WE’RE STILL TOP OF THE TREE FINTECH BOSS JANINE HIRT IS STILL BULLISH ON LONDON P11

COR BLIMEY HEAD TO THE GREEK ISLANDS THIS SUMMER P18

JACK

BARNETT

ACCESS to mobile bank accounts and customers being able to flag concerns about the health of lenders rapidly via social media has raised the risk of Silicon Valley Bank (SVB) and Credit Suisse style collapses happening again in the future, Andrew Bailey warned yesterday.

Speaking at an event at the International Monetary Fund’s spring meeting, the governor of the Bank of England said onhand communication channels such as Twitter and Whatsapp mean bank “runs can go further much more quickly”.

Customers yanked cash from SVB last month almost instantaneously after rumours spread on social media that its huge bet on US government debt was failing .

Greater likelihood of sudden and huge withdrawals sparked by speculation “must beg the question of what are appropriate and desired liquidity buffers” to help banks to survive such runs, Bailey said.

CHARLIE

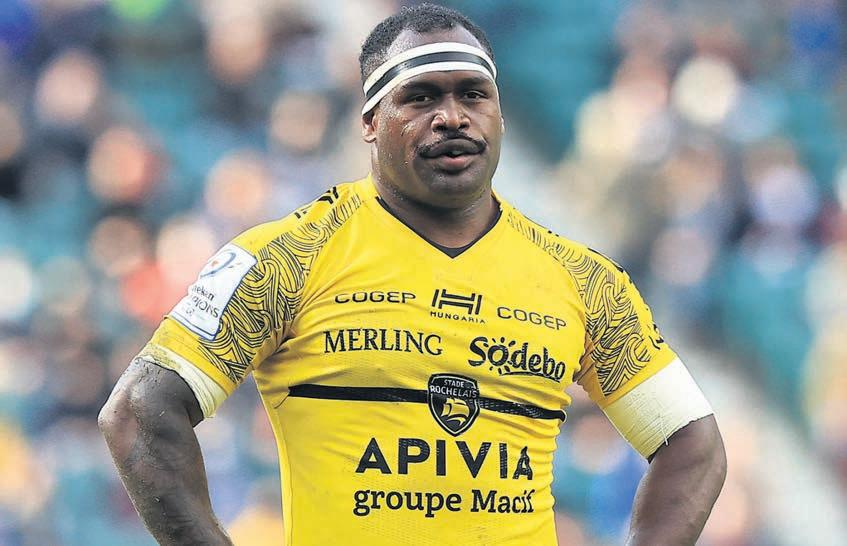

STORIED banknote-maker De La Rue said profits would slump below expectations and warned of a “significant degree of uncertainty” yesterday as it struggles to cope with a downturn in cash usage.

In a trading update, the firm said fullyear-adjusted operating profits would come in below an initial £30m forecast after a sharp fall in demand for its banknotes over the past year.

“The downturn in currency, impacting both De La Rue and the wider industry, is causing a significant degree of uncertainty in terms of outlook for the [full-year

than it has been for 20 years.

Bosses said they had requested a deferral of an £18.75m payout into the firm’s pension scheme and had been forced into negotiations with its bankers to try to rejig the terms of its covenants.

The firm slashed its profit guidance for next year to “the low £20m range”, down from a previous forecast of £40m.

Shares in the firm collapsed more than 21 per cent after the update yesterday, with brokers at Numis placing their recommendation for the stock under review as they await the outcome of the

tenders underway, the timing of recovery remains uncertain,” said Numis analyst James Beard in a note.

The profit warning underscores the struggles of the 202-year-old note printer to diversify beyond its historic staple as cash usage plummets around the country.

Efforts to push into authentication and central bank products have failed to impress investors, with its share price cratering over 91 per cent in the past five years.

The chief of pricing firm Updata, David Linton, told City A.M. yesterday bosses had

“What the stock market was telling the management at De La Rue for more than a decade was that they were in longterm decline,” he said. “Did the market know something that De La Rue’s management didn’t?”

Yesterday’s warning marks the latest troubles for the firm after an aggressive campaign by investor Crystal Amber –one of its biggest shareholders –calling for its chairman Kevin Loosemore to be ousted.

Crystal Amber said last week that De La Rue’s turnaround efforts had “failed by every measure” in a scathing attack.

SVB failed after customers wised up to the US tech lender’s massive wager on US government debt being on track to sour as a result of steep rate rises.

Before it went to the wall, SVB had hundreds of billions of dollars of unrealised losses on its balance sheet.

That event amplified concerns about other lenders being snagged by the higher rate framework, igniting a deposit flight at Credit Suisse.

That recent string of chaos in the global banking system would not distract the Bank from trying to tame inflation, Bailey, a former head of City watchdog the FCA, stressed yesterday.

THE GOVERNORIN 1900, Manhattan saw its first automobile show with pioneers of the industry hawking their (rather slow) wares to an almost disbelieving public. But it took another 20 years for New York’s transportation authorities to install the city’s first traffic light: a 20-year lag between the arrival of the car and a measure to stop them driving into each other. It is worth remembering this as we embrace the digital revolution. Modern technology is moving so

fast that putting traffic lights up today will likely be irrelevant in five years’ time. There were whole teams of regulators working out how to ensure text messages between financial services colleagues could be monitored in the aftermath of the global

financial crisis, only for Whatsapp to turn up and add another layer of complexity. There is now much chatter of regulating AI, despite the fact that by the time governments -- not known for their fleetness of foot -- get something written down on paper, the technology will almost certainly have evolved unrecognisably. In short, attempting to hold back new technology with regulation is akin to King Knut’s attempt to hold

back the tide. What businesses and institutions need to do is adapt, swiftly, when new technology arrives. To that end, Andrew Bailey’s comments yesterday on social media fuelling ever-faster bank runs are striking. He seemed to propose, gently, that combined with the ability to pull out funds with the click of a mouse, the digital transformation of financial services could lead to higher regulatory fences for capital buffers in banks. That

CAN WE TEMPT YOU? Labour leader Sir Keir Starmer and shadow chancellor Rachel Reeves in

UNDERLYING US inflation is putting up a strong fight against the Federal Reserve’s aggressive interest rate hike assault, while general price rises are falling quickly, sending mixed signals to chair Jerome Powell and co ahead of their interest rate decision next month.

Official figures out from the US Bureau of Labor Statistics yesterday showed the underlying rate of price increases – known as core inflation, seen as a more accurate measure of price pressures – hit 5.6 per cent last month.

The reading was in line with Wall

Street’s expectations and is up from 5.5 per cent in February.

The US’s tech-heavy Nasdaq, S&P 500 and Dow Jones stock indices all dropped after a few hours of trading.

The US dollar weakened around 0.4 per cent, according to the Wall Street Journal’s dollar index.

The core inflation rise signals the Fed’s rapid interest rate hikes have yet to fully filter through the US economy.

“This report will not prevent the Fed from hiking in May; officials have made it clear that they want to see a run of slowing increases,” Kieran Clancy, senior US economist at Pantheon Macro-

economics, said.

But a separate reading suggested the rate of price increases is on course to fall quickly this year, suggesting the Fed’s efforts are already taking effect.

Consumer price inflation, the US’s official inflation measure, tumbled to five per cent on an annual basis, lower than Wall Street’s 5.2 per cent forecast and the lowest rate in nearly two years, convincing some the Fed may hold off on further hikes.

New numbers for the UK out next Wednesday are expected to show inflation has finally dropped out of the double digits.

instinctively seems a bad idea: it would hold back businesses because of new technology preventing innovators, disruptors and new players from adapting to it. We are moving to a world where regulators and central banks will have to set principles for the use of new technology, rather than attempt to either constrain it or set rules for each new development. Moral of the story: working in compliance is about to become very lucrative.

The UK and the US yesterday announced a fresh package of sanctions against several “financial fixers” who have assisted Russian oligarchs, including Alisher Usmanov, the metals executive.

A leaked recording suggests World Bank staff were told to ‘curry favour’ with the son of a Trump administration official in 2018 after the US Treasury threw its support behind a $13bn (£10bn) funding increase for the organisation.

The former health secretary Matt Hancock has been placed under investigation by the parliamentary commissioner for standards for allegedly “lobbying” the sleaze watchdog to influence its findings.

RISHI Sunak and Jeremy Hunt are on course to oversee the UK’s debt burden swelling to more than the size of the entire economy, putting one of the pair’s five pledges to taxpayers in peril, according to new forecasts out yesterday.

