MORTGAGE PAIN SET TO SHAPE RATE

RATE-SETTER: CONCERN OVER HOUSEHOLD ‘RESILIENCE’

CHRIS DORRELL

THE BANK of England’s decision on the interest rate will be shaped by the severity of the coming mortgage shock on households, according to one Threadneedle Street rate-setter.

Catherine Mann, who sits on the Bank’s Monetary Policy Committee, said that households had been “very resilient” in the face of inflation so far but said there are “concerns about what’s going to happen to households with a mortage”.

The warning came on the same day that new figures suggested the average London household could face a £7,300 annual increase in their mortgage if they refinance this year.

As recently as two months ago most analysts had expected the Bank rate to top out at five per cent, but a string of data releases suggest-

BANISHED BORIS ELENA SINISCALCO ON WHY WE NEED TO QUIT BOJO P16

YOU’RE SAFER WITH LONDON Howden and insurance market support efforts to avoid oil disaster

ing inflation is stickier than expected have had City watchers upping their rate-cycle peaks to 5.25 or 5.5 per cent.

Mann said “householders will be exposed to significantly higher rates,” as banks pass on rising interest rates.

Consumer resilience in the face of rising rates will be “an important ingredient” for the rate-setting committee, Mann said, and the Bank will keep a close eye on how higher rates transfer into “consumption head-

The Bank’s forecasts suggest that increasing mortgage rates could dent consumption by over 0.5 per cent by the end of 2025, although Mann highlighted a range of uncertainties behind those forecasts.

Mann’s comments came shortly after Santander became the latest bank to temporarily pull a range of products.

The bank said the products will reappear on Wednesday, likely at higher rates.

A Santander spokesperson said: “We continually review our products in light of changing market conditions.”

Natwest has also upped rates on a range of its products, with large increases for buy-to-let mortgages.

Analysts at the Centre for Economics and Business Research reckon mortgage rates will average 5.1 per cent in 2023 and 4.6 per cent in 2024, an £8.7bn increase across the country for those coming to the end of fixed rates.

“While the Bank’s tightening cycle might be nearing its end, the impact on households is only just beginning,” Benjamin Trevis, an economist at the think tank warned, joining a chorus of other voices.

Mann, who has been consistently hawkish since joining the Bank’s most important committee in 2021, was speaking at an event hosted by Signum Global Advisors.

LONDON’s insurance market can add a new feather to its cap after coming together to facilitate a high-risk operation to prevent a stranded ship from causing a potentially catastrophic oil spill.

Insurance giant Howden was appointed by the UN’s Development Programme to arrange cover for a procedure that will see more than 1m barrels-worth of oil transferred from the FSO Safer, which has been moored off Yemen for eight years and is now at risk of breaking up. Conflict in Yemen has prevented basic maintenance of the vessel, holding four times as much oil as the Exxon Valdez. Thirteen different entities are underwriting the operation, with

more than a hundred individual underwriters assessing and pricing what Howden called an “exceptionally specialised” policies. Achim Steiner, the administrator of the UN’s Development Programme, said that without insurance the project could not have gone ahead –risking an ecological disaster.

David Howden, Howden’s CEO, said the coverage was the “perfect example of the power of insurance”, and John Neal, boss of the historic insurance marketplace Lloyd’s of London, said “it’s encouraging to see the knowledge and expertise held in the Lloyd’s market being used to protect what matters most – in this case, our natural environment and the economic activities our world relies on.

London fintech scene is thriving but more talent is required: lending boss

CHARLIE CONCHIE

A LACK of talent is threatening to choke off growth in the UK fintech sector, and ministers must do more to open up borders to immigration, the boss of digital lender Oaknorth said yesterday.

Speaking at London Tech Week,

Rishi Khosla said that the Londonbased digital bank had itself been dogged by hiring troubles and more routes should be opened up to allow workers to flow into the UK.

“The UK has an incredible number of startups – the largest number of startups compared to

any other big European country. However, when it comes to scaling up, [and] getting [people] to come in who have scaled up businesses previously, it’s a challenge,” he told the event.

“It is a challenge that I know my co-founder

and I have faced, and many other entrepreneurs face in this country.”

Oaknorth was founded by Khosla (pictured) and Joel Perlman and has swelled to become one of

the country’s best-known challenger lenders with over 800 staff and a valuation of $2.8bn (£2.2bn) in 2019.

However, Khosla, a former donor to the Tory party, said the UK’s approach to nurturing and attracting talent was a “work in progress”.

GLAMP, DON’T CAMP WE FIND OUT IF A CAMPERVAN CAN EVER TRULY BE COMFORTABLE P18

Risk is the lifeblood of the Square Mile - and we need to take it

Financial services, and the City at large, is primarily an operation derived from risk –the taking of it, and the limiting of it. Nowhere is that clearer than in the insurance industry, which yesterday proved its worth yet again with a London-wide undertaking that will allow the United Nations to avert a potential ecological catastrophe off the coast of Yemen, one that would have made Exxon Valdez look

STANDING UP FOR THE CITY THE

CITY VIEW

miniscule in comparison. Just as with the Ukrainian grain deal, the London market has effectively de-risked a high-risk operation, taking on a decent amount of risk themselves. For all the stereotypes of the insurance industry, not all of which are

entirely without merit as anybody walking through Leadenhall Market at 2pm on a Thursday will know, yesterday’s triumph is a perfect example of the merit of the Square Mile at large. The risk for the capital is, ironically, a lack of risk. Plenty agree. In the last two months alone, the boss of Schroders has said an “aversion to risk” is holding back shareholder returns in the UK.

Julia Hoggett, the London Stock

Exchange chief, says the same thing. The pensions fund industry, handcuffed by regulations that encourage investment in long-term bonds rather than equities or (God forbid) potential high-growth companies, is also the subject of much chat about risk appetite. At London’s Tech Week, there is much enthusiasm for taking on risk; you’d perhaps expect it at a gathering of entrepreneurs, but it was heartening to hear

nonetheless. The politicians in the audience –indeed, one could not move for politicos looking to hang their hat on the tech industry –would do well to listen to that verve. From regulators through to ministers, avoiding the worst-case scenario seems to have become the sine qua non of decision-making; witness the interminable speed of changes to Solvency II regulations for exhibit A. Perhaps we should put the insurers in charge.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE GUARDIAN

GOLD BARS USED TO LURE CHINESE HOMEBUYERS AMID MARKET SLOWDOWN

Gold bars, new cars and mobile phones are among the incentives being offered to potential homebuyers by Chinese property developers as they grow increasingly desperate to boost sales.

THE FINANCIAL TIMES

GOLDMAN AND MORGAN STANLEY CEOS SEE ‘GREEN SHOOTS’ ON WALL STREET

The CEOs of Goldman Sachs and Morgan Stanley said they were seeing “green shoots” after a difficult period in which they implemented large-scale dismissals amid higher interest rates.

THE INDEPENDENT

ELON MUSK EYES ‘HIGHLY HABITABLE’ PLANET THAT’S ‘PRACTICALLY NEXT DOOR’

A study detailing the habitability of a nearby exoplanet appears to have caught the attention of SpaceX boss Elon Musk after Nasa said there was a decent chance it was habitable.

Johnson lashes out at Sunak once again over peerages

JESSICA FRANK-KEYES

BORIS JOHNSON accused Rishi Sunak of “talking rubbish” as the row over his resignation and peerages list became a public slanging match. It came after Sunak laid into his prime ministerial predecessor Boris Johnson, claiming he “asked me to do something I wasn’t prepared to do” over his peerages list.

Johnson’s camp accused the man who was his chancellor of having “secretly blocked” the peerages of former culture secretary Nadine Dorries and other allies in his resignation list.

The former prime minister released a statement saying: “Rishi Sunak is talking rubbish.

“To honour these peerages, it was not necessary to over rule the House of Lords Appointment Commission – but simply to ask them to renew their vetting, which was a mere formality.”

Sunak’s first public comments following the row over Johnson’s resignation as an MP and controversy over his peerages list came at the opening of London Tech Week.

Asked whether Johnson had undermined him, his former chancellor said: “When it comes to honours, honours and Boris Johnson, [he] asked me to do something that I wasn’t prepared to do, because I didn’t think it was right.

“That was to either over-

rule the House of Lords Appointments Committee or to make promises for people. Now, I wasn’t prepared to do that. As I said, I didn’t think it was right. And if people don’t like that, then tough.”

