LONDON’S BUSINESS NEWSPAPER

THE WEEKEND STARTS HERE

OUR EXHAUSTIVE GUIDE TO THE BEST OF A CHILLY CAPITAL P22-23

TALK OF THE CITY MARK KLEINMAN’S MUST-READ COLUMN P10

OUR EXHAUSTIVE GUIDE TO THE BEST OF A CHILLY CAPITAL P22-23

TALK OF THE CITY MARK KLEINMAN’S MUST-READ COLUMN P10

JACK MENDEL AND STAFF

MICHAEL CAINE will be able to rest easy, with production of the iconic Mini set to remain on British shores.

BMW is set to invest a sum close to £500m in its plant in Oxford, with around £75m coming from the UK government’s Automotive Transformation Fund, according to a report from Sky News’ Mark Kleinman.

There had been fears that production of the Mini would move abroad, with allelectric versions of the Italian Job’s automotive star already being produced in China and the Mini Countryman to be manufactured in Germany from this year.

BMW refused to comment on “media speculation” but said with “its high degree of flexibility, competitiveness and expertise, the Oxford plant plays an important role in the BMW Groups’

production network.

“For the next Mini generation, Oxford will produce the majority of Mini models, the Mini Cooper three-door and five-door models, as well as the Mini Convertible — one of our most important vehicles and a worldwide bestseller,” a spokesman continued.

It will be seen as a welcome vote of confidence in the UK’s automotive industry, which had been predicted to be

a casualty of the UK’s exit from the European Union.

Nissan’s chief operating officer last month said producing cars at their Sunderland plant, a totemic part of the UK’s car industry, had become more “challenging” due to higher inflation and energy costs and said the UK government needed to make the operating environment more “competitive”.

JACK MENDEL AND STAFF

HEATHROW said the aviation regulator’s decision to slash airport charges “makes no sense” yesterday as the ongoing row between the Hounslow hub, airlines and the Civil Aviation Authority (CAA) reignited.

The CAA has told Heathrow it must reduce its passenger charge –effectively a fee paid by airlines per passenger in transit –by 20 per cent between 2023 and 2024, and that it must stay until the end of 2026. That will leave it at £25.43, with Heathrow having at one point been pushing for a limit some £15 higher.

“The CAA has chosen to cut airport charges to their lowest real-terms level in a decade at a time when airlines are making massive profits and Heathrow remains loss-making because of fewer passengers and higher financing costs,” a spokesman said yesterday.

The lower charge did not satisfy airlines, either, some of whom have accused Heathrow of underplaying its recovery from the pandemic.

“Heathrow has abused its power throughout this process, peddling false narratives and flawed passenger forecasts in an attempt to win an economic argument,” Virgin Atlantic CEO Shai Weiss said yesterday.

THE BOSS of Lloyd’s of London has said the City needs “to get Monday back” in order to get the Square Mile back to full speed.

The insurance marketplace’s chief executive John Neal (pictured) said yesterday that while “Tuesdays,

Wednesdays and Thursdays are busy”, he now wants to see more City workers in and around his Lime Street headquarters on a Monday in an interview with the Financial Times.

Neal has long been an advocate for flexibility in work and has driven a dramatic change in

working practices at Lloyd’s, with more digital dealing and broking than ever before, moving away from a previous in-person model focused almost exclusively on ‘the room’ at the heart of the Richard Rogersdesigned building.

But Neal has also said

that in-person workplaces are “massively important for younger workers”.

The Lloyd’s boss has argued working in the office helps to “develop… the next generation”, claiming more experienced staff owe a “responsibility”

to less experienced colleagues.

Last week it emerged that Lloyd’s of London was minded to remain in its current location, having previously mulled alternative building options.

The marketplace will announce full year financial results in a fortnight, with analysts optimistic.

WE ARE all well aware that the likelihood of any meaty rabbits emerging from Jeremy Hunt’s hat in the budget next week is somewhere between low and zero. Even with ‘fiscal headroom’ –it is clear that any surprises will be saved for a more politically advantageous time. That does not mean, though, that the economy must be set in stasis until such time as Downing Street strategists decide to release us

from our high tax strait-jacket. The focus on tax policy distracts from the supply-side reforms that could do more to put the UK economy back on track. You could pick any one of a host of issues –our chronic lack of housing chief among them –but arguably the

one area in which the government could make the most immediate impact would be by reforming our childcare system. Quietly, the cost of handing off one’s pride and joy / devil-children to somebody else for the day has become one of the biggest brakes on the UK’s economic growth. As a report from the Adam Smith Institute has found, the UK has the most restrictive childcare rules in the world –with mandatory care ratios in particular driving up the

cost for parents; it’s worth noting that not one of Germany, Denmark or childcare-champion Sweden bother with such ratios. As is the way in Britain these days, rather than addressing the issue successive governments have elected to throw bucketloads of taxpayers’ cash at it. Even that’s been done poorly.

The Institute for Fiscal Studies, in a separate report today, note there are no fewer than eight overlapping schemes for new

parents to navigate. A broken childcare system doesn’t just take cash out of the economy; in many cases it makes going back to work after maternity leave not make any sense.

The uncomfortable reality is that means a lot of smart, careerdriven women leave the workforce for years. Rather than all the guff we saw yesterday, concrete moves to address our childcare system would be a real International Womens’ Day policy.

Dog-shaped robot units by Chinese company Unitree are presented at a demonstration during the World Police Summit 2023 taking place in Dubai

TOP DOGS

Tiktok has announced a data security regime for protecting user information across Europe, as political pressure increases in the US to ban it. The plan involves user data being stored on servers in Ireland and Norway.

The French have lost their taste for wine. More than 300 Bordeaux vineyards are to switch to growing olives and walnuts and thousands of hectares of vines wil be uprooted in an attempt to rescue the claret industry.

THE FINANCIAL TIMES

The UK’s top financial regulator has engaged directly with the boards of some high street banks for failing to pass on interest rate rises to their customers.

THE RMT last night said that strikes will still go ahead next week despite rail union bosses asking them to reconsider after suspending planned industrial action at Network Rail.

The union said the Rail Delivery Group (RDG), which represents operators, had invited it for discussions earlier yesterday on the condition the strikes were suspended. The RMT said the scheduled action will remain in play but the union was “available for discussions”.

It comes after the RMT on Tuesday

suspended planned striked action by Network Rail members on 16 March and committed to balloting on “a new offer from the employer”.

A strike by RMT members at 14 operators is still scheduled to take place on March 16, 18 and 30 and April 1, and is expected to cause major disruption.

The RMT has been engaged in national rail strikes in a row over jobs, pay and conditions since June last year, decimating services.

An RDG spokesman yesterday said the ballot was a “welcome development” but added: “Instead of inflicting more lost pay on its members and

disruption to our passengers, we are calling on the union to call off their strikes and meet us for urgent talks to resolve this dispute.”

The RDG said its offer includes pay rises of at least five per cent for 2022 and four per cent for this year, with a lump sum payment for last year’s increase. It added it was “not conditional on accepting Network Rail’s modernising maintenance agenda”.

The government and the rail industry insist reforms are needed to afford higher salaries as the sector’s finances have been hit by the drop in passengers due to the Covid-19 pandemic.

WHAT THE OTHER PAPERS SAY THIS MORNING

JACK BARNETT

THE BANK of England risks tipping the UK economy into recession and worsening the cost of living crisis if it raises interest rates too aggressively, a top official said yesterday.

Swati Dhingra, an external member of the Bank of England rate setting monetary policy committee (MPC), warned “overtightening poses a more material risk at this point” than elevated inflation embedding into the UK economy. Doing so “risks unnecessarily denting output at a time when the economy is weak and deepening the pain for households when budgets are already squeezed through energy and housing costs,” Dhingra added at an event hosted by the economic think tank the Resolution Foundation. Her remarks illustrate the split emerging on the MPC between officials who

think rates need to keep rising to prevent high price rise increases becoming the norm and those who reckon the Bank has already done enough.

Dhingra voted in the 7-2 minority at the Bank’s meeting last month to keep rates unchanged at 3.5 per cent. The MPC’s next meeting is on 23 March.

Since December 2021, Bank governor Andrew Bailey and the rest of the MPC have bumped borrowing costs up 390 basis points to a 15-year high of four per cent.

That’s the fastest tightening cycle since the 1980s and was launched to try to tame inflation, which has raced to a 40-year high.

