THE

WEEKEND STARTS HERE

‘BANK HOLIDAY’ MAY KICKS OFF WITH OUR GOING OUT GUIDE P18

GUNNERS SHOT DOWN CITY PUT ONE HAND ON TITLE P22

BANKING CRISIS

First Republic on the ropes as shares fall

CHRIS DORRELL

FIRST Republic’s shares fell nearly 40 per cent yesterday before recovering slightly as speculation grows that the ailing lender will have to be rescued.

On Tuesday, the San Francisco-based bank’s share price closed over 30 per cent lower after it revealed on Monday evening that it had seen over $100bn (£80bn) in deposit outflows in the first quarter. Over the year to date, its share price is down over 95 per cent.

COMPETITION WATCHDOG BLOCKS MICROSOFT’S MEGA-BUCKS ACQUISITION OF ACTIVISION - WITH BOTH FIRMS READYING FOR BATTLE

PLAYER 1:

MICROSOFT

‘THIS DECISION REFLECTS A FLAWED UNDERSTANDING OF HOW THIS MARKET WORKS’

THE UK’s competition regulator yesterday blocked Microsoft’s £50bn-plus bid for the video game publisher Activision Blizzard, citing concerns over competition in the fledgling cloud gaming market.

The move by the Competition and Markets Authority (CMA) was criticised by both sides, with Microsoft immediately announcing plans to appeal.

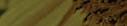

OBITUARY

JACK MENDEL

HEARTFELT tributes have been paid to City grandee Sir Win Bischoff who has died at the age of 81 following a short illness.

The German-born banking boss who had top roles at Schroders and served as chair of Lloyds Banking

“It’s daring, it’s assertive, and [the CMA] will now have to face review by the Competition Appeal Tribunal. That will be the next interesting step,” said Anne Witt, a law professor and competition expert.

Activision said it would “reassess our growth plans for the UK” after the ruling, whilst Microsoft said that the decision “rejects a pragmatic path to address competition concerns and discourages technology innovation and investment in the United Kingdom”.

Group and Citigroup, also held a number of rules at JP Morgan.

The banking giant’s boss Jamie Dimon said yesterday that Bischoff was a “giant of our industry” and a “pivotal and calming leader through the financial crisis. His wisdom has left an indelible influence.”

The current chair of Lloyds

PLAYER 2: ACTIVISION

‘GLOBAL INNOVATORS LARGE AND SMALL WILL TAKE NOTE THATDESPITE ALL IT’S RHETORICTHE UK IS CLOSED FOR BUSINESS’

Activision added that the ruling was a “disservice to UK citizens, who face increasingly dire economic prospects”.

The deal is also being probed by other regulators, the European Commission and the US Federal Trade Commission, but moves by the UK regulator and appeals court are now likely to weigh on their decisions, experts said.

“If Microsoft succeeds, the game goes on,” added Witt.

“It needs to clear the EU and US hurdle.

Banking Group, Robin Budenberg, heralded Sir Win Bischoff as “an exemplary figure in financial services, and “pivotal part in the story of Lloyds Banking Group.” He had, said Budenberg, “played a uniquely influential and

But if the CAT conforms to the CMA’s decision, then it’s truly game over.”

Microsoft had previously pledged a string of proposals, enough to encourage the regulator to set aside its concerns that competition would be stifled in the console market last month.

But the regulator still had concerns that it would be “commercially beneficial” to Microsoft to lock the games into its own cloud gaming service should the deal go ahead.

Investors are concerned that the huge amounts of expensive short-term funding the bank took on to secure its survival will weigh significantly on profitability going forward.

The bank is attempting to come up with a plan for its survival, including cutting 25 per cent of its staff in the next quarter.

Bloomberg reports that First Republic is attempting to sell as much as $100bn in assets to pay off its debts. But the bank faces a race against time and the government may intervene well before any plans can come to fruition.

According to reports, regulators and financiers are scrambling for a plan to prop up the teetering bank, while the government is currently unwilling to intervene.

thoughtful role in the governance of banking and other business sectors –a guiding hand towards a more resilient, sustainable and inclusive financial sector.”

And the Corporation of the City of London’s policy chairman Chris

Hayward said: “Colleagues at the City Corporation are grateful for the opportunity to have known and worked with him over the years and will continue to honour his memory by working towards creating a more sustainable future for all.” Bischoff was knighted in 2000 for services to banking.

THURSDAY 27 APRIL 2023 ISSUE 3,972 FREE

LONDON’S BUSINESS NEWSPAPER

CITYAM.COM

ABBY WALLACE

INSIDE CRH SNUBS LONDON P4 M&S CHIEF SLATES OXFORD STREET P5 HEATHROW RESULTS P8 LONDONERS’ VERDICT ON KHAN P11 THE SQUARE MILE AND ME P12 OPINION P14

‘A giant of our industry’: City grandee Sir Win Bischoff passes away aged 81

STANDING UP FOR THE CITY

Here’s to an extraordinary church and a remarkable banker

To St Paul’s, where one of the City’s founding fathers is being celebrated. It is the 300th anniversary of the death of Sir Christopher Wren this year, and the cathedral at the heart of our national life is celebrating the great builder with an exhibition in the crypt of the Ludgate Hill landmark.

It is a remarkable picture of a man who was so famously commemorated in the words of his son: si monumentum requiris,

THE CITY VIEW

circumspice -- if you seek his monument, look around you.

Wren’s churches, which still dot the City, remain masterpieces. But perhaps most interesting is that whilst Wren’s design and dome have stood the test of time, the cathedral has been no stuck-in-

time affair.

The Victorians decided the interiors were too dull, dirty and austere (Queen Victoria in particular was not a fan) so added a phalanx of glittering mosaics into the stonework. Then, after the impact of World War II -- when the cathedral survived two bombing attacks, one of which had it not been for the quick work of a bomb disposal unit would have surely destroyed the cathedral in full -- further

restorers added to the church interior with an extraordinary baldachin, a sort of canopy, at one end.

Much like the City itself, the great cathedral has evolved through the centuries to remain relevant to modern tastes, and become a more remarkable place for its changes.

If St Paul’s is one of our physical landmarks in the Square Mile, then Sir Win Bischoff must be described as one of our more

FLIGHT TO SAFETY British nationals onboard an RAF aircraft after being evacuated from Sudan. The rescue mission has lifted 301 people while a fragile ceasefire

Sick days in UK reach record high of 185m as cloud of Covid-19 hangs over economy

WORKING days lost in the UK due to people being sick have climbed to a record high of just over 185m.

New figures released by the Office for National Statistics (ONS) indicate that Covid-19 is still impacting the economy and health of the country’s workforce.

In 2019, the volume of days lost to people being ill was 138.2m and had been on a downward slope for 20 years.

The sickness rate, the proportion of working hours lost due to sickness, hit

2.6 per cent: the highest rate since 2004.

Analysts warned this rise could

squeeze the country’s capacity to make goods and services if it continues.

“It signals further deterioration in the country’s production potential”, and “further decline in long-term economic growth” Yael Selfin, chief economist at KPMG’s UK, told City A.M.

The ONS categorises Covid-19 related sickness in its “other” bucket of cases, a reason which has been rising rapidly since 2019. Just under 24 in every 100 sick days were down to this last year.

Minor illnesses were the most common, causing 29 per cent of sick days.

All age groups underwent a jump in their sickness absence rate last year

though women took the most sick days.

People with long-term health issues were also highly likely to miss work, the ONS said, which suggests the strong impact of a rise in chronic sickness.

James Smith, economist at Dutch bank ING, told City A.M. the main factor increasing rates is temporary sickness.

Other ONS figures show 500,000 people have fallen into economic inactivity – defined as out of work and not looking for a job – since 2020.

A paucity of workers could hold back economic growth by stopping businesses from expanding, economists have warned.

corporeal lodestars. A lifelong banker with an extraordinary career who garnered the respect of all those who met or worked with him, Sir Win has passed away, and he will be sorely missed. The tributes paid to him yesterday were entirely in keeping with one of the City’s most wellrespected figures, and in his own way he too can claim to have left his monument in the shape of the modern Square Mile. Rest in peace.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE FINANCIAL TIMES

KPMG FINED £1M OVER ‘RUDIMENTARY’ FAILURES IN THEWORKS AUDIT

KPMG has been fined £1m by the UK accounting regulator over its auditing of stationery seller Theworks.co.uk, taking the total penalties and costs against the firm to £69m over the past five years.

