LONDON’S BUSINESS NEWSPAPER

KEEP AN EYE ON THE METER WE TAKE A SPIN IN A SOUPEDUP, £120,000 BLACK CAB P17

BRITISH tech darling Darktrace has hired EY to review its finances in a bid to win back credibility after a shortseller questioned its accounts.

Darktrace has recruited the Big Four auditor to carry out an independent review after New York investment fund Quintessential Capital Management cast doubt over the “validity” of the tech firm’s financial results.

In a 70-page report, published last month, Quintessential said it was “deeply sceptical about the validity of Darktrace’s financial statements”.

The New York short-seller raised concerns that Darktrace’s “sales, margins, and growth rates may be overstated” and warned the tech firm’s accounts contain “serious accounting red flags”.

The investment fund alleged Darktrace may have used “phantom” customers to bolster

its sales as it raised concerns about the tech firm’s links to shadowy offshore companies.

Darktrace later responded to Quintessential’s allegations, with company chief executive Poppy Gustafsson (pictured) saying the firm is run with the “greatest integrity”.

Quintessential told City A.M. that it welcomed the review but said it would need to be of “sufficient granularity, scepticism and impartiality to provide insights about the dubious transactions” flagged in the report.

Managing partner Gabriel Grego said: “What I say to your readers is do your own due diligence... We’ve always been validated one way or

Grego also took aim at the choice of EY to do the audit, with the accounting giant still bruised from its failure to notice fraud at the collapsed German payments outfit

Wirecard, which it audited for several years.

“EY doesn’t have a great record in uncovering fraud,” said Grego. Markets and analysts however appeared to be more upbeat about the independent audit.

Shares were up nearly 3 per cent at yesterday’s close.

Analysts at Jefferies said: “Reviews of this nature take time but we see this as another sensible step towards putting quality of earnings issues to bed.”

They added: “Management has handled recent newsflow extremely well” citing a “robust response” to the claims and a share buyback move.

Darktrace chairman Gordon Hurst said: “The board believes fully in the robustness of Darktrace’s financial processes and controls.”

“As a sign of that confidence, we have commissioned this independent thirdparty review by E&Y. We look forward to the outcome of this review,” he said. The review will not be completed in time for a trading update on 8 March.

ELENA SINISCALCO WHY DEEPFAKES ARE THE NEW TECH BATTLE P14

BIDEN IN UKRAINE US President makes surprise stop-off in Kyiv

US PRESIDENT Joe Biden made a surprise visit to Kyiv yesterday, in the week which will mark a year since Russia’s invasion of Ukraine.

The President was filmed walking the city’s streets with Ukrainian President Volodymyr Zelensky.

Biden and Zelensky visited the Wall of Remembrance of the Fallen for Ukraine while air raid sirens blared.

He wrote: “Joseph Biden, welcome to Kyiv! Your visit is an extremely important sign of support for all Ukrainians.”

The US revealed after the visit that it had informed the Kremlin of Biden’s visit in the hours beforehand for “deconfliction” purposes.

LAURA MCGUIRE AND CITY A.M. REPORTERS

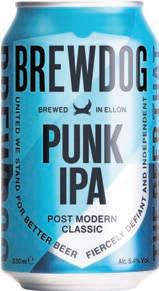

BREWDOG, the self-styled ‘punk’ craft brewer, will soon manufacture its beers in China after a deal with Budweiserowned AB InBev.

The joint venture will see the

Scottish brewer sell its most popular brands such as Punk IPA and Elvis Juice across the growing Chinese market, which will be manufactured at a Chinese Budweiser brewery.

As part of the venture, Brewdog said it was also looking to open several new

hospitality venues in China by 2026, adding to its singular site in Shanghai.

James Watt, founder of Brewdog, described the move as “genuinely transformational” as he claimed that he is looking to bring Brewdog to “every corner” of China.

The deal will raise eyebrows in the wake of Brewdog’s decision to criticise human rights abuses in Qatar just months ago, launching a highprofile advertising campaign on the subject. The Chinese government has also been accused of similar abuses, with

particular focus on the treatment of Uyghur Muslims in Xinjiang — which some international observers have described as ‘genocide.’

BrewDog operates across an international network of more than 110 bars, with two-dozen sites across London.

Owhat a tangled web we weave, when first we practice to make commercial hay from a human rights campaign, as Walter Scott very nearly wrote. Brewdog are the latest example of a brand which has made much of its holier-than-thou culture — only to ditch it in full when the reward is too big to ignore. The short story is thus: Brewdog, keen as ever for publicity, launched an anti-Qatar

advertising campaign in the runup to the World Cup, apparently in solidarity with the myriad groups that have suffered at that particular regime’s hands.

“Taking a stand is always better than saying nothing,” said Brewdog’s boss James Watt.

Fast-forward a few months, and Brewdog has signed a bumper deal with Budweiser to flog its craft beer all across China. Yes, that China, the one with a list of human rights abuses as long as your arm and that most international observers believe to be committing some version of a genocide against Uyghur Muslims in Xinjiang. There’s nothing wrong with Brewdog’s decision to go big in China; it’s a growing market, and

it will no doubt do well. It’ll create jobs, and revenue, and contribute to economic growth. But what sticks in the craw is the hypocrisy of it all. Now, Brewdog are a special case; CEO Watt enjoys the headlines, albeit not perhaps the ones about his management style and the “rotten culture” that former employees accused him of overseeing. But perhaps there is a chink of good news in the reaction to Brewdog’s convenient

picking and choosing of their human rights causes. It is not just us who’ve clocked the inconsistency. Indeed the more we hear of ‘ESG commitments’ from British businesses, the more we hear about ‘purpose’ and ‘standing up for our values,’ the more sceptics there are asking whether they’re worth the paper they’re written on. And goodness knows the whole ESG movement could do with a little more scrutiny.

SCHOOL DAYS Mayor of London Sadiq Khan visits his old school, Fircroft Primary School in Tooting Bec, south London, to announce a free school meals scheme.

CHRIS DORRELL

CONFIDENCE among small and medium-sized businesses (SMEs) continues to grow across the UK, with London leading the way, new data out yesterday showed.

60 per cent of respondents in the capital expect their revenue to grow this quarter while they intend to make 12 new hires, according to Barclays SME Barometer.

London is ahead of the rest of the UK, which has a national average of 55 per cent expecting revenue to grow and an average of just seven new hires.

Across the country, 41 per cent of SMEs were optimistic about the prospects of their business, the highest level in nine months.

Only 15 per cent of SMEs maintained a pessimistic outlook for their own prospects. In London, this figure was only eight per cent.

While SME confidence was improving, the proportion feeling optimistic about their business was still lower than the 49 per cent recorded last year.

73 per cent felt worried about their energy bills, with more than half looking for ways to reduce them.

The strength of the domestic econ-

omy topped the list of concerns cited by small business leaders with 15 per cent citing concerns. Inflation followed at 12 per cent.

More than 50,000 SMEs folded in London last year as inflation, increased borrowing costs and sky-high energy bills cut through the sector.

In October last year, it was reported that over half of SMEs had taken out personal loans to fund their business.

Colin O’Flaherty, Head of SME at Barclaycard Payments, said: “It’s encouraging to see more businesses reporting optimism about their prospects going forward.”

The remote driving of vehicles from overseas could be banned following a government review. The review was carried out by the Law Commission of England and Wales

TIMES GRAND HOTEL IN BRIGHTON SOLD FOR UP TO £60M

The family that controls Fortnum & Mason and Associated British Foods is selling the five-star Grand Hotel in Brighton, with an estimated price of up to £60m. The hotel is being acquired by Israel’s Fattal Group.

THE DAILY TELEGRAPH BRITAIN FACES TOMATO SHORTAGE AS BAD WEATHER SQUEEZES SUPPLY

Britain is facing a tomato shortage after bad weather in Morocco and Spain left importers struggling to find them. Supermarket shelves have been left bare after a weak crop.

WHAT THE OTHER PAPERS SAY THIS MORNINGLondon is at the vanguard of increasing business confidence among SMEs

TESCO IS considering selling Tesco Bank, according to Sky News, which reported that the supermarket giant has started a review process for its banking arm.

The review is at a very early stage and may not lead to a formal sale process,insiders have said. A partial sale or joint venture may also be considered.

