RENTERS FEEL THE PINCH WHY LONDON’S TENANTS ARE GETTING HIT THE HARDEST P12

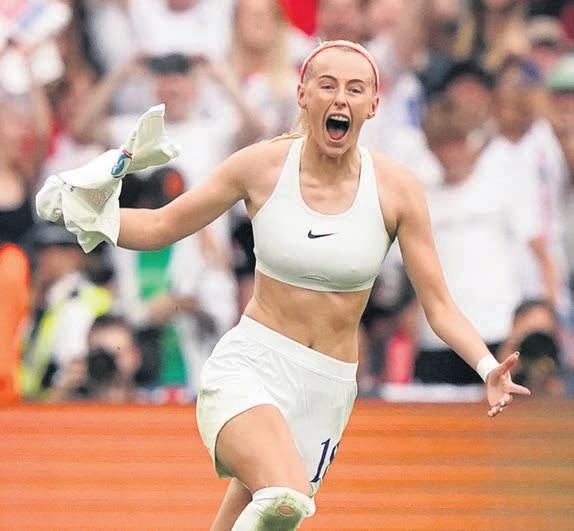

SUMMER OF SPORT THE WOMEN’S GAME LOOKS INCREASINGLY BIG BUSINESS P18

WHERE NEXT FOR NO10?

Sunak: We’re pro-business and proud

‘A SENSE OF SHAME’

BRITAIN’s bruised and battered business lobby group the CBI issued a last gasp plea to its members last night, promising to give them “reason to consider trusting us again”.

The organisation has been rocked by a series of misconduct allegations in recent weeks, with the details of two incidents passed to the City of London police.

Brian McBride, president of the organisation, which was founded in the 1960s, admitted it had been “complacent” and apologised for “mistakes in how we organised the business that led to terrible consequences,” admitting to a “sense of shame”.

“We failed to filter out culturally toxic people during the hiring process. We failed to conduct proper cultural onboarding of

staff,” McBride admitted.

He also set out the first steps of the CBI’s blueprint to turn around the group’s culture to prevent future instances of sexual misconduct in a bid to bring the CBI back from the brink.

“Whether that is possible, I simply don’t know. That is, of course, for each of you to decide,” McBride said, referring to the CBI’s around 190,000 members.

Last week, Britain’s top companies cut ties with the Royal Chartered lobby group, including FTSE 100-listed insurers Aviva, Phoenix, high street stalwart John Lewis and professional services titan EY.

Others, including JP Morgan and Morgan Stanley, paused their membership.

The government and Labour Party have stopped talking with the CBI. Chancellor Jeremy Hunt said yesterday there is “no point” engaging with the lobby right now.

Rain Newton-Smith, its former chief economist of several years, was parachuted in recently to guide the group after the board chose to dismiss Tony Danker as director general over claims he made some female staff feel uncomfortable. Danker, for his part, told the BBC last week that he was being positioned as a “fall guy”. None of the most serious allegations related to the former director general.

A summary of an independent investigation by lawyers Fox Williams has recommended a widespread reorganisation of the CBI’s HR department, but suggested senior management were largely unaware of many of the allegations. Due to ongoing inquiries, the report does not make any judgment on the veracity of existing allegations.

McBridge said that the organisation had

“tried to find resolution in sexual harassment cases when we should have removed those offenders from our business”, which he describes as the organisation’s “most grievous error”.

Last night, the MP for the Cities of London and Westminster, Nickie Aiken, told City A.M. that “it beggars belief that any organisation would fail to take such serious accusations as sexual harassment seriously, let alone the largest business trade body”.

Whilst the CBI attempts to rebuild, others are lining up to replace the organisation as the de facto voice of the country’s largest businesses. City A.M. understands that the embryonic BizUK, an off-shoot of Westminster public affairs and communications shop WPI, is in negotiations with a host of household names to provide a solution to the freezing out of the CBI at the highest levels.

JESSICA FRANK-KEYES

PRIME MINISTER Rishi Sunak yesterday insisted his government is undertaking “the most transformative changes to financial services regulation since the Big Bang”. Sunak, speaking on the fringes of a ‘Business Connect’ conference which saw him and his Cabinet colleagues address an audience of City and business bigwigs, told City A.M. that the Financial Services and Markets Bill, making its way through parliament was a “very significant piece of legislation” and described changes to Solvency II regulations, which will allow pension funds to invest in less liquid and more long-term assets, as a “Brexit opportunity” that would “unlock tens of billions of pounds of capital”.

It was not all smooth sailing for the former hedgie PM. Burberry chair Gerry Murphy described the UK’s decision to ditch tax-free shopping for tourists after Brexit as a “spectacular own promising to look at the data on the issue.

“This government is unashamedly probusiness,” Sunak told the crowd.

THE CITY

VIEW: PAGE 2

City’s revolving door speeds up as bank collapses add to the talent pool

JACK BARNETT

CREDIT Suisse and Silicon Valley Bank’s failures have flooded the City with idled bankers looking for new work, a new report published today suggests.

Over 4,000 more workers in the UK’s financial services sector were

looking for a new gig in the first three months of this year, according to recruiter Morgan McKinley.

The upsurge was “no surprise given the recent setbacks in the financial sector with news of redundancies [and] the collapse of Silicon Valley Bank (SVB) and demise of Credit Suisse,” Hakan Enver,

managing director at Morgan McKinley UK, said.

The news comes as Credit Suisse yesterday posted what could be its last ever set of results as a standalone entity after it was pawned off to UBS by Swiss authorities last month.

The fate of the more than 5,000

London-based Credit Suisse staff, mainly at its Canary Wharf UK base, is still unclear and it is not known how many or whether any of their UK staff have been cut loose.

There were fears for SVB UK’s staff before HSBC snapped it up for £1.

There are signs that the Square

Mile’s banks, brokers and insurers are dipping their toes back in the recruitment market.

Morgan McKinley said the number of vacancies climbed three per cent over the last quarter to 7,497 from 7,245.

£ CREDIT SUISSE RESULTS: PAGE 2

WE MADE MISTAKES ‘THAT LED TO TERRIBLE CONSEQUENCES’

City needs more than warm words from Numbers Ten and Eleven

RISHI Sunak was certainly at home on the stage of the ‘Business Connect’ meeting yesterday, a strange mixture of evangelical church gathering and corporate conference. As you’d expect of a former hedgie – a ‘one of us’ for financial services folk – he can talk a remarkably good game. Indeed, he and Jeremy Hunt, an entrepreneur made good, are arguably the most City-aligned duo in Numbers 10 and 11 for

STANDING UP FOR THE CITY THE CITY VIEW

decades. The question, as ever, is when we’ll see that start to translate into policy. Friends of Sunak would argue that we already have: Jeremy Hunt and he have presided over a calming of markets after Liz Truss’s misadventures. The tech

community certainly warmed to the pair after they worked to save Silicon Valley Bank’s UK branch, brokering a sale to HSBC, which removed the possibility of hundreds of high-growth tech firms being effectively locked out of their accounts. But it is inarguable that for all the warm words towards the City and the announcement of the muchballyhooed Edinburgh reforms, there remains little progress on freeing up the Square Mile to

compete against New York and Singapore. Make no mistake, a failure to do so will leave the capital exposed. Solvency II reforms are being slowed down by overly-cautious regulators within the Bank, delaying the vital deployment of pension fund capital into the UK economy. Listings reforms proposed by Lord Hill have now gathered dust for two years; ditto the fintech strategy of Ron Kalifa and the capital markets solutions brought

forward by Mark Austin, both of which remain on the shelf for reasons best known only to our politicians. Sunak and Hunt could be transformative; they could, in the words of Sunak to this newspaper way back in January 2021, trigger Big Bang 2.0. Instead it still seems rather bitty. Perhaps they are waiting for the next election, calculating that polls won’t reward a liberalisation of the City. That may be a missed opportunity.

FIT CHECK Yeoman warders, known as

pose for a portrait wearing their new uniform featuring King Charles III’s new insignia at the Tower of London yesterday

Credit Suisse: Final results reveal impact of crisis as bank sheds £55bn of assets

CHRIS DORRELL

IN THE QUARTER in which it was taken over by rival UBS, Credit Suisse reported outflows of CHF 61.2bn (£55.3bn) with clients and customers pulling funds as fear over the lender’s stability grew.

These “significant” outflows were concentrated in the second half of March. While they have “moderated” they have not yet reversed.