THE TIMES PWC TO INVEST $1BN IN ARTIFICIAL INTELLIGENCE

PWC has become the latest business to throw its weight behind artificial intelligence, announcing plans to invest $1bn in the tech in order to automate parts of its audit, tax and consulting services in its US business.

THE GUARDIAN ONLINE CASINOS FACE CURBS AFTER REVIEW OF GAMBLING IN UK

Online casinos will face tougher restrictions under government proposals to overhaul Britain’s gambling rules, but the majority of measures will be subject to further consultation.

British workers clocked zero productivity growth last year

JACK BARNETT

BRITISH workers clocked no improvement in the amount of goods and services they produce per hour over the last year.

Office for National Statistics (ONS) figures show output per hour in the three months to December 2022 matched 2021 figures.

The numbers indicate the UK’s sluggish productivity will continue.

Output per hour worked among the Square Mile’s banks, brokers and insurers contributed a 0.4 percentage point contraction to the

overall figures. Construction staff notched the biggest gains, adding 0.7 percentage points to the total. Economists pinpoint productivity growth as the key factor to boosting long-term living standards.

Since 2008’s financial crisis, the rich world has suffered a marked slowdown in productivity growth, choking economic expansion.

On a separate measure, the ONS said productivity growth over the past year was in fact worse: “Output per worker and output per job were 0.2 and 0.3 per cent below their respective Q4 2021 levels”.

CITYAM.COM 02 THURSDAY 27 APRIL 2023 NEWS

JACK BARNETT

holds.

Lynch: Strike law will only lead to wildcat strikes

GUY TAYLOR

RMT general secretary Mick Lynch told MPs yesterday that proposed legislation for enforcing minimum service levels for some services and sectors when strike action is taking place would result in workers walking out without trade unions’ authorisation.

“If we can’t use traditional industrial action, there will be novel forms of action, and there will be wildcat action, which is what happens in France, and Italy, and Spain and elsewhere,” Lynch said. “It’s going to come back on the Conservatives’ heads, I believe.”

The union boss was giving evidence to the Transport Select Committee alongside Mick Whelan, the general secretary of ASLEF and Rob Jenks, TSSA’s policy officer, on the potential impacts of the controversial Minimum Service Levels Bill, which is making its way through parliament.

GIDDY-UP Flutter readies to pursue US listing as London exodus continues

All three argued that the so-called anti-strike bill was unsafe, with none agreeing to accept the legislation in any form. Lynch argued it was a “recipe for disaster.”

“We will never support minimum service level. It is undemocratic,” Lynch said. “It goes straight to peoples right to combine and to be democratic, and to have their freedoms expressed in a free democracy.”

The rail bosses also raised concerns that the policy would result in a total breakdown in the relationship between unions and government.

“When things do go wrong like this, and minimum service levels are imposed, those relationships will be broken,” Jenks said.

“In all my 38 years in this industry I cannot see how this can be done safely,” Whelan said. “There will be more action, and it will worsen industrial relations.”

PADDY POWER owner Flutter is expected to announce that it has secured investor backing for its plans for a second US listing at its annual meeting today, according to Sky News reports.

Beefeater maker Pernod defends resumption of exports to Russia

JACK MENDEL

THE WORLD’s second-largest wine and spirits seller Pernod Ricard has restarted exports to Russia but insists it’s “not business as usual”. Beefeater gin will once more be drunk in Moscow bars following the decision, slammed by the Moral Ratings Agency as “as disgusting as it

New CBI boss says sorry as she takes chair

JESSICA FRANK-KEYES

THE NEW boss of the Confederation of British Industry (CBI) has pledged to “rebuild and reimagine” the crisis-hit organisation and “win back trust” as the group continues to deal with an ongoing sexual misconduct scandal.

is ironic”. The company insisted it stands “firmly with the people of Ukraine” following Russia’s “unjustifiable war” in the country, launched in February 2022, and said the primary reason for restarting exports was to protect its teams. A spokesperson said it was “not business as usual” and the “decisions were not taken lightly”.

Rain Newton-Smith, the new director-general of the CBI, yesterday apologised to the women who made allegations of sexual harassment, assault and rape. Writing on Twitter, she said she wanted to express “how profoundly sorry I am for how our organisation let you down”, as she took over at the under-pressure lobby group. She added: “We know there is so much to do to win back the trust of our members, our colleagues and wider society.

It comes after more than a dozen women who worked for the CBI told the Guardian they had been victims of sexual harassment. Two women alleged they had been raped.

Newton-Smith faces a battle to reform the group after many questioned the wisdom of appointing a CBI insider as leader.

03 THURSDAY 27 APRIL 2023 NEWS CITYAM.COM

Short seller demands Labour MP retracts comments on Kremlin ties

CHARLIE CONCHIE

LABOUR MP Liam Byrne yesterday came under fresh pressure from City short seller Fraser Perring after failing to cough up evidence for his suggestion Perring and his firm Viceroy Research were acting on behalf of the Russian state.

A major war of words has erupted between the pair after Byrne

claimed in a House of Commons debate that Perring was “not an infrequent visitor to Moscow” and called for an investigation into the firm’s activities.

The allegations have triggered a furious response from Perring, who has accused Byrne of abusing parliamentary privilege and yesterday demanded that he retract the claims.

In a new letter to Byrne seen by City

A.M., lawyers for Perring said the MP was “fed these lies by individuals who have their own commercial reasons to attack our client”, and set a deadline of next Tuesday to retract the claims.

“It should be obvious to you by now that he will not rest until you have withdrawn your statements about him and acknowledged their falsity,” Perring’s lawyers said. Byrne did not respond to a request for comment.

CRH confirms New York listing in London snub

CHARLIE CONCHIE

BUILDING supplier CRH yesterday said it will press ahead with plans to ditch its London listing in favour of New York, confirming a major blow to the City as it scrambles to revive the appeal of its capital markets.

CRH, which makes a major chunk of its revenues in the US, announced last month that it was looking to swap from London to a primary listing in New York in order to tap into more “commercial, operational and acquisition opportunities” in the US

The news was seen as a major snub to the City amid fears that London was losing ground on international competitors as a listings destination.

CRH said it had “engaged extensively” with shareholders and had got “strong support” for the move.

“We believe a US primary listing will bring increased commercial, operational and acquisition opportunities for our business, further accelerating our successful integrated solutions strategy

and delivering even higher levels of profitability, returns and cash for our shareholders,” the firm said.

Policymakers and regulatory officials have been looking to breathe life into London’s markets amid fears that growing firms are looking overseas to better attract cash from investors.

A slew of reviews have been launched to overhaul the regulatory frameworks around the public markets, with the latest review into investment research launched by ministers earlier this year.

Ministers have also commissioned deep dives into listing rules and the UK’s secondary markets over the past three years to ease the way that firms can float and raise cash.

London has been dealt a series of blows in recent months however, with chipmaker Arm snubbing London in favour of New York despite a lobbying campaign from ministers and regulators. CRH’s confirmation yesterday came as the firm reported a “positive” start to the year with first quarter sales and earnings ahead of guidance.

London Stock Exchange chief says markets held back by risk aversion

CHARLIE CONCHIE

BRITISH investors need to better understand risk if the UK is to realise the potential of its capital markets, the chief of the London Stock Exchange said yesterday, as top City figures were grilled on an exodus of firms from London.

Julia Hoggett, the chief of London’s bourse, was quizzed on the future of London’s capital markets by the influential Treasury Select Committee alongside City grandee Lord Hill, GSK

chair Jonathan Symonds and the Lord Mayor of London Nicholas Lyons.

“We need to recognise that stock markets are about risk capital,” Hoggett said. “We have to recognise that not every time, companies will succeed. Some will fail, and not every company will have the returns expected.” Hoggett’s comments came as she mounted fresh calls on managers of pension funds to divert more cash into the UK’s stock market to spark the growth of companies.

CITYAM.COM 04 THURSDAY 27 APRIL 2023 NEWS

LSE boss Julia Hoggett said London investors must stop being so cautious

Oxford Street is now a ‘national embarrassment’, says M&S chief

CITY A.M. REPORTER

THE BOSS of Marks & Spencer has said that Oxford Street has become a “national embarrassment”, warning that London and its high streets were on “life support”.

