DISCREDITED OUR FULL REPORT ON AN EXTRAORDINARY DAY AT CREDIT SUISSE’S (LAST) AGM P7

ABBY WALLACE

ABBY WALLACE

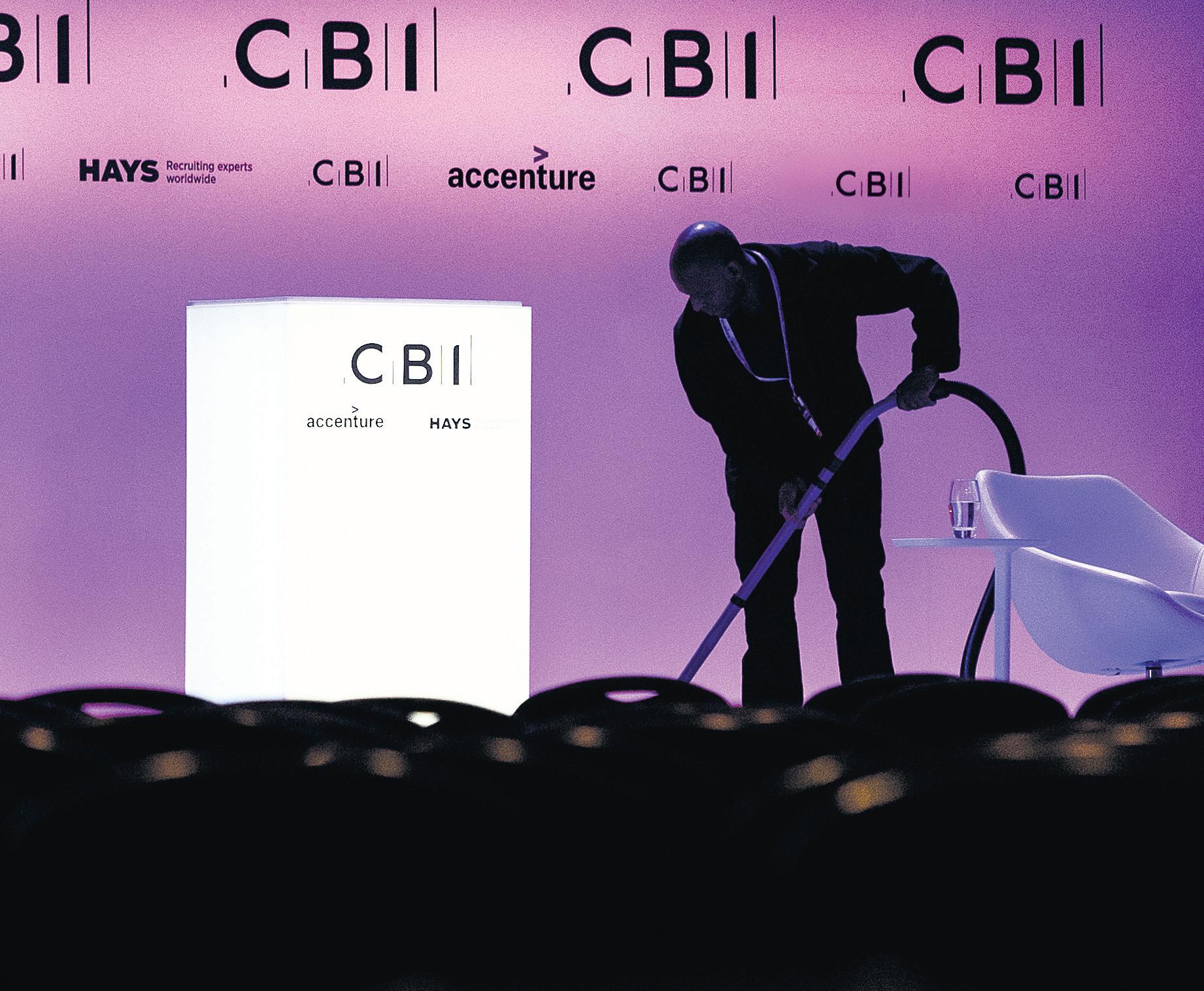

THE CONFEDERATION of British Industry (CBI) has cancelled all upcoming external events in the wake of an ongoing investigation into sexual misconduct allegations at the organisation.

The business lobby group said yesterday that upcoming events — including an annual dinner set to be attended by Bank of England governor Andrew Bailey — would be paused pending initial findings of the

CHARLIE CONCHIE

RATHBONES has partnered up with Investec’s wealth arm in a move which will create one of the UK’s top money managers with £100bn assets under management.

In a statement yesterday, bosses at the two firms said they had struck an £839m deal for an all-share combination of Rathbones with Investec Wealth & Investment Limited (W&I) to create a new “enlarged Rathbones Group”.

The complex terms of the deal will see Rathbones shares issued in exchange for 100 per cent of Investec W&I UK’s share capital.

Investec Group will become a minority shareholder in the newly enlarged Rathbones Group, owning around 40 per cent of the company which will remain as an independent listed firm operating under the same brand.

investigation.

“In light of the very serious allegations that are currently subject to independent investigation, the CBI has decided to temporarily pause its external programme of events, including the annual dinner on 11 May,” the CBI said in a statement.

The lobby group — which has over 700 members — has hired independent lawyers to investigate sexual misconduct at the organisation after complaints were raised about its director general, Tony

Danker, first reported by The Guardian newspaper. Danker has since stepped aside whilst the inquiry is ongoing.

The investigation has been expanded after more than a dozen women raised concerns of a “toxic culture,” first reported by The Guardian, including one victim who claimed she was raped at a staff party.

The fresh claims are unrelated to Danker who has since apologised.

The CBI said it hoped to have preliminary findings after Easter and

would then review the pause in hosting events.

ISS, a partner of the body’s net zero conference, supposed to take place in June, said: “The allegations made about some aspects of the culture at the CBI are deeply concerning. We are taking this matter extremely seriously and have made contact with the CBI to discuss our concerns.”

The CBI has said it “has treated and continues to treat all matters of workplace conduct with the utmost seriousness”.

The combined business will be run out of Investec’s UK headquarters on the corner of Gresham Street and King Street in the City.

In a statement, chair of Rathbones Clive Bannister said the deal will create the “UK’s leading discretionary wealth manager with approximately £100bn of funds under management and administration”.

£ CONTINUED ON PAGE 2

JAMES SILVER

NO LONGER will Zurich-bound early-morning flyers need to dig out their laptop at airport security at London City – with scanners allowing passengers to keep their electronics and liquids safely tucked away in their hand luggage.

The London airport has

introduced C3 scanners which take high-res, 3D images of what’s inside a bag.

The airport’s chief operating officer Alison FitzGerald said it would speed up the “door to gate” process across the airport, which is already the fastest of any UK offering.

The changes will mean that

liquids over 100ml can also be taken on flights.

The government has set a deadline of summer 2024 for other airports to introduce the system, including Heathrow.

Gatwick is currently trialling a system, too.

“The level of processing now through the X-ray is even more

secure than it was previously and the machine has the ability to differentiate between a nondangerous and a dangerous liquid,” FitzGerald said.

City Airport is currently involved in a lengthy planning process which, if approved, would allow it to expand flight numbers and continue to expand.

IT IS always tempting to look at the past through sepia-tinted glasses, and say it was better back when. But in the case of Nigel Lawson’s time in government, it is undoubtedly true. The tributes that have flowed in to the former Chancellor invariably include two great qualities: an intellectual curiosity and a willingness to make, and stick with, decisions. Lawson’s list of achievements are lengthy: a reforming Chancellor

who presided over a genuinely transformative period in the UK economy. He was a key part of turning the City’s fortunes around, giving it the ability not just to compete against global financial centres but outdo them. Above all, it was the tax system he

most altered: corporation tax, VAT, national insurance were all radically altered, as was the top rate of tax – reduced from 60 to 40 per cent. He did these things not because they were necessarily popular but because he knew they were the right thing to do. The Big Bang, for instance. As Lawson recounted twenty years later, the reforms of the City of London began with a deeply unpopular decision, even amongst the Cabinet.

Lawson called off an Office of Fair Trading investigation into the stock exchange in return for a promise from the City’s leading institution to reform itself – and quickly. The decision, as he notes, prompted “predictable outrage” from Labour and even Margaret Thatcher was apprehensive. It turned into the beginning of radical reforms which would give the City a fighting chance. Not for him the focus groups that stultify our politics today, nor the

WITLESS FOR THE PROSECUTION Former US President Donald Trump pleads not guilty to 34 charges of falsifying business records in a court in New York City yesterday

concerns about the ‘optics’ – he was the last Chancellor to drink at the despatch box, a mix of wine and water, while delivering the budget.

The former Chancellor has left his mark – certainly in the Square Mile and Canary Wharf.

Christopher Wren’s tomb in St Paul’s reads ‘si momentum requiris circumspice’: if you seek his monument, look around. The same, in his own way, can be said of Lawson.

The Bank of England has issued a public reprimand to the Greensill-linked Wyelands Bank after discovering “wideranging significant regulatory failings” at the lender, which is owned by Sanjeev Gupta, boss of Liberty Steel. The bank breached a number of rules.

