MARK KLEINMAN THE MAN IN THE KNOW’S MUST-READ SQUARE MILE COLUMN P10

ENGLAND EXPECTS CHRIS TREMLETT’S PREVIEW OF A SPICY ASHES SUMMER P26

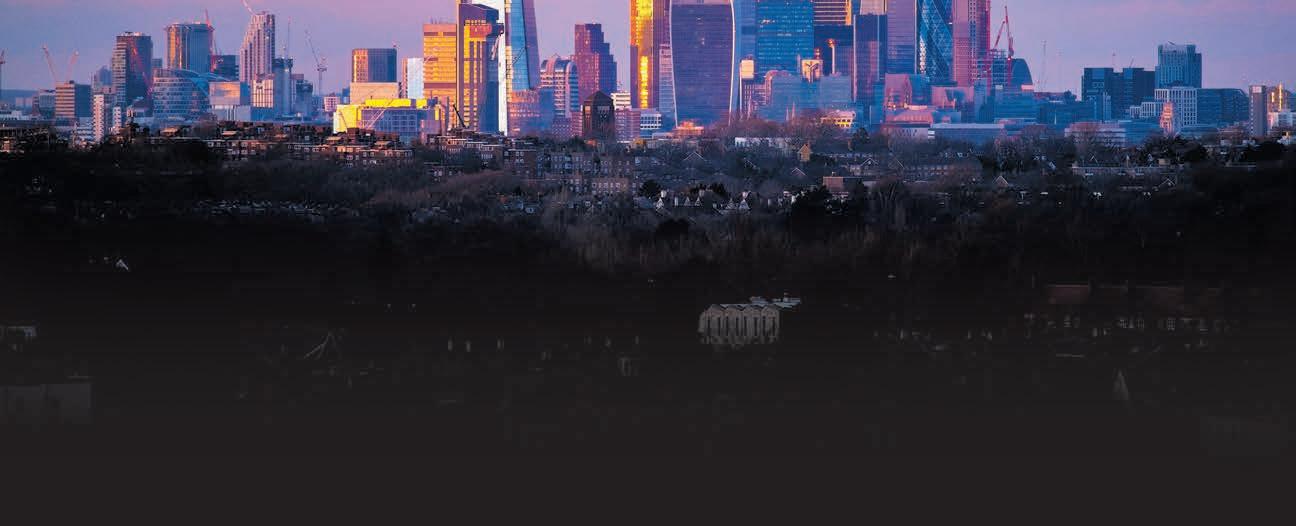

LONDON’s markets were dealt a fresh blow yesterday as WE Soda dramatically ditched its plans for an IPO due to “extreme investor caution” just weeks after first announcing the move.

The Turkish-owned soda ash maker had delivered a boost to the beleaguered London Stock Exchange last week when it revealed what would have been the biggest float in London this year.

However, in a statement yesterday, boss Alasdair Warren said the float had been withdrawn.

“Investors, particularly in the UK, remain extremely cautious about the IPO market and this extreme investor caution in London meant that we were unable to arrive at a valuation that we believe reflects our unique financial and operating characteristics,” he said.

The company planned to raise at least £600m through the IPO for its parent Ciner Group, on an £7m+ valuation.

WE Soda said last week it had already received “considerable” interest from investors.

The initial announcement was hailed as a potential end to the market drought in the capital after a torrid start to the

year. Though some in the City yesterday said the pullout was more about the company than the capital, other analysts said the withdrawal from WE Soda would likely renew fears over London’s appeal for listings.

“This is a fresh blow for London just as confidence in the city as an IPO launch pad appeared to be edging back upwards,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

“Investors are understandably cautious given the nervousness surrounding the UK’s prospects with inflation still running so hot.”

She added that the uncertainty shaking the UK economy is “clearly off-putting” and firms considering IPOs may continue to “set their sights on New York instead”.

London Stock Exchange officials and regulators have been scrambling to revive the appeal of London after the bourse was dealt a series of high-profile snubs, including the move from British chipmaker Arm to float in New York.

The Financial Conduct Authority announced a package of reforms earlier this year to ease the IPO process, while top City figures have been looking to overhaul the “cultural attitude” of the Square Mile to tempt in more listings.

JESS JONESBRITAIN’S competition regulator is set to scrutinise the tie-up of Vodafone and Three, announced yesterday.

The deal will create the largest mobile network in the UK, turning the market effectively into a ‘big three’.

Vodafone boss Margherita Della Valle said the merger is “great for customers, great for the country and great for competition”, but commentators warned last night the Competition and Markets Authority (CMA) was likely to turn a critical eye to the deal.

In 2016, the watchdog made clear their “serious concerns” about the merger between network providers Three and O2, leading the European Commission to block it.

The CMA will soon be on the phone

Pablo Pescatore, a telecoms analyst, said the failure of 2016 has set a precedent and this could be a “hard sale given that both companies have been outperforming the market for the last year or so”.

The firms said they were “levelling the competitive playing field” with EE and O2.

£ CONTINUED ON PAGE 3

THE US Federal Reserve last night held off on firing interest rates higher for the first time in over a year, electing to wait and see what impact prior increases have had on the world’s largest economy.

Chair Jerome Powell (pictured) and

the rest of the Federal Open Market Committee (FOMC) kept borrowing costs unchanged at a range of five per cent and 5.25 per cent.

Fed officials’ decision to take their foot off the brake was charged by stateside inflation falling rapidly from its peak of just over nine per cent to four per cent.

Core inflation remains a concern, which the FOMC said could lure it back into rate rises in the summer if it persists.

“The committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the

committee’s goals,” it said in its latest policy statement.

The US’s rate hold stands in stark contrast to where the Bank of England is tipped to send borrowing costs in the coming months, with markets now expecting UK

interest rates to peak at 5.75 per cent.

UK gross domestic product figures out yesterday from the ONS showed the economy grew 0.2 per cent over the month to April, meaning Britain is still swerving that much-tipped recession.

£ CONTINUED ON P3

THERE is something in the air: a pushback against the charge to net zero, come hell or highwater. Yesterday, Shell said it would ‘stabilise’ its production; Exxon Mobil, separately, said they didn’t think society would bear up to the sacrifices necessary to hit net zero by 2050. Others in government have expressed scepticism about the cost of that process, not least when underdeveloped nations are unlikely to

be in any great hurry to close up the cheap energy production which is a) making them rich and b) powering a vast increase in living standards. We have written many times on these pages that the cost of going green is more significant than

people realise, even in an environmental sense. Indeed, in many ways –as Ed Conway, whose book Material World comes out today, has made clear –hitting net zero targets will require a sizable plundering of the raw materials that many believe should stay firmly in the ground. The amount of copper required in today’s generation of wind turbines is no joke. On the financial side, the hit to household budgets and living

standards could well be dramatic. Net zero by 2050 is, of course, the product of political grandstanding. It’s a noble and worthy aim but it’s fundamentally arbitrary. Far better would be for governments, diplomats and campaigners to mirror the pragmatism we are starting to see from the big energy majors, who have dumped the hairshirt and are now being honest about the fact that –despite their desires to go green –

LONDON’S COMMUTER CANINES Just another Square Mile pup on their way to the office. This one is taking the bus –it might be slower but at least there’s signal...

society wants cheap reliable energy and it wants it now. In the UK, the road to a greener future goes through the energy companies and the City of London. The capital is already a European hub for green finance and will remain in pole position for some time. Governments would be better to set aside the net zero cheerleading and instead look realistically at what the energy mix might be in a few years’ time.

RISHI SUNAK SET TO FACE PROLONGED RUN OF BYELECTION CONTESTS

Rishi Sunak has set in train two perilous by-elections in Tory seats next month but has been left guessing when he will be able to call a third contest in the seat held by former minister Nadine Dorries.

THE GUARDIAN SYNTHETIC HUMAN EMBRYOS CREATED IN GROUNDBREAKING ADVANCE Scientists have created synthetic human embryos using stem cells, in a groundbreaking advance that sidesteps the need for eggs or sperm –and could shine a light on genetic disesase.

THE INDEPENDENT JAILED THERANOS FOUNDER CLAIMS SHE CAN’T AFFORD TO REPAY VICTIMS Jailed Theranos founder Elizabeth Holmes has claimed she is unable to afford restitution payments of $250 per month to victims of her hoax bloodtesting startup.

IN

wake of

abilities, it’s unsurprising Sir Keir Starmer launched into what could have been a brutal takedown of BoJo’s peerage drama. It’s just a shame Starmer’s criticism of the ‘distracting nature’ of the honours row came from the Knight of the Realm himself, giving Sunak the gapingly-obvious opportunity to preen that Sir Keir should “know better”.