Sunak added: “When I got this job, I said I was going to do things differently because I wanted to change politics. And that’s what I’m doing.

“And I’m also keen to make sure that we change how our country works and that’s what I’m here talking about: making sure that we can grow our economy, that we can maintain our lead-

ership in the innovative industries of the future.”

Sunak’s remarks come amid a dispute with the former prime minister and his allies, who blame Downing Street for Conservative MPs failing to appear on his resignation honours list on Friday despite them being nominated, by him, for the House of Lords.

Former culture secretary Nadine Dorries, ex-minister Nigel Adams and Cop26 president Sir Alok Sharma were reportedly put forward by Johnson for peerages.

Dorries and Adams have since resigned as MPs, giving Sunak the headache of three separate by-elections, with Johnson also quitting over complaints about a partygate inquiry.

SILVIO BERLUSCONI Four-time Italian leader and media magnate passes away aged 86, hailed as “one of the most influential men in the history of Italy” by the current PM

Sustainability drops off banks’ list of priorities

CHRIS DORRELL

SUSTAINABILITY is falling down the list of priorities for many UK banks, after a new study found the number of banks stating sustainability was a key part of their business strategy had plummeted by 40 per cent in a year.

Only 60 per cent of banking leaders in the UK say sustainability is an important part of their strategy, down from 100 per cent just a year ago, according to IT firm Mobiquity’s Benchmark for Sustainable Banking Report.

The report said sustainability considerations are dropping down the agenda as falling consumer confidence and rising interest rates sharpen the attention placed on banks’ bottom lines.

The report, based on a survey of 150 UK banking executives conducted by Censuswide, suggests that banks are less concerned about offsetting unsustainable practices than last year. Only 29 per cent are currently offsetting through carbon credit schemes, down

SETTLEMENT JP Morgan agrees to settle with Epstein victim in class action suit

Accountancy group refutes CEO pay report

JESS JONES

from 50 per cent last year.

The number of banks with an executive at board level overseeing sustainability strategy has decreased from 83 per cent last year to 54 per cent.

Peter-Jan Van De Venn at Hexaware Mobiquity said that although banks had made progress in recent years on sustainability, “much of that work is now being undone.”

“The macro-economic headwinds have forced banks to batten down the hatches and focus on activity that will deliver clear, immediate returns. From board level to front-line teams, banks have been concentrating on keeping their bottom lines healthy, forcing sustainability to take a back seat.”

A spokesperson for Britain’s banking lobby, UK Finance, said the sector takes the issues of environmental sustainability and the transition to net zero “very seriously” arguing it plays a “key role in supporting decarbonisation” and “helping finance the transition across the economy.”

JP MORGAN agreed in principle to settle a class action lawsuit with a victim of Jeffrey Epstein, the bank said in a statement yesterday. Litigation is still pending between the US Virgin Islands and JP Morgan Chase, as are JP Morgan Chase’s claims against former executive Jes Staley, the bank said.

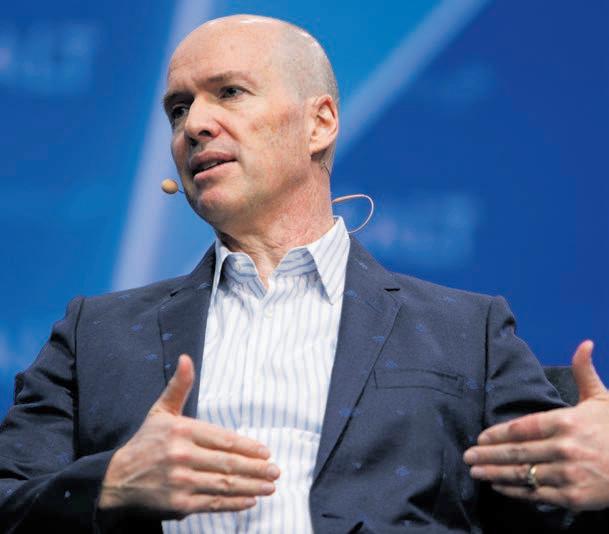

THE PROFESSIONAL body for accountants in England and Wales has hit back at a report claiming that its outgoing chief executive will be handed a huge severance package when he steps down at the end of the year.

Sky News reported that the Institute of Chartered Accountants in England and Wales (ICAEW) could pay Michael Izza (pictured) as much as twice his annual base salary of £492,000 when he leaves.

“We categorically refute claims that Michael Izza will receive ‘twice his annual salary’ when he retires from ICAEW,” a spokesperson for the group told City A.M.

“The terms of his departure are in compliance with his contract of employment,” the spokesperson added.

Izza announced his departure in March this year, saying “it has been an honour to be chief executive of ICAEW and to represent our profession across the world”.

Ashley’s empire grows: Frasers picks up nearly 20 per cent of retailer AO World

CITY A.M. REPORTER

MIKE ASHLEY’s Frasers Group has invested £75m in electronic retailer AO World, taking a stake of almost 20 per cent in the business.

Both firms called the investment a ‘strategic partnership’ that would strengthen both sides of the deal.

“AO is a fantastic business with a clear strategy which is leading the

market in online-only electricals,”

Michael Murray, Frasers Group CEO and Ashley’s son-in-law, said.

“Although the pair may initially appear to be an unlikely match, on closer inspection, there are potential synergies between the two retailers in terms of at-home appliances with Frasers’ sofa range complementing AO’s white goods offering,” Victoria Scholar, head of Investment at

Interactive Investor said.

“Frasers is always one to spot a bargain and the big sell-off in AO’s share price – from above 400p in 2021 to sub-40p last summer – will not have gone unnoticed,” Russ Mould, investment director at AJ Bell said. He said while some might speculate Frasers will eventually acquire AO outright, it “has form for taking equity stakes but not making full takeovers”.

Striking Amazon warehouse staff accuse tech giant of ‘dirty tricks’

JESS JONES

AMAZON workers started their first of three days of strike action yesterday as a dispute over pay continues to drag on and disrupt its operations.

This is the fifth time this year that members of the GMB Union have walked out over low pay, with strikes taking place nearly every month

since the start of this year.

GMB has accused Amazon of playing “dirty tricks” saying the firm went on a hiring spree to deprive the union of the 50 per cent of workers required for statutory union recognition.

“Earlier this year, in one of the busiest periods for retail, Amazon told people there were around 1,400 workers in Coventry,” said Stuart Richards, GMB Senior Organiser.

But according to current GMB members working in Coventry, Amazon has now recruited more than 1,000 new workers who have “flooded” the warehouse.

GMB have now been forced to withdraw their application for statutory recognition.

An Amazon spokesperson told City A.M.: “We respect our employees’ rights to join, or not to join, a union.”

US regulator prepares to block Microsoft’s acquisition of Activision

RAMI AYYUB AND DAVID SHEPARDSON

THE US Federal Trade Commission (FTC) will file an injunction blocking Microsoft’s acquisition of Activision Blizzard, a source familiar with a planned court filing said on Monday.

Microsoft is seeking to acquire the video game maker in a $69bn deal.

The EU approved the Activision deal in May, but British competition authorities blocked the takeover in April.

The FTC, which enforces antitrust law,

Commute YourWay

initially asked a judge to block the transaction in early December, arguing it would give Microsoft's Xbox exclusive access to Activision games Nintendo and Sony out in the cold. President Joe Biden’s administration has so far been tough on antitrust. Yet experts say the FTC faces an uphill battle to convince a judge to block the deal, because of the voluntary concessions offered by Microsoft to allay fears it could dominate the gaming market.

Odey not ‘gating’ funds in wake of allegations

HOLLY WILLIAMS

ODEY Asset Management has insisted its funds are not halting investor withdrawals in the wake of assault allegations against its founder, Crispin Odey.

The company, which has around $4.4bn (£3.5bn) in assets under management, said all its funds are open “as per usual business” following a report that the boards of its EU investment funds were looking at measures to restrict investors pulling out cash, called “gating”.

The Financial Times had reported that restrictions were being mooted amid fears of a rush to withdraw over the coming days.

A spokesman for Odey Asset Management said: “All funds are open today as per usual business and we’re not considering gating any funds.

“The only fund we’re considering closing is the Odey Swan Fund, the Ucits (Undertaking for collective investment in transferable securities) fund formerly run by Crispin Odey.”

