THE MAN IN THE KNOW THE NEW FACES AND CHANGES IN TODAY’S FAST-MOVING CITY P12

THEATRICAL FLAIR CHERYL LEADS LIVE LONDON REVIVAL P18-19

THEATRICAL FLAIR CHERYL LEADS LIVE LONDON REVIVAL P18-19

JESSICA FRANK-KEYES

PRIME MINISTER Rishi Sunak has said “nothing is off the table” after Ukrainian President Volodymyr Zelensky asked the UK to supply him with fighter jets to battle Putin’s army.

The two leaders spoke at a joint press conference at an army base

yesterday after the Ukrainian wartime President flew to the UK and implored the PM to bolster the country’s air power.

Western allies have so far declined to further arm Ukraine but yesterday Sunak confirmed Britain would train Ukrainian pilots to fly modern warplanes, while stopping short of any commitment to supply planes.

No10 said defence secretary Ben Wallace is investigating what aircraft the UK could provide, but stressed this would be a “long-term option”.

Speaking at a joint press conference at Camp Lulworth, Dorset, Zelensky warned if Ukraine continued to go without jets, the war risked military “stagnation” which would pose a “great risk to all of the world”.

He branded Russia a “terrorist” nation and said: “If we don’t get fighter jets or missiles, everything obviously will be running out.

“There will be stagnation and these people will come and be living on our territory and this will pose a great risk to all of the world.”

£ CONTINUED ON PAGE 2

LOUIS GOSS

FULLER’s has filed a lawsuit against insurance giants Aviva and Liberty Mutual in a dispute over a “business interruption” claim.

Fuller Smith & Turner confirmed to City A.M. it is suing the two insurers “in relation to a claim under our business interruption insurance” but refused to state the value of the claim or comment further.

Fuller’s filed its case against Liberty and Aviva on 2 February in the UK’s commercial court.

disposable income rapidly, exclusive research shared with City A.M. reveals.

Nearly £1 in every £8 was spent online via buy-now pay-later providers last month, according to research by Adobe Analytics.

The proportion is up slightly from just over 10 per cent in the same month last year, signalling shoppers are responding to

to buy products by borrowing against their future income. Like credit cards, however, there is a risk that people can get tangled up in serious debt trouble if they fail to repay their debts.

Adobe attributed the rise in demand for BNPL services to Brits trying to “spread the cost of January purchases to ease the financial pressure caused by continued

high levels of inflation and the cost-ofSuzanne Steele, vice president and managing director for Adobe in the UK, said the increase in BNPL use “shows that consumers are still keeping a close eye on their finances”.

“It’s no surprise that more and more people are turning to interest-free BNPL providers like Klarna as banks hike up credit card interest to their highest ever rates,” a spokesperson for Klarna, the darling of the buy-now pay-later sector, told City A.M.

Shoppers do not pay any interest on cash borrowed from Klarna unless they miss a payment deadline, which can vary from 30 days to spreading payments over several months. Using them can impact a consumers’ ability to borrow in the future.

Philip Belamant, chief executive of rival BNPL firm Zilch, told City A.M. that the company “reports to all major [credit rating agencies], protecting customers from over-borrowing elsewhere, and has recently begun working with Stepchange, the UK’s leading debt charity, to help those who fall behind, for free”.

The pub group’s lawsuit follows a surge in business interruption claims from hospitality firms against insurers, which have paid out more than £1.2bn to companies that were forced to close during the lockdowns.

Fuller’s currently owns around 400 pubs throughout Britain, having previously sold its brewing business to Japanese firm Asahi in 2019.

The pub chain closed all of its UK pubs after the British government introduced lockdown measures in 2020 in a bid to slow the spread of Covid-19.

Fuller’s posted a £59.2m loss for the financial year ending in March 2021 as the restrictions battered its revenues.

Aviva was approached for comment, while Liberty Mutual declined to comment.

ALMOST a year ago, we were forced to confront a problem we had been warned about again and again: London was awash with dirty Russian money. Our streets, especially those in the City, had provided a safe haven for the proceeds of Russia’s evil war.

And now, as we approach the anniversary of Vladimir Putin’s invasion of Ukraine, the question of remuneration, and what we do

with the £18bn of frozen Russian assets has been carefully broached on the domestic and international political stage.

Yesterday, as Ukraine’s President Volodymyr Zelensky met with Rishi Sunak in a surprise visit to the UK, the Prime Minister

admitted he was looking at whether we could use the frozen funds to help rebuild Ukraine. Resentment is a powerful emotion and there is an abundance of anger at how London’s lax financial system was used and abused by Russian kleptocrats.

But resentment is not the foundation of international law, with good reason.

In the European Union, leaders are looking carefully at the same

problem, wary of the legal repercussions –even if it is for a cause almost universally backed by Western democracies.

Germany’s Chancellor Olaf Scholz has signalled his support for using the stockpiles of frozen Russian assets as reparations for Ukraine.

The instinct will be to say “yes, absolutely have the money, have all of it” to our Ukrainian friends. However, it cannot come at the expense of the very laws that

make us democracies.

The UK government is already skirting the edges of international law in a bid to stop the number of migrants coming to our shores.

We have thrown our support behind Ukraine with gusto because we believe in the power of democracy, underpinned by the rule of law. Acting carelessly in a spirit contrary to that does all of our efforts a disservice, no matter how well-intentioned.

CONTINUED FROM PAGE 1

Sunak and Zelensky travelled to the base to meet Ukrainian soldiers training to fight using British Challenger 2 tanks and to sign the London Declaration, a joint agreement between the two nations to deepen cooperation in their fight to defend Ukraine against Putin’s Russia.

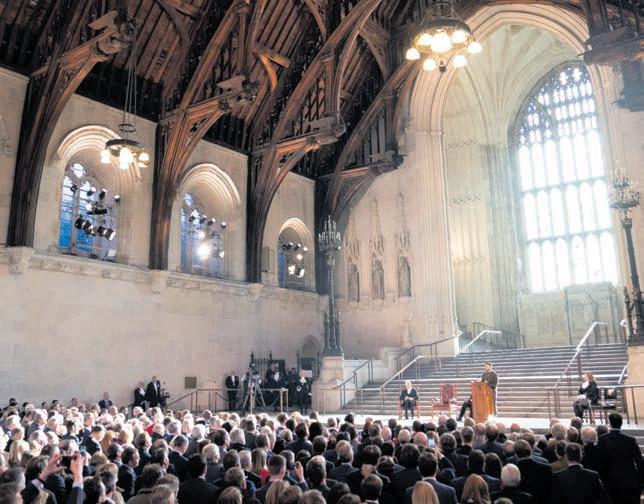

Zelensky addressed MPs and peers in a historic address from the steps of Westminster Hall in the Houses of Parliaments, had breakfast with Sunak at 10 Downing Street and had tea with the King at Buckingham Palace.

Zelensky used his Westminster Hall speech to call on the UK and the West to provide fighter jets, telling parliamentarians: “Combat aircraft for

Ukraine, wings for freedom.” He also presented Commons speaker Sir Lindsey Hoyle with a real Ukrainian pilot’s helmet.

Zelensky also directly thanked former prime minister Boris Johnson for his support to Ukraine and the former leader later urged Sunak to deliver the jets to Ukraine’s fighter pilots. Aircraft including RAF Hawks, Eu-

JACK BARNETT

JEREMY HUNT and Rishi Sunak need to use the spring budget to stimulate growth to prevent the UK tipping into a recession this year, the country’s biggest business group urged yesterday.

The Chancellor and Prime Minister should at the 15 March statement soothe the impact of a sharp rise in the UK’s profit tax to avoid slamming the brakes on investment, according to the Confederation of British Industry (CBI).

Allowing businesses to invest in ma-

chines and technology tax free would boost spending on resources that will lift the country out of its more than decade-long growth malaise, the CBI recommended.

Sunak and Hunt reversed Liz Truss’s decision to scrap a six percentage point corporation tax last year, raising fears investment will become unviable for many businesses, especially after the 130 per cent investment tax relief ends at the same time in April.

“This budget is the opportunity to get the UK out of any recession sooner rather than later and transform the UK into a high-growth, innovation-

first economy,” Tony Danker, directorgeneral of the CBI, said.