Prominent MPC hawk Catherine Mann, also an external member, railed against Dhingra’s view this week, saying more needs to be done on rates to stop firms and workers raising prices steeply and demanding high pay increases respectively.

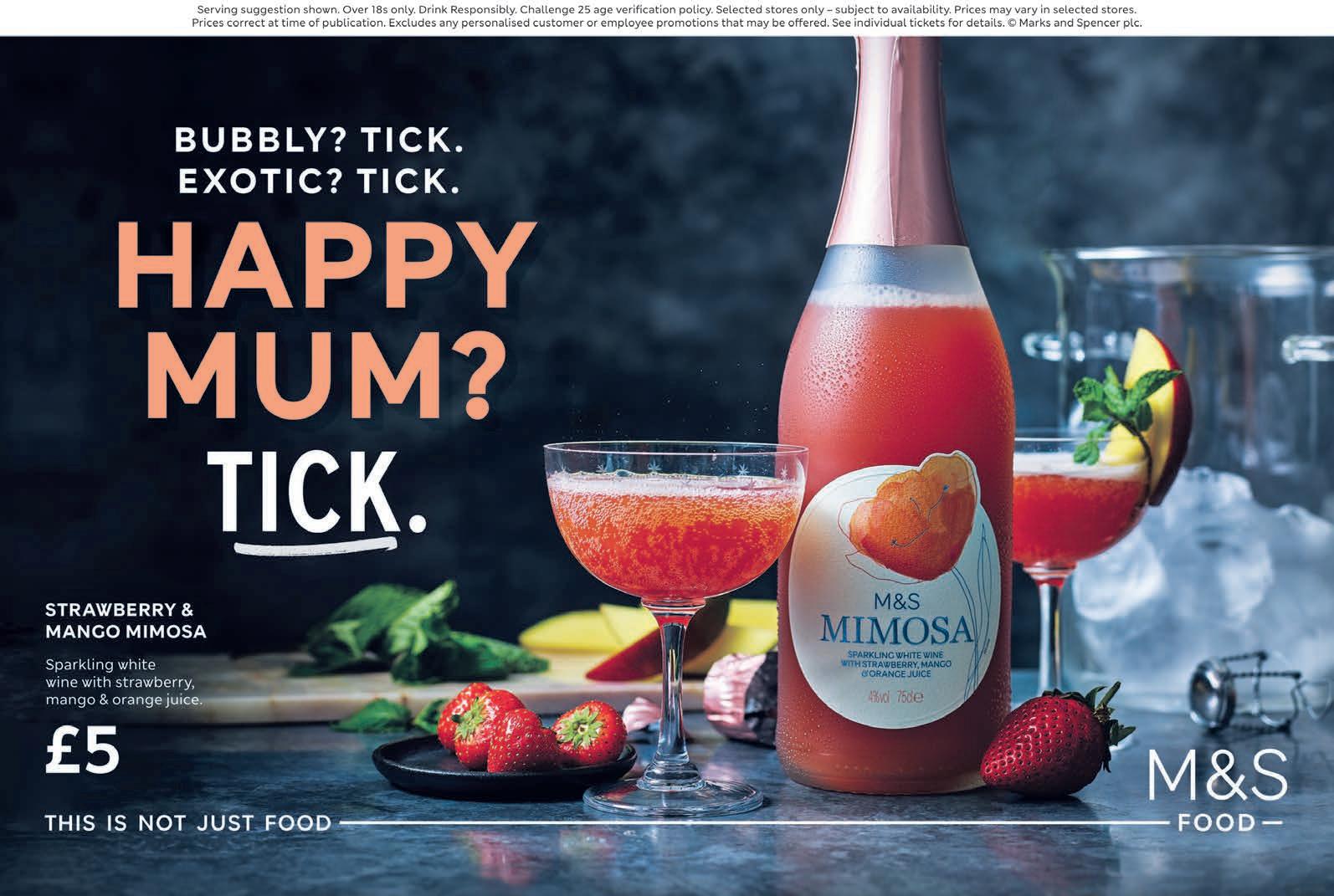

The Restaurant Group said it would convert some loss-making sites to Wagamamas

LAURA MCGUIRE

THE RESTAURANT Group (TRG) yesterday said it will shrink its leisure portfolio by 30 per cent after the group posted an annual loss of £86.8m.

The Wagamama owner said it will shutter some 35 “loss-making” locations, taking its portfolio down to 75-85, due to a “tough macro-

BELEAGUERED lender Amigo said its survival options had “diminished significantly” yesterday as it updated on efforts to raise £45m in a bruising meeting with shareholders.

Amigo has been hunting for investors to underwrite an equity raise as part of its plans to restart its full operations next year.

However, in its annual general meeting yesterday, bosses said after approaching 200 potential backers it had failed to secure the required cash, and warned that a “fallback solution” of an orderly wind-down of the business was the only viable alternative if investors failed to materialise.

environment”.

The listed restaurant group, which also owns Frankie & Benny’s, said that it will look to convert some underperforming sites to Wagamamas.

Andy Hornby, chief executive of TRG, told City A.M that the decision to close the underperforming sites was a “pragmatic” decision.

TRG shares closed down 15 per cent.

Raising the cash was “achievable”, they added, but the “funding gap is large and options to fill that gap have diminished significantly”.

Shares closed down 26 per cent.

The sub-prime lender has been on a survival footing since it was suspended from lending by the FCA after failing to conduct proper affordability checks and for dishing out high-interest loans to borrowers with shaky credit histories.

CHARLIE CONCHIE

PRESSURE is mounting on the Chancellor to scrap changes to research and development (R&D) tax credits in next week’s budget as over 150 start-ups and Britain’s biggest small business body launched a fresh offensive on the Treasury yesterday.

In an open letter published last night, the group of start-ups wrote to Chancellor Jeremy Hunt warning that planned cuts to the R&D credits, outlined in the autumn statement in November, will “damage the UK’s start-up ecosystem”.

Hunt’s plans will see the breadth of the existing scheme scaled back from the start of April and will slash the amount of R&D spend that start-ups can claim back from 33 per cent to 18.6 per cent.

The Sunday Times reported last weekend that Hunt is set to press ahead with the measures, with only small tweaks made for sectors like artificial intelligence and biotechnology to be outlined in the budget next week.

The changes have drawn the ire of startups across the UK, who argue that scaling back the scheme will hammer innova-

LOUIS GOSS

tion investment just as government mounts a push to make Britain a “tech and science superpower”.

Coadec and signatories of the letter have now called on the Chancellor to scrap the plans and reveal more support in the budget coming next week.

“Government backing twinned with British entrepreneurship has built one of the best start-up ecosystems in the world, but these R&D changes put it at risk,” said Dom Hallas, executive director of Coadec.

“The planned R&D tax credit cuts will mean less money for tech start-ups, less hiring and less innovation.”

A government spokesperson said: “The government recognises the hugely important role that R&D plays for the economy and society. At autumn statement, the government recommitted to increasing R&D spending to £20bn per year by 2024/25.”

The calls come as the Federation of Small Business launched a fresh offensive against the changes yesterday, after warning last month that the potential plans risked turning Britain into an “innovation wasteland”.

BEAZLEY was yesterday forced to publish a balance sheet correction after the Financial Times spotted an error in its annual report. In its annual results statement, insurer Beazley overstated the value of its ‘net assets per share’ in reporting them at 420.8c instead of their real value 386.7c.

CHARLIE CONCHIE

THE FINANCIAL Conduct Authority

(FCA) yesterday mounted a defence of its role in the botched charm offensive on British chipmaker Arm after the firm shunned a London listing for New York. Onerous reporting rules required by the FCA were one of the reasons for the firm’s decision to float on New York’s Nasdaq exchange, the Financial Times reported this week.

FCA chief executive Nikhil Rathi told

MPs: “In the case of Arm, we were aware and the government indicated to us that this was a company of national importance.

“Therefore we engaged to look at our rules where there was a case for making modifications,” he said. “You can rest assured that we are very engaged on these issues.”

Arm’s decision presented a wider question for how much the UK should prioritise the development of its capital markets in public policy, he added.

Beazley’s error is particularly significant due to the fact it uses the ‘net asset value per share’ metric as its “central performance indicator”.

The payouts given to Beazley’s top execs are linked to their successes in boosting achieving growth in the ‘net asset value per share’ metric.

