LONDON’S BUSINESS NEWSPAPER

THE NOTEBOOK WHAT CAN INVESTORS LEARN FROM PARIS FASHION WEEK? P10

CHAMPION HURDLE CAN ANYONE TAKE ON CONSTITUTION HILL TODAY? P20

CHARLIE CONCHIE AND CHRISTOPHER DORRELL

HSBC came to the rescue of thousands of panicking tech firms yesterday, buying Silicon Valley Bank’s (SVB) stricken UK arm for £1.

The transaction, which wasn’t finalised until around 6am yesterday, meant SVB’s more than 3,000 UK customers –almost all of whom are in the innovation and tech

space –were able to access banking services and access their deposits, which they feared they would be shut out of.

HSBC emerged as the leading bidder late on Sunday evening and City A.M. understands the bank feels it has given itself ‘scale’ in the high-growth space.

“This acquisition makes excellent strategic sense for our business in the UK. It strengthens our commercial banking franchise and enhances our ability to

serve innovative and fast-growing firms, including in the technology and lifescience sectors, in the UK and internationally,” the bank’s chief Noel Quinn said.

The deal was brokered by the Treasury and Bank of England after 48 hours of non-stop weekend negotiations.

While shareholders were effectively wiped out, tech firms who had feared either a lack of access to working capital

or the loss of sizable, uninsured deposits were full of praise for the government yesterday.

Dom Hallas, the executive director of the Coalition for a Digital Economy, told City A.M. the deal had “saved hundreds of the UK’s most innovative companies”.

Despite the rescue, bank stocks across the world dragged indices well into the red. The FTSE 100 finished more than 2.5 per cent down, with investors spooked by

the possibility SVB’s downfall in the US could be indicative of a wider problem. Barclays sunk six per cent, with Lloyds and Natwest down around five per cent. Europe’s bank index fell by a similar figure, while in the US concerns were growing around other banks –with fellow Californian operation First Republic seeing shares crash by 50 per cent.

£ DEEP DIVE: PAGE FOUR

TUBE train drivers union ASLEF yesterday bragged they were set to “bring London to a standstill” tomorrow, with strike action planned over pensions and conditions.

Drivers will walk out across the

network, with only the Elizabeth Line and the London Overground operating as normal.

The strike is timed to coincide with the budget, to be delivered in the Commons tomorrow by Chancellor Jeremy Hunt.

ASLEF says central government has forced Transport for London (TfL) to

“target staff pensions and working conditions” as part of a bailout deal. While it is true that government has mandated changes to the longterm sustainability of TfL’s pension scheme, the

transport body has yet to announce what changes it will be making. The bailout requires TfL to bring down the annual cost of running the pension scheme by around £100m, down from around

£330m now.

The Tube strike comes a day ahead of planned industrial action on the railways on Thursday, though the RMT is no longer set to participate in that action, lessening the impact on commuters.

TfL has advised all commuters to plan their journeys carefully.

THIS time, it really is different. We promise. The moves by the Treasury, the Bank of England and various other bits of government to find a buyer for Silicon Valley Bank UK over the weekend were an example of the system working well –and they certainly weren’t, as some excitable figures had it, a bailout. Take the facts at hand –SVB UK is and was a profitable business, ringfenced from the bad bets on mortgages

that affected its US parent and widely viewed within the ecosystem that knew it well as a reliable partner. Despite that, there was never a belief within the Treasury that a bailout was a serious option –instead, it would source a buyer, protecting those

with deposits but wiping out shareholders. Instead, the focus was on giving solvent businesses access to their own funds by engineering a last-minute rescue. This was not a bailout; it certainly wasn’t, as one columnist put it yesterday, a bailout of an industry more interested in Silicon Valley itself than London.

If the tech industry is at fault at all here, it is that individual firms didn’t actively diversify their banking partners, which hardly

seems like crime of the century. There is credit to be shared across the piece, from those in government to the Bank who moved quickly. HSBC, too, are said to have shown real commitment to the deal from the start, which allowed for a more orderly opening to Monday’s markets than we might otherwise have seen. They appear on the face of it to have got a good deal, too, and their arrival in the space should add much-needed

THE CITY’s Lord Mayor has handed over the keys for a new van to City Harvest to help the charity in its fight against food poverty after the firm partnered with the Livery Charity Chairs Group in December. The initiative works to rescue surplus food and delivers it to those in need across London, with the charity delivering over 1.25m meals a month. “This van will change people’s lives, offering reliable support and delivering hope in a very bleak time for so many,” City Harvest CEO Sarah Calcutt said. The van will bolster City Harvest’s 17-strong London fleet.

competition and diversification to the funding avenues for startups and scale-ups.

There are lessons to be learned here about risk and governance, but they predominantly need to be asked on the other side of the Atlantic. Many of the organs of Britain’s state have received much criticism over the past few years, not least the Bank of England. That has broadly been deserved. But on this one, they moved fast, and got it right.

Nearly all the UK’s 100 largest listed companies now have at least one minority ethnic director on their boards, according to the latest update from the government-backed Parker review.

RUSSIA ACCUSES WEST OF MISINFORMATION OVER NORD STREAM BLASTS

Russia does not know who was behind the blasts that damaged the Nord Stream pipelines, one of President Putin’s leading allies said as he mocked media reports that said a pro-Ukrainian group was responsible.

THE FINANCIAL TIMES

VW PICKS CANADA FOR BATTERY PLANT AFTER BEING LURED BY US

Volkswagen will build its first North American battery plant in Canada, as US President Joe Biden’s multimilliondollar package of green incentives speeds up its plans for the rollout of electric vehicles on the continent.

JACK BARNETT

BRITAIN is on course to shoulder a tax burden that has “never been sustained before in its history” but is still grappling with fraying public services, a top economist has told City A.M. ahead of Chancellor Jeremy Hunt’s budget tomorrow.

Carl Emmerson, deputy director of the Institute for Fiscal Studies (IFS), said the UK has become a “higher tax country and yet we still see many challenges on the spending side”.

The Chancellor is wrestling with trying to balance the UK’s public finances while maintaining strong public services ahead of his f irst proper budget.

NHS waiting lists have swelled over the past year and public sector workers have launched a wave of strikes in response to the government refusing to raise public sector pay, which has been eaten up by inflation racing to a multidecade high of 10.1 per cent.

A deterioration in the UK’s public services delivery comes despite the tax burden being on track to hit its highest level since the turn of the Second World War.

Under the Tories’ current spending plans, most government departments will suffer real terms spending cuts in the coming years, which comes after years of budgets being squeezed during the Cameron-Osborne austerity era

in the 2010s.

A poor long-term growth outlook and higher interest rates are poised to squeeze the amount of cash Hunt has to play with tomorrow to around £9bn. Although the economy is performing much better than experts forecast at the turn of the year, handing the Chancellor some short-term cash to play with, low GDP growth means Hunt is unlikely to announce any permanent tax cuts or spending rises this week.

Such measures would be “hard to justify,” Emmerson said, adding that the UK’s “terrible growth makes all the trade-offs a lot more diffi-

Britain’s official forecaster the Office for Budget Responsibility is expected to downgrade its projections for GDP growth beyond this year tomorrow, wiping off most of the windfall Hunt has received from spending less than expected on the £2,500

energy price cap.

That downgrade means the margin for error Hunt has to meet his fiscal targets –getting debt as a share of the economy down and capping borrowing at three per cent of GDP in five years –is likely to be wafer thin.

Business groups have urged the Chancellor to soften the six percentage point corporation tax hike to 25 per cent by offering tax reliefs on investment spending, a move intended to be a watered down temporary successor to the 130 per cent super deduction created by Prime Minister Rishi Sunak when he was Chancellor.

“The increase in corporation tax is a risky thing to do,” Emmerson said.

yesterday after it published annual results described by one analyst as “as ugly as can be”. Group profits across 2022 fell to just £21m –down from £581m the year before –thanks to what the firm called a “volatile operating environment”.

Direct Line blamed claims inflation, regulatory changes and higher than expected weather claims, warnings which dragged down fellow insurers on the stock market yesterday.

The insurer’s year from hell has already cost the job of now ex-CEO Penny James, who stepped down in January.

Yesterday, interim boss Jon Greenwood acknowledged it had been a “tough year” and said the

insurance premiums as it battles claims inflation.

“There is a lot to do –it needs to improve its capital strength, rebuild margins and get the business in a shape where it can start paying dividends to shareholders again,” said AJ Bell’s Russ Mould yesterday.