“We know that the economy can –and must –break out of its low growth trap, but we will need action on business investment to achieve it,” he added.

Responding to the CBI comments, the Treasury stated: “Growing the economy is one of the Prime Minister’s top priorities, which is why we have maintained record levels of capital investment and R&D spending.”

“It’s vital we stick to our plan to halve inflation this year and reduce debt,” the department concluded.

rofighter Typhoons and F-35 Lightnings are among those that could be supplied to the eastern European nation, should agreement be reached.

And plans are in place to train Ukrainian helicopter pilots at Shawbury in Shropshire.

Asked whether he was personally willing to supply jets, Sunak said there had been “no reticence” and that

Britain had been “nothing but out in front and will continue to do so”. He said there were complex supply chains and training requirements to fly the sophisticated aircraft safely, but that “nothing was off the table”.

Zelensky said the day’s negotiations had proved “fruitful” and that “together we will cover this difficult path to our victory”.

LOUIS GOSS

MAJOR hold ups at HMRC are “acting as a drag on the UK’s economic growth,” one of Britain’s top accounting bodies has said.

The “unacceptable” delays, caused by backlogs at the UK’s tax authority, “need to be addressed promptly,” ICAEW chief executive Michael Izza said, as he called for the launch of an emergency taskforce to tackle the issues at HRMC.

The accounting chief’s calls come as taxpayers and accountants have been forced to wait for up to a year

for responses from Britain’s tax authority.

HMRC has seen its customer service workforce cut by 6,000 people over the past five years, from 25,500 to 19,500.

Izza noted that, despite HMRC’s “vital role” in collecting taxes and facilitating business, the agency is “often overlooked and overstretched”.

ICAEW called on ministers for an overhaul of HMRC, arguing “poor public services are an obstacle to economic development as well as making all our lives more difficult”.

OIL AND gas major Total Energies has joined the profits party alongside its rivals, posting record full-year earnings of £29.9bn ($36.2bn).

The French energy giant’s bumper profits have been fuelled by soaring oil and gas prices following Russia’s invasion of Ukraine.

Total Energies’ fourth-quarter adjusted net income was $7.6bn, including a $4.1bn impairment from the exclusion of its stake in Russian gas firm Novatek. This compares with $6.8bn a year earlier, and $9.9bn in the third quarter of 2022.

The company is projecting net investments of $16-18bn in 2023, including $5bn for low-carbon energy.

Shareholders will trouser dividends of €2.81 per share, up 6.4 per cent from a year earlier and on top of a €1 per share special payout.

Its robust profits follow similar reports from European rivals BP, Equinor and Shell alongside Stateside operators such as Exxon Mobil and Chevron.

However, energy giants are facing intensifying shouts for the windfall tax to be toughened, with Labour calling for the investment relief to be ditched from

MARTIN LANDI

the domestic Energy Profits Levy.

Ed Miliband, Labour’s shadow climate change and net zero secretary, said: “It’s yet another day of enormous profits at an energy giant, the windfalls of war, coming directly out of the pockets of the British people. What is so outrageous is that, as fossil fuel companies rake in these enormous sums, Rishi Sunak still refuses to bring in a proper windfall tax that would make them pay their fair share.”

Total has booked a $1.7bn provision for extraordinary windfall taxes levied in the European Union and UK in the fourth quarter.

Recently, it pulled out of a £100m investment in the North Sea after the Chancellor, Jeremy Hunt, hiked the Energy Profits Levy from 25 to 35 per cent and extended its duration from three to six years.

At the time, Jean-Luc Guiziou, Total UK country chair, said: “Following another change to the fiscal environment for energy investors in the UK, we are now evaluating the impact of this change on our current and planned projects. We note that, without a price floor to the Energy Profits Levy, the current regime will affect short-cycle investments.”

MICROSOFT’s proposed acquisition of gaming firm Activision Blizzard could result in higher prices, fewer choices or less innovation for UK gamers, the Competition and Markets Authority (CMA) has said. In the provisional findings of its five-month investigation into the $68.7bn (£56.7bn) deal, the CMA

NIVEDITA BALU

UBER yesterday said it had set its sights on delivering profits this year after 2022’s surge in demand for airport and office rides helped the company rebound from pandemic lows.

Dara Khosrowshahi, chief executive of Uber, said the company was now focused on achieving profitability on a GAAP basis this year.

“The pandemic’s impact on our mobility business is now well and truly

behind us,” Khosrowshahi said.

Uber forecast adjusted ebitda, a profitability metric that excludes some costs, between $660m (£546m) and $700m for the first quarter, above the average analyst estimate of $593.06m, according to Refinitiv data.

The rideshare market is benefitting from a return to normal and a rise in car ownership costs, which is pushing many to opt for cab rides. Meanwhile, more drivers are signing up as they look for new sources of income.

said the merger could make Microsoft stronger, stifle competition and harm the rivalry between its Xbox console and Sony’s Playstation.

Activision Blizzard is the maker of a number of popular video games series, including Call Of Duty, and rivals have raised concerns that Microsoft taking over Activision could see their access to the popular franchise restricted – something

Microsoft has denied.

In response, Microsoft’s corporate vice president and deputy general counsel, Rima Alaily, said: “We are committed to offering effective and easily enforceable solutions that address the CMA’s concerns. “Seventy-five per cent of respondents to the CMA’s public consultation agree that this deal is good for competition in UK gaming.”

PA

CHRIS DORRELL

BARRATT Developments yesterday posted profit before tax of more than £520m as the company suggested that its outlook for the year was improving, despite sales at the beginning of 2023 lagging behind last year.

The housebuilder’s revenue increased 24 per cent in the six months to December 31 from the same period last year while its pretax profit rose 16 per cent.

It completed around 600 more houses in the period than it did last year, a 6.9 per cent increase, with its adjusted profit before tax up 15.9 per cent at £521.5m and reported profit before tax also advancing 15.9 per cent to £501.5m.

However, the number of homes reserved by buyers was 44 per cent lower than the last year, with it falling throughout the period due to “politi-

cal and economic uncertainty”.

CEO David Thomas said: “The economic backdrop has clearly been challenging and consumer confidence weakened significantly during the half, which meant we saw lower reservation rates for future sales – particularly in the second quarter.

“While we have seen some early signs of improvement in current trading during January, we will need to see continued momentum over the coming months before we can be confident that these challenging trading conditions are easing,” Thomas continued.

The company said it has seen a “reasonable start” to the new year with 182 net reservations per week. As of 29 January this year, there were nearly 5,000 fewer forward sales than at 30 January last year.

The company said its outlook for 2023 was dependent on the spring selling season.

VICKY SHAW

HOUSE prices are starting to reflect the shift in demand in the market, according to surveyors.

Agreed sales, house prices and new instructions to sell homes remained on a downward trend in January, the Royal Institution of Chartered Surveyors (RICS) said. Property professionals’

expectations suggest this picture is likely to remain in place for a while longer as the market adjusts to higher interest rates, RIC’s report added.

A net balance of 47 per cent of surveyors reported seeing a fall rather than an increase in new buyer inquiries, deteriorating from a balance of 40 per cent who saw this the previous month.

NICHOLAS EARL

ENERGY giant Drax yesterday sought to reassure homes and businesses that electricity supplies would not be affected during nine days of announced industrial action over the coming months.

Drax said its power station would continue to generate base-load renewable power if the strikes went ahead.

A spokesperson said: “In the event of industrial action, Drax has robust plans in place to ensure the power station continues to safely generate renewable electricity for millions of homes and businesses.

“We are deeply disappointed that Unite is planning to go forward with this unnecessary action which will see colleagues lose money instead of securing a significant pay rise. Drax remains open to dialogue with Unite to avoid industrial action.”

This follows claims from Unite, the UK’s second largest union, that the plant risked power cuts if its strike went ahead.

The power plant is responsible for around seven per cent of the UK’s electricity generation.

JESS JONES

LAST year’s men’s world cup helped Murdoch-owned media giant Fox increase revenues by four per cent.

The broadcaster said that revenue in the final quarter of 2022 was up to $4.61bn (£3.82bn) from $4.44bn (£3.68bn) in the same quarter in 2021.

