NIGEL’S MADE PLANS

CITY TITAN TO STEP DOWN FROM TOP JOB AT LEGAL AND GENERAL

JAMES SILVER

SQUARE MILE grandee Sir Nigel Wilson will step away from the top job at Legal and General (L&G) after more than a decade at the helm.

Wilson, who became chief executive at L&G in 2012 after three years as chief financial officer, said the decision to leave was taken with “mixed emotions”. His tenure has been widely considered to be a success in the Square Mile, with a consistently strong financial

performance despite an occasionally challenging global climate.

He will continue on in the role until a successor is found, a process the firm said would take around a year. He said he was retiring from “executive” life and he is highly likely to be sought after for nonexecutive board roles.

“We’ve had some unbelievable challenges that we’ve had to go through,” Wilson said yesterday.

“We’ve had Solvency II, we’ve had Brexit, we’ve had Covid-19 and the

NICHOLAS EARL RIO TINTO has lost a highly radioactive capsule somewhere in Western Australia –after it fell off a truck.

The mining giant has apologised for the alarm it

888 boss quits as firm starts

VIPs inquiry

CITY A.M. REPORTERS

GAMBLING giant 888 yesterday saw its share price collapse after it informed markets that its CEO was leaving immediately, online revenues had fallen by double-digit percentages and it was launching an investigation into money-laundering controls related to VIP gamblers in the Middle East.

Boss Itai Pazner stepped down with immediate effect yesterday, just two weeks after the firm’s chief financial officer also reached a “mutual” agreement to walk.

Ukraine War to deal with. I feel very proud not just for myself but for the whole organisation of what’s been delivered over the past fourteen years,” he added.

Analysts at Panmure Gordon suggested the announcement indicated an external search to find a replacement for Wilson, though tipped current CFO Jeff Davies as a potential internal replacement.

L&G chair Sir John Kingman led the tributes to Wilson yesterday.

“He is a world-class leader who has

has caused, and promised it was taking the incident “very seriously”.

Rio Tinto’s iron ore chief executive Simon Trott said: “We recognise this is clearly very concerning and are sorry for the alarm it has caused in the Western

worked with great passion and energy, and we have been very fortunate to have had his vision, drive and commitment,” he said.

“Nigel has successfully navigated significant geopolitical changes as well as challenges in the regulatory and market environments of each of our core businesses and has steered the Group into a position of strength from which it can continue developing on behalf of its shareholders, customers and people,” the chairman continued.

Australian community.

The silver cylinder is smaller than a penny but contains caesium-137, a highly radioactive isotope.

Authorities believe vibrations from the truck caused the density gauge’s screws to come loose, and

caused the radioactive capsule to fall out of the package and then out of a gap in the vehicle.

The entire route is now expected to be searched until the missing unit is found, which is equivalent to the distance by road from John

“Following an internal compliance review, it has come to light that certain best practices have not been followed in regard to KYC (Know Your Client) and AML (Anti-Money Laundering) processes for 888 VIP customers in the Middle East region,” the firm said in a statement to markets yesterday.

Accounts equivalent to “less than three per cent of group revenues” had been suspended.

Labour peer Lord John Mendelsohn will step in on an interim basis. Shares of the Gibraltar-headquartered firm which owns a number of gambling brands tanked more than a quarter yesterday, finishing down 27 per cent.

£ CONTINUED ON PAGE 3

O’Groats in Scotland to Land’s End in Cornwall.

Specialist radiation detection equipment is being fitted to patrol vehicles that will drive the route.

Curious Aussies have been told to stay away from the capsule should they find it.

STANDING UP FOR THE CITY

Sir Nigel’s leadership deserves the plaudits he is receiving

LEADERSHIP is most easily noticed when it’s not there. It is something intangible and difficult to define but whatever it is, Sir Nigel Wilson had it in droves.

The proof is in the pudding –under his tenure, on every level, the performance of the insurance giant has continued to impress. Shareholder returns, expansion, international ambitions; all the while delivering on its core products and investments. As he

THE CITY VIEW

put it more than once, it’s the long-term view that ensured that L&G remained on course. There is though more to it than that. It’s not too much to say that Wilson has become something of a conscience for the City –sticking up for the financial

services industry when under attack, but also delivering home truths when necessary, as he did on executive pay in the middle of the last decade. He has also been a driving force behind initiatives to make the City more diverse and inclusive and –perhaps fittingly for a man with a still strong County Durham accent –was a strong advocate for the power of financial services in the fight to ‘level up’ parts of the country a long way away from

L&G’s Moorgate headquarters. Wilson will be missed. His job, as he alluded to, is not quite done –plans for international expansion will fall to his successor to take forward. But perhaps most interesting in all the commentary yesterday was Wilson’s own assessment of his legacy in an interview for L&G itself –that the firm would be even more successful after he left, thanks to the team he’d put in place. That sounds like leadership to us.

NORTH EAST PASSAGE Prime Minister Rishi Sunak during an animated Q&A session at Teesside University in Darlington as part of his visit to County Durham yesterday

Germany teetering on edge of recession which could drag down the rest of Europe

JACK BARNETT

GERMANY is teetering on the edge of a recession after fresh figures out yesterday revealed its economy unexpectedly contracted in the final months of last year.

German output dropped 0.2 per cent over the last quarter, below the flatline consensus forecast by investors.

The shock GDP undershoot raises the risk that the wider eurozone economy could marginally fall into a technical slump, defined as two consecutive quarters of contraction, despite experts recently scrapping their recession fore-

casts for the common currency area.

If the eurozone or German economies do tip into recession, it would mean the UK is not the only major economy to undergo a slump this year, as experts such as Goldman Sachs have been warning.

GDP grew 0.4 per cent in the third quarter, meaning Germany has not yet reached technical recession definition, but will if output shrinks again in the current quarter, which analysts said is a real possibility.

The “balance is now, again, tilting towards the idea that Germany is in a technical recession, despite green

shoots in the surveys,” Claus Vistesen, chief eurozone economist at consultancy Pantheon Macroeconomics, said. A gas crisis in Europe sparked by Russia sucking supplies out of the continent in retaliation to sanctions levied on it in response to its invasion of Ukraine led economists to warn the bloc will suffer a recession this year.

“Looking ahead, we think that [German] GDP will fall again in the first quarter as the inventory correction continues and resilience in manufacturing, mainly due to auto sector strength, gives way to weakness,” Vistesen added.

A WORTHY PRIZE

We’re thrilled to be launching a competition for our valued readers in today’s paper –with a sizable prize attached –in conjunction with Lucky Break Competitions. We know that times are tight –with energy bills on the way up and inflation delivering a hefty blow to the budget. We hope you enjoy our competition –and whatever drives you to play, our advice is to limit yourselves to what you can afford, don’t assume you’ll win –and have some fun!

THE GUARDIAN

HEAD OF WATCHDOG RECUSES HIMSELF FROM BBC CHAIR INQUIRY

The head of an investigation into Richard Sharp’s appointment as the BBC chair has recused himself from the process, admitting the pair have met several times.

THE TIMES CUTS COULD LEAVE ARMY UNABLE TO PROTECT UK FROM RUSSIAN AGGRESSION

The British army is in “urgent need” of more money as defence sources warned that the military may not be able to protect the country against aggression from Russia.

THE DAILY TELEGRAPH HOMEOWNERS LOSE £22K AS ONE IN EIGHT NEW-BUILD HOMES RESOLD FOR A LOSS

One in eight new-build homes are being resold at a loss, with the average property losing £22,000 of its value. Homeowners are twice as likely to resell new-build homes at a loss.

WHAT THE OTHER PAPERS SAY THIS MORNINGECB president Lagarde: German volatility could lead to a continent-wide recession

Unilever: Dutch dairy chief given tap for top job

CITY A.M. REPORTERS

A DUTCH dairy boss with business links to activist investor Nelson Peltz will move into the CEO role at the consumer giant.

Hein Schumacher has led the dairy firm Royal Frieslandcampina, an £11bn business operating in over 40 countries, since 2018.

He has sat on Unilever’s board as a non-exec since June of last year.

Schumacher’s appointment comes after embattled boss Alan Jope announced he was stepping down.

Jope had been under pressure for an under-performing share price and while also failing in a bid to buy rival GSK’s consumer healthcare division, which legendary City investor Terry Smith described as a “near-death experience” for the firm.