THE TIMES

RICHARD BRANSON’S VIRGIN ORBIT FILES FOR CHAPTER 11 BANKRUPTCY

Sir Richard Branson’s Virgin Orbit has filed for Chapter 11 bankruptcy after the satellite launch company failed to secure long-term funding. The group has been struggling to recover from a failed launch in Cornwall in January.

FINANCIAL TIMES

EU HOUSING BOOM ENDS WITH FIRST QUARTERLY PRICE FALL SINCE 2015

House prices in the EU have suffered their first quarterly fall since 2015, as rising borrowing costs bring an end to an almost decade-long boom in residential property markets, Eurostat figures have revealed.

CONTINUED FROM PAGE 1

Rathbones chief executive Paul Stockton, who will lead the new firm, told reporters yesterday morning that volatility in the market over the past 12 months had driven an opportunity for consolidation.

“I think it is about an opportunity to grow more together. And secondly, I think it’s recognising that, as a business model, we will be subject over the next five years to an inflationary environment, with very limited opportunity to pass on any pricing increases,” he said. “So inevitably, that’s going to drive a degree of consolidation in the

BEHIND THE DEAL

THE CITY FIGURES WHO BROUGHT THE GIANTS TOGETHER

sector more generally.”

Stockton did not rule out job cuts as part of the deal and told reporters that “there will be obviously some changes to make”.

INVESTEC

Financial advisors and brokers

Fenchurch Advisory, led by Malik Karim (pictured) Investec Invesment Banking, led by Chris Baird (also brokers)

Legal Macfarlanes Comms Lansons

RATHBONES

Financial advisors and brokers

Bank of America

Securities led by Peter Luck (pictured)

Peel Hunt led by Andrew Buchanan

Legal Addleshaw Goddard Comms Camarco

The enlarged Rathbones Group will continue to be chaired by Clive Bannister. Investec W&I UK boss Iain Hooley will also sit on a board made up of an experienced leadership team from both businesses.

Fani Titi, Investec Group chief, said the tie-up “brings together two businesses which have a long-standing heritage in UK wealth management and closely aligned cultures”.

Analysts gave the deal a warm wel-

come, with Jefferies’ wonks saying the assumed synergies of around £60m are “certainly achievable”.

Shore Capital, meanwhile, also said the deal “makes sense”.

“Rathbones Group’s problem has been a lack of growth, because its clients are too old, and the omnibubble deflated a little,” they continued.

“This is an elegant step forwards in profitability.”

Shares in Rathbones rose sharply before settling in the green at 1.27 per cent up by close of play yesterday.

It is not Investec’s first wealth dealthe firm offloaded its Irish wealth division to Brewin Dolphin in 2019.

CHRIS DORRELL

CHRIS DORRELL

JAMIE Dimon yesterday said the banking crisis is not yet over as he warned regulators against making a “kneejerk” response to the crisis.

In a letter to shareholders, the JP Morgan boss wrote “the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come”.

The collapse of Silicon Valley Bank last month sent shockwaves through the financial system, sparking fears that the world could be on the brink of another financial crisis.

While Dimon stressed the current crisis is “nothing like 2008”, he said it was “not clear when this current crisis will end”.

“[The crisis] has provoked lots of jitters in the market and will clearly cause some tightening of financial conditions as banks and other lenders become more conservative,” Dimon wrote.

But Dimon warned regulators against making “knee-jerk, whack-a-mole or politically motivated responses”.

Many commentators have pointed out that regulations were loosened on regional banks such as SVB back in 2018, with them arguing tighter rules could have prevented the collapse.

But Dimon argued that it was unlikely any regulatory reforms would have made a difference to the collapse of Silicon Valley Bank and Signature.

“The debate should not always be about more or less regulation but about what mix of regulations will keep America’s banking system the best in the world,” he said.

Looking further, he criticised how US regulators helped to lay the groundwork for the crisis, arguing governments have incentivised banks to stock up on government bonds.

Dimon said the recent crisis would be felt for years to come

STERLING surged yesterday, breaking above $1.25 for the first time since June 2022, as traders turned bullish on a currency trading well below 2016 levels and the central bank’s chief economist left the door open to more interest rate hikes.

The pound surged 0.9 per cent to $1.2525, its highest level in ten months

THE CHIEF economist at the Bank of England, Huw Pill, has suggested that more work is needed to tame price rises because there is a danger of high inflation becoming embedded in the UK economy.

“The onus remains on ensuring enough monetary tightening is delivered to ‘see the job through’ and sustainably return inflation to target,” Pill said in a speech in Geneva yesterday.

He noted that while inflation is set to fall “significantly in the course of this year… caution is still needed in assessing inflation prospects on account of the potential persistence of domestically generated inflation.”

against a weakening US dollar.

After falling 10.6 per cent in 2022, sterling is the best performing G10 currency this year despite a bleak economic outlook for Britain. But it is still 15.5 per cent below its 2016 levels, before Britain voted to leave the EU.

“A major bull move in the pound is developing here,” said Shaun Osborne, chief currency strategist at Scotiabank.

Reuters

Pill’s remarks came the same day as Silvana Tenreyro, a external member of the MPC, said the Bank will have to cut rates sooner to make sure inflation does not fall below its target of two per cent.

“The high current level of Bank Rate will require an earlier and faster reversal, to avoid a significant inflation undershoot,” she said.

The Bank’s next rate decision is in May, with markets currently forecasting a 25bps hike.

JESSICA FRANK-KEYES

JESSICA FRANK-KEYES

MOST FIRMS have seen no boost to sales this quarter despite rising levels of confidence, a key economic report has revealed, as inflation remains the key concern for business.

The British Chamber of Commerce’s (BCC) quarterly economic survey found in spite of rising optimism, only a third of firms saw sales increase in

the first three months of 2023.

Just 34 per cent recorded a rise, as 24 per cent saw a decrease and 41 per cent no change.

Almost half (47 per cent) of hospitality businesses found cash flow fell in the last quarter, with 38 per cent of retail firms recording a decrease in sales in the last quarter.

It comes despite an apparent dose of positivity, with more than half (52 per

cent) of all UK firms believing turnover will grow in the next year.

David Bharier, BCC head of research, said improving business confidence was coming from a “very weak base” and was “yet to translate into an overall improvement of conditions”. Shevaun Haviland, BCC director general, said the government needed to do more to “to shift the dial” on “stubbornly low” growth.

NICHOLAS EARL

GLENCORE’s failed takeover bid for Canadian miner Teck Resources reflects the growing urgency from miners to demerge from fossil fuels and embrace future-facing minerals such as copper, experts have argued. The commodity giant, if it had been successful, would have demerged the collective coal assets

into a separate company listed in New York., while the green minerals vehicle with Teck would be listed in London.

Investment analysts Jefferies said there was “a compelling strategic rationale for this combination” and expected a return offer from Glencore with a higher valuation – although it was unclear this would be enough to convince Teck shareholders.

Boris Ivanov, founder of commodity

specialist Emiral Resources, told City A.M. the bid highlights the growing demand for new minerals to boost renewable projects.

“With the high demand for critical metals and minerals to power the green energy boom and expected supply crunches, we are likely to see a new wave of consolidation and appetite for large M&A in the mining industry,” he said.

NICHOLAS EARL

OIL PRICES could hit $100 per barrel next year, Goldman Sachs has predicted, after OPEC+ made the surprise move of slashing oil output by 1.1m barrels per day this week.

OPEC+, which consists of the world’s most influential cartel and its allies such as Russia, had been expected to maintain current pledges to cut output at 2m barrels per day until the end of the year.

The new supply cuts, which are mostly to be shouldered by Saudi Arabia, are scheduled to start from May, and coincide with a demand rebound as airport activity takes off.

Goldman has now hiked its predictions for Brent Crude by $5 to $95 per barrel by December 2023, and raised its expectations for December 2024 by $3 to $100 per barrel.

These predictions reflect quite a turnaround for the commodity, as while the International Energy Agency and OPEC have remained bullish over oil de-

mand, both major benchmarks were heavily blunted by financial instability last month.

Turmoil across the banking sector saw Brent Crude prices tumble from $86.18 per barrel to $72.77 per barrel over an 11 day decline last month.

However, following OPEC+’s cuts, markets have now roared back to life, with Brent Crude and WTI Crude trading at $85.70 per barrel and $81.37 per

barrel respectively yesterday afternoon.

Goldman argued OPEC+’s move was surprising, but reflects the cartel’s increasingly interventionist approach in a challenging economic and political climate following the pandemic, invasion of Ukraine and threat of a global economic downturn. The bank said the surprise production cut was “consistent with the new OPEC+ doctrine to act preemptively because they can without significant losses in market share.”

NICHOLAS EARL

A LONDON-listed hydrogen fund has seen its share price show signs of recovery after posting bullish full year results, including a 21 per cent boost in net asset value.

Hydrogen One Capital Growth (Hydrogen One) is enjoying a five per cent boost on the London Stock Exchange, trading at 50p per share in yesterday’s trading.

This follows the company’s brutal

sojourn on the stock market amid a global downturn and a choppy investment climate late last year after former Prime Minister Liz Truss’ disastrous mini budget, which saw its share price plummet from 93.8p per share to 40.8p per share.

Chairman Simon Hogan said: “The last year has been marked by dramatic changes in the macro environment, the war in Ukraine and the energy crisis. The crisis has resulted in extreme power price volatility.”

