LONDON’S BUSINESS NEWSPAPER

WHO NEEDS ST TROPEZ? HOW MONTENEGRO BECAME THE NEW SUPER RICH PLAYGROUND P16

MORE GRID DRAMA ANOTHER F1 RACE FINISHES WITH CONFUSION

ROUGH NORTH SEAS

Windfall tax could force oil pull-out

EXCLUSIVE

NICHOLAS EARL

LONDON-LISTED Ithaca Energy has warned that the UK’s energy tax regime could jeopardise its involvement in a major North Sea oil field.

The FTSE 250 firm has a 20 per cent stake in the project, called Rosebank, which has the potential to produce up to 500m barrels of oil – roughly equivalent to eight per cent of the UK’s entire oil output between 2026 and 2030.

Rosebank was expected to get final approval from the government last week, but an announcement never came through.

REPORTERS

THE COST of living crisis is beginning to be felt in the pockets of ordinary punters –with more than one in three turning towards own brand products to keep the kitchen cupboard stocked.

New research from KPMG suggests more than half of UK consumers have reduced ‘non-essential’ spending, with eating out top of the list of sacrifices.

Though the jury remains out on whether the UK will enter a technical

recession, the country is undergoing its most painful squeeze on real incomes in decades, due in large part to runaway inflation.

More than four in ten have not undertaken any ‘big ticket’ purchases this year, and a third are using their savings to help meet essential household expenditure.

Alongside the rise of own brand and value products, others higher up the financial ladder are increasingly ‘swapping out’ restaurant meals for premium home cooked dinners.

Brits are also set to feel even more pressure on their household finances this week, with a range of tax changes set to hit paycheques.

Linda Ellett, UK head of consumer markets for KPMG, said the costconscious mood might be good news for discounters.

“With energy, mobile, and broadband costs set to rise for many households from April, a number of consumers will likely have to further cut back their discretionary spending,” she said.

“Buying behaviour also continues to change as shoppers look to lower costs – including switching to discounters, buying more own brand and value produce and searching out promotional prices.”

Lidl and Aldi, the discount grocers, have continued to pick up market share from their bigger competitors. The nation’s largest grocer, Tesco, has managed so far to resist competition from the two German outfits, and actually picked up market share over the past year.

Gilad Myerson, executive chairman of Ithaca Energy, told City A.M. he was still “optimistic” a deal could be reached, saying that the firm was engaged in “very constructive” talks with the government over the project and working on solutions that “support the industry as well as tax collection”.

However, Myerson warned that the current windfall tax, and the uncertainty surrounding it, could force it to look at its role in the project.

Ithaca is seeking reassurances over a mooted ‘floor’ attached to the windfall tax, meaning it would not be applicable if prices fall to more historically ‘normal’ levels.

£ CONTINUED ON PAGE 2

Tell Sid 2.0: M&S chair Archie Norman bids to bring shareholding into 21st century

CITY A.M. REPORTERS

M&S CHAIR Archie Norman wants digital AGMs and a more streamlined approach to investor communications as part of an effort to bring shareholder capitalism into the digital age.

Norman has written to business secretary Kemi Badenoch on behalf

of the ‘share your voice’ campaign, supported by the Quoted Companies Alliance and shareholder lobby groups.

The City grandee wants the requirement for physical AGMs to be ditched in favour of hybrid or digital events which he believes would encourage wider participation by investors.

The letter also calls for improved links between companies and their shareholders who use nominee accounts.

“In the 1980s... people were encouraged to ‘Tell Sid’ about the virtues of shareholding, creating

The M&S chair wants to open up markets to the public

a nation of investors.

Today, however, that level of shareholder capitalism would not be possible,” the letter reads.

“The current outdated legislation means that ordinary people who have

invested in the UK’s listed businesses struggle to hear from and communicate with them,” the letter reads.

The business department said it would respond in due course and that a digitisation review was already underway.

The Mail on Sunday first reported the letter.

INSIDE MORE TROUBLE FOR HOME REIT P2 CREDIT SUISSE PLANS IN THE SPOTLIGHT P3 BREWDOG BACK IN THE HEADLINES P8 THE WEEK AHEAD IN THE CITY P13 SPORT P19

MONDAY 3 APRIL 2023 ISSUE 3,960 FREE CITYAM.COM

CITY A.M.

STANDING UP FOR THE CITY

New audit regulator should be based in London, not Birmingham

WILL the arrival of just shy of 200 regulatory staff in Birmingham, relocated from London, make a tremendous difference to the West Midlands economy? Probably not. Will those regulatory staff, of the new auditor watchdog ARGA, be less effective there than if they were in London? That one’s easier: yes. The plan for the CEO of the new regulator to hole up in Birmingham, a rumour

THE CITY VIEW

confirmed by City A.M. at the back end of the last week, is hugely short-sighted. It is of course not the Financial Reporting Council’s fault –the soon-to-be-replaced regulator is a victim of central government policy which demands more

chairs are filled outside the capital. But to put it bluntly: it makes precious little sense for the boss of the auditing regulator to be in a different city to the bosses of the auditors, almost all of whom are (unsurprisingly) based in London. Bearing in mind the regulator will be obliged to put people on site within the organisations they regulate, and the whole thing has the makings of a logistical nightmare and a bucketload of taxpayer-funded

train trips. Perhaps it’s one way to justify HS2, though with the body set to come into life in the coming years there will be plenty of senior staff on the complaints line to Avanti West Coast for a while yet. We are being of course slightly facetious –there are no doubt a number of clerical roles that could happily be based in the west Midlands, or even further afield. But symbolism matters, especially for a new regulator in

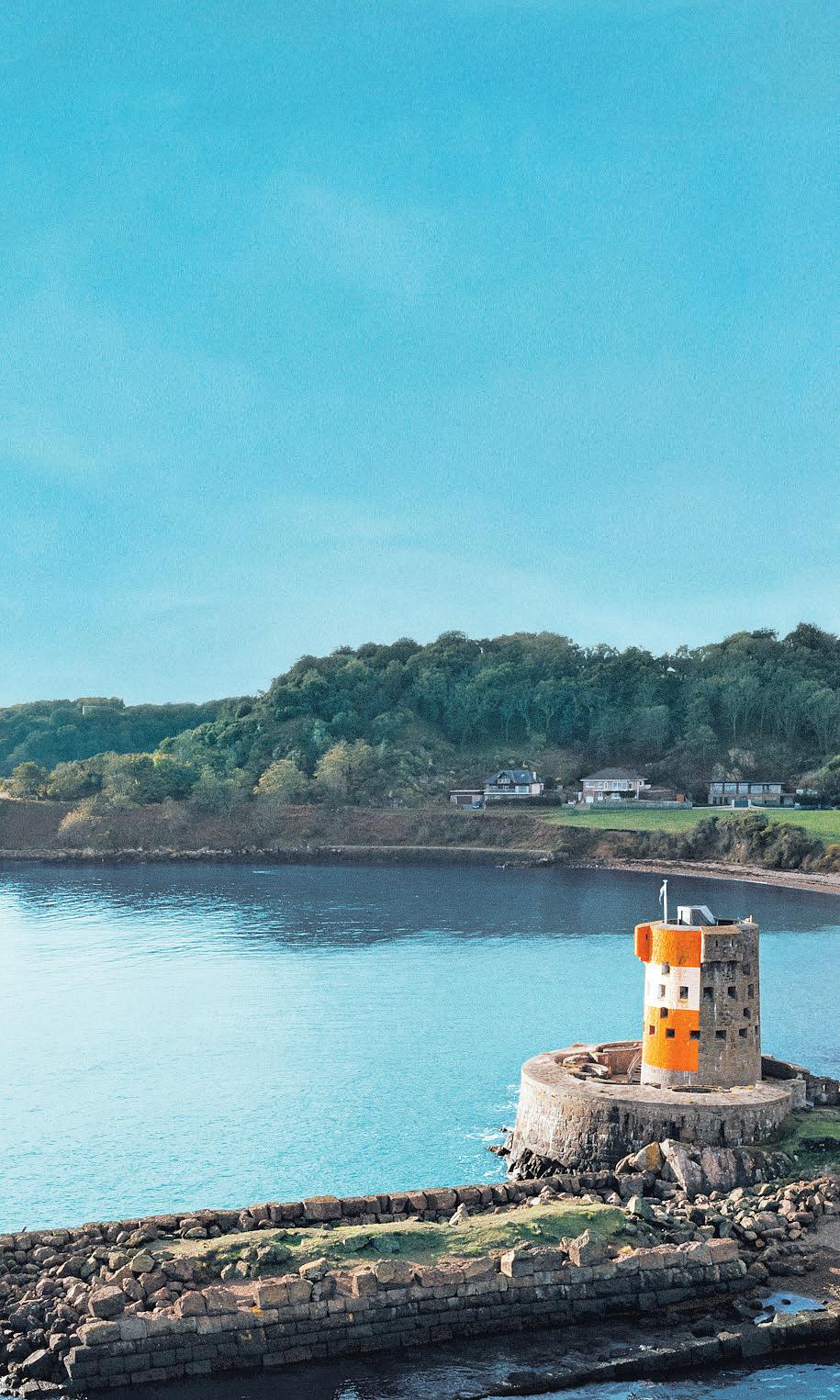

LIFESAVER The RNLI’s new home on the Thames has been floated into place, with the busiest lifeboat station in the country to enjoy a new, energy efficient pad on the river

‘Excessive taxation’ forcing oil businesses to reconsider North Sea energy projects

CONTINUED FROM PAGE 1

“Ultimately, this is going to be a multibillion dollar project and usually when companies commit to such significant expenditure, governments provide certainty around fiscal policy in order to make sure that those interest investments will yield attractive returns,” Myerson said.