Britain’s debt-to-GDP ratio is tipped to climb to just over 101 per cent in 2028 due to a combination of weak economic growth and intensifying pressure on public services, the International Monetary Fund (IMF) has projected.

The Prime Minister and Chancellor have promised to get the debt pile falling in five years, one part of the Conservatives’ fiscal rules. There’s a risk they will miss that target if the IMF’s forecasts materialise.

IMF officials’ calculations run counter to those published by the Office for Budget Responsibility alongside last month’s budget in which the spending watchdog judged Sunak and Hunt would hit their fiscal targets by around £6bn, the slimmest margin of any administration ever.

JP MORGAN has asked its senior bankers in its offices around the world to be in the office five days a week in another sign of executives’ growing frustration with homeworking.

In a memo to staff seen by City A.M., JP Morgan’s operating committee said that its leaders play “a critical role in reinforcing our culture and running our businesses”.

“They have to be visible on the floor, they must meet with clients, they need to teach and advise, and they should always be accessible for immediate feedback and impromptu meetings. We need them to lead by example, which is why we’re asking all managing directors to be in the office five days a week,” the note said, which

was sent to staff last Friday.

In the corporate structure of an investment bank, managing directors are at the highest levels bar the very top executive positions. They typically head up business divisions.

The memo reminded hybridworking staff that they still needed to be in the office three days a week.

ibility, as appropriate”.

It also said that there was “significant work” going in to tracking attendance, particularly related to business travel and client meetings. “Tracking attendance is not only important to manage hybrid work schedules but also for real estate, resiliency and security purposes,” the note added.

“There are a number of employees who aren’t meeting their in-office attendance expectations, and that must change,” the bank said.

It said that managers could take “corrective action” if requirements were not being met. However, the memo also noted that its employees will “have flex-

“Working with one another –in person –is optimal for our company, our clients and our culture. Being together greatly benefits mentoring, learning, collaboration and execution –it is truly the foundation of our culture,” the note said.

JP Morgan confirmed the memo when approached for comment. It comes after Lloyd’s of London chief John Neal called for a move away from the “Tuesday, Wednesday, Thursday world”, and said that he now wants Lloyd’s staff to work in the firm’s City building on Mondays too.

THE FUTURE of the Edinburgh Fringe festival is hanging in the balance due to rising costs, the Edinburgh Festival Fringe Society’s chief executive Shona McCarthy has said.

“It’s not an exaggeration to say that this festival is under existential threat,” said McCarthy, speaking on

Barry Fearn’s Leading Conversations podcast.

It comes as the UK’s second-biggest arts festival, Vault Festival in Waterloo, London, also faces the threat of closure after their landlords turfed the festival out from next year to prioritise more commercial work. The arts are worth around £2.35bn to the Treasury each year.

EVERYMAN Media has said it is “cautiously optimistic” about the year ahead as the upmarket cinema chain posted soaring revenues and eyes six new sites across the UK.

The London-listed entertainment chain posted revenues of £78.8m for the year, up from £49.0m in 2021, as it was bolstered by new partnerships from Jaguar, Green & Black’s and The Times. Despite fears of a decline in popularity of the cinema, Everyman, which has 38 sites across the UK, reported a 70 per cent rise in ticket sales to 3.4m, helped by blockbuster releases such as Top Gun: Maverick and the highly anticipated Avatar sequel. Operating profit came in at £402,000 against a £2.2m operat-

JAMES SILVER

JAMES SILVER

PROPERTY giant Great Portland Estates has put the pandemic well and truly behind it with a record 2022 for leasings.

ing loss in 2021, with Everyman saying it was now “trading in line” with expectations for the year.

The chain is hoping to capitalise on its success, with plans for six new openings across the UK this year.

“As a result of our strong performance in year, we are actively returning to an agenda of managed organic expansion.

The company is also assessing acquisition opportunities of existing cinemas which are suitable to be converted into Everyman venues,” Alex Scrimgeour, chief executive of Everyman, said.

The upbeat results come in contrast to industry giant Cineworld, whose restructuring plans saw shares hit an alltime low this week. Analysts suggested Everyman’s high-end offering had helped it stand out, though shares still dropped on fears the cost of living crisis could dent future growth.

The new Top Gun helped boost sales

CHARLIE CONCHIE

TAKEOVER attempts in the UK tumbled sharply in the first three months of the year as fears of a global banking crisis roiled markets and spooked the City’s dealmakers. The total number of bids for UK firms fell by over a quarter on the same period last year with just 11 new firm offers made to buy UK listed

companies, according to new data from broker Peel Hunt.

The cumulative value of the proposed offers came to just £2.47bn, with bid activity heavily skewed towards small private equity-led deals.

“Bid activity was focused on the smaller end of the market, [with] 10 of the 11 firm offers for companies with undisturbed market capitalisations below £250m,” Peel Hunt analysts said.

Peel Hunt found that deal activity was beginning to pick back up in the smaller end of the market however, as private equity buyers look to snap up firms on the cheap.

“After a quiet 2022, private equity showed signs of increasing activity with two-thirds of firm offers extending from a PE or privately owned bidder during the quarter,” the analysts said.

The London-focused firm secured 105 new leases and renewals across the year generating rent of £55.5m, including the pre-leasing of Clifford Chance’s new office at 2 Aldermanbury Square near the Guildhall.

Boss Toby Courtauld welcomed what he called “sustained demand for... high-quality spaces”.

Rents have been held up even though commuter numbers remain slightly down on pre-pandemic figures, helped by economic upheaval.

“We anticipate that the uncertain outlook in the near term will exacerbate the shortage of new deliveries [of completed office space] in central London, supporting rents for the best spaces,” he said in a statement to markets yesterday.

The last quarter of the year also saw Courtauld’s outfit let the final retail unit at its new Oxford Street development, perhaps signalling a revival of the West End’s tiredlooking main drag.

CHRIS DORRELL

THE WORLD’s top financial authorities need to learn the lessons from Silicon Valley Bank’s (SVB) collapse, warned Klaas Knot, chair of global regulatory body the Financial Stability Board (FSB).

The recent mini-crisis was troubling for “having origins within the financial system,” Knot

wrote in a letter to G20 finance ministers and central bankers.

Although he praised the “rapid and effective actions” taken in the US and Switzerland to contain the fallout from SVB’s collapse and Credit Suisse saga, he warned against complacence.

“The FSB is working closely with the Basel Committee on Banking Supervision and other standardsetting bodies,” Knot continued.

Despite this “reprioritisation”, Knot confirmed the FSB would remain committed to areas such as crypto and shadow banking. Prominent figures, like former governor of the Bank of England Mark Carney and head of the Prudential Regulation Authority Sam Woods, have suggested that liquidity rules could need “recalibrating” to reflect new threats to the sector.

THE LARGEST banks on Wall Street will start reporting their first quarter earnings later this week, with investors set to pay close attention to banks’ deposits.

So far this year, huge amounts of money have flowed into higher-yielding money market funds from bank deposits. This picked up in March after the collapse of Silicon Valley Bank raised questions about the security of deposits in smaller banks. Investors put $367bn (£294bn) into US money market funds in March.

Yet analysts suggested that the largest lenders could emerge with their deposits mostly intact as depositors from regional banks park their money in the Wall Street giants.

Citi, Wells Fargo and JP Morgan will announce first quarter results on Friday. The following Tuesday, Goldman Sachs and Bank of America will release their quarterly report before Morgan Stanley completes the set on Wednesday. Analysts at JP Morgan thought US bank

deposits should hold up “relatively better” as they will benefit from inflows from their smaller rivals.

Bloomberg Intelligence’s Alison Williams said JP Morgan, Bank of America and Wells Fargo will also be “relative winners in the deposits flight to quality”. Looking at the results more broadly, however, analysts are divided about what to expect, with banks under increasing pressure to offer higher interest rates to customers even as the Fed approaches the end of its rate-hiking campaign.

JP Morgan has warned US banks’ first quarter earnings are likely to be “mixed” due to this pressure, though analysts at Baird said pessimism about US banking had been “overdone”. Investment banking is expected to remain subdued in the first quarter, continuing the trend from a very poor 2022. The impact of the mini-meltdown in March will likely have little effect on most figures reported this week and next, but many analysts suggested it pointed to a bleak future for the sector.

JUNIORS will get a rare chance to show up their superiors at a new Wharf hotspot –- if they’re any good at video games, that is. Platform, which combines video game hubs with a bar and food, is the latest in a new line of experiential hospitality venues doing well across the country.