The FIFA World Cup, which took place in Doha back in December last year, pulled the majority of the weight in lifting advertising revenues up five per cent to $98m.

Executive chair and chief executive Lachlan Murdoch said that Fox’s “compelling” sports schedule and busy political news cycle, showed the “power and relevance” of the media company.

Other streams including Fox’s television segment and the Fox Nation subscription service also boosted revenues up 13 per cent.

“Whether measured in terms of engagement, monetisation or profitability, our focused strategy of live news and sports programming, coupled

LAURA MCGUIRE

with our growing digital initiatives, continues to deliver”, the junior Murdoch said.

The World Cup did increase Fox expenses though, despite them being down overall.

Murdoch added that Fox’s $3bn increase of share buyback to a total authorisation of $7bn shows that they are optimistic about their strategy, quality of assets and the strength of their financial position.

MCDONALD’s has signed an agreement with the UK's equality watchdog to promise to protect its staff from sexual harassment following reports of alleged abuse. The fast food chain penned an agreement with the Equality and Human Rights Commission (EHRC) to promise to communicate a “zero

tolerance” approach on sexual harassment and deliver antiharassment training for employees. It comes after the The Bakers, Food and Allied Workers Union (BFAWU) revealed in 2019 that some 1000 McDonald’s workers in the UK were being subjected to a “toxic” work culture and alleged that NDAs were being used to silence victims of sexual harassment.

Alistair Macrow, chief executive at McDonald’s Restaurants in UK and Ireland, said it was “hugely important” that staff feel “safe, respected and included at all times”. Commenting on the news, Georgina Calvert-Lee, an employment law expert at Bellevue Law, said the EHRC only “reserves its resources for those that seem to have more widespread systemic problems.”

While the ad market experienced a downturn towards the end of last year, Fox was one of the few companies to actually post promising results.

This comes as Rupert Murdoch recently abandoned an attempt to merge Fox and News Corp after shareholders expressed their lack of confidence in a reunion of the two media companies, which Murdoch himself separated in 2013.

eBay is joining the ranks of other tech companies laying off staff in a self-preservation effort during a challenging economic environment. The e-commerce giant announced it is cutting 500 jobs – about four per cent of its workforce – so that they can “continue to be successful”, in a memo written to employees on Tuesday by eBay boss Jamie Iannone.

JESS JONES

ZOOM is trimming its workforce by 15 per cent as demand for online working fades into the pandemic past.

Eric Yuan, chief executive of Zoom, said the company needed to “reset” and had made the “tough but necessary decision” to bid farewell to around 1,300 employees, in a memo shared with the public on Tuesday.

In the memo, addressed to his “Zoomies”, Yuan told staff the

redundancies are a result of the global transition to a post-pandemic world.

The video-calling platform is the latest tech firm to announce jobs cuts, as already this year Amazon and Alphabet have announced huge layoffs.

Susannah Streeter, analyst at Hargreaves Lansdown, told City A.M.: “Given that tech heavyweights like Microsoft, Meta and Alphabet have been engulfed in a wave of lay-offs, it’s little surprise that Zoom has been sideswiped by a loss of business.”

BID FOR SURVIVAL Auction giant eBay will be cutting jobs to make it more competitiveArgentina’s Lionel Messi kisses the World Cup

Like some of its fintech peers, Tide has weathered criticism from some quarters over a lack of due diligence when dishing out Covid-19 support and the wobbly performance of its Covid loans since then.

While Tide’s portfolio was comparatively small –it dished out some £60m or 0.1 per cent of the overall lending –26 per cent of those had defaulted by the end of March 2022.

SMALL business banking has played a strangely starring role in the national drama of the past three years. When Covid-19 first began to rip through the economy in 2020, lesser-known loan shops and lenders took centre stage and dished out bumper cash to small businesses. Splashy lending became something of a cause for the nation to throw its weight behind.

London-based small business banking firm Tide, then three years old, was among the firms to rush to sign up to the temporary taxpayer-backed bounce back loan scheme. Now, looking at another recession, soaring energy costs, and darkening economic skies, chief Oliver Prill wonders whether crisis has become the norm for small business owners.

“We’ve not seen radical change in the last 12 months. Clearly, there's pressure [for small businesses],” he tells City A.M. in an interview.

“However, before that there was pressure from Covid-19. Sometimes it’s sort of the question to say ‘what is actually the norm?’”

While three years of “permanent crisis” is yet to rear its head in a wave of defaults and failures, he says, the prevailing mood among Tide’s small business ‘members’ is not a positive one.

“There is of course a lot of exhaustion right now in the small business community, and we’re definitely picking that up,” he says.

For Prill though, who joined Tide from German credit shop Kreditech in 2018, perma-crisis has become par for the course.

Tide’s customer base has swelled to 450,000 under his charge and more than doubled in 2020 as small firms scrambled for new banking platform through the pandemic. Tide’s product base is looking to absorb the full suite of small business needs from current accounts, to accounting software and invoicing.

Tide is now eyeing expansion in Prill’s home market of Germany as well as India –where it has already hired a dedicated team due to struggles hiring onshore talent because of Brexit.

But while growth has been strong for Tide, it has not come without its challenges.

Prill though is quick to put the troubles in the wider context of bounce back loan scheme lending. “With the actual numbers we did, it made virtually no impact on Tide’s overall numbers,” he says.

Tide has been forced to justify its position despite his protests, arguing it was not allowed to prioritise based on firms’ ability to pay. Prill also downplays the schemes’ impact on Tide’s growth.

Rather than the rapid route to customer growth that some suggest, Prill claims the bounce back loan schemes were “the biggest inadvertent retrenchment exercise” in the country as customers rushed back to the big high street lenders.

For their part, small businesses now are likely less concerned with the source of their cash than whether their own business will be around at the end of the year.

The last three years have seen the total population of small firms in the UK shrink by around 400,000 since 2020 after years of sustained growth, according to government figures.

While Prill stops short of suggesting the roll-out of further tailored support schemes for small businesses to cope with the current economic climate, he says ministers cannot hobble small firms further with “adverse actions”.

Moves by Jeremy Hunt to hike taxes on dividends in November, for example, drew the ire of both Prill and the small business community he says that Tide “represents”.

“It’s not because people are making money, as that’s the main way you’re getting paid. If you’re a company owner, you set up a company and then you pay yourself dividends because it has a tax rate,” he says.

A cut to the rate, a boost for R&D tax credits and greater relief for upgrading energy infrastructure would now be top of the wishlist in the autumn budget, he says.

Internally though, Tide has its own priorities for the next 12 months. Prill has not ruled out a shift onto the public markets in the longer term but says international expansion for now is top of the agenda. Domestically too, it is looking to scoop up as much of the business lending market as it can domestically.

For its small business customers looking out on choppy waters ahead, they’ll be hoping a rising Tide lifts all boats.

Crises are becoming par for the course for small business banking firm Tide, writes Charlie Conchie

THE COST of Covid-19-era loan losses to the taxpayer could total £11bn, according to figures released by the British Business Bank.

British banks have already been paid £4.4bn to cover losses including fraud with more in arrears or default.

Of the £77bn issued across three different loan schemes, according to figures published, £4.4bn has been paid out to cover defaults and fraud resulting from the loans while a further £1.8bn has been claimed, without yet being settled.

More payments might be on the way with £3.2bn of the outstanding bal-

ance in arrears and £1.2bn having defaulted without being settled, according to figures from the British Business Bank.

Bounce-back loans made up the majority of the Covid-19-era loans, with £46.6bn of the £77bn total coming from the scheme.

The UK’s bounce back scheme saw banks pay out zero interest loans of up to £50,000 to small and medium enterprises on a six-year basis.

Concerns have repeatedly been raised that bounce back loans were being used for criminal purposes.

Across the bounce-back loans, £1.1bn has been flagged by lenders as potential fraud.

HSBC has been accused of being complicit in proscriptive practices in Hong Kong

CHRIS DORRELL

MPS HAVE accused HSBC and other banks of endorsing the suppression of human rights in a report by the Hong Kong All-Party Parliamentary Group published yesterday.

