LONDON’S BUSINESS NEWSPAPER

WALKOUT WEDNESDAY (AGAIN)

TUBE DRIVERS ON STRIKE –AND TRAIN CHAOS ON THE WAY P2

CHARLIE CONCHIE

THE LONDON Stock Exchange is pinning its hopes on a new figure to whip the capital’s embattled markets into shape this month: Succession star Brian Cox.

The 76-year old actor will ring the bell to open markets in a promotional stunt for the fourth series of the Wall Street drama, in which he plays a foul-mouthed, sharp-tongued scion of a business empire named Logan Roy –with a temper more suited to the open-outcry markets of yesteryear than the data-driven trading floors of today.

Cox will open the markets prior to being grilled by journalists on a dearth of floats in the capital and the regulatory tweaks most likely to once again tempt top firms to the Square Mile –or, more likely fielding questions on the new series from film critic and interviewer Ali Plumb.

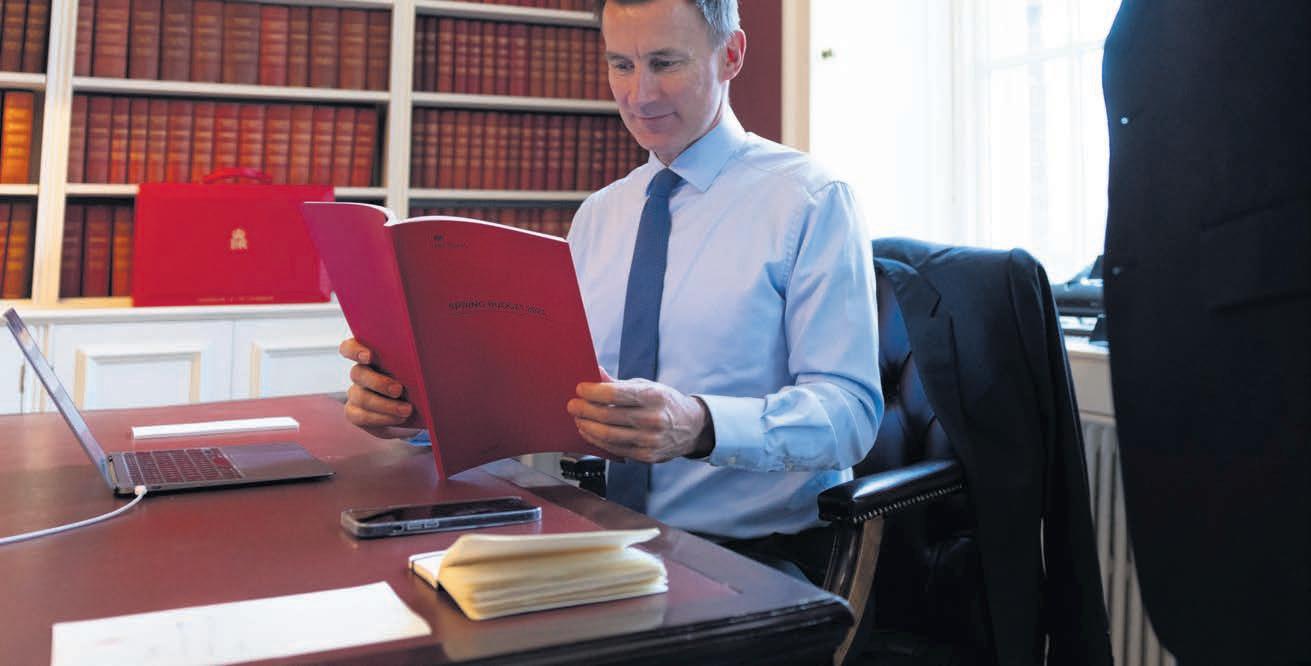

unveil what he will call a “budget for growth” as he attempts to insert confidence into a stuttering UK economy.

He is expected to focus on efforts to remove barriers to employment, drive investment and support high-growth industries, in what has been dubbed a ‘back to work’ budget.

He is likely to be helped by forecasts by the Office for Budget Responsibility,

the economy and the public finances than was the case last year.

It follows months of economic turmoil following the fallout from the Covid-19 pandemic; the war in Ukraine and energy crisis; and city chaos after Liz Truss’ calamitous mini-budget.

After Truss sacked Kwasi Kwarteng from the Treasury, she was forced to appoint Hunt into the role, who swiftly

with much of the pain deferred until after the next election –and hiked taxes to a decades-long high.

The Chancellor will tell MPs: “In the autumn we took difficult decisions to deliver stability and sound money.

“Today, we deliver the next part of our plan: a budget for growth. Not just growth from emerging out of a downturn.

people, provides a safety net for older people, all whilst making our country one of the most prosperous in the world.”

Measures will focus on helping Brits back into work, with childcare costs set to be paid to parents on Universal Credit upfront, as well as packages for disabled and 50-plus workers.

£ WHAT WE KNOW: PAGE 5

Like many founders in the media and tech space, Logan Roy chose to list Waystar Royco in New York.

JACK BARNETT

CONSIDERED “calm” returned to markets yesterday as traders began to see the collapse of Silicon Valley Bank (SVB) as more idiosyncratic than systematic on both sides of the Atlantic Ocean.

The FTSE 100 gained more than

one per cent yesterday, whilst in the US banks that had seen catastrophic share price falls at the start of the week, including First Republic Bank, began to recover their stock losses.

“There was a sense some calm had been restored to markets after a bruising few sessions,” Russ Mould, investment director at broker

AJ Bell, said.

Banking stocks partially reversed their losses yesterday, with HSBC, who stepped in to buy SVB’s UK arm for £1 on Monday, up more than one per cent.

Barclays climbed nearly four per cent, while Lloyds Bank, Britain’s largest mortgage lender, added

around two per cent.

Just eight shares on the FTSE 100 finished in the red yesterday, a far cry from the steep falls clocked on Monday as traders fretted over the knock-on effects on lending of Silicon Valley Bank’s collapse.

A series of bets on global interest rates staying lower hit the bank as a

result of the US Federal Reserve raising borrowing costs sharply.

Oxford Economics yesterday warned that widespread bank funding stress and the knock-on effects on lending could hit global GDP by some three per cent –but also said they felt such a scenario was “unlikely.”

Jeremy Hunt has won himself a number of friends in recent days. The man who –not entirely unfairly –has gained a reputation as a likeable if not entirely dynamic technocrat morphed into a financial Action Man at the weekend, brokering the deal which saw HSBC take the reins of the collapsed UK arm of Silicon Valley Bank before markets opened on Monday morning, and left a host of tech firms without

access to working capital.

Judging from the pre-briefing ahead of the budget, we are unlikely to see him donning his superhero outfit twice in a week. It appears we are set for a return to steady as she goes. It is probably the last chance he and

the Tories have to play it safe. We are now a year and a half, give or take, away from the next election. Labour continues to make the running, with a charm offensive on the City that is certainly full of warm words if a little shy on detail. Hunt entered Number 11 with a mandate to bring stability back to the UK economy after the misadventures of the minibudget and the energy price guarantee, which he has done,

but that will not be enough to convince voters or markets that go-go-growth is just around the corner.

If the Tory party is serious about winning the next election, it must make the country feel it is soon to be a little more prosperous, in ways that matter –with rejuvenated high streets, real pay increases and better public services. Slow and steady will do today, but not for long. This afternoon he must set out a

plan of attack for the next three to five years –how tax rates will come down over the period, how he’ll encourage desperately needed investment, and how he’ll demonstrate to Wall Street and Asia that the UK isn’t just stable but strong. There isn’t much point waiting until a manifesto when you’ve been thirteen years in power. And if they haven’t got the ideas, Britain’s businesses may look elsewhere.

MEMBERS of the tube drivers’ union ASLEF have walked out today, effectively bringing the tube to a standstill. Only the Elizabeth Line and the London Overground will operate full services on the network today, with Transport for London warning passengers to check their journey before they leave. The dispute is over pension conditions.

Adam Tyndall, programme director for transport at lobby group BusinessLDN, said: “Businesses, workers, Londoners and visitors are all fed up with the disruption that strike action brings. Large parts of the capital’s economy rely on public transport for their employees and customers.”

The hospitality industry in particular loses millions whenever transport staff walk out in industrial action.

JACK BARNETT

BRITISH workers’ wages have been eroded by sky high inflation for the 15th month in a row despite them bagging bumper pay rises, official figures out yesterday show.

Real regular pay, which measures pay growth in cash terms minus inflation, fell on a monthly basis in January, according to the Office for National Statistics (ONS).

Over the three months to January, pay fell 4.4 per cent when using the statistics agency’s official measure of inflation, the consumer price index.

The ONS’s latest figures illustrate the scale of damage inflation is doing to family finances.

