CITY READIES FOR RATE TO STAY HIGHER

JACK BARNETT

JACK BARNETT

THE BANK of England is poised to back a 12th straight interest rate hike today, marking what some experts reckon will be the death of the era of ultra-cheap money.

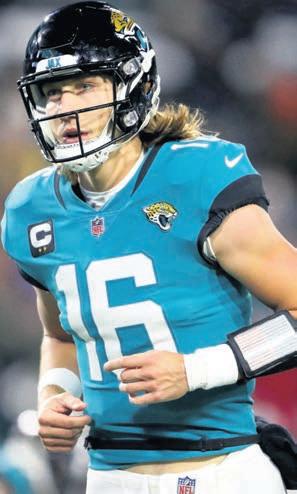

Bank governor Andrew Bailey (pictured) and the rest of the Monetary Policy Committee (MPC) –the nine-member group tasked with setting interest rates in the UK –will vote for a 25 basis point increase, hoisting borrowing costs to a near 15-year high of 4.5 per cent, the City suspects.

Inflation in the UK is running at a historic high of 10.1 per cent and has been in the double digits since last summer, likely luring Bailey and co into piling more misery on businesses and families in a bid to tame prices.

JD Wetherspoon boss Tim

TEAM OF THE YEAR RUGBY STARS WHO STOOD OUT P25

JUST

Martin yesterday stressed inflation remained an “intractable issue” for the hospitality sector and slammed MPs for “a lack of understanding” how inflation could be tackled by freeing businesses from red tape.

Britain’s inflation problem is proving much harder to tackle than the US’s and Europe’s. Numbers out yesterday showed the rate of price increases across the pond fell unexpectedly to 4.9 per cent last month.

That decline strengthened Wall Street’s expectations that the Federal Reserve –the Bank’s American equivalent –will end its aggressive interest rate rise campaign at its next meeting on 14 June.

However, the Bank may eventually send rates to a peak of at least 4.75 per cent and could have to keep policy tight for several years to prevent an in-

flation resurgence.

UK borrowing costs are on course to top four per cent for the whole of this year and next and still be running at 3.25 per cent in 2027, according to forecasts out today from Britain’s oldest economic think tank, the National Institute of Economic and Social Research (NIESR).

If the projections play out, Britain’s monetary policy playbook of the last decade or so would be ripped up.

That move “represents a regime shift that ought to be handled with great care,” Jagjit S Chadha, director of NIESR, said.

Between March 2009 and April 2022, UK interest rates were kept below one per cent after they were slashed in response to the 2008 global financial crisis and the Covid-19 pandemic.

Not everyone thinks Bailey and co should raise rates today. Six members of the Institute of Economic Affairs’ shadow MPC said rates should be kept unchanged. Two backed cuts.

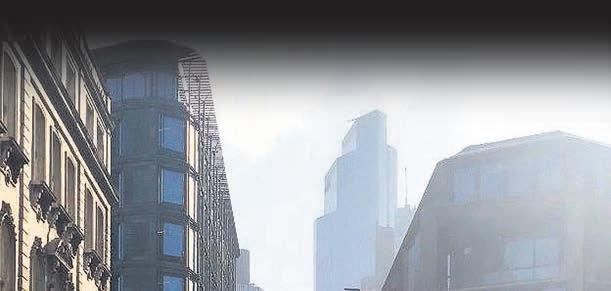

JUST STOP OIL brought chaos to the Square Mile yesterday morning, blocking roads around Moorgate and Bank junction during the morning rush hour.

Commuters were met with the sound of angry horns and bus drivers telling passengers to walk as the twodozen protestors marched through the capital.

The police eventually intervened

to move the protestors on to the pavement.

The campaigners were protesting the investment in new oil and gas projects by some City firms.

London is regarded by most surveys as the leading global hub for green finance, with more than 100 green exchange-traded funds, and where more than £100bn-worth of sustainability-related bonds have been issued in recent years, as per research by think-tank Z/Yen.

LONDON’S BUSINESS NEWSPAPER THURSDAY 11 MAY 2023 ISSUE 3,978 FREE CITYAM.COM

JACK MENDEL AND REPORTERS

WHAT TO SEE THIS WEEKEND

BANK EXPECTED TO HIKE TODAY AND EXPERTS WARN LEVEL WILL STAY ELEVATED FOR SOME TIME YET

INSIDE JOHN LEWIS CHAIR UNDER PRESSURE P3 LIZZY LINE HAILED BY COMMUTERS P6 MARKETS P15 OPINION

P16-P17

P22-P23 SPORT P24-P27

STOP IT Anti-oil protestors come to global green finance hub

COMPORTA CONFIDENTIAL WHY NOW’S THE TIME TO BUY ON THE PORTUGUESE COAST P20-P21

STANDING UP FOR THE CITY

Transport upgrades are vital to keep London at the top of the financial table

ASK most of those who are yet to come back to work three or four or five days a week what the biggest barrier is and the answer is usually either the commute being a pain in the neck or being too expensive. So it won’t necessarily shock you to learn that in the aftermath of the Elizabeth Line’s arrival –relatively cheap, and very easy –the number of people going back to work more regularly has gone up. That data, from office firm IWG, points to another truism: if you build it, they will come.

The UK’s inability to plan and execute national infrastructure schemes is as much a part of our culture as tea and biscuits. Let’s take just two: the south east is in dire need of runway capacity, but both building at Heathrow seems

THE CITY VIEW

to be impossible and a new airport vetoed as too costly. And HS2 –whether it’s a good idea or not –has somehow managed to be started without anyone knowing whether or where it’ll be finished, leading to roadworks on the Euston Road turning a key London axis into gridlock in order to build a platform that may or may not be used. It’s silly to compare the UK to China or anywhere else without democratic recourse, but it is nonetheless staggering. Amidst this miserable track record, the over-budget and delayed Crossrail stands as

something of a triumph –and it might be a model for London’s infrastructure projects going forward. In part funded by the businesses who would get the most benefit from it, raising the capital wasn’t ever a serious problem. Could that be a way for Crossrail 2, or other projects, to go from drawing and design to onthe-ground reality?

One thing is for sure –it doesn’t look like the capital is set to receive much cash from Whitehall to build future-proofed transport projects, with even the current TfL budget dependent on protracted negotiations to come. And the danger of that is the capital’s vital moving parts fall behind international rivals. London is still the golden goose, but that’s no reason for complacency.

City

Developing Producing wind farms oil & gas

+

CITYAM.COM 02 THURSDAY 11 MAY 2023 NEWS

bp’s wider transformation is underway. Whilst today we’re mostly in oil & gas, we’ve increased global investment into our lower carbon & other transition businesses from around 3% in 2019 to around 30% last year.

GET SET... GO The world’s fastest growing sport, Padel, has arrived in the

PADEL, a cross between tennis and squash, has been brought to the Square Mile. Pop-up courts across the City will be available to all. Ruth Duston, MD of Primera, said “boosting the local economy has been at the heart of our activity”.

Embattled John Lewis chair survives confidence vote

LAURA MCGUIRE

JOHN LEWIS chair Sharon White (pictured) will remain chief of the business after winning a vote of confidence on her future leadership, but remains under considerable pressure with partners voting against her performance over the last year.

A majority of partners yesterday said they had confidence in White’s leadership moving forward, but not in her decisions over the past year.

“The council did not support last year’s performance, in which we reported a full-year loss and no partner bonus,” Chris Earnshaw, president of the John Lewis Partnership Council, said. Its understood that exact figures on the vote have not been disclosed yet.

The future of White’s

I THINK I’D RATHER FLY Uber announces new flight feature

reign as leader has looked in the balance recently as she faced backlash over her plans to bring in outside investment and raise cash.

The Partnership, which included department store John Lewis and grocery store Waitrose, has suffered hefty losses over the last year, most recently a £234m loss in 2022.

“Life isn’t about waiting for the storm to pass, it’s about learning to dance in the rain,” White told the PartnerShe also said “the board could consider external investment”.

White, who has previously vowed to keep the Partnership “unique”, also doubled down on her stance to keep the business employee-owned, saying that there were “no ifs no buts” about the stance changing.

UBER has launched a new feature that allows customers to book flights on the app, as the firm looks to expand modes of travel for users. The ridehailing giant is rolling out the new booking tool for domestic and international flights in partnership with online travel agent Hopper. GM Andrew Brem said target booking speeds were just one minute.

Brexit to blame? France beats UK on investment

JACK BARNETT

EXPERTS have today partially blamed post-Brexit uncertainty for helping France pip the UK to Europe’s investment hub crown for the second year in a row. The UK was home to 15.6 per cent, or 929, of all European foreign direct investment (FDI)

projects last year, down from 16.9 per cent in 2021, according to consultancy EY.

Last year’s relatively weaker investment figures are down from the UK bagging more than one in every five European foreign investment projects in 2015 –the year before the Brexit referendum.

“Political uncertainty and the ongoing impact of Brexit on trade and investment will likely have played a part in the UK’s performance,” EY’s report said. Investment projects in France climbed from 1,222 to 1,259 in 2022, breaking the European record for the second year straight.

not or. Discover more

Keeping oil and gas flowing where and when it’s needed and increasing investment in the transition to lower carbon energy. That’s our strategy. Right now, we’re gathering weather data to help us build offshore wind farms that aim to produce enough power for the equivalent of 6 million homes, and help the UK reach its goal of fivefold growth in wind power by 2030. And, crews are operating a drilling rig, destined to help one of our existing facilities keep delivering the energy needed to meet critical demand.

