LICENCE TO TRAVEL EXPLORE EUROPE LIKE JAMES BOND IN THESE 007 HOTSPOTS P17

THE BANK of England is nailed on to raise interest rates for the 13th meeting in a row this Thursday, but markets think there’s an outside chance governor Andrew Bailey and co will revert to an outsized rise to tame what is emerging as the worst inflation problem in the rich world.

Markets reckon the nine-strong Monetary Policy Committee (MPC) –the group of people who set official interest rates in Britain –will kick borrowing costs up 25 basis points to 4.75 per cent this week, taking them to their highest level since April 2008.

However, some think there’s an outside chance the MPC will lift rates 50 basis points, something they have not done since February, in order to signal to markets they are serious about bringing inflation back to the two per cent target.

“A 50 basis points increase seems less likely, but is not out of the question,” analysts at consultancy Oxford Economics said in a note to clients last week. Traders think there is an about 20 per cent chance of such a rise happening.

A string of data of late has indicated UK inflation is proving much harder to tackle compared to the US and Europe.

Prices have increased 8.7 per cent over the last year to April, a smallerthan-expected drop from 10.1 per cent in March. In America and Europe, inflation has dropped to four per cent and 6.1 per cent respectively.

Core UK inflation –which strips out energy and food price movements –leapt to 6.8 per cent from 6.2 per cent, while services inflation, which the Bank focuses on, also rose.

Fresh figures from the Office for National Statistics on Wednesday are expected to show the rise in the cost of

living fell to 8.3 per cent in the 12 months to May, its lowest level since March 2022.

Economists have warned the risk of recession gripping the UK would rise significantly if the Bank were to meet market expectations and hoist borrowing costs to around six per cent. A wave of more than 1m homeowners rolling off of their existing lowerrate mortgage deals and onto contracts with much more punitive monthly repayments is tipped to drive the economic slowdown. Analysis from the Resolution Foundation has found that average annual mortgage repayments will climb £2,900 for this group next year.

Rates on two-year and five-year mortgages have pushed up to nearly six per cent in response to financial markets raising their peak Bank rate forecasts. Last week, lenders Nationwide, HSBC and Natwest all jacked up rates on their products.

LUCY KENNINGHAM

US SECRETARY of state Anthony Blinken and Chinese foreign minister Qin Gang met yesterday in Beijing to begin a two-day set of talks. Whilst neither side expects a major breakthrough to emerge, US officials said the main goal is to stabilise a relationship that has become extremely tense.

The talks come at a time of increasing tensions between the two superpowers over Taiwan and trade,

not helped by the memory of the surveillance balloon incident of February this year, which scuppered a previous attempt to meet.

Yesterday Blinken hailed the conversations as “candid” and “constructive” while Qin confirmed Beijing was committed to building a stable, predictable and constructive relationship with the US. He did, however, warn that Taiwan was the “most prominent risk” for relations.

The US reported that Qin has agreed to visit Washington later in the year.

EXCLUSIVE CHARLIE CONCHIE

THE CITY watchdog is under pressure to investigate scandal-hit social housing investor Home REIT on the grounds it repeatedly misled the market and left investors “badly burnt”, City A.M. can reveal.

In a letter to the Financial Conduct Authority (FCA) obtained by City

A.M., Home REIT shareholder The Boatman Capital called for a probe into claims the firm made on the quality of its housing stock and rental income.

Home REIT, which claimed to invest in “high quality”

accommodation for the homeless, has been engulfed by scandal since November last year when short seller Viceroy Research sounded the alarm over the quality of its tenant base.

The firm initially dismissed the claims made by Viceroy but has

since admitted that its rental take has collapsed and its sprawling portfolio of properties would require some £15m£20m to refurbish.

The shareholder has called on the FCA to investigate

the claims it has made to the market. “Investors have been badly burnt by Home REIT and we believe one reason for this has been the company’s failure to provide complete and accurate information to the market,” it said in the letter.

£ CONTINUED ON P3

RALLYING CRY KEY CHIEF TELLS US WHY TENNIS IS ASLEEP AT THE WHEEL P19

‘CONSTRUCTIVE’ US and China meet in bid to cool tensions

SO, structural weakness in London or the unique circumstances of an emerging market family business? That’s the question on many lips after WE Soda bailed out of its London float last week. The chief exec is (unsurprisingly) in the former camp, suggesting that institutional investors are somehow failing to step up in the capital’s battle for big-ticket flotations. Institutional investors (unsurprisingly) suggest the latter.

Before getting to that thorny question, it’s worth looking at whether it particularly matters that WE Soda has pulled out of what would have been the capital’s biggest float this year –and indeed, whether equity markets at large matter. After all, even the

London Stock Exchange’s bottom line is no longer reliant on headline-grabbing IPOs; it is more of a data company than an exchange. Could London survive without being a global equity markets destination? It could. Would it be a poorer place, in both senses, for it? The answer is unequivocally yes, and not just for the brokers and bookrunners who rely on such things. The public markets bring public, media and investor scrutiny, and sunlight

remains the most effective way to ensure businesses are run in the interests of their shareholders. How then to reinvigorate them?

Goodness knows there has been enough verbiage devoted to the topic, not least by a gamut of government-backed reviews. Most of those weighty –and worthy –tomes now gather dust on the Treasury’s shelves. Reports yesterday suggested regulators remain sceptical about their worth. We share no such concerns. To

NEIGH TIME FOR TRAFFIC An unusual site in the City yesterday as a couple of colourful horse and carts made their way down Lower

MICHAEL GOVE has said two Tories should keep the honours they were handed by Boris Johnson despite attending a pandemic-era gathering at which staff were filmed apparently joking about Covid restrictions.

The levelling up secretary apologised over the footage of a Christmas event at Conservative Party headquarters said to have taken place on 14 December 2020 when indoor socialising was banned.

But Gove said the former prime minister has a right to confer resignation appointments which should not be

blocked.

The video of the party, which was attended by failed London mayoral candidate Shaun Bailey and Tory aide Ben Mallet – who will receive a peerage and an OBE respectively – has reignited criticism of Johnson’s list.

Bailey reportedly left the event before the video was taken and has previously apologised for his involvement.

Asked whether the pair should be blocked from receiving honours, Gove told the BBC’s Sunday with Laura Kuenssberg show: “No, I don’t think that and I have to explain the context for that... The decision to confer hon-

ours on people was one that was made by Boris Johnson as an outgoing prime minister. Outgoing prime ministers have that right. Whether or not they should is a matter of legitimate public debate, but they do at the moment.”

Gove told Sky’s Sunday with Sophy Ridge programme: “I just want to apologise to everyone really, who, looking at that image, will think ‘Well, these are people who were flouting the rules that were put in place to protect us all’.”

However, former Conservative justice secretary Sir Robert Buckland said those implicated in the video should consider declining their honours.

implement some of the suggested reforms would require managed risk; a fact that the City would be comfortable with, but regulators and government seem almost allergic to. On both an individual and an institutional level, risk-taking is all too often considered a negative; a focus not on what could go right if a change is made, but what’s the worst that could go wrong. Britain has a timidity problem, but that’s not the City’s fault.

CHELSEA FC £2.3BN UKRAINE FUND DELAYED BY DISPUTE OVER WHERE IT IS SPENT

The delivery of a £2.3bn Ukrainian aid fund raised from the sale of Chelsea FC more than a year ago has been delayed because of wrangling over where the money should be spent.

THE GUARDIAN SOCIAL MEDIA SITES FAILING TO CURB FAKE REVIEWS, AMAZON SAYS

Shoppers are being deceived because social media platforms and messaging apps are not doing enough to prevent a “cottage industry of fraudsters” soliciting fake reviews, Amazon has said.

THE TIMES

INTEL TO BUILD ISRAELI PLANT IN LATEST DIVERSIFICATION PUSH

Intel has agreed in principle to build a new manufacturing plant in Israel as part of a push by the US semiconductor giant and its chip peers to diversify their production sources.

NINA LLOYD

LABOUR has ended its boycott of the Confederation of British Industry (CBI) to discuss changes the lobby group is making in the wake of a sexual misconduct scandal.

Shadow business secretary Jonathan Reynolds met with new director general Rain Newton-Smith this week.

Both Labour and the Conservatives previously cut ties with the confederation – which claims to represent about 190,000 businesses –after a string of harassment

allegations in March.