In a statement yesterday morning, the FTSE 100 company admitted it had made an “error” in its report, as

Great value skiing in the peaks of the Pyrenees

it issued a correction to figures. The revised statement also saw chief exec Adrian Cox’s salary reduced by £138,464, to a total sum of £1.51m, and saw CFO Sally Lake’s remuneration dropped by £108,119, to £1.26m. However, a Beazley spokesperson told City A.M. that no real money was actually clawed back from its top executives.

NICHOLAS EARL

THE BIGGEST challenge for onshore wind developments is the same as for all renewable projects – the slow speed of connections on the grid, the boss of a leading renewables player has argued.

Zoisa North-Bond, chief executive of Octopus Renewables, criticised the grid as the “biggest limiting

factor” rather than planning hurdles and nimbyism.

The energy boss noted that with offshore wind projects, it was taking up to a decade to connect turbines to the energy network.

She argued that the processes of National Grid were obsolete for the challenge of vastly ramping up renewable power in line with energy security and net zero goals.

Current processes are “still based on ones from decades ago, where... maybe there’ll be two or three applications every few years”, rather than the thousands per year now, North-Bond explained.

A National Grid spokesperson said it was “committed to connecting projects to the grid as fast as possible” and was looking at “new ways to speed up the process”.

THE UK risks an exodus of energy technology developers to rival markets unless it provides more funding, the boss of a British battery cell specialist has warned.

Alan Hollis, chief executive of AMTE Power, told City A.M. that the UK government has to support and invest in technologies, such as batteries for electric vehicles, if it wants to maintain its leading role in the net zero race.

“It’s a very costly and time-consuming process to develop technology and then bring it to market,” Hollis said. “I would like to see more government support to the industry as a whole, to see how it can help accelerate the time to market for ourselves and others… so that we can establish the UK as a technology leading, advanced manufacturing country,” he added. Companies have been pushing the UK to boost funding for the sector as the US

Inflation Reduction Act and Biden’s $391bn clean energy package offers a raft of healthy subsidies and tax incentives, while the EU has also vowed to soften state subsidy limits.

“This is what AMTE Power is having to compete against in the world today,” Hollis said.

“We are driving the development cycle for products that we are bringing to market to support the UK automotive industry without the levels of funding and support that perhaps other companies in other countries are currently getting,” he explained. He hinted that the Londonlisted firm, which manufactures lithium ion and sodium ion battery cells typically used in electric vehicles, could look to other markets for future projects instead of the UK if more support wasn’t provided in the long term.

CHRIS DORRELL

GREEN finance chiefs agreed engagement with polluting companies was better than divesting as they faced MPs’ questions yesterday on how the City of London was supporting the transition to net zero.

Speaking to the Environmental Audit Committee, head of climate change at HSBC Tim Lord said “our strategy is absolutely around engagement”.

“The objective here is real economy

decarbonisation,” Lord said. While he noted the easiest way for an individual financial institution to decarbonise is to divest, “if emissions continue happening then there’s no benefit gained,” he said.

Investment funds have faced widespread pressure to divest from fossil fuels as part of the energy transition. However, many fund managers have argued engaging with companies is a more effective way of driving the energy transition.

Royal London yesterday said it had successfully boosted its profits by 58 per cent in 2022 in the face of “difficult market conditions”.

The insurer saw its operating profits jump to £210m as the adverse impacts on its asset management arm were offset by strong performances across the rest of its business.

Royal London, the UK’s largest mutual insurer, benefitted from high employment which saw its workplace pensions segment grow 29 per cent to hit £4.1bn. This offset a major drop in profits from Royal London’s asset management business. The value of its assets plummeted by £20.3bn.

Hiscox yesterday announced its longserving chairman Robert Childs (pictured) would be stepping down from his position this year after 37 years at the firm.

Hiscox chief executive Aki Hussain said Childs had been “instrumental in building Hiscox into a respected global brand and has navigated the business expertly through many insurance cycles”.

The news came as the insurer posted a strong set of results, posting its highest underwriting profits since 2015.

Profit from its insurance business surged 25 per cent,

from $215.6m (£182m) in 2021 to $269.5m (£227.6m) in 2022, shrugging of the potential impacts from several extreme weather events and the war in Ukraine.

Shares in the firm jumped five per cent after the insurer hiked its dividend from 34.5c to 36c.

Hiscox, however, saw its pre-tax profits drop 76.6 per cent to $44.7m, as rising interest rates caused the value of its bonds to fall.

Speaking to City A.M., Hussain said the firm was “very pleased with the results” and it is “now facing into the best pricing and underwriting conditions we’ve seen in 10 years”.

ahead of Easter and Mother’s Day as consumers pull back spending.

CHARLIE CONCHIE

CYBERSECURITY firm Darktrace yesterday warned of a rise in AI threats after reporting a plunge in profits in the first half of its financial year.

In a trading update on the six months to the end of December, the firm said operating profit had fallen 91.6 per cent to $577,000 (£487,000) compared to the same period in 2021.

Bosses said the fall was down to an “elevated share-based payment and associated employer tax charges” relating to a block of share grants it made when it floated in 2021, but claimed the fluctuation would settle.

The firm also warned over the shifting cybersecurity landscape. Citing the rise of ChatGPT and new “hacktivist” threats, the firm said scams were becoming increasingly sophisticated as criminals capitalise on AI tools.

However, Darktrace CEO Poppy Gustaffson said the firm would ensure its customers were protected against the “threats of tomorrow”.

“We’ve built our whole product set around the notion of defending against threats never seen before through our AI’s bespoke understanding of each individual organisation,” she said.

Revenues at the firm rose 35.8 per cent despite a “noticeable second quarter slowdown” in new business.

The results come after a tricky period for the feted cybersecurity outfit, whose shares have tumbled below their IPO price this year amid questions over its financial processes and controls.

Darktrace announced at the end of last month it would call in EY to inspect its financial processes and controls in a bid to settle investor nerves.

Gustaffson said the business

“continues to deliver against a challenging macro-economic backdrop”, citing the strong yearon-year revenue growth.

Bosses doubled down on their revenue and earnings before deductibles targets for the year.

Shares closed down marginally.

Darktrace boss Gustaffson warned scammers were increasingly employing AI

LOUIS GOSS

LEGAL & General (L&G) yesterday hiked its dividend after outstripping expectations by boosting its profits by 12 per cent.

Higher profits in L&G’s pensions and life insurance segments offset lower incomes from its asset management business, LGIM, after it suffered from market volatility.

L&G upped its dividend by five per cent to 19.37p as its overall

operating profits increased by 12 per cent to £2.52bn.

The London financial services giant derived most of its profits from its pensions business.

L&G chief executive Sir Nigel Wilson, who announced his retirement from the company this year, said the group had “delivered another strong result in 2022, ahead of expectations”.

Shares dropped to close down near two per cent.

Speak with most tech and innovation figures in the UK currently and you will hear a similar gripe: institutional investors are not pulling their weight.

Investment into the UK’s tech sector, as with most of the world, has fallen sharply in the past year and brought into sharp relief a funding gap, one that they argue is driving the UK’s most innovative firms to greener pastures.

Pension and insurance funds, sitting on trillions of pounds of capital, are seen by the tech industry as key to getting the innovation economy moving.

Sam Gyimah, a former Conservative innovation minister who now works for venture capital firm Lakestar, is a man who makes that argument fervently.

“The uniquely British problem is the fact that structurally, if you look at any investment round, where the entrepreneur or the founder is raising more than £100m, it is very rare to find it being led by a British fund or institution,” Gyimah told City A.M.

“You have the Canadians in there, you have funds from the Middle East and you have the Americans in there, but very rarely do you have European investors, and that is a problem.”

from about half of their portfolios to four per cent over the past two decades, according to data from Ondra, as reported by the Financial Times. The holdings in unlisted firms are even more minuscule. Unlike Canadian and US pension giants which have swooped

Gyimah, who left politics in 2019 and says his former life is now “in the rear view mirror”, argues that there is still a mindset issue among institutional investors that needs to be addressed in order to keep firms scaling in the UK.

“In the tech space, in the life sciences

space, you do see [firms going to the US] because there is a perception, quite right in many cases, that there are more investors that are willing to back growth,” he says. “I think that this is an issue that is of serious concern.”

His comments come as the City has been plunged into a period of introspection after a slew of firms ditched London’s markets in favour of the promised land –the US.