03 THURSDAY 11 MAY 2023 NEWS CITYAM.COM

And,

bp.com/PlansIntoAction

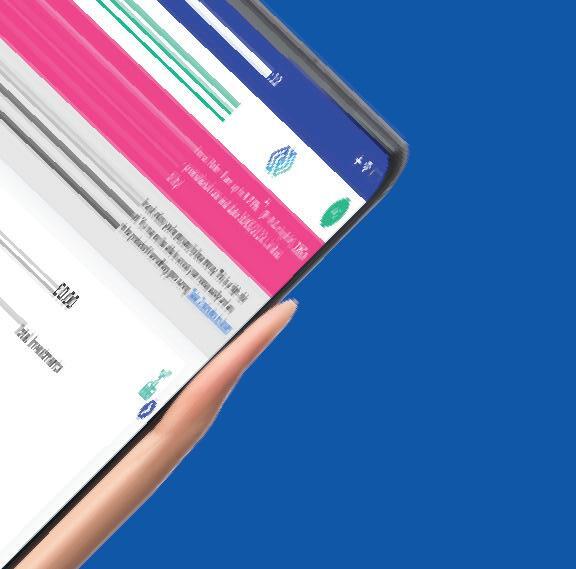

Santander, TSB and Virgin Money probed over ‘measly’ savings rates

CHRIS DORRELL

AN INFLUENTIAL parliamentary body has expanded its inquiry into the low savings rates paid by the UK’s retail banks, describing the current rates on offer as “measly”.

Having investigated the UK’s four largest retail banks, MPs on the Treasury Committee have now sent letters to Nationwide, Santander, TSB and Virgin Money.

These lenders account for a quarter of all personal current accounts,

according to the Financial Conduct Authority.

The MPs have demanded to know why the savings rates on offer at those banks are much lower than the Bank of England’s base rate.

According to the Treasury Committee, Virgin Money’s everyday saver account offers only 0.25 per cent, Santander offers 0.7 per cent and TSB 0.9 per cent.

While Nationwide offers the best rate, at 1.25 per cent, this is still far below the Bank of England’s base rate

of 4.25 per cent, which is likely to be lifted today.

“The UK’s biggest banks are continuing to squeeze record profits from their loyal savers,” Harriett Baldwin, chair of the Treasury Committee, said, adding that “the loyalty penalty” would be particularly severe for elderly customers who might be less able to switch accounts.

Nationwide and Virgin said their savings rates were “competitive”, while TSB and Santander said they will respond to the letter soon.

GUEST ANALYSIS

Hunter

DECKS HAD TO BE CLEANED

The strain of the enforced transformation programme is showing at Asos, although there are some early chinks of light. Ultimately, the company identified that it had, in places, become inefficient and that certain customers, brands, partnerships and indeed geographies were becoming untenable. The group has battened down the hatches to drive towards a sustainable model, with the priority being profitability over growth.

Asos revenues tumble but chief remains ‘hopeful’ despite loss

ASOS yesterday posted a half year loss as the fashion retailer continues to be beaten by a tough economic climate and a slowdown in consumer spending, with its share price closing down over 23 per cent after the news.

The online-only FTSE 250 retailer said it had made an adjusted loss before tax of £87.4m during the six months ending 28

February, compared to a profit of £14.8m the same period last year.

Revenue fell seven per cent in the first six months to February to £1.84bn, down from £2bn for the period last year.

However, the brand, struggling to keep up the momentum of its lockdown growth, said the dip in earning reflects “deliberate actions” by the group to boost profitability.

These actions included reduced

markdowns and enacting a discipline on “marketing spend” – which the group previously hinted at in its turnaround plan called ‘Driving Change’.

Asos chief Jose Antonio Ramos Calamonte remained hopeful about the cost-cutting initiative, with the plans reportedly on track to bring in a return to profitability in during the second half of its 2023 financial year.

Calamonte said: “Over 95 per cent of

the £200m of benefits expected in H2 FY23 are based on initiatives already in place.”

Sarah Riding, retail partner at Gowling WLG, said: “It’s been a difficult period for Asos, having been hit hard by the cost of living crisis, rising inflation and changing consumer trends post-pandemic.

It is hoped the business’ turnaround plan under chief executive Jose Antonio Ramos Calamonte could help it to get back on track.

In the meantime, the decks need to be cleared, which has inevitably come at a cost. The previously announced stock write-off of £128m, property impairments and closure costs such as the head office function each contributed to an overall pretax loss of £290.9m for the period, widening the loss of £15.8m the year previous.

There is little doubt that there is never a perfect moment within a rugged retail environment to be undertaking a transformation of this magnitude.

Even so, the change was necessary and the group has strings to its bow which could prove to be a saviour.

KPMG and PwC China audits had ‘unacceptable’ deficiencies, US finds

CITY A.M. REPORTER

AUDITS by KPMG’s China unit and PwC’s Hong Kong business contained “unacceptable rates” of deficiencies, the US accounting regulator found following a recent inspection.

The Public Company Accounting Oversight Board (PCAOB) said the deficiencies were of such significance

that it believed the firms failed to obtain sufficient evidence to support their work.

The regulator gained access to the audits after the US passed new legislation granting it access to Chinese companies’ accounts that are listed in the US.

The PCAOB did not name any of the firms reviewed in the inspection.

“Any deficiencies are unacceptable,” said PCAOB chair Erica Williams , although she explained first-time inspections often threw up issues.

A spokesperson for PwC said “we are working with the PCAOB to address the issues as part of our commitment to continuous improvement”.

Representatives of KPMG were contacted for comment.

CITYAM.COM 04 THURSDAY 11 MAY 2023 NEWS

MPs said elderly savers that are less able to switch would be hit most by poor rates

LAURA MCGUIRE

later this month in the City’s first

since

TRAVELLING IN STYLE Lord Mayor to travel to China in City’s first visit since 2019

Richard

THE

Interactive Investor LORD Mayor of London Nicholas Lyons and City of London Corporation policy chairmain Chris Hayward will travel to China

visit

the pandemic.

Capita warns of £20m hit from cyber attack

CHARLIE CONCHIE

A CYBER attack against outsourcing firm Capita, which saw personal information leaked onto the dark web is likely to cost £15 to £20m to resolve, the firm has revealed.

Capita, which provides data and IT outsourcing processes, was hit by a cyber attack in March and personal information including addresses and passport images were leaked online. The firm said yesterday it continues to work “closely and at speed with specialist advisers and forensic experts to investigate and resolve the cyber incident”.

“Capita understands now, based on its own forensic work and that of its third-party providers, that some data was exfiltrated from less than 0.1 per cent of its server estate,” the firm said in an update.

“Capita has taken extensive steps to

SPOONS BOOMS Wetherspoon on track for record year amid cost of living crisis

US lenders post record profits despite turmoil

CHRIS DORRELL

PROFITS at US banks in the first quarter reached record levels, rising by a third to a total of $80bn (£63bn), even as the sector dealt with the fallout of Silicon Valley Bank’s (SVB) collapse.

recover and secure the customer, supplier and colleague data contained within the impacted server estate, and to remediate any issues arising from the incident.”

The firm, one of the UK government’s biggest suppliers, said it expects to incur “exceptional costs” of around £15m to £20m as a result of the cyber attack.

The hack triggered warnings from financial regulators in the past week that pension firms and top corporate clients of Capita should investigate whether their customers’ data had been leaked in the attack.

The update came as the firm said its underlying trading performance remained in line with expectations.

Adjusted group revenue for Core Capita for the first four months of 2023 was up by 4.8 per cent year-onyear, while sales performance had been “strong”.

The banking turmoil was in fact a significant contributor to the profit boost. Half of the increase came from First Citizens and Flagstar who saw huge one-time gains from their respective acquisitions of SVB and Signature Bank, according to data compiled by Bankregdata.

Beyond the one-off gains, the data showed that banks benefitted substantially from rising interest rates and the continuing strength of the US economy.

In addition, the data showed low levels of loan default despite fears of an impending recession.

The reports showed that less than five per cent made losses in the first quarter. JP Morgan saw the biggest profit, notching $11.7bn.

The biggest loss was recorded by Pacwest which lost $1.2bn according to the figures. Its shares are down over 70 per cent in the year to date.

05 THURSDAY 11 MAY 2023 NEWS CITYAM.COM

JD WETHERSPOON is expecting a “record” year, with the London-listed boozer reporting its highest ever sales during the Easter week as the cost of living crisis saw punters seek out cheap pints. Shares bounced on the news, closing up 5.24 per cent.

Non-compete clauses slashed as ministers begin post-Brexit changes

JESSICA FRANK-KEYES

NON-COMPETE clauses will be slashed to three months in a bid to boost competition between employers, as a key EU ‘sunset’ clause is ditched. It comes as part of a move by the government to scrap its own plans for thousands of EU laws to automatically expire at the end of the year, in what was dubbed a post-Brexit bonfire.

Business secretary Kemi Badenoch told MPs the government was amending the Retained EU Law Bill

WISE MOVE Fintech chief to take threemonth sabbatical to look after newborn son

(REUL) which would have seen laws copied over to the UK after Brexit deleted from the statute books, unless specifically retained or replaced.

