FRENCH OPEN WORLD No172 BEATS

FANCIED RUSSIAN IN PARIS P24

FRENCH OPEN WORLD No172 BEATS

FANCIED RUSSIAN IN PARIS P24

THE EMBATTLED business trade body

the CBI is expected to lay out a series of measures today which it hopes will allow it to put a sexual harassment scandal behind it.

The CBI, Britain’s biggest business trade body and for decades a mouthpiece for the country’s largest businesses, has been hit with a wave of accusations in recent months which have resulted in the ouster of director general Tony Danker, a whole host of members bailing on their memberships, and the temporary suspension of their engagement with government. The accusations include two rape allegations and a host of other allegations of unwanted sexual advances.

City sources suggest the CBI has been undertaking a “listening” exercise with members in recent weeks, with a new head of culture recruited in an effort to overhaul the culture at the umbrella body.

Yesterday, it was revealed that the

CBI has taken legal advice on insolvency options, should members not be able to back the organisation in a crunch vote next week.

Sky News’s Mark Kleinman reported that the organisation had sought advice beyond its usual law firm, Clarkslegal, as well as Fox Williams, which conducted a root-and-branch review of the CBI’s response to internal allegations.

That report concluded that senior staff dealt appropriately with allegations that they were made aware of.

Nonetheless, a whole host of Britain’s largest corporates pulled their membership, including EY, Kingfisher and Aviva. Others, from Lloyds Bank to Mastercard to Uber, elected to suspend their membership until the CBI had got its house in order.

One City source said a number of corporates were viewing the vote on 6 June as ‘D-Day’ and would make decisions about restarting –or ending –their membership after the CBI’s presentation.

The organisation’s finances will be under significant pressure if further blue-chip members, which pay the highest fees, pull out of the body.

The now-former director general Danker accused the organisation of “throwing [him] under a bus” when it elected to bring in Rain Newton-Smith.

A CBI spokesperson said: “Following a series of member resignations, we know that the CBI will need to be smaller and refocused in the future. The board has sought advice on matters of restructuring as may be appropriate, as any responsible board would.”

Whilst the CBI has suspended its lobbying activity, other bodies have been jockeying for position to replace the organisation.

The consultancy WPI Strategy, which is behind the nascent business grouping BizUK, has recently hired Keir Starmer’s former policy director Claire Ainsley with a view to expanding the work of BizUK over the coming months, City A.M. understands.

AS IF THE STRIKES WEREN’T ENOUGH... Just Stop Oil cause rush-hour chaos on London Bridge

JUST STOP OIL protestors once again forced car and bus drivers to idle their engines yesterday as they blocked London Bridge during the evening commute.

Met Police officers eventually moved the protestors on, but not before traffic

tailed back some distance along Borough High Street.

Just Stop Oil are expected to continue their disruptive action despite politicians of all stripes suggesting the organisation was hurting, rather than helping, the environmental cause.

£ WHY ENOUGH’S ENOUGH: P15

CHARLIE CONCHIE

KPMG has slashed the bonus pool of its UK workforce and reined in commission for salespeople as its profits falter amid a slowdown in the dealmaking environment this year, City A.M. has learned.

The Big Four firm told staff in its

mid-year update last week that some bonuses would be slashed by as much as half while sales staff were told their commission could be held back until the end of the year.

In a note to staff seen by City A.M. bosses told workers that while the company had seen "double-digit

growth in many areas of the firm” it had “not been as high as we’d planned”.

“This means that our profit, and our bonus pool as a result, will be reduced on our original expectations,” bosses said.

Staff in the firm’s UK-wide business development team were

told yesterday that the company would hold back 40 per cent of total discretionary commission until the year end, but it could not guarantee they would be paid the full amount, a source on the call told City A.M. City A.M. understands the measure was last taken by KPMG bosses at the height of the

pandemic in 2020 when corporate clients reined in fees.

A spokesperson for KPMG yesterday told City A.M. payouts for UK staff had been hit by “a challenging economic environment”, which had affected the performance of some areas of the Big Four firm.

ON WEDNESDAYS WE DRINK PINK LIBBY BRODIE’S PICK OF THE BEST ROSÉ WINES P20

IT IS perhaps easy to become fatigued by news of the war in Ukraine. It is now 15 months since Vladimir Putin’s tanks rolled over the frontier for what they thought would be a straightforward victory, an imperial conquest more akin to 1940 or the Napoleonic era than the 21st century.

Through sheer bloodymindedness as much as western-supplied weaponry, the Ukrainians have fought the war

to an effective stalemate. It’s perhaps all too easy to move on to other things; a frozen conflict, far away, and with energy prices settling back to normal, one could make the argument that for all intents and purposes the war has no day-to-

day consequences. That’s understandable, perhaps, but wrong. Every week or so, some atrocity committed by Russian forces –be it yet another bombing of an apartment block, or news of the more than 1,000 attacks on the Ukrainian health system –jolts you back into realising that, no, it’s 2023, and there is war on our continent. Next week Rishi Sunak will meet Joe Biden in DC, with free trade on his mind but, more pressingly,

the desire to show the world that the two most important nations in NATO still stand steadfastly behind the Ukrainian people. In the Kremlin, Putin will no doubt be hoping that we bore of this war; that we become immune to the images of destroyed cities. We got bored by Putin’s invasion of South Ossetia; we got bored by the conflict on the eastern front of Ukraine, which has raged since 2014; we even got bored by Putin’s use of ‘little green men’ in

STAND BEHIND THE YELLOW LINE China has launched the Long March rocket with a new crew for its orbiting space station as it plans to step foot on the moon before 2030

Crimea. That cannot be allowed to happen again –not just because it would give Russia a free hand, but because it would encourage other dormant imperial powers, not least China, in their own foreign adventures. And in the US’s case, at least, it’s beholden on Joe Biden to box in any potential successor into support for Ukraine’s cause. The west –and the States in particular –cannot go wobbly on this one.

THE GUARDIAN

NO10 ACCUSED OF COVER-UP AFTER DENYING IT HAS BORIS JOHNSON MESSAGES

The government has been accused of a cover-up after telling the Covid inquiry it did not have Boris Johnson’s pandemic notebooks and Whatsapp messages, even though government lawyers were given the material.

THE FINANCIAL TIMES

GOLDMAN PLANS ANOTHER ROUND OF JOB CUTS AMID DEALMAKING SLUMP

Goldman Sachs is weighing another round of job cuts amid a prolonged slowdown in dealmaking, which has hit profits at the investment bank, according to people familiar with the matter.

TWITTER NOW WORTH A THIRD OF MUSK’S PURCHASE PRICE, FIDELITY SAYS

Twitter is now worth just one-third of what Elon Musk paid for the socialmedia platform, according to Fidelity, which recently marked down the value of its stake in the company, which Musk had signalled as $20bn earlier this year.

KYIV was once again hit by a wave of Russian drone attacks yesterday as Russian president Vladimir Putin upped the ante in his war against Ukraine. Kyiv itself also launched an attack on the Russian capital Moscow.

One Russian politician described Ukraine’s offensive –which caused largely superficial damage to some wealthy districts –as the most dangerous attack on the city since World War II.

Ukraine did not claim responsibility for the attack but

most impartial observers agreed it was most likely launched by the Kyiv government.

Two people were injured.

Putin said Ukraine had chosen “to intimidate Russia, Russian citizens and attacks on residential buildings”.

In a far more serious assault, however, four people in and around Kyiv were killed by Russia’s latest attacks, with 34 wounded.

The attacks were largely focused on civilian areas.

Reuters reporters on the ground said a 33-year-old woman had died on her balcony when debris from a

destroyed Russian missile hit an apartment building.

Western allies of Ukraine said they were watching events and were gathering information on the attacks on Moscow.

A White House spokesperson said “as a general matter, we do not support attacks inside of Russia.”

The US was “focused on providing Ukraine with the

equipment and training they need to retake their own sovereign territory,” the spokesperson

Prime Minister Rishi Sunak will travel to Washington for high-level talks with US President Joe Biden, with buttressing support for Ukraine on the Ukrainian ministers once again called for further

Putin has upped the ante in his war against Ukraine

military support from the west, with the UK and Germany under pressure to supply Eurofighter jets in order to gain air superiority.

There are fears that, after 15 months, the war may be losing the world’s attention.

Moscow continued to accuse the west of drumming up the conflict, with the Russian foreign minister describing NATO support for Ukraine as equivalent to “supporting genocide.”

Ukraine would “destroy everything Russian” in eastern Ukraine and Crimea, Sergie Lavrov said on a visit to Africa.

