CORPORATION CORONATION

WHAT BRANDS GET WRONG AT GREAT BRITISH OCCASIONS P19

WINDFALL tax-backing politicians were yesterday described as “completely out of ideas” after calling for the already swingeing levy on North Sea operators to go further.

The calls were triggered by healthy first quarter profits for BP of around £4bn, announced to markets yesterday morning.

Labour’s shadow energy secretary Ed Miliband said the firm was enjoying the “unearned windfalls of war”, although analysts noted the price of natural gas is now lower than it was in the aftermath of Russia’s invasion of Ukraine.

Lib Dem leader Ed Davey, meanwhile, said the profits were a “kick in the teeth” to Brits struggling with the cost of living. The so-called energy price levy,

LIBBY BRODIE PICKS

THE FIZZ FOR THE WEEKEND P20

CHRIS DORRELL

THE FINANCIAL Conduct Authority (FCA) should be “praised to the rafters” after proposing a series of simplifications to the listings regime in the capital, the author of a review into the UK’s capital markets told City A.M. last night.

The watchdog has proposed ditching the ‘standard’ and ‘premium’ listing segments of our public markets –which come with different requirements –in favour of a single class of commercial equity shares.

Critics at the time said the levy would harm investment, despite a carve-out that allows UK-based investment to be in part written off. Those sceptics appear to have been proven correct with Harbour Energy, the largest North operator, blaming the levy for job cuts.

CEO Linda Z Cook last night that the existing levy had “all but wiped out our profit for the year” and driven the firm “to reduce our

investment and staffing levels”. Her calls were echoed by some on Conservative benches.

Douglas Ross, the Scottish Tory leader, said calls for a heftier windfall tax was “playing to the gallery” but stopped short of calling for an outright reversal of the policy, while Thatcherite Tory MP Sir John Redwood said the windfall levy had become a “further rise in general business taxation”.

Michael Hewson, chief markets analyst at CMC Markets, said “politicians across our divide are completely out of ideas when it comes to dealing with the challenges facing the UK economy”.

BP produced better-than-expected revenues and profits, though the fall in oil and gas prices in recent months is likely to be felt in the coming year. BP shares fell around four per cent on the day.

Mark Austin, a senior lawyer at Freshfields and the author of the government-backed review, said the proposals “simplify the listing regime meaningfully”.

The moves come amid growing concern that the capital is losing out on equity raises, with Arm the latest firm to look abroad.

Chief executive of the FCA Nikhil Rathi (pictured) said: “Our proposed reforms would significantly rebalance the burden of regulation to the benefit of listed companies and investors who are willing to set their own risk appetite and terms of engagement.”

The City of London Corporation also backed the proposals.

CHRIS DORRELL

REGIONAL banks across the US were under pressure yesterday as investors became increasingly nervous about the state of the banking sector despite JP Morgan’s acquisition of First Republic Bank.

The KBW regional bank index,

which includes a range of regional lenders, shed 5.6 per cent.

Pacwest Bancorp shares were down over 25 per cent, while Western Alliance was down 17 per cent.

Larger banks were also down, although by not as much. Last night, JP Morgan shares were down 1.7 per cent, Citi 2.5 per cent, Bank of

America 3.0 per cent and Wells Fargo 3.7 per cent, with the sell-off indicating the First Republic rescue deal hadn’t immediately calmed investors’ nerves.

Finalto’s Neil Wilson said: “It probably only ends when investors stop asking ‘who’s next?’ We ain’t there yet.”

Following the acquisition of First Republic, JP Morgan boss Jamie Dimon said the immediate banking crisis in the US was “over”, arguing that only a small number of banks were vulnerable to the specific range of problems that impacted Silicon Valley Bank and Signature Bank.

But analysts said warning lights are

still flashing in the sector.

“It is striking that even though the Fed’s emergency lending hasn’t expanded any further since the initial crisis in March, use of the Fed’s discount window remains extremely elevated,” Paul Ashworth, Capital Economics’ chief North America economist, said.

ONE can just about forgive the Labour party and the Lib Dems for their grandstanding over the windfall tax yesterday; after all, there are local elections tomorrow, and the temptation to draw a straight line between increasing council tax, creaking public services and a £4bn profit in three months for a Big Scary Oil Company must have been simply too much to resist. But Labour in particular owe it to the

City to start having more grownup conversations about their vision for the economy going forward if they want to persuade the Square Mile to truly get on board with their bid for power.

Rachel Reeves, the former Bank of England wonk and now shadow

chancellor, has become a regular feature of City away days and conferences. Asked yesterday whether he had met Reeves, Curry’s boss Alex Baldock said that he had, “like everyone in London who wears a suit for a living”. When Reeves or her boss Keir Starmer speak, they make the right noises; but on days like yesterday, when nuance is needed, the party cannot but help raise the red flag and spend money that it’s done absolutely

sod all to earn. It’s all very well being not-Jeremy-Corbyn but at some point that will wear off. Starmer in particular talks in welcome tones about a partnership between the party and business, and the Square Mile. Nothing he says is objectionable; many would agree with the idea of a pooled wealth fund, or whatever he wants to call it, backed by freed-up institutional capital. But calls like yesterday’s give one pause -- it

may be a half-decent idea, but would you trust a party with such tax-and-spend instincts to run it?

The Tories deserve, of course, most of the blame. The windfall tax is an awful idea, cooked up off the back of ill-informed populist anger and proving almost immediately to be a knife in the UK energy industry and terrible news for the energy transition. They never should have given Labour the win in the first place.

Chatbots pretending to be journalists have been discovered running almost 50 AI-generated “content farms” so far, according to an investigation by the anti-misinformation outfit Newsguard.

THE FINANCIAL TIMES

MPS SAY SUE GRAY REFUSED TO HELP INQUIRY INTO NEW ROLE WITH LABOUR

Sue Gray refused to co-operate with the official inquiry into the way she resigned as a senior civil servant in order to take a job with opposition Labour leader Sir Keir Starmer, ministers said yesterday.

BLOOMBERG

RUSSIA NEARS ECONOMIC MILESTONE OF BUYING YUAN AS SANCTIONS HIT EASES

Russia is likely to resume buying foreign currency for its reserves as soon as this month as rising oil earnings stabilise public finances despite international efforts to squeeze Kremlin income.

INFLATION is receding faster than expected in Europe, raising the prospect of the bloc’s central bank slowing the pace of its interest rates hike this week.

The rate of core inflation in the group of 20 countries using the euro thinned to 5.6 per cent last month, down from 5.7 per cent. The reading was slightly below expectations.

Headline inflation edged higher to seven per cent, up from 6.9 per cent, although economists have tended to focus on core inflation, which strips out food and energy price changes, to

yield clues on whether cost pressures are easing in Europe.

European Central Bank (ECB) officials have been trying to bring down inflation in the continent for a year.

Borrowing costs have shifted from being negative for several years to three per cent after several outsized ECB hikes of at least 50 basis points.

Those moves seem to be tackling prices, with inflation dropping from a peak of 10.6 per cent in October. The rate of price rises is tipped to drop quickly throughout this year.

“25 basis points is now the clear consensus, which we think the ECB will

embrace,” Claus Vistesen of Pantheon Macroeconomics, said. However, Andrew Kenningham of Capital Economics thought 50 points more likely.

European lenders reined in credit at the quickest pace since the early 2010s, suggesting economic activity could slim in the coming months.

Analysts reckon European rates will peak between 3.5 and four per cent. Some questioned whether this data will be enough to convince Lagarde to roll back the ECB’s inflation fight.

US Federal Reserve officials are expected to bump rates 25 basis points higher tomorrow.

JACK BARNETT

BRITISH factories are shedding workers after being pounded by soaring costs and weaker spending from customers, according to a closely-watched survey.

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) final purchasing managers’ index (PMI) for the UK manufacturing sector came in at 47.8 points last month, above an earlier reading of 46.6 points.

The number was a three-month low and slightly below expectations.

Softer client demand due to “uncertainty, customer destocking and efforts to control costs” squeezed new business pipelines. Firms also laid off staff in response to their swelling cost base.