Greenwood admitted that the firm had underplayed the impact of inflation, a conclusion already reached by the Square Mile.

In a diplomatic note yesterday, Panmure Gordon’s Abid Hussain said “management reacted later than a number of peers in pushing through adequate price increases” and warned the lack of a permanent CEO could delay strategic decisions.

BRITISH insurer Phoenix Group yesterday posted a £1.2bn paper loss as volatile markets hit the value of the insurance company’s investment portfolio.

Shares in the FTSE 100 company fell slightly on the news as Phoenix pointed to the “challenging economic backdrop”, though the firm did generate a record level of new business.

The insurer, however, upped its dividend as it successfully achieved its own cash generation targets and benefitted from its acquisition of Sun Life UK.

The FTSE 100 firm outstripped the cash generation targets it previously set itself, in generating £1.5bn in cash over 2022. This saw Phoenix exceed its aim to generate £1.3bn£1.4bn worth of cash each year.

The insurer upped its dividend by five per cent, to 50.8p, in line with its pledges to grow its payouts.

“Phoenix has a simple strategy which is focused on the UK longterm savings and retirement market,” Phoenix chief executive Andy Briggs said.

IT’s going down to the wire.” That was the view of Coadec executive director Dom Hallas at 11pm on Sunday evening after hours of meetings had failed to produce a deal on the future of Silicon Valley Bank (SVB) – with the tech industry warning it would be an existential threat to thousands of firms across the sector if nothing was in place by Monday morning.

Four hours later, discussions between the Bank of England, Treasury officials and HSBC reached an advanced stage –with the Canary Wharf bank the preferred bidder.

More than 40 listed firms had lined up announcements revealing the scale of their exposure to the collapsed lender on the London Stock Exchange on Monday morning, with no guarantee a safety net would appear.

And it would take until 6am on Monday to finalise the deal, just two hours before market open – giving tech bosses the chance to breathe a sigh of relief after a weekend of catastrophe planning.

The accord marked the end of a weekend of meetings between tech industry executives, Bank of England and Treasury officials – with the bank’s future still very much in the balance well into the early hours of Monday morning.

ALARM BELLS RINGING

Concerns spread on Thursday last week as top VCs in the US began advising clients to pull their cash from the bank, sending fears of a full-scale bank run rippling across the Atlantic.

By Friday morning, the sudden demise of SVB in the USA was already the subject of discussion at Downing Street, where tech leaders were already meeting as part of efforts to retain more highgrowth firms in the UK.

At around 2:50pm on Friday, the boss of SVB’s UK arm Erin Platt circulated an email to customers and media reassur-

ing that the UK bank was a “standalone entity with its own balance sheet and governance structure”. Just hours later, any trace of that statement had been wiped from the firm’s website.

Senior tech industry figures had begun making increasingly impassioned pleas to regulators to step in and steady the ship throughout Friday evening, acutely aware of the potential devastation that a collapse would wreak across the UK’s start-ups.

The Chancellor was by now personally involved. By midnight, the Bank had announced it was planning to put the bank into insolvency by Sunday evening. Though intended to settle nerves, the Bank’s statement had the opposite effect.

“The Bank of England statement, frankly, was unhelpful and worrying,” a tech boss close to the discussions tells City A.M.

“You have the situation where the Bank of England statement was essentially saying ‘we’re going to let the bank die and it wasn’t a systemic risk’, but then obviously, we could see the risk that it had in the ecosystem.”

The morning after, phone calls began between the Bank and Treasury at the highest level.

As more concerns began to emerge on Linkedin and Twitter, Treasury officials began to scout out information from the tech community on the money they held with SVB UK and their cash flow. SVB UK’s clients are different from most banks; they tended to keep large chunks in their accounts, much of it uninsured.

Senior tech figures including Hallas, Centre for Finance, Innovation and Technology chair Charlotte Crosswell and Tech Nation chief Gerard Grech began rallying a grassroots campaign from tech founders towards the Treasury –which had internally codenamed the effort to find a future for Silicon Valley Bank UK ‘Project Yeti’.

Within hours, officials had received 500 emails from worried founders – intelligence that indicated the scale of the cash crunch.

As many turned to their TV screens to watch England’s humiliation in the Six Nations, meetings were still ongoing in the Treasury as potential buyers began to make themselves known.

As France ran in try after try, expressions of interest began to come in from

the Bank of London, Oaknorth and an Abu Dhabi investment fund, ADQ. Although reports emerged that Barclays was in the mix too, Treasury sources suggest they were never heavily involved in conversations.

The severity of the situation became clear in a roundtable chaired by City minister Andrew Griffith at 5pm.

At this point a preferred option began to emerge: the Chancellor told officials to prioritise a sale process, with mechanisms to protect deposit holders developed as a just-in-case, ruling out a bailout or rescue deal.

At 9pm that evening, Hunt brought Rishi Sunak, Andrew Bailey and the boss of the Prudential Regulation Au-

thority up to date on proceedings.

With a sale process the favoured option, Sunday morning began well –HSBC expressing an interest, having initially had some early conversations on Saturday. Between a host of media interviews ahead of the budget on Wednesday, Hunt began speaking to those interested in buying the bank.

At 2pm, the Prime Minister – en route to San Diego for a meeting with US President Joe Biden and Aussie PM Anthony Albanese – was updated

mid-air.

HSBC’s bid became public knowledge around 6pm, with Sky News’ Mark Kleinman tweeting that the bank was interested.

Around the same time, the Bank of London went public with the news it had made a formal bid, although scepticism at the clearing bank’s ability to pull off the transaction was widespread in the tech community.

City A.M. understands that, by contrast, HSBC’s balance sheet and the bank’s energy and enthusiasm to get the deal done became increasingly appealing to those involved.

As the hours ticked by, HSBC’s bid received ever more attention, with a socalled bridge bank option and liquidity support from the British Business Bank in reserve.

They wouldn’t be needed – with the Chancellor and officials burning the midnight oil, HSBC emerged as the ‘white knight,’ with all sides pointing in the same direction as of Sunday evening.

That wasn’t the end of the phone calls – displaying extraordinary stamina, Griffith and Bailey were on the phone as late – or as early – as 4am.

The announcement steadied the nerves of a tech community which had been on a knife-edge all weekend; so much so that founders sent a ‘thank you’ letter to the Chancellor.

“Thank you to you and your team for understanding the urgency, for appreciating the risk to the UK tech sector and its importance to the UK economy and for working around the clock to find a timely solution,” it read.

SPECULATION is rife among traders that the US Federal Reserve could refrain from hiking interest rates later this month for fear of triggering another Silicon Valley Bank-style collapse.

Turmoil in financial markets sparked by the tech-focused lender’s

collapse has raised the likelihood Fed chair Jerome Powell and co may hold off raising rates any further.

Up until last week, investors had expected the world’s most influential central bank to return to steeper moves and increase rates 50 basis points higher on 22 March.

A batch of hotter-than-expected data over the last month or so

indicated Americans were withstanding the Fed’s rates barrage reasonably well, which amplified a longer-run risk of inflation staying above the bank’s two per cent target.

The federal open market committee has already lifted borrowing costs at the fastest pace since the 1980s, helping to bring inflation down last summer.

CHRIS DORRELL

THE BANK of England yesterday said there was “uncertainty” over whether banks and insurers are “sufficiently capitalised” to deal with climate-related risks, but suggested there was not enough justification to increase their capital requirements at the moment.

In a report published yesterday, the Bank said climate risks create a challenge for regulators as the uncertainty surrounding climate risks are difficult to assess relative to the regulator’s own risk appetites.

Despite highlighting the uncertainty, the Bank said current evidence suggests that the existing timescale over which banks and insurers hold capital are appropriate for climate risks.

“There does not appear to be sufficient justification for regulators, including the Bank, to make a policy change to these time horizons,” it said.

The report confirms statements made at the Treasury Committee last week by Sam Woods, head of the Prudential Regulation Authority.

Woods said fallout from climate change would manifest itself over a long period of time, making it more a “pay as you go” rather than a capital upfront type of risk.

The report did not set out any policy changes with the Bank saying it needs to undertake further analysis before reaching a decision.

Economist at the New Economics Foundation Lukasz Krebel criticised this lack of action.

“Climate-related risks pose a grave and growing threat to the stability of the financial system… It is therefore worrying that the Bank of England acknowledged that actions we take now will influence how serious these risks will grow but failed to act following its capital requirements review,” he said.