Deposit outflows represented 57 per cent of net asset outflows from Credit Suisse’s Swiss Bank and wealth management business.

Asset outflows in the first quarter

represented nine per cent of assets under management in the wealth management division. This is expected to lead to a “substantial loss” in the division in subsequent quarters.

Across the group, assets under management fell by CHF 41bn compared to the end of 2022.

Credit Suisse confirmed it had terminated the $175m (£140m) acquisition of Michael Klein’s boutique investment bank, which was part of a wider strategy to carve out the division.

It also expects the investment bank and wider group to report a “substantial loss” in the second quarter of 2023.

On a reported basis, Credit Suisse’s profit and revenue soared compared to last year – a result of the gains made from the writedown of its AT1 bonds.

The Swiss regulator is facing a lawsuit over its decision to write off $17bn of Credit Suisse’s convertible bonds.

Excluding the impact of the writeoff, it slumped to a CHF 1.3bn quarterly loss, swung from a CHF 300m profit the year before as revenue plummeted 40 per cent.

The results are expected to be Credit Suisse’s last as an independent entity after it was bought by UBS in a government-brokered deal for $3.25bn.

WHAT THE OTHER PAPERS SAY THIS MORNING

HUNT ADMITS UK BUSINESS

TAXES ARE TOO HIGH AS HE IS PRESSED ON STRATEGY

Jeremy Hunt admitted on Monday that British corporate taxes were too high, as business called on the government to make good on promises to mend ties with the private sector.

THE GUARDIAN ELIZABETH LINE TO BE FULLY RUNNING FROM MAY IN ‘LAST MILESTONE’ FOR CROSSRAIL

The Elizabeth line will run 24 trains an hour and start direct services from Essex to Heathrow from 21 May, TfL has confirmed, in the “last milestone” of the heavily anticipated Crossrail project.

BLOOMBERG

APPLE APP STORE POLICIES UPHELD BY COURT IN ANTITRUST CHALLENGE

Apple won an appeals court ruling upholding its app store’s policies in an antitrust challenge brought by Epic Games objecting to Apple’s ban on third-party app marketplaces.

Bitcoin could top $100,000 by 2024 as ‘crypto winter’ thaws

CHARLIE CONCHIE

BITCOIN could surge to $100,000 (£80,000) by the end of next year as central bankers ease interest rates and a so-called “crypto winter” thaws, according to analysts Standard Chartered.

The most valuable cryptocurrency could be boosted by recent volatility in the global banking sector, the end of the Fed’s rate-hiking cycle and improved profitability of crypto mining, Standard Chartered’s Geoff Kendrick said in a note.

A rally in Bitcoin earlier this year

saw prices rise above $30,000 (£24,000) in April for the first time in ten months. However, prices have fallen over 10 per cent in the past week. Bitcoin is currently trading at $27,290 (£21,888).

Trillions of dollars were wiped from the market in 2022 after rate hikes triggered a rush back to safer ground and crypto firms imploded. Predictions of sky-high valuations have been commonplace after past rallies. A Citi analyst said in November 2020 that Bitcoin could climb to $318,000. It closed last year down 65 per cent at $16,500.

‘beefeaters’,THE FINANCIAL TIMES

Watchdog’s big tech unit to get stronger powers

inance” of the sector.

HS2 BOSS: WE DIDN’T KNOW HOW MUCH EUSTON WOULD COST TO DELIVER UNTIL LAST YEAR

PLANS to toughen up the UK’s regulation of technology companies will go before MPs for the first time today, with the competition watchdog’s dedicated digital unit set to be given sharper teeth to deal with big tech.

New laws to regulate big tech firms, such as Google, Amazon and Meta, have been long awaited, with MPs last autumn urging the government to speed up progress on reforms.

Now a draft of the Digital Markets, Competition and Consumers (DMCC) Bill proposes giving statutory status to a key digital unit within the UK’s top competition watchdog.

The digital markets unit (DMU) within the Competition and Markets Authority (CMA) will get regulatory powers to target big tech firms and tackle their perceived “excessive dom-

Government says this has “stifled innovation and growth across the economy” and that its plans will help start -ups and smaller firms gain access to markets and consumers. Powers to administer fines of up to 10 per cent of big tech firms’ global turnover will also be given to the DMU if companies don’t follow the rules.

Protecting consumers online by cracking down on rip offs, unfair subscription ‘traps’ and fake reviews will also come under the legislation.

The imminent publication of the bill, which will put the UK at the forefront of big tech regulation, has raised questions over how it would actually work.

“One way or another, I’m pretty sure there will be an opportunity for big tech and other parties to intervene in that decision making,” said Mark Lewis, a senior consultant at Macfarlanes law firm.

in

HS2’s chief executive Mike Thurston told the Public Accounts Committee yesterday that the Euston development of the project was a long way from its initial target – and that the costs of the last stretch of the line into London were poorly understood until 2022. Thurston told the committee “candidly, it was only until we got to the autumn of last year” that the true costs of the project were fully understood. Scrutiny of the Euston development of HS2 has continued to plague the project, with HS2 recently confirming that the £1.2bn tunnel from Old Oak Common would be paused until 2024.

GOVERNMENT PLEDGES £100M INVESTMENT FOR AI TASKFORCE

810 jobs at risk

LAURA MCGUIRE

PREZZO will shut 46 loss-making sites across the UK including four in London, placing 810 workers at risk of redundancy.

The chain said “the cost of living crisis, the changing face of the high street and soaring inflation has made it impossible to keep all our

as

Prezzo axes four London and 42 UK stores

restaurants operating profitably”.

After being rescued from administration by Cain International in 2020, the group went on to shut 22 restaurants and slash 216 jobs.

Tom Pringle of Gowling WLG said “this is a clear example of the economic fall-out of prolonged high inflation” but hoped Prezzo had acted early enough to avoid further crisis.

The government is to invest £100m for a taskforce to develop AI models which can be used in fields such as healthcare and education. The recently-formed Department for Science, Innovation and Technology said the cash injection will be start-up funding to support the taskforce in the development of foundation models – a type of artificial intelligence used by chatbots such as ChatGPT and Google Bard. The first pilots of the developed models targeting public services are expected to launch in the next six months, the department said, with its chair to be announced later in the summer.

Calm before the storm? UK gears up for PE flurry

CHARLIE CONCHIE

PRIVATE equity deals in the UK slumped to their lowest level since 2020 in the first quarter of the year – but analysts are predicting it may just be the calm before the storm.

The total value of deals announced in the UK between January and the end of March came to just £27.1bn, the lowest total since the third quarter of the 2020 when markets were still roiled by the impact of Covid lockdowns, according to data analysed by Pitchbook for City A.M.

The early 2023 slump came after a torrid year for dealmaking in 2022 as the shocks of war in Ukraine sent markets into a spin and soaring interest rates shut off debt financing for prospective buyers. Dealmaking fell sharply through every quarter of 2022, tumbling from £65.8bn in the first quarter of the year to £32.8bn in the final three months of the year, according to Pitchbook’s figures.

However, analysts have predicted the early 2023 lull may precede a flurry of dealmaking in the UK as buyers capitalise on valuations still weighed down by the impacts of Brexit and fears over the UK’s stagnating economy.

“There’s definitely been a surge in private equity activity [since the start of April] ,” Henrik Persson, head of PLC Advisory at City broker investment bank Finncap, told City A.M.

“You would expect that as there seems to be a sense that interest rate rises are peaking, business sentiment and confidence not as bad as expected, and that this has not yet been fully and universally priced into the stock market (even if the FTSE100 has largely recovered), so there are still some very attractivelypriced assets.”

The predictions come after a surge in takeover activity in recent weeks, as buyers swoop in on London-listed firms.

Payments giant Network International and smart metering firm Sureserve both fell into the sights of private equity last week, while e-commerce firm THG and veterinary medicine maker Dechra were on the receiving end of takeover bids earlier in the month.

Persson said “blockbuster valuation deals” were still missing but the possible £4.6bn bid for pharmaceuticals firm Dechra could be the largest public-to-private deal since the takeover of Morrisons in late 2021.

STILL FARR TO GO New appointment gives beleaguered retailer THG a necessary boost

SHARES in THG jumped almost 10 per cent yesterday after the beleaguered ecommerce platform drafted in British American Tobacco’s Sue Farr as senior independent director to help take it private.