Rob Dobson, director at S&P Global Market Intelligence, said: “The UK manufacturing sector remained in the doldrums at the start of the second quarter. Output and new orders contracted.” However, factories raised prices at the slowest pace for more than two years due to input costs accelerating at the slowest rate in 35 months.

A SHIPPING TRIBUTE HMS Diamond, one of the most advanced warships ever built, arrived in Greenwich yesterday and will remain there for the length of the coronationTHE GUARDIAN

CHRIS DORRELL

HSBC yesterday announced its first quarterly dividend since the pandemic and a $2bn (£1.6bn) share buyback as the bank attempted to convince shareholders of the merits of its global business. Shares popped to close up 3.5 per cent in London.

The bank said it expects the buyback to commence after the bank’s AGM on Friday, while the dividend was worth $0.10 per share.

The payouts came as pretax profit at the bank more than tripled to $12.9bn (£10.3bn) from $4.1bn the year before.

Chief executive Noel Quinn said: “With the good momentum we have in our business, we expect to have substantial future distribution capacity for dividends and share buy-backs.”

The bank’s profit included a provisional gain of $1.5bn on the acquisition of Silicon Valley Bank UK (SVB UK)

in March.

Like other UK banks, HSBC was also boosted by higher interest rates with its net interest income rising 38 per cent to $9.0bn. Profit in the UK-ringfenced bank rose to $3.1bn from $1.2bn last year.

The strong results come as HSBC attempts to ward off an increasingly fractious shareholder campaign to spin off the bank’s Asian business, led by its largest shareholder Ping An.

The Chinese insurer argues that HSBC’s Asian business is held back by its underperforming European and American divisions.

However, Quinn noted “our profits were spread across our major geographies, and all three global businesses performed well as we continued to meet our customers‘ needs through our internationally connected franchises.”

Shareholders will vote on the spin-off proposal at the bank’s AGM this week.

THE tide seemed to turn against Ping An yesterday as HSBC recorded bumper profits and a major shareholder rejected the Chinese insurer’s spin-off campaign ahead of a crunch vote on Friday. Shareholder returns have been a crucial part of Ping An’s campaign to spin off HSBC’s Asian business, particularly after dividends were suspended during the pandemic.

However, on the back of the strong profit figures, HSBC yesterday restored its quarterly dividend and announced a $2bn buyback scheme, with analysts

MORGAN Stanley is reportedly set to cut thousands of jobs before the midway point of the year, as the largest round of banking layoffs since the financial crisis looks set to continue.

The bank is looking to lay off 3,000 staff, Bloomberg reported, representing about five per cent of the bank’s staff. They are expected to be concentrated in the banking and trading group.

suggesting the payouts could help ease tensions ahead of the vote.

Soon after the results were announced, the Norwegian sovereign wealth fund said it would reject the spin-off proposals while a series of influential groups have also recommended investors reject the plans. Ping An’s campaign is unlikely to succeed this Friday. Investors seem to regard the plan as just too risky while Quinn’s plans are a relatively safebet.

The move comes just months after the Wall Street giant laid off around two per cent of its global workforce back in December.

Morgan Stanley declined to comment on the report.

While many banks have recently reported bumper profits thanks to rising interest rates, banks that concentrate more on investment banking, such as Morgan Stanley, have suffered.

In its first quarter results, profit slipped 19 per cent year-on-year to $3bn. Investment banking revenue fell 24 per cent while fixed income -a bright spot for many banks this quarter -- slipped 12 per cent.

SERVICE CHANGES:

28 April to 1 May and 27 to 29 May

Most of the rail network remains open, however some services will be affected as we make improvements to the railway. So, be in the know before you go.

THE HOUSING market showed “tentative” signs of recovery in April as the price of homes rose 0.5 per cent during the month, however prices remain four per cent below their August 2022 peak.

The Nationwide house price index showed that the annual rate of house price growth improved to -2.7 per cent from -3.1 per cent in March, as buyers remain cautious about their financial position due to rising inflation.

The average price of a home in April is now £260,000, up slightly from £257,000 as the market continues to stabilise following the fallout from Liz Truss’ September mini budget.

As inflation remains above 10 per cent, Robert Gardner, Nationwide’s chief economist, said that analysts’ expectations that it could fall in the second half of the year would likely further bolster sentiment, especially if the labour market conditions “remain strong”.

He explained: “This, in turn, would also be likely to support a modest recovery in housing market activity.

“But any upturn is likely to remain fairly pedestrian, as it will take time for household finances to recover, since average earnings have been failing to keep

BERKELEY Homes, one of the UK’s biggest housebuilders, has taken Michael Gove to court over his decision to block one of its developments because he did not like the look of the homes.

development. Berkeley has now written to Gove announcing they are challenging his “irrational decision” to block the project.

The homes were due to be built in Crane

Valley near Tunbridge Wells. Gove refused permission in April 2021 saying it would cause “harm to the landscape and scenic beauty”.

pace with inflation, and by a wide margin over the last few years.”

Matt Thompson, head of sales at Chestertons, said: “Savvy house hunters used the Easter holidays to continue their search online and enquire about properties to arrange a viewing as soon as possible.

“April has therefore been a busy month, particularly as buyers are a lot more aware of today’s competitive market conditions.

“As a result, most buyers have also been preparing their paperwork as much as they can in order to make an offer and secure a property before the summer.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, added: ‘Average property prices fell again in April but not as far as in March as the spring market gets into gear and buyers and sellers start to see an end in sight with regard to high inflation and interest rates.

“Swap rates, which underpin the pricing of fixed-rate mortgages, have risen again on the back of short-term volatility. However, lenders continue to reduce their fixed rates, albeit at a slower pace than before, with bigger reductions seen on higher loan-to-value mortgages as they try to attract first-time buyers.”

LONDONERS’ desire to get on the property ladder has helped fuel the housing market in the capital, despite households now needing an extra £12,000 to afford their own place.

Figures released by Zoopla show house price growth in London rose 0.5 per cent in April as demand and market activity continued to outperform other southern regions.

The average household income in London required to buy a two-bed home is now £97,000, up from £91,000 in 2020. A three-bed home is £115,000, up from £103,000 three years ago.

“Demand and market activity in the London sales market is doing better than in other regions... because house

prices have lagged behind the rest of the market since 2016,” Richard Donnell, executive director at Zoopla said.

Nationwide’s recently published data showed a small increase in house prices, nationally, month on month.

As prospective buyers continue to feel the squeeze of high inflation and rising living costs, Donnell said Londoners are also seeking out inner city flats, as the value of these pads are now the same as in 2016, down 24 per cent in real terms.

“Inner London flats are attracting demand from renters facing steep rental increases,” he added.

Renters in London are facing soaring renting costs as landlords have been forced to hike prices as interest rates on mortgages continue to rise. Those who can are increasingly looking to buy.

The housing secretary overruled planning inspectors to refuse permission for the 165-home

Gove: UK housing model is ‘broken’

The decision is believed to be the first time the housing secretary has blocked the build of homes for aesthetic reasons. It follows claims last year he would clamp down on ugly “identikit” houses.

SHARES in Wagamama owner The Restaurant Group (TRG) soared over 14 per cent yesterday as it reported strong growth for the year so far, defying previous concerns from investors.

TRG told the market that Wagamama sales were up nine per cent in the first leg of the year and performance in its pubs and leisure business was also trading positively.

Analysts welcomed the news, with Barclays upping the share’s target price and Stifel and Investec both giving the results a warm welcome.

The London-listed business, which also owns Frankie & Benny’s, said it was able to deliver £5m-worth of cost savings initiatives, and expects to benefit from 70 per cent of the figure throughout the year.

In March, TRG revealed that it would shut 35 sites taking its portfolio from

166 restaurants down to 75-85 due to a “tough macro-environment”. But it also revealed plans to open a further eight Wagamama restaurants.

The boost comes as TRG has been engaged in a spat with activist investors at Oasis, who just last week said they would vote down chief Andy Hornby’s “disproportionate” pay packet in its upcoming AGM.