“The high street which is meant to be the jewel in London’s crown, today is a national embarrassment, with a proliferation of tacky candy

Persimmon share price jumps on optimism for home sales recovery

LAURA MCGUIRE

PERSIMMON Homes’ share price lifted over five per cent yesterday, despite the group reporting a 42 per cent knock in the number of homes completed in the first leg of the year.

The house building group, which is one of the largest in the UK, said sales secured on homes was down to 1,136 at the start of this year compared to 1,950 homes last year.

However, Persimmon reported strong

traffic to its website and improvement in sales, reassuring investors.

Moreover, the group said its pricing remained “firm” in the first quarter as the selling price on private homes grew 10 per cent on the same period last year.

“Trading over recent weeks has offered some signs of encouragement with visitor numbers up, cancellation levels normalising and sales rates continuing the steady improvement evident since the start of the year,” Persimmon boss Dean Finch said.

Interest rates boost Standard Chartered profit

CHRIS DORRELL

STANDARD Chartered beat expectations in the first quarter as rising interest rates once again boosted the bank but confirmed there had been not contact with First Abu Dhabi Bank.

The emerging markets-focused lender yesterday reported a pretax profit of $1.8bn (£1.4bn), up 25 per cent year on year and beating market expectations of a $1.4bn profit.

The increase came as higher interest rates continued to benefit the bank. Its net interest margin widened to 1.63 per cent, helping interest income climb 18 per cent.

Both the bank’s corporate and consumer divisions recorded significant income growth although its venture capital arm slumped to a $103m loss.

The underlying profit figures were the bank’s best since 2014.

Chief executive Bill Winters said: “Business performance continues to improve across our markets and products and has been achieved

in what continues to be an uncertain environment.”

The bank said that its deposit base remained “strong and stable” following the collapse of Silicon Valley Bank.

Chief financial officer Andy Halford said “we’ve actually had a really stable period for deposits which have been stable throughout the quarter”.

Halford suggested the volatility in the banking sector, and particularly the collapse of Credit Suisse, could create opportunities for Standard Chartered and it “will not be shy of seeking to grab them”.

The outlook looks bright with the bank guiding for 10 per cent income growth, at the top of its previously guided range.

The bank has been a target of takeover talks in recent months with First Abu Dhabi Bank confirming in January it had been interested in acquiring the bank. However, Halford confirmed there had been “no contact at all” with either First Abu Dhabi or any other suitor.

stores, antisocial behaviour and footfall remaining in the doldrums,” Stuart Machin, M&S chief executive, wrote in the Evening Standard.

“Meanwhile other cities are beginning to thrive again,” Manchin said, adding that “for too long now it has been on life support”.

His comments come as M&S battles to redevelop its Marble Arch store on Oxford Street.

Manchin said the government’s decision to scrap tax-free shopping for international visitors “only holds London back further”.

His comments were made alongside an announcement that M&S will inject £12.5m into its London stores, creating 200 jobs.

“As a proud Londoner I want to invest in a London we can be proud of,” he said.

05 THURSDAY 27 APRIL 2023 NEWS CITYAM.COM

The housebuilder said it had seen a recent uptick in demand

Boss Bill Winters praised the group’s resilience

Jupiter chair exits following rocky start to the year

CITY A.M. REPORTER

FUND management vet Nichola Pease stood down as chair of Jupiter yesterday, citing personal reasons for her sudden resignation.

Pease, who started her career at Kleinwort Benson and was formerly CEO of Hambro Capital Management, served in the top board chair for three years but leaves with the fund manager suffering a rocky start to the year.

They pulled a net £900m from the business in the first quarter alone, with the firm saying the outflows were a result of a “risk off” environment continuing from 2022 into early 2023.

“Client demand for UK and European equities remained muted, although this was partially offset by continued positive net inflows into global equity strategies,” the firm’s statement to markets read.

David Cruickshank, who spent his executive career at Deloitte and was elected as chair of the firm’s global board in 2015, will take the reins in the

John Lewis boss vows to keep employee-owned retailer ‘unique’

LAURA MCGUIRE

DAME Sharon White (pictured) has vowed to preserve what makes the John Lewis Partnership “unique”, as the chief of the struggling retail chain outlined how the company plans to navigate the cost of living crisis and retain its customer base.

“effects of the pandemic” and doesn’t believe that the sector is yet to land at a “new normal”.

Jupiter boardroom.

“Nichola leaves an experienced and talented board, who are focused on helping deliver our strategy and I would like to extend our thanks to Nichola, on behalf of the board, for her strong leadership and support,” he said yesterday.

The firm’s share price has largely survived an uncertain market, up around 20 per cent in the last six months.

Jupiter’s assets under management also rose by £600m in the first quarter to £50.8bn despite fears of a banking crisis delivering a dent at the end of the quarter, though Peel Hunt analysts said looking ahead they expected the firm’s performance to remain muted.

Pease’s legacy will largely be seen as managing the transition of Merian, which Jupiter bought in 2020, into the wider Jupiter business.

Roger Yates, a board member, said she had led the manager through “exceptional circumstances”.

LONDON GETS DRESSED UP Covent Garden readies for historic Coronation weekend

Dame Sharon told The Telegraph retailers are continuing to see the

Man Group records $1.1bn net inflows

as investor jitters ease

CHARLIE CONCHIE

HEDGE FUND firm Man Group yesterday revealed it had notched $1.1bn (£883m) of net flows into its funds in the first three months of the year and bumped up its assets under management as investors edged back into the market after a turbulent 12 months.

The London-listed investor said its managed assets rose one per cent to $144bn (£115bn) between January and March, while net inflows from clients in

the first three months of this year came in at $1.1bn.

Positive currency moves on its finances were offset by “negative performance-linked leverage movements” in the quarter, it said.

After a tricky year for London’s money managers exacerbated by recent banking turmoil, analysts at Barclays said it was a “solid update” with inflows beating analyst estimates.

Shares in the firm rose to close up over three per cent.

The retailer announced plans to cut prices by £100m in Waitrose and has drafted in Tesco Clubcard pioneer Dunnhumby to reshape its loyalty card scheme in a bid to revive itself.

Dame Sharon’s vow to keep the employee-owned business “unique” comes amid a difficult time for the retailer, as just last month it was revealed that the chief was looking to sell a minority stake in the company to raise much needed funds for its lossmaking brands.

07 THURSDAY 27 APRIL 2023 NEWS CITYAM.COM

Punters at Covent Garden are now being greeted by the union flag flying high –and lots of them –ahead of King Charles III’s Coronation next weekend. The City of London Corporation announced a host of Square Mile events for the weekend yesterday.

Nichola Pease steps down after three years

BP gears up for AGM with oil giant set to face wrath of pension funds

NICHOLAS EARL

BP HAS defended its decision not to let shareholders to vote on its weakened climate targets ahead of today’s AGM, where its chairman could be ditched. The energy giant plans to relax its reductions in oil and gas production from 40 to 25 per cent by 2030 – and views this change as part of its wider climate strategy which was previously approved by shareholders last year. BP claims this move is in line with both its net zero target for 2050 and

the Paris Climate Agreement.

A spokesperson said: “We have increased our aims for reducing operational emissions and for reducing emissions intensity of our energy sales, and for investing in our transition businesses.”

Five UK pension groups plan to oust chairman Helge Lund from his position, in response to the watereddown climate pledges.

Diandra Soobiah of Nest -- one of the five groups -- told City A.M.: “What’s particularly worrying is they haven’t

Heathrow trims losses but claims hit from strikes

GUY TAYLOR

HEATHROW Airport narrowed its losses this quarter, but said results were impacted by the Civil Aviation Authority’s (CAA) price cap, and strike action.

The airport posted adjusted pre-tax losses of £139m, down from £223m the previous year, writing this was due to “the revenue allowance in the CAA’s H7 settlement being set too low.” It forecasts no dividends for 2023.

The group welcomed 16.9m passengers in the first quarter, retaining its position as Europe’s busiest airport and second in the world for international travel.

Revenues increased by 57 per cent to £814m, up from £516m in 2022.

The results come after a period of industrial action, which saw Heathrow security guards strike for 10 days over Easter. Heathrow’s ongoing spat with airlines over the price cap continued, as both Heathrow and Virgin Atlantic announced their decision to appeal to the CAA over the decision.

The airport also plans to increase the frequency of trips to China as it reopens

its borders, and called on the government to end the ‘tourist tax’.

Heathrow CEO John Holland-Kaye said: “We are building our route network to connect all of Britain to the growing markets of the world. Now we need the government to lure international visitors back by scrapping the ‘tourist tax’.