LAURA MCGUIRE

BRITS are swapping alcopops for frozen fruit as the nation looks to favour more healthy and environmental options in 2023, statistics from the ONS’ inflation basket can reveal. The tool which measures consumer spending patterns has also shown that non-chart CDs and digital compact cameras have disappeared from UK shopping lists in the past year, as consumers continue to favour

smartphones over clunky technology.

“The impact of mobile phone technology continues to resonate with the removal of CDs and digital cameras from our basket, reflecting how most of us listen to music and take pictures straight from our phones these days,” Mike Hardie, deputy director of price transformation at the ONS, said.

With the year quickly being defined by a hike in living costs and soaring food inflation, frozen fruit is growing in popularity with savvy consumers

adding the goods to their basket to save costs on home-made smoothies.

The ONS figures also showed consumers opting for green purchases, with electric bikes also growing in popularity.

“The latest inflation basket reflects a changing market – one that is both increasingly technologically savvy and health conscious it seems with e-bikes, home security cameras, soundbars and frozen berries among the new additions,” Myron Jobson, analyst at Interactive Investor, said.

NICHOLAS EARL

SMALL firms have pleaded with Jeremy Hunt to extend business support for energy bills by three more months ahead of tomorrow’s much-vaunted spring budget.

The Federation of Small Businesses (FSB) warned companies on fixed-term energy contracts are at risk of being exposed to ultra-high

prices when the support package for businesses is slashed next month.

“We estimate over 350,000, or 28 per cent of small businesses who signed fixed tariffs last year, could need to shrink, restructure or close if their bills revert to the higher rates in April,” Martin McTague, national chair of the FSB, said.

McTague urged the Chancellor to allow businesses to agree new terms

with suppliers or to extend the Energy Bills Relief Scheme for another three months, when wholesale costs are expected to drop significantly. Extending the support package would be comparable to the expected U-turn for household support, with Hunt expected to keep support at current levels for domestic users until the expected decline in bills in the second half of the year.

OIL PRICES will be supported by the combination of strong demand this year and flagging OPEC production levels, even if this is not currently being reflected in spot prices, a leading energy analyst has argued.

Callum Macpherson, head of commodities strategy at Investec, told City A.M. that he did not expect the upcoming monthly forecasts from OPEC and the International Energy Agency to have much effect on markets.

However, he expected them to reflect the central dilemma within oil markets, which is that oil production is unlikely to meet consumption needs later into the year – increasing market tightness.

He said: “I think the reports have been saying essentially the same thing for quite some time, and that is that demand is going to be strong, particularly the second half of this year. That puts a big onus on OPEC to increase output to cover that shortfall. OPEC doesn’t really have the capacity to do that. Or at least not without Saudi Arabia and the UAE going it alone and plugging the gap.” This contrasts with the signals being

provided in spot markets, with oil prices weighed down by conservative economic estimates from China, a hawkish Federal Reserve ratcheting up interest rates and, more recently, concerns over the collapse of Silicon Valley and its wider implications for the economy. However, Macpherson was expecting these macro-factors to be overruled over time by the fundamental issues between demand and supply.

He argued spot prices were not “necessarily a rational assessment of where the market thinks that the right price ought to be in the future.

“The spot market tends to be dominated by what is happening now in the physical market, and what is going on in other markets – the sentiments. At the moment, the market is fairly well supplied, but the forward outlook is that the market is going to tighten,” he explained.

Last month, the IEA predicted China will drive oil consumption to record levels this year – over 100m barrels per day –as the world’s second largest economy reopens following sustained lockdowns. It also warned that restrained OPEC+ production could mean a supply deficit in the second half of the year.

THE GOVERNMENT should scrap traditional prepayment meters and only allow suppliers to install smart prepayment meters as part of its crackdown on the energy sector, the boss of a major energy firm has argued.

Bill Bullen, chief executive of Utilita, told City A.M. he supported Chancellor Jeremy Hunt’s plans to eradicate the “prepayment premium” – the price difference between the standard

variable tariff and prepayment meters. However, he opposed a blanket prepayment meter ban as he argued that they empowered people to make decisions over their usage to save money and energy. In his view, this could be best achieved through smart prepayment meters.

“The most important change required is for a full ban on the installation of old-style traditional pay as you go meters, which leave households high and dry in times of need,” Bullen said.

ON A SCALE of 1 to 10 how financially in control do you feel right now? If you were pleasantly surprised to score yourself pretty high, you’re not alone.

More than half of us are actually feeling more positive about how we’re handling our money right now - even if our confidence is trailing behind and our anxiety levels about what’s around the corner are still sky-high.

The latest research, carried out as part of Fidelity’s Global Women and Money study and released last week to coincide with International Women’s Day, shows that just over half of UK women (51 per cent) feel financially independent today.

That’s up from 45 per cent a year ago. However, when we talk to women about their financial confidence, that has fallen; with just over a third calling themselves financially confident.

That’s hardly a surprise though when we’re in the middle of a cost of living crisis, hot on the heels of the pandemic.

Women’s financial empowerment still lags behind men’s, and by quite a way. Some 58 per cent of men say they feel financially independent today, compared with 45 per cent this time a year ago. So, there is still plenty of work to be done when it comes to women’s sense of financial independence. And while we can celebrate these steps towards more women feeling financially independent, challenges remain on the long road ahead.

The fact that our latest Women and Money study reveals a mixed picture of how UK women feel about their finances, helps us realise a) we’re not alone and b) what we need to do to maintain that sense of financial independence.

The challenges that many people have encountered over the past year have led towards greater engagement with their finances –for example, the push effect of people having to mitigate rising costs has in turn driven more women to pay close attention to their finances.

By keeping your regular savings and investment plans going, even if the contributions are minimal, you make sure your future plans stay on track.

Losing out on six months, or worse-still a year or two, could have a detrimental impact on your longer-term financial security.

Staying on top of your day-today finances and your longer-term savings, where possible, is the key to both financial independence and that all-important confidence. Because when the outlook remains uncertain it’s more important than ever that we feel in control of our finances.

It’s almost enough to put you off your vegan sausage roll! Greggs, the bakery chain, hiked prices on some of its pastries and pasties not once, not twice but four times last year, as the cost of ingredients soared. But I did say almost –because while some customers may have lamented the rise in costs of these everyday snacks, Greggs has still managed to dish out strong growth in sales – proving the nation’s favourite highstreet pastry snack is anything

but flaky. With over 2,300 outlets across the country, and plans to open another 150 this year, Greggs has clear ambitions for growth, and will be one to watch among investors. And the icing on the currant bun?

An annual payout to shareholders that has risen by, on average, about 11 per cent a year over the past 20 years. If that isn’t enough to get wouldbe investors drooling, I don’t know what is.

If croissant and café creme is more your cup of tea, then you’re probably already au fait with the scenestealers at this year’s Paris Fashion Week from the eyebrow-raising leaf-shaped top worn by model Emily Ratajkowski to supermodel Naomi Campbell’s at-a-glance surprisingly sober black trouserblack leather trench-grey handbag ensemble, complete with shoes that looked as though they’d been made out of kids’ party balloons (google it). Fashion Week is a timely reminder that trends come and go and the ‘next big thing’ isn’t always the Next. Big. Thing. It’s the same with investing, some things never go out of fashion. As Greggs’ loyal band of costconscious customers shows, some simple staples will always be in vogue.

You’ve got the New Course and the Old Course, but there’s another track that everyone’s talking about at Prestbury Park this year.

In conjunction with The Jockey Club, UK producer DJ Cuddles has remixed the famous Cheltenham Roar to create a dance anthem titled ‘Roar Remix’!

Whether you wince, laugh or enjoyably bob your head to the 130BPM electronic melody, it’s certainly a bit of fun.

William Hill have even offered odds of it making the UK Top 10 at 3/1, but we’re not sure it’s going to be knocking Miley Cyrus off of top spot.

There’s an extra incentive to cheer home the Mark Walford-trained Into Overdrive in today’s Ultima Handicap Chase at Cheltenham. Champion jockey Brian Hughes has picked the 8/1-shot as his €500 charity bet with bookmaker Novibet.ie. Speaking on the Irish bookmaker’s Champ On

Cheltenham podcast, Hughes said: “He has the sort of profile that looks just right for this and 8/1 looks very generous. I’ve been moved by Rob Burrow’s battle with MND and hope Into Overdrive can give everyone a little bit extra to cheer at Cheltenham.” The full pod is available on Youtube.

SPONSORED BY

What do you expect to pay for a pint these days?

