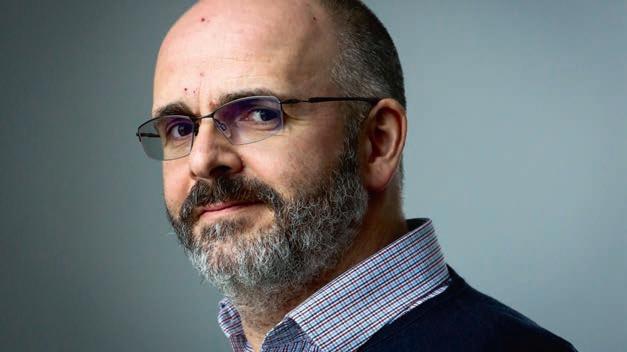

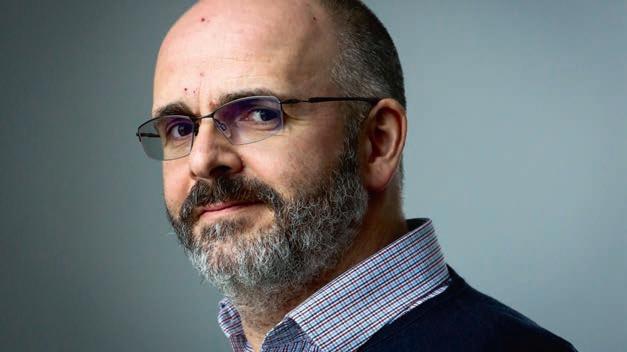

CITY BIGWIGS reckon Prime Minister Rishi Sunak has restored competence to government, but he will need to show more of a ‘pro-growth’ agenda in the run-up to next year’s election.

A host of grandees contacted by City

A.M. said Sunak, a former hedgie and holder of a Stanford MBA, had impressed them since taking the job in the immediate aftermath of the collapse of Liz Truss’ ill-fated administration.

“I think the consensus is that Sunak is

SAFARI WITHOUT THE GUILT WE ROAD-TEST A SUSTAINABLE SOUTH AFRICAN OFFERING P16

TAXING TIMES

WOULD LONDON SLAP A CHARGE ON TOURISTS? P9

CITY WARMS UP TO RISHI

“[He’s a] highly competent ‘details man’ who has gone into the job with an approach we haven’t seen from a UK premier for too long.”

Top fund manager Martin Gilbert said: “What I would say is there’s an air of competence about [this current government]. They’ve steadied the ship –to use that dreadful term.

“I think amongst the electorate, there’s a desire to have someone competent running the country and

“it would be nice to see more of a pro-growth agenda” from the government, which is currently overseeing the highest tax burden for some 70 years.

The recent turbulence at Credit Suisse and the collapse of SVB UK also appear to have reminded City figures of the value of having a money

and all-night phone calls were praised by Innovate Finance chief executive Janine Hirt for displaying their “commitment to the tech sector”.

“The government’s rapid response, and its willingness to engage with industry throughout, showed that it is serious about supporting the UK’s tech and

The PM has won plaudits for cool competence

turned around the Tory ship sufficiently. Hotel magnate and party donor Sir Rocco Forte told GB News yesterday he would no longer be donating, criticising a “social democratic” party that hasn’t “delivered good growth”.

And Martin Sorrell, the advertising supremo who founded WPP, told The Times this weekend that the party would need to go further on taxation reductions to win back voters before next year’s general election.

Energy windfall tax holding back bank lending to North Sea oil and gas operators

BANKS are slashing their support for North Sea oil and gas firms as the windfall tax begins to impact firms’ ability to secure more favourable financing deals for future projects.

After the Energy Profits Levy (EPL) was first introduced last May, banks didn’t factor in the EPL when making decisions about loaning oil and gas firms money – via a process known as ‘reserve-based lending’ –because it was considered to have a limited time span, set to conclude by 2025 at the latest.

But Hunt has since expanded its lifespan to six years, saying the government “will no longer consider phasing out the levy ahead of its end date of March 2028”.

Most UK banks no longer fund projects in the North Sea, leaving European banks to pick up the slack.

The big three banks seen as the main supporters of North Sea firms are ING, BNP Paribas and DNB Group, while the likes of Deutsche Bank, Credit Agricole and Societe General are also frequent lenders. All declined to comment.

But one source at a major European bank told City A.M. they

now regard the temporary tax as permanent and it is now factored into loan agreements for North Sea companies – making the terms of the loan less generous, meaning oil and gas firms inevitably borrow less from banks.

£ CONTINUED ON PAGE 3

INSIDE GLENCORE’S BID TO WOO TECK P4 WH SMITH SET FOR GROWTH P6 JET ZERO TO DRAG UP FLIGHT PRICES P7 MARKETS: WHAT TO EXPECT THIS WEEK P12 OPINION P14 LONDON’S BUSINESS NEWSPAPER MONDAY 17 APRIL 2023 ISSUE 3,966 FREE CITYAM.COM

NICHOLAS EARL AND CHRISTOPHER DORRELL

JESSICA FRANK-KEYES

Steady start for Sunak shouldn’t distract from the real challenge

THERE is something to be said for cool competence. That’s certainly the view of the City grandees we’ve spoken to about Rishi Sunak’s performance as Prime Minister, now six months into the job. Taking office just after the sterling collapse triggered by the misjudged mini-budget perhaps lowered the bar, it would have taken some doing to make things actively worse – but the ship has been steadied.

STANDING UP FOR THE CITY THE CITY VIEW

When he took the job, we headlined our front page “now comes the difficult bit”. The truth for Sunak is that this has not changed. Restoring sanity to markets was one thing; setting the UK up for a more prosperous future is another entirely.

On that front there is much to do. It is not credible for the Conservatives to claim to be a progrowth, low-tax party when there is precious little growth and taxes remain at a 70-year high. The probusiness policies that do exist are around the margins; freeports and investment zones are all well and good, but they are at best nice-to-haves rather than anything transformative. And transformative is, in fact, what Britain needs. An ageing

population will continue to put more pressure on alreadycreaking public services, and our unreformed NHS will soon eat up even more of the budget. Without growth, reform can’t be paid for; without reform, it won’t get better. Down that path lies –at best – stagnation. It will be tempting for Rishi Sunak and his advisors to play the cautious, competent card all the way until the next election. The polls, though suggesting a Labour

DOING IT FOR THE KUDOS? Cyclists plough down Aonach Mor in Scotland’s Nevis range in a mass mountain bike race, MacAvalanche, featuring a “gnarly” 900m descent

Further bullying allegations rock Tories as Cop26 President Alok Sharma accused

JESSICA FRANK-KEYES

CONSERVATIVE MP and former Cop26

President Sir Alok Sharma has been accused of “bullying” civil servants, according to a report.

Sharma is said to have been “difficult, unpredictable and could quickly lose his temper”, according to allegations reported by Bloomberg.

Four senior officials who worked with Sharma between 2020 and 2022 claimed he would “insult staff’s work” and “use profanity”, as well as allegedly call junior staff without warning to deliver criticism, Bloomberg wrote.

One junior official called a colleague in tears, and a former civil servant said they needed antidepressants and mental health support to cope in their role, it was claimed.

Issues arose during his time at the Department for Business, Energy and Industrial Strategy, Bloomberg reported, and some behaviour supposedly continued in the United Nations Cop26 role.

Two staff, who wished to remain anonymous,

characterised his behaviour during the Covid-19 pandemic in 2020 as bullying, the report said. Complaints were reportedly made to civil service bosses at least four times in 2020, but staff did not escalate proceedings officially. An official spokesperson told Bloomberg the government has no record of any complaints.

Sharma has denied the allegations. The report into allegations of bullying by deputy prime minister Dominic Raab is set to be published soon.

victory, can move significantly between here and whenever Britain goes to the ballot box, not least with the personable Rishi up against the occasionally robotic Keir Starmer. But for the country that’s a shame; we need to get a move on.

As the obituaries published earlier this month of Nigel Lawson proved, radicalism and dynamism can be rewarded. Let’s hope that both parties can rise to the challenge of the moment.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE GUARDIAN

LLOYD’S OFFERS TO INSURE NHS FOR UNEXPECTED COSTS SUCH AS PANDEMIC

The head of Lloyd’s of London has offered to strike a world-first deal with the UK government to help the NHS meet unexpected costs triggered by major events such as another pandemic.

