds Bush Market and the Old Laundry Yard with plans to create a life science incubator as well as affordable homes within the area.

However, in a cost of living crisis and political turmoil it's easy for some to question the capital's position as one of the most “successful” cities in the world, especially as businesses buckle under inflationary pressures.

“It's going to take a lot to knock London off its perch,” said Hitchcox, stating that the capital's investment property still sets it aside from competitors. He concludes: “However bad the politics are, however bad the management is, the buildings carry the City forward."

St, Aldersgate Rotunda, Aldersgate St, St Martin’s Le Grand, Mobile Crane

Utility Works

Mobile Crane

“Cricket must face up to the fact that it’s not banter or just a few bad apples”

THE SCATHING VERDICT ON THE STATE OF ENGLISH CRICKET FROM AN INDEPENDENT PANEL PAGE 20

John Hitchcox redefined London living. Now he’s doing so again, with a rural escape.Hitchcox has a number of London projects, but his Cotswolds idyll is a real escape

UK HOUSEBUILDERS have taken a beating lately. Over the past five trading days, Persimmon is down over 10 per cent, Barratt Developments down over eight per cent and Taylor Wimpey has shed around seven per cent of its stock market value. Over the past month, these losses are even steeper.

Not long ago, sentiment towards the housebuilders was rosy. After the fiscal fiasco around the “mini budget” last September which sent the sector sharply lower, UK housebuilders entered recovery mode with shares regaining ground. Investors were buying the sector after Liz Truss’s plans for unfunded tax cuts were ditched.

Plus, there were hopes that inflation was beginning to ease after it peaked in October with the end of the Bank of England’s rate hiking cycle somewhere in sight.

However, recent developments have punished UK housebuilders.

Last week, the Bank of England upped rates by 50 basis points to

five per cent with further increases expected. The decision followed the latest inflation figures for May with the consumer price index coming in ahead of forecasts, unchanged at 8.7 per cent, pointing to persistent price pressures in the UK.

Earlier in June, labour market data saw wages grow at their fastest pace on record outside of the pandemic, raising concerns about second-round inflationary effects and the risk that price pressures become entrenched.

Moneyfacts report UK fixed-rate mortgages have risen to fresh seven-month highs this week with two-year fixed deals at 6.23 per cent, having surpassed six per cent last week. This is likely to dampen demand for UK property and push up rental costs.

These near-term headwinds are weighing on housebuilders. But if signs emerge that inflation is coming down, opportunistic investors may start to turn back to the sector, snapping up these stocks at a discount.

Shares in Aston Martin Lagonda jumped yesterday after it agreed to a deal with Lucid Group which gives the US electric vehicle firm a 3.7 per cent stake in the British luxury carmaker, while in exchange Aston Martin gets access to Lucid Group’s highperformance technology. Aston Martin will issue around 28.4m new shares to Lucid and will pay it $232m over time. Aston Martin has surged by more than 100 per cent over the past six months, making it the best performing stock on the FTSE 250 this year.

£After over 20 years in Canary Wharf, HSBC is relocating to the City of London. It is reportedly looking at BT’s former head office near St Paul’s for when its current lease at 8 Canada Square, which it has occupied since 2002, expires in 2027. Rising interest rates and the shift towards working from home, prompting businesses to downsize their office space, have caused pain for commercial property in Canary Wharf, which suffered a credit rating downgrade in May.

£As the end of H1 approaches, the Nasdaq 100 has rallied by more than a third so far in 2023, on track for a record six-month performance. US tech stocks have been recovering from last year. The 2022 ‘tech wreck’ sent the Nasdaq sharply lower, driven by concerns about inflation and rising interest rates. But the tables have turned this year. Nvidia, Meta and Tesla topped the leader board, surging by more than 100 per cent year-todate each while Amazon, Palo Alto and AMD are up by over half.

Prime Minister Rishi Sunak speaking to Laura Kuenssberg about rising interest rates and sticky inflation

The High Performance Podcast, hosted by Jake Humphrey and professor Damian Hughes, provides a look into the lives of high-achieving, successful individuals, sharing their firsthand experiences and lessons. Guests come from a range of different industries including sport, music, business, arts and entertainment, allowing listeners to glean an insight into their non-negotiable behaviours that get them to the top and keep them there. The latest episode is with Matt Willis, musician, singer and co-founder of the band Busted. Matt shares his experience of addiction after Busted split when he was only 21, which left him feeling short of direction and purpose. Previous guests include Sir Keir Starmer, Gary Barlow and Tyson Fury.