Reports first published in Sky News suggest that Farr’s appointment is fuelled by chairman Lord Allen’s motive to reshape its board ahead of a potential takeover by private equity group Apollo Global Management.

Regulators demand LDI ‘buffers’ following mini budget meltdown

CHARLIE CONCHIE

REGULATORS are pressing managers of debt-fuelled liability driven investment (LDI) strategies to boost their access to quick cash and review the make up of their clients after the market was plunged into crisis by Liz Truss’s disastrous mini budget last year.

The Financial Conduct Authority (FCA) and The Pension Regulator are now looking to shore up the market from future turmoil. They laid out a

host of recommendations for LDI managers yesterday, including diversifying exposure to certain types of assets and the spread of a firm’s clients.

Sarah Pritchard, executive director of markets at the FCA, said that while the sector is now much more resilient to risks, there remains “more to be done”.

“We expect managers to [r]eview the design of product operations, including features such as recapitalisation processes and buffer triggers,” the FCA said in its recommendations.

Ovo boss calls for reform of energy pricing system

NICHOLAS EARL

THE BOSS of Big Six supplier Ovo Energy has urged the government to speed up plans to separate electricity prices from gas prices, so that the lower costs of renewables are reflected in household bills.

Speaking exclusively with City A.M., Raman Bhatia, chief executive of Ovo, argued that the government should act on its review of electricity market arrangements (REMA) and help drive down bills for customers.

“We are concerned about everything which impacts customers. One such area is price signals for customers, including adoption of electrification. I think we need to accelerate the REMA conversation around decoupling electricity prices from wholesale gas,” he said.

As it stands, power prices for electricity are dictated by the UK’s energy mix, which remains highly dependent on gas. This means soaring fossil fuel prices have caused electricity bills to skyrocket, even if power is sourced from renewables.

Ovo is not the only supplier calling for

Not funding Sizewell C risks UK’s green ambitions, industry warns

NICHOLAS EARL

reforms, with Octopus Energy having previously raised concerns over the role of gas in power prices.

Last month, the Department for Energy Security and Net Zero (DESNZ) published the conclusion of its first REMA consultation. It revealed that over 80 per cent of industry respondents believe the current market arrangements are not fit for purpose. However, there was no unified response, with only 47 per cent of respondents supporting a split.

Bhatia said the UK should decouple gas and electricity prices

Adam Bell, head of policy at Stonehaven, told City A.M. that REMA risked “falling by the wayside” because it has proven so difficult for DESNZ to come up with an alternative to the current market – with potentially all options ending up in the “too hard” pile.

“If Ovo wants to do it, they will need to find a way of doing it themselves – just to give DESNZ the intellectual kick they need,” he said.

CRUNCH TIME FOR BP CHAIR Activist pressure builds on BP over climate agenda

BP CHAIRMAN

Helge Lund risks being ousted this Thursday, with five of the UK’s biggest pension schemes set to vote against his re-election at the energy giant’s AGM. Activist investor group Follow This has also urged shareholders to back proposals to toughen BP’s climate agenda, after the firm recently eased its pledges.

Labour puts pressure on Tories over plans to tackle sewage leaks

NICHOLAS EARL

THE GOVERNMENT faces further pressure over its handling of the water industry, with Labour set to force a binding vote on draft legislation aimed at bringing sewage dumping to an end. Labour confirmed it will table an opposition day motion today in the House of Commons for a debate on the Water Quality (Sewage Discharge) Bill. The private members’ bill aims to enforce legally-binding reduction

THE NUCLEAR industry has rushed to defend the £35bn Sizewell C nuclear project amid reports the project is struggling to lure in domestic investors – by highlighting its green credentials. Tom Greatrex, chief executive of the Nuclear Industry Association, told City A.M.: “It’s important to

remember that Sizewell C will make the greatest single contribution to fighting climate change of any project in UK history. It will use a tiny amount of space to create a huge amount of low carbon energy, freeing up land for nature.”

Sizewell C is a proposed 3.2GW nuclear power plant in Suffolk, which awaits a final investment decision and approval from the government. If

completed, the plant will power 6m homes and support over 10,000 jobs. Nevertheless, the project has reportedly suffered difficulties in securing funding, with fund managers at Legal & General and Aviva both opting against supporting the project, according to The Telegraph, despite the government easing financial conditions for nuclear projects.

targets and automatic fines for companies found to be dumping waste in rivers and the sea.

Labour’s analysis of Environment Agency data has revealed that since 2016, a new sewage dumping event has taken place an average of every two-anda-half minutes.

Shadow environment secretary Jim McMahon has called on Tory MPs to support the bill, which he said would “put an end to sewage dumping once and for all” if pushed through.

Medica becomes latest London-listed private equity target in £269m deal

CHARLIE CONCHIE

A MEDICAL technology firm which supplies the NHS yesterday became the latest company to fall into the sights of private equity, as bidders capitalise on low prices and swoop on listed British companies.

Medica, which delivers “diagnostic support” and telemedicine services, said it struck a £269m take-private deal with a firm controlled by London-based private equity outfit IK Partners. Bosses said they would

recommend the offer to shareholders.

The offer represents a 32.5 per cent premium on the firm’s share price on 21 April, the last date before the offer was made. Shares in the firm surged by over a third yesterday after the deal was announced to the market.

The bidding firm said it considers Medica to be a “high-quality business that is a leader in the global teleradiology and wider imaging diagnostics sector”.

THE BIG BUCKS LVMH becomes first European company to reach $500bn market cap

Founded in 2004, Hastingsheadquartered Medica was admitted onto the main market of the London Stock Exchange in 2017. The firm has over 400 staff globally with operations in the UK, Ireland, the US and Australia.

The take-private swoop for the firm comes amid a flurry of deals in recent weeks, with payments giant Network International and metering firm Sureserve among the companies to fall into the sights of private buyers last week.

LVMH yesterday became the first European company to reach $500bn (£401bn) in market capitalisation as the luxury retailer was strengthened by a renewed demand from Chinese consumers. Shares in the fashion giant, owned by the world’s richest man Bernard Arnault, have been soaring since the start of 2023, largely thanks to the reopening of the Chinese market post-pandemic.

‘No ceiling’ on Lidl growth as it plots 247 new London stores

LIDL SAID it is planning to open a further 200 stores across London as soaring food costs continue to drive demand for discount supermarkets.

The German supermarket, which already has 120 stores across London, yesterday released its list of priority locations for new stores across the UK,

including 247 locations across the capital.

Richard Taylor, Lidl GB’s chief development officer, said: “Our vision is to have over 1,100 stores in the future, but really there’s no ceiling on our ambition or growth potential.”

As the cost of food and everyday goods has continued to soar, the demand for value grocery stores has increased, with discount grocers such as Lidl and Aldi

steadily increasing their market share.

Just last month, Lidl was named as the fastest growing supermarket in the UK, as it welcomed over 1.4m new customers.

Lidl CEO Ryan McDonnell said: “We’re more committed than ever to ensuring every household has access to a Lidl store... Our focus is firmly on the future as we continue to grow and invest in our infrastructure, while keeping a lookout for

more sites and locations countrywide.

“Customers refuse to pay a premium for their shopping, when they know they can get the same, if not better quality at Lidl,” he continued.

In the midst of an ongoing grocers’ war, Lidl recently won a trademark lawsuit against Tesco over the use of a yellow circle on a blue background in its ‘Clubcard’ discount logo.

IN BRIEF

IN BRIEF

DISNEY TO CUT THOUSANDS OF JOBS THIS WEEK, REPORTS SAY

Disney will cut thousands of jobs this week, taking the total number of layoffs to 4,000, according to media reports. Disney first announced it would start axing jobs in February as part of a $5.5bn (£4.5bn) cost-cutting drive under chief executive Bob Iger. Iger – who returned as Disney’s chief in November following the tumultuous tenure of his successor, Bob Chapek – announced Disney would cut 7,000 jobs as part of a “significant transformation”. The latest round of layoffs will affect teams across Disney Entertainment, ESPN and theme parks, and represent three per cent of Disney’s total workforce as of 1 October, reports said. Disney was approached for comment by City A.M. but did not immediately respond.