In a bid to divert from yet another ride on the Johnson merry-go-round, Sunak attempted the shooting range instead, blasting the Labour leader with criticisms of peer Tom Watson and harking back to

(checks calendar) 2015’s “chaos with Ed Miliband”. That ageing roasted chestnut still delivering a poll lead of (ahem) minus 14 something per cent.

Sadly his aim was amiss and –despite benches on both sides being close to standing room only and the press and public

galleries packed to the rafters –there was a distinct lack of energy, leaving City A.M. wondering if an exhausted Tory cohort is beginning to give up the ghost.

Ducking out of his party’s haunted house, however, Starmer landed a custard pie of his own as Sunak refused to say whether he would “buckle” to Iron Lady-impersonator Liz Truss and deliver gongs to her “Institute for Economic Affairs extremists”. However, with mortgage rates a growing concern – and the public’s ghost train ride of ever-growing interest hikes showing no sign of slowing down – it’s likely we could all be back at the fairground before too long.

SHELL will ditch a plan to gradually reduce oil production over the coming years and choose instead to “stabilise” production until the end of the decade in a bid to focus on the most profitable assets of the business.

The bombshell announcement came in the same market update which revealed a 15 per cent dividend bump-up from the second quarter of this year.

CEO Wael Sawan will also move forward with share buybacks of at least $5bn over the second half of the year.

Shell confirmed it still plans to become a “net zero emissions energy business” by 2050, but a 2021 plan to gradually roll back production of oil appears to have gone by the wayside.

The firm will, however, invest $10 to $15bn (£7.88bn to £11.82bn) over the next two years to support the development of low-carbon energy including biofuels, hydrogen and carbon capture and storage.

The move will anger

PHILIP Schofield’s affair with a young colleague wasn’t appropriate but ITV had no evidence of it, chief exec Dame Carolyn McCall told MPs yesterday. She was. answering questions from MPs about Schofield’s exit.

CONTINUED FROM P1

The GDP figures join a string of recent data showing the UK economy is holding up well in response to 12 successive interest rate increases, which has raised concerns about inflation hanging around.

drop from March’s 10.1 per cent increase expected by the Bank and the City.

Numbers earlier this week revealed wages are growing at their quickest pace on record –outside of the Covid19 pandemic.

would mean a further five rate increases this year at least.

Speaking to Sky News yesterday, Chancellor Jeremy Hunt said the Bank has “no alternative” but to keep raising borrowing costs to curb price increases.

green-focused politicians.

Shell has been bruised and battered by the windfall tax, brought in on oil and gas firms which operate in the North Sea.

Though only around five per cent of its revenues come from the UK, it expects to pay more than £400m additional tax to the Treasury this year.

The firm is also expected to be affected by the slide in oil prices.

OPEC members are keeping supply limited, but it is doing little to boost the price of a barrel, which now sits around $70 to $80.

Last week, Shell confirmed it has decided to exit its home retail energy businesses in the UK, Germany and the Netherlands due to their poor Shell launched a strategic review of its European retail businesses in January, citing “tough market conditions”, shortly after Sawan took office as chief executive at the beginning of the

Prices in the UK rose 8.7 per cent over the year to April, a smaller

CONTINUED FROM PAGE 1

Head of financial analysis at AJ Bell

Danni Hewson said the increase in consumers will lessen competition even if the service is improved and the CMA will take into account “such dominance down the line”.

“The i’s have been dotted and the t’s crossed. But the devil is always in the detail, and the CMA will be interrogating every word, especially those in small print,” Hewson said.

In addition to the potentially increased competition, the CMA will also consider the combined firm’s investment into 5G infrastructure, said Olexandr Kyrychenko, partner at IMD Corporate, giving reason for some optimism.

Hargreaves Lansdown equity analyst Matt Britzman also believes hope could exist “given how challenging and expensive the 5G rollout is” and the merged firm’s plan to invest £11bn in expanding 5G.

Those figures have pushed financial market expectations of peak UK interest rates to just under six per cent from 5.5 per cent last week. That

Meanwhile, European Central Bank officials are expected to conclude their rate hike cycle today with a final 25 basis point increase to 3.5 per cent.

EEK Schofield’s affair ‘deeply inappropriate’ but we had no evidence, ITV boss tells MPs

BRITISH do-it-yourself investors are pouring back into technology funds in a bid to cash in on a tech-fuelled market rally in the US and Asia. Stateside markets have rallied hard on the back of a surge in tech stocks in recent months as investor confidence turns back to so-called growth firms after a torrid performance last year. The tech-heavy Nasdaq 100 is trading up nearly 27 per cent over the past six months, pushed higher by the

sudden boom in interest in artificial intelligence and a surge in value for firms like chipmaker Nvidia, which topped a $1trn valuation in May.

Analysts at Hargreaves Lansdown said the market boost has seen British retail investors on its platform pour back into tech funds this year.

“In the US in particular, the tech top performers have posted spectacular gains – Facebook parent company Meta, electric vehicle behemoth Tesla and global artificial intelligent firm Nvidia,” said Emma

GUY TAYLOR

THE UK TRAVEL sector has called on the government to address difficulties in employing British staff in EU holiday destinations, due to post-Brexit red tape and rising hiring costs.

Trade association Abta’s report found the number of UK workers in holiday roles in the EU has dipped 69 per cent from 11,970 to 3,700 between 2017 and 2023.

The cost of employing tour guides, chalet hosts and other roles has risen dramatically. In France, it now costs £880 more to hire each UK seasonal worker, the report found.

Overall, 61 per cent of UK travel companies said problems recruiting could reduce growth over the next five years, a concern that ranked higher than the effect of the cost of living crisis.

The findings will fuel growing calls among industry leaders to sort out post-Brexit regulations and restrictions, which have hit the travel industry hard.

Abta’s chief executive Mark Tanzer said: “It can’t be emphasised enough just how fundamental being able to work abroad is for the UK travel industry. Yet there are simple and sensible

solutions to overcome these barriers, and I’d urge ministers to make this a priority and take action urgently.”

Tanzer said: “A mutual mobility scheme needs to be put in place for young people starting in the industry – for Europeans wishing to work here temporarily and [vice versa].”

Aviation minister Baroness Vere, who spoke at the same event, responded to questions on the report by stating “it’s a Home Office decision”, but later added that her collaboration with border force on the issue was positive.

The UK’s outbound travel segment currently supports more than 840,000 jobs in the UK and contributes over £49bn a year in gross value added to the economy.

The sector is calling for a range of new policies, including additions to the current UK-EU Trade and Cooperation Agreement, which they argue places stringent limits on the length of time overseas workers can stay abroad.

Given the €40bn contribution UK tourism makes to the EU each year, “it is in both the UK and EU’s interest to provide a policy framework that enables travel and tourism between the UK and EU to thrive,” the report said.

Wall, head of investment analysis and research at Hargreaves Lansdown.

Some of the most bought funds on the platform in recent weeks are techheavy Baillie Gifford American and Legal & General US Index, plus Legal & General Global Technology Index and Liontrust Global Technology.

Hargreaves Lansdown’s most-bought investment trusts had a similar tech tilt being the Allianz Technology Trust and Polar Capital Technology Trust. Elsewhere, Japanese funds have also proved a hit.

TOYOTA BOSS WINS VOTE

Toyota’s chair and former president Akio Toyoda survived a shareholder challenge on governance and climate policy yesterday, sending shares in the automaker up 6.3 per cent. It follows Toyota’s unveiling of a new electric strategy on Monday, which also nudged up shares. The outcome of the vote follows months of turbulence for the company, which had seen US proxy advisers Glass Lewis urge shareholders to vote against Toyoda –while concerns were also raised over the company’s environmental position and EV transition.

E.ON HIT WITH £5M FINE

GUY TAYLOR

AIRBUS has upped its 20-year forecast for the number of new aircraft it expects to deliver, estimating a total of 40,850 by 2042, up from 39,490 last year amid rising demand for fuelefficient jets.

The aircraft manufacturer’s forecast assumes a 3.6 per cent uptick in traffic growth over the period.

Airbus said the strongest growth would be seen in Asian markets, with aviation’s “centre of gravity” shifting towards the far east.

Post-pandemic growth in demand for aircrafts has so far been led by Asian markets.

The revised forecast also comes as airlines rush to replace their fleets with greener, fuel-efficient planes in a bid to gain competitiveness amid a period of pent-up demand.

“More and more people are flying for the first time than ever before, while emissions per revenue passenger kilometre have halved through technology and operational improvements over the last 30 years,” the group said yesterday.