CHARLIE

CONCHIETHE FORMER investment manager of scandal-hit property firm Home REIT passed over “inaccurate” information to an ESG inspector and certain top figures had “undisclosed potential business interests” with third parties, a damning internal report has revealed.

In the initial findings of a muchawaited investigation yesterday, embattled former FTSE 250 firm Home REIT also revealed that its former investment adviser Alvarium allowed tenants to strike sideline refurbishment deals with external developers and did not tell the Home REIT board how much rent had been paid to the firm.

The report comes after Home REIT called in forensic accountants at Alvarez & Marsal (A&M) earlier this year after receiving serious allegations of wrongdoing in some of its property deals.

In a damning verdict on Alvarium’s management of the portfolio, A&M found that Alvarium’s “ongoing monitoring of tenants was limited” and the information it provided to an external ESG inspection firm, The Good Economy, was inaccurate.

The Good Economy’s findings fed into a report and were key to tempting in top City investors on ESG grounds.

“The board believes that these matters were likely to have had an impact on the conclusions reached by [The Good Economy] in their assessment of the company,” Home REIT said.

Home REIT added that A&M also identified the existence of “certain undisclosed potential outside business interests and undeclared potential conflicts of interest as between certain persons associated with [Alvarium] and third parties”.

“The board may decide to investigate some or all of these additional matters further, particularly if new information comes to light,” it added.

Property firm Home REIT yesterday published a much-anticipated internal report

Many of Home REIT’s shareholders, tenants and adversaries hoped the appointment of a new investment adviser last week would signal an end to the obfuscation of the past seven months.

AEW, a recognisable and seemingly safe pair of hands, gave some reasonable hope it would be straight talking from then on. No such luck. Yesterday’s initial findings of the much awaited wrongdoing report marked a complete 360 on Home REIT’s previous statements to the market and somehow left an exasperated investor base scratching

ANDREW MACASKILL

ANDREW MACASKILL

PRIME Minister Rishi Sunak will hold talks with US President Joe Biden next week when they will discuss improving economic ties and how to sustain military support for Ukraine in its conflict with Russia.

Sunak will be in Washington on Wednesday and Thursday next week for meetings with Biden, members of Congress and US business leaders, but there will be no talks about a formal free trade deal, Sunak’s spokesman said yesterday. The trip marks his first official visit to Washington since he was appointed prime minister in October.

their heads with yet more questions. Home REIT in many cases confirmed what short sellers said seven months ago. Shareholder Boatman Capital told City A.M. the statement was “confirmation by the board of their own incompetence”. Worn-out shareholders now just want clarity on when they will be able to trade their shares again. But given the sporadic and chaotic communication of theboard so far, they don’t seem to be holding their breath.

CHARLIE CONCHIE“The visit is an opportunity to build on discussions that the Prime Minister and President Biden have had in recent months about enhancing cooperation and coordination on economic challenges that will define our future,” the spokesman said.

JACK BARNETT

JACK BARNETT

LONDON businesses are poised to lead the UK economy out of its slowdown, although they remain acutely concerned about the impact of higher interest rates and scorching inflation, a new survey out today shows. Confidence among the capital’s firms slimmed four points to 43 per cent, although that was the highest

reading of any area in the UK, according to Lloyds Bank’s business barometer. It is the second month in a row that London has topped the business confidence table.

Firms are focusing on channelling cash into their existing workforce in a bid to scale up productivity and likely avoid having to pay high starting salaries to attract new workers amid a tight labour market.

Just over a third of London firms told Lloyds Bank that investing in their staff was their top priority.

Becci Wicks, regional director for London at Lloyds Bank Commercial Banking, said: “Although the business barometer registered a slight dip in confidence, the results are overwhelmingly positive as the country’s capital gears up for the busy summer months.”

LAURA MCGUIRE AND STAFF

LAURA MCGUIRE AND STAFF

THE ISSA brothers-owned Asda announced the acquisition of the Issa brothers-owned forecourts giant EG Group yesterday, creating what the grocer’s chair Stuart Rose described as a “consumer champion like the UK has never seen”.

The deal is worth around £2.3bn and will create a company with annual revenues in the region of £30bn.

The Issa brothers, who own both businesses alongside private equity firm TDR Capital, said the move would be “positive” for motorists, with Rose rubbishing fears that the tie-up could lead to higher petrol prices for consumers.

Analysts said the deal was the cleanest way for EG to deal with a substantial debt pile of

around £7bn.

“Our experts believe the primary driver of the deal is the need for debt refinancing. The merger appears to be the most logical option when weighed against the costs associated with alternative actions. Without [it], EG would have to either refinance its debt in considerably more expensive debt markets or opt for listing on the equity markets, albeit at a lower valuation than the potential that could be attained,” said Third Bridge analyst Orwa Mohamad.

Rose hit back at accusations the deal was driven by debt considerations.

“The primary driver of this deal was creating a business, which is a different business and a multi-channel champion,” he said in a media call.

“If as a consequence of that, you’ve also got the opportunity of deleveraging on the upside, then what’s wrong with that?” he added.

GUY TAYLOR

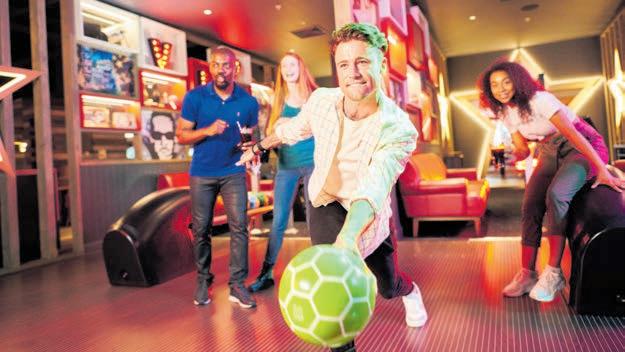

HOLLYWOOD Bowl yesterday reported record revenues in its half year results as Brits continued to turn to cheap fun despite the cost of living crisis and inflationary pressure.

The leisure group reported half year revenues of £110.2m, up 20.7 per cent on 2022 amid strong sales, and said it would continue to roll out new sites.

AKASH SRIRAM AND SAMRHITHA

A

NVIDIA joined an elite club of US firms sporting a $1trn market value yesterday, as investors piled into the chipmaker.

The stock's value has tripled in less then eight months, reflecting the surge in interest in AI following rapid advances in generative AI, which can engage in human-like conversation and craft everything from jokes to poetry.

Nvidia has gained roughly 240 per cent since October, far outpacing any other member of the broad-market S&P 500 index. The rally has propelled its valuation past its peers, but some analysts say the boom means the stock should still be worth more.

Its shares were up 5.7 per cent yesterday. Just four other US firms currently are valued at over $1trn.

“We view Nvidia as the most important company on the planet," said Angelo Zino of CFRA Research.

The latest surge furthers a rally from last week, which was jumpstarted by a revenue forecast that surpassed the mean Wall Street estimate by more than 50 per cent, which some analysts called “unfathomable”.

However, the bowling operator reported a drop in its pretax profits to £26.7m for the six months to 31 March, down from £33.4m.

Bowling boss Stephen Burns said: “We are looking forward to driving further growth in the UK and Canada, capturing the significant market opportunity ahead. Our resilience to inflationary pressures, strong balance sheet and cash-generative model gives

us confidence for the future.”

The leisure business said that 2023 will be a “record year of investment” as it looks to open new sites across the UK and Canada.

The firm yesterday said it was “on track” to meet target of 15 to 20 new centre openings by the end of 2025, with a strong pipeline for its Hollywood Bowl and Puttstars brands. Shares closed up 1.15 per cent.

CHRIS DORRELL

CHRIS DORRELL

EXPERTS were quick to praise proposals to relax rules on smaller domestic banks as the consultation on the socalled ‘strong and simple regime’ came to an end yesterday.

The proposals include simplifying disclosure and liquidity rules for domestically-focused banks with less than £15bn in assets.

The Prudential Regulation Authority (PRA) said the rules aim to mitigate the ‘complexity problem’ so as to promote competition. The complexity problem is when small banks face higher costs than large banks interpreting and implementing financial regulations.

Jake Ghanty, partner at Wedlake Bell, commented: “This is potentially a game-changer for the City in being able to attract and retain start-up banks, with the offer of a more straightforward Prudential regulatory

regime that is proportionate to the risks that these entities present.”

Although supportive of the underlying intentions, KPMG’s UK head of banking Peter Rothwell warned the reforms would be “highly complex to implement” as the PRA would have to balance “financial stability and promoting competition”.