Late on Sunday, the firm announced a shake-up of management for key funds that were run by Odey, after it was an-

nounced he would be leaving .

The company said Odey’s main hedge fund will be run by his co-manager, Freddie Neave, as part of the changes.

“We plan to announce a complete rebrand of the partnership in the near future,” the company said in a further move to contain the fallout.

A report in the FT, together with Tortoise Media, last Thursday included a series of allegations of sexual harassment or misconduct from women who either worked at the firm or had social or professional dealings with Odey.

The allegations involve 13 women who claim Odey abused or harassed them, with eight saying he sexually assaulted them. Odey denise the claims and has dismissed them as “rubbish”.

The report sparked the Financial Conduct Authority to widen an investigation into the asset manager and some of the firm’s key banks and brokers to review or cut their ties with the group.

Announcing Odey’s departure on Saturday, Odey Asset Management said its founder will “no longer have any economic or personal involvement in the partnership”.

Glencore makes fresh bid for Teck’s coal arm

NICHOLAS EARL

GLENCORE has redoubled its efforts to acquire Canadian miner Teck Resources, offering to buy its steelmaking coal business as a standalone company.

In the latest twist of a protracted industry saga, the commodities giant has changed its approach after both its attempts to merge the two companies with a £17.9bn ($22.5bn) bid were rebuffed by Teck’s board in April.

Under the fresh proposal, Glencore would snap up Teck’s steelmaking coal business and then de-merge the business unit together with its own energy coal assets one to two years after the deal closes.

The size of the offer is undisclosed.

The company confirmed it was still “willing to pursue” its offer to buy the whole of Teck — including its North American industrial metal mines.

Teck Resources told Reuters that

Glencore’s latest offer was “one of a number of proposals under consideration” and “preliminary in detail, conditional and non-binding”.

It revealed that on 6 June it had received several proposals for its coal business, including Canadian mining entrepreneur Pierre Lassonde and Japan’s Nippon Steel Corporation.

Teck has to consider prospective offers for the company, with shareholders scrutinising the company’s board, share structure and demerger plans.

While Teck managed to push back Glencore’s previous offers, it has also failed to secure enough shareholder support for its own plans.

The latest bid reflects Glencore’s persistence and interest in Teck, but is also a concession by the company, with chief executive Gary Nagle last month arguing buying Teck’s coal business as a standalone unit was a “distant second” compared to merging plans.

GLENCORE’s latest bid for Teck Resources reflects the creative strategy of a commodities giant that is normally used to getting its way, plus the company’s desperation to grow its market share in green future-facing commodities while reducing its reliance on thermal coal. Glencore is trying all it can to initiate discussions with Teck’s senior team. And shareholders are not keen on Teck’s go-it-alone strategy, in part

ANALYSIS

due to the company’s share structure and overarching role of the Keevil family in its operations.

Yet, Teck’s shareholders are still not flocking to Glencore’s bid – even after many have been directly approached by CEO Gary Nagle. This highlights a growing unease

about taking on more long-term carbon intensive assets.

Glencore is also trying win over its own sceptical investors and showcase its green credentials. With Glencore’s bid floating and Teck failing to impress, it will be worth keeping a watchful eye on bids from other suitors – rumoured to include Nippon Steel and Pierre Lassonde.

NICHOLAS EARL

UK car insurance costs likely to rise for another two years, report says

GUY TAYLOR

UK CAR insurance costs are set to rise for at least another two years, according to a new report.

The price for Brits to insure their cars is expected to rise 14 per cent in 2023 and will not flatten until 2025, according to a report by consultancy Oxbow Partners.

It comes as inflation has driven up the price of car repair costs, which has pushed big firms such as Aviva and Admiral to hike up cost of coverage.

But insurance groups have been criticised for the price rises amid the ongoing cost of living, with some arguing that it could deter customers from getting insured entirely.

Last week, insurance bosses from Admiral and Aviva argued that rising costs were not down to “profiteering” of any kind, but were instead down to “significant cost pressures.”

“The price of certain raw materials and energy costs are rising at rates well above general inflation, and these costs are becoming increasingly

Oil prices drop as investors fear US rate hikes

NICHOLAS EARL

OIL PRICES dropped over $2 per barrel in yesterday morning’s trading as investors feared further rate hikes from the US Federal Reserve.

Concerns over flagging fuel demand in China and rising supplies of Russian crude are also weighing down both major benchmarks.

Brent Crude dipped 2.58 per cent to $72.86 per barrel, while WTI Crude sank 2.91 per cent to $68.13 per barrel yesterday morning.

The Fed is set to announce its latest interest rate decision on Wednesday. As it stands, interest rates set at 5 to 5.25 per cent, driving down prices and making commodities more expensive for holders of other currencies.

Ricardo Evangelista, senior analyst at Activ Trades said: “The consensus amongst analysts is that the central bank will keep interest rates on hold, but observers will focus on the tone used to deliver the announcement.

“Should the Fed continue to focus on fighting persistently high inflation through stringent monetary tightening, it will eventually achieve its objective, but the side effect will be an economic slowdown. It’s this perspec-

tive of a Fed-driven decline in demand that is now being discounted by investors, creating a downside for oil prices.”

Meanwhile, persistently gloomy economic data from China has raised concerns about demand in the world's largest crude importer.

Fiona Cincotta, senior financial markets analyst at City Index argued that global recession fears will continue to drag on the demand outlook despite OPEC’s attempts to prop up prices.

“Oil fell last week after disappointing Chinese data raised concerns over the strength of the recovery of China, the world’s largest importer of oil. This offset the production cut of 1m barrels per day announced by Saudi Arabia,” she said.

Saudi Arabia’s energy minister Prince Abdulaziz bin Salman warned last weekend that OPEC+ was battling against “uncertainties and sentiment” within the market.

While Saudi Arabia has cut oil production four times in the past year, Russian production has held up under the weight of Western sanctions, as it has boosted exports to China and India.

challenging to absorb,” the Association of British Insurers argued previously.

Paul De’Ath, head of market intelligence at Oxbow, told City A.M. that the price rises were “driven by high levels of claims inflation in 2022 which has continued into 2023,” but said this inflation could ease in the second half of this year.

He added it that customers were unlikely to cancel their insurance in response to rising costs and would simply opt for lower-coverage products instead.

OPEC's best efforts to prop up prices by slashing output by millions of barrels per day have been vastly outweighed by investors' fears over economic volatility and waning oil demand.

This exposes not just the limits of the cartel's influence over oil's major benchmarks, but also how concerned the market is with the upcoming US Federal Reserve sessions, with the central bank weighing up whether to further raise interest rates and likely strengthen the dollar.

Source: Tradingeconomics.com

There is also more robust production in Russia than expected –a mixed blessing for the West as it weighs down prices but also exposes the ineffectiveness of their economic sanctions.

This has caused Goldman Sachs to slash its oil price forecasts, alongside more output from Iran and Venezuela. Its crude price forecast for December 2023 now stands at $86 a barrel for

Brent, down from $95, and at $81 per barrel for WTI, down from $89. Nevertheless, some remain bullish on oil prices. They believe prices will rebound in the second half of the year as Chinese demand inevitably grows as the economy recovers from the pandemic. The International Energy Agency is set to release its annual medium-term oil report later this month. It will be interesting to see which factors they believe will have the biggest effect on prices in the months ahead.

EARL

EU carmakers warn they could lose

£3.7bn due to post-Brexit tariffs

GUY TAYLOR

EUROPEAN carmakers have said they could lose up to €4.3bn (£3.69bn) and cut production by nearly 500,000 vehicles, if the European Union does not delay putting in place tariffs between the EU and UK.

The European Automobile Manufacturers Association (ACEA)

said that China would benefit if the EU does not agree to delay changes from 2024 to 2027.

EVs delivered between the UK and EU will face 10 per cent tariffs from next January under post-Brexit ‘rules of origin’ laws, which place tariffs on vehicles if less than 45 per cent of the value of the components are sourced within the areas.

Sigrid de Vries, director-general of ACEA told the Financial Times: “Money is being spent to support electrification and the building of a European supply chain is accelerating. But it needs time. We have all been too optimistic.”

“We are not asking to change the Trade and Cooperation Agreement... we just need more time,” she said.

UBS completes CS takeover and draws ‘red lines’

CHRIS DORRELLUBS confirmed that it has completed its takeover of Credit Suisse (CS) yesterday as reports suggested that Credit Suisse bankers will face tight restrictions on their activity going forward.