“We urge ministers to make the UK more competitive for overseas visitors versus the EU by removing the ‘tourist tax’ of VAT on shopping which will drive more spend in shops, restau-

gone back to shareholders and given us a chance to vote on such a significant decision.”

Concerned investors will have to express their disagreement through other key votes tomorrow.

Lund was backed by 96.6 per cent of shareholders at last year’s AGM. Today’s outcome is not yet clear.

The company’s shares soared 20 per cent in February when it announced plans to ease fossil fuel reductions, which had powered the company to record £23bn profits last year.

rants and attractions across Britain.”

Last month, the CAA confirmed the cap on how much Heathrow Airport can charge airlines will remain fixed at the level set earlier this year.

The CAA published its final decision for the annual caps that will apply to the charges that Heathrow levies on airlines for using the airport until the end of 2026.

CITY A.M. REPORTER

IT MAY be the end of cheap flying, according to a new report, which shows flight costs could surge by as much as 230 per cent without urgent investment in green aviation tech.

Ted Christie-Miller, director of carbon removal at Be Zero Carbon, said: “The age of cheap flights is over. Unless we act now to bring down costs of key technologies such as

Boeing plans to ramp up 737 Max production after significant delays

GUY TAYLOR

US PLANE MAKER Boeing yesterday announced plans to ramp up production of its 737 Max planes after manufacturing issues led to significant delivery delays. There had been major concerns that the manufacturer would not be able to meet its annual target of

making at least 400 737 planes, but the firm said it now hopes to produce 38 planes per month and deliver 400450 aeroplanes this year.

The group did caution, however, that near-term deliveries and production on its 737 program will continue to be impacted.

In its quarterly statement, it also reported a 28 per cent increase in

revenue on the same period last year.

“We are progressing through recent supply chain disruptions but remain confident in the goals we set for this year, as well as for the longer term,” Dave Calhoun, Boeing president and chief executive officer, said yesterday.

Boeing shares took off, finishing up 2.72 per cent.

sustainable aviation fuels and direct air capture, aviation will become out of reach for most consumers.”

The whopping 230 per cent figure – the worst-case scenario – would be caused if no action was taken by the industry. This would mean that Londoners flying to New York would see the average price of a return ticket skyrocket from £540 to nearly £1,800 by 2050.

Christie-Miller added: “Armed with

more sustainable fuel options and effective and high-quality engineered carbon removal credits, the aviation industry could protect consumers from skyrocketing costs, and the planet from harmful emissions.”

The report comes as the government announced its ‘Jet Zero’ plan last week, in which it aims to decarbonise aviation by 2050 and boost production of sustainable aviation fuels.

CITYAM.COM 08 THURSDAY 27 APRIL 2023 NEWS

Investors welcomed news of increased production of Boeing’s lucrative 737 Max

‘The age of cheap flights is over’: Invest in green aviation tech or pay (triple) the price, group warns

Flight

up to 230 per cent

serious action to decarbonise the sector, Be Zero Carbon has warned Heathrow

BP is facing pressure over plans to water down its climate pledges

prices could skyrocket

without

reported its busiest day since Covid over Easter this year

Reckitt names insider Kris Licht as new top dog

LAURA MCGUIRE

DETTOL maker Reckitt Benckiser yesterday named company insider Kris Licht as its new chief executive, after posting strong revenue growth in the first leg of the year.

Licht, who currently serves as president of Reckitt’s health business as well as chief customer officer, will take up the role in May. He replaces interim CEO Nicandro Durante, who took the role in 2022 after the unexpected departure of former chief Laxman Narasimhan.

“Kris is the right leader to take Reckitt on the next stage of its exciting journey. I look forward to working with Kris to deliver a seamless and uninterrupted transition,” Durante said.

The news came as the cleaning products to sexual health company posted first quarter results yesterday, reporting like-for-like revenue growth of 7.9 per cent, beating estimates. The Gaviscon creator also said net revenue growth in its health offering grew 12.5 per cent to £1.6bn, however Reckitt noted that sales in Dettol declined as the demand for the product dwindles post-Covid.

The company, which also owns Durex and Nurofen, also revealed it had hiked prices 12.4 per cent in the first quarter.

Shares fell after the update, closing down 3.45 per cent yesterday.

CV

KRIS LICHT

2002 - 2014: Danish national Kris Licht began his career in the world of retail and consumer in Dallas, where he served as a partner for 12 years at consulting firm McKinsey & Co, focusing on clients in beauty and confectionery.

2014 - 2019: In 2014, Licht made the move to Pepsico where he held a number of senior positions over the

GSK: Covid drug sales provide shot in the arm

AUGUST GRAHAM

A STRONG performance from its Covid-19 antibody treatment helped drugs giant GSK blast through expectations over the last three months.

GSK turned over £9.8bn in the first quarter, up 32 per cent from the same period last year.

It was considerably ahead of the £9.2bn experts had been expecting, and benefitted from good performances from the Covid drug and a shingles vaccine.

span of five years. His final and most senior role at Pepsico was division president for Pepsi Beverages North America, where he oversaw revenues of $4bn (£3.2bn) 2019 - 2023: In 2019, Licht made the move to Reckitt where he joined first as global chief customer officer, before eventually being promoted to the president of its health global business unit, where he helped grow revenues by £1.4bn. He will be relocating from the New York to the UK for his new gig as chief exec in May.

GSK also said it was on track to split from its consumer healthcare arm in July. The multibillion-pound company will be renamed Haleon.

“We have delivered strong first quarter results in this landmark year for GSK, as we separate consumer healthcare and start a new period of sustained growth,” chief exec Emma Walmsley said.

GSK reconfirmed its guidance for the rest of the year, saying it expects to grow sales by between five per cent and seven per cent.

Investors seemed put off by the conservative forward guidance, with shares dropping 3.87 per cent.

PA

09 THURSDAY 27 APRIL 2023 NEWS CITYAM.COM

The cleaning giant has suffered from a drop-off in sales since Covid-19

INTERVIEW

LEGAL AND PUBLIC NOTICES

Town and Country Planning (Development Management Procedure) (England) Order 2015

NOTICE UNDER ARTICLE 13 OF APPLICATION FOR PLANNING PERMISSION

Proposed development at:

55 and 65 Old Broad Street, London, EC2M 1RX

Take notice that an application is being made by: LS Old Broad Street Limited

To the City of London Corporation for planning permission for:

“Partial demolition of existing buildings and construction of a new building comprising ground floor plus 23 upper storeys (plus 2 existing basement levels), with a retained ground plus 5 storeys building, and renovated listed Bath House building, providing office (Class E), flexible retail / café (Class E), maker / studio (Class E), flexible retail / café / maker / studio (Class E), flexible maker / studio / office (Class E), public house (Sui Generis) and cultural / event uses (Sui Generis); alongside new and improved public realm and routes; ancillary basement cycle parking, servicing and plant; and other works and highway improvements associated with the development.”

Any owner* of the land or tenant** who wishes to make representations about this application, should write to the City of London at the address below within 14 days of the date of this notice.

Local Planning Authority to whom the application is being submitted:

City of London, Guildhall, PO Box 270, London, EC2P 2EJ

Signatory: DP9 Ltd on behalf of Applicant

Date: 27th April 2023

Statement of owners’ rights

The grant of planning permission does not affect owners’ rights to retain or dispose of their property, unless there is some provision to the contrary in an agreement or lease.

Statement of agricultural tenants’ rights

The grant of planning permission for non-agricultural development may affect agricultural tenants’ security of tenure.

*‘Owner’ means a person having a freehold interest or a leasehold interest the unexpired term of which is not less than seven years.

**‘Tenant’ means a tenant of an agricultural holding any part of which is comprised in the land.

ESG has become the City’s favourite acronym over the past three years and almost every boss and investment manager has scrambled to plant their flag on the standards as closely as they possibly can.

But those claims and labels don’t always stand up to scrutiny. Greenwashing is running rampant. Clean and green claims are being abused, and a regulatory reckoning now looms.

Sacha Sadan, director of ESG at the Financial Conduct Authority (FCA), has been tasked with leading the clampdown on greenwashing in the UK since 2021. And he tells City A.M. in an interview that he has not been afraid to ruffle a few feathers in the process.

“I came into this role knowing that I wouldn’t be loved. It’s okay,” Sadan says. “I’m old enough and I’ve supported a crappy football team for long enough not to worry about being a glory hunter.”