TIKTOK has been fined £12.7m for using children’s personal data without parental consent, the Information Commissioner’s Office (ICO) has announced.

The ICO said the social media giant allowed up to 1.4m children under the age of 13 to use the app in 2020, breaching its own rules, and used their personal data without gaining consent from parents or guardians.

John Edwards, UK information commissioner, said: “Tiktok should have known better. Tiktok should have done better. Our £12.7m fine reflects the serious impact their failures may have had.”

Platforms which allow children under the age of 13 to use their services must have consent from parents or guardians before gathering personal data, according to UK data protection law.

“Tiktok did not abide by those laws,” and “did not respond adequately” when concerns were raised about underage users, the ICO said.

Last September, the ICO handed Tiktok a ‘notice of intent’ over the alleged breaches. At the time, Tiktok was facing a possible £27m fine over the claims.

A Tiktok spokesperson told City A.M. yesterday: “Tiktok is a platform for users aged 13 and over. We invest heavily to help keep under 13s off the platform and our 40,000 strong safety team works around the clock to help keep the platform safe for our community.

“While we disagree with the ICO’s decision, which relates to May 2018-July 2020, we are pleased that the fine has been reduced to under half the amount proposed last year.”

The fine comes as the latest blow to the Chinese-owned app, which was last month banned from UK government devices over data security concerns.

SCRUB-A-DUB-DUB The Body Shop owners sell ‘avant-garde’ skincare and soap brand Aesop to Loreal for cool $2.5bnL’OREAL yesterday announced it had snapped up Australian skincare brand Aesop for $2.5bn (£2bn) from Body Shop owners Natura &Co, who bought the brand for £1.6bn in 2019. The cult skincare brand, which L’Oreal chief exec Nicolas Hieronimus called “the epitome of avant-garde beauty”, has almost 400 stores globally and also sells its products in John Lewis.

CREDIT SUISSE chair Axel Lehmann apologised to angry shareholders at the bank’s last annual general meeting yesterday in Zurich for failing to turn around the beleaguered bank that was forced into a rescue takeover by UBS last month.

Lehmann told shareholders that he understood the “bitterness, anger and shock of all those who are disappointed, overwhelmed and affected by the developments of the past few weeks”.

Lehmann said that, although he was confident in the bank’s turnaround plans, the plan didn’t have time to “bear fruit”.

“The period from October to March was not enough,” he said. “In that fateful week in March our plans were thwarted… and for that I’m truly sorry.”

Chief executive Ulrich Körner agreed, saying “we were executing at pace and making good progress,” but the bank “ran out of time”.

Credit Su-

isse faced massive deposit outflows and a spiralling share price earlier in March after its top investor ruled out providing more funding.

Over the following weekend, UBS agreed to buy Credit Suisse for $3.25bn, less than half of Credit Suisse’s market capitalisation at the end of the week to avoid wider financial instability.

Shareholders crystallised enormous losses and were prevented from voting on the deal, as they normally would have done, by government legislation.

The events that led to Credit Suisse’s collapse took place just a week after the collapse of Silicon Valley Bank.

Lehmann highlighted this context, saying the bank collapsed “following fears about contagion from US banks… social media fanned the flames of these fears”.

In the end, Lehmann said the UBS’ shotgun acquisition of Credit Suisse had to go through.

“Deal or bankruptcy – the merger had to go through. The terms had to be accepted,” he said.

Credit Suisse’s final AGM was a suitably bizarre event for a firm that has become the byword for corporate scandal in recent years.

As many disgruntled shareholders said, the bank’s collapse has been long in the making with a string of scandals slowly eroding trust in the Zurich fixture.

Fortunately, a less reliable string of characters were on hand to provide Credit Suisse with a fond farewell.

First up we had a man in a red tie and a grey suit, with the latter representing the “people at Credit Suisse who had stepped outside the grey zone”, he said, while the red tie showed that he and

“other shareholders are seeing red”. He added, disarmingly: “I didn't bring my gun along today, don't worry.”

The violent imagery continued. Another shareholder: “I can only remind you of what would have happened to you in mediaeval times, you would have been crucified.” Crucifixion, admittedly, was a more Roman tradition.

Then things really went nuts. Literally.

Having purchased a packet of walnuts for the price of one Credit Suisse share, the shareholder had removed the nut from the shell before putting the shell back together again. He then offered the empty shells –presumably meant to

symbolise something like the bank’s empty promises –to Credit Suisse’s unflappable chair.

Fortunately, Lehmann already had his own packet of nuts to keep him going. This was just as well as the AGM lasted the best part of five hours.

The nutty shareholder also had an empty coconut shell, bought for the price of eight shares. It’s unclear why.

The comical antics at Credit Suisse’s AGM almost obscured the justified anger that its shareholders feel about the deal. Lehmann expressed genuine regret. But UBS has a lot on its hands.

CHRIS DORRELL

AUGUST GRAHAM

OVER-50s specialist Saga yesterday said its losses increased more than tenfold last year as it took a major one-off hit to its insurance business.

It led to Saga taking a £269m impairment to the goodwill in its insurance business, pushing the company deep into a loss.

Shares in the company finished down over 16 per cent yesterday after the update.

Before tax Saga made a loss of £254.2m in the year to the end of January, up from £23.5m the year before, it revealed yesterday.

Without the impairment and other one-off costs the business swung from a £6.7m loss in the previous year to a profit of £21.5m in the latest 12month period.

Saga’s cruise business, however, had fared better as it bounced back from the pandemic, chief executive Euan Sutherland said.

HARDLYa week goes by without a new survey showing the slump in M&A activity in 2022. By some estimates M&A dropped 18 per cent after the flurry in 2021. However, looking a little closer reveals a more nuanced picture. Mid-level M&A remained fairly consistent while certain sectors saw continued growth. One of the most prominent of the growth sectors was clean energy, where there were actually more deals in 2022 than the year before.

There were 2,047 deals for clean energy companies in 2022, up from 1,362 in 2020. Industry figures only expect that number to rise in the coming years as decarbonisation picks up pace.

Lead of KPMG’s clean energy M&A team Gavin Quantock reckons his team are well placed to capitalise on the “flurry of activity” in the sector.

“We are going from strength to strength and there has never been a more exciting time to be working in energy. There is so much M&A activity in the sector

and it is only going to continue and I want to ensure that we remain at the heart of it.”

Quantock said his team is the largest clean-energy team in the city, having grown from eight in 2019 to 35 at the moment. The team work on mobilising “the wall of capital focused on decarbonising the planet”.

Quantock describes decarbonisation like a rocket. “There’s an initial lift-off phase to take the rocket into orbit before a second phase in orbit when it really takes off.” Clean energy investment is about to hit the second phase, Quantock argues, and its not difficult to see why.

Across the globe, governments are rushing to put in place subsidies and incentives to expand green investment.

The scale of government intervention is a reflection of the

Of course, clean energy is a broad label. It covers everything from solar and wind, to hydrogen and biomass. While there have been questions about whether it is wise to pursue growth across the sweep of clean energy industries, Quantock suggests its best to pursue a range of different options to suit the different

needs around the world.

“There needs to be a mixed-energy economy,” Quantock said, saying “there’s a clean energy source for everyone.”

Across all sectors, clean energy is expected to increase to 5,600 gigawatts over the next five years, up from 2,400 gigawatts at the moment. It can only increase at that speed with a substantial influx of capital – “there is a lot of dry powder out there ready and willing to enact the energy transition,” Quantock says.

Quantock’s team closed the UK’s most recent green hydrogen deal with GeoPura, whose customers include the BBC and HS2. GeoPura received £36m in investment from a consortium including General Motors’ investment arm and Barclays Sustainable Impact Capital. Perhaps most prominently, Quantock worked with Octopus Energy for four years, helping to bring in a range of different investors –including Tokyo Gas and Al Gore's investment fund. With Quantock, Octopus raised over £1bn.

And “energy is more global than ever”, Quantock says. He has concluded transactions in Finland, Sweden and South Korea as well as domestic mergers. With so much more to be done around the world to finance the transition, Quantock and his team are likely to be in high demand for years to come.

WHEN Catherine Powell made the jump from the magic of Disney to Airbnb in January 2020, she couldn’t have predicted the nightmare of a global pandemic for the travel and tourism industry.

But just three months after she became global head of hosting, she was thrown in at the deep end.

“The pandemic hit and I had to suspend all experiences in March 2020,” she said.

As soon as she moved, she questioned whether she’d made the right call.

“It was terrible,” she said. “I mean, I had no job. It was like, ‘what am I going to do now?’.”

Airbnb’s earnings plummeted and it was forced to make around a quarter of its staff redundant, with Brian Chesky, its president and CEO, saying, according to Powell, that he “didn’t know whether Airbnb was going to survive” just six months after headlines about a possible IPO.

Three years on, Airbnb has not only survived, it is thriving, notching its first fullyear profit in 2022.

The short-term rental company recorded rev-

enues of £6.7bn last year, and had a net income of £1.52bn .

While the global travel rebound helped lift the firm’s earnings, Powell says its new singular vision also helped drive the company forward.

As part of a “massive refocus,” Chesky and Powell decided it “needed to just jettison things that are not core to the business” such as its studio magazine, and go back to the roots of its business – hosts.

Powell said the firm is now in a “very strong position” and that she is “very optimistic” about the future.

