HOME REIT IN ESG ‘BOX TICK’ EMAIL LEAK

BELEAGUERED FUND SET FOR NEW RAFT OF QUESTIONS

EXCLUSIVE

CHARLIE CONCHIE

EMBATTLED property firm Home REIT and a dealmaker urged the firm’s tenants to “corroborate” dubious sustainability claims as part of an environmental, social and governance (ESG) “box ticking exercise”, City A.M. can reveal.

Gareth Jones, a partner at the beleaguered social housing firm’s former investment adviser Alvarium, told property vendor Christopher Downing in August to ensure that tenants backed up its sustainability claims when quizzed by ESG analysis firm The Good Economy, which had been called in in March to compile a report on its housing stock, leaked emails seen by City A.M. reveal.

After The Good Economy flagged concerns over the shoddy state of some homes leased to Home REIT tenant Serenity CIC, Jones tried to explain away the issues and told Downing to ensure that Serenity

backed up its claims if asked. Serenity was at the time run by Downing’s daughter.

A private email from Jones to Downing’s personal email address read: “Hey mate –see below –this is that we’ve gone back to the ESG Auditor in relation to enquiries about some properties. Can you make sure they [Serenity CIC] get and corroborate in line if asked?”

A separate email sent the previous month by Downing to a group of community interest companies, who leased properties that Downing’s property aggregation company Karla had sold to Home REIT, told tenants to put a positive spin on the homes when questioned.

“Their [Home REIT’s] investors want to be told that they are ESG compliant with positive outcomes, and it is the investors that pay for their lifestyle, they Homes REIT (sic) tell us that they would like to receive such information and with notes of positive interaction and ESG compliance, and

Homes REIT funds the lifestyle of Karla and now I on behalf of Karla am asking that all of you to take this seriously, because Karla funds your lifestyle, including mine and I like my lifestyle,” Downing wrote to the tenants.

“So can we stop for a second and realise how important this small box ticking exercise is within the small bubble we live in,” he added.

The exchanges raise fresh questions over how much Home REIT bosses knew of the state of its housing and whether investors were misled.

City A.M. can also reveal The Good Economy froze its relationship in November before publishing the report, amid questions over the stability of Home REIT’s business model and housing stock.

Several of the homes queried by The Good Economy were derelict, with the firm told by Home REIT they were going to be renovated.

£ CONTINUED ON PAGE TWO

JAMES SILVER

MORE THAN a third of services are delayed, nearly one in five is cancelled and strike action continues to make services a lottery –but commuters will still be coughing up more for their journey into work after the government announced a fare increase.

Regulated fares –around 45 per cent of those on the network –will go up by 5.9 per cent, which lags inflation but will still add a significant chunk to the price of a season ticket.

Last year the government agreed a 4.8 per cent hike. Passenger numbers are still behind pre-pandemic levels, putting significant stress on the business models of rail operators.

Fintechs and pension funds meet to discuss City of London growth fund

EXCLUSIVE CHARLIE CONCHIE

TECH AND fintech industry chiefs have met with some of the City’s top pension funds as part of plans to create a UK “sovereign wealth fund” that could help unleash a wave of funding into the UK’s tech startups,

City A.M. can reveal.

In a Square Mile meeting convened by the Lord Mayor of London Nicholas Lyons at the end of January, top pension firms including Phoenix, Aviva and L&G met with attendees including the fintech industry body Innovate Finance and big four firm EY to

discuss pooling institutional capital in a £50bn private-sector led fund that would mimic the role of a “sovereign wealth fund”, City A.M. has learned.

Pension consultants and top trustees were also in attendance at the meeting as tech leaders looked to convince the pensions industry to

throw its weight behind growth investments.

The meeting is understood to be the first of a number of planned sessions this year as Lyons looks to galvanise support for plans for a ‘future growth fund’.

When approached for comment, a spokesperson for the City of London

Corporation told City A.M. that “we need to ensure that highgrowth companies... don’t feel that they must leave our shores in order to grow”.

A source at the meeting said that pension managers were “positive” in the discussions but said there was still a “mindset” issue.

A COSTLY BUSINESS Commuters to be hit by further fares increase

A GLITTERING EVENING ALL THE PHOTOS FROM THE ANNUAL CITY A.M. AWARDS BASH P8-10

STANDING UP FOR THE CITY

Tech ecosystem needs work to make London a listing hotspot

IN TRUTH, it was always highly unlikely that Arm would list in London. From the moment a proposed takeover by Nvidia collapsed, any other result other than a Wall Street debut was almost a non-starter. But the British firm’s decision to cross the Atlantic for a public offering should not be ignored just because it isn’t much of a surprise.

The sad fact is that when it comes to high-end tech IPOs, London

THE

CITY VIEW

right now cannot compete with New York. A host of recent dud floats haven’t helped shift the perception that London undervalues tech firms. Ask some CEOs –either listed or pondering –and they simply don’t believe that the capital right

now has the ecosystem, from thoughtful analysts to longerterm investment capital, to sustain the most technologically advanced firms on its public markets. Addressing this won’t be easy; it, of course, isn’t just tech firms which appear undervalued. London-listed firms lag, badly, on price to earning ratios compared to international competitors and, as we now know, the weakness of sterling on top

makes listing in London a risky enterprise should US private equity firms come calling. Chief among the moves to remedy this must be for government and regulators to move further and faster with the implementation of two vital reviews; the Hill Review into listing rules, and the Kalifa review into the future of fintech. The recommendations therein are far from silver bullets, but the alternative –for them to gather dust on the shelf –would be to

TENSIONS FLARE Demonstrators clashed in Dover over the weekend as tensions raised by the small boats crisis saw anti-immigration protestors rally in the town

Banks must pass on rate hikes to savers to stave off windfall tax calls, experts warn

CHRIS DORRELL

BANKS should pass on higher interest rates to savers in order to stave off pressure for a windfall tax, a host of experts have warned.

After a decade of ultra-low interest rates, sharp rate hikes throughout 2022 widened banks’ net interest margins –the difference between what banks pay out and receive in interest – and earned them bumper profits.

Analysts warned that imposing a windfall tax on the sector would do more harm than good, putting off investment in a sector that already faces

high taxes.

Martin Hartley, UK managing director of Emagine Consulting and a member of the Bank of England Decision Maker Panel asked: “Why should a well-run commercial enterprise, which employs thousands of people… be penalised for its success by contributing to huge tax bills?”

Alesandro Hatami, co-author of Reinventing Banking and Finance, said “a windfall tax would introduce a level of arbitrariness to a sector that requires stability”. But Hatami did suggest that there should be greater regulation to ensure that consumers saw the benefits

of higher interest rates.

“What’s needed instead is a change in regulation,” he said, suggesting new rules could mandate banks to transfer advantageous changes in the base rate to savings for customers within a specified time frame.

Sudeepto Mukherjee, head of financial services EMEA & APAC at Publicis Sapient, said “banks should be encouraged to pass more of the interest rate rises to deposit holders” but suggested the conversation should be more focused on “increasing collaboration with the government” in order to direct more capital to investment.

waste an awful lot of hard work, and good ideas. They have thus far been held up by political instability; with that in theory in the past, it is high time that we start to see more aggressive action to ensure London remains an attractive destination to list. There is also, though, work for the private sector to do. In a city that may lack institutional knowledge of high-tech firms, it seems a nobrainer that the first to build it would do well indeed.

THE FINANCIAL TIMES

KROLL AND JONES DAY ACCUSED OF CONSPIRACY TO PROTECT WIRECARD

Law firm Jones Day and corporate intelligence group Kroll are facing accusations of an unlawful conspiracy and “campaign of harassment” to protect Wirecard in a High Court lawsuit.

THE TIMES

UK IS MORE ATTRACTIVE THAN UK FOR ENERGY INVESTMENT, WARNS SHELL

America is significantly more attractive than Britain for energy investment, Shell’s new chief executive has said. Wael Sawan said the government should “take a page” from the US.

THE GUARDIAN

TOBLERONE TO CHANGE DESIGN UNDER ‘SWISSNESS RULES’

The image of the Matterhorn mountain peak will be removed from Toblerone packaging after some of the chocolate bar’s production is moved outside Switzerland.