Since then, dozens of women have come forward claiming to have experienced misconduct.

Labour’s meeting, first reported by the Financial Times, is an early sign relations could be starting to thaw with the business group.

A party source said: “Jonathan and Rain met to discuss the changes the CBI are making. Labour have resumed staff level contact as per the government and will continue to review political engagement as the CBI work to restore the confidence of their members.”

EX-TESCO boss John Allan yesterday said there was “absolutely no substance” to the allegations of misconduct against him, arguing he had not been treated fairly.

Since the misconduct allegations were made against him last month, Allan has left his role as chair of Tesco, where he served for eight years, and Barratt Developments, where he had been chair for nine years.

Speaking to Sky News, Allan said following the allegations the companies “felt they had to be seen to do something, and the easiest and simplest thing was to propel me under the nearest bus”.

Allan said there needs to be more fairness for people who are accused of misconduct, saying “I don’t think I was particularly

fairly treated”.

“I think it’s important because there are cases where people are inappropriately treated and I don’t think we should overlook that, but also fair to people who are accused, that there is some form of due process, some form of investigation, before judgments are made about them,” he said.

Allan, who was also chair of the Confederation of British Industry (CBI), stands accused of four different accounts of inappropriate or unprofessional behaviour. The accusations were first reported in the

Allan denies three of the allegations against him, including that he touched a woman’s bottom, and has “unreservedly apologised” for the fourth, which was commenting on a woman’s figure.

Tesco said it also found no evidence of wrongdoing.

SVB’s collapse in March triggered the worst banking crisis since 2008

AKANKSHA KHUSHI

SVB FINANCIAL Group yesterday said it has entered into an agreement to sell its investment banking division, SVB Securities, to a group led by Jeff Leerink and backed by funds managed by The Baupost Group. The bidder group led by Leerink, who is chief executive of SVB Securities, will acquire the

GUY TAYLOR

MCDONALD’S expansion plans are being held back by UK red tape, boss Alastair Macrow said this weekend as he hit out at Britain’s excessive planning rules.

Speaking to The Telegraph, Macrow said the fast food chain is seeing three-year delays to open new restaurants, due to a long-winded

“We are concerned that statements made by Home REIT have been demonstrated to be false and/or misleading and, as such, we are calling on the FCA to investigate,” the firm added.

The provision of sub-standard properties to vulnerable people is the “opposite of what investors were promised in Home REIT’s prospectus”, the Boatman said.

The calls will add to the mounting woes of Home REIT after a disastrous eight months for the firm in which it has been suspended on the London Stock Exchange and attracted the scrutiny of the National Crime Agency.

investment banking business for a combination of cash, repayment of an intercompany note, and a five per cent equity instrument, the company said.

planning process and excessive bureaucracy.

“The planning timeline in this country for us has on average increased by 55 weeks since Covid,” Macrow told the Telegraph.

“Today it takes us pretty much three years from the moment that we approve a new site to open. Of those three years, only 43 weeks are within our control, the rest is outside of it,”

he said.

Macrow said that delays at local council level and planning red tape have hampered the fast food giant’s plans to expand its restaurant chain. Delays in the planning approval process have seen developers across the country complain of excessive waiting times. Over 100,000 planning decisions took longer than eight weeks to reach a verdict in 2022.

The deal comes after the Federal Deposit Insurance Corporation took over Silicon Valley Bank in March after depositors rushed to pull out their money in a bank run that wiped out more than half the market value of several US regional lenders.

In the two months after Viceroy’s allegations, Home REIT insisted repeatedly that its properties were high quality and fully refurbished. However, City A.M. revealed in January that one of Home REIT’s biggest tenants, the Big Help Group, had negotiated a rent relief deal worth £5.5m due to the dilapidated state of its housing.

The FCA declined to comment on whether it had opened an investigation into the firm. Home REIT declined to comment.

Reuters

Mcdonald’s boss John Macrow said the chain was being held back by UK planning rules

UK BUSINESSES must prepare to adhere to new EU artificial intelligence (AI) standards if they plan to trade in the bloc, lawyers and industry experts have said. It comes after the European Parliament last week voted to adopt the Artificial Intelligence Act, which aims to encourage “human-centric

and trustworthy” AI.

Tamara Quinn, partner in Osborne Clarke’s international AI team, said a challenge for the UK is that “access to neighbouring EU markets will depend on compliance with the EU AI Act”.

Without AI-specific legislation in the UK, developers might make the EU standards their “benchmark for compliance”, Quinn explained.

She added it was “well worth”

businesses investing time in understanding AI compliance if they want to unleash AI products and services in EU markets.

The EU AI Act is based on a high-tolow risk scale, with AI technologies deemed ‘high risk’ regulated more heavily. If approved by Brussels, the AI Act is anticipated to come into force in early 2024, making it the world’s first law regulating AI.

PUBS are closing at the quickest pace in a decade and experts have warned a further wave of failures are on the way, new research out today shows.

Some 620 of Britain’s watering holes disappeared over the year to the end of March, a 68 per cent increase from the 369 failures in the same period last year, according to chartered accountants Price Bailey.

Soaring energy prices have heaped pressure on pubs’ balance sheets, as have increasing wages and a slowdown in consumer spending.

That has lifted pub insolvencies sharply over the last year.

However, experts have warned the Bank of England’s 12 successive interest rate increases are poised to pump closures up even further as the year progresses.

“Rising interest rates will increasingly leave highly leveraged businesses in the restaurant sector unable to meet loan repayments. At the same time banks are clamping down harder on non-performing loans,” Price Bailey said.

A shortage of staff compounded by elevated gas and electricity prices has forced pubs to cut operating hours, meaning they are unable to maximise income from thirsty publicans.

Price Bailey also said banks who have lent cash to pubs and bars are likely to ignore the UK economy’s better-than-expected performance this year and demand money be repaid quickly. “There is often a lag between a return to more robust economic activity and declining insolvencies,” Matt Howard, head of the insolvency and recovery Team at Price Bailey, said. “Banks will likely start to put increasing pressure on debtors to perform or pay off loans. Focus will start to shift from financially stressed businesses to startups and those with better prospects, which may mean that insolvencies continue to rise despite many pubs seeing improved takings,” he added.

Soaring energy bills have seen a record number of pubs call last orders

GUY TAYLOR

THE WORLD’s largest hybrid, doubleended ferry marks its maiden voyage in the English Channel today as part of a £250m investment from P&O Ferries.

The P&O Pioneer can carry 1,500 passengers and 700 vehicles, and will help bring a 40 per cent reduction in carbon emissions, according to P&O.

The colossal 230-metre ferry is propelled by traditional fuel and battery power, and, designed with two bridges

at either end, improves fuel efficiency.

It marks a ramp-up of P&O’s operations on the famous route, which handles around £144bn worth of trade in goods with the EU per year.

CEO Peter Hebblethwaite said the “P&O Pioneer marks a new era in lowcarbon travel and trade for the UK and France, with the investment of £250m in new hybrid ships on the iconic DoverCalais route”. The two “ultra-modern” ferries will deliver a “fantastic travel experience,” he added.

HOUSE prices have dropped for the first time this year, sparked by the property market being whacked by the Bank of England’s 12 successive interest rate hikes to quash inflation, new figures out today show.

The average price of a home coming to market fell £82 over the last month to £372,812, the first drop in June since 2017, a month in which the housing market typically springs back to life after its early year slowdown, according to numbers from property search site Rightmove.

On an annual basis, prices are still rising, up 1.1 per cent over the year to June.

London house prices also fell over the last month, down sharply by 1.6 per cent, the biggest monthly fall of any UK region. They are still elevated at more than £685,000.

A big jump in mortgage rates in re-

sponse to financial markets jacking up their expectations for how high the Bank will pump up borrowing costs to tame inflation has squeezed people out of the market. Markets think Bank governor Andrew Bailey and co will send rates up again on Thursday, probably by 25 basis points to 4.75 per cent.

Average rates on two-year and five-year mortgages have climbed to just under six per cent, more than doubling over the last year.

As a result, potential buyers are rethinking their home purchase plans, putting pressure on sellers to drop prices in order to find customers.

“Buyer affordability constraints and more pricing realism from new sellers have brought forward the usual summer slowdown,” Rightmove said.