Power supplier E.On Next has been ordered to pay £5m in compensation to more than 500,000 customers for “unacceptable” call services. Customers were forced to wait on hold for 18 minutes on average, while half of all calls were dropped, according to Ofgem. The regulator said E.On Next will pay £4m to more than 500,000 customers who were potentially affected, working out at £8 each. An E.On spokesman said the firm had already begun improving its services before the Ofgem review.

POUND HITS YEAR-HIGH

Pound sterling yesterday climbed to its highest level against the US dollar in over a year, driven upwards by investors betting that the Bank of England will surpass the Federal Reserve in its interest rate rise cycle to bring down inflation. Britain’s currency jumped around 0.7 per cent today to nearly $1.27, taking it to its strongest level against the greenback since April 2022. Sterling’s ascent has been fuelled by markets betting on the UK having to keep hiking interest rates to tame a tough inflation problem.

TSB BANK has called on Meta to make urgent interventions to protect consumers from spiralling levels of fraud with customers at risk of losing hundreds of millions of pounds. According to current industry projections, consumers could lose up to £250m from Meta platforms in 2023 if no action is taken.

TSB data showed fraud instigated through content on Meta accounts for 80 per cent of fraud cases within TSB’s three biggest fraud categories.

TSB chief executive Robin Bulloch outlined a range of measures Meta should take to clamp down on fraud.

He said the firm should introduce a secure payment mechanism for Facebook Marketplace; stop unregulated firms advertising on

Facebook and Instagram; and issue a clear commitment to investigate and remove potentially fraudulent content within 24 hours.

Meta says it already has systems in place to block scams and noted advertisers had to be authorised by the Financial Conduct Authority to appear on their sites.

A spokesman for Meta said: “This is an industry-wide issue.”

LAURA MCGUIRE

SHAFTESBURY yesterday delivered a confident update to the markets as a return to international tourism and its £4.9bn merger with Capco helped boost activity in London’s West End.

The two West End landlords merged last March, meaning Shaftesbury and Capco now operate under one ownership.

In an update ahead of its AGM today, the property owner reported strong trading across its retail and hospitality portfolio as customers returned to the West End, with sales in aggregate 13 per cent above 2019 on a like-for-like basis.

Footfall improved, with Shaftesbury crediting a return to international tourism, a post-pandemic lift and the coronation. The group said it predicts the boost to

“continue through the summer” as warm weather draws in shoppers.

New restaurant openings in China Town and Kingly Court in Carnaby Street also attracted new customers.

As workers return to the office, the group said demand for offices “remains healthy”, with its office scheme at 36 Carnaby Street now fully pre-let or under offer, representing £0.9m of income. Chief executive Ian Hawksworth said: “Against a backdrop of macroeconomic uncertainty, demand for space in our West End locations continues to be strong across all uses, with 173 leasing transactions completing in the first five months of the year, at rents on average six per cent ahead of December 2022

ERV providing confidence for rental growth prospects.”

BETTING ON EUROPE Ladbrokes owner Entain set to raise £600m to fund its takeover of Poland’s largest bookie

A GROUP of MPs yesterday called for the Financial Conduct Authority (FCA) to reveal the depths of its previous probes into Crispin Odey (pictured) as the scandal surrounding the financier deepens this week.

Odey was accused of sexual misconduct by 13 women last week as part of an investigation by the Financial Times. He denies the allegations.

The chief of the influential Treasury Select Committee of MPs, Harriet Baldwin, has now written to FCA chief Nikhil Rathi demanding details of the “nature and intensity” of its “supervision and engagement with Odey Asset Management (OAM) over the last five years”.

“The FT paints a deeply negative picture of one powerful individual’s conduct regarding those two committee priorities and is potentially damaging to the reputation

of the entire sector,” Baldwin wrote to Rathi.

The FCA was reported to have been privately investigating the firm prior to the FT’s report and was reportedly given a report of Odey’s conduct in early 2021 after the firm took disciplinary action against him.

Baldwin asked the regulator to confirm whether it had received that information and what action it had taken in response.

The FCA has been set a deadline of Wednesday 5 July to respond to the questions from Baldwin. Top executives at the FCA are also set to be grilled by the Treasury Committee in person next month over their role in investigating OAM.

A spokesperson for the FCA said: “We understand the committee’s interest in this and we’ll of course reply shortly.”

CHRIS DORRELL

LAWMAKERS yesterday agreed the digital pound, or ‘Britcoin’, should not be introduced without proper parliamentary scrutiny.

Speaking in the House of Lords, Lord Forsyth said the notion that the Treasury and Bank of England could introduce the digital pound “without having proper parliamentary

CHRIS DORRELL

HSBC HAS agreed new terms for the sale of its French retail division to Cerberus-backed My Money Group, paving the way for the delayed sale to be completed early next year. Under the new terms of the deal, Cerberus will invest €225m (£192.5m) into the business while HSBC will retain a €7.0bn portfolio of loans which were originally going to be transferred.

The bank said it will take a €100m hit from the costs of retaining the loans. It may sell this portfolio at a later date.

HSBC will also invest up to €407m in My Money’s holding company in exchange for a profit participation interest of 1.25 the amount it ends up investing.

The transaction is expected to lead to a pretax loss on sale of up to $2.7bn for HSBC, up from $2.3bn when the deal was first announced. This will be recognised in the second half of this year.

HSBC has been withdrawing from underperforming markets around the world in recent months, including Canada and Greece. It is aiming to pivot to Asia, where it makes the majority of its money.

scrutiny… is utterly ridiculous.”

The Bank of England and Treasury are currently consulting on the introduction of a digital pound.

Britcoin is a digital form of cash which will be created by the Bank of England. The Bank suggests it is “likely to be needed in future” as digital payments become more important.

Forsyth argued a digital pound would have an impact on a range of

different issues, including financial stability and civil liberties.

Chancellor Jeremy Hunt has provided a written commitment to holding a vote on its introduction but this has not been put into law.

Lord Bridges saidthe written commitment was a “step forward” but said he would “much prefer” it to be on the bill adding: “Who knows which government will be around”.

GLOBAL recruitment agency Robert Walters shares nosedived yesterday as the staffing firm warned that its profits for the year would be “significantly” lower than previously anticipated.

Shares in the London-listed recruiter plunged to close down 12 per cent after the group posted a 10 per cent fall in net fee income rates.

Employers taking longer to make hiring decisions on potential candidates and reduced levels of “candidate confidence”, first flagged by Robert Walters in 2022, were blamed for the impact on trading.

“Recruitment market fundamentals such as job flow, candidate shortages and wage inflation remain solid, suggesting that when market confidence recovers there will likely be a return to meaningful growth,” the firm said.

The group also said it will look to take “appropriate cost reduction” to ease the short-term pressure.

The eponymous company has also recently waved goodbye to its longstanding chief and founder Robert Walters.

Last year the group racked in £1.1bn

in revenues as it was aided by a competitive market post-pandemic, especially in the tech sector.

However, in January it first issued a profit warning that its full year profits would be below prior expectations.

Economic uncertainty has impacted the jobs markets and has made employers more cautious about hiring.

Employees’ work attitudes have also altered post-pandemic with many candidates now looking for more flexibility and hybrid working.

“Businesses are watching their pennies in the current environment, and there has been a growing trend, particularly in the tech and telecoms space, to cut jobs to try to become leaner entities, particularly after circa 18 months of intense cost pressures,” Russ Mould, investment director at AJ Bell said.

“In this scenario workers are likely to stay put rather than look for a new job, for fear they might join somewhere new and become the ‘last in, first out’ candidate if cutbacks are made later on.

“That’s bad for recruitment agencies because they thrive when there is a high turnover of people moving jobs,” Mould added.

Warhammer-maker Games Workshop yesterday said it is expecting to post a boost in profits for the year as it feels the lift of a blockbuster deal with Amazon signed in December.

The figurines firm said its core revenue would come in at not less than £440m, up from £387m last year, while pretax profits were expected to jump to £170m from £157m last year.

The boost comes after a tricky update in January when the firm posted record sales but missed its targets.

The firm signed a lucrative licensing deal with Amazon in December, which will see its Warhammer figures cast on screen.

Philip Day’s Edinburgh Woollen Mill Group empire is understood to still owe money to unsecured creditors following its collapse almost three years ago. The cluster of retail assets, which included Jaeger, Peacocks, Bonmarche, and Edinburgh Woollen Mill, fell into administration in 2020 but administrator reports for the brands now show that £167m owed to unsecured creditors has not been paid following the businesses collapse, according to reports in The Times. Documents seen by the outlet show each of the parties are due to receive dividends worth up to £600,000 (£1.8m in total).

The maker of Pyrex and Instant Pot has filed for Chapter 11 bankruptcy as dwindling sales and high inflation have battered the business.