Home REIT says investigation into complaints is ongoing

CONTINUED FROM PAGE ONE

A Home REIT spokesperson told City A.M. thatthere “have been a number of allegations made against the company, all of which the board takes seriously”.

“As announced, an investigation is ongoing with Alvarez & Marsal. This investigation is complex and covering a broad range of different issues,” the spokesperson said.

Jones, who was contacted for comment, stepped back from Home REIT in November for “health reasons”. Downing’s lawyers did not

respond to a request for comment.

Home REIT has said repeatedly that the property aggregators like Downing, who put together huge portfolios of properties before selling them on to the fund, were responsible for refurbishing the houses out of their own pocket.

After a short seller report from Viceroy Research in November sounded the alarm over the firm’s business model, Home REIT insisted it only acquired “fully refurbished” and “high quality” homes. However, it admitted the scale of dilapidation in its portfolio last month.

WHAT THE OTHER PAPERS SAY THIS MORNING

Sunak and Boris criticised over Arm charm fail

CHARLIE CONCHIE

THE GOVERNMENT has come under fire for a failed attempt to woo British chipmaking giant Arm into listing in London after the Cambridge-based firm confirmed it would float in New York on Friday.

The move from Arm has dealt a major blow to the UK’s efforts to promote itself as a premier listing hub and comes despite a major charm offensive from successive British prime ministers and regulatory officials to tempt Arm into an IPO in the capital.

Rishi Sunak had restarted talks with Arm’s owner Softbank in recent months after initial attempts by Boris Johnson and London Stock Exchange officials had proved unsuccessful.

Arm chief Rene Haas said on Friday that after engaging with ministers and the Financial Conduct Authority “over several months”, Softbank and Arm

decided that “pursuing a US-only listing of Arm in 2023 is the best path forward for the company and its stakeholders”.

UK tech leaders described the move as a “significant blow” to the UK’s tech sector and the future of its semiconductor industry, and slammed ministers’ failures to win over the firm.

“Ultimately, this will reinforce valuable lessons. Arm’s decision must be upheld as a case study for the UK government of how ‘not to do it’,” said Russ Shaw, chief of Tech London Advocates. “Arm’s journey to the Nasdaq was somewhat sealed when it was allowed to be sold to an overseas acquirer back in 2016.”

Ian Manocha, the chief of Londonlisted tech firm Gresham Technologies, said the decision was proof “government should do more to encourage investment into listed companies as a distinct asset class”.

Joe Wicks is one of the backers of the home meal delivery service

Gousto cash raise leaves small shareholders in uproar: reports

JAMES SILVER

THE JOE WICKS-backed food delivery service has found itself in the middle of a governance row after excluding some investors from a discounted capital raise last month, according to reports over the weekend.

Sky News’ Mark Kleinman first reported that Gousto had slashed its

valuation from £1.4bn to just £250m last month as the pandemicera darling joined the ranks of tech-enabled firms looking to reset their operations.

However, some smaller shareholders were reportedly not given the offer to come in on the raise, prompting complaints to the board’s chairman Katherine GarrettCox, Kleinman reported yesterday.

NETWORK RAIL BOSS LEFT FRUSTRATED AT IMPASSE

Network Rail’s boss has expressed his frustration at the failure to resolve the ongoing dispute with rail unions. “We don’t understand what it will take,” Andrew Haines told The Sunday Times. “Three times now we think we’ve shaken hands with the negotiators over a deal, and three times it has been overturned.” His comments came ahead of a new report by MPs, published today, that warns the Strikes Bill is likely to be incompatible with the European Convention on Human Rights. MPs worry the bill will clash with Article 11 rights –the freedom of association for workers –and have called on the government to reconsider the bill.

LONDON’S OPEN AI RIVAL SET FOR $5BN VALUATION

London-based Stability AI is in talks with potential investors about raising funds, which could see its valuation rise to $5bn (£4.3bn), The Sunday Times reported. The firm, which operates the Stable Diffusion tool that generates detailed images based on text prompts, looks set to benefit from the wave of funds pouring into AI tech firms after Open AI’s ChatGPT sparked an AI arms race among the tech giants. News of the talks comes some five months after it raised $101m at a $1bn valuation. But an ongoing UK court battle with Getty Images, which is suing the firm over claims it illegally scrapped its images, hangs over the AI challenger.

Hunt to face ‘tough choices’ in Budget despite £30bn wiggle room

LOUIS GOSS

JEREMY HUNT will be forced to make tough decisions in his upcoming Budget, experts have warned, despite the Chancellor having considerably more wiggle room than previously thought.

Falling wholesale energy prices and better tax receipts due to stronger growth mean Jeremy Hunt

will have to borrow £30bn less than the Office for Budget Responsibility’s November forecast showed, according to the Resolution Foundation.

The Chancellor will, however, still face “tough choices” in delivering his Budget next week, as he will be forced to deal with the combined problems of the UK’s cost of living crisis, countrywide labour shortages and public sector strikes, the Resolution

Foundation said.

Cara Pacitti, a senior economist at the think thank, warned of the challenges facing Hunt, with the Chancellor needing to both “end public sector pay disputes” while tackling the “UK’s stagnant economic growth”. Meanwhile “there is no escape from having to focus on the cost of living crisis that families are still living through,” she added.

SFO to face ENRC in court as legal battle continues

LOUIS GOSS

THE UK’s Serious Fraud Office (SFO) will today face Kazakh mining company ENRC in London’s High Court, as it continues its fight against the British government agency almost 10 years after it first launched an investigation into the former FTSE 100 firm.

The SFO first launched its investigation into ENRC in April 2013 in relation to fraud, corruption, and bribery allegations surrounding the mining company’s activities in Kazakhstan and Africa but has so far failed to secure any convictions against the Kazakh firm. In the 10 years following the launch of the initial probe, ENRC has pursued the agency through Britain’s courts.

The High Court will now seek to determine whether the SFO’s investigation into ENRC would have ever taken place if ex-City lawyer Neil Gerrard – US law firm Dechert’s ex-head of white-collar crime –hadn’t leaked the mining firm’s confidential information to the SFO.

The trial will also decide whether the SFO and Dechert should be liable to pay ENRC damages. ENRC is seeking more than £21m from the SFO and Dechert

over claims it was unnecessarily forced to pay out millions in legal fees and carry the costs of undertaking extra work, court documents show.

ENRC’s claim comes after High Court judge David Waksman in May 2022 ruled Gerrard breached his duties by leaking ENRC’s confidential information to the SFO and three British newspapers while carrying out an internal probe on behalf of the Kazakh mining firm.

Judge Waksman ruled Gerrard leaked ENRC’s information in order to bring in more work and maximize his fees. The High Court judge also ruled SFO officials had acted “recklessly” by accepting the leaked documents from Gerrard.

However, Judge Waksman largely cleared the SFO of wrongdoing, as it determined the fraud investigator had not colluded with Gerrard to help maximise his fees, but that it had instead engaged in “bad faith opportunism” while taking information from the ex-Dechert lawyer.

The judge also allowed the SFO to continue using evidence it gained from Gerrard in its ongoing investigation into ENRC.

Dechert declined to comment. The SFO and ENRC were approached by City A.M

EY to push ahead with mid-year promotions as KPMG calls off round

LOUIS GOSS

EY HAS said it is pushing ahead with this year’s round of mid-year promotions “as normal”, following reports that Big Four rival KPMG has called off its own round of April promotions.

An EY spokesperson told City A.M. the “small number of mid-year promotions” it makes “every year” are “continuing as normal”.

KPMG, by contrast, has called off

plans to hand out promotions to its auditors this April, after carrying out a “thorough review of workforce planning,” The Times first reported.

The report comes after KPMG laid off 700 of its US staff –equivalent to two per cent of its US workforce – as the global economic downturn has hit the Big Four firm.

A spokesperson for KPMG said “many” of its colleagues would be promoted as part of its “annual promotions cycle later this year”.

CULTURE CLASH? Reports turnaround boss left John Lewis over ‘partnership’ issues

Takeover chat to overshadow M&G full-years

CHARLIE CONCHIE

BOSSES at asset management and insurance giant M&G are set to be quizzed by investors over a potential takeover swoop from Australian financial services Macquarie this week, as the firm updates the City with its full year results on Thursday.

The update will mark chief executive Andrea Rossi’s first update at the helm of the FTSE 100 firm after taking over in October, and comes at a crucial time in which rumours are swirling around the Square Mile of a potential multibillion pound takeover.