Six quid, or maybe £7.50 if you’re at the Cheltenham Festival this week, but those in Fitzdares’ on-course club in the Orchard could be sipping on something a bit special.

Coming in at a whopping £20 and recognised as the most expensive pint of the ‘Black Stuff’ ever sold at the track, the bookmaker’s 50/50 concoction of English Sparkling wine and Guinness should slide down nicely… especially if you’re backing some winners!

welcomed a human and equine star of the race to London for a special photoshoot.

Gold Cup-winning jockey Rachael Blackmore and the now-retired 2018 hero Native River, one sparkling in jewels and the other with his customary sheepskin noseband applied, celebrated the deal outside Boodles’ New Bond Street showroom. Blackmore made history 12 months ago by becoming the first female jockey to win jump racing’s blue riband event and Boodles MD Michael Wainwright was more than happy to extend his company’s partnership with the race.

“The whole experience was fabulous for Boodles,” said Wainwright. “And for me personally it provided one of the best days of my life.”

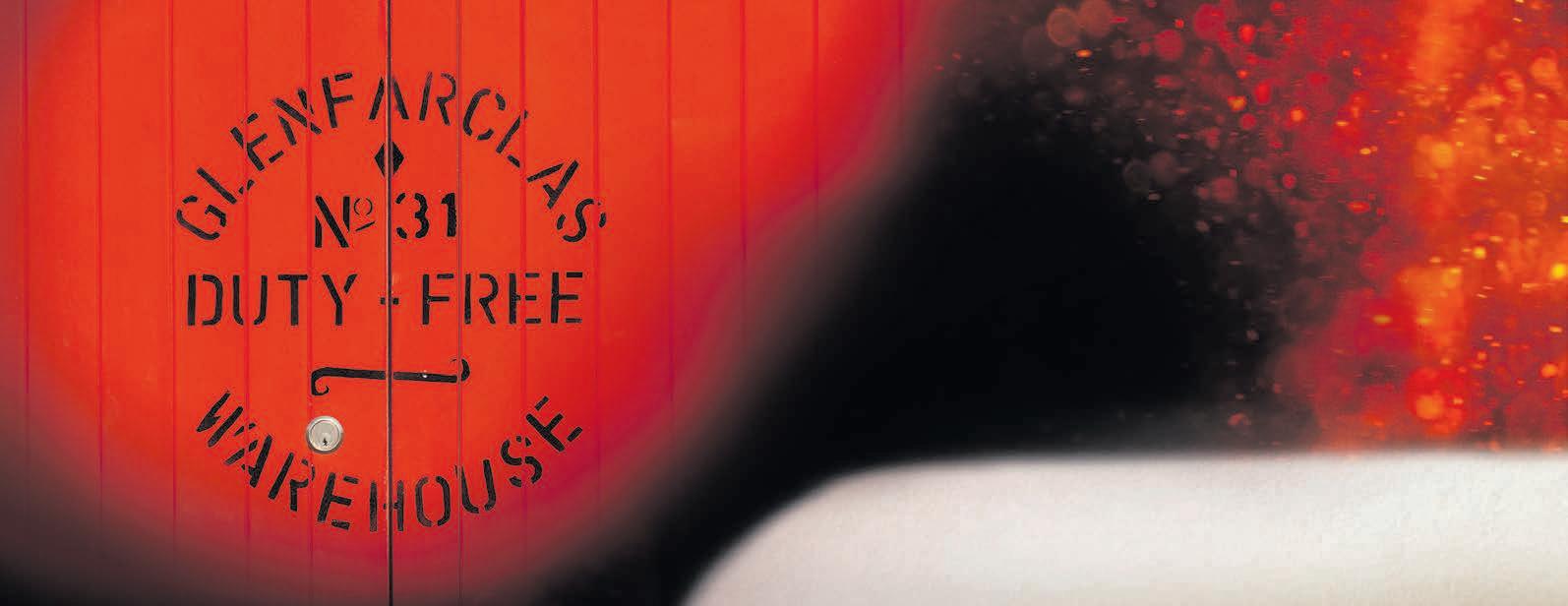

CHANGE BUT OUR SPIRIT HASN’T

We are dedicated to taking time: we wait, we learn, we perfect. Share the unique character of Glenfarclas.

THE BOSS of Wagamama‘s owner

The Restaurant Group (TRG) has claimed that casual dining out will never be as popular as it was pre-pandemic – but said he is reassured that chains will not disappear from the British high street altogether.

“I don’t think the [casual dining]

industry will ever be quite as big as it was,” TRG chief executive Andy Hornby said in an interview with the Telegraph.

Just last week, Hornby announced that he was shuttering some 35 “underperforming” eateries across the UK, as a hike in living costs took a bite out of profits for the year.

The listed restaurant group, which also owns Frankie & Benny’s, said

that it will look to convert a handful of sites to Wagamama restaurants –its most popular brand.

Speaking at the time, Hornby said: “Current trading has been very encouraging to the great credit of our teams who continue to ensure our customers receive the best experience possible.”

Shares in TRG have dropped 44 per cent over the past twelve months.

COCKTAIL bar operator Nightcap has estimated that 13 days of rail strikes over the last year has cost the company £1.2m.

The bar company, which operates a number of venues across Clapham and central London, claimed rail strikers “deliberate targeting” of Thursdays and Saturdays, the most lucrative trading days for the hospitality sector, caused a dent in profits.

Rail strikes, which began in the middle of last year and continue this week, are estimated to have cost the industry at large a cool £2.5bn, according to previous figures from UKHospitality.

“The rail strikes are having such a huge impact on the hospitality sector. We have more rail strikes to come [this week] and the deliberate targeting of the really critical trading days – Thursday and Saturdays for hospitality –will continue to see the high street struggle if they continue,” Nightcap chief Sarah Willingham (pictured) told City A.M. She continued: “However,

hospitality continues to pivot its business model, put events on other days like a Sunday or a Wednesday to compensate because at the end of the day people still want to go out, there is a big demand there, but we just need to be allowed to trade.”

Despite the disruptions, the listed bar group reported a revenues increase of 48.7 per cent to £23.5m, which was fuelled by the opening of six new sites across its The Cocktail Club, Tonight Josephine and Barrio brands. The results saw shares jump almost five per cent. Nightcap has also said the outlook for the year remains “encouraging” as the bar group continues to target millennial and Gen Z customers which have a higher disposable income than other age groups.

Willingham has previously said the tougher economic climate will force hospitality firms to adjust quickly.

“In a bull market, it’s ‘grow, grow,’ in a bear [market], you have to keep an eye on every aspect of the business,” she said in an interview with City A.M. at the back end of 2022.

LAURA MCGUIRE

THE WEST End and Knightsbridge have urged the chancellor to relax Sunday trading restrictions and help them rake in an estimated £350m a year.

The duo have submitted a joint proposal to Jeremy Hunt ahead of this week’s budget, urging the government to relax Sunday trading laws within the popular London districts.

New West End Company and Knightsbridge Partnership, the bodies

which represent each district, have said that removing the law which only allows shops to trade between 10am and 6pm on a Sunday could result in an estimated £350m of net additional sales annually.

The pair said that both districts are “major attractions” for international shoppers, with the majority of foreign consumers hitting the West End and Knightsbridge when on holiday and helping to bring £28.4bn to the UK economy.

RUSSIA’s invasion of Ukraine and Chinese posturing over Taiwan risk creating a world “defined by danger, disorder and division”, Prime Minister Rishi Sunak warned yesterday.

Britain is committed to “swift and robust action” to counter any threat to UK national interests

CHANCELLOR Jeremy Hunt was last night turning his attention to a crucial budget announcement tomorrow, having spent his weekend orchestrating HSBC’s rescue of Silicon Valley Bank UK. Hunt is expected to deliver a “steady as she goes” statement in the Commons at 12:30 tomorrow, positioning the former health secretary and MP of 20 years standing as Britain’s ‘calm down’ Chancellor.

He has already spent much time pouring cold water over the economic heat that saw household energy bills, mortgage payments and grocery prices spiral skyward.

But with rightwingers demanding he forsake a planned corporation tax hike to 25 per cent in a bid to go for growth, the UK’s money man is widely expected to dash Tory hopes as well. It appears more likely that he will use any unexpected ‘headroom’ in the Office for Budget Responsibility’s forecasts for the government finances to loosen the purse strings for public sector workers.

Leaking the contents of a budget prior to it being announced in the House of Commons was once such a no-no that Labour Chancellor Hugh Dalton –after accidentally giving details to the evening press prior to his speech in 1947 –resigned on principle.