“British banks such as HSBC Bank

2ND MARCH 2023

THE GUILDHALL

VISIT: cityam.com/awards-2023

Plc have been complicit in suppressing the human rights of Hongkongers, by proactively supporting the National Security Law,” the report said. An HSBC spokesperson said: “Like all banks, we have to obey the law, and the instructions of the regulators, in every region in which we operate.”

Fintech clearing bank the Bank of London yesterday revealed it had bagged a fresh $40m funding injection as it gears up for full operations after winning its banking licence last month. The Londonbased clearing bank, which is only the second such firm to launch in the UK in 250 years, said it had maintained its ‘unicorn’ $1.1bn valuation in the funding round led by Mangrove Capital Partners and 14W Venture Capital.

Ashmore’s profits plunged during the first six months of its financial year, with the emerging markets asset manager blaming extreme market turbulence for investors’ decision to pull their cash. The London-listed asset manager notched up pre-tax profits of £53.8m in the six months to the end of December, a fall of 54 per cent on the previous year. Net outflows from its funds topped $7.6bn (£6.2bn) after investors pulled their cash from the market after being spooked by plunging valuations.

CHANGES are on the way to one of the City’s busiest transport intersections, as part of a major improvement programme.

From Monday, 13 February, Queen Victoria Street will close permanently to motor vehicles where it meets Bank Junction. Meanwhile a temporary oneway system will be introduced westbound in Mansion House Street, with a diversion route in place for eastbound traffic, including cycles.

Road users are advised journeys may take longer than normal during the work, with diversions and temporary traffic signals in place.

The work marks the next phase of All Change At Bank, a City of London Corporation scheme timed to coincide with Transport for London’s Bank station upgrade.

More information is at www.cityoflondon.gov.uk/ allchangeatbank

STREETLINK can help end rough sleeping by enabling members of the public to connect people sleeping rough with the local services that can support them.

If you are concerned about someone over the age of 18 that you have seen sleeping rough (or are sleeping rough yourself), you can send an alert to StreetLink. The details you provide are sent to the City Corporation or the outreach service for the City, to help them find the individual and connect

them to support (if they appear under 18 please call the police not Streetlink).

Report online at www.streetlink.org.uk or by dowloading the Streetlink app.

gov uk/eshot

Given the quality of the two sides, the corking anthems and the sense of occasion, the match between Ireland and France in Dublin should be a battle for the ages

OLLIE PHILLIPS ON THIS WEEKEND’S SIX NATIONS

PAGE 21

THE UK Supreme Court has ruled the Northern Ireland Protocol is lawful, rejecting a legal challenge to the Brexit process.

The legality of the contentious trading arrangements has been challenged by a collective of unionists and Brexiteers.

Judge Lord Stephens said in his ruling: “The most fundamental rule of UK constitutional law is that Parliament, or more precisely the Crown in Parliament, is sovereign and that legislation enacted by Parliament is supreme.

“A clear answer has been expressly provided by Parliament in relation to any conflict between the Protocol and the rights in the trade limb of article VI (of the Acts of Union 1800).”

Former Brexit party MEP Ben Habib, one of those who brought the legal challenge against the lawfulness of the

Northern Ireland Protocol, said the Supreme Court judgement provided “constitutional clarity” that the Good Friday Agreement was “broken”. Reacting to the court judgement, Habib told the BBC: “We have just had the Supreme Court confirm there is an Irish Sea border and it was imposed without cross-community consent and that is what we have been arguing for.

“They may have ruled that it has legally done so but effectively the United Kingdom of Great Britain and Northern Ireland is broken, the Good Friday Agreement is broken and that is complete constitutional clarity for us.”

Reacting to the judgement, DUP leader Sir Jeffery Donaldson said the protocol represented “an existential threat to the future of Northern Ireland’s place within the Union”.

“The longer the protocol remains, the more it will harm the Union itself,” he said.

The Lord Mayor’s Appeal and Pret A Manger’s charity, The Pret Foundation, will join forces with Lady Mayoress Felicity Lyons and Lord Mayor Alderman Nicholas Lyons this March for the second annual Lady Mayoress’s Sleep Out. Taking place at Guildhall Yard overnight on Thursday 16 March 2023, the event asks participants to ditch their deliciously warm beds for the night to raise awareness and funds for rising number of Londoners sleeping rough.

The Lady Mayoress Felicity Lyons says: “Homelessness is a cause very close to my heart, which is why I am planning to swap my warm bed in Mansion House for a sleeping bag to raise awareness of what it’s like for a growing number of Londoners sleeping rough in the City and beyond. Together with The Lord Mayor’s Appeal and The Pret Foundation, we hope to encourage people to embrace a night under the stars and raise muchneeded funds for those without a safe home to go to.”

To take part in The Lady Mayoress’s Sleep Out comes with a registration fee of just £25, with a minimum sponsorship target of £500 excluding Gift Aid. Participants will need to bring their own sleeping bags, cardboard, waterproof and warm clothing, evening snacks, water bottles and anything else they need for an overnight stay at Guildhall Yard. Hot drinks and breakfast rolls from Pret will be provided for all sleepers on the morning of Friday 17 March.

According to Crisis UK, 45% of people experiencing homelessness have been diagnosed with a mental health issue which rises to 8 out of 10 people who are sleeping rough. The proceeds donated to The Lord Mayor’s Appeal will support mental health issues via their charity partner MQ Mental Health Research and initiatives like This is Me, helping to end stigma around mental health in the workplace.

Aiming to help tackle hunger, poverty and homelessness in commu-

BRITAIN’s infrastructure is falling apart, the country is plagued by strikes and Rishi Sunak’s government can’t shake off a hangover from Boris Johnson. If Volodymyr Zelensky was struggling to fill up his gratitude list, I humbly offer these as suggestions for the ultimate benefactor of bad vibes Britain.

Yesterday’s PMQs was almost entirely dedicated to the Ukrainian leader’s surprise visit to the UK, just as we promised another round of support for the nation invaded by Vladimir Putin.

Ukrainian pilots will be trained to fly NATO jets in a bid to combat the continued offensive from Russia, the government confirmed this week.

And Prime Minister’s Questions was a rehashing of Britain’s support for the wartorn country, alongside a hint that we might be prepared to use frozen Russian

assets to help fund the rebuilding of Ukraine at the eventual end of the war.

“We’ve ensured the provision of funds here will be put in a foundation for reconstruction in Ukraine and we’re currently working with international partners through the legal process to use those assets to fund Ukrainian reconstruction,” Sunak told MPs.

Dominic Raab, sitting by Rishi Sunak’s side, was thrilled he could repurpose Johnson’s old manoeuvre to cling onto his office longer than anyone expected by rolling out the literal red carpet for the Ukrainian leader. It was a trick tried and tested by Liz Truss too, who undoubtedly was furious

Zelensky didn’t recognise her without her hat.

It also gave the freshly reshuffled Suella Braverman, Grant Shapps and Michelle Donelan a chance to memorise their new titles, and what on earth each of their departments are supposed to do. Keir Starmer wasn’t complaining either. The Labour leader loves an opportunity to remind us he was in fact a lawyer, and was even willing to haul Putin and his cronies in front of The Hague.

The Labour leader dipped his toe into partisan politics, talking up Labour’s role in joining NATO, but quickly read the room, and said “we must all speak with one voice” in our support for Ukraine.

nities local to Pret shops around the world, The Pret Foundation donates Pret’s freshly made unsold food at the end of every day to ensure it reaches people who need it most. It also offers financial support to grassroots charities and helps to break the cycle of homelessness by providing training and employment opportunities at Pret through their Rising Stars programme.

A MEMBER OF THE PRET FOUNDATION’S RISING STARS SAYS…

“I was working as a journalist and was under a lot of pressure through work. Then my father died, my income stopped, my bank account was overdrawn, I had nowhere to stay and ended up sleeping at St Pancras train station. I knew Pret was based near Victoria, so went into one of the shops, asked for directions and two staff members who later became colleagues very kindly took me to the office and I asked to join the Rising Stars programme.”

(On taking part in the Lady May-

oress’s Sleep Out) “The feeling you have before a charity “Sleep Out” is very similar to the feeling of actually being homeless. As the night gets closer, you have a sense of dread and regret but it’s a good challenge to face and in the morning, you’ll feel a sense of achievement –having done some-

thing selfless for the greater good (especially if there’s a Pret breakfast roll nearby!)”