We’ve got to hold our nerve and stick to the plan

YOUR

LONDON’s FTSE 100 was dragged into the red yesterday, driven by Britain’s largest banks struggling amid concerns about how much higher UK interest rates will go and Vodafone tumbling.

The capital’s premier index fell 0.11 per cent to 7,453.59 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, slipped 0.49 per cent to 17,974.67 points.

Fears have been mounting of late about the Bank of England continuing to raise interest rates aggressively to stomp on scorching inflation, which remained stuck at just below nine per cent in May.

That has amplified traders’ concerns about whether borrowers will be able to repay debts with significantly higher rates.

Barclays, Natwest, Lloyds Bank and Asia-focused Standard Chartered anchored the FTSE 100, all dropping at least more than one per cent during opening trading.

They retraced ground in the afternoon session, though Barclays and Lloyds still closed lower.

Telecoms giant Vodafone was yesterday’s worst performer on the premier index, shedding 3.62 per cent after it hit back at claims its proposed tie up with rival Three would pose national security risks.

Jitters about the UK’s economic sluggish performance have pushed the FTSE 100 far below its 2023 peak of more than 8,000 points hit back in February.

But, bets on more monetary policy tightening has put upward pressure on pound sterling, making it one of the best performing currencies this year, up five per cent against the US dollar.

Boutique investment manager Polar Capital is keeping its cool, posting profits in line with expectations –which were 31 per cent lower at £47.9m for the full year. This downturn follows a decline in tech fund valuations and outflows across the healthcare sector. Peel Hunt believes its lower share price fails to reflect its diversification and believes the fund is well placed for a revival, holding a buy stance at 610p per share.

US gaming entertainer Sportech has announced plans to distribute £3.5m to shareholders (3.5p per current share), with ambitious plans to restructure the company. The decision is set for a crunch shareholder vote at an upcoming general meeting with Peel Hunt approving of the move, holding a buy stance in the company at a target price of 43p per share.

“Despite weekend events in Russia, European markets have proved to be reasonably resilient, although we did see the FTSE 100 fall close to three-month lows in early trade. The early weakness proved short-lived with markets recovering towards break-even levels in the afternoon session.”

MICHAEL HEWSON, CMC MARKETS

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership.

JOIN

CONVERSATION AND BECOME A PART OF ONE OF LONDON’S MOST TRUSTED NEWS SOURCES

WITH Glastonbury over, the festival season is in full swing. Every summer, millions of people make the most of the opportunity to listen to their favourite artists, spend time with friends and dance the stress of daily life away.

Festivals are an incredible machine, employing people and moving money. The almost 1,000 music festivals that took place in the UK in 2019 contributed £1.76bn in gross value added to the economy.

Also fuelling Britons’ love of festivals is a rampant drug trade. Between 2017 and 2021 at least fourteen young people died in England after taking drugs during festivals. Experts believe the actual number to be higher.

To reduce the risk of harm, festival organisers introduced on-site “back-of house” drug testing. They partnered with local authorities, police and drug testing organisations to take the drugs confiscated or left in amnesty bins and test them to look for extra strong and dangerous samples.

If the scientists testing them find potentially dangerous drugs, the festival sends an alert to all the people attending through social media or billboards, warning them that a bad batch is doing the rounds. The mother of Georgia Jones, who died at 18 at the Mutiny festival in 2018 after taking MDMA, is

convinced her daughter might still be alive had there been drug testing at the festival.

Inexplicably, this summer will be different. Just days before Parklife festival started, Sacha Lord, the organiser and night time economy adviser for Greater Manchester, was informed he needed a special licence to conduct the drug testing which has been in place for the last nine years. The Home Office told the drug-testing agency, called The Loop, that the usual agreement with the local police wasn’t enough.

But it can take up to three months to get the licence, at a cost of over £3,000. So drug-testing didn’t take place at Parklife, and might not take place at many festivals this summer. Lord said

that after thirty years in the industry, this summer he was “the most alarmed I’ve ever been before” because of this. “It’s wrong and it’s taking us back in the 1980s”, he said.