Campaigners had warned the government this so-called ‘sunset clause’ could lead to crucial laws and regulations simply vanishing or being overlooked –but Brexit-backing MPs are likely to be angered by the move.

Badenoch said her department would “replace the current sunset in the bill with a list of the retained EU laws that we intend to revoke at the

Lizzy Line proves a hit with return to work crowd

GUY TAYLOR

LONDON’s popular Elizabeth Line has prompted a surge in workers heading into the office, new research for its oneyear anniversary shows.

Footfall data from the workspace operator IWG has today revealed a 23 per cent increase in the number of visits to offices across nine Elizabeth Line stops since the month before it opened last year.

Inner city locations had particularly strong boosts in attendance, with Paddington and Canary Wharf office spaces seeing respective rises of 50 and 22 per cent.

The findings come after an immensely successful year for the new line, which now accounts for a whopping one in six of all rail journeys made in the UK, according to figures released by the Office for Rail and Road in March.

Mark Dixon, CEO of IWG said: “There is now a wealth of evidence to show that long and costly daily commutes will be

a thing of the past for a large proportion of white-collar workers, as hybrid working continues to take hold.

“Where arduous commuting barriers have been reduced, be that through improved transport links such as the Elizabeth Line or the increased availability of local workspaces in the suburbs and former dormitory towns, the demand for offices and hybrid workspace is thriving.”

The data also showed newly connected suburbs outside London are reaping the benefits of increased connectivity. Reading saw an uptick close to 45 per cent on the previous year, with Slough, and Maidenhead seeing rises of 38 and 19 per cent respectively.

The firm said the figures demonstrate the “integral role that shorter commutes play in bringing workers together to collaborate in person”, as further IWG research showed 58 per cent would be put off applying for jobs with a long daily commute.

end of 2023” when the EU bill is back in parliament next week.

She said: “This provides certainty for business by making it clear which regulations will be removed.”

Deregulation measures announced included changes to employment law on recording working hours which the government says could help save firms around £1bn a year –while retaining the EU’s 48-hour working time directive.

Labour blasted the government’s Uturn as “humiliating”.

HEY BIG SPENDER Wealthy splurge £3.1bn on luxury London homes as demand rises

WISE chief Kristo Kaarman yesterday announced he will be taking a three-month sabbatical from September to spend time with his family. The news comes after the firm in June confirmed Kaarman was under investigation by the FCA in relation to an outstanding tax bill.

Virgin Media O2 price hikes lift revenue

ABBY WALLACE

VIRGIN Media O2 yesterday reported a slight increase in revenue in the first quarter of 2023 as a result of price increases and stronger consumer retention. Adjusted quarterly revenue increased 3.9 per cent on the same period last year to £2.6bn, the company announced yesterday. Meanwhile, adjusted ebitda for the first quarter increased two per cent to £950.4m. The company said that its earnings were partly held back by higher energy costs.

Mobile revenues also grew by 3.4 per cent to £1.43bn as the company benefitted from raising contract prices.

The company said its fixed customer base grew by 20,900 net additions in the quarter, taking the total base to 5.8m as it held onto customers despite price increases.

It added that it was on track to deliver 5G services to half of UK homes this year and did not change its full year guidance.

“We continue to invest in the upgrade and expansion of our footprint and we are on target to cover 80 per cent of the country with full fibre. When coupled with bringing 5G services to more areas and reaching half of the UK this year, we are playing a big role in future-proofing the UK’s digital infrastructure,” chief executive Lutz Schuler said in a statement.

Meanwhile... London’s less rich seek smaller and more affordable homes

VICKY SHAW

SOME property professionals are seeing trends towards home buyers looking for smaller, more affordable homes and people moving out of older homes to buy more energy-efficient new-builds, according to surveyors.

Overall, there are signs that buyer demand remains subdued in the face

of relatively high borrowing costs, the Royal Institution of Chartered Surveyors (Rics) said.

Its April market survey of the UK property market found that a net balance of 37 per cent of professionals reported demand from buyers falling, rather than rising.

New instructions to sell were broadly flat, with the survey pointing

to a slight decline in fresh properties coming to market along with a downward pressure on house prices.

Simon Rubinsohn, Rics chief economist, said: “Most notably, buyer demand still appears to be subdued in the face of relatively high borrowing costs, the prospect of at least one more interest rate hike and ongoing affordability challenges.”

CITYAM.COM 06 THURSDAY 11 MAY 2023 NEWS

High borrowing

have

costs

seen buyer demand soften, Rics said

CANARY WHARF LIVERPOOL ST INCREASE IN FOOTFALL Office workers up by 50 per cent Attendance up by 22 per cent Up by 21 per cent PADDINGTON

LONDON’s mega wealthy splurged £3.1bn on 161 luxury homes across the capital's most affluent boroughs in the year to 23 March – the strongest year for London’s luxury property market since the Brexit vote. Kensington, Belgravia and Mayfair led the charge.

PA

National Express announces new name ‘Mobico’

GUY TAYLOR

GUY TAYLOR

NATIONAL Express is to change its parent company name to Mobico Group from June 2023.

The coach operator said it believes the name ‘Mobico’ “better reflects” the “international nature” of the group, as it continues a shift to mass transit.

Ignacio Garat, group chief executive at National Express, said: “Whilst National Express is a highly valued consumer brand, Mobico better represents our multi-modal operations, global reach and future ambitions.”

Its subsidiaries will retain their wellknown names, with National Express still used for the UK national coach network.

Brands across the group’s global oper-

ations such as Alsa, Wedriveu and Peterman, will also retain their names, with the company currently operating in North America, Europe, North Africa and the Middle East. Garat added: “We remain focused on providing best-inclass services and delivering our evolve strategy, with the intent of establishing Mobico Group as the world’s premier shared mobility operator.”

Earlier this year, National Express said a series of train strikes helped it more than triple annual profits as passengers switched to buses and coaches to avoid rail disruption.

The group reported underlying pretax profits of £145.9m, up from £39.7m in 2021, with annual revenues surpassing pre-pandemic levels for the first time since Covid hit.

WHAT’S IN A NAME?

NATIONAL EXPRESS ISN’T THE FIRST TO TRY A NEW MONIKER...

ROYAL MAIL BECOMES CONSIGNIA... AND THEN ROYAL MAIL AGAIN:

Few names changes have made national news, but the decision to ditch Royal Mail in favour of Consignia (a mash-up of Consign and Insignia, geddit) lasted only a year before being reversed. The current boss Simon Thompson, allegedly on the way out, may wish his problems were as easy to fix.

BRITISH GAS BECOMES CENTRICA:

Another controversial move at the time, the rebranding of the parent company of British Gas has usually gone down as one of the more successful –not least because it allowed the company to leave behind associations with the state-owned, not entirely reliable energy provider that it had been born from after privatisation.

STANDARD LIFE ABERDEEN TO ABRDN:

The merger of two financial giants, Standard Life and Aberdeen Asset Management, did leave a fairly clunky moniker, but few were impressed when the answer to this particular riddle was simply pulling the vowels out. It’s been some time since the change, and it’s still pronounced Aberdeen, but it lks lke a wst f tm nd mny to us.

EUROSTAR BECOMES, ERR, EUROSTAR:

A quick paint job on Eurostar’s European trains could have been left at just that, but advertising it as a full corporate rebrand was going some. “Eurostar was selected (as the new name) due to high consumer awareness at both a European and a global level,” the rail operator said. Well, yes, funny that.

Tui shares down as bookings fail to woo investors

GUY TAYLOR

TUI REPORTED revenues overtook pre-pandemic levels in its half year results yesterday as it cashed in on increased bookings and stronger summer travel demand.

The travel company reported revenues of £2.78bn, a £870m improvement on the previous year, with bookings hitting 12.9m across the winter and summer seasons. Losses shrunk by £180.75m.

Chief Sebastian Ebel said “strong booking development and significantly improved quarterly figures underline our expectations”.

The operator said capacity was returning to pre-pandemic levels, with the agency “confident” it will close in on 2019 figures this summer. This comes after TUI announced the era of ultra cheap flights was ‘over’, as reported in the Times.

However, Sophie Lund-Yates of Hargreaves Lansdown said despite the positives, the results had not done enough to “plug the biggest hole” as liquidity risk remained “at the forefront of investors’ minds”. This proved true, with shares closing down five per cent.

07 THURSDAY 11 MAY 2023 NEWS CITYAM.COM

New data shows UK ‘fraud capital of the world’

CHRIS DORRELL

THE UK has far further to go in its campaign against fraud as fresh figures show over £1.2bn was stolen in 2022.

According to new figures from UK Finance, £2,300 was lost every minute to authorised push payment (APP) fraud and unauthorised fraud last year. Commenting on the report, UK Finance chief executive David Postings called the UK “the fraud capital of the world”.

Unauthorised fraud losses from payment cards, remote banking and cheques reached £726.9m in 2022, less than one per cent below 2021 figures.

APP fraud reached £485.2m, down 17 per cent compared to 2021. APP fraud is when a customer is tricked into authorising a payment to an account controlled by a criminal.

Although the figures showed a slight decrease in fraud levels, director of economic insight and research Lee Hopley pointed out this represented

CRACKDOWN LOOMS Firms warned to clean up before consumer duty shake-up

Liontrust’s GAM takeover could face challenges

CHARLIE CONCHIE

LONDON-LISTED fund manager

Liontrust is facing a battle with a group of GAM shareholders and a potential challenge from regulators after a takeover move last week.

an “unwinding” of trends during the pandemic when financial crime spiked.