Politicians and regulators are now working hard to boost London’s appeal. Gyimah says progress in reform has been “very encouraging”, but what is ultimately needed is a “consolidation” of defined contribution pension plans and a way to “incentivise some of the capital to flow towards growth”.

Because in Gyimah’seyes, it is big institutional investors that hold the key to London's capital markets success.

BRITAIN’s accounting watchdog has fined PwC and two of its former partners a combined sum of almost £8m over repeated failures in the firm’s audits of UK defence company Babcock International and its Plymouth dockyard subsidiary.

The UK’s Financial Reporting Council (FRC) hit PwC with a £7.5m fine – discounted to £5.625m for the firm’s compliance – over its repeated failures to properly scrutinise Babcock’s accounts.

The watchdog said PwC repeatedly failed to challenge Babcock’s management in its 2017 and 2018 audits of the firm and failed to obtain sufficient evidence to properly carry out its job.

The FRC said that, in auditing Babcock, PwC failed to get hold of a 30-year contract that accounted for around £77mworth of the defence company’s 2018 revenues. The Big Four auditor also failed to translate a 10-year government contract, written in French, worth €640m, despite the fact no one

on PwC’s audit team had sufficient language skills to interpret it properly.

A PwC spokesperson said:

“We’re sorry that the work in question was not of the standard required and that we demand of ourselves.”

The FCA launched a similar crackdown on crypto ATMs in Leeds

KIRSTIN RIDLEY

BRITAIN’s markets regulator and police have swooped on suspected illegal crypto cashpoints (ATMs) across east London as authorities step up attempts to disrupt unregistered businesses deemed high risk for consumers.

The Financial Conduct Authority (FCA), which last month launched a

LAURA MCGUIRE

JOHN LEWIS has faced pushback over its first build-to-rent development after the leader of Ealing council accused the firm of “bullying” and raised concerns about the lack of affordable homes for locals in the area.

Peter Mason, leader of Ealing council, took to Twitter to slam the retail group about the possibility of it not delivering on its promise of making 35 per cent of the homes in its new 19-storey apartment scheme affordable, as the west London suburb becomes oversaturated in private rental builds.

“Ealing needs genuinely affordable housing, above all, and above all other types of housing,” the tweet read.

The grand plans to build 430 new homes above a Waitrose supermarket are already “months behind schedule” according to local residents, The Times reports.

Speaking to The Times, Chris Harris, director of property at John Lewis, played down the dispute, stating that there was

“always a bit of argy-bargy” in high profile developments.

A John Lewis Partnership spokesperson told City A.M. that the group has given a “great deal” of thought to the design and the latest consultation, which will take place later this year, is another important step in “continuing our conversation with the council and local people in helping to shape our plans”. The homes are due to be ready by 2028.

similar crackdown in Leeds, yesterday said it was reviewing evidence gathered from “a number of sites” and might take further action. The inspections were conducted under money-laundering regulations, which allow officers to enter premises without a warrant, observe activities, seek explanations about documents or information and take copies.

Crypto ATMs (CATMs) allow people to buy or convert money into cryptoassets. But no CATM operators are registered with the FCA, which means any operating here breach British anti-money laundering regulations. CoinATMRadar put the number of these cashpoints in Britain at more than 270 in 2020. It is now showing only 19 locations, 12 of which are in London.

PLANS for a major new development in the Square Mile that will boost its cultural offer and support it as a seven-day-a-week visitor destination have been approved.

The scheme at 65 Crutched Friars will create a new permanent home for the Migration Museum, currently based in Lewisham, over three floors including exhibition and event space, a cafe and shop.

The Museum explores how the movement of people to and from Britain across the ages has made us who we are – as individuals and as a nation. It will include an educational outreach

programme to engage with diverse communities across London and the UK.

The development will include a mix of studio apartments and shared accommodation for students with 35% of the 769 rooms classed as affordable housing.

RESIDENTS and organisations in the City are being asked to give their views on what volunteering means to them.

The City of London Corporation is carrying out a survey aimed at understanding the volunteering needs of residents and how Square Mile organisations can best involve them.

It has commissioned volunteering charity Tempo Time Credits to carry out the research, which can be completed online or by attending drop-in sessions. The results of the survey will shape how

the Square Mile’s governing body supports residents to volunteer and community groups to engage volunteers.

Access the survey at bit.ly/3ZDMu7o

ADOMINANT CEO, a board willing to ignore the interests of small shareholders and a spiralling share price: mix the ingredients together, and deliver to shareholders.

A corporate governance row unfolding at Gousto, the healthy meal-kit delivery company, offers a salient reminder that privately owned company boards are just as capable of screwing these matters up as their more closely scrutinised listed peers.

To recap: Gousto, which attained a unicorn valuation in 2021 and trumpeted a $1.7bn price tag just over a year ago, decided late last year that it needed to raise another £50m in equity and £20m in debt to ride through an anticipated economic downturn.

So far, so sensible. It’s also hard to argue against the idea that a steep valuation discount would be required in order to get the raise away quickly.

But an 80 per cent discount to the last round, 13 months previously, for a company not obviously in distress? That is steep.

Worse, Gousto’s board, chaired by Katherine Garrett-Cox, the former Alliance Trust chief executive, excluded a number of smaller, long-standing investors from the round, while simultaneously approaching a number of institutions which are not currently shareholders in the company.

Given the heavily dilutive effect of the Series M fundraising, the indignation of the investors who were frozen out is understandable.

ISUPPOSE you can’t accuse him of not being a straight talker. Presenting London Stock Exchange Group’s full-year results last week, CEO David Schwimmer was asked about the sudden fears of an exodus from the UK equity markets. The question was prompted by the announcement from building materials group CRH that it plans to shift its listing to the US, in the wake of Flutter Entertainment’s decision to launch a

similar move. Then at the weekend, I reported that Wandisco, the data company, was preparing to establish a dual listing in the US – which the company then confirmed on Monday.

Schwimmer’s nonchalant response? “If companies are going to make decisions when most of their business is in the US, that sort of is what it is.”

The company’s response is that over 90 per cent of shareholders were eligible to take part in the open offer. It’s baffling that Gousto hasn’t clocked that this marginal squeezeout makes its conduct worse, not better.

It’s hard to square Gousto’s trumpeted B-Corporation status with the actions of a company whose founder sold shares at a $1.7bn valuation 13 months ago, only to buy more stock at a sub-$300m valuation in a cash call that was not open to all of his investors.

Shouldn’t Boldt, conscious of the longstanding support of his early backers, have declined the opportunity to take part? Or better still, insisted that all shareholders be included in the open offer?

I understand that the terms of the latest share sale included a 3x preferred return clause, meaning that investors in the latest round will receive the first £150m in proceeds from a future sale of the company.

A Gousto spokesman acknowledged that Boldt had participated in the recent cash call, spinning it as “reflecting Timo’s continued commitment to the business and his belief in its future growth prospects”.

Beyond that, requests to Garrett-Cox and Powerscourt, the company’s financial PR adviser, are met with stony silence. Gousto is now, in valuation terms, an erstwhile unicorn. If it continues to harbour ambitions for a future public market listing, it has some serious growing up to do if it isn’t to risk going the same way as the mythical creature.

I understand some colleagues at the LSE subsidiary were somewhat displeased by their boss’s remark. The Exchange may be a mere utility and relatively insignificant in the context of LSEG’s earnings, but its symbolic importance to the City and the UK economy remains profound. Schwimmer would do well to remember that.

OH, the irony. A matter of weeks after M&G fund managers forecast a wave of overseas bids for London-listed companies, it turns out that one of those targets is M&G itself.

The latest suitor, as I reported on Sky News last week, is Macquarie, the Australian financial behemoth. Acquiring M&G’s asset management business would fill a notable gap in Macquarie’s European fund

management operations, even if a deal will be laden with complexity.

The Australian group is seeking a partner to take on M&G’s insurance operations, with one of the obvious players –Phoenix Group –already consumed with digesting

earlier acquisitions. Executing a deal might also be more straightforward if a London-listed insurer provides the vehicle to acquire M&G and sells the fund management arm on to Macquarie, rather than vice versa.

M&G’s ability to forge a

robust bid defence looks flimsy: a new management team and a weak track record of value creation since it was spun out of Prudential.

The absence of a stock exchange confirmation about Macquarie’s interest has removed the temporary ballast from M&G’s lacklustre share price, but I am reliably informed that a formal approach to its board is now not far away.