CHRIS DORRELL

HSBC has hired over 40 new bankers who used to work at Silicon Valley Bank (SVB) as it establishes a new banking division focused on the “innovation economy” in the US.

The new unit will sit in the bank’s commercial banking division and will focus on serving tech and healthcare companies. Many banks are attempting to attract these high-growth clients after SVB’s collapse.

HSBC has assembled a team of more than 40 bankers in the Bay Area, Boston and New York as part of this initiative, it said in a statement late on Tuesday. David Sabow, who previously led technology and healthcare banking at SVB, will lead the team.

The hires come shortly after HSBC acquired SVB UK for £1 last month as the bank attempts to expand its footprint in high-growth industries such as life sciences, technology and fintech.

A JUDICIAL review into the expansion of the ultra low emission zone (ULEZ) across Greater London has been granted after a court ruling yesterday.

London mayor Sadiq Khan opted to push ahead with plans to roll out the zone across all of outer London last year despite opposition.

It will mean that from 29 August all drivers of vehicles in the capital’s

BEN

LIZ TRUSS said it was a mistake and a sign of “weakness” to ask for China’s help in ending the war in Ukraine as she hit out at French president Emmanuel Macron during a speech focusing on the need to defend Western capitalism and freedoms.

The Conservative former Prime Minister was speaking in the US and delivering the Margaret Thatcher Lecture for the right-wing think tank Heritage Foundation.

Earlier this month, Macron and European Commission president Ursula von der Leyen met with the Chinese leader Xi Jinping.

Macron said in Beijing: “I know I can count on you President Xi, under the two principles I just mentioned, to bring Russia to its senses and bring everyone back to the negotiating table.”

Truss said in her speech: “Putin and Xi have made it very clear that they are allies against Western capitalism. That’s why I think it was a mistake for Western leaders to visit President Xi

and ask for him to intervene in seeking a resolution to the conflict in Ukraine.

“I believe that was a sign of weakness. It’s also why it’s wrong for President Macron to suggest that Taiwan is simply something not of direct interest to Europe. I don’t agree with that at all.

“It is of direct interest to Europe, and I think we should be doing all we can to make sure Taiwan has the support it needs to defend itself.”

Truss later said: “The idea that we can treat China as just another global player is wrong.

“It is a totalitarian regime and we need to adapt our policies accordingly and we need to be much more sceptical about what is said by China and what their promises are. And we need to make sure that we are working together as an alliance.

“So I don’t agree at all with the visit by Ursula von der Leyen and Macron. I think it was a mistake. I think it showed a divide in the West which doesn’t exist.”

33 boroughs that do not comply with emissions standards will be subject to a daily charge of £12.50.

However, boroughs Bexley, Bromley, Hillingdon and Harrow and Surrey County Council filed a legal challenge against Khan’s decision earlier this year.

Yesterday, the High Court granted permission for the judicial review to go ahead, with proceedings expected to take place later this year.

“The mayor clearly does not have the legal grounds to proceed with his ULEZ tax plans, which take money from charities, small businesses and low income Londoners who cannot afford a new car,” Nick Rogers, City Hall Conservatives transport spokesperson, said.

A spokesperson for Khan said the mayor would “continue to robustly defend his life-saving decision to expand the ULEZ”.

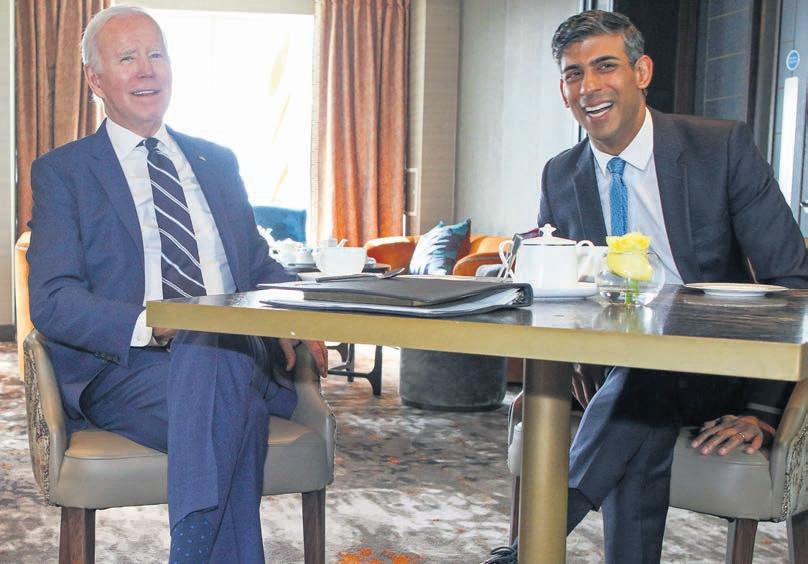

RISHI Sunak has said the relationship between the UK and the US is in “great shape”, after meeting with US President Joe Biden during his brief visit to Northern Ireland. The length of the visit, which saw Biden arrive late on Tuesday before departing yesterday afternoon for the Republic of Ireland, had been seen by some as low key, with the Prime Minister also not attending the President’s afternoon address at Ulster University.

THE LABOUR Party’s poll lead in a key set of ‘blue wall’ seats in southern England has narrowed to a record low, new data has revealed. Labour is leading the Conservatives by just two per cent among affluent Tory shire constituencies – a joint record low and a six point drop from last month.

Pollsters at Redfield and Wilton

GUY TAYLOR

GUY TAYLOR

THE TRADE Union Congress (TUC) criticised the government’s underfunding of the public transport sector yesterday, arguing that providing better public transport was crucial to cutting carbon emissions and lifting other parts of the UK economy.

In a new report, the TUC described transport as the “problem sector” that has failed to reduce climatedamaging emissions. It excluded London and Scotland, although it noted the “need for improvement” in London’s transport network to meet the UK’s climate targets.

TUC general secretary Paul Nowak said properly investing in public

transport will also create jobs throughout the country.

“Commuters will have faster and cheaper journeys to work. New connections will bring new businesses to places where people need economic opportunities. We will save lives with cleaner air,” he said.

The Department for Transport was contacted for comment.

Strategies found support for Labour appears to have decreased in the forty-two ‘blue wall’ seats they track – traditionally Conservative-backing areas including Chesham and Amersham in Buckinghamshire, Putney and Wimbledon in Greater London, and South Cambridgeshire.

Labour received 37 per cent support from blue wall voters, after losing two points, while the Conservatives achieved 35 per cent

for the first time, with a four per cent increase in backing.

Nearly two thirds (63 per cent) of those who voted Conservative in 2019 now say they would support the party again if a general election were held tomorrow – the highest number since the tracker began.

Sunak’s net approval rating in blue wall areas was +2 per cent –his first net positive approval rating in these seats since late November.

DRONES will take to the sky in the Orkney Islands, as part of a £1.2m funding package to encourage more innovative and cleaner freight delivery solutions across the country. Skysports Deliveries, which provides infrastructure for the air mobility industry, won £150,000 in the first round of the government’s Freight Innovation Fund. It will use the drones to “improve island to island connectivity”.

The fund, backed by £7m overall, forms part of the government’s Future of Freight plan, which launched last year. It aims to encourage economic growth and tackle the global HGV driver shortage caused by the pandemic.

Skysports Deliveries joins nine other first round winners including Electric Assisted Vehicles who received £150,000 to develop a new lightweight delivery vehicle.

Roads minister Richard Holden said: “Whether it’s drones for

NICHOLAS EARL

A LEADING campaign group has urged the government to maintain a toughened windfall tax amid pressure from the North Sea industry giants for a price floor to be put into the levy.

The Energy Profits Levy was first introduced last May as a tax on oil and gas producer profits in the North Sea –toughened to 25 per cent from 35 per cent under Chancellor Jeremy Hunt six months later, while a 45 per cent levy on renewables was also brought in -- known as the Electricity Generator Levy.

It was designed to harness record earnings from energy giants after Russia’s invasion of Ukraine and fund consumer support packages amid soaring energy bills.

The windfall tax does include a 91p in the pound form of investment relief for companies developing projects in the North Sea, but the instability of the investment climate has dissuaded producers from new projects.

Tessa Khan, executive director of Uplift, a group calling for no further oil

and gas investments in the North Sea, told City A.M. there can be “no return to the days” when the UK was “offering one of the most generous tax environments in the world for large oil and gas projects”.