Tesco is said to be considering bringing in Goldman Sachs to advise on Tesco Bank’s future, according to the report.

Sky News confirmed that there is no suggestion there will be job losses or any form of wind down.

Analysts suggested that the move would make sense and would allow Tesco to cut costs and to concentrate on its core business.

IG Group’s Chris Beauchamp said Tesco “needs to focus relentlessly on costs.”

“With so much of its business under pressure due to higher prices and weaker spending, it’s time Tesco ditched its banking arm...if only to free up cash to help maintain its market share,” Beauchamp said.

Professor Joshua Bamfield at the Centre of Retail Research agreed, telling City

A.M. that “the Bank is a diversion from its main business while the proceeds of a Tesco Bank sale could be poured into making its grocery shopping more efficient and lower cost.”

Tesco Bank was launched in 1997. It has more than five million customers across its banking and insurance business.

Bamfield commented that, while Tesco Bank is “undoubtedly successful, getting into retail banking has been pretty tough for many of the big players in shopping such as M&S (which closed down its current accounts) and Sainsbury’s (which tried to sell its bank in 2021).”

Last month, Jacqui Ferguson, formerly of Hewlett Packard Enterprise Services, was appointed its interim chair after Sir John Kingman, the former Treasury mandarin, resigned to become chair of Barclays’s UK ring-fenced bank. Kingman had been chair since 2019.

In 2019, it divested its UK residential mortgage portfolio to Lloyds in a deal worth £3.7bn. In 2021, the bank stopped offering current accounts in order to concentrate on its savings accounts and credit cards.

Tesco declined to comment. Goldman Sachs was contacted for comment.

BUSINESSES that have adopted a four-day working week for all staff have said they are more productive and profitable, and hailed a healthier and happier workforce. It comes as the world’s biggest trial of a four-day working week was deemed a success by

researchers, as the vast majority of companies involved said they will continue to adopt a shorter week after the pilot ended.

Some 61 companies took part in the pilot scheme, ranging from charities and financial services firms to retailers and a fish and chip shop.

All the firms had to make sure there was no reduction in salary for

their employees.

5 Squirrels, a Brighton-based skincare company that took part in the trial, said its four-day working week had “worked across the board” and significantly increased productivity across the team. Digital bank Atom moved all staff to a four-day working week back in November 2021, with no change in salary. PA

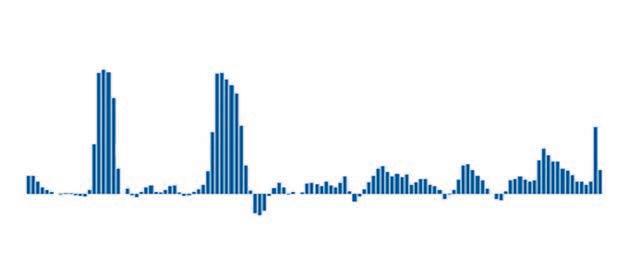

THE UK has spent more than £50 billion extra on gas since Russia’s invasion of Ukraine, a new analysis suggests.

Wholesale gas prices exploded after the invasion and have been in a volatile state ever since, with many British households now burdened with much higher bills.

The analysis, carried out by the Energy and Climate Intelligence Unit (ECIU), estimates that the UK paid

between £50-60 billion more for wholesale gas in 2022 than in a typical pre-pandemic year.

British households have been hit harder by the current crisis than in any other Western European country, according to the IMF, because of the UK’s dependence on imported gas. Gas is used to produce around 40 per cent of the country’s electricity as well as to heat 85 per cent of British homes, which are among the least energy efficient in Europe.

Facebook and Instagram owner Meta will soon roll out a paid-for verification model, copying a similar move by rival social media platform Twitter. In a bid to calm jittery investors, Meta chief executive Mark Zuckerberg revealed he was launching a new subscription service for between £1012.50 a month. PA

THE FINANCIAL Conduct Authority said it is in talks to strike a deal with the manager of Neil Woodford’s collapsed investment fund to ensure burnt investors can get redress following its collapse in 2019.

In a statement yesterday, the FCA said it was in “advanced confidential discussions” with Link Group and its UK arm Link Fund Solutions to win compensation for investors “by agreement”.

It came as Link Group said it was in “exclusive negotiation” with fund service firm Waystone Group over the sale of Link Fund Solutions business excluding “Woodford related liabilities”.

A deal with the FCA would see the firm dodge punitive enforcement action laid out by the watchdog in September that included a proposed penalty of £50m and redress payments for consumers of up to £306m.

In its statement, the FCA said it is “focused on ensuring that consumers affected by the suspension of the Woodford Equity Income Fund (WEIF) obtain redress.”

“To assist a potential resolution, the FCA has provided time for Link Group to realise assets, including Link Group held assets, to meet the FCA’s concerns,” the watchdog said, adding that it will “provide a further update as soon as [it] is able to”.

Individual investors were left thousands of pounds out of pocket after formerly famed stock picker Neil Woodford began splashing investors’ cash in speculative bets on unlisted firms. Investors rushed to withdraw money from the fund before Link eventually froze withdrawals in 2019, trapping around £3.7bn of investors’ cash.

Woodford’s funds lost colossal sums

The funding will be used to help develop its hydrogen power generation technology

THE government has appointed Natwest boss Dame Alison Rose to spearhead its new energy efficiency task-force.

Rose has been named co-chair of the body, which was set up as part of the government's drive to slash the country's energy consumption and cut household bills — helping to push down inflation.

She will work alongside co-chair Lord Callanan, the long-standing Tory peer and a minister at the department for energy security and net zero.

NICHOLAS EARL

GREEN hydrogen specialist Geopura has secured £36m from its latest funding round with plans to scale its business.

The funding round was led by major industry players such as GM Ventures — the investment arm of General Motors — and co-led by Barclays Sustainable Impact Capital, with SWEN CP and Siemens Energy

AN AUSTRALIAN litigation funder has more than doubled its money after giving Carillion’s liquidator millions to fight a £1.3bn lawsuit against KPMG. Litigation Capital Management (LCM) has generated more than £7m in profits after funding the claim brought by Carillion’s liquidator against the Big Four firm, the Aussie firm said.

Litigation funders raise cash from investors with a view to bankrolling lawsuits on a ‘no win, no fee’ basis and taking a cut of any potential winnings.

LCM first began funding the claim against KPMG in 2021, after Carillion’s liquidator “went to the litigation finance markets” in pursuit of external cash, the fund’s chief executive Patrick Moloney told City A.M.

He explained that bankrupt

companies seeking to sue auditors often require external funding, due to lacking sufficient cash to fund lawsuits themselves.

The case saw LCM invest £5.2m in the case before announcing it had generated £12.5m returns, including £7m in profit. Moloney explained that funds raised from pension funds, university endowments and investment banks were used.

Ventures also participating. These investors will also act as strategic partners for Geopura as it scales its hydrogen power generation technology — which replaces dieselfuelled generators with zero-emission hydrogen power units (HPUs). The HPUs are used for temporary, supplementary, off grid and backup power, with Geopura delivering its first HPU in collaboration with Siemens Energy in 2019.

The taskforce aims to accelerate household insulation, boiler upgrades and business energy efficiency measures to help cut national energy consumption by 15 per cent over the next seven years.

It will devise a work-plan to help reduce total UK energy demand by 15 per cent from 2021 levels by 2030 across domestic, logistics and commercial buildings and industrial processes.

The Chancellor Jeremy Hunt confirmed the appointment at a meeting with nearly 100 representatives from the UK’s top green firms.

KPMG received £29m in fees for its audits of Carillion over a 19-year period

LOUIS GOSS

KEYSTONE Law has benefited from the widespread shift to homeworking, the law firm’s founder and chief executive James Knight told City A.M. , as it forecast revenues and pre-tax profits for the year will beat expectations.

Keystone Law, which is listed on London’s Alternative Investment Market, said it expects its revenues and pre-tax profits will be “marginally ahead of current market expectations” for the year to 31 January 2023.

“Over the last two years, the legal profession has experienced something of a bull market,” Knight said. “We have been able to benefit off the back of that.”

Knight added that the uptick in business also helped Keystone offset higher costs related to the “extremely competitive” recruitment market, as competition for talent has driven up salaries throughout the legal sector.

As well as the bull market, the widespread shift to homeworking also benefited Keystone’s business, Knight argued.