LONDON’S FIRST SPAC HAMBRO PERKS TO WIND DOWN AFTER ROUGH RIDE

Hambro Perks Acquisition Company –the first special purpose acquisition company (Spac) to list in London under new rules brought in by Rishi Sunak –yesterday announced it would cease operations, having failed to find a merger target. Hambro Perks chair Anthony Salz cited “current market conditions” for the decision, with there being “little likelihood of achieving a successful business combination within our permitted timeframe”. The company said it would wind down after returning funds to investors. The news follows chief executive Dominic Perks’s abrupt resignation from the Spac last week. It comes as a blow to the UK’s Spac ambitions, with Sunak bringing in rules as Chancellor in a hope to replicate the success found for the listing vehicles in the US.

Evri to triple green deliveries as it expands London e-cargo bike fleet

DELIVERY titan Evri has launched new plans to triple annual parcel deliveries using electric-cargo bikes.

Evri, formerly Hermes, will expand its e-cargo bike fleet to London and Leeds this year, as the company looks to reduce its carbon footprint in the ‘last mile’ of deliveries.

Evri said its services completed

154,000 deliveries in the financial year to February 2023, but hopes to triple this, targeting 500,000 next year.

Nancy Hobhouse, Evri’s head of ESG, said: “We continue to push ahead with our deployment of e-cargo bikes, which are not only more reliable... but are also better for the environment.

The UK e-cargo bike industry has taken off in the last year. Industry experts forecast a rise by 60 per cent

between 2022 and 23, and a 15-fold market size increase in the next five years.

It comes after Amazon launched the first ever fleet of e-cargo bikes in the UK last summer, as a central part of its £300m investment to decarbonise.

Rising petrol prices have fuelled the surge, as well as increasing incentives for delivery companies to decarbonise.

Getting a train over the May bank holidays?

SERVICE CHANGES:

28 April to 1 May and 27 to 29 May

Most of the rail network remains open, however some services will be affected as we make improvements to the railway. So, be in the know before you go.

THE NOTE BOOK

Another fine mess for battered Credit Suisse

CREDIT Suisse released its final set of earnings for the period ahead of the CHF 3bn takeover from UBS in March. The Swiss bank suffered a CHF 67bn drop in customer deposits in the first quarter, CHF 61bn in net assets outflows and a sharp drop in the size of its wealth management division from CHF 707bn to CHF 502.5bn year-on-year.

The recent turmoil in the banking sector and existential concerns about Credit Suisse prompted a mass exodus from its clients in recent months. In March, Credit Suisse said it found ‘material weakness’ in its financial statements and negative comments from the Saudi National Bank, its biggest shareholder, exacerbated the bank’s woes and its sliding share price.

However, Credit Suisse’s problems began far earlier than 2023. Last year, it reported a loss of CHF 7.3bn, its worst annual profit slump since the global financial crisis, and liquidity worries resulted in major clients outflows in the final quarter of 2022. This came after a series of scandals that embroiled the 167-year-old Swiss lender; Credit Suisse was linked to the

LUXURY STILL WINS THE DAY

collapse of Greensill Capital, as well as the failed US hedge fund, Archegos. The Swiss lender was also found guilty in 2022 of involvement in money laundering relating to the Bulgarian mafia.

Prior to the UBS takeover, Credit Suisse has already been trying to reinvigorate its financial health through a major restructuring programme including slashing thousands of jobs, shrinking the investment bank, and focusing on wealth management. However, bigger changes are likely to be around the corner.

While the deal is expected to complete this year, fully merging the two entities could take up to four years. Restoring confidence among shareholders and employees will be top of the agenda for returning UBS CEO Sergio Ermotti, who expects “change and hard decisions” ahead. According to Swiss newspaper Tages-Anzeiger up to 20-30 per cent of Credit Suisse’s workforce could be slashed as part of the tie-up. Plus there are many disgruntled investors to contend with, particularly Credit Suisse’s AT1 bondholders who saw their investments wiped out to zero.

Where interesting people say interesting things. Today, it’s Victoria Scholar, head of investment at Interactive Investor

Luxury group Kering, behind brands like Gucci and YSL, is reportedly paying a record £13m plus a year in rent for its Bond Street store in London. This is according to The Sunday Times which said Kering beat off stiff competition from other luxury conglomerates such as LVMH and Richemont. The deal surpasses the previous record paid by Ralph Laurent of £11m for its Bond Street location. Despite the cost of living crisis, luxury has been faring well this year, boosted by China’s economic reopening post-pandemic.

£ Olive oil prices have hit a record high as the lack of rainfall across Europe ruined supplies. According to reports, oil prices have surged almost 60 per cent since June to around €5.4 (£4.8) per kilogram on the back of painful droughts in Spain and Italy. Spain is the world’s largest olive oil producer, accounting for around 50 per cent of the global supply. It is expected to suffer the driest April on record this month, boosting prices for the versatile cooking accompaniment.

Over half of UK firms giving cost of living support

CITY A.M. REPORTERS

JUST SHY of half of British businesses have stepped in to support employees with ‘regular’ financial support during the cost of living crisis, per a new study.

Inflation has been running well ahead of average pay increases since the Covid-19 pandemic and has contributed to the tightest squeeze on real incomes for decades.

Some 43 per cent of business owners told Rathbones that they had given ‘regular financial support’ to employees over the past six months whilst a further 22 per cent have dished out a one-off cash payment to help employees with rising costs.

A host of City outfits have dug deep for so-called ‘cost-of-living’ payments. Lloyds of London, the insurance market, was one of the first to contribute with a £1,500 payment to all staff earning less than £75,000.

A host of other big names including Barratt, Taylor Wimpey, Nationwide, HSBC and Rolls Royce have also all issued similar ‘cost-of-living bonuses’ to their staff, ranging from £1,000 to £2,000 payments.

Ian Dembinski, head of client development at Rathbones, said: “It is in challenging times where you feel the benefits of having your community

the most.

“With times tough for many individuals, it’s encouraging to see so many business owners stepping in to support their employees.”

Rathbones’ research also suggested high net worth individuals were increasingly contributing to household bills for other members of their family.

A separate piece of research by consultancy Barnett Waddingham identified a host of additional benefits offered to staff over the past six months.

Just shy of 10 per cent of employees surveyed have received cost-of-living loans, in which firms offer short-term financial assistance at favourable rates to staff.

Others have offered specific support for energy bills and six per cent have bumped up pension contributions.

Experts warned employers would need to respond to cost-of-living concerns in order to compete for talent in a still tight workforce.

“The fuse has been lit, and if employers are not careful, they will be faced with a financially vulnerable workforce. This can impact physical and mental health, and ultimately will reduce productivity and hit the bottom line,” said Julia Turney, a partner at Barnett Waddingham.

£ Alphabet’s CEO Sundar Pichai was awarded $226m (£181m) last year. According to a securities report, he was paid mostly through equities but also through his annual salary of $2m (£1.6m). It comes at a time when Google’s parent company has been caught up in the ‘tech wreck’ across the sector on the back of rising interest rates which saw investors shift away from growth stocks last year. As a result, the tech sector has been awash with job reductions including at Alphabet which announced 12,000 cuts in January.

CAN I QUOTE YOU ON THAT?

Interest

Former Bank of England policymaker Michael Saunders tells Radio 4’s Today Programme

Each week

The Economist publishes a podcast called Editor’s Picks, reading aloud three essential articles from the latest issue of the magazine. This week, a topic under discussion was the paper’s new banana index, which is a novel way to measure the relative carbon impact of foods. It compares popular foods on three metrics – weight, calories and protein – indexed to the humble banana with some surprising results. The Economist says that while it is obvious that a “juicy steak is worse for the environment than frying up some tofu”, when considering the level of calories and protein in plant-based foods versus meats, it becomes harder to compare emissions of meals which are equally nutritious.

Nickel debacle sees big gains for LME brokers

ERIC ONSTADMOST brokers and banks trading on the London Metal Exchange (LME) had a bumper year in 2022 in a highly volatile market, but a provision by JP Morgan due to a nickel crisis weighed on its profits, according to results and industry sources.

In March last year, nickel prices saw a wild price spike, spurring the LME to shut down trading for the first time since 1988 and cancel deals. The resulting turbulent price action provided rich opportunities for trading.

Regulator Ofcom has called on broadband companies to better advertise cheaper rates

Ofcom: Millions of households overpaying for broadband in UK

ABBY WALLACE

MORE THAN half of low-income homes who qualify for cheaper broadband tariffs are missing out on deals, according to the UK communications regulator.