Schumacher began his career in finance at Unilever and has also worked for Heinz –where he met Peltz, who at the time was invested in the firm.

He will take the top job at the start of July of this year.

Peltz’s arrival on the board of Unilever was closely followed by Schumacher’s.

Yesterday Peltz said: “Like all of my fellow Unilever directors, I strongly support Hein as our new CEO and look forward to working closely with him to drive significant sustainable stake-

“I first met Hein when I served as a director at Heinz from 2006 to 2013 and was impressed by his leadership skills.”

The aforementioned Smith also made headlines when he attacked the company’s focus – citing a desire to give Hellmann’s mayonnaise a higher meaning as a suggestion the firm had “lost the plot”.

Renault

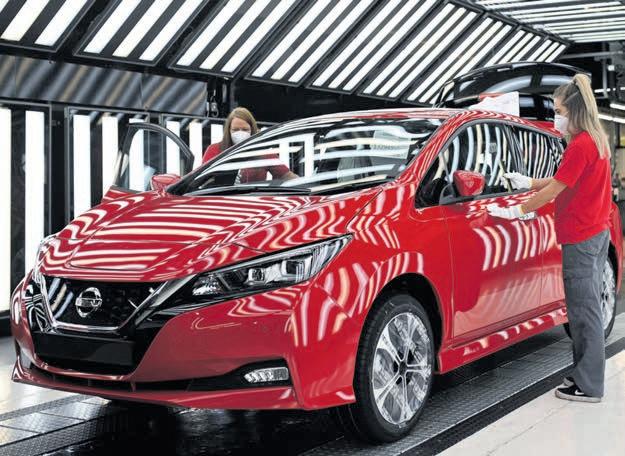

Renault and Nissan refine their future automotive partnership

JESS JONES

RENAULT and Nissan have agreed on a deal which will put the automobile manufacturing giants on a more equal footing as the partnership looks to build a more constructive relationship.

Renault is reducing its stake in the Japanese carmaker to 15 per cent, down from about 43 per cent, which

888 promises to right ship after dismal month

CONTINUED FROM PAGE ONE

“Itai has played a very important role in building a business with powerful proprietary technology, and has overseen successful early stages to the William Hill integration process. We wish him well in his future endeavours,” Mendelsohn said of the departing chief executive.

Pazner had been leading the integration of the firm’s business with William Hill’s European business which it bought for around £1.9bn last year.

Pazner had announced cost savings targets in November with plans to create ‘synergies’ from the deal saving as much as £150m.

balances the companies’ crossshareholdings more equally. The leftover 28.4 per cent will be transferred to a French trust.

Nissan will invest in Ampere, Renault’s new electric vehicle , becoming a strategic shareholder.

“The ambition is to strengthen the ties of the Alliance”, the motor companies said in a statement yesterday.

Separately 888 confirmed trading was in line with expectations, but online revenues were down by 15 per cent year on year.

The firm said this was due to enhanced player protection measures in the UK and the closure of its Netherlands operation.

“Gambling stocks are under enough regulatory scrutiny as it is without inviting reasons for further attention and yet that’s exactly what 888 has done,” said AJ Bell’s investment director Russ Mould.

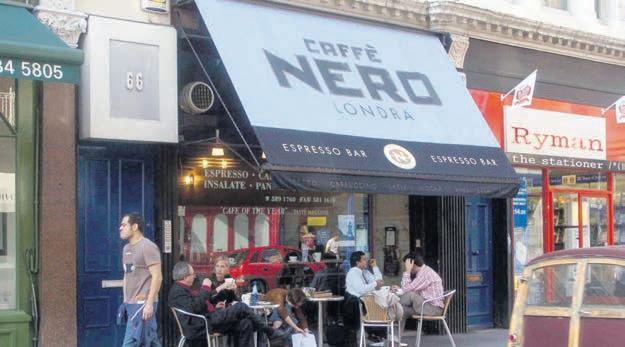

Caffeine high: Caffe Nero’s no hasbean with sales up on pre-pandemic

LAURA MCGUIRE

CAFFE Nero generated UK sales of £150m for the first half of the financial year, averaging 104 per cent of pre-pandemic levels and an increase of 17 per cent for the same period in 2021, it said yesterday.

The coffee chain added Deliveroo and Just Eat to its delivery partner service last year, which it said helped

secure £3.5m in revenues.

Moreover, Caffe Nero reported £1.5m in sales for its Coffee At Home business, which was supported by a new partnership with Waitrose and continued partnerships with retailers Amazon, Ocado and Sainsbury’s.

Gerry Ford, Caffe Nero founder and group CEO, said: “We’ve seen a very encouraging first half of our financial year. Despite significant

inflationary pressures which have continued to mount since June, we have demonstrated strong cost control and delivered solid sales growth. We traded at 110 per cent of pre-pandemic sales in December.

“That is a testament to the hard work and outstanding service from our store teams as well as a very well received Christmas menu with our customers.”

UK reputation falls on annual CPI graft index

LOUIS GOSS

BRITAIN has received its lowest ever score and ranking on Transparency International’s annual Corruption Perceptions Index (CPI).

The drop “is a powerful indictment” in the decline in public standards, campaigners say, which have been dragged down by a series of recent government scandals around the procurement of PPE during the pandemic and multiple ministerial breaches.

The UK has fallen seven positions on the NGO’s annual index, published today, dropping from 11th to 18th place – the lowest position it has occupied on the index since 2012.

Britain’s score on the index has also fallen, from 78 out of 100 in 2021 to record lows of 73 out of 100 in 2022.

The five point drop saw Britain’s score fall at a sharper rate than all but two other countries – Azerbaijan (-7)

and Oman (-8).

The UK’s drop to 18th place caused Britain to fall behind countries including Uruguay, Estonia and Luxembourg, putting it on par with Belgium and Japan.

Denmark topped the global rankings with a score of 90 out of 100 while Somalia (12), Syria (13), and South Sudan (13) lay at the bottom of the NGO’s index.

Transparency International said that various scandals around the procurement of PPE during the pandemic and multiple ministerial breaches have now begun to impact the country’s standing around the world.

“This sharp fall in the UK’s score is a powerful indictment of a recent decline in standards in government and controls over the use of taxpayer money,” Daniel Bruce, chief executive of Transparency International UK, said.

Sunak: UK’s ‘huge strides’ since EU exit

JAMES SILVER

RISHI SUNAK has hailed Britain’s “huge strides” over the past three years as he marks the anniversary of the country’s exit from the European Union.

In a statement to mark the occasion, Sunak claims the country has harnessed “the freedoms unlocked by Brexit to tackle generational challenges.”

Mayor Khan has been extremely critical of the government’s levelling up procedure

Levelling up fund has been a ‘disaster for London’, Khan says

ELENA SINISCALCO

SADIQ Khan yesterday accused the government of forcing local councils to waste money bidding for cash as part of the “levelling up fund”. Speaking in front of the Levelling Up Committee, Khan said councils are criticised if they fail to bid for funding from Westminster, even though only

one in five councils is successful.

The London Mayor said that the £2bn Levelling Up fund had been a “disaster” for London and accused the government of scapegoating the capital, even though it has some of the highest deprivation levels in the country.

“Oliver Twist didn’t have to pay to beg,” he told MPs.

“And in my first 100 days as Prime Minister, that momentum hasn’t slowed – we’re cutting red tape for businesses, levelling up through our freeports, and designing our own, fairer farming system to protect the British countryside,” he added.

However a separate poll suggested that Sunak’s boosterism isn’t changing stubborn poll ratings.

Just two in ten of those surveyed by Ipsos felt the government was doing a “good job,” and Labour leader Sir Keir Starmer now leads Sunak on a ‘capable leader’ measure.

Labour leads the Conservatives by around 25 points, according to the Ipsos poll. The firm’s head of political research said Sunak faces “significant challenges”.

Travel rebound sees Ryanair profit skyrocket

ILARIA GRASSO MACOLA

RYANAIR has posted its largest third quarter profit after tax for the winter quarter as a boom in demand helped it soar past pre-pandemic levels.

In the three months ending 31 December, the Dublin-based carrier reported a pre-tax profit of €211m (£184.9m), up from last year’s loss of €96m.

This was also up on the €88m profit reported in the third quarter of its 2020 financial year. Ryanair added that the average fare paid was 14 per cent higher during the same period.

Revenue surged 57 per cent to reach €2.31bn after passenger levels topped 38.4m with a load factor of 93 per cent.