These days the budget is a more stagemanaged affair, and we know a little about what will be in tomorrow’s announcement.

Parents will soon receive childcare payments upfront rather than in arrears, and there is some suggestion the Chancellor may go further on a politically hot topic.

Hunt is expected to tackle the

Pressure came from a further source yesterday when a cross-party group of MPs pushed Hunt to deliver a budget that “recognises London as an invaluable national asset”.

Sir Bob Neill, the chair of the all-party parliamentary group for London, said: “Rather than try to level London down, the government must do everything it can to get London back in business.”

The group called for increased and secure funding for new transport projects in the capital including Crossrail 2, the reintroduction of tax-free shopping for tourists to give West End businesses a much-needed boost, and changes to the Apprenticeship Levy.

Hospitality firms also called on Hunt to reduce the tax burden on them, with many still feeling the after-effects of changing footfall patterns and sky-high energy bills.

Kate Nicholls, the CEO of UKHospitality, told GB News yesterday that allowing businesses to “fail now or fail to provide a shot of oxygen” would risk wasting the taxpayer funding given to those businesses during the pandemic.

productivity crisis with a list of measures designed to get everyone from the over50s to the long-term unemployed back into work or to up their hours.

Traders will have six more days to submit border crossing forms, and reforms will make it easier to deal with cross-border bureaucracy.

Finally, Hunt is expected to cough up £33m over the next three years to support veterans. It will address housing needs, support with serious injuries and follow an £8.5m package to tackle veteran homelessness announced last year.

from China, according to an updated blueprint for the UK’s foreign and defence policy.

The so-called ‘refreshed’ integrated review (IR23) document says China under Communist Party rule represents an “epoch-defining challenge” to government policy and British lives.

It is an update to former PM Boris Johnson’s original review in response

to war in Ukraine – and comes alongside a pledge to bolster defence spending by £5bn over the next two years. Some £3bn will go on defensive nuclear abilities and almost £2bn will boost stockpiles.

The review was unveiled as the Prime Minister visited San Diego, California, for a trilateral summit with the US and Australia as part of the AUKUS project.

WHISPER it very, very softly, but the Bank of England (secretly) is trying to force you out of your job. That’s right. Governor Andrew Bailey wants to toss you to the wolves in the name of the fight against inflation.

That’s overegging it. No one is directly trying to make someone else unemployed.

A kernel of truth exists though in the Bank and even Chancellor Jeremy Hunt’s actions having an indirect impact on people’s lives that will eventually leave them poorer.

Ten straight interest rate hikes generating a cumulative 390 basis point tightening cycle is unusual, the effects of which have yet to properly spread across the UK economy.

Despite the dire recession warnings, the jobs market has held up pretty well.

Unemployment is hovering at multi-decade lows, vacancies have been running around record highs and pay has been rising, in cash terms, at the quickest pace in around 20 years.

Signs that the workforce is ever so slightly fraying are creeping into the key pieces of economic data.

Firms’ appetite for workers has chilled, primarily as a result of not expecting to need more staff amid the economic downturn.

Companies have probably made a big dent in clearing huge vacancy backlogs.

“The employment index of the S&P Global composite PMI survey has been consistent over the last three months with broadly flat private-sector employment,” Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, has noted.

Latest Office for National Statistics data on the labour market for January indicate planned redundancies are tracking close to their early 2021 trend when the country was in the teeth of Covid-19 curbs.

Staff availability has climbed to a 23-month high, according to KPMG and the Recruitment and Employment Confederation, mainly

because companies are trimming costs by letting workers go.

What all these changes mean is that resources have been freed up in the UK economy, and are what economists call slack.

Slack is an important factor in determining the inflation rate in an economy.

Too few workers and too hot demand for staff can force wages far and above inflation and bake in elevated price increases for years to come.

second-round effects, a cycle in which workers demand inflation-busting pay rises and firms raise prices to offset higher wage bills.

Keeping a lid on wage growth that isn’t offset by productivity gains is important to tame price pressure, but businesses have also played a role in fuelling the inflation surge by hiking prices to boost profits.

Paul Donovan, chief economist at UBS Wealth Management, highlighted recently that typically “15 per cent of inflation [comes] from margin expansion, but the number today is around 50 per cent”.

The opposite happens when demand is low and workers are in surplus. In the jobs market, bargaining power oscillates between these two positions.

For about 18 months, workers have held all the cards, helping to push private sector pay growth up around seven per cent, although regular pay increases have actually trailed inflation for 14 straight

windows.

You may inspect copies of the application, the plans and any other documents submitted with it on-line or telephone 020 7332 1710.

Anyone who wishes to make representations about this application should do so online: Any observations must be received within a period of 21 days beginning with the date of this notice (unless otherwise stated) and will be taken into account in the consideration of this application.

In the event that an appeal against a decision of the Council proceeds by way of the expedited procedure, any representations made about the application will be passed to the Secretary of State and there will be no opportunity to make further representations.

I’m sure the economically-minded noted the National Institute of Economic and Social Research’s budget preview last week. It was, as Treasury officials noted, an outlier. Britain’s oldest economic think tank reckons Chancellor Jeremy Hunt has around £100bn to spend tomorrow, primarily because inflation will stay higher for longer and boost tax revenues. By comparison, the IFS and Resolution Foundation put the fiscal firepower at somewhere around £9bn. BNP Paribas think it could be north of £10bn.

months. Tides are beginning to shift in the UK though. Workers will soon be forced to trim wage expectations and owners of capital forced to ditch assets cheaply.

Inflation should come down.

What the Bank is trying to prevent is expectations of future inflation staying high among businesses and workers.

That could spark what economists call

Last week, external monetary policy committee official Swati Dhingra said there were no severe second-round effects swirling around the economy.

As usual in economics, nothing is black and white. Many moving parts have contributed to last year’s historic inflation crisis.

And just as several factors have pushed up prices, several factors will bring inflation lower.

We’re now in the early throes of a cycle in which both the Bank’s ten straight rate hikes and inflation eroding household incomes will begin to soften the economy.

Slack is emerging, but not without a human cost. People will lose their jobs.

While that will bring inflation lower, it’s worth remembering the key source of this 40-year high inflation shock: elevated energy prices caused by Russia’s invasion of Ukraine, not workers trying to shield their living standards.

Energy prices have tumbled, which will bring inflation down, with or without you being sacked.

To appear in Best of the Brokers, email your research to notes@cityam.com

LONDON’s FTSE 100 was dragged down into a global market selloff yesterday driven by fears over how far the effects of the collapse of tech-focused Silicon Valley Bank (SVB) could ricochet through the financial system.

The capital’s premier index slid more than two per cent to close at 7,548.64 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell 2.75 per cent to below the 19,000 point mark.

Europe’s top indexes also dropped sharply yesterday. France’s Cac 40 was down over two per cent, while Germany’s Dax slipped nearly three per cent.

US stocks meanwhile opened higher, with all three of Wall Street’s top indexes up around one per cent. Markets sold off sharply at the end of the last week after tech-focused lender Silicon Valley Bank collapsed, sparking fears over whether companies have lost their cash at the bank.

Bets on US interest rates that soured due to the Federal Reserve raising borrowing costs steeply to combat inflation led to Silicon Valley Bank’s demise.

It emerged yesterday that HSBC had snapped up the lender’s UK arm for £1,

protecting UK customers’ deposits. The Fed over the weekend said it will insure American deposits.

Despite the takeover reducing the risk of SVB’s failure rippling through the UK financial system, market sentiment was weaker yesterday.

“After a mixed session in Asia, European markets have opened lower with the FTSE MIB in Italy leading the declines while the FTSE 100 is also under pressure, dashing hopes of a market rebound,” Victoria Scholar, head of investment at fund manager Interactive Investor, said.

HSBC was among the biggest fallers after the purchase announcement yesterday, shedding more than four per cent.

Other FTSE 100 listed lenders followed the Asia-focused lender on its spiral. Standard Chartered had more than six per cent clipped from its share price, while Lloyds Bank trimmed more than four per cent.

Fellow financial stocks also dragged the FTSE 100 lower yesterday. Insurer Aviva was down more than five per cent. Natwest dropped around 4.3 per cent.

On the mid-cap index, Virgin Money was trading near the bottom, down a shade under nine per cent.

