LONDON’S BUSINESS NEWSPAPER

SCOTTISH STRAMASH SNP IN CRISIS AS BIG QUESTIONS REMAIN FOR THE PARTY P10

THE CBI, Britain’s biggest business trade body, has become persona non grata on Whitehall after a string of sexual misconduct allegations.

The Treasury and the business department have ‘paused’ engagement with a body that on its website claims to “proactively” talk with government to give policy a “business steer”.

Last night the Labour party confirmed to City

A.M. that it, too, had broken off relations with the group.

On Monday, the Guardian published allegations that as many as twelve women within the organisation felt they had been victims of sexual misconduct.

Those allegations came just two

months after the organisation’s director general, Tony Danker, stepped aside after allegations about his own behaviour which triggered an investigation by the law firm Fox Williams.

Danker said it was “mortifying to hear that I have caused offence or anxiety to any colleague” and it is understood that none of the further allegations relate to his conduct.

Last night, a host of corporate members of the CBI, all of whom pay substantial fees to the representative body, expressed concern about the allegations.

Big 4 outfit EY said the “allegations about the CBI are extremely concerning” but that they would wait for the inquiry to report before commenting further.

City A.M. also understands at least

one large British business has written to the acting director general to seek reassurances that the allegations are being taken seriously and that those making them are being supported.

A senior figure at a separate business body said “as industry bodies and trade associations, it is imperative that our own conduct reflects the positive conduct we expect of our members and the wider industry”.

And a spokesman for Rolls-Royce told The Times that it expected “the CBI to thoroughly investigate and take real action on any findings from that investigation. We will await the outcome of the investigation before considering our membership.”

The CBI said it treats any allegation of misconduct “with the utmost seriousness”.

The body hopes to receive initial findings, and actions, from the investigation soon after Easter. “We will not hesitate to take any necessary action” in due course, a spokesman said.

EATEN UP London-listed Franco Manca owner latest to sell up

LAURA MCGUIRE

LAURA MCGUIRE

THE OWNER of Franco Manca has been snapped up by a Japanese food franchiser in a £93m deal –the latest in a long line of London-listed firms to be taken private by foreign raiders.

Fulham Shore, which also owns The Real Greek franchise, announced that it was offloading the business to Toridoll, a Tokyo-listed business which owns fast food chains Wok to Walk and Marugame Udon in London.

The offer represents around a 38 per cent premium on the firm’s closing price on Tuesday.

The company described the offer as a “significant opportunity” to grow the business, with plans for expansion from its 97 restaurants now on the table.

A note to investors read: “Fulham Shore is well positioned to continue to benefit from favourable market trends, particularly an anticipated growth in demand for Italian cuisine.”

JESSICA FRANK-KEYES

RECORD levels of Britons now want experts to run the country, a King’s College London survey has found. Almost two thirds of the British public (61 per cent) in 2022 said having experts, not politicians, make decisions according to what

they think best was a good way of governing.

The finding comes six years after cabinet minister Michael Gove famously claimed during the 2016 Brexit campaign: “People in this country have had enough of experts.”

It marked a significant rise over

the last two decades, with just 41 per cent backing the same question in 1999.

The UK also has the highest level of support of any Western nation, of the two dozen surveyed, beating Australia (at 59 per cent) and Spain (on 57 per cent).

Professor Bobby Duffy said that

“increasing support for expert roles in national decision-making” is now at “record levels” in the UK and shows Brits “recognise the importance of expertise”.

Researchers also found the UK had low levels of satisfaction with politics – with just 17 per cent of people saying they were “highly

satisfied”, among the lowest of the 23 nations asked.

It put Britain on par with Russia (16 per cent), Mexico (17 per cent) and Nigeria (15 per cent).

The UK also ranks far behind Norway (41 per cent) and Canada (36 per cent), but beat France (13 per cent) and the US (12 per cent).

What do Myspace, Nokia and Xerox have in common? That’s the question posed by our columnist Rainer Zitelmann later in these pages.

The answer, without giving away any spoilers, is that they were once seen as insurmountable industry winners runaway monopolies, never to be challenged by competitors. Of course, each in their own way have been well and truly muscled out. As early adopters of new

technologies they pushed the boundaries, but newer, leaner, sharper competitors found their way to the front of the queue soon enough. Dr Zitelmann contends that the reason these giants fell from their podium is the same reason they got there: good oldfashioned capitalism. He’s right,

of course. Facebook jumped Myspace by offering a more customer-friendly experience. Nokia’s mobiles looked out of date as soon as Apple rocked up with the iPhone –or, to be honest, when Motorola gave you the chance to fold your mobile in two. Should we, then, boot the regulators out and simply let capitalism take its course? You might expect a rampant freemarket outfit like ours to suggest so, yet the picture is a little more nuanced. Monopolies, left

unchecked, can hurt consumers and erect too-high barriers to entry for competitors, kneecapping them even if their business models may be smarter and their operations leaner. The role of the various watchdogs then becomes vital.

Some, in this country, work; the Competition and Markets Authority, while not perfect, has a sharp eye for anything that might lead to monopolistic behaviour. Other bodies which actually preside over monopolies deserve

CAT’S ENTERTAINMENT A rare critically endangered Sumatran Tiger enjoying a tasty Easter treat at ZSL London Zoo in Regent’s Park in London in the spring sunshine

less credit; Ofwat has allowed our monopolistic water companies to run up significant debt and undershoot targets, while Ofgem the energy regulator has been behind the eight-ball throughout the energy crisis. As for our rail system, anybody trying to move around the country this weekend will have their own view of what happens when competition is taken out of the equation. Regulators are important parts of free markets. When they work, that is.

THE UK’s service sector is on a threemonth growth spree, however new data showed a slowdown between February and March despite record export growth.

The S&P Global/CIPS UK services PMI survey showed a reading of 52.9 last month, down from a score of 53.5 in February. Experts had forecast that the score would hit 52.8. Any score above 50 means that the sector is growing, according to the survey.

The businesses which were asked reported their biggest jump in export

sales since the survey started tracking that data in September 2014.

“Export sales provided an additional boost to the service economy during March as the ongoing recovery in business travel and events helped to drive the fastest rise in new orders from abroad for at least eight and a half years,” said Tim Moore, economics director at S&P Global Market Intelligence which compiles the survey.

The responses also showed that the increase in prices that service companies charge dropped to a 19-month low in March, but is still higher than at any point between 1996 when the survey

began and 2021.

Similarly the increase in costs that these businesses faced eased to its lowest for 22 months, but remained “exceptionally strong”, the surveyors said.

“Prices charged by service sector businesses increased at the weakest rate for 19 months in March, which provides a clear signal that competitive pressures and improved supply conditions will start to bring down headline rates of consumer price inflation in the coming months,” Moore said.

CIPS chief economist Dr John Glen said the data “could trigger hopes a turnaround is finally on the horizon”.

The fortune of Bernard Arnault, the world’s richest person, has topped $200bn for the first time as shares in his LVMH luxury goods empire hit a record . The 74-year old has become only the third person in history to pass this mark.

Odey Asset Management has liquidated a hedge fund personally backed by founder Crispin Odey. The firm has shuttered the Concentrated Natural Resources Fund after losses tied to its large Russian positions last year.

THE FINANCIAL TIMES

The Swiss government has cut bonuses for about 1,000 senior bankers at Credit Suisse, with the executive team losing their outstanding variable pay entirely, after the lender’s rescue by UBS.

WHAT THE OTHER PAPERS SAY THIS MORNINGUK’s service sector has been growing but hit a temporary blip in February and March

THE FINANCIAL Conduct Authority

(FCA) has laid out plans to “make the UK a more attractive place for business” yesterday after a flurry of firms have ditched the UK in favour of foreign markets in recent months.

In its 12-month plan published yesterday, the City watchdog said it had set out plans to achieve “better outcomes for consumers and markets” including reforms to the UK’s listing regime and an overhaul of consumer protections.