Sky News reported last week that Australian Macquarie was in the early stages of exploring a takeover of the firm. The potential bid comes after London-listed asset manager Schroders also previously explored a takeover bid for the firm in 2021 before abandoning it on concerns of a culture clash.

M&G declined to comment on market speculation when approached by City A.M.

M&G has suffered a turbulent period since its spin-off from Prudential in 2019 and Rossi and his executive team are looking to arrest outflows and a slide in managed assets. However, consensus figures compiled by M&G are predicting total assets under management to have tumbled to £340bn in the full year, down from £370bn in 2021.

On the day he took over in October, Rossi told analysts a break-up or sale of M&G was “one option that I will not pursue”.

However, analysts at UBS quibbled.

“M&G remains our most preferred traditional UK life insurer ahead of [full year] results as we see multiple potential catalysts for the stock including recent M&A speculation,” Nasib Ahmed, UBS analyst wrote in a note to investors.

More spice added to Wagamama owner’s battle with activist

THE ONGOING battle between The Restaurant Group (TRG) and restive shareholder Oasis continued this weekend with a tit-for-tat played out in the national newspapers.

The Wagamama-owner has been under pressure from Oasis in recent weeks, with the hedge fund claiming

the group is underperforming its peers. Oasis is now pushing for the group to begin offloading its 80-strong pub division as well as airport concessions in a strategy update this week, per reports in the Sunday Times. A TRG spokesperson said both divisions were performing “strongly compared to the sector” and TRG had already improved its cash flow.

AROUND 630,000 SMALL BUSINESSES AT RISK OF GOING BUST

Around 630,000 small and microbusinesses are at risk of going bust in the face of rocketing costs and pressures on consumers, according to new research. Data analysis of 2.3m British microbusinesses – which are typically firms with fewer than 10 employees –highlighted growing pressure among small businesses due to rocketing costs, such as increased energy bills. The Venture Forward report, produced by Godaddy, indicated that the potential collapse of these companies would be a roughly £12bn blow to the economy.

PA

BIG ISSUE SELLERS UP DUE TO COST OF LIVING CRISIS, SAYS FOUNDER

The number of Big Issue sellers has risen 10 per cent in the past year, with the social enterprise group putting the increase down to cost of living pressures. Founder Lord Bird said more people have had to turn to selling the magazine due to the “dire set of circumstances they are facing”. There were 3,642 vendors in 2022 compared to 3,296 the year before, figures from the Big Issue Group show. Big Issue Group said more than two-thirds (69 per cent) of new vendors stated they were selling the magazine as their main source of income or as an additional income source, while 10 per cent wanted to use it as a springboard to finding fulltime employment.

PA

THE NOTE BOOK

Capital growth still too alien a concept to many investors this side of the pond

ANex-CFO of a FTSE 100 company once said to me “I love seeing US investors because they recognise the role of the capital markets is to provide capital to grow.”

“For UK investors, it is all about capital preservation and the dividends,” they continued. Capital growth and capital preservation: two phrases, one word difference. However, if you want an explanation why CRH and ARM are listing elsewhere, look to that phrase.

A company spending wisely on investment will drive higher growth and should see a higher valuation. That is not rocket science and most (good) managements recognise this. It does not mean investment and returns are mutually exclusive (look

WAGES DRIVE

at the tech companies, at least until recently) but, where there is a choice, the former is more optimal.

ARM WRESTLE

Yet, in my twenty-plus years as a media and tech equities analyst, many UK managements worried about investors’ reaction if they did this. There are exceptions: Sky was an excellent example of one who didn’t and was rewarded with a high acquisition multiple. But too often, investors seemed to have a natural scepticism money would be spent wisely. It therefore should come as no surprise many firms decide not to list in London. Yes, US investors do not always get it right nor are UK investors always wrong to be sceptical. However, I can see why managements go elsewhere for listings. As usual, this is not investment advice.

Target is offering its employees in the US $24 per hour in wages plus free healthcare if you work over 25 hours a week.

Starbucks has set its minimum wage at $15 per hour and others have followed suit. Throughout the West increasingly, the lowest paid are getting much needed pay boosts as the unwinding of Covid-19 continues and job markets remain tight. It is a welcome trend.

£ One of my sidelines is betting on political events. Keir Starmer is odds-on favourite to be the next PM but I am not so sure. He has not sealed the deal with the public as Tony Blair did and Rishi Sunak has started to enjoy some noticeable successes, such as the Northern Ireland agreement with the EU and in seeing off Nicola Sturgeon as Scottish First Minister. Don’t count Sunak out.

Donelan to put tech at heart of growth policy

JAMES SILVER

THE GOVERNMENT’s new technology secretary has promised to turn the UK’s research triumphs into “actual, tangible benefits” for the country as she launches a new science and tech framework today.

Writing for City A.M., Michelle Donelan said the UK’s “most incredible days of innovation are not in our past [but] are happening right now.”

Donelan will today announce a £370m injection of cash into research into AI, quantum computing and engineering biology.

She is the first ‘technology secretary’ in Britain’s history, with the department created from a reorganisation of the Business Department last month.

The science and tech framework announced today promises to, amongst a range of commitments, put public sector procurement to use to boost investment and will “leverage postBrexit freedoms to create world-lead-

ing, pro-innovation regulation and influence global technical standards”.

“If we achieve what we are setting out, one day Britons of the future will look back on our society and see us as the starting gun for a Britain that lives smarter, longer, happier and healthier,” she writes today in a piece published on our website.

Amongst the funding commitments both new and old is a £117m fund to back hundreds of new PhDs for AI researchers and a £50m uplift to the UK’s ‘World Class Labs’ programme.

The announcement of the new framework comes amid signs that the UK could soon be able to rejoin the cross-Europe research programme Horizon, with the country’s membership a casualty of Brexit.

Last week after the signing of the Windsor Framework on Northern Ireland, European Commission president Ursula von der Leyen said she would welcome talks as soon as the deal was implemented. However there have been reports the Prime Minister, Rishi Sunak, may look for a more limited engagement in Horizon.

£ Another sideline is a part-time Masters in War Studies at King’s College London, a topical subject but one that has led to some useful business insights, not least the lessons of the “McNamara Fallacy” (named after the US Defence Secretary in the 1960s) which highlights the cardinal error of mistaking quantification for a proper strategy. It is a lesson many in the business world –particularly in the media and tech world –should heed.

I run a series of podcasts with outdoor company JC Decaux UK and recently interviewed Zoe Harrison from 1854 Media and Janet Guest from Decaux about the Portrait of Britain photography series. If you have not viewed it online, do so. It is not only a powerful illustration of the diversity of the British population but a strong reminder that it is easy living in central London to forget there is a wider Britain out there which has perhaps vastly different experiences to the readers of this column. We ignore the issue of growing polarisation in our society at our peril.

CAN I QUOTE YOU ON THAT?

I came to a moment where it was a very dark moment. I’ll leave it at that but I came out of that moment.

Government minister Steve Baker opens up on his mental health issues

Hancock tried to ‘frighten the pants off ’ public

JESS FRANK-KEYES

MATT HANCOCK said he wanted to “frighten the pants off everyone” to ensure compliance with Covid-19 restrictions, according to leaked Whatsapp messages published by the Telegraph.

The revelations have continued after a tranche of more than 100,000 messages was shared by journalist Isabel Oakeshott, leading to outcry over government actions during the pandemic.

Some have said Gray’s Labour move risks undermining civil service impartiality rules

Starmer must publish Sue Gray messages, Tory minister argues

JESS FRANK-KEYES

LABOUR leader Sir Keir Starmer should publish any Whatsapp messages with Sue Gray ahead of her becoming his chief of staff, a Conservative minister has argued.

Starmer should publish his messages with the civil servant and partygate investigator to clear up any questions about her move to the senior role, Northern Ireland secretary Chris Heaton-Harris told the Sophy Ridge On Sunday programme on Sky News.

Heaton-Harris said: “This is where Keir can help out his new chief of staff by just publishing all the messages

and things he might have had with her at that point in time.

“I’ve dealt with Sue Gray in the Northern Ireland Office as a civil servant. I see her as a woman of integrity as well. So I have no issue with that.

“I think Keir can clear this up in seconds by saying this is what we talked about at that time, there’s nothing to see here.”

