BUSINESS NEWSPAPER

DEADLINE LOOMING LONDON IRISH MUST PROVE FUNDS BY JUNE OR RISK POSITION P20

ASTON MARTIN NEW SUPERCAR MARKS END OF AN ERA P18

NO DEAL Apollo spikes £1.7bn bid for Wood Group

GUY TAYLOR

SHARES in John Wood Group plummeted nearly 35 per cent yesterday after US private equity firm Apollo Global dropped its £1.7bn takeover bid for the oil and gas engineering firm.

GREEDFLATION ROW HEATS UP

EX-RATE SETTER SAYS PROFITEERING NOT TO BLAME FOR PRICE SURGE

AS

WATCHDOG STEPS UP SCRUTINY OF FOOD AND FUEL PRICES

JACK BARNETT AND GUY TAYLOR

“GREEDFLATION” is not to blame for prices surging in the UK, a former Bank of England rate setter said yesterday, arguing that companies are instead pushing up prices in response to soaring costs.

Michael Saunders, who is now senior economic adviser at consultancy Oxford Economics, said isolated incidents of rising profits “do not reflect the overall picture” of the UK economy.

Speculation that companies have been exploiting the inflation crisis by unfairly

lifting prices to beef up profits, a process known as “greedflation”, has gathered momentum in recent weeks.

Supermarkets have been criticised for not passing on the reduction in commodity and transport costs as quickly as they raised prices after those costs soared.

But Saunders rejected assertions supermarkets are participating in greedflation.

“The bulk of UK food price inflation reflects cost increases from the international surge in prices for agricultural commodities and energy,” he said in a note

to clients yesterday.

His comments came as the Competition and Markets Authority (CMA) stepped up its review of the grocery sector due to ongoing concerns about high prices.

CMA chief executive Sarah Cardell, however, said she recognised “that global factors are behind many of the grocery price increases” adding that it has seen “no evidence at this stage of specific competition problems”.

Andrew Opie, director of food and sustainability at the British Retail Consortium, said: “When cost pressures

Restart game? EU approves Microsoft’s

JACK MENDEL

MICROSOFT’s $68.7bn (£54.8bn) bid for Activision Blizzard was approved by EU regulators yesterday, just weeks after the UK’s competition agency blocked the deal. The European Commission decided to approve the deal as it was satisfied

with the measures the firms had put in place to address competition concerns.

The UK’s Competition and Markets Authority (CMA) blocked the deal last month, sparking furious reactions from both firms, with Activision saying “the UK is clearly closed for business”.

facing retailers do eventually ease, retail prices will follow fast as they fiercely compete for market share.”

But in an update to a separate study into fuel prices at supermarket petrol forecourts, the CMA said the evidence shows “while the majority of fuel price increases are due to global factors, such as the Russian invasion of Ukraine, indications are that higher pump prices cannot be attributed solely to factors outside the control of the retailers”.

£ CONTINUED ON PAGE 2

$69bn Activision bid

The US Federal Trade Commission has also moved to block the deal.

Following the Commission’s decision, CMA chief executive Sarah Cardell said the agency stood by its decision, which both companies are challenging.

She said Microsoft’s proposals, which were accepted by the

after

Commission, “would allow Microsoft to set the terms and conditions for this market for the next ten years”.

“They would replace a free, open and competitive market with one subject to ongoing regulation of the games Microsoft sells, the platforms to which it sells them, and the conditions of sale. This is one of the

Apollo’s decision not to make an offer for the Aberdeenheadquartered firm came just two days before the 17 May deal deadline to make a firm bid or walk away.

Following Apollo’s announcement, Wood Group said the board “remains confident in the firm’s strategic direction and longterm prospects” and believes that after a strong year, and with new executive leadership, it was “well placed to deliver substantial value for shareholders”.

Wood Group first revealed in February that it had rejected three unsolicited approaches from Apollo, saying at the time that each bid “significantly undervalued the repositioned group’s prospects”.

But after rejecting another bid, it decided to consider a fifth bid for 240p a share in cash, which valued Wood Group at around £1.66bn.

Last week, Wood Group maintained its annual forecasts as it revealed turnover for the first quarter of around $1.45bn. (£1.25bn).

UK blocked deal

reasons the CMA’s independent panel group rejected Microsoft’s proposals and prevented this deal,” she said.

“While we recognise and respect that the European Commission is entitled to take a different view, the CMA stands by its decision,” she added.

INSIDE FISCAL DRAG TO CATCH OUT MILLIONS P3 UK LOOKS TO UNIVERSITY SPINOUTS P10 THE FIRM THAT COULD TRANSFORM THE METALS MARKET –FOR GOOD P11 OPINION P16

LONDON’S

TUESDAY 16 MAY 2023 ISSUE 3,980 FREE CITYAM.COM

Business should not be blamed for this vicious inflation crisis

ARE corporations causing inflation? The short answer is no. But this idea, coined “greedflation” is gaining worrying traction. Michael Saunders is right to challenge the notion that companies are profiteering from the inflation crisis the UK and much of the West finds itself in today. As he and others have pointed out, the evidence for greedflation is paper thin. Sure, a few bad apples seeking to grossly profit in a time

STANDING UP FOR THE CITY THE CITY VIEW

of crisis may well get found out. But business as a whole should not be blamed for this tough climate we find ourselves in. The endless company results statements this paper’s reporters pour through every day have for the past 18 months repeatedly

flagged huge cost pressures. Many have been on their knees asking for support as a result of rising energy bills. A tight labour market has also added further pressure on wages. Many have been forced to put up their prices as a last resort following less severe cost saving measures –surely a better option than redundancies. And these price rises are not higher than necessary, as those blaming the firms would argue. As Saunders

WESTMINSTER Home secretary Suella Braverman yesterday set out her political vision as she addressed the National Conservatism conference in Westminster

Data shows companies are not pumping up inflation to hoist profits, Saunders says

CONTINUED FROM PAGE 1

“We are very pleased to hear that the Competition and Markets Authority has confirmed what we have been saying for a long time about the biggest retailers taking more margin per litre on fuel than they have in the past,” the RAC said in response.

Similarly, oil and gas giants BP and Shell have come under intense scrutiny for pocketing huge windfalls from the increase in global energy prices after Russia’s full-scale invasion of Ukraine. But Saunders said if their financials are excluded from the UK’s corporate

margin estimates, data shows firms aren’t pumping up inflation to hoist profits.

Saunders pointed out that if profiteering was widespread, then companies would “support [economic] activity, through increased spending on investment and employment, or through higher dividend payments and rising equity prices”.

“In turn, this would sustain job growth and eventually feed through to a recovery in real wages,” he added.

Instead, because both profits and families’ real incomes are being squeezed by inflation – a scenario that

Saunders said more closely reflected the present dynamics in the UK economy – then firms’ margins would be trimmed as a result of a reduction in demand.

This would create “disinflationary pressures that will help bring inflation substantially lower,” he added.

Saunders’ comments come after current MPC external member Catherine Mann said earlier this year she is concerned firms’ “strong pricing power” risks keeping inflation high.

The European Central Bank has also signalled it is on the lookout for companies launching excessive price rises.

explained, the cost of materials used by food manufacturers have jumped 29 per cent over the last two years, while consumer prices have also leapt by 29 per cent over the same period. As ever, people always want to blame someone or something for the problems we have to face. But people should be pointing the finger at Russia and its invasion of Ukraine that sent oil prices rocketing, not companies trying to keep their heads above water.

WHAT THE OTHER PAPERS SAY THIS MORNING

INEOS WARNS UK IS TAXING NORTH SEA ‘TO DEATH’

Ineos owner Sir Jim Ratcliffe has accused the British government of taxing the North Sea oil and gas industry “to death” and warned that plans to spend up to £1bn upgrading key pipelines were at risk.

THE TIMES

LUXURY GOODS TRADE BODY WALPOLE URGES A RETURN TO TAX-FREE SHOPPING

The British luxury goods trade body Walpole has urged the government to reinstate tax-free shopping to guarantee London’s position as the “world’s number one luxury city”.

THE GUARDIAN

JOHN LEWIS OWNER PICKS SAATCHI & SAATCHI AS NEW ADVERTISING AGENCY

The owner of John Lewis and Waitrose has replaced its advertising partner of 14 years, which helped turn the retailer’s Christmas ads into an annual event, with Saatchi & Saatchi.