She criticised oil and gas firms’ vying for a price floor, including Harbour Energy, the UK’s largest independent operator in the North Sea. Khan said: “Companies like Harbour need to read the room. A windfall tax is hugely popular with a public who are still facing eye-watering energy bills. People overwhelmingly support a rapid shift away from oil and gas.”

Yet Ithaca Energy, a FTSE 250 oil and gas operator, warned it could pull out of the Rosebank oil and gas field if a price floor was not included.

A Treasury spokesperson said: “The Energy Profits Levy strikes a balance between funding cost of living support while encouraging investment.” Harbour Energy declined to comment.

deliveries on remote islands or zero emission buggies, we want to invest in future technology that could transform how we move goods around the country while reducing emissions and traffic and creating skilled jobs.”

Nicola Yates OBE, CEO of Connected Places Catapults, which will deliver the programme, said: “Working with innovators and industry partners allows us to develop a pipeline of technology and new ideas.”

THE

NICHOLAS EARL

THE LATEST ongoing auction window for offshore wind projects could result in higher generation prices and a shortage in bidders, the UK’s leading wind industry body warned.

Renewable UK told City A.M. the government had failed to commit sufficient subsidies to reflect the

pressures of inflation on critical minerals, supply chains and financing on wind developments.

A spokesperson said: “The cost of key inputs and commodities, like steel and copper, has risen to record levels in the last 18 months. The short term impact is that new wind farms are facing higher costs.”

The latest application round for

new projects will run until 24 April, with energy firms bidding for sites to develop offshore wind farms. Results are expected later this summer.

Renewable UK has previously criticised the level of funding for the ongoing allocation round, set at £205m by the government.

However, Downing Street remain confident they will attract applicants.

UNIVERSAL Music Group has warned streaming platforms to clamp down on artificial intelligence (AI) tools wielding copyrighted songs for training purposes.

In a letter sent to streaming platforms such as Spotify and Apple, the music corporation expressed concern that AI tools would collect data from copyrighted songs available on the platform to train themselves to produce tracks that mimic music artists, according to a report in the Financial Times.

“We will not hesitate to take steps to protect our rights and those of our artists,” the record label wrote.

City A.M. contacted Universal

Music Group but was not able to independently verify the report.

The letter comes amid growing prominence of AI tools across the music industry. A recent research report from Google revealed the AI tool MusicLM could generate “high-fidelity” tracks from simple lines of text.

The tool was able to respond to descriptions such as “a calming violin melody backed by a distorted guitar riff”, Google said in its report.

Other popular AI tools have also recently come under fire, including the widely-recognised chatbot ChatGPT, which was banned in Italy last week over privacy concerns.

Both Apple and Spotify were approached for comment but did not immediately respond.

The South African-born impresario on his decision to purchase Twitter

The entrepreneur explains that not all of the thousands of employees let go enjoyed a face-to-face meeting

Musk’s tweet from Tuesday, which came alongside reports that a California court filing said the company had been folded into a new company, X

ELON MUSK claimed social media platform Twitter had just “four months to live” when he took it over in an extraordinary interview with a BBC reporter yesterday.

Musk, who bought the platform at a toppy price of $44bn (£35.3bn) last year, said it was now “roughly” breaking even and that advertisers who had fled the platform upon his arrival in the top job had gradually

come back to the fold.

In less than one month, Twitter lost half of its top advertisers which collectively accounted for almost $2bn since 2020.

The company reported a drop of 40 per cent year on year in revenue and adjusted earnings for the month of December after advertisers ditched the platform, the Wall Street Journal reported last month.

Musk told the BBC, however, that Twitter was heading towards being

“cash flow positive”.

The eccentric billionaire also confirmed that the BBC would have a “government-funded media” tag removed from its profile, a move which had infuriated higher-ups at the public broadcaster.

On the acquisition of Twitter, he told the BBC: “It’s not been boring. It has been quite a rollercoaster.”

Most analysts believe Musk significantly overpaid for the bluebird platform.

The pain level has been extremely high, this hasn’t been some kind of party

It’s not possible to talk with that many people faceto-face

FINTECHfounders and venture capitalists are not known for their pessimism. The sector rode a wave of good vibes for a decade as funding flooded in, new firms sprung up and policymakers hailed it as the shining jewel in Britain’s financial services crown.

Then-Chancellor Rishi Sunak laid something like the icing on the cake last year as he threw his full-throated support behind making the UK a hub for digital assets.

But that optimism has faded somewhat. The industry has been rocked by the economic downturn of the past 12 months and the ripple effects of rapid rate hikes have hit fintech as hard as any other sector.

As the great and good of the global industry gather next week for the ninth annual Innovate Finance Global Summit, they will for the first time in a long time be forced to contend with an unfam iliar shiver of doubt and uncertainty.

Still though, the chief of the fintech industry body Innovate Finance Janine Hirt is unphased.

“I actually think there’s an opportunity here for fintech to really lead the way on how we want our financial

services to look going forward, and to make sure that the next chapter of financial services looks the way we want it to,” she tells City A.M.

“Fintech has a really important role in driving that more positive chapter.”

That more positive chapter has looked uncertain at times over the past few months. The collapse of Silicon Valley Bank and its UK arm triggered fears about a possible wave of implosions across the sector.

That came after fintech players had already been rocked by a year-long funding slowdown as sharp rate hikes turned off the taps of cheap money However, as Hirt points out, the UK’s funding figures still look healthy when stacked up against international competitors.

British fintech firms bagged $12.5bn (£10bn) last year – an eight per cent dip on the previous year but still more than the 13 next most successful European countries combined.

While there has been much talk of France smelling blood in the water and mounting a state-backed offensive to knock the UK off its top spot, Hirt is staying calm; she says there is no imminent threat.

“A lot of the initiatives that are gaining attention in other European hubs are the types of initiatives that are done early on to support an ecosystem, like Station-F [a Parisian start-up hub], whereas in the UK our fintech ecosystem is very mature,” she says.

“We have players here that are becoming substantial parts of the financial services system having once been new entrants in fintech. I think that’s the distinction.”

When people talk about what’s happening in Europe, she says, there should be a “nod to the fact that we are in a much later stage of the game”. Even with that superiority, solving the funding puzzle remains top of the agenda for Innovate Finance and the wider fintech industry.

A familiar gripe across much of the sector is that UK institutional investors are too conservative to throw their weight behind homegrown British start-ups. A major push is now underway, spearheaded by the Mayor of London with support from Innovate

Finance, to get more pension cash directed into the UK’s growth firms.

In a Powerful Pension report, authored last month, Innovate Finance and the City of London called for a pooling of £50bn of pension cash to be directed towards growth start-ups and fill the multi-billion dollar funding hole facing the sector.

Hirt says the debate will be at the forefront of next week’s summit and is essential to ensuring we don’t “rest on our laurels” as a country.

“Later stage growth capital investment and pension funds are very important pieces of the puzzle,” she adds.

The pension campaign underlines a perennial question facing UK policymakers: how can we turn plucky startups into £10bn giants?

Commentators have already predicted those efforts could be under threat this year.

A number of big name fintechs and tech firms have been picked off by bigger players. Pensions fintech Cushon was snapped up by Natwest and GoHenry was bought by US savings firm Acorn just last week.

Hirt says the key challenge in the current conditions will be ensuring that firms can get the funding to become the acquirers. “That means creating an environment here where UK firms can grow larger and scale,” she says.

The topics on the agenda at this year’s summit point to the reality of those challenges. Hirt says there will be a real focus on mergers and acquisitions, and helping firms navigate and deal with the acquisition process. Despite all the positivity, this gathering at the Guildhall will have a more circumspect feel than in previous years. But Hirt and the fintech sector remain optimistic about the future.

There should be a recognition that in the UK we’re at a much later stage of the game compared to Europe

Charlie Conchie interviews the biggest names in tech, fintech and financial services

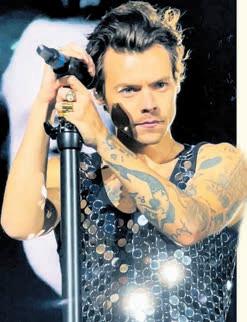

Despite the naysayers, Innovative Finance boss Janine Hirt remains in good spirits about the future of the fintech sector in London, writes Charlie Conchie

WHAT WAS YOUR FIRST JOB?

I had the dream first job –as a lifelong watersports enthusiast, my first job was driving the chase boat for a daring marine photographer. High-speed manoeuvres, out in all weather and positioning the photographer in some hairy positions to take the perfect sailing action shot!

WHAT WAS YOUR FIRST JOB IN FINANCIAL SERVICES?