THE FINANCIAL TIMES US MANUFACTURING COMMITMENTS DOUBLE AFTER BIDEN SUBSIDIES

Companies have committed over $200bn to US manufacturing projects since Congress passed sweeping subsidies last year, as Biden’s efforts to spark a new industrial revolution gains momentum.

THE TELEGRAPH YOUSAF FACING CALLS TO SUSPEND STURGEON FROM SNP AFTER EMAIL LEAK

Humza Yousaf is facing calls to suspend Nicola Sturgeon from the SNP over claims her attempts to shut down scrutiny of the party’s finances are now being investigated by police.

Top Tory donor says he won’t give the party any more cash

JESSICA FRANK-KEYES

TOP TORY donor and hotel mogul Sir Rocco Forte has said he won’t hand over any more cash to the Conservative Party.

Speaking to GB News, the founder of the Rocco Forte hotel chain, who previously donated £100,000 to Boris Johnson, said the party no longer stands for anything he believes in and he is “not a fan” of Chancellor Jeremy Hunt.

“What’s the point of having a Conservative government which is following policies which have been

followed for the last 15 years and haven’t delivered good growth? We have a sort of social democratic government in parliament. We don’t have a Conservative government and there’s noone who really believes in driving the economy and changing the system to do that.”

He said he was yet to consider donating money to Reform UK, but said: “Reform UK is sort of a protest party which will take votes from the Conservative Party and if it’s allowed to grow to the level the Brexit party did, it could force the Conservatives into a different direction.”

CITYAM.COM 02 MONDAY 17 APRIL 2023 NEWS

Sharma strongly refutes all claims

Interest rate cuts not expected until Christmas

JACK BARNETT

THE BANK of England is poised to cut interest rates at Christmas, lured into the decision by inflation falling rapidly over the course of this year, new forecasts that also say the UK will dodge a recession out today claim.

Governor Andrew Bailey and his team of economists are tipped to launch the first rate reduction since the emergency decrease in the early days of the pandemic around the end of this year. That’s according to projections from consultant EY ITEM Club, who reckon the monetary policy committee will back a twelfth straight and final increase to borrowing costs of 25 basis points at their next meeting on 11 May, taking Britain’s official interest rate to 4.5 per cent, a 15-year high.

Inflation has raged for more than a year and has been in the double digits since last summer, forcing the Bank

into a series of tough rate hikes.

That batch of rate increases has heaped pressure on families, amplifying the cost of living crisis, but has helped tackle inflation, which the EY ITEM Club reckons will dip below three per cent at the end of this year, still above the Bank’s two per cent target.

Official numbers from the Office for National Statistics out on Wednesday are expected to show inflation is still running extremely high at 9.8 per cent.

The EY ITEM Club reckons after flatlining in the first half of this year, the UK economy is on track to return to growth and avoid a recession.

The organisation said UK GDP will jump 0.2 per cent this year, a huge upgrade from their previous forecast of a 0.7 per cent contraction published just a few months ago.

“The UK economy seems to be turning a corner, albeit very slowly,” Hywel Ball, UK chair of consultancy EY, said.

Britain still at risk of ‘mild recession’, Lloyds chief predicts

JACK BARNETT

BRITAIN could still suffer “a mild recession” despite the economy performing much better than experts warned at the turn of the year, the head of Lloyd’s Bank, the country’s largest mortgage lender, has said.

Charlie Nunn, CEO of Lloyds Bank, told The Sunday Times that there is a

Lending options falling away as taxation bites

CONTINUED FROM PAGE 1

The change is more likely to impact smaller North Sea oil and gas firms, rather than global energy giants such as BP or Shell, who make the majority of their income outside of the UK.

Iain Lewis, chief financial officer at UK oil and gas firm Ithaca Energy, told City A.M. that “there’s no doubt that the current structure of the EPL being linked to RBLs will impact our capital expenditure profile.”

“The EPL has been constructed in such a way that it's very difficult for the banks to be supportive,” he added.

“more positive outlook” about the UK economy versus a few months ago.

Nunn’s recession bet runs against the International Monetary Fund, which reckons the UK economy will shrink 0.3 per cent this year.

The Bank of England and Office for Budget Responsibility have both canned their recession forecasts for 2023.

One North Sea industry source told City A.M. that some lending facilities are being reduced by as much as 40-50 per cent.

Another industry source told City A.M. that multiple energy firms have faced RBL issues over the past few months following changes to the windfall tax.

The Treasury said the windfall tax “strikes a balance” between “excess profits” and “encouraging investment” in the UK.

03 MONDAY 17 APRIL 2023 NEWS CITYAM.COM

Lloyds boss Charlie Nunn judges the UK economy’s outlook has improved, a bit

G7: UK forms nuclear fuel alliance with US, Canada, Japan and France

SOPHIE

WINGATE

THE UK, US, Canada, Japan and France have formed an alliance to develop shared supply chains for nuclear fuel.

The announcement, made at G7 talks in the northern Japanese city of Sapporo, is aimed at pushing Russia out of the international nuclear energy market, the

Department for Energy Security and Net Zero said.

The five countries will use their civil nuclear power sectors to undermine Russia’s grip on supply chains, cutting off another means for President Vladimir Putin to fund his invasion of Ukraine.

Energy security secretary Grant

Shapps said: “The UK has been at the very heart of global efforts to support

Ukraine, defeat Putin and ensure neither him nor anyone like him can ever think they can hold the world to ransom over their energy again.

“This is the next vital step, uniting with other countries to show Putin that Russia isn’t welcome anymore, and in shoring up our global energy security by using a reliable international supply of nuclear fuel from safe, secure sources.”

Investors urge Teck to engage with Glencore bid

NICHOLAS EARL

TECK Resources is facing increasing pressure from its own investors to hold talks with Glencore, after the Canadian miner rejected its latest bid for the firm.

Teck has rebuffed two takeover bids from the European commodities giant, including a sweetened £19.7bn bid earlier this week.

Glencore has proposed combining their metals businesses to create a £72.5bn commodity juggernaut, while separately combining their coal assets in a spin-off company.

The latest offer from the FTSE 100 company involved a £6.6bn cash component for investors looking to avoid exposure to Glencore’s thermal coal businesses.

Some investors are also pushing back against Teck’s own plans to split its business.

Influential shareholder group Glass Lewis has backed calls from investment advisors ISS for Teck shareholders to reject its own business plans, ahead of a crucial vote on the matter on 26 April.

Glass Lewis has argued, according to

reports, that Glencore’s offer was “a reasonably compelling strategic alternative that, at a minimum, warrants the company hitting the pause button on the separation and engaging in further discussions with Glencore”.

Glencore boss Gary Nagle has allegedly been meeting Teck investors in Canada to convince them not to back the Teck split, speaking to around 120 shareholders, The Sunday Times reported.

Teck chief executive Jonathan Price has consistently argued its separation plan will create more value for shareholders.

Teck is effectively controlled by the founding Keevil family. A controversial dual-class structure means they control the majority of the more powerful A shares. Norman Keevil, chairman emeritus, has confirmed he is not willing to sell at any price.

Meanwhile, some Teck investors question its decision to spin off its coal assets but continue to use its cashflows to fund the separate metals business. Glencore declined to comment while Teck was not immediately available.

John Wood Group warms

to

Apollo’s £1.7bn takeover offer

NICHOLAS EARL

OIL AND GAS engineering giant John Wood Group is reportedly warming to a £1.7bn takeover offer from Apollo Global Management after previously rejecting multiple bids.

After rejecting four proposals and refusing to engage with the bidder, Wood has now written to seek assurances on certain basic issues such as how the deal would be financed and whether there would be any

competition problems, according to The Sunday Times.

The group set its final bid at 240p per share, representing a 59 per cent premium and 20 per cent increase on the first approach.

Wood Group’s response is considered a prelude to opening full negotiations, and indicates the offer is close to being acceptable for Wood’s board.

Takeover rules mean Apollo must make a formal offer or walk away by the close of play on Wednesday.

CITYAM.COM 04 MONDAY 17 APRIL 2023 NEWS

Teck has rejected two takeover bids from mining giant Glencore

PA

Top chiefs say regulation key to closing fintech’s gender pay gap

CHARLIE CONCHIE

REGULATORS should step in to help narrow a gender pay gap in the fintech sector or female leaders will continue to be shut out from top jobs, some of the UK’s top female fintech chiefs have warned. In a joint report shared exclusively with City A.M., big four firm EY and industry body

Man and a van provider Shift acquires Movinga

GUY TAYLOR

LOGISTICS tech company Shift has acquired the European home move platform Movinga, as the firm looks to expand overseas.