The shift away from conventional working practices has “completely validated” Keystone’s decentralised, fully remote-working business model, Knight said, which the firm implemented back in 2011.

He said the “countrywide revolt” against returning to the office could now benefit Keystone further, as lawyers opt to leave firms that require them to work for a certain number of days each week.

LAURA MCGUIRE

PLANET Organic is reported to have taken on advisers with a view to a possible sale.

According to reports first published in Sky News, the British grocer is working with financial advisory firm Interpath on a review of its “strategic options”.

Sources revealed to the outlet that Planet Organic was seeking funding to “help deliver its growth plans”.

A spokesperson for Planet Organic told Sky News that the group was “working closely” with its advisers to help “navigate options to secure further investment”. They added: “This additional funding will enable us to support the next phase of our current

growth plans.” Last September, the organic grocer said that it was looking to raise £30m over the next two years to help with the roll out of over 100 stores across the UK.

The grocery chain, which is headed by George Dymond, currently has 13 stores in London and is set to open a new site in Teddington at the end of February.

The economy is doing slightly better than expected. Which, to be fair, might not be saying much. But it has led to calls for the Chancellor to loosen the iron grip on families and businesses in next month’s Budget. Senior Conservative MPs, alongside fresher faces in the Conservative Growth Group, think this is the moment to drop the planned increase in corporation tax from 19 to 25 per cent. After all, an investment shortage (and the resulting lack of productivity growth) lies at the heart of our woes. Increasing a profits grab is unlikely to help.

The government was quick to squash this idea over the weekend, given the Prime Minister’s big pledge is to halve inflation by the end of the year — even though it’s doubtful how much control the government has over that number. But they might do well to keep an open mind. While civil servants may feel that our successive cuts to the headline rate of corporation tax

from 30 to 19 per cent did little to stimulate investment, Chancellor Jeremy Hunt himself perhaps doesn’t agree. Let’s remember, it was he who had the punchiest of pledges on corporation tax during last year’s (first) leadership campaign, calling for a headline rate of 15 per cent.

In any case, it’s easy to look across the Irish Sea for a counterview. AstraZeneca last week announced that it would locate a new manufacturing plant in Ireland rather than the UK. While there will be more than one reason for this decision, Sir Pascal Soriot made it abundantly clear that the UK’s “discouraging” tax regime was a contributing factor.

The European Commission forecasts heady growth rates of almost 5 per cent for Ireland this year. We should be so lucky — anything above zero is a big win for the UK at present. Perhaps the government ought to consider giving the economy a little more room to grow.

Forecasts indicate that rail services will be subsidised by £11 billion in the financial year 2022-23. The average rail fare in 2022-23 will be £6.12 per journey. An additional £7.51 in subsidy is required to make up the full cost of that journey. It's worth bearing in mind that rail sector pay over and above that recommended by the independent pay review body is likely to be met by taxpayers, not the rail operating companies.

£ Talking of taxes, it emerged that three quarters of county councils are planning to hike council tax as much as they can without triggering a local referendum — with 84 of 113 already declared saying they’ll be upping rates by 4.99 per cent. This equates to an extra £100 per year for the average band D property. Three councils have special dispensation to hike by even more — dodging a referendumincluding Thurrock, which lost a bob or two on some property speculations. Perhaps better to focus on frontline services…

£ The Department for Business, Energy and Industrial Strategy was split into four as part of a bigger reshuffle. How much will it cost?

The Lib Dems reckon it’ll be £60 million, with other estimates closer to £100 million. Why not relocate officials in the new departments out of London? We’ve estimated that £371 million of savings can be found by moving 53,196 civil servants elsewhere.

Encouragingly, Kemi Badenoch’s department will have a renewed focus on growth — which, if achieved, can help bring down those sky-high tax bills.

The BBC boss Tim Davie was probably right when talking to staff about licence fee payments: it consistently polls as one of the most unpopular taxes.

Leviathan by Thomas Hobbes. John Locke’s Two Treatises of Government. Edmund Burke’s Reflections on the Revolution in France. 1984 by Orwell. All great works, that surely don't need yet another recommendation. Although, if you were to pick up any of these works you could find yourself on the government's naughty list. According to reports, the Home Office-run Prevent Programme flagged some classic texts under its Research Information and Communications Unit as opening the door to extremism. It didn't stop there. Terrifying TV programmes such as The Thick Of It and Great British Railways also proved troublesome. And that's to say nothing of the attempts to rewrite classic Roald Dahl stories. Maybe you've already read and watched all of the above. But surely they are self-recommending now they have a new edge.

John

It’s truly amazing what we’re pulling off, by the way.

SIZEWELL C will be a huge boost to the UK’s energy ambitions, helping the country cut its reliance on overseas suppliers to meet its needs, the leading nuclear industry body argued.

Tom Greatrex, chief executive of Nuclear Industry Association, came out in defence of the upcoming project, after EDF raised its estimate for the cost of sister power plant Hinkley Point C. He told City A.M.: “Sizewell C will be one of Britain’s biggest-ever green infrastructure projects alongside Hinkley Point C, providing home-grown, clean electricity for six million homes for 80 years, significantly strengthening UK energy security and net zero targets.

“Britain needs more nuclear alongside other clean energy infrastructure projects to prevent more gas-driven crises sending inflation soaring, which has led to supply chain challenges across the clean energy sector.”

Greatrex’s support of the UK’s nuclear ambitions follows EDF hiking projections for Hinkley Point C’s overall construction costs from £26bn to £33bn in line with inflation — which was way

LAURA MCGUIRE

VIRGIN Media O2 is reportedly eyeing a takeover of Trooli, a Kentbased alternative broadband network provider.

above its initial £18bn budget.

The project is also facing a cash crunch, with Hinkley Point C’s Chinese state partner CGN not required to offer further funding for the project — which is supposed to be completed in 2027.

This raises questions over the construction process for Sizewell C — with government paying £100m to force CGN out of the project.

EDF’s hike in estimates for Hinkley Point C reflects the difference in inflation between 2015 and 2023 when the project was priced — with customers incurring no extra costs.

However, it brings into sharp focus the heavy upfront cost of the UK’s nuclear ambitions, with Rolls Royce’s plans for small modular reactors facing delays over funding concerns — with the government pushing back a decision over whether to back the initiative with more taxpayer money.

Greatrex argued that the best way to drive down the heavy upfront costs for new power plants was to approve a pipeline of projects, which would be built in stages — rather than going from one project to another.

Virgin Media O2 is among a “substantial number” of parties exploring offers for Trooli as part of a formal bidding process, Sky News reported.

NICHOLAS EARL

THE ENERGY sector is ramping up pressure on the government to bolster investment in green projects, with Renewable UK the latest to raise concerns the country could be overtaken by rivals like the US and EU. The industry body, which supports wind and tidal energy, has called on Downing Street to bring in fiscal incentives such as new capital allowances for renewable technology.

It also favours sustained supply chain investment in the UK to expand green jobs, and speeding up the planning process.

Executive director of policy, Energy UK, Ana Musat said: “We’re urging the Chancellor to look at the recommendations set out in this report ahead of his spring Budget, as the renewable energy sector is facing a perfect storm this year, with inflation squeezing out already tight profit margins.”

Telecom industry sources told Sky News that the offer was likely to be worth over £100m.

It has been reported that Trooli, which provides broadband to rural areas, is exploring a sale due to a growing pressure placed on alternative network providers, which have been hit with supply chain issues and rising costs.

The market is currently

dominated by BT's Openreach division, but it also includes large competitors such as CityFibre Holdings.

The sale process is being handled by financial services firm Lazard, Sky News reported.

Trooli is focused on rural and semi-rural postcodes in places like Kent and Berkshire. Virgin Media O2 declined to comment on the report.

POLITICAL CAPITAL OPEC+ decisions are not politicised, Saudi Arabia arguesSaudi Arabian energy minister Prince Abdulaziz bin Salman felt it was unclear how much longer global fiscal tightening would continue — which would also influence OPEC policy. “The jury is still out on how much more inflation may come,” he admitted.

NICHOLAS EARL

WATER companies across England will have to explain why storm outflows are happening and what is being done to fix them, under new government plans to clamp down on sewage spills.

Environment Secretary Therese Coffey wants all water and sewerage firms to provide an improvement plan for every storm outflow — with suppliers being told to prioritise sewage reductions at bathing sites and nature habitats.