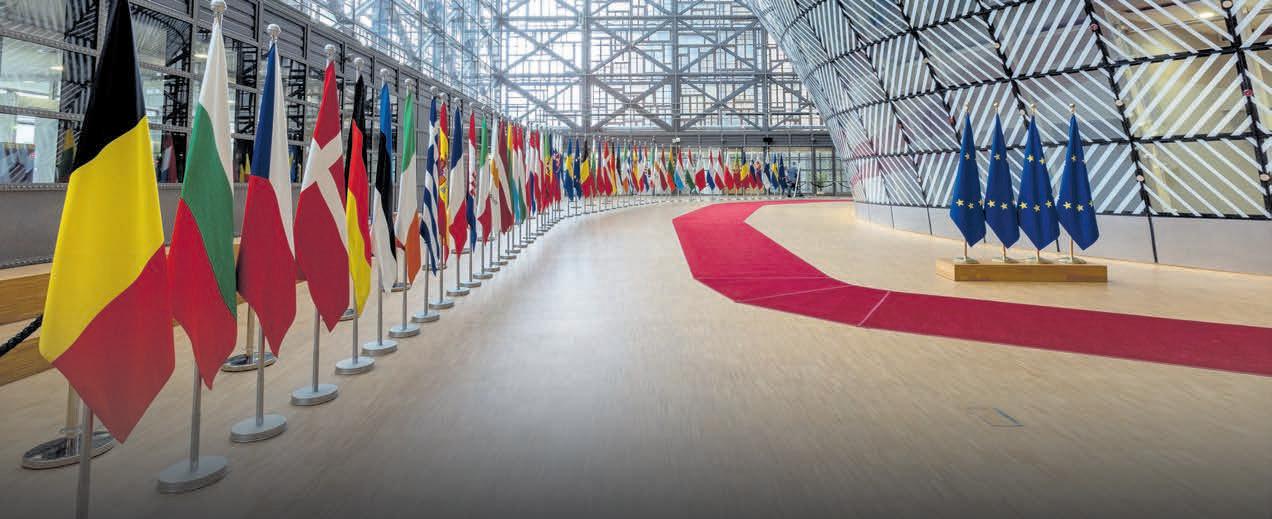

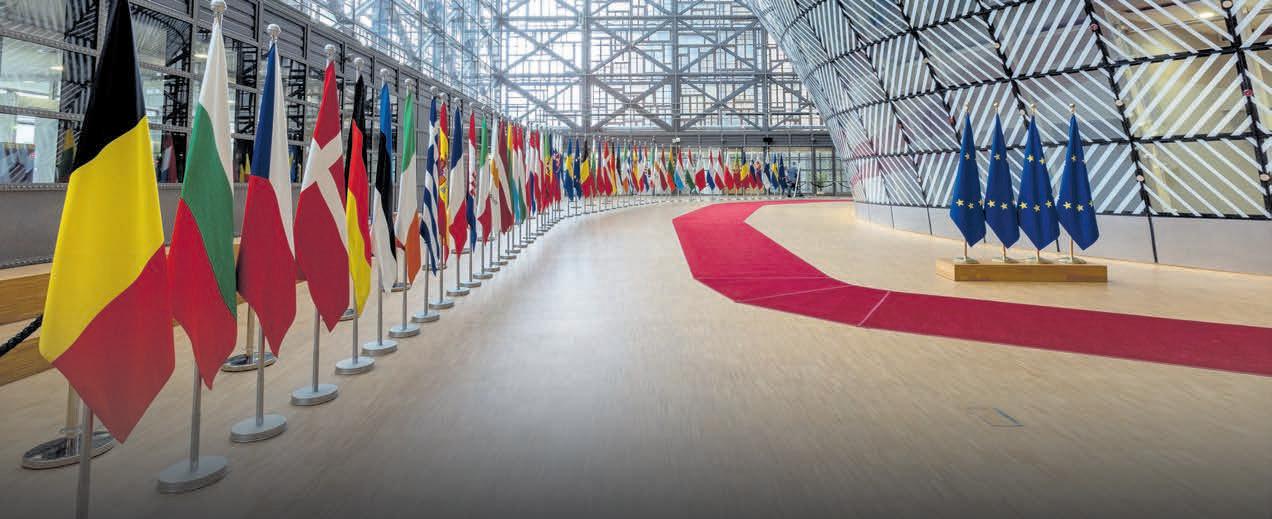

Europe’s growth forecast lifted as bloc ducks downturn

ASSOCIATED PRESS REPORTER

THE EUROPEAN Union’s executive body has raised its economic growth forecast, saying Europe has dodged a winter recession that was feared amid an energy crisis.

The outlook for the 20 countries using the euro currency improved to growth of 1.1 per cent this year from 0.9 per cent in the previous predictions in February, the European Commission said in its spring forecast.

The European economy “is holding up remarkably well in the face of

Russia’s aggression against Ukraine”, said executive vice president Valdis Dombrovskis.

Europe faced expectations of a winter energy catastrophe after Russia cut off most supplies of natural gas to the continent. But a scramble for new sources of natural gas along with a mild winter helped Europe avoid a crisis.

However, Dombrovskis cautioned that ”core inflation remains persistently high, which could erode people’s purchasing power, slow investment growth and impede access to credit”.

PA CITYAM.COM 02 TUESDAY 16 MAY 2023 NEWS

THE FINANCIAL TIMES

Millions more to be caught by higher tax rate

JACK BARNETT

MORE THAN an additional 6m Brits are poised to be caught in the higher income tax net compared to the early 1990s in what has been characterised as the steepest tax hike in four decades, new research out today reveals.

Prime Minister Rishi Sunak’s decision as Boris Johnson’s Chancellor to freeze tax bands for several years in March 2021 is tipped to shift millions of extra workers into paying the higher 40 per cent rate of income tax, according to the economic think tank the Institute for Fiscal Studies (IFS).

Current Chancellor Jeremy Hunt last November stuck an extra year on top of an already six year freeze to income tax bands, which is forecast by the Treasury to raise tens of billions of pounds. That policy now represents the largest tax increase since ex-Chancellor Geoffrey Howe doubled VAT in 1979, the IFS

calculated.

The organisation’s research found the number of people paying the steeper levy will reach 7.8m by 2027/28, or 14 per cent of the population, up from 1.6m (3.5 per cent of the population) in 1991/92 –a near quadruple increase.

Crystallising tax thresholds drags workers into paying more tax when they receive a pay rise, a process known as “fiscal drag”. This dynamic is amplified during periods of high inflation.

“In the space of 40 years, higher rates of income tax will have gone from being a feature of the system reserved for those with the very highest incomes, to one that impacts a far more substantial proportion of the population,” the IFS said.

A Treasury spokesperson said: “After borrowing hundreds of billions to support the economy during the pandemic and Putin’s energy shock, we had to take some difficult decisions to repair the repair the public finances.”

BoE’s Pill regrets living standards viral comments

HENRY SAKER-CLARK

HENRY SAKER-CLARK

THE BANK of England’s top economist has said he should have been more careful over his wording after he faced criticism for indicating that some British households “need to accept” they are poorer.

HSBC chief exec Noel Quinn has been under mounting pressure from Ping An

HSBC targets Asia growth amid pressure from top shareholder

ANNA WISE

HSBC YESTERDAY unveiled plans to bolster revenues in its Asia business amid mounting pressure from its top shareholder to improve performance across the region. The banking giant told investors it is aiming for revenues in Asia’s wealth business to grow by up to nine per

cent in the next three to four years.

“All parts of HSBC Asia are now motoring,” group chief executive Noel Quinn stated. The goals follow an escalating dispute between the bank and its biggest shareholder, Ping An, whose calls for a Hong-Kong listed spinout business were rejected by shareholders at HSBC’s AGM earlier this month.

Huw Pill, chief economist at the central bank, said the country’s economy is facing “very difficult and challenging” times but that he should have used language that was “less inflammatory”.

It came after he told a podcast last month: “You don’t need to be much of an economist to realise that if what you’re buying has gone up a lot relative to what you’re selling, you’re going to be worse off.

“So, somehow in the UK, someone needs to accept that they’re worse off and stop trying to maintain their real spending power by bidding up prices whether through higher wages or passing energy costs on to customers.”

Speaking yesterday, Pill said: “If I had the chance again to use different words I would use somewhat different words to describe the challenges we all face.” PA PA

03 TUESDAY 16 MAY 2023 NEWS CITYAM.COM

Waitrose own label products. Selected stores. Subject to availability. Minimum online spend and delivery charges apply. SHOULDN’T DAIRY COWS GET MORE COW TIME? We think so. When the weather’s nice, the free range dairy cows that produce our fresh milk (including Essential Waitrose) spend over half their year grazing outdoors. And when the weather’s bad, they can relax indoors, just like the rest of us. Find out more at waitrose.com/feelgoodabout

City grandees lay out vision for UK markets

CHARLIE CONCHIE

A GROUP of City of London grandees are drawing up a “new market model” for the UK’s capital markets after a bruising few months in which the capital has been rocked by a slew of firms heading towards New York.

The Capital Markets Industry Taskforce, headed by London Stock Exchange chief Julia Hoggett (pictured), yesterday announced it had commissioned a new deep dive on UK capital markets in a bid to carve out a new narrative for Britain as an international financial centre.

The fresh report follows a host of government-commissioned reviews over the past three years that have looked to usher in reform and keep London competitive, including a 2020 review of the listings regime.

However, London has been hit by a sharp slump in IPO and list-

EY to slim down UK leadership team in reset

GUY TAYLOR

EY IS PLANNING to alter the leadership team of its UK operations just weeks after it scrapped plans to break up its audit and consulting business.

ings activity over the past 12 months, fuelling fears that the capital is losing ground to international rivals.

The new Capital Markets of Tomorrow report, the brainchild of Freshfields lawyer and capital markets guru Mark Austin, will now look to reset the narrative around London.

“Everyone recognises what the central question is, but we’ve all got a slightly different perspective and solution to the problem,” he told City A.M.

“This all needs putting together into one cohesive, simple to understand model and vision.”

The report will also delve into divisive issues around renumeration, with some top figures arguing London is failing to attract top talent because of restrictions on executive pay.