Chief executive Sergio Ermotti and chair Colm Kelleher said in an open letter that “this is the start of a new chapter –for UBS, Switzerland as a financial centre and the global financial industry”.

Although the bank warned of challenges, it also argued there were “many opportunities” in the deal, as it sought to create “an even stronger combined firm”.

Credit Suisse was taken over by UBS in a state-brokered deal earlier this year. Years of scandal had taken their toll on Credit Suisse, which saw mass clients outflows and a consistent share price decline.

Reflecting concerns about Credit Suisse’s willingness to take on more risk,

MIXING IT UP A BIT Brasserie Blanc owner announces new name and expansion plan

Evelyn snaps up Dart Capital as IPO talk grows

CHRIS DORRELL

WEALTH management and accountancy firm Evelyn Partners has acquired boutique City firm Dart Capital for an undisclosed sum.

UBS is set to impose tight restrictions on Credit Suisse bankers with UBS executives drawing up a list of “red lines”, the Financial Times reported.

The restrictions, which came into force yesterday, include a ban on clients from high-risk countries, like Libya, Sudan and Russia, and on launching any complex financial products. In the open letter UBS said it would “never compromise” on its “strong culture, conservative risk approach or quality service”.

Tens of thousands of jobs are thought to be at risk over the coming months as it gradually combines Credit Suisse into its operations.

Speaking to Swiss media on Monday, Ermotti said that 10 per cent of Credit Suisse’s workforce had left already.

The Financial Times reported that five senior ex-Credit Suisse bankers left the bank shortly after the deal was concluded. This included Credit Suisse's ex-chief financial officer Dixit Joshi.

UBS was contacted for comment.

Brexit cited as a major concern as US business confidence in Britain drops

JESS JONES

US BUSINESS confidence in the UK has fallen for the third consecutive year, with the fallout from Brexit being cited as one of the main reasons for the collapse in confidence.

The Transatlantic Confidence Index, published by British American Business (BAB) and Bain & Company, found that the average US business

confidence rating for the UK dropped to 6.5 from 7.3 out of 10 in 2022.

Of the 79 companies surveyed, which do business in both countries, three quarters said the repercussions of the UK’s exit from the European Union was one of their top three concerns.

Duncan Edwards, chief executive of British American Business, said: “It is no surprise that the political turmoil seen in the UK over the last 12 months

has taken its toll.

“This instability, coupled with ongoing concerns over Brexit, growth prospects and taxation have led to a drop of confidence in the UK for a third year in a row.

“The message from US investors is clear. They are calling for a stable political environment and business friendly policies from the UK government.”

The acquisition is the latest in a series of deals that has seen Evelyn Partners grow to have over £53bn in assets under management, making it the UK’s second largest wealth manager.

Dart Capital, which was incorporated in 1987, had £739m in under its control as of 6 June.

The deal, which is subject to regulatory approval, is expected to complete later this year.

Since the start of this year, Evelyn has also acquired two accountancy firms, Leather in Newcastle and Ashcroft in Cambridge.

The latest deal comes shortly after Evelyn hired Paul Geddes, formerly of Direct Line, as its new CEO.

The move stoked speculation that Evelyn, which is thought to be worth between £2bn and £3bn, could be lining up a flotation as Geddes led Direct Line’s own IPO back in 2012. In 2022 Evelyn recorded a slight drop in assets under management as, like many wealth managers, it was hit by economic volatility.

Heathrow booms but boss calls for tax-free change

GUY TAYLOR

LONDON’s Heathrow Airport saw 6.7m passengers travel via the hub in May as a triple bank holiday and strong demand for transatlantic routes helped it shrug off eight days of strike action.

The airport has said it currently has “more daily flights than ever before between the UK and USA” with one in four passengers flying between the USA and Europe in May having passed through Heathrow.

However, bosses at the airport believe the UK is still being held back by the government’s decision not to U-turn on the removal of tax-free shopping for visitors, which many believe is pushing wealthy tourists to Paris or Milan rather than the capital.

“Government must reinstate Tax Free Shopping to let British businesses and the UK economy maximise the benefits from recovering markets,” the airport’s market update read.

Since 2020, the UK has been the only major European country not to offer tax-free shopping to tourists, and we are seeing the consequences. High-spending travellers have been visiting Paris, Milan and Madrid instead.

The evidence backs up the warnings from retailers that this policy would mean the UK lost out. In 2022, for example, international retail spending reached less than two-thirds of 2019 levels, while France hit a record 108%.

The number of high-spending visitors from the Gulf also reached 65 per cent of 2019 levels, but grew to 158 per cent and 166 per cent in Spain and Italy respectively. Each visitor that chooses to go, and

In total, 1.6m passengers flew across the North Atlantic from Heathrow, and North American travel saw a 34 per cent increase year on year.

Chief executive John Holland-Kaye said: “The unrivalled choice of destinations and high frequency to cities like New York make flights from Heathrow vital trade routes with the USA –Britain’s most important export market.”

It marks the beginning of what is expected to be a record summer for travel, with airlines anticipating bumper bookings as post-pandemic pent-up demand sees Brits opt for cheap holidays despite cost of living pressures. Transatlantic travel has seen a particular boost in the period, with North Atlantic routes recovering from CovidHolland-Kaye said: “We have delivered excellent service to passengers, with no cancellations, over eight days of strikes on the busiest days in May, and do not anticipate cancellations as a result of strikes during the summer holiday getaway.”

Paul Barnes

Paul Barnes

spend, elsewhere represents money lost to British businesses. That’s why companies across the country are calling on the Treasury to follow the evidence and reintroduce tax-free shopping, so that we grow, not just recover, from the pandemic.

Space-based solar to get an early lift off from the UK, says minister

NICHOLAS EARL

SOLAR panels in space could help meet the UK's energy needs, with the government poised to announce funding for eight projects centred around wirelessly transmitting energy from the sun back to earth via satellites.

Energy security secretary Grant Shapps is set to unveil £4.3m to finance early-stage development in the nascent industry. This includes £3.3m from the Department for Energy

Security and Net Zero and £1m from the UK Space Agency.

The government's winning projects include Cambridge University and Queen Mary University in London.

Shapps will announce the move in a speech at London Tech Week today.

The UK is currently aiming for 70GW of solar energy generation by 2035 – with around 17GW currently generated nationwide.

If space-based solar lifts off satellites could help generate up to 10GW of electricity a year - a quarter of the UK's

Knight Frank is quids in despite market chaos

LAURA MCGUIRE

ESTATE agency Knight Frank has posted a surge in revenues for the year overcoming “considerable market disruption” over the last 12 months caused by Liz Truss’s mini-budget.

Revenues for the year ending 31 March 2023 reached £670m, up from £665m last year.

The opening of the Elizabeth Line enticed buyers towards office space by improving commuter connections across London, it said.

Knight Frank, which also instructs sales and leases on homes, said that the number of new prospective buyers in London registering in the first quarter of 2023 was 42 per cent higher than the five-year average (excluding 2020) and new sales were up 20 per cent.

“The further the UK housing market gets from September 2022’s mini-budget, the stronger the market becomes,” Knight Frank said.

With bricks-and-mortar retail and leisure still recovering post pandemic, largely due to changing consumer

habits, Knight Frank said that consumer markets have held up “far better than anticipated” with positive retail sales growth in the quarter one of 5.6 per cent.

The company also said that occupier failure has been limited with some 512 stores impacted so far this year compared to 2,318 in 2022.

“Capital markets, leasing activity and residential sales have all been impacted by global economic conditions over the last 12 months, but Knight Frank has proved its resilience

power needs, by 2050 according to a study from consultancy Frazer Nash commissioned by the government. Space solar could even create a multi-billion pound industry, with 143,000 jobs across the country.

The tech aims to collect energy from the Sun using panels on satellites and beaming it back to earth with wireless technology - most likely to a receiving station and then to the national grid.

The UK is among several countries, including Japan and the US weighing up the prospect of space-based solar.

Courts to gain powers to get rid of ‘Slapps’

SOPHIE WINGATE

JUDGES will be given more powers to throw out lawsuits that allow the rich and powerful to gag the press, under new government proposals to help protect public interest speech. These legal threats, called strategic lawsuits against public participation (Slapps), are used by wealthy individuals and firms to try to stop journalists exposing wrong-doing under defamation and privacy laws.