In a statement, the airline said: “Ryanair secured strong market share gains in key EU markets as we operated 112 per cent of our pre-Covid capacity during the first nine months of the 2023 financial year.”

Chief executive Michael O’Leary told investors yesterday the carrier is better equipped for growth compared to both low-cost rivals such as Easyjet and Wizz Air as well as legacy airlines.

“There’s been an extraordinary widening of the unit cost gap between us and every other airline in Europe,” O’Leary said.

According to Ryanair calculations, unit costs have dropped to €30 per seat while those of competitors have surged, with Easyjet’s up 42 per cent and IAG’s 60 per cent.

“It’s one of the reasons why we are continuing to grow so strongly but also why profitability has rebounded strongly this year,” he continued.

O’Leary added that the low-cost airline was expecting very “robust demand” for Easter and the summer seasons as more tourists return to Europe from abroad due to a strong dollar and China’s reopening of its border.

NARROW CASTING Streamers Netflix and Amazon Prime brace for UK cancellations

JD Sports hack leaks data of 10m customers

AUGUST GRAHAMAROUND 10m people might have had their addresses, phone numbers and email addresses among other things stolen in a hack that hit JD Sports.

The business said payment card details were safe, and that it has no reason to think the hackers have accessed users’ passwords.

Hackers accessed a system which contained information on orders placed between November 2018 and October 2020 by JD Sports customers, the company said.

The impacted brands include JD, Size?, Millets, Blacks, Scotts and Milletsport.

The intruders could have gained access to billing, delivery and email addresses, full names, phone numbers, details of orders that customers have placed and the final four digits of their payment cards.

JD warned customers to be vigilant against any potential fraudsters and said they were working with leading cyber security experts and engaging with the relevant authorities, including the ICO.

MORE Brits are planning to cancel video streaming subsciptions this year, after new data revealed the number of paid-for subscriptions in the UK fell by two million last year as rising costs continue to eat into budgets. Data analytics group Kantar revealed the number of video streaming subscriptions in the UK fell from 30.5m to 28.5m in 2022.

Lidl to invest a hefty £4bn into British food businesses over the coming year

LAURA MCGUIRELIDL has revealed plans to invest £4bn into British food businesses this year, as it charges ahead with growth plans.

Lidl GB, the British arm of the German retail group, said it would accelerate the spending plans it announced in 2019.

Lidl GB, which had committed to a £15bn investment in the British food

industry between 2020 and 2025, has now raised that amount to £17bn.

Ryan McDonnell, CEO at Lidl GB, said: “The farmers and producers that supply us, some of which have been with us for decades, are paramount to the success of our business.

“We see them as partners in our mission to provide households with high quality affordable produce, and for many, working with Lidl GB and

being part of our growth has opened opportunities for their own expansion.”

Lidl GB works directly with over 650 suppliers across the country and currently sources two-thirds of its core produce from the UK.

Martin Kottbauer, chief trading officer at Lidl GB, added: “Providing our suppliers with the certainty needed for them to grow has been a big focus for us over the years.”

It is the latest in a series of highprofile cyber attacks, with Royal Mail reportedly hit by a ransomware attack last week.

Strikes to see hospitality lose £100m in sales

LAURA

MCGUIRE

RETAIL and hospitality figures have described strike action set to take place on Wednesday as “damaging” to the sector and “entirely avoidable”.

Kate Nicholls, chief executive of UKHospitality, told City A.M. she estimates union strikes this week will set the sector back a further £100m in lost sales, with “much of that impact being felt in London”.

Nicholls said: “The situation is entirely avoidable but provides yet another pressure for a sector contending with soaring energy costs, workforce challenges and dampening consumer confidence.

“Hospitality continues to suffer as collateral damage as a result of this dispute, so it’s vital that all parties reach an agreement as soon as possibleto prevent unnecessar y damage to businesses at this increasingly

challenging time.”

On Wednesday, half a million workers including train drivers, teachers and civil servants are set to strike in what will be the biggest planned industrial action since 2011.

Kris Hamer, director of insight at the British Retail Consortium, told City A.M. that the upcoming rail strikes, which will also take place on Friday, will be damaging for retail, as strikes “limit commuter, leisure and tourist traffic”.

He said: “Given the reliance of London on its public transport system, it is likely that many people will choose to work from home to avoid travel disruption, impacting already-vulnerable city centre businesses reliant on their custom.

“UK footfall remains down on prepandemic levels, and this will only slow the progress retailers have made to bring people back to stores.”

WEST END RING MASTER Covent Garden owner Capco reports strong rental demand ahead of £3.5bn merger with Shaftesbury

Shakeup at Shell as new boss cuts board members

HENRY SAKER-CLARK

SHELL yesterday revealed it will combine its oil and gas production and liquified natural gas (LNG) divisions as part of an overhaul by its new chief executive.

Wael Sawan, who took over at the start of this month, said the changes will take place from July.

The new operation, which will combine Shell’s most profitable divisions, is to be led by Zoe Yujnovich, currently the group’s upstream director. The internal restructure will also see its renewables operations merged with its oil refining and marketing business, the company said.

Shell confirmed the shakeup will reduce the size of its executive committee from nine to seven members in order to “simplify the organisation further and improve performance”.

Sawan said: “I’m making these

changes as part of Shell’s natural and continuous evolution.

“Our core purpose is to provide energy to our customers, safely and profitably, while helping them – and us –to decarbonise.

“I believe that fewer interfaces mean greater co-operation, discipline and speed, enabling us to focus on strengthening performance across the businesses and generating strong returns for our investors.”

It comes less than a week after Shell launched a strategic review into the energy supply business which employs around 2,000 people in the UK.

Shell Energy supplies power to around 1.4m homes across the country and broadband to around half a million customers.

On Thursday, Shell is expected to announce profits of around £22bn for the past year although this would include a quarterly profit decline.

BP says oil and gas investment will be needed for 30 more years

NICHOLAS EARL

THE WORLD risks energy price swings and shortages unless there is continued investment in the oil and gas sector over the next three decades, BP has warned. In its annual energy outlook published yesterday, the fossil fuel giant argued that natural declines in

Windfall tax an opportunity, says oil boss

NICHOLAS EARL

THE UK’s oil and gas industry should have taken the chance to invest in new projects instead of fighting the windfall tax, the boss of a North Sea oil and gas producer has said.

Steve Brown, chief executive of Orcadian Energy, told City A.M. that the Energy Profits Levy (EPL) created a “big incentive to invest” with the 91 per cent tax relief for fossil fuel producers prepared to develop new projects in the North Sea.

This includes Orcadian's proposed Pilot development in the central North Sea, which is projected to produce up to 79m barrels of oil over its lifetime. But the company is still looking for an investor for it.

existing oil fields will mean further exploration and development will still be necessary.

“The recent energy shortages and price spikes highlight the importance of the transition away from hydrocarbons being orderly, such that the demand for hydrocarbons falls in line with available supplies,” Spencer Dale, BP’s chief economist, said.

Brown said: “My hope was I would see lots of these companies which have big energy profits levy bills become very keen to get involved in new projects. They would look at our project, see its environmental performance and want to jump in.

“Instead, they really focused on trying to push back on the EPL rather than take advantage of opportunities.”

Global dealmaking hits 10-year low but optimism remains for 2023

CHRIS DORRELLTHE VALUE of mergers and acquisitions (M&A) globally dropped 36 per cent last year to a 10-year low but executives remain confident for dealmaking in 2023, a new report from Bain out today shows.

The report shows that M&A, particularly mega-deals worth over $10bn, slumped from June 2022

after five months of pre-pandemic levels of dealmaking.

Median deal multiples globally fell to a 10-year low of 11.9 times ebitda in 2022, off an all-time high in 2021, with the largest falls coming in the tech and healthcare and life sciences sectors. Valuations typically find a floor at around nine or ten times enterprise value to ebitda, Bain said.

The year’s turning point was an

interest rate hike from the US Federal Reserve in June –the first of four 75 basis point rises –which “put a chill on the deal market”. However, executives were confident in the ability of dealmaking to create value going forward. “History tells us that companies making bold moves during times of turbulence tend to win over the long term,” Les Baird, head of Bain’s global M&A, said.

Broker Howden capitalises on volatile market

LOUIS GOSS

INSURANCE broker Howden yesterday posted “record” results for 2022, reporting a 60 per cent increase in revenue, with its chief executive adding that the firm was primed to further profit from the economic uncertainty heading into 2023.