GLORY HUNTING

And ruffle feathers Sadan certainly has. In its most significant greenwashing push yet, the FCA is setting out rigorous sustainability disclosure requirements and drawing up standards around investment labels to try and restore consumers’ trust in “sustainable investment products”.

He argues the move will ramp up protection for consumers and is already winning the admiration of regulators globally. But he has also warned that if applied to the market in its current state, it would flush out some two thirds of the products currently labelled as ESG friendly in the industry.

That prediction has triggered backlash from certain political and industry figures. The chair of the influential Treasury Select Committee Harriet Baldwin accused the FCA of using “suspiciously round numbers” to justify its claims, while industry body the Investment Association (IA) warned it risked sparking a major market “dislocation”. Sadan, however, says the FCA is sim-

ply guiding firms along a path most of them are already taking, and not every firm can just claim to be green without repercussions.

“I’m not here to tell people to do ESG -- they’re already doing it. They’re already making commitments. They’re already selling lots of products, and people are buying them,” he says. “I’m just trying to put standards in place and trying to do it internationally.”

But, he adds, we do “need to raise the bar” and “not every fund [can] get in”.

The FCA is set to lay out its policy statement on labelling in the third quarter of this year after receiving some 240 responses to its consultation. Despite the punchy rhetoric from the IA and certain members of the Treasury Select Committee, he says the move has been broadly welcomed.

Sadan and his team are now on an industry-wide engagement push to roll the ground ahead of future rules and help the industry understand their impact.

FOSSIL FUELS AND WAR

The acronym is still misinterpreted by many as a synonym for climatefriendly and green, but, in reality, it is more complicated than that, Sadan explains.

Sadan, who was plucked from his former role at Legal & General Investment Management by FCA chief Nikhil Rathi, says he went out of his way to stress that point to staff at the regulator.

He raised eyebrows internally by calling in the chairman of weapons and defence firm BAE Systems, Sir Roger Carr, to be his first webinar guest at the FCA.

“This was way before the RussiaUkraine crisis. I got him in and of course, there were people saying ‘you’re the ESG guy -- why don’t you get a wind turbine farm?’

“Roger is chairman of just about one of the biggest employers in the UK. Brilliant apprenticeships, engineering degrees, world-leading stuff going on,” Sadan said.

The crux of the issue lies not in the fact that it’s a defence company, but “what kind of defence company it is”, Sadan says. And the same standard extends into the legacy oil and gas giants.

“It’s okay to own an oil and gas company in a climate change fund if you are trying to do something with it. [Tackling] climate change is more than just owning solar panel farms,” he says.

“I do like solar panels farms. I think they’re really important. But we have to make sure we reduce emissions in the industries that are [already] there.”

BLACK AND WHITE ISSUE?

That pragmatic approach to ESG rules has thrust the FCA towards the front of the pack in regulatory standards internationally.

Outside of the EU, the City’s watchdog has been among the fastest movers and is now at the heart of bringing rules together in a more consistent international framework. Sadan heads up an International Sustainability Taskforce for the international body IOSCO and says UK regulation is now playing an integral role in shaping what global rules could look like.

“We are working with everyone from the SEC, Hong Kong... Japan is doing something very similar on ESG ratings,” he says. “Things are moving, but are they moving fast enough for everyone? Of course not, it takes time.”

GROWING PAINS

The fragmentation of rules remains one of the fundamental issues facing the sector. The US is moving at a more sluggish pace than the UK and Europe, triggering some fears that business may gravitate towards the slacker regulatory framework.

But Sadan says the FCA has no plans of slowing down. Demand among retail investors is shifting further towards sustainability and he argues his duty is to “look after UK consumers”. “We have a commitment from the government and therefore we should try to do this. Others will follow -- we can’t just be followers,” he says.

CITYAM.COM 10 THURSDAY 27 APRIL 2023 NEWS

Charlie Conchie interviews the biggest names in tech, fintech and financial services

‘I knew I wouldn’t be loved’: The FCA’s ESG chief talks greenwashing and how the UK is leading a clampdown

Half of Londoners say Sadiq Khan is doing ‘badly’, new poll says

JESSICA FRANK-KEYES

HALF OF Londoners say they think Sadiq Khan is doing “badly” at City Hall, polling has found.

Exactly 50 per cent rated him as doing “badly” while almost a third (32 per cent) think the mayor is doing “very badly”, pollsters at YouGov said.

Over a third of Londoners think he is doing “well”, according to the poll, conducted between 14 and 25 April.

Yet the survey of 1,107 adults in the capital marks a three-point drop from the last round of polling on the mayor in January 2022.

It comes amid controversy over the mayor’s plans to expand the ultra-low emission zone (ULEZ) in a bid to tackle air pollution. A judicial review by five Tory councils to challenge the legality

Rishi and his conga line of (non) Doms

SKETCH

of the policy is underway.

Meanwhile, London’s Met Police and the fire brigade have both been placed under special measures.

Khan was particularly unpopular with older voters, with 81 per cent of Londoners aged over 65 saying he was doing “badly” or “very badly”.

However, Londoners aged 18 to 24 were more positive and the only group to rate him positively (albeit just): 40 per cent said he was doing “well” and 37 per cent said he was doing “badly”.

On specific issues, 65 per cent of the respondents said Khan was doing “badly” on housing; 62 per cent “badly” on crime; and 55 per cent “badly” on transport.

The mayor’s office and the Labour Party were contacted for comment.

Sascha O’Sullivan

IF YOU were to traipse through Rishi Sunak’s nightmares for a night or two, you would find yourself enduring a conga line of Doms, coming and going. First there’s Dom Cummings slagging him off on Substack. Then there’s Dom Raab, hurling tomatoes from across the room but blaming it on the Civil Service. Lastly there’s a faceless, ephemeral beast holding him in a political chokehold and luring him with cash, known simply as ‘the non-dom’. Shrugging off its seriousness, both to Keir Starmer and his own psyche, Sunak dismissed it simply as the “non-dom thing” at yesterday’s Prime Minister’s Questions.

UKRAINIAN officials have long been calling on Beijing to use its influence in Russia to help end the war.

Chinese President Xi Jinping spoke by telephone yesterday to Ukraine’s Volodymyr Zelensky for the first time since Russia’s invasion of Ukraine last year, fulfilling a longstanding goal of Kyiv which had publicly sought such talks for months. Zelensky immediately signalled the importance of the chance to open closer relations with Russia’s most powerful friend, naming a former cabinet minister as Ukraine’s new ambassador to Beijing.

Met Police chief Mark Rowley locked in war of words with MPs over force’s extensive failings

JESSICA FRANK-KEYES

MET POLICE chief Sir Mark Rowley was accused of lacking “honesty” yesterday as he was grilled by MPs over the force’s extensive failures.

Senior Conservative MP Lee Anderson traded blows during a House of Commons hearing on policing standards, with the top cop insisting he was “ferociously” tackling issues in the force.

Rowley told MPs he was “doubling down on standards” and the “majority” of cops were “good people”.

But deputy party chairman Anderson accused him of “not

being very honest” when he refused to give an example of any racist, misogynist or homophobic incidents during his career.

“You must have been walking around with your eyes closed… it would appear that you’re in denial,” Anderson said.

Meanwhile, on environmental protestors, Anderson told Rowley to “leave [his] ivory tower” and end the disruption.

The commissioner insisted he had to “work to the law rather than whim”.

Starmer, jaded from a week of Mr Whippy jokes after Sunak’s “Sir Softie” jibe, labelled Sunak “Mr 24 Taxman”. A new character in politics, Mr 24 Taxman would likely be cast by a wayward pollster as a psephological competitor to Stevanage Woman.

Rishi was ready to recall Labour’s time in government: “Same old Labour, always running out of other people’s money.”

He made a mental note to thank Greg Hands for his daily tweet of that letter from Alistair Darling, even if posting it in a novel location substituted an actual plan to fight for thousands of local election seats.

“The rank hypocrisy of it,” Sunak

declared. “When it comes to his own special pensions scheme, it’s one law for him and a tax rise for everyone else.” And then, like a ballerina, he pivoted to his favourite schtick of asking Labour for ideas on what they would do on the economy if they were in charge. Oliver Dowden, his new Dom, whipped out a notepad and pen, in case he suggested anything decent. Typically, Sir Softie held them close to his chest.

“Woeful,” Dom Raab hissed from the backbenches and even Sir Lindsay Hoyle was too scared to tell him to go for a tea break.