Analysts at Peel Hunt said Pan African Resources, a mid-tier gold producer, can expect shares to run strongly given the new certainty over funding for Mintails. It comes as the group revealed it had completed the funding for the Mintails project - which will see it sell 4,846 ounces of gold per month, for 24 months. Analysts rated it a “buy”.

Analysts at Peel Hunt said that Trustpilot, the customer review platform, has immediately accessible cash of $24m (£19m) and $4.5m (£3.7m) guaranteed by the US Fed. Peel Hunt said that given this morning’s SVB UK news, its liquidity situation should be “under control”. The analyst rated it a “buy”.

THERE’S

TELL “The first rush of relief has been replaced by niggling concerns that the era of high rates might be more difficult for some banks to stomach than had been previously thought... The fallout from the financial crash still looms large in people’s memories, and government pledges can only go so far in restoring confidence. It’s a cliché, but time really will tell the story, and right now volatility is back with a vengeance.”

DANNI HEWSON, AJ BELL

IF YOU find yourself in North Kensington on a cold, rainy day, you should pop into the warm Adriana’s Cafe on St. Helen’s Gardens. The cafe is small and cosy, the food on display mouth-watering - and the owner, Adriana, has a story to tell. It’s her own story, but it’s also the story of her community’s resilience in the wake of the Grenfell tragedy. It’s the story of her neighbours, of the community that came together and the businesses which decided to stay put rather than start afresh somewhere else.

Over scrambled eggs, Adriana talks about moving to the UK in 1995 as a 21year-old, to find work and support her family back in war-torn Kosovo. London became her home: she met her husband, who is also from Kosovo, and they moved to Grenfell Tower. They lived there for fifteen years.

Then the fire happened. In an instant, they lost everything they had; they moved in with Adriana’s sister, and were then placed in temporary accommodation. At the time, Adriana was working in the same cafe she now owns. “Everybody found their own way to deal with it. For me, it was work: I came back to work after five days”, she says. Shortly after, the cafe closed down and Adriana was jobless. The landlord of the property suggested she should

take over the space herself, but she wasn’t sure it was the right time - it was only one year after Grenfell. Then she thought: “what do I have to lose? I’ve already lost everything”. The next day, the cafe was hers.

Adriana has been through a war, the inferno at Grenfell, but all she talks about is the need to give back to the community. She sends hot meals to local hospitals and works with schools to provide healthier food for children. She calls the cafe her “second home”. She had no experience opening a business, so she sought advice from

Stuart Woodrow of Portobello Business Centre. Woodrow was one of the consultants employed by the council to advise the businesses impacted by the Grenfell fire. When his work was finished, he didn’t leave; he stayed and now leads the North Kensington Business Forum, a group that connects and supports entrepreneurs. He still advises local businesses, including Adriana’s. He’s one of those who helped rebuild this scarred community, brick by brick.

Over 85 local businesses were directly impacted by the fire, due to re-

duced footfall, lack of premises, road closures and the psychological trauma. They were provided with initial financial support from the council, but that didn’t last long. Through the aid of organisations like Portobello Business Centre - and sheer force of will - many of them have now achieved long-term stability.

Another business advised by Woodrow is Holland Park Autos. The local garage is located below the arches right in front of Grenfell Tower. On the day I visit, the tower looms close against a grey sky - a reminder of a

LANDLORDS and developers are, for the most part, dinosaurs. The younger, or more visionary landlord and developer might describe themselves as “placemakers”, which is amusing as we humans have been making places as a species for around 250,000 years.

But creating senses of place is essential. It’s the character behind the city which attracts people to it; this drives national and local economies, it creates community which engenders stronger individual wellbeing and it creates cities-within-cities, where different people can fall in love and feel at home in the place they are in.

This is what Vault Festival has done, the second biggest arts event in the UK, in an underground spot below Waterloo station. It has brought thousands of people together for a laugh at a budding comedian’s stand up gig, it has undoubtedly created new friendships as audience members grabbed a drink together between cabaret shows and it has added a great deal to our

Richard Uptoncultural scene.

But on Sunday, Vault will be forced out of their venue. Leaving these socalled “placemakers” grappling with filling the vacancy left by this beacon of creativity.

Rip out beautiful things like Vault and you may leave a gaping hole in your “place”. The Vault Festival was served notice by their landlords last month, who said they are favouring more commercial work than the grassroots arts festival, which helps so many new creatives get their first break. This decision means the arts festival in the UK has to find a new home.

As and when the market turns for

the worse this idea of favouring more commercial work could be a tragic decision for developers as well as for culture in London.

But the issue of Vault Festival and their landlords, The Vaults, is so much deeper than The Vaults itself. The issue is about real places, and The Vaults is a real place. That is, defined by heritage, the story of “place”, along with thousands of brilliant and independent minds which capture, in the shaping of that place, the rhythms of humanityin lasting legacy.

Most developers shape things “top down”, but the best places are shaped from “bottom up” (or, more accurately, “organically”). The wise developer allows the organic to grow from young seeds. That creates a better place. And, incidentally for landlords and developers, a more valuable and sustainable place.

These matters are usually technically and legally complex. But the idea that character and commercial success are mutually exclusive will hollow out our

city if we’re not careful. If we buy into the belief the only way to turn a profit is to accept a soulless long lease, we may as well give up on the idea of cities altogether.

We need only look to efforts to make Canary Wharf more interesting, with the Winter Lights Festival, to see the importance of drawing people in with more than just a building.

On the cusp of Soho, the number of pop up exhibitions near Tottenham Court Road Station are a haven for tourists and commuters, and a chance for up and coming artists to show their work.

There can be way more value than the internal rate of return of a “commercial property” alternative, if one is clever. Let’s hope the developer of The Vaults is the most progressive of all dinosaurs - and stitches The Vaults back in. For the benefit of their shareholders, and for all of us to enjoy.

£ Richard Upton is a creative entrepreneur and patron of the arts

tragedy that could have been avoided. The owner of the garage, Jack, has been working in the local community for over fifty-four years. He’s over seventy, but comes in to work six days a week, and is a mentor for many young kids in the area.

“When Grenfell happened, I was standing here”, he says. The front of his garage was covered in debris from the tower, and the street where its business is located had to be closed. Everyone had to come in from the back of the garage, and it took the business a long time to get back to normal.

Local councillor Marwan Elnaghi speaks of communal trauma among those who were affected by the Grenfell tragedy. “We are a forgotten community, we don’t feel we are a priority”, he says. Supporting businesses post-Grenfell in an area that already sees high levels of deprivation should have been one of the council’s priorities. Yet everywhere you turn, people speak more of the support they’ve received from their neighbours and friends than from the council.

In his book ‘Show Me the Bodies’, housing journalist Peter Apps writes that “the world that gave us the Grenfell Tower fire looks irredeemably dishonest”. Yet he also says there is “another vision of humanity” available from the tragedy: everyone who provided support in the aftermath, offering a clean jumper, a toothbrush, or a bed. In short, the community. It is this same community local businesses worked hard to cater to and protect; and as they face yet another challenge with the cost-of-living crisis, their strength should be an inspiration for everyone who cares to look.

SHARP END OF THE KNIFE

After booting Gary Lineker off air and then being forced to convince him to come back on, it was Richard Sharp and Tim Davie, the Chair and Director General of the BBC, who were looking at unemployment after the PM’s spokesperson couldn’t say if he had confidence in the pair

[Re: UK gender pay gap widens as childcare costs worsen ‘motherhood penalty’, March 7]

The findings from PwC’s Women in Work Index show how much impact childcare costs have upon the gender pay gap and is further evidence of how imperative a reform of the childcare system in the UK is.

The UK should look for inspiration from the Nordic countries, where the childcare model is world leading and the gender pay gap is less pronounced. In the Nordics, childcare arrangements are among the most generous in the

world, supporting parents from the early days of pregnancy to school and beyond.

This has massive benefits, and on average across the Nordic countries, almost three in four women are in paid employment, gender employment gaps are among the OECD’s smallest, and mothers are more likely to be in work than in other countries.

This is thanks to affordable childcare and the right to paid parental leave and employment protection – two things that the UK could and should learn from.

The UK should look at adopting the Nordic model to childcare sooner rather than later.

Lorna Crowley WinningtempSWEDISH company Klarna is a bona fide fintech unicorn, valued at $45.6bn with over 150 million active global consumers, 16 million of whom are in the UK. Klarna is a buy-now-paylater (BNPL) lender, offering a type of consumer credit that allows you to borrow money to make a small purchase, and then spread out the cost by paying the loan back in instalments that are often interest free.