Only 220,000 households were on a social tariff as of February 2023, while 53 per cent of people receiving benefit payments were completely unaware of cheaper deals, Ofcom revealed in a report yesterday.

Social tariffs – which ensure affordable rates for people receiving

benefit payments in the UK – could save eligible homes around £200 per year, Ofcom said.

The regulator called on providers to better publicise cheaper rates, which could ease the burden of broadband costs in what has been dubbed ‘awful April’, with many low-income households struggling under the pressure of rising food and fuel bills.

Only 5.1 per cent of the 4.3m homes receiving universal credit payments were signed up to social tariffs, Ofcom said.

StoneX, one of eight top-tier members of the LME that are allowed to trade on the open-outcry floor, saw overall net profit soar 78 per cent to $207m (£166m) last year.

It did not break down profits for its metals business, but chairman John Radziwill noted that the 146year-old LME experienced its “biggest crisis in decades” when nickel prices doubled to more than $100,000 per tonne in a matter of hours.

But even though volumes fell on the world's oldest metals exchange, the price swings boosted business for LME brokers, many of which, including Nanhua Financial UK and CCBI Global Markets UK, confirmed they had strong results last year.

JP Morgan Chase, one of the biggest banks in metals, took a provision of $120m (£96m) for the nickel crisis last year and has not provided an update since then. An industry source said including the provision meant largely flat profits for JP Morgan in its metals business last year.

rates going up meeting after meeting? I think that’s largely over.

WHY YOU CAN STILL JUSTIFY THAT JUICY T-BONE STEAK

ECONOMICS

PEOPLE doubtless would’ve gasped at headlines last week about UK interest rates being on course for five per cent. Such a path looked implausible in March when Silicon Valley Bank’s collapse and Credit Suisse’s shotgun marriage to UBS sparked fears of a financial market meltdown.

After those events, traders trimmed their expectations of how much more damage central banks could do to their respective economies without causing more things to break in the global banking network.

Now, certainly in the UK, when it comes to market expectations of where borrowing costs are headed, we’re back to levels not seen since the weeks after Liz Truss’s mini budget roiled the UK debt market.

After numbers from the Office for National Statistics (ONS) last week revealed inflation hung in the double digits last month at 10.1 per cent – above the Bank of England and City’s projections – traders hiked their peak rate forecasts sharply.

Make no mistake, that’s a huge jump. Yes, they expected another 25 basis point increase on 11 May before last Wednesday’s inflation numbers, but that was it.

Now Bank governor Andrew Bailey and the rest of the Monetary Policy Committee are poised to really strain the UK economy to get rid of the inflation beast.

Monetary policy has a few pipelines that channel its effects, with the housing market being among the most influential.

Higher mortgage rates and a greater risk of unemployment have sent UK house prices down for seven straight months, according to Nationwide’s data.

Banks have effectively forced people out of the market by passing on Bailey and co’s rate increases, meaning sellers have to slim asking prices to find buyers. With rates now on course for five per cent, the outlook for house prices has got a whole lot worse.

Mortgage rates will probably reverse some of

ANNOUNCEMENTS

UK’s renters have been the real victims in this inflation and interest rate upward march

their decline since the Truss-induced volatility. That rise also risks engineering a lot of friction between landlords and tenants, a relationship that’s been strained ad infinitum. Rates on buy-to-let mortgages – which landlords use to purchase a home to rent –have jumped from 3.22 per cent to 5.56 per cent over the last year, according to data provider Moneyfacts.

LEGAL AND PUBLIC NOTICES

CITY of LONDON

The PLANNING ACTS and the Orders and Regulations made thereunder

This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission Calico House, 42 Bow Lane, London, EC4M 9DT

23/00250/FULL

The installation of replacement plant and associated works at roof level on Block C.

The Arches, 34-36 Mansell Street And 2330 Goodman’s Court, London, E1 8AA

23/00314/FULL

Change of use of Arches 34, 35 and 36 Mansell

repairs to roof, chimney stacks and rainwater goods, and internal repairs and redecorations.

34 Threadneedle Street, London, EC2R 8AY 23/00323/FULL

rear elevation, including removal of redundant staircase and replacement of doors and windows.

The University of Chicago Booth, 1 Bartholomew Close, London, EC1A 7BL 23/00376/FULL

That surge has prompted landlords to hoist rents steeply over the last year. The ONS said last year rents leapt 4.9 per cent annually in March, the biggest rise since the data was first tracked in 2016.

In London, they rose five per cent. Of course, that average hides some of the larger increases at the top of the range.

Renters are at the sharp end of the cost of living crisis. They typically have less income

roller shutter doors, new entrance doors and louvres.

34 Threadneedle Street, London, EC2R 8AY 23/00320/LBC

staircase, replacement of doors and windows,

Basildon House, 7 - 11 Moorgate, London, EC2R 6AF 23/00382/LBC

YOU MIGHT HAVE MISSED

Germany’s top economic indicator, the Ifo index, climbed for the seventh month in a row, to 93.6 this month from 93.2 in March.

Analysts now reckon Europe’s largest economy has avoided a recession –for now.

consideration of this application.

than homeowners, meaning a greater share of their finances are eaten up by housing bills.

Resolution Foundation research last week found they’ve been more likely to fall behind on rent payments than homeowners have on mortgage bills since inflation took off.

And there are signs that young, talented workers are fleeing London due to massive

living costs or just shunning the capital altogether after they graduate.

House prices have been turbocharged by ultra-low interest rates since the financial crisis and quantitative easing pumping cheap cash in the economy.

That has meant landlords have to borrow more to buy a home, pushing up rents.

More important than those two factors is bad supply. As research from the Centre for Policy Studies (CPS) points out, countries in Europe have also had rock bottom rates for more than a decade, but house prices have not risen as much as in the UK.

“Despite having similar population growth over the period as a whole, both France and the Netherlands roughly doubled their housing stock, whereas the UK’s has grown by just 46 per cent. Accordingly, real house price increases in the UK have been more than double those of France and the Netherlands, even as interest rates have been broadly comparable,” a report penned by Alex Morton and Elizabeth Dunkley for the CPS found.

To rebalance the housing market so that people don’t have to shoulder unaffordable rents and offer young people a genuine chance of getting on the property ladder, we have to build more liveable and sustainable homes.

Providing immediate help to the poorest who can’t afford massive rent and mortgage bill increases is necessary to tackle hardship.

But fundamentally we need to pursue a policy mix that increases housing supply to prevent such sudden and sharp increases from happening in the first place.

WHAT I’M READING

We are – Morgan Stanley absolutely promise – very, very close to the end of the world’s central banks raising interest rates to tackle inflation. The coming round of meetings, which include everyone from the Federal Reserve, Bank of England and Bank of Japan to Sweden’s Riksbank (the world’s oldest monetary authority), are poised to mark the final rate increases in this current tightening cycle, Morgan Stanley’s analysts reckon.

City A.M.’s economics editor Jack Barnett takes a deep dive into the state of the economy in his weekly column

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

To appear in Best of the Brokers, email your research to notes@cityam.com

FTSE 100: Credit Suisse suffers £55bn outflow as BP and Shell drag London index lower

LONDON’s FTSE 100 kicked off a new week in subdued style yesterday, dragged lower by big industrial firms extending last week’s poor performance.

The capital’s premier index slipped 0.26 per cent to 7,893.87 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, edged 0.07 per cent lower to 19,255.94 points.

Shares of big mining and oil companies fell sharply in the City this morning, building on losses they racked up last week fuelled by investors sweating over whether central banks could knock the global economy by hiking interest rates too aggressively to tame inflation.

Downward price movements extended into the new week, with miner Glencore losing 1.7 per cent.

Oil mega caps BP and Shell followed closely behind, skidding around 1.4 per cent lower each.

The FTSE 100 has benefited from having a massive gearing toward so-called “old economy” stocks like miners, oil producers and commodity suppliers due to the huge surge in raw material prices over the past year or so.

They represent a big chunk of the bucket of shares on the index, meaning their price movements exert a strong influence on whether the FTSE 100 is up or down.

“The FTSE 100 is under pressure trading below 7,900 with oil giants Shell and BP near the bottom of the index, dragged down by softer oil prices,” Victoria Scholar, head of investment at Interactive Investor, said.

Pound sterling was pretty much flat against the US dollar. Things weren’t much prettier on the continent, where investors were met with “a sea of red across European indices”.