My first role in the City was a junior sales job at JP Morgan Asset Management after making a career change aged 32 from the telecoms industry. The world was just emerging from the Global Financial Crisis so it was a risky move as my wife and I had just started a family and we had a big mortgage.

Jasper Berens ran JPM’s UK Funds business at the time –he had the choice of great candidates with plentiful financial services experience yet he took a risk on me, for which I am eternally grateful.

WHAT’S ONE THING YOU LOVE ABOUT THE CITY?

I love the combination of the heritage and innovation of the City –some of the investment trusts that continue to prosper today once funded the industrialisation of America and the City is still the cutting edge of financial services progress.

AND ONE THING YOU’D CHANGE?

The City still has a poor reputation when it comes to balancing family life with work life. Post-Covid flexible working has certainly made things easier, but we must not forget that we work to live rather than live to work. My mother-in-law once said to me: “you will remember every nativity play you miss but you won’t remember what you missed it for”.

WE’RE GOING FOR LUNCH AND YOU’RE PICKING –WHERE ARE WE GOING?

I am a real pizza lover. However, I eat with clients at least three times a week so that wouldn’t work from a health perspective! Let’s go to 1 Lombard Street for the Torbay Cod and seasonal veg!

WHAT’S THE MOST MEMORABLE DAY YOU’VE WORKED?

The day my first investment company IPO listed - the pressure to get an IPO ‘over the line’ is so intense, but the sense of relief and satisfaction was amazing. I sent a copy of the RNS announcement to my parents –I’m

FAVOURITE...

FILM: TOP GUN

BAND: QUEEN

FAVOURITE VIEW OF LONDON: KING HENRY’S MOUND – THE VIEW FROM RICHMOND PARK TO ST PAUL’S CATHEDRAL

FAVOURITE BOOK: NO EXCUSE TO LOSE BY DENNIS CONNOR

COFFEE ORDER: BLACK AMERICANO

not sure it meant too much to them but they were very proud!

AND WHAT’S BEEN YOUR MOST MEMORABLE MOMENT?

The moment I will never forget was the surreal drinks party on the Friday night before we implemented the Team A/B fortnightly rotation as a Covid containment strategy. It was mid-March and we were joking with each other that we’d next see each other at the Christmas party. We had no idea at the time how much life

AND IF WE’RE GOING FOR AFTER

A pint of Jugged Hare at the Jugged

ARE YOU OPTIMISTIC FOR THE

I’m optimistic for the rest of 2023. As a firm believer in long-term investing. With valuations in many asset classes being quite weak, this is a great time to build positions in those companies that have strong balance sheets, d management teams and a long-term competitive advantage.

GIVE US ONE OPINION THAT SAILS AGAINST THE PREVAILING

Prevailing wisdom says we should never meet our heroes. If your heroes are TV or sports celebrities, then this may be true and an Instagramfollowing relationship is probably more than enough! Proper heroes should be met –they’ll inspire and generously share their knowledge. I e my heroes –both personal and professional.

WHERE’S HOME DURING THE

Home during the week is Lymington, Hampshire. I commute for 18 hours each week but wouldn’t change it for the world. Living in the New Forest with immediate access to the countryside and the sea is priceless

race or cruise; if it floats we love it.

YOU’VE GOT A WELL DESERVED TWO WEEKS OFF –WHERE ARE YOU GOING, AND WITH WHO?

A fortnight’s holiday without doubt will involve boats, my wife and our

Where we ask the big questions of the City’s big names. This week, Janus Henderson’s head of investment trusts Dan Howe tells us about the Jugged Hare and his first IPO celebration

To appear in Best of the Brokers, email your research to notes@cityam.com

ASUDDEN boost to London’s FTSE 100 from better than expected US inflation numbers ran out of steam toward the end of yesterday’s trading session, although the premier index still notched gains.

The FTSE 100 jumped 0.5 per cent to close at 7,824.83 points, while its mid-cap counterpart, the FTSE 250, which is more responsive to the health of the UK economy, added 0.25 per cent to finish just shy of 19,000 points. Traders kept their powder dry during opening exchanges yesterday until the US inflation numbers were announced. The rate of price increases has been gradually falling in the US since last summer and fell quickly to five per cent from six per cent last month, a slightly bigger drop than Wall Street’s expected 5.2 per cent rate.

That undershoot sent shares in London’s top companies soaring, but those advances lost momentum as traders wised up to the fact that US core inflation is ultimately still running very high. It climbed to 5.6 from 5.5 per cent, in line with analysts’ forecasts. That number could lure Fed chair Jerome Powell into announcing another rate hike next month.

Interest rate sensitive stocks led the FTSE 100 higher yesterday, with housebuilders Barratt and Persimmon adding around 1.9 per cent and 1.3 per cent respectively.

UK bank note maker and former passport manufacturer De La Rue plunged as much as a third after it issued a profit due to sharp reduction in demand for physical cash. The pound gained around 0.2 per cent against the US dollar, while oil prices surged over 1.5 per cent.

Subversive youth media giant LBG Media, parent of Ladbible, posted a bullish 15 per cent hike in revenues, rising to £62.8m over 2022 with ebitda of £15.7m. Investment analysts at Peel Hunt believe the new year has started well. With LBG shares down almost 40 per cent year to date, it considers forecasts to be conservative. It has maintained its buy stance with a target price of 135p per share.

Accommodation firm Unite is closing in on a full house: it has now sold 90 per cent of rooms for the 2023/24 academic year versus 78 per cent a year ago. This remains supportive of guidance for full occupancy, and six to seven per cent rental growth. It has agreed terms for a £400m secured loan to refinance a maturing bond. Peel Hunt has maintained its add recommendation at a target price of 1,050p per share.

ACROSS THE POND “US inflation has cooled to five per cent, which suggests the cure of higher interest rates is working. But core inflation remains stubbornly elevated, and that will continue to cause concern at the Federal Reserve, even if they choose to pause their rate-hiking activities.”

LAITH KHALAF, AJ BELL

would also risk imposing significant costs on businesses, who in pursuit of a “papers please” faux feminism would be forced to monitor their workers and customers.

ACROSS Westminster, both parties have switched into election mode, as they prepare for next month’s local elections, the first electoral test since Boris Johnson stepped down as Prime Minister.

But there’s a lot of space between now and the next parliamentary ballot, giving the government the ability to, in theory, keep passing legislation deep into December next year. Actions taken late into a parliament can have profound consequences; Jim Callaghan secured a promise from the Americans to sell us Trident months before his government fell, whilst John Major’s privatisation of the railways was only completed the same year as Tony Blair entered Downing Street.

More recently, the Equality Act was only passed into law during the final days of the 2005-2010 Parliament. This act overhauled the patchwork of ad hoc equalities legislation, creating a unified system of nine protected characteristics against which people would be treated equitably in the provision of goods, services, and employment. It not only harmonised what is meant by discrimination across different characteristics but clearly codified the responsibilities of organisations to combat it.

This has led to Britain taking great

strides towards becoming a more equal society over the past thirteen years, despite the governing party frequently striking a pose against what it would now dismiss as “wokery”. That the Tories began by sharing power with the Liberal Democrats and were then led by Theresa May who helped Labour pass the Equality Act, explains some but not all of this irony.

The reality is that legislation means a lot more to the lives of ordinary people, and the trading conditions of business, than whatever a minister says on television. It is why Kemi Badenoch, a rare example within today’s Tories of being both a culture warrior and a diligent minister, has made such an unusual and important intervention.

Back in February she asked the Equality and Human Rights Commission to

consider whether the protected characteristic of sex should be redefined to exclusively refer to biological sex as a way of resolving what she saw as the ambiguity over the rights of trans people. Last week the Commission responded by agreeing with Badenoch that such a change may well be beneficial. Ignore the mild-mannered legalese, what they are proposing is a radical change in the status quo. The Equality Act is indeed ambiguous about where the line is drawn between sex and gender identity, but that has meant trans people have had the greatest possible access to single-sex spaces. In those rare cases where something should be limited, the organisation that controls it must follow a robust process to demonstrate that the exclusion is a proportionate method in service of a

legitimate need. The reason why trans people have been included in most single-sex spaces, is because organisation after organisation has not been able to meet that threshold.

What Badenoch and the Equality and Human Rights Commission are proposing would change all that. It would not just allow organisations to openly discriminate against trans people, but it would create a formal charter where any worker or customer could claim their sex-based rights were being impinged by the lack of measures to ensure trans people were excluded. Such measures would not only upend twenty years of progress towards trans equality, robbing people of civil rights that even today are supported by 64 per cent of all Britons according to the British Social Attitudes Survey. But it

THE government wants to build a nuclear reactor on the moon.