L&G chief Sir Nigel Wilson and ex-Direct Line CEO Penny James will also help author the report, which they hope to publish in July.

Scandal-hit Wandisco warns it could run out of cash by August

CHARLIE CONCHIE

SCANDAL-HIT data firm Wandisco yesterday warned it could run out of cash as soon as mid-July as it announced an emergency $30m (£23.9m) fundraise to bolster its balance sheet following a fraud scandal. London-listed WANdisco, which was forced to write off over $115m in sales bookings after uncovering “potentially

Gold miner Newcrest backs $17.8bn takeover offer from rival Newmont

SCOTT MURDOCH

AND MELANIE BURTON

AUSTRALIAN gold miner Newcrest

Mining yesterday said it would back Newmont Corp’s A$26.2bn (£14.02bn) takeover offer in one of the world’s largest buyouts so far this year.

The deal, subject to approval from shareholders of both companies and other regulatory hurdles, would lift

Newmont’s gold output to nearly double its nearest rival, Barrick Gold Corp, and catapult the miner past Freeport McMoRan to become the largest US gold and copper producer by market capitalisation.

Newcrest shareholders would receive 0.400 Newmont share for each share held, with an implied value of A$29.27 a share, higher than a previous exchange ratio of

0.380 that Newcrest’s board rejected in February.

Newcrest shares opened yesterday 1.5 per cent higher at A$28.68, and the offer is a 30.4 per cent premium to the stock’s price in February before the Newmont bid became public.

Newcrest said it recommended its shareholders vote in favour of the deal at a meeting expected to be held in September or October.

fraudulent irregularities” on its books in April, warned it had $8.1m in cash reserves and would only be able to sustain itself through to mid July.

Bosses are now planning to launch an equity fundraise towards the end of June to “build balance sheet strength”. The news marks the latest turnaround bid launched by the firm, whose shares have been suspended on the AIM exchange since April.

The Big four accountancy firm’s UK managing partner Alison Kay, one of Britain’s top executives and a likely candidate for the top job, will move to a European role, potentially removing her from the running.

According to reports from Sky News’ Mark Kleinman yesterday, a memo was circulated to EY partners last week, informing them that its executive committee would be cut from 13 members to seven and that the UK operations would no longer have a chief operating officer.

The announcement comes weeks after the audit giant called off plans that would have seen the break-up of its audit and consulting sections, intended to address growing concerns over conflicts of interest.

Commenting on the news, an EY spokesperson said the firm had “reshaped two of its internal UK management teams”.

“These changes will allow more EY Partners to be focused on serving our clients and stakeholders.”

05 TUESDAY 16 MAY 2023 NEWS CITYAM.COM

Our best price ever Search BT Business Deals Call 0800 916 0428 £19.45/month Offer ends 18 June Excl VAT Fibre 38 for only Reliable business speeds, unmissable price Offer ends 18/06/23. Standard price of £29.95/month for 38mbps, broadband only, 2 year contract. Prices exclude 20% VAT with CPI plus 3.9% each April. £19.95 hub delivery and install charge applies. Offer applicable to new customers only. Your service is subject to terms and conditions found at https://business.bt.com/terms/ under the Broadband and internet and Mobile services sections. You will be subject to a minimum 24 month contract term and at the end of this minimum contract term you will pay the full standard price see Section 59, Part 4, Sub-Part 1 of the BT Price List found at www.bt.com/pricing. Before your service starts, you will be provided with the Minimum Guaranteed Access Line Speed and an estimate of the upload and download speed you may expect. After 10 days from the start of your service, if your speed is regularly at or below this speed, you may contact BT and BT will try to fix it. If BT is unable to fix it within 30 days, you can terminate your service without paying any charges (other than for any service already received) but you must return any BT Hub. Tech

grandee Stephen Kelly has been parachuted in as interim chief at the data firm

The deal could create the US’ largest gold and copper producer by market capitalisation Reuters

CAN FRENCH PATISSERIE BE EASY AS PIE?

We think so. Our Tarte aux Fruits is made in France to a classic recipe with all-butter pastry, juicy baked purple plums and sweet apricots, then hand finished with Heritage raspberries. Conveniently frozen for when there’s no time to make it yourself.

No.1 Frozen Tarte aux Fruits. Selected stores. Subject to availability. Minimum online spend and delivery charges apply.

British American Tobacco raises questions as it appoints new chief

YADARISA SHABONG

BRITISH American Tobacco (BAT)

yesterday appointed finance director Tadeu Marroco as CEO, succeeding Jack Bowles who is stepping down after about four years.

Marroco started working for the tobacco firm in Brazil in 1992 and was appointed to the board in 2019.

Bowles, who also joined the board in 2019, has led the maker of Lucky Strike and Dunhill cigarettes through a transformation to focus growth on

new categories such as vape.

The Brazilian, who has a degree in electrical engineering, joined BAT’s management board in 2014 as its business development director.

Prior to leading the company’s transformation charge, Marroco headed its key Europe and North Africa regions.

Director Javed Iqbal will be interim finance director while the group looks for a permanent replacement.

BAT shares have risen about eight per cent since the start of 2019, but

Currys shares up as retailer raises profit guidance

GUY TAYLOR

CURRYS has lifted its prospects for the rest of the year, saying its profit before tax is expected to be £110m-£120m, up from around £104m previously.

Shares in the retailer jumped over five per cent following the announcement yesterday, to their highest level since early April.

Currys, which sells everything from computers and hoovers to TVs and fridges, also said prospects for its net debt had been narrowed from £150m to £100m.

It said UK trading had been “been better than expectations, especially in the final two months of the year”, despite year-onyear sales for the first five months being 10 per cent down.

The group continues to grapple with the impact of the cost of living crisis on Brits’ spending habits, which has hit the firm’s share price over the last year.

The electricals retailer had previously lowered its profit expectations in March, primarily due to a weakened performance from the Nordic section of the business, which has faced heavy

competition from local rivals offering cheap discounts.

Its Nordic contingent, which accounts for over 40 per cent of group revenues, saw like-for-like sales down 12 per cent this half.

A structural shift following the poor performance saw regional CEO Erik Sønsterud step down.

The retailer yesterday said the environment remains “challenging, but under new management we have made progress on mar-

underperformed a 15 per cent rise in the FTSE 100 over the same period.

“We believe Tadeu Marroco is a worthy successor.. and we would not expect a broader shift in strategy as a result,” JP Morgan analysts said. Meanwhile, AJ Bell investment director Russ Mould said the news suggested “something is not right in the business”.

“It’s never a good look when a company says its chief executive is leaving with immediate effect, and after only four years,” he said.

gins and costs”.

Richard Hunter, head of markets at Interactive Investor, said “a brief but positive update has provided some respite for a beleaguered share price, with a profit upgrade propelling the shares higher.”

“Currys may be winning the battle but it has a considerable way to go to win the war. The Nordics region in particular remains under pressure.”

More detailed full year results are expected on 6 July.

Center Parcs’s five UK holiday sites are reportedly worth £4.1bn according to an independent valuation

Center Parcs put up for sale with owner Brookfield eyeing a £5bn price tag for holiday resort estate

GUY TAYLOR

CENTER Parcs’ owner Brookfield has reportedly put the UK holiday resort up for sale.

The Toronto-based private equity firm is hoping to fetch between £4bn and £5bn pounds for the company, the Financial Times reported yesterday.

Center Parcs operates six major holiday villages in the UK and Ireland, in counties including Wiltshire, Cumbria and Bedfordshire.

The real estate of the five UK sites

were independently valued at £4.1bn, the report said.

A sale in that price range would see Brookfield make a handsome profit on its initial purchase from Blackstone back in 2015 when it was valued at £2.4bn.

Brookfield recruited investment bankers that have been scouting out potential buyers over the last week.

The firm has reportedly been mulling selling the company for the last few months.

Brookfield declined to comment on the report.

Center Parcs was contacted for comment.

The potential sale comes amid falling growth in UK property prices and an economy hampered by high interest rates and inflation, which could put off investors.

But the UK tourism and hotel industry continues to do well as Brits have opted to keep spending money on holidays. The staycation market in particular is perceived as more resilient to cost of living concerns, with UK travel offering a more affordable option than overseas trips.

Travelodge hits record profits as Brits continue to opt for staycations

GUY TAYLOR

TRAVELODGE, the UK’s largest independent hotel brand, has reported results significantly ahead of its previous record year in 2019, as Brits continued to opt for staycation breaks and business travel.

The London-listed hotel company, which offers cheap beds in the UK

Spain and Ireland, said revenues were up 25 per cent from 2019 to £909.9m, while pre-tax earnings for the year increased £83.8m to hit £212.9m.

Jo Boydell, Travelodge chief executive said: “Travelodge delivered an excellent trading performance in 2022, with record profits and revenue growth.”

“The market recovered, with strong

demand for events and short staycation breaks throughout the year as well as for essential business travel and we continued to outperform the midscale and economy segment.”

The firm said it is targeting 300 new locations across the UK and expects to open eight new hotels in 2023.

07 TUESDAY 16 MAY 2023 NEWS CITYAM.COM

Travelodge has benefitted from a continuation of pandemic-era staycation demand

Marroco began his career with BAT in 1992 in the company’s Brazil division

Currys raised its full year expectations despite reporting “challenges”

Reuters

Getting a train over the May bank holidays?