Following the deal, Shift now hopes to become the largest marketplace for large-item logistics across Europe, with over 300 employees and operations in seven countries –the UK, Ireland, France, Germany, Austria, Sweden and Switzerland.

Shift did not disclose the value of the deal.

Founded in 2017, Shift began as a startup to help people move items by matching them with a network of ‘man and a van’ drivers looking for work.

The London-based firm later evolved to support businesses including Homebase and IKEA with large-item delivery solutions, facilitating over 300,000 deliveries and home moves in 2022.

Commenting on the deal, Jacob Corlett, chief executive officer of Shift,

said: “The underinvested home-move and large-item logistics markets across Europe are ready for disruption.

“This acquisition takes us to a new level, unlocking more countries where we can deploy proven tech and new ideas that will make a significant difference to people and businesses.

“Movinga has excellent brand equity and is renowned across its key European markets. It has a network of quality service providers and represents a fantastic cultural fit given the shared drive and vision.”

Silvio and Tobias Hinteregger, co-chief executive officers of Movinga, said: “We are excited to join forces with Shift, combining our expertise to deliver a seamless and efficient moving experience for customers across Europe.

“This collaboration will allow us to launch in the UK and Ireland, further enhancing our position as a leading player in the relocation and logistics services industry.”

Yonder London secures £62.5m funding to grow outside London

NOAH EASTWOOD

YONDER, a credit card rewards firm geared towards millennials and Gen Z consumers, has secured £62.5m as part of a funding round to expand its operations outside of London.

The company offers a points-based rewards scheme for use at London eateries, cinemas and wine merchants.

Tim Chong, CEO and co-founder, said: “We’ve built Yonder as a key to the city for young professionals, which encourages responsible use of credit while helping them to unlock more value from their spending.”

“We’ve built Yonder as a key to the city for young professionals, which encourages responsible use of credit.”

The funding package, which consists of £12.5m in equity and £50m of debt, will help Yonder boost hiring and expand into more UK cities.

The Series A funding round was backed by capital firms Northzone and RTP Global, with angel investors Joseph Moore, Crust Bros founder, and Kunal Shah, the founder of Cred, joining existing major shareholders Sharmadean Reid, Gocardless founder Matt Robinson, and former footballer Rio Ferdinand.

Innovate Finance said “barriers still exist within the sector” and action from the City watchdogs could help enforce change.

EY’s fintech policy partner Anita Kimber told City A.M. it is “frustrating that with a skills shortage we continue to see obstacles in the way of female progression in fintech”.

Over a quarter of female leaders blamed a lack of recognition and

non-transparent promotion access for a lack of progress in the sector, Innovate Finance uncovered.

ONS data shows the UK’s gender pay gap is around 14.9 per cent. Yet EY analysis suggests that figure is 22 per cent in the fintech sector. The findings come as the industry grapples with diversity and gender issues as data shows male founders bag the vast majority of investment.

05 MONDAY 17 APRIL 2023 NEWS CITYAM.COM

Shift’s acquisition will aid its ambitions to expand into the European market

Travel rebound spells growth for WH Smith

HENRY SAKER-CLARK

WH SMITH shareholders will be hoping the stationery-to-snacks retailer posts higher sales when it reveals its half-year results this week.

The group, which has shifted focus further from the high street to travel sites in recent years, is expected to be boosted by the continued recovery in traveller numbers at airports and train stations.

It is likely to reveal growth in revenues over the six months to February when it updates the market on Thursday.

Analysts at Numis have forecast that travel revenues will have increased by around 70 per cent year-on-year, amid comparisons with sales weighed down by the spread of the Omicron variant of coronavirus in the previous period.

The group’s travel business, which includes 120 Inmotion technology stores, now represents around two-thirds of its revenues.

Numis analysts Tim Barrett and Richard Stuber said: “Rail strikes will have continued to impact the UK business, with 10 days impacting the December-February period.” But they added:

WH Smith has pivoted its focus from the high street to travel hubs

“As the business pivots towards travel, it has become increasingly H2 weighted (March-August) given the importance of the summer holiday period to airports.”

Shares in WH Smith are 30 per cent higher for the past six months as sentiment around the economy and the outlook for consumer travel demand has continued to improve.

BT runs supply chain ‘war game’ amid growing fears of China-Taiwan conflict

ABBY WALLACE

ABBY WALLACE

TELECOMS group BT carried out tests on its supply chain in order to prepare for any fallout amid escalating conflict between China and Taiwan in a “war game” last year.

The two-day simulation was conducted after US speaker Nancy Pelosi’s visit to Taiwan last August, the Financial Times reported on Sunday,

SpaceX’s Starship gets green light to launch

ABBY WALLACE

A SUPER rocket that Elon Musk hopes will one day carry people to Mars and the moon has been cleared for its first orbital launch, which he has said will go ahead today.

The US Federal Aviation Administration (FAA) granted SpaceX

a licence to launch the super heavylift launch vehicle, comprised of a rocket, dubbed Super Heavy, and spacecraft, dubbed Starship, into orbit from its Texas base on Friday, having cleared regulatory checks.

The US Federal Aviation Administration (FAA) granted SpaceX

a licence to launch the super heavylift launch vehicle, comprised of a rocket, dubbed Super Heavy, and spacecraft, dubbed Starship, into orbit from its Texas base on Friday, having cleared regulatory checks.

The commercial rocket manufacturer tweeted soon after that it would target today, Monday 17 April, for the launch.

At almost 400-feet tall, Starship is one of the most powerful rockets ever built. The FAA told City A.M.: “After a comprehensive licence evaluation process, the FAA determined SpaceX met all safety, environmental, policy, payload,

airspace integration and financial responsibility requirements. The licence is valid for five years.”

The launch rocket boasts over 30 raptor engines and is designed to carry up to 100 people on “interplanetary” missions, according to SpaceX.

NASA has already awarded SpaceX a contract to develop Starship for exploration of the moon as part of its Artemis project.

The Starship rocket has already gone through a number of test flights, four of which have ended in explosions.

It is reusable and designed to land back on earth vertically. However, for this test flight, Starship is expected to splash down off the coast of Hawaii after completing its orbit, according to reports. The Super Heavy rocket booster will also splash down in the ocean before that, near the Gulf of Mexico.

The 150-minute test window will begin at 7am central time today, SpaceX said. It will also stream the takeoff on its site.

Musk claims a launch this week has only a 50 per cent chance of success, but thinks there’s an 80 per cent chance of reaching orbit by the end of the year.

citing people familiar with the matter. This revelation is the latest sign that companies — already hit with supply chain disruption in the wake of Russia’s invasion of Ukraine — are making preparations against a backdrop of growing tension.

BT told the Financial Times they “regularly run simulations to stress test our business.” The company was contacted by City A.M. but did not

immediately respond.

China has been carrying out military drills around Taiwan, which it claims as part of its territory. Industries — such as telecoms — are anxious about the scale of potential disruption since Taiwan produces the majority of semiconductors globally, which are used in electronic goods from phones to fridges, as well as in electric cars and wireless technology.

Taiwan produces over 60 per cent of the world’s semiconductors

CITYAM.COM 06 MONDAY 17 APRIL 2023 NEWS PA

#GLORI

T A T A AT Q QA EHT R A F G E K B OOB L VA ITSE OWDOOG A 1 ME 3 ROFE Y AY U 1 – 5 A V A AV D S NA TSUGU E 1

OUS

Musk working on AI tool to compete with ChatGPT despite safety concerns

ABBY WALLACE

ELON MUSK is reportedly planning to launch an AI tool to rival OpenAI’s ChatGPT.

The billionaire founder of SpaceX and Tesla is gathering a team of AI researchers and has acquired the graphics processing units needed to produce the AI tool, the Financial Times reported.

Musk is also in talks with SpaceX and Tesla investors to secure funding for the new project, a person familiar

with the matter told the newspaper.

The report stated that Musk incorporated a company dubbed X.AI on 9 March, listing himself as the sole director.

He has already secured thousands of GPU processors –the chips needed to build language models such as ChatGPT –sources told the Financial Times.

The eccentric billionaire also recently changed the name of Twitter, which he bought for $44bn (£35bn) last year, to X Corp in

Flight demand to be dented by green premium

NEIL LANCEFIELD

AIRLINE passenger numbers will be hit by the cost of decarbonising flights, the UK’s aviation industry has admitted. Paying for measures such as making Sustainable Aviation Fuel (SAF) widespread will put some people off travelling, according to a new report. But the Net Zero Carbon Road Map published by Sustainable Aviation – an alliance including companies such as airlines, airports and manufacturers – insisted “people will still want to fly” despite “slightly” higher costs.