Bizarrely, the Home Office was at pains to say they never wanted to block drug testing and a licence was always needed in order to conduct drug testing at festivals. But the festival organisers insist local agreements with police forces have always been enough.

It’s certainly no secret festivals have been doing on-site drugs testing. Indeed, Lord’s festival Parklife piloted the scheme with the Home Office in 2012. If a licence was needed, the Home Office would have presumably wanted festivals to comply before now. To add more confusion to the mix, the

Home Office is the regulator of drug testing and has no actual power to fine or block festivals from testing drugs. According to sources in the department, the agency never asked for permission before, and instead relied on agreements with local police. It was only this year when they thought to ask, and were rebuffed. The Loop declined to comment.

What should have been an administrative mix-up with a solution at hand has instead blown up into a debate over testing.

Drug testing has proved to be successful in reducing harm. According to a study conducted in 2016, almost one in five users disposed of their drugs once aware of the content at festivals. Ninety-seven per cent of festival-goers

and ninety-six per cent of clubbers said they would use drug testing if it was available. Another three-year research project found zero evidence that drug testing made people feel encouraged to take drugs.

Suella Braverman has taken a zero tolerance approach to drugs, even where it creates more harm. Neither her or any of her predecessors as Home Secretary have been willing to deal with a reality where drug-use is widespread, and instead have relied on “war on drugs” rhetoric, despite yielding little results.

“Back-of house” testing isn’t even that progressive. Other countries, like the Netherlands, do widespread “frontof-house” testing, where people can bring their drugs to get tested to make sure they’re safe, without fear of confiscation or repercussions.

There are other ways of testing drugs. Some festival-goers told City A.M. they test their drugs at home with reagent kits. These are legal in the UK, but can never give a perfect result as they’re presumptive tests. Glastonbury also found another way of doing things, agreeing to send the confiscated substances to off-site laboratories that have the required licence. It will prove more complex - and probably more expensive than on-site testing - but it’s better than nothing.

In the meantime, DJs including Fatboy Slim and a cross-party group of MPs have written to the Home Office asking them to backtrack on this decision. Lord and other festival organisers are considering a judicial review of the Home Office’s stance.

They’re right in doing so: it’s almost impossible to stop bad drugs from entering the world of festivals, so everything that can be done to safeguard people can save lives.

THE pandemic changed work as we know it; and yet, not just for the knowledge workers but for the rarely acknowledged army of domestic staff that support them.

Knowledge workers revel in their newfound flexibility but spare a thought for the nanny whose workplace is now shared with her employers. A combination of more mums and dads working from home, the rise of over-attentive parenting, tech and a cost of living squeeze means a job that was previously characterised by autonomy and trust is now dealing with hovering parents, surveillance devices and ever growing demands.

Forget mumsnet, if you want an insight into modern parenting take a peek on nanny forums. You find everything from the downright mean to the undeniably illegal. There are accounts

of employers banning their nannies from eating the food in the fridge, nannies being forced to look after additional children for no extra pay, or being fired for getting pregnant. Tech surveillance is now an occupational hazard; one nanny says she was made to wear a body camera around her neck. Nannies also report being pressured to accept cash in hand by taxdodging middle classes feeling the squeeze. It used to be that if someone had a great nanny or cleaner they would bend over backwards to keep them. So what's happened to the English paternalistic tradition?

Before we assume this is just an issue for the super-rich, let’s remember that the rise of professional women over the

last thirty years has necessitated (and been enabled by) the employment of domestic labour - mostly working class women of colour or European migrants. The reintroduction of the servant economy in the 21st century isn't often talked about, but the fact is that complaining about nannies, cleaners and babysitters is as much a part of life as complaining about the commute. Brexit and the pandemic have created a tighter labour market and increased costs but there is also something else afoot: the ‘Amazonification' of service that the millennial generation in particular have internalised. The fact that we can order food to our door, hire someone to hang a picture, clean our toilet or look after our kids all at a

swipe has diminished our respect for these services and the people who perform them, and in turn our willingness to pay fairly and treat them well. As has been said: ‘There was never any lockdown. There were just middle-class people hiding while working-class people brought them things.’