SERVICE CHANGES:

28 April to 1 May and 27 to 29 May

Most of the rail network remains open, however some services will be affected as we make improvements to the railway. So, be in the know before you go.

CHECK BEFORE YOU TRAVEL nationalrail.co.uk/May

THE NOTE BOOK

Our love of big brands helps fuel inflation fires

BRAND power is the muchlauded virtue of the world’s most successful companies. But this muchadmired characteristic is partly why we are finding inflation a tough nut to crack.

The Bank of England says that the price spiral will take longer to reverse than forecast, due to higher food costs. This has renewed accusations that supermarkets and food producers are unfairly hiking prices, claims retailers deny. Should more of the blame lay at the door of the consumer –that’s me and you –and how we lap up marketing claims like there’ s no tomorrow?

We don’t have a choice when it comes to the rising cost of essential goods, which is why inflation is hitting those on lower incomes the hardest.

BRAND HANNAH

But even though household budgets have been hammered across the income spectrum, the pulling power of the big brands – many of which have been able to sustain margins by hiking pricesseems largely unaffected. One of the oft-touted tips for consumers struggling to afford puffed-up prices in the supermarket is to trade down to cheaper ownlabel or discounted alternatives, but it’s a strategy worth considering even if you can afford the full-price, branded option. Those eye-watering price tags for branded ketchup, tea bags and butter will only start to fall when sales do, and their manufacturers are forced to trim some of the fat they’re still enjoying to hang onto market share.

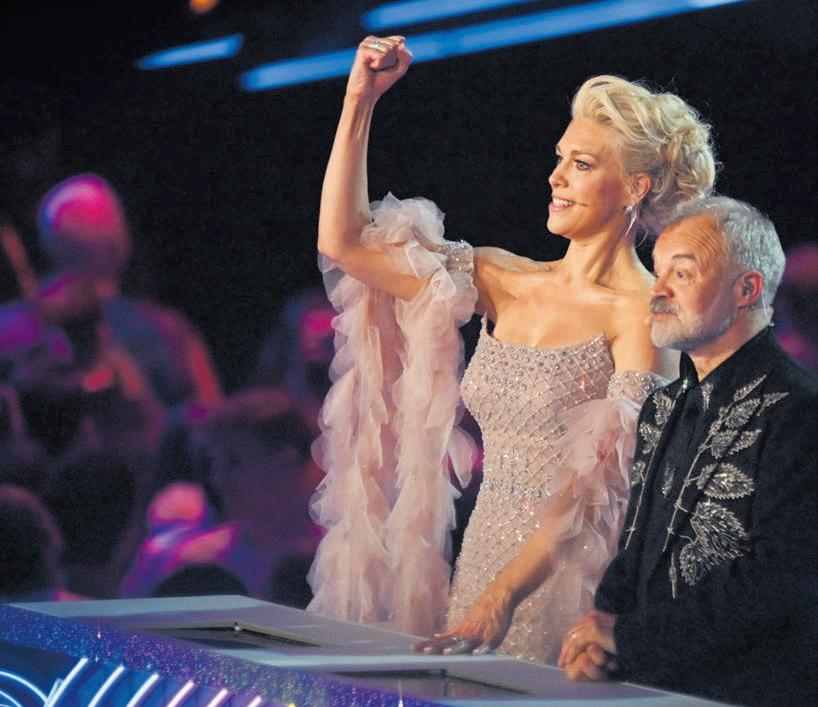

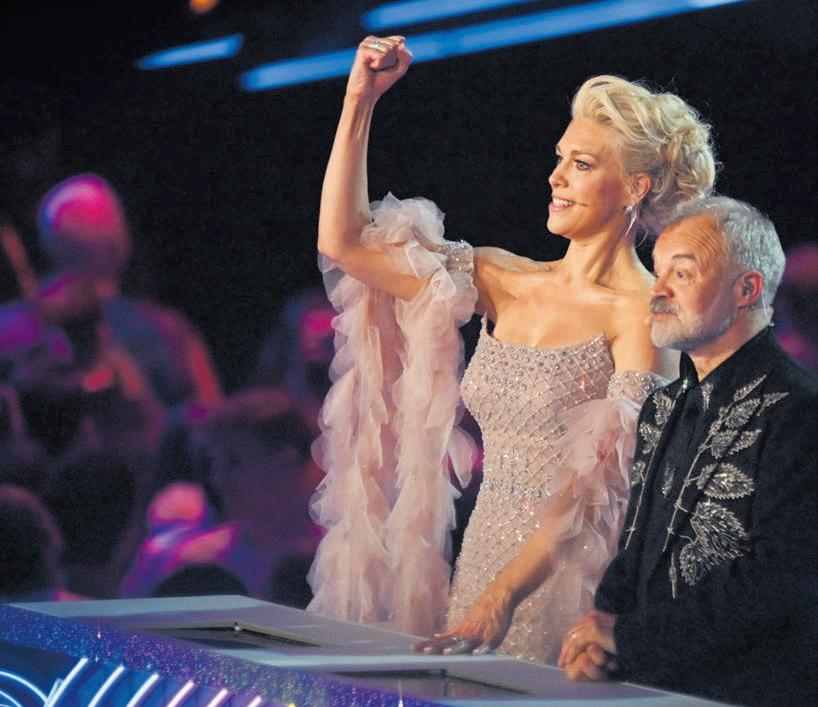

Forget Europop and Australian rock, the British actor, presenter, singer and comedian Hannah Waddingham has been the standout act of Eurovision. Her ferocious talent is undeniable, but her star status was hidden in the West End for years. Her delight at stepping into the TV and film limelight is a joy to see. So why has it taken so long? Blame the Hollywood mega brand. It’s so strong, that casting directors and producers often won’t take a chance on talent elsewhere. But James Cordon cracked open the door to prime-time US fame after his West End performance in One Man, Two Guvnors was taken to Broadway. Jason Sudekis took a chance on Hannah Waddingham for Ted Lasso –and the rest is history. As Hannah the Great declared at the Emmy’s in 2021 – West End musical theatre performers need to be seen on screen more. Her own wish has been granted but it’s high time the film and TV world woke up to West End’s wider galaxy of stars.’

Streeter

£ There’s a big reason JD Sports has bought up Courir in France – brand power. A pair of the new must-have sneakers has a huge draw, sucking away parental savings or increasing the credit card balances of cash-strapped twenty-somethings. LVMH is the industrial scale magnet for designer desires. The boss, Bernard Arnault is now the world’s richest man and LVMH shareholders have been royally rewarded. Our love of the logo –whether on drinks, cereal boxes, phones is part of the reason we're scaling record levels of debt and why there is little incentive for the big manufacturers to cut prices.

CAN I QUOTE YOU ON THAT?

BRC chief exec Helen Dickinson on how Brits’ love of ready meals is keeping food prices higher than on the continent

09 TUESDAY 16 MAY 2023 NEWS CITYAM.COM

Where the City’s top thinkers get a few things off their chest. Today, it’s Hargreaves Lansdowne’s Susannah

The knock-on effect from increased production and packaging costs meant that ready meals became more expensive

UK looks to uni spinouts to realise science dream

CHARLIE CONCHIE

TOP TECH investors and policymakers are looking to ease the flow of cash into a new wave of start-ups coming out of British universities, as ministers lean on the private sector to turn the UK into a “tech and science superpower”.

Universities have long been viewed as fertile breeding grounds for tech start-ups by private investors, with equity funding into the UK’s so-called academic spinouts climbing from £405m in 2012 to £2.54bn in 2021, according to data from Beahurst. However, the venture capital industry has been buffeted globally by rapid rate hike and soaring inflation over the past year. Tech figures are now looking to ease the route for investors to pump cash into university projects to ensure a pipeline of innovation does not dry up.

A group of top investors and universities last month laid out the USIT Guide to provide a “blueprint” and put

“rocket boosters” under the way that universities spinout start-ups and take advantage of research breakthroughs.

“We’re trying to help the entire university ecosystem recognise how we can get more spinouts from those institutions and how we can deliver more value for the UK,” Diarmuid O’Brien, chief executive of Cambridge Enterprise and chair of the USIT Guide working group, told City A.M

CIAO Former Chancellor George Osborne to chair Italian investment firm Lingotto

The efforts to ease the flow of cash into start-ups come as ministers mount plans to turn the UK into a tech and science superpower.

A commitment for £370m funding from government was met with derision from the tech industry but ministers are hoping a flood of private capital will supercharge the plans.

The Treasury called in two top academics in March to assess the landscape for tech spinouts and assess how to best turn academic projects into commercial success.

“We’ve a group of organisations between us that have raised about £8bn over the last five years, and we’re taking the lessons learned, trying to codify it, and giving it back to the sector and the venture community in a way that we can derive more value.”

The new plans have won the backing of VC firms Abbingworth, CIC, Sofinnova, as well as top unis including Cambridge, Imperial, Oxford and UCL.

O’Brien told City A.M. that unlocking pension capital and providing certainty on research and development tax rules should be top policy priorities to boost the pipeline of spinouts in the UK.

Potter Clarkson partner Sara Holland, however, warned the government had insufficient technical expertise and was lagging behind the US.