Tech giants including Twitter, Facebook owner Meta, Amazon, Microsoft and Apple, have all laid off thousands of staff in recent months. But Powell said that Airbnb will not be following suit, thanks to past “disciplined” decision

“Since that terrible point, that low point in 2020, we have remained ruthlessly disciplined and focused on what we do,” she said.

“When we saw our business taking off and recovering, we did not expand and go back into the businesses that we

were in before.

“We did not suddenly inflate the workforce by 25 per cent again. We remained very steady, very disciplined, very focused,” she said.

“We do not have plans for layoffs,” she said, adding that, on the contrary, it is hiring, but insisted it was targeted and “very focused”.

Despite bouncing back, Airbnb has not operated in the UK without controversy.

Over the years, it has faced accusations that some of its hosting undermines local communities because hosts can make more money putting their property on Airbnb rather than by living and working there.

Asked about the impact of Airbnb on local communities, which has been documented in tourist hot spots like North Wales and Cornwall, she said the firm takes the issue “very seriously”.

“We want to be good partners. We want hosts to be welcomed in the communities in which they live. We want communities to thrive and to want Airbnb,” she said.

She said Airbnb is “very supportive of having rules,” adding that it welcomed the UK government’s decision to introduce a short-term let register, which it has long called for.

THE AVERAGE time to sell a home jumped by 15 days year-on-year in March as the UK’s housing market continued to be slowed by increased living costs.

Estate agent Zoopla said homes in London took the longest time to sell with property taking an average of 44 days, likely fuelled by the soaring prices of homes in the nation's

capital where the average price of a property was £285,000.

Carlos Riveros, manager of Chestertons’ West End office, told City A.M.: “In central London, the majority of sellers are in no rush to sell and are therefore willing to wait for higher offers before even considering a price reduction.

Inevitably, this extends the timeframe that a property is listed.

“Each of London’s areas has its

JACK MENDELown micro-market which means properties can sell faster in one place than in another,” he added.

According to Zoopla there were 65 per cent more homes available for sale compared to March last year.

Richard Donnell, executive director at Zoopla said: “The housing market is arguably more balanced than it has been for more than three years.”

Alison FitzGerald, Chief Operating Officer at London City Airport

I’m willing to bet the most often heard phrase at any UK airport is “take your liquids and your electronics out of your bag, please!”

Despite having been in place since 2006, there’s always someone who forgets and the next thing you know, you’re watching travellers furiously trying to find their iPad or desperately trying to cram that last liquid bottle into their small plastic bag. And of course, there are always the unlucky ones who forget to empty that rogue bottle of water before placing their carry-on into the tray. And we know how that story ends –you either drink it on the spot, or it gets confiscated!

While of course there’s very good reason for the security rules to be in place, the scenarios mentioned above slow things down, creating hassle and increased levels of stress for passengers and staff alike.

We have now scrapped these measures at London City Airport, so from now on, you can keep everything in your hand luggage.

Yesterday we became the first mainstream airport in the UK to operate a complete next- generation security experience.

We’ve always prided ourselves on being early adopters of new technology and on continuously striving to make our experience even better.

The new scanners will mean that your laptops can stay in your bag and you’ll be able to carry bottles with a capacity of 2 litres – quite the step up from the 100ml limit we’ve been grappling with for the past 17 years. Furthermore, they’ll enable us to process 30% more passengers per hour than we did previously. So, it’s not a stretch to say that London City Airport is now even quicker, and we were quick to begin with!

You might think that this is quite the step change, but I think it’s more that we, as an industry, after the impacts of Covid-19 and its legacy last year, are finally back in the place of embracing and deploying the latest technology.

The machines themselves operate to the highest security specification, taking rotating 3D images of the contents of your bag. Very much like what’s used today

in hospitals.

While London City is a trailblazer in the new security technology space, by the end of 2024, you’ll have a consistent experience at all airports across our domestic route network. Something, I believe, which will make flying between LCY and Scotland and Northern Ireland even more attractive than it is today.

Europe is a tougher nut to crack. But I’m hopeful that many of our partners will look at how successfully the product has been deployed at LCY, and at other airports like Schiphol and LaGuardia, and convince them to make the investment.

Looking ahead to the summer, I can say with increased confidence that we will be running the most efficient, reliable and fast airport operation in London.

And it’s not just our airport operation that’s slick. We, in partnership with our airlines, have the best on-time performance of all the six London airports.

It’s shaping up to be an exciting period. It’ll be busy, but we’ll be ready. And not only that, following a recent investment of £12m in our departures lounge, we’ll have much more seating, two new stylish dining experiences and duty-free shopping, extra washrooms and a brand-new look and feel throughout the departure lounge.

So, if you haven’t tried LCY before, there’s no better time than now.

UK

buyers in London are forced to play the waiting game

Yesterday we became the first mainstream airport in the UK to operate a complete next-generation security experience.Powell: Airbnb needed to “go back to its core business”

JAMES SILVER

JAMES SILVER

A LONDON-BASED digital transformation business has been acquired by a US outfit in a multimillion pound deal.

Pracedo, which implements solutions for firms using the Salesforce platform and which has offices in Australia, the Netherlands and Serbia, was

founded in 2010. Its current leadership will remain in place after the acquisition.

The Salesforce platform is a customer relationship management tool that allows businesses to manage their client base. As the platform has grown in usage, more and more consultancies have popped up to advise businesses on how best to use it.

Pracedo’s founder and CEO, Matthew Schutz, said: “We are thrilled to be joining with Collabera Digital. We see this move as a major next step on our shared path to expansion and better value for clients.

“By combining forces, Collabera Digital and Pracedo can deliver unparalleled digital transformation solutions with Salesforce.”

SLUGGISH progress on open banking regulation has left consumers “unduly at risk” and regulators need to urgently ramp up protection measures, a group of experts has warned.

Open banking, which was rolled out by regulators in 2017 to force high street lenders to open customers’ data to trusted third-party firms, has been consistently touted by fintech firms as crucial to competition in financial services.

long-term consumer benefits that open banking can unlock, but worry that progress is slowing.”

The group added that products which would benefit consumers in vulnerable circumstances “remain limited in availability and uptake”.

“At a time when every pound counts and finding the best deal is difficult, consumers can’t understand why they can share their current account data but not most savings account or loan data,” the letter said.

However, a group of experts involved in shaping the future regulation of the sector has warned that not enough weight has been given to consumer protection measures, and products currently on offer are too limited in scope.

“We remain concerned that opening up wider data sharing and new ways to pay without also considering associated protections could leave consumers unduly at risk,” the group, which includes Open Data Institute principal consultant John D’Addario, financial services consumer panel member Francis McGee and Which? senior policy advisor Tony Herbert, said.

“We remain enthusiastic about the

The warning comes as fintech firms and banks await a crucial update on the future regulation of the industry in the coming weeks.

The regulatory council drawing up rules for the sector, were expected to lay out the next steps for the industry last week but City A.M. revealed the announcement had been delayed.

A spokesperson for the Financial Conduct Authority (FCA) told City A.M. it is “committed to the continued development of Open Banking” and the Joint Regulatory Oversight Committee (JROC) in charge of drawing up the rules has set out a “vision for unlocking its potential”.

CHARLIE CONCHIE

CITY fintech firm Railsr has appointed

a former blockchain boss as its new chief executive as it looks to steady the ship with three senior appointments after it was saved from the brink of bankruptcy last month.

In early March, Railsr, an embedded banking platform, was bought by a consortium led by London-based investor D Squared Capital in a deal reportedly worth under £500,000

– a sharp fall from its previous near$1bn valuation.

The company, formerly known as Railsbank, said yesterday it was now looking to “start the new phase on the front foot” with the appointment of Philippe Morel as chief executive, Debbie Lotz as finance chief and Nick Charteris as chief operating officer.

Morel was previously the head of blockchain fintech SETL for four years until its acquisition in early 2023.

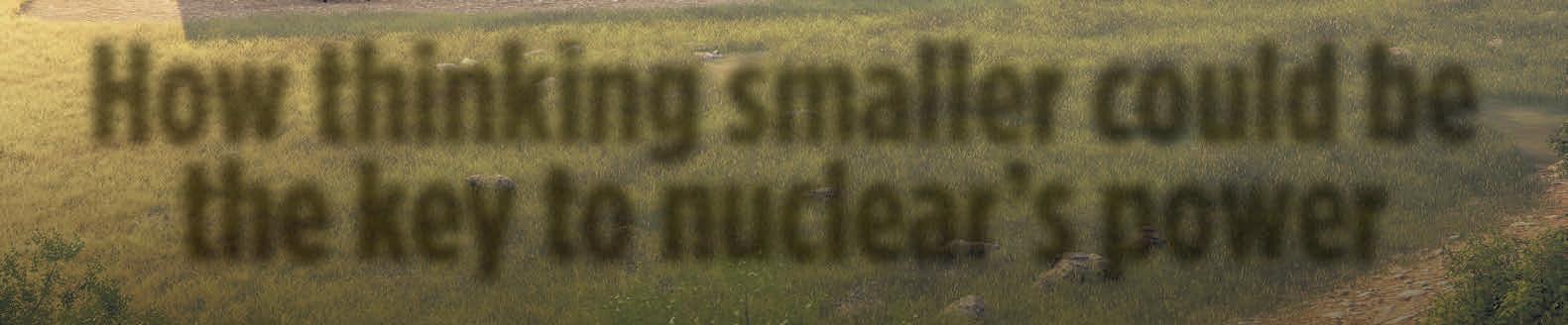

NUCLEARpower is typically associated with projects of vast scale, often designed and built with the intention of powering millions of homes.