Previously, Oasis also said the chain needed an “immediate” change of governance because it had “one of the worst performing share prices of any UK leisure company”.

Hornby said: “Wagamama and our Brunning & Price pubs continue to trade very strongly and it is especially pleasing to see the consistent growth in ‘dine in’ sales with customers clearly enjoying eating out despite the economic backdrop. Our Concessions business is also performing strongly as air travel continues to recover.”

LAURA MCGUIRE

LAURA MCGUIRE

GREENE King yesterday announced revenues of over £2bn, but the chief executive warned inflation and the cost of living would prove a “tough backdrop” for the hospitality sector.

The pub operator, which has over 2,000 sites across the UK, reported a revenue hike of 62.2 per cent for the year end 1 January 2023.

Greene King said revenues totalled £2.17bn, up from £1.34bn, as the easing of Covid-19 restrictions and sporting events, like the World Cup saw drinkers flocking to its pubs.

The business saw operating profits reach £192.6m for the year, up from £18.6m year on year.

However, as consumers cut down on spending due to the cost of living crisis, Greene King said that customer confidence remained “depressed throughout the year”.

Nick Mackenzie, chief executive, said he expected the “tough backdrop” of high energy costs and inflation to continue but assured that the business had “planned for this” and had implemented energy hedging to offset soaring price increases.

A BRITISH scientist dubbed the “Godfather of AI” has quit his role at Google due to concerns about the dangers of artificial intelligence (AI), such as its potential ability to spread misinformation and overhaul the jobs market.

Geoffrey Hinton -- who joined Google a decade ago to build on what was then the foundation of AI technology -- quit over concerns the technology could be used to create images and text so that people will “not be able to know what is true anymore,” he told The New York Times.

Hinton also said that AI could be a risk to some jobs and could even become smarter than humans.

“It is hard to see how you can prevent the bad actors

EMBATTLED fashion brand Superdry yesterday confirmed a £12m share sell, equivalent to a 19 per cent equity raise, in a bid to improve its balance sheet after a period of tough trading. The equity raise was underwritten by Superdry chief exec and founder Julian Dunkerton. The news comes after the retailer last month said it was looking to cut costs by more than £35m due to low consumer spending. Shares closed down 1.63 per cent.

from using it for bad things,” he told The Times.

“I don’t think they should scale this up more until they have understood whether they can control it.”

Back in 2012, Hinton, alongside two of his students, created a neural network, technology foundational to the AI used by Google today, for which they later won the Turing Prize.

The scientist told The New York Times that he sometimes regrets his work, but added: “I console myself with the normal excuse: If I hadn’t done it, somebody else would have.”

Hinton’s comments are the latest in a string of remarks from industry leaders expressing concerns about the rapid advancement of AI, with Google chief exec Sundar Pichai and Tesla founder Elon Musk both also voicing concerns.

ABBY WALLACE

ABBY WALLACE

SHARES in London-listed educational publisher Pearson fell yesterday after US rival Chegg warned ChatGPT was hurting its business.

The California-based online learning platform yesterday said ChatGPT was starting to have a negative impact on the number of students using the platform, as it

reported a seven per cent slump in revenue to $187.6m (£150.4m).

“In the first part of the year, we saw no noticeable impact from ChatGPT on our new account growth and we were meeting expectations on new sign-ups,” Dan Rosensweig, Chegg’s president and chief executive, said.

“However, since March we saw a significant spike in student interest in ChatGPT. We now believe it’s

having an impact on our new customer growth rate,” he said.

Chegg also withdrew its full year guidance and warned revenues would likely fall in the next quarter, causing shares to fall nearly 50 per cent.

The warning spooked investors throughout the sector, with Pearson’s shares closing down near 15 per cent, while shares in US-listed rivals Udemy and Coursera also dropped.

Mitie, the all-things-to-all-men operation, yesterday picked up security firm RH Irving for a total sum of £19.1m. RH Irving makes perimeter security and security technology. James Towse, Mitie’s CEO, said: “R H Irving Industrials is our second security-related acquisition in recent months, reflecting the Group's strategy to invest in high growth, high margin companies in the key sectors of security technology, decarbonisation, and telecoms.” Shares in the group, which have risen 67 per cent in the last year, continued their climb yesterday.

Banknote printer De La Rue has warned over possible job cuts as it looks to ramp up cost savings after warning over full-year results for the third time this year. Chief executive Clive Vacher told PA that moves to strip out another £12m in costs under an ongoing overhaul will impact its workforce. He said it was too early to say how many roles would be impacted or give further details. But he said the cost savings would be “global and right across the cost base”. It comes as the group, which prints banknotes for the Bank of England and other central banks across the globe, slumped to a £15.9m loss in the six months to September as demand for cash falls. The group said inflation would drive banknote demand, however.

THE AVIATION industry is looking forward to a surge in demand this summer, with major airlines forecasting bumper profits for 2023.

Flights will surge this summer, with airlines rapidly closing in on pre-pandemic levels amid an uplift in departures, according to data shared with City A.M. by analytics firm Cirium. Ryanair, Jet2, Virgin Atlantic and Easyjet are all predicted to see increases in departures in the third quarter when compared with 2019. Jet2 expects the highest rise, with departures set to reach 119 per cent of its previous total. British Airways is forecast to hit 88 per cent of pre-pandemic levels.

Overall, UK departures are expected to reach 90 per cent of 2019 levels with over 49m flight seats filled, representing a near full recovery, Cirium’s

figures show.

Lufthansa’s director of sales Heinrich Lange told City A.M. “special effects” such as “pent-up demand” after years of restrictions as well as the recent reopening of China and Japan were to thank for the travel boom.

Lange added the Lufthansa Group has already added 20 per cent capacity for flights, with the company doing “a lot of preparation”, including investing in more staff for the coming months.

Deidre Fulton, an analyst at the intelligence company OAG, said that “there’s no doubt that demand is certainly strong”. Holidaymakers have remained unperturbed by the cost of living crisis, she explained, with many “still prioritising travel”.

It comes as OAG data showed Brits were particularly keen to travel, with the UK set for the sharpest recovery in in aviation demand in western Europe this summer.

Communities across England are preparing to celebrate the coronation at more than 3,000 street parties, new data shows. Councils in England have approved 3,087 road closures for gatherings marking the royal event, according to One.network.

A.M.

THE AVIATION revival appears to be continuing apace, with new figures from Wizz Air showing passenger numbers in April were up more than a third on the year before.

The airline carried 4.9m passengers, with a so-called load factor of 90 per cent –effectively, how many of its available seats it managed to sell.

Shares took off a little on the news,

settling up two per cent.

The forthcoming coronation appears set to also give a boost to the wider airline industry –especially those flying into the UK.

Some 18,881 flights are scheduled to land in the UK this week, up 11 per cent on last year, with the day before the coronation expected to be the busiest. Wizz Air separately announced a £5m

investment into a sustainable aviation fuel producer Firefly, which was advised by Burges Salmon.

“The investment will accelerate the commercialisation of our gamechanging Firefly process, with the binding offtake agreement saving a staggering 1.5m tonnes of carbon emissions. Firefly will facilitate a step change towards the future of air travel,” said Firefly boss James Hygate.

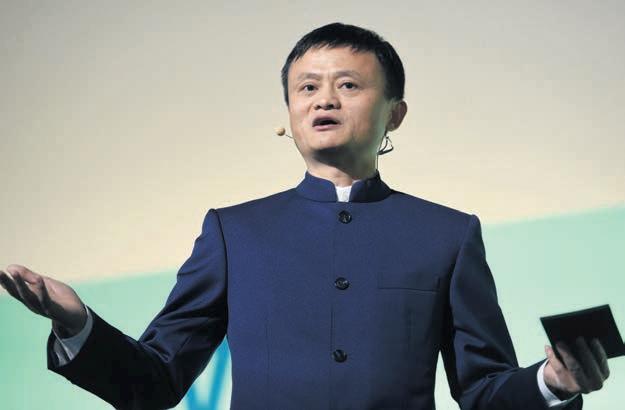

ALIBABA founder Jack Ma has taken up a university teaching position, in a shift away from his sprawling tech businesses.