Staff in the private sector took home a seven per cent pay rise over the last three months, which is exceptionally high by historical standards.

However, those elevated pay rises were not enough to outpace inflation, which is currently running above 10 per cent.

“Although the inflation rate has come down a little, it’s still outstripping earnings growth, meaning real pay continues to fall,” Darren Morgan, director of economic statistics

at the ONS, said.

The rate of price growth has trimmed three months in a row and is tipped to fall this year. However, wages are forecast to trail it for most of 2023, generating the biggest living standards erosion in recent memory.

City workers took home the largest pay rises of any sector, with regular wages up 7.7 per cent.

Although private sector pay is rising faster than usual, there are signs it has passed its peak, potentially emboldening Bank of England officials to hold off on an eleventh interest rate rise on 23 March.

The accountancy and audit firm Baker Tilly has lost its CEO Alan Whitman after clashes with the board, resigning suddenly yesterday. Whitman expanded Baker Tilly’s size and scope and it is now one of the ten largest accountancy firms in the US.

The firm behind the Daily Mirror and the Daily Express announced another round of redundancies yesterday, with 420 roles at risk. Almost 200 jobs were lost as recently as January of this year, with ad markets increasingly tough.

The online venture of Hard Rock’s iconic cafes has signed a deal with Londonlisted Playtech to licence the latter’s gaming technology. Hard Rock’s digital gaming operation is part-owned by the Seminole Native American tribe.

JACK BARNETT

US INFLATION has dropped to the lowest level since September 2021, but underlying price pressures are still sticking around, complicating the Federal Reserve’s rate decision next week, official figures released yesterday show.

The rate of price growth in the world’s largest economy trimmed to six per cent over the year to February, down from 6.4 per cent.

While the headline index dropped quickly, the core inflation measure, which strips out volatile food and

energy products and is seen as a more accurate measure of price pressures, nudged higher to 0.5 per cent on a monthly basis.

The figures were broadly in line with market expectations.

Fed chair Jerome Powell and the rest of the federal open market committee’s policy decision has been complicated by the collapse of Silicon Valley Bank last week. The lender wilted under the weight of the Fed’s aggressive rate campaign that has seen it jack up borrowing costs nearly 500 basis points in around a year.

WHAT THE OTHER PAPERS SAY THIS MORNING

TUBE DRIVERS ON STRIKE London brought to a standstill yet again with industrial action shutting most underground lines –with more to come on the trains tomorrowBAKER TILLY LOSES CEO

FACEBOOK owner Meta will sack 10,000 of its staff and close 5,000 vacancies as the tech sector continues to slim down in a bid to trim losses - just months after an equally brutal round of cuts.

In a post on Facebook, CEO Mark Zuckerberg (pictured) made the announcement, saying it was being done to help “improve [its] financial performance” and make it a “better tech company”.

The company announced 11,000 redundancies in November, including around 600 in the UK.

Zuckerberg recognised the changes “creates uncertainty and stress” but said making the changes now would allow more long term growth.

“We expect to reduce our team size

FEARED investment firm

by around 10,000 people and to close around 5,000 additional open roles that we haven’t yet hired”, he said.

Zuckerberg said the cuts would be “tough” and the firm would lift hiring freezes after restructuring.

However, the tech boss acknowledged the November headcount cut had improved outcomes. “Since we reduced our workforce last year, one surprising result is that many things have gone faster. In retrospect, I underestimated the indirect costs of lower priority projects,”

Analysts had been critical of Zuckerberg for spending on noncore projects, including his bet on the ‘Metaverse.’ The cuts, however, are popular: the firm’s share price was up more than seven per cent last night.

Elliott has called in former BT chairman Sir Michael Rake to advise it as it looks to ramp up its private equity operation and soften its reputation around the City. The New York-headquartered firm, which has built a name for activist campaigns has brought in the former CBI president to advise it across its existing portfolio while also helping it scope out new opportunities. Elliott has made a conscious effort in recent years to be seen as a more constructive partner to its portfolio companies.

NICHOLAS EARL

BRITISH Gas was aware of every visit Arvato Financial Services took to people’s homes for forced prepayment installations, confirmed Debbie Nolan, managing director of the third party service. Nolan told a leading committee of MPs in Westminster yesterday that

energy companies have to greenlight whether to go forward with a visit after a warrant is approved.

“At a visit, our agent will have the warrant and they will be accompanied by an engineer from the energy provider –and a locksmith the provider has contracted as well,” Nolan said.

Nolan was speaking to MPs

following reports that Arvato had forced entry into vulnerable people’s homes, after being hired by British Gas to install prepayment meters. Chris O’Shea, chief exec of British Gas owner Centrica, said while British Gas knew about every visit, the supplier was unaware Arvato was imposing prepayment meters on vulnerable customers.

CHRIS DORRELL

NATWEST has imposed stricter restrictions on cryptocurrency transfers as it seeks to protect its customers after £329m was lost by UK consumers last year.

The bank is implementing a daily limit of £1,000 and a 30-day payment limit of £5,000 to cryptocurrency exchanges.

It is implementing the rules to “help protect customers losing lifechanging sums of money”.

Men over 35 are most at risk due to them being more willing to take on risky investments, Natwest said.

The cost of living crisis is also having an impact with promises of high returns used by criminals to entice investors.

Stuart Skinner, head of fraud

protection at NatWest, said: “We have seen an increase in the number of scams using cryptocurrency exchanges and we are acting to protect our customers.”

Other banks have also recently put restrictions on crypto, with both Nationwide and HSBC putting curbs on cryptocurrency purchases on its credit cards. Both banks cited FCA concerns about the risks of crypto.

CREDIT Suisse’s shares fell to another record low yesterday after it admitted “material weaknesses” in its financial reporting controls as it released its delayed annual report.

The bank’s shares fell more than four per cent in morning trading before settling slightly in the afternoon.

The embattled lender said its “internal control over financial reporting was not effective” for both 2021 and 2022. It confirmed that its results were unaffected by the problems in reporting.

It said it was developing a “remediation plan to address the material weaknesses”. This includes strengthening its risk and control frameworks.

The bank said that it might have to “expend significant resources to correct the material weaknesses”.

However, it warned “there can be no assurance that these measures will remediate the material weaknesses in our internal control over financial reporting or that additional material weaknesses in

NAKED Wines slipped to a £200,000 pretax loss for the past half year, down from a £1.3m profit over the same period last year, as it made the first steps in its turnaround programme. Shares closed up almost two per cent yesterday despite the loss.

our internal control over financial reporting will not be identified in the future”.

The report published yesterday was delayed last week following a call from the US Securities and Exchange Commission the evening before the report was expected to be published. The bank had revised how it filed a series of cash flows, including share-based payments and foreign exchange hedges in its 2021 report.

The news comes as the embattled lender seeks to recover from a “horrifying” 2022 facing scandals, talent outflows and even speculation that it might collapse in October.

In the fourth quarter of last year it reported outflows of CHF110.5m (£99.5m). Around two thirds of the net outflows in the quarter were concentrated in October.

In its report published yesterday, the bank said that outflows stabilised to much lower levels but “had not yet reversed” by year-end.

Credit Suisse also released details of its remuneration policy. The executive board collectively waived its bonuses for the first time since the financial crisis.

LOUIS GOSS AND STAFF

ONE LITIGATION funder yesterday described the demise of Silicon Valley Bank (SVB) as symptomatic of “myriad litigation” opportunities amid a wave of insolvencies.

The bank collapsed in the US last week and Litigation Capital Management boss Patrick Moloney told City A.M. yesterday that there was growing “recognition” in the legal profession of the value of businesses

like his –with insolvencies and adminstrations on the increase providing opportunities for court proceedings.

Meanwhile, bosses at SVB’s parent company are now being sued by some shareholders who are accusing them of hiding the lender’ vulnerability to the effects of rising interest rates.

CEO Greg Becker and CFO Daniel Beck are named in the suit, which alleges the firm did not disclose their susceptibility to a bank run.

JEREMY Hunt will look to make targeted cuts to the tax burden today, albeit in the context of a significant hike in corporation tax.

The rate will go up to 25 per cent from April, up from the current rate of 19 per cent, in line with plans set out by Rishi Sunak when Chancellor in 2021.

However, in welcome news for energy firms, Hunt is expected to bring in a price floor for the windfall tax amid fears Equinor could pull out of the massive Rosebank oil and gas field, City A.M. understands.

The Norwegian energy giant is concerned about the lack of stability in the tax regime compared to its home market, which has higher taxes but an established investment allowance and a calmer political climate.

Downing Street has been under pressure to ease the levy amid fears it could

lead to an investment exodus since it was first introduced last May.

Under the new price floor proposals, the windfall tax will be switched off when oil and gas prices return to ‘normal levels’. However, what constitutes ‘normal levels’ for the price floor has not yet been agreed.