“These increases in rates and monthly mortgage payments may mean that some have to pause their plans for now,” the FTSE 100-listed firm added.

FORMER advisor to Boris Johnson

Samuel Kasumu yesterday called the Conservative party’s scrapping of mandatory housebuilding targets “borderline unforgivable”.

Kasumu, who did not make it on to the Conservative shortlist to be the party’s candidate in next year’s London mayoral race, told the BBC: “I think Michael Gove is a fine politician, but, bluntly, the scrapping of mandatory targets for housebuilding is borderline unforgivable, and I think we’re going to probably pay for that in the polls next year.

“It was, in my opinion, a political decision, but a very short-term decision, because I think there are a lot of young people, around my age, who are struggling not just to buy a home but to pay rent, and as a result, they are looking for politicians that can empathise with the experiences that they currently have.”

Asked about the former prime minister’s legacy, Kasumu said: “It’s completely possible to achieve great things and still be a bit of a nob, I think. Not that I’m calling Boris Johnson a nob of course.”

JOHN LEWIS property boss Chris Harris has resigned after a five-year stint, placing further pressure on the struggling retailer’s chair Dame Sharon White. Property director Harris resigned last week, according to the Sunday Times, but will remain in role until November.

He had played a key role in the retailer’s plans to expand into rental housing, and was the architect of a major £500m deal with investment firm Abrdn to build 1,000 residential rental homes – the first step of its target of constructing 10,000 new homes over the next decade.

The resignation is a particular blow to White, who has come under criticism during her tenure for a long-term period of losses at the retailer, and for considering out-

side investment to raise funds, in a decision that could have marked the end of the business being employee owned.

Last month, White marginally won a vote of confidence in her leadership, but saw partners voice a lack of confidence in previous decisions.

This followed annual losses of £234m posted in March, as the firm struggled under the weight of inflation and the cost of living crisis and warned of future job losses.

“As we need to become more efficient and productive, that will have an impact on our number of partners. That’s a massive regret to me personally,” White said at

John Lewis did not respond to a request for comment.

BOEING has forecast the global aircraft fleet will double by 2042 to 48,600, with growth driven by low-cost carriers and $8 trillion (£6.24 trillion) of new commercial jets added to the market. In its annual 20-year forecast, the US planemaker said it anticipates demand

for 42,595 new commercial aircraft over the period, a rise from its previous projection of 41,170 in 2022.

Boeing said the increase will be driven by demand for single-aisle fleets from low-cost carriers, which will account for 75 per cent of all new deliveries and operate 40 per cent of the narrowbody jet fleet by 2042.

Only three years ago the majority of the global airline fleet was grounded. Brad McMullen, senior VP of sales and marketing at Boeing, said the report “reflects further evolution of passenger traffic tied to global growth of the middle class, investments in sustainability [and] continued growth for low-cost carriers”.

ACADEMIC Brett Christophers has warned governments’ attempts to outsource the response to climate change to asset managers, such as those at Blackstone and Brookfield, will have damaging consequences.

Christophers, who recently published Our Lives in their Portfolios, told City A.M. “the infrastructural response to climate change both in terms of mitigation and adaptation is essentially being outsourced by

governments to the private sector”.

Governments around the world have been attempting to scale up their response to climate change.

But Christophers says “to the extent the public expenditures are involved it is about catalysing and subsidising private expenditures rather than investing in publicly-owned assets”.

In particular, governments are turning towards asset managers to act as the “hub” of private sector investment against climate change.

Christophers said asset managers

HOUSEBUILDER Berkeley is looking to soothe fears of more interest rate pain and a slump in the housing market this week as it updates the City on its full year’s performance.

Investors and analysts are fretting over the outlook for the country’s big housebuilders as the Bank of England prepares to hike interest rates further to tame inflation.

Analysts are now pricing in a peak rate of 5.75 per cent which would inflict further misery on mortgage holders and drag on the housing market.

Shares in Berkeley Group, which will report its full year results on Wednesday, are languishing around a quarter below their all-time peak in February 2020 – despite bosses ramping up completion and profit targets, and hiking the outlook on dividend payouts.

Analysts said the market outlook was likely to blame for the lacklustre share price.

“This may be down to investor concerns

over the direction of the UK housing market, amid concerns over interest rate rises, housing affordability and the UK’s modest rate of GDP growth, as well as the impact upon Berkeley’s profit margins of input cost inflation and shortages of qualified staff,” said Russ Mould, investment director at AJ Bell. “No doubt longstanding CEO Rob Perrins will address all these issues alongside the results for the six months to the end of October.”

March’s trading update featured “no nasty surprises” and analysts and shareholders will be looking for further reassurance, Mould said.

Berkeley has said it is expecting pretax profits of around £600m in the year to April 2023 and more than £400m in the year to April 2024. The firm also intends to return £283m, or 262p a share, to shareholders each and every year through to September 2025 via a mix of dividends and share buybacks.

Berkeley’s operating margin came under pressure last year and analysts are pricing in another drop.

are as “unsuitable as you can get amongst private sector owners” for combatting climate change largely due to their short termism, as many investment funds are closed-end. He suggests the negative consequences of the privatisation of infrastructure are “particularly marked” in the case of asset managers. Within this framework, he claims there is little incentive for asset managers to invest in an asset if the benefit will only be felt after the end of the fund’s lifetime.

NEIL LANCEFIELD

CONSUMERS will become “less obsessed” with home deliveries as awareness of the “sustainability argument” for sending parcels to collection points grows, according to an industry leader.

Mike Hancox, CEO of delivery company Yodel, said locations such as

shops, petrol stations and lockers are “a much more efficient network” for getting goods to and from customers.

The so-called final mile of delivery –when a package is transported to a consumer’s doorstep – faces “a lot of challenges” in the UK, he told PA.

“Dropping off 10 parcels at a shop will allow the whole industry to deliver more parcels efficiently. Over

time, people will be less obsessed with delivery to home.”

Yodel has recorded a “significant acceleration” in the number of parcels it delivers to its 5,500 pick-up and drop-off (Pudo) locations.

In addition to the impact on the environment from online shopping deliveries, there are also concerns about the effect on congestion.

E-COMMERCE retailers, which were bolstered by Brits stuck at home during the pandemic, are now going bust, a new report shows. The number of insolvencies of UK e-commerce businesses rose 71 per cent to 529 in the past year, up from 309 in the previous year, according to Mazars, the international audit,

tax and advisory firm.

As physical retail was forced to close during the pandemic, shoppers turned online to get their fashion fix –driving up sales and interest in online brands such as Asos and Boohoo. In the year of the first lockdown, Boohoo saw a 41 per cent surge in revenues racking in a whopping £1.745m.

However, two years on and the

Manchester-based brand is struggling, haemorrhaging £90m in its latest financial results as the reopening of traditional stores and economic uncertainty hindered sales. Mazars partner Rebecca Dacre said: “The sharp jump in e-commerce businesses going bust is a clear sign that the pandemic ‘golden age’ of small online retail start-ups is now behind us.”

THE BOSS of WE Soda yesterday took aim at the “commitment” of London and European investors after the soda ashmaker ditched its listing plans last week due to the meagre valuation mooted by the market.

The Turkish firm revealed plans to list in London to much fanfare two weeks ago but dramatically scrapped the proposition last week citing “extreme investor caution” in the City.

WE Soda had been targeting a valuation of $7.5bn (£5.9bn) but analysts were reportedly angling for as much as a 20 per cent discount on the asking price.

The firm’s boss Alasdair Warren has now slammed the caution of investors in Europe and suggested the firm could find a more game reception on the other side of the Atlantic or Asia.

“It’s not just London, but Europe,” Warren told the Sunday Times.

“You get local support for domestic floats in the Middle East and they get done. In the US, you can always find a clearing level [to get a good deal] but here in London and Europe the institutions do not have the commitment to

step up and take ownership.”

Warren told the paper that if the firm was to reconsider a float it could be in New York in the next few years. The comments follow his warnings last week that investors in the US “tend to have higher levels of conviction to back themselves as opposed to following others”.

The comments will fuel more anxiousness in the City as London tries to revive its listings market. The amount of cash raised by IPOs plummeted 80 per cent in the first quarter, according to figures from EY.