Ma joined Tokyo college, run by the University of Tokyo, as a visiting professor on Monday, the institute announced.

The move represents one of the first public roles the Chinese business magnate will have assumed after almost three years of keeping

a low profile.

The university said Ma, who is a former English teacher, would specialise in conducting research on sustainable agriculture and food production.

Ma has maintained a low profile since he criticised Chinese regulators in a speech in October 2021 and Beijing tightened regulation of tech.

A $37bn (£29.7bn) initial public offering (IPO) of Ant Group, an affiliate of Alibaba, was cancelled at

A SECOND major group of Credit Suisse alternative tier 1 (AT1) bondholders is suing the Swiss financial markets regulator, known as Finma, over its decision to write down $17bn-worth of AT1 bonds as part of UBS’s forced takeover of the Swiss bank.

Law firm Pallas Partners yesterday said it is working on litigation, filed in the Swiss courts last month, on behalf of two large groups of Credit Suisse AT1 bondholders that account for roughly $1.65bn (£1.32bn) in nominal value of AT1s.

“Finma didn’t have the authority to issue the order to write down the bonds. This was an abuse of process and the resolution procedure should not be used by Switzerland to enable UBS to take over Credit Suisse to the detriment of AT1 holders,” Natasha Harrison, founder and managing partner at the firm, said in a statement.

“The purported write down of the AT1s was unlawful, and our clients must be fully compensated,” she added.

According to standards set in the wake of the 2008 financial crisis, holders of AT1 bonds – also known as con-

tingent convertibles, or CoCos – rank above equity holders in the creditor hierarchy.

But Finma contends that the AT1 bonds had a provision in the contracts allowing them to be written off in a ‘viability event’, in particular if government support was provided.

In response to the latest claim, Finma pointed City A.M. to a previous statement defending its decision.

The claim follows a similar case led by law firm Quinn Emanuel, which is representing investors that held some $4.5bn (£3.61bn) of wiped-out Credit Suisse bonds.

The firm previously acted on behalf of Banco Popular bondholders after it was acquired by Santander in a deal that also saw AT1 and AT2 bonds written down to zero.

On Sunday, UBS announced it is working towards spinning off the Swiss part of Credit Suisse and having the business’s current head, Andre Helfenstein, run it, NZZ am Sonntag reported on Sunday.

The Swiss newspaper cited a source as saying UBS had come around to the idea of a spin-off, which it initially deemed “out of the question”, amid growing public and political pressure.

the last minute in November 2020.

Ma ceded control of Ant Group earlier this year in a move which pushed the tycoon further out of touch with his businesses.

Some analysts said the move could pave the way for the company to revive its IPO, but the changes are likely to result in a further delay due to listing regulations in China.

Ma’s new gig is said to be a visiting professorship at the college rather than a full-time teaching position.

PLANS for the £1.5bn redevelopment of Liverpool Street station, which include an open rooftop and heated lido, were submitted this week by Network Rail, MTR and Sellar. The station’s concourse would more than double while Liverpool Street itself would be pedestrianised under the proposals.

ARTIFICIAL intelligence could replace 7,800 jobs at tech giant IBM, according to its chief executive.

Arvind Krishna told Bloomberg the company expected to pause hiring for non-customer facing roles, like human resources, around 30 per cent of which could be replaced by artificial intelligence in the next five years.

IBM said there is “no blanket hiring ‘pause’ in place” adding IBM “is being deliberate and thoughtful in our hiring with a focus on revenue-

generating roles, and we’re being very selective when filling jobs that don’t directly touch our clients or technology. We are actively hiring for thousands of positions right now.”

Neither Krishna nor IBM have confirmed when the expected move could start to take place.

The chief executive’s comments come amid growing concerns in the industry that artificial intelligence could overhaul the job market, by helping workers fob off remedial tasks to computers to free up time.

Some 44 per cent of C-suite

executives think artificial intelligence could perform tasks to a similar or better quality than humans, according to a recent YouGov poll of more than 1,000 business decision-makers.

The technology is already being used in industries such as the legal sector to save paralegals time on administrative tasks.

Three quarters of companies plan on adopting technologies including cloud computing and artificial intelligence within the next five years, according to a survey by the World Economic Forum.

CITY A.M. REPORTER

UKRAINE-FOCUSED miner Ferrexpo yesterday said Jim North will step down as chief executive officer.

The change will be effective from 30 June, after North’s nine years with the group. He is leaving to pursue other opportunities.

The mining group announced that board chair Lucio Genovese will act as

executive chair on an interim basis and assume leadership of the company from 1 July.

The change comes as Ferrexpo has had to scale down production in Ukraine since its conflict with Russia led to severe logistical constraints and damages to Ukraine's electrical infrastructure.

Ferrexpo also said chief financial officer Nikolay Kladiev will become

an executive director of the group with effect from 25 May, when its annual general meeting ends.

Ferrexpo reported a slump in its full-year profit in March, as the miner took a hit from higher costs and lower production volumes.

Ferrexpo is the world’s third-largest exporter of iron ore pellets.

Shares finished up 1.58 per cent yesterday.

THE other day my bike appeared in The Sun. Like any proud owner, I have carefully kept the cutting.

The reason for this was a colleague needed a prop for his anti-pothole campaign, catchily called “Pot Trumps”. Each day he features a large and terrifying pot hole on Instagram in a forlorn attempt to persuade Essex County Council to do something about it.

I mention this because potholes, the bane of a local councillor’s life, are about to become big news. Tomorrow, many of us are going to the polls in local elections.

In our area potholes have become one of the top items on the agenda, and I doubt we are alone.

Our ward has been Conservative since the Ark came to rest on Mount Ararat, but the signs are that we will usher in a Green Party candidate. And potholes are one of the main reasons for this extraordinary uprising. Put aside for a moment the irony of this. The Green Party’s preferred way of dealing with potholes would, after all,

be an outright ban on cars. But it does suggest that the Conservatives have forgotten a prime political rule – that (in the words of Tip O’Neill, the former US Speaker) all politics are local.

All of us have experienced the dreadful deterioration of our roads.

Drivers and cyclists have all had flat tyres and worse to show for it. It is now estimated it would cost £14bn and take 11 years to fix them. But the government is barely interested.

The Chancellor did provide an extra £200m for potholes in his budget but this is such a derisory sum he may as well have poured it into – ahem – a hole in the ground. Instead, they prefer flashy, huge infrastructure projects like HS2, when most people simply want to get to work or school without having their transmission ripped out. Potholes matter – for many they are a visible symbol of national economic success or decline, as well as a safety hazard. I predict potholes will have a significant effect on voting tomorrow. The only question is whether anyone in local or national government will take notice.

script writer. “I have to go,” he said suddenly, “I have to be on strike by midnight and have a scene to write before then”. When I realised this was not a reference to a Cinderella remake, but an edict from the Writers Guild of America, I was part impressed but puzzled. Impressed that an American union can impose its will globally. Puzzled, because surely a blanket strike is a blunt instrument that will take months to have any real effect. If the writers really wanted to cause disruption, surely they should simply withhold the scripts of the final, shattering episode to each series? That would bring us all to the table.

£ Following the resignation of Richard Sharp (pictured) as chair of the BBC, the bookies are busy preparing the board on the race to succeed him. I am not sure it will be a packed field. After all, who would want a job with enormous responsibility but little power and where you are expected to resign the moment something bad happens, even when it is unlikely to be your fault? One

thing strikes me though: given that the BBC is facing existential challenges in an era of digital streaming and vast budgets, wouldn’t it for once we good to have a chair who really understands the media industry? Only one of the past six chairs was a real media pro and that was Lord Grade, who rather than resign was poached after only two years to go to ITV, which says it all.