For the first time, in the second half of the year UK Finance also collected data on where the fraud originated.

The data showed 78 per cent of APP fraud cases originated online.

A further 18 per cent of fraud cases originated via telecommunications.

Generally, fraud from telecom companies was of a higher value and accounted for 44 per cent of losses.

The figures come shortly after the government released its strategy to tackle fraud which controversially watered down proposals to make tech companies reimburse fraud victims.

Postings said that “tech companies should be reimbursing” victims of fraud. “There’s no reason they couldn’t [use] a reimbursement fund.”

Proposals under consideration by the Payment System Regulator would force banks to reimburse all victims of APP fraud where the loss is over £100.

THE FINANCIAL Conduct Authority (FCA) is preparing to roll out its new consumer duty this summer, which will shift more responsibility onto firms. The new rules, which will come into force from 31 July, will set “higher and clearer standards” across financial services in a bid to safeguard consumers, FCA executive director Sheldon Mills (right) said.

Used car market accelerates as supply chain issues ease and prices lower

GUY TAYLOR

THE UK’s used car market has seen its biggest quarter of growth since 2020 as consumers opt to cut costs and supply chain issues finally ease.

Figures published by the Society of Motor Manufacturers and Traders (SMMT) showed the UK market for second-hand vehicles rose 4.1 per cent in the first quarter of 2023, following

three successive periods of decline. Some 1.85m deals took place, up 72,798 on the same period in 2022.

SMMT chief Mike Hawes said “easing supply chain challenges have re-energised new car registrations”.

Post pandemic sky-high prices stunted sales of used vehicles, caused by demand outstripping supply.

Supply chain issues and the global semiconductor shortage caused a

slowdown in new vehicle production while demand for used motors rose.

Chris Knight of KPMG told City A.M. higher household essential bills and borrowing costs,” would also be “key factors” for consumers deciding to buy a used car, rather than new.”

He added: “Used car prices remain elevated versus pre-pandemic [and] demand continues to be ahead of supply for some brands and models.”

Liontrust struck a £96m deal to buy former rival GAM as chief John Ions continues an acquisitive push. However, the deal is now facing a formal challenge from an investor group made of NewGAMe and Bruellan (which together own 8.4 per cent of GAM), who argue the takeover “is contrary to... Swiss takeover law”.

The pushback may prove a speed bump for Liontrust’s takeover of the firm due to the investor challenges.

Shareholders have been given until 11 August to greenlight the deal, but investors may not receive the exchanged Liontrust shares until the end of the year, leaving them in limbo until the deal is complete.

Analysts also voiced concerns over the deal last week. David McCann of Numis said he had “strong reservations” over the deal due to hefty deal costs Liontrust and GAM declined to comment. Finma, the Swiss regulator, did not respond to a request for comment.

CITYAM.COM 08 THURSDAY 11 MAY 2023 NEWS

USED CAR MARKET FIRST QUARTER SALES 2,063,674 2016 2,133,956 2017 2,031,661 2018 2,020,144 2019 1,185,919 2020 1,174,351 2022 1,847,149 2023 Source: SMMT 1,187,755 2021

Cleverly talks down hopes of US trade deal

JESSICA FRANK-KEYES

FOREIGN secretary James Cleverly (pictured) has talked down hopes of a UKUS trade deal during a visit to Washington DC.

Speaking in the US yesterday, Cleverly said the government was not “prioritising” a free trade agreement (FTA) but aiming for “real economic coordination” with the superpower.

His comments came at a press conference held with US secretary of state Anthony Blinken.

Cleverly told reporters: “I know FTAs are often used as a shorthand for closer economic partnerships. We are not prioritizing an FTA with the US because there are many areas where we can work more closely, more collaboratively, have real economic coordination that does not require the traditional kind of tariff-reducing elements of an FTA.”

Sunak, Starmer and the ghosts of prime ministers past

SKETCH

Blinken was also asked about concerns allies might feel the US’s Inflation Reduction Act is “protectionist” –the 2022 federal legislative package aims to cut rising prices by reducing the deficit and investing in domestic energy production and clean energy.

Blinken responded that the law marked a “historic commitment” to tackling climate issues, and housed an intent to work with international players to “build the strongest possible collective infrastructure, supply chains, and ecosystem to produce [new] technologies”.

“There are profound benefits for many of our partners around the world,” Blinken stressed.

Negotiations on an FTA with the US began back in May 2020, but the House of Commons says there is no current deal and “an agreement is not expected soon”.

AFTER a weekend imbued with tradition, Rishi Sunak and Keir Starmer continued the national history lesson, and used Prime Minister’s Questions to quote former inhabitants of Downing Street. With a strong opening gambit after dismal local election results, Sunak recycled a vintage PMQs line from Tony Blair in 2007, who once told David Cameron: “The right honourable gentleman can be as cocky as he likes about the local elections, come a general election, policy counts.”

He couldn’t, however, quite bring himself to finish the quote, which said: “On policy, we win and he loses.” Stung by the use of his idol as a verbal bayonet, Starmer told Sunak he had yet to even win a vote amongst his own party, let

alone the election.

“Last year, he lost a Tory beauty contest to (Liz Truss), who then lost to a lettuce. No matter who the electorate is, the Prime Minister keeps entering a two-horse race, and somehow finishing third.”

An unusually boisterous Rishi, still feeling svelte from his Taylor-Swift themed Soul Cycle class over the weekend, clawed back some control, threatening to read the extensive list of promises made by Keir Starmer which he has now backtracked on.

“It’s a bit rich to hear about mandates,” yelled the PM, “when he’s broken every promise he was elected on. He’s not just Sir Softie, he’s Sir Flaky too.”

Thankfully Sunak, who hasn’t eaten processed sugar since 2012, managed to get the words out before he started salivating, before launching an attack on Rachel Reeves to distract everyone while he scoffed down a Mexican Coke. Starmer, leaping to the defence of his shadow chancellor and still smarting from the Blair insult, bellowed back: “There’s only one party who broke the economy and they’re sitting right there.”

As he waved his finger wildly over the opposite benches, trying to draw the ghost of Theresa May in the air, he continued: “To quote one of his more electorally successful predecessors, ‘nothing has changed’.”

09 THURSDAY 11 MAY 2023 NEWS CITYAM.COM

Sascha O’Sullivan

Sunak backs UK oil and gas industry in grilling over Rosebank oilfield

NICHOLAS EARL

RISHI SUNAK has backed continuing North Sea oil and gas production, arguing that the UK “will need fossil fuels for the next few decades”. Speaking in Parliament yesterday, Sunak cited the latest report from the Climate Change Committee, which predicts half of the UK’s energy requirements between now and 2050 will still be met by oil and gas, and as much as 64 per cent between 2022 and 2037.

“We will need fossil fuels for the next few decades as we transition to a greener future. During that period, it makes absolutely no sense not to invest in the resources we have here at home,” Sunak said.

He added that importing foreign fossil fuels “at twice the carbon emissions as our local resources” also made no sense.

Sunak’s comments came in response to a grilling at PMQs from Green Party MP Caroline Lucas, who questioned whether he could “look

Not too late to build a British battery industry

NICHOLAS EARL

THE UK government must continue to support the creation of a British battery industry, a senior tech boss has warned, as a growing number of firms are being pulled towards the US due to its attractive investment environment.

Alan Hollis, chief executive of battery cell specialist AMTE Power –Britain's only surviving home-grown battery producer –said the sector was of vital importance to the UK’s green transition, supporting both electric vehicles and renewable power storage.

“We need to make sure that we are creating the UK battery industry at sufficient scale so that we can have the infrastructure and the global supply chain to support a battery industry, because it’s critical in the drive to net zero and for our energy security,” Hollis told City A.M.

But he said the UK needs to get an industrial strategy in place soon.

“We’ve got to get an end-to-end industrial strategy in place and, hopefully, the government in the autumn statement will come forward with some excellent proposals on creating the right environment to drive investment into the UK battery industry,” he said.

Hollis said it was “absolutely possible” for the West to challenge China’s dominance in the market.

“It’s not something that can happen overnight and this is why there’s an awful lot of battery production facilities and supply chains being developed in Europe and North America at this particular moment in time,” he said.

Hollis’ comments follow the collapse of Britishvolt, which was supposed to be the hub of the UK’s electric vehicle battery ambitions. It was later sold to Aussie rival Recharge.

It also follows the unveiling of $400bn (£317bn) in green subsidies included in the US Inflation Reduction Act, which has seen a host of firms pivot to invest there to take advantage of the more lucrative investment climate on offer.

In light of the act, Hollis previously hinted to Sky News that his firm could consider moving a huge chunk of its operations across the pond.

But Hollis said the company is still going ahead with developing its manufacturing facilities in Thurso, Scotland.

“I’m confident that we will be able to develop our facility here in the UK, because that’s what we want to do,” he said.

his daughter in the eye” if he allows Rosebank, the largest undeveloped North Sea oilfield, to be approved.

Sunak has previously called his daughter the “climate change champion” in his house.

“I wonder if he’s asked her what she thinks about Rosebank,” Lucas said.