Annual passenger numbers are expected to grow by nearly 250m by 2050. The document stated that the use of SAF could make up at least three quarters of all aviation fuel for UK flights by that time, with the majority of it produced in the UK.

SAF is produced from sustainable sources such as agricultural waste and used cooking oil. It reduces carbon emissions by up to 80 per cent compared with traditional jet fuel, but is currently several times more expensive to produce.

Heathrow Airport’s director of sustainability Matthew Gorman, who chairs Sustainable Aviation, said new technologies such as SAF will have a “green premium before the market scales up and costs fall”.

“There will be some additional costs for those, and that will have some impact on future demand,” he told PA. “But we can still grow significantly... because what the evidence shows is in most cases people are happy to pay a bit more to travel.”

The UK has ambitions for at least five commercial SAF plants to be under

The costs of jet zero will mean flights initially become more expensive

construction by 2025.

The Jet Zero Council will meet at Farnborough Airport today to devise a two-year plan on how to help accelerate the production of SAF amid warnings incentives in the US could mean the UK falls behind.

“At the moment, if you’re an investor looking to invest in a SAF plant, you’re going to go to the US rather than the UK,” Gorman said.

company filings.

OpenAI and Elon Musk were both contacted for comment.

Musk has previously been openly critical of OpenAI, which he cofounded before stepping down from the board in 2018 over reported conflicts of interest.

In a tweet in February, he criticised the company — originally a non-profit — for becoming profit-centred under Microsoft. Most recently, Musk also co-signed a letter calling for a pause in AI research, citing safety risks.

WHAT’S IN A NAME Twiggy loses trademark case over her name

Short seller Viceroy hits back after Labour MP suggests links to Putin

BEN LUCAS AND CHARLIE CONCHIE

A WAR OF words erupted between short seller Viceroy Research and Liam Byrne over the weekend after the Labour MP suggested the firm had ties to the Kremlin.

In a parliamentary debate last month, the MP called for an investigation into “the activities of

short-selling attack group Viceroy Research and its leader Fraser Perring”, adding that Perring was “not an infrequent visitor to Moscow”.

“We must ensure that short-selling groups are not another weapon in Putin’s arsenal,” he said.

However, Viceroy hit back at Byrne’s claims and demanded he retract them.

In a letter to Byrne seen by City A.M.,

Perring’s lawyers said he had “never been to Moscow” and the “imputation conveyed by this false statement is highly damaging”.

The lawyers also rejected suggestions that Perring or Viceroy had targeted scandal-stricken social housing firm Home REIT.

A spokesperson for Byrne declined to comment.

07 MONDAY 17 APRIL 2023 NEWS CITYAM.COM PA

Viceroy chief Fraser Perring denied that he had links to Moscow

Musk has been openly critical of ChatGPT owner OpenAI, the company he co-founded

SIXTIES icon Twiggy has lost a legal dispute with dog accessories company Twiggy Tags over the rights to her name, with the pet business allowed to proceed with registering its brand’s trademark. “Legendary status doesn’t give you automatic trademark rights,” said Lord Alan Sugar, whose company Trade Mark Wizards worked on behalf of Twiggy Tags.

Stockport named ‘one of the coolest areas of the country’ by The Times

8 minutes by train to Manchester city centre. Under 2 hours by train to London

Largest economy in Greater Manchester, topping UK regional growth forecasts Capital growth is forecast to increase by 19.3% in the next four years*

Limited investor options, high tenant demand Regeneration area with funding from Stockport council and The Heritage Fund Rental growth is forecast to rise by 21.6% in the same period*

St Mary’s Gate at The Underbanks Stockport

is phase one of a small residential development in the heart of The Underbanks regeneration area, built by a family run developer with a 25 year track record.

1&2

bed apartments

from just £173,000

Estimated completion Q3 2024. Many apartments have private entrance, outside space or winter gardens.

BuyAssociationGroup.com/en-gb/cityam-ub Call +44 (0) 333 123 0320 Scan the QR code to download your free investment deck now or visit: Why you should invest in the UK’s next property hotspot, Stockport, Greater Manchester. *Figures source - JLL report We are rated EXCELLENT

TOURIST TAX GAINS: ZILCH

Paris, Barcelona, er? Laura McGuire on why London isn’t taxing its tourists

WHATsets London apart from its neighbouring European cities? The City’s bustling financial centre?

A super-connected underground rail system? Its diverse population of inhabitants?

The answer could, in fact, be London’s hesitancy to tax its tourists for overnight stays. Even the country’s defacto second city Manchester has followed in the footsteps of Paris and Barcelona and introduced a £1 charge for all holidaymakers.

Called the ‘City Visitor Charge’, the fee will be added to the bill for every guest staying in one of the hotels within the Northern city and will, in theory, generate £3m which will fund a new business improvement district, ABID.

Whilst it’s not strictly a tax – Manchester City Council is only involved as they are handling the billing – it’s an interesting move and one that will be watched elsewhere.

According to the Greater London Au-

thority, in 2022 it was estimated that 11.2m tourists flocked to the capital. Accordingly, if London introduced a £1 tourist tax similar to Manchester it could take in a further £11m to pump across various sectors in the capital.

“London is out of step with other global cities that have charged a tourism tax for many years,” Nick Bowes, chief executive for Centre for London told City A.M.

“Allowing the city to come up with a

Paris €0.25-5

to make London an even more attractive place to visit.”

While it tends to fly under the radar, the argument for a tourist levy in London has existed for some time.

In 2017, a paper published by the Greater London Authority said that revenues from the tax could be used to fund “cultural attractions” and help bolster “hotel employees and owners for activities to support the sector such as education and training”.

Rome €3-7

A spokesperson for the Mayor told City A.M. that while he has “no powers” to implement a tourism levy he would offer his support to industry leaders in the hotel and restaurants businesses if they were to push for its introduction.

Barcelona €4-6.75

scheme that charges a few additional pounds a night on hotel bills would provide a steady income stream independent of the central government,” he explained.

“This would lead to vital reinvestment

They said: “The development of any such scheme would have to be led by London’s world-class hospitality industry. If industry leaders wish to develop such a scheme, the Mayor would support them.”

It seems there’s little chance of that for now. UKHospitality expressed fears that such levies could be “punitive” and “deter visitors” in what is an already challenging time for the sector.

Kate Nicholls, UKHospitality chief told City A.M., said: “UKHospitality has been consistent that levies that are punitive, deter visitors or are incorrectly targeted are ineffective and should be avoided at all costs.

09 MONDAY 17 APRIL 2023 NEWS CITYAM.COM

Piccadilly Circus is one of the most famous intersections on the planet with 100m visitors annually

THE NOTE BOOK

A lot to talk about at fintech summit

ITIS NO secret that the past months have been marked by turbulence: rising inflation, a persistent cost of living crisis, and a global-tech downturn dominating the economic picture.

Yet amid the uncertainty, there are grounds for optimism when looking at the UK’s fintech sector, which has continued to perform strongly against heavy headwinds to deliver for consumers and businesses.

The fintech sector can trace its roots back to the 2008 global financial crisis, emerging as a response to the call for greater transparency, choice and speed.

In 2022, despite the difficult global conditions, more than $12.5bn was invested into the UK fintech ecosystem – more than the 13 other best-performing European countries combined.

And the appetite for UK fintech is equally high among consumers, with eight out of every 10 adults in the UK using at least one fintech tool regularly.

Despite a recent slowdown in global investment, there are other signs that the UK remains a leading

BELFAST –A FUTURE FINTECH HUB?

place for fintechs looking to grow. Look no further than the incredible speed at which the government and the Bank of England responded to the collapse of Silicon Valley Bank.

With a fast intervention from Westminster and Threadneedle Street, the sale of the UK arm to HSBC was completed swiftly over the course of a single weekend –after markets closed on Friday and before they opened on Monday morning.

This was a testament to the government’s commitment to support this vibrant and thriving sector of our economy.

It was also indicative of the level of collaboration that exists within the ecosystem. This appetite to work together –industry, government and regulators –towards positive solutions is what will continue to set the UK apart from our international peers. These issues and more will be at the heart of the discussions taking place at the Innovate Finance Global Summit 2023 which kicks off today.