Over 2,000 jobs lost as Tuffnells crashes into administration

GUY TAYLOR

through our unrivalled client base among private capital and institutional investors around the world,”

William Beardmore-Gray, senior partner and group chair, Knight Frank, said.

“Our approach of being truly client centric partners enables us to provide high-quality impartial knowledge to our clients to help them thrive whatever the markets.”

OVER 2,000 workers are expected to be pushed into redundancy after British delivery giant Tuffnells went into administration yesterday. The firm appointed joint administrators from Interpath Advisory to handle its bankruptcy after failing to secure additional funding.

Tuffnells – a leading distributor of mixed freight – has 33 depots across the UK and provides services to over 4,000 businesses, including the home

Wickes, Spaldings and Evans Cycles. It delivered to over 160 destinations in the UK and internationally.

Interpath’s Rick Harrison said: “Unfortunately, the highly competitive nature of the UK parcel delivery market, coupled with significant inflation across the company’s fixed cost base in recent times, has resulted in an intense pressure on cashflow.”

Expectations that the company would enter administration had been building. All drivers were reportedly called back to their depots on Friday, before yesterday’s announcement.

The government has tabled amendments to the Economic Crime and Corporate Transparency Bill which will establish an early dismissal mechanism to make it easier for courts in England and Wales to quickly dismiss Slapps related to economic crime, according to the Ministry of Justice (MoJ).

The government also plans to introduce a cap on the high costs of Slapps to prevent them from being financially ruinous, the MoJ said. Justice secretary Alex Chalk said: “We are stamping out the brazen abuse of our legal system that has allowed wealthy individuals to silence investigators who are trying to expose their wrongdoing.”

The Government has been under pressure to end the use of Slapps. There have been prominent examples of Russian oligarchs using Slapps to silence critics in recent years, including a defamation case involving author Catherine Belton and Roman Abramovich. PA

Small firms need flexible payment options to ease energy bills burden

NICHOLAS EARL

THOUSANDS of small businesses are at risk of closure if energy suppliers fail to offer firms more flexible options for paying off their energy bills, a leading business group has warned.

Martin McTague, national chair of the Federation of Small Businesses

(FSB) told City A.M. that small businesses are “trapped” in fixed tariffs from last year’s period of peak energy bills.

“Allowing small businesses to come out from the energy contracts they fixed during market peak last year is vital to their survival,” he said.

The FSB’s research reveals that more than one in eight (13 per cent) of small

firms fixed their energy contracts in the second half of last year, and 93,000 firms are at risk of closing, downsizing or radically restructuring if suppliers do not show flexibility.

The FSB has called on suppliers to offer ‘blend and extend’ options, where fixed contracts are lengthened in exchange for a reduced monthly rate.

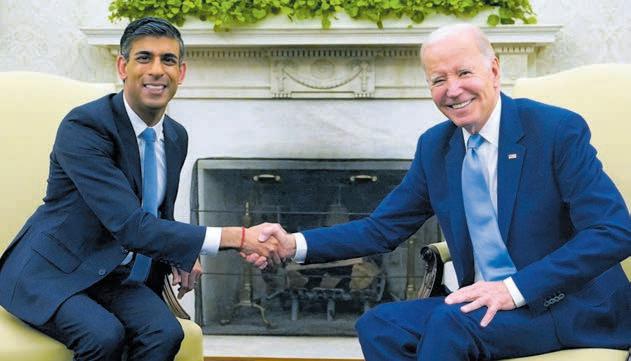

Sunak: Britain must lead on global AI safety

CHARLIE CONCHIE

ARTIFICIAL intelligence (AI) “does not respect borders” and the UK must lead on drawing up global regulation for the technology, the Prime Minister, Rishi Sunak, said yesterday.

Speaking at London Tech Week, Sunak warned that the adoption of AI would have an impact on employment that would be akin to the “industrial revolution” and said its adoption must be done “safely”.

“The possibilities are extraordinary. But we must, and we will, do it safely,” Sunak said.

“I know people are concerned. The very pioneers of AI are warning us about the ways these technologies can undermine our values and freedoms through to the most extreme risks of all.

“And that’s why leading on AI also means leading on AI safety.”

Sunak says that he wants to make the UK “not just the intellectual home, but the geographical home of global AI safety regulation.”

The comments come after the gov-

ANNOUNCEMENTS

ernment tabled plans for an AI safety summit in the autumn which will look to draw up a global framework to manage AI.

Sunak won the backing of US president Joe Biden for the conference on a recent trip to Washington.

The Prime Minister added that there is a “balance to be struck between regulation that supports innovation and [regulation that] puts appropriate protection in place”.

“I think the UK has a track record of getting that balance right,” Sunak said, adding that “AI doesn’t respect national borders” and a global approach to regulation would be needed.

The push for AI regulation comes amid a boom in the technology triggered by the launch of Open AI’s Chat GPT last NoSince then, cash has been pouring into the sector and has pushed the valuations of AI-adjacent firms to new highs. At the same time there have been calls to stop its development.

Rishi Sunak opened London’s Tech Week

LEGAL AND PUBLIC NOTICES

CITY of LONDON

The PLANNING ACTS and the Orders and Regulations made thereunder

This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission Walbrook Wharf, 79 - 83 Upper Thames Street, London, EC4R 3TD 23/00357/FULLR3

Replacement of part of main roof and replacement of rainwater goods to match existing.

55 And 65 Old Broad Street, London, EC2M 1RX 23/00469/FULEIA

Partial demolition of existing buildings and the redevelopment of the site comprising the construction of a new building comprising basement levels (55 Old Broad Street) for the

Khan: AI can help tackle climate threat

JESSICA FRANK-KEYESARTIFICIAL intelligence (AI) can be deployed to help London tackle the threat from climate change, Sadiq Khan said yesterday.

The mayor of London has launched a review exploring how data and technology can help the capital thrive in a changing environment.

At the opening of London Tech Week on Monday, Khan outlined how heatwaves and flash floods last summer highlighted London’s vulnerability to global warming.

US VC firm Andreessen Horowitz launches London crypto push

CHARLIE CONCHIE

ANDREESSEN Horowitz, the storied US venture capital firm, has revealed plans for a major growth push in the UK with a first international office in London and a crypto accelerator programme to take place next year.

The Silicon Valley investor said the new London office will operate under its crypto division, which manages $7.6bn of committed capital.

Andreessen Horowitz is also set to

associated with the proposed development. 84 Moorgate, London, EC2M 6SQ 23/00478/LBC

Installation of ventilation shafts and associated works for the basement substations running from the basement into the south lightwell of Grade II building.

150 - 152 Fenchurch Street, London, EC3M 6BB 23/00561/FULL

launch a Crypto Startup School to work alongside UK universities to nurture tech talent and startups. The push comes as ministers try and turn the UK into a global hub for crypto and scoop up more investment from the US amid a warpath from US regulators.

Prime Minister Rishi Sunak said he was “determined to unlock opportunities for this technology and turn the UK into the world’s Web3 centre.”

TECH DISPATCH

Announcing the London Climate Resilience Review he said: “London is at the forefront of cities globally in using data and technology to reduce congestion, improve air quality and public transport.

“This review will gain independent insight into what more needs to be done to make us a climate resilient city as we harness the power of our thriving tech industry.”

City Hall says the mayor has invested £25m to date to increase climate resilience, and the review is set to recommend what more can be done to harness developing tech.

The review will be led by Green Finance Institute chairman Emma Howard Boyd and call on the tech industry to contribute to vital efforts to combat climate disaster.

Howard Boyd, a former chairman of the Environment Agency, said that “failure to prepare [for climate changes] would be a disaster”.

Charlie Conchie is our man on the ground at London Tech Week

£ There will be some happy faces in the comms teams of Numbers 10 and 11 today. The government managed to stack the morning agenda of London Tech Week and fire a barrage of key messages at an audience of tech figures and overseas investors.

But there is surely a question for the organisers here. In a packed room on day one, which bruising interviewer was grilling the Chancellor, HSBC UK chief and the boss of the bank formerly known as SVB UK? Hunt’s colleague, the science and innovation minister Chloe Smith.

minor amendments including new external siting at roof level as green roof. date of this notice (unless otherwise stated) and will be taken into account in the consideration of this application.

renovation of Grade II Listed Bath House building for the provision of cultural / event uses (Sui

MORE HEAT THAN LIGHT?