Under chief Nikhil Rathi, the FCA set out a three-year strategy last year to become an “innovative, more assertive, more adaptive” regulator. Rathi said that the latest 12-month strategy would feed into its three-year vision and help “outcomes for consumers and markets”.

“We set out a bold vision last year of what we wanted the FCA to be, and we are well underway to achieving our ob-

jectives thanks to our talented colleagues and the better use of technology across our organisation,” he said.

The plans came as pressure builds on the regulator to reform the UK’s capital markets regime, after a number of firms snubbed London, including building supplier CRH and chipmaker Arm for rival New York.

The FCA yesterday said that it will set out further proposals in the next year to reform the listing rules to “attract world-leading firms”.

Asset management regulation and the quality of investment data have also been earmarked for overhaul.

City firms have also been scrambling to fall in line with impending consumer regulation changes this year as the FCA’s new consumer duty comes into force.

The change has proved contentious in some circles, with City minister Andrew Griffith reportedly criticising the plans for tangling firms up in unnecessary red tape.

A lot of work still needs to be done to narrow the gender salary gap in the City

IAN WITHERS

HSBC, Goldman Sachs, Morgan Stanley and Standard Chartered reported a widening in the gap between what they paid women and men in 2022, according to data reviewed by Reuters. The data also showed that, at the banks which detailed their pay gaps by ethnicity, the gap was widest between Black staff and their white colleagues.

LONDON-LISTED banknote maker De La Rue is facing a shareholder revolt after a major investor demanded that chair Kevin Loosemore be removed for failing to improve the company’s performance.

In a letter to shareholders yesterday, AIM-listed activist fund Crystal Amber argued that De La Rue is failing to meet its financial targets, which it set as part of a turnaround plan back in February 2020.

Crystal Amber, which has a near-10 per cent stake in the firm, said that based on current market expectations, revenue for the year will be £340.5m, 25 per cent below the forecasts.

“The turnaround plan has failed by every measure,” the fund wrote in the letter.

HSBC reported a wider mean average gap for the year, disclosing women were paid 45.2 per cent less than men, up from 44.9 per cent the prior year. The British arm of Goldman Sachs’ gap increased to 53.2 per cent. All four banks said in their gender pay gap reports that the figures reflected the under-representation of women in senior roles and they were taking steps to address this. Reuters

As a result of the company’s performance, Crystal Amber said Loosemore needs to step down, adding that he “continues to fail to take responsibility” and instead “blames external factors, including ‘the cycle'”.

De La Rue declined to comment on the letter.

A DEEPER DIVE: P12

CHARLIE CONCHIE

FORMER chancellor Philip Hammond (pictured) has called for the City to become the world’s top trading venue for crypto currencies and other digital assets despite last year’s crypto chaos. While many would look back at the FCA’s crypto-caution as a positive given the carnage of the past 12 months, Hammond, who is now chair of crypto custody firm Copper, suggested the failure to embrace crypto was instead a post-Brexit missed opportunity.

“The UK’s financial markets have prospered in the past when UK regulators have been agile and supportive of new products and new markets,” Hammond told City A.M. in an interview.

“And London, frankly, badly needs a new product and a new market culture at the moment. We need a story to tell post-Brexit: what is the future of Britain’s financial services industry?

“I would like the answer to be [it is] the world’s preferred trading venue for the next generation of digitised

asset trading,” he said. Those words might have seemed very much in line with his Treasury successors’ one year ago, but crypto enthusiasm has dimmed somewhat. Sunak and former City minister John Glen were forced to quietly can their much-mocked NFT, and the emphasis has since been on drawing up firmer guardrails.

“Politicians, I’m afraid,

Hammond: “City should embrace crypto”

speaking as a former practitioner, are always very much influenced by shortterm factors,” he said.

Hammond’s firm wasn’t entirely shielded from the crypto chaos, which saw a wave of high-profile names implode. Copper was forced to slash its headcount, but it bucked the worst of the sector slump, raising $196m in October.

Hammond, who holds a personal stake in Copper, says the past 12

months have been a period of growing up for the firm and its peers.

“Periods of very fast growth often don’t coincide with periods of huge attention to detail, and I think across the industry there were some signs of rapid growth syndrome and [some signs] of those who are going to be long-term survivors,” he said.

Copper, he claims, is now “90 per cent” of the way on its journey from being a “very fast-growing, slightly excitable, tech-focused business,” to being “a grown up infrastructure provider”.

THE CO-OPERATIVE Group yesterday warned that ongoing inflation is likely to reduce its profits in 2023.

The food, insurance and funeral care provider yesterday revealed its underlying profit remained flat at £100m for the year while ebitda dropped £15m to £490m, down from £505m in 2021.

While the listed retailer felt the loss in sales from the 132 petrol forecourt sites it offloaded to Asda in October, the company said it would have fallen to a loss without the deal.

The Co-op said that the lucrative £611m deal helped generate net proceeds of £408m and further reduced its lease commitments by £171m. Group revenues overall also crept up to £11.5bn, up from £11.2bn in 2021.

However, Co-op’s insurance arm saw overall income down to £24m from £34m as the group blamed “the contracting motor insurance” with customers hesitant to splash out on new cars.

JOSIE CLARK

MARCH delivered a “sharp shock” to retailers as consumers reined in to spending to cover essential shopping in the face of spiralling cost of living pressures.

increase seen between January and February, according to MRI Springboard. Footfall on UK high streets was down 18.7 per cent on 2019 levels and 0.6 per cent below last March.

1.4 per cent across UK high streets at the weekend – the first month ever this has occurred.

Allan Leighton, chair of the Co-operative Group, said: “The inflationary challenges facing most consumer-facing businesses are well known, so for our Coop to have delivered this level of performance over the year is encouraging.

“The board accepts and understands that ongoing inflation in energy and salary levels will mean our profits are likely to reduce in 2023 as we face into another year of economic

Footfall across all UK retail destinations fell by 2.8 per cent on the month before – a significant drop from the 9.4 per cent

MRI Springboard said inflationary pressures and interest rates had led to consumer trips now being driven by essential shopping, demonstrated by an annual decline in footfall of

MRI Springboard’s Diane Wehrle said: “For many consumers a period of austerity has started, with the driver of trips now being essential spending rather than experience as many consumers rein in leisurebased trips to destinations to reduce their spending.”

uncertainty and higher prices.”

It comes as Co-op’s board prepares for a serious shakeup as long-standing members Sir Christopher Kelly, Simon Burke, Stevie Spring, Paul Chandler and Allan Leighton all reach the maximum nine years of tenure and will be forced to step down at different points during 2023 and early 2024. The search is currently ongoing for replacements.

LAURA MCGUIRE

LAURA MCGUIRE

MEAT PACKER Hilton Foods yesterday blamed “significant” challenges in its seafood wing for nosediving profits, as it welcomes a former Co-op boss to head up the business.

The FTSE 250 firm’s share price closed down five per cent yesterday, as it witnessed a steep decline in profits down to £29.6m from £47.4m the previous year.

The beleaguered firm said it suffered

as global supply chain issues and soaring inflation battered earnings, despite it having reaped benefits from new partnerships in its meat division.

“After the challenges we faced last year in our seafood business, we took a series of steps to rebuild profitability and we are now well placed for the year ahead,” Philip Heffer, chief executive of Hilton Foods, said.

It comes as the group welcomes in former Co-op boss Steve Murrells to replace outgoing chief Philip Heffer.

NICHOLAS EARL

ENQUEST has joined industry calls for a windfall tax price floor, putting further pressure on the government to reform the Energy Profits Levy (EPL), after revealing net losses of £33m.

Amjad Bseisu, chief executive of the North Sea oil and gas operator, told City A.M. that a price floor was key for companies taking on new projects.

He said: “We’re very supportive of the floor. We continue to be. Banks use a much lower price than the market price. This means a floor is very important to establish credit and financing for businesses.”

The EPL, which was introduced last year, is a 35 per cent tax on profits to help fund support packages for businesses and households grappling with record energy bills.

In his view, reforming the EPL was essential for “encouraging investment”

and called on the government to commit to “competitive taxes on a worldwide basis to encourage investment.”