Efforts from top City figures are underway to try and boost the taste for longer term growth investment. The Capital Markets Industry Taskforce headed by London Stock Exchange chief executive Julia Hoggett is looking to reset the narrative around the City.

A GROUP of the UK’s largest banks have told Prime Minister Rishi Sunak that big tech firms should help contribute to the reimbursement of fraud victims. According to Sky News, the banks said the rising tide of fraud in the UK is having a “material impact on how attractive the wider UK financial sector is perceived by inward investors, which as we know, is critical for the health of the City of London and wider economy”.

Figures from UK Finance show £1.2bn was lost to fraudsters last year, making the UK the “fraud capital of the world”. A range of proposals has been put forward to clamp down on the problem. The government launched its National Fraud Strategy earlier this year with a unit of new specialised investigators. The letter – signed by the big four banks, Nationwide, Santander, TSB, Starling and Handelsbanken – argued that the responsibility to tackle fraud went beyond the banks involved.

ASANAmerican who has built up a legal practice in London, I have seen differing views on what is dubbed the ‘revolving door’ between business and government on either side of the Atlantic.

In the UK, politicians and the media are often highly critical: people are accused of seeking to ‘cash in’ on knowledge and contacts they have built up while working for the state.

In the US, lawyers often switch between private practice and working in government. Many young lawyers start in the government and then move on to private firms later in their careers. Others may join government permanently or for a term after a successful private career.

Because government salaries are generally lower than private practice, working for the government is often about ‘giving back’, but it is also a good route to a better private job. Those who leave government are recognised

as having done good service to the nation, and to have earned the right to a better-paying position.

Cohen & Gresser specialises in complex fraud cases, often involving large numbers of documents, and I am completely unembarrassed about the fact that I have looked to the Serious Fraud Office (SFO) for expertise.

The SFO’s former director, Sir David Green, is among those we have hired. John Gibson joined the SFO after years as a barrister, and has now returned to practice with us. Pere Puig Folch, the architect of the digital data review system at the SFO, oversees our use of data and AI in complex fraud cases. The government should be proud that the people they attract and the training and experience they get are highly prized by other organisations.

It is time the UK adopted the US’s attitude to the ‘revolving door’ and welcomed it as an entirely good thing for both the public and private sectors.

In my office, we now recommend that people come in at least four days a week. Like many workplaces, Fridays can still be pretty quiet, particularly now the sun is shining. The old routine of heading off to the pub on Friday afternoons may be replaced with sitting in the garden all day. At some point, firms and employees are going to have to re-examine how alternative working arrangements are operating. It’s time to get back to the office, for the benefit of young careers, as well as clients.

£ Both have built up cults of personality and faced potentially career-ending crises in recent days. In the US, Donald Trump is facing legal charges for allegedly mishandling classified documents, while Boris Johnson has quit parliament after being found to have lied about lockdown parties. It is an interesting reflection of the different political and legal systems that the US issues are being dealt with by the courts, and the UK’s by Parliament. However each country does it, both the US and the UK are trying to maintain the rule of law and show that democracies can hold their leaders to account.

£ The government has just introduced strong new anti-protest laws. Before these were even in place, at the coronation the police rounded up potential protesters long before they could begin to protest about anything. Of course that was an over-reach, and the police apologised when releasing suspects who had done nothing wrong. We mustn’t forget peaceful protest is the mark of a functioning democracy and the UK has a great tradition of it.

I highly recommend the movie Air, about a story that transformed the world of sports marketing and product sponsorship. It offers fantastic insight into how businesses really operate: how different personalities, goals, pressures, ideas, insights, disputes and risks permeate the corporate environment, and –in particular –how really big deals get to be done. It’s particularly informative for anybody working on complex negotiations with clients. Often you will find you are not just dealing with one person, but families, friends and competitors working behind the scenes –each with complex and possibly contradictory motivations. Matt Damon’s character goes all in for what he believes in, and somehow drags the entire organisation with him to an amazing result. He seals the deal with intensity, determination, guile and courage, often ignoring the rules and the corporate culture.

SHELLhas slashed its green ambitions, reneging on pledges to cut back oil production while also ramping up payouts to shareholders.

At its capital investor day last week, the fossil fuel giant ditched its modest target of a one to two per cent cut in oil production year-on-year until the end of the decade, instead sustaining output and ensuring investors cash in on black gold’s chunky returns.

While Shell remains publicly committed to its climate agenda and denies it has rolled back climate pledges, it can easily be seen as a rebuke of net zero. Its decision follows rival BP rowing back emissions targets this decade and US juggernaut Exxon Mobil recently describing the 2050 carbon emissions goal as ‘remote’.

The FTSE 100 firm is now set to invest $40bn in fossil fuel production between 2023 and 2035, compared

to reach $528bn this year, its highest level since 2015 and growing 11 per cent yearon-year.

Shell’s strategy was hammered by its usual critics, with investor activist group Follow This hoping it would be a “wake-up call” to climate-friendly shareholders, while Greenpeace argued the mask had now slipped and the energy giant was “showing their true colours”.

Climate-conscious asset manager LGIM has even called on Shell to explain how it plans to reach net zero emissions by 2050 while hiking investments in fossil fuels. However, there is no need for alarmism or public declarations, with Shell’s decisions little more than a distraction from the wider picture.

The same day Shell unveiled its latest plans to shareholders, the International Energy Agency (IEA) predicted that the peak in world oil demand could be just five years away – putting a ticking clock under the plans of all fossil fuel majors.

The Paris-based climate agency expects demand for oil will slow almost to a halt this decade, with a marriage of government energy strategies and consumer behaviour driving the change. Its latest medium-term market report forecasts that global oil demand will rise just six per cent between 2022 and 2028 to reach 105.7m barrels per day – but that overall annual demand growth will shrivel from 2.4m barrels per day this

year to just 0.4m in 2028, putting a peak in demand in sight.

In particular, growth in oil demand for transport will crumble after 2026 as the expansion of electric vehicles, biofuels and improving fuel economy reduce consumption – reflecting how policy, business innovation and customer choices can make the world a greener place. High oil and gas prices – which have fuelled the global energy crisis – are driving consumers towards greener alternatives for transport, power, and heating, while security of supply concerns following Russia’s invasion of Ukraine last year mean governments are focusing on energy policies powered by wind, solar, hydrogen and mass electrification of domestic energy networks.

This is being reflected in the data, with the IEA also predicting earlier this month that renewable energy capacity will jump a third this year – the largest annual increase ever recorded. It expects the world’s total renewable capacity will rise to 4,500 gigawatts, equal to the total power output of China and the US combined.

The fundamental driver of this expansion is China – which will account for 55 per cent of global additions of renewable power capacity in both 2023 and 2024 –while the US Inflation Reduction Act has also begun luring investment across the Atlantic.

Electric vehicle sales are also on course to rise sharply across developed markets according to the IEA. However, this does not mean the world is yet on course to reach net zero.

Thousands of renewable projects now

exist in the global development pipeline but challenges such as upgrading grid connections, securing investment amid inflationary headwinds, easing planning laws, extracting minerals and establishing supply chains must be overcome to keep up with consumption demand over the coming decades.

The reality of reaching net zero will be a painful one, with difficult arguments to be had over how much we should expect our lifestyles to be changed, and how much we’re prepared to pay to reach these goals.

Oil and gas production and trading will be a factor –albeit a declining one – over the short and medium term. This could mean that while net zero is desirable, the time frame has to be extended from 2050. Yet the shift to renewables is clearly underway, and this will help mitigate the damaging costs of not reaching net zero, and the wider environmental harms we all fear.

The current focus may be on oil majors embracing their chief source of income –fossil fuels – but a downturn in demand is coming, and this means Shell will be compelled to catch up if it wants to remain one of the world’s biggest energy giants.

What can we do to make sure we reach net zero? Email energy editor Nicholas Earl at nicholas.earl@cityam.com

UK gas prices have nearly doubled this month –rising from near pre-crisis levels of 54p per therm to over £1 per therm, reflecting tightening markets.The price cap for household energy bills is forecast to remain at around £2,000 per year this winter, exposing the likelihood of another supply scramble this winter despite recent excitement over lower prices on the spot market.