The government is also considering plans to expand the scope of the investment relief – set at 91p in the pound –to include carbon capture and storage if tagged onto existing oil and gas fields to reduce emissions.

It is unclear whether Chancellor Jeremy Hunt will go through with the proposals, but an announcement could be made at the budget today.

Equinor refused to comment on the speculation, but told City A.M. it was keen for a stable investment climate.

“Surprising changes in taxes will affect our discussions on investments going forward,” a spokesperson said.

The hike to 25 per cent, announced by Hunt when he first took the job and settled post-mini-budget nerves, isn’t going anywhere. That’ll annoy backbenchers who are concerned about hiking business taxes with the economy struggling to get off the ground.

As part of moves to get older workers back into jobs, Hunt will up the lifetime pensions allowance –how much you can put in your pension before being taxed –on an annual and a lifetime basis. It’s a reversal of a policy which lasted through George Osborne’s time in Number 11.

CHILDCARE

Those on universal credit will be paid their childcare benefits up front, rather than in arrears, but some believe this may be where Hunt finds a rabbit to pull out of the hat on an issue that is becoming increasingly important to Tory voting middle-classes.

DEFENCE SPENDING

There will be further spending on defence,

though how much is ‘new’ is debated by critics –but it’ll be a crowd-pleaser for Tory hardliners concerned about Russia and China. But will it be enough to quieten restive defence secretary Ben Wallace?

INVESTMENT ZONES

It might look like an industrial strategy and quack like an industrial strategy, but some expect Hunt to unveil plans to focus investment into around a dozen areas of the country. The number being bandied around is £1bn. How this will interact with Liz Truss’ (surviving) freeports is unclear, and it’s unlikely that much of the money will head towards areas in the more prosperous south-east.

NICHOLAS EARL

SAUDI Aramco is the latest oil major to ramp up spending in oil and gas despite net zero pledges, following record profits last week.

The oil major has committed $55bn in fossil fuel spending this year, up from $37.6bn last year, in a move which has prompted criticism from green activists.

Aramco’s targets include a 1m barrels per day boost in oil production from 12m to 13m over the next four years, and a 50 per cent hike in gas production by the end of the year.

It comes after the company unveiled bumper profits last week, the largest ever in the history of fossil fuel companies, dwarfing its rivals with a record $161bn full-year earnings.

The firm’s rivals are also boosting their own oil and gas spending plans and maintaining their role in the sector for multiple decades despite net zero pledges – while renewable spending lags far behind.

BP chief executive Bernard Looney ar-

NICHOLAS EARL

per cent – which is unchanged from its February forecast.

gued spending on both renewables and fossil fuels was an “and” not an “or” question, and has eased the company’s emissions targets.

The energy giant had previously promised its emissions would be 35-40 per cent lower by the end of this decade – but it is now targeting a 20-30 per cent cut, and plans a greater production of oil and gas over the next seven years compared with previous targets. Meanwhile, new Shell boss Wael Sawan has warned that “cutting oil and gas production is not healthy” and implied the company’s plan to reduce output 1-2 per cent every year over this decade is now under review.

Andy Mayer energy analyst at free market think the Institute of Economic Affairs, warned producers would only shift to renewables when a clear business case was made.

“The companies deserve to be criticised for their prior incaution with words, not their current wisdom with new investments,” Mayer said.

Aramco, BP and Shell have been approached for comment.

CHINESE demand could bolster the oil market over the year, even as crude prices tumble following the collapse of Silicon Valley Bank, which has made investors cautious. According to the latest monthly report from OPEC, world oil demand in 2023 will rise by 2.32m barrels per day (bpd) – around 2.3

NICHOLAS EARL

BRITISH Gas owner Centrica expects to boost its electricity generation volume with another six terawatt hours between 2024 and 2026, following EDF’s decision to extend the lifespan of two nuclear power stations. This equates to roughly 70 per cent of Centrica’s total nuclear power volume in 2022.

EDF revealed last week that the Heysham 1 and Hartlepool nuclear

power stations are now expected to close in March 2026, two years later than originally planned.

Centrica holds a 20 per cent stake in the UK’s nuclear plants through a joint venture with EDF Energy’s parent company – which is now owned by the French state.

Chris O’Shea, chief exec of Centrica, said: “I’m delighted we’ve been able to work with EDF to strengthen the UK’s energy security by extending the life of these critical power stations.”

The world’s largest oil cartel has now raised its forecast for Chinese oil demand growth in 2023 due to the relaxation of the country’s zeroCovid approach.

“China’s reopening, following the lifting of the strict zero-Covid-19 policy, will add considerable momentum to global economic

growth,” OPEC said in the report. Overall, it expects Chinese oil demand to grow by 710,000 bpd in 2023, up from last month’s forecast of 590,000.

The global total, however, was steady due to downward revisions in Western markets, with OPEC flagging potential risks for the world economy from rising interest rates.

US LAW firm Dechert has argued the UK’s Serious Fraud Office should take a “fair share of the blame” for its former lawyer’s leaks in an ongoing legal battle concerning Kazakh mining firm ENRC. The law firm’s charge comes as it responds to a High Court claim by ENRC, which is seeking £21m to cover the costs it claims it incurred due to Neil Gerrard’s decision to leak its information and the SFO’s subsequent decision to launch a criminal probe into the former FTSE 100 company.

Dechert has admitted liability for the actions of Gerrard – the US law firm’s former head of white-collar crime – but is now arguing the SFO should be forced to pay half of the £21m sum. Lawyers acting on behalf of Dechert told the court that “without the SFO’s encouragement and willing participation there would have been no breach

“We say that the SFO was just as much to blame as we were.

“[We] are throwing SFO a reasonable lifeline, a 50/50 split is reasonable. The SFO has just doubled down. It says wrongful conduct is irrelevant and it should get off scot-free.”

The SFO argues Gerrard would have leaked ENRC’s information anyway, even if no inducement on the part of its officials had occurred. The agency claims the City lawyer started trying to maximise his workload well before he came into contact with the SFO.

A spokesperson for Dechert said: “The firm is taking an appropriate, reasonable, and pragmatic approach to the issues of causation and damages.”

An SFO spokesperson said: “Our criminal investigation into ENRC remains ongoing. We deny any liability to ENRC.” ENRC was approached for comment.

EY’s plans to split its audit division from its consulting arm are on the brink of collapse amid a fight over the future of its tax business. The Big Four accounting firm said it has “paused” the plans in the face of fierce disagreements over the extent to which its tax division should stay with its audit business, the Financial Times first reported.

CLOSE Brothers shares slumped almost five per cent yesterday after the bank reported it had set aside over £100m for bad loans relating to legal finance specialist Novitas.

As a result of the provisions the London-based merchant bank’s adjusted operating profit fell 90 per

LOUIS GOSS

SANJEEV Gupta’s GFG Alliance has set out its plan to block steel producer Aartee Bright Bar (ABB) from being forced into bankruptcy. The conglomerate, which fully acquired the Midlands company last month, said it would ask a court to block New York investment fund FGI from plunging ABB into insolvency.

GFG said its rescue plan would return the Midlands steelmaker to profitability.

Gupta’s steelmaking conglomerate will pledge to financially support ABB into recovery, although a spokesperson for the company declined to comment on the sums of money GFG would be willing to provide.

cent to £12.6m during the six months ending January 2023.

In total, the bank recognised provisions of £114.6m in the first half, taking the overall credit provisions against Novitas to £183.2m.

CEO Adrian Sainsbury noted it had been “a challenging six months” but maintained the bank, excluding Novitas, had seen “strong margins”.

Gupta’s steel firm noted it has already given £620,000 to pay wages owed to the Midlands steelmaker’s staff and given £200m to support its UK businesses over the past 18 months.

GFG’s chief transformation officer Jeffrey Kabel said its plan for ABB - a buyer of the consortium’s steelwould protect jobs and reinvigorate the business.

JACK MENDEL

JACK MENDEL

THE RISE of hybrid working, the TWaTs and Zoom ennui have done little to sate the appetite of firms and developers to build up and out in the Square Mile, according to new figures.

Some 52 major planning applications were submitted to the City of London Corporation between 2020 and 2022 –a bump up from 42 on the three years leading up to the Covid-19 pandemic.

Amongst those approved are a host of towers in the eastern end of the City as well as re-imagined office spaces in the Holborn and Fleet Street areas heading to the West End.

In a sign of continued confidence in the Square Mile, the Corporation granted planning consent for almost 370,000 sq m of office space as hundreds of workers returned to their desks. It also gave the green light to 13,690 sq m of retail space and nearly 50,000 sq m dedicated to community, education and cultural spaces.