Instant Brands, which is US owned, is said to have much as $1bn (£790m) in liabilities.

Instant Brand, which trades in John Lewis and Argos, was impacted by a slowdown in spending post-pandemic as the public now have less disposable income to splurge on home appliances. Its 2,400 employees have not been impacted by the move.

To further help business operations has also secured $132.5m (£104.8m) in financing from its existing lenders.

SHREYAA NARAYANAN

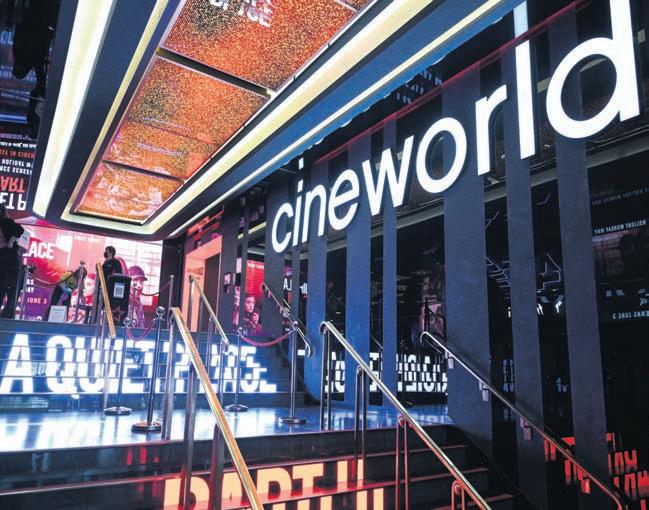

BRITISH cinema chain operator

Cineworld is preparing to file for administration as a part of a financial restructuring plan, as first reported by Sky News yesterday.

The company is lining up Alix Partners to act as administrator to help with the transfer of ownership to its lenders, with an announcement expected to be made by the end of next week, a source told the outlet.

Cineworld declined to comment to a Reuters request, while Alix Partners could not be immediately reached.

The insolvency process for the holding company will not impact Cineworld's operations, Sky News added.

In May, Cineworld said it expected to emerge from Chapter 11 bankruptcy protection in July, adding that its proposed debt restructuring had the backing of most of its lenders.The company had filed for US bankruptcy protection in September.

sides is promising. The polarisation has largely disappeared, he says, and when “you speak to Keir and you speak to current government” and you can’t work out “which way around” they are.

Khosla, it’s important to note, has not always been so impartial. He rarely appears in certain sections of the press without the prefix ‘Tory donor’. Donating is something he says he won’t be considering again.

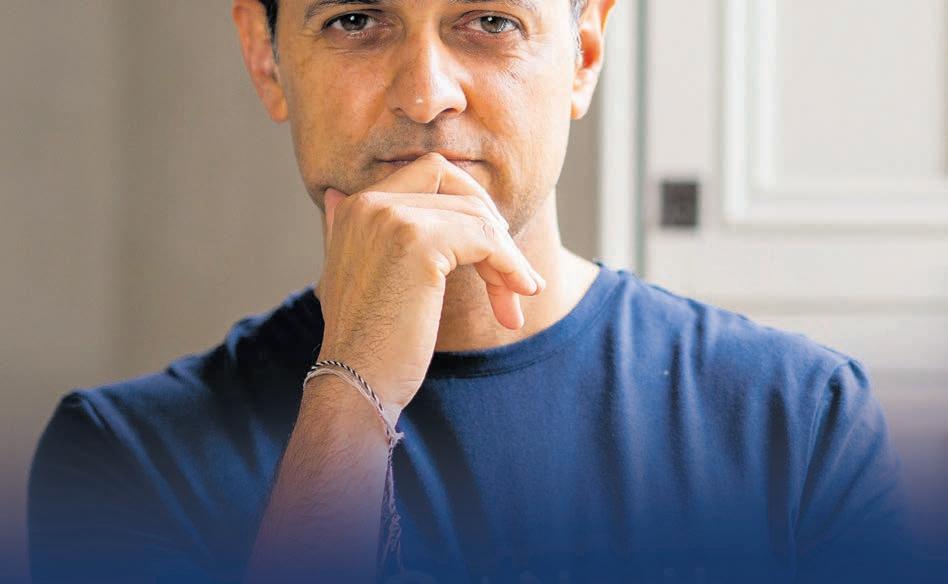

RISHI Khosla is leaning off the side of a treadmill desk in an Oaknorth branded t-shirt, deep in conversation with cofounder Joel Perlman. He steps down and walks into a corner office at the firm’s glass-walled HQ, where an assistant brings in a stone bowl of frothy luminous green liquid. He pours it into a separate stone cup.

The scene, it’s fair to say, is straight out of tech founder central casting –one you might expect to see among the upper echelons of Silicon Valley rather than Soho.

But for the Oaknorth chief, that expectation is a large part of the problem. Khosla is among a class of founders at the vanguard of the UK fintech scene that, he feels, have failed to achieve celebration and recognition like their peers over the pond.

“If you ask the common person on the street today, who are the top British entrepreneurs, you’ll probably get Branson and Dyson –both guys who I admire,” he tells City A.M. in an interview. “But what about all the guys who have been building businesses in the last 10, 20 years? Right? I mean, no one probably knows their names.”

For Khosla, that lack of entrepreneurial cut-through points to a faultline in the British business psyche, one which he has taken on as something of a cause celebre.

Speaking at London Tech Week this week, he railed against the cultural challenges choking off growth in the UK’s entrepreneurial landscape. Dominating them were access to talent and a British aversion to success.

“Success is not celebrated in the business world here. If you’re successful, what people do is hide away,” he says.

This annoyance has been slow burning for Khosla. Business lender Oaknorth is his and Perlman’s second venture after they set up analytics firm Copal Partners in 2002, growing the firm to 3,000 people before selling up to US credit rating agency Moody’s in 2014. The pair landed upon the idea for Oaknorth after being “kicked out” of two commercial banks while on the hunt for a line of credit at their previous firm. That experience underscored what Khosla calls a “missing middle” in banking, one where companies at the so-called scale-up stage are poorly served by the offer from both the big commercial banks and the smaller specialised new crop of lenders.

The approach has clearly tapped into a need. Founded in 2015, Oaknorth has dished out £8.5bn loans since its inception, and by its own analysis helped create some 38,000 jobs in the process.

In its latest funding round in 2019 it fetched a valuation of $2.8bn (£2.2bn) and managed to shrug off turbulence last year to post pre-tax profits of £152.3m last year.

But that growth, in Khosla’s view, has come largely in spite of the landscape around him rather than because of it. Khosla has led Oaknorth through a period of change in which its target small business market has been shaken by the tectonic shifts of a

“Do you know why? Because the media keep on putting the fact that I gave some money to a political party. Like it’s a tagline!”

Despite his new-found impartiality, Oaknorth has found itself in close proximity to the big political machinations of UK tech this year. Khosla launched a bid to buy the collapsed UK arm of Silicon Valley Bank in March as the government negotiated a shotgun sale of the firm, which ultimately went to HSBC. HSBC this week rebranded the firm as ‘HSBC Innovation Banking’ to much political fanfare and a personal celebration from the Prime Minster and Chancellor.

But while HSBC provided “full stability” to the market and he “fully understands” why they were the ultimate buyer, Khosla still maintains it was a mistake.

“When I look at it from the... perspective of fuelling the entrepreneurial environment in the UK, supporting growth companies, making the UK an innovation economy, supporting the

design, we just didn’t build a [loan] book which had that exposure.”

Political tumult and the rhetoric of the Tory party have similarly damaged the once shiny appeal of the UK for fintech firms and talent, he argues, and Oaknorth is struggling to attract the staff to grow the company.

blow as both political parties mount efforts to reinvigorate the appeal of the country’s tech sector. Rishi Sunak, Jeremy Hunt and Keir Starmer have all taken to the stage at London Tech Week this week to mount their pitch to revive some of its lustre.

Khosla reckons the pitch from both

financing of those companies, I think it is absolutely the wrong decision,” he

In Khosla’s view, the move is the latest in a number of policy missteps and failed manoeuvres which are struggling to revive the UK’s appeal.

Ministers and stock exchange officials have been on a multi-year charm offensive to woo tech firms to the market, with a slew of reviews launched to try and make it a more welcoming home for growth firms.

Oaknorth’s listing would be a prized fruit of that labour, but he is blunt in his assessment of the progress made.

“Would we be open to listing in London? Of course, but show me a market which works, right? We need growth investors in this market to support growth companies.”

Khosla’s complaint points to the wider efforts to reset the cultural narrative and appeal of the UK. The issue for Khosla is one of trying to knock down success. Fix that, and the rest will come.