£ The boss of British Gas owner Centrica is not the ideal messenger for uncomfortable truths –with the energy firm caught breaking into the homes of vulnerable customers to forcibly install prepayment meters last winter. However, Chris O’Shea’s warning that customers will face higher energy bills if households are allowed to rack up larger and larger debts is valid. Suppliers need to be regulated stringently, but enforcement on debt is still needed for the market to function –with or without prepayment meters.

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his weekly columnShell chief exec Wael Sawan

future is

can no longer afford to ignore it

Nobody changed the dismal science of economics quite like Adam Smith, the Scottish philosopher, author of The Wealth of Nations and The Theory of Moral Sentiments, and father of market economics. June marks the 300th anniversary of Smith’s baptism –nobody quite knows his actual birthday –and to mark the occasion, German historian and sociologist Dr Rainer Zitelmann interviewed Dr Eamonn Butler, the founder of London’s Adam Smith Institute, on Smith’s life and work

Dr Rainer Zitelmann: If you were to highlight the single most important thought in all of Smith’s work, what would it be?

Dr Eamonn Butler: The Wealth of Nations contains so many insights that changed our thinking that it is hard to single out any one of them. In the very first paragraph, for example, he invents the notion of GDP and then he goes on to describe the division of labour, the benefits of free commerce, and so many more new concepts including the Invisible Hand idea. But to answer your question, I would plump for his insight in The Theory of Moral Sentiments that human morality is driven by sympathy –our desire as social creatures to act in ways that bring the approval of others and to avoid actions that others disapprove of. It’s a very powerful idea, an evolutionary idea that was a century ahead of Darwin.

That sense of sympathy is interesting. Why does Smith not explicitly refer to the entrepreneur, who above all must be empathetic in order to develop and sell a product?

When he wrote The Theory of Moral Sentiments in 1759 he was a college professor with little experience of the business world. So that is hardly surprising. But interestingly, I have been asked to give talks on the relevance of Smith’s ethics to entrepreneurship and business, and his moral ideas are indeed very relevant. Take, for example, his emphasis on the virtue of prudence. Prudence means acting in your own best interest –your long-term interest, not what may seem good at the time (like keeping healthy rather than lazing on the sofa with beer and pizza). That’s entirely true in business. You do not build a business by trying to make a quick buck out of people, but in building up reputation for giving customers what they want and need. Customers will come back only if they trust you and see that you have integrity and good reputation.

What significance does the theme of poverty have in Smith’s work?

Would you agree with me when I say that Adam Smith’s primary concern was to show the way out of poverty?

Definitely. Smith supported free trade and free commerce for the same reason I do, namely that it is the best way of improving the condition of the working poor –or more properly, the best way to allow the working poor to better their own condition. Bettering your condition, he thought, is a natural human desire, but it is too often blocked by

onerous taxes and regulations imposed by people in authority. And too often, those rules are deliberately proposed by established businesspeople who want to keep out any competition, and imposed by their friends and cronies in government. Sweep that away, says Smith, and the ’system of natural liberty’ will bring prosperity to all.

Authors like Samuel Fleischacker and Elizabeth Anderson tend to associate Smith with leftist, even egalitarian values. Is this a distortion of Smith? Where do these authors have a point and where are they wrong? Did Smith perhaps attach greater importance to the state than you and I would?

Smith was certainly motivated largely by the condition of the working poor. And he of course wrote that no country could count itself as prosperous if the greater part of the population was poor. So to that extent his motives are the same as those of the left. His solutions, however, are the exact opposite of theirs. Rather than arguing that the state should have more power in order to improve the lot of the poorest, he argues the exact opposite –that it is the oppression of those in authority that constrains the ambition of the poor and keeps them in poverty. His solution, therefore, is to set the people free of all that.

To a modern reader, Smith’s books, especially The Theory of Moral Sentiments, are more reminiscent of self-help books (like Dale Carnegie’s How to Win Friends) than of modern economic texts, in which you largely find a lot of mathematical calculations and formulas. ‘Moral philosophy’ was, after all, also more concerned with teaching about human behaviour. The point had not occurred to me, but yes, Smith’s analysis of the human mind is drawn from innumerable practical examples of real-live dilemmas. In The Theory of Moral Sentiments it is about what one might feel and think and do when faced with a moral problem, in The Wealth of Nations it is about the incentives that draw people into one economic action rather than another. So yes, they are very relevant for those who want to understand their own minds and put their thoughts and actions on a rational foundation.

More generally, if Smith were able to look down at us from heaven today and say something about our modern world, what do you think he would say?

It is always unwise to speculate about what an 18th-century character would say about our 20th-century lives. But I will break my rule. He would, of course, be amazed by the wealth around in the world and the sheer number of goods and services that are available, even to the poorest people in the developed countries. We are 50 or 100 times richer today than people were in Smith’s time. But equally, when he reviewed the laws and regulations that constrain our every action and cripple our enterprise, and when he discovered that governments routinely take 40 or 50 per cent of the nation’s product for their own purposes, he would undoubtedly conclude that we are, regrettably, living under the most profound tyranny.

UK inflation is poised to recede to its lowest level in over a year, pushed lower by food and energy price rises easing, markets are betting.

Fresh cost of living figures from the Office for National Statistics (ONS) on Wednesday will top investors’ minds in a busy week of data that will shape movements in financial markets.

Investors think the rate of price increases fell to 8.3 per cent in May, down from 8.7 per cent in April, taking it to its weakest level since March 2022 when it was running at seven per cent.

“We think food price inflation should ease slightly as the lagged effect of global commodity prices retreating starts to feed through, while declining energy prices should slowly lower the cost pressures facing supermarkets,” analysts at Oxford Economics said.

To appear in Best of the Brokers, email your research to notes@cityam.com

Bank economists are tipped to hoist rates 25 basis points on Thursday to 4.75 per cent in response to sticky inflation, although some corners of the City think they could opt for 50 basis point rise.

Fresh purchasing managers’ indexes on Friday are expected to confirm the UK economy is still dodging a much feared recession, but that activity is cooling.

The services survey will edge lower to 54.8 in June from 55.2, albeit still much higher than the 50 point threshold that separates growth and contraction. The manufacturing downturn is set to gather pace, with the sector’s PMI poised to trim from May’s 47.1 reading.

Meanwhile, an additional bank holiday in May to celebrate the King’s coronation is likely to have kept retail sales in negative territory, falling 2.6 per cent over the year to May, numbers from the ONS on Friday are tipped to show.

Peel Hunt have rated Alpha FMC a “Buy”, with the financial markets consultancy expected to report results ahead of market expectations. Analysts said “Alpha continues to successfully deliver good sales wins and has maintained its strong opportunity pipeline”, with organic growth alongside a focus on asset and wealth management acquisitions in APAC.

Analysts at Peel Hunt have marked Telecom Plus as a “Buy”, with the dividend at the utilities company dividend expected to increase by 40 per cent. Despite lower energy prices providing a headwind, “the company is well set to continue to deliver strong double-digit growth”, around 55 per cent, Peel Hunt analysts said.

“Huge week for the market, this. A Bank of England interest rate decision. Inflation estimates. PMIs. Consumer confidence, to name but a few events. Expect another big upward movement jolt in gilt markets if core inflation doesn’t fall significantly.”

JACK BARNETT, ECONOMICS EDITOR

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership.

EDITED BY SASCHA O’SULLIVAN

EDITED BY SASCHA O’SULLIVAN

Max von Thun

Max von Thun

LAST month the UK’s competition regulator, the Competition and Markets Authority (CMA), drew a crowd after it decided to block Microsoft’s acquisition of Activision over fears it would allow Microsoft to monopolise the emerging cloud gaming sector.

While some criticised the decision for attempting to second guess the evolution of unpredictable technology markets, the CMA was right to withstand political pressure and stop yet another anti-competitive Big Tech merger. But it is now faced with another mega-merger whose harms are even easier to spot. Vodafone’s planned tie-up with rival Three, announced last Wednesday, would create the UK’s largest mobile operator, with almost half the country’s mobile subscribers. This sharp increase in market concentration would almost certainly increase prices for consumers. It also poses a national security threat from China in the form of Three’s owner, Hong Kong-based CK Hutchison. The deal looks like an open-and-shut case of an anti-competitive horizontal merger reducing the number of players in the market, widening profit margins at the expense of prices, service quality and innovation. It’s yet another instance of the 4-to-3 telecoms mergers

that competition authorities around the world rightly take a deeply sceptical view of, including CK Hutchison’s attempted acquisition of O2 blocked by the European Commission in 2016.