Ingesting harmful bacteria from human waste such as coliforms can lead to nausea, vomiting and diarrhoea. It can also cause more serious infections in the elderly or immune-compromised — targeting the lungs, skin, eyes, nervous system, kidneys or liver.

Companies also face the prospect of immediate fines for polluting rivers, lakes and seas, as Coffey is looking to make it easier and quicker to hit polluting companies with penalties. This means water suppliers will have

to cough up straight away rather than waiting for criminal prosecutions to conclude.

Coffey said: “People are concerned about the impacts of sewage entering our rivers and seas and I am crystal clear that this is totally unacceptable.

“I am now demanding every company to come back to me with a clear plan for what they are doing on every storm overflow, prioritising those near sites where people swim and our most precious habitats.”

Coffey also slapped down speculation she wanted to ease potential increases in fines for water companies.

She confirmed that, when it came to the upper limit of fines, “all options remain on the table,” including the £250m maximum fine cap proposed by predecessor Ranil Jayawardena.

This follows Prime Minister Rishi Sunak denying reports last week that Coffey was backing away from plans to hike the maximum fine from £250,000 to £250m.

The PLANNING ACTS and the Orders and Regulations made thereunder

This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building

Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

1 Bishopsgate, London, EC2N 3AQ

23/00072/FULL & 23/00073/LBC

Removal of two ATMs and replacement with one external ATM.

Shaws Booksellers Public House, 31 - 34 St Andrew’s Hill, London, EC4V 5DE

23/00079/LBC

Installation and display of: (i) one externally illuminated fascia sign measuring 2.96m x 2.4m, (ii) two externally illuminated fascia signs measuring 2.57m x 2.18m, (iii) two internally illuminated projecting signs measuring 0.8m x 1.1m; (iv) two lantern lights outside the main entrance

Sign A - 1 x Sign written house name text to painted fascia area. Illuminated by new LED trough light, painted to match fascia colour.

Sign B- 2 x Sign written secondary texts to painted fascia area. Illuminated by new LED trough lights, painted to match fascia colour.

Sign C - 1 x Internally illuminated wall mounted pictorial sign, with refurbished cartouche header.

Sign D - 2 x A4 portrait brass menu case holders. brackets.

1 Red Lion Court, London, EC4A 3EB

23/00103/FULL

The extension to the existing core, the introduction of a roof terrace and the installation of plant machinery and associated works at rooftop level.

Retail Unit, 18 Devonshire Row, London, EC2M 4RH

23/00107/FULL

Installation of one air conditioning condenser unit to the rear of the retail unit.

Lloyds Chambers, 1 Portsoken Street, London, E1 8BT

23/00114/FULL

use (Class E).

Telecommunications Mast, Scottish Provident Building, 1 - 6 Lombard Street, London

23/00123/FULL & 23/00124/LBC

Removal and replacement of 3no antennas, internal upgrade of existing equipment room and associated ancillary works thereto.

King George V Block, St Bartholomews

EC1A 7BE

23/00127/FULL

External alterations to the eastern elevation

window and installation of louvres to serve a new plant room; (ii) new opening casement to adjacent

You may inspect copies of the application, the plans and any other documents submitted with it on-line or telephone 020 7332 1710.

Anyone who wishes to make representations about this application should do so online:

Any observations must be received within a period of 21 days beginning with the date of this notice (unless otherwise stated) and will be taken into account in the consideration of this application.

In the event that an appeal against a decision of the Council proceeds by way of the expedited procedure, any representations made about the application will be passed to the Secretary of State and there will be no opportunity to make further representations.

Sainsbury’s is the latest supermarket chain to reduce the cost of its products to reflect the cost of living crisis

LAURA MCGUIRE

SAINSBURY’S has become the latest British supermarket to try and reduce the price of their products amid a cost of living crunch, after it revealed it will launch discount £2 fruit and vegetable boxes.

Sainsbury’s said that its ‘Taste Me, Don’t Waste Me’ boxes will include a variety of surplus fresh fruit and vegetables with the boxes being sold at a lower price to “ensure customers have access to affordable nutritious food, as the

cost of living continues to rise”.

Other supermarkets have also sought to minimise the impact of inflation across their produce, with both Waitrose and Morrisons investing £100m and £25m respectively to reduce the price of their own brand items.

“Price hikes, and rising labour costs, have placed supermarkets between a rock and a hard place”, Sachin Jangam, partner for Retail at Infosys Consulting told City A.M

“To remain competitive as food sales drop, supermarkets need to

focus on their price match schemes to stay competitive,” Jangam said.

Yesterday Tesco announced it would be upping staff pay by seven per cent in the third rise in under a year.

"We know that many colleagues have felt the pressure... this year, and we are absolutely committed to supporting them with competitive base pay and exclusive colleague benefits," the firm’s chief commercial officer Jason Tarry said.

Why English rugby is set for a radical shake-up in governance in the wake of Worcester’s collapse

REAL

BALL ACTION IS OFF THE PARK, SAYS MATT

JESSICA FRANK-KEYES

SCOTLAND’S FINANCE secretary Kate Forbes has announced she will run to succeed Nicola Sturgeon as SNP leader and first minister of Scotland. Announcing her bid on Twitter yesterday she said: “I am today launching my bid to become Scotland’s next first minister, with the vision, experience and competence to inspire voters across Scotland.”

In a video message accompanying her tweet, Ms Forbes said: “Friends in the SNP, our nation and our movement are at a major crossroads. The choices that we make in the next few weeks will have a profound impact on

Forbes is in the running for first minister of Scotland

our future and on our children’s future.

“I can’t sit back and watch our nation thwarted on the road to self-determination.

Our small independent neighbours enjoy wealthier, fairer and greener societies and so should we.”

It came shortly after longstanding MSP Angus Robertson ruled himself out of the race to replace Sturgeon, by tweeting a letter saying he had decided not to stand due to family commitments. Robertson, who represents Edinburgh Central, wrote: “Since Nicola Sturgeon announced she is stepping down, I have been encouraged by many to consider running for the SNP leadership and to become first minister.

Corporation tax is set to rise from 19 per cent to 25 per cent this April

JESSICA FRANK-KEYES

PRIME Minister Rishi Sunak is facing down the prospect of a rebellion over next month’s budget as renewed pressure mounts over a planned increase in corporation tax. Seven top Tory backbenchers and business owners including Wetherspoons boss Tim Martin have

DAVID HUGHES AND SOPHIE WINGATE

SENIOR Tories have rallied round former Cabinet minister Damian Green after he was rejected as the party’s candidate for a newly created seat.

Mr Green, who was effectively deputy prime minister under Theresa May, said he was “disappointed” not to have been selected for the Weald of Kent constituency.

JESSICA FRANK-KEYES

SUGGESTIONS that ministers could be vetoed or deploy exemptions to Sadiq Khan’s controversial expansion of the Ultra Low Emission Zone (ULEZ) scheme were played down by the government yesterday.

Under the expansion plans, drivers across the capital will face a daily charge of £12.50 for using vehicles which do not meet emissions standards from August — including commuters who live outside of London.

Speculation has been mounting that government officials could consider vetoing Khan’s plans,

according to reports in the Telegraph, after rising opposition to the plans from Tory-led borough councils, former mayor and ex-PM Boris Johnson and even Labour MPs.

Under the Greater London Authority (GLA) Act of 1999 — which defines the relationship between central government and the powers devolved to the capital — ministers retain the authority to exempt certain individuals from road user charging schemes, such as ULEZ. However, the government yesterday played down any suggestion it could move to derail Khan’s plans and insisted road user charging was a matter for themayor.

A spokesperson for the Department of Levelling Up, Housing and Communities (DLUHC) said: “Transport in London is devolved and decisions on ultra-low emission zones are a matter for the mayor and TfL, who have a responsibility to consult with communities.”

The prime minister’s official spokesman told journalists it was for the mayor to “justify the decision to residents and businesses”.

A spokesperson for the mayor said: “We are confident that this complaint is groundless, but the monitoring officer will carry out an initial assessment.”

urged Sunak and chancellor Jeremy Hunt to scrap the planned rise. Corporation tax rates are set to increase from 19 per cent to 25 per cent from 1 April, under plans made by Sunak in his role as chancellor — but the move has been unpopular with MPs who fear the plans risk tanking any green shoots of Britain’s economic growth.