Bseisu considered $60-$70 per barrel to be a fair level for any price floor in the windfall tax, which City A.M. understands has not been clarified in Treasury proposals beyond “normal levels”.

Bseisu’s comments follow Enquest unveiling its full-year results, where it confirmed it is deferring drilling on its Kraken field in the North Sea, which it now plans to leave for “natural decline.”

It previously announced plans to delay further developments on the project, but has now opted against tapping into the remaining 33m barrels of resources available.

This was “primarily driven” by the £142.8m tax liability Enquest associates with EPL in its results.

Overall, the company reported gross profits of £522.7m, which was transformed to a £33m loss after taxes.

THE UK’s new car market has grown for eight consecutive months, figures show, with new car registrations up 18 per cent in March on 2022 levels, according to the SMMT. The increase was attributed to an easing of global supply chain shortages on top of the usual uptick in demand in March due to the introduction of new number plates.

NICHOLAS EARL

SUPPLIERS will have to ringfence renewable payments separately from their commercial operations or risk breaching the requirements of their licence in Ofgem’s latest move to crack down on the energy sector.

The watchdog has enshrined the requirement into the licencing conditions for suppliers amid the

shift to renewable energy, with firms expected to help fund the UK’s green ambitions.

Ofgem has also shown itself prepared to issue fines, with Delta Gas forced to cough up £530,000 last year for unpaid renewable obligation payments, with threats to take away its licence for late payments.

The additional requirement of ringfencing under the licensing terms

for renewable payments toughens the green obligations suppliers face.

An Ofgem spokesperson said: “Our robust processes have kept millions of customers on supply when their energy firm has collapsed. We’ve taken a range of steps to reduce the cost to consumers if and when a supplier does collapse and, crucially, taken steps to reduce the risk of supplier failure in the first place.”

OFCOM has proposed referring UK cloud services to the competition regulator, citing concerns that key players Amazon and Microsoft could stifle competition. The communications regulator said it has proposed referring the sector to the Competition and Markets Authority (CMA) after it identified features which make it harder for customers to switch or use multiple providers.

It added that it was “particularly concerned about the practices of Amazon and Microsoft” due to their market position.

Amazon’s cloud service, Amazon Web Services (AWS), and Microsoft‘s Azure collectively dominate up to 70 per cent of the market, according to Ofcom. Google, who is their closest competitor, holds between five and 10 per cent.

“We’ve done a deep dive into the digital backbone of our economy, and uncovered some concerning practices, including by some of the biggest tech firms in the world,” said Fergal Farragher, a director at Ofcom.

Ofcom, which launched an investigation into cloud services in October, added that barriers to switching suppliers are

TECH FIRMS may try to dodge a UK government tax levied on digital companies if international tax reforms on the sector are delayed, parliament’s spending watchdog has warned.

tax in its first year, 30 per cent more than expected, but added that it was still unclear how much tax should have been paid due to its “novelty”.

It added if the tax remains in place longer than intended due to a likely delay in international reforms, tech companies could avoid payments.

resources and expertise at their disposal to circumvent the tax,” it said in a report.

already harming competition across the whole sector, including high fees associated with transferring data.

“We think more in-depth scrutiny is needed, to make sure it’s working well for people and businesses who rely on these services,” Farragher added.

The CMA said it is reviewing Ofcom’s initial findings.

“We stand ready to carry out a market investigation into this area, should Ofcom determine it is required following the completion of its consultation process,” it added.

Ofcom said it would publish its final decision on market investigation recommendations by October.

Amazon said it would continue to work with Ofcom ahead of the publication of its final report.

“At AWS, we design our cloud services to give customers the freedom to build the solution that is right for them, with the technology of their choice. This has driven increased competition across a range of sectors in the UK economy by broadening access to innovative, highly secure, and scalable IT services,” it added.

Microsoft said: “We remain committed to ensuring the UK cloud industry stays highly competitive.”

The public accounts committee said this week that it had raised £358m from the digital services

“We are concerned that this may prompt businesses within the scope of the tax to consider using the huge

The tax was introduced in 2020 to prevent profits reaped by international digital companies being transferred and taxed abroad. “[HMRC] needs to up its game on how the tax will actually operate,” said Sarah Olney, a Liberal Democrat MP who led the enquiry.

CHARLIE CONCHIE

SCANDAL-STRICKEN social housing investor Home REIT yesterday said it is looking to offload some properties as it scrambles to raise cash and “stabilise” its portfolio ahead of the appointment of a new investment adviser.

In a statement yesterday morning, bosses said the former FTSE 250 firm “continues to explore all available options” as it waits to call in a new fund manager to replace Alvarium in the coming weeks, which has been at

the heart of the breakdown in its business model.

“[The Board] is giving particular consideration to the potential sale in the near-term of a limited number of properties, as the company works to stabilise its property portfolio,”

Home REIT said.

A report by social housing firm Simpact recently found that Home REIT’s tenants had paid just 23 per cent of total rent while its housing would require some £15-£20m to refurbish.

UBS CHAIR Colm Kelleher said the bank’s $3.25bn (£2.61bn) acquisition of Credit Suisse would not force it to change its strategy over the next few years, but admitted the integration represented a “major challenge”.

Speaking at the bank’s AGM in Basel yesterday, Kelleher said the acquisition was “a new beginning” and brought “huge opportunities ahead for the combined bank and for the Swiss financial centre as a whole”.

“This transaction is financially attractive… I’m convinced we made the right choice,” he said.

However, Kelleher warned that the integration posed “significant execution risk”. It was as a result of those risks, he confirmed, that the bank turned to exchief executive Sergio Ermotti.

Ermotti, who was chief executive for nine years up to 2020, was brought

back in as head honcho last week. Kelleher said he was “convinced this decision will help deliver a successful integration”.

Outgoing CEO Ralph Hamers also said the acquisition would be a huge challenge, conceding that it would require someone with “a different leadership profile”.

Kelleher said, however, that the deal would not endanger the bank’s strategic plan. “The strategy is clear and unchanged by the acquisition of Credit Suisse,” he said, claiming that the takeover, in fact, “accelerates its implementation”.

UBS has downsized its investment bank in recent years, concentrated on its wealth and asset management business and sought to expand in the US and Asia.

Shareholders, however, raised concerns the deal could lead to job cuts and expose the bank to Credit Suisse’s risk.

SWITZERLAND’s financial markets regulator has defended the rescue of Credit Suisse through a takeover by rival bank UBS as the solution with the least risk of creating a wider crisis and damaging the country’s standing as a financial centre.

The merger was “the best option” and one that “minimised risk of contagion and maximised trust”, said Urban Angehrn, chief executive of the Swiss Financial Market Supervisory Authority, known as Finma.

Angern said two other options — a

takeover by the Swiss government or putting Credit Suisse into insolvency proceedings — had serious drawbacks.

Insolvency would have left the functional parts of Credit Suisse in operation as a Swiss-only bank but one with a “damaged reputation” through bankruptcy, he told reporters in the Swiss capital of Bern.

A temporary takeover by the Swiss government would have exposed taxpayers to the risk of losses.

“One can well imagine what devastating effect the insolvency of a big wealth management bank of Credit Suisse AG would have had on

Swiss private banking,” Angern said. “Many other Swiss banks could have faced a bank run, just as Credit Suisse did itself in the fourth quarter.”

The globe’s biggest banks are required to submit emergency plans for winding them up if they fail. Triggering such an emergency plan “would have achieved its immediate aim” of preserving payments and supporting the economy in Switzerland, Angehrn said.

“But the damage to Switzerland as a place to do business, to the reputation of Switzerland, to tax revenue and jobs, would have been enormous.”

GAMBLING giant Entain has snapped up sports media firm 365scores in a deal worth up to £128m.

Entain, which owns betting brands Ladbrokes and Coral, said the acquisition is aimed at improving its interactive content and experience for users.

Shares in the London-listed firm edged higher on Wednesday morning as a result.

The betting and gaming firm said it will pay an initial consideration of around $150m (approximately £120m) for the business.