The price floor had been expected to be part of Jeremy Hunt’s budget last month, but failed to make the cut.

“I think it’s clear to everyone that, by definition, a windfall tax is when there are windfall profits. Where oil

and gas prices are at the moment, there are no windfall profits. So, it’s very difficult to essentially call it a windfall tax,” Myerson said. “It’s just excessive taxation.”

Myerson added: “And when a company faces excessive taxation, then ultimately it needs to review its investments, and then prioritise accordingly, because the amount of cash available for these investments goes down considerably.”

A spokesperson for Norwegian oil titan Equinor, which owns the remaining 80 per cent stake in Rosebank, told City A.M. it was “committed to develop

the Rosebank field”, adding that it hoped to “make a final investment decision and award the first contracts this year”.

A Treasury spokesperson said: “The Energy Profits Levy strikes a balance between funding cost of living support from excess profits while encouraging investment in order to bolster the UK’s energy security.

“We have been clear that we want to encourage reinvestment of the sector’s profits to support the economy, jobs, and our energy security, which is why the more investment a firm makes into the UK, the less tax they will pay.”

an industry in desperate need of better oversight, and lawyers and supervisory staff should be here. London’s professional services are a powerful driver of the UK’s economy, and in order for them to remain so it is vital that they have a regulator with authority and substance, and presence in all senses of the word.

The plans for a two-office structure and a half-here, halfthere CEO are difficult to square with that goal.

WHAT THE OTHER PAPERS SAY THIS MORNING

CHINA PRESSES JAPAN TO CHANGE COURSE ON CHIP EXPORT CURBS

China has attempted to dissuade Japan from imposing big curbs on exports of semiconductor manufacturing equipment, as part of a battle over the world’s most advanced chips.

THE TELEGRAPH TESLA SALES BREAK RECORDS AFTER ELON MUSK SLASHES PRICE

Electric car giant Tesla sold a record number of cars in the first three months of the year after Elon Musk slashed prices in the face of growing competition from rivals.

THE GUARDIAN PROPERTY TYCOON NICK CANDY LOCKED IN LEGAL FIGHT WITH ROBERT BONNIER

The property tycoon Nick Candy is locked in a butter legal dispute with a former business partner in which they have traded allegations about each other’s conduct and financial worth.

New drama at Home REIT as more

tenants slip into arrears

CHARLIE CONCHIE

THE BOSS of Home REIT’s nowbankrupt biggest tenant controlled nearly a quarter of the firm’s rental income via three different companies –none of which have paid rent to the embattled investment trust, City A.M. can reveal today.

Gurpaal Judge, the chief of Home REIT’s collapsed biggest tenant Lotus Housing, also ran tenants Redemption and Eden Safe, which collectively accounted for 23.5 per cent of its total rental income.

City A.M. understands that both Redemption and Eden Safe are in arrears to Home REIT.

Lotus Housing alone accounted for 12.2 per cent of Home REIT’s rent but collapsed at the beginning of this month after failing to secure so-called exempt housing status, which would have entitled it to taxpayer-backed rental support.

The investment trust currently has its shares suspended amid a strategic review of the company.

Home REIT and Gurpal Judge did not respond to requests for comment.

CITYAM.COM 02 MONDAY 3 APRIL 2023 NEWS

THE FINANCIAL TIMES

UBS-Credit Suisse deal faces probe

opened an investigation into the state brokered takeover of Credit Suisse by UBS, according to the Financial Times. The newspaper reported that the prosecutor is looking into possible breaches of Swiss criminal law by government officials, regulators and bank executives.

Swiss financial centre and has set up monitoring in order to take immediate action in any situation that falls within its field of activity,” the authority told the Financial Times.

Over the years there have been “numerous aspects of events around Credit Suisse” that justified investigation,

the [prosecutor]”.

The deal has been very unpopular in Switzerland with the two largest political parties expressing discontent with the takeover. The junior house of the Swiss parliament has called for a parliamentary inquiry to examine the acquisition. Ordinarily such a deal would have to

Risk of UBS job cuts following CS takeover

CHRISTOPHER DORRELL

CHRISTOPHER DORRELL

UBS MAY cut as much as a third of its workforce following its takeover of Credit Suisse, Swiss newspaper Tages-Anzeiger reported this weekend, as the bank considers its options for delivering the deal.

At the end of 2022, the bank employed around 125,000 people, where approximately 30 per cent of those were based in Switzerland. However, according to the report, some 30,000 jobs could be at risk, as the two banks have significant overlap in their workforce.

Citing unnamed senior managers, the Swiss daily reported that as many as 11,000 employees could be laid off in Switzerland.

bank was acquired for half its market cap.

The news piles further woe on Credit Suisse, which is set to face a difficult annual general meeting on Tuesday.

A top 10 investor, Norges Bank Investment Management is set to vote against the re-election of chair Axel Lehmann and six other directors.

UBS Chair Colm Kelleher has previously signalled his intention to “downsize” Credit Suisse’s investment banking business, which has been the source of much of its recent unhappiness.

Credit Suisse was already undergoing an extensive round of job cuts, aiming to reduce its head count by as much as 9,000. UBS was not immediately available for comment.

03 MONDAY 3 APRIL 2023 NEWS CITYAM.COM

Bank’s former hawk turns into dove on rates

CHRISTOPHER DORRELL

THE FORMER chief economist of the Bank of England Andy Haldane has cautioned his old colleagues against pushing further rate rises, warning they might unsettle an economy that is on “unsteady legs”.

“I think given the extent of tightening we had during the course of last year, and the early part of this, and given the economy is still on relatively unsteady legs, now might be a time to pause and take stock for a bit,” Haldane said in an interview with The Sunday Times.

“There is still a lot of [monetary] tightening in the pipeline. And the last thing we want to do is take out the legs of a still very unsteady recovery,” he said.

Haldane, who left the Bank before the current hiking cycle, was

previously considered one of the Bank’s most hawkish members.

The Bank of England has embarked on a vigorous campaign of monetary tightening in an attempt to combat rising inflation.

After inflation surged to double digits last year, the Bank has hiked rates eleven times in a row, taking the base rate to 4.25 per cent – its highest position since 2008. Higher interest rates take the heat out of an economy, helping to lower prices.

In a speech last week, Governor Andrew Bailey signalled that there might be further rate hikes to come.

The Bank is still “very alert to any signs of persistent inflationary pressures”, he said.

The mining firm managed to misplace a radioactive iron ore capsule back in January

Rio Tinto set for battle at AGM over boss Stausholm’s salary

NOAH EASTWOOD

RIO TINTO is reportedly set to face down a shareholder revolt at the mining giant’s annual general meeting this Thursday after the firm raised the chief executive’s pay by 70 per cent.

Danish boss Jakob Stausholm took home £4.8 million in 2022, up from

PAYDAY FOR MANDY AS TIKTOK USE FORMER LABOUR MAN’S FIRM FOR LOBBYING ADVICE

A public affairs firm set up by Lord Mandelson is advising Chineseowned Tiktok, which faces bans over spying fears. Global Counsel, which Mandelson founded in 2016, is helping Tiktok “frame their messaging” to assuage concerns that it would pass on data to Chinese state intelligence agencies if asked, according to a report in The Mail on Sunday. The report quoted an industry source saying that Mandelson’s firm was “telling Tiktok how to interact with the various international regulators”, adding that “they’re also telling them how to frame their messaging”. Mandelson told the paper that he was “not directly involved” in the advice.

CENTRICA LOSES COURT CASE OVER BULB DEAL

£2.8 million in 2021.

According to a report in the Mail on Sunday, investors have been urged by the proxy advisory group PIRC to vote against the pay scheme, which sets the CEO’s salary based on the company’s performance. PIRC have also called for investors to pull support for the firm’s pay chair and sustainability chief.

Centrica is considering filing an appeal after it lost its legal challenge against the government over Octopus Energy's takeover of fallen rival Bulb. The British Gas owner said the judgement, handed down on Friday, was “disappointing,” and warned that the deal structure for Octopus' takeover distorts the energy market and “creates serious risk for taxpayers and energy consumers.” It added that it will “review the judgement carefully and consider our options.”

05 MONDAY 3 APRIL 2023 NEWS CITYAM.COM

IN BRIEF

Haldane now leads the Royal Society of Arts

Much to improve as UK’s major listed firms given ESG scorecards

CHRISTOPHER DORRELL

‘MANAGEMENT of emissions’ and ‘air pollution’ are the biggest ESG risk factors for the UK’s largest listed companies, according to new research by London reinsurance firm Chaucer.

On average the UK’s largest listed companies scored just 13.7 and 14.3 out of 100 for ‘management of

emissions’ and ‘air pollution’, key topics for some green investors.