City of London m or f ert Regis vente one t iles update

ainabil t sus on R

May in ty ity

tream of this year’s Ne lives join the oTER now t EGIS

inance ainable ft one in the sus y Summit- a o DeliverZer

calendar2ednesdaMa4y - on W

ate leaderpor inance and cor Join f

t

s and ate leader

s as we discuss making the policy maker

addressing the climate crisis.

7 in tween COP2 point beythe halfwa . It mar 7 Egyptian Presidency COP2 ation, in association with the the City of London bItyted is hos

Anderson, MP for Ashfield, added: “You might want to believe that you’re doing your job correctly, but I don’t think you are. I feel like I’m wasting my time with you.” Rowley hit back: “If you want to be personally offensive then write it in newspapers… but I’m not going to answer these questions.”

ks . It mar

ds vices

hange and its ef kling climate c cat ates. The agenda will focus on how Emir Egypt and COP28 in the United Ar

y

y weekend onation Bank Holida Cor

t Stree y are the Flee Leading the wa

ab

ds ttacticalwaroeps s essential, pr summit.com netzerodeliv

.ytrindus inancial ser the fypioneered b actice and the solutions being t prbes developing countries. It will also look at ticularly in par,y and inclusive wa ties can be delivered in a fair on socie fects

ound the City anged in and ar arr itself, events and activities are being

EC, Aldgate and Cheapside

tream here: ter for the lives

11 THURSDAY 27 APRIL 2023 NEWS CITYAM.COM

and over the the big dao IN the run up t ce onation Cor t Stree ht in lebations ty City e a s fer of and ofin s,weN welcome a Pearly King and Pearly Prince t will ke 1am-4pm), Leadenhall Mar (1 y 5 Marida ations, on F t of celebr As par green King. onation of our new ate the Cor celebr ty of green-inspired activities t varie tricts, with a ovement Dis Business Impr ter, r, Quar ww gov london tyofcity www t cityoflondon.gov.uk/coronation formances. hall per singalongs along with quir tunities, and holding tr oppor fering phot s, visitgreeoforting t will y y 5 Ma o k/eshotuk/ ky musical aditional o fering phot

‘LONG AND MEANINGFUL’ Zelensky describes his first call with China since war began. Xi pledged to try to mediate peace.

Rowley has been chief since September

THE SQUARE MILE AND ME

WHAT WAS YOUR FIRST JOB?

My first job was as a silver service waiter for functions at the Lansdown Grove hotel in Bath, when I was 14. I pretty much filled in every role in the hotel over the next seven years on weekends and holidays from washerup to receptionist and bar manager. This gave me the financial breathing space to do unpaid work in radio, TV and newspapers through school and university while still managing to have a social life.

AND YOUR FIRST JOB IN THE WORLD OF BUSINESS JOURNALISM?

I became a business reporter and presenter at BBC Breakfast in 2005, after being part of the launch team for BBC Three News. This entailed getting up at the crack of dawn and going on pursuit of breaking consumer and corporate news. It took me everywhere from Glasgow and Paris to Newquay and Bangor – with stints presenting live from the London Stock Exchange. I covered everything from the pitfalls of buying property abroad, to the business of fake tans, all overtaken of course by the Great Financial Crisis and its repercussions.

WHAT'S YOUR MEMORY OF YOUR FIRST WEEK?

On my first day, I was reporting live on Tesco making its first £2bn annual profit, outside the store on the A4 in Kensington, at 6am. Later that week, I helped Stuart Rose manoeuvre a coat rail full of garments into the Stock Exchange studio for a backdrop, before interviewing him on the challenges M&S faced from fast fashion rivals. A particular white suit kept falling off its hanger.

WHAT'S BEEN YOUR MOST MEMORABLE LUNCH?

My most memorable lunch was a long way from the City of London. With my RAF Reserves beret held firmly on, I landed in a Chinook helicopter on HMS Illustrious which was in the Gulf, in the run up to the invasion of Afghanistan. We’d spent three weeks in a hot tent in the Omani desert, so drinking tea from a china cup in the state room of the aircraft carrier was a surreal moment.

WHAT’S ONE THING YOU LOVE ABOUT THE CITY OF LONDON?

QUICKFIRE ROUND

important to start investing early.

WE'RE GOING FOR LUNCH IN LONDON AND YOU'RE PICKINGWHERE ARE WE GOING?

Greenberry Cafe, on Regents Park road. It’s a little haven in the capital, and only 14 minutes from Bank station to Chalk Farm on the Northern Line. You can sample Welsh wine, beautiful food and then stroll to catch a marvellous glimpse of the city from Primrose Hill.

AND FOR DRINKS AFTER WORK?

Cafe Kick, Exmouth Market has the best negronis in the City, possibly the world. It’s also got the freshest oysters and is always a lot of laughs. You never know who you will meet, but you know you will have a great time.

ARE YOU OPTIMISTIC FOR BRITISH BUSINESS IN THE MONTHS TO COME?

I am a glass half full person and the resilience of British businesses keeps being under-estimated. It’s still going to be tough going but the pandemic has made companies so much more adaptable, flexible and ready for change ahead.

WHERE WOULD WE FIND YOU AT THE WEEKEND?

Ideally swimming somewhere, anywhere with lidos, lakes or the sea.

IF YOU COULD CHANGE ONE THING TO MAKE BRITISH BUSINESS MORE COMPETITIVE, WHAT WOULD IT BE?

Eliminate the mountain of new paperwork which companies trading with Europe now have to fill in, which is a hugely unnecessary burden. It’s crucial that trading relations with Europe are improved, with estimates from the OBR that leaving the EU will reduce long-term output by about 4 per cent.

WHAT'S

ONE MOMENT FROM YOUR CAREER YOU'LL NEVER FORGET ?

Interviewing Adam Applegarth, then chief executive of Northern Rock live on BBC Breakfast as queues were building up outside the bank in 2007. It was a very awkward interview as he was less than forthcoming when I asked him about the extent of the withdrawals, the bank’s business model and its over-reliance on wholesale funding. It serves as a salient reminder to check the money in your accounts are fully covered by the Financial Services Compensation scheme.

The inter-connectedness of the business eco-system, from the shoe shine stalls to the trading desks, the coffee shops to the legal chambers, with a whiff of history at every turn. I particularly love ducking down the narrow alleyways imagining generations past rushing by in their quest to turn a shilling and help London thrive.

AND ONE THING YOU'D CHANGE?

The perception that it’s all men in suits and only for the wealthy few. Capital markets will work much more effectively, and the population as a whole will build financial resilience if more opportunities are open to ordinary investors. This means cutting out the jargon, changing perceptions and helping people understand why it’s so

FAVOURITE... BOOK: THE GREAT GATSBY

BAND: MASSIVE ATTACK

MOVIE: GROUNDHOG DAY –IT JUST GETS ME EVERY TIME

FAVOURITE VIEW OF LONDON: PRIMROSE HILL

DRINK: TEA OR COFFEE?

TWO TEAS THEN A COFFEE –EVERY MORNING

WHO IS THE BUSINESS FIGURE YOU MOST ADMIRE?

There are so many, but I am going to single out Merryn Somerset Webb and Anne Boden. Merryn, who is the former editor of Money Week and now Bloomberg columnist, was always a delight to interview at the BBC, and was one of my first guests at the London Stock Exchange. Her witty and wise commentary has helped make investing fun, knowledgeable and accessible. Meanwhile, Starling Bank’s Anne Boden has disrupted the traditional banking system, overcoming huge setbacks along the way.

WHERE'S HOME DURING THE WEEK?

Mainly Bristol, but I stay in Primrose Hill quite a bit.

AND WHEN YOU'VE GOT A WELLDESERVED TWO WEEKS OFF, WHERE ARE YOU GOING AND WITH WHO?

To Hourtin, on the French Atlantic coast, to surf with my children and drink Medoc wine with my husband and good friends.

We dig into the memory bank of the City’s great and good: this week, former journalist and now Hargreaves Lansdown’s head of money and markets Susannah Streeter spills the tea

CITYAM.COM 12 THURSDAY 27 APRIL 2023 NEWS

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS LONDON REPORT BEST OF THE BROKERS

FTSE 100: Standard Chartered and Persimmon peg London losses

LONDON’s FTSE 100 skidded lower yesterday despite a decent batch of results pumping up shares in banks and house builders.