He pointed out that because of the threshold at which the reforms apply, medium-sized banks could be stranded

The closure of the consultation comes amid instability in the regional banking sector in the US which many have argued derived from relaxing regulations on smaller banks. Some suggested the crisis would make the PRA less likely to relax rules in the UK.

Nisha Sanghani, partner at Ashurst Risk Advisory, said it is crucial the regulator does not “inadvertently” create another problem in its attempts to solve the complexity problem.

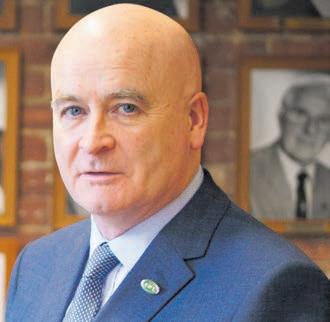

BRITS are bracing for fresh industrial action on the railways this week, with the RMT (headed by Mick Lynch, pictured) and ASLEF unions having announced planned walkouts today, Friday and Saturday, the day of three major sporting events (an FA Cup Final Manchester derby, Epsom derby and England vs Ireland at Lords).

INFLATION in the UK is set to top the Bank of England’s target for at least the next three years, likely forcing governor Andrew Bailey and co to tip the country into recession via yet more interest rate rises, a top Wall Street bank has warned.

Researchers at Goldman Sachs late last night hiked their forecasts for inflation over the next few years after last week’s numbers from the Office for National Statistics (ONS) revealed price pressures are going nowhere.

The firm suspects headline inflation, measured by the consumer price index, will still be above two per cent by 2026. It said by the end of this year, CPI will be running at 4.7 per cent –and then 3.2 per cent by Christmas 2024.

Core inflation – which the ONS last week calculated hit 6.8 per cent last month, up from 6.2 per cent in March –risks staying much higher than previously thought at six per cent in six months and more than three per cent by the end of 202, Goldman said.

Economists are concerned that the Bank of England’s 12 successive interest rate rises are failing to get to the heart of

LISTED legal and business services firm DWF yesterday delivered an upbeat full year update to markets, with eight per cent revenue growth headlining what CEO Sir Nigel Knowles described as a “robust” performance.

produces its audited full-year results.

DWF also said its cost reduction programme, which was expected to deliver around £10m-£12m in savings, will now shave £15m from the cost column, with most of the benefits in the 2024 financial year.

delivered consistently strong revenue growth and underlying organic growth, with the initial benefits of our cost control programme also coming through.”

the inflation surge. Borrowing costs have leapt to 4.5 per cent from 0.1 per cent and inflation is still at 8.7 per cent, far above the Bank’s two per cent target.

Analysts last week roundly jacked up their projections for peak UK interest rates. Deutsche Bank think they will hit 5.25 per cent, as do Japanese investment bank Nomura.

Last month’s core inflation jump suggests the surge in international energy prices after Russia’s invasion of Ukraine that initially drove up inflation is pushing up prices across the UK economy.

The Wall Street investment banking giant’s researchers also said robust wage growth caused by workers demanding pay rises to offset living costs threatens to keep services inflation elevated.

“We expect services inflation to stay elevated for longer, however, largely because we remain concerned about wage growth not cooling sufficiently and sustainably over the medium term,” they said in a note to clients late last night.

Food prices climbed nearly a fifth over the last year, according to the ONS, maintaining the fastest acceleration in around four decades, although Goldman’s analysts said that speed should slow soon.

Revenues are expected to sit around £380m when the company

CITY A.M. REPORTER

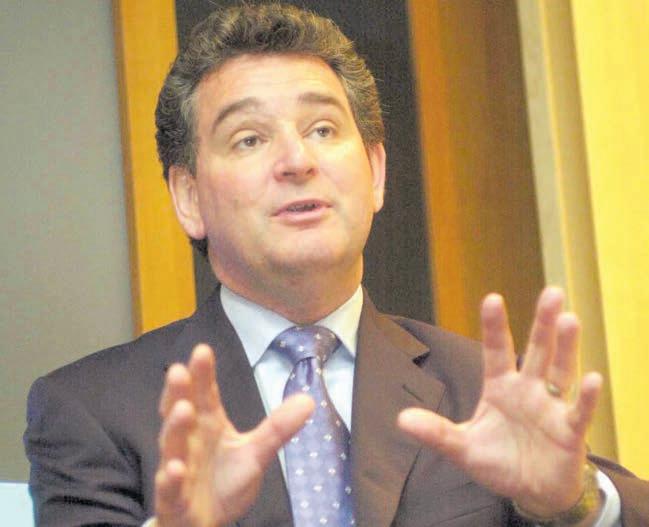

JONATHAN Bloomer, the current chair of Morgan Stanley International and law firm DWF, will add the top boardroom chair at Hiscox to his portfolio next month.

Hiscox, the Bermuda-headquartered insurance giant, announced Bloomer’s appointment as chair designate yesterday. He will replace Robert Childs, who will retire over the summer.

Bloomer was a partner at Arthur

Anderson before joining Prudential, initially as CFO in 1995 before leading the firm for five years as CEO from 2000. Since then he has served on a number of high-profile boards.

Colin Keogh, Hiscox senior independent director, said: “After an extensive search I am delighted to have led the process that resulted in the nominations and governance committee selecting Jonathan as the board’s next chair. We will benefit from his experience and leadership.”

CEO Sir Nigel Knowles said: “Our performance continues to show how robust a business we are, even in a challenging environment. We have

DWF’s acquisition of Canadian law firm Whitelaw Twining in December –the group’s first foray into North America –was also a cause for optimism, he added. Shares closed up 2.9 per cent.

CHARLIE CONCHIE

EVER-ACQUISITIVE outsourcing group Bunzl said it is eyeing yet another spate of deals today as it passed the 200 acquisition mark with the purchase of two Brazilian and Spanish safety distributors.

The FTSE 100 London-based firm yesterday said it had struck two deals to buy Leal Equipamentos de

Protecao, a specialised safety distributor in Brazil, and Irudek, a safety and personal protective equipment maker based in Spain. The two deals mean Bunzl has now made more than 200 acquisitions since 2004 in a relentless 19 year dealmaking drive. The group said its acquisitions had driven approximately two thirds of revenue growth over the last 10 years.

“This is a significant milestone to have reached and demonstrates our ability to successfully execute and integrate value accretive acquisitions as part of our compounding growth strategy,” Bunzl boss Frank van Zanten said.

“Our pipeline is active... and we see significant opportunities for further acquisition growth to supplement our resilient organic growth,” he added.

SPECIAL shipments of handpicked UK goods including Fever-Tree mixers and Beano Comics have been sent Down Under to mark the lifting of tariffs under new UK trade deals with Australia and New Zealand –the first such deals negotiated since Brexit.

THE SCOTTISH Mortgage Investment

Trust has rebutted fresh claims from its former director Amar Bhide after he filed a complaint with regulators claiming the firm misled investors over his exit.

Bhide, who left the firm in a boardroom bust-up in March after alleging that Scottish Mortgage’s directors lacked independence and should not be punting investors’ cash on private companies, has now claimed the trust gave a “highly incomplete” and “seriously misleading” account of his departure to the market.

The trust nodded to the row in its results on the 17 May, saying it was about “a fundamental difference in view on the suitability of the company’s investment policy” towards private firms and “managing the discount/premium”.

However, The Times yesterday reported that Bhide had launched a flurry of fresh allegations in a letter to regulators, suggesting the trust misled shareholders over

the main reasons for his departure.

“My dispute primarily started with and centred on the process for selecting and appointing the new directors. The [Scottish Mortgage] statement makes no mention of this at all,” he reportedly wrote in the letter.

Bhide claimed that his candidates to replace him on the board had also not been properly considered. However, City A.M. understands that two said no, two did not reply and one was quickly ruled out.

The firm has hit back at the suggestions, with incoming chairman Justin Dowley yesterday saying “the board is entirely happy that they are in compliance with all their governance and disclosure obligations”.

The scandal has unsettled the management of the investment trust after a bruising year in which it was rocked by the sharp sell-off in tech stocks.

In its final year results earlier this month, the firm acknowledged it had been “painful for shareholders” after the trust plunged 33.5 per cent in value over the year.

LAURA MCGUIRE

UNILEVER has announced a shake up at the top with both its chief financial officer and chief digital and commercial officer departing their roles just weeks before new CEO Hein Schumacher takes the reins.

Graeme Pitkethly, who headed the consumer goods giant’s finances, is

retiring after 21 year at the business. He will retire from the role in 2024 with Unilever launching a formal internal and external search for his successor.