His failure to win the nomination has driven speculation that MPs who played a part in Boris Johnson’s downfall could face the wrath of grassroots activists. Party chairman Greg Hands said Mr Green “has our full support” and “we stand behind our MPs”. Mr Green, chairman of the centrist One Nation Conservatives caucus, has been MP for Ashford since 1997 but boundary changes will see the constituency split up.

Former Cabinet minister Simon Clarke — a supporter of Mr Johnson — said he hoped Mr Green finds a seat because “he is a fantastic MP”. PA

CITY of LONDON

undermentioned streets made several Orders on 16 February 2023 except Bride Lane which has

Aldersgate Street Carriageway Works

Coleman Street Mobile Crane

Creechurch Lane Utility Works

Minories Carriageway Works

Dukes Place Bevis Marks Carriageway Works

Bride Lane Building Site Works

King Street COL Scheme Works

Kingscote Street Mobile Crane

Tudor Street Utility Works

21 February 2023

BEAN counters are running the Treasury again. I’m imagining sheets of paper plastered with Jeremy Hunt’s current fiscal rules pinned up around Whitehall to remind departments of the belt-tightening needed to balance the books.

Fiscal rules are targets Chancellors have aimed to meet since George Osborne pivoted away from Gordon Brown’s “Golden Rules” in 2010 after the financial crisis wreaked havoc on the public finances.

They often include some mixture of driving down the debt stock as a proportion of the economy and yearly borrowing.

Hunt’s current targets are to have the debt-to-GDP ratio falling and make sure borrowing does not exceed three per cent of GDP in five years.

Sources at the Office for Budget Responsibility have told City A.M. the last Chancellor to hit their goals was Philip Hammond, Theresa May’s money man.

The intention of placing a restraint on the state’s purse strings is to convince global investors of “the UK’s ability to pay back its debt and thus offer favourable borrowing conditions,” according to the Institute for Public Policy Research think tank.

Breaching those parameters can have disastrous consequences for the UK economy, as we saw with the aftershock of Liz Truss’s mini budget that ricocheted through international financial markets.

Government spending and tax rules were actually a lot tighter when Truss signed off on £45bn of unfunded tax cuts back in September last year, meaning she and then Chancellor Kwasi Kwarteng were even further away from hitting them. The adverse market reaction to that historic fiscal event was likely triggered by two things.

First, and by far the largest factor, inflation was in the double digits, mainly because the economy was running too hot and suffering from an external energy shock caused by Russia’s invasion of Ukraine.

We were operating at what economists call ‘above our potential’, putting upward pressure on prices.

Stimulating the economy with tax cuts risked pushing inflation and expectations of future inflation higher, prompting the Bank of England to hike interest rates aggressively.

Investors priced in that higher-thanexpected rate path by selling government bonds, pushing yields higher. They also demanded a larger return to compensate for the possibility of higher inflation eroding their returns. That ignited the LDI-pension chaos.

Rapidly rising prices keep a lid on what the government can do to support households and businesses. Jeremy Hunt recognised this and ditched nearly all of Truss’s measures and launched a further £55bn of tightening in November.

But what happens after inflation is tamed? Bar another big economic shock, it seemingly is on a downward path this year

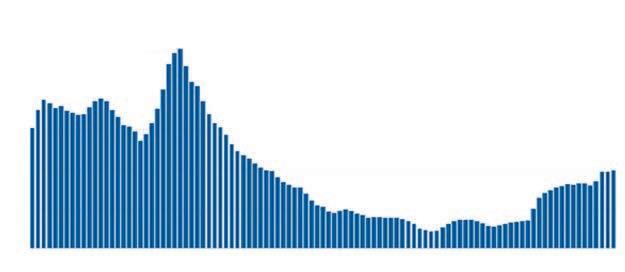

Brits’ pounds aren’t stretching as far as they used to. The value of retail sales in January was 14 per cent higher than in February 2020 despite sales volumes falling more than one per cent, the Office for National Statistics said last Friday. The figures illustrate families are having to spend more on each product they buy. Inflation has eroded the value of pay increases over the last year, prompting economists last week to warn January’s 0.5 per cent sale volume rise is unlikely to carry on through the first half of this year. But with energy prices falling rapidly, the strain on household finances will ease at the end of the year, hopefully boosting consumer spending.

after figures last week showed it dropped for the third straight month to 10.1 per cent.

In and of themselves, fiscal rules basically mean nothing for a country’s public finances.

The real constraint is inflation and whether boosting spending or cutting taxes will release the inflation tiger from its cage.

In fact, some corners of the economics

profession argue our dogmatic approach to hitting fiscal rules has been a primary factor weighing on economic growth since the financial crisis.

“There is no definition of the objective of fiscal policy that meets a social welfare objective,” the National Institute of Economic and Social Research (NIESR) has argued.

CHARLIE CONCHIE

THE FINANCIAL Conduct Authority

(FCA) is looking to overhaul rules governing the asset management industry in a bid to keep the UK attractive to international money managers following Brexit.

In a discussion paper released yesterday, the FCA said it was looking to “improve asset management

regulation with a more modern and tailored regime” as part of its overhaul of financial rules postBrexit.

The UK asset management industry — which collectively handles around £11 trillion in assets — is still governed by retained EU laws which the FCA will now have powers to reform under the Future Regulatory Framework, tabled by ministers to

boost the powers of UK financial regulators.

In the discussion paper, the watchdog said it wants to ensure that the UK “remains an attractive domicile for internationally active asset managers”.

A consultation on the plans is now underway with the industry invited to weigh in on the overhaul before May.

Persistently trying to just reduce the debt stock has shut off routes to launching policy that can boost growth powered by productivity improvements, the holy grail for any economy.

“If public borrowing is ‘spent’ on things that have a high chance of increasing GDP growth, such as public investment, then this

will be much better for public finances than spending it on things that are unlikely to improve economic performance substantially… It is thus crucial that fiscal rules do not prevent governments from borrowing to invest,” the IPPR has said.

Critics of too much government interference in an economy argue it risks pushing interest rates higher by increasing debt supply and curtails dynamism and innovation, two factors that are needed to raise productivity growth.

However, any type of investment, all else equal, will expand a country’s capacity to make things, raising the chances of clinching growth that doesn’t pump prices. Politicians tend to chop and change their promises to tweak the economy because they try to catch the wind of voter intention. While those choices help lawmakers win elections, they can be a roadblock to social progress.

“The sad but obvious fact is that the demands of the economy cannot be folded into political horizons,” Jagjit Chadha, the NIESR’s chief, has said.

Since their modernisation in 2010, the UK’s fiscal rules have changed pretty much every year. Notwithstanding their arbitrary nature, fiscal rules are a set of targets trying to contain an economy - an ever-changing organism - which typically leaves government tax and spending policy wanting.

What we need now is a dynamic set of targets that focuses on raising living standards, not a return to “budgetarianism” that simply balances the books.

City A.M.’s economics editor Jack Barnett takes a deep dive into the state of the economy in his weekly column

London’s FTSE 100 kicked off the week with a positive start, led higher by Lloyds Bank and Barclays which both rose ahead of UK banks’ earnings season ramping up.

The capital’s premier index nudged 0.12 per cent higher to 8,014.22 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, was pretty flat at 20,098.41 points.

Britain’s biggest high street lenders led London shares higher yesterday, signalling investors are upbeat about the final week of banks’ earnings season.

Lloyds Bank, pushed towards the top of the index yesterday despite analysts warning that the firm’s profits could be trimmed by it setting aside hundreds of millions to deal with an ex-

pected jump in defaults.

Barclays, which last week reported that its profits slimmed eight per cent, forcing its shares to the bottom of the index, advanced by a modest one per cent yesterday.

HSBC will also update shareholders this week.

Despite the good news elsewhere, partly taxpayerowned NatWest was trading near the bottom of the index.

Mike Ashley’s Frasers Group nearly topped the index, up over three per cent, after it announced a fresh £80m share buyback.

London’s FTSE 100 has raced out of the blocks in 2023, topping the 8,000 point mark for the first time ever. Analysts said some of the froth of the new year rally on stock markets could recede due to investors finally waking up to the fact central banks are unlikely to cut interest rates this year.