Simon Wells from HSBC predicts a modest economic boost to the UK from this weekend’s coronation

Among my various extracurricular, I am proud to be a trustee of the Charles Dickens Museum. I am therefore keen to recommend you all pay a visit to the museum’s latest exhibition Fog, which examines the author’s repeated references to London’s murky pea soupers, both literal and metaphorical, through his novels. It is a sharp reminder of just how grimy our city used to be and the work we still need to do to ensure we have air fit to breathe.

Until 22 October at 48-49 Doughty Street, WC1.

The British Lion may not quite be roaring for the coronation. But it is holding its head up high

I’M not a numbers person”, says former bank employee who turned to Tide for its simplicity

‘’For me, running a business, it’s all about speed. If you can do something for me quickly, it means I can focus my time on running my business elsewhere, especially making stuff.”

A former bank employee who turned her side passion into a viable business says banking doesn’t have to be painful and clunky.

That was her experience when she worked at a large bank bailed out in the aftermath of the 2008 financial crash, Angela Kitchen, Director and Founder of Fur the Love of Toys, a clothing and accessories company for pets, said: “In the nicest possible way, I wouldn’t want to open a bank account with them, knowing what the procedure is.”

Angela was a Business Manager in Financial Crime for the bank before founding her company.

Though Angela has fond memories of her time there, calling the bank “a good employer”, she nevertheless now chooses to bank with Tide.

“For me, it was about the account opening process. I didn’t want to send off 16 copies of my passport. It was just aggravation that I didn’t need”, she said.

“It was all online and the bank account, I think, was open within 24 hours or thereabouts”, she added.

Angela has not regretted installing Tide, valuing the service for its speed, simplicity and the time it saves.

Angela ran her business from her personal account before installing Tide be-

cause she did not yet know how far her business would develop.

“I didn’t really think about banking then”, she said.

“And then of course, once I started to do a tax return, it was just like, ‘oh my god, kill me now’, because I’m not a numbers person”, she added.

Tide saves her from having to sift through paper receipts for tax returns because of “a really handy” feature by which users can upload photos or screenshots of receipts, with the option of saving it into an account’s expenses.

“Whenever I pay for anything I just take a photo and upload that. And then I haven’t got the aggravation of worrying about where everything is”, she said.

The simplicity of the app also spares Angela the ordeal of waiting on hold for customer service.

“I don’t think I’ve ever had to speak to a person at Tide, which is not a bad thing. Because any problems I’ve had have been solved so easily”, she said.

“You know, there’s one thing I don’t have time for and that’s sitting on phone queues waiting to speak to somebody, waiting for somebody to ring you back, to give you an authentication number,’’she said.

Saving time has saved Angela money. She had to employ an accountant during the first year of her business to file returns but Tide has since simplified the process, allowing her to do so without having to go through “hundreds and hundreds of transactions”.

“My life has just become so much easier now”, she said.

Ultimately, Tide has allowed Angela to take control of her life by allowing her to enjoy running her own business even though she is “possibly one of the most disorganised people that you could ever meet”.

Fur the Love of Toys, 70 per cent of whose products are handmade by Angela, is a labour of passion. Angela had

her first pet aged just 7, a Yorkshire Terrier called Roxy, and has had pets by her side almost without interruption ever since.

Angela started her business for the benefit of her prized pooch, Harley, after realising that the only tug of war toys she could find for him were made of cotton strands.

Cotton strands can separate from the

toy and be digested, leading, in extreme cases, to the death of pets.

“Not that I didn’t enjoy my previous job, but it’s a lot more satisfying, I probably would say, than the kind of corporate world I was used to”, she said.

“You’re doing it for yourself, I’m my own boss. Everything that I’m doing is basically for me, and what I want

to do. In the corporate world I found myself being in the situation where you’d say something and perhaps in some instances might get brushed aside or pushed aside a little bit”, she added.

Former colleagues at the bank, which was a “great company to work for”, were split by Angela’s decision. Leaving the bank meant leaving a

By Heather Cobb, SVP Member Engagement

By Heather Cobb, SVP Member Engagement

IN today's rapidly changing business world, women are breaking barriers and pursuing their goals with unbridled determination. According to the 2022 Rose Review on female entrepreneurship1, a record number of women have started their own businesses, with almost three times as many all-female-led incorporations launched in 2022 compared to 2018. Our latest Women in Business survey* at Tide, where we received nearly 2,000 responses, showed that more than 1 in 5 (21%) of our female members are running SMEs in London. These stats prove women are shattering stereotypes and making their mark in the business world.

Gone are the days when women settled for a ‘job for life’ – rises in equality, ambition, and longer life expectancy mean women also crave non-traditional work. This means new paths, flexible opportunities, and seeking meaning and purpose. Entrepreneurship, freelancing gigs in different industries – especially in the capital - are some of the options.

female business owners based in London find it either challenging or very challenging to start their own business. The biggest obstacle is the lack of access to finance (41%) and moral support from loved ones (15%). Some women mentioned a struggle with self-confidence (6%).

Top areas where women want support to grow their businesses are marketing, sales and other business growth support (26%), business mentoring, advisory, learning and development (22%) and accountancy and financial planning (16%).

substantial salary behind.

“Some people were just like, ‘Are you absolutely crazy? Like, what? Why would you want to do that?’. And other people were like, ‘Wow, that’s amazing. I would love to be able to do that, I would love to have the balls to just get up and do that’”, she said.

Four years on, Angela has no regrets.

The feeling of freedom and responsibil-

ity more than compensate for the adjustments she has had to make, she said. Running her own business, Angela is entitled neither to statutory sick pay nor annual leave.

“If I’m not well I can’t just find somebody to say I’m going to come in. I still have to process that work and I still have to do those orders. So it is incredibly difficult”, she said.

According to our survey, Londonbased women are motivated by five primary reasons: to use specialist skills (23%), to seek autonomy and become their own bosses (22%), to pursue creative business ideas (20%), to follow their passion for a business idea (11%) and to seize the opportunity and “just go for it” (8%).

Another reason is that women also want a better work-life balance with flexible working hours (8%).

Starting a business is not without roadblocks: more than half (52%) of

At Tide, we’ve welcomed over 100,000** women to our platform, exceeding our 100,000 target almost a year early. But our work doesn’t stop here. By providing further support in business, including networking opportunities, operational advice and recommendation on securing finance, we can help women achieve their goals, make a positive impact on communities, and inspire future generations of female entrepreneurs. So, here's to all the women who are pursuing their dreams – we’re your unwavering allies through every step of your journey.

*The Tide member survey was conducted between 3 and 7 February 2023, with 1,961 total respondents. Based on an average sample survey of Tide members.

1The 2022 Rose Review Progress Report on female entrepreneurship

SOARINGinflation, stagnant economic growth and intense pressure on mineral supply chains means the renewable industry expects the cost of wind power to rise for the first time in nearly a decade this year. While media attention is focused on windfall taxes and slashed investment plans across fossil fuel operators, it is worth noting that the UK’s supposed long-term solution – offshore wind generation – is now facing real cost challenges to building new turbines.

Currently, energy firms are bidding against each other for potential projects in the North Sea, as part of the latest auction round for new developments overseen by the government.

This is where companies bid to offer the lowest fixed-rates –known as ‘strike prices’ –to provide electricity, which is supported via the contracts for difference (CfD) scheme.

The CfD scheme is the government’s chief mechanism for delivering renewable energy at a low cost to consumers.

Set up in 2015 and now undergoing its fifth allocation round, it means that when wholesale electricity prices are higher than the price agreed in the CfD scheme, generators pay back the difference.

So far, the government has awarded 27GW of low carbon energy through CfDs–with the last round securing almost 11GW. This is enough to power 12m homes across the country. It has also seen the strike price for renewable generation decline from £155 per megawatt in 2015 to £37 per MWh last year.

Those lower prices, naturally, threaten the margins of generators.

Ana Musat, executive director of policy and engagement at Renewable UK, criticised the government’s £205m funding pledge for the latest CfD round– deeming it too low to ease pressure on energy firms.