Solving the UK’s investment gap is not just a case of tweaking regulation, Chancellor Jeremy Hunt said yesterday, but transforming our national attitude into a “truly growth mindset”. What, we might ask, is a “truly growth mindset”? And how can we get one? There aren’t really answers to those questions yet, but that’s not preventing the call becoming a common one as Square Mile bosses push for a reset of the UK’s “cultural attitude”. Soon though someone will need to lay out how to actually tackle this epidemic of negativity. Until then, the calls look likely to keep swirling round conference halls with little impact on the outside.

£ Even so, sitting in the steaming hot QEII centre it was hard not to feel something was ‘back’. Some mojo, it seemed, had been restored.

Scores of foreign trade officials hurried between meetings. The prime minister flipped into full Silicon Valley mode and Hunt backslapped with banking bosses.

Even with the political overkill, there was a feeling that perhaps more than just lip service was being paid to UK tech once again. Who knows whether the famed Stanford man Rishi Sunak can bring some of the Silicon Valley entrepreneurial risk-taking back to the capital’s newest industries?

THE NOTE BOOK

Is AI’s biggest benefit its use as a buzzword?

BT announced last month it is cutting up to 55,000 jobs as it restructures and stream lines its business. What particularly caught the eye of many was the statement that 10,000 of these jobs would be replaced by Artificial Intelligence (AI), fuelling the fears of those who see AI as a potential job destroyer.

The naysayers may be right but not for the reasons they think. Where probably the greatest risk from AI lies is not in which jobs it replaces, but how companies use the term to boost their share price.

My own view on AI is on the sceptical side of the equation. For a start, AI's progress in the militarynot for lack of trying –has been incredibly slow. There are also plenty of other practical questions as well. The available technology, particularly in semiconductors, is a hot topic at the moment given China’s threats to Taiwan.

There is then also the cost and whether the private equity and venture capital markets –where access to capital has been reduced significantly –can truly fund innovative AI research outside

READ ALL ABOUT IT

Microsoft and Google. However, companies, and the financial markets in general, are never slow to jump on a bandwagon and AI seems the latest version in town.

BT's announcement should raise a number of immediate practical questions. If nobody knows the future direction of AI, which seems true, how does BT have the strategic insight to claim which jobs it can cut? Do we know whether AI is robust enough to deal with humans? Is there a risk that BT is locking itself into a strategy that may soon seem outdated?

Yet many companies are unlikely to care. If your company is under pressure, AI can seem like a nice phrase - like the Metaverse was a year ago - to chuck into a statement to please analysts and investors. The Metaverse example has aged like milk yet it arguably got a few companies through awkward questions about their strategic direction. Long-term trends are good for that.

So I would be wary of those who see AI as a major treatment for their ills. It is early days and nobody knows where things will go.

The future of the Daily Telegraph, put up for sale after its owners fell out with Lloyds over debt, is now an open question. Who might be interested? It’s unlikely that either Reach or News UK would go for the Telegraph, so of the big media groups, DMGT looks the most obvious potential buyer. Don’t rule out a trophy purchase, though. Newspapers are both businesses, and –to some –valuable assets.

£ Anecdotally, advertising spending for the 2024 US electoral cycle –which includes presidential and congressional elections –is already starting to take off, which is much earlier than usually happens. That is a good sign for the US advertising market over the next 12 months, but it does raise questions about what next year's elections will look like, especially –as of today –we are gearing up for a re-run of 2020's Biden v Trump. Round 2 everyone.

£ Anyone reading the UK media over the past month would have thought that the most important topic du jour was not the UkraineRussia conflict, rising interest rates or stubborn inflation but the saga of 'Holly and Phil' (or should that be 'Phil and Holly'?). May I make a plea to end the endless discussion right now? Given the entry of a number of 'celebs' into the debate, the whole episode is starting to resemble a brawl at the Dog and Duck at closing time on a Friday night –and it’s about as edifying.

MORAL CASE BOLSTERED BY FINANCIAL TREATMENT

CAN I QUOTE YOU ON THAT?

For a company like

BT boss Philip Jansen. For reasons to be more sceptical, see my main piece.

I mentioned last time I run a series of podcasts with outdoor company JC Decaux UK. One of my recent interviews was with Lydia Amoah, founder of the Black Pound Report, which informs and persuades advertisers of the potential in the multi-ethnic consumer market. Lydia's approach is very clear –there is a huge opportunity, financially, for companies to benefit from the market, and many companies are missing out on these opportunities because they are not targeting the market correctly. While the moral case is already well-established, Lydia presents the economic and financial side. Well worth a listen.

Where interesting people say interesting things. Today, it’s Ian Whittaker, media analyst and founder of Liberty Sky Advisors

BT there is a huge opportunity to use AI to be more efficient

Ukraine makes slow progress in eastwards push

JAMES SILVER

JAMES SILVER

UKRAINIAN forces claimed to be making ground as a long-awaited offensive in the east of the country takes shape. Kyiv authorities said forces had captured a fourth village on Monday, adding to weekend gains.

Whilst it is the country’s most rapid push in seven months in what is increasingly a frozen conflict in the east, Ukraine’s forces are still around 55 miles away from their believed goalthe Russian land bridge to Crimea.

Analysts at the US-based Institute for the Study of War told Reuters that it would be difficult for Kyiv to make rapid progress.

They said Ukraine was attempting

“an extraordinary difficul tactical operation - a frontal assault against prepared defensive positions, further complicated by a lack of air superiority.”

Elsewhere, the Dutch defence minister told reporters that Ukrainian pilots would begin training in US-manufactured F-16 jets as soon as the next two months.

Though Kyiv has called for F-16s to be supplied immediately, western governments appear to see the advanced aircraft as a post-conflict boon to Ukraine’s defences.

A further civilian was killed in southeastern Ukraine by Russian shelling of civilian infrastructure in the town of Orikhiv, local authorities reported.

Privatbank trial begins alleging ‘epic’ fraud

BRIAN FARMER

UKRAINE’s biggest bank has accused two former owners of “fraud on an epic scale” covered up by “money laundering on a vast scale” at a High Court trial in London.

Privatbank says its former owners Igor Kolomoisky and Gennadiy Bogolyubov misappropriated more than £1.5 billion (nearly two billion US dollars).

A judge began overseeing a trial yesterday, which is due to last 15 weeks.

Kolomoisky and Bogolyubov are fighting the case.

The trial was due to start a year ago but lawyers representing Mr Kolomoisky and Mr Bogolyubov persuaded Justice Trower that it should be delayed because of the war in Ukraine.

Neither Kolomoisky nor Bogolyubov are giving evidence during the trial.

“He’s gone under the radar because Anderson and Broad have been so good for so long.”

HUSSAIN ON WHY OLLIE ROBINSON COULD

CHOO-CHOOSE THE TRAIN The Royal train was pulled by the Flying Scotsman yesterday

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

BEST OF THE BROKERS

London markets rise ahead of Fed and ECB decisions

LONDON markets closed higher on Monday ahead of a big week for central banks, with the Fed, European Central Bank (ECB) and Bank of Japan all set for their latest interest rate decision.

The capital’s premier index climbed 0.1 per cent to 7,570.69 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, jumped 0.5 per cent to 19,190.81 points.

“To pause or not to pause – is the big question investors are mulling about the intentions of Fed policymakers ahead of the crunch meeting this week,” Hargreaves Lansdown’s Susannah Streeter commented.

“They’ve taken up arms against a rising sea of inflation by hiking rates at the fastest pace in 40 years, but with signs that the economy is shuffling off into a potential recession, the expectation is that they are likely to keep rates on hold.”

The ECB is expected to continue hiking despite signs of a slowing economy. Inflation in the eurozone remains stubbornly high with investors expecting at least one more hike this year.

Although the Bank of England is not making any rate decision this week,

member of the rate setting committee Jonathan Haskel suggested there are more hikes in the pipeline.

On the FTSE 100, Ocado continued its positive spell rising 3.8 per cent on Monday. Over the last few days it is up nearly 16 per cent.

Croda International gained 3.2 per cent after tanking on Friday after a profit warning.

In company news, Glencore made a fresh offer to take over the steelmaking coal business of Canadian miner Teck Resources. This follows two previous attempts to merge the companies which were rejected by Teck’s board.

The latest bid reflects Glencore’s persistence and interest in Teck, but is also a concession by the company, with CEO Gary Nagle last month arguing that buying Teck’s coal business as a standalone unit was a “distant second” for the Swiss mining company compared to merging plans. The commodities giant closed 0.3 per cent higher.