To sign up to The Lady Mayoress’s Sleep Out visit thelordmayorsappeal.org/sleepout2023

A healthy dividend and growing revenues suggest the Zebra-enthused private bank is on the right path. The London-listed share price was up more than 20 per cent in 2022 despite an equities market spitting out red readings, helped no doubt by consistent returns to shareholders. Profit before tax in the first six months of the year was up more than 24 per cent, too. UK boss Ruth Leas has also driven the bank’s continuing commitment to its social enterprise programme, Beyond Business, which has invested in more than 300 London businesses.

Another bumper year for Lloyds is expected to result in a healthy return to shareholders through dividends and buybacks. Double-digit income growth and a healthy increase in mortgage balances despite the housing market slowdown has seen analysts impressed, with the firm still the UK’s largest provider. A shake-up of the firm’s divisions spearheaded by boss Charlie Nunn appears to have set the bank fair for continued growth.

A year that saw a significant anti moneylaundering fine is a strange one to nominate Natwest, but the way the bank dealt with the fallout and beefed up its procedures earned it some City credit. It was also the year the bank left majority state ownership, and boss Alison Rose continues to impress the City with what looks from the outside like shrewd management.

Having entered the UK market more than a decade ago, 2022 was a landmark for SVB in the UK with the branch becoming a wholly owned subsidiary. It has since led a £300m credit line for Wise, a similar line for Hello Fresh and a £150mplus line for Moonpig. The firm expanded into the Nordics with a Swedish acquisition and took a minority stake in accelerator organisation the Founders Forum Group as it makes a strong play in the UK scale-up market.

Last year’s winner reported its first full-year profit in the middle of 2022 and CEO Anne Boden reckons the firm is on track to quadruple that in this financial year. The firm’s lending book continues to grow with the acquisition of buy-tolet mortgage specialist Fleet paying off in 2022 with £1.2bn-worth of mortgages completed despite a choppy housing market.

The expertise and skills of people underpin the success of virtually every organisation. Yet ongoing skills shortages are preventing today’s organisations from accessing the talent they need to innovate and grow.

ACCA’s inaugural 2023 Global Talent Trends Survey highlights some of the most pressing staffing challenges faced by employers globally, including in the UK. It shows that financial professionals are on the move, confident that there are opportunities to get new roles which will progress their careers, and at the same time better fit their personal lives.

From an employers point of view, the study highlights the challenges in attracting, retaining and motivating their people. So, what should they focus on?

The survey, reflecting the views of more than 8,400 professional accountants across 148 countries, identifies seven key themes for employers to consider as they plan their workforce strategies for the next 12 months and beyond:

WAGE PRESSURES.

High rates of inflation in markets around the world are effectively reducing real wages. As a result, remuneration is a major concern for financial professionals across the world and in most sectors. This leaves employers in the unenviable position of having to balance the wage demands of their talent with the need to keep their cost base under control.

Hybrid working. While the new era of hybrid working appeared to be ushered in following the outbreak of the Covid-19 pandemic, the reality is a more nuanced picture. Over 87 per cent of respondents to ACCA’s research said they would like to work remotely for at least one day a week. The data reveals that the UK and Ireland are leading the way in the adoption of hybrid working, with 64 per cent and 69 per cent respectively working in this way. But globally, there is much further opportunity across the profession to transition to hybrid working practices.

Some employees cited concerns about remote working, with almost half (47 per cent) of our global survey suggesting that they find team collaboration harder when they work remotely. Furthermore, a third (34 per cent) claimed to be disengaged from their managers when working from home. Making hybrid-working practices more effective in the future will be a critical imperative for employers.

Nevertheless, the data found that finance professionals working in hybrid roles appeared to be happier at work than those working full time in the office. This is likely to have positive implications for their productivity.

BURNOUT.

The pressures of the pandemic have taken their toll on workers around the world. An overwhelming majority of respondents to the research (88 per cent) said they wanted a better worklife balance, with men more likely to express this desire than women. Three

in five (61 per cent) respondents to the survey admitted that their mental health suffered because of work pressures, although the UK fares better in this regard with a lower, albeit still alarming, figure of 54 per cent.

Professional mobility. Today’s employees don’t expect to stay in their job for life – or even for the next two years.

In fact, they are keeping a constant eye out for the next opportunity, whether that’s inside – or outside – their current organisation. Our research found that in the UK more than a third of respondents (36 percent) expect to move to their next role within the next 12 months, rising to more than twothirds (58 per cent) over the next two years. This finding presents both opportunities and risks to employers. While workforce mobility brings the advantage of fresh perspectives, it can also result in operational disruption and the loss of vital knowledge.

Technology skills concern. Technology is crucial for enabling organisations to thrive into the future and

respondents recognise how it empowers them to add value. Yet many employees don’t believe they have the skills to take advantage of the powerful tools available to them. Globally, over four-fifths (86 per cent) want more training support on technology from their employers.

Social mobility. A lack of social mobility is an ongoing issue in many industries and professions, including finance. While almost 70 per cent of

global respondents to the research thought their organisational culture was inclusive, almost half of respondents globally (49 per cent) indicated that a low socio-economic background was a barrier to career progression within their organisation – this figure is a lower but still high 32 per cent for UK respondents.

Although employees are benefiting from professional mobility, they still value the career security that professions like accountancy can provide. For example, accountancy is seen as a smart choice in terms of the skills, prospects and rewards it offers, as well as its ability to support cross-sectoral and international mobility. Another plus of a career in accountancy is that it enables employees to have a positive impact on the world. Over two-thirds (69 per cent) of global respondents to the ACCA research agreed that accountants will play a bigger part in helping organisations to address sus-

tainability and climate issues in the future.

The economic outlook for this year remains highly uncertain. At the same time, working practices are still evolving and the world continues to change at pace, with new technologies emerging all the time.

To prosper in this volatile environment, organisations need talented workforces more than ever. What’s more, they need them to be happy, healthy, productive and equipped with critical skills.

The research shows that the top three “attraction” factors that will allow employers to attract and retain good staff are career and learning opportunities, remuneration, and work life balance. These are challenging times for employers of professionals, but hopefully these findings will provide useful insights as we look ahead to 2023.

To learn more about the ACCA research, visit accaglobal.com/talenttrends2023

Financial professionals are on the move, confident there are more opportunities

November 23, 2021 was a landmark day for the London stock market: the unveiling of the first special purpose acquisition company (SPAC) to launch a City float. The bigger picture? It might begin clawing back some of the vast swathes of ground lost to New York during the boom for blank cheque vehicles.

Hambro Perks Acquisition Company, which raised nearly £150m from a swathe of blue-chip investors, was given 15 months to find a merger target – and last month it looked as if it had secured its prize: a combination with Istesso, a developer of drugs designed to treat chronic diseases such as arthritis and multiple sclerosis.

At a time when the UK public markets are crying out for more innovationfocused companies, this looked like a compelling addition to the ranks of London-listed biotech businesses. Moreover, it would have offered a shot in the arm to Istesso’s majority shareholder, IP Group, the intellectual property commercialisation-focused incubator. One banking source said the transaction would have valued Istesso at more than $350m – but within 48 hours of the negotiations being publicly

Hollywood don’t always make you a lot of money” –or so the actor Ray Winstone once said. So the star of Scum and The Departed has built a tidy sideincome in the Byzantine world of sports management.

Integral Management, the consultancy founded by Winstone and Gary Pettit, the former UK chief executive of

ED&F Man Capital Markets, is returning to the financial markets with its latest hire. I understand that Steve Ashley, a City veteran who is president of Laser Digital, Nomura’s cryptocurrency assets venture, is joining Integral as chairman. Working with athletes in sports including football, golf, superbikes racing and

disclosed, both IP Group and the SPAC issued statements to say that they had been terminated.

This should be of concern to stakeholders across the City: those involved in the Capital Markets Industry Taskforce, the body chaired by London Stock Exchange CEO Julia Hoggett, institutional investors and Lord Hill, the Treasury non-executive director who oversaw the 2021 review of the UK listings regime.

Dominic Perks, founder of the eponymous venture investor and chief executive of the SPAC it spawned, said at the time of its intention to float that it had chosen London as its listing venue “because it’s the technology capital of Europe”.