According to one comprehensive academic study based on data from 33 countries over 13 years, 4-to-3 telecoms mergers increase prices by an average of 16.3 per cent per customer. Drawing on this and other similar evidence, a new report by Tommaso Valletti (former Chief Competition Economist at the European Commission) finds that the Vodafone-Three merger could be expected to raise individual mobile bills by up to £180 per year.

This would be problematic at any moment, but is all the more so at a time

of rapidly rising prices. UK annual inflation – at 8.7 per cent – remains very high and above levels in the EU and US, while the number of households struggling to pay their bills has in-

creased by over three million in just one year. This includes phone bills, with operators – including Vodafone –introducing inflation-busting price increases earlier this year. These excessive price rises already point to a potential lack of competition in the market, which the proposed merger would of course make worse.

Vodafone and Three argue that the deal will boost investment in the UK’s telecoms infrastructure, as merging telecoms operators tend to do. Yet another quick glance at the evidence puts such claims to bed. The same peer-reviewed study on 4-to-3 mergers cited above also finds that such consolidation resulted in no increase whatsoever in investment at the national level.

GEOPOLITICAL tensions, rising interest rates and other global economic pressures have served to put a spanner in the works of the globally increasing presence of fintechs. Funding concerns have cast a shadow over the vibrant industry and have left many once keen investors changing their behaviour to the pain of start-up founders.

In the backdrop of these temporal pressures lay even stronger concerns in the way of artificial intelligence (AI) and digital currencies such as crypto. Recent reports on AI have turned from celebrating its ground-breaking successes to now heavily warning of its life-threatening risks. And in the case of crypto, fears of money laundering and fraud threaten to put a muzzle on the prospects of these new products. In the face of these concerns, however, the UK is rising above its competitors as a global leader in fintech. Andreessen Horowitz, one of the largest tech investment firms in the world, recently announced it had chosen London for its

Nicholas Lyonsfirst international office, looking to Britain as a hospitable climate for digital currency start-ups. The government is also backing this surge as Prime Minister Rishi Sunak announced we will host the first global summit on AI safety aiming to make Britain the home of AI safety regulation.

Our competitors even look to us for inspiration as French officials seek to create their own version of the Enterprise Investment Scheme (EIS) and Seed Investment Enterprise Scheme (SEIS) programmes, which provide early-state tax incentives credited with helping to make us Europe’s undisputed entrepreneurial leader.

The world is taking our lead for solutions to the very real threats to fintech innovation. But we must address the day’s concerns with a robust plan and not with apprehension and dithering. There is a reason there are 135 unicorns in the UK and why in 2022 the we had more fintech investment than Japan, Singapore, Hong Kong, France and Germany combined. It’s because for so long Britain has provided a dynamic ecosystem that allows start-ups to build and become successful.

Competition is still fierce. If we want to be the home for fintech companies to list and grow, we must go further. It’s fantastic that eight out of the top 10 areas for tech are in London, as a new report found, but we need a network of vibrant regional clusters across the country – an objective already underway as the research notes continued start-up growth outside of the Golden Triangle of Oxford, Cambridge and London.

Initiatives like the City of London Corporation’s Finance for Growth, set to be unveiled this Autumn, will provide

a road map for how new regulations can support the growth of fintechs here in Britain. UK fintechs can also look forward to seeing what the Centre for Finance, Innovation and Technology (CFIT) will produce, which was one of the key recommendations from the 2021 Kalifa Review of UK Fintech. This private-sector led body will create a designated group committed to identifying and addressing opportunities and barriers to growth for fintechs. This will not be a secluded group of individuals speaking into a silo, but a “coalitions” approach bringing together individuals and organisations from across the ecosystem. We leave behind a risk averse attitude if we want the innovation that powers our competitive edge. Without it, we will fail to see the full and exciting potential of British fintech and forfeit the opportunity for impact far beyond our shores.

£ Nicholas Lyons is the Lord Mayor of the City of London Corporation

Similarly, another paper published earlier this year looked at investment by major telecoms operators in the US and EU, observing higher rates of investment in the less-concentrated EU market than in the more monopolistic US. In markets with less competition, companies do not need to invest as much to protect their position from challengers.

There is clearly much to be worried about on competition grounds. But the merger is also problematic from a national security perspective. Three owner CK Hutchison is closely entwined with the Chinese state, from backing Beijing’s draconian crackdown in Hong Kong to sitting on numerous government committees. The deal would give Hutchison access to sensitive information on Vodafone’s 27 million UK customers and its contracts with the British government, information it could potentially be forced to divulge to the Chinese government under that country’s national security laws.

In light of these serious concerns, the Vodafone-Three merger should be intensely scrutinised under both the UK’s competition and national security investment screening laws. Investment in the UK’s network infrastructure is undoubtedly critical, and the government should do what it can to enable this, including investing itself and facilitating innovative solutions such as network sharing. But waving through harmful consolidation is not the solution.

£ Max von Thun is Director of Europe & Transatlantic Partnerships at the Open Markets Institute

Everyone, we would like you to get your tiny violins out for David Hinton, the CEO of South West Water, who said it wasn’t his fault parts of Sussex had run out of water. The firm brought in a hosepipe ban last week, citing increased customer demand.

Summer, a surprise every year.

In markets with less competition, companies do not need to invest as much to succeed

[Re: AI’s biggest benefit its use as a buzzword?, June 13]

As a BT employee with a focus on AI, I would like to respond to Ian Whittaker’s column. Many things about Ian Whittaker’s column are easy to agree with. No one quite knows what the latest developments in Artificial Intelligence will bring. AI itself, is an overused buzzword, often inaccurately applied to attract attention and investment. That doesn’t mean, however, that it won’t become an intrinsic part of our life. AI isn’t a mysterious unknowable force. It is a catch-all term for the development and use of technology that can undertake the kinds of tasks usually attributed to human-level intelligence, such as perception, reasoning, planning, learning, adaptation, understanding natural language, interpreting images,

and so on. We have been developing and using these capabilities for decades, for work planning and optimisation, identifying potential nuisance calls, and understanding mobility patterns, for example.

History will be on the side of people who safely harness the transformative potential of AI capabilities as they continue to develop and become more widely accessible. Generative AI, as unlocked by the ‘large language models’ made popular by ChatGPT, represents some of the latest developments in AI and stands poised to turbocharge the potential of AI tenfold given its scale and accessibility.

BT Group is investing in, and rapidly building, the digital infrastructure that homes and businesses across the UK need. As that work nears completion and we become a hi-tech, high-margin business, our workforce will change –as it always has.

Dr Zoë Webster Artificial Intelligence Director, BT Group

IT IS inevitable and necessary that successful politicians are wired just slightly differently from the rest of humanity. They must have an unshakeable belief that their contribution to any debate is vital, and they must be devoid of what most people would recognise as a sense of shame. Enter the excitable Member for MidBedfordshire, Nadine Dorries.

It is nearly 20 years since Dorries arrived in the House of Commons, a frank, outspoken and obviously sincere social conservative with workingclass roots in Liverpool and a lived-out Thatcherite parable of having started as a nurse before moving to the private sector and ending up a director of Bupa after selling her day-care business to them. She was utterly authentic but equally untroubled by self-doubt, and quickly found a niche as the blue-collar conscience of the Conservative Party, ready to speak uncomfortable truth to the modernising leadership of David Cameron and his fellow “posh boys”.

Today, MPs will be voting on the damning report that found Boris Johnson guilty of misleading Parliament over Partygate. The former prime minister will likely have to say goodbye to his parliamentary pass.

But Johnson and his allies are refusing to go away without making a fair amount of noise.

Nadine Dorries, Johnson’s best ally, announced she would resign but has since then been saying she’ll do it only once it’s clear why she didn’t get

a peerage.

Sunak already has two difficult by-elections to grapple with in mid-July, so Dorries refusing to let go of her seat only makes things harder for his government.

Jacob Rees-Mogg, another diehard Johnson supporter, also hit at “the Boris haters in the Conservative party” last week. They might be a minority, but the members of Team Boris certainly seem keen to prove a vocal nuisance for Rishi.