But there is another factor, too; knowledge workers are working harder than ever. Because of digitalisation and the normalisation of relentless long hours, the laptop class has increased their productivity the most in the last decade. As Anne Helen Peterson has written, the more educated you are, the more money you earn, the more status is equated with being busy and the less likely you are to have boundaries. It is

precisely this group who struggle to employ and engage with services and people who actually do have quite specific parameters. An experienced nanny is there to care for children; not to run errands.

Over-stretched white-collar workers also struggle to support unionised public sector workers. Although solidarity for striking healthcare workers remains solid, there is less support for striking teachers and declining support for railway workers. Overall it signals a growing divide between white and blue collar workers, evident in our homes, our offices and in our current economic malaise.

Contemporary middle class martyrdom is justified; we are working harder than ever to achieve less than our parents did. But there's another factor at play here; we are less interconnected; where are the genuinely socio-economically diverse spaces? We are divided by class in our weekly shop, our annual holiday, housing, even modes of transport. This is socially dangerous, and if an employer has less and less in common with their nanny, they're more likely to treat them worse and worse.

£ Eliza Filby is a generations expert and a historian

[Re: It’s a great time to be alive in the London tech scene for new early-stage start-ups, June 12]

As the landscape of the global tech industry continues to evolve, London’s role in this arena comes under increasing scrutiny. The city welcomed over 18,000 new tech start-ups in 2021, marking a 94 per cent surge despite the shadow of Brexit. In the same breath, questions arise around the decision of major UK firms, such as Monzo, to list on overseas exchanges due to more favourable valuations and trading volumes. Despite facing global competition and Brexitinduced uncertainties, the UK remains a tech powerhouse. Our tech industry, valued at $1tn and home to 13 decacorns, is testament to our

dynamism and resilience. Our vibrant cities, renowned universities, and tech initiatives like Tech Nation, Digital Skills Partnership, and the Catapults networks continue to attract a diverse talent pool and support our tech firms.

Yet we must also acknowledge the challenges we face, such as the high cost of living and competition from global tech hubs. These challenges, while real, also present opportunities for innovation, risk-taking, and growth. But this will require planning strategically for the future.

It’s not just about weathering the storm, but instead about charting a course that allows the UK tech industry to thrive in an evolving global landscape. As we navigate through the uncertainties of Brexit and global tech competition, we must not lose sight of our inherent strengths.

Adrian Holt Director at Capita Scaling PartnerIT IS always laughably easier to describe the reasons for something happening after it is over, rather than seeing what will happen in real time amidst the chaos. And the war in Ukraine has taught us this lesson over and over again. After the initial invasion, there was a din of voices claiming to have always foreseen the eventual sequence of events.

This past weekend’s shocking Wagner mutiny has proved another case in point. Amidst the fog of war, it is entirely unclear what will happen next. Pretending otherwise or simply providing a re-run of events does a disservice to those hankering for useful analysis. As much as we will it to be different, the quickly wound-back threat of civil war in Russia changed little of the reality of the conflict in Ukraine.

Let’s start with the fact that the war has long since ground down into a stalemate. The Russian offensive of the spring resembled nothing so much as the charnel house of World War I, with hundreds dying for negligible gains in territory. The Ukrainian town of Bakhmut, a city of little strategic importance, became the Verdun of this new war, with the ferocity of fighting over mere metres of territory far outstretching the relevance of the place. The Russian offensive petered out to no strategic effect and the stalemate that characterizes the whole conflict was not altered.

After a weekend of domestic turmoil in Russia, following an attempt from mercenary leader Yevgeny Prigozhin to stir a coup against Vladimir Putin, the head of the UK army warned of a “generational struggle” with Moscow.

Chief of the General Staff, General Sir Patrick Sanders, said the West needs to be prepared for protracted tensions with Russia, even after Putin faced one of the greatest threats to his leadership.

Sir Patrick warned that the British Army was not up to date with what was expected of a

modern military. He said some of the army’s tanks and armoured vehicles were the equivalent of ‘rotary dial telephones in an iPhone age’.

It’s not the first time we’ve heard rumblings about the state of the UK army. Defence Secretary Ben Wallace has long warned of the need to invest in Britain’s miltary readiness.