“At the moment, spinouts happily relocate to the US because the investment across the pond is something that the UK doesn’t have. The support and money needs to be there if we are to keep our spinouts,” she said.

ENGLAND RETURNS TO THE HOME OF POLO TO TAKE ON IRELAND!

On the 9th of June, the England Polo team once again will return to the home of polo, Hurlingham Park. The Rules of Polo were written at Hurlingham back in 1875. This year England takes on Ireland to compete for the Olympic trophy (which is the original Olympic polo trophy, first played for in 1908)

Nina Clarkin, the world's best female polo player and captain of the women’s England polo team joins the England men's Polo team alongside, Max Charlton and Ed Banner-Eve to take on Max Hutchinson, Niall Donnelly, and The Earl of Tyrone from the all-male Ireland polo team for this year's international match at Chestertons Polo in the Park.

Expect a display of remarkable sportsmanship, fierce competitiveness, and unwavering determination as these two teams battle it out. Ireland will look to replicate their winning performance of 2018 to win the Olympic Trophy once again, while England will be determined to level the scoreboard. It’s a fixture that you won’t want to miss!

Hurlingham was the cradle and home of English polo and for 65 years the game flourished there and made the name of the club famous all over the polo-playing world.

A favourite resort during the summer season, thousands flocked to Hurlingham to watch the more important matches”. This quote, taken from The Hurlingham Club Captain Taprell Dorling (1953) perfectly sums up the importance and relevance of The Hurlingham Club in the history of British polo; and in an interesting co-

incidence it was our own ‘Team GB’ that won gold in the last London Olympic polo battle (1908), which was also played at The Hurlingham Club. Although it was widely considered to be the home of polo, the sport was not played at the Club between 1939 and 2009, when Chestertons Polo in the Park finally brought the game back home.

THE CLUB

In 1867 Mr Frank Heathcote obtained the leave of Mr Naylor to promote pi-

geon shooting matches at Hurlingham. His next step was the formation of the Hurlingham Club “as an agreeable country resort”.

Polo was first brought to England in 1869. Owning largely to the initiative of one of the Club’s first trustees, Lord De L’Isle and Dudley, the game was established at Hurlingham in 1875, five years after the first official game of polo in England between the 9th Lancers and the 10th Hussars on Hounslow Heath. The name “Hurlingham” then became synonymous with polo

and for 65 years The Hurlingham Club was the headquarters for polo for the British Empire. Hurlingham became the undisputed home of polo after having hosted the 1908 London Olympics Polo Final (when England won the gold medal), and the prestigious Westchester Cup between England and the USA from 1910 to 1939. But with the outbreak of the Second World War, the polo grounds – that once attracted 10,000 spectators – were converted into allotments, and the last polo event took place at Hurlingham in 1939 between The Jaguars and The Milers. Notably, the name of Hurlingham lived on, lending its name to the Hurlingham Polo Association (HPA). Seventy years on, and over 80% of poloplaying countries play under the rules of the HPA.

Whether you are a seasoned polo aficionado or a newcomer to the sport, Chestertons Polo in the Park promises an unparalleled experience that will leave you spellbound. Don't miss your chance to witness world-class polo, soak in the electric ambience, and be part of the world’s largest three-day polo and luxury lifestyle event, all taking place in the heart of London.

£ Visit our website for tickets and more information –www.polointheparklondon.com

CITYAM.COM 10 TUESDAY 16 MAY 2023 NEWS

LINGOTTO Investment Management, backed by Italy’s Agnelli family, has hired former Chancellor George Osborne as its new non-executive chairman, the firm revealed yesterday. Lingotto had around $3bn in assets under management at the end of March.

ADVERTORIAL

Chestertons

Polo in the Park promises an unparalleled experience

Policymakers are hoping the UK’s university talent can revive the tech scene

WELCOME TO GREEN ALCHEMY

On a non-descript industrial estate on the outskirts of Cambridge, a former telecoms executive, a Rugby World Cup winner and some disarmingly intelligent chemists are plotting a revolution that could change the shape of global politics.

If that sounds overwrought, consider the phone in your pocket. The metals that make up that extraordinary piece of kit are increasingly becoming the prized natural resources of the future, with western and emerging powers competing across the world.

So it’s rather odd that –to this point –the vast majority of that tech, once used, gets chucked in a smelter. Most of Europe’s goes to plants in Belgium or Sweden –hugely environmentally unfriendly, and not particularly efficient at recovering those valued metals.

Step in Bioscope Tech, and the aforementioned quiet revolutionaries. Chairman Phil Allington is buzzing with enthusiasm even at 9am on a Monday morning, excited by a new challenge after decades with BT.

To work out how he’s ended up in a room with me and Andy Gomarsall, the former scrum-half known for a World Cup win and eye-catching spells with Quins and Gloucester amongst others turned tech business development supremo, one has to start at an unusual location: Britain’s telephone exchanges.

“There are hundreds of them around the country and they all need, effectively, decommissioning. That means stripping out all the kit, from wires to the circuitboards,” Allington tells me. Whilst tasked with the job at BT, he came into contact with N2S, an electronic recycling firm run by Gomarsall’s father. They stripped off the tech and recycled what they could.

It’s a successful growing business, but it’s the chemists N2S sponsored at the University of Coventry that’s led us here. They managed to answer a question: could we find a way to re-use the copper, the lead, and even the gold that’s in these millions of redundant circuitboards? Turns out the answer is yes. And that’s why we’re standing next to a series of vats in a Cambridge industrial estate, the beating heart of N2S spin-off Bioscope.

Phil breaks the idea down for an unsophisticated audience, which is welcome. Chemists sponsored and now employed by N2S and Bioscope have

developed a bacteria that can eat away, gradually, at all the plastics in circuitboards, leaving metals and dust: the former to be recycled via the London Metal Exchange, the latter to be used in cheap plastics. It’s a devastatingly simple concept that has required years of fine-tuning.

The Cambridge site, with the capability to turn around significant amounts of electronic waste, is hopefully just the first step in a journey to a much bigger project.

“You’ve got to imagine the potential,” says Gomarsall. “Think how much tech, how many circuitboards, there are even on you right now.” Looking

down at two phones, a laptop, a tablet and some wireless headphones and I’m starting to see his point.

“At the moment that gets stuck in a lorry to Belgium or Sweden and thrown in a fire. We can put it in a vat and recycle it.”

At scale, that could transform the global metals market –but for now Bioscope is focused on the recovered kit produced by N2S. The plan, and the reason for the spin-out, is that in time Bioscope would be able to take waste from the two or three other firms that do UK tech clearouts.

The numbers are already impressive –using this technology, N2S recy-

cled more than 247.19 tonnes of circuit boards and 277.36 tonnes of electric cable, producing 255 tonnes of copper for re-use. That’s about the same amount of copper as you’d get from 35,000 tonnes of mined copper ore. Gomarsall believes corporates are going to start waking up to the impact of their tech on the environment, particularly with so-called Scope 3 emissions –effectively, emissions in your supply chain –soon to be a constant feature of annual reports. It’s certainly hard to argue that a fire in Belgium is a better resting place for your work phone than a green (in all senses) chemical vat.

London pension fintech Smart gears up for deals after £76m injection

CHARLIE CONCHIE

LONDON-BASED pensions fintech firm Smart yesterday said it was gearing up for a flurry of dealmaking as it bagged a $95m (£76m) funding round from a host of big name backers including New York-based outfit Aquiline. Smart, a savings and pension firm, said it had closed the series E funding

round led by Aquiline alongside investors including Chrysalis Investments, Fidelity International Strategic Ventures and Barclays.

The deal marks one of the biggest for fintech firms this year and comes after a torrid 12 months for fundraising in which start-ups have been forced to write down their valuations to raise cash.

Smart declined to disclose a valuation from the round but it is understood to have not suffered a downgrade in the latest round.

Co-founders Andrew Evans and Will Wynne, who set up the firm in 2014, said the investment was “strong recognition of Smart’s success” and a “vote of confidence in the UK’s fintech sector”.

11 TUESDAY 16 MAY 2023 NEWS CITYAM.COM

Smart’s funding round marks one of the biggest in the UK fintech scene this year

Phil Allington tells Andy Silvester how Bioscope Tech is transforming the metals market by turning old into new

You’ve got to examine the potential. Think how much tech, how many circuitboards, there are on you right now.

UK pledges extra military aid after Zelensky visit

PA REPORTERS

THE UK will provide Ukraine with air defence missiles and attack drones, Downing Street announced yesterday, as Volodymyr Zelensky met Rishi Sunak at Chequers.

In the latest leg of the Ukrainian president’s tour of western allies, Zelensky said the two leaders had also discussed western fighter jets and he anticipated “very important decisions” to be made soon.

No 10 said Britain will send hundreds of air defence missiles and further unmanned aerial systems to the war-torn country as the Prime Minister met Zelensky at Chequers yesterday.

It follows meetings in Paris, Berlin and Rome and comes three months after the Ukrainian leader’s first trip to London since the start of Russia’s invasion.

Following the meeting, the president said the two countries were “real partners”, with Sunak knowing details of developments on the battlefield.

“We want to create this jets coalition and I’m very positive with it,” he said.

“We spoke about it and I see that in the closest time you will hear some, I

ANNOUNCEMENTS

think very important decisions but we have to work a little bit more on it.”