“If he gives this the green light, will he be able to look his daughter in the eye and honestly say that he has done everything in his power to give her and all other young people a liveable future?”

could produce a total of 500m barrels of oil

Harbour blames windfall tax as it cuts 350 jobs

NICHOLAS EARL

HARBOUR Energy, the largest oil and gas producer in the North Sea yesterday confirmed it still expects to cut hundreds of jobs in the UK.

It first announced its intentions to downsize its UK operations last month, after its profits were scrubbed out by the windfall tax.

In its latest quarterly update, Harbour revealed the company’s review of its British operations is on track to complete in the second half of this year – including the slashing of 20 per cent of its Aberdeenshirebased workforce.

Wind makes more electrcity than gas in a quarter for first time ever

NICHOLAS EARL

THE UK’s growing fleet of wind turbines generated more electricity than gas-fired power stations in the first three months of this year, according to new data released by Drax.

Almost a third (32.4 per cent) of the UK’s electricity was supplied from wind power during the first quarter of 2023, outpacing gas which delivered 31.7 per cent.

It is the first time wind has provided the largest share of power in

any quarter in the history of the country’s electricity grid.

Across the three months, Britain’s turbines generated 24 TWh of electricity – enough to charge more than 300m Tesla Model Ys.

Output from wind was three per cent higher than during the same quarter last year, while gas was down five per cent.

Almost 42 per cent of Britain’s electricity came from renewable sources (wind, solar, biomass, and hydro) in the first three months of 2023.

It now predicts “a reduction of about 350 onshore positions” which would deliver annual savings of about £40m from 2024, alongside an estimated £12m one-off charge in Harbour’s 2023 results.

Harbour has suffered heavily from the windfall tax since it was introduced last May – which has effectively established a 75 per cent tax on profits in the North Sea for the next six years.

Harbour blamed the tax for driving down its full-year profits from £2.1bn to just £7m last year –with the energy firm calculating a £1.3bn hit from the Energy Profits Levy alone.

Its headline figures over the first three months of this year are encouraging, however, with the FTSE 250 company posting an estimated revenue of £870m.

Virgin Atlantic hits out at Heathrow ‘failings’ as high costs hit recovery

GUY TAYLOR

VIRGIN ATLANTIC said yesterday that challenges surrounding last year’s passenger cap at Heathrow and ongoing economic uncertainty affected its final year results, with the airline not expecting to return to profit until 2024.

Rising fuel prices and a cost of

living crisis “contributed towards losses, albeit significantly improved on 2021,” Shai Weiss, Virgin Atlantic’s CEO, said.

But Weiss added that, as demand begun to return last year, “failings at Heathrow and the complexities of ramp up pushed our operation to its limits.”

It reported total revenues of £2.9bn

in 2022, and pre-tax losses of £206m. Passenger numbers inched closer to pre-Covid numbers, reaching 75 per cent of 2019 levels.

Interactive Investor’s Victoria Scholar said Virgin was lagging behind rivals like IAG. “While there were rumours of an IPO in 2021, it looks like that is no longer happening anytime soon,” she said.

11 THURSDAY 11 MAY 2023 NEWS CITYAM.COM

Virgin Atlantic said it does not expect to return to profit until 2024

The government is currently targeting a vast ramp up in wind power

It is estimated that Rosebank

THE NOTE BOOK

BOOK-WRITING novices need know one thing before putting metaphorical pen to paper: submitting that manuscript after months of toil is certainly a punctuation mark in the author’s journey, but far from a full stop. That’s because once your ideas are organised, polished and have been passed along to the editing process it is time to consider how to find an audience for them. The natural extension of the philosophical question “if a tree falls in a forest and no one is around to hear it, does it make a sound?” is that

“if a book is written and no-one reads it, has it ever been published?”

Consequently, there is much hard marketing that goes into shifting hardbacks, which starts with glossy, colourful covers designed to leap from the shelves and ends – well, never really.

I’ve only ever published in lockdown, when launch parties extended to a simple glass of fizz at home. So last night in Waterstones off Leadenhall Market

was a chance to push the boat out with friends and family for ‘The Everything Blueprint’, my tale of the UK’s great technology success, the microchip designer Arm. The promotion kicked off long before the first bottle was opened, with a string of social media posts teasing milestones in the story and generous endorsements secured from Sir James Dyson and veteran venture capitalist Sir Michael Moritz. Then there was a well-timed newspaper serialisation and the now obligatory video of author opening box of books and cradling the finished product for the first time.

I’d like to think the story sells itself, but why leave that to chance? I could do worse than follow the playbook of Arm’s founding fathers who were great salesmen. They went global from the off to find customers for its designs that are today used 30bn times a year to power smartphones, car systems, laptops and data centres. If only I could shift that many copies.

ANNOUNCEMENTS LEGAL AND PUBLIC NOTICES

CITY of LONDON - Notice of Making

A WORTHY PRIZE

Far from the non-fiction section, I celebrated another title, ‘The Boy with Flowers in His Hair’, which won our 10th annual Oscar’s Book Prize on Tuesday night. The £10,000 award celebrates the best in picture books, which are vital to spark a child’s love of reading and all-round curiosity. Oscar was our son, who we lost in 2012, and his is a glorious legacy. Our prize will always be 45 years younger than the Booker Prize but our chosen category is

£ Arm’s story is a reminder that business success is often unpredictable. Warren East, who attended last night’s launch party, was the company’s chief executive when rival chip giant Intel was intent on extending its dominance of the PC world into Arm’s mobile heartland.

When East joined a conference call with Apple in April 2008, he was convinced Arm was about to be ejected from the iPhone in favour of Intel. In fact, Apple wanted to forge a tighter relationship that continues to this day.

BULLISHNESS ON CAPITAL MARKETS IN SHORT SUPPLY

I’ve always thought business people are fundamentally optimistic and, back at my day job, the latest Quoted Companies Alliance Small and Mid-cap Sentiment Index proves it. Despite stubborn inflation, political uncertainties and new technological challenges, directors are more bullish about the prospects for the UK economy and their own businesses than they were six months ago.

£ One theme of the book is how microchips became the commodity that underpins the global economy rests, which explains the US-China tensions centred on Taiwan. But it also highlights human quirks. In all likelihood Arm and Nokia would have found each other eventually, but first contact came because a Brit who worked for the company in Oulu, northern Finland, was sent Arm’s first brochure as a joke. A colleague back home thought its headquarters, a barn, looked just like a sauna which the Finns would enjoy.

Less welcome is the fact that one in three were concerned they would face a takeover bid during the next 12 months – a reminder that UK equities are on the whole going cheap. Meanwhile, one in seven are likely to consider delisting and one in six are likely or fairly likely to move their primary listing. Not so optimistic for London’s world-leading capital markets.

City of London

Basinghall Street and Nicholas Lane – Amendments to the waiting and loading restrictions

The City of London (Waiting and Loading Restriction) (Amendment No. 7) Order 2023

1. NOTICE IS HEREBY GIVEN that the Common Council of the City of London Corporation has all other enabling powers. By amending The City of London (Waiting and Loading Restriction) (Consolidation No. 2) Order 2021. This order shall come into operation on the 10 May 2023 and may be cited as The City of London (Waiting and Loading Restriction) (Amendment No. 7) Order 2023.

2. The effect of the Orders will be to:

(a) Basinghall Street to:-

(1) extend the existing no waiting at any time and no loading Mon - Fri 7am – 7pm restrictions on both sides to a point 1.2m north of the northern side of Masons Avenue.

(2) to revoke the existing no waiting restriction (single yellow line) for the length described in (a) (1) above.

(b) Nicholas Lane to:-

(2) to revoke the existing no waiting restriction (single yellow line) for the length described in (b) (1) above.

3. Copies of the Order, which will come into operation on 10 May 2023, the statement of reasons hours on Monday to Fridays inclusive for a period of six weeks from the date on which the Orders were made at the Planning Enquiry Desk, North Wing, Guildhall, London, EC2V 7HH or on the Further information and copies of the documents may be obtained from Network Performance, City of

4. Any person desiring to question the validity of the Orders or of any provision contained therein on has not been complied with may, within six weeks from the date on which the Orders were made, make an application for the purpose to the High Court.

Dated 4 May 2023

Ian Hughes, Director, City Operations

Notice of Proposal

Amendment to the one-way restriction at Widegate Street. The City of London (One Way Streets) (Amendment No. *) (Widegate Street) Order 202*

In exercise of the powers conferred by sections 6, 122 and 124 of, Act 1984 and of all other powers, NOTICE IS HEREBY GIVEN that the Common Council of the City of London Corporation intend to make an amendment to The City of London (One Way amendment Order. The effect of the Orders would be in:

(a) Widegate Street, One Way Street

Street, from east to west.

Copies of the proposed Order, the statement of reasons for proposing to make the Order and plans showing the proposals, & Projects, City of London, PO Box 270, Guildhall, London EC2P 2EJ or by telephone No. 020 7332 3970 or email to policy. make representation to the proposals should send a statement of their objection or representation and the grounds thereof in writing to the Head of Network Performance at the address reference 2023-Widegate/OW.

CITYAM.COM 12 THURSDAY 11 MAY 2023 NEWS

Today, James Ashton, author of ‘The Everything Blueprint’ and CEO of the Quoted Companies Alliance, takes the City A.M. pen

Getting it under your Arm is almost as much work as writing the book

no less important.