A new headquarters for law firm Hogan Lovells at Holborn Viaduct, a new site for the Museum of London and the Salisbury Square development –to be home to the City of London Law courts and City of London Police HQ –were among those granted consent or resolved to grant in the last two years.

“Throughout the pandemic we were confident that the City’s 1,000-year history as a business location was secure, and this is borne out by the planning figures we have released for the first time today”, City of London Corporation policy chair Chris Hayward said. This comes as many businesses alter working week, with Fridays increasingly becoming a working from home day. Hayward, however, was insistent that “the City of London is here to stay not just as a five day a week location, but as a seven-day a week destination”

“Global businesses continue to want a significant presence in the Square Mile, and UK-based and global developers and investors are flocking to provide a new type of highly sustainable, modern office space for these companies,” he said.

Writing a column on the morning of Budget Day is always a thankless task. By the time you read this, most of you will have some idea of what will come out of that red box, while I can only speculate.

That said, it’s nice to see that Jeremy Hunt is now following in his predecessors’ footsteps by leaving a trail of news breadcrumbs in the run-up to his announcement, just to set the tone. The biggest one at the time of writing is the suggestion at the time of writing that he is going to raise the lifetime cap on pension saving. This will no doubt annoy George Osborne, who spent years cutting it with evident enthusiasm. This is said to be intended to persuade the 50-somethings who have taken early retirement to return to work, especially doctors. If so, it may be a case of wrong diagnosis, wrong cure. I believe that the main reason people have taken early retirement in the past few years is rather more closely related to the pension freedoms that were announced by Osborne a decade ago, rather than the restrictions on savings. While few people will have blown their pot on a

Lamborghini, as the pensions minister speculated at that time, they might certainly have grabbed it to fund an early exit from the workplace.

A financial adviser once told me that there were two universal truths in his job – clients always over-estimate the returns they will make on their savings and underestimate their life expectancy. As a result, they risk chronic financial hardship late in their retirement when their financial needs are greatest (for social care etc) and their opportunities to work again are minimal.

An effective way of dealing with this would be to reintroduce some structure into pension planning, ensuring that a proportion of a pension pot was only available after the age of 70 or 75 perhaps. And that is what the increased cap could be reserved for. In the shorter term why not offer National Insurance relief to people who have paid NICs for 30 years or more and therefore already qualify for a full state pension? If we really are becoming a nation of silverhaired idlers, then the Chancellor needs to dream up some rather more immediate incentives than this one.

The aftershocks from the SVB failure, however well handled by the powers that be, will do nothing to restore confidence to the financial markets. In the Square Mile deal volumes, and especially IPO volumes, are lower than ever. Most firms are holding on, waiting for the upturn to come and the creak of tightening belts can be heard from Cheapside to Canada Square. One old hand said he had hoped things would pick up in H2 this year. Now he is looking out to H1 2024 for any real action. Ever the optimist, I will remain on green shoots watch and report back when I see one.

£ That said, I was impressed by the speed with which the Government reacted to the Silicon Valley Bank failure this weekend and managed to secure a market solution within 48 hours. I doubt Rishi Sunak’s predecessors would have moved so effectively

and decisively – then again if there is one thing he knows about, it is banking. In the West End, things weren’t so impressive. What does it say about the BBC that it took longer for them to clear up the Gary Lineker mess than the government took to resolve the largest bank failure for fifteen years?

This week I would like to recommend you go to see a rather wonderful new exhibition called Reflections of the Silk Road in the Brighton Royal Pavilion on the 21 and 22 March (10am-5pm). This will display a unique collection of handmade porcelain produced from a small studio in Sussex that captures the full richness of the artistic tradition of the Silk Road, from Persia to China.

William Woodham, Fitzdares CEO, is unapologetic about the £20 price of his Guinness and bubbles cocktail at Cheltenham

The centrepiece will be the Coronation Bowls – seven vases that are inscribed with a 360-yearold poem celebrating the Coronation of Charles II, that has come to light just before the Coronation of Charles III. I would like to see you all there, not only because it will be a very special affair, but also because the artist, Carole Bennett, happens to be my wife. All proceeds are being donated to Depaul International

Where interesting people say interesting things. Today, it’s Neil Bennett, global co-ceo of advisory and comms firm H/Advisors

Cheltenham now boasts British racing’s first self-serve bar.

Punters, who are estimated to guzzle down 220,000 pints of Guinness alone this week, can beat the bigger queues and pour their own pints in the popular Cottage Rake bar.

The self-serve tap wall idea was originally pitched on Dragons' Den by Dublin-based Drink Command back in 2015.

The £200,000 investment for a 10 percent stake didn’t interest any of the five Dragons, with only Deborah Meaden showing an interest.

The firm has since installed machines at major sporting venues, as well as recently going global with their first taps at Kansas City International airport.

Matt Hancock, health secretary when Cheltenham became the final major sporting event to allow fans before lockdown came into force, was spotted at the track on Tuesday.

Previously MP for West Suffolk, which encompasses the traditional HQ of British horseracing, Newmarket, Han-

cock has always had a soft spot for thoroughbreds.

Back in 2012, when dubbed ‘Action Matt’, the I’m A Celeb bronze medallist shed two stone and went under intense training to compete in a charity horse race. Might we see Matt back in the saddle again?

Former Apprentice contestant Tommy Skinner made a winning Cheltenham debut yesterday. Backing El Fabiolo saw the entrepreneurial Skinner turn a profit in the Arkle, but maybe not enough to buy himself a runner for next year’s Festival: "I might have to ring him up, 'Can I borrow some money?'”, said Skinner when asked if he might think about going into ownership with Lord Alan Sugar. I wonder what they’d name it… BOSH?

Teenage jockey John Gleeson will be studying the form this week rather than Biology, Geography and Business. The 18-year-old has secured a week off school in order to ride red-hot Champion Bumper favourite, A Dream To Share. “I had to request the week off

from school and thankfully got accepted!” said Gleeson, who has ridden the horse in all of his three career wins to date.We’re sure St Augustine’s College in County Waterford, along with thousands of favourite backers, will be cheering him on.

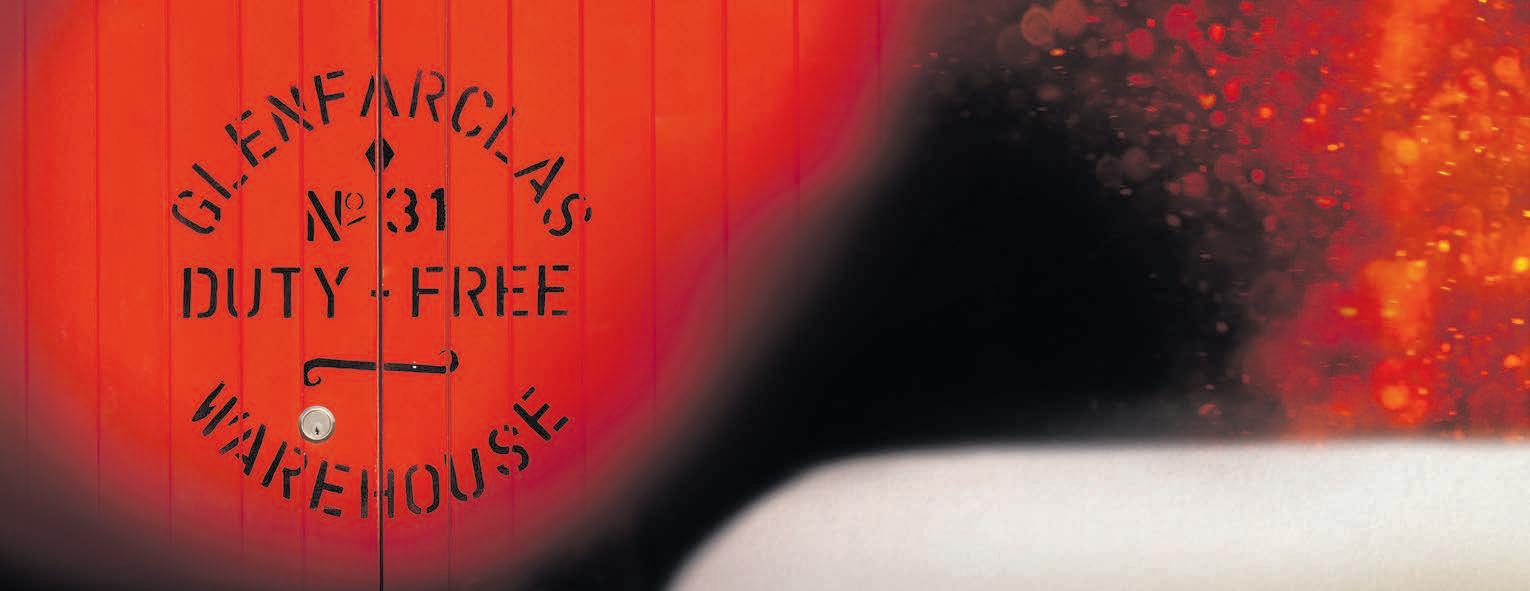

BUT OUR SPIRIT HASN’T

We are dedicated to taking time: we wait, we learn, we perfect. Share the unique character of Glenfarclas.