The Prime Minister stressed that the provision of warplanes was “not a straightforward thing” but said the UK was committed to training Ukrainian pilots using Nato-standard aircraft.

No 10 said an elementary flying phase for cohorts of Ukrainian pilots will begin this summer, going hand in hand with British efforts to work with other countries on providing F-16 jets.

Sunak said: “This is a crucial moment in

Zelensky met Sunak at Chequers yesterday in a surprise visit to the UK

Ukraine’s resistance to a terrible war of aggression they did not choose or provoke... We must not let them down.”

The visit comes days after Liverpool hosted Eurovision on behalf of Ukraine and ahead of a week of intense diplomatic activity on the Ukraine crisis. Sunak will attend a Council of Europe summit in Iceland, with Zelensky joining virtually, before heading to Japan for the G7 gathering in Hiroshima.

LEGAL AND PUBLIC NOTICES

CITY of LONDON

undermentioned streets will make several Orders on 25 May 2023

Basinghall Street (Gresham Street to Basinghall Avenue) ---- Mobile Crane

Coleman Street (Gresham Street to Basinghall Avenue) ---- Mobile Crane

Holborn (New Fetter Lane to Furnival Street) ---- Mobile Crane

Holborn Viaduct (Snow Hill to Holborn Circus) ---- Resurfacing Works

Printer Street Little New Street Street) ---- Mobile Crane

Little New St, Shoe Ln, St Andrew St, New Fetter Ln, Bartlett Crt & New St Sq or via Little New St, Shoe Lane (Shoe Lane Bridge to Charterhouse Street) ---- Resurfacing Works

Temple Avenue Resurfacing Works

Royal Mail fell short of its target for 93 per cent of first class mail to be delivered on time, reaching only 73.7 per cent

Ian Hughes

16 May 2023

REGULATOR Ofcom yesterday said it has launched an investigation into Royal Mail’s failure to meet its delivery targets in the past year – and could hand out a fine. The British delivery firm fell short of its performance targets across the 2022 to 2023 financial year for first and second class mail and deliveries.

working day across the year. The target was 93 per cent.

Ofcom said it takes quality of service very seriously and could fine Royal Mail if it cannot reasonably explain why it missed the targets.

The pandemic can no longer be used as an excuse for poor delivery performance, Ofcom said.

ANNOUNCEMENTS

news that boss Simon Thompson will step down by the end of the year. His departure was announced weeks after a lengthy dispute with the main postal union came to an end.

Grant McPherson, chief operating officer of Royal Mail, said: “Improving quality of service is our top priority.”

LEGAL AND PUBLIC NOTICES

CITY of LONDON

undermentioned streets made several Orders on 11 May 2023

Eldon Street (Junction with Wilson Street) ---- Utility Works

Fenchurch Street Tower Crane Dismantle

King William Street Utility Works

Prince’s Street Mobile Crane

CITYAM.COM 12 TUESDAY 16 MAY 2023 NEWS

16 May 2023

South Place Eldon Street Lorries

PA PA

Royal Mail to be investigated by Ofcom over missed delivery targets ahead of boss’s exit

SPORT

“Pep is the master of getting the absolute most out of each player in his squad.”

TREVOR STEVEN ON MANCHESTER CITY AHEAD OF REAL MADRID CLASH TOMORROW PAGE 19

ECONOMICS

WHAT I’M READING

Interest rates may fall faster than the market expects to three per cent rather than the four per cent priced in by the end of next year. That’s according to consultancy Capital Economics. The odds are very finely balanced on whether the Bank of England will raise borrowing costs again at its next MPC meeting on 22 June after last week’s twelfth straight hike to 4.5 per cent.

YOU MIGHT HAVE MISSED

UK isn’t alone in this recession merry-go-round, just look at Europe

IT’S WORTH remembering that Britain isn’t some sort of pariah in the rich world that’s undergoing a tough economic slump, which is threatening to extend the growth slowdown since the 2008 financial crisis.

Europe’s major economies, led by Germany, its powerhouse, are also in the teeth of a slump.

Numbers out last week revealed the bloc’s biggest economy’s industrial sector, which it relies on to generate a big chunk of its output, shrunk 3.4 per cent in March –a much steeper fall than expected by analysts and a reversal from a more than two per cent increase in February.

That batch of data led economists to roundly agree Germany is on the brink of a recession, which Britain has also seemingly been flirting with for months and months.

In fact, production across the 20 members that make up the eurozone, the common currency area, is trending in line with Britain.

Gross domestic product –a measure of goods and services an economy makes –grew just 0.1 per cent in the first three months of this year in the eurozone, the same as the UK’s first quarter figure.

Germany’s economy stagnated after shrinking 0.5 per cent in the final months of last year, meaning they would slip into a recession if Eurostat –the stats agency that produces the continent’s main economic data –revises its estimate lower.

France grew 0.2 per cent; Italy 0.5 per cent; Spain 0.5 per cent; and Ireland contracted 2.7 per cent.

In sum, not wholly good.

The dynamic that has shredded UK growth over the last year, and probably next, shares similarities with that which is sweeping through Europe.

Energy prices jolted higher after Russia sucked gas out of international markets in response to sanctions slapped on it in retaliation for its full-scale invasion of Ukraine. That made large swathes of business activity in Europe unviable, crimping output.

European consumers have also been squeezed by a historic inflation surge –peaking at more than 10 per cent in October – sparking a spending slowdown.

The European Central Bank, much like the Bank of England, has responded to that price surge with aggressive interest rate rises, sending them to 3.25 per cent and is expected to keep heaping pain on businesses and families in the coming months. The former is tipped to maybe back two more rate increases. The Bank may have one more rise in it.

Eurozone banks have also reined in lending sharply in response to US banking failures, adding to the squeeze on firms.

Sound familiar?

Both the UK and Europe dodged the dire predictions of blackouts and a tough recession tabled in the months after Russia’s invasion of Ukraine.

And now Britain’s economic prospects are looking a damn lot better compared to just a few months ago, if one takes the Bank of England’s word for it.

Governor Andrew Bailey and co last week upgraded GDP by the greatest amount (about two per cent) since the central bank was made independent in 1997. It had expected the longest recession in a century not too long ago.

Similarly, the European Commission yesterday raised its expectations for GDP growth across the bloc – up to 1.1 per cent and 1.6 per cent this year and next.

Stronger than expected demand and persistent price pressures concentrated in the food production sector mean inflation this year will be higher than the Commission previously predicted at 5.8 per cent, up from 5.6 per cent.

What ties assessments of the UK and European economies – which, under the same pressures, have moved more in

tandem than one might have thought – is that they have been overly pessimistic. Experts over-baked their recession warnings, justifiably so because of the huge energy price shock that at the time looked set to sweep through households and businesses’ finances. Energy prices have come down markedly over the last few months, prompting the recent round of forecast reversals.

Compare two passages from the Commission and Bank’s new projections, starting with the former, each of which explain why they lifted their GDP outlook.

“Lower energy prices, abating supply constraints, improved business confidence and a strong labour market underpinned this positive outcome.”

“This reflects stronger global growth, lower energy prices, the fiscal support in the Spring Budget, and the possibility of lower precautionary saving by households than previously assumed in turn related to a lower risk of job loss.”

Hard to tell the difference, isn’t it?

Both the UK and Europe are now on the path to avoiding a recession. It's worth remembering to take a look at our European neighbours before wrongly concluding that the UK is somehow alone on the recession merry-go-round.

A combination of both the Help to Buy and super deduction governmentbacked schemes ending shoved business investment up more than one per cent in the UK in the first three months of the year, according to Office for National Statistics numbers out last week.

ANNOUNCEMENTS LEGAL AND PUBLIC NOTICES

CITY of LONDON

The PLANNING ACTS and the Orders and Regulations made thereunder This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission FIBI House, 24 Creechurch Lane, London, EC3A 5JX 23/00223/FULL

Whittington House, 19 - 20 College Hill, London, EC4R 2RP 23/00390/LBC

Bin Stores, 10 Hosier Lane, London, EC1A 9LJ 23/00262/FULL

panel and installation of a new louvre vent panel

The Writers’ House, 13 Haydon Street, London, EC3N 1DB 23/00365/FULMAJ

Redevelopment of 30-33 Minories to provide a (Class E) and town centre uses (Class E and Sui

improvements associated with the development 2 - 7 Salisbury Court, London, EC4Y 8AA 23/00375/LBC

(Listed Buildings and Conservation Areas) Act

External maintenance of main roof including slate Kings College Maughan Library, Chancery Lane, London, WC2A 1LR 23/00396/TCA

3 - 6 Gracechurch Street, London, EC3V 0AT 23/00407/FULL

Installation of two replacement chiller units and 49B London Wall, London, EC2M 5TE 23/00416/FULL

Alterations to the existing shopfront involving the creation of an additional entrance to provide level 156 Fleet Street, London, EC4A 2DX 23/00418/FULL

level, including the removal of one ATM and one

6 Frederick’s Place, London, EC2R 8AB 23/00446/FULL & 23/00447/LBC

13 TUESDAY 16 MAY 2023 NEWS CITYAM.COM

City A.M.’s economics editor Jack Barnett takes a deep dive into the state of the economy in his weekly column

BANK OF ENGLAND HAS CONSISTENTLY

GDP FORECASTS

Q1 GROWTH WAS SLUGGISH IN EUROPE AND UK

RAISED

Bank of England, Nomura -3.0 IrelandGermanyUKEurozoneFranceSpainItaly 0.0 0.10.1 0.2 0.50.5 -2.5 -2.0 -1.5 -1.0 -0.5 0.0 0.5 1.0 % 97 2022 2023 2024 98 99 100 101 102 Forecasts for GDP levels Q1 2022 =100 BoE Nov 2022 BoE Feb 2023 BoE May 2023 Consensus latest Nomura latest -2.7

SOURCE: Eurostat, ONS

CITY DASHBOARD YOUR

ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

FTSE 100: HSBC and Lloyds lead gains in London

LONDON’s FTSE 100 kicked off a new week in decent style yesterday, led higher by Britain’s largest banks clocking strong gains.