It comes as a fresh Opinium poll for the Observer indicated just 23 per cent of voters believed the Conservative Party had the UK’s best interests at heart, compared to 41 per cent

The latest set of exchanges show the former ‘I’m A Celebrity’ contestant and others discussing how to use an announcement about the Kent variant of the virus to scare the public into changing their behaviour.

In December 2020, texts appeared to show Hancock’s adviser saying: “Rather than doing too much forward signalling, we can roll pitch with the new strain.”

The then-health secretary responded: “We frighten the pants off everyone with the new strain.”

Leaks have previously revealed Hancock expressing concern about the then-Chancellor’s so-called ‘eat out to help out’ scheme helping to spread the virus.

Oakeshott originally received the texts in the course of her work ghostwriting Hancock’s ‘Pandemic Diaries’ book.

He has condemned the leak as a “massive betrayal” in support of an “anti-lockdown agenda”, and said all the Whatsapps had been shared with the official Covid-19 inquiry.

Where interesting people say interesting things. Today, it’s Ian Whittaker, a City analyst with twenty years of tech experience

PORTRAIT OF A COUNTRY THAT LOOKS DIFFERENT

A STAR-STUDDED CITY EVENING

This year’s City

A.M.

THESQUARE Mile’s biggest names joined City A.M. for a glittering awards ceremony on Thursday evening of last week –with Aviva boss Amanda blanc walking away with the coveted ‘Personality of the Year’ award. The awards returned to the Guild-

awards –on Thursday of last week –saw the great and the good at the Guildhall

hall, the historic centre of the City of London, with some 800 guests gathered in the Great Hall.

The big winner of the evening was Blanc, who follows in the footsteps of City and political figures such as Nigel Wilson, Anne Boden and Boris Johnson in winning the personality of

the year title.

Blanc said she was “proud” of the award and said the City as a whole should be “proud” of the work that it does.

That was a common theme in the evening, with City A.M. editor Andy Silvester telling the audience that the

Andy Silvester (left) opened the awards while guest speaker Nick Ferrari regaled the audience with tales from his glittering career

City is not a “nefarious black hole sucking the life out of the country” but instead provided the financial and professional know-how to allow “millions of Brits to get on and improve their lot”.

Host Julia Streets was joined on stage by guest speaker Nick Ferrari, the leg-

endary LBC broadcaster.

Other big winners on the night included Investec, who took home the Bank of the Year trophy, Rare Restaurants which won the Business of the Year category and insurer Phoenix, which triumphed in a heavyweight field of industry giants.

Contemi Solutions’ Daniel Ovesen Thafvelin presented Phoenix Group’s Shellie Wells with the insurer of the year trophy (above), while Rare Restaurants’ boss Martin Williams –the man behind Gaucho and M –took home the business of the year category title (near left).

The winners in full: Recognising the very best of the Square Mile’s talent

AMANDA Blanc’s willingness to speak out on important issues –as well as her leadership of the resurgent Aviva –impressed the judges sufficiently to award her the personality of the year trophy at the City A.M. awards, but Blanc was far from the only deserving winner.

Law firm of the year was Milbank, with judges impressed by the acquisition of London powerhouse Dickson Minto.

The winner of innovative company of the year was Wandisco, as it continues to drive adoption of the ‘internet of things’.

Insurer Phoenix was recognised by judges in its category as being “ahead of the curve” on policy issues as well as winning plaudits for its

steady, reliable UK performance.

The rebranded Tilney, Smith & Williamson –Evelyn Partners –received the award for accountancy firm of the year, with judges noting the rarity of a professional services merger delivering results so early on.

Analyst of the year was Victoria Scholar from Interactive Investor, whose plain English explanations of financial turmoil in the City impressed the judges.

Jefferies’ analyst Giles Thorne was highly commended in the same category.

Legal & General Investment Management wrapped up the ESG award for the second year in a row for its approach to sustainability investing, with judges impressed the

firm continued to walk the walk as well as talk the talk.

Investor of the year was Elliott Advisors, with many boardrooms now seeing the activist as a healthy boardroom presence, and judges impressed by their long-term view of business performance.

Bank of the year was Investec, with UK boss Ruth Leas on hand to take home the trophy. Judges said “high quality and reliable performance” in a tumultuous market was well worthy of recognition.

Rare Restaurants won business of the year, with the owner of Gaucho and M Restaurants now all but unrecognisable from the period in which the firm bought Gaucho out of administration several years ago.

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his weekly column

TURNING UP THE HEAT

Octopus Energy has seemingly stretched its tentacles into the world of online smut, with a dedicated workplace

Slack channel for “segsy pictures” of its wind turbines –displayed in full glory across beautiful blue backdrops of the sea and sky. Greg Jackson, the energy firm’s affable chief executive, dubbed the pics “the Octopus Onlyfans channel –home to some serious beauties”.

ELECTRIC DREAMS PUT TO BED?

BRITAIN’s electric dreams descended into nightmares with the collapse of Britishvolt earlier this year, jeopardising the country’s ambitions to revive its flagging car industry.

Aussie power group Recharge has since spared the government’s blushes with its takeover of the company – but it no longer plans to use the proposed gigafactory as a hub for hundreds of thousands of electric vehicle (EV) batteries every year.

Instead, the factory will operate as a clean energy storage producer, before shifting into batteries for luxury sports cars.

This pivot reflects the hesitancy companies have towards reviving the UK’s car industry through championing mainstream, massmarket EV batteries.

Prospective producer Jaguar Land Rover owner Tata motors has decided not to let a crisis go to waste, and is now demanding a whopping £500m in taxpayer funds to build its own factory for EVs in the UK – threatening to take its plans to Spain if the government refuses.

The Indian motor giant has sensed weakness in a government desperate to remain a leader in the green energy race, and has essentially triggered a ‘stick or twist’ situation for the government.

This raises the question of whether the

government should dust itself down and try once again to spearhead EV manufacturing or stay out of a highly competitive and costly challenge in the green energy race.

UK UNABLE TO COMPETE WITH THE BIG PLAYERS

Alongside its ambitious net zero target, the government has created a ticking clock for its EV goals – with the UK set to ban new petrol and diesel sales by the end of the decade, and hybrids by 2035.

It has reportedly set aside £850m to invest in rejuvenating the car industry, with the UK trailing both the EU and US in EV developments. This is a hefty sum in taxpayer money, but considerably less than the kinds of figures associated with the US Inflation Reduction Act –which has committed nearly $400bn in tax breaks and subsidies to green investment –with Jeremy Hunt warning last month the UK is not in a position to compete like-for-like with the world’s biggest economy.

As it stands, the UK is home to just one Chinese-owned EV battery plant next to the Nissan factory in Sunderland, while 35 EV battery plants are planned or under construction within the EU.

China continues to dominate the sector –which is home to six of the top 10 battery companies, and produces 77 per cent of the

world’s EV battery supply. This suggests the UK could simply be too small of a player to compete, and should instead pivot to securing alliances with countries holding shared interests.

Adam Bell, head of policy at Stonehaven and ex-head of energy at BEIS, argued that the UK should prioritise creating an environment that would encourage people to buy more EVs.

He told City A.M.: “While we can attempt to subsidise our way back towards increasing production, we are far better off seeking to reduce trade barriers to enable greater participation in the global car value chain and sending strong demand signals for EVs by investing in better charging infrastructure.”

Meanwhile, Andy Mayer, energy analyst at free market think tank the Institute for Economic Affairs, argued “this is a race we can’t win”, and said the government should cut its losses to avoid more Britishvolts.

He said: “We cannot outspend the EU, we cannot out-manufacture China, and we have decided to have more expensive land, energy, and regulations than the USA. The UK’s better option would be to create a generally attractive investment climate for all types of business and see which succeed. This means lower stable taxes, proportionate regulation, and where there is support, for early-stage innovation only, not commercial subsidies.”

STOP THROWING MONEY AT THE PROBLEM

While the commercial argument for manufacturing EVs is difficult to make, there is a strategic argument for developing a new car industry.

In the same way the government has an energy strategy to boost domestic generation and reduce its reliance on overseas vendors for supplies, investment in EV battery production could make the UK more independent during the net zero transition, while also boosting development in the North East as part of its levelling up agenda.