With a distinctive millennial pink brand, Klarna targets itself squarely at a younger customer. It’s cultivated an inclusive brand ethos, using a saccharine tone that encourages customers to “shop like a queen”, while reminding them to consider the environmental sustainability of their purchasing habits. It’s even launched tongue-incheek campaigns with billboards proclaiming and then de-bunking statements like “Millennials are useless with money” and “pink is for girls”. This has come alongside tactical partnerships with brands that have a younger customer base, including ASOS and Missguided.

Yesterday, Rishi Sunak met with his US and Australia counterparts to unveil a new AUKUS submarine deal. It is aimed at increasing defence capabilities in the Indo-Pacific and amping up its defence against China. It’s not the only alliance China is worried about. A separate deal with Taiwan drew the ire of Beijing, after the UK granted 25 export licences to the island for submarines’ components. In the first nine months of last year, the licences for these exports reached £167m in value.

When it comes to China, Sunak always had a hard time. The more hawkish MPs on his backbenches think he’s too soft on Beijing. Sunak has consistently refused to call China a “threat to national security”. His more moderate language swept into the new integrated review, published yesterday, where China was indeed described as posing “an epochdefining challenge”. Alicia Kearns, the chair of the foreign affairs select committee, was unhappy about this wording, to say the least.

Klarna’s strategy, and that of its similarly youth-focused competitors like Clearpay, has worked. Polling carried out by Savanta in 2022 shows that 42 per cent of 18 to 24-year-olds and 56 per cent of 25 to 34-year-olds have used BNPL, demonstrating the incredible extent to which these lenders have ingratiated themselves into consumer habits.

“Klarna is really my best friend. Her and I should’ve crossed paths years ago,” a young woman tweeted earlier this month. “Hiiiii bestie!” Klarna cheerfully replied. The young woman responded, “Hi bestie, thanks for making my life easier.”

This exchange encapsulates the new, disagreeably friendly face of debt that sees companies like PayPal – which has enthusiastically leapt into the BNPL market – barrage my inbox with breathless emails telling me that I am eligible for their pay later scheme (lucky me!), which apparently offers a great way for me to “take control of my budget”.

But rather than a benign alternative to traditional forms of credit, the effect of BNPL is to encourage consumers to regularly spend just a little bit beyond their means, a predatory attempt to

create a pay-later culture that sees the budgets of those who can ill-afford it permanently stretched. In 2020, it was revealed that 30,000 people have damaged their credit scores by missing Klarna payments and the company’s own promotional material for retailers proudly stated that customers spent an average of 55 per cent more when able to spread payments over multiple instalments.

Worryingly, with a proliferation of BNPL lenders, consumers can potentially quickly build up high levels of indebtedness by taking out loans with multiple companies. The Financial Conduct Authority has published a report pointing this out, with one BNPL user quoted as saying: “If I’m at my limit with Klarna, I’ll look and see if the shop offers another type.”

Now, the government is launching a consultation as part of a long-awaited move to increase regulation of BNPL companies and better protect consumers. This comes as Klarna intro-

duces late fees for the first time from March 16 onwards. Chief executive officer Alex Marsh claimed the change was altruistic. He wrote in this newspaper that not having late fees was “not in the best interest of our customers” in the company’s quest to build “the world’s most responsible credit business”.

There’s a cloud of economic drizzle over the UK, we’re being crunched by the cost-of-living crisis, and no one under the age of 35 without a criminal enterprise or wealthy and obliging parents is likely to be able to buy a house any time soon. Do not judge the harried customer who decides to spread out the cost of a new mascara over a few weeks. Instead, be gladdened that the government has realised that what Klarna and its ilk peddle are simply unstructured credit products in need of tougher regulation – good luck besties!

£ Phoebe Arslanagic Wakefield is Chair of the Women in Think Tanks Forum

LOST YOUR MARBLES Elgin Marbles will stay put in the British Museum

WE ENTEROslo’s sprawling Kia dealership and there, parked in pride of place, is an immaculate Sephia saloon. Sold as the Mentor in the UK, it’s an instantly forgettable minicab-in-the-making. Back in 1994, however, this was the first modern Kia that wasn’t simply a Mazda in a South Korean suit.

Outside the showroom window, recharged and raring to go, is an EV6 GT. Kia’s new flagship is a 585hp electric crossover with Porsche-baiting performance (0-62mph in 3.5 seconds) and a price tag of £62,645. The gulf between the two cars could hardly be greater.

A low nose and rakish coupe roofline do lend the EV6 an aura of budget Porsche Taycan. It’s also entirely different to the retro-look Hyundai Ioniq 5, which shares the same E-GMP platform. You can spot the GT chiefly

by its neon green brake callipers, along with restyled bumpers and 21inch alloy wheels.

Leaving Oslo and its bewildering ring road behind, our plan is to head north, carving between jagged hills and snowcarpeted valleys, to a frozen fjord near the ski resort of Gol. There, we’ll put the GT’s drifting ability to the test on a challenging ice driving circuit. All in the name of consumer research, of course.

Norway has the highest density of electric cars in the world, and 88 percent of Kias sold here are EVs. By law, major roads must have a rapid charger every 50 kilometres (31 miles), but the GT’s 263-mile range is enough to reach Gol in one hit. When its 77.4kWh battery does run low, 350kW charging capability means a 10-80 percent top-up takes just 18 minutes.

Supportive, suede-trimmed seats and a refined ride take the edge off hours

PRICE: £62,645

POWER: 585HP

0-62MPH: 3.5SECS

TOP SPEED: 162MPH

BATTERY SIZE: 77.4KWH

RANGE: 263MILES

of steady driving, watched over by Norway’s many speed cameras. Finally, we turn off for the fjord, and the road suddenly resembles a rally stage. On hardpacked snow, the Michelin Pilot Sport tyres fitted to UK cars would be nearuseless, but the Scandi-spec Nokian winter rubber offers superb traction. The ice that covers the tranquil Tisleifjorden is nearly a metre thick: reassuring when you’re inside a 2,165kg

SUV. I grab a coffee in the hospitality tent – powered by an electric Kia Niro – then cross to a small oval track. Here, we can practise car control, slaloming on the straights and drifting around the bends, before we attempt the two-mile circuit.

The lake surface is sheet ice dusted with a loose layer of powder, so even standing up straight isn’t easy. Yet with the Kia’s default stability systems activated, you can drive like a hooligan and it simply refuses to spin. Factor in the EV6 GT’s beefed-up brakes and electronic limited-slip diff, and I’m soon brimming with a cocky sense of selfconfidence.

That melts away when the systems are switched off. Having 546lb ft of torque from a standstill makes the car easy to coax into a slide, but holding it there is far trickier. Find the right combination of steering input and throttle angle

and it will dance in graceful arcs like a figure skater. But flex your right ankle too early and you’ll end up beached on a snowbank. As I did, several times.

The full circuit is tightly coiled and much narrower. There’s no space for showboating here; choosing the right line is vital to staying off the snow. With its calm balance and urgent speed, driving the EV6 GT feels like being at the eye of a storm. It’s exhilarating and exhausting, and definitely the most fun I’ve had in an electric car.

That might sound like damning with faint praise. But while it’s true that even a Kia Mentor (née Sephia) would be fun on a frozen lake, the EV6 GT is something else entirely: a fitting flagship for a company that has come so far, so fast. Back in 1994, we’d never have believed it.

Tim Pitt writes for motoringresearch.com

THEMG4 EV has been crowned UK Car of the Year 2023 in a closefought contest judged by 27 automotive journalists, including Tim Pitt of City A.M. The MG4 took top honours ahead of the Dacia Jogger (voted Best Large Family Car) and the Toyota GR86 (Best Coupe).

BAs in 2022, when the Hyundai Ioniq 5 claimed the title, this year's UK Car of the Year is fully electric. The MG4 is available with 51kWh (170hp) or 64kWh (204hp) batteries, offering 150kW charging capability and a maximum range of 281 miles.

Starting from £26,995 (or £269 a

month on a four-year PCP finance deal), the MG won particular plaudits for its affordability. "In a world where practical electric cars are priced to the sky, the MG4 offers genuine value for money," said Tom Ford of Top Gear magazine. “MG has done a great job of bringing EVs to more people, thanks to its pricing," added Andrew Clews, co-host of The Motoring Podcast.

Presenting the trophy, John Challen, director of the UK Car of the Year Awards, said: "The MG4 proves that electric cars can be affordable, practical and appeal to all areas of the automotive market. Fully charged, it

offers more than enough miles for most journeys, while the design and driving dynamics tick two other important boxes for consumers."