TALKS aimed at resolving a longrunning dispute at Royal Mail have ended without agreement.

The company has been meeting the Communication Workers Union (CWU) to try to reach a deal over pay, jobs and conditions.

including mediation by Sir Brendan Barber and Acas, we are deeply concerned that our talks with CWU have concluded without an agreement.

“We made substantial efforts to reach an agreement, including making a number of further improvements to our offer.

the deal until April 2025.

media content alongside Entain’s global scale and market-leading platform capabilities will provide customers with a broader offering of interactive content and experiences.

“The acquisition unlocks further growth opportunities and supports our global strategic ambitions.”

Victoria Scholar, head of investment at Interactive Investor, said: “The sports betting and gaming industry is no stranger to inorganic growth.

*In the last year

It will also pay up to $10m (£8m) in additional contingency payments linked to performance.

365scores, which was founded in 2012, is a sports media and scores business which provides sport information, editorial and social content across 10 different sports and more than 2,000 competitions around the world.

In a statement to shareholders, Entain said: “The combination of 365scores’ deep expertise in data-driven sports

“But this bolt-on is slightly different, pushing Entain into sports media content, underscoring the importance of data when it comes to targeting new audiences.

“Shares in Entain have struggled over the last year, down by 25 per cent, in stark contrast to its rival Flutter which is one of the top performers on the FTSE 100, up around 60 per cent.”

Declining online net gaming revenue post-pandemic, a tightening regulatory landscape and an averted takeover from MGM Resorts in February have also dented the firm, Scholar added.

A Royal Mail spokesman said: “After 11 months of talks,

Royal Mail said that it had increased its pay offer and extended

A CWU spokesman yesterday said: “There has been progress in several areas, and the union made it clear last night that we are willing to continue negotiations today and tomorrow to finalise an agreement. “We will be consulting with the union’s postal executive later today and considering all available options with regards to our next steps.”

LAURA MCGUIRE

TOPPS TILES share price closed up nearly seven per cent yesterday after the retailer posted bumper revenues for the first half of the year.

The Leicester-headquartered business reported a 9.5 per cent jump in revenues to £130.5m in the 26-week period ending April 1, with some £9m of the revenue growth related to its acquisition of DIY business Pro Tiler Tools and the launch of Tile

Warehouse in 2022.

Chief executive Rob Parker said that while the economic outlook “remains uncertain” the company was confident about its performance for the year ahead.

It comes as the market had been signalling a slowdown of the DIY boom which was fuelled by the pandemic.

Earlier this year, B&Q-owner Kingfisher and fellow DIY retailer Wickes both reported a fall in pre-tax profits for the year.

FORMER SNP chief executive Peter Murrell was last night “released without charge pending further investigation” after being arrested earlier yesterday in a probe into the party’s finances.

It comes after police were yesterday seen scouring the back garden of former first minister Nicola Sturgeon after her husband was arrested following an investigation into the SNP’s finances.

Peter Murrell, who married the former party leader in 2010, stepped down as the SNP’s chief executive last month following a controversy about misleading information being given to journalists over the party’s membership numbers.

Murrell was arrested yesterday as a result of a long-running, police investigation into the spending of about

Scottish independence campaigning. Police also launched a search of the party’s Edinburgh headquarters. According to reports, a spokesperson for Nicola Sturgeon said she had “no prior knowledge” of Police Scotland’s “actions or intentions” over the arrest of her husband, and said Sturgeon would “fully cooperate” with the police if required.

First minister Humza Yousaf, who took over from Sturgeon last week, described the arrest as a “difficult day” with the party.

“My reaction, as you’d imagine, much like anybody involved in the SNP, is that this is a difficulty for the party,” he said. Asked if the investigation was the real reason Nicola Sturgeon resigned, Yousaf told PA: “Nicola’s legacy stands on its own.”

IT’s been a tricky couple of months for the SNP: from rows over gender recognition reform to the Supreme Court blocking its attempts to call a second referendum on independence –not forgetting a chaotic and recriminatory election battle to replace Nicola Sturgeon as leader and first minister.

Now, more drama around Sturgeon’s husband, Peter Murrell, in connection to the “ongoing investigation into the funding and finances” of the party can be added to the pile of woes.

Whatever the outcome of the police investigation, these are not headlines the party wants to make while it’s also pushing for a second referendum.

A Redfield-Wilton poll this week showed the SNP is still on course to win the most Scottish seats at a general election, at 36 per cent, but Labour is closing the gap, on 31 per cent.

Numbers like that will give the Tories pause too, as Scotland’s shift to the SNP has seen Labour’s constituency numbers hollowed out in recent years.

A Labour win in Scotland will make the path to holding on to No10 even slippier for Sunak.

JESSICA FRANK-KEYES

JESSICA FRANK-KEYES

GAS PRICES will not return to pre-energy crisis levels for another three years despite the recent drop-off across wholesale markets, investment group Stifel has warned.

Managing director Chis Wheaton told City A.M. that a return to formerly established prices in the UK when gas traded at around 40p per therm would require a vast hike in liquefied natural gas production, with Europe now reliant on tankers from the US to meet its energy needs.

LNG is natural gas that has been reduced to a liquid state through a process of cooling before it is later converted back into a gas for use.

The UK and Europe has relied on shipments from the US and Qatar to meet its energy needs over the winter.

Wheaton calculated that Europe requires 125m tonnes of LNG to replace

the natural gas resources Russia was supplying by pipeline prior to the invasion of Ukraine, before its throttling of supplies in response to Western sanctions.

He said: “It will take until at least 2026 to return to close to pre-crisis levels. This is because there is limited additional supply of LNG in the near term, as it takes three to four years and £640m to add one million tonnes per year of LNG supply, so it can’t be delivered immediately.”

UK gas prices climbed to a record high of nearly £8 per therm last summer following Russia’s invasion of Ukraine –with Western sanctions and a Kremlinbacked supply squeeze raising fears of supply shortages on the continent.

The benchmark was already operating at historically elevated levels after the collapse of dozens of domestic energy suppliers amid rebounding demand from the pandemic.

Highview Power has joined forces with wind power colossus Orsted to prove the feasibility of merging offshore turbines with storage

NICHOLAS EARL

ENERGY storage player Highview Power and wind power giant Orsted have teamed up to try and prove the feasibility and economic value of merging offshore wind turbines with long-duration storage.

The two companies have signed a memorandum of understanding to

investigate whether combining Orsted’s wind technology with Highview Power’s liquid air energy storage can deliver a stronger case for future offshore wind projects.

Liquid air energy storage uses electricity to cool air until it liquefies, and then stores liquid air in a tank.

The liquid air is then heated up and reverted back into to a gaseous

state, which is then used to turn a turbine and generate electricity.

Duncan Clark, managing director offshore and country chair UK & Ireland for Orsted, said: “Together our technologies can be a catalyst to accelerate the transition from fossil fuels to renewable energy and help unlock the economic potential of that transition for the UK.”

How’s that licence to print money going? Not so well if you’re a long-standing investor in De La Rue, the authentication and currency specialist which has managed to squander a market-leading position and hundreds of millions of pounds in shareholder value. Oberthur Technologies, its French-based peer, tabled an indicative offer in 2010 worth 905p-a-share, or nearly £900m.

After a fierce battle, the cross-Channel raid was thwarted. It must now feel like the best French defeat since Napoleon. Since then, De La Rue’s stock has plummeted. The shares now change hands for little more than 50p .

A rescue rights issue in 2020 has failed to stem the tide. Indeed, discounting the £100m it raised then, its equity would now be virtually worthless.

For a company operating in markets with high barriers to entry, this level of value destruction is unforgivable.

So a degree of public frustration among De La Rue shareholders would seem inevitable. Yet efforts by Crystal Amber Funds, the vehicle run by prominent activist Richard Bernstein, to galvanise fellow investors have hitherto largely fallen flat.

Crystal Amber, which owns just shy of 10 per cent of the company, is putting it to the test again. As I revealed last week, it has written to the company to requisition a general meeting seeking the removal of Kevin Loosemore as De La Rue chairman.