VISIT: CITYAM.COM/IMPACT-AM/ ANNOUNCEMENTS LEGAL AND PUBLIC NOTICES

JOIN THE CONVERSATION AND BECOME A PART OF ONE OF LONDON’S MOST TRUSTED NEWS SOURCES

INTERVIEW

Primarybid chief executive Anand Sambasivan on why he’s bullish on London

WHEN Anand Sambasivan, then a young banker at Credit Suisse, mapped out his next move in the wake of the financial crisis in 2009, he had two options before him: London or New York.

The Wall Street banker had already enjoyed a seven-year stint at two firms that straddled both Cities, but as he prepared to now set out on his own venture, the decision was quickly made for him: “I came to London on a temporary basis, and I never looked back. I immediately fell in love with the city,” he tells City A.M. in an interview.

Sambasivan founded his first firm in London in 2010 before setting up feted fintech firm Primarybid in 2016, with the intention of opening up the public markets to retail investors.

Looking back a decade and a half later amid a troubling period for London’s financial services sector, does he have any regrets?

“I’m getting so tired of all of the UK and City bashing that’s going on. The one point I’ll make very loud and clear is the UK is an incredible place to start a business, especially a fintech business.”

SKIN IN THE GAME

Sambasivan’s seems a rare positive voice in the Square Mile these days amid a mood of existential panic, fuelled by a slew of firms seemingly snubbing London’s markets in favour of the Big Apple.

Charlie Conchie interviews the biggest movers and shakers in tech, fintech and financial services

down 61 per cent compared to the same period in 2022.

And the equity markets downturn has triggered accelerated moves into new areas for Primarybid. Rising interest rates and the dearth of IPOs have made debt a more important pillar, and the firm is now eyeing growth with new bond issuance for firms.

He says the firm is already in talks with a number of “large, publicly-listed corporates” in London who are scoping out how to utilise its platform for debt issuance.

CAPITAL MARKETS COMEBACK

Even with those new revenue streams, however, Sambasivan says he’s bolshy on the comeback of the firm’s core business in the UK. Regulators and officials at the London Stock Exchange have rolled out a number of regulatory tweaks over the past three years to try and boost the amount of cash flowing into the public markets.

Reviews of the listing regime in 2020 and secondary markets last year have been ushered forward at some pace, and central to those has been increasing retail investor participation. Planned reforms fall squarely in line with Primarybids’ ambitions, he says. “Public markets are there to kind of democratise access and wealth creation… but it really wasn’t happening outside of the secondary

He does, of course, have skin in the game. Primarybid thrives on a steady stream of capital raising and IPOs in its home market, and he says the slump in IPO activity in both London and beyond has hit the firm.

“We are going to be in periods where the markets are up, and when the markets are down. We’re in the period when markets are down. And yes, it isn’t great,” he says.

“I’m a banker. So I am a deal junkie at the end of the day and I love to see deals.”

Primarybid’s investor base also points to how entwined it has become with the capital markets ecosystem in London. The firm added the London Stock Exchange Group to its investor roll in 2019 and has struck an equity and debt issuance deal with the bourse.

While London has been hit particularly hard by an IPO downturn –total cash raised fell by 80 per cent in the first quarter compared to last year –he points to the fact the IPO downturn is not a London phenomenon. Globally, there were just 299 IPOs in the first quarter of the year raising $21.5bn –

OF ALL THE UK BASHING - IT’S AN INCREDIBLE PLACE TO START A BUSINESS’

markets,” he adds. “Primarybid was formed with this notion that the markets are either public or they’re not –you can’t have it both ways.”

He says crucially the appetite for greater retail investor participation in the public markets in the UK is coming from firms themselves rather than investors. While volatility on the public markets has caused firms to issue less over the past 18 months, “when they do, they want to do retail”.

That appetite for retail is also now growing internationally. Primarybid has integrated its technology into European exchange Euronext and in 2021 allowed retail investors to participate in the New York float of London members’ group Soho House.

STATESIDE EXPANSION

As a number of big name firms eye potential listings in New York, he says Primarybid could help tap into a hefty retail following in the UK.

Those comments are to be expected from a firm that is eyeing big growth plans in the US. But, he insists, it will be a “focused expansion” rather than “diluting anything we’re doing here in the UK”.

Primarybid, Sambasivan says, is one firm that will not be ditching its London hub in favour of New York. Even as negative headlines abound over the flood of firms away from the capital, he says Primarybid is as positive as ever over London’s prospects.

“I hear the negativity, but I don’t subscribe to it. If anything, it’s gotten better,” he says. “From where I sit, if I was to start over today, this would be the place I would do it.”

13 THURSDAY 11 MAY 2023 FEATURE CITYAM.COM

I hear the negativity, but I don’t subscribe to it... if I was to start over today, this would be the place I would do it

We’re in the period when markets are down. And yes, it isn’t great... I am a deal junkie at the end of the day

‘I’M SICK

THE SQUARE MILE AND ME

WHAT WAS YOUR FIRST JOB?

From the age of 13 I had a paper round. I grew up in a very rural community in Somerset, the round involved cycling up some big hills to remote farms – a great start to the day! I then took on a sales job in a Bridal Boutique – I loved this, lots of tulle and talking.

WHAT WAS YOUR FIRST JOB IN FINANCIAL SERVICES?

I fell into finance at the university milk round, having studied history – and was offered a training contract with Price Waterhouse. Frankly I wasn’t sure what I had signed up for – but serendipity played a part and I quickly realised that the fit was good!

WHEN DID YOU FIRST KNOW YOU WERE IN THE RIGHT JOB?

I am naturally inquisitive. I was fascinated by all the many businesses I visited. I loved learning about what they did and the people in those businesses – ideal for an auditor and invaluable experience in the job I do today.

WHO IS THE CITY OF LONDON FIGURE YOU MOST ADMIRE AND WHY?

Can I have two?

Sheridan Ash (right), who is technology and innovation leader at PwC UK, and Claire Thorne, who is venture partner at Deep Science Ventures. Sheridan and Claire are co-CEOs of Tech She Can, a charity working together with industry, government, and schools to improve the ratio of women in technology roles.

WHAT’S ONE THING YOU LOVE ABOUT THE CITY OF LONDON? AND ONE THING YOU WOULD CHANGE?

There is a vibrancy in the City that isn’t seen anywhere else. The blend of old and new is a powerful reminder of our roots. However, when you walk along Cheapside at lunchtime the lack of diversity is painfully apparent. In the most creative and diverse place in the world, we are not seeing diversity in the City. I’m one of a relatively small number of female CEOs in the executive search industry. As a business community we must change how we identify our future leaders, the pace of change in shifting the diversity dial is painfully slow. We all should be challenging convention to drive change. It’s a non-negotiable.

WHAT’S BEEN YOUR PROUDEST ACHIEVEMENT?

Personally, having taken 10 years out of the formal workplace whilst my girls were little, to find myself running a dynamic, successful forward-looking organisation is pretty awesome! Now I am working with a very talented team to drive change in a very traditional industry. Technology allied with open minded leaders is how we will do this. AI has negative associations at the moment, but it is my belief that when we integrate AI responsibly and deliberately, we enhance the result. With valuable input from brilliant human minds it is a powerful force for good.

We dig into the memory bank of the City’s great and good: this week, Katrina Cheverton, CEO of recruitment and consulting firm Savannah Group, joins City A.M. for a chat

WHAT’S YOUR MOST MEMORABLE INTERVIEW?

I will never forget the interview with John Ellis, former CEO of Savannah Group. John’s warmth and genuine interest in people are unforgettable.

WE’RE GOING FOR LUNCH AND YOU’RE PICKING –WHERE ARE WE GOING?

Aqua Shard is one of my favourites… shows off the wonderful City Skyline –a treat.

AND DO YOU HAVE A FAVOURITE POST-WORK WATERING HOLE?

Where.s Fred.s – a lockdown phoenix round the back of The Ned. Excellent service and a super atmosphere – at any time of the day or night. We love to support our local.

QUICKFIRE ROUND

WHAT’S YOUR FAVOURITE...

MOVIE: LORD OF THE RINGS

BOOK: REBECCA

MUSICIAN/ARTIST: TAKE THAT TEA OR COFFEE? BUILDER’S TEA PLEASE

ARE YOU OPTIMISTIC FOR THE REST OF 2023?

Absolutely! The environment is always changing, but with that comes opportunity. Bold ideas backed with innovation and integrity will succeed. I am convinced that H2 2023 will see an exciting turnaround.

GIVE US ONE BOLD PREDICTION FOR THE CITY THIS YEAR?

The second half of 2023 will see unexpected confidence and growth; and diverse senior hires will stop being

headline news – as they become expected.

WHERE’S HOME DURING THE WEEK?

I live with my family in Tunbridge Wells.

AND WHERE WOULD WE FIND YOU ON A SATURDAY AFTERNOON?

In my garden, or driving my daughter to a golf match.

YOU’VE GOT A WELL-DESERVED TWO WEEKS OFF. WHERE ARE YOU GOING, AND WHO WITH?

Holidays are a real motivator for me. Last year we spent three weeks exploring Western Canada – amazing memories for us and our girls. So, another exploring trip would be on my list.

CITYAM.COM 14 THURSDAY 11 MAY 2023 NEWS

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

FTSE 100: Asos shares nosedive as markets gear up for rate rise

LONDON’s FTSE 100 slipped in the City yesterday as online fashion retailer ASOS was pummelled after a dim set of results. The capital’s premier index shed 0.29 per cent to close at 7,741.32 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, lost 0.15 per cent to finish at 19,248.3 points.