The other category winners in the UK Car of the Year Awards 2023 were the Toyota Aygo X (Best City Car), Kia Niro (Best Crossover), Range Rover (Best Large Crossover) and Lotus Emira (Best Performance Car). The clock is now ticking towards the World Car Awards 2023, with Richard Aucock of City A.M. among the judges. The overall winner will be revealed at the New York International Auto Show on 5 April.

A frozen lake is the perfect playground for the 585hp Kia EV6 GT. Tim Pitt heads to Norway and learns how to drift.

TIMING is a huge thing in sport. Imagine how many more Grand Slams Roger Federer, Rafael Nadal or Novak Djokovic would have won if the other two hadn’t been around.

In the aftermath of day one at last year’s Cheltenham Festival, there was plenty of controversy comparing the Supreme Novices’ winner CONSTITUTION HILL with dual Champion Hurdle heroine Honeysuckle.

The younger horse did something that day that you very rarely see –in fact, almost never.

The time of the Supreme pretty much defied belief and he was immediately installed as favourite for the 2023 Champion Hurdle.

Connections of Honeysuckle were a little put out by what they saw as a lack of respect for the (at the time) unbeaten mare.

She has been incredible over these past few years, winning at three straight Festivals, and the reception she got after the 2022 Irish Champion Hurdle will live long in the memory.

But in those three seasons she never came up against Constitution Hill and that is the difference.

A Timeform rating of 177 is the highest ever given to a novice hurdler which shows what we’re dealing with.

Yes, he has to go and prove it in a

Champion Hurdle, but his two runs this season in the Fighting Fifth and Christmas Hurdle have been faultless, beating stablemate and 2020 Champion Hurdler Epatante by 12 and 17 lengths respectively.

He is just a freak and it will be a huge shock if he is beaten this afternoon – as his price of 1/3 suggests.

STATE MAN is a different test and will almost certainly be the biggest one he has faced so far in his career, but you still get the feeling there is a gap between them.

In any normal year, State Man would be a hot favourite, but he may have just come around at the wrong time.

Since falling two out in a maiden hurdle at Leopardstown on Boxing Day in 2021, Willie Mullins’ hurdler has won all six of his starts.

He was really well backed in the County Hurdle 12 months ago and won easily before going on to land the Grade One novice hurdle at Punchestown over two and a half miles.

Like Constitution Hill, he has stepped up a level in open company, never looking like getting beaten in three runs this season, including last time out in the Irish Champion Hurdle.

Paul Townend will have decisions to make in the race, but whatever he does I don’t think will make a difference as he is taking on a superstar.

While they look to be the obvious one-two, it should be an interesting battle for third.

Vauban was a hugely impressive winner of the Triumph Hurdle but, as is so often the case, he has struggled slightly in his five-year-old season. A return to Prestbury Park could reignite the fire and it often depends on who is ridden for third and who goes for broke in races like this.

I would certainly favour I LIKE TO MOVE IT over him to pick up the bronze medal.

He couldn’t have won the Kingwell Hurdle any easier last month and he has good form at Cheltenham, winning the Greatwood back in November and a couple of races over course and distance the winter before.

Stamina looked to be the issue in the Relkeel Hurdle on New Year’s Day, but back over this trip he looks the most likely to cling on for third.

Zanahiyr, Jason The Militant and Not So Sleepy make up the rest of the field, but all three are 80/1 or bigger, so it would be a surprise if any of them were good enough for a podium finish.

Regardless, this race is all about Constitution Hill and what he can do against the best hurdler in Ireland at the moment.

I expect him to pass his assignment with flying colours.

NICKY Henderson and Willie Mullins have won seven of the last 10 runnings of the Sporting Life Arkle (2.10pm) and it will be a huge shock if one of them doesn’t land the prize again this year.

The two stables are responsible for the first four in the market and even though Mullins saddles four in total against his British counterpart’s sole runner, that doesn’t necessarily mean he will be lifting the trophy.

Henderson has won the Arkle a record seven times (compared with Mullins’ four) and this will be the only day that has mattered for JON-

BON all season.

He is a master at getting horses ready for Cheltenham. He’s done it time and time again, and the Kingmaker at Warwick was never going to be where we would see Jonbon at his best.

I know he wasn’t impressive in beating Calico, but he still managed to get the job done and we can expect to see a different horse this afternoon.

Jonbon has always been highly regarded at Seven Barrows, with his only defeat in nine starts coming against stablemate Constitution Hill when second in last year’s Supreme Novices’ Hurdle.

EL FABIOLO is vying for favouritism

with him at around the 6/4 mark after an excellent win in the Grade One Irish Arkle at the Dublin Racing Festival. He clearly has a massive engine, but his jumping is a worry and he was beaten by Jonbon at Aintree last year. A serious blunder four out at Leopardstown could have been the end of his race and he certainly doesn’t want to be doing that at Cheltenham. Dysart Dynamo will go out and try to make all. I know plenty think he’ll be able to hold on, but I’m not so sure. He’s a very good jumper, but it’s a long way up that hill and I can see him setting it up for the others.

The one horse who looks overpriced is SAINT ROI, also from the Mullins yard, at 8/1 with William Hill.

He won a Grade One at Leopardstown over Christmas on just his second start over fences and then unseated Mark Walsh in the Irish Arkle when stumbling on the flat.

The winner of the County Hurdle in 2020, he came back to the Festival last year and finished third to Honeysuckle in the Champion Hurdle. He is a classy horse on his day and would be the one for me to follow home Jonbon if you’re backing the straight forecast or exacta.

BILL ESDAILE’S 1-2-3

BSky Bet Supreme Novices’ Hurdle (1:30pm), I have to declare that I head up the syndicate that owns RARE EDITION, trained by Charlie Longsdon.

He has been a dream horse for us, winning four of his five starts under rules, with the second coming last time out in the Sidney Banks at Huntingdon.

Although he was a little disappointing that day, his scope was dirty after the race and I also don’t think he was in love with the ground which was pretty quick.

After some rest and recuperation, he has worked really well over the past week so we go there hopeful he

The form of his win at Kempton on Boxing Day looks strong and while he now has to take on the best of the Irish, if he was to finish in the first three or four it would be a dream come true. In fact, it’s a dream to even have a runner in the race.

Facile Vega is the Irish hotpot, but I couldn’t be considering him at just 2/1 on the back of his run at the Dublin Racing Festival.

To me, the most likely winner is MARINE NATIONALE for Barry Connell and Michael O’Sullivan.

His trainer has been hugely enthusiastic about his chances and he arrives here unbeaten in

four starts, the last of which came in the Grade One Royal Bond at Fairyhouse in December.

My other selection is IL ETAIT TEMPS who won the Grade One where Facile Vega disappointed last month.

He wouldn’t have the typical profile of a Willie Mullins Supreme winner, but he has plenty of experience having finished a fair fifth in last year’s Triumph Hurdle.

BILL ESDAILE’S

1 Marine Nationale

The Qatar Goodwood Festival, which takes place from Tuesday 1 to Saturday 5 August, is one of the undisputed highlights of the British sporting calendar and social.

As one of Britain's oldest and most prestigious horseracing amphitheatres, the hallowed turf of Goodwood Racecourse hosted its first public race meeting in 1802. Today, 19 days of racing across the summer season are on offer with a record prize pool of over £8 million awarded to winning connections.

The flagship Qatar Goodwood Festival will feature 13 Group races attracting the who's who from racing's global stage. Day one gets underway with the historic Goodwood Cup, the highest ranked stayers race in the world.

The best milers go head-to-head on day two in the most valuable race of the festival for the £1 million Qatar Sussex Stakes. A race famed for many an epic 'Duel on the Downs,' in recent years. Thursday features a celebration of the best fillies and mares in the world, Japanese trained racehorse Dierdre raised the roof when success-

ful in the Qatar Nassau Stakes in 2019.

A total of four quality Group races on Friday, with the headline King George Qatar Stakes featuring the fastest horses in the world. The Coral Stewards' Cup cavalry charge on Saturday concludes the week.

Each enclosure offers a wealth of places to eat and drink alongside exceptional experiences.

Unique entertaining spaces include the Charlton Hunt Restaurant, where accents of walnut and marble pair with menus celebrating the finest local produce.

Shared bars such as botanicalthemed Sussex Roof Garden, are perfect for that family reunion or celebratory occasion, while the Sussex Lounge bar offers a more informal place to use as a base for group get togethers.