Investors in Manolete Partners, the litigation financing company, have had a humdrum ride since its London stock market debut in 2018. The shares listed at 175p, so at 242p yesterday, it would be hard to label them a disastrous investment.

One bright spot for the stock should be the pilot project it is working on with Barclays to aid the bank’s recovery of Covid Bounce Back Loans.

Early results have been encouraging, with 20 per cent of the 45 cases assigned to Manolete

In his place, the activist wants to install Pepijn Dinandt, a seasoned industrial turnaround executive.

It will be the third time in under a year that investors will have voted on Loosemore’s leadership. The first, at the 2022 AGM, saw him overwhelmingly re-elected; the second –a vote called by the company amid demands from Crystal Amber that he step down –produced the same outcome, albeit with a slightly narrower margin of victory.

Sources close to De La Rue label the decision to convene another poll a distraction from the focus on its turnaround plan.

They miss a simple point: that plan isn’t working. Only a few weeks ago, the company asked its pension trustees to consent to the deferral of £20m in payments into its retirement scheme. The list of mishaps goes on: in January, it disclosed that it was suspending banknote printing operations in Kenya, as well as an investigation into a former Indian finance minister in which it had become implicated.

A takeover or break-up of De La Rue looks as elusive as ever, leaving shareholders with an important choice: stick with the incumbent management team, or take a calculated risk that Dinandt can hardly make a worse fist of it than Loosemore.

It’s hard to believe that institutional investors can be so supine as to reject out-of-hand Crystal Amber’s efforts to revive a once-proud industrial name. If they do, its ongoing immolation will be on their watch too.

resulting in directors offering or agreeing to relay the misappropriated loan.

In a stock exchange announcement this month, Manolete said it was in advanced talks with another major UK high street bank about a

similar programme. Banking sources say the second lender in question is Lloyds Banking Group: a successful partnership there could be good for Manolete’s stock price –and be welcome news for British taxpayers.

Is there a more hapless economic regulator operating in Britain today than Ofgem? If so, the list cannot be very long.

At every turn since the start of the energy prices crisis, Ofgem has been found wanting.

To his credit, its chief executive has acknowledged some of its many shortcomings – most notably, at the end of 2021, as his organisation watched household gas and electricity suppliers toppling like dominoes, Jonathan Brearley admitted that its rules were insufficiently

robust to contend with soaring prices. The result? A re-concentration of the industry among a small group of large players with balance sheets strong enough to cope with wholesale pricing shocks.

Recently, though, things have taken a more bizarre turn. It was bad enough that Ofgem failed to clamp down on the outrageous practice of some suppliers enforcing the

installation of pre-payment meters in the homes of vulnerable consumers. That scandal came to light only because of reporting by The Times. Instead of congratulating it on its investigative work, Ofgem sent legal threats to the newspaper in an attempt to uncover its sources. Grant Shapps, the energy secretary, made obvious his disdain for Ofgem’s behaviour, prompting a grovelling apology from its boss.

After I reported recently that the government was searching a new slate of Ofgem board members, I received a series of whingeing messages from its press office protesting at my description of the process as a boardroom overhaul.

This is self-evidently an organisation in crisis. Mr Shapps should now go further by finding a successor to Brearley with a readier grasp of the energy regulator’s priorities during arguably the most crucial period in the sector’s history.

Bounce back loans could give Manolete a spring

In the sixth of an eight-week series, German historian and sociologist Dr Rainer Zitelmann takes apart the arguments of those who’d battle against free markets, bit by bit. This week, he takes on the idea that capitalism creates monopolies - and points to Nokia and Myspace as example 1A and 1B

INan international survey on popular perceptions of capitalism, which I commissioned for the book In Defence of Capitalism, one of the main criticisms levelled at capitalism was that it leads to monopolies. And this is true. Capitalism can lead to monopolies. But it is also true that nothing destroys monopolies more effectively than capitalism. Monopolies appear indestructible at the height of their power, but they are far from eternal. Today, many people believe that giants like Amazon and Google are so dominant they could only ever seriously be challenged by government anti-trust policies. However, history teaches us that monopolies are much less durable than most people believe.

The social network Myspace was founded in 2003 and quickly gained millions of users. By June 2006, Myspace was the most-visited website in the US, even ahead of Google. In 2007, The Guardian asked, “Will Myspace ever lose its monopoly?”. By early 2008, Myspace had a 74.4 per cent share of the social network market, and by December 2008, it had 75.9m visitors in the United States alone. But just six months later, Facebook overtook Myspace in the US, and the company’s market share had fallen to just 30 per cent by the end of 2009. Today, Myspace has become almost entirely irrelevant.

In November 2008, Forbes magazine ran a major story on the mobile phone manufacturer Nokia. The cover story’s headline read “One Billion Customers – Can Anyone Catch the Cell Phone King?”. After consistently being the world’s largest mobile phone manufacturer from 1998 to 2011, Nokia was overtaken by Samsung in the first quarter of 2012 as the South Korean company took an estimated 25.4 per cent share of the market. Nokia still accounted for a respectable 22.5 per cent of the market and Apple had 9.5 per cent. Nevertheless, Nokia’s share had

fallen by more than a third since 2008. Strikingly, Nokia developed the world’s very first smartphone in the 1990s, but it did not appreciate the importance of apps to mobile phone users until it was too late. In 2013, Microsoft bought Nokia’s cell phone division, which at the time had a global market share of just three per cent.

Another example is Xerox, which invented the first photocopier in 1960 and dominated the market in 1970 with a market share of almost 100 per cent. Just as people today say “I’ll

while Xerox wanted to continue making money on copy volume like a reliable subscription, as it had always done. Today, Xerox is stuck on less than two per cent of the global photocopier market.

THE Small Business Research + Enterprise Centre (SBREC) is reopening its doors at a new location on 11 April.

Google it” when they search the internet, people back then referred to “Xeroxing” whenever they photocopied something. In 1973, Xerox was accused of violating antitrust laws and a drawn-out legal battle ensued. But back then – more so than today –the problem was settled by the market, as companies such as IBM, Eastman-Kodak, Canon, Minolta, Ricoh and others all launched smaller and cheaper photocopiers. These competitors developed machines that used low-maintenance liquid toner and were built with inexpensive, standardised parts. They were sold through ordinary office supply stores rather than through an expensive proprietary network. All of a sudden, the Japanese were selling low-end copiers at prices below the manufacturing cost of Xerox’s machines,

And in 1976, Kodak held over 90 per cent of the US film market and 85 per cent of the US camera market. Kodak fully underestimated the shift to digital cameras, before the market evolved again to come to be dominated by high-spec smartphone cameras. In 2012, the company filed for bankruptcy and later tried its luck with other business models. Competition and monopoly are not absolute opposites, but they are a dialectical contradiction: competition creates monopoly because the best product prevails. High monopoly profits attract new competitors, who gradually destroy the monopoly, but at a certain point may themselves temporarily become a monopoly, only to be destroyed again by their competitors. It is only in the case of public monopolies that this cannot happen, since government power prevents it from being subject to competition. Monopolies that are not public monopolies will typically disappear sooner or later because the monopolists become overly bureaucratic as they grow larger, they are subject to minimal competitive pressures and their mentality becomes more and more like that of governmentowned enterprises.

£ Rainer Zitelmann is a historian and sociologist. His book In Defence of Capitalism has just been published. https://in-defence-of-capitalism.com/

Now based in 80 Basinghall Street EC2V 5AG (the site of the former City Centre), it will offer a new dedicated space to support anyone starting a business and carrying out market research. It will also offer access to exclusive events to support you and the growth of your business.

And why not become a member of the SBREC? Membership gives small businesses across the UK remote access to a wide range of invaluable

business information, including company contacts and market research.

The Centre will be open MondayThursday 10am-5pm.