She argued that if the cost of renewable energy generation kept rising, without government support this would make projects more expensive – jeopardising the UK’s push to reach its net zero and energy security goals.

There was also the prospect of fewer bids, with underwhelming auction rounds in Europe – including no winning bids in Spain’s allocation window last November.

The government has opened a consultation on offshore wind auctions –proposing that the wider societal benefits of wind projects are factored in alongside strike prices for winning bids.

This would mean the role of wind turbines in boosting supply security and fostering green jobs in a domestic industry would be taken into account alongside delivery.

The idea was particularly topical in the context of vast subsidy pledges in the US Inflation Reduction Act and proposed EU policies – and was broadly supported by Renewable UK.

However, Andy Mayer, energy analyst at free market think tank the Institute of Economic Affairs, argued the “best path for affordable decarbonisation is ruthless price competition”.

This would mean renewable costs rise in the short term, but would also allow fair competition with other industries like nuclear, hydrogen, batteries and carbon mitigation technologies.

“The government needs to maintain steely indifference to special pleading from vested interests with fantasy British growth plans. The climate doesn’t care where or how carbon is saved, or who owns the company, nor should they. The only sustainable green growth comes from real businesses inventing things others want to buy, not subsidies,” Mayer said.

Leading renewables player Octopus Energy remains bullish about the sector’s

potential, attributing inflation to supply chain costs, which it considered to be a blip in the context of a long-term decline in prices.

Zoisa North-Bond, chief executive of Octopus Energy Generation, said: “Renewable energy prices have completely plummeted over the last decade –and consistently far below what was ever expected.

“It’s clear prices will only continue to come down even more in the long run as the technologies scale further. This will ultimately accelerate the drive to a low cost and more secure energy system for Britain, and lowering energy bills as a result.”

However, Kathryn Porter, energy consultant at Watt Logic, was more sceptical. She noted that turbine manufacturers are suffering large losses –having to swallow these cost increases.

Last week, the chief executives of Orsted and Siemens Gamesa cautioned that the status quo is unsustainable, acknowledging that they cannot continue to support loss-making projects.

Porter argued this will “inevitably drive up prices in the CfD”.

She also warned that wind power suffered from a long-term challenge of high capital requirements but near-zero operating costs, meaning wind farms risked not recovering their capex costs due to intermittent generation.

The energy expert called for a more relative CfD where support for wind farms was based on need rather than purely on generation potential.

The industry’s struggles with the challenges of rising costs reflect the reality that the push to net zero over the next three decades will not come without challenges.

The prospect of higher prices is a legitimate one, and whether it is an incidental blip or painful trend – it reminds us that continued ingenuity is essential for meeting our net zero goals.

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his weekly column

As offshore wind prices rise for the first time in a decade, experts fail to

WHAT kind of world do we live in today? From an economist’s view, one that’s very different from just a few years ago.

War in Europe; strained global trade; government debt stocks at multi-decade highs (certainly in the UK): these are all fixtures of our present day lives.

But there’s two things that have shifted the economic goalposts: higher inflation and interest rates.

The former has been on a real tear for more than a year. It has plagued family finances, raided businesses’ balance sheets and triggered huge interventions from governments.

For Stephen King, senior economic adviser to HSBC boasting a long CV of top roles in policymaking and research, the return of inflation has drawn central bankers – those tasked with keeping prices steady – into an uncertain world.

“Inflation appeared to be dead and buried for many decades. No one was interested in it at all,” he told City A.M. high up HSBC’s Canary Wharf offices. That’s all changed.

“You could arguably define price stability as a world where people just aren’t talking about inflation. It’s just not part of the average dinner conversation,” he said.

In Britain, families have devoted hours to discussions on whether to keep the heating on or how much to spend on the weekly shop for some time now.

Prices in Britain have jumped 10.1 per cent over the last year after peaking at a 11.1 per cent increase in October. Multidecade high inflation rates were reached in the US, Europe and, well, pretty much the world over in 2022.

Those lofty levels came after the likes of the Bank of England, Federal Reserve and European Central Bank told the public that inflation would be “transitory”. After months of persistence, King wasn’t buying it.

“I just thought this doesn’t feel like the sort of thing we were used to... It requires a story to be told.”

King has just published his fourth book, ‘We Need To Talk About Inflation’, in which he draws on some of history’s most notorious bouts of inflation to yield 14 lessons, a sort of playbook on how to keep prices stable.

One point King repeats throughout the book is that fiscal policy (government tax and spending decisions) and monetary policy (central banks’ interest rate decisions) cannot be separated, something he defines as the “Burton-Taylor” law.

He is referring to the 1960s Hollywood on-again off-again power couple Richard Burton and Elizabeth Taylor, who divorced and married twice.

Taylor always maintained Burton was the love of her life. She was buried alongside his last ever letter to her.

King’s point is that monetary and fiscal policy are forever tied.

And he points out that policymakers have partly forgotten that relationship in recent years, most apparent in central banks’ massive bond buying programmes – or quantitative easing (QE) –since the 2008 financial crisis.

“I don’t think it was anyone’s intention to create inflation by adopting QE. I think it is possible to suggest that QE has made the management of inflation more difficult than would otherwise have been the case,” he said.

“QE is a way in which the central bank nationalises the government’s bond market, and that in turn means that the yields on government bonds can’t necessarily move to anticipate higher rates of inflation.

“This is the equivalent of

‘We Need to Talk About Inflation’ is King’s fourth book

removing your radar system before an enemy bombing.”

Just last autumn the gilt markets showed how powerful they can be. They effectively made Liz Truss the shortest serving prime minister ever, spitting out her ill-fated mini-budget by forcing debt rates higher.

Normally, when debt rates rise, it strengthens a country’s currency by making said country’s assets more appealing. The pound hit a record low against the US dollar shortly after that not-so-mini-budget.

But King in his book is more occupied with monetary rather than fiscal policy, using the lessons from the past to scrutinise the Bank of England’s, Federal Reserve’s and, to a lesser extent, European Central Bank’s roles in letting inflation get out of hand.

The series of tough interest rate rises over the past year have been in part an attempt to “recapture some of the credibility that they thought they

had, which has proved to be a little more difficult to maintain more recently”.

Public perceptions matter. If people don’t think a central bank is willing or able to tame inflation, then there’s no rational reason for them to believe it will stabilise.

If central banks take “people’s attitudes as a given that they never change, then there’s a significant danger of making a policy error,” King stressed.

The big question now is when will inflation drop back to two per cent?

Families in Britain, America, Europe and across much of the world are worried about higher living costs sticking around.

“Once [they’re] established… it becomes a political and social problem because inflation is an incredibly arbitrary way of creating winners and losers within the society,” King said.

“In that sense, it’s profoundly undemocratic.”

Inflation is an incredibly arbitrary way of creating winners and losers in society

Jack Barnettsits

downwith

revered economist Stephen King to discuss his new book, Richard Burton and Elizabeth Taylor, and where the Bank of England went wrong

LONDON’s FTSE 100 was dragged deep into the red in the final hours of trading yesterday after Wall Street was pushed lower by investors sweating over more possible banking collapses.

The capital’s premier index initially climbed before eventually closing 1.23 per cent lower at 7,774.12 points. The domesticallyfocused mid-cap FTSE 250 index, more aligned with the health of the UK economy, fell 0.49 per cent to 19,330.52 points.

Losses in London gathered pace after US traders restarted their sharp selloff of regional bank shares despite the sale of First Republic to JP Morgan. Fed officials are tipped to raise rates

again today, by 25 basis points, raising the risk of further strain in the US banking system propping up, likely amplifying investor jitters.

Nasdaq, S&P 500 and Dow Jones all collapsed around 1.5 per cent during opening exchanges yesterday.

The FTSE 100’s early advances were driven by HSBC telling investors profits tripled in the first three months of this year.

Dividends and share buybacks are back at the Asia-focused lender, sparking hopes that other big banks will follow. Its shares rose just under four per cent.

Persimmon leapt around five per cent to the top of the FTSE 100, trailed closely by Taylor Wimpey and Barratt.