“One of the key issues is the gloomier picture for corporate earnings growth. Earnings drive share prices and the prospect of slower growth and/or squeezed margins does not bode well for equities,” AJ Bell investment director Russ Mould said.

Credit Suisse posted what is likely to be its final ever set of results yesterday after it was pawned off to its biggest rival UBS by Swiss regulators to avert its failures contaminating the wider European banking sector.

It said it had suffered around £55bn of outflows in the first three months of the year, pushing the bank toward the edge of the cliff.

Horizonte Minerals has now completed half of its Araguaia project. Analysts at Peel Hunt said it remains “on budget and schedule”. Over 90 per cent of total capex has been awarded meaning the budget risk is “receding rapidly”. The analysts maintained a ‘buy’ rating with a target price of 200p.

Supermarket Income REIT purchased a Tesco in Worcester for £38.3m yesterday. The price reflects a yield of 6.0 per cent. Analysts at Peel Hunt said the rent, about £50 per sq ft, is “higher than most of the existing SUPR portfolio”. The analysts rate Supermarket Income REIT a ‘Reduce’ with a target price of 85p.

Telecom Plus held an event in Telford last weekend attended by analysts at Peel Hunt. The analysts said there was a “clear emphasis on the scale of opportunity” and the firm had an “obvious confidence” in its customer offer. They expect it to continue delivering double digit profit growth, and rated it a ‘buy’ with a target price of 2,600p.

NERVOUS TENSION “A sea of red across European indices says everything you need to know about investors’ mood. While the losses are relatively minor, the fact the key European markets are falling at the start of the new trading week suggest that investors are nervous once again about the outlook.”

RUSS MOULD, AJ BELL

OPINION

EDITED BY SASCHA O’SULLIVANOur languishing reputation on foreign aid opens the door to China’s influence

Elena SiniscalcoIT IS a big week for migration in the UK. The Illegal Migration Bill comes back to Parliament tomorrow for its third reading. At the same time, there is a four-day Court of Appeal hearing against plans to send refugees to Rwanda.

One of the chief complaints on migration is the cost of housing refugees. But what many don’t know is that much of this money doesn’t come from the Home Office budget, but from the aid budget. Under international aid rules, the UK is allowed to pay for basic services and accommodation for refugees during their first year in the UK through the aid budget. The government spent £3.7bn on this in 2022, a sizable increase from the £31.bn spent in 2020. This is more than what the Foreign, Commonwealth and Development Office spent in Africa and Asia combined.

The government is making “a political choice to provide support to people in need of sanctuary in the UK at the expense of helping people facing conflict, climate change and inequality globally”, says Stephanie Draper, chief executive at Bond, a network of civil society organisations. This choice is political precisely because by taking this money from the aid budget, the Conservatives can claim no domestic cash

Tom Westgarth

Tom Westgarth

IT IS easy to look back with clarity on the pandemic. At this distance it is clear the signs were all there. Lockdowns in China, the heaving hospital wards in Lombardy. Even the exponential growth data in January and February 2020 should have pointed to the need to act and act now.

The rampant growth in AI is a similar story. GPT-3, a landmark large language model (LLM) that can predict the next sequence of words in a sentence, was produced by Open AI in June 2020. Since then, the open-source community has improved models faster than many could imagine. It is not just poems and art that the new era of “generative AI” has produced: new tools and businesses have helped to design antibodies, produce new music, and have even become a Linux terminal. The release of GPT-4 in the last few weeks makes ChatGPT, which went viral in late 2022, look like the dumb younger sibling. Time moves fast in AI years.

is being spent on refugees. It’s an ingenious strategy for the short term, but the failure to tackle the causes of migration - hunger, high fertility rates, oppressive political regimes - will only lead to more migration.

Remember when Tony Blair stood up and promised to tackle “crime and the underlying causes of crime”? If you were to swap crime with migration, spending the handful of aid money we have left on a domestic problem is the equivalent of focusing on the former almost completely to the exclusion of the latter. If Blair had promised more police officers and nothing else, he would have been a source of ridicule.

This money also comes from a

shrinking budget, at 0.5 per cent of the GDP. The 0.7 per cent target, axed under Boris Johnson, was signed off by Rishi Sunak, then the Chancellor. Gone are the days of Britain as a “development superpower”. Now as aid projects get cancelled and partner organisations are left in the dark about when they might resume, our reputation as a generous partner fades away.

Clare Short left front line politics long ago. But as International Development Secretary under Blair, she was credited with making Britain an “intellectual leader” in foreign development, according to Jean-Paul Faguet, a professor of political economy at LSE. Her “outside the box” ideas were

picked up and followed by the World Bank. She eventually quit Blair’s Cabinet in protest of Iraq. The baton was then passed to David Cameron. A fierce supporter of maintaining Blairite levels of foreign aid, he oversaw a series of above-inflation increases to the budget, and saw it as key to overturning the Tories’ “nasty party” reputation. But political forces were moving against him, with the newly established UKIP pushing to cut the budget. Less money means less influence abroad. Conscious of reduced national capabilities, politicians have suggested focusing on aid that can be provided through multilateral organisations such as the World Bank and the IMF.

Britain is nowhere near ready for the challenges and benefits artificial intelligence will give us

During the pandemic, there were respectable institutions in place, and yet the response was still botched. The World Health Organisation (WHO), all the various national health security agencies, and the Centre for Disease Control got it wrong on the initial risk and on basics such as masks and scaling up testing. Even with all those institutions in place, governments still failed to deal with the crisis.

And yet we barely have a Health Security Agency equivalent for AI, let alone a WHO. Offices for AI are not equipped to deal with the next generation of emerging challenges.

Take the UK’s approach. The government’s AI strategy, while highly regarded by experts in its aims, was not even funded. Its office for AI, while producing policy and research, has no statutory regulatory mandate and has arguably not been given the political prioritisation it deserves in order to co-

ordinate responses to AI.

Technologists and entrepreneurs eagerly await this year’s release of the UK’s “pro-innovation” regulatory framework for AI. But with only a couple of dozen or so employees at the office for AI, the team there has its work cut out if it is to anticipate and respond to emerging challenges, as well as creating an environment for markets to mature. There are big questions that already need to be answered. We want people to be able to use AI tools for creative purposes. But how do we enable people to create AI music while also ensuring that artists’ IP is protected? If someone creates original music from AI trained on tools that harvest data from the internet, have they violated copyright?

UK-based Stability AI, the latest potential AI leviathan behind Stable Diffusion, is now facing a lawsuit for allegedly scraping artist’s work without their consent. The outcome of this case

will be significant for the future of the British AI market. Are the relevant UK government departments going to be proactive and make legislation or will a judge decide the course of AI copyright in the UK? Technological maturity will not be brought about without institutional maturity.

We require better institutional capabilities to arm ministers and officials with information of this kind. As models and the dilemmas they pose increase in complexity, our capacity must necessarily do so as well.

One possibility is for the office for AI to lead a “whole of government” foresight approach to understanding how to benefit from AI’s disruption. The office for AI should go to every single government department, and ask them to consider all the potential ways public services could benefit from new generative AI tools - and the foreseeable problems.

Just days ago, Cameron was suggesting reforming the World Bank to counter the influence of Chinese investments in African countries.

Cameron wants the World Bank to pursue riskier investments, so it can raise more money to be spent in countries that need it. There is a decent appetite for reform at the Bank, especially with Barbados PM Mia Mottley leading the Bridgetown Initiative. Mottley wants to help countries facing high debts by mitigating unsustainable debt servicing - in simpler terms, finding new solutions to unlock liquidity for countries that otherwise struggle to access multilaterals’ money.

But this government has stepped back from a leading seat at the international aid table. At his recent trip to the US for the World Bank spring meetings, Jeremy Hunt flew under the radar. Whatever the World Bank and the IMF manage to achieve, it can’t substitute countries’ individual commitments to aid.

A government spokesperson notes the UK spent more than £12.7bn in aid last year and says it “remains one of the largest global aid donors”. Yet this is also a government that doesn’t want to talk about aid: two vocal MPs, Andrew Mitchell and Tom Tugendhat, are now in government so cannot openly campaign for a return to the 0.7 per cent of GDP budget.

International aid might not be a political lever like the NHS or crime, but downgrading it to the bottom of the list denotes blindfolded short-termism. In the currently fraught international climate, the UK needs friends; but as long as it retreats into Scrooge-like nationalism, it will make few.