JESSICA FRANK-KEYES

IMMIGRATION to the UK has hit record levels, despite labour shortages in key sectors, amid a fresh wave of public positivity towards arrivals. In the year ending in June 2022, long-term immigration into the UK was around 1.1m, up by 435,000 on the previous annual figure.

Employment-related migration fell in vital sectors such as hospitality and transport, sparking worker shortfalls , a UK in a Changing Europe (UKICE) report found.

But the post-Brexit era has seen the biggest flow of refugees to the UK since the Second World War.

It comes just days after Prime Minister Rishi Sunak unveiled tough

new legislation aimed at stopping small boat crossings in a bid to deliver on his five key pledges ahead of an election.

Jonathan Portes from UKICE said: “The biggest shake-up in UK immigration policy for half a century coincides with a sustained shift in public attitudes in a more positive direction.”

LSEG boss can’t Schwim against the tide of the City’s history

Lour inaugural Global Talent Trends 2023 survey, which shared valuable insights into workplace trends and practices from more than 8,400 professional accountants around the world. We found that out of all the topics covered in the report, hybrid working attracted the most attention.

This deep interest in hybrid work models is not surprising given many companies – including major employers like Apple and Amazon - are still trying to figure out how to apply them in practice. ACCA’s research highlighted a couple of significant challenges. While most employees (70 per cent) believe they are more productive when working remotely, nearly half (47 per cent) find it harder to collaborate while over a third (34 per cent) admit to feeling more disengaged from their manager.

The collaboration and engagement challenges associated with hybrid working help to explain why a fifth of UK accountants, and more than half of accountants globally, still work full time in the office. This is despite most respondents to our research (87 per cent) saying they would like to work remotely for at least one day a week. Additionally, the data indicates that workers with hybrid arrangements are less likely to suffer from mental health issues, meaning a lower chance they will take time off work.

International Women’s Day, yesterday, is an important time to note the

Brand

differences for women, who are more likely to believe they are more productive when working remotely. Female workers are also less likely than their male counterparts to struggle with collaboration or engagement. That said, it’s important to emphasise that both men and women are strong advocates of hybrid working, which suggests the practice could contribute to a more inclusive and gender-equal workplace in future. Overall, our data suggests finance professionals working in hybrid roles are happier and less likely to leave their organisations.

Going forward, hybrid working will be fundamental to the employer value proposition for many employers, although it’s important to note that it’s a luxury that is not practical for all sectors and professions. But for those where it is possible, including many in finance and accountancy, what is preventing more employers from adopting the model today? And how can we make hybrid working work more effectively, for both employers and employ-

ees? How can employers provide the leadership that is so important to make it a success?

A recent webinar hosted by ACCA offered some useful pointers. Firstly, employers should recognise that there is no one-size-fits-all model for hybrid working. Different organisations will need specific approaches that fit with their own culture and needs. They should also engage with their people to determine the model that will work best for them, being mindful of risks relating to data protection and proximity bias (where managers favour employees they see face-to-face).

Furthermore, hybrid working is not just about where people work, it is also about how and when they work.

So, it’s essential to equip employees with the right technological tools to collaborate – while providing clear guidance for how to use these tools and recognising that no one wants to spend their working day in back-toback online meetings.

Finally, if employers want to encourage their employees to interact in person, they need to reimagine their physical workspaces. Workspaces must be destinations that people actively want to spend time in, and employers should create reasons for people to come into the office –whether that’s to collaborate on a project, celebrate a success, or participate in certain types of training. Faceto-face meetings can also be useful for onboarding new joiners and facilitating mentoring.

At ACCA, we have had a very positive experience of adopting hybrid working practices. We’ve adopted what we describe as a ‘blended approach’, where most of our employees work mainly from home, but we use our offices to enable people to gather physically where there is a clear need and desire, and to ensure they have a choice of workplace. We believe that work is about productivity, not visibility, and we have found that hybrid working has boosted the effectiveness of our globally distributed teams.

It’s important to bear in mind that we are all still learning and adjusting to the new reality. There’s no shame in taking a trial-and-error approach. By showing flexibility, sensitivity, and a willingness to communicate, employers will be best placed to develop a practical hybrid work model that reduces the stress felt by employees and enables them to be more productive and derive greater enjoyment from their jobs.

Hybrid working is ultimately a winwin for both employers and employees. It is good for employees’ mental health and helps previously excluded people to become more visible. At the same time, it brings greater choice to employers by enabling them to recruit from the broadest possible talent pool. It’s in everyone’s interests that we make hybrid working work.

Read the research at accaglobal.com/talenttrends2023

We believe hybrid work is about boosted productivity, not visibility

JEREMY Hunt is going to let a lot of people down at his budget next Wednesday. Businesses. Families. Even former Prime Ministers.

The Chancellor is poised to resist calls to save a flatlining economy by staying the course set in his November autumn statement of balancing the books.

Households want an extension of energy support into the summer. Companies are crying out for at least some softening to the six point corporation tax hike. There’s a risk neither will happen.

Bound by his fiscal rules of slashing the debt stock and capping day-to-day borrowing at three per cent of GDP, the 15 March budget will be a calm affair, focused on trimming down government support and sticking with tax rises.

There may be a small tax cut here or a slight spending rise there. But Hunt and Prime Minister Rishi Sunak will save the meaty giveaways until the run up to the next election, which has to happen before late January 2025.

“With crowd-pleasing tax cuts likely to come far closer to the election, and further away from our current period of high inflation, the upcoming budget is not likely to be one where tax policy shifts markedly,” James Smith, research director at the Resolution Foundation, told City A.M.

In sum, most expect this to be a placeholder budget.

So what will Hunt actually do? Or, a better question, what can he do?

The objective of any Chancellor is to ensure their tax and spending decisions keep them within their fiscal rules.

Recent developments have made the near-term outlook for the public much better.

Hunt is calculated to have pocketed an around £11bn saving from energy prices tumbling below their RussiaUkraine war levels reducing spending

on the £2,500 energy bill freeze (part of this saving has been offset by lower receipts from the energy company windfall tax).

Much lower interest rate expectations compared to November and a faster than projected inflation drop will curb debt interest spending, handing Hunt “something like £10bn a year (but would still imply more debt interest spending than expected a year ago),” Carl Emmerson, deputy director of the Institute for Fiscal Studies, told City A.M.

In sum, borrowing this year and next

is now projected to be around £30bn lower than the Office for Budget Responsibility (OBR) forecast a few months ago.

However, the official forecaster has told Treasury officials it has slashed its long term GDP forecasts, which could wipe out nearly all Hunt’s breathing space over the coming years.

“This will probably leave the Chancellor with ‘headroom’ of £8bn against his fiscal target… compared to £9.2bn in November,” Ruth Gregory, deputy chief UK economist at Capital Economics, said.

Lower growth cuts government revenues due to people being sacked and spending less.

So Hunt has some near-term firepower he could unleash, generated from savings on a lower debt interest

bill and less costly energy support packages. But most of this will be eaten up by structurally weaker GDP growth.

Although Treasury officials have said no decision has been taken yet on fuel duty, the Chancellor is almost certain to freeze it again, costing him around £6bn.

It was scheduled to rise sharply, which the OBR baked into its November forecasts.

No Chancellor has allowed it to jump since 2011.

“This would be a bad decision –apart from climate considerations, fuel duty cuts largely benefit the wealthiest households who are more likely to drive petrol-hungry SUVs,” Lukasz

Krebel, an economist at the New Economics Foundation, told City A.M.

There is a chance he will “soften the tax rises set to kick in in April,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, thinks.

He sees “an even chance of him raising the income tax personal allowance to demonstrate that his cautious stewardship of the public finances is bearing fruit”.

One surprise move the Chancellor may opt for is “asking the Bank of England to stop paying interest on part of its reserves,” Smith added.

Doing so would ease pressure on the public finances by reducing payouts from the Treasury to the Bank of England to cover a spread between what the central bank gains on bonds it purchased under quantitative easing and

pays on reserves. The Bank booked its first loss on the QE bonds recently due to interest rates rising. Bond prices have dropped sharply over the last year to account for higher rate expectations, forcing yields higher.

The Bank also booked a near £4bn profit on bonds purchased after the mini-budget, money that has flowed back to the Treasury.

Hunt is also reportedly mulling softening a corporation tax rise to 25 per cent from 19 per cent by watering down and extending the 130 per cent investment tax relief.