But after extensive briefings suggesting the defence budget would rise by up to £11bn over the next two years, the Chancellor only agreed a £5bn package in the spring budget this year.

Even in light of the Prigozhin mutiny of the weekend, there is little evidence the present stagnant Ukrainian effort will be able to take advantage of Russian political chaos. Up until now, as the frank admission of President Zelensky makes clear, the summer Ukrainian offensive has gotten off to a slow start. Despite local tactical gains being made, it is also unlikely to upend the general strategic stalemate.

Given that this is the case, only outside drivers will materially affect the result. This has remained unchanged since the Wagner mutiny. Either American support for Ukraine, estimated at a whopping $110bn and counting, could wane as the huge outlay of weapons and money fail to bring victory. Or, Russian public opinion could tire of a war that everyone thought Putin would win in a matter of weeks.

If further reservist troops are called up to man Russia’s war or worse, a general

draft is called for, Russian public opinion could darken quickly, with Putin himself being blamed for the debacle. It would be open season on the Russian president. This was true before the Wagner mutiny and remains the case now.

If Russian public and elite opinion wobbles over the war, and Putin is actually ousted, the victor is unlikely to be a darling of the Western NGO community. As the thug Prigozhin illustrates (this is a man who enjoyed filming his troops taking a sledgehammer to the head of a deserter), the new tsar would be likely to come from Russia’s siloviki class, the hard men around Putin who run the military, intelligence and power ministries. They would be against Putin because he was prosecuting the war badly, not because he was prosecuting the war at all. A successor would not be good news either for Kyiv or the West. Ultimately, the West has almost no

say in the outcome of any future Russian power struggle. To meddle would likely only make Russian paranoia even worse. Instead, the West must stick to its red lines over the war: Use of Russian nuclear weapons will be treated as an abomination; China must be leveraged into pressing its client Russia to the negotiating table in time; the West must also corral the maximalist hopes of Zelensky and company, as a settled conflict is in our interests.

This is because it remains overwhelmingly likely that neither side will decisively and unconditionally win the present war. As this remains the case, a negotiated settlement—as emotionally unsatisfactory as that is—remains the only viable way to end the conflict. These are hard political truths. Now is not the time for wishful thinking.

£John Hulsman is a political risk analyst and a columnist at City A.M.

Even

IF CHOOSING another grey German saloon seems just too predictable, the Alfa Romeo Giulia is the compact executive car for you. It has been around since 2015, but Alfa has just treated it to a later-life update.

For a design that is now eight years old, the Giulia can still turn heads. The subtle facelift has added new ‘Trilobo’ matrix LED headlights, reminiscent of classic Alfas, along with a dark finish for the front grille.

Changes have been made inside as well, with Alfa Romeo seeking to address complaints about earlier models. They include a leather-wrapped gear lever to replace the previous, cheaplooking item. Cabin quality has improved, but is still unlikely to give Audi or BMW any sleepless nights. At least there are proper physical controls for the climate control system.

A new 8.8-inch infotainment screen

still seems small in comparison to iPadstyle hardware seen in rivals, although the Guilia’s 12.3-inch digital driver display looks neat.

Aside from the Ferrari-derived 2.9-litre turbocharged V6 in the ultra-rapid Quadrifoglio version, there is now only one engine offered for the Giulia. Producing 280hp, the 2.0-litre four-cylinder petrol in this Veloce version is pleasingly free from turbo lag.

This makes it feel even faster than the official 0-62mph time of 5.7 seconds. A healthy 295lb ft slug of torque makes for effortless real-world performance, too. This is certainly enough power to show the rear-wheel-drive layout – and accompanying 50:50 weight distribution – in its best light.

An eight-speed automatic gearbox is standard, with no manual transmission available. There are huge aluminium paddles attached to the steering col-

ALFA ROMEO GIULIA VELOCE

PRICE: £47,759

POWER: 280HP

0-62MPH: 5.7SECS

TOP SPEED: 149MPH

FUEL ECONOMY: 39.2MPG

CO2 EMISSIONS: 162G/KM

umn, though, which respond rapidly to requests for another gear. Take control and the Giulia’s gearbox will not try to second-guess what you want, but leave you to change gear as desired.