Mitie, the all-things-to-everyone services provider, is a good bet, analysts Peel Hunt reckons. The purchase of R H Irving Industrials, a security company, reflects Mitie’s strategy to “invest in high growth, high margin companies in key sectors”.

Wagamama owner the Restaurant Group’s drive to accelerate its cost-cutting drive by closing more than 20 leisure sites has driven analysts at Peel Hunt to upgrade their recommendation to buy the company’s shares.

ARSENAL’s 4-1 loss to Manchester City last week has taken the title race out of their hands. But whether Man City wind up dropping the necessary points or not, Arsenal’s season has been a success in terms of its brand. YouGov Football Index data can reveal that the team’s performance this year has led to a significant increase in Recommend scores (perceptions of whether a club is successful or not). At the beginning of this year’s campaign, these scores were at 7.5; as of April 26, they are 33.3 (+25.8): a near-fivefold improvement.

Stephan ShakespeareQuality scores, attitudes towards management, also jumped from 3.3 to 16.0 (+12.7). This positive narrative has likely contributed to an increase in Consideration scores (whether a club is likable or not): over the same period, as did Sat-

isfaction scores among the club’s fans –more than doubling. Overall Index scores, a picture of a club’s general brand health, increased from 7.6 to 17.1 (+9.5). Win or not, we can say now that the club’s brand performs favourably in this metric compared to Man City (16.3). If Man City do prevail this year, Arsenal can take heart from the groundswell of public positivity towards its team, its management, and its overall brand.

Stephan Shakespeare is the co-founder and CEO of YouGov

ARSENAL’S TITLE CHALLENGE HAS MORE THAN DOUBLED THE CLUB’S BRAND HEALTH

YouGov

“European markets have got off to a weak start to the month ahead of two important central bank rate meetings this week...

Investors are adopting a wait and see approach ahead of today’s Fed rate decision.”

MICHAEL HEWSON, CMC MARKETS

Elena Siniscalco

Elena Siniscalco

IN THE last couple of weeks, EU trade policy was in turmoil. Where Ukrainian grain once made its way through the Black Sea, it now travels by land through its border states. But ill-equipped to deal with the new quantum of wheat passing through, Poland, Hungary, Slovakia and Bulgaria have individually decided to ban new imports. They claim the price of their own agricultural products has been driven down by the glut of crops. The European Commission had to intervene, ultimately introducing emergency safeguards for wheat, sunflower seeds and other products.

While negotiations were taking place in the rooms of Brussels, missiles were crashing down on Ukrainian cities last Friday. One of the Ukrainian agricultural experts interviewed by City A.M. sent several videos of a building on fire in his hometown of Uman. At least twelve people were killed in that Russian attack.

This is the daily reality for Ukrainian farmers - a deadly war, an unfavourable season of heavy rains, and now a protectionist ban on their products.

The initiative was led by Poland - a staunch supporter of Ukraine up until now. Warsaw quickly clarified the ban had nothing to do with its support of Kyiv, calling it a domestic matter. The

Polish farming community is very influential - a series of protests staged by angry farmers led to the government’s decision - and with an election in sight, politicians eventually conceded.

The European Commission, taken aback, intervened to ensure that Ukrainian grain and other products could at least transit through these countries to be exported elsewhere. It agreed to €100m in compensation for the rebelling farmers.

Yet the economic case for the ban is questionable. Comparing the gap between global market prices of grain and local prices in Poland, it’s “close to the same it was before the war”, says Oleg Nivievski, head of the Center for

Food and land use research of the Kyiv School of Economics.

“This is a big blow to the unity of the EU and its security”, says Nivievski. He might just be right; agricultural policy is nothing like defence, but this still shows cracks in the Western front.

Ukrainians were startled. “If I listen to my European friends complain about their problems, I’m just laughing, because they can’t even imagine what problems we have here” says Alex Lissitsa, the president of the Ukrainian Agribusiness Club. One of his dairy farms of almost 100 cows was destroyed during the war. Lissitsa says that without the “solidarity lanes” established at the beginning of the war

through countries like Poland and Slovakia, the only two ways to export from Ukraine are through the river Danube and the Black Sea. Problems with both are well reported: the Danube way is expensive and allows for very limited capacity, and Russia is currently slowing the Black Sea corridor, and plans to close it in mid-May.

The Ukrainian foreign ministry condemned the grain deal as “unacceptable”. Vysotsky Taras, the Ukrainian deputy minister of agrarian policy and food, says that lots of industrial associations in Poland didn’t even support the ban. “Their only target beneficial group is farmers”, says Taras.

International experts tend to agree.

IN ANCIENT Greek, economics means simply the “law (nomos) of the house (oikos)”. The analogy of how we finance home purchases is useful to understanding current fears about the global banking system - and the changes that need to be made to make it more sustainable.

Consider a house that was purchased for £400,000 with a 70 per cent LTV mortgage on fixed rate, amortising terms over a 25-year duration. The value of the house may fluctuate but as long as the owner can not be required by the lender to sell it assuming the loan is being repaid; and can pay the interest and repayments on the loan, then over the long term the debt will be repaid. This leaves real equity value to the householder’s account.

By contrast, consider a financing deal for the same £400,000 house, where the owner borrows using an 85 per cent LTV mortgage on floating rate terms, of which say 50 per cent of that mortgage can be demanded by the lender at any time for any reason, on short notice.

Hugo LlewelynThis is essentially where banks are at today.

The highest equity ratios of mainstream banks at the current time are around 15 per cent of total asset value. This means that a bank with $3tn of assets might have liabilities of around $2.6tn and a market capitalisation of a significant percentage of the difference, though that is largely irrelevant given the level of gearing and the effect of percentage movements in asset values. A 15 per cent fall in the bank’s assets would wipe out equity here.

Banks make a healthy chunk of their profits on equity from borrowing at deposit and interbank rates and lending

out longer-term at higher rates. Those deposits are often repayable on a shortterm basis, so the confidence of depositors is key to a bank’s ability to make profits and keep lending.

If the financial turmoil we are witnessing deepens, and more banks reveal their mismatch in liability and asset durations, what we will see is depositors fleeing from smaller institutions to those deemed ‘too big to fail’. They will offer lower deposit rates and charge higher rates to lend to others, so increase their profits materially. The smaller banks face being bought by the larger ones.

This has wider implications for the economy. A reduction in the number of banks lending and taking in deposits is negative for the financial markets for both competition and pricing.

Simply put, in nearly all cases, banks need to be less leveraged and better capitalised with equity. Like our housing example above, an equity ratio of 30 per cent of assets might be more appropriate, combined with longer duration deposits paying a slightly higher rate. This

would lead to less short-term profit on equity and short-term rewards for management, so would need coordinated government regulation to enforce.

This is in the long-term interest of all bank stakeholders, including shareholders. The short-term profitability of SVB did not stop its shareholder equity being wiped out and no annual dividends, however progressive, will compensate for that.

It is not all downside either: higher profits of the surviving banks after this crisis will reduce the dilutive impact of enforced equity raising. Governments cannot rest on their laurels. Increasing levels of deposit insurance, as currently proposed, will not have a material impact for larger depositors while transferring risk from the private sector to the public. A recapitalisation of banks is needed – or the whole financial system risks becoming a house of cards that collapses.

£ Hugo Llewelyn is chief executive officer at Newcore Capital

“If Ukrainian grain piles up at Polish ports, exporters will stop bidding up the price of local grain for export and prices will fall anyway”, says Dennis Voznesenski, agriculture analyst at RaboBank. Anna Nagurney, a professor of the university of Massachusetts Amherst, also notes that severing transport routes from supply markets to demand markets “can have a major impact on rising food insecurity”. If you remember the food commodity prices crisis of last year, this warning will make you shiver.