“If [someone] creates a few £100m of value, and they get paid £10m a year, let’s celebrate it,” he says.

“Let’s make another 100 people think that they can be one of those people who gets paid £10m a year and strive for that.

“That's how we'll drive innovation. That’s how we'll drive hunger in people.”

Rishi Khosla has built a successful fintech lender. Now he wants others to follow.Charlie Conchie interviews the biggest movers and shakers in tech, fintech and financial services

We need growth investors to support growth companies

WHY THE UK IS LOSING ITS LUSTRE

Success is not celebrated here. If you’re successful, you hide away

It can lead you astray,” says Rupert Moore with a chuckle as we discuss Japan’s variety of fried food options.

It’s a country he knows well - Moore, now UK CEO of Reinsurance Solutions for global professional services giant Aon, worked out there for the firm for 10 years.

And it’s to Japan he goes when I ask him about a piece of work he’s particularly proud of.

“The earthquake and tsunami in Japan in 2011 left huge devastation, and we represented a lot of the large mutual insurers and a number of large companies,” he tells me.

“There was one particular mutual that had seen their whole coastline of properties destroyed, but the majority of the losses were insured and when we went up there a few years afterwards the local team were hugely emotional, telling us about the damage to the community and how the insurance and reinsurance industries had enabled them to rebuild.

“There are countless examples across the world of this type of situation, but

that was just one that makes you feel pretty good about what you do - something to touch and feel; a tangible thing.”

Indeed insurance, at its heart, provides exactly that - help and support in tough times. But in London it’s more than that, with the insurance and reinsurance markets supporting and enabling global commerce. Simply put, without insurance, not a lot of business gets done - by de-risking investments, the industry provides the certainty for firms to get on and grow.

London remains its global centre, with Aon’s offices a stone’s throw from Leadenhall Market and the Lloyd’s building a key, beating heart of the industry. Moore is a ‘lifer’ - joining Aon as a graduate some 23 years ago. He’s spent 14 years abroad - Japan, Hong Kong, and three years in the US - and now back in London, he’s well-placed to opine on the changes to the industry over more than two decades, both in terms of the work and those working in the sector.

“I think probably the biggest change is how important analytics is,” he says. Over decades, Aon has increasingly invested in highly sophisticated data models and academic collaborations in order to assess its clients’ exposures, or the likelihood of a particular event occurring, and enable better decisionmaking. That’s become especially relevant in recent years when it comes to catastrophe insurance, with so-called severe weather events increasing in regularity.

“It’s true insight into everything from hurricanes to earthquakes - and what’s changed is how much time and effort and investment we put into those,” says Moore.

“When I first joined there wasn’t really a great deal of analytics technology in London, and now it’s front and centre.”

In that sense, it’s a sign of how much more sophisticated the industry has become - and the new skills the biggest players require.

“Different skill sets have become essential as the industry has become more technical and analytical,” he continues.

“We now need not only people who can transact business, but those who can create specialist tools such as financial and catastrophe models; the industry now draws upon a wide range of diverse skills.

“There’s also a huge demographic change taking place, with a lot of people retiring or about to retire - which to me looks like a tremendous opportunity for career-minded young talent.

“The grad scheme I joined more than 20 years ago had about 14 or 16 of us. Now we hire about 50 school leavers and graduates just for reinsurance, and about 250 across UK insurance.”

Those new starters, Moore reckons, will benefit from a sector which has always been collaborative. Career veterans are keen to pass on their knowledge to those who join the insurance and reinsurance industrieswhich Moore says are the “best kept secret” in the Square Mile.

“It’s a fantastic opportunity,” he says.

Certainly, it appears the old stereotypes of insurance are out of date in an industry that has become a sophisticated, multi-faceted London success story.

Aon’s Rupert Moore tells City A.M. why a career in the insurance industry is a rewarding opportunity

Different skills set have become essential as the industry has become more technical and analytical

DON’T DO as I do, do as I say. That appears to be a fitting mantra for the Institute of Chartered Accountants in England and Wales (ICAEW), which loves to virtue signal about the importance of effective corporate governance among its members.

Examples abound of backslapping and self-congratulation from the body. As an example, how about this corker from 2018, in response to a government consultation on executive pay?

“Boards need to put themselves in a position where they can be confident, open and fearless in publicly explaining who gets paid what and why,” it said.

“Individual board directors must feel able to deliver a public explanation regardless of whether or not an explanation is actually requested or required, or whether they are the chosen spokesperson.”

It’s only natural, then, that faced with an enquiry about why Michael Izza, its retiring chief executive, is to receive a six-figure payment when he leaves at the end of this year, its approach was to obfuscate and evade.

The idea that he would get a sum roughly

equal to twice his £492,000 basic salary was met with derision. Eventually, an insider suggested the actual amount was more like £250,000; yet the ICAEW refused to quantify it precisely, saying that we would have to wait until the publication of next year's annual report to find out.

The “terms of his departure are in

Anyone for an Eton mess? It was intriguing to read in the Daily Mail that the final round of interviews for the Provost of arguably the world’s most famous school was due to take place this week.

According to the newspaper, the two “key figures” on the shortlist are Sir Nicholas Coleridge, the former Conde Nast boss, and

compliance with his contract of employment,” was all it would say officially. Why Izza’s contract states that he should get a six-figure windfall purely for retiring is a mystery. It sounds highly inappropriate from a governance perspective.

The ICAEW has been at the centre of a long-running row about its retention of fines

general Sir Nicholas Carter, former chief of the defence staff. But I understand another name has also been in the mix: Dame Helena Morrissey, former boss of Newton Investment Management and former chair of AJ Bell, the retail investment platform. Morrissey, who couldn’t be reached for comment, has famously juggled her City career

imposed on the audit industry.

Asked last year whether a £13.5m penalty imposed on KPMG over its botched audit of Silentnight, the beds retailer, should instead be repatriated to the pensioners who lost out financially from its collapse, Izza is reported to have said that it wasn’t the role of the Accountancy Scheme to compensate them.

Instead, he has presided over an accumulation of fines from miscreants which has generated reserves totalling well in excess of £100m.

These funds, the body has said in the past, are used to aid its purpose of “serving the public good”. That’s not nearly transparent enough.

Virtue-signalling trade associations are, as the CBI has so vividly demonstrated, rightly being subjected to greater scrutiny.

In the case of the ICAEW, which also has a regulatory role, that’s even more crucial. The body is on the brink of a governance shake-up, having announced that it would appoint an independent chair for the first time.

The secrecy surrounding Izza’s payoff suggests that move is overdue.

with an all-consuming family life –understandably, given that she has raised nine children with husband Richard.

At £46,296-a-year, the annual bill for all of those offspring were they to have attended Eton simultaneously would have been close to £420,000. The arch-Brexiter and recent critic of the CBI is surely a formidable candidate to beat.

Anyone but Boris: that probably sums up what

Rishi Sunak is thinking in relation to most things after the events of the last week, but nowhere would it be more applicable than the future ownership of The Daily Telegraph.

No sooner had Lloyds Banking Group seized control of the presses from the Barclay family than the former PM was being linked with a bid for control of the Tory-supporting newspapers.

Johnson, awash with cash from speaking engagements and with a surfeit of time on his hands after the resignation of his Commons seat, might well fancy using the Telegraph as a Sunakbashing vehicle in the run-up to next year’s general election –and then ride to Britain’s political rescue in its aftermath.

That idea looks rather more fanciful than Lloyds’s hopes of drawing a £600m price tag for the papers, though. The business has seen a commercial revival only partly driven by cost cutting

in recent years, and profits for the latest financial year are expected to show a significant uplift, according to reports. While some may scoff at the idea of newspapers still being regarded as trophy assets, the line-up of prospective suitors is certain to be long and prestigious. My money is on them ending up in the embrace of a proprietor new to the industry in Britain, and not being folded into the empires of either Rupert Murdoch or Lord Rothermere.

JESSICA FRANK-KEYES

POLICE are set to get controversial new powers to stop groups like Just Stop Oil holding ‘slow walking’ protests. Government measures to make it easier to tackle disruptive protests have been approved, after a bid by the Greens in the House of Lords to kill off the law was defeated by 154 to 68.

Police will have the ability to intervene –when eco-protestors, such as Extinction Rebellion and Insulate Britain, block roads –beefed up.

“The public are sick of Just Stop Oil’s planned programme of deliberate disruptions to daily lives,” policing minister Chris Philp wrote on Twitter.

The statutory instrument, which came into effect at midnight, is part of

a bid to bring in the rules via so-called secondary legislation, after a prior attempt to introduce the changes under the Public Order Bill failed. A Just Stop Oil spokesperson said: “These laws now make protest illegal if police deem it causes anything other than ‘minor inconvenience’. Ask yourself, what protest has ever fitted neatly into a working day?”