The capital’s premier index advanced 0.30 per cent to 7,777.69 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 0.37 per cent to 19,258.75 points.

Lenders were among the best performing sectors in the City on the first trading day of a new week, with HSBC, Lloyds Bank and Natwest all up more than one per cent and trading close to the top of the index.

The gains came after the Bank of England last week hiked interest rates for the twelfth time in a row to 4.5 per cent, their highest level since October 2008.

Higher borrowing costs tend to lift market sentiment toward banks as they allow them to charge more for loans, which widens their net interest margin, which is the difference between what rate banks give savers and make borrowers pay.

European stocks also received a boost from a positive overnight session in Asia, analysts said.

“Stocks in Europe however made broad gains in early trading on Monday, following a broadly positive Asian session that saw the Nikkei 225 hit its highest in 18 months,” Neil Wilson, chief market analyst at Finalto, said.

Consumer-focused and supermarket stocks held back the FTSE 100’s ascent, likely triggered by investors fleeing them after Britain’s competition regulator the Competition and Markets Authority said it is investigating whether food producers are engaged in so-called “greedflation”.

Online supermarket and middle class favourite Ocado dropped 2.3 per cent and to the bottom of the index, while Britain’s largest supermarket, Tesco, shed 0.91 per cent. Sainsbury’s also came under selling pressure.

Electronics retailer Curry’s lifted its profit outlook yesterday, boosting its shares nearly four per cent.

The pound strengthened around a halve a percentage point against the US dollar.

The Turkish lira was highly volatile against the world’s major currencies after Sunday’s inconclusive election triggered a re-run between Tayyip Erdoğan and Kemal Kılıçdaroğl.

Following a strong performance from its broking division and a positive trading performance, Clarkson’s expectations remain unchanged. Peel Hunt made “no changes to our forecasts” of 3.4 per cent growth in 2023 pre-tax profits on 2022. Buy the stock, they say.

SUNNY START

Learning technologies saw lower than expected near term growth in both revenues and profitability yesterday. Reflecting this, Peel Hunt lowered its target share price from 200p to 135p. Peel Hunt said the business is “fundamentally undervalued in our view” and they reiterated their buy now rating.

best to start the new week on the front foot... There is still room for last minute wobbles at the end of the week when Federal Reserve chair Jerome Powell holds a public discussion with former chair Ben Bernanke in Washington. Markets will be looking for any nugget of information that could give a hint to the Fed’s next move with interest rates.”

RUSS MOULD, AJ BELL

RUSS MOULD, AJ BELL

Restore cut its full-year targets yesterday, despite revenues rising, as it saw slower recovery in recycling volumes in its tech unit. Peel Hunt said there was “uncertainty as to how long the weakness in technology will persist and the pace of recovery thereafter.” It retained its buy rating but lowered its target price from 448p to 298p.

CITYAM.COM 14 TUESDAY 16 MAY 2023 MARKETS

P 10 May 9 May 12 May CLARKSON 15 May 3,020 15 May 11 May 2,950 3,100 3,050 3,000 To appear in Best of the Brokers, email your research to notes@cityam.com P 15 May 100 10 May 9 May 12 May LEARNING TECHNOLOGIES 15 May 11 May 98 104 102 100 P 15 May 270 10 May 9 May 12 May RESTORE 15 May 11 May 240 300 280 260

“A weekend of sunshine appears to have put investors in a better mood, with the main UK market indices doing their

OPINION

EDITED BY ELENA SINISCALCO

To win younger voters, Labour needs to weed out the anti-housing nimbies

configuration” of these homes was wrong. She said it was “just a private development by a company looking to make a fast buck”.

IF YOU listen to politicians on both the left and the right, you’d be excused for thinking a race to build new homes is on. Just yesterday, London Mayor Sadiq Khan was boasting about the rate of new affordable homes being built in the capital in 2022. And over the weekend, Levelling Up Secretary Michael Gove was having a fight with councils in the Peak District over their failure to approve enough new homes, threatening them of revoking their planning powers.

Both parties have finally started to appreciate that housing will be a key voting issue at the next general election, and are wrestling to position themselves as the “party of housing”. The Conservatives lost credibility when Rishi Sunak conceded to his backbenches and agreed to scrap housing targets at the end of last year. He later admitted he did it because Tory councillors and members were against the targets - helping create the image, in many voters’ minds, of the Tory party as the nimby club par excellence. This perception alienates voters who suffer most from the consequences of the housing crisis, including younger people. A report from King’s College London titled “Are Millennials really killing the Tory party?” found housing policies overly supporting older voters made younger generations shy away from voting Tory.

Against this backdrop, Keir Starmer is keen to make clear he’s the man who’ll fix the housing crisis. He promised he would reintroduce housing targets if his party got into government. He would also give more power to local authorities, incentivising them to work together on new projects at a regional level through the promise of fresh infrastructure as a reward.

Lisa Nandy, the shadow Levelling Up Secretary, has been on his side arguing Labour doesn’t only want to build more affordable homes and help renters, but is also the party of firsttime buyers. Nandy wants to take

them by the hand with a mortgage guarantee scheme to help them get on the housing ladder. Through these promises, Labour is trying to lure in young professionals who might have previously voted Conservative but are now feeling fed up with the lack of opportunities in the housing market.

But to be credible, Starmer must prove there are no nimbies on his backbenches threatening to force him into the same position as Sunak if he makes it to No10. Or, if he concedes they will always exist, he must show he’s still unmoved by them. He might have to give this strategy a first try

soon, after Rupa Huq, the Labour MP for Ealing Central and Acton, celebrated the ditching of a plan for almost 500 new homes in her area on Twitter. The development would have comprised six buildings, bringing 477 new homes to Ealing. It would have also brought new offices to the council, which has instead blocked it and decided to retrofit the existing office spaces.

Huq told City A.M. that “of course” she supports “well-thought-out high quality housing” that could help the local families living in overcrowded flats, but claimed the “price point and

A CEO-style figure managing Whitehall would make achieving real reform possible

SINCE leaving the EU, our elected leaders have been handed a unique opportunity to accelerate reform. But voters on both sides of the Brexit divide have been left disappointed. Remainers still feel bitter because they lost the referendum; Leavers have yet to see that any actual benefits of Brexit outweigh the practical disruption and discomfort of following a different path to that of our close neighbours and friends.

Last week Kemi Badenoch, the Secretary of State for Business and Trade, reneged on a promise to automatically scrap up to 4,000 pieces of legislation by the end of the year, blaming “Whitehall intransigence”, which she says stifled her department’s attempts. Her predecessor, Jacob ReesMogg, declared that the “blob” had triumphed. Despite our top ministers and their top civil servants’ best efforts, nothing tangible has actually happened.

What’s happening becomes a bit clearer if you stand back from the de-

Tim Knox

tails of the latest impasse. This story of government failure is one with a long track record. For although the language used by Badenoch and ReesMogg may be more eye-catching, their claims are reminiscent of those made by Tony Blair over twenty years ago when he found that pulling the levers of government was fruitless and that he wanted reform in Whitehall “to make it more effective and entrepreneurial”. Similarly, John Reid described the Home Office as “not fit for service”. Almost every prime minister since Harold Wilson in the 1960s has set up a Commission, a Delivery Unit or some sort of body of wise, eminent men and women to look into why the

so-called Rolls Royce machine of government has stalled so badly.

But despite all these efforts, nothing has changed.

Designed in 1854, our system of Whitehall government discourages ministers from executing any meaningful reforms due to its inefficient nature. This significantly undermines departments’ abilities to deliver their government’s agenda. The result is that new policies are not implemented effectively, innovation dwindles, and the government – whatever its colour – just limps on from one crisis to another.

All this at a time when the UK faces ever-more complex, long-term challenges: the huge task of leaving the European Union, the right response to climate change, reform to the NHS, unsustainable pensions, our ageing demography. We can’t afford to keep tinkering with the broken machinery of government as we have done for so long.

In a new paper from the Effective Governance Forum, we explore in de-

tail the deep-seated problems of governance – and their possible solutions. In particular, we argue that introducing a CEO-style position responsible for the management of government departments would allow ministers to focus on their primary strengths: strategy and communication, not the details of implementation or managing a department larger than almost all the top 100 companies in the UK.

This is a radical, yet simple and achievable reform. Similar professional, modern management structures like these are used at the top of most charities, business and local government.

Badenoch, widely recognised as one of the more determined and imaginative recent ministers, is just the latest in a long line of politicians to be let down by the system. And she won’t be the last until someone has the guts to take on the system and drive through real reform. The time for that is now.