“The number of unicorns in the UK and Europe has grown significantly over recent years as we have seen a migration of talent and capital to private growth companies,” he added. “Investors want to back differentiated, scalable businesses with great leadership, and those are exactly the characteristics we’ll be seeking in our target.”

Perks’ optimism, who declined to comment on the SPAC’s plans ahead of its deadline to secure a deal, may, sadly, turn out to have been misplaced.

tennis, Integral’s appointment of Ashley suggests its board is hatching plans for a more ambitious expansion. Could a float one day be on the cards?

Winstone would certainly make for one of the more entertaining presences at the often-dry affairs which pass as plc annual shareholder meetings.

It’s all change at the top of one of the UK’s most prominent family offices.

IPGL, the investment vehicle of Lord Spencer, has replaced its chief executive, with Sam Wren stepping down as chief executive after nearly four years. She is being replaced by Ion Bogdaneris, an experienced private office executive who has previously worked with one of Canada’s wealthiest families.

Disclosed in accounts filed at Companies

House this week, Bogdaneris took up the role some weeks ago, according to people close to Lord Spencer.

At IPGL, Bogdaneris will assume oversight of a portfolio which now includes 50 investments, including stakes in Klarna, the buy now pay later platform, the Chapel Down vineyard (pictured) and the

Tote and Elvie, the women’s health app.

The former ICAP billionaire expressed satisfaction with its performance last year, citing its “wellpositioned portfolio” that was able to withstand volatility in public markets exacerbated

by the war in Ukraine”.

Mohamed Mansour, the new Conservative party treasurer, will be relieved at IPGL’s resilient results. The accounts also disclosed that the family office donated nearly £55,000 to Tory coffers, although this was sharply down on the previous year’s contribution of £170,000. Bogdaneris will have a role to play in ensuring Sunak’s election machine is in decent shape in 18 months’ time.

ILARIA

MAERSK has shrunk its profit expectations for 2023 as volumes and freight rates normalise after two booming years.

The shipping giant yesterday said it expects its underlying ebitda to be between $8bn (£6.6bn) and $11bn – 78 per cent down on last year’s $36.8bn.

“Guidance is based on the expectation that inventory correction will be complete by the end of the first half [of 2023], leading to a more balanced demand environment,” the company said in a statement. Revenue in the fourth quarter of 2022 slumped 3.8 per cent to $17.8bn due to the number of containers loaded onto ships decreasing by 14 per

cent, while underlying ebitda dropped 17.7 per cent to $6.5bn.

According to Maersk, global container demand will shrink between -2.5 and 0.5 per cent as global GDP growth “remains muted.”

“We are determined to speed up our business transformation and increase our operational excellence,” said chief executive Vincent Clerc.

Winstone returns to the markets to head up his sports sideline

I must mention a very entertaining Saturday job at my uncles’ shoe repairers, The Master Cobbler, in Highbury Barn, an area full of character and characters; never a dull moment. On one day, a passing hearse had a gearbox fire forcing them to put the coffin in our shop and resulting in this headline in The Sun come Monday morning: ‘Body and Soles’. My first “proper” job was in the summer of 1987, as a research assistant at the LSE’s Centre for Labour Economics, where I learned so much. As for my “proper City” job, it was as the UK economist at the venerable Hoare Govett, a name sadly no more, as indeed are so many other legendary City brands.

WHAT’S YOUR FIRST MEMORY OF THE CITY OF LONDON / FINANCIAL SERVICES?

Walking onto the equities floor at Hoare’s at 2 Broadgate one still dark cold November morning and being wowed by the scene. I thought it was a film set because it looked so much like what I had only seen on the big screen. My first steps onto the dealing floor made me think: “this is the place where I want to work from here on in”.

WHAT’S YOUR MOST MEMORABLE CITY LUNCH?

With the caveat that the best lunches are those one cannot remember and/or talk about, my best lunches are any of the St George’s Day Lunches at the Brewery on Chiswell Street. Starting at just gone 11 at the All Bar One Finsbury Pavement, for a ‘few’ drinks then at the table with great mates –none more so than the dearly missed Deans Chilton. More drinks, little bit of food, bit of comedy with the irrepressible Roger Dakin, meeting England’s legends in football, cricket and rugby, singalong to Land of Hope & Glory, followed by Lardies outside the South Place Hotel.

The Lamb in Leadenhall Market is such a special place, full of fond memories. So too are the Corney & Barrow in Bishopsgate and Broadgate – the ‘railway carriage’ and ‘airport lounge’ respectively. These were the home pitches of Hoare Govett and Laing & (Bang) Cruikshank, my first and second City firms (one Dutch-owned the other French), but very much firmly still back then in old city hands.

We will lunch at George & Vulture –Barnsley Chop with a fried egg on top and a few bottles of red (only one variety of course). Lunch will be sandwiched between drinks at the Jamaica Inn, The Jam Pot, ending with a Lardy outside.

The sense of urgency but order. Special mention to the City of London Police, who always made you feel protected and special.

I wouldn’t change anything about the place physically as it has evolved wonderfully; keeping old institutions and yet its commercial real estate being brought up to date so well. The city knocks the spots off New York and Docklands. For the record, I would like to see the return of the freedom to act individually, and being allowed to give as good as you got, matters settled without the need for ‘HR’.

Tufnell Park where I grew up and returned to a few years ago.

If Arsenal are at home at the weekend then watching them from the edge

FAVOURITE...

FILM: THE LONG GOOD FRIDAY

BOOK: ONE DAY IN THE LIFE OF IVAN DENISOVICH

MUSICIAN OR BAND: LIVE WOULD BE FRANKIE VALLI AND GEORGIE FAME. FROM THE PAST FRANK SINATRA AND MATT MONRO

DAY OF THE WEEK:

IN MY PROPER CITY DAYS’ THURSDAY –WORK HARD, PLAY HARD

TEA OR COFFEE: BUILDERS TEA

of my seat, in block 83, with my minder, Vidos. We would start with a bit of Greek food and wine at the wonderful Koutoukaki on Holloway Road, post-game up to ‘The LP’ (Lord Palmerston) on Dartmouth Park Hill.

City will finish second to Arsenal in the Premier League, and we won’t need them to have a points deduction.

The worst and yet best fell on the same day – September 17th 1992, the Thursday after what was at first called “Black” but has since become known as “White Wednesday”. As I entered the dealing floor at Hoard Govett, I knew that awaiting me was my research printed overnight which claimed the pound would not devalue by leaving the Exchange Rate Mechanism. My day only got worse when it was pointed out to me that in my research two sider to clients there was a spelling mistake: I had left an n out of “annus horribilis”. Despite the head of research, the extremely nice Nigel Hugh-Smith, threatening to fire anyone sending the piece out, Matt Siebert frenetically faxed away –just one of the pranks he played on me and others, all of which actually created the camaraderie that I so much enjoyed about working in the City.

31 years later, we still find ourselves working together, Matt being a fantastic micro-cap fund manager. That

Thursday back in mid-September 92 was also my best because it taught me the valuable lesson – think very carefully about what you put your name to and don’t be duped by politicians.

The City figure I will admire most is whichever player messes up most so that Arsenal get six points home and away. In terms of ‘The City’, I admire so many colleagues, now friends, not least all the market makers I came to know who were always the best of company –in the office and outside it, with the best nicknames.

I’d go anywhere with sun and sea with an assortment of mates, almost all of whom are from the Arsenal side of Norf London, apart from my mate Mike Ackers, an “Essex Red”. Mike was the man who on my first “shout” (standing with a microphone on the huge dealing floor to talk about the latest economic data), stood up from behind his screens, to shout “oi Stavros, where’s my doner Keady and remember no chilli sauce”. Strangely after I calmed down we became good mates, and his son Tony is now a colleague.

We dig into the memory bank of the City’s great and good: this week it ’s Savvas

Savouri, chief economist and partner at Toscafund Asset Management

To appear in Best of the Brokers, email your research to notes@cityam.com

LONDON’s FTSE 100 pumped to a record intraday high yesterday led higher by oil giant BP and investors globally cheering signs that central banks are nearing the end of their interest rate rises.