The insurance broker’s chief executive David Howden told City A.M. the London firm was primed to capitalise on the “very turbulent market” as customers increasingly seek out better value insurance deals.

The chief executive explained that Howden was in a solid position to help clients navigate the “challenging times” ahead, as inflationary pressures have caused insurance premiums to soar.

Inflation has driven up the costs insurers face in fulfilling claims, particularly in fixing damaged buildings and repairing and replacing damaged and stolen cars in a movement that has caused premiums to rise.

The global economic down-

David Howden welcomed record 2022 results

turn has also hit companies’ profitability in a shift that has pushed them towards brokers in their efforts to reduce insurance costs and seek out better deals.

“You’ve never seen such pressures on the insurance market,” Howden told City A.M. “Our job as brokers is to find the very best deal for our clients.”

Howden’s comments came as the insurance broker yesterday posted “record” results for the financial year 2022.

The London broker saw its overall revenues increase 60 per cent to £1.84bn on the back of fast-paced organic growth and a far-reaching M&A splurge.

The increase in Howden’s revenues came as the firm completed 31 acquisitions in the past financial year, in a push that boosted its headcount by

The M&A spree has in turn seen Howden become the UK’s largest insurance broker, employing 5,000 workers across 160 offices.

The uptick in Howden’s revenues saw the broker’s earnings before interest, tax, deprecation, and amortisation (ebitda) increase 69 per cent to £565m.

British Steel and Tata Steel must ‘go green’ if given £600m bailout

NICHOLAS EARL

BRITISH Steel and Tata Steel must be forced to commit to a host of green targets if they receive a bumper bailout from the UK taxpayer, green think tanks and campaign groups have said.

Environmental think tank Green Alliance has urged Chancellor Jeremy Hunt to ensure the reported £600m in public funds that will be spent propping up both British Steel and Tata Steel is used to speed up the industry’s

transition to clean production rather than just support a flagging sector.

The think tank has called on the government to bring in stringent targets for the companies as part of the funding deals, such as requiring the steel industry to shift half the capacity of each site to electric arc furnaces.

Dr Doug Parr, chief scientist and director of policy at Greenpeace, told City A.M. the steel companies “cannot be economically competitive in the 21st century if not carbon competitive”.

Hunting for growth: UK GDP to contract

JACK BARNETTBRITAIN will emerge as the “sick man” of the world’s richest countries this year, snatching the unwanted title of being the only G7 economy to contract in 2023, according to forecasts by the International Monetary Fund (IMF).

The world’s economic watchdog has slashed its expectations for UK GDP again, now pencilling in a 0.6 per cent contraction in 2023, down from 0.3 per cent growth predicted in October.

The downgrade means Britain is stumbling behind its G7 peers. The IMF reckons the American, French and German economies will grow 1.4 per cent, 0.7 per cent and 0.1 per cent respectively in 2023.

Raging inflation, still running above 10 per cent and more than five times the Bank of England’s two per cent target, has eroded household spending power rapidly, squeezing demand and dragging down the economy.

The Bank’s nine successive interest rate hikes to tame price rises has heaped more misery on consumers and businesses, further hobbling the economy.

Governor Andrew Bailey and co are

expected to kick borrowing costs 50 basis points higher to four per cent, a post-financial crisis high, on Thursday.

“Tighter fiscal and monetary policies and financial conditions and stillhigh energy retail prices weighing on household budgets” has choked UK GDP, the IMF said in its latest global economic outlook released in the early hours of this morning.

A string of better-than-expected data recently had boosted confidence in the underlying strength of the UK economy.

Output unexpectedly jumped 0.1 per cent in November, beating expecta-

tions of a small contraction and slashing the odds on the UK falling into a technical recession –two quarters of contraction –at the back end of last year.

The IMF also reckons Britain had the fastest growth last year, although that was driven by the country suffering a sharper hit from the Covid-19 pandemic.

However, the UK is still the only G7 country with an economy smaller than it was before the pandemic.

Chancellor Jeremy Hunt batted away the IMF’s gloomy forecasts, saying they “should not obscure our longterm prospects”.

“The UK outperformed many forecasts last year, and if we stick to our plan to halve inflation, the UK is still predicted to grow faster than Germany and Japan over the coming years,” Hunt, who last Friday warned against British declinism, added.

The IMF did lift its outlook for UK growth next year to 0.9 per cent, up from the 0.6 per cent expansion previously forecast.

The Washington-based organisation also bumped its global GDP growth expectations to 2.9 per cent from 2.7 per cent.

The downgrade means Britain is stumbling behind its G7 peers in its economic predictions

FCA landed on ‘suspicious’ figures to justify ESG rules, claims top MP

CHARLIE CONCHIE

THE CHAIR of the influential Treasury committee has slammed the FCA over its methodology for its planned ‘greenwashing’ rules.

Harriet Baldwin, who was elected to chair of the committee last year, wrote to FCA chief Nikhil Rathi in December over the regulator’s proposed rules for ESG investments.

The spat comes after the FCA revealed plans in October to crack down on greenwashing.

However, Baldwin has questioned the watchdog’s methodology, casting doubt over the regulator’s claims that a hefty portion of firms would fall foul of the proposed rules.

“The FCA states one third of investment funds wouldn’t qualify... under their new sustainability

labelling proposals,” she said in a statement yesterday. “It isn’t clear what methodology the regulator has used to come to these suspiciously round figures, and if they have fully considered the consequences of their proposals,” Baldwin added.

A spokesperson for the FCA said it “welcomed the comments” and had “provided the committee with more detail on the assumptions we used”.

Persimmon and Barratt to sign cladding contract

ELENA SINISCALCO AND CHRIS DORRELL

A HANDFUL of developers plan to sign the government contract to fix buildings affected by cladding and other fire risks in the coming weeks.

Levelling up secretary Michael Gove gave developers a six-week deadline to commit to more than £2bn of repairs to fix the issues in buildings taller than 11m. This comes on top of a levy of £3bn that will have to be paid by the companies over the next decade.

The developers who refuse to sign the pledge will be blocked from getting planning or building approvals, and will be “named and shamed” by Gove.

What is effectively a ban from the market will also apply to schemes that already have planning permission. Gove will be able to do this through a new “responsible actor scheme” set to come into force in the spring.

Persimmon was the first developer to confirm it will sign the contract.

Another of the largest UK developers Barratt homes said they had “a view” to sign the contract.

A spokesperson for the company told

City A.M.: “We will be carefully considering the detail of the Developer Remediation Contract with a view to signing it over the coming weeks.”

But there remained hesitancy in the construction industry, with Vistry refusing the comment on their plans, and Bellway, another top tier developer, insisting they were “committed to the principle” of the government’s initial pledge, which is not legally binding.

Bellway added it would review the contract sent by DLUHC.

Others in the industry said the government should foot the bill and recoup costs from developers after Gove admitted to faulty building regulations in a Sunday Times interview.

Mary-Anne Bowring of property group Ringley Group said it would mean “leaseholders don’t have to pay”. It could also be the first step towards banks offering loans on buildings with the combustible cladding, meaning those who bought properties prior to the blaze at Grenfell are able to sell their properties. As many as 500,000 people have been left unable to sell or refinance their mortgage since the fire in 2017.

SLEEPWALKING INTO THE RED Dutch giant Philips slashes jobs as it reports £1.5bn loss

PHILIPS is cutting 6,000 jobs globally in a bid to improve the efficiency of its supply chains. The Dutch health tech company said it would cut around eight per cent of its workforce by 2025, as it counts the costs of suspected faulty sleep devices which it is still recalling.

Hambro SPAC ditches merger talks with biotech firm Istesso

CHARLIE CONCHIE

HAMBRO Perks Acquisition Company

(HPAC), a pioneering special purpose acquisition company (SPAC), has abandoned plans for a merger with biotech firm Istesso.

HPAC, which became the first SPAC to float in London in November 2021 after regulators overhauled UK rules, had been in talks with Istesso over a merger.

Istesso is part-owned by London-listed IP Group and is involved in a field called

immunometabolism, which it says has the potential to “revolutionise the treatment of autoimmunity”. Sky News reported on Sunday that HPAC had set its sight on a merger with the firm. However both companies said the talks have since been ditched.