There could be some tweaks to pension tax reliefs as well.

One benefit of launching temporary support packages to soothe economic shocks is that Chancellors can use short-term financial windfalls to expand or extend them, so long as they’re actually time-limited.

The energy price cap is poised to jump to £3,000 from April, a decision made at a time when international gas prices were sky high and the Treasury

wanted to limit its exposure to energy market movements.

A huge price climb down since means, come the beginning of summer, energy regulator Ofgem is set to peg the cap at below £2,500, meaning Hunt would only need to step up spending to help families with their bills for around an extra three months.

According to the Resolution Foundation, keeping the cap at its current level would cost just £3bn.

Britain is suffering from a peculiar drop in workforce participation since the beginning of the Covid-19 crisis, with about 900,000 fewer people economically active.

Hunt has devoted big chunks of speeches since the turn of the year to luring these people back into work, with a particular focus on early retirees.

However a string of experts have urged him to focus on mothers and disabled people to plug employment gaps, not older Brits who are unlikely to come back from the golf course.

The Centre for Progressive Policy, Oxford Economics, Confederation of British Industry and other economic groups have urged Hunt to step up childcare support to boost labour market participation.

Public sector pay awards are also being weighed up by the Chancellor and Prime Minister Rishi Sunak.

In sum, next week’s budget is set to shift cash around, but not expand the actual public spending envelope or raise taxes meaningfully: a placeholder budget to tide us over until the run up to the next election.

Structurally weaker growth will eat away at the benefits of lower energy prices

A placeholder budget until the next election

Jack Barnett looks at whether Jeremy Hunt might surprise markets next week –or whether the Tories are banking on boring

WHAT WAS YOUR FIRST JOB?

I grew up in Texas and my very first “real” job - not counting underage babysitting at the age of 11 - was at Popeye’s Chicken on my 16th birthday. I was a cashier after school, and on weekends, for about 6 months before going to work in a retail store.

WHEN DID YOU KNOW THIS WAS THE INDUSTRY FOR YOUAND WHEN DID YOU KNOW YOU MIGHT BE GOOD AT IT?

When I was in 8th grade, a company donated a computer to my school. I was fascinated and even asked my teacher if I could take it apart to see how it worked inside. When I went to university, I took a job in the computer lab at the school of engineering, and it changed my life, literally. I shifted my major to Information Systems because there was one female teacher in that program, and there were no female teachers in the engineering school.

WHAT'S ONE THING YOU LOVE ABOUT THE CITY OF LONDON…

That’s it’s a city within a city, with its own vibe and culture.

...AND ONE THING YOU'D CHANGE

There is still visibly a lack of women of colour in the City of London. While there’s been much progress since the first time I visited 16 years ago, Professor Louise Ashley’s research, which specifically focuses on law firms in the City, shows that more than half of all partners are white, male, and privately educated. I would like to see significant progress on this issue, particularly at the management level.

ARE YOU OPTIMISTIC FOR THE YEAR AHEAD?

Yes I am. My organisation – the Chartered Management Institute – is really shaping how businesses think about management and we’ve actually flourished during and postpandemic. I credit the culture and people of the CMI who believe and stand by our mission.

WHO'S THE CITY OR BUSINESS

FIGURE YOU MOST ADMIRE?

I hugely admire Dr Elizabeth Shaw, the founder of 1000 Black Voices. An organisation that works to tackle the disadvantages that ethnic minorities face in the technology industry and in broader society.

WHAT'S YOUR MOST MEMORABLE JOB INTERVIEW?

My most memorable job interview was at the start of my career. I was

interviewed by a panel of six men where one of the interviewees actually said, “we were expecting a man for this job…it is a technical position, but since you are here, you can stay.” To which I replied, “Oh, I had every intention of staying.”

I got the job thanks to the “support” of one of the other men in the room telling me he liked my “feisty” attitude, and that I would shake things up with the boys.

If that scenario happened today, I would not have taken the job, but that role did help launch my career, and I learned a lot (both good and bad) about how to navigate in an industry that was heavily male-dominated at that time.

YOU'RE HOSTING A BUSINESS LUNCH IN THE CITY. WHERE

FAVOURITE...

FILM:

THE IMITATION OF LIFE, I WATCH IT WITH MY GRANDMOTHER AND MOTHER

BOOK:

FREAKONOMICS BY STEPHEN J. DUBNER AND STEVEN LEVITT

BAND, MUSICIAN OR ARTIST: I AM MORE INTO THE 90S GENRE OF R&B AND NEOSOUL COFFEE ORDER: I DON’T DRINK COFFEE

NEWSPAPER: APART FROM CITY AM, THE DIGITAL VERSION OF THE SUNDAY TIMES

ARE WE GOING?

I don’t often go into the City for lunch, but I’ve always loved the Grade I architecture of the Ned on 27 Poultry.

AND WHERE'S YOUR FAVOURITE PUB IN LONDON?

Despite living in London for many years, I’ve never quite gotten into the pub scene. The only time you’ll really catch me in a pub is for a friend's birthday.

WHERE'S HOME DURING THE WEEK?

My flat in Central London or the South of France.

AND WHERE MIGHT WE FIND YOU ON A SATURDAY AFTERNOON?

My reformer Pilates class in the morning then enjoying a relaxing day with my husband. That usually involves going for a walk, maybe to a museum, or going for a drive.

YOU'VE GOT A WELLDESERVED TWO WEEKS OFF.

WHERE ARE YOU GOING?

Back to Texas to spend time with my family and friends. I can’t relax if I take off more than two weeks, so the time I do take off for more than a week, it’s to go back to the USA.

We dig into the memory bank of the City’s great and good: this week, the Chartered Management Institute’s tech chief Tavier Taylor tells us about Texas, job interviews and pilates

Great strides have been made over the past few years around raising the profile of mental health and wellbeing and its importance in our lives. Since the pandemic there has been an increased acknowledgement, both at individual and at societal level, of the need to respect and care for our mental health. And now with pressures related to the cost of living affecting people, it’s even more important to shore up our mental resilience and normalise asking for help if we need it.

This shift in attitude has profound implications, reframing an issue that affects all of us. Just as we experience variations to our physical health, the same applies to our mental health, and increased acknowledgment of this has stripped much of the stigma away, allowing more people to access help and support.

One misnomer over the years has been the idea that mental health is the same as mental illness. While mental illnesses are diagnosed con-

ditions that affect thoughts and behaviour, mental health refers to anyone's state of mental and emotional wellbeing. And as a building block to our life experience, good mental health is something we should –and can – pro-actively maintain.

TAKING CHARGE

Staying on top of our mental health helps us cope with the normal stresses of life, deal better with challenges we may face in the future and, over time, can also reduce our risk of physical health problems and help to build mental resilience.

Often the first step is just to realise there is help out there that can make a real difference. The digital age has opened up access to mentalhealth resources and helpline services, with much of it now available at the touch of a button.

Those experiencing low mood or sleep problems, but who are coping, having normalised these negative feelings, or those who are starting to struggle and experience distress might not necessarily need clinical

or therapeutic interventions, but could benefit from improving their mental health and wellbeing. Using the open-access digital resources available can be a powerful way of doing this and preventing difficulties from escalating into problems that may eventually require clinical intervention. The NHS App is an invaluable resource to find available mental health support. Other help in the palm of your hand includes Samaritan’s Self-Help (selfhelp.samaritans.org), where you can explore relaxation techniques, record your mood and look for patterns in how you’re feeling and make a personal safety plan, and Shout (www.giveusashout.org) whose website provides resources and tips on coping with feeling anxious, low, stressed or overwhelmed.

The Better Health - Every Mind Matters website tackles the four most common sub-clinical mental health concerns of anxiety, low mood, stress and sleep difficulties, and offers a free personalised Mind Plan to help you feel more in control — Amazon Alexa users can say,

The free NHS App is a simple, secure way to access NHS services including ordering repeat prescriptions and finding mental health services. It is available to anyone aged 13 and over registered with an NHS GP practice in England and the Isle of Man. Visit nhs.uk/nhs-app or download from the App Store or Google Play.

‘Alexa, start my Mind Plan’ to access it — while the Every Mind Matters email programme has tips on how to deal with anxiety and make these new steps part of your daily routine.