On the positive side, listed companies performed best on involvement in the ‘armaments industry’ and ‘diversity & inclusion’, scoring 87.8 and 79 respectively. Across all ESG risks, the UK’s largest listed companies scored 66.8 out of 100.

Chaucer’s Simon Tighe said the low scores reflected the lack of ESG

disclosures in the UK.

“The reason why so many major listed companies achieve low ESG rankings is that they aren’t disclosing enough data - which is the equivalent to them falling at the first fence,” Tighe said.

The UK is currently considering plans which would require firms to publish their plans for transitioning to net zero.

No charges for failure to prevent tax evasion laws

LOUIS GOSS

THE UK taxman has not charged any British firm with the ‘failure to prevent tax evasion’ offence since it was introduced six years ago, HMRC has confirmed.

Under the offence, introduced in 2017, a British company can be criminally prosecuted if it was found to have not put adequate checks and systems to prevent its staff from facilitating tax evasion.

While HMRC confirmed it hasn’t secured any convictions, it did say it has nine ongoing investigations into possible breaches of the 2017 law.

It added that it is reviewing a further 26 cases for potential investigation, having previously rejected a total of 77 opportunities to open an investigation.

In explaining the lack of convictions, a HMRC spokesperson told City A.M. the offences were introduced to “drive behavioural change and encourage organisations to put preventative measures in place to reduce tax evasion”.

The HMRC spokesperson claimed the 2017 laws had already achieved “success” in driving a “corporate culture shift to-

wards anti-tax evasion awareness and procedures”.

However, City lawyers warned that failure to bring any cases means the law risks losing its deterrent effect.

“An important component of criminal law is the deterrent effect,” Barry Vitou, head of white-collar crime at law firm HFW, said.

“However, the bottom line is that in order for (it) to be a deterrent, you need to prosecute and punish wrongdoers.”

Vitou explained that funding cuts at HMRC have left the taxman “under resourced”, with resourcing issues likely a “key factor” in the lack of prosecutions.

Nicholas Gardner, a tax partner at Ashurst, said the lack of enforcement action risks lowering the appetite firms have to “spend substantial sums” on ensuring they are on the right side of the ‘failure to prevent’ laws, as he argued a “successful conviction” would drive a “tightening” of companies’ policies.

However, corporate crime lawyer Aziz Rahman, senior partner at Rahman Ravelli, highlighted that it often takes years for such cases to “work their way through the system”.

LONDON SHAKEUP M&S slams ‘inaccurate’ report of looming job cuts at London HQ

MARKS & Spencer has dismissed a report that it will cut hundreds of jobs at its London head office as “simply inaccurate”. It comes after The Sunday Times reported the chain was expected to drastically downsize its London HQ, with “hundred of jobs” to be cut. “As previously reported in October, we have said the lease on our London office ends in 2028 and that is a sensible time to think about the amount of space we have in London vs elsewhere,” the retail chain said.

Recharge looks to rehire former Britishvolt execs as rescue falters

NICHOLAS EARL

THE AUSSIE power group that recently bought Britishvolt is reportedly in talks to rehire two former top executives, amid concerns its rescue attempt for the collapsed battery maker is faltering.

Recharge Industries approached former Britishvolt chairman Peter Rolton to be chief operating office and its former chief operating officer Tony Laydon to be

chief executive, according to The Sunday Times.

Recharge, which is run by former PwC partner David Collard, bought Britishvolt out of administration for £8.6m last month. However, there are concerns over the deal after Recharge missed a deadline last Friday to pay £9.7m to Katch Fund Solutions, a finance firm that has a hold over the land.

How we reported on Britishvolt’s collapse

CITYAM.COM 06 MONDAY 3 APRIL 2023 NEWS

WATT NOW? BEER BOSS SAYS HE’S LEARNT FROM ERRORS

MOST public figures who have found themselves embroiled in the number of scandals that James Watt, the chief executive of craft beer firm Brewdog, has managed would by now surely have retreated from the public spotlight.

However, that’s not Watt’s style. The outspoken founder of the Punk IPA brand is once again generating his own headlines, with the launch of a new competition which will see the businessman inject five million pounds of his own cash in search of the next billion-dollar company.

Watt has coined the project ‘The Next Unicorn’ and it will see him team up with the world’s largest equity crowdfunding platform Crowdcube to receive pitches from a range of European entrepreneurs.

As part of the process he will then whittle down entrants with the help of a carefully selected panel, including Crowdcube CEO Matt Cooper and Evelyn McDonald, CEO of Scottish Edge –which helped the brewing company get started 16 years ago.

The competition is an attempt to rival BBC’s television hit Dragons Den which Watt was rejected from twice, once when he sought early funding in 2009 and separately when he was approached and shortlisted to become a Dragon himself, but ultimately didn’t end up getting the seat.

“I have no resentment towards Dragon’s Den at all,” Watt tells City A.M –but does say that he was spurred on by those rejections and believes that he can do “something better” for the budding entrepreneurs.

‘A DIFFICULT JOURNEY’

Since Brewdog’s formation in 2007 the business has experienced extraordinary growth, expanding to some 78 bar locations across the globe and securing lucrative trade deals with major supermarkets – however Watt admits that the experience of a CEO in a high performing company can be “lonely” and a “difficult journey”.

He says: “[As part of the competition] I want to share my experience in building a remarkable company and hope to help them do the same”.

Watt reveals that he also wants to help these potential high growth businesses learn from some of the “pitfalls” and “challenges” that Brewdog has faced.

He says: “I think what we have done well, when we’ve got things wrong, is we have held our hands up and put means in place to help

ensure we build the best company we can.”

The launch of ‘The Next Unicorn’ comes as the dust is slowly starting to settle on a number of scandals which soured the reputation of Brewdog – including being accused of creating a “culture of fear” since its rise to prominence.

In January 2021, Watt was forced to apologise to former employees after an open letter went viral on Twitter, in

which 61 former workers alleged that the company cultivated a “toxic” culture that left staff suffering from mental illness.

Reflecting on the crisis, Watt said: “We definitely had some challenges and there are definitely some things that we could have done better.”

The firm was also criticised after launching a PR campaign criticising Qatar’s hosting of the World Cup, only for it to become apparent that the firm’s beers were on sale there.

Moreover, late last year Brewdog was forced to give up its B-Corp certificate –because the organisation that hands out the profit with purpose hallmark “requested additional measures”.

Watt told City A.M that “B-Corp or no B-Corp”, Brewdog is “focused on building the best company it can” and has achieved its first year of ‘carbon negative’ operation.

He said: “[Its removal] doesn’t change us working hard to make sure we get better at everything we do every single day.”

Robert Walters update to reveal effects of cooling UK jobs market

AUGUST GRAHAM

ROBERT Walters is likely to give investors a sneak peak behind the curtain this week to see how a cooling jobs market might be affecting the recruitment industry.

The firm is expected to issue an update on the first quarter of 2023 before markets open on Thursday.

Recent data from the Office for National Statistics showed there was a 51,000 drop in the number of vacancies in the UK to 1.12m in the three months to February. Redundancies also grew.

“Investors must accept that employment data comes with an inbuilt lag,” Russ Mould and Danni Hewson, from AJ Bell, wrote.

“That caveat aside, this update should be informative, not least because Robert Walters reported record profits in 2022.”

Previous updates from Robert Walters have shown that wages grew significantly amid a short supply of workers, meaning it could charge higher fees. Investors will be keen to know if this has continued.

CITYAM.COM 08 MONDAY 3 APRIL 2023 NEWS

will be keen to see how falling vacancies are affecting the recruitment sector

Investors

Laura McGuire meets Brewdog boss James Watt as the PR savvy beer chief looks for ‘the next unicorn’

PA

We’ve had challenges and there are definitely some things that we could have done better

The beer boss has built a global business

THE NOTE BOOK

UP UP AND AWAY... BUT NOT YET

LONDONpolicy wonks love to collect examples of all the ways in which the capital supports the whole country. Two events last week gave me fresh material for the list, in the form of an (oftoverlooked) aspect of our transport networks: freight.

London Gateway port handles a quarter of all deepsea cargo and has plans to expand capacity by 30 per cent as part of the new Thames Freeport. And three quarters of the nation’s air freight travels through London’s airports with Heathrow the most valuable of any UK port, handling £200bn in goods every year.

But the thing that business leaders kept coming back to was the lack of joined-up thinking from policymakers. Freeports have been given the green light on the basis of wider infrastructure improvements, but without any guarantee that planning

permission will be granted locally. The delays to the planned Lower Thames Crossing are a case in point. Even without getting into the (desperate) need for more capacity at Heathrow, the airport is operating under a weight of regulation that competitors don’t have to bear. It takes about 12 hours to process transit cargo in the UK, compared to a couple of hours at the major European hubs and within the hour at airports in the Middle East. Within London, wellintentioned but uncoordinated policy and congested roads make moving stuff around a real challenge. As you’d expect it’s pushing companies to innovate and there are promising trials on both the river and the railways. Faster and more reliable delivery times are possible, but scaling up will need investment and policy support.

Where interesting people say interesting things. Today it’s Adam Tyndall, programme director for transport at BusinessLDN

The government’s “Green Day” was as underwhelming as everything produced by the band since 2004, and a striking gap was in relation to sustainable aviation fuels. These fuels exist today and can be put in regular jet engines. They could reduce UK aviation emissions by about a third – not a silver bullet but a big contribution to net zero. The US and EU are providing policy and subsidies to massively expand production. We urgently need the same.