Wars are all different, but also share something: after a while, allies get bored of pumping out money and weapons, and support starts to falter, bit by bit. With Ukraine, the EU, the UK and the US have been extremely supportive - out of sheer generosity as much as because the war is on European soil. You could almost think this sacrifice to please local farming communities wouldn’t matter. And maybe it wouldn’t, if it wasn’t that Ukraine is called Europe’s “breadbasket”. It lives off its agricultural sector, and with at least 30 per cent of it either occupied by Russian forces or unsafe, any added pressure is dangerous for the economy. Ukrainian fields are full of Russian mines: some farmers had to choose between skipping the sowing season or risking their lives. High logistic costs have been driving profits down. Now with a new planting season approaching, farmers won’t know what to do because they don’t know how much they can export with the new ban in place. Once - and if - Ukraine becomes a member of the EU, a similar prospect will become unacceptable. But for now, the Union has made its choice.

GRAY

If Sue Gray, the brains behind the Partygate investigation, wanted a quiet life, she’s out of luck. She’s now been accused of breaching the civil service code by talking to Keir Starmer about her new role, as his chief of staff, while working at the top of Whitehall

[Re: Huw Pill: Brits ‘need to accept’ they’re poorer, April 25]

Talking of the “pass the parcel” taking place in the economy, Huw Pill is right to say that it could exacerbate the inflation problem “by bidding up prices”. The UK has been hit by an inflation shock; it’s a tax which makes us all poorer.

And it is an entirely factual observation to note that if a business’s costs are going up quicker than their sales then it’ll be worse off. After three years of economic tribulations, I imagine many businesses in the UK are all too familiar with this concept. In fact, when we recently surveyed businesses to better understand their pressures, rising energy bills and the increasing cost of doing business were cited as their two biggest threats for this year, followed by weakening customer demand. It is equally factual that inflation tends to have uneven impacts on households and businesses across the country: this

is where the message could have been calibrated more carefully. Keeping inflation at reasonable levels is the job of the central bank after all, not the responsibility of orkers.

But with both wage and core inflation now at around 6 per cent, the Bank of England will be legitimately worried about a wage price spiral, which could push interest rates higher than currently envisaged.

By ensuring price stability, the Bank of England plays a crucial role in the economic system, allowing households and businesses to plan their spending and investments more predictably. It thus makes total sense for the chief economist of the Bank to be worried about inflation, but getting the communication right is key for central bankers, especially at times of crises, when stakes are higher.

If anything, the question to be asked is how inflation could get so high and whether the Old Lady could have done something different (or earlier) to prevent that from happening. This is an open question that will occupy legions of economists for the years to come.

Tommaso AquilanteScreenwriters in Hollywood were clearly envious of the UK and France, and have gone on strike after negotiations between the Writers Guild of America and the trade body, the Alliance of Motion Picture and Television, broke down.

Just over a month ago, we were reporting the phasing out of Help to Buy, which was closed to new entrants last year. Now, Rishi Sunak is considering reintroducing the policy. Talk about a U-turn.

The scheme was introduced in 2013 to help first-time buyers get onto the housing ladder. It offered lower interest rates and only a 5 per cent deposit for new properties. Help to Buy was always controversial: more than 350,000

GOOD news everyone! Amazon’s video doorbell company Ring is having a sale! Why, you ask? Because it’s the Coronation, and nothing says “new era, new monarch” like being able to see in high definition at a slightly reduced price exactly which bush the Amazon delivery man left your latest package. Marketing departments will latch onto anything as an excuse to push their products. National awareness days, weeks and months have become so huge, it would not surprise me if we soon need a day of awareness to recognise all the awareness days.

But, if the Queen’s death taught us anything, it’s that corporations have at least started to realise that trying to insert themselves into the story of the royal family isn’t a necessary ingredient to business success.

The only positive contribution companies made during the immediate aftermath of her death being announced was to stay quiet.

All they needed to do was make sure customers knew if they were open or closed and that staff were being looked after properly. Lead with your actions, not by telling people about them.

Businesses that made the news during that period were for all the wrong reasons. Center Parcs was atop the pyramid with its disastrous idea to shut its sites and kick out guests.

And let’s not forget Playmobil’s tributes of plastic Queen figurines on social media, Ann Summers’ website thanking the Queen directly above its “popular categories” of sex toys, or Crossfit UK creating the “Queen Elizabeth II workout”.

used it to buy their first home, something that might have otherwise been impossible. Yet others argued it inflated house prices, especially in London.

The prime minister is trying to prove his party can still deliver on housing, after voters lost hope it could realistically deliver the number of homes Britain needs. But he should carefully consider whether Help to Buy would be best as a relic of the past - and perhaps focus on building more to unleash affordability.

This time round, companies have hopefully learned their lesson and realised holding their counsel is better than trying to jump onto the bandwagon.

It is true that newspapers will have reams and reams of pages to fill on the coronation but, from a look at the coverage so far, it has followed the far more obvious route of “what will he wear?” “how will guests arrive?” or “what food will be served?”

Peppered among the stories are the “me and my King” features or crystal ball gazing “what we can expect” pieces. But, businesses take note – no one cares what your company thinks

about the Coronation unless you are actively involved.

I am sure that will not stop some marketing and PR departments from thinking “ah, but there is a great opportunity to win some easy coverage! Who wouldn’t want to read about the time King Charles visited a street near our offices!”

But companies would be wise to know when to deploy their news. Life will go on but it could mar your message later on when you actually have something sensible to say.

The itch to say something during an event like the Coronation reminds me all too well of budget days where every company feels it is imperative that they impart their wisdom of the government’s latest changes and the impact it will have on their sector.

A journalist on budget day will often wind up with close to 300 emails in the space of a few hours, with business leaders saying they “welcome” the government’s latest announcement, squeezed between potholes and use-

less train edicts.

Budget days should be about keeping an eye out for the small nuggets hidden away in the Red Book of data and highlighting things that may have slipped through unnoticed. It should be about making sense of something complicated rather than repeating the same line.

The same mindset should be adopted for the coronation. If your business has nothing to say beyond “we welcome the new King and hope he does well”, then don’t feel the need to broadcast it.

A hospital telling us it cured a patient immediately conjures the thought of “if that’s news, then how many people have they killed!”. It's not necessary and just risks having the opposite effect. I'm sure the new King will have other things on his mind than whether Currys wished him good luck.

£ Simon Neville is Media Strategy and Content Director at SEC Newgate, he was formerly City Editor at Press Association

WE BRITS really do enjoy a party and this Saturday will see festivities up and down the country for the coronation of King Charles. The tradition of celebrating these occasions is part of our nation’s heritage, with documents even describing the coronation of unlucky Anne Boleyn as having the streets hung with flags and bunting and the wine flowing.

Moving forward in time there have been parties up and down the country whenever a new Royal head is crowned but perhaps nothing is quite as British as the neighbourly Street Party. These came into full force during the 1900s after World War I when “Peace Teas” were organised, mainly as a treat for the neighbourhood’s children, with tables and chairs down the middle of the street.

The seated affairs continued for the Coronation of King George VI in 1937 with alcohol for the adults and have been going strong ever since, most recently for the Queen’s Jubilee last year.

When it comes to group catering then nothing says a special occasion like a magnum. Often slightly more economical given it is two bottles in one, the larger size makes a splash, however as I mentioned in my last column, bag in box wines are winning my vote. Not only do you get three bottles worth in one convenient box, but they are also light to carry, there are no fears of spillages or broken glass, and everyone can help themselves from the easy tap on the side.

If you are looking for the royal seal of approval, the Champagne houses fortunate to have caught the palate and approval of the Royal family are Bollinger, GH Mumm, Krug, Lanson, Laurent-Perrier, Louis Roederer, Moët & Chandon, Pol Roger and Veuve Clicquot.

However, if you want to be truly patriotic then Cornwall’s Camel Valley was the first and to date only English winery to receive a Royal Warrant. Originally planted in 1989 by ex-RAF pilot Bob and wife Annie Lindo, their son Sam is now the winemaker of the estate, winning various awards and supplying the Royal household. There is some rumour that Camel Valley will be served at the Royal Coronation with the Lindo’s having received an invitation to Buckingham Palace’s Garden Party and Charles, as Prince of Wales, having originally appointed them, due in part to their sustainability.