Conny Braams, chief digital and commercial officer at the Ben and Jerry’s maker will also depart at the end of the summer, with a successor set to be announced in “due course”.

SUPANTHA MUKHERJEE

TOP ARTIFICIAL intelligence executives including OpenAI CEO Sam Altman yesterday joined experts and professors in raising the “risk of extinction from AI”, which they urged policymakers to equate at par with risks posed by pandemics and nuclear war.

“Mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks such as pandemics and nuclear war," more than 350 signatories wrote in a letter published by the nonprofit Center for AI Safety (CAIS).

As well as Altman, they included the CEOs of AI firms Deepmind and Anthropic, and executives from Microsoft and Google.

Also among them were Geoffrey Hinton and Yoshua Bengio –two of the three so-called “godfathers of AI” who received the 2018 Turing Award for

their work on deep learning - and professors from institutions ranging from Harvard to China's Tsinghua University.

A statement from CAIS singled out Meta, where the third godfather of AI, Yann LeCun, works, for not signing the letter.

The letter coincided with the US-EU Trade and Technology Council meeting in Sweden where politicians are expected to talk about regulating AI.

Elon Musk and a group of AI experts and industry executives were the first ones to cite potential risks to society in April.

Recent developments in AI have created tools supporters say can be used in applications from medical diagnostics to writing legal briefs, but this has sparked fears the technology could lead to privacy violations, power misinformation campaigns, and lead to issues with “smart machines” thinking for themselves.

THE DROIDS ARE COMING Tech experts from around the world gather in London for international robotics conference

Describing the most popular dish on her menu, Caroline Gardner leaves little to the imagination. That would be “our papadias which are like quesadillas but with crispy mashed potato and grilled onions. And then fried, but crispy on the outside and fluffy on the inside. And covered in salsa.”.

Caroline, with help from her mother and her boyfriend, runs a Birmingham street food business called Buena Onda (“good vibes” or “good times”) specialising in Mexican cuisine. Caroline’s mum came to the UK from Jalisco, the Mexican state where tequila is made. . Food is important to the family. “It’s always been a treat”, she says. The policy growing up was “no one can leave mum’s house hungry. She’s very nice, very hospitable, and loves a spread. We can just eat and chat, chat and eat nonstop.”.

Buena Onda was born during the pandemic, when the rule of six was still in place and food could only be served outside.

Daunting as it was, she's enjoyed the experience of setting up the business, she has found the process simpler than expected thanks to business financial platforms like Tide. With that not as much of a concern as it might have been, she's been able to enjoy seeing her business grow.

Having been cooped up indoors for months it was “magical”, says Caroline, to finally “wonder freely through this market”, watching people enjoy her food. It “just felt like a glimpse of real life, something we hadn’t seen in so long”.

Even before the pandemic, Caroline had been cooped up in a “job that I

hated”, working for a student accommodation company. But one day she saw her local market advertising for “‘experienced’” food traders on Instagram. She had no experience at all but applied anyway, thinking that her mum’s nachos were so delicious that she might as well try and sell them. “I thought, ‘I’m not doing anything else right now, I’m looking for other work, it’s summer’”, she says.

Running a business is hard, so she’s grateful that Tide has the financial side of the business covered, allowing her to focus on the bits of the job she enjoys.

Cooking for large numbers of people quickly is “high pressure. It’s blood, sweat and tears.” And “it’s always completely different. Just because 26 people came last Saturday, it doesn’t mean they will this Saturday.” Everything from train strikes to the weather can spoil a day’s trading, and you can “stand there feeling quite demoralised”, if, say, a chip van undercuts you at a school fête.

Markets charge hefty prices, too, sometimes up to 30 per cent of the day’s takings in addition to a pitch fee. The best piece of advice she has been given, she says, was to put up her prices. “We were still making a little bit of profit but not enough. When you’re feeling new and like I’m not a trained chef you think, ‘Oh gosh, it just feels a little bit cheeky.’” But you do what you have to.

Two years in, Caroline and team still feel “a little bit of panic” set in when they set off for the day. Luckily, there is “still a feeling of sheer joy whenever we’ve finished having a really great

weekend somewhere”. Those weekends are a lot easier thanks to Tide, the mobile-first bank for small and medium-sized businesses. Caroline’s grateful she found what amounts to a one-stop-shop for the financial side of her food operation.

Caroline got the app on day two of setting up the business, finding Tide almost by luck whilst googling in bed on her laptop.

“I looked on Martin Lewis’ Money Saving Expert for the best business accounts for small businesses,” she said. The bank she used for her personal fi-

nances wouldn’t allow her to open an account as a pop-up caterer, so it was a case of “on to the next.”

“I personally haven’t loved my experience with other more traditional banks”, she says. She has memories of a “little calculator thing for codes. I don’t want that. I want something

that’s simply built for an iPhone”, she says. Caroline remembers the need to open up a laptop and remember 12digit-codes with other banks, whereas on Tide it’s a simple - but safe - process on your phone.

Tide is simple to use and the “transactions come out really quickly” un-

By Heather Cobb, SVP Member

By Heather Cobb, SVP Member

Female entrepreneurship is thriving. Echoing the rise in female executives leading the workplace, we’ve seen a sharp rise in the number of women starting their own businesses over the past decade. Latest data from the Rose Review into entrepreneurship shows that the number of all-female-led incorporations accounted for 20% of new UK businesses started in 2022, up from 16% in 20181

Our latest Women in Business survey of almost 2,000 Tide members2 found that the West Midlands is one region in the UK where we’re seeing a rise in female entrepreneurs. Here, over a quarter (27%) of women stated that ‘being my own boss’ was the top reason they started their business. Take Tide member Caroline Gardner, for example. Caroline left her stressful job in student accommodation during the pandemic to set up Buena Onda (‘good vibes’ or ‘good times’), a Mexican street food business. What she loves most about having her own business is the “freedom to move around and adapt our menu based on the weather, the venue, the occasion”.

quite monotonous. Crucially, she wanted to give her business idea a shot.

Despite major progress on female entrepreneurship, one troubling fact persists – three times more women (19%) than men told us that gender was a barrier to launching their businesses. Like the rest of the UK, the biggest obstacle facing female business owners in the West Midlands, in particular, is a limited access to finance (20%). This is followed by lack of knowledge about a particular business area or not receiving financial support from friends or family (both 16%).

At Tide, we recently met our target of welcoming 100,000 female-led businesses to our platform3, with some of our key growth areas including cities such as Birmingham, Manchester, and Leeds, amongst others.

like with the big banks.

Tide’s connectivity to third party accountancy tools is especially useful, says Caroline. She simply import pictures of receipts from Tide into the accountancy software, saving her stress and time. Her first VAT return was not as “traumatic” as she had expected,

she says, “thanks to Tide and the accountancy software I had in place. I thought it was going to take me the whole month of January but it was actually like two hours.” Tide frees up Caroline to spend more hands-on time with her business. She can get more joy out of it.

Caroline’s story tracks with a broader narrative - a major incentive for women to start their own business is to gain more autonomy. Going back to our survey, almost one in five (18%) launched their venture to have flexible working hours and a better work-life balance – almost twice as likely as their male counterparts (10%). Expressing creativity is another motivator for female business owners, with over a quarter (26%) of our female members in the West Midlands admitting they started their business to pursue a creative idea. Others felt like it was the right time to pursue their passion (8%) or put their specialist skills to work (14%) For Caroline, it was cooking the food she loved, and the chance to break away from a previous role that had been

But our work doesn’t stop here. Helping women overcome barriers to successfully run their own businesses is an important goal for us. We’re committed to supporting these women reach their full potential, whether that be through operational advice, networking opportunities or finance recommendations. We know that it’s only when women feel empowered and supported in achieving their goals, that they can make a positive and lasting impact on their communities – and help inspire the next generation of female entrepreneurs.

1 The Alison Rose Review of Female Entrepreneurship – 2023’s progress report

2 The Tide member survey was conducted UKwide between 3 and 7 February 2023, with 1,961 total respondents, with regional data on the West Midlands.

3 We’ve onboarded more than 100,000 female members. Here’s what they’ve told us about starting a business. Based on an average sample survey of Tide members

BOTH MAJOR oil benchmarks dipped yesterday – conceding earlier gains this week – as fears over the sustainability of the US debt ceiling made investors more cautious across markets.

Brent Crude was down 0.8 per cent in early trading, dropping to $76.45 per barrel while WTI Crude slumped 0.58 per cent to $72.25 per barrel – down 0.6 per cent from Friday’s close.