£ Any discussion of freight reminds me of the best book I read in 2022: The Box by Marc Levinson. It’s 400 pages on the story of the shipping container which, it turns out, is pretty much the story of the global post-war economy. There are swashbuckling American industrialists, labour relations battles and real wars. Not to mention the economic rise of Asia. And it’s a genuine page-turner. I’ve been recommending it to anyone who will listen.

Trump heads for court in Manhattan but no sign Presidential bid to stop

JAMES SILVER

FORMER US President Donald Trump will be fingerprinted and photographed by prosecutors tomorrow as he faces criminal charges in New York.

Trump is expected to be hit with more than two-dozen charges related to a hush money payment to the former porn star, Stormy Daniels.

Trump will fly from Mar-a-Lago in

LORDING IT UP IN THE NETS –AND IN THE MIDDLE

Florida to Manhattan today.

The former President, who is running again for the White House despite a string of scandals and his complicity in the 2021 Capitol riot, has been using the charges as a fundraising tool in recent days.

He has also taken to his social media channels to rain down insults at the Manhattan judge expected to oversee his case.

Senior Republicans have also

criticised the Manhattan District Attorney for what they describe as politically motivated justice. Ahead of the formal indictment, a grand jury was presented with evidence of a $130,000 payment to Daniels in the last days of the 2016 Presidential election, which she says was to keep quiet about a sexual encounter with Trump in 2016. Trump is unlikely to be handcuffed during his time in court.

£ By the time you read this I should be in Kathmandu. The aviation industry seems to be suffering none of the handwringing over passengers returning after the pandemic that still afflicts the public transport sector. It probably has something to do with not needing to ask the Treasury.

The fantastic coaches at the Lord’s Indoor Cricket Centre have realised it’s not just kids who need help. I picked up a bat again after 15 years when a friend suffered ping-demic dropouts. It’s the ideal sport to return to in your thirties and a reminder of the value of having hobbies even – or especially? – ones that you’re not very good at. Thanks to the team at Lord’s, my batting confidence is restored and some of my leg spin is occasionally on target. The season opener is against a team from TfL so if practice doesn’t make perfect, I can always resort to sledging about strike rates.

CITYAM.COM 10 MONDAY 3 APRIL 2023 NEWS

“I moved my ISA to InvestEngine and couldn’t be happier” Find out just how powerful, easy and affordable ETF investing can be Earn up to £125 bonus Sign up before 2nd May 2023* Transfer or open your free ISA at investengine.com/ISA-CityAM A t d ISestEngine uldnoand c ev“I mo - James, Smart Money P ut ho ind oF e happi t b’uldn d my ISe oney People asy ul, e erffu w w ”ere happi ngine estEvnoIA t esting cv ETF in dableorff ffoa ean b esting c e 2nd M efor fo ign up bS 5 b12£ ot 23*ay 20 us on5 b -CAom/ISc.engineestvin freneureryoor op ansfrT *Ts Ts&Cs apply. Capital at risk. ETF c A ate IS . ETF costs apply nge.

US President Donald Trump will find out the specifics of his charges on Tuesday

London’s value to the wider economy still underestimated

ENERGY

GREEN day is over. In both a failure of ambition and communication – Grant Shapps last week cobbled together a piecemeal array of previously pledged policies and minor updates, while failing to halt a runaway train of industry briefings to an expectant media. This had built up hopes of a robust response to vast US subsidies that never materialised –drawing the energy sector’s ire.

Among the more colourful criticisms last week, Renewable UK warned the country “risks falling behind and surrendering our global lead”, while Good Energy feared “Shapps has had his head turned by the mythical beasts promising business as usual”.

In the aftermath, Chancellor Jeremy Hunt has cautioned that the UK will not go “toe-totoe with our friends and allies in some distortive global subsidy race” following the US Inflation Reduction Act, which includes $368bn of financial support for new energy projects set up Stateside.

If we are being generous, the government achieved one of the six targets put forward in my column last week – a new competition for small modular reactors, overseen by the freshly-launched Great British Nuclear.

Now the dust has settled on Shapps’ much drummed-up plans, which were officially named “Powering up Britain”, City A.M. will highlight some of the winners that could lead to a greener future.

CARBON CAPTURE, USAGE AND STORAGE

The government announced £20bn of support for carbon capture, storage and usage earlier this month, but Shapps has now confirmed where the money is going –meaning the wheels are finally in motion for the UK’s first energy projects which will capture their carbon emissions.

Eight proposed developments were shortlisted for “Track-1” funding, the first round of allocated taxpayer support, which will help finance the projects for the next two decades.

Downing Street has shortlisted projects from two carbon capture and storage “clusters” –the East Coast Cluster and HyNet Cluster rubber-stamped for projects.

The East Coast Cluster looks to capture emissions from the northeast and store them in a saline aquifer in the North Sea, while HyNet aims to capture emissions from the northwest and store them in disused gasfields under the Irish Sea. The government hopes these two regions will be capturing 20m-30m tonnes of CO2 a year, equivalent to the annual emissions from 10m-15m cars.

BP are the big winners with three projects selected for funding including the UK’s first carbon capture and storage power plant, which could produce enough electricity to power 1.3m homes per year, alongside plans to develop low-carbon hydrogen from natural gas with carbon capture and storage.

Meanwhile, exciting projects were shortlisted by the government as leading contenders for “Track-2” funding in the

GREEN DAY’S GOOD NEWS

project in the Southern Humber region. There was bad news for other Humber projects, with SSE developments missing out on shortlisting despite the region being part of the East Coast Cluster. The biggest loser, however, was Drax – whose £2bn-plus biomass carbon capture project missed the cut for “Track 1” selection, despite suspending financing for the facility unless it was greenlit for subsidies and approval, raising doubts over the future of the project.

FLOATING OFFSHORE WIND

Taller than the Shard, and with twice as much concrete as the Eiffel Tower – floating offshore wind turbines are as extraordinary in size as they are in invention.

Propped up with buoyed platforms and supported with undersea cables, they can be located in deep, challenging waters not

and Celtic Sea. The government is targeting 5GW of generation by the end of the decade, and has now launched its £160m Floating Offshore Wind Scheme to upgrade ports.

Renewable UK has been pushing for £4bn in funding but the UK is still well positioned to become a global leader in floating wind tech, with the biggest project pipeline in the world of 37GW (one-fifth of global projects).

The value of floating offshore wind is not just in generation targets – it is in utilising a nascent industry to revitalise declining regions of the country, helping to meaningfully realign the economy alongside reaching the UK’s energy goals.

HEAT PUMPS

Energy security starts in the home, and while heat pumps are not a silver bullet for all energy users, they could have a highly

Channelling his inner-Partridge, Shapps has unveiled £30m for the Heat Pump Investment Accelerator, designed to leverage £270m private investment to boost UK manufacturing and supply of heat pumps.

Currently, 85 per cent of the UK’s housing stock is heated by gas, but Downing Street is targeting 600,000 installations of heat pumps every year by 2028. Last year, just 42,779 heat pumps were installed, but the government hopes industry players such as Octopus Energy offering installations at £2,500 per year could lure more people to the tech.

The discounted rate includes the £5,000 grant from the Boiler Upgrade Scheme, which will be extended to 2028.

It has also allocated some of £12.6bn in energy efficiency funding this decade to installing heat pumps across vulnerable households and public buildings.

CLEANING UP THE WATER INDUSTRY

Environment secretary Therese Coffey is expected to announce water companies will face unlimited penalties if they fail to tackle sewage leaks and pollution. This follows watchdog Environment Agency revealing there were 301,091 sewage spills in 2022 - an average of 824 a day. This was a 20 per cent decrease on last year but the fall was due to dry weather rather than measures taken by water firms.

STILL CATCHING UP IN THE RACE TO NET ZERO

£ The ‘Powering Up Britain’ strategy is not just an outline of the UK’s energy agenda, but was part of a courtmandated response to a judge’s ruling last year that the government’s net zero strategy lacked sufficient detail. However, the government’s own analysis in the report shows the new policies will only enable the UK to reach 92 per cent of the cuts for its 2030 emissions target – which was a 68 per cent overall reduction compared to 1990 levels.

SEND US YOUR THOUGHTS

What can we do to improve energy security? Email energy editor Nicholas Earl at nicholas.earl@cityam.com

OPEC surprises with further cuts to oil production amid demand fears

NICHOLAS EARL

OIL markets could enjoy robust trading this morning, with prices supported by further surprise cuts to production from the world’s most influential energy cartel. OPEC and its allies including Russia, known as OPEC+, have announced voluntary cuts to their

production amounting to around 1.15m barrels per day.

This is on top of the 2m barrels per day cuts agreed last November – and will kick in from next month.

OPEC argued the move was aimed at supporting market stability following volatility across the financial sector.

“OPEC is taking pre-emptive steps

in case of any possible demand reduction,” Amrita Sen, founder and director of Energy Aspects told news agency Reuters.

The move is a shock development –as the group had been expected to stick to current pledges when its ministerial panel meets virtually later today.

Prices have risen in the last week.