Alan Hollis, chief executive of AMTE Power, a UK-based battery cell specialist, said the government should be engaged in the battery race but argued if it was serious about EVs, it couldn’t be half-measures. Instead, it must boost infrastructure, research and development, and make cars cheaper to buy and operate – vast financial commitments.

This reflects the challenge for the UK: there is a strategic case for domestic EVs, but it relies on nothing short of transformational funding and considerably more imaginative thinking than it has so far shown.

If it doesn’t have the commitment for such ambitions, it would make more sense to close the curtain on its ambitions with the Britishvolt debacle, than to chase dreams it can’t achieve.

MAKING GREEN BY GOING GREEN

£ Connecting all of the UK’s electric vehicles and heat pumps to the UK’s electricity grid could save up to £4.7bn a year by 2030, according to Ofgem. It estimates households could save between £3.2bn and £4.7bn a year compared to the alternative, keeping gas power plants running. However, this comes with responsibility, as Ofgem’s preferred proposals will give households a bigger role in fine tuning supply and demand. For instance, electric cars parked in people’s driveways could be required to send electricity back into the grid when supplies are tight.

SEND US YOUR THOUGHTS

How can the UK reignite its electric dreams? Email energy editor Nicholas Earl at nicholas.earl@cityam.com

All eyes on Darktrace results after short seller report doubts accounts

CITY A.M. REPORTER

INVESTORS will be paying close attention to Darktrace’s half year results on Wednesday as the firm looks to restore trust in its operations after a short seller report raised questions about the firm’s accounts.

The cybersecurity company’s management have said that they

expect first half revenue to come in at $258m (£214m), an increase of 35.2 per cent from a year ago, as well as a boost in the number of customers, according to analysts at CMC Markets. But the Cambridge-headquartered firm was recently forced to bring in Big Four auditor EY to carry out a review of its accounts, after New York investment fund Quintessential

Capital Management cast doubt over the “validity” of the tech firm’s financial results, taking an active short position.

Boss Poppy Gustafsson responded to the claims saying the firm is run with the “greatest integrity”. The company’s share price has recovered since Quintessential published its report.

How do you solve a problem like the

shadow banking sector? Chris Dorrell investigates

SOMEwould argue that predicting the next financial crisis is a near impossible task. But Nobelprize winning economist Douglas Diamond said in October last year: “The last [financial crisis] started in the banks, it stayed in the banks. This one’s going to start in the shadow banks and the companies.”

Shadow banking encompasses a variety of financial institutions that provide similar services to banks but without equivalent regulation. They do not take deposits. Instead they generally rely on short-term funding, which can often leave them facing liquidity troubles if something goes wrong.

Over the past few years, a series of major financial blow-ups in the shadow banking sector, such as the collapse of Archegos Capital and implosion of Greensill Capital, have sparked calls for stricter regulations to be imposed on the sector.

Near the end of last year the Bank of International Settlements said the sector had “the potential to cause financial stability concerns”, while the Financial Stability Board (FSB) identified nonbanks as a “key priority” for regulators to focus on in 2023.

ON THE LOOKOUT

Despite these concerns, some financial watchdogs have been criticised for falling behind on regulating the shadow banking sector.

At Davos last month, Colm Kelleher, chair of banking giant UBS, said regulators had “taken their eye off the ball” when it came to shadow banks, while François Villeroy de Galhau, governor of the Bank of France, said the world’s regulators “lag behind” when it comes to keeping up with the sector.

Regulators in the UK have not been idle, however. Following the LDI crisis, the UK introduced stress testing for private equity funds and hedge funds, the first country in the world to do so.

‘Market-based finance’ (MBF), the term most regulators use for shadow banking, was a prominent topic in the Bank of England’s financial stability report too. MBF is the system of markets, non-bank market participants and infrastructure which provides credit alongside the traditional financial sector.

At the end of 2021, MBF accounted for £776bn, about 55 per cent of all lending to UK businesses.

The Bank said “international and domestic regulators urgently need to develop and implement appropriate policy reforms to address the risks from MBF”.

“Until this policy work is complete… the underlying risks remain significant and could resurface.”

RISKY BUSINESS

Despite the mostly peripheral nature of shadow banks, experts are concerned that the traditional financial sector will still face risks of contagion if large shadow banks were to collapse.

While it is difficult to predict where the pressure points are in the sector, the FSB identified the commodities market as a potential flashpoint due to the widespread use of leverage in the sector.

The surge in oil prices after Russia’s invasion of Ukraine last year led to a spike in margin calls on commodities derivatives contracts, particularly in Europe, resulting in an increased demand for liquidity to meet those calls. A similar shock in the near future could have impacts throughout the sector.

Regulating risks lurking in the shadow banks

Analysts at S&P Global, however, pointed out it’s “hard to match deeper stress” in the commodities market than last year and, in the end, “liquidity was found where it was needed”.

The analysts identified credit hedge funds and broker dealers as amongst the most risky shadow banks due to their higher level of leverage. Other institutions, such as money market funds, are much less risky according to S&P Global.

A TRICKY TASK

But experts told City A.M. that rushing into shadow banking regulation wasn’t a straight-forward task.

“Regulators can’t use a one size fits all policy for regulating non- banks,” S&P Global Ratings’ analyst Alexandre Birry said.

Birry said that regulators need to be “really cognizant of the type of activities” that various shadow banks and non-banks perform “because the nature of the risks they take will be different.”

Kate Troup, a partner at law firm Fladgate who specialises in financial services regulation, noted that the variety of shadow banking makes it a difficult target for regulators.

There is no “easy way” to regulate shadow banking, Troup suggested, because it “covers a wide range of activShadow banks have played an important role in diversifying the financial sector as the stricter regulatory framework has pushed traditional banks away from riskier forms of lending.

Drew Nicol

of the Alternative Investment Management Association drew attention to private credit funds and the role they play in lending to SMEs.

“Reform of the banking sector means that big banks have reduced their lending activity to SMEs and mid-market businesses. Private credit funds have stepped into the gap,” Nicol said.

Private credit funds maintained or even increased lending during periods of market uncertainty such as the Covid-19 pandemic and the invasion of Ukraine.

“This counter-cyclical lending activity is a good example of how the sector supports the resilience of the financial system and economy more generally,” he continued.

Additionally, Nicol suggested hedge funds make it easier for banks to offer fixed-rate mortgages by trading interest rate derivatives.

“Without commodity derivatives trading by hedge funds, airlines would find it more difficult to control the costs related to their fuel consumption,” he said.

James Barrett, director of Burges Salmon’s banking and finance team, even suggested that the label ‘shadow banking’ is a “misnomer” given the “increasingly prominent and legitimate role of non-bank provided financial services”.

But Barratt admitted that recent

events like the collapse of Archegos have raised legitimate concerns around “the dangers of hidden leverage and maturity mismatches” in the non-bank sector and showed “potential for serious and systemic amplification risk”.

TOO BIG TO FAIL?

Global assets in shadow banking have increased to $68 trillion from about $30 trillion in the immediate aftermath of the financial crisis, representing 14 per cent of global assets.

However, at just three per cent of banks’ total assets, S&P Global’s report suggests traditional banks are relatively well insulated from dangers in the sector.

The report also suggested that the growth of the shadow banking sector may slow over the coming year as higher interest rates will reduce shadow banks’ competitive advantage over traditional banks.

“If some of these smaller shadow banks fail, that’s okay”, Birry said, although he did caution that there are big discrepancies across countries and that some areas might require different forms of regulation.

But whether it be in commodities, the gilt market or somewhere completely unexpected, regulators will have to keep an eye on the shadows in 2023.

It seems they’ve got a tricky task on their hands.

Regulators can’t use a one size fits all policy for regulating non-banks

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

To appear in Best of the Brokers, email your research to notes@cityam.com

Insurers set for market scrutiny as top firms prepare to report

THE INSURANCE sector is set to dominate this week’s corporate results filings as Admiral, Royal London, Legal & General and Hiscox post results on Wednesday, while Aviva is due to report its full year results on Thursday.

Investors will be keen to see how the Ukraine war and Hurricane Ian –the third-costliest natural disaster on record – has impacted the insurers’ bottom lines.

In the retail sector Greggs is due to file its halfyear results, where the market will get a sense of whether punters are still heading to the sausage roll connoisseur for their baked snacks after raising its prices over the last year. Last week, new figures revealed grocery price inflation in the UK reached a record 17.1 per cent.