At the weekend, Democratic President Joe Biden and Republican speaker for the House of Representatives Kevin McCarthy reached an agreement over US debt –which stands at over $31 trillion.

Nevertheless, with the margins tight in both chambers of Congress, there are concerns the deal could be spoiled by various wings of the two parties.

The progressive wing of the Democrats could oppose spending restrictions, while the hard-right phalanx of Republican lawmakers revealed they might oppose the deal for raising the debt ceiling.

The agreement must pass a divided US Congress before 5 June – the day the Treasury has warned the country will not be able to meet its financial obligations

LUCY KENNINGHAM

Trent,

breaches of these overflow permits.

– which could disrupt financial markets across the world, with the dollar being the global, dominant currency. This would have a significant effect on the outlook for oil demand and influence policies over supplies across government and major producers.

The debt deadline is just a day after the next meeting of OPEC and its allies including Russia (OPEC+).

The group announced surprise cuts to output earlier this year – raising reductions to around 3.7m barrels per day.

As it stands, it is unclear how they will act with the recent slump in prices dragging down the market – with the previous manoeuvres only providing a short-term bump-up in markets.

News agency Reuters has reported that Russian deputy prime minister Alexander Novak expects Russia to leave its own output unchanged. The country is the world’s third largest producer.

However, Saudi Arabian energy minister Abdulaziz bin Salman last week warned that short sellers anticipating oil prices will fall should “watch out,” in a possible sign OPEC+ may cut output.

Chinese manufacturing and service sector data is out later this week.

THE ENVIRONMENT Agency (EA) has fined four water companies for breaching an overflow permit used to dump sewage into rivers and the sea between 2018 and 2022. According to data from a Freedom of Information request submitted by the FT, the watchdog prosecuted Southern Water, Severn

NICHOLAS EARL

MORE RESIDENTIAL and small-scale commercial rooftop solar power installations are expected to be made this year than ever before, stimulated by the high cost of grid electricity.

If the current pattern of growth continues, about 230,000 installations will be made in 2023, according to the latest data from industry body Solar Energy UK and certifier MCS, shared exclusively with City A.M.

This would raise the UK’s number of solar roofs from 1.24m to 1.47m.

The bounce suggests consumers are less anxious about the upfront costs of new installations, which typically cost around £6,000, with a payback time of 10 to 11 years, as shown in data from Money Saving Expert.

MCS chief executive Ian Rippin said: “The growth we’ve seen highlights the appetite for solar panels and does give some insight into the growing reliance on home-grown energy in the UK.”

Water over seven cases – amounting to a total fine of over £94m.

One fine against Southern Water accounted for the majority – £90m.

A ‘storm overflow’ permit allows waste water to be released from the sewerage system into rivers or the sea under certain circumstances.

Last year, there were over 300,000 instances of sewage spills; 554 were

The EA said it is “holding the water industry to account on a scale never seen before”.

Southern Water told the FT it is “at the forefront of the industry in monitoring and self-reporting to the EA”, whilst Yorkshire Water admitted “sometimes things can go wrong”.

Anglian Water and Severn Trent declined to comment to the FT.

LAURA MCGUIRE

THE RETURN to global travel and weak pound fuelled the recovery of London’s prime property market in the first third of 2023.

Data from Knight Frank shows sales on luxury pads above the £5m price point are up 40 per cent compared to the same period last year –as a relatively weaker pound

has allowed international investors to secure better deals.

Buyer demand was up 35 per cent above the five-year average in the first four months of the year, though transactions on properties below the £2m mark was down three per cent.

“Higher levels of cash sales, housing equity and affluence mean buyers and sellers inside zone one have been more immune from the

volatility in mortgage rates,” Knight Frank’s Tom Bill said. Yet there was concern over Labour plans to raise stamp duty for overseas buyers –although for now, “what is happening in the economy or lending market” trumps politics, Bill explained. But that will change in 12 to 18 months with the election. Labour has been approached for comment.

STEVE Forbes, the publisher behind the eponymous magazine, has warned that the US and the UK are on their way to a “planned, modern social economy” in an exclusive interview with the German historian Dr Rainer Zitelmann.

Forbes, who served as an economic adviser to John McCain and who has run for president himself, said that the US in particular had seen a “diminution of economic freedom” through a combination of the expansion of the “regulatory state” and the devaluation of the dollar through quantitative easing and low interest rates.

“The antidotes are simple: cut tax rates, stabilise the dollar and deregulate,” Forbes told Zitelmann, in the interview shared with City A.M.

Forbes, who has long advocated for policies close to that pursued by former president Ronald Reagan in the 1980s,

criticised candidates for the presidency for lacking an economic vision.

“So far none of the candidates or would-be candidates have spelled out a growth program the way Ronald Reagan did when he ran in 1980. Key to Reagan’s platform was a 30 per cent across-theboard cut in personal income tax rates,” he said.

“These would-be Republican presidents also need to spell out what they would do with the clueless Federal Reserve,” he added.

The Fed is believed to have come close to the top of its rate-hike cycle, with some critics accusing the body of moving too slowly –as inflationary pressures first became apparent in the economy as early as the winter of 2020/21. Forbes remains editor in chief of Forbes magazine, part of the Forbes Global Media Holdings group, which earlier this month said it had agreed to sell up to a consortium led by a 28-year-old tech CEO.

SAM TOBIN AND PAUL SANDLE

MICROSOFT yesterday accused Britain’s anti-trust regulator of being a global “outlier” in blocking its $69bn takeover of Call of Duty maker Activision.

The Competition and Markets Authority (CMA) vetoed the deal in April, saying it could hurt competition in the nascent cloud gaming market.

The company’s appeal is likely to be heard in late July, a judge at the Competition Appeal Tribunal (CAT)

indicated on Tuesday.

Microsoft’s lawyer Daniel Beard told the CAT: “If this process does not move forward quickly, it jeopardises this merger being completed.”

Microsoft argues the CMA was wrong to conclude the deal would lead to a substantial lessening of competition in the UK’s cloud gaming market. Beard said 10 regulators, including the EU’s, have already approved the merger.

“The CMA is the outlier,” Beard said, “[and it] risks derailing this deal.”

IN A depressingly familiar tale, the latest bank holiday weekend was characterised by vast disruption across the country, from airport e-gates failing to function to engineering work crippling the country’s rail network.

But what also caught the eye were more protests from Just Stop Oil, who interrupted showcase events such as the rugby union’s premiership final at Twickenham and the world-famous Chelsea Flower Show with their orange dye antics.

Just Stop Oil is an environmental activist group, in many ways a successor to groups like Extinction Rebellion and Insulate Britain. They are calling for no new oil and gas projects in the UK.

This is a credible position for people concerned about net zero carbon emissions and eager for the UK to reach the Paris Agreement goal of sustaining global temperatures within two degrees of preindustrial levels.

What is less reasonable is their method.

On Saturday, two protestors leapt over the barriers at Twickenham and unleashed a cloud of dye on the pitch, halting the game between Sale Sharks and Saracens, a day after three activists rinsed a Chelsea Flower Show garden in orange dust, which ironically had been planted to promote biodiversity and sustainability.

This is not Just Stop Oil’s first rodeo – with similar tactics being displayed this year at The Crucible during the World Snooker Championship when a protestor plastered the table with powder.

The group also recently tried and failed to storm the stage at Shell’s AGM, and has been taking part in so-called ‘slow marches’ across London, blocking bridges and busy roads.

Most unpleasantly, activists have taken to fouling valuable artworks – including Vincent van Gogh’s ‘Sunflowers’ at the National Gallery.

After all, it is so much easier to destroy and taint what is precious and meaningful to people than to build anything valuable yourself.

Yet, what is noteworthy is the public response to these tactics.

The intruders at the rugby were booed and heckled as they were dragged off by stewards and some of the players, the Chelsea Flower Show charlatans were given short shrift by visitors to the park, and, in a less palatable episode, a man was detained by police for shoving away protestors blocking a busy, rush-hour road in central London.

While assault can never be condoned,

War-torn Ukraine has built more onshore wind turbines than England since it was invaded by Russia – as the government aims to relax restrictions on onshore windfarms.

Yet, only two onshore wind turbines have been installed in England since Russia invaded Ukraine last February, generating 1 megawatt (MW) of electricity in the Staffordshire village of Keele. By contrast, Ukraine’s Tyligulska wind power plant – which is the first to be built in a conflict zone –has begun generating enough clean electricity with its 19 new turbines to power about 200,000 homes just 60 miles from the frontline in Mykolaiv.