Yes, you read that right. The UK Space Agency has backed Rolls Royce scientists to find a way to use nuclear power to live and work on the moon, before we even have it comprehensively in the UK.

The reason is familiar: excessive regulatory overhead, a broken planning system, and fickle public opinion. Small modular reactor nuclear technology could transform our current clean energy system. At just 10 per cent the size of a traditional nuclear power plant, small reactors are a strategic move away from megaprojects which struggle to gain approval. This new approach will take up less space and less money. As a consequence, they should be much cheaper, safer and faster to build.

It will also be a crucial part of the shift to green energy. Alongside a mass swap to renewables, fully decarbonising the grid will require nuclear power to compensate for weaknesses in renewable energy - such as maintaining a baseload supply.

Alex PetropoulosNuclear already meets a quarter of our electricity demand. But by 2030, all but one of our existing reactors will be decommissioned. The obvious solution should be building new electricity generation as fast as possible.

In the most recent budget, the government reclassified nuclear as green energy, allowing it to benefit from new funding. But more regulatory barriers block progress. The newly created nuclear body, Great British Nuclear, has made small reactors’ funding contingent on approval from the Office for Nuclear Regulation, which won’t happen until 2024 at the earliest.

This bureaucracy is getting in the way

of developers scoping out potential sites and building local support.

The UK’s last nuclear project to get approved, Sizewell C, had to submit 44,260 pages worth of environmental planning documentation, despite being built on a site with two already approved nuclear plants. The average size of planning applications for major infrastructure projects has increased threefold since 2012. Because of the delays, infrastructure projects’ costs balloon. Even those that have received regulatory approval commonly face construction delays from legal review. Even now, environmental campaigners are trying to slow down or even block the construction of Sizewell C.

Our convoluted system doesn’t just block nuclear projects. It hinders all clean energy construction. If even a single Brit opposes the construction of an onshore wind turbine, the entire project risks being scrapped. Our planning system has effectively banned building the cheapest and most abundant source of clean energy.

It gets worse. Locals across the country

have been blocking the construction of critical electricity infrastructure which gets power from the generator to your home. No new solar, wind or nuclear can be built without upgraded transmission infrastructure. To decarbonise our grid in time, we’d need to increase our current rate of transmission construction by five times. Instead, our stringent planning laws are slowing them down.

We’re standing in our own way, and in the meantime, we keep relying on fossil fuels fast approaching their final expiration date. If not for the environment, we should loosen these rules to lower our utility bills — high energy prices are self-made. For a decade, it’s become harder and harder to build, but we can reverse that trend.

In space, no one can hear you scream opposition to critical infrastructure development, so things get built. If Britain wants cheap energy, it must first fix its broken planning system.

£ Alex Petropoulos is a political commentator with Young Voices UK

It would add further confusion to review one part of the Equality Act in isolation to everything else. Especially when this seems to be done out of discomfort with how ideas about gender have evolved as the act has been implemented, and social attitudes have changed. Laws, by their nature, are adapted and interpreted by bureaucrats and judges to meet the needs of ordinary people. Trying to reverse this for ideological reasons, would add further complexity and toxicity to the debate, not less.

It is therefore fortunate that time is against Badenoch. The Tories' majority, whilst still large, has been whittled down by a series of scandals, by-elections and in-fighting which has left them badly divided. It would not be a simple task to pass legislation through the Commons, let alone the House of Lords where they have no majority, without Labour's cooperation.

Keir Starmer will have many people advising him to swerve fighting a culture war by going along with Badenoch’s gambit. For all his faults, he should remember he is a lawyer and give a lawyer's answer. He should insist that if the Equality Act is going to be reviewed, then all of it must be, with the aim being to enhance everyone’s rights, not solely to persecute one of the smallest minorities in British society.

£ Will Cooling writes about politics and pop culture at the It Could Be Said substack

Rupert Murdoch may have called off his impending nuptials, but that doesn’t mean he wasn’t in for a present. The media magnate and his son Lachlan are being sued over allegations of airing ‘false’ claims on Fox News about the 2020 presidential elections being ‘stolen’ from Donald Trump

[Re: Solar power pipeline exceeds onshore wind, April 4]

The UK is at risk of missing out on the huge benefits solar power presents; only 1 per cent of commercial property roofs in the UK have solar panels and landlords have been a significant blocker of investment to date. While the government speaks to the desire to get more solar installed on commercial rooftops, there’s no real mandate to motivate landlords. Nor does it set out any tangible measures to meet its own solar target of 70 GW by 2035. The government must legislate that putting solar on commercial building roofs does not constitute a material change, thereby removing the landlord barrier standing in the way of businesses

accessing cheap electricity. Free solar rooftop is now available to businesses, so there are no longer financial challenges to installing solar.

Adding low-cost green solar electricity to businesses’ energy mix will significantly reduce their electricity bills.

The FSB has found 24 per cent of small firms are trapped in fixed energy contracts, with 28 per cent forced into downsizing or closing entirely as a result. This cannot be allowed to happen.

But landlords are a major barrier to businesses accessing cheap solar electricity – under current rules, tenants need express permission from landlords to make “material changes” to properties, including installing solar. And the majority of landlords simply don’t care about their tenants getting cheaper electricity prices. This apathy from both landlords and government cannot be allowed to continue.

Daniel Green

LASTweek, there was a historic shift in the power dynamic in Europe: Nato’s border with Russia doubled, almost overnight, as Finland joined the defence alliance. It is precisely the increased Western influence in the region Russia invaded Ukraine to try to prevent. Instead, the Kremlin is on the back foot internationally, under increased pressure at home and struggling to turn around the disastrous campaign in Ukraine itself. All of this leaves Putin weakened. Potentially even fatally so. Unfortunately, it won’t be a slow death. While pressure is mounting on Putin on both the pro and anti-war fronts at home, there is no clear successor. Crucially, there is also no clear alternative path for a new leader in prosecuting the war in Ukraine. Russia’s military struggles are now endemic. But the West should by no means just wait and see what happens in Moscow. Our efforts to help Ukraine and isolate Russia were never going to be a one-off show of support. Finland’s accession to Nato has the potential to take a war of diplomatic attrition to an acute turning point.

It was a controversial policy, especially in the US where scepticism towards vaccines was much higher than in Britain. But the tech giant Google has now dropped the requirement for staff to have had the jab.

What are two things that never grow old? Rows over BBC funding and Elon Musk’s bizarre decisions about Twitter. Now the two have come together, sparking a conversation that reaches from North America to the UK.

It all started days ago when a Twitter badge appeared on the BBC Twitter page describing it as “government funded”. The BBC was furious, responding it is publicly funded through the licence fee and asking Musk to change the badge.

Musk replied all news

organisations have bias, but the BBC is “one of the least biased”. The billionaire hasn’t been shy about his mixed feelings when it comes to journalists, questioning their impartiality - especially when he doesn’t like what they publish.

In the end though, Musk capitulated. He went on to a last-minute interview with the BBC yesterday where he agreed he would change the badge. “I know the BBC is generally not thrilled about being labelled state media", he said.

On every level the invasion of Ukraine has been a disaster for Putin. Since last February Russia has suffered up to 200,000 casualties. While the territory it controls in Ukraine is greater than preinvasion, the Kremlin’s war aims have not been met. When Putin decided to launch the full-scale invasion of Ukraine he expected a lightning victory. He expected the West to be wrong-footed and weakened, and countries in a similar position to Ukraine, such as Moldova, to be deterred from closer ties with Europe. None of this has happened. On the contrary, it is Russia now isolated, the West united and countries in the region increasingly looking to the West and Nato for security. In 2003 9 per cent of Finns supported Nato membership compared with non-alignment. By last autumn, in light of Russia’s invasion, this number rose to 59 per cent.

The pressure on Putin has mounted not just internationally but at home too. Recent reports from within Russia paint a picture of an increasingly isolated Putin, deeply concerned about the survival of his regime. Passports of senior Russian officials have been confiscated to avoid them fleeing Russia. The economy has weathered the storm of

sanctions better than expected but the oil price cap could bite this year. Domestic opposition to Putin has ramped up on both his flanks: those opposed to the war and those who agree with it but think it has been prosecuted badly. Further conscription within the country risks fatally damaging support for the war among the wider public.