£ Tim Knox is editor of the Effective Governance Forum

£ Tim Knox is editor of the Effective Governance Forum

But the damage is done - and it goes beyond angry comments from the Twitter bubble. Calling good news the blocking of new homes that would have been built on a car park is a bad look for a party attempting to portray itself as the party of housing. Ben Everitt, a Conservative MP on the Housing Committee, pointed out the new flats would have been on a brownfield site. “Of course they should build them”, he said.

Only 1066 new homes were built in Ealing last year. The average cost of a home in the area is almost £555,000, making it “completely inaccessible” for most families, according to Tom Spencer, director of Research at campaigning group PricedOut. “Preventing developments like this has a significant effect in worsening the conditions for those desperate to find a place to live”, said Spencer.

Of course a balance must be struck between tossing concrete onto communities and building sustainable and affordable new homes, suited for the local community. But at the moment we’re not doing either. As most politicians have now recognised, there’s no way out of the housing crisis without increasing supply. MPs like Huq, on both sides of the political spectrum, are simply picking up the wrong battle. Starmer publicly said his party was prepared to take on people who try to ward off housing plans in their local areas. If these people end up being his own MPs, he should be prepared for a big headache pre-elections.

CITYAM.COM 16 TUESDAY 16 MAY 2023 OPINION

Keir Starmer has pledged to increase homeownership up and down the country

HELLO FROM TAIWAN Liz Truss is in Taiwan - although it is not exactly clear who, ever, asked her to go. While there, she’ll call for greater military collaboration as a stronger China deterrent. Her visit is likely to prove as controversial as when US Speaker of the House Nancy Pelosi rocked up in Taipei last year

Elena Siniscalco

Comment and features deputy editor at City AM

WE WANT TO HEAR YOUR VIEWS

LETTERS TO THE EDITOR

Tell me about the digital pound

[Re: Britcoin: BoE’s CBDC head says digital pound will have ‘very highest standards of privacy’, May 9]

Despite the Bank of England’s Head of Fintech Tom Mutton pointing out the Bank itself would not receive “personally identifiable information” from customers using the digital pound, there are still unanswered concerns over the digital pound requiring its users to share their financial data.

Many customers have understandable fears over the security of a system they know very little about.

The Bank of England is also yet to quell customer fears over a future cashless society. With so many banking branches and ATMs closing across the country,

there is a need for the banking community to strike a balance between driving the sector forward with innovation and digital transformation and ensuring banking services remain accessible for all. Moving forward, banking customers need to be provided with a clear understanding of not only how a digital pound would work, but also how it would impact their access to other banking services.

People across the UK are rightly uncertain about what the future of banking will look like. The Bank of England and HM Treasury’s consultation paper on the digital pound didn’t go far enough.

The Bank must clarify its plans before it can gain the trust of UK banking customers.

Jorge Lesmes Senior Banking Director at NTT DATA UK&I

DON’T TOUCH MY PIG Percy Pig ice cream renamed after M&S complaints

is not as bad as we think -

won’t be our magic bullet for growth

Tim Sarson

WE BRITS do like to moan about our country. For people in the business world, the one popular recent complaint is that our tax system is uncompetitive. Punitive, unstable and complex, they say it’s putting off business from investing, which in turn is trashing the economy. It’s the topic I’ve been asked most about in the past year, and not just by journalists: the government and the opposition want to get to the bottom of this competitiveness puzzle too. But is it true? Is our tax system turning away business investment, or are we just doing ourselves down? Well - it depends. Competitiveness is relative. It depends on who we’re comparing ourselves to, and whether we are interested in how our system works for a US multinational or a domestic start-up. Our apparatus has strengths and weaknesses. It’s pretty good if you’re a big R&D investor with patents, or a movie production company claiming film tax credit. It’s not so great if you are a small trader close to the VAT registration threshold or a retailer facing unaffordable business rates.

Fabio Vincenti, the owner of an ice cream parlour, didn’t think he was doing anything wrong when he named his new ice cream flavour Percy Pig. But M&S intervened to reclaim the copyright of their beloved brand of sweets - in the last of a series of copyright squabbles between big and small businesses.

EXPLAINER-IN-BRIEF: A RENEWED BRITISH COMMITMENT TO SUPPORT UKRAINE

The British government has been holding a leading role in gathering Western support for Ukraine since Russia’s invasion. It took a new, further step in this direction yesterday when Rishi Sunak promised more weapons in a meeting at Chequers with Ukrainian president Volodymyr Zelenskyy. Sunak confirmed the UK will provide Ukraine with longrange missiles which it hopes will make a big difference in the counter-offensive Zelenskyy plans to mount against Russia. The

missiles supplied by the UK government, called Storm Shadow, have a range of 250km. This means they can travel much further than the missiles supplied by the US, for instance, that have a range of around 80km. Sunak has also pledged to provide the Ukrainian military with attack drones. Before meeting Sunak in the UK, Zelenskyy also visited Italy, France and Germany, shoring up some more military support. It’s a positive sign that the appetite to aid Ukraine is still strong.

But these are marginal cases; the most important lessons can be found looking at mainstream business taxation. I’ve spent many years helping a wide range of businesses decide where to build an R&D centre or factory, or where to locate a European HQ. One factor they take into account is the tax system: the headline rate, the reliefs and incentives available, and the ease or complexity of compliance. We’ve waxed and waned on this score over time, but today we are squarely bog standard.

Take the headline corporation tax rate of 25 per cent. That’s the same as France, the Netherlands, Italy, Spain, Japan, Korea and – once we take into account state taxes – the USA. Everyone’s at 25 per cent bar a few high tax outliers and those traditional low tax destinations which can’t really go below a tax rate of 15 per cent for large businesses anymore because of the new global minimum tax.

In terms of incentives and reliefs, we’ve heard a lot about the new US Inflation Reduction Act (IRA) and its supersized tax incentives for green investment, and the EU’s intended re-

sponse in the Green Deal Industrial Plan. Here again, we are middling. We can’t compete with the US for the sheer scale of largesse and that’s a worry, but nor can the rest of Europe. The global trade effects of that vast public subsidy to US domestic investment will be significant.

Back home, the full expensing announced in the last Budget is welcome if you have enough taxable income to absorb the deductions, but it’s not hugely more generous than several other regimes. Our patent box and R&D regimes are good, but far from unique. We are quite restrictive on deductions for interest costs, but so are most of our peers. The IRA aside, we’re in the middle of the pack.

And finally our tax compliance burden is, well, so-so. Every year complying with the tax rules becomes more demanding: more paperwork, more supporting data, more governance. But relationships between business and HMRC are generally pretty decent.

No major developed economy gives business taxpayers an easy ride. But we do lag behind in giving taxpayers upfront certainty through binding rulings.

So where does this leave us? It means our tax system overall is probably not actively attracting or repelling many businesses, although it’s having an effect at the margins.

The rest of what the UK has to offer needs to fill in the gaps. We remain a highly investable country with strong soft power - as the global viewing figures for the Coronation show. But we need the other things too: skilled labour, a supportive planning and subsidy regime, decent transport infrastructure, strong domestic demand, and as close to frictionless trading links with the EU as possible. Tax is important, but it’s not going to be doing the heavy lifting anytime soon.

£ Tim Sarson is head of tax policy at KPMG UK

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900 Email: news@cityam.com Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com Editorial Editor Andy Silvester | News Editor Ben Lucas Comment & Features Editor Sascha O’Sullivan Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Commercial Sales Director Jeremy Slattery 17 TUESDAY 16 MAY 2023 OPINION CITYAM.COM

Our tax system

but it

› E: opinion@cityam.com COMMENT AT: cityam.com/opinion

Relationships between HMRC and businesses in the UK tend to be smooth

Certified Distribution from 09/01/2023 till 26/01/2023 is 67,090

CITYAM.COM 18 TUESDAY 16 MAY 2023 LIFE&STYLE

MOTORING

THE MIGHTY BOOST

Induction. Compression. Ignition. Combustion. Exhaust. In most cars, this explosive reaction between fuel, oxygen and electricity is anaesthetised into something spiritless and mundane. The Aston Martin DBS 770 Ultimate doesn’t do mundane. Its 5.2-litre V12 is one of the most exhilarating, awe-inspiring engines ever unleashed onto the road.

The 770 Ultimate is described as an ‘emphatic last word’ for the DBS –Aston Martin’s answer to the Bentley Continental GT Speed and Ferrari 812 Superfast – after five years in production. A total of 300 coupes and 199 Volante convertibles will be built, with the entire run sold out in advance.

So, why does it matter? Well, partly because the DBS 770 Ultimate marks the end of an era, as possibly the last Aston Martin (apart from the Valkyrie hypercar) with a V12 engine. And also because the way it drives bodes bril-

liantly for the DB11’s replacement, which arrives this summer.

We’ll get to driving shortly, but first let’s delve into the details. Thanks to more boost from its twin turbochargers, the Ultimate musters a mighty 770hp – up from 725hp in the ‘standard’ DBS, and sufficient for 062mph in 3.2 seconds (3.4 in the Volante) and a top speed of 211mph. Maximum torque remains at 664lb ft, mainly to protect the quicker-shifting eight-speed automatic ’box.