Last week, President Biden visited Belfast to mark 25 years since the signing of the Good Friday Agreement that brought an end to the Troubles. A big focus of Biden’s address was the potential of the youth in Northern Ireland. It is precisely these educated, passionate and entrepreneurial young people, many graduating each year from Northern Ireland’s world-class universities, who will help drive even more innovation across society. I, for one, cannot wait to see what the future holds for fintech in the region.

£ It was reported last week that the use of cash has fallen to its lowest point in 20 years, thanks to the incredible ease with which anyone can make and receive digital payments. Surely, you’d expect me to be the first to raise a glass to this momentum on the digital front? Yet inclusivity is key to a functioning financial system – so ensuring that we are supporting all individuals, including those that rely on cash, has to be at the core of our progress.

£ Leading voices in global financial regulation have made calls for stricter rules following the recent banking turmoil. Klaas Knot, chair of the Financial Stability Board, encouraged the industry to “learn lessons’’ from this. Indeed, this is a moment to evaluate the lessons. But it is also an opportunity to think about what the financial service industry will look like moving forward – and how collaboration can make sure the next chapter is a positive one.

CITYAM.COM 10 MONDAY 17 APRIL 2023 NEWS

Where interesting people say interesting things. Today, it’s Innovate Finance chief executive Janine Hirt

THEFUTURE of the UK’s steel industry remains in the balance – with no resolution over how to make the sector fiscally sound and environmentally viable after protracted negotiations between Tata, British Steel and the government.

The industry is under pressure from ultrahigh operating costs, powered by soaring energy prices after Russia’s invasion of Ukraine last year, and growing expectations to ‘go green’ through installing costly electric arc furnaces and producing more carbon-friendly steel.

Steel is an alloyed metal consisting of iron ore, limestone, sinter and metallurgical coal – with the furnaces typically powered by fossil fuels such as coal or gas.

It is essential for the ramp up in renewables needed to head off the worst effects of climate change.

Yet steel manufacturing is also responsible for seven per cent of global carbon emissions, with Port Talbot steelworks the single biggest carbon emitter in the UK –home to two of the country’s four blast furnaces.

If the taxpayers are going to be footing the bill, steel has to be a strategic asset to help the country go greener through decarbonisation.

GOING GREEN WITH STEEL HARDER THAN IT SEEMS

Port Talbot owner Tata has been in talks with the government over upgrading the furnaces to electric arc designs – made up of graphite electrodes and 50MW-per-hour electric currents – with gas providing around a third of the heat, before shifting over time to green hydrogen.

While a bailout deal had been expected in January, talks are still ongoing with Tata initially demanding £1.5bn in taxpayer funds to upgrade its business and the government offering £300m in response.

Negotiations between British Steel, which operates the UK’s two other blast furnaces in Scunthorpe, and the government are also at an impasse over cash.

This logjam to progress is frustrating with the Energy and Climate Intelligence Unit noting the EU already has 23 green steel plants underway, while the US Inflation Reduction act includes vast steel subsidies.

Nevertheless, green steel powering the UK’s green ambitions is easier said than done, with the sector clearly in decline. The industry now supports just over 33,000 jobs – a tenfold decline on its peak –and contributed just £2bn to the UK’s economy in 2020, around 0.1 per cent of

SHOWING SOME STEEL

While the UK produced seven million tonnes of steel in 2019, China produced 996m tonnes – with the country’s exports now flooding European markets and propping up much of the West’s renewables agenda from wind turbines to electrification.

It is unlikely the UK can compete directly

with this, and the government needs to press the industry into a ‘make-do-andmend’ approach to utilised resources –such as embracing the use of scrap steel.

FEEDING OFF SCRAPS

Scrap steel is a combination of waste metal material and repurposed steel, and is a perfectly valid material for construction in roads, bridges, pipelines,

home furnishings and even some electrical appliances.

As it stands, over a third of the world’s production – around 680m tonnes – is being recycled, shaving off around a billion tonnes in CO2 emissions alone.

The UK, with its 33m cars and 25m homes, generates comfortably enough scrap steel to provide for all of the material it currently uses, but its potential is unfulfilled.

Verner Viisainen, of environmental think tank Green Alliance, told City A.M. “The UK produces millions of tonnes of scrap steel every year, but it is currently being wasted and exported overseas. Instead, by recycling the steel domestically, it could help cut emissions when used in tandem with electric arc furnaces. There is a great opportunity here for the UK to increase its self-sufficiency and futureproof this strategically important sector for net zero.”

The London Metal Exchange (LME) has seen a significant uptick in investor interest in scrap steel. However, this was in emerging markets with easily secured contracts for commodity trading.

Alberto Xodo, vice president of sales at the LME, told City A.M., that its most successful contract was the steel scrap benchmark for Turkey, which is based on scrapping imports into the country.

In the eight years since launch, its prices have risen from $180-200 (£145-161) to around $440 (£354) per metric tonne today.

“The good thing about scrap is that it’s a great way of decarbonising the industry and reducing emissions. Scrap generation has much lower CO2 emissions, greenhouse gas emissions, and much lower energy consumption,’ Xodo said.

Alistair Ramsay, vice president of Rystad Energy, argued the UK had an opportunity to create its own domestic scrap sector –even if there was a potential three-decade timespan on the sector before the likely pressure of material shortages.

He said: “It is also becoming increasingly regional as different countries’ steelproducing fraternities successfully lobby governments to block its export. This lobbying is in fact directly related to net zero strategies, given how scrap, from an emissions perspective, is the most attractive raw material available to steel mills.”

In such circumstances, scrap steel has to be part of the debate in reforming the industry – if the UK wants to ensure real value for the taxpayer and present a realistic proposition for going green in a global renewables race.

11 MONDAY 17 APRIL 2023 NEWS CITYAM.COM “I moved my ISA to InvestEngine and couldn’t be happier” Find out just how powerful, easy and affordable ETF investing can be Earn up to £125 bonus Sign up before 2nd May 2023* Transfer or open your free ISA at investengine.com/ISA-CityAM A t d ISestEngine uldnoand c ev“I mo - James, Smart Money P ut ho ind oF e happi t b’uldn d my ISe oney People asy ul, e erffu w w ”ere happi ngine estEvnoIA t esting cv ETF in dableorff ffoa ean b esting c e 2nd M efor fo ign up bS 5 b12£ ot 23*ay 20 us on5 b -CAom/ISc.engineestvin freneureryoor op ansfrT *Ts Ts&Cs apply. Capital at risk. ETF c A ate IS . ETF costs apply nge. ENERGY City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his weekly column

The London Metal Exchange has seen a real uptick in interest

CITY DASHBOARD

Week ahead: Inflation poised to finally slip out of double digits

UK INFLATION is poised to slip out of the double digits for the first time since last summer in what could be the beginning of the cost of living crisis gradually releasing its grip on families over the rest of the year. Official figures from the Office for National Statistics (ONS) on Wednesday are expected to show inflation trimmed to 9.8 per cent in March, down from 10.4 per cent.

A large drop in petrol prices is tipped to bring down the consumer price index, Britain’s main measure of inflation.

Most economists reckon inflation will now fall throughout the year, possibly to around three per cent by Christmas. It has been in the double digits since last September.

But there are likely to be strong price pressures hidden within the numbers,

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

To appear in Best of the Brokers, email your research to notes@cityam.com

TURNING

CORNER

with the rate of core inflation poised to stay elevated.

Elsewhere, jobs figures from the ONS on Tuesday are tipped to show unemployment held steady in February at 3.7 per cent, a multi-decade low. That could raise expectations for another rate rise from the Bank on 11 May. Officials at the central bank are concerned that strong wage growth amid a tight labour market could keep inflation above its two per cent target over the long term.

Fresh Purchasing Managers’ Indexes (PMI) out on Friday, which are closely watched by the City, could show British factories are performing a bit better despite a big rise in costs.

On the corporate front, online fashion retailer THG posts final results on Tuesday, while US banks’ earnings season draws to a close.

YouGov announced last week that Steve Hatch will be joining as the firm's new CEO on 1 August. Analysts at Peel Hunt believed this was “a high-quality appointment” for the polling firm. Despite its share price falling more than 30 per cent over the past year, Peel Hunt said the company’s shares remain “undervalued” and reiterated its buy recommendation with a target price of 1,295p.

Fashion chain Superdry warned that it no longer expects to make a profit for 2023 and revealed plans to cut costs by more than £35m after a sluggish start to the year. Analysts at Peel Hunt said the cost saving measures “goes some way to getting the group back onto the right path”. Peel Hunt, however, held its buy rating with a target price of 200p.