Chasing the Stigma’s Hub of Hope website and free app is another wide-ranging resource, listing local and national resources to help you tackle a range of mental health concerns, including NHS, community, voluntary and private sector services. For those struggling with common mental health disorders including depression, anxiety, phobias, panic attacks, obsessive

compulsive disorder (OCD), body dysmorphia or post-traumatic stress disorder (PTSD), NHS talking therapies are free, effective and confidential treatments delivered by fully trained and accredited NHS practitioners. Go to nhs.uk/talk to find your local NHS talking therapies service. To be eligible you just need to be registered with a GP. It’s vital not to wait until your mental health has declined to support it, and to take timely action if it has dipped, rather than allow problems to grow.

Oftenit’s the range and creativity of support that might be something people haven’t considered. Luke Funnell runs Project Rewild, a community-based Hastings initiative aimed at helping men with their mental health through outdoor activities such as fishing, swimming or even just sitting round a firepit. Funnell says, “I know from experience it can be quite hard to engage men, especially when you’re asking them to talk about their feelings. I

was trying to make it accessible rather than just do some sport, to help people connect with the natural world and with each other.” The feedback, he says, has been transformative: “For the regulars in particular you sense it’s having a big impact on their lives. They're opening up and talking to us more about things but also realising that other men are going through similar problems or fears and listening too.”

Rachel Conlisk, who runs the friendship café, Creative Active Lives in Stourbridge, West Midlands, believes finding kindred spirits helps improve people’s mental wellbeing. She set up her initiative offering free activities such as steel drumming, coding and crafting, after hula-hooping helped her find a way to connect with others when she was feeling low ten years ago. “I was anxious and depressed, but hulahooping gave me confidence and brought me into a circle of people I felt comfortable talking to, “she says. “That helped me feel less isolated.”

Few people go through life without needing help. There are many simple things we can do to improve our mental health and make a positive difference to how we feel.

The way we think, feel and behave are linked. Sometimes we develop patterns of thought that are unhelpful, so recognising them, thinking about them differently and replacing them with alternatives can improve your mental wellbeing. Think about what you might say to a friend in a similar situation; you’ll probably take a more compassionate approach.

Spending quality time with friends or family, talking to someone about how you’re feeling or finding ways to help other people can all help stop you from feeling lonely and improve your mental health and wellbeing. This can be online, over the phone or seeing someone

in person.

Being active is not just good for physical health, it’s good for your mind too. It can help you burn off nervous energy, and, while it will not make feelings of distress disappear completely, it can make them less intense. You might choose a short walk in the fresh air, gentle yoga or set yourself a bigger challenge. The NHS Active 10 app can help you track your daily walks or you can build up to running 5km in nine weeks with the NHS Couch to 5k app.

Being active, enjoying the outdoors and having a healthy, balanced diet all impact how we feel. Also, binning bad habits like smoking and cutting down on alcohol can have a positive effect on our mood. Visit nhs.uk/better-health for more help.

Make a plan for managing upcoming stressful days or events – a to-do

list, travel timetable or note of things you need to take can help. If a task seems overwhelming and difficult to start, try breaking it down into more manageable chunks and give yourself credit for completing them.

Keep a diary of what you are doing and how you feel at different times to help identify what's making you anxious and what you need to do to manage it. You can also write down some of the challenging situations you have overcome in the past as a reminder of what you’re capable of.

Take time to appreciate the present moment — known as being ‘mindful’ — and not think about the future or the past. This can be helpful as you have some control over the present, but you have no ability to change things that have already happened and have less control than you might think over future events.

USEFUL RESOURCES

Better Health -Every Mind Matters

www.nhs.uk/every-mind-matters

NHS Talking Therapies nhs.uk/talk Hub of Hope Hubofhope.co.uk Samaritans Self-Help selfhelp.samaritans.org SHOUT www.giveusashout.org

If you are having thoughts about suicide, are harming yourself or have considered self-harm, it’s important to tell someone. If you can’t wait to see a doctor, get support here: Your local 24/7 NHS crisis line: at nhs.uk/urgentmentalhealth or visit 111.nhs.uk

Under 35? Visit papyrus-uk.org, call 0800 068 4141 (9am-midnight, seven days a week, 365 days a year), text 07860 039967 or email pat@papyrus-uk.org.

If you do not feel you can keep yourself or someone else safe, call 999

LONDON’s FTSE 100 was tamed yesterday by a sell-off that gathered pace in Wall Street Tuesday night after US Federal Reserve chair Jerome Powell signalled outsized interest rate rises could be back on the menu.

The capital’s premier index squeezed out a 0.13 per cent gain to close at 7,929.93 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell 0.52 per cent to 19,851.97 points.

America’s top indexes the S&P 500, Dow Jones and techheavy Nasdaq all clocked steep falls on Tuesday following chair Powell’s hawkish remarks to the US congress.

London markets traded for about an hour after Powell’s comments and eventually closed just about in the red.

Powell said the eventual interest rate

peak may wind up being higher than expected to tame inflation that has shown signs of late of sticking around.

Victoria Scholar, head of investment at Interactive Investor, said: “European markets [were] mostly in the red [in the morning] taking their cues from last night’s Fed-driven sell-off on Wall Street.”

A rally from insurer Hiscox sending it more than five per cent higher helped the FTSE 100 just about keep its head above water.

The pound, which slid sharply Tuesday after Powell’s speech, losing as much as 1.2 per cent against the US dollar, was broadly flat yesterday.

Traders piled into the greenback on the prospect of bagging gains on higher rates on US government debt. The yield on the two-year treasury hit its highest level since 2007 on Tuesday. Yields and prices move inversely.

Investment confidence in Hotel Chocolat is melting away, with backers flaking over its lower-than-expected profitability – which is now expected to come in at £4-7mwith its gross margin weighed down 200 basis points from cost pressures. However, Peel Hunt is committing to a long stay with the stock, maintaining a hold position at 175p per share.

Industrial laundry and workwear apparel giant Johnson Service Group has strong organic revenue growth of 28.8 per cent –although activity in the UK is still slightly below the 2019 level. Pricing momentum is well orientated in the UK, especially in hospitality and in healthcare. Peel Hunt has placed the buoyant firm on its add list, with a target price of 124p per share.

“US markets opened modestly higher after the latest ADP payrolls report showed that 242,000 jobs were added in February, slightly above expectations. On wages, there was a slight drop to 7.2 per cent from 7.3 per cent, which still remains well above core inflation.

MICHAEL HEWSON, CMC MARKETS

ALMOST a decade on from losing their investments, customers of collapsed crypto exchange Mt. Gox could see some of their funds returned by the end of the year.

Mt. Gox was a Tokyo-based exchange which launched in 2010only a year after the original cryptocurrency, Bitcoin, was created. By 2014 it was handling almost three-quarters of global Bitcoin transactions.

However, a whirlwind of revelations about its role in the loss of hundreds of millions of US dollars in Bitcoin saw operations shut down in February 2014. Trading was suspended, the website and exchange were closed, and Mt. Gox filed for bankruptcy protection from creditors. More than 200,000 Bitcoin have been found since liquidation proceedings began in April 2014, but many more remain unaccounted for.

At the time, company chiefs said nearly 750,000 Bitcoin held by customers disappeared along with 100,000 of Mt. Gox's own holdings, amounting to more than seven per cent of Bitcoin in circulation in 2014 when a single Bitcoin was worth around $62. In November 2021, Bitcoin reached an all-time high of $67,566.

Nine years ago, Mt. Gox blamed hackers and mounted a search for the lost digital assets, saying "The company believes there is a high possibility that the Bitcoins were stolen".

On March 14 2019, Mt. Gox's CEOFrench entrepreneur Mark Karpelès

was found guilty by the Tokyo District Court of falsifying data to inflate Mt. Gox’s holdings by $33.5 million. He was acquitted on several other charges - including aggravated breach of trust and embezzlementbased on the court's belief that Karpelès had acted without ill intent.

He was sentenced to 30 months in prison, suspended for four years,

meaning he will serve no time behind bars for his role in the Mt. Gox scandal if he can make it to this coming Tuesday without committing any additional offences. Even more immediate than Tuesday for the customers who lost out almost a decade ago comes a significant way-marker in their attempted recovery of losses - tomorrow's dead-

POPULAR multichain decentralised exchange PancakeSwap has revealed it will be launching ‘PancakeSwap V3’, at the start of April. The upgrade will serve up a full menu of new features, including improved liquidity provisioning, competitive trading fees, trading incentives, and an enhanced yield farming experience.