This doesn’t put Putin’s in the last, existential throes of his leadership. There is still no credible alternative. There is also no clear path forward for a different leader on how to conduct the war in Ukraine. There appear very few options for how to better conduct the war, given the position Russia is in on the ground. Neither could a different leader afford to withdraw. No credible alternative, no credible path to end the war. So, for now, we, and Russia, appear stuck with Putin.

Stuck, but not powerless; we don’t know at what point the balance of power against Putin will shift decisively, but we can ensure maximum pressure is put on the regime.

This requires a renewed two-prong multi-domain approach. First, the West needs a coordinated and united strategy to support Ukraine in its upcoming Spring offensive which will likely be focussed on the land corridor between Russia and Crimea. Providing ongoing assistance and training can deliver a strategy to both help end the war, and implement Ukraine’s postconflict vision.

We need to ensure pressure is kept on Russia internationally. After Finland’s accession, Sweden will now come into focus, for instance, with their membership now a priority.

Finally, the West needs to ensure it is properly focussed on understanding Russia’s international role, particularly in its region, and supporting those surrounding states such as Moldova and Georgia, who could become the new frontline of Russian interference.

Daniel Sleat is senior policy advisor of global trends at the Tony Blair Institute

Author Hanya Yanagihara has said of her 814-page, millioncopy bestseller that she set out to create the literary version of an ‘ombre cloth’, a piece of material that’s light at the top and becomes increasingly saturated towards the bottom.

It’s a fitting metaphor for A Little Life in its book form. The doorstop of a novel follows four college friends –JB, Jude, Malcolm and Willem – as they embark upon adult life in New York City. And while the story of central character Jude St Francis is at times unbearably bleak, it’s interspersed with moments of lightness and love.

Belgian director Ivo van Hove’s adaptation, on the other hand, is a close to four-hour slog of unrelenting misery. As ever with van Hove, there’s a lot to be impressed by in the direction but

taken as a whole it begins to feel like an endurance test – whether or not it’s enjoyable is almost beside the point.

At the heart of it all is James Norton. His performance as Jude – from abandoned boy to broken man – is breathtaking. He barely leaves the stage as his character is put through seemingly endless suffering. One scene in which he sits quietly, alone and still, brought me close to tears; he deserves every award he’s sure to be nominated for.

The staging is clever and immersive, with some audience members seated directly behind the action, and the cast cooking, eating, smoking and cleaning on stage before the show begins and throughout the production. Screens on either side of the set show rolling footage of city streets and buzz with static, while a live string quartet provides the soundtrack, heightening the tension.

Past and present are interwoven, with figures from Jude’s childhood talking to his adult self, as his traumatic memories literally stalk him across the stage. Elliot Cowan, who depicts his trio of tormentors is another standout, with a softly chilling man-

ner giving way to stomach-turning cruelty.

But the litany of what basically amounts to mediaeval tortures – paedophilia, graphic rape, visceral selfharm and violence, literal pools of blood – almost numb you to Jude’s pain. The content warning leaflets handed to audience members upon arrival are entirely warranted. Some of the play’s flaws come from issues with the book, not least its length, which makes it worthy of at least two plays, if not a trilogy, and its baroque excess at times lacks realism.

But van Hove must accept the larger portion of the blame. Yanagihara’s story asks us to consider our beliefs about art and exploitation, to question our impulses to turn away from others, and to bear witness to the lifelong effects of trauma. But the loss of Jude’s humanity is all the more painful when shown in contrast to his fleeting moments of joy – the top end of that ombre cloth – and without these this play borders on the gratuitous.

Only around half the novel is staged and van Hove appears to have chosen all of the dark and none of the light.

RECOMMENDED

RENFIELD

DIR. CHRIS MCKAY BY VICTORIA LUXFORDIt’s that special time of year when Nicolas Cage stars in a film so batshit crazy it just might work. This time he plays Dracula with enough scenery-chewing to make Hammer Horror look like The Shining.

He’s joined by Nicholas Hoult in the title role of Renfield, Dracula’s “familiar”, who is given some of the Count’s powers in order to bring him people to eat. Unsatisfied with his lot in life, he turns to a support group for toxic relationships and realises he deserves better. Alas, his push for independence is scuppered when he falls foul of a violent drug kingpin (Ben Schwartz).

Zipping along at a brisk ninety minutes, there are some similarities with Hoult’s 2013 “Zom-Com” Warm Bodies, but whereas that film quickly ran out of steam, here Hoult keeps the laughs coming.

Director Chris McKay knows what you came for, and that’s Cage in full Dracula mode. While he’s not on screen as often as his co-stars, every scene is a gem as he camps it up for all he’s worth (an early flashback styled like the Bella Lugosi Dracula films is a delight).

Hoult makes an excellent double act with Awkwafina, playing a cop looking for vengeance for the death of his father. Renfield leaves the coffin door open for a sequel, which might be pushing the concept too far. However, there’s plenty of bite in this comedy to make it a low brow crowd pleaser.

UNMISSABLE

SUZUME

DIR. MAKOTO SHINKAI BY VICTORIA LUXFORD

Japanese animation can often be unfairly categorised as a niche genre, meant for the arthouses but not the multiplex.

Disproving this point, Suzume arrives on these shores already a blockbuster.

Its director, Makoto Shinkai, is an animation veteran who has found international success in the last few years with 2016's Your Name and 2019's Weathering with You. This new film

A

A

has exploded records across the world, grossing a heroic $221m thus far.

Sticking with his themes of fantasy and wonder, Suzume tells the story of the title character, a young girl whose trip to school is interrupted by a boy called Souta, who claims he is looking for a door.

Helping him find it, she learns that it is a portal to another world that, when opened, unleashes destruction. The two must travel across the land, closing doors in order to save their world.

Shinkai is a master at balancing high concept, the beauty of the everyday, and gorgeous animation. He takes huge chances, coming out of the

Forget the T-Rex. Forget even the Diplodocus –the biggest dinosaur ever to stomp across the earth was the Titanosaur, a creature of such exceptional length and girth it’s almost impossible to conveive its size. Unless you’re standing underneath it, that it, which is what you can do at the Natural History Museum, where one is on loan for the rest of the year.

STEVE MCQUEEN: GRENFELL

The British filmmaker, artist and photographer has created a provocative, confrontational memorial to Grenfell and the 72 people who perished in the 2017 fire. Featuring aerial footage of the burned husk of the tower block, McQueen confronts viewers with the stark, dark tragedy of the fire and its legacy, felt acrss London and beyond. You can see it at the Serpentine Gallery.

FLORENCE PEAKE

Southwark Park Galleries in Bermondsey will from Saturday be home to a bold, brash new exhibition by dancer, choreographer, and visual artist Florence Peake. Featuring a 50mlong painting and live dance routines, it promises to be an exhibition quite unlike any other, from a rising star of the art world.

RECOMMENDED

Religion and politics intersect in this nail-biting thriller set in a historic Egyptian college. Tawfeek Barhom plays David, an intelligent young man who is chosen from his small village to study at the prestigious faith-based AlAzhar University.

After the Grand Imam dies suddenly,

David becomes embroiled in a conspiracy to influence the election of his successor, all manipulated by government fixer Ibrahim (Fares Fares). With a tone reminiscent of Homeland, Cairo Conspiracy separates itself from a crowded genre by touching on a subject few are brave enough to approach. The conflict between church and state is felt throughout as devout young men find themselves torn between two ideological pillars, and David is repeatedly forced to answer questions he never expected to be faced with. These theological questions may be why the EgyptianSwedish co-production isn't actually shot in Cairo, with Istanbul standing in during filming.

Pressure ramps up over the course of two hours, and while there are moments of action, the film's energy is almost all provided by two excellent leads. Fares Fares is downright unsettling as the shadowy figure who can be a friend one moment and a nemesis the next. The Rogue One and Chernobyl actor stares thoughtfully as he moves people like chess pieces, exploding into moments of menace without warning. On the flip side, it can be unbearable watching the innocent Barhom be dragged into a situation where he has no control.

A hit at festivals (under the title Boy From Heaven), Cairo Conspiracy makes for thrilling viewing even if you’re unfamiliar with the political context.

THE ROSSETTIS TATE BRITAIN BY

STEVE DINNEENgate flying with stakes that couldn't be higher, and then somehow stacks them even further.

Newcomers may leave a little purplexed but it's a pleasure to see a visionary filmmaker let loose to realise exactly the kind of story he wants to tell. The extraordinary is used to comment on everyday sentiments, with the whole thing unfolding on a canvas so colourful and sweet you might need a filling afterwards.