11 MONDAY 3 APRIL 2023 NEWS CITYAM.COM

Oil fields in the North Sea will benefit from higher global prices for the black gold

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his weekly column

Our mental health columnist Alejandra Sarmiento on staying sane in a high pressure world

At the football and in the office, how you behave matters

IWASat a football match recently. To my left, there was a man, probably in his early 40s. His son, ten years old at the most, sat on the other side of him. For the first twenty minutes of the match, this man incessantly shouted vile abuse at the players, waving his fist and occasionally standing up to emphasise an emotion. His son sat quietly, spending more time watching his dad than following the players on the pitch. By the second half, however, this little boy looked and sounded just like his dad. Same words being hurled at the players, same body language. Like father, like son.

I don’t know if that game was the little boy’s first match in a stadium with his dad. I don’t know if his dad always expresses himself at football matches with such hostility and anger. I don’t know if this little boy already uses such abusive language. What I do know is that children learn so much of their behaviour simply from observing how parents, or carers, behave. They repeat what they witness from the adults around them. This is true both for learning physical actions and expressing emotional responses. This process of learning, and imitating is often automatic and unconscious. In other words, reactions and behaviours

become internalised. In turn, these patterns of internalised learning become coping mechanisms, if the home life of a child is dysfunctional.

A child who is often criticised, bullied or who frequently witnesses rage at home will likely become an adult who craves control and power as a means of

ensuring the safety that they did not feel growing up.

A child who consistently seeks perfection and achievement as a way of

trying to avoid adding more stress to an already stressful home life will grow up to be an adult who struggles to set boundaries at work. They will do all that they can to maintain appearances, no matter what the real cost may be to their relationships and to their own happiness and wellbeing.

A child who observes how a parent (or carer) locks themselves away in their room, argument after argument, will also start to isolate themselves in their room. This child will very possibly grow up being mainly attracted to unavailable partners, creating fantasy scenarios that never quite materialise.

A child who becomes an emotional crutch and surrogate companion as a way to compensate for the lack of connection and support between their parents (or carers) can be expected to become an adult who gives much more than appropriate in relationships. They will continuously self-abandon and will have no real understanding that their own needs, desires, happiness and safety matter too.

As adults, we must learn to consciously recognise our harmful patterns of behaviours so that we can move away from toxic relationships towards relationships that make us feel seen, safe and satisfied.

CITYAM.COM 12 MONDAY 3 APRIL 2023 NEWS ASSEENONTV LUXURY LODGES FOR SALE IN CORNWALL & WEST WALES SCAN THE QR CODE FOR MORE INFORMATION Contact us 0800 677 1777 residences.luxurylodges.com/city-am BUY TO LET OPTIONS Stunning spaces An exclusive collection of coastal lodges that combine the luxuries of hotel living with the freedom of holiday home ownership.

HEAD SPACE

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

Markets stumble into second quarter as City winds down for break

LAST Friday’s market close brought down the curtain on what AJ Bell analysts called a ‘topsy-turvy’ first quarter, with the FTSE 100 tapping a record high before a banking panic left it only a touch higher than at the start of the year.

“Fears of another banking meltdown might have receded, but nerves are still raw and there is a sense that investors are waiting for the other shoe to drop, wondering where else cracks might be forming under the weight of those interest rate hikes,” the firm’s Danni Hewson said.

It’s set to be a quieter week in the City with most firms holding their fire until after Easter.

Recruiter Robert Walters will be closely watched on Thursday for signs of the resilience of the job market, whilst Saga –reporting on Tuesday –

will no doubt update on the firm’s recent progress.

Otherwise it’ll be data that drives sentiment, with manufacturing PMIs due today and US factory order numbers the day after.

It’s also a week for American job numbers (Tuesday and Friday) with many looking to see whether the wobbles in the American banking sector and the Fed’s go-go rate hikes will slow the economy and hiring. The usual caveat that jobs figures are backward looking will as ever apply, which in this case is very much a doubleedged sword.

Elsewhere, the Aussie central bank will announce its interest rate decision, as well as neighbours in New Zealand. Meanwhile the fallout from OPEC’s cut to oil production will no doubt fuel plenty of uppish action on the price of black gold.

The global car dealer is still motoring, at least according to analysts at Berenberg, who see plenty of reasons for upside. Analysts don’t believe Inchcape will suffer from any slowdown in the global car market due to a combination of cost-savings and continued M&A in fragmented end markets. “We think these levers make our current forecasts conservative,” Berenberg say, giving a buy rating a 1,085p target.

UP

Liberum analysts were full of the joys of spring last week at the news that Zillah Byng-Thorne, the highly thought-of former boss of Future, would join Saatchi’s board. For an organisation not exactly unfamiliar with boardroom drama, Saatchi will benefit from Byng-Thorne’s “brilliant track record” and experience, they say. They’ve kept their buy rating, with a healthy 260p target price.

NEWSLETTERS CITYAM.COM/NEWSLETTERS SIGN UP TO OUR THREE DAILY EMAILS - MORNING, NOON AND NIGHT The biggest stories direct to your inbox Breaking news, exclusives, scoops, interviews, blogs, opinion, sports, life & style, travel and more. 13 MONDAY 3 APRIL 2023 MARKETS CITYAM.COM

P 31 Mar 774.5 28 Mar 27 Mar 30 Mar INCHCAPE 31 Mar 29 Mar 700 780 760 740 720

appear in Best of the Brokers, email your research to notes@cityam.com P 31 Mar 192.4 28 Mar 27 Mar 30 Mar M&C SAATCHI 31 Mar 29 Mar 186 194 192 190 188

To

EYES

“The Bank of England is stressing that the overall banking system is safe as houses, but hairline cracks in other areas still risk widening into deeper financial problems, so it’s surveying remedial work that may be needed. It’s little surprise the Bank is highly attuned to further problems which could emerge on the horizon

SUSANNAH STREETER

OPINION

EDITED BY SASCHA O’SULLIVAN

China’s undeclared information war with Taiwan is a warning from Beijing

laptops, microwaves and ATMs along the way. For Taiwan to fall under the control of the Chinese Communist Party would be all but unthinkable.

WHEN people show you who they are, believe them” may not be an infallible guide in international diplomacy. After all, every schoolboy learns Henry Wotton’s definition of an ambassador as “an honest gentleman sent to lie abroad for the good of his country”. The Jacobean envoy captures the light and shade of relations between states, but it may be the first maxim which is more valuable when dealing with China at this moment.

President Xi Jinping, elected for an unprecedented third term last month, has always regarded the annexation of Taiwan as an essential part of his tenure. He calls it “national reunification”, but of course Taiwan has never been ruled by the Chinese Communist Party, being the last redoubt of Chiang Kai-shek’s Republic of China. But the CCP regards the island as the unredeemed spoils of its victory in the civil war of 1945-49, and Xi has made the seizure of Taiwan a near-existential goal. We should believe the Chinese president because we know this is not an idle boast. William Burns, the director of the CIA, identified China as America’s “biggest geopolitical test” when

he was confirmed (unanimously) by the Senate in 2021; in February of this year, he announced that as “a matter of intelligence” he knew that Xi had instructed the People’s Liberation Army, the Chinese armed forces, to be ready for an invasion of Taiwan by 2027. Even now, the only new aspect is our certainty: since 1979, the US has been bound by the Taiwan Relations Act, which requires it to provide its ally with a self-defence capability sufficient to ward off the threat from the mainland.

Why should we care? The military interventions in Afghanistan and, especially, Iraq (which celebrated its dismal 20th anniversary last month) dealt a

grievous blow to western interventionism. Taiwan is thousands of miles from the United States, and even further from the UK, while the Taiwan Strait is only 100 miles across. From Kinmen, Taiwan’s most westerly province, you can see the skyscrapers of the Chinese city of Xiamen just over six miles away. In cold geographical terms, it seems easy to file as Someone Else’s Problem.

A Chinese takeover is not a simple matter. The PLA may have two million men under arms and the world’s second-largest defence budget, but it still has to get to Taiwan. Dr Thomas Barnett, the brilliant American geostrategist, refers to a potential invasion as

“the million-man swim”, and it is hard to imagine a physical seizure of the island without Chinese boots on Taiwanese beaches, and a slaughter which would make D-Day pale by comparison. But it matters. Quite apart from fuelling our high-minded notions of the defence of democracy against aggressive totalitarianism, Taiwan hosts a semiconductor industry which supplies about 60 per cent of the global market, and makes 90 per cent of the most advanced semiconductors. Although the Taiwan Semiconductor Manufacturing Company is beginning to broaden its production base, the island’s microchips essentially power everything from mobile telephones to electric cars, taking in

We can’t allow New York or Paris to further chip away at London’s competitive edge

ATTENTION on financial services has been high in recent weeks, following Jeremy Hunt’s budget, the Bank of England raising interest rates again, and turbulence in the banking sector.

Our leading economic actors have taken big decisions with big impacts, which have drawn significant public interest. Perhaps less well known though is the broader impact of our industry across the country.

Financial and professional services firms employ over seven per cent of the UK workforce: over 2.3 million people, two-thirds of whom are outside London. We have outstanding fintech clusters in Manchester and Belfast; the Centre for Finance, Innovation and Technology has just launched in Leeds; and Edinburgh is home to banking excellence.