NEWSLETTERS CITYAM.COM/NEWSLETTERS SIGN UP TO OUR THREE DAILY EMAILS - MORNING, NOON AND NIGHT

The biggest stories direct to your inbox Breaking news, exclusives, scoops, interviews, blogs, opinion, sports, life & style, travel and more. LONDON REPORT BEST OF THE BROKERS

P 14 Apr 89 11 Apr 6 Apr 13 Apr SUPERDRY 14 Apr 12 Apr 85 95 90 110 100 105

P 11 Apr 6 Apr 13 Apr YOUGOV 14 Apr 876 14 Apr 12 Apr 850 870 860 880 890

A

“It’s been better-than-feared news on the UK economy since the turn of the year. We’ll probably get a bit more of that this week when numbers on Wednesday show inflation has slipped out of the double digits for the first time since last summer. Don’t bet against another rate rise from the Bank next month though.”

JACK BARNETT, ECONOMICS EDITOR

CITYAM.COM 12 MONDAY 17 APRIL 2023 MARKETS

OPINION

EDITED BY SASCHA O’SULLIVAN

Renaming the Met Police would give it a license to ignore wholesale reform

signal broader, more profound reform.

IT is only six years until the 200th anniversary of the Metropolitan Police Act 1829, the statute which created the modern system of policing that London has today. Even in a country as steeped in heritage as this one, that is quite extraordinary. Think about it: the one-time Prince Regent, the buffoonish figure played by Hugh Laurie in Blackadder the Third, was still on the throne when our police force was first established. But change is in the wind. The Metropolitan Police has lurched from crisis to catastrophe over the past decade or two, at an accelerating pace, embroiled in financial, ethical, racial and sexual scandals, as well as accused of basic inefficiency. The latest blow came last month with the publication of a review of the Met’s standards of behaviour and internal culture by Baroness Casey, one of our most eminent quangocrats. The review exposed institutional racism, sexism and homophobia, and said the Met was unable to enforce its own standards.

It is not yet clear whether the Casey review is another in a series of death by a thousand cuts, or whether it will prove to be the proverbial camel-endangering straw. It is, however, obvious that this is a desperately serious situation. The capital’s police force, long mistrusted by ethnic minorities, is

now becoming even more widely discredited and diminished, dismissed as obsessed with modish gender and race jargon but incapable of enforcing the law.

Three of the last four commissioners of the Metropolitan Police have resigned under challenging circumstances, and media outlets never have to look very far for an interviewee to criticise the police, whose chyron will display some variant of the words “Former officer, Metropolitan Police Service”. The Met faces a crisis which is genuinely existential, as there are calls for it to lose its national responsibility for counter-terrorism or otherwise be remodelled to pursue its core duties.

Enter Sir Keir Starmer, leader of the Labour Party (and former director of public prosecutions, lest we forget). Speaking on the News Agents podcast, he described the scandal of David Carrick, the policeman and serial rapist nicknamed “Bastard Dave” by his colleagues, as “jaw-droppingly shocking” and acknowledged a slew of other instances of criminal conduct by police officers.

Among his other proposals, Sir Keir suggested that any reform of the Metropolitan Police might have to look to the Northern Ireland peace process as a model and consider a change of name. “If changing the name signals a change”, he argued, it was a step

worth considering. Nothing should be out of bounds. “Do we need to strip it down? And look again? Yes.” It would be unfair to suggest that rebranding was Sir Keir’s only suggestion, but it is significant because it indicates the way his mind works. And he shares a mindset with many politicians. What’s in a name? Well, for ministers and MPs, quite a lot. Changing an organisation’s name is always tempting for politicians because it is an immediate indicator of change and it can be done solely by their fiat.

Look at the way prime ministers change the names of Whitehall departments. It happens at the wave of a hand. It is eye-catching and attempts to

London fintech punches above its weight, but it still needs to stay ahead of the curve

IF there was ever a sector in which the UK was punching well above its weight, it’s our fintech and start-up scene. The UK’s world-leading fintech sector has a 10 per cent global market share and our success is reflected by the historic levels of investment into the sector over the last five years.

Fintech brings together our existing strengths in financial services with our growing tech expertise. The result is a sector that ranks third globally in terms of venture capital invested, behind the United States and China. Last year alone, over $12.5bn was invested in UK fintech. That investment supports our outstanding fintech companies, of which over half of Deloitte’s top 50 fintech firms are based here in London, whilst a further 2000 businesses are spread across the UK in fintech hot spots like Cardiff, Leeds, Edinburgh and Bristol.

To truly harvest our fintech rewards, to ensure that London and the wider UK remains a world-leader for years to come, we need a concerted effort to

Chris Hayward

fast-track visa system for fintech scale ups to make it easier for firms to recruit and retain talent.

In this case it would be a mistake. Not only would it serve as a proxy for real action, allowing any home secretary or mayor of London to sit back and congratulate him or herself for decisive change. The rechristening of the Royal Ulster Constabulary as the Police Service of Northern Ireland, while bitterly controversial, achieved something for the nationalist community because it removed the word “royal” and its hated associations with British governance. But it also required a decade of affirmative action to recruit substantial numbers of Catholic officers.

Anyone familiar with the corporate world knows, however, that rebranding is always expensive but not as reliably effective, and sometimes damaging. Twenty years ago, Royal Mail briefly became Consignia, attempting to broaden its business from simply carrying letters and parcels. A public backlash saw it simply as junking the organisation’s heritage, and after spending millions of pounds it reverted to Royal Mail in the summer of 2002.

Renaming the Met would be a quick win. It would suggest to the public that the government “got it”, that it understood the need for London’s police to change and had acted quickly and decisively. But it would risk standing as a proxy for achieving deeper cultural change, which the Met very urgently needs. And it might risk tarnishing the force’s reputation still further. It is a politician’s response, and, without wanting to be too harsh to Keir Starmer, it just isn’t enough.

£ Eliot Wilson is co-founder of Pivot Point and a columnist at City A.M.

WHAT NEXT?

continue innovating, building partnerships, and investing. The Kalifa Review, published in early 2021, warned that a “digital big bang” was necessary for the UK to remain competitive in the sector.

A key recommendation was a Centre for Finance, Innovation, and Technology, to strengthen national coordination across the fintech ecosystem to boost growth. This was finally launched recently, with the financial backing of Treasury.

Since Kalifa, the government has worked closely with industry and regulators to deliver on other recommendations, including introducing a

Most crucial, is the continued work to reform our listings regime to keep London an attractive destination to list. This has received increasing attention in recent weeks, as firms continued to choose the US over London. City of London’s annual benchmarking report of global financial centres performances has highlighted the increasing levels of investment being drawn away from our shores. Part of ensuring these businesses are not drawn to Wall Street or elsewhere is plugging the funding gap that highgrowth firms like those in fintech face.

The UK’s strengths in fintech are in areas such as payments, wealthtech, and especially regulation technology. With rules growing and evolving to keep up with technological changes, it’s up to businesses to be proactive and detect and prevent compliance issues within their own operations, but for many this is costly and inefficient. Reg-

ulation tech creates a cost effective way to deliver productivity gains, and keep costs down – essential requirements if a firm is to remain competitive in financial services. The sector has drawn nearly £14bn of funding in the last couple of years.

We should be nurturing competitive strengths in fintech. The City of London Corporation and Innovate Finance are working together to build on this. Creating further successful regulation tech will enable all future fintech companies to succeed in the future, with a strong backbone to focus on growth while meeting regulatory requirements.

Since the Kalifa Review, our fintech sector has made significant progress, moving from strength to strength. It is crucial that collectively, across government, regulators, and industry, we continue to address the challenges facing the industry and do all we can to maintain our fintech crown.

£ Chris Hayward is the Policy Chair of the City of London Corporation

Many, many people have voiced many, many criticisms of Elon Musk’s Twitter. But today, the question is not what will happen to blue ticks, but what bizarre thing with the Tesla CEO say next?

Last week, he started posting, uh, phallic related jokes about French novelist Honore de Balzac

CITYAM.COM 14 MONDAY 17 APRIL 2023 OPINION

Eliot Wilson

Sir Mark Rowley has promised to reform the Metropolitan Police

LETTERS TO THE EDITOR Internet, uninterrupted

[Re: We either need to break up broadband monopolies or nationalise connectivity, April 14]

In an opinion piece on Friday, Jon Seal lamented the state of UK broadband, and said we should ‘open up the market’ or nationalise it. However, he seems to be a few years behind in his understanding of the market, and I have good news for him – the problems he identified are well on their way to being solved.