However, as the government looks to revive nuclear power and replenish its ageing fleet of reactors, nimbler parties are also looking to play a part.

This includes small modular reactors – which could theoretically provide as much as a quarter of the power of a nuclear plant but an eighth of the cost –like the project pushed forward by Rolls-Royce that has secured £210m in funding.

But there are companies thinking even smaller.

US startup Last Energy, set up in 2020, is looking to roll out micro nuclear power plants.

Last Energy plans to design, manufacture and operate the reactors on behalf of heavy energy users, such as factories, scientific campuses and industrial plants. It would then look to install its reactors on site and operate as an energy vendor, while maintaining owner-

ship of the nuclear asset, selling the energy they generate to the factory under long-term energy contracts.

Its reactors are about 20MW in scale, take around two years to build, ship and set up, and cost Last Energy around $100m. By contrast, the proposed power plant Sizewell C is 3,200MW, will take over a decade to build and could cost between £20bn-£35bn, with the early stages funded by the taxpayer.

Chief executive of Last Energy UK Mike Reynolds considers its business model to be a profitable one, and no different from the tried and tested energy supply deals that big industry players currently sign up to.

“Those long-term deals provide enough revenue and profits to make it worth us doing. Crucially, what they enable us to do is to go out and fundraise and privately finance the whole thing,” Reynolds said. “We don’t ask the government to support it or fund it in any way.”

The firm is also very keen to tout the green benefits of its reactors, arguing that each micro reactor could prevent as much as 79,000 tonnes of CO2 being emitted per year.

The company, one of the first of its kind, is backed by multiple investment partners including First Round Capital and Gigafund, and former Microsoft chairman David Marquardt.

Anumber of UK firms are supposedly interested in what the firm has to offer.

Last Energy said it has struck provisional deals with a life sciences campus, a sustainable fuels manufacturer and a data centre company, for a total of 24 mini nuclear reactors.

It declined to name the firms, however, until any of the plans are approved by UK regulators, the Office for Nuclear Regulation and Environment Agency, which require each individual design to be approved before construction. If signed off by regulators, they could generate over £11.4bn in future electricity sales, it claims. So far, however, the company has only built a prototype of its nuclear reactor in Houston, Texas.

Reynolds said the firm is currently on the hunt for a big heavy industry customer that it could use to show its product can help decarbonise sectors with energy-intensive processes.

He revealed Last Energy is in talks with multiple potential big clients and that the first three were just the “tip of the iceberg in the UK” as it has a “very significant pipeline of opportunities”.

The Nuclear Industry Association (NIA) is highly supportive of Last Energy’s pitch and its mission to provide clean energy to the industrial sector.

“Smaller, more advanced reactors offer a real solution for industrial energy users looking to wean off expen-

sive and volatile fossil fuels,” Tom Greatrex, chief exec of the NIA, said.

But there are some limitations.

Last Energy’s reactors can provide energy to generate 300C in heat, making it viable for some but not all of the UK’s industries.

Steel, for example, requires temperatures of between 900 degrees to 1,300 degrees in furnaces to operate properly. However, production facilities for mining or chemicals, for example, would be viable.

“The problem we’re trying to solve is not grid-connected scale power. What we’re trying to solve is localised generation,” Reynolds explained. “There’s a real challenge with the decarbonisation of heat for industry. What’s the alternative? Currently, they’re burning gas. What are they going to switch to?”

There’s no doubt that the idea is still at a relatively early stage, and firms may not be prepared to sign up to what it is offering until the first projects have been successfully rolled out.

But the potential it has to help the UK’s heavy industry go green definitely means it is a firm, and concept, worth keeping an eye on.

CHASE announced last year that a million customers had signed up, adding up to some £10bn of deposits with JP Morgan’s UK neobank. According to the bank’s managing director, Shaun Port, it’s just the beginning. As he recently told City A.M.: “[Chase] hasn’t entered the market just to be a small challenger”.

But beyond racking up customers, data from YouGov BrandIndex UK shows that the bank has made headway in terms of its public perception over the past year. With the help of offers such as one per cent cashback and a three per cent savings account, Chase’s Impressions (which measure general sentiment towards a brand) went from a neutral 0.4 to a positive 6.0 (+5.6) between 1 April 2022 and 1 April 2023. It outperformed the aver-

Stephan Shakespeare

age score for the banks and building societies sector, which went from 3.7 to 4.6 (+0.9) over the same period.

Similarly, looking at Quality scores for Chase show an improvement from 0.7 to 6.5 (+5.8) over the last year, compared to a sector-wide movement from 4.5 to 5.3 (+0.8), while Chase’s Value for Money jumped from -0.8 to 4.4 (+5.2), while the banking sector inched up from 0.4 to 1.1 (+0.7). JP Morgan’s digital challenger has also eclipsed the in-

dustry average in terms of Reputation scores, which track whether consumers would be proud or embarrassed to work for a brand. These measures went from 1.9 to 8.1. between April 2022 and 2023 (+6.2), while those for the sector went from 6.1 to 6.9 (+0.8).

While the mission to make Chase more than a challenger is ongoing, the brand has made clear progress over the last year. Whether it can build on this progress while it makes changes to some of those flashy early offers – the one per cent cashback, for example, is to be capped at £15 a month from May 2023 and will require £500 in monthly deposits – remains to be seen, but it has certainly been a positive start.

Stephan Shakespeare is the co-founder and CEO of YouGov

Index scores: Average of impression, Quality, Value, Satisfaction, Recommend and Reputation scores –Chase (4 week moving average)

Smaller, more advanced reactors offer a real solution for industrial energy users looking to wean off fossil fuels

looks at how micro nuclear power plants could help the UK go green

Stockport named ‘one of the coolest areas of the country’ by The Times

8 minutes by train to Manchester city centre. Under 2 hours by train to London

Largest economy in Greater Manchester, topping UK regional growth forecasts Capital growth is forecast to increase by 19.3% in the next four years*

Limited investor options, high tenant demand Regeneration area with funding from Stockport council and The Heritage Fund Rental growth is forecast to rise by 21.6% in the same period*

is phase one of a small residential development in the heart of The Underbanks regeneration area, built by a family run developer with a 25 year track record.

1&2

from just £173,000

Estimated completion Q3 2024. Many apartments have private entrance, outside space or winter gardens.

To appear in Best of the Brokers, email your research to notes@cityam.com

THE FTSE 100 closed lower yesterday as markets ran out of steam despite a strong performance from many of the index’s mining giants.

The capital’s premier index closed 0.5 per cent lower at 7,634.52 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, ended 0.34 per cent lower at 18,815.04 points.

The FTSE’s top performer was Fresnillo, which ended 3.5 per cent higher. The miner benefitted from higher gold prices. The yellow metal stormed past $8,000 per ounce after data on the US labour market suggested the Fed may have to stop hiking interest rates soon.

Fellow gold miner Endeavour Mining also posted gains, ending 1.5 per cent higher.

Glencore held on to gains from earlier

in the day, ending 1.7 per cent higher, despite having an unsolicited offer for Canada’s Teck Resources being snubbed on Monday.

The offer would have seen Glencore acquire Teck, creating a $90bn giant and requiring Switzerland-based Glencore to undergo massive restructuring.

Glencore’s bid reflects the latest shift in the mining industry, with commodity giants looking to make deals again and consolidate market shares of valuable minerals and metals.

Elsewhere, Saga dropped over 15 per cent despite its revenue growing by more than 50 per cent as older Brits returned to cruises post-pandemic. However, revenue from its insurance business fell seven per cent year-on-year.

The pound rose 0.69 per cent against the dollar, breaking the $1.25 mark which had previously been a point of resistance.

Analysts

Analysts at Peel Hunt have said trading for manufacturing company Gooch & Housego has been “inline with expectations” with revenues expected to be £71m, up from £52.1m last year. “Cost inflation continues to be managed, and the balance sheet remains in good shape,” analysts explained. “We look forward to more details from the strategic review under new CEO Charlie Peppiatt at the interims on 6 June,” they said. The analyst rated it a buy.

MIXED-BAG

“Optimism over the UK economy has been improving in recent weeks, helping to drive the recent gains in sterling, however the resilience in the pound does appear to be acting as a bit of a drag on the wider UK market, which slipped into negative territory.”

MICHAEL HEWSON, CMC MARKETS

at Peel Hunt have updated numbers for FY23 FD Technologies, increasing revenue one per cent to £296m and ebitda two per cent to £35m. Analyst said that given market uncertainty, it makes “no changes” to its income statement numbers for FY24/25. “The performance of the KX division, where we believe most future value will derive from, was extremely encouraging across the year,” an analyst said. The analyst rated it a buy.