Collectively, financial and professional services produced £278bn in economic output in 2022 and contributed nearly £100bn in taxes in 2020, providing over 13 per cent of the UK’s total tax revenue.

Chris Hayward

The success of this industry is in the national interest. If companies start choosing to list or trade elsewhere, or move their entire businesses, that should be a national concern.

At present, there are numerous global competitors who want to take our position as the world’s leading financial centre. New York, Singapore, and Paris are all snapping at our heels to attract businesses, jobs, and investment.

Last week, the City of London Corporation published our annual global competitiveness study, showing that for the first time, London is not the clear choice for financial and professional services. Instead, we jointly lead the way with New York.

London was still the only financial centre to consistently perform well across the five major categories: innovation, financial reach, infrastructure, talent, and business environment. Indeed, London retained its position as the most innovative ecosystem in the world.

In sustainable finance in particular the City is leading the pack. Net zero offers huge opportunities: mobilising private sector investment into the green economy, supporting carbon intensive sectors to transition and providing clarity around disclosures and ratings will help give firms the confidence to press ahead with their plans. But competitors, such as New York, are continuing to make great strides in areas such as tech investment. In the meantime Singapore is producing a growing number of highly skilled, well-qualified graduates alongside being at the frontier of the digital revolution.

The Financial Conduct Authority (FCA) is looking to launch a consultation to see how the listing environment can be improved - and this is a

good thing. The UK is home to some of the most innovative start-ups and fintechs. There are 135 unicorns in the UK. In 2022, the UK saw more fintech investment than Japan, Singapore, Hong Kong, France, and Germany combined. But for these firms to list in the UK, they need to be nurtured.

We need to continue to fight for our competitive edge. In the longer term, we need a sense of direction for financial and professional services.

The City Corporation, alongside influential figures in the industry such as Lloyd’s, Schroders and KPMG, is putting together a roadmap for the future, which will contain recommendations for the government and the broader sector to reinforce our position.

Delivered successfully, it will ensure the UK remains a competitive, attractive, and leading place for financial and professional services for the end of the decade and beyond.

£ Chris Hayward is the Policy Chair of the City of London Corporation

In truth, Chinese soldiers swarming ashore on the Taiwanese coast is not the only threat. There is an ongoing undeclared disinformation war being waged by the mainland, chipping away at the confidence of the Taiwanese in their government to respond adequately to crises, and undermining the faith they place in their allies, especially the US, to come to their aid in the event of a conflict.

The Chinese are also changing facts on the ground, or the seabed. Off Xiamen, they are reclaiming land in the bay to build a new airport, while further into the straits, Chinese ships often cross the internationally accepted maritime borders, while PLA aircraft overfly Taiwan without permission. All of this erodes Taiwan’s sense of security slowly but inexorably.

There is a crisis coming over Taiwan. While the UK congratulates itself for its support of President Zelenskyy in Kyiv, President Xi noted that the US did not put military units on the ground in Ukraine, and he is emboldened. Like any Chinese politician, he can wait, but he will be 70 in June, so he cannot wait forever. We are in the final approach. Foreign policy determined now must reflect how we intend to act when, not if, China challenges Taiwan. Because the shockwave of communist success would be global.

£ Eliot Wilson is co-founder of Pivot Point and a columnist at City A.M.

BOILING POINT

Grant Shapps has had an offer from a knight in shining armour. After admitting he, as Net Zero Sec, had a gas boiler instead of the heat pumps he’s trying to push on the rest of the country, he was offered a freebie from heat pump firm Lowe & Oliver to convince him of the merits

CITYAM.COM 14 MONDAY 3 APRIL 2023 OPINION

Eliot Wilson

President Xi Jingping won a third term last month

WE

LETTERS TO THE EDITOR

Crypto still has a lot of road to run

[Re: Cryptocurrencies add nothing useful to society, says chip-maker Nvidia. March 26]

Nvidia’s negative perception around crypto is unsurprising, given the challenges the market has faced recently.

Dismissing an entire industry as useless to society overlooks several points. Crypto, like AI, is a sector very much still in its infancy, having only emerged less than 15 years ago. Naturally, there will be periods of volatility and change as both technologies establish a foothold. Moreover, the use of cryptocurrencies extends far beyond

high-frequency trading. Cryptocurrencies can be (and often are) used as utility tokens – enabling the governance of decentralised networks by giving token holders voting rights over key decisions of networks or helping ensure the security of networks by issuing tokens to validators that keep networks secure.

These tokens, then, represent a part of a much bigger puzzle that is blockchain – the underlying technology beyond crypto which can bring significant benefits to society. Already, blockchain has been used to bring huge societal benefits: validating and encouraging green energy consumption being just one example, and new ones are emerging all the time.

Alan Vey, Aventus

EASTER CHAOS Security guards at Heathrow walk out for ten days

A six month pause on new artificial intelligence won’t stop the race for dominance

LAST week, as the race to dominate the artificial intelligence space continued in earnest, more than 1,000 tech experts, including Elon Musk, signed an open letter to the AI community pleading for a pause in development of powerful new systems for a period of six months.

The underlying concern raised by the signatories is that these powerful AI systems may, without proper planning and management, pose a profound risk to society and humanity. As development carries on at a pace, the letter argues that a pause is needed to enable AI labs and independent experts to “jointly develop and implement a set of shared safety protocols for advanced AI design and development”.

In parallel policymakers are requested to accelerate the development of robust AI governance systems.

This letter has caused plenty of discussion within the AI community about whether attention should be focussed on the long-term risks highlighted by the letter or more present harms such as information security and data privacy risks. Some commentators have even suggested the letter merely advances the AI hype cycle instead of addressing the actual risks.

If you’re planning on flying to warmer soils this Easter, it’d be better if you don’t do it from Heathrow. About 1,400 security officers and guards will go on strike over the holidays after the airport management made no offer on pay. British Airways has already cancelled hundreds of flights.

EXPLAINER-IN-BRIEF: WHAT’S GOING ON AT TESLA? MANY PROBLEMS AT THE CAR-MAKER

Elon Musk is planning to visit China this month, amid problem after problem shaking Tesla Musk was eager to double production capacity at the carmaking plant in Shanghai, but delays have stalled his plans. Tesla is struggling in China because of competition from BYD, another electric car manufacturer. More broadly, Tesla is struggling to hold on to its value. The worth of its second hand electric cars has fallen extensively in the last six

months, and while this phenomenon is not unique to Tesla, its cars’ fall in value has been far worse than for other competitors. Against this backdrop, Musk hopes to rub shoulders with Chinese politicians in order to strengthen its access to the local market.

He’ll try to meet up with Premier Li Qiang. Whether that’d be enough to reignite his company’s motors - and finances - is a matter for another explainer.

ELENA SINISCALCO

I do not intend to debate the merits of pausing development here but would instead like to focus on the practicality of the demands.

The responsibility for enacting the pause is being laid at the feet of the AI labs themselves. This would require cross-industry consensus. In a still relatively nascent market where growing investment is targeted at those at the forefront of development, where is the incentive to lay down tools?

Companies that do follow the letter’s recommendation risk falling irreversibly behind as their competitors ignore the advice or merely pay lip-service to it. It is worth noting that the signatories to the letter do not include anyone from OpenAI or the Csuite at Microsoft or Google DeepMind.

Any pause will achieve little without the backing of the major market players. In the exceedingly likely scenario that those players do not listen, the letter recommends governments should “step in and institute a moratorium” instead. The intention then being that governments could, within that time,

legislate to provide a governance framework for AI with an emphasis on safety.

For that to work we would need buyin from governments across the world, an agreed common purpose, and trust. I am far from convinced of that possibility. The biggest GDP gains from AI increasing productivity are expected to be seen in North America and China. Without the US or China being in lockstep this plan looks destined to fail.

We have seen countries, including

China, regulate AI to an extent and the EU has published proposals for regulations in the Artificial Intelligence Act, but the global approach is not aligned. It is difficult to see a scenario in the near-term where it even comes close.

Contrary to the EU’s approach, in the same week as the Future of Life Institute’s letter was published, the UK government released its white paper for AI regulation. In a style that mirrors the government’s current thinking in other areas, the focus is on a relatively hands-off approach to regulation. Responsibility for AI governance will not be given to an overarching regulator, but rather existing bodies will be required to come up with their own approaches on a sector specific basis within the confines of current law.

To expect one government to be able to deliver a suitable regulatory framework for AI governance within six months is fanciful. To expect it on a global scale is preposterous.