Mr Seal claims that just 8 per cent of UK homes have access to full-fibre broadband. However, that’s a figure from 2019. Today, roughly 50 per cent of homes have full-fibre access, and if we

add Virgin Media’s cable coverage, 75 per cent of homes can access gigabit services. Further, these figures are increasing rapidly. Openreach alone is deploying fibre to 25m premises, or 84 per cent of the country.

Bafflingly, Mr Seal claims that “the lack of competition in the market [means] infrastructure is not being upgraded”. In fact, the UK has over 100 operators deploying full fibre. Their announced deployment plans are equivalent to 2.5 fibre connections for every premise in the country.

There’s no need to stress about opening the market – it’s already happened. And there’s certainly no need for the government to spend the tens of billions that nationalisation would require.

Robert Kenny Communications Chambers

CHATTING IT UP European leaders hatch plan to regulate AI technology

Our measure of productivity should be how much energy it takes to create new growth

Martin Rossen

OVER the last decade, we stopped talking about productivity. We shelved it from our political vocabulary. As economies struggle to get back on track, it has made a slow return to our lexicon.

In February this year, Jeremy Hunt, the UK Chancellor laid out a four point plan to boost productivity. At the same time, he said billions more would be spent on the energy price cap. Productivity of our workers and our businesses is essential for growth, but what matters just as much, if not more, is energy productivity - the volume of services or products we can generate per unit of energy.

One of the biggest challenges for the UK and for Europe is maintaining competitiveness in the face of America’s muscular, pro green-business incentives laid out in Joe Biden’s Inflation Reduction Act. Productivity growth in the euro area has been muted for decades for various reasons, trending downwards. According to the ECB, average annual growth in labour productivity – measured as real GDP per hour worked – in the euro area countries that have sufficiently long time series has continuously declined from about 7 per cent in the 1960s to around 1 per cent in recent years.

EXPLAINER-IN-BRIEF: ARE WE RUNNING OUT OF WATER?

Last week, a senior water executive took the dramatic step of telling Brits to stop flushing the toilet after they wee to save water.

The comments came from Cathryn Ross, the strategy and regulatory affairs director at Thames Water, who said our current water consumption was ‘unsustainable’.

There is cause for concern.

British hotters are set to get hotter, increasingly the likelihood of drought. At the same time, our population is expected to grow.

The chief exeucive of the Environment Agency has suggested parts of England will run out of water by 2050.

But it was still quite an astonishing comment from Thames Water, who last summer admitted to wasting millions of litres of water every day thanks to leaks they have failed to fix.

The water company - the very same pumping sewage into the sea - was ordered to focus on fixing the leaks before it resorts to using treated waste water in London taps.

Since the financial crisis, we have benefited from both cheap and relatively stable energy prices along with low interest rates, meaning that the money has been uncritically invested in overpriced properties and digital startups, instead of increased productivity.

Focusing on labour productivity, as Hunt and European leaders have done, is a useful metric. But as is energy productivity, which begins to address this question of competitiveness, while also furthering ambitions to reduce our reliance and expenditure on energy imports. It also leads to higher energy security and more job creation.

New EU-wide data from January 2021 to January 2023 show that the price of energy in the EU reached record levels in 2022. The causes of this rise are well documented, dating back to the second half of the pandemic and growing international demand, and aggravated by Ukraine and extreme weather events across Europe.

In Asia and the US, energy prices

have not risen to the same highs as in Europe, and they are unlikely to do so. Our energy markets are much more closely tied to the war in Ukraine, and heatwaves from summer last year meant we needed more, while producing less.

The erosion of Europe's competitiveness will continue if politicians and business leaders do not integrate energy productivity at its core of their future growth strategies and place it as the new competitive parameter.

Paradoxically, efficiency progress is slowing in the industrial sector. From 2015 to 2020, the rate of improvement in the energy needed to produce one US dollar of industrial value dropped from the almost 2 per cent per year achieved over 2010-15 to just under 1 per cent. The industrial sector needs to improve its energy efficiency at a rate of 3 per cent annually to meet net zero

This is not even difficult. We have most of the solutions to reduce energy consumption and increase energy pro-

ductivity and the costs are significantly lower than building out renewables. If we do nothing, we are looking into a future where high energy costs and a faltering transition to a green economy mean our future growth cannot be based on increased energy consumption. On the contrary, the key to a competitive, green European business is precisely that we manage to get more value out of each unit of energy than we do today.

In 2013, US President Obama challenged his countrymen to double U.S. energy productivity over 2010 levels by 2030. The challenge was drowned in congressional banter, but the idea was good. Europe could set a similar change. If we don’t, security of supply will decrease, competitiveness will decline relative to the US and Asia and access to affordable energy will become even more scarce.

£ Martin Rossen is senior vice president of communication at Danfoss

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900 Email: news@cityam.com Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com Editorial Editor Andy Silvester | News Editor Ben Lucas Comment & Features Editor Sascha O’Sullivan Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Commercial Sales Director Jeremy Slattery 15 MONDAY 17 APRIL 2023 OPINION CITYAM.COM

HEAR YOUR VIEWS › E: opinion@cityam.com COMMENT AT: cityam.com/opinion

WE WANT TO

European parliament is getting ready to introduce new measures to dramatically curb the use of artificial intelligence. It comes after ChatGPT was accused of using copyrighted material and content behind paywalls.

Certified Distribution from 09/01/2023 till 26/01/2023 is 67,090

Joe Biden’s Inflation Reduction Act is seen by many as a threat to UK competitiveness

I’Madmiring the rolling plains of the Lapalala Wilderness Reserve, but not with the naked eye - on a computer screen. Flashing red dots indicate roaming beasts, rhinos and leopards, which are being monitored, and tiny, moving shapes show the reserve’s trackers as they drive around this remote part of northern South Africa.

We’re three hours from Johannesburg in the operations suite of Lapalala’s anti-poaching unit, where an ‘unseen’ task force of 17 men and women work. Some are ex-military or ex-police, targeting the theft of rhino horn, said to be one of the most valuable commodities in the world.

Going to South Africa to see the wild animals is nice, but these days, responsible tourism means doing our bit to understand the threat to the animals we love, and how we can help.

Glenn Philipps, CEO of Lapalala Wilderness Reserve, tells me that up until 2019 the reserve was miraculously free from poachers. “But we knew they were coming,” he says. “Rhino horn sells for one million rand, approx. £50,000, per kilo and so poaching is one of the most lucrative targets for organised criminal gangs. Many animal sanctuaries in Africa have already resorted to dehorning rhinos to avoid the poachers killing the animals. “We are one of the last places not to do that, hence why we now have such a high level security strategy.”

State-of-the-art surveillance cameras and GPS systems track wildlife, and there are 15 field rangers on fence duty around the clock (it takes a full two weeks to walk the whole perimeter of the reserve which stretches across 50,000 hectares). Intelligence on any attempts to poach is shared with other reserves in the country.

“Without building a relationship and developing trust with local people, poachers will find a way to infiltrate the communities,” continues Glenn. “We’ll help where we can to build trust – only last week we heard a water pipe had broken so we sent a few guys to fix it. When locals understand what we are trying to do, they are on side. After all, our job is to simply protect these amazing animals.”

The Lapalala Wilderness Reserve was created in the 1980s for that very reason. Two conservationists, Dale Parker and Clive Walker, (the latter founded The Endangered Wildlife Trust) began purchasing neighbouring farms to create a private reserve for black rhinoceros, which they re-introduced in 1990. Now it is one of the leading rhino sanctuaries in South Africa. There is also a focus on cheetah and pangolin conservation, as well as being home to the ‘Magnificent Seven’ (lion, leopard, elephant, rhinoceros, buffalo, cheetah and wild dog). With an eye on the future, the duo also set up the nearby Lapalala Wilderness School, which thousands of youngsters attend each year to learn about ecology and conservation.

Bumping over terracotta-red earth, past anthills stretching metres high and swerving snooty giraffes blocking our path, we’re driving an hour north to Noka Camp, which works alongside Lapalala to fund research to establish the reserve as a centre of excellence, offering standout wildlife experiences to guests.

One of Africa’s few entirely not-for-profit safari lodges, Lepogo, says Kate, was devel-

SUPPORTING SOUTH AFRICA’S WILDLIFE, LIVING IN UTTER SPLENDOUR

THE TRAVEL HACK

If you’re staying in London for the King’s Coronation, why not live like the King for a weekend and book the DUKES Coronation package? Get tailoring experiences at St James tailors that work for the King, and a meal inspired by King Charles’ favourite foods. dukeshotel.com/coro nation-package/

oped as part of a life-long dream to create a sustainable conservation legacy in Africa, with 100% of any financial gains made reinvested back into the reserve.