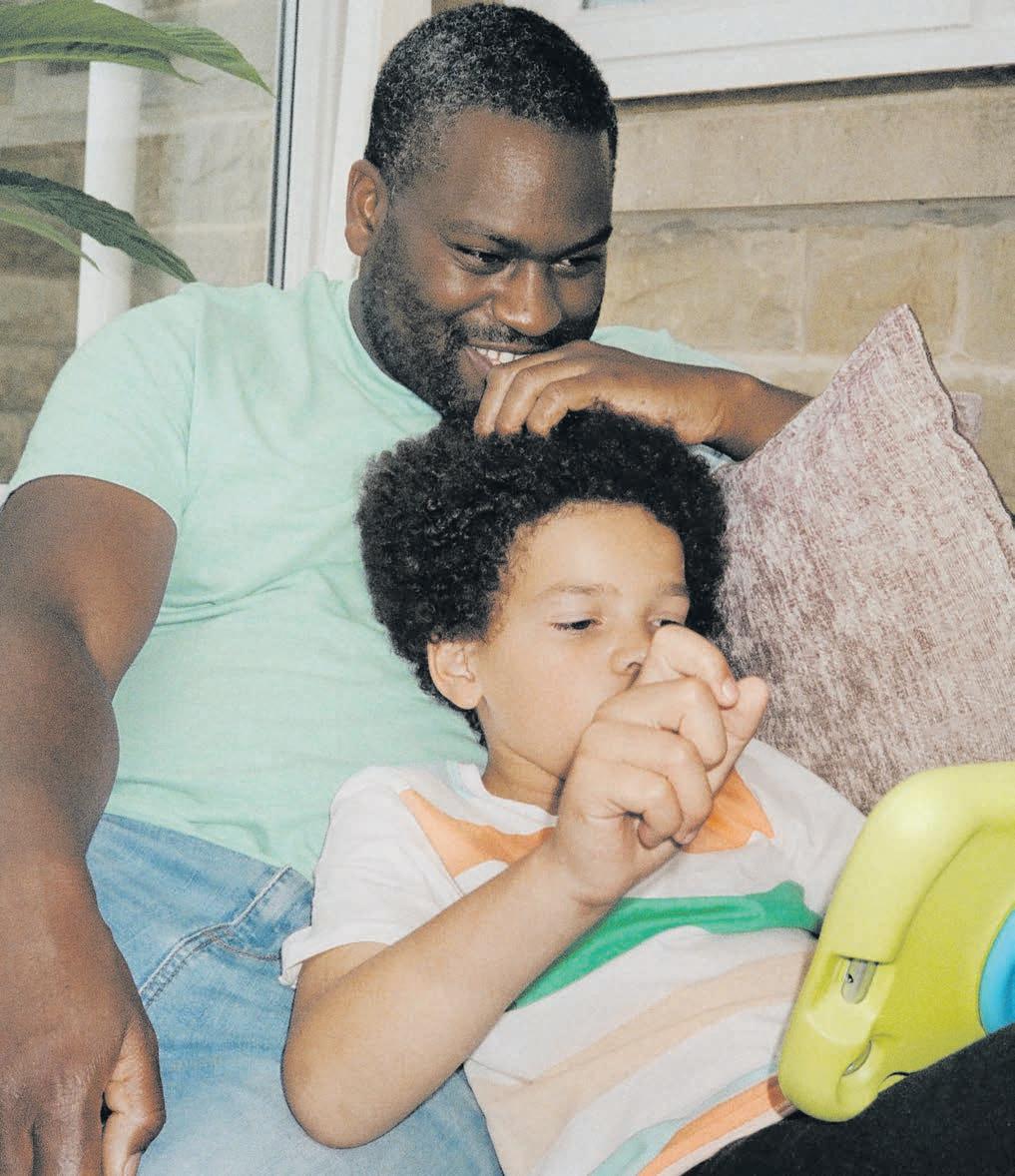

AH THE travails of modern life. Rushing to and fro, from work to pick up the kids, to see an old school friend and then answering a stack of emails before you hit the pillow.

If only there was more time. We fantasise about it on a Sunday night, as we scroll through Instagram: we would go to Sicily, we would bake homemade lemon drizzle cake for our kids’ bake sale, not the store bought one. Most importantly, we would sleep. We would have a good night’s sleep for the first time in forever.

The idea we don’t have enough time has driven dozens of initiatives to change the way we work, from the four day working week, trialled by a handful of firms in the UK, to hybrid work, which cuts out the daily commute and gives us back 90 minutes in the day, to job shares or nebulously named “wellbeing days”.

It turns out, we do actually have enough time, and we are getting enough sleep.

In fact, many of us are sleeping more, according to research from think tank Onward. Today’s adults are getting an extra 30 minutes kip compared to those in 1974. Women, often seen as the most sleep deprived, are sleeping 8 hours, 38 minutes, on average, 27 minutes more than in the 70s. Men are sleeping 8 hours 32 minutes, 25 minutes more than their predecessors.

Our leisure time and time with our

kids isn’t squeezed either.

Some of us are working more, with women working an extra 13 per cent, but the changes in technology, which have removed some of the burden of “keeping a home” with washing machines and hoovers, means there is still extra time in the day. Men meanwhile, are working 2 per cent less.

We’re all so tired because we’re trying to do so many things at once, not because we’re doing more of each individual thing. Multitasking is making us exhausted.

In 1974, we spent five hours on an average weekend day with four distinct “episodes” of leisure time, now we squeeze seven things into four hours. We also change activities more; men do

31 different activities in a day now, compared to 18 forty years ago. We’re trying to answer emails while picking up the kids, we’re flicking through a recipe book while watching TV. Very few of our activities demand our undivided attention.

Taking an extra day out of the work week is unlikely to make us feel instantly rejuvenated, nor is working from home. In fact both might put more pressure on the need to multitask. Much was made about the ability to put the laundry on or keep an eye on a stew while working on a report; and these are benefits to working from home, but they are also drawbacks. By splitting our attention across a million things, our time feels more pressured. Even when

we are absorbed in a book, if we’re told we have to do something else in an hour's time, we feel like we only have 40 minutes to read. If we have nothing on afterwards, we feel as if we have 49 minutes. It sounds like a small increase, but a substantial one in terms of the psychological benefits of not feeling stretched.

Perhaps the only policy which addresses this is the rule in France which makes it illegal to send emails after hours, the so-called “right to disconnect”. It tries to cut down on the things demanding our attention when we’re supposed to be relaxing.

One of the surest things in modern life is if there’s a problem, there’s an app to solve it. My own social media feeds have been inundated with promoted posts

FIFTY years ago, the Euro area accounted for 30 per cent of the world’s economy. Since then, there has been a steady fall; now, its share of world output has halved.

In contrast, the Asia-Pacific economies have grown much faster. These trends are well established, and this region will increasingly dominate the world economy.

Yet, on the logic of the received wisdom in UK economics, any weakening of our links with the EU is a disaster. In contrast, any recognition given to strengthening our links with the AsiaPacific region is at best grudging. Hence the estimate published last week by the Office for Budget Responsibility (OBR). It calculated the new trade deal between the UK and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) would only add a trivial 0.08 per cent to the size of our economy.

The CPTPP countries do not include Asian giants India and China, but their share of world output is now not much

Paul Ormerodless than that of the EU. Despite this, the models used to estimate these effects churned out a dismally low number.

Truth is, the models used to predict the economy at the macro level are just not very good, to say the least. “Macro” of course means “big”: in economics, the term refers to things such as inflation, the growth of the economy and overall movements in trade.

Because of the media exposure it gets, most people think economics is mainly about macro. But whether it is in theory or in practice, most of economics is carried out at the “micro” level, trying to understand how individuals and companies behave.

Here, economics has made a lot of

progress over the past thirty years. Descriptions of behaviour are now much more realistic. There is still a way to go, but this part of the discipline is in good health.

The same cannot be said of macroeconomics. The models are mathematically more sophisticated than the ones which I used when doing economic forecasting in the late 70s and 80s. But their performance is no better.

A stark illustration of this is provided by two of the 2019 Nobel Laureates, Abhijit Banerjee and Esther Duflo, in their book “Good Economics for Hard Times”. They devote a long chapter specifically to international trade.

They note that a number of key propositions in trade theory in economics lack empirical support. Indeed, the evidence even appears to contradict some of them.

Macroeconomics in the UK, whether on the Monetary Policy Committee or in the wide forecasting community, suffers from a problem which Keynes identified in the 1930s when writing about the economic crisis: “A sound

banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional way along with his fellows, so that no one can really blame him.”

What this means is that there’s a real reluctance amongst macroeconomists in the UK to go out on a limb. There are exceptions such as Tim Congdon, the founder of the Institute of International Monetary Research, but groupthink pervades the community.

The Bank of England’s recent record on inflation, for example, has been catastrophically poor. The Treasury’s original Project Fear warning of the consequences of a Leave vote was, according to many, completely wrong.

There is not, unfortunately, a rival set of theories which are scientifically unequivocally superior. But we can start by stopping treating pronouncements from the likes of the OBR as though they were science. A healthy dose of scepticism would prove useful.

£ Paul Ormerod is an author and economist at Volterra LLP

for a program called “Motion”, billed as a kind of AI-personal assistant. It looks at where you’re wasting your time, and supposedly makes it more efficient. In fact, one of the ads for it shows a woman trying to answer an email, while remembering to do the washing, and then calling a friend, before coming back to eventually send the email. It tries to condense our time into more coherent segments.

Full disclosure: I haven’t tried it. My own diary remains antiquated, made from paper and bound by cardboard and glue. I dutifully write down (most of) the Google calendar invites I get.