The capital’s premier index lost 0.49 per cent to close at 7,852.63 points yesterday afternoon, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, edged 0.04 per cent lower to 19,207.97 points.

Share price drops among Britain’s largest companies weren’t offset by a string of decent financial out yesterday boosting London’s biggest listed lenders and constructors.

Persimmon, one of the UK’s largest home providers, jumped to the top of the FTSE 100, adding nearly five per cent.

The share price bump came despite the firm saying it has built fewer homes in the first three months of this year due to a slump in demand caused

by the Bank of England hiking interest rates 11 times in a row.

Banks also led gains in the City after Asia-focused lender Standard Chartered said it posted its best profits in nearly a decade.

It climbed 2.8 per cent, but signs that the UK banking sector held up pretty well amid last month’s financial market turmoil that laid waste to Credit Suisse and Silicon Valley Bank lifted sentiment toward the sector.

Barclays and Natwest both closed near the top of the FTSE 100.

Industrial giants also recouped some of their sharp losses in recent days, with miners Glencore and Antofagasta advancing over 1.5 per cent apiece.

Oil mega caps BP and Shell – which as a pair represent a large chunk of the

FTSE 100 – both clocked in decent advances during opening trading, before running out of steam.

Dragging the premier into the red was Primark owner Associated British Foods sliding a little under two per cent, adding to Tuesday’s losses after it posted soft results that warned inflation was eating into its profits.

Pharma giant GSK’s shares clocked steep losses, stumbling 3.87 per cent after it posted results that showed the revenue bump it’s received from Covid-19 vaccines is receding.

Wall Street’s top indices the tech-heavy Nasdaq, S&P 500 and Dow Jones also nursed heavy losses last night due to investors fretting over the state of the US economy.

The pound strengthened about 0.6 per cent against the US dollar.

Construction group Breedon reported an increase in revenue of 10 per cent in its latest quarter as a result of higher pricing levels. At its annual general meeting, the company said cost pressures were beginning to recover, while enquiries were up. Peel Hunt adds it to its buy list, but leaves its target share price at 86p.

Outsourcing company Bunzl reported an increase in revenues of 8.4 per cent in its latest quarter on the back of support from inflationary pressure. Its outlook and guidance, however, remain unchanged. Peel Hunt has placed the company on its add list with a target price of £3.20 per share.

As bills skyrocket, have businesses curbed their energy costs over the last year?

THE UK has launched a campaign to help organisations

“boost their energy efficiency, cut costs and increase their cashflow”. But YouGov data suggests the government might have its work cut out for it: a poll of 1,028 business decision-makers can reveal that overall, 17 per cent say their organisations are using less energy compared to March 2022, 44 per cent say their usage has remained about the same – and 26 per cent say their usage has increased.

In businesses with fewer than 10 employees, where decision-makers are perhaps more likely to have greater insight into their organisation’s day-to-day

Stephan Shakespeare

costs, respondents were less likely to say usage had increased (20 per cent) –but more likely to say their usage had remained the same (59 per cent).

So overall, 79 per cent of micro businesses said their energy use remained roughly on par with last year – or increased. A majority of businesses with

50 to 249 employees (79 per cent) reported the same. Large businesses were more likely to report an increase in usage (32 per cent) – although with a higher proportion of respondents answering “don’t know”, they may have had less visibility into their utility bills. We can’t say whether businesses can feasibly reduce their energy costs or not. We can say that most have not done so just yet, and with firms worrying they will have to scale back their operations, they may not appreciate being told to use their gas and electricity sparingly.

Stephan Shakespeare is the co-founder and CEO of YouGov

MOST BUSINESSES SAY THEY AREN’T USING LESS ENERGY COMPARED TO LAST YEAR

Is your business using more or less energy now compared to this time last year, or has your level of energy usage stayed about the same? (% of 1,028 business decision makers)

13 THURSDAY 27 APRIL 2023 MARKETS CITYAM.COM

P 26 Apr 67.72 21 Apr 20 Apr 25 Apr BREEDON 26 Apr 24 Apr 67 71 70 69 68 To appear in Best of the Brokers, email your research to notes@cityam.com P 26 Apr 3,151 21 Apr 20 Apr 25 Apr BUNZL 26 Apr 24 Apr 3,050 3,250 3,200 3,150 3,100

Much/slightly more About the same Much/slightly less Don’t know All businesses Micro businesses (<10 employees) Small businesses (10-49 employees) Medium businesses (50-249 employees) Large businesses (250+ employees) 26 44 1317 20 59 516 2746 12 16 28 51 12 9 3229 19 21

OPINION

EDITED BY SASCHA O’SULLIVAN

Diane Abbott and Dominic Raab share the fate of being doomed to the fringes

Cabinet and remove the whip from Jeremy Corbyn.

AS WE watch two wealthy men who achieved genuine success in elite professions before entering parliament strive to win the centre ground of politics, it’s easy to forget that until very recently British politics was dominated by revolutions on its right and left. In 2016 the Tory Right destroyed David Cameron’s premiership and achieved what it had been fighting for since the early 1990s, as the country voted to leave the European Union. Meanwhile, the year before had seen the Labour Party travelling back in time to 1980s, as admirers and confidants of Tony Benn finally seized control of the party with the election of Jeremy Corbyn as leader.

As the Duke of Wellington once warned, “next to a battle lost, the saddest thing is a battle won”, because both Tory Brexit Ultras and Labour Corbynites have much to dislike in the aftermath of their great victories.

Whilst Britain has left the European Union, and Labour is still advocating for policies way to the left of Ed Miliband’s manifesto in 2015, the people most associated with those changes have been cast to one side; Boris Johnson is battling to avoid suspension from the House of Commons and Jeremy Corbyn has been expelled

Leon Emirali

WHEN Netflix this week announced a $2.5bn investment to produce more South Korean entertainment, they did so to encourage the production of captivating thrillers and glossy rom-coms that have made so-called K-Drama’s a worldwide hit.

Inadvertently perhaps, Netflix’s announcement could also be considered an investment in the world’s most unlikely nuclear deterrent.

As tensions simmer on the Korean Peninsula and the South faces an unpredictable nuclear threat from Kim Jong-Un in the North, the West would likely find itself compelled to defend its ally in the event of a hot war. Not only because of traditional geopolitical factors but also due to the cultural impact of the Hallyu Wave - the name given to the huge popularity of K-Pop and K-Dramas that has spread across the world.

Much like Ukraine, South Korea re-

from the Parliamentary Labour Party.

The temptation is for either side to blame the establishment for having destroyed any hope that their revolution might succeed on its own terms.

But what happened to Dominic Raab and Diane Abbott last week exposes how such talk is merely an excuse for politicians that failed the test that victory brings.

Until Friday, Raab had been Deputy Prime Minister and Justice Secretary, only to have to resign after being found to have bullied staff members.

Until Sunday, Abbott was a Labour MP, she was Shadow Home Secretary under Jeremy Corbyn, and now has had the Labour whip suspended after sending a letter to The Observer that

argued against the possibility that white people from Jewish, Irish or Traveller communities could experience racism. There have been attempts to excuse or defend both politicians’ behaviour, but leave to one side the merits of either case, and instead ask yourself one question: are these the behaviours of disciplined radicals who genuinely believe that they are operating against a merciless establishment that would seize upon any slip-up to destroy them?

Would a minister determined to implement controversial policies against the views of a civil service filled with their ideological opponents behave like Raab did? After all, it was his un-

forced and reckless promise to resign should any allegation be proven, that moved the burden of proof away from his accusers and onto himself, and so left Rishi Sunak no option but to ask for his resignation.

Likewise, would a veteran backbencher gripped by the fear that the new leadership were looking for any excuse to remove the whip from her and her associates, behave like Abbott did? Her explanation that a first draft was sent by mistake, reveals staggering incompetence given the sensitivity of the issue in question. After all, it was Keir Starmer’s belief in the Corbynite tendency to dismiss antisemitism that caused him to fire Rebecca Long-Bailey from the Shadow

Netflix’s £2bn gamble on South Korea and a new Squid Game is an unlikely nuclear deterrent

lies on the West for its security. There is a chilling parallel between these two nations. Both have faced invasions and territorial disputes from their powerful neighbours. South Korea, however, has turned to soft power in the form of K-Pop and K-Dramas to build an international coalition and drum-up potential support in the event of a crisis.