Shares in London were fairly muted in the opening session, with banks leading the way, driven by investors piling into the sector the day before the Bank of England’s next interest rate decision.

Markets reckon the Monetary Policy Committee will opt for a 25 basis

points rise to 4.5 per cent, the 12th straight upward move.

Those expectations put upward pressure on shares in high street banks, who tend to benefit from a higher interest rate environment. Barclays advanced 1.32 per cent, while Natwest and Lloyds Bank added around 0.9 per cent apiece. However those gains ran out of steam in the afternoon.

Consumer-focused stocks suffered heavy selling likely on concerns households could finally cut back on spending in response to inflation.

Ocado led losses on the FTSE 100, while Asos catapulted more than 20 per cent lower to the bottom of the FTSE 250 after posting a half-year loss.

JD Wetherspoon yesterday said it was expecting “record” sales this year as it shrugged off inflationary pressure. Analysts at Peel Hunt increased their full year profit-before-tax forecast by 31 per cent to £41m and said the chain had “long-term recovery potential.” They recommended holding shares at a target price of 700p.

Manufacturing company Spirax-Sarco reported sales growth in line with expectations in a quarterly update on Wednesday. The company did not change its full year guidance. Peel Hunt analysts also did not alter their forecasts and recommended a target price of 12,000p.

Was jumping on the coronation worth it for brands? Here’s what the public think

THE CORONATION of King Charles III saw a big marketing and advertising push from brands. Some are logical enough but others, have been less obvious (for example, Heinz’s Tomato “Kingchup”, or Aldi’s Coronation Carrot).

So it might be useful to ask if jumping on to major royal events like this is actually worth it for businesses. For one thing, YouGov Daily data shows that seven in 10 Britons think brands focusing activities on the coronation of King Charles are doing so to maintain a positive public image for themselves – with

Stephan Shakespeare

just one in 10 believing they are sincere. For another thing, Britons’ royalists are, in some respects, less interested in certain forms of advertising.

YouGov Profiles shows that those members of the public who follow the Royal Family are more likely to believe

that ads are a waste of time than the general public. Perhaps most importantly, just seven per cent (of both the public and Britons in general) think the monarchy are an acceptable topic for brands to communicate about.

So, it may be worth remembering for the future that whatever commercial boon brands receive from royal-themed promotions could be dulled by a general suspicion of advertising – and a scepticism that companies offering congratulation to the royals are being genuine.

Stephan Shakespeare is the co-founder and CEO of YouGov

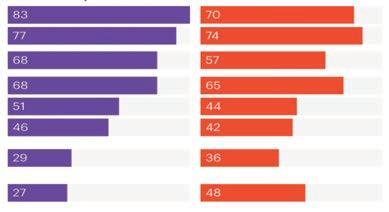

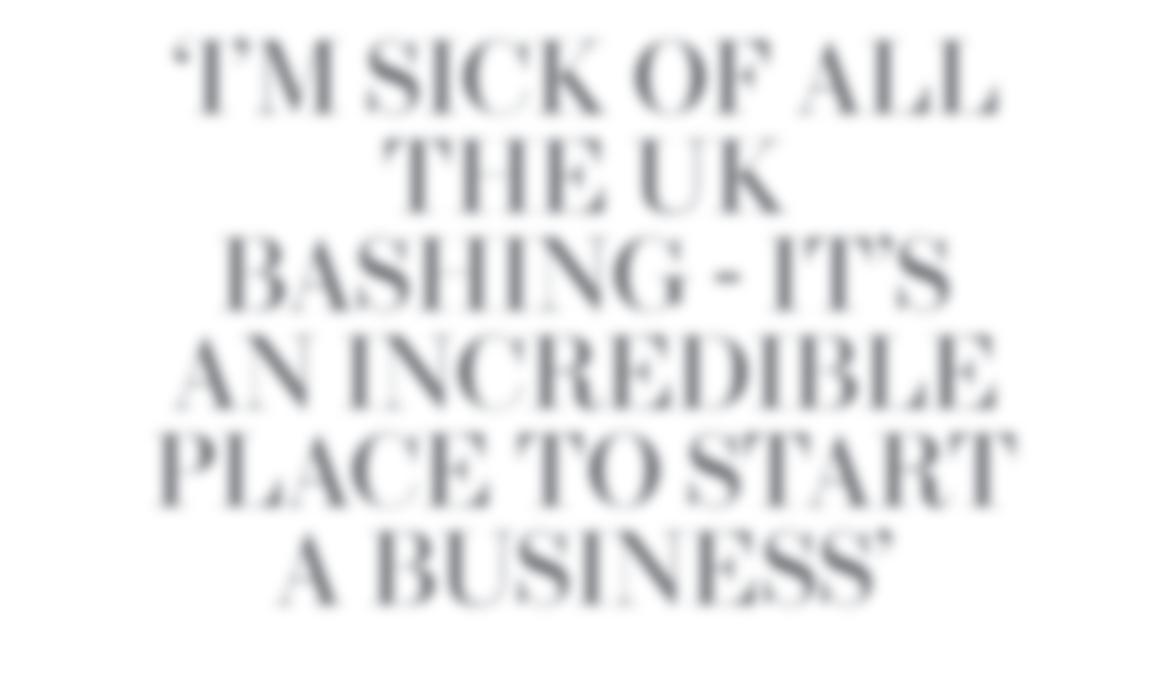

HOW BRITONS WHO ARE INTERESTED IN THE MONARCHY FEEL ABOUT ADVERTISING

% of Britons who answered “Definitely/tend to

I rarely notice who sponsors an event

I find advertising annoying

I don’t think brands should express views on political or social issues

I feel bombarded by advertising

I think ads are a waste of time

I don’t trust the adverts on TV

I would consider spending a short amount of my time to interact with a promotional stand or event

I often notice the advertisements on the internet

15 THURSDAY 11 MAY 2023 MARKETS CITYAM.COM

P 4 May 3 May 9 May JD WETHERSPOON 10 May 783.5 10 May 5 May 700 720 740 760 780 790 To appear in Best of the Brokers, email your research to notes@cityam.com P 4 May 3 May 9 May SPIRAX-SARCO ENGINEERING 10 May 11,180 10 May 5 May 10,600 11,600 11,400 11,200 11,000 10,800

BOE DECISION CASTS SHADOW OVER UK “London markets ended the day on the back foot. What is certain is that double digit inflation can’t be ignored and at least another quarter per cent rate hike has been priced in.”

DANNI HEWSON, AJ BELL

with the following

YouGov profiles 30 April 2023 Britons who

General public

agree”

statements

are interested in the monachy

83 70 77 74 68 57 68 65 51 44 46 42 29 36 27 48

OPINION

EDITED BY SASCHA O’SULLIVAN

Rishi Sunak’s fate is cursed by 13 years of the Conservatives’ electoral success

LAST week much of England went to the polls in what may well end up being the last major test of public opinion before the next general election. On raw numbers, it was a disaster for the Tories, who lost over a thousand individual councillors and ceded control of 48 councils.

You could reasonably conclude that a set of elections which put Labour as the largest party in local government since 2003 would be a triumph for the party. But instead, John Curtice and Michael Thrasher, widely regarded as the country’s top election analysts, used statistical games to suggest that if you instead analyse a sample of council wards to reflect the entirety of the UK, Labour is projected to still fall short of an overall majority at a general election.

Let’s be quite clear – this is nonsense built on stilts. Such projections are useful for seeing how parties’ performance has changed from one local election to another, but local elections cannot accurately predict how people would vote in a general election, nor how such votes would translate into seats. This is because the political dynamics in councils are simply too varied and peculiar to match the two-party race for Downing Street, with minor parties or independents having long done better at local elec-

tions. The best evidence for this is that nobody genuinely believes that over a third of the electorate is going to vote for parties other than Labour or the Tories at the next general election, as both Curtice and Thrasher have projected.

This tendency to give the Conservatives more credit than they are due, is based on a flawed assumption that the massive majority won in 2019 would take some kind of miracle to overturn. Much of the chatter around the next election, while acknowledging Labour’s current advantage, still assumes Starmer, like David Cameron, would need a coalition as a staging post for their next government. Only

this week, rumours of a pact with the Lib Dems sent the tabloids into a feeding frenzy. But British politics is no stranger to

the type of sudden change in fortune needed to turn Jeremy Corbyn's defeat into Keir Starmer's triumph in the space of one election. Unlike the US system, there is little opportunity to entrench local power by gerrymandering or doling out local government jobs to those with the right political allegiances. As recently as the 2015 general election we saw once dominant parties swept away, with Labour losing 98 per cent of its seats in Scotland, while across Britain the Liberal Democrats lost 86 per cent of their MPs. In other words: it’s very possible for Labour to gain enough seats to secure a working majority. Clement Attlee and Tony Blair both secured more than

Artificial intelligence will make my job obsolete, and I’m (almost) at peace with it

LISTENING to Jeff Buckley, I'm gripped. An almost overpowering sadness and melancholia floods the room. As tears trickle down my cheeks, I realise I'm crying for the second time in as many days to the haunting rendition of Corpus Christi Carol. It's not the bittersweet vocals bringing me down. It's a much deeper sorrow; I realise I'm mourning the passing of an age.