The Rt Hon The Lord Mayor of the City of London Nicholas Lyons and Lady Mayoress were joined by a number of high-profile guests and speakers at Mansion House this week, for the launch of City Giving Day. Now in its 10th year, City Giving Day is an annual event hosted by The Lord Mayor’s Appeal uniting the City to celebrate and promote the positive impact of philanthropy. Taking place on Tuesday 26 September 2023, it gives companies the chance to showcase their charitable and community work – collectively sharing their community outreach via the City Giving Day webpage and social media. Whether City businesses support The Lord Mayor’s Appeal, or their own chosen charities – it gives companies a platform to tell their fundraising and volunteering stories and to collaborate with other businesses within the City community.

Taking place every spring, the City Giving Day launch is the rallying call for companies to register and be inspired to start forming event ideas from hosting an office sports day to organizing a company-wide sponsored silence. The annual breakfast taking place in the Egyptian Hall at Mansion House, hosts a series of honored guests from Alderman and Sheriffs of the City to CSR professionals and senior business leaders.

Highlights this year included a rousing opening speech from The Lord Mayor who asked participants to, “Shine a spotlight on what the City has always done well but never really talked about. Whether you do something on a grand scale or do it on a small scale, do something. City Giving Day is our opportunity to show the world what we do for the most vulnerable people in our society.”

Other guest speakers included Lea Milligan, CEO of The Lord Mayor’s Appeal’s charity partner, MQ Mental Health Research who said, “We’re so excited to be working with The Lord Mayor’s Appeal to generate more breakthroughs. Working in partnership, we’ll aim to carry out pioneering research into the cost-of-living crisis and our mental health, fund the most promising new research projects with an emphasis on generating results for those affected by mental illness and increase participation in mental health research through our bespoke Participate platform.”

He gave guests an insight into how they can help to create a world where mental illnesses are understood, effectively treated and eventually prevented and promised guests “we want to work with companies in the City to make sure our research has impart on the ground.”

Andrew Izzet Lee, Group Corporate Responsibility Manager at Mott MacDonald spoke on how the company “wanted to participate in City Giving Day because it helps us recognise key causes and community organisations within our City. It also helps us appreciate the time and effort of our people who go above and beyond to contribute. City Giving Day gives us a platform to build momentum and encourage others to get involved.”

He went on to say; “Last year we hosted a workshop in our office in collaboration with a social enterprise, to help local refugees with their employability skills. This consisted of brainstorming key skills and practising a mock interview in a professional setting. It gained encouraging feedback and emphasized to the beneficiaries that we are a united City which comes together.”

Fiona McArthur, Social Value Manager at Skanska shared how they intend to “focus on activities that will support our social value aspirations with expertise-based volunteering”

City Giving Day.

To further inspire philanthropic ideas and get the ball rolling on corporate collaboration, guests were then led in round-table discussions by a series of VIP guests and representatives from some of the City’s most prevalent companies including Bank of China, Bloomberg, Skanska, Cleary Gottlieb LLP and Aon while grazing on a breakfast of bacon and egg rolls, pastries and fruit. The Lord Mayor and Lady Mayoress joined other City representatives in getting behind City Giving Day selfie frames, posting their pictures on social media to help spread the word.

With just over six months to sign up and start organising fundraising events or showcase existing philanthropy for City Giving Day on 26 September 2023, The Lord Mayor’s Appeal will go back to a purely in person event this year though they will still be encouraging businesses, organisations and individuals to take part in their own way across the globee. On the run up to City Giving

Day, companies will have the chance to attend more breakfast events hosted by the Lord Mayor, receive regular newsletters and download top tips and promotional materials from The Lord Mayor’s Appeal website. In addition to their own fundraising activities, The Lord Mayor’s Appeal also host a number of annual City Giving Day events which companies are welcome to join. These include

lenge where company teams of up to five people compete against each other in a thrilling 40 minute static bike race, divided into five eightminute slots; City Walks – a one hour lunchtime walking tour taking place around the City hosted by expert City of London Guides; a Treasure Hunt inviting teams of up to six people to solve a series of clues discovering some little known facts about the City of London; and a Quiz Night challenging teams of up to six to test their general knowledge and compete with the greatest minds in the City As part of The Lord Mayor’s Appeal’s commitment to create a fair society, City Giving Day has grown year on year since its launch in 2015 with 526 companies involved in 2022 and the aim to reach 694 companies this year,

around the UK.

Funds raised by The Lord Mayor’s Appeal on City Giving Day will be used to support the work of their three charity partners National Numeracy, MQ Mental Health Research and The Duke of Edinburgh’s Award. Aiming to create a Better City for All that is Inclusive, Healthy, Skilled and Fair, The Appeal’s thought leadership initiatives Power of Inclusion, This is Me, We Can Be and City Giving Day offer learning, development and engagement opportunities for employees across the Square Mile.

To find out more or to register for City Giving Day visit: https://www.thelordmayorsappeal.org/i nitiatives/a-fair-city/register-and-getinvolved/

City Giving Day is our opportunity to show the world what we do for the most vulerable people in our society

ONE CHILD in every classroom in London is homeless, on average, shock new data from councils across the capital has claimed. There are 166,000 homeless people living in the capital and of these, 81,000 are children, a new report from the London Councils

LABOUR’s business charm offensive continued yesterday as shadow chancellor Rachel Reeves met City bosses to discuss plans to boost investment.

Keir Starmer’s Labour has positioned itself as the ‘party of business’ as it aims to exploit the Conservatives’ reputational hit following the economic chaos of Liz Truss’s calamitous mini-budget.

Starmer and Reeves have met nearly 200 chief execs over the past year as part of their so-called “salmon and scrambled eggs offensive” to sell their vision of the economy.

Reeves continued the party’s charge yesterday afternoon as she discussed plans to boost business investment at a roundtable with chief executives including Mark Versry, Aviva Investors; Charlie Nunn, Lloyds; Nigel Wilson, Legal and General; and Simon Carter, British Land. She told firms Labour’s mission to make the UK the fastest growing economy in the G7 will be underpinned by a focus on boosting business investment.

It comes after recent analysis found the UK currently has the lowest investment across the world’s biggest economies.

The shadow chancellor said the party’s plans include ending the current ‘yo-yo’ approach to business taxation; launching an industrial strategy; boosting investment via a plan for green prosperity; and reforming the apprenticeship levy. Labour says businesses missed out on around £1bn a week after ONS statistics revealed net foreign investment from abroad dropped by almost £52bn in 2021. However across the previous four years, levels appeared to remain higher than pre-Brexit numbers.

Shadow business secretary Jonathan Reynolds said: “Britain is a fantastic place to invest, but we are missing out because we don’t have a government that can offer the economic stability British business needs to succeed.”

Derk Bleeker, EMEA president at Sage, welcomed plans, adding: “Boosting investment by small and medium-sized businesses is critical to unlocking their full potential and driving UK economic growth.

“We welcome plans for a stable business environment and modern industrial strategy where the UK moves to being an advanced digital economy, supporting SMBs in their tech adoption journey.”

JESSICA FRANK-KEYES

SECURITY fears over social media video app Tiktok are being investigated by a top cyber watchdog, the government has confirmed.

Minister Tom Tugendhat told Sky News he had asked the National Cyber Security Centre (NCSC) to look into concerns over the app, which is owned by Chinese firm Bytedance. He told the broadcaster: “Understanding exactly what the

challenges these apps pose, and what they’re asking for and how they’re reaching into our lives is incredibly important.”

It comes after the EU and the US have both made moves to ban the app from secure government devices.

The Times also reported on Sunday ministers were set to recommend a ban on UK government-issued devices.

Tiktok previously told this newspaper it takes national security concerns very seriously.

network claimed yesterday.

On average, this means one in every 23 children in London is homeless –living without permanent and suitable accommodation.

According to the analysis, the number of people turning to their London local authority for housing support increased by 18 per cent in November last year compared to the

same month the year before.

“When you look at that statistic, it’s atrocious, but sadly it’s also probably underestimated”, Ben Howarth, managing director of Howart Housing, said.

Tim Bissett, director of St-Martinin-the-Fields Charity, told City A.M. rough sleeping is only the “tip of the iceberg”, with many children in unsuitable homes and hostels.