There is a market for it: last September Motion announced they had raised $13m to try and coordinate people’s lives better. But, if Onward’s hypothesis is to be believed, this bid for efficiency will still leave us just, if not more exhausted.

This is an important lesson for businesses as well. As investment into workplace wellbeing continues to grow, so too does the varied nature of our jobs. Giving people variety and room to grow is, of course, important. But not by simply piling on more, disparate responsibilities onto their desk. If anything, it will be counteracting against all those lunch time yoga sessions trying to boost productivity.

The modern workforce prizes the ability to multitask almost above all else. At the risk of sounding trite, it turns out we’re all exceptional multitaskers, and it’s not doing us any good. Focus is the thing we’re really missing.

Maybe it’s a French-style, viva la revolution or maybe your dad was right, when he said: “Can you just put down the goddamn phone at the dinner table?”

Michelle Donelan was in Brussels yesterday trying to hash out a deal to rejoin the European Union’s science and research funding program, Horizon. British academics lamented the loss of cash for their projects, warning it puts our ‘science super power’ hopes in peril

[Re:A six month pause on new artificial intelligence won’t stop the race for dominance, April 3]

The letter co-signed by Elon Musk and others last week calling for a pause on the development of large-scale AI systems leaves governments and the tech industry in somewhat of a limbo.

Only last month did the Chancellor show his support for the tech sector in the Budget, with dedicated funding to develop science and tech innovation, and AI in particular, in the UK. Now leading voices in the AI community are calling for a halt.

It’s absolutely right that adequate regulation is given to AI development; agreeing on a collective and global

ethics model will be key. But we must also recognise the benefits AI provides.

Everyday AI-powered tech is making workplaces more productive, regulated industries more secure, transport more efficient, ecommerce more personalised; the list goes on. And the concerted effort into AI is much more valuable to people and businesses than the rise of the metaverse, which was happening this time 12 months ago.

One important element to consider is also the investment the UK is making in this sector: we are seeing heavy investment from the US and China.

The AI community is correct to call out the need for proper regulation of the technology; the pressure on governments to deliver this is mounting every day. But it shouldn’t come to the detriment of future development of this exciting technology.

Mihai Vlad

NO more ChatGPT, no more lab-grown meat, no more insects in food or even English words. Yes, that’s right. This is modern-day Italy, hell-bent, it seems, on banning the future. In attempting to defend its culture, Italy is also positioning itself against progress.

The lab-grown meat example is particularly striking: it’s simply not Italian to have “fake” meat. The ban is meant to defend “the health of our citizens, of our productive model, of our quality, of our culture, to put it simply of our food sovereignty”, said the minister of Agriculture Francesco Lollobrigida. As if innovation per se was the antithesis of Italian culture.

There are problems with this banthe first being it is basically useless. The government can’t ban imports, it could only ban the production of labgrown meat. This means when the market for it will open up - and likely explode - Italian companies will be able to import the product but not make it themselves, losing even the possibility of playing what increasingly looks like a very lucrative game.

There is no scientific analysis suggesting lab-grown meat could have any negative impact on our health either, despite what was implied by Lollobrigida. If anything, several studies point to the great environmental benefits that this burgeoning market could bring.

Yesterday, TikTok was fined £12.7 by the Information Commissioner’s Office (ICO) for having up to 1.4 million under13s on the platform. According to the terms and conditions of the social media giant, under13s are not allowed. On top of that, in the UK processing the data of children under 13 without parental consent is illegal.

This is bad enough, but the ICO also found that concerns about this were raised internally at senior level - which makes

the company look even worse.

TikTok says it’s the most transparent app when it comes to disclosing age removals.

It’s not a great period for TikTok: just a day before the fine, the Australian government banned the app from public servants’ work phones, following in the footsteps of the European Commission, the UK, the US, Canada and New Zealand. They all raised concerns that the app was being used by Beijing to harvest sensible data.

Some say when it comes to food, all Italians are conservatives. It’s probably true: a refusal to engage with the possibility of lab-grown meat “made in Italy” can be found historically on both sides of the political spectrum.

And it’s not only the government: indeed it wasn’t Giorgia Meloni, the Italian prime minister, but the privacy regulator who decided to ban AI chatbot ChatGPT. Just days ago it disappeared from Italians’ google searches, after the regulator complained about the lack of clarity on how users’ data is collected and stored. More than one Twitter user jokingly said the ban was implemented after ChatGPT said it was acceptable to put pineapple on pizza.

Italy is the first country to implement this type of ban. It’s been shaped as a battle between good and evil, between the protectors of privacy and the evil giants collecting your personal in-

formation without your consent. It’s also political: one of the members of the board of the privacy authority rocked up to an interview with a t-shirt reading “Privacy First”.

But ChatGPT is not going away; if anything it will likely be incorporated into the way employees work and students learn. There’s a difference between regulating AI - which is necessary and impellent - and banning it. The latter means choosing not to engage, and lagging behind when what looks scary now becomes mainstream later.

Part of it is the old-fashioned political strategy of distraction - and you can see it in the UK as much as in Italy. When governments have problems, they breed policies and new laws like golden retrievers breed puppies. And Meloni’s government has more than one problem to worry about. People keep on drowning in the Mediterranean trying to reach Italian shores; there is increased scrutiny of the government’s inability to coherently

spend the European funds for recovery; public services struggle, and young researchers move abroad because there are no funds for their projects, stifling innovation.

So the idea of banning English words from public use and job descriptions, and of teaching university courses in foreign languages only if there are foreign students enrolled, somehow makes sense. It screams “Italianness” from the rooftops - something this government loves.

It’s kind of funny to think that a government is banning insects in pizzaand after all, it could only happen in Italy, where a love of food is synonymous with national pride. But the humour has a bite when you think that some of these decisions will have an impact in five or ten years; and that a country that desperately needs to embrace innovation in all its forms is doing exactly the opposite. It’s not even a matter of conservatism or progressivism, in the end; it’s just daft.

until the end of the school year

A24-hour-display dial takes a bit of adjustment to read as instantly as your usual 12-hour. But not as long as you’d think. Patek Philippe’s Calatrava Travel Time was the blue-eyed posterboy of the resurgent Watches and Wonders event, Geneva’s luxury watchmaking fair, which took place last week. A consolidation of the now-defunct ‘Baselworld’ and Richemont Group’s breakaway ‘SIHH’, Watches and Wonders is now the pre-eminent in-person watch expo, and a fittingly luxurious space to show off Patek’s latest creation.

Doubly fitting is that the Calatrava Travel Time is a metropolitan, global traveller’s timepiece. Urbane in cerulean, warm precious metal and rakish typography, it’s not only a Patek Philippe – Swiss for ‘finest watch in the world’ – but a Patek Philippe with cool, calm, time-zonestraddling sociability.

The Genevan horloger has deployed 24-hour read-outs in the past, notably on the clubsubscription

‘Chronometro Gondolo’ watches produced in the early 20th century for the Brazilian retailer Gondolo & Labouriau.

One of these, an extravagantly ‘calligraphised’ pocket watch made in 1905, is now exhibited in the Patek Philippe Museum (No. P-527, pictured). For the new Reference 5224R-001, Patek’s design team have reinterpreted this unconventional type of indication in a resolutely modern spirit, choosing to place noon at 12 o’clock, rather than at 6 o’clock as is usually the case, thereby ensuring decent legibility through daytime hours.

Adjusting one’s eyes to all this isn’t a big ask. Nor is the task of slowing the hours hands by 50 per cent, as its own cog in the underlying geartrain need only have its tooth-count upped by 100% per cent. However, this does present downstream technical challenges as – much like any delicately poised anatomy – there’s literally no room. So, with a slightly upped diameter for the hours wheel, a nudge and a shuffle must happen elsewhere, everywhere.

Visible through a transparent sapphire-crystal back, the ‘new’ – i.e. massaged, whittled and painstakingly finessed – self-

winding calibre 31-260 PS FUS 24H movement, powered by a micro-rotor in platinum, retains a case whose 9.85mm height is perfectly suited to the marque’s measure of ‘Calatrava’ classicism. To preserve the sleek lines, Patek Philippe also replaced the traditional correction pushers for the secondary ‘local’ hours hand on the left flank of the case with a patented correction system using the crown pulled out to the intermediate position (backwards and forwards adjustments in onehour steps).

If not, worry not. The important thing is that Swiss watchmaking is back on the move, making movements to move you, which happen to prove genuinely useful when on the actual move. Though hopefully a little further beyond a conference centre neighbouring a taxiway on the outskirts of Geneva.

The Patek Philippe Ref. 5224R is available now in rose gold on calfskin leather with nubuck finish, £46,190, patek.com

Cross the (tastefully appointed) maximum-security threshold of Watches and Wonders and the hierarchy is instantly apparent.

There’s Patek Philippe with its parked-up spaceship, conveying its blueblooded, dyed-in-the-metal pedigree (see above). And then there are 30-something other Swiss watchmakers all clamouring to make a noise in the revitalised, post-Covid white noise of horological newness. This is an industry that’s been supercharged by a rush for tangible asset-class investments, not to

Edited by Alex Doakmention spending power at higher-than-ever echelons of disposable income.

So it comes as a surprise – a pleasant one, mind –to find two notoriously staid stalwarts of Switzerland getting in on this purple patch with uncharacteristic… well, uncharacteristic-ness.