£ Comedians Steve Coogan and Lee Mack have lent their support to a protest against sewage discharges into Lake Windemere, the biggest in the Lake District.

what is heartening is that the public can see Just Stop Oil for what it truly is – an antidemocratic mob looking to impose its will on others, without even trying to engage and argue with or convince people of the moral value of its aims.

Blocking roads and disrupting events enjoyed by millions and butchering artworks that make up our cultural inheritance is not freedom of expression. It is imposing your demands on others in a bid to dictate the policies of a government with the mandate of millions of people.

Polling consistently shows Brits care deeply about the planet, and most people engaged in the discussion around climate change know the world is not going fast enough to reduce emissions – and that this could have severe ecological and environmental consequences, potentially damaging our standard of living and causing severe harm to the natural world.

Essentially, we don’t need Just Stop Oil to showcase their message, especially as the debate they pretend is not being held is

underway already, and doesn’t require their voice.

Labour have confirmed, after months of foreshadowing, that if they win the next election, they will stop any new fossil fuel projects in the North Sea. Meanwhile, BNP Paribas has recently opted to stop funding new oil and gas developments.

Elsewhere, pressure groups such as Uplift have also been calling for no new sites in British waters –and their views are in line with the recent statements from the International Energy Agency and Intergovernmental Panel on Climate Change. Nevertheless, they are mistaken. The UK requires fossil fuels to meet its supply needs for the next three decades, even as the government wisely ramps up renewable generation to reach net zero. After all, 85 per cent of its housing stock depends on gas for heating.

In such a scenario, securing the least carbon intensive supplies is essential. Domestic oil and gas is considerably less environmentally damaging than overseas imports of liquefied natural gas, alongside being more reliable and supporting tens of thousands of jobs.

It is also the case that energy giants such as BP and Shell will be essential to funding the transition from fossil fuels to hydrogen and offshore wind, while North Sea operators such as Harbour and Neptune will likely be key for carbon capture projects.

Such an argument would only fall on deaf ears if made to Just Stop Oil activists, as would the fact that London is the heart of green investment, making its routine attempts to bring the capital to a logjammed standstill as counterproductive as they are ignorant.

The UK’s energy future, environmental goals and creaking North Sea oil and gas industry are debates of real consequence, and would be best served if Just Stop Oil no longer featured in them.

Such a site is a key feature in Britain’s cultural inheritance, yet water supplier United Utilies was responsible for 246 days in 2022 when sewage was discharged from storm overflows, according to Environment Agency data. Typically, celebrity support for a cause is an irksome issue best left unexplored, but calling for Lake Windemere to sustain its status as one of the most beautiful lakes in the world reflects a genuine sense of care for the tourist trap.

It also wouldn’t be a bad time to film another series of The Trip. That we can all get behind.

YOUR

What can we do to improve energy security? Email energy editor Nicholas Earl at nicholas.earl@cityam.com

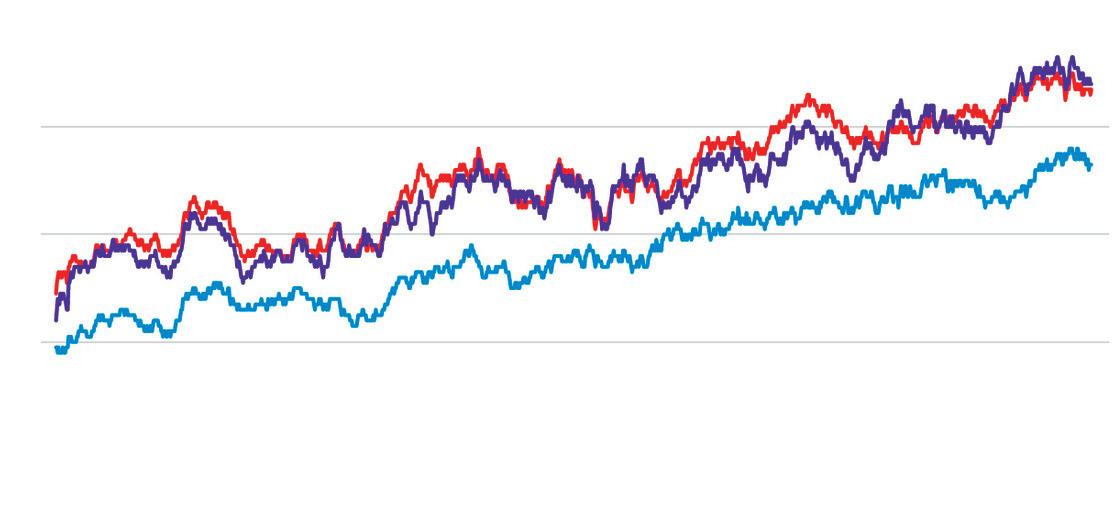

NINE years after founding Starling Bank, CEO Anne Boden is stepping down. But how badly will the app-based challenger bank miss Boden?

Looking at her tenure from the beginning of 2020 to 25 May 2023 – a period that encompassed a pandemic, a cost of living crisis and three prime ministers – shows that Starling has grown in the public’s estimation across a number of key metrics.

YouGov BrandIndex Impression scores for Starling Bank, which measure overall sentiment towards a brand, more than doubled, rising from 3.6 to 8.2 (+4.6), as did Quality scores, which rose from 2.8 to 6.4 (+3.6). These beat the scores of banks and building societies on average for both metrics (currently 6.0 and 5.3) respectively.

This has also been a period of user growth. Current Customer scores jumped from 1.9 to 5.3 (+3.4), and those customers seem to be getting happier: Satisfaction scores went from 1.8 to 4.8 (+3.0) between January 2020 and now, while Recommend scores tripled from 2.4 to 6.8 (+4.4). Beyond existing customers, Starling Bank has seen real improvement in Consideration scores, which asks consumers which brand they would bank with the next time they are in the

market for a financial product: these scores increased from 5.6 to 9.5 (+3.9). Starling Bank also appears to have become a more attractive place to work, with Reputation scores (a measure of whether consumers would be proud to work for a company or not) increasing from 4.5 to 9.6 (+5.1). Index scores, which measure brand health, grew from 2.9 to 6.7 over this period (+3.9) – while the average score across the sector grew from 3.9 to 4.5 over the same timeframe.

The departure of a founder can be a psychologically tricky moment for a company – especially when they’ve been at the helm during a period of success and growth. Boden’s last few years at Starling suggest she might well be a tough act to follow.

Stephan Shakespeare is the co-founder and CEO of YouGov

STARLING BANK HAS GONE FROM STRENGTH TO STRENGTH IN CUSTOMER PERCEPTIONS OVER THE PAST THREE YEARS

YouGov BrandIndex: Index, Recommend, Current Customer scores (eight-week moving average)

Index

Recommend

Current Customer

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his weekly columnStephan Shakespeare

LONDON’s FTSE 100 dropped sharply yesterday as recession fears outweighed US lawmakers closing in a deal to end the debt ceiling deadlock.

The capital’s premier index slid 1.38 per cent to 7,522.08 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, was broadly flat, closing at 18,807.37 points.

Traders in the City were seemingly unmoved by Republicans and Democrats over the weekend reaching an agreement to raise the cap on the amount of cash the US can borrow, dropping the risk of the world’s largest economy defaulting.

Republicans agreed to vote through pushing the debt ceiling above its current level of just over $31trn in exchange for spending cuts by the

Biden administration.

While such a move would help rebalance America’s public finances, it raises the risk of curbing economic growth at a time when the country is toying with slipping into recession. Instead, investors were more concerned with the growing threat of the UK slipping into a recession after all this year.

FTSE stocks dropped “on the back of weakness in the consumer staples and energy sector, as recession risks rise,” Michael Hewson, chief market analysts at CMC Markets UK, said. Online supermarket and middle-class favourite Ocado was yesterday’s largest faller, down nearly four per cent.

Interest rate-sensitive stocks also nursed tough losses, with HSBC, Barclays and Natwest all finishing near the bottom of the index, while Persimmon shed just over one per cent.

Bumper profits, up eight per cent, at leisure firm (and retail park stalwart) Hollywood Bowl signals a strong year ahead, according to Peel Hunt’s experts. Nearly £70m of untapped cash sitting on the balance sheet also means shareholders shouldn’t expect any danger of not receiving their dividend. Hollywood Bowl’s expansion plans are more than affordable, Peel Hunt added.

“A deal may have been struck on the debt ceiling, but it’s not fully calmed nervousness on financial markets. Limits on spending are being imposed just as America looks set to head towards recession, which could make it harder for growth to snap back.”