Entain, the gambling giant behind

Ladbrokes and Coral, reports its full year results on Thursday.

Last month, it raised it earnings guidance after a strong final quarter of 2022, buoyed by a “successful” men’s World Cup.

Entain said earnings are now due to be within a range of between £985m and £995m for the year.

Finally, the North Sea’s biggest oil and gas producer Harbour will update the market, also on Thursday.

The firm has been very vocal in its opposition to the windfall tax and previously warned it is reassessing its future UK plans and could even cut jobs in response to the levy.

“If you take the decision to overtax businesses, especially small ones, don’t be surprised if they choose to walk away,” Michael Hewson, chief market analyst at CMC Markets, said.

FTSE 250 engineering company IMI lifted its yearly dividend on Friday after it reported double-digit profit growth of 13 per cent, and remained confident about the year ahead. Analysts at Peel Hunt said it was delivering “top tier operational performance”, even if it lags behind rivals. It backs buying the stock with a target price of 1,900p.

Analysts at Peel Hunt were reassured by Rightmove’s “resilient set of numbers” after the online real estate portal said on Friday it was untroubled by the cooling housing market and expected the number of customers who use the platform over the year to be broadly similar to the second half of last year. It advised to buy the stock and set a target price of 580p.

STANDING UP FOR BUSINESS

STAYING CHEERFUL “A sea of green greeted the main European indices on Friday including a 0.3 per cent rise in the FTSE 100 and a 0.7 per cent advance in the Dax. Miners and packaging companies were in demand last week, implying that investors continue to find reasons to stay optimistic despite patchy economic conditions.”

RUSS MOULD, AJ BELL

OPINION

EDITED BY ELENA SINISCALCOIf Sue Gray becomes Starmer’s chief of staff, she’ll have some answers to give

Eliot WilsonSOMETIMES life comes at you fast. It’s not much more than five years since Sue Gray was a name relished by Whitehall insiders but without any resonance with the public. When she handled the investigation into the sexual conduct of Damian Green, then Theresa May’s de facto deputy PM, newspapers had to explain who she was. The late Paul Flynn MP summed her up in a meeting as “deputy God”. Yet last week she was a news story herself - which, as a civil servant, usually means you are very senior or have done something very wrong.

In a story which unravelled with dizzying speed, it was reported that Sir Keir Starmer was considering Gray - by now second permanent secretary at the Cabinet Office - as a candidate to be his new chief of staff. The reason this was headline worthy is that Gray undertook the inquiry into lockdown breaches at Downing Street under the tenure of Boris Johnson, fuelling the “Partygate” scandal which some think unjustly brought him low.

As a civil servant, she carried out an investigation which had the most sharply political consequences. So her apparent acceptance of a much more partisan role caused everyone to look

back and think again about the grim last months of Johnson’s Downing Street years. Those in the Conservative Party who still abase themselves before Johnson have had no difficulty in seeing the Starmer appointment as the culmination of Gray’s long-suspected betrayal. They see her almost as a sleeper agent of the Islington set who now reveals herself. If it goes ahead, it will be an unusual appointment. The Downing Street chief of staff role is not a very old one, first held from 1997 by Jonathan Powell, whom Tony Blair had recruited when the former was first secretary at the

British Embassy in Washington. Nor is it by necessity a political post: Sir Tom Scholar, sacked last year as permanent secretary to the Treasury as part of Liz Truss’s performative purge of the institutions of government, held the job for a few months in 2007/2008. He was eventually succeeded by the late and legendary Sir Jeremy Heywood, later cabinet secretary. The ideological status of Dan Rosenfield, a former civil servant but recruited from the private sector, was never clear during his tenure in 2021/2022, though he was brought in to bring methodology rather than sharply partisan views.

Sue Gray will be the most senior civil servant to cross the political Tiber in this particular way, however. She has been in the civil service since leaving school, and has operated at some of the most sensitive edges of government, not just in terms of ministerial conduct but also, it is widely believed, on at least the fringes of intelligence and security in her husband’s native Northern Ireland. Her background includes at least a decade keeping tabs on ministerial behaviour and conduct.

In principle, Gray has every right to take the job. To pretend civil servants have no politics, and that it is a stark be-

We must strengthen our ties with the US, so London and New York can grow together

NOW that an agreement over the Northern Ireland Protocol has been reached, the government has an opportunity to bolster post-Brexit partnerships in Europe and beyond. Within Europe, signing the memorandum of understanding on financial services will allow markets on both sides of the Channel to progress outstanding issues. Outside of Europe, a clear priority should now be the United States.

Prior to the referendum, the American market was held up by Brexiteers as one of the greatest prizes to be had from leaving the EU. But since the vote, political realities in Westminster and Washington’s corridors have made the notion of a comprehensive free trade agreement seem a distant dream.

Initially, there seemed to be a prospect of a full trade agreement, with president Donald Trump suggesting a “bigger and more lucrative” deal than any EU-UK offer. The emergence of Joe Biden’s presidency dampened expectations.

Instead, thoughts have turned to the

possibility of economic cooperation outside of a formal free trade agreement. At a meeting of the G20 in Bali last November, prime minister Rishi Sunak met president Biden and underscored this pragmatic way forward, declaring, “we didn't discuss the trade deal in particular, but we did discuss our economic partnership”.

Now, more than ever, there is a clear need for strong ties between our two countries. Whether in dealing with the pandemic, cost-of-living, or Russia’s invasion of Ukraine, we face imminent and serious shared challenges.

Having worked closely together on such obstacles on the political level in recent times, the prospect of closer eco-

nomic ties has only deepened with the Windsor Framework, which Biden described as an “essential step” to progress in Northern Ireland. There is a window of opportunity here that we must seize.

The US and the UK remain the world’s leading financial centres. From our innovative ecosystems to the levels of financial activity and fintech investment, and much more, New York and London dominate the marketplace. Indeed, London and New York are ranked first and second in the list of financial centres in our own City of London Corporation’s report. These twin pillars of the financial community are more competitive in their offerings than rival cities like Singapore and Frankfurt.

To cement our place as financial powerhouses and improve our ties, we should be furthering our alignment. This is the message that I am currently delivering on one of my regular visits to policymakers and regulators throughout Washington DC, including the US Treasury and the Securities and Exchange Commission (SEC).

Areas such as climate finance regulation, innovation in digital assets and operational resilience are all ripe for closer regulatory alignment. Critical to achieving it will be the Financial Regulatory Working Group, a group of highlevel UK and US financial actors. Formed over five years ago to further cooperation after the Brexit referendum, the group focuses on issues integral to the City including financial stability, market efficiency, and investor protections.

Bodies like this can help provide the impetus for British and American leadership on the international stage. We can set standards, reduce costs and burdens on businesses, and ultimately deliver tangible policy returns to help the financial sector thrive.

At a time when growth is high on everyone’s agenda, securing economic cooperation within one of our most long-standing and meaningful allies is a vital step forward.

£ Chris Hayward is the policy chair of the City of London Corporation

trayal when their views turn out to be contrary to our own, is lazy and false. The civil service relies on professionalism and an ability to distance the personal from the public. I did that every day for eleven years as a clerk in the House of Commons; it becomes a habit.

Nevertheless, because of Gray’s very recent involvement in a process which contributed to the fall of a prime minister, there are some questions she needs to answer. When did she decide to apply for a partisan political role? Is chief of staff to Keir Starmer the only role of this kind she has considered? Did she apply to the leader of the opposition’s office for a vacancy, or did they come to her? None of these is a fatal blow to her next step, but each needs to be smoothed out.

If by the end of next year Sue Gray is running the Downing Street operation for the newly elected prime minister Keir Starmer, he will have an experienced ally. That is a benefit to the cause of good governance. But how Gray manages her transition may well have profound effects on the attitude of the current governing party towards the impartial civil service and the norms on which Whitehall operates. The knives are already out and being polished by some including Nadine Dorries, and even Johnson himself.

Gray has one last duty towards the community of officials: make sure her departure is smooth and held to the highest ethical standards. It would be a fitting sign-off to an extraordinary Whitehall career.

ANOTHER

WEEK

IN the life of alleged bully Dominic Raab.

The inquiry looking at the claims he bullied civil servants continues, with some calling his behaviour “nasty and difficult”.