Australian navy as part of pact

FOR MORE than 20 years, researchers at Yale University have been publishing the Environmental Performance Index (EPI), which ranks countries according to their environmental health and ecosystem vitality. A comparison can be made between the EPI and the Heritage Foundation’s Index of Economic Freedom, which has been measuring economic freedom around the globe since 1995. The Index, which is also referred to by many as the capitalism index, analyses the level of economic freedom in 178 countries.

These countries are grouped into five categories: “Free”, “Mostly Free”, “Moderately Free”, “Mostly Unfree” and “Repressed”. The Heritage Foundation’s researchers compared the two indices and found that the countries with the highest levels of economic freedom also had the highest EPI scores. The “Mostly Unfree” and “Repressed” countries registered by far the worst green performance

The economist Daniel Fernández Méndez addressed the potential objection that countries with greater economic freedom are “exporting” their polluting industries to less free developing countries, while keeping their non-polluting industries. However, this is clearly not the case. “With the data analysed, we can see that capitalism suits the environment. The greater the economic freedom, the better the environmental quality indexes. The ‘cleaner’ countries do not export their pollution by relocating companies”.

Nowhere has environmental degradation been as bad as in former socialist states. Is this a relevant argument? Yes, because if an economic order based on private property, competition and freely set prices were the cause of environmental pollution, then, logically, there would have to be significantly less pollution in countries that do not have these characteristics – which is not the case.

Capitalist West Germany (the Federal Republic) and socialist East Germany (the GDR) make for a good comparison:

In 1989, the GDR emitted more than three times as much CO2 for each unit of GDP than the Federal Republic. On air pollution, it’s a similar story: in 1988, the GDR emitted 10 times as much sulphur dioxide per km2 as the Federal Republic.

Similarly, airborne particles: the average load in the GDR was more than ten times higher than the Federal Republic. Coal-fired stoves: in private households, almost twothirds of the apartments in the GDR were heated with solid fuels such as lignite briquettes at the time of reunification.

Having considered the facts, many people will concede that socialism is worse for the environment than capitalism, but they are still left with reasonable doubts: isn’t economic growth in general bad for the environment? There is one argument in particular that seems logical, at least at first glance: because the earth’s raw materials are finite, infinite growth is impossible. This leads many to conclude that, somehow, growth must be curtailed.

But based on numerous data series, the American scientist Andrew McAfee proves in his book More from Less that economic growth has decoupled itself from the consumption of raw materials. Data for the US shows that of 72 commodities, only six have not yet reached their consumption maximum. Although the US economy has grown strongly in recent years, consumption of many commodities is declining.

Such developments are all due to the laws of much-maligned capitalism: companies are constantly looking for new ways to produce more efficiently, i.e. to get by with fewer raw materials. They do this, of course, not primarily to protect the environment, but to cut costs.

What’s more, innovation has promoted a trend we call miniaturisation or dematerialisation. One example of this trend is the smartphone. Just consider how many individual devices your smartphone contains and how many raw materials they used to consume. Many people today no longer have a fax or use printed road maps because they have everything at their fingertips in their smartphone, and some even do without a wristwatch. In the past you had four separate microphones in your telephone, audio cassette recorder, Dictaphone and video camera. Today, the single microphone in your smartphone has replaced all of these devices.

At no time in human history have planned economies been the solution to problems, but they have caused a host of problems, especially environmental problems. In contrast, capitalism with its manifold innovations has already solved so many problems, including and especially in the area of the environment. It is therefore absurd to assume that abolishing capitalism would solve the problems of climate change and environmental destruction.

£ Dr Rainer Zitelmann’s new book, In Defence of Capitalism, has just been published and is widely available.

In the third of an eight-week series, German historian and sociologist Rainer Zitelmann takes apart the arguments against capitalism. This week, he rebuts the myth that free markets are responsible for environmental damage

LONDON’s FTSE 100 surged yesterday, arresting the sharp declines notched on Monday as it was caught up in a global market sell off driven by investors’ fretting over the impact of Silicon Valley Bank (SVB) collapsing.

The capital’s premier index gained 1.17 per cent to close at 7,637.12 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, advanced more than one per cent to drag itself back above the 19,000 points mark.

Steep stock price falls seen at the beginning of the week were put to bed today as traders trimmed their fears over how bad the fallout from SVB’s failure could be.

The premier index shed more than two per cent on Monday, while Europe’s top indexes all closed deeply in the red.

“There was a sense some calm had

been restored to markets after a bruising few sessions,” Russ Mould, investment director at broker AJ Bell, said.

Banking stocks partially reversed their losses yesterday, with HSBC, who stepped in to buy SVB’s UK arm for £1, up more than one per cent. Barclays climbed nearly four per cent, while Lloyds Bank, Britain’s largest mortgage lender, added around two per cent.

Just eight shares on the FTSE 100 finished in the red yesterday, a far cry from the steep falls clocked on Monday.

Across the pond, credit rating agency Moodys yesterday downgraded its outlook on the entire American banking sector after the fiasco.

Traders have pared back their expectations of Fed chair Jerome Powell and co raising rates again on 22 March, betting the central bank will want to avoid sparking further financial market instability.

Investors in IWG are essentially making a “bet” on the long-term future of demand for flexible offices, Peel Hunt’s analysts said, as they noted company chief executive Mark Dixon is aiming to profit on the contingent of workers that prefer to work away from home who also want to avoid long commutes by going to local serviced offices. The analysts gave IWG an “add” rating with a price target of 210p.

Sabre Insurance Group is well positioned to capitalise on improvements in the motor insurance market, having hiked its prices to catch up with inflation, Peel Hunt’s analysts said, as they noted the firm’s underwriting segment generated a small profit in 2022, in a sign of the firm’s disciplined approach to business. Peel Hunt’s analysts gave Sabre Insurance Group an “add” rating with a price target of 130p.

IN NEED OF A FAIRY GODMOTHER

“If this was a Disney production inflation would have cooled considerably in the month of February, paving the Fed’s path with sparkling yellow bricks. But this isn’t a fairy tale, and the Fed has an increasingly pothole strewn path to navigate.”

DANNI HEWSON, AJ BELL

BUILDING an energy system in any market requires consideration of three key factors.

First, the cost of energy. Second, the security of energy supply. And third, reducing the carbon footprint or CO2 emissions of the energy we use.

In Europe and the UK, in the last 20 years, there has been a growing focus by regulators and policymakers on cutting CO2 emissions. But, simultaneously, there has been little focus on the cost and security of energy.

Following Russia’s invasion of Ukraine last year, the ramifications of this imbalanced approach to energy are now clear to see.

In some senses, Europe’s energy crisis has been far less severe than many anticipated. A mild winter and record temperatures in some parts of the continent helped ease the pressure on supply, pushing down costs and hitting commodity prices. And consumers, both industrial and domestic, acted and responded in kind by reducing their energy usage.

Equally, gas storage was sufficiently topped up over the summer – but this was only because Russian gas kept flowing into Europe. This has since stopped and eventually winter will roll around again.

Government attention has therefore pivoted to become laser focused on the cost and security of the UK’s energy supply. The good news is that renewable energy sources offer a cheap, secure and carbon-free alternative. Building a wind or solar farm is significantly less cost intensive than a new offshore gas field, despite supply chain disruption increasing the cost of renewables recently. Such infrastructure provides a domestic, secure energy supply as most renewables are not at the mercy of unpredictable geopolitical considerations.

In the US, the Inflation Reduction Act is a significant piece of legislation that provides a clear pathway for the

energy transition. Much ink has been spilled on how Europe will respond, and it seems that EU initiatives to try and incentivise renewable energy sources are coming. But in the UK we have so far only seen rhetoric, limited political will, and solutions which are unfit for purpose.

Take the government’s decision to impose windfall taxes on all energy companies. Windfall taxes on upstream oil and gas are one thing, but windfall taxes on renewable energy –without the ability to offset for capital expenditure investment – are incredibly disappointing.

The UK has a massive potential advantage here and could become a

world leader in offshore wind through its scale and expertise, especially in the North Sea. But an unconstructive policy environment leaves investors wondering: if the government can move the goalposts once, will they do it again?

The UK’s competitive position could be lost as international investors look at the windfall taxes without capex offsets and turn elsewhere – namely to the US.

The Inflation Reduction Act creates a hyper-productive environment for investment. A significant part of the IRA is onshoring and convincing companies to grow in the US. US policymakers appreciate that if you do not keep

LIKE most people, the revelations from the leaked WhatsApps of government ministers during the pandemic have left me with a mixture of emotions.

At one level, they reveal how difficult it is to make decisions amidst considerable uncertainty. It is always easy, after the event, to point to mistakes and say they could have been done differently.

So anyone except those – and there are plenty of them around – with a dogmatic central planning mentality will empathise with the initial struggles of the government to deal with the problem.