For the highest-impact scenarios, we should put in place an adaptation framework for the different stages of development and use of AI. A similar framework was provided as a blueprint for us by Stanford’s Cyber Policy Centre and OpenAI for dealing with emerging disinformation threats.

This tactic should be part of a suite of new responsibilities that an expanded government AI body takes on. Talk of being ‘AI ready’ is cheap; if you do not have the talent, foresight, and ambition to be able to respond in an agile way to emerging risks and opportunities, you may as well follow the pandemic era advice and stay at home.

As things stand, little of this is a political priority. So-called horizon scanning to understand emerging AI does take place in some departments, but in a disparate manner. We need dedicated teams to take on this role, but that will only come if the Department for Science, Innovation and Technology gives it adequate backing.

Nowhere is AI currently on a list of “most important issues to the public”. But tomorrow, a national scandal (for example, a huge cyber hack of a public database assisted by GPT-4) would catapult the field into being a key voter concern.

£ Tom Westgarth is a Senior Policy Analyst at the Tony Blair Institute

WE WANT TO HEAR YOUR VIEWS

LETTERS TO THE EDITOR

Retail’s novel approach

[Re: Retail: Sixth wettest March on record dampens sales as shoppers’ fail to weather inflation hike, April 21]

The news that retail sales are now falling is upsetting for many UK businesses, big and small, but we must not let this be the end of our work to save the British high street. Some of the reasons cited by the ONS as causing this downturn include inflation, as well as bad weather causing people to stay home.

The answer to all this? Provide consumers with something actually worth leaving the house on a rainy day for. The future of the high street lies in

understanding it takes more than the same old offerings to get the UK public into your store. Businesses need to understand the power of experiential marketing and bring it into action if they want to come out victorious in this new era of retail.

Personalised experiences are a must in so many industries now. Just think of the success of TikTok’s ‘For You’ page, which targets users with exactly what they want to see. With this in mind, the retail industry needs to catch up and do the same if they want to see these growth figures become larger over the coming months. While the road ahead may be bumpy, retailers who are able to adapt and pivot quickly will be better positioned to weather the storm and emerge stronger than ever.

John Hoyle SookMOON IN MARS UAE Space Agency takes

Our fintech sector is stalling and taking the competitive pressure off of the big banks

Andrew BeckleyTHERE is a cloud of uncertainty hanging over the fintech landscape. Usually so sure of itself, the fintech ecosystem in London and the rest of the UK has taken a battering of late, with Brexit, a talent shortage and a less favourable funding environment combining to leave businesses and investors in a difficult situation. Even last week’s UK fintech week - normally a celebration of the industry’s offering - was dampened by the challenges ahead.

Investment into the UK’s fintech sector slumped eight per cent last year, although we remain well ahead of rival hubs in Europe and Asia. Yet fintech success stories have been few and far between in recent months amid the furore around Generative AI and the growing focus on sustainability. But why is that? And what does it mean for the future of fintech and the wider financial services industry?

Fintech’s relative decline has coin-

EXPLAINER-IN-BRIEF: WHY ARE LANDLORDS QUITTING LONDON?

You don’t need us to tell you the capital’s housing sector is in disarray. And buy-to-let investors in London are selling up at the fastest rate in the country, according to research by Zoopla. During the first three months of the year, 26 per cent of the homes for sale were previously let out in the capital, compared with 11 per cent across the rest of the country.

This is being partly driven by “punitive” taxes. The main change is to mortgage interest rates. Since 2020, most landlords

can deduct 20 per cent of their mortgage interest costs when they pay taxes.

Great, you’d think? Not really, given that before 2017, they could deduct the entirety of their interest costs. This is a big change, and it means they pay the same in tax regardless of the state of mortgage interest rates.

So many landlords are selling not because they think it’s a particularly good moment to do so, but because it makes more sense financially to get rid of a very expensive property.

cided with a rebound of the institutions the industry was supposed to replace. Indeed, nothing summarises the resurgence of Big Banks quite like the recent fire sale of Silicon Valley Bank to HSBC shortly after Barclays took over Tech Nation’s role in the UK tech ecosystem.

Simply put, innovation and creativity put the fintech industry ahead of the big players, but rather than pressing on the accelerator, they’ve allowed themselves to stall. For too long, founders and their teams have had the financial services product blinkers on. By following shallow money needs such as splitting funds into pots, offering cashback on purchases, and chasing customers on an individual basis, fintechs have lost their innovative edge

and allure among the VC community.

Unfortunately nothing in fintech has broken through as originally expected. For example, the industry has so far failed to deliver the Open Banking revolution that was promised. Although it could yet have a major impact, investors have grown tired of the broken promises and have moved on to other opportunities.

Is there enough space left to innovate? Definitely. But this comes with a whole host of caveats. If fintech ventures revert to a consolidated underlying need mostly, they are little more than a digital front-end on a legacy industry. This has created an emerging sense of having lost their way, where clear-sighted leadership and bold ambition is lacking or has been burnt out by the grind of daily customer acquisition reporting. They are add ons to current offering, rather than pushing the boundaries of what could be achieved. With the fintech slowdown reducing some of the competitive pressure on the big banks, it seems many have reverted to safe and expensive rather

than innovative and actionable. Swooping in to save the likes of Silicon Valley Bank and to replace Tech Nation, these institutions have proved their worth with stability and size. While the fintech industry has faltered, the legacy players have reminded us who has the muscle to create impact.

At the same time, this probably isn’t an existential crisis for fintech. Although it is vital the industry regroups and begins delivering ideas that reshape financial outcomes for people, not just their digital experiences.

There is also a huge opportunity for fintech to join the movement to make a more sustainable world. After all, economic empowerment is fundamental to the world changing its ways more sustainably.

The fintech industry has a choice to make, stand up, lead that movement or be content with middle age and the irrelevance to come.

£ Andrew Beckley is General Manager of Class35Founders and their teams have been operating with their financial services blinkers on

a punt on seeing Mars’ moons

MOTORING

BRAND DESIGNS

Richard Aucock drives the Audi Q8 E-Tron, an electric SUV with a new name and new tech. Should it be your next family car?

THEAudi Q8 E-tron is the German premium brand cleaning up. That’s the environment, of course, courtesy of its zero tailpipe emissions and the carbon-neutral Belgian factory it’s built in. But also, Audi’s model name hierarchy: this electric SUV is a revised and rechristened version of the former Audi E-tron – because the ‘E-tron’ moniker is now applied to every Audi EV.

At the E-tron launch in 2018, some of us drew parallels with the original Audi Quattro. Audi has made lots of quattros, but only one Quattro (with a capital ‘Q’). The E-tron wasn’t good enough to become iconic, though, so Audi has transformed it into the Q8 Etron, creating a new flagship electric SUV – reflected by prices that start from £67,800. The ‘55’ version I drove costs from £77,800.

A hefty front-end overhaul provides added presence, helped by a full-width version of Audi’s singleframe grille, an integrated light bar and cool 2D version of the four rings logo. Stick with traditional door mirrors rather than the optional rear-view cameras, though. They are virtually useless: the tech simply isn’t ready yet.

Inside, it’s screen-heavy, but Teutonically solid, even if the haptic touchscreens don’t respond as quickly as your smartphone, needing more of a finger-jab than seems polite. You can now use the ‘Hey Audi’ voice assistant, but of course, nobody will.

Bigger batteries bolster the car’s appeal. There are two sizes; the 50 E-tron now has an 89kWh battery, while the 55 E-tron has a whopping 106kWh. For comparison, a standard Tesla Model 3 has an estimated 58kWh battery.

This means the Audi can now travel

PRICE: FROM £77,800

POWER: 408HP

0-62MPH: 5.6SEC

TOP SPEED: 124MPH

BATTERY SIZE: 106KWH

RANGE: 330 MILES

up to 330 miles between charges. There is a Q8 Sportback version too, with a swoopier, more aerodynamic rear end for up to 343 miles of range. The bigger battery can rapid-charge at up to 170kW, going from 10-80 percent in 31 minutes.

The two motors of the Q8 50 E-tron produce 340hp, for 0-62mph in 6.0 seconds. All you need? Well, the Q8 55 e-tron’s 408hp only cuts the 0-62mph time to 5.6 seconds, but it offers that

50 miles of extra range.