Frasers Group fell 0.3 per cent after a £75m investment in AO World giving it a stake of almost 20 per cent.

The pound continued to strengthen against the dollar, trading just below $1.2590.

Analysts at Peel Hunt have rated electrical retailer AO World a “Hold” following news Frasers Group acquired the stake previously held by Odey Asset Management. Frasers acquired an 18.9 per cent stake in AO World for £75m. Peel Hunt explained that: “Both parties are calling the stake a strategic partnership”.

BIT OF A FLOP

Analysts at Peel Hunt have rated mining services Capital Limited a “Buy” after it announced that it has secured a five-year mining services contract in Gabon. “Capital note that the contract should generate $30m (£24m) in revenues a year once at full capacity,” analysts said.

“If the intention of Saudi Arabia was to help push oil prices higher with its decision to cut production to 9m barrels a day from next month, then recent price action would suggest that they have failed in that aim. With Brent crude prices falling back close to their lowest levels this month we can’t even blame the strength of the US dollar for yesterday’s weakness. Markets appear to be more concerned about economic conditions in China.

MICHAEL HEWSON, CMC MARKETSAnalysts at Peel Hunt have rated Whitbread a “Buy” ahead of its first quarter update on 22 June. It comes as reports emerged the hotel group is eyeing a sale of its pub restaurants. But: “If Whitbread can cash [the pubs] in at a fair price it could drive higher returns,” analysts said.

OPINION

EDITED BY ELENA SINISCALCOScrapping inheritance tax won’t help the Tories win over young voters

to the top 4 per cent will not alter this perception.

THE ISSUE of inheritance tax, once again brought into focus by a number of Conservative MPs, has resurfaced like a fiscal Lazarus. Advocates of eliminating the tax are thinking that, with the Conservatives behind in the polls, abolishing the inheritance tax may provide a pathway to electoral victory.

But, much like in 1997, promising to scrap the tax will not save the party from electoral oblivion. Conversely, proposing its abolition shows how out of touch many Conservative MPs are with the crucial demographic that they need to win over - young people.

Whenever the Conservatives are in an uncertain electoral position, the idea of scrapping inheritance tax gains prominence. Just months before Tony Blair’s Labour landslide, Ken Clarke promised to abolish it. Then, in 2007, after ten years in opposition and still unsure of the Party’s future prospects, the Conservatives once again floated something similar. George Osborne promised at the time to raise the threshold from which one pays inheritance tax to one million pounds. The theory goes that Gordon Brown was persuaded against calling a snap election because of public opinion turning towards the Tories after the announce-

ment. But the success of the 2010 election was not down to this promise. At the time, Labour lost because their electability was undercut by the credit crunch.

Fast forward to the present, the Conservatives find themselves 16 points behind in the polls. Panic is setting in and inheritance tax reform is back at the forefront. Several prominent Conservative MPs are calling for the abolition of inheritance tax, labelling it as “morally wrong.” Nadhim Zahawi MP, the flagbearer of this campaign, claimed that by abolishing inheritance tax the government “can show that

they back families in their desire to pass on their hard-earned savings to the next generation.”

A lot of this campaign’s ideas about inheritance tax revolve around the perception that it penalises hard-working families and deprives them of their savings. However, only around 4 per cent of deaths in the UK result in an inheritance tax charge. Ordinary taxpayers, workers and young people would be left largely unaffected, especially as the median age to inherit is 61. Consequently, it would not be an electoral asset.

Almost half of the UK population is

under 40. Yet even in the 2019 election, with its resounding Conservative victory, the under-40s overwhelmingly sided with Labour, with age being the strongest determinant of voting intention.

To make things worse for the Tories, it’s no longer the case that people become more conservative as they age. The majority of young people continue to perceive them as out of touch, while they see Labour as relatable and supportive. Indeed, a recent report from Onward showed that those below 35 are increasingly unlikely to vote Conservative. Merely offering tax benefits

Our obsession with Johnson and other leaders of the past is ruining our politics

LAST weekend was filled with political drama. And as it’s often been the case in the past few years, at the centre of that drama was Boris Johnson. Specifically, this time, it was his melodramatic exit from politics last Friday. The former prime minister decided to resign after the investigation into Partygate found him guilty of misleading parliament. Johnson would have had to face a suspension from the House of Commons. He couldn’t accept such an affront to his dignity, so he decided to leave politics altogether (“at least for now”) with a raving resignation letter. “I did not lie, and I believe that in their hearts the committee know it”, wrote Johnson, accusing the committee of being a “kangaroo court”.

He criticised Rishi Sunak’s government for not being Conservative enough and brought down a few people with him. Energy secretary Grant Shapps wrapped it up on Sunday saying people wanted to move on from the “drama” of the chaotic former

prime minister. But did they really?

We are all obsessed with political personalities of the recent past. New laws and policies get thrown out sporadically - and they’re often so controversial that they spend months ping-ponging in Parliament as the Lords desperately try to block them.

But despite Sunak’s efforts to look all grown-up and focus on doing rather than talking, Westminster is completely addicted to the drama.

On the other side of the pond they’re not doing much better. Their blonde-haired problem could be described as even more farcical than Johnson. Former president Donald Trump is facing his most serious legal threat to date: federal charges of mishandling classified documents. We’re talking about national security

briefs stocked up in his bathroom in Mar-a-Lago. All while he was ramping up his attempt to get back into the White House.

The Trump story is unique. And don’t get me wrong: it deserves much coverage and reflection. It’s a story about entitlement, power, and what went wrong in American politics. Yet in a way, it’s all part of the same paradox: an obsession with the past, with the drama, with those figures who could provide us, at times, with some “light-hearted fun” or absurdity.

Yesterday Silvio Berlusconi, by far the most influential political figure in Italy in recent history, passed away at the age of eighty-six. He was known for building a media empire; for leading four different governments; and for his links to dirty money and prostitution. His “politically incorrect” jokes defined a language, an era, a country.

Italy will fairly take the time to mourn him - but it’s impossible to deny the country was addicted to him. And this long-standing addic-

tion stole time from policy-making that could have really helped a country with so many social and economic problems.

Incidentally - or perhaps not - these big personalities are always men. Female political leaders are too busy proving their worth in the most impossible ways; they don’t have time for scandals and drama. Even thinking of Nicola Sturgeon’s temporary arrest over the weekend, it’s fair to say it’s a very different story. And whether you like Sturgeon or not, she brought seriousness to her politics. Politics can be boring; some drama might make it entertaining, and even more accessible. But there’s a real need, in the UK and elsewhere, for some serious politics. Many have made the case that we simply choose the wrong political leaders - individuals who have charisma, but no idea how to run a country. Instead we deserve politicians who pour over alternatives, confront solutions and come up with feasible policies. These men’s jokes, after all, are not that funny.

This is despite the fact that young people hold some values that resonate with the Conservative Party. They have recently been characterised as “shy capitalists,” who prioritise economic equality, but believe they should retain their hard-earned money. They view low taxes favourably, with lowering income tax ranking as the fourth most popular policy amongst this demographic. Among the general population, it only ranks seventh place. Given their desire for fiscal policy that benefits working people, abolishing inheritance tax wouldn’t be a particularly poignant issue amongst the young. They would rightly see it as exacerbating wealth inequality between generations and social classes. Not only does it fail to achieve distributive justice, but it would also fuel resentment that it is again young people who are being overlooked for tax cuts.

Just like in 1996, the Conservatives face the serious risk of electoral defeat. Scrapping inheritance tax is not the path to avert it. If the Tories do go ahead and eliminate it, it will only serve to prove that they indeed are disconnected from young people and favour supporting those leaving the workforce rather than those entering it.

The Conservative Party will have to garner the support of young people somehow if they are to succeed. Abolishing inheritance tax is not the way to do so.

£ Thomas Nurcombe is a research assistant at think tank Bright Blue

A BITTER PILL

Who wanted to be in Boris Johnson’s honours list? Not Michael Gove, he reassured us. Gove said he wasn’t expecting a peerage like others who served in Johnson’s government. He also pointed out Boris had a tendency not to follow his advice.