When data first started emerging from Wuhan, it suggested the death rate for those infected was between 3 and 4 per cent. Our television screens were quickly filled with nightmarish scenes from Northern Italy.

Understandably - against the then Prime Minister Boris Johnson’s libertarian instincts - a lockdown was imposed, coming into force on 23 March 2020.

Paul Ormerod

Paul Ormerod

of years: we stopped seeing one another. In the modern jargon, social mixing fell dramatically.

innovation close to home, you risk losing out. And if the UK does not grasp this fact, it won’t just be investment it loses, but jobs and expertise too.

National Grid - a transmission grid which is better than most national or state-level energy grids - talks about its partnership with educational institutions to support the build out of the UK grid. But fundamentally, if prospects for the sector are better elsewhere, we risk a UK green energy “brain drain”.

Clearly, to turn around our prospects, we need an end to windfall taxes – especially those with no exemption for capital expenditure. Extending these taxes to renewable providers will only discourage international investment.

We also need a return to consistent leadership from government and the promise of a stable policy agenda. We keep being told that net zero has broad support across the political spectrum in the UK, but actual results in terms of incentives have been haphazard.

The UK is in a global race to power the future. If we do not make our own market attractive to investment –whether through funding, skills, training, incentives or regulation – we risk an exodus of skills and talent to other global markets.

How we power our economy in the future is being decided now. If the last 12 months have taught us anything, it is the importance of being able to control our own affordable and sustainable energy supply. Now is the moment for policymakers to double down on renewables and make the UK a global leader in clean energy.

£ Jim Wright is a fund manager at Premier Miton Global Infrastructure Income Fund

But whereas the initial uncertainty was huge, it quickly narrowed as firmer information emerged.

For example, in the notorious paper from Neil Ferguson and his team from Imperial team College London, they assumed a death rate of “only” 0.9 per cent, translating into half a million deaths without a lockdown. So even then it was accepted that the death rate would be very much less than the terrifying Wuhan figures had suggested. As it turns out, the true number was very much lower than the Imperial estimate.

By early April, it was apparent that the public across Europe had reacted to the pandemic in the way in which humanity has reacted to plagues for thousands

By the simple expedient of taking the peak day for deaths and backtracking the known average time from infection to death, it was obvious that the number of cases in almost every country had started to fall before lockdowns were imposed. People themselves were taking steps to avoid being infected. Within just a couple of weeks of lockdown, then, the case for it had been seriously weakened.

A number of distinguished economists such as David Miles of Imperial College and Bob Rowthorn at Cambridge published papers in May and June of 2020 carrying out cost-benefit analyses of lockdown.

This methodology is routinely applied to all other aspects of government policy - except lockdowns. Rishi Sunak, then Chancellor, was one of the few proponents of reinstating a run-of-themill way of evaluating the effectiveness of policies. He was overruled.

What the post mortem by The Telegraph has demonstrated is not simply that, as we now know, costs exceeded the benefits, but that ministers knew this. Children’s prospects, mental health, deaths from delayed treatments, all these things were known at the very top of government.

And yet lockdown persisted. It is abundantly clear that the government’s own diktat of “following the science” was ignored. Science means looking at a vast array of different factors, not listening to a very small group of people. When evidence emerged which contradicted the “theory” that lockdowns were essential, they simply disregarded it.

Many have called lockdowns proof that ministers are unable to deal with uncertainty and make decisions based on risk. This is overly generous: they had a good idea of what would happen, and they did it anyway.

£ Paul Ormerod is an author and economist at Volterra Partners LLP

ME? It’ll be just like Matt Hancock on I’m a Celebrity, Get Me Out of Here! Except (for once) Boris Johnson won’t be paid to be on TV. The former PM will have to front up to the privileges committee next week to face questions on his handling of lockdowns and all the parties at No10

[Re: Over 50s aren’t staying out of work because they’re sick – it’s because they’re rich, March 10]

I think the author, Ben Cope, is halfway there, as flexible working should begin with short term, limited company contracts. These benefit the worker and the company and should be the start of older workers returning to work. The government wrecked this option when they reinstated IR35 with all the conditions and controls. These frighten

most employers into offering only contracts inside IR35 in fear of HMRC penalties and shows disrespect of the worker in my opinion and I certainly would not consider any contracts that are inside IR35.

There are more reasons than money to return to work and Ben's comments highlight this.

Mostly it comes down to respect and appreciation of the knowledge and skills most older workers have along with their dedication to sharing these skills are considered most important. In my opinion if the employment doesn’t start with trust its not going to start at all, hence the lack of older workers.

Rob Powell

IF RISHI Sunak is serious about making the UK a science superpower then a very good place to start is with the bacon roll you may well be eating while you read the newspaper this morning. Because, almost unnoticed by many in government, British scientists and businesses have quietly been laying down extremely strong foundations in alternative proteins – the delicious, nutritious and increasingly “meat-like” meat-free products you can now enjoy everywhere from high-end French restaurants to your local Wetherspoons.

One of the most familiar brands, Quorn, is already a great British success story: created in Buckinghamshire in 1985, it now exports across Europe and around the world, providing jobs for almost 900 people here in the UK. There’s no reason we can’t repeat that success again and again. The UK is the home of breakthroughs and pioneers in all aspects of the alternative protein industry, both the products themselves and the know-how required to make them.

I know it sounds like it, but this isn’t about the ethics of eating meat. The Alternative Proteins Association (APA) wasn’t established to tell people what to have for dinner, but to provide a voice for an industry that has massive potential to boost both the UK’s economic growth and our food security.

The Chancellor will today hand out £63m to leisure centres with pools in a one-year fund. Part of the money is for energyefficiency measures and decarbonisation, and part of it is simply to keep the public centres afloat. After all, if energy bills are up for families and businesses, they’re up for swimming pools too.

This has absolutely nothing to do, we’ve been reassured, with Rishi Sunak’s own swimming pool saga. The totally relatable

and down to earth prime minister has a swimming pool so cool that it has extra energy needs which meant the local electricity grid needed an upgrade.

Sunak personally covered all the costs - estimated to be in the tens of thousands of pounds. It’s unfortunate timing. The local public pool in North Yorkshire had to reduce public access due to increasing costs. Many others are reducing the hours they can be open as a result of costs.

Get this right and we could see thousands of new jobs created. Thousands more protected in farming. A whole new export industry. And vastly reduced reliance on the global supply chains that, as anyone who has tried to buy a tomato lately can tell you, are not as reliable as we would like.

It speaks volumes that Singapore –known less as an international hotbed of liberal woke-ism than as the home of a hugely successful innovation-driven economy – has swiftly established itself as a world leader in this field.

It’s just one of the nations that has recognised the potential. Israel has really got behind its alternative protein industries. And in the US, the FDA recently gave its first-ever green light to a cultivated meat product, “chicken” grown from a handful of cells rather than a bird.

That’s not the only extra choice available to US consumers. For half a

decade, Americans have been enjoying the “bleeding” plant-based Impossible Burger – you can even buy them at Disney World. Yet while our transatlantic cousins tuck in, the burger is banned from the UK by anachronistic retained EU legislation on GM-derived ingredients.

That American families are free to make their own decisions about what they eat isn’t down to their food regulators cutting corners or taking risks. Nobody in the industry wants that.

The FDA have simply updated the rules to reflect what’s possible in food tech in the 21st century.

Here in the UK the regulations have, for years, allowed us to eat cheese made with artificial rennet created using the exact same technology. But for burgers and bangers the bureaucrats say “no”. And so instead of contributing to the economic growth we need, our industry is being held back by rules that were drawn up when GM science was in its infancy and the technology to create cultivated meat didn’t

even exist.

Producers don’t want giant cheques, they just want regulations that encourage scientific innovation rather than stifling it; clarity on existing rules; a level playing field on taxation; updated regulation on everything from labelling to GMOs to reflect what’s possible in the 21st century; a world-leading “sandbox” where producers and consumers can safely test new products; and so on.

The costs are tiny, but the potential benefits are enormous. Growth in the global alternative protein market shows no sign of stopping. Later this year the UN’s Food & Agriculture Organisation will set out its own roadmap to a more sustainable food system, giving investors the certainty they need to really get behind alternative proteins. This is a future that’s coming; the question is whether the UK wants to be a leader or a follower.

£ Jeremy Coller is President of the Alternative Proteins Association

near-perfect chips and a heritage tomato salad.

We could have gone for cod, guinea fowl, a miso and rocket salad or seasonal vegetable risotto, or a couple of other steaks. A burger made the menu too, but that’s it.

It’s a sign of confidence to have a short but decent menu like this, and the restaurant reflects this energy. Not only in what they put on the plate, but in being a sort of sophisticated rooftop bar that shouts less loudly.

There have been more Google searches for ‘London rooftop bars’ than for ‘new London bars’ this past month - and it’s still winter.