Exhibit A: Rolex, the quite giant of watches, famous for its glacially iterative evolution across

an otherwise unshifting oeuvre. Whether it’s a diving watch, mountaineering watch, flying watch, driving watch or just-plain everyday ‘watch watch’, a Rolex will always fit the bill perfectly,

So praise be for the double-take, record-needle scratch that is the 1908: not

‘Perpetual’ collection, named after

the year Hans Wilsdorf devised the name ‘Rolex’ while still based in London, but the first dress watch in years to display (rearside, where the majority of your money and Rolex’s repute resides) the movement. Calibre 7140 ticks to a precision of –2/+2 seconds a day, whether up a mountain or in a submarine, and now you can watch it do so. While wearing a Rolex that isn’t the Rolex everyone else in the boardroom is wearing. Meanwhile, exhibit B: Kermit. As in the Muppet, whose beloved amphibian form serves as the ‘1’ for the date display of Oris’s latest ProPilot X. A fit-for-purpose pilot’s watch encased by titanium, kitted out with the brand’s new in-house-engineered Calibre 400 mechanics, chronometer-certified… with a frog-green dial, a Muppet every month, and on every delegate’s Top 5 list of Watches and Wonders.

ProPilot X Kermit in titanium, £3,700; 1908 in yellow gold, £18,550. (Whichever's for you, best move fast!)

While Oris puts an actual Muppet on its pilot watch –Kermit resides in the date window –Rolex opens up with disarming élanInspiration: the 'Chronometro Gondolo' (1905) displayed at Patek's museum

Aston Martin and Girard-Perregaux prove it ain’t easy being British-Racing green, Dr Rebecca Struthers makes a similarly convincing ‘case’ for British watchmaking, while George Bamford doubles down in W1K

Girard-Perregaux puts pedal to porcelain with 007’s favourite wheels

Girard-Perregaux’s latest piece of high-octane wristwear calls on appropriately brilliant engineering in rendering its octagonal ‘Laureato’ sports watch in lightweight ceramic.

It was unveiled at the spiritual home of Aston Martin (Girard-Perregau being the British marque’s Swiss watch partner) in Newport Pagnell, where the original factory is now in the business of turning barn-find DB5s into auction-house stars for a flat fee of £400,000.

Available in either 388 examples of 42mm or 188 38mm sizes (both brands being far too classy to pigeonhole according to gender), Aston’s British racing green is matched perfectly across the board, despite the fickle uncertainties of sintering zirconium oxide at 1,200ºC, with all the 30 per cent shrinkage and

brittle hand-finishing that comes downstream. Four limited editions in, it seems that G-P and AM’s own match is one that’ll stick. In the wise words of Marek Reichman, chief creative officer at Aston:

“Patrick [Pruniaux, CEO at G-P] and I spent a lot of time talking about the folklore of the Laureato and the design play between shape and proportion of its iconic bezel.

“When he shared G-P’s exploration into the optical properties of technical ceramics, microbeads and microns, I became enchanted by this idea of the past becoming the future.”

From £21,200, girard-perregaux.com

WORDS BY LAURA MCCREDDIE-DOAKThis latest Baignoire looks simple (the Francophone among you are correct: it really is named after its bath-like shape) but its creation is anything but. In order to impose angular geometry on to its signature oval, the case had to be in two parts – one white gold, the other yellow. The gold segments have been either hand guillochéed, covered in black enamel or coated with a translucent lacquer luminated with suspended mica. A full 212 brilliant diamonds adorn the case, while an extra 23 are on the buckle. And all that only takes two years.

£POA, cartier.co.uk

JAEGER-LECOULTRE REVERSO ONE PRECIOUS COLOURS

This Reverso is probably more suited to the Polo Bar than the polo pitch. Flip over the mother of pearl dial and rather than a ball-deflecting steel rearside (as originally conceived on the sidelines of the British Raj’s fields in Jaipur), the back of this Reverso is set with an Escheresque crosshatch of contrasting blue and black enamel interspersed with insets of diamonds. More stones top and tail the dial and trail onto the lugs, all set into warm rose gold. Of course, you could take to the pitch in it – at treading-in time.

£128,000, jaeger-lecoultre.com

Books on clocks and watches are usually authored by men of a certain age who want you to know many facts. Hands of Time: A Watchmaker’s History of Time is not that book. It’s written by Dr Rebecca Struthers, a watchmaker based in Birmingham’s historic Jewellery Quarter, whose day job is making and restoring mechanical masterpieces alongside her husband Craig Struthers.

Dr Struthers is the first person to be awarded a doctorate in horology, which combines with her youthful, cosmopolitan cool to serve up a gripping history of timekeeping that necessarily starts with the personal, but then embarks the reader on a journey through time, examining how timepieces have shaped humanity not just

in our daily lives but philosophically too. Starting in the darkness of pre-history with 40,000-year-old bone etchings, it spans millennia to reach our 21st century atomic clocks. Struthers examines how everything from our working hours to our leisure time has been influenced by developments in timekeeping.

“I spend whole days working on mechanisms which can contain hundreds of tiny components,” she says. “Each of them has a specific task to perform. Every morning when I sit at my bench, it is an adventure into a new timepiece with its own history to lose myself in. And in their history, we can find the history of time itself.”

Hodder & Stoughton, £22.00

George Bamford’s urbanadventurer imprint comes home, to Mayfair’s evergreen hive of creativity

Bamford London kickstarts 2023 with a watch, the B80, that embodies the unique brand of hyper-opportunistic, personalised luxury that it has pioneered for two decades. A celebration of founder and JCB scion,George Bamford’s commitment to fluid, contemporary and coherent design language, B80 takes its name from the home of its conception: 80 South Audley Street. An elegant Mayfair townhouse that George likes to call ‘The Hive’ after his and his wife’s ‘Mr and Mrs B’ moniker among loved ones – committing right down to its honeybee door knocker and vestibule wallpaper.

For the B80, its sleek titanium case contains Swiss-made Sellita mechanics, and a choice of three moods: ‘Heritage’ in black or blue, ‘Modern’, emphasising Bamford’s position to bring flexibility and customisation to the watch world (not to mention the patronage thereof from TAG Heuer and Zenith), with a further two colourways in yellow delivering a summery neon, or signature ‘Bamford’ blue. Then there’s the B80 ‘Adventure’ with a swatch of hazy green, ochre, or walnut. Three tones speaking irresistibly and warmly of member’s club rooms or vintage Bentley interiors, with a particularly fair price-tag that’s far south of either.

The Bamford B80 watch is available at an astonishingly affordable £1,250 from bamfordlondon.com

For Coco Chanel, the lion was a symbol of strength, among so many other leitmotifs dear to the fashion powerhouse, from camellias to ears of wheat. Now this powerful icon has been transformed into a cuff as part of a new collection for its métiers d’art showcase, Mademoiselle Privé. Leo’s yellow-gold head, which conceals the dial, is set with 252 brilliant-cut diamonds, plus onyx eyes, black-lacquered nose and ears. Another 32 are on the bezel, while the cuff itself is made from titanium in the brand’s signature black. It’s power-dressing, the Chanel way.

£POA, chanel.com

PUTTING ON THE GLITZ PINCHING FROM YOUR MAN’S DRESSER IS ALL VERY WELL, BUT HAUTE JOAILLERIE ALWAYS TICKS THE FINEST BOXES

CHANEL MADEMOISELLE PRIVÉ LION CUFF

It’s a delicate balance of lines and facets that, like every industrial icon, never dates and always bears revisiting.

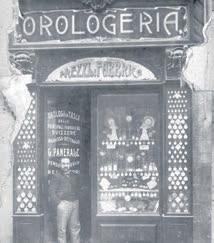

Bringing us to the latest ’Quaranta’ evolution, fittingly revealed during Milan Design Week, marking Panerai’s debut as partner to the 2023 edition of the ‘Salone del Mobile’.

In the brand’s proprietary copper-infused ‘Goldtech’ alloy, the Radiomir Quaranta (£16,100) retains all those mid-century features, only with a small seconds and date added into the mix, and – as the nomenclature implies – pared down to a versatile,

Panerai originally answered a brief from naval 'Incursori' frogmen

gender-neutral diameter of 40mm.

White dials, blue dials, alligator straps, unisex proportions… it’s all a far cry from cigar-chomping A-listers at Planet Hollywood parties, let alone daring WWII saboteurs.

That the Radiomir can legitimately remain true to its 87-year-old utilitarian form, however, says everything of good watchmaking’s ability to transcend time itself. It’ll always be back.

Inthe nineties, you didn’t have Patagonia gilets, quarter-zip sweaters or Logan Roy logo-less baseball caps –you had ‘oversize’ watches. They were status symbols you could drive right into the boardroom, unlike your 911, and style statements to mark you out in a sea of suits.

The sea is an appropriate metaphor, as the ur oversize timepiece started life sculling beneath Mediterranean waves, as anything but a statement timepiece.

Long before the likes of Audemars Piguet’s Royal Oak Offshore swaggered onto the scene 30 years ago, Florentine engineering firm Officine Panerai was, in 1935, answering a request from the Royal Italian Navy: to create a waterproof watch for its covert frogmen, to keep them synchronised while sneaking up to enemy ships’ hulls and attaching limpet mines.