Last week, I heard that very same hymn in very different circumstances. Either the pollen count inside St Bride’s church was unpleasant in the extreme, or others were pierced by the same shards of emotional shrapnel that punctured the air in remembrance of a man I had known for decades. I'm not ashamed to say it; but as I wept, I could sense I was not alone.

St Bride's has long been regarded as the journalist's church. Sadly, this was not the first time I'd been here to say goodbye to a friend and colleague and I don't expect it to be my last. However, there was something very

Andy Blackmore

out of the ordinary about the level of emotion I felt that day.

Eamonn McCabe was a true Fleet Street superstar and giant in the world of photography; it is his life we were gathered here to celebrate. He was a photographer and picture editor par excellence. I accept many of you reading this will not have heard of him, however, he helped change the way you look at news and sports photography.

I was lucky enough to work for Eamonn in the mid 90s. In retrospect, this was our last hurrah; a golden age for photojournalism and press photographers. Eamonn was a secret weapon drafted in by Peter Preston, then Editor

at The Guardian. He gave up being a sportsphotographer to become a picture editor; parachuted into the position in an effort to win a circulation war with a brash new kid on the blockThe Independent.

Well they called it a war, but it's a strange conflict that has no losers. In fact, both the reader and photography were left all better for such tilting at windmills, indeed some might say it was Fleet Street's finest hour. Eamonn was a man who cared passionately about photography and photographers and passed that enthusiasm on to me. The rise of the internet and the move to digital, plunging circulations, slashed budgets, increased costs, lower rates and less work all mean that today, life as a editorial photographer is, more or less, unsustainable as a career. Inevitably, new technology proved a disaster for a profession now forced to accept to the mantra of doing more with less. Thankfully, we thought, things can't get much worse. And then, you guessed it - things just got worse. In the time

since Eamonn's death, the world seems to have gone bonkers, obsessed with all things AI and ChatGPT-4.

The final nail in the coffin was hammered home a few weeks ago when an AI-generated image won first prize at one of the world’s most prestigious photography competitions. Eamonn would have been apoplectic, undoubtedly spewing a wholly unprintable monologue.

Now, you may call me cynical but don't ever call me stupid, for I have enough painful experience to know what can happen when we are harnessed by a desire to cut corners, at whatever cost. Left unchecked, the rise of AI machines eventually makes dinosaurs of us all. But as we photographers and picture editors stood around St Bride's, it was a mass extinction event. Quite simply, the end of an era. And if that doesn't make you weep, what on earth will?

£ Andy Blackmore is the picture editor of City A.M.

140 gains to take Labour from a distant second place into government with massive majorities. They were able to do this because the Tory vote imploded as the party exhausted itself and the public during a long period in office. In both 1945 and 1997 the Tories share of the vote fell by more than eleven percentage points; a fast-receding tide which made it impossible for the party to run an effective defensive campaign to minimise losses. And today’s Tories are currently on pace to lose an even bigger chunk of their previous support than John Major or Winston Churchill.

True, Starmer is no Tony Blair; he doesn’t excite voters in the way the New Labour leader did. But then again neither did Attlee or before him Henry Campbell-Bannerman, the Liberal leader who defeated the Tories in 1906. Attlee and Campbell-Bannerman secured progressive victories over the Tories just as crushing as New Labour. Blair’s personal charisma undoubtedly had a powerful sway on the electorate, but just as important was voters' exhaustion with a failing government. This is also true of local elections where people across England voted for whichever party was best placed to defeat the Conservatives.

By the time we get to the next election, we will have been ruled by Toryled governments for fourteen years or more. No party since Lord Liverpool was Prime Minister in the 1820s has managed to win re-election after being in office for thirteen years or longer. It is not Sir Keir Starmer who needs a miracle to be living in Downing Street after the next general election: it’s Rishi Sunak.

£ Will Cooling writes about politics and pop culture for the It Could be Said substack

YOU’RE BEING MANIPULATED

CITYAM.COM 16 THURSDAY 11 MAY 2023 OPINION

Will Cooling

The Conservatives lost a thousand councillors at the local elections

Tucker Carlson may have been kicked off of Fox News for spreading misinformation, but that’s not holding him back. The former presenter has launched a talkshow on Twitter, a platform he claims is the only one left which allows free speech

We assume Starmer, like Cameron, will need a coalition as a staging post

WE WANT TO HEAR YOUR VIEWS

LETTERS TO THE EDITOR

We need an AI watchdog, fast

[Re: Britain badly needs a godfather of AI regulation, but we’ll never be able to afford him (or her), May 4] City A.M is right to raise concern over the impact of AI and the need for a watchdog.

New technology always has both good and bad implications for society –including the City. We are still adjusting to the rise of the internet and are again living under a very real threat of nuclear warfare.

The technology could lead to better decisions but also make whole industries obsolete - and these are just outcomes we understand. Job losses

aren’t merely creative destruction. Processing forms might not be a great career but if it’s the only work in a town ravaged by globalisation, the loss is catastrophic.

The crux issue is that the UK legislates based on past disasters and AI is too big to leave to the market. The EU is already moving and the UK is being left behind. Regulators - that we can afford - are already in place for medicine, nuclear energy and finance. AI has the same if not greater risk profile.

Prevention is better than cure. One of the key figures in creating AI has just warned we may not be around if we don’t respond – and that surely is the call to action we must heed.

Chris Smith Public Finance

CLEANING UP OUR ACT Conde Naste forced into pay settlement for cleaners

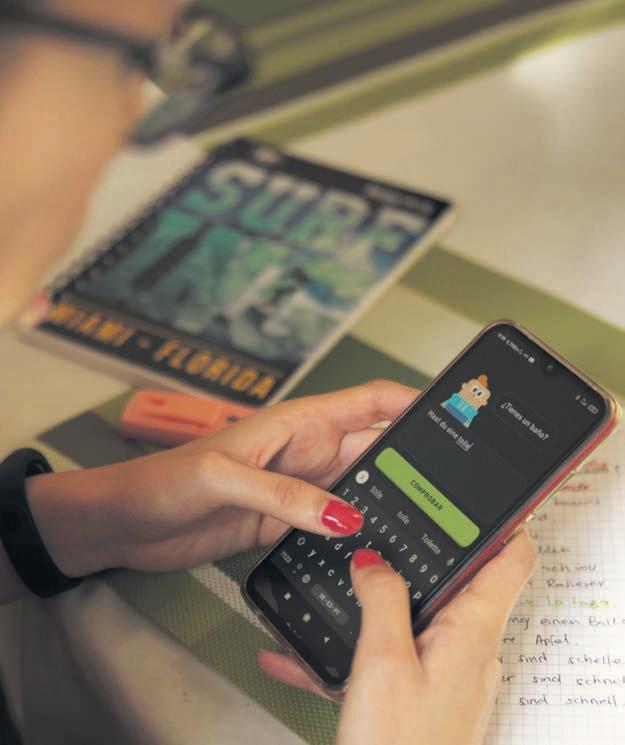

Brits will flock to Duolingo to dust up on their French but they’re terrified of maths

Phoebe Arslanagic Wakefield

Phoebe Arslanagic Wakefield

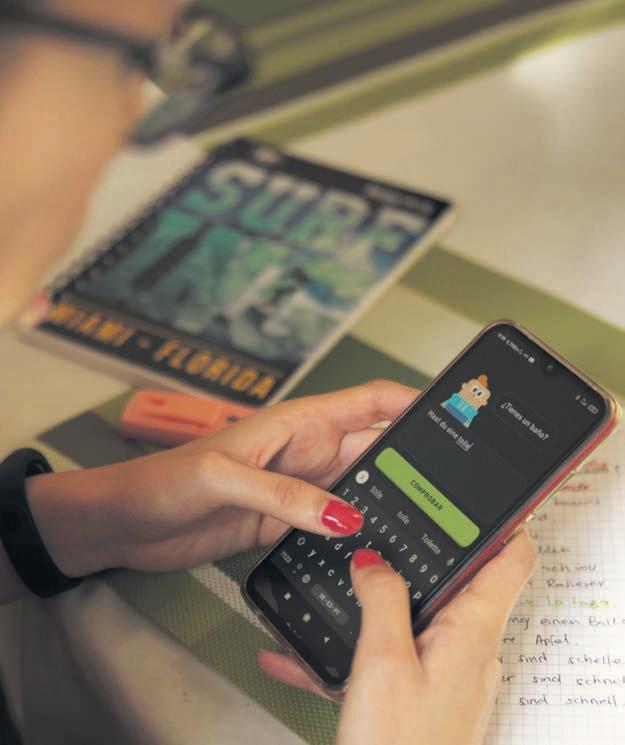

UK STUDENTS are some of the most anxious about maths in the world, also scoring highly in their negative perceptions towards the subject, with around a third of students failing to pass their maths GCSE. By Rishi Sunak’s arithmetic, poor numeracy costs our economy so he wants to make it compulsory for teens to study maths, in some form, up until the age of 18.

But the reaction to this policy in some quarters – fair questions regarding how deliverable it is with maths teachers in short supply aside – leaves me wondering if it is not only schoolkids who are in need of an arithmetical attitude adjustment. Actor Simon Pegg took to social media to vent his frustration at the announcement, saying that he had hated maths at school and claiming Sunak wants to create a “f****** drone army of data-entering robots”.