“HPAC confirms that discussions with Istesso have been terminated,” Hambro Perks said. “An announcement regarding any potential extension of the deadline to implement a business combination will be made in due course.”

ENTER OUR PRIZE COMPETITION TO WIN

£10,000 CASH

BY ANSWERING THE QUESTION ON OUR WEBSITE

GETS YOU FIVE ENTRIES £5

SIMPLY ENTER FOR YOUR CHANCE TO WIN AND YOU WILL AUTOMATICALLY BE ENTERED INTO OUR FREE £1,000 DRAWS. RECOMMEND A FRIEND AND YOU COULD ALSO WIN AN EXTRA £2,000. TICKETS COST FROM £5 FOR 5 ENTRIES. FREE ENTRY ROUTE AVAILABLE. T&C'S APPLY. CLOSES 23.59 ON 14.02.23 ENTER NOW

When will the Bank, Fed and ECB start cutting rates? Sooner than you think

ANNOUNCEMENTS

by the Department of The Built Environment

Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building

Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

1 Red Lion Court, London, EC4A 3EB 22/01201/FULL

External alterations and refurbishments works including: removal of parapet wall and masonry

and introduction of a platform lift.

The Counting House Public House, 50 Cornhill, London, EC3V 3PD 22/01235/FULL

associated kitchen and toilets associated with the public house (sui generis) to create 6 hotel rooms associated with a mixed use comprising public house and hotel bedrooms (sui generis) with of six condenser units on the existing plant deck and new drainage connections.

The Counting House Public House, 50 Cornhill, London, EC3V 3PD 22/01236/LBC

change of use from function room and associated kitchen and toilets to six (6) hotel bedrooms including new partitions, lowered ceilings, installation of building services and secondary and internal alterations to “Partner’s room” at mezzanine level to accommodate the re-routing of condenser units on the existing plant deck and new drainage connections.

61 - 65 Holborn Viaduct, London, EC1A 2FD 22/01243/FULMAJ

Application under Section 73 of the Town and Country Planning Act 1990 (as amended) of planning permission 21/00781/FULMAJ (dated 02.09.2022) for the variation of condition 63 (approved drawings) to facilitate amendments to the approved scheme including but not limited to: alterations to

layouts to provide an additional 25 rooms of purpose height of balustrades to roof.

10 Gresham Street, London, EC2V 7JD 22/01244/FULL

The refurbishment and extension to the host building, including the erection of a single storey roof extension (use class E), a roof terrace, refurbishment to the existing entrance, hard and soft landscaping and cycle parking provision.

The Punch Tavern Public House, 99 Fleet Street, London, EC4Y 1DE

23/00033/FULL & 23/00034/LBC

Retention of an electric fan [500 wide x 680 long and 750mm high] at roof level.

172 Lauderdale Tower, Barbican, London, EC2Y 8BY

23/00041/LBC

Internal alterations including replacement of internal walls and kitchen and bathroom refurbishment.

45 Andrewes House, Barbican, London, EC2Y 8AX

23/00045/LBC

Internal alterations to kitchen and bathroom. You may inspect copies of the application, the plans and any other documents submitted with it on-line or telephone 020 7332 1710.

Anyone who wishes to make representations about this application should do so online: Any observations must be received within a period of 21 days beginning with the date of this notice (unless otherwise stated) and will be taken into account in the consideration of this application.

In the event that an appeal against a decision of the Council proceeds by way of the expedited procedure, any representations made about the application will be passed to the Secretary of State and there will be no opportunity to make further representations.

CENTRAL banks around the world this year are going to take their lead from an unlikely source: the Bank of Canada. While being the central bank of a G7 country, it’s not exactly the biggest of players in the global monetary policy and financial network.

Tiff Macklem, the BoC’s chief, has led one of the most aggressive campaigns against inflation over the last year or so. Under his stewardship, borrowing costs in Canada have risen rapidly, powered by a one-off whole percentage point rise.

Neither the Bank of England, US Federal Reserve or European Central Bank (ECB) can say they’ve done that.

Last week, Macklem nudged rates 25 basis points higher. But the statement, alongside the decision, was prophetic of what is to come from other rate setting institutions this year.

The BoC said it now intends to “hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases”.

Forward guidance is back.

After central banks last year killed it off due to rapidly changing economic conditions, it’s back in vogue as a tool to deliver monetary policy objectives.

The BoC’s statement is an explicit shot at markets to hold fire and not expect more tightening any time soon. Basically, its intention is to shape expectations in financial markets, exactly what forward guidance is designed to do.

Jerome Powell, Andrew Bailey and Christine Lagarde, you’ve been warned.

It’s not going to be this week. All three leaders and their respective rate setting teams will hike, probably 25 basis points from the Fed on Wednesday and 50 basis points from the ECB and Bank on Thursday.

The ECB’s hiking cycle has a lot more legs due to it trailing the Fed and Bank. Financial markets also need jolting out of a psyche of expecting a free lunch after years of negative interest rates in the eurozone.

So why are central banks going to ease off the brake?

Businesses are being crushed by struggling to find affordable credit. That’s chilled activity, raising the risk of unemployment rising. Incentives for households to save are now much stronger. Coupled with rock bottom confidence and worries about being laid off, consumers are stockpiling funds for a rainy day.

As a result, the UK and eurozone (not so much the US) economies are wilting. A slowdown in spending will put extra downward pressure on prices.

Monetary policy operates with a lag, so it would be counter-intuitive to keep raising rates so aggressively when doing so is likely to push inflation below central banks’ two per cent target.

In fact, the Bank even hinted it agreed with that argument in November, forecasting inflation would fall below its two per cent target in the middle of next year if it sent rates above five per cent –what markets expected at that time.

Central banks essentially want to push inflation down without tipping their respective economies into a recession, achieving the so-called “soft landing”.

Their repeat jumbo hikes aren’t likely to fully filter through the economy for a few months yet. Inflation is already on a downward spiral and tightening more now risks overdoing it.

That argument probably holds less sway in the corridors of the ECB’s Frankfurt office, but eventually heads will start turning,

maybe in the second half of the year.

So, yes, rate hikes from the three big players this week. Pain for mortgagors, joy for savers.

But the moves will take the Fed, BoE and ECB all a step closer to the end of their respective tightening cycles.

In fact, the first set of rate cuts could come as soon as Christmas this year.

HUNT’S BOOSTERISM

Chancellor Jeremy Hunt’s speech at Bloomberg HQ last Friday had a whiff of hastiness about it.

Most of what he covered had already been announced. He devoted a large chunk of time to reinforcing the government’s commitment to halving inflation, getting debt down, blah, blah, blah, I forget.

In terms of policy, there was none. It felt as if the government just had to say something positive about the economy to avoid getting all the blame for the coming recession. There’s certainly a lot to be optimistic about.

A proper roadmap toward growth has to come sooner rather than later. Chop chop.

Our awards are a chance to celebrate the brightest and best

IT IS scarcely believable that it is a year since our last City A.M. awards –when 800 of the City’s movers and shakers gathered in the Guildhall to celebrate the Square Mile’s rebound from the pandemic.

We are all hugely excited to repeat the evening this year.

Editor Andy SilvesterCATEGORY ACCOUNTANCY FIRM OF THE YEAR

Much has changed since that evening –after all, Boris Johnson was still Prime Minister –but much has also stayed the same. More than anything, what strikes me is the same values we celebrated last year –innovation, resilience and a willingness to take risks –are the same ones

that our nominees this year have displayed.

The Square Mile does not always get a fair hearing in the UK. But through the pandemic, the cost of living crisis at home and in the swift financial response to Russia’s heinous invasion of Ukraine, the City of London has

stood up when it mattered.

The Guildhall is an extraordinary venue, one that is imbued with history. But what I love about our awards and the businesses we celebrate is the buzz of the modern City coming together for an exceptional evening. To all our nominees, a hearty well done.

THE NOMINEES

BEGBIES TRAYNOR

The country’s leader in “business rescue and recovery” has, regrettably, been busy over the past year. Revenues were up handily in the first half of the year and the acquisition of Budworth Hardcastle in the summer appears to be paying dividends already. Several higher profile administration appointments and work on the recovery of bounce back loans for a major bank also suggest a firm gaining in recognition in a crowded field.

EVELYN PARTNERS

Part wealth manager, part accountant, part professional services firm Evelyn Partners –the renamed Tilney Smith & Williamson –continues to grow revenues outside of the Big 4. A 2020 merger has seen the firm grow new business in financial services and net new business flows were 12 per cent higher in the first half of 2022 than the year before. A new professional service tech platform ‘Ignite’ shows a commitment to improvement.