Eton ponders

‘supermum’ Morrissey as school’s new Provost

THE TORIES appear to have done a real botch-job of selecting their candidate for next year’s mayoral election. Most who were paying attention expected the final three or four to be a combination of Paul Scully, the minister for London and Sutton MP, social media star and former adviser Samuel Kasumu, techie and diplomat Daniel Korski and perhaps one of the party’s representatives in the GLA. As it is, neither Scully nor Kasumu made the final cut, a decision made by an interview panel. With no disrespect to those candidates who did make it –Korski, Susan Hall and the barrister Mozammel Hossain –it seems like a missed opportunity.

Kasumu offered new ideas –with a particular focus on housing which rode against his party’s increasingly Nimbyish tendencies. Scully has experience as a minister and knows the incumbent mayor Sadiq Khan well. It seems strange that two strong candidates who had already secured endorsements were not given a pass into the next stage of the

battle to take on the Labour candidate in a year’s time. It furthers the impression that London is suffering from a democratic deficit. At the practical level, the mayoralty and the GLA still lack the powers they need to govern the capital –particularly on tax and spend. That flows through to an apathy in the capital about both the top job and those who hold the mayor to account. It is high time that changed; London remains almost unique amongst global cities in being largely governed by central rather than local government, an issue which of course comes into starker light when the government of the day seems uninterested in the capital’s success.

Of the candidates, Hall has shown herself to be a thorn in the side of the mayor over many year. Little is known of Hossain’s positions. Korski, however, has made a real push in recent weeks and his fundamentally optimistic view of what a looking-to-the-future London does have some appeal. He looks the favourite to wear the blue rosette for now.

When I started in business journalism, I found the easiest way to understand the City’s businesses was through the prism of sport. Take one example –when results aren’t going well on the pitch, even the most well-meaning club chairman is likely to give in to fans’ demands for the manager’s head. Ask the recently departed Nick Read (Vodafone) and Alan Jope (Unilever) if that story

Only an hour or so down the M4 lies Heckfield Place, a stunning country hotel not too far from Reading. It’s a delightful place with a Wind in the Willows feel, but the star of the show might be Hearth, an open-fire restaurant overseen by Skye Gyngell of Spring fame. We drove down at the weekend and the food is remarkable, with a host of small plates to start in which impossibly fresh vegetables drawn from the onsite farm take centre stage, tasting every bit like the first day of summer. Bigger dishes were just as good: a pancetta-wrapped saddle of rabbit was cooked perfectly, and the grilled lobster with curry leaves and quite extraordinary smoked tomatoes comes with our hearty recommendation. A strawberry fraisier for dessert was equally memorable. Guests staying at the hotel have the luxury of an afternoon swim in the lake on the grounds, but even for those not staying the night, Hearth –and its glorious terrace –is well worth the journey.

sounds familiar after their own brushes with activist investors. Occasionally, the worlds collide. Fans of Oakland Athletics on Tuesday held a ‘reverse boycott’ of the team’s baseball game against Tampa, turning up en masse to demand the owner sells the team rather than move it to Vegas. Will 30,000 fans holding ‘sell’ shirts force the owner’s hand? Personally, as a former regular in the Oakland bleachers, one hopes so.

Ashes?

The one-word text message that England captain Ben Stokes sent to retired spinner Moeen Ali, asking him to come back for one more Test series. Stokes is already a case study in leadership. Let’s hope he adds to his legend this summer.

GUY TAYLOR

FLYING air taxis will take to the skies in San Francisco as part of a collaboration between United Airlines and producer Eve Air Mobility, it was announced yesterday.

The partnership will see Eve’s electrical vertical takeoff and landing aircrafts (eVTOL’s) carry commuters to work in helicopterlike drones.

“Urban Air Mobility has the potential to revolutionise how United customers work, live, and travel,” Michael Leskinen, president of United Airlines, said.

“Eve’s proposed route is a critical first step towards making this allelectric and quiet commute a reality for Bay Area residents.”

The announcement follows a $15m (£11.86m) investment from the Chicago-based airline in September, and a conditional purchase

agreement of 400 eVTOLs, as part of its strategy to invest in new cutting edge, sustainable technologies.

“The Bay Area is perfect for eVTOL flights given its size, traffic, focus on sustainability, innovation and commitment to add other options for mobility,” Andre Stein, co-CEO of Eve Air Mobility, said. It is still some time until the first flying taxi flight will take place in the Bay Area, with Eve’s eVTOL’s scheduled to enter service in 2026.

£ Horse racing and sparkling wine are always welcome bedfellows, and I was pleased to meet both the Tote’s boss Alex Frost and the CEO of Kent vineyard Chapel Down, Andrew Carter, at a recent lunch. For all the negativity in the business pages at the moment, both operations are innovating their way to very successful futures and can rightly claim to be success stories directly rooted –quite literally –in Britain’s turf. Best of luck to them.

£ Another book arrives which goes straight on the ‘must-read’ list. Ed Conway’s Material World is a story of the raw materials that power the modern world. As the blurb puts it, “this is the story of civilisation”. Conway is one of the most adroit commentators on economics and business of our time and his columns on the complicated world of natural resources have been must-reads for years. It’s out today and if his previous work is anything to go by it will be a very well-deserved bestseller.

THE City of London Corporation has launched the City Belonging Project, an exciting new initiative to build a more inclusive and connected Square Mile.

The scheme launched with representatives from more than 160 of the City's leading organisations in attendance, including the Bank of England, Lloyds Banking Group, and Bloomberg. It will support and improve the links between diversity networks and help make sure the City’s institutions and events are open to all communities.

The City Belonging Project, along with its partners, will work to ensure events,

activities and spaces are more inclusive. And using its convening powers, the City Corporation will bring together groups and individuals from across the City to create and develop new inter-company networks.

To find out more or sign up for updates: https://belongingproject.city

PETE Townshend’s guitar flying through the air at Madison Square Garden and Liam and Noel Gallagher photographed during the making of the Wonderwall video are two of the remarkable images in a new City of London Corporation exhibition.

Taken nearly 20 years apart, those timeless photographs of The Who and Oasis taken by Michael Putland and Jill Furmanovsky will feature in ‘In The Moment: The Art of Music Photography’, which opens on 16 June at Barbican Music Library.

The free exhibition celebrates the 25th anniversary of Rockarchive.com as a collective of leading music photographers: cityoflondon.gov.uk/services/ libraries/barbican-music-library

Andy Silvester takes the notebook pen

When I was 13 years old, I worked at a fruit and veg stall in Wembley after school which led to me being “headhunted” by the convenience shop opposite to pack shelfs. They matched my hourly rate and threw in an egg and bacon sandwich, cheese and onion Walkers crisps and a fizzy drink per shift. How could I say no? I always say it was my first experience being recruited and negotiating a better package!

My first full-time job was at 16 playing professional football. I was paid £42.50 per week, which felt like a King’s ransom, as I was predominantly used to being paid with food...

WHEN DID YOU KNOW THE CITY WAS THE PLACE FOR YOU?

Whether it’s the road sweepers in Leadenhall Market, stall holders, shop workers or FTSE 100 CEOs, I love the spirit of enterprise that you can find in every corner of the City. You can’t help but feel excited and inspired by it. I also love that the City is built on hard work and aptitude.

AND ONE THING YOU WOULD CHANGE?

There is a negative perception that the City is only for people from certain demographics, and is very much closed off to everyone else. The Square Mile should be for everyone and anyone who has the potential, desire and commitment to succeed, and we need to create the opportunities to ensure that this is achieved. This is something that myself and many others are trying to accomplish, and it is a big reason why I co-founded 10,000 Black Interns in 2020.

I have worked with, and for, some phenomenal leaders who have taught me a plethora of skills. If I had to pick one person, it would be Robyn Grew, the newly appointed CEO of Man Group. Robyn is an incredible person who has led with authenticity and has done impactful work around inclusivity, diversity, inclusion, equity and belonging.

WHAT’S BEEN YOUR MOST MEMORABLE MOMENT IN THE CITY?

When my wife was undergoing chemotherapy in 2018, I took a year off to focus on my family. The love and support that I received from clients and the wider City will forever remain with me, as it allowed my organisation to continue to successfully trade without me.

Additionally, in the summer of 2020 when I co-founded 10,000 Black Interns, my co-founders and I weren’t confident that we would secure 100 interns into paid roles, let alone 10,000. However, through the support of City-based companies, we were able

to secure over 2,500 paid internships within the first year. By the end of the summer, 6,000 paid interns, across 850 firms would have come through the programme. I am so grateful for the commitment and backing that has been shown to the scheme and proud that we have been able to make a difference.