PancakeSwap has been one of the most celebrated DeFi projects in the industry, with more than $438 billion in total trading volume and in excess of $2.5 billion in total liquidity locked.

INDUSTRY leviathans Coinbase and Galaxy Digital have ditched Silvergate Capital as their banking partner over concerns about the lender’s future. Eyebrows were raised at Silvergate’s most recent filings which appeared to question its ability to remain a viable business. The collapse of the FTX exchange triggered concern among investors – a ripple effect now showing up in the deterioration of the California-based lender’s capital position. Silvergate shares halved in value as bosses revealed they were working on keeping the crypto-reliant business afloat, saying they were “evaluating the impact that these subsequent events have on its ability to continue as a going concern for the 12 months following the issuance of its financial statements”.

line to select repayment options.

It could be the last chance for those caught up in the world's first major crypto scandal to recuperate some losses - losses that, in many of their minds, could have gone on to create great fortunes. Had they kept hold of their Bitcoin with Mt. Gox until 2021 it would have increased in value by more than a thousand times.

THE CRYPTOmarkets have seen further pull back this week, with the price of Bitcoin falling seven per cent over the past seven days. There was a sharp drop late last Thursday/early Friday to around $22k.

The weaker performance came ahead of Fed Chair Jerome Powell’s announcement this week that hinted the recent program of rapid interest rate rises that has been driving the market's haywire will continue. Powell explained the “latest economic data have come in stronger than expected, which suggests

that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes”. Crypto and traditional risk-on markets responded to the announcement with immediate red candles, with analysts saying that some consolation to yesterday’s news may be the softer than expected market reaction to Powell’s remarks due the amount of de-risking and deleveraging that has already

happened in the last few months. There were also several negative industry-specific headlines last week to worry about. Silvergate announced that it would delay its filing, citing that the company could “be less than wellcapitalised”. Silvergate has been an important fiat payment rail in the crypto market and, thus, important for the market plumbing and liquidity. Investors may be skittish, but use cases continue to be seen for crypto around the world. In Nigeria, a recent economic cash crisis has reportedly increased Bitcoin

adoption in the country as Nigerians look to Bitcoin, according to Forbes.

They noted that Bitcoin is viewed by many Nigerians, especially among the younger generation, as a safe haven for the underbanked and unbanked as economic conditions worsen. Nigerians are currently facing record-high inflation of 21%.

SOME of the 100 exclusive tickets for the Crypto AM Spring Awakening at the end of the month are still available.

The event – the first of Crypto AM’s series of prominent gatherings across 2023 – will be held at The Mansion House, official residence of the Lord Mayor London, on Thursday March 30. The theme of the Spring Awakening will be the ‘State of the Union of Crypto in the UK’, and will include a prestigious three-course networking lunch in the magnificent surroundings of the historic Egyptian Hall. Tickets, priced £120, can be purchased by visiting https://www.cityam.com/crypto-springawakening/.

IN a week where most cryptocurrencies have found themselves in the red, exchange token Voyager (VGX) has produced some strong results. The Ethereum-based reward token for the Voyager centralised exchange rose in price by more than 60 per cent yesterday to $0.61 – up almost 50 per cent over seven days. Trading volume for the $164m market cap token rocketed to an astonishing 520 per cent in 24 hours to $196m. However, it still has some considerable distanced to travel to match its all-time high of $12.54 set in January 2018.

CONSIDERING whether a parent, relative or partner might need to move into a care home is no happy business. The process is all-consuming, delicate and above all, expensive. People selling their houses to be able to afford care is now accepted as a fact in the UK, but would look extreme in many other countries.

Of the estimated 360,792 care home residents in England, almost 35 per cent are self-funders. The costs are high: the average weekly cost of a residential care home in the country is £704. For a nursing home, where residents get 24-hour support, the cost is £888 per week.

The NHS differentiates between health needs - related to disease, illness, injury or disability - and care needs, which is when you need help to go about with everyday tasks. If someone’s needs are primarily related to health, the NHS covers all costs under something called Continuing Healthcare Funding (CHC). Or at least, it should. But there are families across the country now claiming back money which was owed to them, because of the myriad flaws in how social care funding is organised. These are people who had to go through the trauma of selling their family home to ensure an elderly relative was looked after, and

were often paid a pittance years after the fact.

To be eligible for the funding, the person needs to go through a screening process managed by the local integrated care board. But the assessment tool used by the care boards is open to interpretation. It leads to a postcode lottery system that sees huge disparities in the number of people who get the money in different parts of England.

In the north west of England, 5,059 individuals were eligible for funding in the third quarter of 2022/2023, while 6,709 got the funding in north east and Yorkshire and 6,225 got it in the Midlands. By contrast, only 3,724 people were eligible in the east of Eng-

land, 2,858 in the south west and 3,890 in London. The population size does not account for the differences: you’re simply more likely to get funding in the north than in the south. The assessment is based on indicators including mobility problems, medications and cognitive impairment. They’re judged on a scale that goes from no need to priority. The board also looks at the nature, intensity, unpredictability and complexity of someone’s needs. It’s easy to see how these descriptive indicators lead to subjectivity.

“It shouldn’t be a financial decision, but we’ve seen cases where it has”, says Lisa Morgan, partner and head of nursing care at Hugh James. Some local

boards, pressured by reduced social care budgets, enforce a restrictive - or sometimes just wrong - interpretation of the indicators.

On top of that, a lot of people don’t know about this funding, so don’t even ask for the assessment to be undertaken. The number of people receiving it has reduced over the years, and yet we are an ageing population. Care homes earn more from self-funded residents, so have no incentive in advertising it - and broke local boards have no incentive either.

Paul and Jill Pearsons are only one of the many families affected by the cracks in the system. In 2006, they decided that Kath, Paul’s mum, needed to be in a care home as she suffered

LAST week, Labour leader Keir Starmer warned that Poland is set to overtake the UK’s economic growth by the end of the decade.

This claim isn’t just scaremongering. Since 2010, Poland’s economic growth has averaged 3.6 per cent per year compared to the UK’s measly 0.5 per cent. If this trend continues, the average Pole will be £500 richer than their British counterpart by 2030.

Poland’s economic transformation started with “shock therapy” as the Eastern Bloc started to collapse. The country needed a swift transition from a planned economy to one masked on free markets.

To grow Britain’s economy, we urgently need policies which prioritise spontaneous, bottom-up economic activity —rather than top-down state intervention. For all his talk, the Labour leader has shown little willingness to do so.

Starmer has vowed to support the corporation tax increase to 25 per cent — while Poland has signalled no intention of abandoning its 19 per cent rate. The

Harrison GriffithsUK must do more to make itself an attractive destination for foreign investment and UK entrepreneurs, particularly as neighbours like Poland and Ireland intend to retain competitive corporation tax rates.

Likewise, the Labour leader led the chorus of criticism for reducing the top rate of income tax to 40 per cent last year. If he thought that proposal was radical, Poland’s 32 per cent top rate might blow his socks off. Although Starmer supported reducing the basic rate of tax by 1 per cent to 19 per cent, that is still a far cry from Poland’s 12 per cent rate on income below 120,000 Zloty (£22,400).

Poland’s competitive tax rates are com-

plemented by its top ranking among all countries for ease of doing business across borders. Rather than emulating the Poles by promising to take advantage of new free trade opportunities, Starmer – like the Sunak government –has dogmatically insisted that British industry should be protected in future trade negotiations. This only serves to prevent Britons from enjoying the ease of trade across borders which has been a key feature of Poland’s growth.

As with the high-spending Conservative government’s of the post-Cameron era, Starmer seems to care little about reducing the national debt. In fact, he has pledged new spending commitments on clean energy, schools, and the NHS.

At just over 85 per cent, the UK’s debtGDP ratio dwarfs Poland’s at 46 per cent. Emulating the pro-growth Poles in this area would mean not only scrapping those commitments, but also embarking on billions worth of cuts to existing spending.

Of course, it would be inaccurate to paint Poland as some kind of liberal

utopia. The governing right-wing populist Law and Justice Party’s attitude towards LGBTQ+ rights and judicial independence is a blight on Poland’s flourishing liberal experiment. EU investment in the country has been extensive and its tax system is overly complex. Nonetheless, we must learn from Poland’s friendliness to foreign and domestic investment if we want to kickstart our own economic miracle.