Nobody can fault EY’s ambition, with a forthcoming split of its audit and consulting arms requiring a significant amount of work –but potentially changing the sector forever. Record UK revenues of £3.2bn last year suggest it hasn’t distracted too much, with consulting growing by a cool 33 per cent, and acquisitions continue with the pickup of a host of growing digital businesses.

MAZARS

The accountant’s accountant appears set fair for continued revenue growth but it’s the firm’s new pitch to employees that caught the eye –putting diversity and inclusion at the heart of the firm’s culture. The giant deserves credit for its willingness to pull out of lucrative deals it’s no longer happy with –resigning from British Steel and bailing out of the entire crypto market.

PWC

PwC chair Kevin Ellis continues to lead with aplomb, leaving some unfortunate episodes behind. The firm retained a bumper piece of work with HSBC worth up to $1bn and continues to grow revenues –with worldwide takings hitting a record $50bn last year. Ellis himself has been vocal about the need to diversify the influx of talent into the profession, with a particular focus on apprenticeships.

Planting the beans of growth

It’s one of the most scrutinised corners of the financial services industry at the minute, with big and small auditors alike coming under the microscope yet again. But some firms are leading the way in putting audit and accountancy’s reputation back on the right track.

CITY DASHBOARD

FTSE kicks off week in soft style with jitters from interest rate rises

LONDON’s FTSE 100 kicked off a new week in soft style yesterday, with gains held lower by investors sweating over a string of big central banks raising interest rates this week.

The capital’s premier index jumped 0.25 per cent to 7,784.88 points, while the domestically-focused midcap FTSE 250 index, which is more aligned with the health of the UK economy, fell 0.6 per cent to 19,914.41 points.

Yesterday’s small advances in the City came ahead of the Bank of England, US Federal Reserve and European Central Bank (ECB) all announcing their moves on borrowing costs this week.

Analysts expect Bank governor Andrew Bailey and ECB president Christine Lagarde to kick rates 50 basis points higher on Thursday, while Fed chair Jerome Powell is likely to slow

down to a 25 basis point rise on Wednesday.

Although inflation has seemingly turned a corner in the UK, US and eurozone, central bankers are worried that, if they hold off on rate rises now, they run the risk of allowing price pressures to stick around.

But this week’s hikes from the Fed and BoE are expected to be their penultimate or final hikes in the current tightening cycle.

The ECB is far from finished, investors think.

“Stocks were on the back foot early Monday as attention shifts to this week’s vital Federal Reserve meeting, as well as supporting acts in the shape of ECB and BoE,” Neil Wilson, chief market analyst at Finalto, said.

Big British banks led the FTSE 100 lower in opening exchanges, with high street lender Natwest down 1.26 per cent, before eventually closing higher.

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

To appear in Best of the Brokers, email your research to notes@cityam.com

BACK TO REALITY

Analysts at Peel Hunt have picked the numbers of Intercontinental Hotels Group and reduced its recommendation from ‘buy’ to ‘hold’ while maintaining its 5,750p target price. Over the past year, the hotel powerhouse has continued to deliver, with its share price up 23 per cent in the last month. Analysts expect 2023 to be a good year for the group as “leisure demand continues to be robust”.

Environmental treatment control firm Porvair has exceeded analyst expectations by growing revenue by 13 per cent, while ebitda margins rose to 11.9 per cent. Adjusted profit soared to £19.4m – 24 per cent above forecasts. “We increase our forecast for FY24E from 32p to 33p, expecting margins to rise higher,” analysts said. They added that the business is well positioned for growth.

“For now stock markets look strong, however this week could well be the pin that pops this month’s rally and injects a dose of realism into market expectations. Whether it’s the Federal Reserve, or the European Central Bank, the market could well get delivered a few home truths by central bankers later this week.”

MICHAEL HEWSON, CMC MARKETS

OPINION

EDITED BY SASCHA O’SULLIVANWhen recessions hit and policy breaks down, we need charities to fill the gap

Elena Siniscalco

WALKING along the aisles of St Martin-in-the-Fields is a powerful experiencewhether you’re religious or not. In between services, the church is completely silent, a peaceful place - you hear the echo of your footsteps as loud bangs. The church, tucked on the side of one of the busiest spots in London - Trafalgar Square - is gorgeous on the outside and simple on the inside. Within its four walls, it holds a story of resilience and compassion.

It all started a hundred years ago.

When the church’s vicar Dick Sheppard came back from the first world war, he was deeply touched by the state of his city. He saw crippling poverty, rising levels of homelessness and people losing their hope for a brighter future. He decided he had to do something. Sheppard was a wellliked and connected man, and wanted to put his influence to use. History has it that while having lunch with Lord Reith, the director general of the BBC at the time, he had an idea: they would air the Christmas appeal on the broadcaster to raise money for provertystricken Londoners.

The first appeal was in 1925; the first on Radio Times was two years later. This tradition has stood the test of time, turning a hundred years old in two years. In 1927, the vicar managed

to raise £3,500. In 2015, the appeal on Radio 4 reached £2.5m.

From one man’s idea sprung a network of community and support that is still expanding today. The St Martinin-the-Fields Charity was born in 2014 as an independent homelessness charity, and is housed in the building next door. It funds and supports individuals, frontline workers and other homelessness charities up and down the country, including the Connection, based in the same building.

The Connection works with people sleeping rough in London. It’s an institution in the capital - people have come through their door for a warm meal or a chat for decades. The main

common room is painted orange, the colour of joy and energy. Upstairs, there’s a canteen and an Internet room. The place is full of artworks

St Martin-inthe-field church by Trafalgar Square (Credit: Marc Gascoigne Photography)

made by the people who come in; the art room, on yet another floor, is tall, spacious and full of light.

Walking around, it’s obvious the premise of this space is that people sleeping rough need support not only in finding work, claiming benefits, or with migration application forms. They also need a space to decompress, where they can do things and find trust in their community. Not having a safe, warm place to get back to in the evening in a city as big and chaotic as London is dramatically difficult. It was in 1925, and it still is in 2023. What people working in food banks or homelessness charities always say is that they’d prefer if their job didn’t

Hunt can plead older workers to go back to work, but businesses need to hire them

CHANCELLOR Jeremy Hunt

channelled his inner Lord Kitchener on Friday, in his first speech of the new year. His “Britain needs you” plea to those who have left the workforce to return to work highlighted the critical strain of soaring workplace vacancies on the UK’s labour market and the economy.

According to the latest Office for National Statistics (ONS) figures, there are a record 1.2 million job vacancies in the UK, with the number of inactive workers rising by 630,000 since the start of the pandemic. This increase has been driven in no small part by an increasing number of Brits taking early retirement.

Yet government entreaties alone will not suffice to convince these early retirees to return to the labour market. Employers need to change internal attitudes and recognise the benefits that older workers can bring to their organisations.

Ann Francke

A new report from my organisationthe Chartered Management Institute (CMI) - found that employers are significantly less open to hiring older workers than bringing in younger talent. In fact, our survey of more than 1,000 managers working in UK businesses and public services found that less than half of managers (42 per cent) would be open to hiring people aged between 50 and 64 to a large extent. For those over 65, the number drops even further, with only 3 in 10 expressing openness to hiring those close to state retirement age or older. A staggering 1 in 5 said their organisation was not open to hir-

ing those over 65 at all.

The mismatch between a government proposing raising the pension age to 68, and a majority of managers not open to hiring older workers, highlights the need for attitudes across businesses to change, quickly. We call it the “say/do gap” between what business is saying and what’s happening on the ground.

Employers complaining of severe labour shortages while also admitting that they are hesitant to bring in older workers point to both cultural and leadership failings in businesses of all sizes. Data from the ONS demonstrates the impact of these attitudes on potential older recruits, with one of the critical reasons cited by those who have become inactive since Covid-19 is feeling “discouraged” by potential employers.

Alongside a shift in attitude, companies need a more compelling offer for older workers. This means offering flexible working, predictable rotas, ad-

equate health benefits, and ensuring

older workers have equal access to training opportunities, including apprenticeships so that they too can learn while they earn.

Above it all, they need to ensure older workers are included in their diversity and inclusion strategies. These changes aren’t “nice to haves,” they’re essential in a modern workplace and will benefit employees of all ages and boost retention.