Goodman Steak House in Old Jewry. I’m a creature of habit and have been going there for over a decade, to the point I was awarded my own signature knife. I tend to go for the medium rare ribeye, spinach, and depending on whether I’m watching my carbs or not, the fries.

I love all the pubs and bars in Leadenhall Market, they’re lively, engaging, and you can always hear compelling stories from the market-

FAVOURITE...

FILM: SHAWSHANK REDEMPTION AND DO THE RIGHT THING

BOOK: WHAT GOT YOU HERE WON’T GET YOU THERE, BY MARSHALL GOLDSMITH.

MUSICIAN: MY FELLOW IPSWICH FAN, ED SHEERAN DRINK: TEA OR COFFEE? COFFEE. A DOUBLE ESPRESSO FROM AUX MERVEILLEUX DE FRED

goers. My drink of choice would probably be a Guinness.

Yes, I believe that the last few years have been difficult and we are still going through some challenges.

However, the City as a whole is fighting back. I would like to see the hospitality sector receive more support. Those restaurants, cafes and bars are the lifeblood of the City and help to make London an internationally desirable destination.

The City can be a place packed full of opportunity and can be somewhere that folks from all sorts of backgrounds can thrive and succeed. My story is proof, if you needed any. It is my mission to do everything I can to make sure that we demonstrate that the City can be for everyone, and not just a select few.

During the week, home is a flat near the City, so it’s a short walk to work. My day often starts at 5am with a walk to see my trainer at Ultimate Performance on Paul Street, and often finishes late

after attending events or meeting with friends, so it makes sense to be close. There’s something almost magical about being able to stroll through the City first thing in the morning just before it starts to come alive.

You’ll find me at home in Suffolk during the weekend, or on the sidelines watching my daughters Beau and Lexi playing hockey, or my son Aston at a rugby match. Failing that, I’ll be watching the mighty Ipswich Town FC.

My good friend Wol Kolade, who is founder and managing partner at Livingbridge (Private Equity), gave me some excellent advice: if I want to spend quality time with my kids over the summer, I need to invest in nice holidays. This summer, I’m heading to Megnasi in Greece with my kids, my wife, mum and stepfather.

Each week we ask the City’s movers and shakers for their stories. This week, it’s recruitment supremo Michael Barrington-Hibbert of Barrington Hibbert Associates

LONDON FTSE 100 jumped yesterday, led higher by industrial giants offsetting losses among retail and consumer-focused firms and housebuilders.

The capital’s premier index added 0.1 per cent to close at 7,602.75 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, was largely unchanged at 19,175.50 points.

Gains among the UK’s largest companies were concentrated in the raw materials sector, which represents a large share of the FTSE 100.

Miners Rio Tinto, Anglo American and Glencore all up by a range of four

per cent and 2.5 per cent, aided by gains in raw material prices.

London’s FTSE 100 has a heavy gearing toward companies that produce key inputs in production, like copper and nickel. When the sector rises, it tends to lift the overall index along with it.

Yesterday’s rises in the City came after numbers from the Office for National Statistics (ONS) revealed the UK economy is still continuing to dodge a much-tipped recession.

Gross domestic product in April jumped 0.2 per cent, a recovery from March’s 0.3 per cent contraction, although growth was weaker than the City expected.

Peel Hunt have rated marine engineer James Fisher a “Buy” as the group trades above expectations and the defence division shows improvement. Analysts were confident: “The defence sales pipeline remains strong”.

Analysts at Peel Hunt have rated steel construction firm Severfield a “Buy” following an excellent end to the year due to a strong core UK business. “The outlook is a confident one and remains assured of an in-line out turn,” said analysts.

The North Face came under fire recently from news outlets including the Daily Express, Mail Online and The Sun for partnering with the drag queen Pattie Gonia for the second year of its “Summer of Pride” campaign. The coverage has drawn comparisons to the backlash similar faced by Bud Light in the US after it partnered with trans Tiktok influencer Dylan Mulvaney earlier this year.

But data from YouGov Brand Index UK suggests that the public aren’t particularly bothered by it. Between 23 May 2023 – when the ad launched on Instagram – and 10 June 2023, Buzz scores

for The North Face (which measure whether consumers have heard anything positive or negative about a brand) saw a slight dip from 5.7 to 5.4 (0.3). But Impression scores, which measure overall sentiment, went from 34.5 to 38.5 (+4.0) over the same period.

These measures did hit a low of 28.3 on 5 June, but the brand rapidly made up the losses and now stand higher than that any point over this period. Similarly, Quality scores increased four points – from 40.5 to 44.5 – while customer satisfaction scores saw similar gains, rising from 17.7 to 22.0 (+4.3). Reputation scores, which track whether consumers would be proud or embarrassed to work for a particular brand, went from 29.3 to 30.7 (+1.4) – reaching a nadir of 25.6 on 6 June, but again recovering swiftly.

Stephan Shakespeare is the co-founder and CEO of YouGov

THE NORTH FACE’S BRAND HAS NOT BEEN DAMAGED BY TABLOID HEADLINES OVER THE PATTIE GONIA STORY YouGov BrandIndex: Quality, Impression, Satisfaction scores (1 week moving average)

OVER THE CHANNEL “The euro has broken above its recent range highs at 1.0820 ahead of today’s ECB rate meeting, where we can expect the ECB to hike rates by another 25bps, as it continues to play catchup to its peers on its own rate hiking cycle.”

MICHAEL HEWSON CMC MARKETS

SINCE the pandemic eased, the challenge facing governments across the world has been the return of inflation, with wages and price rises surging far beyond the 2 per cent that central banks have typically been trying to hit since the 1990s. While there have often been temporary factors that have contributed to high inflation, core inflation, which strips these out, remains stubbornly high. Indeed, in Britain it reached a thirty-year high this March of 6.8 per cent, which was not only higher than forecast but is 240 per cent above target.

Britain entered this period of resurgent inflation with unusual vulnerabilities. Brexit was explicitly sold to wavering voters as a way of increasing both wages and prices by reducing foreign competition, something that comes at a greater economic cost now outside of a low-inflation environment. The implosion of so many lowcost suppliers and our continued overreliance on natural gas means that domestic and industrial fuel will continue to be higher than what we were accustomed to.

But above all our enduring weakness has been monetary policy. The advent of the European Monetary Union has fundamentally changed Britain’s rela-

Simon Neville

Simon Neville

MEDIA training for City types is almost always an exercise in explaining to terrified business leaders that not all journalists are like Jeremy Paxman. Most of the time, reporters want to understand more about what they are doing, rather than go out of their way to make them look stupid.

The natural instinct for companies when facing difficult questions is to keep their heads down and hope that the noise goes away. As Jack Doyle, former director of communications in Downing Street, famously wrote when the first press enquiries about Partygate were received: “just be robust and they’ll get bored”.

This strategy may seem like a safe approach but, as the government fallout showed, it has the potential to backfire enormously. Another example of the heads down approach reared into view over the past week at Odey Asset Management (OAM).

tionship with the continent, as now we have the unique ability in Western Europe to engage in competitive devaluation against our neighbours. It is an ability we have repeatedly made use of throughout the 2010s, which is why statistics on British economic performance have become so sensitive to if and how you correct for exchange rates. That’s why the markets responded so badly when they felt the short-lived Chancellor Kwasi Kwarteng was threatening another, even greater dose, of the same medicine.

But beyond all this, the Bank of England has not successfully combated high inflation with interest rate rises like the American Federal Reserve did

in the 1980s or the Bundesbank consistently did in pre-EMU Germany. Until 1997 it was the Chancellor of the Exchequer that set interest rates and they typically chose fiscal rather than monetary solutions to combat high inflation. Indeed, when tasked with tackling rising inflation last autumn through monetary policy amid a sudden relaxation of fiscal policy, Threadneedle Street openly sat on their hands until the residents of Downing Street were persuaded to change course.

It cannot be stressed enough what a hammer blow interest rate rises place on an economy. They concentrate pain on the government, as well as those

individuals and companies that borrowed during the good times. This not only depresses their spending and reduces all our incomes, it encourages everyone to be more cautious. In the short-term banks pay for people and companies to park money in their vaults, but even when the crisis abates, there’s a lingering fear of being caught out owing too much money if the cost of borrowing increases again. Given that Britain has long struggled with there being too little investment in its industrial base or public infrastructure, the last thing we need is for people to become even more risk averse.

Sadly, it seems that too many people

The Financial Times reported allegations made by 13 women of sexual assault or harassment by Crispin Odey over 25 years, claims Odey denies. But even with blaring headlines, several major institutions refused to comment on their dealings with the business and what their future relationship would look like.