Now her career has reached the oddest of apogees. The most fervently loyal of all the Boris Johnson cultists, Dorries had been widely expected to be given a peerage by the departing prime minister, but her name was rejected by the House of Lords Appointments Committee, allegedly because she had not announced her intention to leave the Commons. One can understand her frustration if Johnson had assured her of the nomination, but equally she should know better than to rely on the promises of a proven habitual liar. Most of us, in this rather unlikely scenario, would feel embarrassed and a little exposed. One might direct some resentment towards Johnson, and even towards the prime minister who had, after all, to sign off on the list of honours. But in Dorries’s bizarre mental landscape, she is the victim of betrayal by the establishment and of a conspiracy to keep her out of the House of Lords because of her working-class origins. I will let you read that again. Inevitably, Dorries is the unwitting stooge in this miasma of skulduggery. (That part, at least, is easy to believe.) She claims she was given every reason to think the peerage would be hers, and was told by the government chief whip, Simon Hart (educated at Radley and the Royal Agricultural College;

dangerous “posh boy” vibes), only half an hour before it was published that her name was not on the list. She has form for seeing conspiracies. When she was a member of the Science and Technology Committee in 2007 (she never managed to attend a meeting), it produced a report on abortion law which essentially endorsed the status quo. Dorries, a passionate pro-life campaigner, was unhappy with its conclusions, but particularly concerned by how Ben Goldacre, the academic and science writer, had obtained a piece of evidence submitted to the committee. She demanded an inquiry, insistent that there must be a leak. In fact the evidence had, like almost all evidence to select committees, been published on the committee’s website.

A conspiracy is heart-rending enough. Dorries has said that “This story is about a girl from Liverpool… who had something that was offered to her… removed by two privileged posh boys”. But think of the cost to her! She is “heart-broken”, not, as cynics

might suppose, at the loss of a lifetime place in the legislature and a daily allowance of £323, but “for everyone who comes from a background like mine”. After all, do we really live in a meritocracy if a self-assured but often ignorant political brawler cannot use a seat in cabinet for which she was woefully unqualified to make that last step into the House of Lords? No wonder she feels that Downing Street has “bullied” her.

Few are currently possessed of higher dudgeon than Nadine Dorries. Her reaction to understandable but hardly life-ruining disappointment is cartoonish, almost the stuff of satire, but it is really happening. A mediocre politician who rose improbably high on little more than dewy-eyed devotion to the prime minister has bumped against the ermine ceiling and she is furious. There is, I fear, more to come on this story.

£ Eliot Wilson is co-founder of Pivot Point and a columnist at City A.M.

BEIJING

This

Where would you like to go?”

I asked my beaming but bemused 65 year-old dad as we stood scanning the departures list in Gatwick’s north terminal on a grey November morning. “Somewhere warm?” Was his excited response.

As much as he tried, he couldn’t hide his disappointment when I revealed notoriously rainy Scotland as our destination. It may have seemed insensitive but I couldn’t help but smile back at him: I had in my ammunition the knowledge that we were about to have an exceptional bonding experience together, no matter what the sky had to say about it.

I had organised everything, planned a dream trip for him that was a bucket list adventure for me too, and one on which we could make special memories together. The extent of dad’s travels in the last two decades have been cheap and cheerful holidays to Spain and France, and so this was set to be something else. How long could I keep it from him before he found out what was in store?

The night before we left, mum, who was in on the surprise, helped dad pack his bag. As we were staying somewhere fancy, this meant going through his wardrobe and trying on smart trousers and shirts to see if they still fit since the last time he had worn them was many moons ago. As items went in the bag, his questions had us almost crying with laughter: “do I need sun cream?” Imagining that we were going somewhere exotic, he asked if we’ll be snorkeling and whether he should bring his swim hat. I was laughing so hard I barely managed a response. Dad is very laid back and happily went along with the whole surprise, which made it so much fun for everyone around him, and I made sure to tell everyone in the neighbourhood about our trip so that they could all tease him in the build-up to our departure.

His initial disappointment was quickly forgotten when we arrived at the newlyopened Edinburgh Gleneagles Townhouse, centrally located in St Andrew’s Square. Founded in 1924, the original Gleneagles is one of the most prestigious properties in Scotland. Known as the ‘glorious playground,’ the hotel hosts all manner of country sports, while being home to champion golf courses considered among the best in the world.

For amateaur golfers such as my dad who sees the world’s golfing megastars playing the Gleneagles course on TV, the opportunity to stay and play the course is a bucket list experience indeed.

Last autumn, the Townhouse opened, bringing the cosy countryside vibe of the historical property into the city centre for the first time. The former bank building that houses the hotel took six years to renovate and convert, and is now an exceptional 33-room boutique hotel that’s easily the most significant hotel launch in Edinburgh in recent years.

After a lunch of west coast crab omelette, eaten under the glass domed roof in the hotel’s Spence restaurant, we set off for an afternoon exploring the city, walking up to the castle and wandering around the old town, appreciating the city’s famed architecture. Later that

Crystal Cruises were one of the most iconic cruise companiesthey’ve been acquired by Abercrombie & Kent and now have more spacious rooms. Book summer cruises now at crystalcruises.com/ses now

evening, it was over a drink in the rooftop bar ‘Lamplighters’ that I casually informed dad that we were leaving the hotel and the city the next day.

In the latest guessing game, dad wrongly wondered if we were swapping cities with nearby Glasgow. But I had a better idea: dad is an avid golfer who plays rather badly every Sunday with close friends he has known for decades. It’s a meeting that is often the highlight of their week, so I thought I’d better surprise him with a spot of his favourite sport.

I pulled out his battered golf shoes, hidden in my bag by mum and accomplice, and informed him that we were being driven to the Gleneagles country house after breakfast, and that he would be playing on the famous King golf course in the afternoon. With the big reveal, it is no exaggeration to say that he was so happy, I genuinely thought he was going to cry tears of happiness.

Even I, as a non-golfer, know of the prestige and occasion it is to stay, and play golf at Gleneagles. This was confirmed as we pulled up at the grand entrance of the hotel and a very friendly member of staff in a tartan skirt opened the car door and greeted us with a broad smile and thick Scottish accent.

Dad beamed, and soon after, I took his proud photo at the first tee, dream realised, before watching him walk off into the mist, pulling his golf trolley behind him.

Between mouthfuls of the tuna sashimi starter and large gulps of Barolo wine at the Birnam restaurant that evening, dad bemoaned, “why the hell has your bloody mother packed me thermals?” Laughing mischievously, I replied “she’s worried about you getting cold”. He shook his head at mums moddlycoddling, but his contemptuous expression flipped to delight when I revealed the final surprise for our

last day, and indeed, why mum had packed his thermals.

We’d be going on a guided flyfishing excursion together in the morning. As a child, I used to play in the rock pools while dad netted prawns on the beach where we lived on the east Sussex coast, and I just about remember inspecting the bucket of mackerel he produced when returning from fishing trips. But life, grandkids and golf has taken up his time, and he’s barely fished in two decades, despite it being one of his favourite past times.

The fish didn’t come near our bait, but dad didn’t seem to mind. Rod in hand, stood in a lone, little wooden paddle boat in the middle of the motionless lake, surrounded by the misty hills coloured all shades of autumnal orange, dad was in his happy place, and I breathed in the calming, near whimsical tranquility.

The always dependable anchor in our family, dad deserved this treat. The whole

summer, take your dad (or someone equally special) to Scotland for the ultimate bonding trip, says Justine Gosling

Research from Gay Times magazine revealed that 60% of LGBTQ travellers seek out experiences like Pride events when they travel. This Pride Month, why not book a Pride somewhere gorgeously far-flung? Barcelona’s is 15 July and Amsterdam Pride is 1 - 6 August.

family loved the fun of keeping the surprise, and I delighted in sharing his hobbies with him, while enjoying the luxury surroundings of the two Gleneagles hotels, Scottish countryside and hospitality. Much more than a fun surprise and weekend away, our Gleneagles trip made us reminisce childhood memories, ticked a box on dad’s bucket list, helped us enjoy precious time together, and made dad even more excited to plan for his retirement.

I’m not sure who got more from the weekend, me or him, but we’ll both cherish our time together in Scotland.

Rates at Gleneagles Townhouse start from £350 BB in low season and from £620 BB in high season, based on staying in a House Room https://gleneagles.com/townhouse/

Rates at Gleneagles start from £575 based on two sharing and including breakfast.