The premier index hit its record intraday high of a shade over 7,925 points at the open in the City yesterday. It then pared back some of those gains, closing up 0.26 per cent at 7,885.18 points.

Its domestically-focused mid-cap peer, the FTSE 250 index, which tends to respond to sentiment toward the UK economy, was lifted in its slip stream, up 0.68 per cent to 20,325.87 points.

The top index had actually closed at its highest level ever last Friday.

Oil giant BP climbed to near the top of the FTSE 100, advancing around three per cent, driven by investors piling into the stock after it posted record

profits of £23bn yesterday and ramped up shareholder giveaways.

Central banks are beginning to near peak interest rates after they tightened aggressively, strengthening market sentiment toward stocks.

“Jay Powell is still giving bulls enough rope to hang themselves by as he is not sounding hawkish enough,” Neil Wilson, chief market analyst at Finalto, said.

Retailers supported the FTSE 100, likely boosted by new forecasts out yesterday from the National Institute of Economic and Social Research that project the UK will not tip into a recession this year.

High street fashion giant Next climbed more than one per cent, while

Mike Ashley’s Frasers Group added nearly the same amount.

The pound strengthened more than 0.2 per cent against the US dollar.

Transport group Firstgroup acquired Ensign Bus Company yesterday. Peel Hunt analysts noted Ensign has a young fleet of 55 buses with “limited capex requirements for several years”. Ensign also has a vehicle refurbishment and re-sale business. It expects the market for used diesel vehicles to remain robust. The analysts maintained a ‘buy’ rating with a target price of 153p.

In a trading update released yesterday, magazine publisher Future said the slowdown in its audience numbers from the end of the 2022 financial year has continued into the new year. Analysts at Peel Hunt pointed out this has had an impact on the digital advertising segment. However, magazines were “resilient” while the company’s affiliates also performed “broadly in line”. The analysts held a ‘buy’ rating with a 2,300p target price.

THEY ALWAYS COME BACK “It’s been another day of record highs for the FTSE 100 as this often-unloved index starts to come back onto investor radars. In this new era of rising interest rates, the likes of the UK blue chip has come back into favour not only for its more defensive qualities, but also for the ability of the companies contained within it to generate an income for shareholders.

MICHAEL HEWSON, CMC MARKETS

UNREPENTANT, Liz Truss is on manoeuvres. Silent since her short premiership, this week she broke cover, speaking directly to the Conservative heartland, first writing in the Telegraph, then interviewed by Spectator editor, Fraser Nelson. Her economic policies were, she still believes, the right ones. The fault for their abject failure rests not with her, but with the forces of economic orthodoxy – in places like the Office for Budget Responsibility, an institution that could have been named to spite her. The closest we got to mea culpa was her admission that “perhaps” the speed of her reforms was “a bridge too far”.

In truth, Truss’s re-heated Thatcherism was the wrong tonic for our times. Cutting taxes made sense in 1979, when the highest rate of income tax was 83 percent. Making a bonfire of red tape made sense when British business was in the doldrums, often stifled by poor management by the state. Neither is a fair description of Britain today. The OECD describes market regulations in Britain as amongst the most competitive in the world. Britain’s top tax rate is lower than that of France and Germany, and on a par with Switzerland.

And yet Truss wasn’t entirely wrong. While her prescriptions were amiss, her diagnosis of what ails the British was right. Last week, the IMF predicted that only Britain’s economy, amongst all G7 countries, would shrink in 2023. Productivity has been persistently low since as early as 2007, long before the travails of Truss’s mini-budget and the Brexit vote. While Britain is home to one global economic titan - Londonthe rest of the country lags far behind on every measure.

Truss understood at least some of this. So did her predecessor, Boris Johnson. While “levelling up” never made it

beyond an ill-defined mission and some pork-barrel politics, the underlying idea was that Britain needs growth, and that the need is particularly acute outside London.

Today, searching for what might one day be called Sunakism, it is impossible to divine a plan for growth. Admittedly, the first order of business for Sunak and his chancellor, Jeremy Hunt, was to fill the Liz Truss shaped hole in the nation’s finances. But when the Chancellor threatened to do more, presenting a growth plan at the end of last month, it was frustratingly broad and vague. His “four Es” – enterprise,

education, employment and everywhere – weren’t just an offence to grammar. The Institute of Directors, whose support a Conservative Chancellor should covet, was withering on the substance, declaring that Hunt’s speech demanded a fifth E: “empty”.

In pursuit of growth, we would do well to lift our eyes to the United States, where the Biden administration is making a bold pitch for growth. While some here have long looked across the Atlantic for a model of free-market fundamentalism, America has in fact long been far more comfortable with industrial strategies that promote growth

IN October 1980, at the first US presidential debate, Republican challenger Ronald Reagan asked, “Are you better off than you were four years ago?” Reagan pointed not only to the prices in shops and unemployment but also asked whether America was respected, secure, and strong. He told people who didn’t like the vibes to vote differently, and they did, turfing out incumbent Democrat Jimmy Carter.

Today, the United Kingdom is facing a similar predicament. It’s not just that the statistics are flashing red –inflation has skyrocketed and economic growth is anaemic – but there’s even more below the surface. We’re facing a Crisis of Bad Vibes. This crisis may partly be a response to the objective facts before us, but it risks sinking us further and creating a doom spiral.

We experience this reality every day. We wake up in the morning only to wonder whether the train will be overcrowded, delayed or cancelled.

Matthew LeshWe read news stories about the avalanche of teachers, ambulance staff, nurses and firefighters on strike. A Christmas card sent back in December only just arrives in the mail. The evening rush to a supermarket for a quick dinner is just another reminder that everything is getting more expensive. If that wasn’t enough, a family member is waiting for treatment on the NHS while a friend is facing a ridiculous rent increase. The evening news is about a criminal let out of jail far too soon, committing another heinous act, or another story about

war and natural disasters. Meanwhile, taxes are on their way up, despite the quality of public services appearing to be on their way down.

No wonder Rishi Sunak is doing awfully in the polls, despite the general lack of enthusiasm for Keir Starmer. Not only that, but the government can only ever seem to achieve very little. Big vision has been replaced by lowering expectations and managing decline. The pessimism makes politics even more zero-sum. More money for one group means less for others; any reforms, be it to the NHS or housebuilding, are treated with extreme suspicion.

The malaise hurts the economy and could prevent a recovery. If there’s shrinking hope for a better future, why will businesses bother to invest? Why will people take risks by starting innovative companies? The number of UK businesses has shrunk from 6.0 to 5.5 million between 2020 and 2022 –driven by a reduction in self-employment. There have been reports from

S&P Global in recent weeks about a downturn in activity across the British construction, manufacturing and service sectors. A survey in December from KPMG found 61 per cent of consumers intend to reduce spending on discretionary goods, including the likes of eating out, holidays and clothing.

There isn’t a simple solution to the Crisis of Bad Vibes. No magic switch can change everyone’s mood. Getting inflation under control, ultimately a role for the Bank of England, will help ease much of the political pressures and get the economy moving in the right direction. But building prosperity could take something different: hope. Politics has a role to play, in fixing the issues plaguing our lives, but this won’t just come top-down. We need to once again, somehow, find a way to believe our lives are on an upward trajectory.

£ Matthew Lesh is head of public policy at the Institute of Economic Affairs

than we have been in Britain.

President Biden’s new Infrastructure Act is the most significant piece of industrial strategy the West has made in decades. The Infrastructure Act will invest $1.2tn in new, green infrastructure over the next ten years. The CHIPS Act will invest $280bn in building up America’s semi-conductor industry. The Inflation Reduction Act will subsidise green tech to the tune of at least $400bn.

Biden’s goals are threefold. First, to stimulate economic growth by rebuilding industrial might across the country. Second, to reduce America’s dependence on China, an international foe which has long distorted free trade with subsidies to gain a stranglehold over international supply chains. Third, to address the greatest long-term crisis the world faces – climate change – and become a green tech superpower in the process.

In Britain, investment like this is far beyond our means. However, we can begin to think like the American President. We too must look at the rise of green technology and ask where we can be a global leader. We too must reduce our reliance on adversaries, like Russian energy and Chinese manufacturing. And we too must spread growth across Britain. Today, there is little sign that our government is looking far beyond the immediate horizon. Ever since the financial crisis, Britain’s horizons have been limited to the considerable travails of today. Without a growth plan now, we will waste yet another tomorrow.