British Airways owner International Airlines Group is expected to rise in the slipstream of big carriers’ results of late, analysts at broker Peel Hunt reckon. “Booking volumes and yields seem to have been strong over the peak holiday period to more than mitigate cost inflation,” they said in a note over the weekend. If its results are decent on Friday, Peel Hunt may upgrade the stockrecommendation.

Strong reservation volumes ahead of the new academic year in September will be key to whether investors pile into student accommodation provider Unite after its results are released next Tuesday. Peel Hunt reckon income generated from the sprawling group could rise with an at least five per cent boost to rental growth. Investors should add the FTSE 100 listed shares.

A

“In the absence of US markets for President’s Day, it’s been a quiet and subdued session for markets in Europe, with little in the way of direction, with the FTSE 100 holding steady in and around the 8,000 level.”

MICHAEL HEWSON, CMC MARKETS

THE FBI has informed me that it is very likely that these are visitors of extraterrestrial nature”, said US President Joe Biden last week in a speech about the flying objects identified over US airspace. “I advise the American people to remain calm”, he added in a video that racked up millions of views. Except he didn’t. The video was a deepfake - a piece of multimedia content altered through artificial intelligence to look real.

If you have an active internet presence, you have encountered deepfakes. They’re everywhere. There was the viral video of Mark Zuckerberg admitting control of “billions of people’s stolen data” in 2019 - a piece of satire forming part of an art exhibition. There is a Tom Cruise deepfake account making waves on TikTok. And there are much darker examples like deepfakes of Ukrainian president Volodymyr Zelensky calling on his citizens to surrender.

Deepfakes permeate online culture; they have penetrated the meme industry, from TikTok to Twitter. There’s nothing wrong with that: as often is the case with tech, deepfake technology is not inherently good or bad. But they’re the symptom of a broader development: we are past the age

where we can believe in what we see with our own eyes. If before, audio and video were considered definite proofs of truth - audio of a phone conversation was evidence in a police investigation, a video of a protest could be evidence of police brutality - now, they can as easily be faked. We are now in the world of synthetic media - or “ChatGPT on steroids”, as Touradj Ebrahimi, professor at the Swiss Federal Institute of Technology in Lausanne, calls it.

Ebrahimi says we witnessed a “true democratisation of the manipulation of visual and audio content”. This democratisation is precisely the memes’ strength: because they’re accessible,

and pretty much anyone can create them and enjoy them, they enable community. They bring people together, allowing them to engage with topics they wouldn’t necessarily encounter otherwise.

This is true particularly for politics. A video of Barack Obama calling Donald Trump “a total and complete dipshit” broke the Internet four years ago. It was a deepfake made by American filmmaker Jordan Peele to warn people about the importance of relying on trusted news sources in an era of disinformation. In becoming an Internet sensation, it also drew attention to what was soon to become a key topic of public conversation.

When deepfakes emerged in 2017, it was hard to make good ones: you needed processors, high-end desktops and specific skills. Now you can make them on your phone. The viral Twitter meme of Elon Musk faceswapped into The Rock was made with Reface. The app has been downloaded more than 250 million times. Chief executive and co-founder Dima Shvets says much of the predictions of synthetic media “causing an infocalypise so far have not been realised”.

Yet the problem is not just disinformation. The “liar’s dividend” is what Jeffrey McGregor, chief executive of software company TruePic, is really worried about. “Bad actors can under-

AFTER nearly a decade in service of the UK tech ecosystem, Tech Nation will close its doors from the beginning of April. It leaves in its wake, a tech sector transformed. One that is resilient, globally-focused, and at the centre of the UK’s economic story.

The creation of Tech Nation stemmed from an ambition for the UK to be a top five global centre for digital entrepreneurship. An ambition many at the time scoffed at.

At the time, the UK’s tech economy was in its infancy. It was heavily focused in London and only a handful of tech firms had achieved the mythical unicorn status – a $1bn valuation.

While the community felt energised and inspiring, it was disparate and somewhat disconnected. There were gaps to fill regarding digital education, founder networking, access to capital, and visas to attract and keep top talent on our shores.

Nearly a decade later, the UK has a national network of digital excellence, with ambitious startups and scaleups

Gerard Grechoperating across every region of the UK, employing 5 million people.

Britain boasts over 20 locations with one tech unicorn or more, almost triple our nearest European counterpart.

The combined value of UK tech companies reached over $1trn by the end of 2022 (up from $60bn in 2013).

Today, the UK is only the third country in the world to pass this milestone. Just the US and China stand ahead of us.

But the value of UK tech doesn’t lie in impressive statistics. It lies in the impact our tech sector is having on the rest of the world. The UK’s tech startups and scaleups are solving the

world’s most important challenges with drive and determination. Whether employing AI to upgrade healthcare systems or harnessing green tech to combat the worsening effects of climate change – the strength and depth of our ingenuity is extraordinary.

As founding chief executive of Tech Nation, it’s been a privilege to have had a front-row seat as wave after wave of incredible innovation has swept through every corner of the UK. Many of the tech stars we take for granted today – from Monzo to Skyscanner, from Deliveroo to Depop – passed through Tech Nation’s programmes on their way to success.

With our successes in hand, you could argue that it is mission accomplished. But for the first time in decades, macroeconomic headwinds threaten Britain’s tech leadership. Our startup and scaleup ecosystem has shown enormous resilience during a global pullback in access to venture capital. The sector is under immense strain, with widespread job losses and

some of our brightest businesses collapsing all together.

The government has made clear its ambitions for the UK: just a week after Tech Nation lost its funding, Jeremy Hunt reiterated his vision for the UK to be the “next Silicon Valley”. Rhetoric must be met with support mechanisms.

The creation last week of a dedicated Department of Science, Innovation and Technology is a step in the right direction but much will depend on its priorities and how it sets out coherent plans for them. Otherwise our entrepreneurial legacy could begin to crack, challenged by the might of other European countries and a faster economic bounce back in Silicon Valley.

This next chapter of UK innovation and entrepreneurship will require consistent and attentive leadership. Not platitudes, but meaningful action. Let’s not squander it.

£ Gerard Grech is the chief executive of Tech Nation

mine all digital imagery by suggesting it may be fake”, he says. The impact of this in a world where conspiracy theories are much more mainstream than they’ve ever been is momentous. It already happened in Gabon in 2019, when the president, who had been ill for months, appeared in a video explaining he had a stroke but was now stable. Many thought the video looked odd - the military went further, staging a coup claiming the video was a deepfake and the president was actually dead. Needless to say, he wasn’t. Governments have started to wake up to the danger. California has made it illegal to create or distribute videos, images of audio or politicians modified to resemble real footage within 60 days of an election. But with such chameleonic AI, legislation alone can’t do all the heavy lifting. “Users are also accomplices: they retweet, they share, they contribute”, says Siwei Lyu, professor at the Department of Computer Science and Engineering at the University at Buffalo. For him, the best way to engage with the issue is to improve users’ awareness and resilience to fake media. The line between memes and disinformation becomes thin with deepfakes. We should train ourselves to detect what’s real and what’s fake - and we should be thinking of the motivation behind making a deepfake. There are clues: Ricardo Amper, chief exec of Incode, suggests looking for “unusual skin tones, strange lighting, and oddly positioned shadows, comparing all these elements to an original reference”. And ultimately, in a world that increasingly relies on everything digital, we must take more responsibility for everything we share.

Liz Truss is missing the limelight and started her campaign for Most Vocal Backbencher. The exPM spent the weekend promoting an ‘economic Nato’ to stave off China’s influence and yesterday addressed the Commons in a debate on Ukraine

WE WANT TO HEAR YOUR VIEWS

[Re: ‘Offshore wind plans must be sped up’, Feb 16]

From planning rules to accessing capital, your article hits several of the challenges facing offshore wind developers squarely on the nose. What isn’t mentioned, however, is the significant opportunity presented by floating offshore wind (FLOW), which could represent the future of the sector.

Presently, FLOW is being hobbled by the lack of a specific licencing and regulatory regime, meaning that developers and investors lack clarity on the tender process. Such conditions

make raising capital near impossible, potentially shutting out the very innovators we need to encourage. Rather than simply shoehorn FLOW into existing offshore rules, the Government should take the opportunity to develop a customised planning and approval process to facilitate a faster flow of FLOW. One early example of how this could be done is the INTOG leasing round. The initiative not only recognises the opportunity FLOW presents for regulatory reform and streamlining, but, crucially, grants early exclusivity to areas of the seabed, enabling developers, investors and financiers to confidently take the plunge, knowing their innovations are protected.