Best example of frenemies

LETTERS TO THE EDITOR

Don’t greenwash me please

[Re: Shell hits backs at advertising watchdog after it labels green campaign ‘misleading’, June 7]

In a clampdown on greenwashing, the Advertising Standards Authority has banned Shell’s adverts claiming they misled consumers given most of its business is based on environmentally damaging fossil fuels such as petrol. And this isn’t the first time we’ve seen the ASA take a stand against big corporations with past clampdowns including bans against Persil and Lufthansa. While Shell have said they “strongly” disagree with the ASA’s findings and that increased scrutiny like this could slow down the UK’s drive towards renewable energy, it shows the growing importance of transparency,

brand reputation and consumer trust as corporates work to reach climate targets. As companies strategize to hit those net-zero targets, they cannot ignore the marketing side of things. There’s still a big gap between marketing and sustainability with some companies over exaggerating sustainability claims. We are likely to see an uptick in environmental claims being studied under the microscope from advertising regulators, consumer watchdogs and even governments. Ultimately, collaboration is key here. A sustainability strategy should be integrated across all parts of a company including marketing, operations and finance, and its stakeholder ecosystem. It’s about how companies achieve netzero plans, but also about how they communicate it and the value they put behind it.

Duncan Reid Reset Connect LondonDISCOUNTS TIME Waitrose cut the cost of more than 200 products

Artificial intelligence could turn human contact into a prerogative of the wealthy

SPEND too much time on Twitter and you quickly become inured to the predictions of techie soothsayers that humanity’s last days will be lived out under the thumb of an omnipotent artificial intelligence. But putting the end of our species to one side, how else might the substance of our societies be subtly shaped into a new form by the integration of AI into our daily lives?

This includes not only the major question of whether AI, in automating white-collar jobs, will hollow out the middle classes and widen wealth inequalities, but also how the advantages and disadvantages of AI-enhancements will be shared out.

Might the richer among us enjoy luxuriantly lazy AI lifestyles in homes run by digital assistants, while those lower down the socio-economic scale still have to get up to switch on the light or – gasp! – drive their own car?

Wealthier people’s easier access to new advances might easily be the first thing one thinks about when reflecting on how AI could end up deepening inequalities. But increasingly, it is the non-tech, “human experience” that is the preserve of the super-rich.

As the price of food goes up, Waitrose has decided the price of its products should go down - with everyday staples getting a reduction of at least 10 per cent. The supermarket giant has cut the price of bread, beef mince, butter, sugar and many other products in a bid to support customers.

EXPLAINER-IN-BRIEF: WHY NATO HAS BEEN FLYING ITS TROOPS ABOVE GERMANY

We might think of China hovering over Taiwan when we think of military exercises, but everyone does them - including NATO. In fact the military alliance is currently busy with the biggest air force exercise in its history, employing 250 planes and 10,000 troops. One hundred aircraft have been sent by the US alone. The scenario is, predictably, a potential clash with Russia. It will be guided by Germany, and 25 member nations will take part.

Air Defender 23 (that’s the name of the exercise) will include fake air battles and airfield evacuations. Three flight zones will be closed, and delays to civilian air traffic are expected in the next ten days. The message the alliance wants to send is that they’re prepared to protect their borders, whatever it takes. The US ambassador to Germany said Putin and other world leaders should take note of the “strength” of NATO.

ELENA SINISCALCOAlready, ordinary people are corralled by businesses that use chatbots to handle customer service. Dealing with my bank recently, I ran a gamut of robot voices as I struggled to make my way to a human being who might actually be able to help me. Is this an experience familiar to the customers of the private Coutts Bank, for which you need £1 million in investable assets to open a current account, and whose clients include the King? It seems unlikely.

AI’s reach will go beyond the purely commercial. Gillian Keegan, the Secretary of State for Education, has called for AI to enter the classroom and take “the heavy lifting out of teaching” by automating marking and lesson plans. Major international institutions like UNESCO are similarly excited about the applications of AI in education, through innovations that include highly personalised classroom experiences that use ‘intelligent tutoring systems’.

Wealthy families are likely to pay for a very different experience. Tech-elite Silicon Valley parents – including Google CEO Sundal Pichai – are known

for their commitment to providing their kids with ‘screen-free’ childhoods. In the UK, institutions like The London Acorn School list “an over-reliance on technology is detrimental to children” as a core belief, priding themselves on tech-free classrooms. British parents who want to secure their child a place in this analogue world can do so for a little over £10,000 a year.

Similarly, in the teeth of a mental health crisis, a cost-of-living crisis, and long NHS waiting lists, digital mental health is big business and AI has a role to play there too.

Take Woebot, an AI-enabled ‘automated conversational agent’ that offers users Cognitive Behavioural Therapy (CBT). The app’s CEO claims it has tens of thousands of users. Woebot

is free, but a CBT session with a flesh and blood therapist will set you back around £60 to £100 an hour. Even remote therapy companies – they advertise aggressively on political analysis podcasts, make of that what you will –offer sessions for a similar price.

The result of this trend might be a world in which the differences between the lives of the haves and havenots is not demarcated by who flies first class or chooses a staycation. Instead, the divides may stand starkly between those who can afford a human tutor for their child or an appointment with a human therapist, and those who must rely on affordable, but cookie cutter, advice dispensed by AI.

£ Phoebe Arslanagic-Wakefield, a City A.M columnist, is chair of Women in Think Tanks

MOTORING

HOTEL CALIFORNIA

The Volkswagen Grand California is a family bus that’s more

It’s Asense of freedom you don’t get with other holidays.” Jay from The Inbetweeners might have been prone to wishful thinking (“the first rule of Caravan Club is that everyone gets some”) or even outright lies (“the Camber Sands meeting is always like a massive orgy”), but he clearly enjoyed a traditional British getaway.

Me? I still felt scarred by memories of a week in Wales, huddled with my parents in a cold caravan while the rain drummed endlessly on the roof. It was, well, a sense of freezing you don’t get with other holidays. Thankfully, this time would be different. This time, we were headed to New Forest and the forecast was wall-to-wall sunshine. And this time, instead of a flimsy fibreglass box, we had a Volkswagen Grand California. With central heating, a bathroom, kitchen facilities and dimmable ambient lighting, this fully-kitted camper is like a

hip studio apartment on wheels. “You kids don’t know you’re born,” I may have muttered, as the Pitts piled aboard.

In two-tone red and white, the Grand California 600 channels the spirit of the classic VW Microbus. Or maybe it just looks like an ice cream van, I can’t decide. The cabin sleeps four, with one double bed at the back and another in the hightop roof above the driver and front passenger. It’s beautifully built, with loads of clever storage and a huge 800-litre ‘garage’ for your luggage. You could pack the kitchen sink, if it didn’t already have one. Volkswagen doesn’t quote a 0-62mph time for the Grand California, but be assured that nothing happens in a hurry. Its gruff 177hp 2.0-litre diesel engine sounds pretty ‘light commercial’, too. Nonetheless, a high driving position, tight turning circle and big mirrors, plus an array of sensors and cameras, all make for comfortable,

VOLKSWAGEN GRAND CALIFORNIA 600

PRICE: £80,666

POWER: 177HP

TORQUE: 302LB FT

TOP SPEED: 101MPH

FUEL ECONOMY: 26.2MPG

CO2 EMISSIONS: 284G/KM

stress-free progress. You can’t say that about a Ryanair flight to the Med.

The New Forest is teeming with Volkswagen campers: mostly recent T4 and T5 models, many of them customised with airbrushed paint and alloy wheels. Our flagship T6 Grand California turns plenty of heads and, sure enough, I’m soon approached by a fellow dad (“Oooh, van friend!”) who asks for a guided tour. Nosey neighbours aside, getting settled in the Grand California couldn’t be easier. You simply park up, plug in and un-

pack the custom-fit table and chairs. Oh, and light the barbecue. On a balmy summer evening, it really does feel idyllic.

Everyone gets a solid night’s sleep, too. The mattresses are only 80mm thick, but the springs underneath add some extra squidge. The upper bed is really for children only, but our two (aged nine and 12) had no complaints. And while tentdwellers were roused at dawn by bright sunshine and stifling humidity, we managed a quiet, climate-controlled lie-in.

Some downsides of being a “bus w**ker” become apparent the next day, starting with a cramped shower, then emptying the toilet waste: not a task I’d recommend after breakfast. We then realise that driving anywhere means clearing the kitchen, folding away the top bunk and stashing everything in the cupboards again. It’s certainly not as spontaneous as simply unhitching a caravan and jumping in

your car.