Raab claims innocence, but has said he will resign if the inquiry finds him guilty of bullying

LETTERS TO THE EDITOR

The Mayor on unity in London

[Re: PMQs: Sunak escapes Brexit grilling amid Hancock WhatsApp row, March 1]

I am writing to you today to express my concerns about the inference made by Keir Starmer regarding Poland during PMQs last week, when Mr. Starmer suggested the average family in Britain could be poorer than the average family in Poland by 2030. Mr. Starmer's statements have been seen as stereotyping Poland and have caused offense to many in the Polish community in London. As the Mayor of London, I believe it is important to promote unity and understanding between different communities, and to celebrate the contributions that people from all backgrounds make to our city. This includes the significant contributions that the Polish community has made to London. Polish people have a long and proud

history in London, dating back to the Second World War when many Poles fought bravely alongside the British to defend our country. Since then, the Polish community has continued to make a valuable contribution to London, in fields as diverse as business, culture, and the arts. During Covid, many Londonders saw firsthand how critical Poles are in the NHS. Polish experts work everywhere in the city from law and accounting. Countless fast-growing startups are founded by people of Polish origin. And Poles have made significant contributions to London's construction industry, helping to build many of the city's iconic buildings. It’s important that we celebrate these contributions, and that we work to build bridges between different communities in our city, not castigate Poland as a backward nation. I therefore urge you to join me in celebrating the many contributions that the Polish community has made to London over the years.

Sadiq KhanTo save the NHS, we need radical reform designed by independent experts

Martin JonesTHE NHS is currently facing the worst crisis in its 74-year history. Just last week, the public accounts committee stated our health service won’t meet its backlog targets, with record waits for cancer care.

As the situation worsens so does the blame game, with politicians at loggerheads while trying to address a crisis which is possibly the most politically thankless task they’ve ever faced.

Some of them do bring valuable solutions and ideas to the table. Last year, Sajid Javid set out a digital agenda to harness technological breakthroughs and drive transformation in the NHS and social care. By devolving tasks to technology, medical staff will have more time to focus on critical and urgent aspects of care.

A decade ago, the then prime minister David Cameron launched his national dementia challenge - an unprecedented action in a neglected field, a day that neurologists compare to Richard Nixon’s “war on cancer” in the 1970s.

Nuclear plants are expensive and Sizewell C is no exception. They also take a long time: the project was launched a decade ago, but construction won’t start before the government raises £20bn in private funding through equity and debt. That could take until the end of next year.

EXPLAINER-IN-BRIEF: SUNAK’S DOUBTS ON THE EU HORIZON SCIENCE PROGRAMME

One of the details of Rishi Sunak’s deal on Northern Ireland is the removal of the block on the UK joining Horizon. The latter is the EU’s funding programme for research and innovation. The Union always insisted that progress on this point was dependent on progress on the NI protocol - and now that a deal has been lashed out, it’s down to Rishi Sunak to rejoin the EU scheme. Except for the fact that he might not be so keen. He is said to be doubtful about the merit of the

€95.5bn science programme, and wary of the cost of participating in it. The government and the EU have yet to negotiate how much the UK has to contribute to get back into the scheme. But British scientists and academics have been extremely vocal in their support of rejoining Horizon, spending months pressuring Sunak into making progress with the EU. Now that he finally has, they will campaign even harder to get back into the programme.

ELENA SINISCALCOMayor of Greater Manchester Andy Burnham has been pushing the idea of integrating health and social care for a number of years - an approach which many believe could be pivotal in preventing the collapse of the NHS. Such ideas and innovation are invaluable. Yet we can’t ignore critical structural and procedural problems within health and social care. These must be addressed before real change can ever be properly realised.

The NHS is like a big ship, and it’s going to take time to turn it around. Chances are the plans set in place by today’s political leaders will wane as governments change – and as we’ve seen, prime ministers and health secretaries come and go quite quickly.

Some of the most pressing issues we face today cannot be solved by politicians alone. It’s time to move the big decisions about health and social care out of government control to an independent body.

There’s precedent for this. When it comes to that key part of the economy, interest rates, we turn to the Monetary Policy Committee (MPC), a selection of independent and informed thinkers, to make the big fiscal calls.

Perhaps we need another MPC - a Medical Policy Committee - to set fund-

ing and make other crucial decisions for health and social care. Such a committee could be made up of individuals bringing genuine expertise from inside and outside the sector. It would build consistency in thinking and planning - something that wouldn’t need to be reset every time a government or political leadership changed.

We need nothing short of a drastic reorganisation, because the situation across our health services is only going to get worse. The biggest threat we face is our ageing population - an exponential challenge which as a society we’re poorly prepared for. We’re sleepwalking into a disaster as demand for health services is already at a boiling point.

The way we organise and operate social care to cope with this demographic change is obviously crucial.

The home is a much-overlooked potential ally to the NHS, particularly when it comes to minor medical procedures

and care of the elderly. The NHS could allocate tasks and refer certain patients to providers outside the bricksand-mortar of the hospital to start relieving the pressure on our overburdened system.

To achieve this, we need to professionalise the role of the caregiving workforce, with enhanced training for specialist diseases such as dementia and Parkinson’s in addition to clinical training to help designate more health tasks in the home. Better trained care professionals will turn our care workers into a critical support network to the NHS and help free up capacity for those who truly need it.

For nearly all older people independence is a priority - with independence comes dignity. Likewise, the NHS deserves some independence to help it revitalise itself and thrive once again.

£ Martin Jones is the UK & International chief executive officer of Home Instead

MONEY, MONEY, MONEY Government still needs to raise £20bn for Sizewell C

TRAVEL

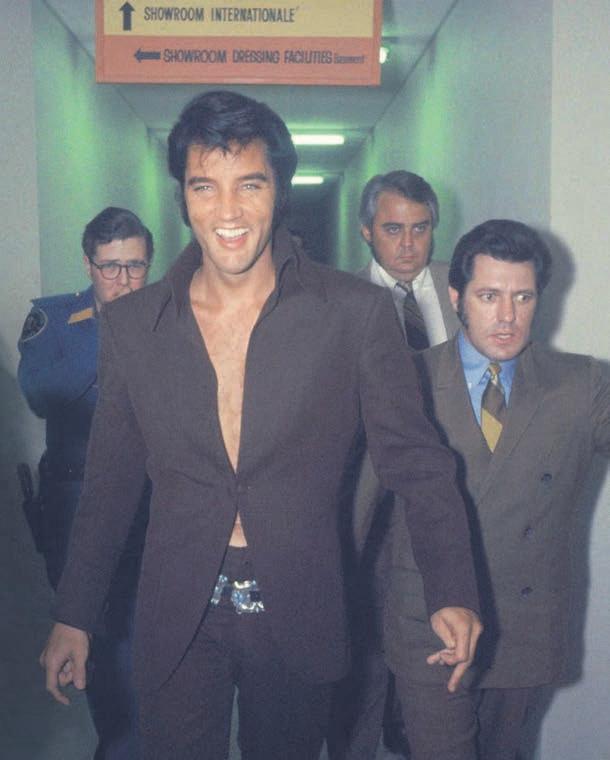

Austin Butler’s powerhouse performance as Elvis inspired Adam Bloodworth to touch down in Las Vegas, in pursuit of the King’s legacy

Baz Lurhmann’s Elvis biopic has the white bodysuits and the polished quiff, of course. But for those of us under 40, it’s also a vital lesson revealing the cultural significance of Elvis to the generations of us who had reduced him to cliché. Elvis’ philanthropy and passion for civil rights, for instance, are unpacked. He had been jumping racial segregation barriers in the 1950s long before being inclusive was cool, and was refusing to stop being photographed with Black artists like B.B. King despite being condemned for it by the white community.

Until Austin Butler came along, it felt like these details about Elvis' legacy were finally starting to fade. But the 31-year-old Californian actor has brought it right back into the public consciousness. He won the BAFTA and the Golden Globe for Best Actor for his portrayal of the King, and he’s tipped to win the Oscar next week. Rightly so: Elvis is a pioneering film, preserving the singer’s legacy for future generations. It throws us into the action like only Luhrmann can, conveying the visceral reaction teenage girls and boys had to Elvis’ gyrating hips in the era when performers tended towards the more puritanical.