SUSANNAH STREETER, HARGREAVES LANSDOWN

Shares in online fast fashion retailer Boohoo are a snip. That’s according to brokers Peel Hunt, who recommend their clients take on the stock. Better-thanfeared consumer spending since the turn of the year also provides some strong tailwinds for the firm, though investors are still concerned about an “ESG blow up,” Peel Hunt said.

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership.

THE CONVERSATION AND BECOME A PART OF ONE OF LONDON’S MOST TRUSTED NEWS SOURCES

Comment and features deputy editor at City AM

Comment and features deputy editor at City AM

AMID the migration figures causing spasmodic twitching within the Tory party last week, there was a remarkable one: the backlog of asylum cases in the country hit a new record high. At the end of March, more than 172,000 people were waiting for an initial decision on their asylum application. That is an increase of 57 per cent compared to the same time last year.

The UK has a legal obligation to provide adequate accommodation for these people - but during a housing crisis like the one we’re witnessing, it’s difficult. The Tories have resorted to putting asylum seekers in hotels - a practice with many flaws, including its cost of £6m a day. The latest proposal is to temporarily scrap basic housing regulations to free up housing quickly, and more cheaply.

Earlier this month, while Levelling

Up Secretary Michael Gove was unveiling new laws protecting renters’ rights, somewhere else in the rooms of Parliament his colleagues were debating the government’s intention to scrap HMO licensing for asylum seekers’ accommodation. HMO stands for “houses in multiple occupation”, a term used to describe a property in which at least three people who come from different households live and share communal spaces like bathrooms and kitchens.

To be rented, houses occupied by five or more people need a special licence granted by a local authority. This is because historically, HMO has been more

ties will struggle to even know these properties are there. The responsibility of enforcement will then be on the Home Office, but the record on enforcement of standards on governmental contracted accommodation is very poor - think of the conditions at the overcrowded Manston centre. Private HMO landlords, often based abroad, will rent their unlicensed properties to government-contracted providers like Serco and Clearsprings Ready Homes, creating a murky chain of responsibility. Both Serco and Clearsprings refused to comment.

THE YIELDS on British government bonds have drifted upwards again. As many commentators have pointed out, we are back at the levels experienced during the short-lived premiership of Liz Truss.

An obvious culprit is government debt, now at around 100 per cent of GDP in the UK. This in itself can create anxiety in the financial markets.

But there is no hard and fast rule which connects the debt to GDP ratio with the degree of confidence in a country’s bonds and hence the interest rate required for new issues to be taken up.

Indeed, throughout the Western world governments have run up similarly massive amounts of debt, mainly due to lockdown policies. The markets

dangerous and

more open to abuse. Because so many people live in these homes, the risk of dying in a fire is six times greater than in other types of rented properties, and 16 times greater if the property has three or more floors. In March, a man died in a fire at Maddocks House, in Shadwell. More than fifteen people were reported to be living in the three-bedroom flat, which Tower Hamlets council had previously denounced as overcrowded.

“It’s a real criminal end of the market, the bottom end of this”, says Ben Reeve-Lewis of the Safer Renting programme.

Licensing was introduced in 2006 to ensure strict fire safety and space stan-

dards were respected. According to Reeve-Lewis, there are many rogue landlords, refusing to put fire doors and make repairs, operating under the radar in this sector. Some of them will look at the government’s proposal and lick their lips.

Scrapping licensing for two years for asylum seekers’ accommodation is “being done by regulation, not primary legislation, which is a lot easier to get through Parliament without proper scrutiny”, says Giles Peaker, a housing solicitor. The risks are twofold: there’s the immediate risk to the health and safety of asylum seekers and the communities around them, and the long-term risk of creating a set

of sub-standard, unlicensed housing stock.

It’s unclear what the government plans to do with these homes after the two years window - unless the policy gets extended. Does creating poor oneuse housing ever make sense? The government could decide to bring the properties back into licensing. But if that doesn’t happen, it will have created substandard housing in communities all over the country. “There are unfortunately going to be desperate people who are willing to rent these properties”, says Bridget Young, director of the No Accommodation Network.

Without a licence list, local authori-

appear to be taking much of this in their stride. Although yields on 10-year government bonds have risen, to some 2.4 and 3.0 per cent in Germany and France for example, they are still at historically low levels. But when we look at Germany, everything seems very familiar. The German railway workers are on strike for a 12 per cent increase. The Köln Institute for Economic Research has shown that the worker shortage in Germany has reached an all-time high, with 630,000 unfilled vacancies. Although both the UK and Germany have been teetering on the brink of a recession, Germany is now officially in one.

To some extent, the British government is simply being unlucky. The elusive factor of “confidence” has slipped away from the UK in financial markets, and yields on government bonds have risen as a result.

John Maynard Keynes attached the greatest importance to confidence, although he believed that at any point in time it was often “confused”. Keynes did not mean that confidence was determined in a completely irrational manner; he ruled this out explicitly. Rather, it was not necessarily completely logical. This makes much more sense than the completely rational expectations which mainstream economists now assume in

many of their models. Everyone is assumed to know the true model of the economy and to use it to form expectations. This is a tricky assumption to sustain when economists disagree amongst themselves as to what is the correct model.

But there are some fundamental worries about our government’s financial situation, so even allowing for “confusion” still seems pertinent. Index linked bonds make up over 20 per cent of total UK central government debt, compared to less than 5 per cent in Germany. With inflation being high, this means the Treasury has to pay out huge sums purely in interest on these bonds. In the

A government spokesperson ensured “the changes will not compromise standards and all properties will be independently inspected to ensure they continue to meet national housing quality requirements”. They pointed to the need to end “the use of expensive hotels” to house asylum seekers. HMO will undoubtedly prove cheaper, but one wonders at what cost, given the dangers of living somewhere that lacks gas safety certificates and carbon monoxide alarms. “It’s really a dangerous precedent, encouraging landlords to avoid existing schemes”, says John Perry, policy adviser at the Chartered Institute of Housing.

Ultimately, all this underscores a broader problem: the government is unable to look at migration and housing as two interlinked issues. The necessity of housing asylum seekers is not that different, in practical terms, from the necessity of housing homeless households. The problems with supply, quality and affordability of our homes are ubiquitous. Only a failure to grasp this and look at policy-making organically explains how a government could think creating unsafe homes for the long-term and putting asylum seekers in them was ever a decent strategy.

space of just a few months, the Office for Budget Responsibility has more or less doubled its estimate, now projecting £83bn of interest payments on government debt this year.

A key way of paying off debt is through a growing economy. This generates a stream of extra tax revenues from the higher levels of economic activity. But UK productivity, whether per worker or per hour, is the same as it was before the pandemic: zero growth in over three years.

Imagine an economy in which all government debt was index linked, so that inflation could not erode its value in real terms. Imagine further there was zero growth. In this fantasy world, the only way to repay debt incurred today would be by tax increases in the future. Although Britain is a long way off this nightmare world, we are much closer to it than Germany is. The economy is stagnating and our ability to repay government debt without massive tax rises is increasingly being called into question. No wonder that financial markets have the jitters on UK bonds.

£ Paul Ormerod is an author and economist at Volterra Partners LLP

[Re: Private funds expect incoming ESG regulations to boost sector – but UK will trail US and EU, May 30]

As the investment community awaits to hear more from the government on specific ESG provisions, the legal sector is affected too.

Law firms are not only challenging their own ESG practices, but increasingly those of their clients. Compliance for companies remains problematic.

Detailed laws and regulations are largely disclosure-based and will vary greatly by each jurisdiction, and sometimes even within individual jurisdictions.

An effective response is constrained by

a number of factors such as ESG data aggregators not being regulated, the lack of a consistent framework for a meaningful comparison of disclosures by different companies, and even the litigation risk of the best-intentioned disclosures.

In the UK, the regulations must balance reputational and technical excellence with the pragmatic need to attract domestic and international companies. In view of the narrative which is developing around capital markets post Brexit, and particularly over the last 12 months, that aspect cannot be overstated. This is a real challenge and if not properly addressed it could place the UK at a lasting competitive disadvantage in the market for new business.

Alex Tamlyn Partner, DLA Piper

THE EVOLUTION of tech usually goes through three phases. First – someone creates a new piece of kit or technology that changes the way we think and act. It is hailed as revolutionary and, in most cases, makes its founders very rich.

Second – unintended consequences emerge. They start small but soon spiral, with vocal critics imploring firms behind the tech to introduce safeguards whilst lobbying politicians to legislate.

Third – governments and regulators step in with a series of regulations to stem the harm. They typically arrive too late because the tech entrepreneurs, founders and funders have moved on to discover the next big thing.