There’s also an even faster and pricier SQ8 e-tron, with three motors and a 062mph time of 4.5 seconds, but that’s not here yet. Yet I didn’t feel shortchanged in the 55 E-tron. Like all EVs, it accelerates quickly, but there’s an added layer of Audi sophistication here that really appeals.

Air suspension is standard, so the awful ride formerly experienced in bigwheeled Audis is traded for fluid absorbency. Yet it’s not over-soft or squidgy and, with crisp and tight steering, it drives in a clever and convincing way. It definitely has more character than the old Audi E-tron.

It's a pity it still doesn’t seem very efficient. The range has been improved simply by bolting in bigger batteries, rather than boosting how many miles it can cover for each kWh of electricity. On a reasonably brisk test drive, I barely

covered two miles per kWh. I run a long-term Kia Niro EV and that travels 70 percent further for every pricey kWh of electricity.

Even so, the E-Tron goes further between charges than it did, and that’s what matters. It is also satisfying to drive, a refined thing to ride in, and looks good in a sector of decidedly mixed rivals. Among these, the excellent Jaguar I-Pace is now getting old, the Mercedes-Benz EQC is also aged and feels it, the Genesis Electrified GV70 awaits a dealer network, and the BMW iX’s superb cabin and drive are ruined by that exterior.

Will Audi clean up with the new Q8 E-tron? Well, it should do a lot better than before. Not least because people may actually know what it is.

Richard

Aucockwrites for motoringresearch.com

MERCEDES-MAYBACH EQS IS THE ULTIMATE ELECTRIC SUV

MERCEDES-MAYBACHhas revealed its first fully electric car. The opulent EQS 680 SUV is designed to deliver maximum comfort –particularly for those being chauffeured in the back – and effortless electric performance.

With two motors and four-wheel drive, the EQS 680 develops a mighty 649hp and 701lb ft of torque.

Accelerating from 0-62mph takes just 4.4 seconds, while fully-charged range is up to 373 miles. The flagship Mercedes-Benz is arguably the world's most luxurious electric SUV – at least until battery-powered versions of the Bentley Bentayga and Rolls-Royce Cullinan arrive.

Starting with the Mercedes-Benz EQS SUV, the Maybach ladles on plenty

of extra chrome and an imposing front grille. Illuminated sideboards and alloy wheels up to 22 inches in diameter also provide extra bling. The MercedesMaybach 'double M' logo is even incorporated into the front bumper intakes, with a look seemingly inspired by high-end luggage and handbags.

However, it is the 680’s interior that truly stands apart from the regular Mercedes-EQ model. It features a Maybach-specific version of the fullwidth MBUX Hyperscreen for infotainment. The digital instrument panel is customised with rose gold surrounds and pointers that resemble ‘a silk scarf that moves elegantly in the wind’.

The Maybach EQS also features the first use of vegetable-tanned Nappa

leather, while other elements of the interior are derived from recycled or sustainable materials.

Two individual seats are separated by a large 'floating' centre console. Passengers can enjoy watching 11.6inch multimedia screens, along with active ambient lighting that adjusts automatically throughout the day.

A Burmester 4D sound system with 15 speakers is standard, and those in the back receive their own headphones. Extensive sound deadening helps to cocoon occupants from the road.

Mercedes has yet to announce prices for the Maybach EQS 680 SUV, but expect a hefty premium over the £153,495 asked for the existing EQS 580 4Matic SUV.

SPORT

FOOTBALL

US fund ‘eyeing football clubs’ amid Everton takeover talk

EXCLUSIVE

MATT HARDY

777 PARTNERS has confirmed it is “looking for interesting assets” amid reports that the US investment group is close to takeover of Everton.

Owner of the British Basketball League and its leading club London Lions, as well as European football clubs Hertha Berlin and Genoa, 777 has been on a buying spree of late and has been linked with an investment in cash-strapped Everton.

The Merseyside club, who have reported losses of more than £430m in their last five annual accounts, are facing further financial challenges if they fail to avoid relegation from the Premier League this season.

Asked about 777 Partners’ reported interest in Everton, the group’s vicepresident of investment Lenz Balan told City A.M.: “We’ve done a number of football deals: 777 acquired Hertha Berlin, we acquired a Melbourne club [Victory], and there are rumours we are looking at a Premier League team, so we are in an acquisition phase.

“We are looking for interesting assets. I am spending most of my time on basketball but we’re acquisitive, we’ve been incredibly acquisitive in the sports sector and I think that’s going to continue in the near to long term future. It’s a question of how many of

ATHLETICS

these things can you own before you stop doing it.”

The group began its European acquisition spree with the London Lions in 2020, followed by a 45 per cent stake in BBL and a takeover of Serie B side Genoa in 2021. Miami-based 777 Partners, which also has 15 per cent of Sevilla, acquired a stake in Standard Liege last year and last month bought 65 per cent of Hertha Berlin. The multiclub model also includes Red Star of France’s third tier, Brazilian club Vasco da Gama and Melbourne Victory.

“There’s a general investment thesis around being around storied franchises, being around places where we think there’s a lot of op-

Spurs sack Stellini after ‘unacceptable’ result

portunity that either hasn’t been captured or we think we can bring value,” Balan added. “For sure you can apply that investment thesis to a football club if you want to in the UK. That’s about all I can say about that.”

Everton have fallen on hard times but remain one of English football’s most historically popular teams. They are currently in the Premier League relegation places, 18th in the table, with six games left this season. The club’s owner, British–Iranian businessman Farhad Moshiri, bought a 49.9 per cent stake in 2016 and increased his holding to 94 per cent in 2022.

London Marathon in talks to help rescue UK Athletics

MATT HARDY

THE LONDON Marathon is in talks to help save UK Athletics from going bust after it emerged that the track and field organisation lost £1.8m last year.

Alongside a potential bailout from the London Marathon – which saw the second fastest ever 26.2-mile race run on Sunday – reports suggest the Great North Run could also chip in to save UK Athletics. “This is an amazing sport,” said London Marathon director Hugh Brasher.

“We had 8,000 kids on Saturday at the Mini Marathon.

“We have a responsibility to the sport and absolutely we are talking to UK Athletics about how we can help.”

Reports of UK Athletics’ financial woes come despite over 30,000 tickets being sold for this year’s Diamond League event at West Ham’s London Stadium.

Kenya’s Kelvin Kiptum won the men’s elite race in London on Sunday in a course record time of two hours, one minute and 25 seconds.

Dutch athlete Sifan Hassan transitioned from the track to the road in style by winning the women’s elite race on debut.

MATT HARDY

TOTTENHAM Hotspur have sacked Cristian Stellini as interim manager following Sunday’s 6-1 humiliation at Newcastle and appointed Ryan Mason as head coach until the end of the season.

Stellini - Antonio Conte’s former No2 - had only been in charge of the north Londoners for four matches since taking the reins after his fellow Italian was sacked in March.

In his short-lived tenure at the Tottenham Hotspur Stadium, his side conceded 11 goals in and just managed a solitary win – a 2-1 victory against Brighton.

In a statement Tottenham chairman Daniel Levy said: “Sunday’s performance against Newcastle was wholly unacceptable. It was devastating to see.

“We can look at many reasons why it happened and whilst myself, the Board, the coaches and players must all take collective responsibility, ultimately the responsibility is mine.

“Cristian will leave his current role along with his coaching staff. Cristian stepped in at a difficult point in our season and I want to thank him for the professional manner in which he and his coaching staff have conducted

RUGBY UNION

themselves during such a challenging time. We wish him and his staff well.

“Ryan Mason will take over Head Coach duties with immediate effect. Ryan knows the Club and the players well. We shall update further on his coaching staff in due course.”

Tottenham are currently fifth in the Premier League table, six points behind Manchester United in fourth.

They are being hunted for their European place, however, by the likes of Aston Villa – two points behind – and Liverpool – three points behind.

Top two English rugby tiers to join for cup competition

MATT HARDY

ENGLAND’S first and second-tier rugby clubs will come together next season in a revamped Premiership Rugby Cup.

The 24 teams from the top flight and the Championship will be divided into four pools of six teams with group matches and knockout fixtures.

The move comes amid increasing frustration from clubs in the second tier over their relationship with the top flight and the country’s governing body, the Rugby Football Union. Group games will take place in the autumn, during the period in which internationals will be preparing for and playing in the Rugby World Cup.

The semi-finals will take place in February with the final in March.