I wanted to understand more, so I went on the trail of Elvis in the place with which his performances - and his downfall - had become synonymous. Las Vegas. The city that arguably killed Elvis.

It’s widely thought his manager The Colonel kept him contracted into performing here year after year due to the financial difficulties Elvis ran into over his addiction to drugs.

It was at the Las Vegas Hilton where he would perform 636 sold-out performances from 1969 to 1976. One of the final scenes in the Luhrmann movie - and one of the most spectacular - juxtaposes images of Elvis during one of his last performances in Vegas with Butler’s version of the performance.

Elvis is sweating, overweight and unable to hold his own microphone, but his baritone is pitch perfect.

It turns out everyone and their mum has a story about Elvis in Vegas. The Golden Steer, the oldest steakhouse in the city, is

SEARCHING FOR ELVIS IN LAS VEGAS

deal status is the long queue that forms every day an hour before opening. Inside, I notice one shiny black leather booth has a small silver plaque reading “Elvis Presley’s booth.” It’s four o’clock on a weekday and outside the sun blares unforgivingly, but in here there’s the dark intensity of a nightclub and barely a free table.

Later I roll my window down on South Las Vegas Boulevard to see the Normandie Motel’s sign which reads “Elvis slept here.”

Vickie’s Diner, not far from the former Las Vegas Hilton, now called the Westgate Hotel, boasts that the King popped in for burgers. I did too and the owner speaks fondly of the before times. Bequiffed impersonators marry hundreds of couples at Elvis chapels each week, even if some look more like fraudsters attempting to commit Elvis

Main image: Austin Butler as Elvis and the rest; Elvis at the Westgate Hotel and Adam with Elvis’ step-brother David Stanley

to be ten-a-penny on the Strip. One sign of the times is my twenty-something taxi driver, who calls Celine Dion the “dinosaur” of the Strip. What on Earth does that make Elvis? These days, Someone Like You has a higher cache in Vegas than Suspicious Minds. The most popular impersonator show in town, Legends of Las Vegas, features Adele and Lady Gaga but there’s no mention of the King.

There is one place that remains key to Elvis’ legacy: the Westgate Hotel, where the singer lived and performed for the final years of his life. The Westgate is a vital historical beacon amid a city of constant, ferocious change. Currently, the family hotels of the 1990s, including The Mirage, are being ripped out and replaced with more conventional luxury properties such as the

newly built Aria and Resorts World, but amid this, the Westgate remains.

It’s fabulously camp. The 68,000 crystals in the chandeliers in the lobby are original from when the hotel opened in 1969. There’s a photograph on the wall of the James Bond movie Diamonds are Forever, which was shot here. At Sid’s Cafe on the left of the lobby, the decor and waiters have been the same for over 40 years; there’s also a carbonara worth writing home about.

“Pull your best Elvis pose!” says Gordy Prouty, the Westgate’s vice president of public relations. He’s snapping pics of me on my phone while I try - badly - to emulate the dance moves that earned Elvis the nickname ‘Elvis the Pelvis’. We’re standing in the middle of the Westgate International Theatre stage, where Elvis performed two shows a day before retiring to his 30th floor penthouse suite. I get the sense Gordy has done this before: he knows almost to the metre where I should stand to feel properly in the shadow of the late legend. Very little in the auditorium has changed, except the conch shell seating, which has been ripped out and replaced with conventional rows. Within the context of Vegas’ constant renewal, it’s miraculous this stage has survived.

Barry Manilow performed here the day before I visit, but really, everything’s still set up for Elvis. Exiting stage left, a sign earmarks where the King would hold his hand to the wall and pray before every performance. Five metres away is the lift Elvis used to get from the downstairs dressing room. Downstairs, ten metres from the bottom of the lift in the main dressing room, the bartop Elvis designed and his large mirror remain. The simple cream shower room and toilet facilities are the same as they always have been, so Manilow poops where Elvis did. It’s haunting but thrilling to pep my own collar and stare into the mirror hoping - praying, like Elvis did - for my own sonic inspiration. Nearby, there’s a water fountain Gordy tells me “fans go crazy for,” pre-

sumably because it’s where Elvis drank. I’m struck by how little these practical objects change over time.

The Westgate’s lobby has an old school type of ostentatious charm. A statue of Elvis gyrating with mic in hand is the first thing you notice, and there are gorgeous black and white photos of the King smiling in his heyday lining the walls. There’s also a little exhibition of some of the other stars who’ve played here.

Occasionally, Elvis would stroll through the casino after shows, but he wouldn’t go much further. It turns out we should perhaps have suspicious minds about the image of Elvis gallivanting around restaurants and staying in nearby motels after shows.

“I was with Elvis for 17 years, every show, and we never went to the Golden Steer,” says David Stanley, Elvis’ stepbrother. Stanley works at the Westgate now but in the 1970s he was Elvis’ assistant and lived with him at the hotel. “Everybody wants him to be this…” Stanley gestures, suggesting some larger-than-life character. “He just didn't do that.”

Stanley has begun meeting and greeting fans in the lobby recently, after another employee at the hotel found out about his historical connection. He signs autographs and poses for photos a few days a week. Stanley’s written six books about his step-brother and loves telling

stories about his days with Elvis. He now lives on the 28th floor of the hotel, two floors below the penthouse suite where he spent years working with Elvis.

“There’s times I’ll be sitting in my suite, looking out the window and go, ‘God this is so surreal.’ I was here when it was happening. I lived the history. They look at me at the Westgate as a historical figure who can check what’s real and what’s not. There’s people say a lot of things about Elvis that are just not true. ‘Elvis hung out at the Golden Steer’ - no he didn't - he might have went there once… He had food brought up to the room, we had a great steakhouse here back then, and a great Italian restaurant. He wasn’t jumping in the limo and cruising the strip, that just wasn’t Elvis, that’s not who he was.”

Instead they’d stay in the expansive

suite, which has been remodelled now but used to have a rooftop area for sunbathing and karate. “We’d train an hour or two, on Sundays we’d watch football, we just lived here,” says Stanley. “We’d go outside on the roof to get sun and lay on the roof of the hotel. He was very big brotherish, and talked a lot about faith, that was his biggest advice, embrace your faith.”

Up on the 30th floor, there are views of the scorched mountains in the distance, and the roads stretching towards Arizona, exactly as Elvis would have viewed them. The Verona Sky Villa suite, at 15,000 square feet, is where Elvis’ suite used to be and has an ostentatious European style, with gold embossed detailing everywhere and enough rooms to get properly lost in. It might be the most opulent place I’ve ever been.

Gordy describes the feel in this suite as “close to timeless,” which feels like a fitting tribute to the King.

NEED TO KNOW

Rooms at the Westgate start from £57 per night. The Verona Sky Villa, which occupies the space where Elvis’ Penthouse was, is costed on request. DOS@wgresorts.com for information. Barry Manilow has more concerts in Elvis’ old theatre throughout the year. VIP Elvis backstage and dressing room tours are available for small groups, use email above

The Westgate Hotel, where Elvis played, is a vital historical beacon amid a city of constant, ferocious changeElvis backstage at the hotel

Smith performance a win-win for Borthwick

WITH a ball as his baton, a rugby kit as his tuxedo, and Twickenham his symphony hall, Marcus Smith demonstrated what it means to orchestrate a sports team at the weekend.

His pivotal, leading role in Harlequins’ 40-5 win over Exeter Chiefs on Saturday not only reminded the rugby community of what the Filipino-born No10 can do at the helm but it vindicated Steve Borthwick’s decision to drop the fly-half from England’s training camp to give him game time.

It appears as if, under the Steve Borthwick era of England Rugby, that Smith will be banished to the bench more often than not to ensure that the head coach’s captain Owen Farrell starts at fly-half.

So when against Wales 24-year-old Smith got just a matter of seconds to make an impact on a huge match in the Six Nations and little came of it, fans were rightly frustrated.

Because Smith is a colossal talent in English rugby. It is rare a player plying

FORMULA 1

Key talking points as Verstappen wins

Bahrain Grand Prix with Alonso third, writes Matt Hardy

ASTUNNING Fernando Alonso drive reminiscent of his optimal Ferrari days, a pair of woeful McLaren’s and the early omens of the curse of Bahrain, the Kingdom’s Formula 1 race had a little bit of everything.