This pattern stretches back for generations. It is incredible to think it took until 1965 for the government to legislate that all car manufacturers must install seatbelts – decades after the technology to build motorcars first evolved.

More recently, Uber upended the taxi industry with cute wordplay that had big implications for employment and tax laws, before loopholes were shut down. And today, social media companies are finally seeing new rules over online safety and threats to their business models if they don’t step up to protect vulnerable users.

Gone are the days when housing was boring; now, it seems to be all politicians want to talk about. Labour has a new announcement ready every week: this week, it’s about forcing landowners to sell at lower prices to stimulate housebuilding. Councils currently buy land through “compulsory purchase orders”, which include the “hope value”, based on the assumption that land will gain planning permission in the future. Labour wants to scrap this and let councils buy land at its agricultural value, enabling

them to find new places to build much needed homes. This outstrips current government plans, allowing the purchase of land for affordable homes at its face value - only in certain circumstances. Michael Gove won’t be happy - especially after reports Tory donors in the property industry are considering withholding their financial support because they think the government is not allowing enough homes to be built. Could they move to Labour, if they become convinced Starmer’s party is the one with housebuilding in mind?

It is with this history that you’d hope lawmakers want to get on the front foot with the next innovation – the rise of artificial intelligence.

On Tuesday, the godfather of AI, Geoffrey Hinton, co-signed a letter stating that “mitigating the risk of extinction from AI should be a global priority”. If anyone knows about the unintended consequences from the second phase of technology’s evolution – you would think it is him.

With that in mind, what can politicians do to try and get ahead of the game?

Investors in the technology will continue to focus on the bottom line and the firms developing the systems will talk of “ethical considerations”. Some might have pretty brochures and websites about the importance of ESG and may even hire an ESG expert.

But history shows changes only come when governments step in. So perhaps governments should insert themselves

into AI firms at an early stage and take on equity stakes to have a seat at the table to instil some oversight from day one.

Free market thinkers will say there isn’t a place for the state to interfere with the forces of capitalism. They will say it isn’t for governments to pick winners by offering investment for equity stakes in firms during the startup phase.

Governments will happily give tax incentives, create grant schemes and invest indirectly through pots of money that VC funds can tap into but they rarely want to see a piece of the action for themselves, lest they end up with egg on their faces. But they might need to swallow their pride and take a different course when it comes to AI.

Nation states need a seat at the table, to protect the interests of the citizens who will be using AI and seeing the outcomes – both good and bad.They need to put people over profits, ensuring growth but not at the potential cost to society.

The UK government still holds a golden share in a handful of British companies. The premise of these shares

is to protect these former state-owned firms from falling into foreign ownership.

It acts as a safeguard, even if merely symbolic, that the company is on the radar of the state, who will – in theory – put the interests of the public above those of the markets, if required.

When the government was forced to step in and take on NatWest during the 2008 financial crisis, its ownership saw a marked change in the way the bank operated – with a heavy slant towards acting ethically. This wasn’t through diktat, but with soft power as those in charge recognised they had a responsibility to the public to act beyond reproach.

If governments around the world want to ensure AI is properly scrutinised and the warning of Hinton and others is heeded, perhaps they need some skin in the game today, instead of turning up long after the party has ended and the tech world has moved on.

£ Simon Neville, former City Editor at Press Association, is Media Strategy and Content Director at SEC Newgate

ROSÉseason is finally here, and pink bottles can be seen glinting in the sun everywhere from rooftop ice buckets to picnic blankets.

Rosé is a crowd-pleaser, perhaps the most accessible of all the wine styles –and it is on the rise. According to Wine Business Monthly, sales in the US are growing by 40 per cent each year. In the UK we consume 12m cases annually. It may have once been seen as a drink for the ladies but sanity has prevailed, and it is increasingly enjoyed by both genders globally. As Bon Jovi said last year when I interviewed him about Hampton Water (£19.99, Selfridges), “real men drink pink”.

Among those welcoming Summer is South Africa’s Babylonstoren Mourvèdre Rosé 2023 ( The Newt In Somerset, £16.75), the official partner of the Chelsea Flower Show, which is fitting given its rosewater and rhubarb notes.

England’s most awarded rosé FOLC has just released its new vintage ( £19.95, Marlo ) to wide-spread acclaim for its refreshing vibrancy, ideal for a warm day.

Those worried about the inevitable all-day drinking aspect of sunshine filled weekends can relax with Thomas & Scott’s dealcoholized wines. Noughty AF is still the best I have found with fantastic still ( £10.99, Drydrinker ) and sparkling (£8.50, Waitrose) rosé options.

Roséis also the most versatile of styles to pair with food, able to handle spice, smoke, citrus and even bit-

YALUMBA THE VIRGILIUS VIOGNIER 2019

£40 OCADO

Taking it to the next level, this is the flagship of Australia’s most acclaimed Viognier specialists. From their oldest vines and best grapes, this is worthy of a 20 minute decant ahead of drinking. Exceptional.

Brodie

Brodie

ter green leaves of a crunchy salad. If in doubt, pair it with rosé. I recently sampled Chapel Down’s English Rosé (£14.99, Waitrose) at a friend’s BBQ and the texture of the wine held its own against the meatiest of kebabs.

One of the biggest wine myths out there is that the colour of your rosé is linked to its sweetness levels. This is simply untrue. Colour is all about skin contact when the grape juice has been pressed and the bottom line is you get some remarkable dry darker rosés.

Tavel is world famous –try some Arbousset Tavel Rosé (£12, Tesco) or the flavourful Greek Xinomavro, which creates deep, sumptuous rosés such as Kir-Yianni’s Akakies (£14.95, Great Wine Co).

No mention of rosé is going to be complete without the region that put it on the map for the UK: Provence. These refined blushes and elegant shell-pink wines seem to suit both poolside quaffing and long, gastronomic lunches.

Chateau Roseline’s Prestige Rosé (£15.50, Ocado) is fruity, fresh and gets the party started. Alternatively go premium with Chateau Minuty 281 (£71.99, Selfridges) –coming in a stunning bottle, this is one of my favourite wines, a complex, petal-soft rosé that takes you straight to the St Tropez sunshine.

Whatever your favourite region, grape or style, this rosé-tinted bubble isn’t bursting any time soon.

TAITTINGER PRÉLUDE GRANDS CRUS NV

£56 JOHN LEWIS

A richly generous and expressive champagne, Taittinger always seems to get it right when it comes to celebrations. A good price too given all the grapes come from their premium Grand Cru sites.

TRIVENTO GOLDEN RESERVE

MALBEC 2019

£15 TESCO

Awarded a fantastic 96 points at the International Wine Challenge, this silky red offers up waves of intense aromas. A bold, juicy Malbec from the first Argentinian winery to join the United Nations' Global Compact for sustainability.

HATTINGLEY VALLEY ENTICE

DESSERT WINE

£25

GREAT WINE COMPANY

A finely crafted English sweet wine reminiscent of a fresh, whistleclean Icewine but with luscious layers of perfumed tropical blossoms and sugared lemons. A delight served chilled with dessert.

KALFU SUMPAI SAUVIGNON BLANC 2020

£18.50 FRONTIER FINE WINES

A fresh, zippy white wine with sophisticated saline precision underpinning gentle layers of green herbs and warm citrus. A structured, satisfying, grown up Sauvignon Blanc which would be a perfect pour with ceviche or salads.

FEMALE-founded Pink Diesel rosé began as a pandemic passion project but made speedy waves with its tongue-incheek-yet-chic branding. Co-founder Amy Gatehouse is the woman taking it to the top.

HOW DID YOU GET INTO WINE?

I grew up with it as my father’s hobby, but it was while working in hospitality in Hong Kong, pairing wines with dim sum, that Australian winemaker

Eddie McDougall taught me how food-friendly rosé is. I moved to London just before the pandemic, working in interior design. My housemate Marina Ayton suggested creating a craft gin, but I thought the market was oversaturated. I have a background in PR, marketing and branding, not wine. But rosé is growing so fast, it’s accessible and you don’t have to know the grapes –plus we were drinking a lot of it.

We wanted to make fun of the “lady petrol” idea of rosé that you can find in the stuffier, male-dominated side of the industry – but in a chic way. In January 2021 we tasted 80 blends from 30 Provence producers then launched in May with a family-run HVE certified winery. In 2022 I raised £150,000 and quit my job to take it on full-time. We have just cracked the on-trade with Entoria & Coe which is exciting.

I really enjoy a glass of cold, crisp Wild Idol. I drink a lot of my own

wine, so I like a non-alcoholic option to maintain my sanity.