This isn’t accidental. The government's proactive involvement in supporting these industries is clear through the establishment of dedicated agencies, such as the Korea Creative Content Agency and funding programs like the Hallyu Globalisation Project. This government backing, coupled with the soaring popularity of K-Pop groups like BTS and BLACKPINK, as well as K-dramas like "Squid Game" and "Crash Landing on You," has enabled South Korea to wield its soft power sublimely, ex-

panding its economic and diplomatic footprint worldwide.

South Korea is now a soft power juggernaut; its entertainment and pop culture exports are used as a means of diplomacy and geopolitical influence. No nation, perhaps since the US in the 1980s, has done this so effectively.

Netflix's latest investment is a testament to that influence. By producing and distributing more South Korean content, the streaming giant is not only cashing in on the Hallyu Wave's popularity but also contributing to a strategic geopolitical alliance between South Korea and its Western allies that could have a huge sway in determining the fate of the region.

The cultural affinity that the global audience has developed for South Korean entertainment would make it difficult for elected Western leaders with voters to please to turn a blind eye to any aggression from the North, as the

public outcry would be immense – especially from younger voters.

Russia’s invasion of Ukraine serves as a cautionary tale. In the lead-up to the conflict, Ukraine's reliance on the West for security was apparent, with the country's leaders seeking assistance from NATO and the European Union. The international community's response to the invasion highlighted the political and strategic significance of Western support. But that support has been hard-won, with some in the West now questioning such extensive support to battle Putin when global inflation continues to bite.

South Korea's soft power strategy, however, may prove more successful than Ukraine's, specifically thanks to its investment in pop culture. By beaming in scenes from Seoul and beyond to our living rooms every night, the West has a familiarity and affinity

It is of course true that both Brexit and Corbynite socialism had powerful enemies, especially within the more respectable corridors of Westminster, Whitehall, and Fleet Street. But the knowledge that you are fighting an establishment should sharpen, not dull, a politician’s survival instincts. And radicals have shown this necessary mixture of guile and steel at various points in British history; whether it be Nye Bevan fighting to establish the NHS, Roy Jenkins working with socially liberal backbenchers to create a more permissive society in the 1960s, or the various thinkers and bruisers that made sure Margaret Thatcher succeeded where Ted Heath failed.

But whether it be Tory Brexiters or Labour’s Corbynites, the belief that they were fighting an all-powerful establishment seems to have inspired no such efforts. On the contrary, it seemingly removed the motivation to do the hard work of developing coherent policies, persuading key stakeholders, or tactically outmanoeuvring opponents.

It's not a coincidence that both factions which once inspired such terror, today look so pathetic, but it is surely pathetic to excuse your failure on the grounds that your opponents had the temerity to oppose you. The people who should be angriest with the likes of Dominic Raab and Diane Abbott, are not those who disagree with them, but those who share their beliefs. It is after all those beliefs that have been diminished and discredited by their incompetence.

£ Will Cooling writes on politics and pop culture for the It Could be Said Substack

to South Korea that it never had with Ukraine.

In other words, South Korean politicians are banking on the millions of KPop and K-Drama fans worldwide to clamour for Western support if they were ever under threat.

The strength of K-Pop and K-Dramas as a nuclear deterrent is not merely symbolic. The South Korean cultural industry has had a tangible impact on the country's economy, and tangentially its readiness for war. The entertainment industry has emerged as a crucial component of South Korea's economy, with the rapid growth of the cultural sector contributing significantly to the nation's GDP. The cultural and creative industries accounted for 4.3 per cent of the GDP in 2020, a figure that has been steadily on the rise since the early 2000s.

The popularity of K-Pop and K-Dramas in the West may well be South Korea's most potent weapon in the face of North Korean aggression. Whilst we all hope the drama stays on our TV screens and not in the trenches, the cultural and economic ties between South Korea and its Western allies increases the likelihood of Western support in the event of a such a crisis on the Korean peninsula.

£ Leon Emirali is a former ministerial aide and adviser to PLMR

CITYAM.COM 14 THURSDAY 27 APRIL 2023 OPINION

Will Cooling

LETTERS TO THE EDITOR Another US listing blow

[Re:London over and out: CRH confirms New York listing swap after ‘strong support’ from shareholders, April 26]

Charlie Conchie’s article rightly spares no punches on building giant CRH’s switch to a New York listing. A range of factors are drawing more firms to the US. There are ongoing concerns about the stability of the UK trading environment, especially the long-term effects of Brexit. A US listing also provides access to more capital, all in a risk-tolerant market that is much more receptive to backing cutting-edge products - even at earlier stages of company growth.

So how can we avoid repeats of CRH and ARM? To incentivise firms to list

domestically, we need to establish a business environment built on access to growth capital, fostering innovation, and supporting growth. This will likely require changes to the FTSE listings rules, which look increasingly antiquated compared to other markets. Then we need an ambitious plan from the UK government to steer the giants of private capital to back UK plc. Recent ideas, as covered in this paper, like the plan to get major pension funds to back a proposed UK sovereign wealth fund, are exactly the bold steps needed. The time to act is now. London needs to demonstrate why it remains the best place for firms to raise funds and grow their business. Should this fail, other listing options in financial centres like New York, Paris, or Amsterdam will be waiting.

Naureen Zahid OpenOcean

SCARF-FACE Free scarves sent to Amazon customers to boost sales

Our relationship with China has been overhauled, but it’s still a

one for the City

Juha Jarvinen

ON THE last day of January 2020, Virgin Atlantic suspended all flights between London and Shanghai. Few could have predicted the scale of global crisis that would follow, or the way that UK businesses, especially airlines, would have to adapt to the loss of frictionless travel to major markets like China.

Shanghai was the first of many global cities to be cut off, sparking unprecedented upheaval. As an airline, we faced a previously unimagineable scenario of flying zero passengers for three months from April 2020. It’s now been more than three years since we stopped flights to China, but from next Monday, planes between London Heathrow and Shanghai will resume.

The UK will once more be connected by a UK flag carrier to China’s business and financial hub, the epicentre of our second largest trading partner.

As Covid-19 restrictions finally unwind, China remains a powerhouse of economic activity. Total trade in goods and services between the UK and

EXPLAINER-IN-BRIEF: THE MORAL CONUNDRUM OF A £30 PRET SUBSCRIPTION

If, like me, you’re a Pret subscriber, you would have been stunned by the news that their subscription service is going up by £5 to a monthly £30 from June. “Did you read our email on subscription?”, my favourite Pret employee asked me yesterday as I was picking up my coffee. I had read it indeed.

The hike doesn’t come in a vacuum; everything in Pret has been going up in price gradually over the past months. You wake up one day to discover that your Italian prosciutto sandwich is 20p

more expensive, again. That day is never a good day.

Pret justified the move by blaming food inflation. According to the latest analysis by the ONS, the price of food and nonalcoholic drinks rose at the fastest rate in more than 45 years in the twelve months to March 2023.

Customers will have, once more, to decide whether the treat - the coffee - is worth the price - those additional £5. As for myself, if the alternative is the office’s instant coffee, it will be a hard decision.

ELENA SINISCALCO

China is worth £103.5bn per year and despite the pandemic, the Chinese economy grew by 8 per cent in 2021 and 3 per cent in 2022. It’s a two-way street. Chinese visitors to the UK surged between 2009 and 2019 as seat capacity on direct flights doubled, spending £1.7bn here in 2019 – the UK’s second most valuable inbound market.

For the City of London, it reopens a new chapter of UK-China financial opportunity. Three years of China’s stringent lockdowns and pursuit of a “zero Covid” strategy had a profound impact, and there is rightly scrutiny of its domestic and foreign policies. But as Foreign Secretary James Cleverly said last week, Britain should not “pull the

shutters down”. The business community understandably looked to other parts of the world as choked supply chains added to the perfect storm, but those shutters are now reopening.

Airlines, like countless businesses with interests in China, had to be agile to respond to its closed borders. As part of decisive action to ensure survival, we expanded cargo-only flying, strapping boxes of PPE from China to seats ordinarily reserved for customers, and diversified our route network to new markets like Pakistan, while retiring less fuel-efficient Boeing 747s.

Another sign of the changed landscape is the added complexity for UK carriers serving Asian destinations, following the closure of Russian airspace. Despite longer journey times, connectivity with China remains vital both for the movement of people and crucial cargo. The return to Shanghai offers a barometer of pandemic recovery, evidence of the aviation sector’s return to strength and a milestone for UK plc – reinstating links that will help fulfil China’s market potential.