£ Charles Mallows is an Associate at the law firm Charles Russell Speechlys

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900 Email: news@cityam.com Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com Editorial Editor Andy Silvester | News Editor Ben Lucas Comment & Features Editor Sascha O’Sullivan Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Commercial Sales Director Jeremy Slattery 15 MONDAY 3 APRIL 2023 OPINION CITYAM.COM

Charles Mallows

Without the US and China in lockstep on a pause for AI, the plan is destined to fail

WANT

HEAR YOUR VIEWS › E: opinion@cityam.com COMMENT AT: cityam.com/opinion

TO

Elon Musk was one of 1,000 tech leaders calling for a pause on AI development

Certified Distribution from 09/01/2023 till 26/01/2023 is 67,090

TRAVEL

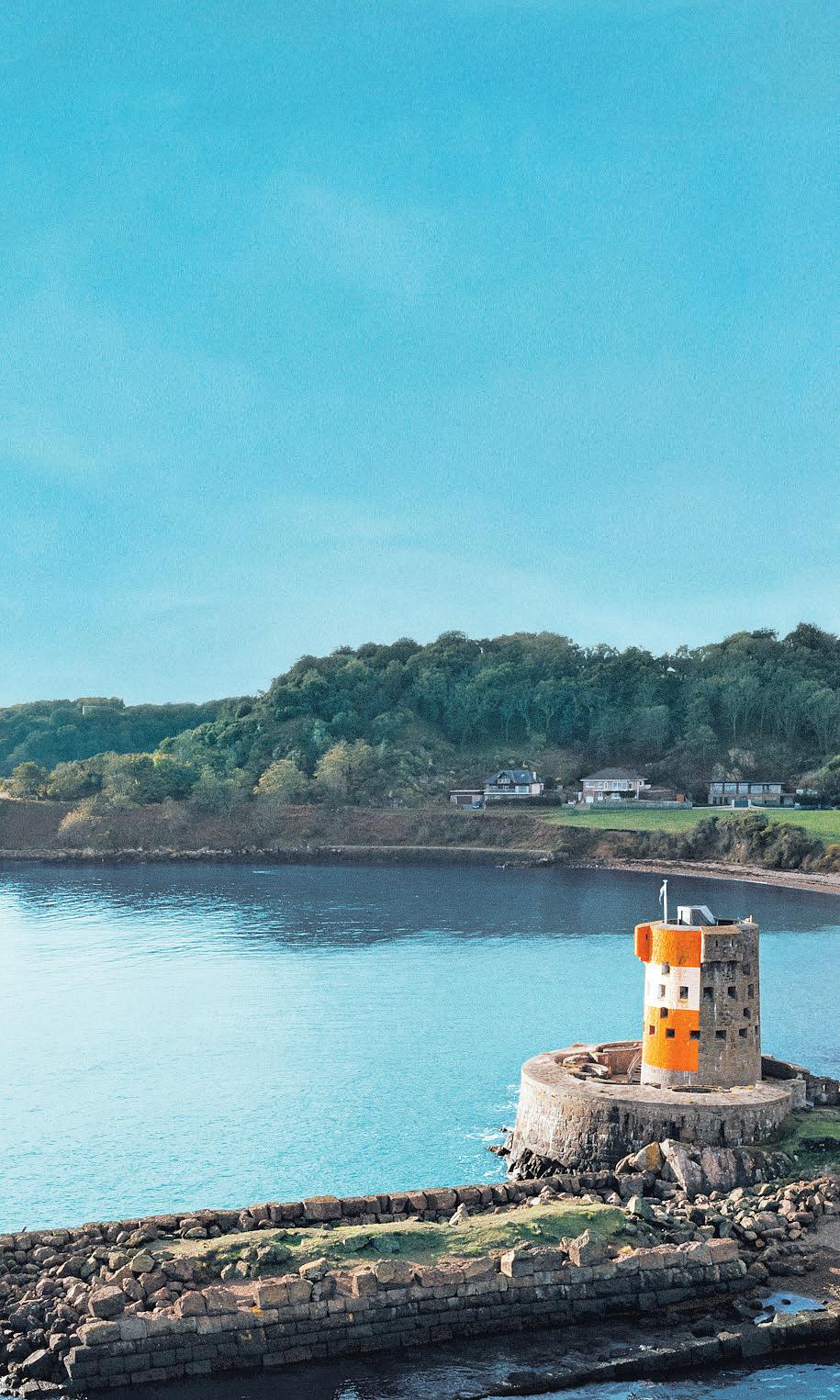

The marketing slogan for Porto Montenegro, a luxury 450-berth marina and residential village, is A Life less Ordinary. And what could be less ordinary than the accompanying launch photo of a small boy fishing with his dad from the back of their boat: a gigantic superyacht?

But given this new development is funded by the Investment Corporation of Dubai whose president is Sheikh Mohammed bin Rashid Al Maktoum, prime minister of the United Arab Emirates, displays of ostentatious wealth are actually pretty ordinary, really… But anyway.

Located in the UNESCO protected Bay of Kotor, Porto Montenegro is housed on the land that was once the base for the Austro-Hungarian navy. It’s only 40% complete but it’s not difficult to see how in the next decade, this sun-drenched harbour could fulfil the developers’ dreams and become a leading Mediterranean superyacht destination - a new Monaco or St Tropez housed in a dramatic fjord-like inlet enclosed by rugged mountains.

The former Yugoslavian republic of Montenegro is located between Croatia, Bosnia-Herzegovina, and Albania on the eastern shore of the Adriatic. The nearest airports are Tivat, 3 miles away, and there are twice-weekly Easyjet flights to Tivat. Dubrovnik is under 30 miles away if you fancy a jaunt elsewhere.

The name Montenegro means black mountain and here there is a truly mountain lifestyle: you can swim off the Adriatic coast in the morning and go Alpine skiing in the afternoon in the northern mountains. There is also the Tara River gorge, the second-largest gorge after the Grand Canyon, mediaeval villages, fortified towns, secluded unspoilt beaches and forests with bears, wolves and eagles.

Judging by the impressive array of super yachts in the Porto Montenegro harbour, the billionaire visitors like what they see. Last year, Roman Abramovich, who is worth an estimated £11.5 billion, was linked to the destination. Although the marina would normally be teeming with an assortment of oligarchs’ luxury vessels, Russian billionaires are currently in short supply. One particularly impressive boat is the 107.6 metre behemoth Luminosity which costs an eye-watering £20 million a year to run. It might be the understatement of the century to call it an impressive sight.

During my visit two of the world’s biggest sailing yachts, Black Pearl at 106 metres long and the Maltese Falcon, 88 metres, were also moored in the harbour. Tourists tend to visit in the July and August peak summer months, but it’s equally pretty earlier in the year, when the seafood restaurants have more available tables so there isn’t the constant need to think about booking.

There’s more to see away from the boats, though you could gawp at them for days.

A chic nautical village centre is reminiscent of Los Angeles’ Rodeo Drive, with big name boutiques including Alexander McQueen, Lamborghini and Valentino. There’s also a Rolex salon that can service your timepiece as you tuck into grilled octopus and sip Veuve Clicquot.

Even at less than half built, Porto Montenegro is the largest superyacht home

THE NEW ST TROPEZ

port in the Mediterranean. It also holds the record for being the deepest natural harbour in Southern Europe.

More impossibly high-end boutique shopping and entertainment galleries are to come as the futuristic development continues to take shape. A market, food hall, three-screen cinema and all sorts of mind-boggling wellness facilities are expected, plus summer entertainment including classical music and rock concerts. There’s even a polo field, because of course there is.

The latest stage is the Boka Place development, with 144 luxury serviced residences and 69 private residences. Activities for home owners have included underwater art galleries reachable exclusively via scuba diving. A life less ordinary indeed.

I fancy a slice of this excess myself, so I check into the five-star Regent Porto Mon-

THE TRAVEL HACK

Intrepid, the originators of experiential travel, have great packages going out over Easter. Go to intrepidtravel.com for last-minute prices on trips to Kruger in South Africa and Vietnam.

tenegro, its decor inspired by Venetian-Renaissance architecture. To access the lobby you enter via one of three striking archways which emerge into a grand space centred around a fountain and clad in floor-to-ceiling mirrors. The decor was conceived by Parisian interiors designer Tino Zervudachi, who was behind Mick Jagger’s and Jacob Rothschild’s interiors.

I lived the life of a billionaire. The Regent Spa offered me a massage before I languished in the sauna, steam room and hammam. Then I dove into the outdoor pool overlooking the marina. Oh, then I had a go in the 40-metre infinity pool.

That night I drank well in Marea, a stylish bar with tangerine-coloured chairs and black tables with a gold backsplash marble bar. The food’s great too: I had monkfish in truffle sauce, lobster and delicious homemade pasta a la vodka with

CITYAM.COM 16 MONDAY 3 APRIL 2023 LIFE&STYLE

Porto Montenegro is the hottest new billionaries’ playground. Keith Perry goes to gawp at the super yachts

shrimps. Later the bar turns into an impromptu discotheque but I’m ready to fall into bed.

Crush Wine Station is also unmissable: a chic wine bar set on an outdoor terrace overlooking the superyachts of the marina’s jetty, it’s known as Montenegro’s top viticultural venue.

I was craving an understanding of the wider area, so I headed to nearby Perast on Boka Bay, a quaint village overlooking the water. Here we explored stone villas that date back almost four centuries to when this area was part of the Adriatic empire of La Serenissima. From Perast we take a boat to the tiny island of Our Lady of the Rocks, an artificial island separated from the sea by a defensive bulwark.