Find our more by visiting cityoflondon.gov.uk/sbrec

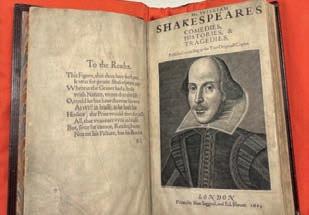

ONE of the world’s finest copies of the First Folio will go on rare public display at Guildhall Library for one day this month, as part of its 400th anniversary celebrations.

The City of London Corporation, which owns the library and the First Folio, will display the book on Monday 24 April for a limited period (10.30am to 3.30pm), accompanied by a 10-minute introductory talk about the First Folio given on the hour throughout the day.

Published in an edition of around 750

copies on 8 November 1623 – seven years after Shakespeare’s death - and widely regarded as one of the most valuable books in the literary world, the First Folio brought together 36 plays in one volume.

Competition and monopoly are not opposite, but they are a dialectical contradiction

LONDON’s blue chip index ended in the green yesterday despite weak data from the US raising the spectre of a looming recession risk.

The capital’s premier index closed 0.37 per cent higher at 7,662.94 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, ended 1.14 per cent lower at 18,601.42 points.

Analysts suggested the market moved in response to weak jobs data from the US out yesterday.

ADP employment figures undershot expectations which reinforced data suggesting that the labour market is beginning to weaken.

Although this suggests the US is on track for a recession, it also raises the chance that the Fed will move to rate cuts sooner rather than later.

“Sometimes markets go up on bad data, as it means rate cuts are coming, and sometimes they go down, since recession fears rise,” IG’s Chris Beauchamp commented.

The FTSE’s pharmaceutical companies performed well with Astrazeneca and GSK rising 3.1 per cent and 2.5 per cent respectively.

Astrazeneca announced positive trial results yesterday for a new treatment for ovarian cancer.

Insurer Direct Line maintained gains from earlier in the day, ending over six per cent higher. Citi moved its rating from ‘sell’ to ‘buy’ on the shares.

Shares in Fulham Shore rocketed over 30 per cent after it announced it was being bought by Japanese food franchise company Toridoll in a £93m deal. The offer represents around a 38 per cent premium on the firm’s closing price on Tuesday.

North Sea oil and gas producer Serica Energy has posted a bullish reserves report, positively revising its net production levels three-fold to 38.9m barrels of oil equivalent. This follows the maturation of resources including for infill wells in the Triton area fields and well work on the Bruce field, alongside extension of production from both the Bruce and Triton hubs from 2030 to 2035. Peel Hunt has kept its buy stance at a 437p target price.

Equipment hire specialist Speedy Hire is clearly no tool, after announcing a fullyear trading update in line with robust expectations, including 14 per cent revenue growth powered by strong customer service. Its outlook is confident with pipeline of new business offsetting some expected end market softness. Peel Hunt has maintained its buy stance at a target price of 70p per share.

“The FTSE 100 is heading into Easter with a spring in its step despite weaker than expected data from the US. Figures on job openings and factory orders are pointing towards a potential recession for the world’s largest economy, but the upside might be a pause in interest rates which would typically be a positive for stocks.”

DANNI HEWSON, AJ BELL

WHAT WAS YOUR FIRST JOB?

Graduate trainee at Charterhouse Bank. The key question at interview seemed to be which rugby club I intended playing for. It was actually a rather thorough graduate scheme which gave me a solid grounding in the capital markets.

WHAT WAS YOUR FIRST JOB IN FINANCIAL SERVICES (OR ADJACENT TOO)

As above. I soon realised that, while I enjoyed business and finance, I was not destined to be a banker and I ‘ran away’ to the world of communications in my twenties.

WHEN DID YOU FIRST REALISE THIS INDUSTRY WAS THE PLACE FOR YOU?

Straight away. Communications is a people business –which I like. Meanwhile the perceived value of reputation continues to rise, matched by the ever-greater complexity that the twenty-first century brings. So, it has been a career full of changes and challenges. For someone like me who gets bored easily, it’s perfect.

WHAT’S ONE THING YOU LOVE ABOUT THE SQUARE MILE

I pretty much instantly fell in love with the City. I still remember my first ’liquid lunch’ at the hands of a top-rated equity analyst at The Lamb in Leadenhall Market. I enjoy the gossip and the intrigue and the buccaneering spirit that hopefully will always set London in good stead.

WHAT’S ONE THING YOU’D CHANGE…

Founding a company alongside my business partner, Louise Nicolson, has been an eye-opener in terms of understanding the level of casual misogyny that still exists. I was honoured to be asked to join the 30 per cent Club Steering Committee last year as this is something that needs to be addressed.

WHAT’S YOUR MOST MEMORABLE LUNCH?

So many memorable lunches! If I had to pick one, I always look forward to getting together with my pals Nick Ferrari and David Buik over lunch. Stalwarts of the media and the City respectively. Lots of stories and tales –some of them even true.

SPEAKING OF, WE’RE OFF TO LUNCH –YOU’RE PICKING. WHERE ARE WE GOING?

My favourite restaurants include J Sheekey, Lyle’s and Bancone (home to the finest fresh pasta in London).

AND WHAT’S YOUR FAVOURITE WATERING HOLE?

The Lamb & Flag in Covent Garden. My name is on a brass plaque on the

wall – testament to a misspent youth.

ARE YOU OPTIMISTIC FOR THE CITY THIS YEAR?

I hosted a private dinner last week

with a dozen CEOs and CFOs drawn from the UK financial services sector. I was genuinely surprised (and pleased) to witness a high degree of optimism around the table.

WHAT’S THE MOST REWARDING THING ABOUT YOUR JOB?

It’s great fun to work with such a wonderful team. Trite but true.

WHAT’S BEEN THE MOST FUN ABOUT SETTING UP WILLIAMS NICOLSON?

The world of communications is about to be hit by a wall of data and we see ourselves as being at the forefront. It’s been exciting to help companies open their eyes and see the new possibilities before them.

WHERE’S HOME DURING THE WEEK?

Hammersmith. If you were an estate agent, you would call it Fulham. Trust me, it’s Hammersmith.

IT’S A SATURDAY AFTERNOON –WHERE ABOUTS ARE YOU?

During the Six Nations, watching a

rugby match. Otherwise, on a ski slope, in a salmon river or on a hike. AND YOU’VE GOT TWO WEEKS OFF –WHERE ARE YOU OFF TO?

As my family will vouch, I’m generally not a great one for lounging around on holiday so I like to spend time in places where there’s plenty to do. I like Italy a lot –a great mixture of history, landscape and food and drink to explore.

We dig into the memory bank of the City’s grandees: this week, Williams Nicolson’s Steffan Williams tells us about the value of PR, Welsh rugby and his favourite London pub

THE Crypto AM Spring Awakening has been hailed a resounding success by industry leaders and guests who attended the event at Mansion House. More than a hundred people gathered for an exclusive day of panels, discussion and a lavish lunch in the sumptuous setting of the Egyptian Hall.

The event was opened by former City of London mayor Sir William Russell and Lord Holmes of Richmond who both spoke passionately about how London can seize an opportunity to be the world leader in a digital future.

Hosting the Spring Awakening, Crypto AM founder and editor-at-large James Bowater said he wanted to echo the mantra of ‘we can do this’ reflected by several of the day’s speakers.

“At the Crypto AM Spring Awakening we asked the question ‘Can traditional finance and decentralised finance co-

exist?’. We believe the answer is ‘yes’, but we’re not there yet and we need to work hard towards this,” he said.

“London is the home of law, finance and all the necessary tools - all the component pieces are here to cement ourselves as the epicentre of this industry.

“We aim to compile all our learnings from the day into a manifesto on how we can do this, which we will be publishing. We need to have a new, definitive, fit-for-purpose representation of the industry and how we, therefore, deal with government and traditional finance.

“This is our moment to lead and set the global benchmark… we can do this!”

The next event in the Crypto AM calendar will be the ‘SOLSTICE Unlocking Summer and 5th Birthday Party’ at the Boisdale in Canary Wharf on Wednesday June 21.

IT IS almost six months since Rishi Sunak became Prime Minister, and while he has outlasted his predecessor, it remains to be seen whether he can turn around the problems his party, and the country, face. At least, after half a year, we have a sense of how he intends to lead: as Rishi Sunak, Chief Executive Officer of the UK.