The status quo “no comment” is hardly an option with a story like this. Either other fund managers would continue to work with OAM despite the allegations or they would cut ties in light of them. There was no middle ground and, too slowly, those institutions realised they had to distance themselves from him.

Two fund managers announced on Friday they would cut back their dealings with Odey’s funds and another went public this week.

The executive board at OAM took until the weekend to announce he would be leaving and the Financial Conduct Authority started answering questions on an investigation it was conducting after a deluge of calls. But the allegations of Odey’s behaviour were not new. So, why did it take until now for these firms to act? Were these companies adopting the tried and tested method of “heads down, nothing to see here”? Had they seen the previous allegations – all denied by Odey - and decided that if it had blown over once, it could blow over again?

After Odey’s court case in 2021 over allegations of sexual harassment, where he was cleared of the charges, the Sunday Times reported separate allegations. Tortoise media also reported allegations on Odey prior to

the FT story and laid out the claims from four women to the financier and his company back in November last year. All allegations were denied.

When the scandal of allegations of sexual harassment unfolded at the CBI, they were quickly cut off. Meanwhile, investors kept using his services and the media remained hooked to him for comments.

The cut off point at which allegations lead to actions has been all too arbitrary. When Tortoise, a niche publication, reported four allegations, Odey’s board were seemingly unphased. But thirteen more in the FT warranted taking a stand.

One of the managers to eventually cut ties with the fund only sold off its final holdings in Odey Swan - a fund run by Odey - after the FT allegations were first published. OAM has subse-

have learnt the wrong lesson from Liz Truss, behaving as if her premiership imploded because she couldn’t say “pork markets” sweetly enough. Her aggression and maladroitness merely threw into stark relief the key problem facing our economy, and that is we need to get inflation, and therefore interest rates, under control so that the cost of government, corporate and individual debt doesn’t become unbearable to service.

The crisis Liz Truss and Kwasi Kwarteng provoked was long coming, and it hasn’t gone away. There are no easy or simple answers to get our country out of this mess, but you cannot seek a solution without recognising the problem. There is simply no valid reason for the government to still be running a deficit when unemployment is less than 4 per cent and inflation is so high. Indeed, it is positively dangerous for this to continue while the Bank of England is raising the cost of borrowing to cool the economy down. Such incoherence may provoke a credit crunch as the little money people want to lend rather than save flows to the government rather than private enterprise.

The government can choose to close that deficit through lower public spending, or higher taxes, or securing greater economic growth through deregulation or closer alignment with Europe. But close it they must. Otherwise, before too long we’ll be right back in the same demeaning chaos as last October, and that really would be a disgrace.

£ Will Cooling writes about politics and pop culture for the It Could be Said substack

quently closed Odey’s Swan fund and stopped investors from withdrawing money from two others run by its subsidiary, Brook Asset Management, making it look more like a financial decision than a moral one. Have those other institutions pulling money out said they are doing it on a point of principle, or because they are worried that if they don’t, they may be stuck from withdrawing it because the funds end up frozen for an unspecified period of time?

For all the talk of the City having its own MeToo movement and the rise of ESG, it remains the case that money talks. Still, companies tend to only act when it is in their financial interests.

If a company’s financial future is at stake, that’s when it will act. If there is even the smallest of chances a business can ride it out, then they seemingly will.

It is right and proper that allegations like those against Odey, or the CBI, or any other senior business leader, see the light of day. But if companies remain wedded to the idea that the best instinct when facing difficult questions is to say nothing, then nothing will change.

£ Simon Neville is Media Strategy and Content Director at SEC Newgate, he was formerly City Editor at Press Association

[Re: Women ‘key’ to growth but are leading just 12 per cent of FTSE 250 firms]

As the shadow women and equalities secretary rightly points out, the generation of women born into the Equal Pay Act 53 years ago are yet to see gender parity, or anything close, with female executives at only 12 per cent of FTSE 250 firms. However, ‘empowering’ women to make it to the top is not simply a case of more flexible work policies but must start with an overhaul of hiring practices to nip inequalities in the bud. A lack of transparency propagates bias

and women start their careers on the back foot when there is a lack of diversity amongst the C-suite. A smaller pool of decision makers will benefit a smaller pool of individuals. Transparency is also the key to closing the gender pay gap. When negotiating salary for new job moves, women are often met with low-ball offers and are seen as the more affordable option. Discussions should focus on a candidate’s pay expectations, rather than their current earnings, to reverse this power imbalance. There is no lack of female talent, so why are few making it to the top? It’s time to pull back the curtain on our hiring practices and be open about pay.

Tanja Albers Partner, Major, Lindsey & AfricaWATCH ME STRIKE Junior doctors walk out from Wednesday to Saturday

Junior doctors in England are in the midst of a 72-hour walkout in a bid to convince the government to come up with a better pay offer. So far the government has offered 5 per cent; junior doctors want a 35 per cent pay rise. It follows previous strikes in March and April.

Interest rates are currently at 4.5 per cent, and could rise further. In theory, it’s a good time to keep money in your account, because you’d get good rates on your savings. But with most high street banks that’s not the case. They very rarely pass on the full benefits to the customer, setting much lower rates compared to the Bank of England. Barclays has a 0.70 per cent rate on all Everyday Saver accounts; NatWest has 1.00 per cent on all balances going from £1 to £24,999. HSBC has a slightly higher one at 1.35 per cent on its

Flexible Saver accounts. Enter Wise, the fintech company competing with Revolut and Monzo. The money transfer firm has decided to “commit itself to passing on rising central bank rates to consumers” and has set its rate at 4.12 per cent, much higher than all traditional banks. It is a clear bid to convince people to save their money long term with them, a historically sore spot for fintechs, which have grown increasingly popular for everyday usage accounts.

ELENA SINISCALCOIN 2011, David Cameron launched a ‘Red Tape Challenge’ and declared the need to “free businesses to compete and create jobs”. In 2021, pretty much exactly a decade later, Boris Johnson said the “time is now” to start working with businesses to deregulate the British economy. Last summer, Rishi Sunak pledged to scrap or reform “all of the EU law, red tape and bureaucracy” before the next election.

Despite all this rhetoric, the piles of legislation, regulation and guidance only seem to grow. Since just 2017, the regulatory burden on businesses has increased by an astonishing £22bn –and that’s just according to official government estimates that tend to viciously underestimate the actual regulatory costs.

Meanwhile, regulators seem incapable of making decisions in a timely manner. Sam Dumitriu of Britain Remade has calculatedt hat the time it takes for a decision on a major project grew from 17 months to 22 months between just 2012 and 2022. Perhaps that’s because the required paperwork is, frankly, extraordinary. The Jubilee Line extension, which began in 1993, called for a 400 page environmental assessment – Sizewell C required 44,000 pages.

That’s not all. Despite the rhetoric about regulatory reduction, the government is marching in the opposite direction. From the football regulator, renters’ reform, and gambling regulation to building standards, online safety, and AI the government’s default response to every question appears to be more regulation.

This is perhaps not difficult to understand – there’s always an impetus to ‘do something’ and safety is an ad-

mirable goal. The issue is that each piece of regulation imposes costs and often has unintended consequences. Governments often like to regulate because, unlike taxes that people directly pay, regulation costs are dispersed and thus relatively hidden. Indeed, incumbent businesses often support regulation, as the costs impose barriers to entry on potential competitors. But have no doubt, these costs add up, with each piece of additional regulation adding the cumulative burden on businesses and individuals.

Employment regulations, like minimum wages and working time limits, are meant to help workers; but they also increase operating costs and reduce working hours and wages. Planning rules are meant to ensure orderly development; yet have delivered a housing crisis, political strife, and a major infrastructure shortage. New environmental standards and clean-up mandates for water companies, recently passed through Parliament, are set to impose billions in additional costs on water bills. The upcoming ban on supermarket buy-one-get-one-free

offers could cost households £634 a year and will only reduce calorie consumption by one grape a day. Regulation also has broader impacts. It damages economic growth by stifling our productivity and, accordingly, household incomes. We make our businesses less competitive and reduce their ability to innovate. This particularly hurts lower income households, who tend to consume highly regulated products in greater quantities. Last year, the Institute of Economic Affairs calculated that an average family with two children could save £9,000 a year by cutting red tape across housing, childcare, and energy. The goal of regulation should be to achieve a stated objective – be it environmental protection or product safety – at the minimal possible cost for society. Unfortunately, the length and complexity of the rules have actively harmed this goal. It will take an entirely new, focused approach to repair the damage.

£ Matthew Lesh is the Director of Public Policy and Communications at the IEA

be honest,

Since just 2017, the regulatory burden on businesses has increased by an astonishing £22bn