From the moment you arrive at Noka you are immersed in the depths of wilderness that surrounds the tiny lodge. Built on top of a 100ft cliff, each of its five villas offers views across the undulating bush and over the Palala River. Entirely off-grid, there are no electricity lines or buildings. Instead, power is gained from solar panels built into the roof of a walkway that connects the villas and communal areas. From your bed, you can spend hours watching rainbowcoloured lilac-breasted rollers or European bee-eaters swooping through the sky. It’s as if you’ve sunk into the pages of a magical realism novel.

Architect Yuji Yamazaki sought inspiration from his award-winning, over-water villas in the Maldives. Meanwhile, the interiors, by Cape Town-based designer Sarah Ord, are inspired by the locality. Soft rosepink day-beds reflect the sun-dried earth and hand embroidered mats are made by a local woman’s co-operative. There are pastel-coloured textiles, side tables made of recycled cork and pretty, beaded lampshades sourced from local artisans.

‘Lepogo’ means ‘cheetah’ in the local Sotho language, and Kate has been instrumental in funding a breeding programme for these animals. During one of the twicedaily game drives, we are lucky enough to see the results of this up close, when our guide Juan decides its safe for us to ap-

proach a relaxing cheetah and her cubs on foot, going near enough for her to curl her lip in warning and causing us to silently retreat. Cheetahs are far rarer to see than lions so I feel really lucky.

No game drive disappoints. Each morning we leave the lodge early, just as the sun begins to streak the sky a candy-cotton pink, and we pass countless zebra, impala, antelope, wildebeest and, yes, many black and white rhino. From high up in the luxury Land Cruiser, it’s a full-throttle experience, with the sharp-eyed Juan pointing out wildlife scenes most of us have only seen in The Lion King.

We trace a sleeping pride of lions; ox-

CITYAM.COM 16 MONDAY 17 APRIL 2023 LIFE&STYLE

TRAVEL

One of South Africa’s only not-for-profit lodges invites Angelina Villa-Clarke to become a part of their conservation legacy

PINE CLIFFS ALGARVE, PORTUGAL THE LONG WEEKEND

The Pine Cliffs resort is the perfect location to explore the Algarve, finds Angelina Villa-Clarke

BOOK THIS

Are you a watersports lover looking for somewhere new? Lithuania is an underrated destination for surfing and sailing, with guaranteed waves near the pretty port town of Klaipėda, and mediaeval views when sailing around the beautiful Trakai Castle on Lake Galve.

peckers picking ticks out from the ears of giraffe; a giant kingfisher high in the branches of a baobab tree.

After nightfall, we look for the yellow eyes of the jackal. We learn that a cloying popcorn smell means leopards are nearby and that a pungent scent, which Juan describes as “smelling like death”, is the Silver Cluster tree. There are giant flying dung-beetles to avoid that “can take your eye out” and

warthogs that trot fancifully past, breaking the tension by making us laugh.

We pit stop for a sundowner each night, a glass of something fancy with the palpable threat of predators lurking nearby. One morning, we’re taken for a ‘secret breakfast’, served in a disused wooden hut, with the Waterberg Mountains misty in the distance. Frogs croak dutifully along, and there’s homemade granola and lamb sausages cooked over coals.

In-between game drives I splash into my private plunge pool to counteract the heat of the midday sun. White and lemon tinted butterflies land on the water to join me in my splash about. Another day I soak the dust away in the huge tub with locallymade aromatherapy oils. There’s a complimentary larder of snacks, home-made nachos and brownies, and one day, I practised yoga on a raised deck while a friendly impala watched from below. At the bar, there’s Amarula and coconut cocktails to taste and local food like kingklip fish and African sweet potato curry.

Night descends fast at Noka. Ask for a ‘sky bed’ to be made up on your terrace. You’ll sleep shrouded under mosquito nets, slumbering under what must be the brightest, star-lit sky on earth. Just remember to close your eyes.

NEED TO KNOW

Rates at Lepogo Lodges start from £806 per person, per night for a Luxury Clifftop Villa on an all-inclusive board basis. lepogolodges.com

THE WEEKEND: Perched on the cliffs above Falésia Beach on Portugal’s Algarve coastline, Pine Cliffs resort is the perfect gateway to exploring this sun-drenched region of southern Portugal. In reach are resort towns, such as Vilamoura and Albufeira, as well as the charming inland village of Estoi and Santa Bárbara de Nexe (the latter is renowned for its accordion-playing inhabitants). The Seven Hanging Valleys trail is also a must-do. The trail starts from the Vale Centianes Beach and takes you 5.7km along a rugged coastal path to the stunning Marinha Beach, voted one of the top ten beaches in Europe. The walk is known for its epic views across the Atlantic, over sea arches and dramatic rock stacks.

THE STAY: There is loads to do in the area, but you won’t get bored at Pine Cliffs Resort. You can stay in the central hotel or in one of the newer ocean suites, which are apartment- style, suited to families. The sprawling property, part of Marriott’s Luxury Collection group, stretches across 172 acres and has a nine-hole golf course, 11 restaurants and bars, eight pools, a health club and a destination spa. From the handpainted tile headboards to the piazzas with potted lemon trees, Pine Cliffs may be vast, but it

manages to conjure a real sense of place through its design ethos.

DON’T MISS: The Serenity Spa has 13 treatment rooms and an extensive thermal suite offering a range of hot and cold therapies, and cutting-edge wellbeing treatments. Facilities include a hydrotherapy pool; sauna with Himalayan salt; steam room and Kneipp therapy pool. Treatments include new CBD therapies, in partnership with British organic brand Ila. There’s also a Turkish bathing ritual, which takes place in a traditional marble Hammam and there are dedicated men’s treatments by Gentlemen’s Tonic. The ‘Senses of the Algarve’ body ritual is a highlight and harnesses local ingredients, such as sea salt and sand within a scrub, and carob in the body wrap. The 90-minute experience concludes with a deep body massage using Algarvian orange essential oil.

THE FOOD: There’s a huge choice on offer – from casual Portuguese dishes at Corda Café to standout seafood at the beachside Maré (think: seabass ceviche and fried cuttlefish). There’s Japanese fine dining at Yakuza Algarve by Oliver and champagne cocktails at the clifftop Mirador Champagne Bar. For something healthy, Zest offers acai bowls, keto salads, smoothies and immunity ‘shots’.

ASK ABOUT: MIMO Algarve is part cookery school and part intimate dining venue. By day, you can learn to cook local dishes, such as bacalao (or salted cod) or embark on a wine-tasting course. By night, it transforms into a space for tapas events and gourmet Chef’s Table suppers.

AND AFTER THAT? Book a tour with the local company Algarvian Roots. Founder Francisco Simões specialises in bespoke itineraries which take you off the beaten track. There are hikes through the hills of Monchique, via cork forests and oak woods, olive oil tastings on rural farms and pottery workshops with local artists.

TRY SOME SPORT: The fitness facilities at Pine Cliffs are top tier –from the Annabel Croft tennis academy to the new outdoor circuit training, called Bootcamp Active. It’s made up of interesting obstacles and a 250 metre running path, inspired by military training techniques. A range of specialised training plans tackle muscle toning, weight loss, rehabilitation from injuries and performance fine tuning.

NEED TO KNOW: Rooms at Pine Cliffs Hotel are from £230 B&B in a deluxe room resort in May. Easyjet flies from London to Faro from £65 return.

17 MONDAY 17 APRIL 2023 LIFE&STYLE CITYAM.COM

FOOTBALL FOOTBALL

United go third as Champions League place edges closer

MATT HARDY

MANCHESTER United continued their push for Champions League qualification with a 2-0 victory over strugglers Nottingham Forest yesterday in the Premier League at the City Ground.

The result puts Erik ten Hag’s side third, six points clear of Tottenham Hotspur in fifth and three ahead of Newcastle United in fourth.

Forest remain in the Premier League relegation places and are 18th, level on points with Everton in 17th but with a worse goal difference.

HAMMER BLOW

Ham United yesterday.

The Gunners scored twice inside the opening 10 minutes before blowing a two-goal lead and drawing 2-2 for the second match in succession – even missing a penalty for good measure. It leaves them four points ahead of Manchester City at the top of the table, but having played one game more than the champions, who they face in a huge fixture on 26 April.