This model is hardly surprising for a man who made his career first at Goldmans and then at hedge funds; now he has taken an approach of calculating competence into Downing Street. We are told he has infused government with the language of management –setting his ministers quarterly goals and performance reviews, seeking to build a new spirit of delivery within politics.

It certainly marks a change from his predecessors. Truss’ tenure was almost too brief to establish anything and Boris’s time in office was perennially chaotic. Even accounting for the disruptions of Brexit and Covid, he rarely seemed to have things in hand. Ministers were appointed and promoted for loyalty, not ability, and the government seemed determined to govern by announcement rather than achievement. Its biggest success - the vaccine

rollout - was largely handed-off to figures outside of politics.

By contrast, Sunak appears to be delivering. His Windsor Framework has brought some closure to the running sore of the Northern Ireland Protocol, reaching accord with the EU and passing parliament with only a minor rebellion. Equally, the economic forecast is starting to improve. The question is whether this can continue, and if it will be enough to save the Tories from defeat.

Those around the party leader believe there is a path to victory in quiet, competent government. A chance to refresh the Tories once more and

sneak through a fifth successive election in power. This relies on tackling the major issues facing the country and doing so well. Sunak must be clear on his own objectives and how to hit them.

The economy is an obvious one: no governing party has recovered from a recession. While the OBR now predicts we will avoid a technical recession, the cost-of-living crisis continues to bite, and even if inflation drop back, prices will still be significantly higher than when he took charge.

On top of this, he has staked his reputation on stopping the small boats. This is an evocative issue for conserva-

tive leaning voters, and a real mark of difference between the Tories and Labour. Yet it will not be easy to achieve. Much of the plan, including the use of deportation to Rwanda, will face a raft of legal and logistical challenges. If he fails to achieve it, the government could face the double hammer of looking both cruel and incompetent.

At the same time, the Tories need to control the unravelling public services. Ongoing disputes with a variety of unions, including teachers, doctors and nurses, put their post pandemic plans at risk, and heighten a general malaise in government provision. En-

LONDONERS are facing even more monstrous rents. According to Rightmove, the average asking price in the capital has jumped to £2,480, a 15 per cent annual increase. In response, London mayor Sadiq Khan has reiterated demands for the power to freeze rents. Rent controls are deceptively attractive and it is easy to see why. An immediate freeze would initially reduce financial risks to the over 1 million people currently renting in London. This is an understandably popular –perhaps even a populist – idea among London renters facing the risk of stiff increases.

But do not be fooled. Henry Hazlitt’s classic book, Economics in One Lesson, emphasises the importance of “looking not merely at the immediate but at the longer effects” of any policy. In this respect, rent controls are consistently and unquestionably an unmitigated disaster. Rent controls would worsen the underlying issue, the lack of housing supply, while reducing the quality of accommodation and mak-

Matthew Leshing London even less accessible to newcomers.

It doesn’t require an advanced degree in economics to realise that when you set a price floor, forcing a supplier to sell something below the market price, they will produce less of the product, resulting in a shortage.

Housing is no different. Rent control would discourage housebuilders from constructing, meaning fewer places for people to live. This will exacerbate the underlying housing crisis – driven by the UK building 4.3 million fewer homes than necessary, compared to the European average.

Rent controls would also encourage landlords to take their properties off

the rental market – as has happened in Ireland and Scotland. This would particularly hurt the likes of students and migrants, who lack the capital to purchase a property. The result will be hundreds of people lining up for viewings, as was the case last September in Dublin as students scrambled to find an apartment or in Stockholm where it takes an average of 11 years to get a rent-controlled apartment. London is a dynamic, entrepreneurial and highly mobile city. People come and go. Brits beginning their careers in the capital. Foreigners coming to take high-powered roles in the city. Lifetime locals upsizing and downsizing throughout their lives. This drives economic growth, as the most productive workers move into the capital. Rent controls would make this significantly more difficult. Immigrants would find moving into the capital far harder, both since the new housing supply would be scarce and existing tenants would opt not to move to maintain their favourable rents. Thus rent control would turn London into a

closed city, much less accessible to outsiders. London would not be “open,” as Khan declared during the Trump era, but almost entirely “closed”. The only alternative would be a black market, as has developed in Stockholm, with the lucky or connected few getting access to apartments.

Proponents claim things will be different next time. They speak about well-designed rent control. Sadiq Khan used to point to Berlin, which introduced rent control in 2020. The German capital’s rent control, which only applied to older apartments, resulted in a halving of new apartments coming onto the market. In the unregulated sector, rents were even higher.

Assar Lindbeck, the socialist Swedish economist, once described rent control as “the most efficient technique presently known to destroy a city—except for bombing.” It ranks somewhere between farce and tragedy that we consistently fail to learn this lesson.

£ Matthew Lesh is the Director of Public Policy and Communications at the IEA

£ Matthew Lesh is the Director of Public Policy and Communications at the IEA

tering an election year with disrupted education and stubbornly high waiting lists would make an almost impossible electoral challenge.

Sunak took on the premiership as a distressed purchase. The challenges ahead of him were enormous, and so far, he has only been able to chip away at them. He has now had the time to establish his style of government and align his top team – but there are meaty problems to tackle, which require more than polished slide decks and punchy objective setting. It’s hard to transform anything if the fundamentals are against you.

Just as difficult for CEO Sunak is his fight with the Tory brand. The last couple of years has damaged the party’s image immeasurably. They are now polling consistently in the mid-20s and have become totally alienated from certain groups of voters – most notably the under-40s and women. If people no longer trust you, it’s hard to win them back no matter what you are offering, and it’s not possible to completely rebadge and relaunch a political party. Many with Sunak’s background have made their names turning around companies that have slid through chaotic leadership and missed targets. His initial pitch to the party was based on his competent managerialism, and six months in he has laid the foundations and chalked up some quick wins. With the general election around four quarters away, it’s time to see if CEO Sunak can do the same, or simply caretake long enough to offload it on to the next volunteer.

£ John Oxley is a political commentator

Let’sRishi Sunak sets quarterly goals and performance reviews for his ministers

LUCK O’ THE IRISH Leo Varadkar, the Irish Taioseach, has heaped praise onto Joe Biden, ahead of the US President’s trip to Ireland to mark the anniversary of the Good Friday Agreement. Varadkar said Biden, whose great great grandfather was Irish, had ‘always been a friend to Ireland’,

[Re: Problematic Puccini is back again at the ROH, 23rd March]

I read with interest the review of the Royal Opera House's recently revived production of Turandot. As someone who has researched the intersection of race, culture, and authenticity in Puccini's operas, I would like to offer a different perspective on this matter.

It is this conundrum that lies at the heart of the issue of cultural appropriation and Orientalism in opera: how to address the problematic elements of these works while still preserving their artistic integrity and historical context. In my view, it is possible to do both, but it requires a nuanced and thoughtful approach that takes into account the diverse perspectives of different

communities.

Whilst it is important to acknowledge the longstanding history of Orientalism and cultural appropriation in opera productions that depict non-Western cultures, it is equally important to recognise that there is no 'one-size-fitsall' solution as a way of addressing these issues. In some cases, such as with the Seattle Opera's 2017 production of Madama Butterfly, their approach has involved hosting panel discussions with community leaders, activists, and local Asian artists to raise awareness of the culturally sensitive aspects of the opera.

Therefore, I would encourage the Royal Opera House and other institutions to continue engaging with these issues in a meaningful way, by listening to and incorporating the voices of diverse communities, and by striving to create productions that are both artistically compelling and culturally sensitive.

Vivek HariaAS SOON as a business starts to believe it has a divine right to exist, you can be sure that company is heading for trouble.

No UK retailer has embodied that spirit more than the John Lewis Partnership in the past two decades and I’m amazed the laurels they’ve been resting on haven’t started to decay by now.

I understand why JLP has managed to rest up so easy for several years and a big part of that must stem from the fact that it has a partnership model.