Gavin Watson Pillsbury

It all started with Twitter Blue and the outrage from those who had worked hard to earn their verified status; now just about anyone can have a once-coveted blue tick for £8 a month.

Elon Musk’s gambit on paid-for verification was meant to justify his purchase of Twitter, the social media site which hasn’t booked a profit since 2019. Around 290,000 people had signed up to the subscription service as of January this year. Musk has said he expected 69 billion users by 2025.

But if it’s good enough for Musk,

it’s good enough for Mark Zuckerberg apparently.

The Meta owner announced he was planning to launch a paid-for service to increase “authenticity” on Instagram and Facebook. For £10 a month, users will be able to be “verified” with government-issued ID. It is meant to protect people from impersonation, Zuckerberg said.

Meta has had its own revenue woes, and is copying the Twitter model of using subscriptions to plug holes in its cash stores. Whether it works is another question.

OVER the past year there has been a surge of calls for rent controls in the private rented sector. It is understandable, household budgets are being hit by a cost-of-living crisis. A mismatch of supply and demand for rental property, not helped by either policy, or the pandemic, has also put pressure on rents.

Rent controls are seen as a “golden ticket” by a few politicians – a costfree and populist way to put money into voters’ pockets, and at no cost to the state. This explains some of the loose statistics that politicians bandy around. Sadiq Khan for example, has quoted rents rising at 16 per cent. A day later, his City Hall statistical unit referred to official national statistics of 4 per cent in London, and 4.2 per cent annual growth in the rest of England.

The former stat probably came from advertised new lets, from one of the property portals. The lower actual number reflects rents within existing tenancies, as well as new lets. And therein lies one of the great contradictions of rent controls. Those who benefit from rent controls are those already in their homes, whose owners will tend to moderate their rents anyway, because the benefit of keeping a good tenant far outweighs the cost of reletting.

Rent controls do nothing for those desperate to get a first foot on the housing ladder. The private rented sector has housed more people in the past decade than the state-funded affordable sector has with subsidies in short supply.

The private rented sector is under significant strain though. Fewer properties are coming forward. Nationally there were 29 per cent fewer portal listings in the third quarter of 2022 versus the 2017-19 average. Since 2019, there have been close to 182,000 buy-to-let loan redemptions. Smaller property owners left the market just as pent-up demand from the pandemic exploded. As a result, it’s taking about half the time it normally would to let a home.

Rent controls will only make this situation worse. Putting a cap on rents impacts investment and reduces rental housing supply. It favours tenants on higher incomes with stable

employment at the expense of those on lower incomes and families and reduces funding available for property maintenance. In the long term, it can create a long shadow on the rental market with lower quality homes.

Perhaps the most prescient argument against rent controls is that they deprive more people of homes.

Of course, if the state was to fund a large expansion of social housing that might provide the counterweight to a shrinking private rented sector, but in my lifetime I have yet to meet a politician that is willing to put up taxes to fund a large expansion of social housing.

At a time when the private rented sector is bursting at the seams, to introduce rent controls and further reduce investment and therefore supply in the private rented sector would be utter folly.

It also opens up the nightmare scenario of politicians getting into a bidding war over rent controls, with

rents driven to a level that bears no relationship to what is sufficient for investors to make a return or what it costs to fund the upkeep of private rented sector properties. One person advocates 3 per cent rent rises, another 2 per cent, and then another 1 per cent. It’s not hard to imagine. The shelves of academia are littered with evidence showing the damaging impact of rent controls in places as diverse as New York, Los Angeles, San Francisco, Berlin, Sweden, Denmark, the Netherlands, and so on. Fundamentally, while rent control may be seen as a solution to a symptom of a problem, it fails to address the supply and demand equation. And in the process, let’s be honest that rent controls will limit access to the sector and deprive the most vulnerable of a place to call home – the housing-havenots.

£ Ian Fletcher is Director of Policy at the British Property Federation

STEPPINGinto the VIP Class taxi for the first time, I’m reminded of that moment when Dorothy opens the door of her familiar Kansas home to enter the fantastical land of Oz. On the outside, this is a regular black cab: one of around 15,000 that tirelessly roam London’s streets. Relax into one of the reclining rear seats, though, and it feels more akin to a limousine or private jet.

“Toto, I've a feeling we're not in Kilburn anymore…”

Actually, we’re just up the road in St John’s Wood, where Clive Sutton is based. Best known for importing XXL American trucks and muscle cars, the dealership also has a Sutton Bespoke division that specialises in made-to-order modified cars. At one extreme is the tyre-smoking 850hp Sutton Mustang CS850R, guaranteed to turn heads and get your pulse racing. At the other is the

VIP Class taxi, designed for quite the opposite.

“Plenty of people like being driven in comfort without attracting lots of attention,” explains Luke Sutton, son of company founder Clive. “And nobody looks twice at a black cab.” For £120,000 or so, a wealthy wallflower can be whisked between board meetings in under-the-radar opulence. Just don’t expect to side-step London traffic by using the bus lanes; only an officially licensed Hackney Carriage driver can do that.

Beneath the bodywork – usually black, although you can specify any colour you like – is a standard LEVC TX taxi, based on Volvo hardware and built in Coventry (ironically enough) by the London Electric Vehicle Company. Its plug-in hybrid drivetrain joins a 1.5-litre petrol engine, acting solely as a generator, to a 110kW electric motor and 31kWh battery. Fully

PRICE: £120,000

POWER: 150HP

0-62MPH: 13.2SEC

TOP SPEED: 80MPH

FUEL ECONOMY: 334.7MPG

CO2 EMISSIONS: 19G/KM

charged, you get 80 miles of EV range – ample for zero-emissions city use. Open the rear door and you pull back the metaphorical velvet rope to enter the VIP area. The taxi’s passenger compartment is offered with five, four, three or two seats. My cab had the latter, with a pair of airline-style armchairs trimmed in plush Bentley leather, plus fold-out tray tables sourced from Mercedes-Maybach. The smooth and silent electric door-closing mechanism? That comes from a

Rolls-Royce Ghost.

Further luxuries denied to fare-paying proles include a champagne fridge, 20-inch Apple TV screen, Bluetooth audio system and in-car wi-fi, along with subtle ambient lighting and lashings of polished wood trim. A built-in PlayStation or Xbox console is on the options list, should your taxi be regularly tasked with the school run.

Old habits die hard, so I jump into the front seat first. The TX is longer than a Land Rover Defender 110, but its light steering and famously tight turning circle – mandated to 25 feet, supposedly to negotiate the tiny roundabout outside the Savoy Hotel –make it easy to manoeuvre. Factor in good visibility and kerb-friendly tall tyres, plus the ever-ready torque of the electric motor, and even several laps of Camden’s baffling one-way system prove to be relatively stress-free.

Still, VIP Class buyers invariably have

a chauffeur, says Luke, so in the noble spirit of consumer journalism, I swap into the back seat. With my feet up and neck cradled on pillowy leather, we turn towards the Square Mile and I dreamily watch London’s landmarks pass by the panoramic glass roof, enjoying the vast headroom, supple ride and a chilled soft drink. The champagne stays in the cooler, though – this is serious research, remember?

Granted, the taxi isn't as whisperquiet as a Rolls-Royce, particularly once the three-cylinder engine wakes up, but then it only costs half the price. And Joe Public (or indeed Joe Paparazzi) will just assume you’ve just paid a few quid for a cab ride. In straitened times, when showy displays of wealth seem at odds with the zeitgeist, that anonymity feels like a luxury in itself.

Tim Pitt writes for motoringresearch.com

THISyear marks the 25th anniversary of the Audi TT, which was first launched in 1998. However, the celebrations will be bittersweet.

Audi plans to end production of the TT Coupe and Roadster models later this year, sending them off with a fully-loaded Final Edition. Offered in both closed and droptop guises, buyers have a choice of engines – including the powerful 320hp TTS. All Final Edition models wear a black styling pack, with the Audi badges, side mirrors, exhaust tailpipes and rear spoiler all getting the noir treatment. Buyers can pick from Tango Red, Glacier White or

Chronos Grey paint, with 20-inch alloy wheels standard.