£ Josh Williams is a writer and director of communications at Labour Together

Masayoshi Son, the chief exec of SoftBank, is on the hook for more than $5.1bn for side deals he set up in a bid to boost his compensation. The founder is in the red with his employer after he saw his unrealised losses widen by around $400m in Q4 last year

[Re: BEIS break-up: New department will help government combat energy crisis, argue experts, Feb 7]

A new department focused on Science, Innovation and Technology is welcome news (BEIS break-up: New department will help government combat energy crisis, argue experts, 7 February 2023). This is a much needed opportunity to improve co-ordination between the disparate innovation departments and reduce bureaucracy. While progress has been made with UK Research and Innovation now home to seven research

councils and Innovate UK, many businesses - particularly SMEs - still find working with government on innovation hard to navigate. The new department needs to now move away from the timescales and attitudes of research departments and adapt to the opportunities and challenges in driving business growth. It needs to focus on moving on from process and aspiration and look at how other countries set top down direction and prioritisation, whilst also allowing for bottom up ideas to succeed. With the right outlook and priorities, this new department marks a significant opportunity to bring real benefit to the UK and allow ideas to flourish.

Shaun Delaney

THIS National Apprenticeship Week is a moment to celebrate everything that is good about apprenticeships, how they enable career trajectories that wouldn’t otherwise be possible, but also to take a look at how they could be improved.

Last month, the International Monetary Fund predicted that Britain’s economy will fare worse than any other advanced nation. The projections have come under criticism from some corners of the economic and political establishment, but clearly the UK faces a unique set of challenges.

Skills is a key part of this equation, an issue which successive governments have tried to address. According to the Federation of Small Businesses, 80 per cent of small firms are struggling to recruit applicants with suitable skills. Meanwhile, the apprenticeship levy has had mixed responses from business leaders.

According to research from Accenture, less than half of UK companies are

portunity to boost social mobility and drive more productivity and growth in the UK.

The spectre of 7.2 milllion people waiting for medical care has haunted the UK since the pandemic, when much routine treatment was put on hold.

Last year Rishi Sunak set out plans for those lists to finally start to move, and, according to the Institute for Fiscal Studies, they will finally start falling from March next year.

While this is a glimmer of good news, it does also mean the number of people waiting for treatment will broadly flatline for the next year.

The recovery plan to get waiting

lists moving in the right direction would cost £12bn, the IFS said.

But they also warned Rishi Sunak’s ambition to increase acitivity by 30 per cent on prepandemic levels was unlikely to be met.

Sunak made NHS waiting lists one of his five priorities for this year, but strikes and staff shortages have hindered progress.

Nearly 150,000 appointments have been cancelled as a result of strikes over the last few month.

There is little end in sight, with Sunak refusing to up the pay offer for nurses and ambulance staff.

actively creating more diverse kinds of pathways, such as apprenticeships, to deliver advanced skills.

There was a false start in the apprenticeship sphere, with the number of people participating in schemes improving over the last year. But at the same time, the rate of apprenticeship achievements fell. The eventual outcome is that we are worse off in developing the skills in technology, engineering, data science and design, which are becoming increasingly important. According to the education and skills think tank, EDSK, almost half of apprentices failed to complete their courses in 2021, with many of them blaming the poor quality of the training offered.

It also means we are missing an op-

The challenges facing employers in the apprenticeships system have been well documented, including challenges around funding and the notoriously complex system they must navigate. Simultaneously, young people are deterred from taking up apprenticeships as a result of low wages and lack of high-quality training available to increase their future career prospects.

Giving up on apprenticeships in the skills gap conundrum won’t do, but we do need to take a fresh look at how we build these courses to address the skills deficit. This requires long-term planning now if businesses are to access, create, and unlock talent in the future.

To level the playing field to offer better opportunities to all young people, particularly those from lower socio-economic backgrounds, businesses should look to partnerships rather than just hoping to solve the issue on their own. By working with public bodies, such as local authorities, businesses can pool resources and expertise to boost high

growth areas with clear skills shortages. This model will help SMEs around the UK to address shortages more effectively in specific regions, helping to unlock a diverse talent base by connecting them with local SMEs, especially those not in education, employment, or training.

Instead of complicated funding models, we need innovation in pre-apprenticeships programmes to attract young people to key growth sectors. For many young people, particularly from low-income backgrounds, the challenge starts with knowing when and where to find apprenticeships, let alone performing well in an interview.

It’s not simply about the skills offered in apprenticeships, but ensuring the right people end up in the right schemes. Employers, alongside local authorities, need to reach out into communities and provide robust pastoral and financial support to ensure their investment into apprenticeships is paying off.

£ Simon Eaves is the UK chief executive officer of Accenture

Young people are deterred from taking up apprenticeships with low

Men, killing men, killing men, killing men, killing women, killing men, killing men, killing children… Titus Andronicus at The Sam Wanamaker Playhouse demonstrates that revenge is a dish best served hot and messy.

Titus Andronicus was Shakespeare’s first tragedy, and his juvenile enthusiasm for violence and depravity has fascinated and appalled audiences since its earliest performances. A content note in the programme for this production warns that the “play contains incidents and themes of anti-black racism, ableism, sexual assault and its aftermath, murder, infanticide and extreme violence including bodily mutilations, cannibalism, rape and self-harm”, and suggests that many may find it “extremely upsetting”. But regular and often riotous laughter from the audience told another story, that while such acts in fiction may be harrowing in isolation, offering up a surfeit of horrors can tip over into the absurd.

Director Jude Christian apparently

Another year, another Carmen.

The English National Opera, having secured another year of Arts Council funding in 2023, starts off the season with Bizet’s beloved opera.

Carmen and Don José’s boy meets girl, girl spurns boy, boy kills girl, love story still satisfies the desire for operatic tragedy, even in director Calixto Bieito’s updated production.

Rusty cars as makeshift homes and dust covered military uniforms provide the Spanish colonial setting, where Franco’s tyrannical dictatorship reigns supreme. In this world, aggression and poverty inform social relationships, even between lovers.

Making her ENO debut, Ginger Costa-Jackson adds yet another Carmen portrayal to her impressive list of performances. Sultry, clever and assertive, Costa-Jackson’s flighty yet restrained depiction of Carmen is captivating, as is her unique voice. Her low notes possess an intimate depth, while her higher range sparkles off the London Coliseum stage.

The clingy and ordinary Micaëla, the childhood friend who attempts to win José’s affection, stood no chance against Carmen, although Carrie-Ann Williams made an impressive ENO debut in the role, filling in for the ill Gemma Summerfield.

shares the sensibilities of splatter movie auteurs like Sam Raimi and Peter Jackson, who found humour in gratuitous, over-the-top displays of violence. The production sets out its stall immediately, with a musical opening number that is the best song about taking enjoyment in the misfortune of others since the puppets of Avenue Q discovered the meaning of “schadenfreude”. The cast cavorts around the stage, cheerily promising that the audience will find the suffering of the characters cathartic. Honestly, it’s a relief, because the characters definitely suffer.

Despite being one of Shakespeare’s most engaging plays, for obvious reasons it is seldom studied in school, and therefore audiences may not be familiar with the plot. Suffice to say that by the end of the play, pretty much all the characters are dead, most have been mutilated but only one has been tricked into eating their own children.

The play has an all-woman cast, but

the reason for this is not immediately evident. Perhaps it is an inversion of the traditional Shakespearean productions in which all the parts were played by men, perhaps it is a commentary on male violence against women (or a way to pre-empt complaints sometimes levelled against the play that it glorifies, normalises, excuses, or presents such violence uncritically), or perhaps they were simply the best actors for the job. Certainly, there are solid dramatic performances from Katy Stephens as Titus, Georgia-Mae Myers as his daughter Lavinia, and Kibong Tanji as Tamora’s co-conspirator, Aaron. However, it is the comic performances that really shine. Lucy McCormick brings the same swivel-eyed, childish intensity to Saturninus that Malcom McDowell delivered in Caligula, backed-up with impeccable improvisational skills. Meanwhile, Beau Holland delivers perfectly measured humour in several minor roles.