The media has always placed JLP on a pedestal and given it a far easier time than many of its rivals. But JLP seem to have failed to grasp that the reason for that is because of its employee-owned structure. To consider changing that –even in small ways as the company seems to be suggesting – would lose so much of that goodwill.

The problem John Lewis now faces is how can it justify changing its ownership model?

It also brings up a bigger question on how partnership and member models can work at all in the UK. If JLP can’t make the model work, then who can?

One only needs to look at the hammering LV= faced when its previous management tried to demutualise via a private equity takeover by Bain Capital.

Every day there is a new everyday essential getting more expensive. But the cost of cars could be on a downward trajectory, after car manufacturers made more cars than we need, according to UBS. The number of cars being made across the world is set to exceed sales by 6 per cent this year, the bank said.

The car industry has been plagued by supply chain problems over the last few years. As those continue to ease, they will be buoyed up in the short

term as they fulfil orders.

In fact, new car registrations jumped for the eight month in a row - an 18.2 per cent growth from the same time last year. But towards the end of the year, the squeeze on living costs will see the number of people looking to buy a car fall, leading to a possible price war.

The cost of electric cars has already started to fall significantly. The cost of a new Tesla, often seen as the crème de la crème of EVs, has been cut by as much as £8,000.

John Lewis is a far more well-known brand and I would be surprised if the media doesn’t go hell for leather to ensure no outside investors try to dilute such a heralded structure. It is also baffling to me that JLP didn’t see this coming.

Much has been said about the company’s boss Dame Sharon White – she is out of her depth, doesn’t understand retail and is just a career civil servant.

This is somewhat unfair and it is possible to detect the faintest whiff of racism, with a heavy dose of sexism. But as the former head of Ofcom, you would think she might know a thing or two about how the media industry she regulated operates and how best to get your message across.

She might also be a bit more clued into what is happening in Westminster and be following the ongoing debate on the future of mutuals set up in the wake of the LV= aborted deal.

The Co-operatives, Mutuals and Friendly Societies Bill is working its

way through parliament and would be a good place for JLP to find its voice, if raising capital remains such an issue for the business.

Unfortunately for JLP, White seems to be the kind of person who struggles with listening and engaging. Like the media organisations she once regulated, it appears she prefers to only operate in broadcast mode.

This is a common issue for lots of businesses and something we keep telling firms when they seek my advice. Engaging with the media and the public must be a two-way experience. The days of big beasts of industry and retail talking at people has now gone.

Bosses must sell their story by building relationships, giving guidance and providing clarity so that everyone understands all sides of the point of view.

White has failed to do any of that since the day she arrived at JLP’s Victoria offices and from a glance at the communications since the plans to change the partnership first leaked, that position hasn’t changed.

We still don’t know who has been approached, how far along the process is, what is the next step, how will partners be impacted, what will any funds be used for - and from speaking to other journalists it sounds like even

background information has been hard to come by.

Behind the scenes, there are now reports of a leak inquiry into how details of the plans to water down the partnership model ended up in the media.

The fact that details of the leak inquiry were themselves leaked shows just how utterly pointless a leak inquiry will be.

It also shows White has not learned from previous mistakes.

During the pandemic, I broke the news that JLP might not reopen all its department stores after lockdown. White subsequently recorded a video message to senior management describing her fury over the leak.

Naturally, that video was leaked to me. I occasionally watch it back to remind myself that even people at the top of their industry can struggle to see the wood from the trees.

But, if John Lewis is to ever emerge from the overgrown forest of its own making, it might want to start with being honest and open with the public. Otherwise, any remaining goodwill will be lost forever.

£ Simon Neville is Media Strategy and Content Director at SEC Newgate, he was formerly City Editor at Press Association

ROYAL HEADACHE Royal Mail pay talks with union break down... again

There is a saying among locals in the Chinese city of Xi’an that the worst thing that could happen during a trip there would be to miss the world famous Terracotta Army. The second worst thing would be to see the Terracotta Army.

You see, despite this lifesize army of clay soldiers being a genuine marvel –it’s sometimes called the eighth wonder of the world – there’s something stultifying about the whole experience, from the aircraft hanger they are housed within to the gauntlet of gift shops you must pass through to reach it. It takes something magical and, through systematising and commodifying it, reduces it to the mundane.

Chinese dissident artist Ai Weiwei –infamously placed under house arrest for his outspoken stance on the Chinese state – does the opposite in his work, taking objects that seem mundane individually and creating something magical through sheer, bloody-minded repetition.

Perhaps the most famous example is his 2010 Tate Modern installation in which he filled the Turbine Hall with

millions of hand-crafted porcelain sunflower seeds.

When you enter the Design Museum’s main exhibition space, you can see echoes of that installation: four vast rectangles cover the floor in the centre of the space like neatly ploughed fields.

One is filled with the sad remains of glazed pots made by Ai and his team, which were smashed by the Chinese authorities during one of their raids on his studio. Another is filled with more than 250,000 spouts from porcelain teapots dating from between 9601279CE (any imperfect pot would have the spout snapped off and, presumably, thrown into a big spout pit), each one representing a mouth that has been silenced.

Then there’s a field of 200,000 handmade stone cannon balls that have been meticulously arranged into a calming pattern that recalls a Japanese Zen garden, a far cry from their violent origins.

The final field is made up of neolithic tools – axe-heads, chisels, knives and the like – things that we have been trained to think of as rare but are clearly abundant enough for Ai to have amassed in their thousands, many from flea markets.

Through works like these, Ai has become perhaps the world’s leading collector and chronicler of Chinese historical artefacts, each one representing a past he says is being destroyed through reckless expansionism.

Circling the fields are bleak photo-

RECOMMENDED

THE SUPER MARIO BROS MOVIE

DIR. AARON HORVATH, MICHAEL JELENIC

BY VICTORIA LUXFORDAfter his one-time rival Sonic became a box office hit, it seemed inevitable that Nintendo mascot Mario would get his own movie. Illumination, the animation studio behind Minions, will be hoping this animated adaptation fares better than the 1993 live action disaster with Bob Hoskins. Taking inspiration from 40 plus years of gaming history, The Super Mario Bros Movie centres on Mario and Luigi, voiced by Chris Pratt and Charlie Day.

The Brooklyn plumbers embark on what seems like a routine job, only for Luigi to be sucked into another realm known as The Mushroom Kingdom.

Mario arrives soon after, learning that Luigi has been kidnapped by Bowser (Jack Black), the maniacal leader of the Koopa Army. Teaming up with Princess Peach (Anya Taylor-Joy), he must fight Bowser to save the kingdom, and his sibling.

The casting of Pratt as the traditionally Italian character was controversial but the film builds in a reason for his American accent, while still throwing in the odd “lets a-go!” along the way. This will no doubt enrage purists, but

this wacky quest is aiming to please audiences born after Mario had already become a console favourite.

The colourful, creature-filled world of Mario is perfect for the animation genre, with potential for numerous spin-offs and sequels. But the script plays it safe with an unsurprising 90 minute romp. Whether it’s racing down rainbow roads or facing haunted mansions, there are lots of nostalgic moments that will make gamers smile. It doesn’t elevate the subject matter, but the target audience of families on Easter holidays won’t mind.

Pratt makes for a dependable lead who allows his supporting players to do a lot of the heavy lifting. Taylor-Joy’s Peach is a tough leader who stands beside Mario against Black’s villain, who is surprisingly menacing. The always-entertaining Keegan Michael Key as sidekick Toad, and the unmistakable tones of Seth Rogen as Donkey Kong, both give well-known characters a fresh coat of paint. It’s a shame Day’s Luigi isn’t featured as much, given he’s fun than his co-star.

The Super Mario Bros Movie is ultimately a film intended for kids, and in that regard it provides enough laughs to make this another success for Illumination. Older fans might be disappointed in the surface-level storytelling, but it’s hard not to smile at the affection shown for the games’ legacy.

graphs of construction sites that have usurped local populations, while a triptych of videos show footage recorded at various points along Beijing’s three vast ringroads.