Suzume may feel too unfamiliar for audiences more used to American animation, but fans of Shinkai's work will leave delighted by another inimitable entry into the filmmaker’s exceptional filmography.

The Pre-Raphaelite Brotherhood, the horniest of all the Victorians, have had a good run of it. This bunch of bohemians who spent their days painting big, silly pictures of King Arthur and sleeping with each other’s wives, have been celebrated in major exhibitions including Reflections: Van Eyck and the PreRaphaelites; Edward Burne-Jones; and now

The Rossettis at the Tate Britain. It’s the largest exhibition of works by Dante Gabriel Rossetti in decades, and the largest collection of works by his wife Elizabeth Siddal. Expect lots of paintings of Jane Morris, the wife of his bezzie William Morris, with whom Rossetti had a longstanding affair. Steamy stuff.

Gazing out across the waters of Corfu from my villa’s infinity pool, I see rickety boats and intrepid paddleboarders. Further away, across the Ionian Sea, is the craggy coastline of Albania.

Sea views often sound clichéd, but Corfu really is spectacular – and a perfect destination for spring.

I picked Corfu as I’m a fan of Gerald Durrell’s My Family And Other Animals, an autobiographical book about the British naturalist and his time as a child growing up on Corfu.

But we’re here to fully switch off, too. Our home for the week is Villa Skyline, an impressive newbuild carved high into the rockface of Corfu’s north-east coast. It is one of the villas on offer through Villa Collective, a platform launched by father-and-son team Richard and Nick Cookson offering rentals on high-end Mediterranean villas directly from their owners, often villas not available anywhere else.

The six-bedroom villa offers uninterrupted sea views with direct access for swimming, and there’s a separate summer house with dining area and huge barbecue for entertaining. Villa Skyline is also close to Agni Bay, a beautiful beach with some of the best tavernas in the area, only a threeminute drive away or 15 minutes’ walk.

There’s an optional butler and chef service although we go for the daily maid option, who replenishes our fruit bowl, changes linen and tidies after our two messy teenagers. Our fridge has already been pre-stocked by the concierge so there’s a bottle of Champagne already sitting in an ice bucket on arrival.

It’s a nose-to-tail service: we’re picked up from the airport in a sleek black Mercedes minibus and the concierge

has sorted car hire, with the vehicle delivered to our front door by the rental company, a family-run local business that beats its bigger rivals on price.

Tempting as it is to wander no further than between the pool, sun lounger and massive fridge, I’m keen to see the sights, so the car is essential.

It’s a half-hour drive down the coast to Corfu Old Town. Listed as a UNESCO World Heritage site, its historical influences date to the 8th century BC. Forts here were once used to defend the Republic of Venice against the Ottoman Empire. The town’s Venetian architecture is worth seeing by meandering through the twisty alleyways. There’s plenty of places to stop for a decent beer too.

The next day we headed northward on the coast road, getting stressed over which of the stunning beaches to visit. (Don’t they say relaxing is the hardest

They tell us how, if we’re lucky, we might spot a pod of dolphins

thing for City workers? I’d agree.) We end up choosing Kalami Bay, a small but pristine beach that also happens to be the Durrells’ former home. The family moved to Corfu before the Second World War and their books have inspired tens of thousands of holidaymakers to make a pilgrimage to the island ever since.

Lawrence Durrell lived here with his wife in The White House, a former fisherman’s cottage facing the sea. Today, the ground floor of the White House is a pleasant taverna, with old photographs of the Durrell family adorning the walls. The stone-built al fresco taverna boasts 180-degree views of Kalami Bay so it’s easy to see why the naturalist loved it here so much. Many of the dishes are based on traditional Corfiot recipes, handed down over the generations. Corfiot chef Lefteris Lazarou is the first Greek chef to be awarded a Michelin star, and I’d

highly recommended the crispy anchovies in panko crust. Crayfish risotto with green asparagus and crayfish oil is also delicious.

The next morning after a breakfast delivered by staff of locally made honey, fresh figs and the white peaches typical of Corfu, we take the short stroll from the villa to Krouzeri Beach, where Madalena tours whisks us along the north-east coastline by boat, passing pretty bays and skirting Albania by a mile – so close our phones switch to the Balkan country’s (expensive) network.

The crew are a cheerful bunch serving G&Ts from the bar. They tell us how, if we’re lucky, we might spot a pod of dolphins chasing sardines, although the skipper stresses there will be no jumping to swim with them as they’re wild animals and should be respected. “It’s not good for them to get too close to boats and people, especially if they have babies.” That’s us told.

We stop for lunch at Kassiopi, an old fishing village. The boat-filled harbour is lined with shops and restaurants but we eat at Porto Nuovo, overlooking the harbour, with downable cocktails and a tasty local crab linguine. Above us up the hill sits the ruins of a Byzantine castle. En route back, we swim more, and jump off the boat at yet another unspoiled beach. We stop to snorkel at Nissaki, where sea caves are home to shoals of brightly coloured fish darting among the rocks.

But it was from our villa that we whiled away the better part of our trip, often using our paddle board from the local Agni Boat Hire to drift into neighbouring Agni Bay, where a small taverna serving fresh local seafood became our saving grace at midday.

For the final night we thought we’d better put on some clothes, so we went for dinner at the nearby Nikolas Taverna for a slap-up Greek meal, with calamari, souvlaki and beef stifado, washed down with bucket loads of local white wine. Cats weave in and out of the tables –cats are always hanging around Corfiot tavernas, looking for leftover whitebait. Gerald Durrell loved animals and, squinting at the horizon, I could imagine him scooping these cats up to take home.

£ Villas on Corfu with Villa Collective range from £7,000 - £16,000 per week. To book visit villacollective.com or call 0203 950 1588

NOTHING

£99,

Nothing Tech sells itself as a cooler, more rebellious and –crucially – cheaper alternative to Apple. Its Nothing (1) smartphone follows 80 per cent of the Cupertino playbook but then mixes it up with a clear back panel that displays the phone’s innards, as well as using a retro dot matrix font in place of industry-standard Helvetica curves.

The company followed up its debut smartphone with the Nothing Ear (Stick) – it doesn’t use capital letters but that looks weird in print – a pair of smart, compact ear buds.

The first thing you notice is the case, which is a tiny design marvel.

The buds sit within a clear cylinder, which protects them from the elements until you rotate the tube, giving you access to the sweet technology within.

The buds themselves consist of a simple white sphere connected to a clear plastic stick (hence the name), which, like the company’s phone,

allows you to see the workings within. They fit neatly within your ear but the lack of a rubber seal means there is a lot of noise leakage, which works in both directions, so not ideal for use in a communal office.

The slightly loose fit also means that, while comfortable for extended use, they’re prone to slipping out if you

move faster than a brisk walk, so if you’re looking for gym headphones, these are probably not for you. In terms of sound quality, they’re… okay, with fairly decent mid and high ranges and decidedly tinny bass. You can boost this in the accompanying app (very slick, as you would expect) but that has a knock-on effect on the overall sound quality.

But what makes them a tough product to recommend for a commuter newspaper is the fact they are all but unusable when you’re on the Underground. With no noise cancellation, they are essentially useless to me from the moment the doors close on the Victoria line. Nothing Tech has a higher-end Ear (2) product that includes noise cancellation, which I’m looking forward to trying but even priced at a reasonable £99 it’s hard to recommend the (Stick) to anyone who plans to work out, commute or use them in an office.

hhiii | BY STEVE DINNEEN

The crew are a cheerful bunch serving G&Ts from the bar.

YOU don’t need me to tell you that the star of the show on Thursday is Constitution Hill and barring one of the biggest shocks in living memory, he will win the William Hill Aintree Hurdle (3.30pm) with ease.

His price of 1/8 suggests just that and the fact firms are betting on how far Nicky Henderson’s stable star will win by, not if he’ll win, shows the superiority he has over his other five rivals despite this being the first time he’s run over 2m4f.

While he is certainly not a betting proposition for me at that sort of price, the 9/4 about ZANAHIYR in the ‘without the favourite market’ is.

Gordon Elliott’s charge ran really well in the Champion Hurdle last time and the forecast rain will certainly be in his favour, particularly over this longer trip of 2m4f.

He’s always been a strong stayer and that asset is why I favour him over Epatante, who is a very speedy mare, so the potentially softer ground won’t do her any favours.

Constitution Hill is impossible to oppose and I think he’ll win this with ease, but I thought Zanahiyr was a solid bet to follow him home.