According to legend, the island was created over centuries by local seamen who would lay a rock in the bay after returning from successful voyages. The ritual is still

BOOK THIS

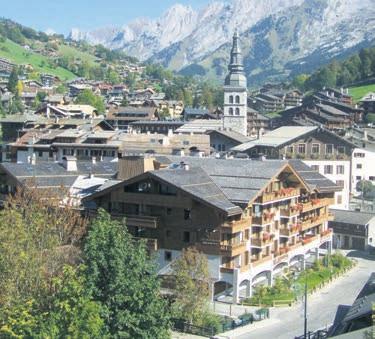

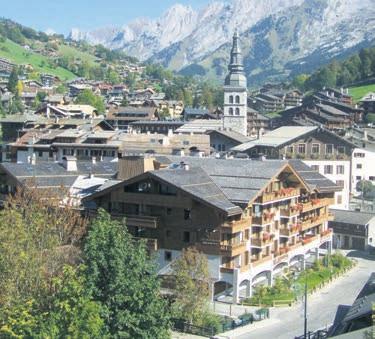

The French Alps are just as stunning in the spring-summer as they are in the winter.

The village of La Clusaz in the Auvergne-Rhône-Alpes region is a proper village, not just a ski tourist destination, meaning residents live there all year round. For that reason, it’s buzzing with life in the better weather, when hiking, mountain biking and sitting in the hot tub and admiring the wild flowers are all essential activities.

laclusaz.com

alive and well today, and each year on July 22 the locals hold an event called fašinada, where everyone takes to their boats and throws rocks into the sea.

Kotor, a charming mediaeval town surrounded by stone walls built like a maze to confuse invaders, is also fascinating for a visit, with its narrow cobbled streets and Baroque, Venetian and Austrian architecture.

Lord Byron described Kotor Bay as “the most beautiful encounter of land and sea.” What would he make of Porto Montenegro? We will never know, but as a hedonist himself, I’m sure he’d approve.

NEED TO KNOW

Visit portomontenegro.com for more information on the destination. Go to ihg.com/regent/hotels/us/en/reservation to book a stay

THE LONG WEEKEND

WHAT IS IT? The idea of getting away from it all and disconnecting from your job/social media/the relentless news cycle has been part of the travel zeitgeist years –but Covid really kicked it into overdrive. Instagram is littered with impossibly dreamy pictures of mirrored treehouses and squat Scottish bothies, all seemingly unmoored from civilization. Now a company called Unyoked has built a series of luxury cabins in the South Downs, the Black Mountains in Wales, and Norfolk, with plans to expand further across the UK. Starting out in Australia, Unyoked is all about escaping the daily grind and reconnecting with nature. It’s all very slick, a Silicon Valley start-up mentality transplanted into the forested wilderness. Before you arrive you download an app that has all the information you need about getting to your cabin, as well as a bunch of supplementary material (podcasts, recipes) presented in a way that’s part new age self help book, part Innocent Smoothie packet.

With some of the cabins within a couple of hours of London, it’s a great way to escape it all for a few days, and with a room for two starting at £154 for weekdays and £179 for weekends, it won’t break the bank.

THE STAY: Arriving at the cabin feels like an adventure in itself. Preferring not to drive, we took a train to Haslemere in south west Surrey, then got a cab for the last 20 minutes to a place just outside a village called Chithurst within the South Downs National Park. The Google Maps pin took us to a tiny road flanked on both sides by dense woodland. Momentarily at a loss about where to go next, we spotted a little yellow sign with the Unyoked branding and followed a series of arrows, like a little treasure hunt, until we

Unyoked lets you get away from it all in a chic cabin in the woods within easy travelling distance of London. Steve Dinneen takes a genuinely rejuvenating break in the South Downs

arrived five minutes later at our cabin, called Maynard (they all have human names: Josef, Esme, Marley, etcetera).

TOP TIP

If you like the idea of getting away from it all but still want some digital comforts, consider packing a multiplug adapter. It may slightly defeat the purpose but it will save arguments about who gets to recharge their phone in the limited supply of sockets

The cabin itself is like a slate grey Monopoly house scaled up to human size. It’s just big enough to fit a sizable bed, log burner, small bank of kitchen cabinets with a stove, and a separate shower/toilet. It’s undeniably bijou but it never felt cramped. Everything is finished in bare wood, with cosy accents added by throws and little knitted hot water bottles. It is a genuinely lovely place to hang out, which was just as well as we went in January and the weather was... not great. It seems terribly cliche to point this out, but coming from London you’re struck by the remoteness. As the evening drew in and the huge windows became mirrored sheets against the darkness, the only sounds were owls hooting and the occasional crack of some woodland creature crossing the small clearing outside. In better weather you could build a campfire and gaze at the stars, which are actually visible this far from the city lights. But we were content to stoke the wood burner (logs provided) and play games of Scrabble. There are a handful of paperbacks about the local flora and fauna in the cabin and quaint, analogue touches include a cassette player with some tapes and a wireless radio. We woke with the sun streaming through the windows, providing us with views through the woodland to the superbly-named Titty Hill. Between downpours we managed a couple of trips to the nearest pub, a pleasant 20-minute stroll down the closest road. All things considered, this really is the life.

NEED TO KNOW

Cabins start from £154 with a two-night minimum –for more go to unyoked.co

17 MONDAY 3 APRIL 2023 LIFE&STYLE CITYAM.COM

Australian Grand Prix had three red flags and lots of chaos, reports Matt Hardy

IT WAS a race that many said reignited the debate surrounding whether Formula 1 is about show business over racing, but yesterday’s Australian Grand Prix in Melbourne was a mesmerising couple of hours of chaos, class and kerfuffle. Here are five things we learned as Max Verstappen drove to a second win of the 2023 F1 season.

BULL FIGHTING

In his first ever win Down Under, Red Bull’s Max Verstappen extended his lead at the top of the 2023 driver standings but it was not a win in the same fashion as his parade in Saudi Arabia.

Overtaken by both George Russell and Lewis Hamilton of Mercedes on the first lap, Verstappen looked as if he was on the back foot – and soon blamed others for losing places. But three red flags later the Grand Prix finished with the cars rolling over the line under safety car flags with Verstappen in the lead.

It wasn’t a classic and it was not pretty but Verstappen got the job done, a key attribute of any aspiring threetime world champion.

Teammate Sergio Perez joined Verstappen in showing how incredible the Red Bull pace is at the moment, breezing past every other team in the process on his way to fifth having started last.

ARROWS FINDING TARGET

It may have taken three races but Hamilton’s second place was his, and Mercedes’, first podium of the season. Everybody knew the Silver Arrows would be taking upgrades to Melbourne and other drivers – including Fernando Alonso and Carlos Sainz –had suggested their rivals had been underplaying the improvements. But it is a welcome return for Mercedes to the podium and there are hopes old rivalries could reignite for the rest of the season.

ASTONISHING START

It’s three races and three podiums for Alonso and Aston Martin. And though the second red flag restart saw the

WHO SAID WHAT AND STANDINGS

1ST –MAX VERSTAPPEN

“We had a very poor start, and lap one I was careful because I had a lot to lose and they had a lot to win.

“It was a bit of a mess, but we survived everything and we won, which, of course, is the most important thing.”

2ND –LEWIS HAMILTON

“To get those points is really amazing today. I definitely didn’t expect to be second. So I am super grateful for it.

“I still feel uncomfortable in the car, I don’t feel connected to it so I am driving as best I can with that disconnect and I am working as hard as I can to try and create that connect but it is a long project.”

3RD –FERNANDO ALONSO

“We had a roller coaster of emotions today and [there were] many things going on at the beginning but also at the end. We got lucky again but P3 and P4 [Lance Stroll] is good for the team.”

MANIC IN MELBOURNE

down the rankings, due to the time in the race his third place was reinstated for the rolling finish. Anyhow, it is good to see the 41-yearold back in the mix after a number of years without success in Formula 1. Moreover, it is promising to see another constructor fighting for points at the top end of the championship –where Aston Martin are now second.

LE FLOP

His DNF in Bahrain was looked on as misfortune, but a seventh placed-fin-

other DNF in Melbourne seems to suggest that Ferrari’s Charles Leclerc might just be on a bad run of luck.

Last season’s failure to challenge throughout the year was put down to Ferrari’s tactical choices but it’s the rotten luck of the Prancing Horses this season. In Australia Leclerc was hit on the first lap and became beached in the gravel on turn four, a awful string of luck goes on for the 25-year-old.

ORANGE IS THE NEW SCORER

It may only be six points for Lando Nor-

2023 DRIVER STANDINGS

1. Max Verstappen..................69

2. Sergio Perez.........................54

3. Fernando Alonso.................45

4. Lewis Hamilton...................38

5. Carlos Sainz.........................20

6. Lance Stroll..........................20

7. George Russell.....................18

8. Lando Norris........................08

9. Nico Hulkenberg.................06

10. Charles Leclerc..................06

ris and four for Oscar Piastri but it represents the first points for McLaren this season.

The outfit have had issues in this campaign amid reports of issues with their car dating back months.

It’s a small step forward for the Papaya team but in this sport, a single point can be the difference between a good and a monster payout at the end of the season.

We’re stuck without a Grand Prix until the final day of this month so just revel in the utter madness that unfolded yesterday morning.

19 MONDAY 3 APRIL 2023 SPORT CITYAM.COM

We’re without a Grand Prix until the end of April so revel in the utter madness that unfolded

FORMULA 1

SPORT

FOOTBALL

Magpies jump United while West Ham out of bottom three

he met a free-kick with a header to find the back of the net.

DRAMA DOWN UNDER Takeaways from a manic Australian Formula 1 Grand Prix in Melbourne