Economic recovery and long-term resilience will depend on whether companies utilise all the talent and perspectives in our workforce.

With flexible working options and adequate support and training, older workers can be lured back. But unless those doing the hiring revisit their attitudes, older workers will continue to be excluded just when the labour market needs them the most.

£ Ann Francke is chief executive officer of the Chartered Management Institute

exist. As a society, and as a city where homelessness is so rampant, we offer a helping hand. But it’s still a world in which one in 58 Londoners was homeless last year and had to rely on the kindness of strangers.

Networks of care like the one at St Martin-in-the-Fields hold the city together at a time when so many things are breaking apart in politics and society. They create a circle of taking and giving. Sara was supported by a grant from St Martin’s back in the 1970s, when she was jumping from one temporary accommodation to another with her kids. A small grant from the charity meant she could buy a kettle and a washing machine. “We literally had nothing. I used to heat up water in the kettle and stand the kids in the washing machine to wash them”, she says. Sara was homeless more than once, but ended up becoming a social worker herself. She often helped people applying for the same St Martin’s grants she once applied for. She says she feels a great deal of personal gratitude for the charity, but also their “flexible, pragmatic and non-judgmental” approach.

We don’t often hear these stories because when it comes to homelessness, we prioritise policy-making - so far poor and ineffective to say the least. But when governments fail to act, someone else always has to step inoften unsung heroes of big cities like London. Realising that needs are different, and someone might need a kettle more than a mattress is what differentiates a human approach from a dehumanising one. People who have been part of this corner of Trafalgar Square, like Sara, want to maintain that link. So maybe for once, it’s right to tell these stories.

ZAHAWI’S LAST STAND

Rishi Sunak probably hoped the now ex-Chair of the Conservative party would go quietly. But Nadhim Zahawi is sticking around for the fight, claiming he hasn’t had a chance to explain himself for having to pay £4.7m to HMRC, which included a penalty. He has the mic now.

Networks of care and charities hold the city together when politics is breaking down

LETTERS TO THE EDITOR

Don’t amp up

the watchdog

[Re: Wait, so who’s watching the watchdog? Jan 23]

Lord Holmes is right to question the role and responsibilities of our finance industry regulators, currently being debated as part of the Financial Services and Markets Bill. However, he omits that a crucial part of the effectiveness of these regulators is their independence not just from government, but from the industry they are responsible for policing.

Unfortunately the proposal in the Bill to give them an objective to promote the “international competitiveness” of that industry would fundamentally undermine this, handing them the impossible task of being both watchdog and cheerleader. This threat has been pointed out by over 50 economists, a coalition of 40 civil society groups, and

the Treasury Select Committee. Of the few international examples of similar regimes that he cites, none is exactly alike to the UK proposal, which specifies that regulators should pursue not only the competitiveness and growth of the economy as a whole, but “in particular the financial services industry”. As Sir John Vickers has pointed out, if the aim of the Bill is to support overall UK growth, the inclusion of such wording is “either pointless or dangerous”. We saw in 2008 that charging regulators with industry competitiveness isn’t good for the country or the industry itself.

Lord Holmes deserves great credit for his important work in championing financial inclusion, and it is another problem with this Bill that there is far too little in it to address that important issue. That will not be helped by compromising the independence and thus effectiveness of the regulators.

Marloes Nicholls OxfordLEARN YOUR B, B, C’S Beeb reporters ‘lack understanding’ of economics

No, HS2 won’t stop in west London, but it does show us why transport projects fail

Adam TyndallHS2 is happening and it will terminate in central London – despite the latest flurry of headlines (later slapped down by the Chancellor) suggesting the line could end at Old Oak Common in west London, rather than at Euston. Land has been cleared, tunnels are being dug, and huge structures popping up between London and Birmingham. HS2 will deliver the biggest boost to railway capacity in the UK since the boom years of the nineteenth century. It will mean that express intercity services can be separated from local commuter services, delivering benefits for passengers well beyond those who live near HS2 stations.

ANALYSIS: WHEN IS A PLAN FOR THE NHS NOT A PLAN FOR THE NHS?

Rishi Sunak needs a win, but his ‘emergency’ plans for the NHS faced criticism yesterday.

The blueprint is meant to speed up ambulance response times and prevent unnecessary admissions to hospital.

By March next year, 76 per cent of patients will wait no longer than four hours at A&E, and ambulances will have to arrive on the scene for suspect strokes and heart attacks within an average of 30 minutes.

This is still 12 minutes longer than the target of 18 minutes and could be the difference

between life and death. Much of the problem is getting people out of hospitals when there are not enough provisions for the social care sector.

In other words, it’s not clear how to solve the bigger picture of a health system past breaking point, without addressing social care. Given much of the health and social care levy, introduced by Rishi Sunak way back in 2021, initially was directed towards frontline NHS services hurt badly by the pandemic, the sector is still strapped for cash and its workforce depleted.

Just as the Elizabeth Line has shown in the south east, HS2 will also transform our mental geography. It will lead to new patterns of life and travel, which will catalyse investment across the country – including at Euston which remains a major central London regeneration opportunity despite being part of a growing, internationally renowned science and innovation cluster. But to realise all this potential, HS2 must be built in full. Saying it is too difficult would be to accept the narrative of national decline that the Chancellor spent Friday lamenting. Stopping at Birmingham would very obviously deny these benefits to the north, but stopping in the suburbs of west London would be equally damaging. What message would it send if passengers arriving from the home counties get rail termini in zone one, whilst those from further afield are forced to change trains to complete their journeys?

Tourists arriving in the capital already complain about the complexity of getting to other destinations around

the UK. Having to shuttle out to Old Oak Common to find an onward train is hardly the way to get more of them spending more time and more money outside the capital.

Similarly, the reason that both Eurostar and City Airport remain so successful is because they are in the heart of the city and business travellers demand efficiency. If HS2 is going to help attract investment to cities other than London, it needs to be a simple, intuitive connection for those without the time or inclination to decode the quirks of the transport network.

There are many good reasons why delivering major infrastructure is hard, but the politician’s urge to re-visit decisions about the scope of projects is surely one of the worst. Making Old Oak Common the permanent terminus for HS2 would require a complete redesign of the station (not to mention adding pressure to the Elizabeth Line which is already carrying 75 per cent more passengers than was forecast). And it would leave a literal hole in the ground at Euston.

Lopping bits off projects – or scrap-

ping them entirely – just inflates the price. The Elizabeth Line is a prime example. When it was debated in Parliament in the early 1990s, the line was expected to cost £2bn. That plan was “cancelled” only to re-emerge over a decade later with a price tag five times higher in real terms. Good infrastructure projects don’t die, they just get put back on a shelf where they gather dust and cost until the inevitable is allowed to proceed.

There will be a new railway between the UK’s two biggest cities, and beyond. The eastern leg will reappear because railway operations, political calculation, and environmental necessity all require it. And if anyone removed Euston from the plans out of some misguided attempt to spend less in London, the decision would not hold. Not least because it would be farcical if travelling between city centres on a twenty-first century railway took longer than it currently does on Victorian infrastructure.

£ Adam Tyndall is Programme Director of Transport at BusinessLDN

Good infrastructure projects don’t die, they just get put on the shelf to gather dust and cost

LIFE&STYLE

GOLF WITH BALLS

Tim Pitt drives Volkswagen's ultimate hot hatchback: the 333hp Golf R 20 Years

FORTY-eight thousand pounds. However you do the maths, that’s a lot of money for a Volkswagen Golf. Then again, this is the most powerful, quickest accelerating and outright fastest Golf ever sold. So perhaps inevitably, it’s also the most expensive.

You already know the Golf GTI story: launched in 1975, the archetypal hot hatchback, red go-faster stripes, blah, blah. What’s less often reported is how Volkswagen changed the game again 20 years ago with the Golf R32. The new Golf R 20 Years is here to remind us of that.

The R32 arguably invented the modern ‘super hatch’ – presaging cars such as Audi RS 3 and Mercedes-AMG A45 S. With a 241hp 3.2-litre V6 and 4Motion four-wheel drive, it was a cut above the contemporary Mk4 GTI in both price and performance. It was also

the first production car with a dualclutch (DSG) gearbox: technology that has become de rigeur today.