WHAT IS IT: Your mission, 007, is for your next holiday to be to one of the iconic James Bond filming locations in Europe. Black Tomato has launched the ultimate trips of a lifetime for James Bond fans, a new range of excursions to destinations famous from the films, and depending on the trip, a stunt person or even star from the films will join you. They are on sale now and locations include Lake Como in Italy.

WHERE? Go for dinner in Paris with a former Bond girl, take a fall with an official James Bond stuntman, drive an Aston Martin like they do in Casino Royale, visit Ice Q in Austria to discuss how Spectre was shot with an special effects advisor and go yachting along the coastline from Monaco with Bond girls from the Roger Moore era. If that’s not enough, ski Austria’s three highest peaks over 3,000 metres, with lift access, all in one day, in the region where The Spy Who Loved Me and The World Is Not Enough were filmed. Black Tomato say: “Together with guidance from EON Productions, we have gained access to incredible brands, remarkable people and rare experiences that anyone from an appreciator of the film and the locations, to a Bond superfan, will relish.”

Ali James, Bond location manager, adds: “This creative collaboration allows us to get travellers into Bond's world and offering truly extraordinary experiences, some of which are only accessible with these trips.”

HOW DOES IT WORK: Trips are designed bespoke, taking in as many of the 007 experiences as you’d like. You can book to

Book one of the James Bond experiences on the Black Tomato website. Visit blacktomato.com/ james-bond for more information and for The Assignment twelveday curated trip, visit blacktomato.com/ james-bond/theassignment

experience the destinations whenever you like throughout the year. There is one way to take in plenty of the activities in one trip, though, with the 12-day ‘The Assignment' experience by Black Tomato, which runs March through to October annually.

THE ASSIGNMENT: Here are a few of our favourite bits from The Assignment twelve-day trip: you’ll speed along the Thames in the same boat used by the Cigar Girl in The World Is Not Enough, and in the company of Ali James, a Bond location manager. You’ll take in a stunt masterclass with Lee Morrison, stunt coordinator on the past five Bond films, before taking the Eurostar to Paris where you’ll visit the Bollinger Estate, typically closed to the public. You can also be joined for dinner by Carole Ashby, who played Dominique in A View To A Kill, when back in Paris that night. Visit the horsetraining centre in the French countryside that featured in A View To A Kill, before arriving in Monaco and experiencing a private yacht charter along the Côte d’Azur as featured in Skyfall. Drop into the casino used in Goldeneye, and even choose to be joined by the gambling consultant from Casino Royale, Andreas Daniel, for advice on how to play your hand. Next you’ll arrive in Lake Como, as featured in Casino Royale, driving yourself in an Aston Martin V8 Vantage. Take a private seaplane over the lake before heading to Venice. Visit the blue tower from Moonraker before visiting iconic filming locations, like where Bond pursued Vesper in Casino Royale. Take a nighttime gondola ride like they did in From Russia With Love, and explore the Venetian lagoon on a private yacht.

ALITTLE over two years after English football shut the door on a host of foreign talent by implementing strict postBrexit rules, it prised it open again when the Home Office approved a relaxation of the regulations.

The biggest change affords clubs more scope to appeal for an exception to be made if a potential signing does not meet the points-based criteria to automatically qualify for the Governing Body Endorsement (GBE) needed.

In theory, it should mean that English clubs do not miss out on exceptional talent – especially emerging stars yet to gain much experience – to their overseas rivals and further strengthen the Premier League’s dominant position in the transfer market.

Former Arsenal and Chelsea player Cesc Fabregas, who moved to England from Spain as a 16-year-old in 2003, has

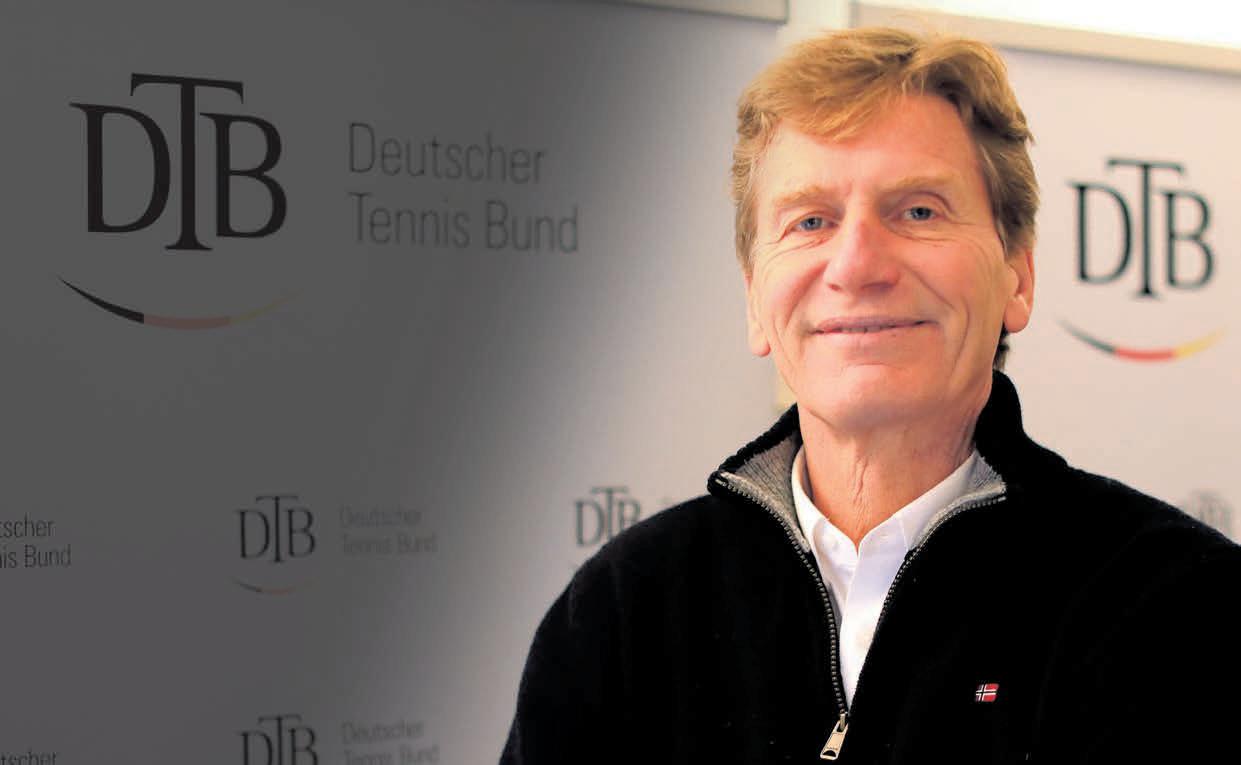

WITH Novak Djokovic still in record-breaking shape, Iga Swiatek underlining her status as one the sport’s new stars and focus turning to the pristine lawns of Wimbledon, it would be easy to assume that all is well with the tennis world.

Scratch beneath the surface, however, and the game faces a number of challenges, from the financial uncertainty threatening the future of the Davis Cup and its women’s equivalent, the Billie Jean King Cup, to the competing agendas of the Grand Slams, elite tours and players.

Some of these issues have caused an existential crisis of sorts at the International Tennis Federation (ITF), where under-fire incumbent David Haggerty faces a contest for the presidency from Germany’s Dietloff von Arnim later this year.

TIME TO DELIVER

“I think tennis needs a wake-up call. Tennis is asleep at the wheel at the moment,” Von Arnim, who has been president of the German Tennis Federation since 2020, told City A.M.

“Tennis is not competing against other racket sports or other sports, tennis is competing against media and I think we have to gain territory. We really must and can do better in this.

“We have had a leader [Haggerty] for eight years – I think that is enough. What he hasn’t delivered in eight years I hope he will deliver in year nine, 10, 11 and 12, but I have some doubts about it.

“I was asked by other federations if I would stand for the change. They see that tennis is working quite well in Germany at the moment. So we think that tennis can work, we see it in certain countries, but from the ITF point of view my strong belief is that we must do better.”

The collapse in recent months of a $3bn, 25-year deal with private investors Kosmos to revamp the Davis Cup has turned up the heat on Haggerty and the ITF, which has been ac-