It’s just one sign that the capital’s intense love-in with sky-high hedonism shows no signs of slowing. It’s a love affair that continues with Wagtail, the rooftop spot near Monument that’s about to celebrate its first year of existence - and I reckon it’s smarter than a lot of the competition.

The bridge and tunnel crowd that disembark at Liverpool Street for rooftop bars like Madison and Sushisamba wouldn’t dream of venturing as far south as Monument for Wagtail, and duly, this rooftop enclave feels relaxed by comparison. Away from the screaming hordes, me and my City A.M. colleagues who work a stone’s throw away come here to unwind.

Up on the ninth floor rooftop, Wagtail is also relaxing because of the way it’s been dressed. Chairs are gentle forest greens and there’s a parquet wooden flooring, creating warmth. Ask for one of the banquette seats adjacent to the bar for Shard views, and to peer at the turret that perches on the roof of the building we’re on top of. Inside that turret is the restaurant’s impressive private dining room.

But back with the ordinary folk in the restaurant, it’s been a long day and I can’t bear staring at a menu, so thank goodness for easy decisions. The food list comprises a handful of classic ‘best of British’ dishes made to a superb quality. I chose Devon scallops given an interesting saline twist with seaweed, and a friend had a very decent beef tartare with soy cured egg yolk. We shared the Chateaubriand with some

There are just eight cocktails too; we hoovered up the Blush with mezcal and a heady mix of Cointreau, white port and grapefruit soda.

One floor up is the outdoor area and bar space, at the very top of the building. Here there are more conventionally London rooftop bar vibes, but on both of my visits it’s been easy enough to get a table - inside or out - and the view’s lovely if not quite panoramic. Obviously booking will be required for the better weather, but it still won’t be as manic up here as the spots closer to Bank or the main train stations.

Best is that after midnight when the rooftop closes the restaurant turns into

a late-night bar, with decent house music, not the naff stuff, and servers bowl on until 1.30am. Granted, it does feel a bit like drinking in a restaurant, but it’s a darn sight better than being turfed out and having to fight with the hordes at the other chaotic late night bars nearby.

Wagtail is somewhere to go to properly unwind. And for a tired City worker, that’s reason enough to book ten more times. Wagtaillondon.com

Whether covering yourself with shamrock face paint or just getting completely and utterly sloshed on Guinness, St Patrick’s Day is this Friday and that means celebrations are required. Here’s where to raise a glass this Friday.

BIG PENNY SOCIAL

Blackhorse Lane’s Big Penny Social has a special list of Irish whiskey cocktails and traditional Irish music - dancing will be encouraged as part of their Irish dancing ‘dance academy.’ DJs take over when the live music finishes. 17 March

SAVAGE GARDEN

This Tower Bridge rooftop bar has its own list of Irish cocktails to get people in the door if Guinness isn’t your tipple. Try the Leprechaun, with Irish whiskey, Cointreau, orange marmalade and ginger ale or the St Paddy’s Coffee, with Irish whiskey, hard cider syrup, hot filter coffee, double cream and baileys float – served with cinnamon and nutmeg powder.

WAXY O’CONNOR’S

Why go anywhere different when

the capital’s most famous Irish drinking bolthole is welcoming drinkers with open arms? The Wardour Street and Rupert Street outposts of Waxy O’Connors are both sure to be a riot - though head for Wardour for the proper party, in the giant sprawling pub that seemingly never ends.

ST PATRICK’S DAY RUN

Run off the hangover on Saturday morning. A group has organised a 5k communal run around Hyde Park on the 18th, and don’t worry, it’s not until

3 o’clock so you can still have your lay in. Runners should meet at the Lodge Cafe at the entrance to the park that is nearest Hyde Park Corner. Get back on the beers again after as the Six Nations kicks off at 5pm.

The two Skylight bars and rooftops are throwing St Patrick’s

Day events. There’s a live band at Skylight Peckham and games and Irish-themed drinks at both, by Jameson. Privately hireable igloos are available for groups and there are DJs playing until late.

IRISH DINING

Rotunda King’s Cross has a special St Patrick’s Day menu, with dishes including Irish gin-cured salmon, Irish apple cake and Guinness-braised blade of beef.

Rooftop bars are the essence of the Square Mile, but not many are like Wagtail, writes Adam Bloodworth

Wagtail is a sophisticated rooftop bar that shouts less loudlyit’s for properly unwinding

If you haven’t been to Eataly yet, London’s shrine to Italian food, swerve the restaurants and make your own dinner this Mother’s Day. Mums, nonnas and “special mother figures in your life” are welcome to learn classic Italian recipes. Everything’s broken down step-by-step for novices. Oh, and you’ll eat your dishes too, which is the important part.

£ 17 March, 7pm, £70

BABUR AT BROCKLEY

BROCKLEY

This Indian restaurant, 37 years young, has a popular Sunday buffet and for Mother’s Day they are adding a special dish. The ‘raan’ is traditional but rarely served. It comprises a whole leg of lamb marinated over a number of days for tenderness, and buffet-style, goes well with whole-roasted tandoori chicken and handmade breads.

£ 119 Brockley Rise, babur.info

BIG

HACKNEY WICK

Expect foam, giant balloons and bubbles at this daytime rave in Hackney Wick for mums, dads and children aged up to 8. House and techno music will be played by a live DJ, and there are a couple of break-out zones for when the dancing gets too tiring: a licensed bar for the parents and soft play area for the kids. £11 for adults, £8 for children.

£ 19 March, bigfishlittlefishevents.com

It’s where Ian Fleming used to drink, and where Diana would hide from the paparazzi, and now, its Afternoon Tea has been redesigned with a motherly twist. Start with a Kirk Royale cocktail and then a selection of sandwiches including roasted gammon, fig relish and aged cheddar on spinach bread, before moving onto the goats cheese and onion tart. Rhubarb parfait is for dessert.

£ 19 March, £60 per person, dukeshotel.com

MUMS

LAUREL’S

Book lunch at Laurel’s on the Rooftop. It’s a spectacular new restaurant on the roof of the Mondrian Shoreditch hotel that even has its own pool to eat next to while dreaming of Mediterannean climes. For Mother’s Day the restaurant is offering lunch for mums for free, for all table bookings of four and above. From £35 per person.

£ 19 March, ennismore.com/hotels

Enjoy a jaunt through the countryside on the British Pullman train, built in the 1920s, going from London to Kent. Carriages are decorated with opulent Art Deco finishes, and each guest has their own arm chair to admire the nature view outside. Half a bottle of Veuve Clicquot is included per person, as is an afternoon tea with sandwiches, cakes and scones across the four-hour journey. £400, Sunday 19 March.

£ 19 March, London Victoria, belmond.com/trains

OCHRE

NATIONAL GALLERY

The National Gallery’s restaurant Ochre has designed a special cocktail for mothers, named after one of the gallery’s paintings. The Lady Cockburn and Her Three Eldest Sons cocktail has Mirabeau Gin, Lillet Rose, pomegranate basil soda and rose Champagne syrup and is named after the famous painting by Sir Joshua Reynolds. Pop to see it after, but first, a cheers, to pair with Ochre’s ultimate Sunday roast, Roasts from £26; cocktail £14.

£ 19 March, ochre.london

Masterchef winner Alex Webb runs the restaurant at the Intercontinental hotel on Park Lane. For Mother’s Day Alex has created a menu inspired by nostalgic memories from his childhood. Dishes include a Devon crab tart with pickled cucumber and Exmoor caviar. £95 per person, £38 extra with paired wines.

£ 19 March, parklane.intercontinental.com

YOU DO not get many harder races to find the winner of than the 26-runner Coral Cup (2:50pm).

The last two were 50/1 and 33/1 and there have only been two single-figure priced winners in the past decade.

You cannot rule anything out, but I must admit that I do find it hard to ignore the claims of last year’s fourth CAMPROND towards the head of the market.

The ground got very soft on the Wednesday last year, but Philip Hobbs’ inmate still ran a cracker and went on to comfortably land a competitive handicap hurdle at the Punchestown Festival.

Connections have done well to get him down to a 2lb lower mark than last year and there is a chance the ground could dry out a touch on Wednesday.

Now jointly trained by Hobbs and Johnson White, this will undoubtedly have been the plan all year and he must surely go well at 11/1 with William Hill, who are offering six places.

There are lots of interesting Irish runners including Run For Oscar, HMS Seahorse, Captain Conby and Fil Dor. The last-named beat Sharjah last time out, which is very strong form, and he could well improve for the trip.

of my selections.

However, this is a hard race for a fiveyear-old, especially one so high up the weights, so he is reluctantly left out.

Nicky Henderson is the leading trainer in this race with four winners and his runners always need a second look.

Call Me Lord wouldn’t be out of it,