Six generations and 300,000 cars later, the ‘R’ brand is an established part of the hot VW hierarchy, and one-in-10 Golf hatchbacks sold in Britain is a Golf R. So what does this 20th anniversary special edition bring to the party?

Firstly, the familiar four-cylinder ‘EA888’ engine gains a modest power boost from 320 to 333hp.That’s good for 0-62mph in 4.6sec: exactly half the time taken by the original Golf GTI. A new throttle body helps keep the turbo spinning for sharper response, while the seven-speed DSG ’box is recalibrated for more aggressive shifts.

The 20 Years also gains the Performance Pack as standard, which means 19-inch alloy wheels with optional blue accents, a larger rear spoiler, a derestricted top speed (168mph, since

VOLKSWAGEN GOLF R 20 YEARS

PRICE: £48,095

POWER: 333HP

0-62MPH: 4.6SEC

TOP SPEED: 168MPH

FUEL ECONOMY: 36.2MPG

CO2 EMISSIONS: 175G/KM

you ask) and two additional driving modes. Drift mode is designed for doing skids, while track-focused Special mode was configured (where else?) at the Nurburgring. Incidentally, a lap time of 7min 47.3sec makes this the fastest ‘R’ around the Nordschleife, just 0.1sec behind the lightweight, twoseat Golf GTI Clubsport S.

Inside, the 20 Years features Nappa leather sports seats and slabs of genuine carbon fibre on the dashboard and

doors. Unfortunately, it also has the glitchy touchscreen and over-sensitive haptic controls common to all Mk8 Golfs. From a company renowned for sober, no-nonsense ergonomics, it feels like a major misstep.

Ignore the infotainment, though, and the 20 Years is still an easy car to live with. It rides well in Comfort mode, cruises effortlessly on the motorway and offers all the practicality of a regular, grocery-getting Golf. Hot hatchbacks aren’t just weekend playthings, after all.

If you do want to play, however, this Golf is definitely game. A new touchpad on the steering wheel provides a shortcut to Race mode, which stiffens the (optional) adaptive dampers and injects a shot of adrenaline into the drivetrain. Gear changes are now super-sharp, walloping you in the back on full-throttle upshifts, while the quad tailpipes add some feisty crackle and pop.

Indeed, forget the Nurburgring, on real-world roads – particularly with a ‘real-world’ driver like me calling the shots – the Golf R can cover ground more quickly than almost anything. It digs in, grips hard, then slingshots out of corners on a wave of turbocharged torque. All that’s missing is that extra frisson of feedback you’d enjoy in, say, a Honda Civic Type R – or indeed the previous Golf R. For me, even as a serial Golf GTI owner, the Mk8 R thus feels like a car to admire, rather than truly desire. That’s equally true for the 20 Years edition, which can easily exceed £50,000 with a few options (the Akrapovic exhaust alone is £3,500). Alternatively, you could spend half that amount on a late Mk7 Golf R, which is almost as fast and more fun. You do the maths.

Tim Pitt writes for motoringresearch.com

AMERICAN PSYCHO AUTHOR COMES TO SOUTHBANK CENTRE THIS WEEK

BRET EASTON ELLIS has been getting cancelled since long before the phrase “cancel culture” existed. His third novel, American Psycho, was so controversial it was dropped at the eleventh hour by his publisher and was subsequently sold shrink-wrapped in some countries.

Then, in 2019, he published White, a meandering series of essays targeting things like safe-spaces, identity politics and the essential snowflakiness of millennials –just as the culture wars were reaching their zenith under Donald Trump.

After a 13 year wait, his latest novel is out. Called The Shards, it’s part hazy, ethereal account of the

author’s own teenage years in Los Angeles, part serial-killer yarn complete with scenes that would make Patrick Bateman squirm.

The novel –which Ellis coyly claims is all more or less true –was first serialised as a podcast before finally being published in hardcover this month.

Ellis claims the novel would never have been published in its current form had he gone through the usual channels, which is probably not true given it’s both an excellent read in its own right, and very much more of the same good stuff from Ellis.

But this is why his appearance at the Southbank Centre on Thursday

promises to be such so fascinating –he’s both candid and forever in character, living out his role as the fictional character Bret Easton Ellis.

He’ll be interviewed by author and former Times literary editor Erica Wagner, which promises to be an exciting clash of minds.

Topics likely to be discussed include the future of publishing, the state of the “culture wars” and what it’s like being an enfant terrible who grew up.

£ Bret Easton Ellis: The Shards is on at the Southbank Centre on Thursday 2 February at 7.30. Tickets, from £15, available from southbankcentre.co.uk

McIlroy was too good for rival Reed in Dubai

RORY McIlroy had it all thrown at him during the Dubai Desert Classic – a host of LIV Golf players, led by Patrick Reed, hunting him down and even that rarity in the Middle East, a rain delay.

But the world No1 took it all in his stride. He handled the extra day’s play and in the end he proved too good for Reed and his LIV colleagues Ian Poulter, Henrik Stenson, Richard Bland and Bernd Wiesberger. His bogey at the 15th hole and Reed’s at 16 left McIlroy needing to birdie two of the last three holes to win – and he did.

The 18th had given him problems in the past, including on Sunday, and he reckoned he got lucky in avoiding another dip in the water on Monday, but he played a good lay-up and holed a

Wales legend says unions must get behind doc to show off sport, writes Matt Hardy

WELSH cross-code rugby legend Jonathan Davies believes the upcoming Six Nations documentary can be crucial in helping rugby get ahead of the curve.

The 37-cap back, known as Jiffy, has said Netflix’s venture into the sport can be a good addition ahead of the Championship kicking off this weekend.

“I think it’d be interesting to see,” Davies told City A.M. “Rugby sometimes has been a little bit behind the curve with allowing access – and sometimes to their detriment. Look at F1 and the popularity that it gets from Drive to Survive.

“They’ve always sort of resisted this [saying] ‘oh, you can’t get a camera in the changing rooms’ and all the players now are very press conscious. They don’t say much though, their personalities have gone.

“It will be interesting to see where Netflix comes in and what they offer differently – whether the players will be guarded or they will be able to talk freely will be a very, very interesting watch.

“So I hope that it enhances [the sport] and it shows people what happens and how intense it is and the pressure that coaches and players get. Anything to advance the sport and promote the sport I’m all behind.”

City A.M. reported this week that there were still teething issues between some unions and producers over the level of access set to be granted.

Wales coach Warren Gatland has questioned the lack of editorial control available to unions, citing potential sensitivities in broadcasting what is said in the changing rooms.

“They [coaches] are used to it, they’re always under the spotlight, so if they say something they’ve got to take it on the chin,” added Davies.

“That’s what Netflix are paying them

GOLF COMMENT

Sam Torrance

tricky putt to win by one shot. Fair dos.

McIlroy admitted afterwards that he had particularly enjoyed beating Reed and you could see how much this win meant to him from his celebrations.

Teegate – his spat with the American on the driving range last week – was pathetic, schoolboy stuff, but once it has become part of the storyline it is difficult to shut it down.

I’m sure he will also have been de-

lighted to underline his world No1 credentials and pick up where he left off a terrific season last year.

McIlroy’s first ever professional win came at the Dubai Desert Classic, so his third triumph at a happy hunting ground also had some extra resonance.

The Northern Irishman was fairly critical of some aspects of his performance but that is to be expected on his first outing since November.

When you are as good as McIlroy you want perfection and that’s what he’s trying to attain. There’s no secret –when my father passed away he was still seeking it.

SHINKWIN SHINES

Elsewhere in Dubai, Callum Shinkwin produced a great finish featuring five birdies on the back nine to take fourth place, one of his best finishes on the DP World Tour.

The Englishman is a lovely bloke and a hell of a player who really thrived at the recent Hero Cup in Abu Dhabi. Being in that environment, with players like Tommy Fleetwood and Francesco Molinari, does give you a boost and it certainly will have helped Shinkwin.

It will also have been a glimpse at what playing in the Ryder Cup is like, and he could be a dark horse for a place in the

European team in Italy later this year.

HOMA RUN

Over on the PGA Tour, Max Homa seems to have followed Tony Finau in opening the floodgates.

Homa lost his tour card twice before breaking his duck in 2019 and, after victory at the Farmers Insurance Open on Sunday, has now won five more times in 46 starts.

There has been so much hype among other players about the 32-year-old and I can see why because he’s got a gorgeous game. Homa just steps up and swishes it straight down the middle of the fairway, making it look easy.