On the inside, the door armrests, pull handles and centre console trim are all trimmed in leather. Alcantara swathes the steering wheel and sports seats, which have sporty red stitching. More red detailing is found on the air vents, centre console and floor mats. All models come with Audi’s MMI Navigation Plus infotainment setup, while opting for the TTS Final Edition adds a Bang & Olufsen audio system, parking sensors and a reversing camera.

The TT debuted as a Bauhausinspired concept car at the 1995

Frankfurt Motor Show, with the production model following in 1998. Audi was forced to add a rear spoiler soon after launch, following a spate of high-speed accidents.

Despite its inauspicious start, the TT swiftly established itself as a stylesetting icon. A second-generation model was launched in 2006, including the supercar-chasing 340hp TTRS. The current, thirdgeneration TT has continued to combine speed and style since 2014.

The UK has been an important market for the TT, accounting for one-third of all global sales in 2022.

Priced from £41,910, the TT Final Edition goes on sale next month.

Tim Pitt takes a ride in the Clive Sutton VIP Class taxi: a £120,000 black cab that’s the less ostentatious alternative to a Rolls-Royce

PREMIERSHIPRugby has announced plans to overhaul its governance with a new sporting commission and financial monitoring panel.

The moves are part of sweeping changes at the top of the English game following the downfall of both Worcester Warriors and Wasps.

“We’re setting up an independent reporting commission to make sporting decisions on behalf of the Premiership,” Premiership Rugby chief executive Simon Massie-Taylor told City A.M.

“At the moment the way it is structured is that all clubs are represented in that forum and that in itself presents a risk of conflict but also the decision making is quite complicated in that a lot of things require a super-majority or unanimous decision making.

“There are certain things that will continue to be that, but we’re trying to devolve and simplify the regular and important sporting decisions that we make around whether it’s season formats or player welfare and other things.”

The commission will be made up of an independent chair, three independent members – including a recent explayer – Massie-Taylor and Phil Winstanley, rugby director.

Legal heavyweight Sir Nigel Board-

TENNIS

man, a former partner at City law firm Slaughter and May, will lead a review into how Wasps and Worcester went into administration earlier this season.

“Financial reform of professional elite rugby in England is at the top of Premiership Rugby’s agenda and today’s announcement is a significant step forward for us,” said chair Martyn Phillips.

“When Worcester Warriors and Wasps went into administration it was a devastating blow to two communities and professional rugby in England.

“Sir Nigel will begin a vital process that will see the establishment of a Financial Monitoring

Panel (FMP), supported by a fit for purpose regulatory framework, to have better oversight of Premiership clubs’ financials and to put necessary safeguards in place to ensure our clubs become financially stronger and more sustainable in the future.”

Boardman led the government inquiry into the Greensill Capital lobbying row in 2021 and last year called time on a near-50-year stint with Slaughter and May. The M&A specialist also acted for the government during the financial crisis and mixed business with pleasure by representing his beloved Arsenal in sports law matters.

The principal owner of Premier League club Liverpool, John W Henry, yesterday said that the club was not for sale and that the Fenway Sports Group is only looking for additional investment for the Reds. “I know there has been a lot of conversation and quotes about LFC but I keep to the facts: we merely formalised an ongoing process,” Henry said. “Will we be in England forever? No. Are we selling LFC? No. Are we talking with investors about LFC? Yes.” Liverpool was purchased in 2010 by Fenway for around £300m with the club now believed to be worth £3bn.

FRANK DALLERES

MANCHESTERUnited suitors want the Glazer family to go public with their plans for the club and quell concerns that they are not serious about a possible £5bn sale.

British billionaire Sir Jim Ratcliffe and Sheikh Jassim Bin Hamad Al Thani of Qatar both confirmed submitting bids to buy the Premier League club last week, but the Glazers have remained silent since inviting offers three months ago. Their stance could delay dialogue between bidders and fans’ groups, who have called for talks with the prospective new owners.

“I don’t think anyone will do a thing until they know the Glazers are selling and interested in a bid,” said one person with knowledge of the process.

“They’ve said absolutely nothing –all the while everyone is focused on the bidders. The next words have to come from the Glazers.”

The Glazers’ advisors have further irked bidders by demanding they refrain from any explicit or implicit criticism of the Americans during the bidding process.

“If you really want to sell, why do you give a single damn what anyone says about you?” said one source.

“Both statements [from Ratcliffe

FORMULA 1

and Sheikh Jassim] have been pretty rational and balanced. And what do they expect bidders to say, ‘we want to continue the great work of the Glazers’?”

While Ratcliffe and Sheikh Jassim are the only parties known to have bid for majority or full ownership, three US funds have told Raine they can provide finance to other bids. They include Elliott Management, which owned AC Milan until last summer, MSD Partners and Oaktree Capital Management. None wants to bid to buy United outright from the Glazers, who are said to want £6bn, but are open to working with other suitors on a takeover.

MATT HARDY

THE Women’s Tennis Association (WTA) has offered to reduce a £1m fine imposed on the Lawn Tennis Association (LTA) last year if Russians and Belarusians are allowed to compete in LTA competitions this year.

Athletes from the two countries were controversially denied entry to the Wimbledon Championships as well as warm-up events including Nottingham, Birmingham and Eastbourne.

In response the WTA, and its male equivalent the ATP, imposed fines on the LTA and the All England

Club. It is unlikely that the LTA will appeal against the ATP.

“As we have said before, we disagree with the outcome and the fines levied,” said an LTA spokesperson. “Nevertheless, our current focus is on working with the WTA, ATP, ITF, AELTC and UK government in order to find a resolution for events in 2023.”

It looks likely that both the LTA and the All England Lawn Tennis Club will have to back down from a stance last year which saw the likes of Daniil Medvedev unable to compete at Wimbledon –but which saw Moscow-born Elena Rybakina win the women’s title.

MATT HARDY

SAUDI Arabia’s motorsport chief has entertained the idea of a Formula 1 team owned by the Middle Eastern Kingdom in the future.

Prince Khalid bin Sultan Al-Abdullah Al-Faisal, chairman of the Saudi Motorsport Company, said the commercial history between the country and Formula 1 lent itself to the Gulf state owning a team.

“We have a lot of history with motorsport as the Kingdom of Saudi Arabia was the first Middle East country to be involved in Formula 1,” he said.

“It dates back to the sponsorship deal with Williams in 1978. I was really

proud to see my country and the name of a company from Saudi Arabia in such a prestigious, international event such as Formula 1.

“This legacy that has taken us to hosting a race may one day expand to us having our own Saudi F1 team.

“Today we see many more Saudi companies partnering with F1 and teams such as Aramco and Aston Martin and NEOM and McLaren so I expect our relationship to grow.”

This year’s season begins next month in the Middle Eastern island nation of Bahrain and the series will return to the region a further three times on the 2023 calendar, for dates in Saudi Arabia, Qatar and Abu Dhabi.

AT THEIR best Liverpool have been irresistible under Jurgen Klopp – except, it seems, when facing Real Madrid.

Klopp has led the Reds into battle with the Spanish giants four times since he took the helm at Anfield in 2015. They have lost three, won none and scored just two goals. So, as the two teams prepare to meet again tonight in the first leg of their Champions League last-16 tie, have Real Madrid cracked how to beat Liverpool?

“If we don’t play our best we don’t have a chance,” said Klopp. “Real Madrid doesn’t have to play their best and still have a chance.”

Perhaps it is a case of Carlo Ancelotti, Real Madrid’s head coach, having Klopp’s number. The Liverpool boss has lost five and won just three of his 11 meetings with the Italian. Of all coaches to have faced Klopp 10

IF YOU were looking for a nation to grab something traditional by the horns and zhuzh it up, it would be the United States wouldn’t it? Well, now rugby is entering the rodeo ring to have that treatment.

Because last month, Major League Rugby (MLR) franchise Utah Warriors announced a partnership with fivetime European champions and French giants Toulouse which they have termed “The Rugby Alliance”.

And the chief executive and cofounder of the MLR team, former US international scrum-half Kimball Kjar, tells City A.M. about the plans to expand beyond the Top14 side.

“It's long-term,” he says. “Call this overly grandiose or biting off more than what people possibly can consider and chew but this alliance is not just about the Warriors and Toulouse, it's finding like-minded professional clubs that want to continue to innovate and create new opportunities commercially on a global scale.