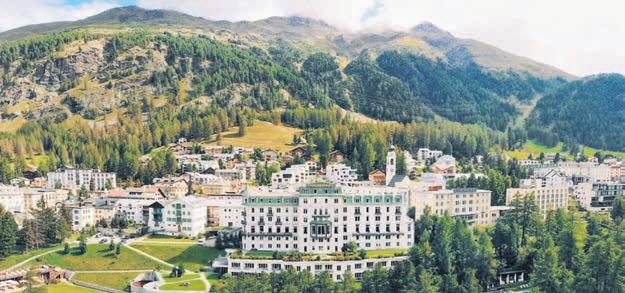

SKI IN STYLE SAN MORITZ STILL IMPRESSES EVEN THE MOST WELL-TRAVELLED P16

NADHIM Zahawi was sacked by Prime Minister Rishi Sunak yesterday after weeks of speculation about the Conservative party chair’s tax affairs.

Sunak told Zahawi, 55, that, after an independent investigation, “it is clear that there has been a serious breach of the Ministerial Code,” forcing him to ditch the MP for Stratfordon-Avon.

Sunak’s letter said he wanted his government to “have integrity, professionalism and accountability at every level,” a promise he made when entering Number 10 late last year.

Zahawi should be “extremely proud” of his

morning

“wide-ranging achievements”, Sunak wrote, in particular of his stewardship of the successful Covid-19 vaccine rollout.

The former Chancellor has been in the spotlight for weeks over an estimated £4.8m bill he settled with the taxman while Chancellor. The bill related to the sale of shares in YouGov, the polling business founded by

The probe into Zahawi’s tax affairs was carried out by Sir Laurie Magnus, the government’s ethics adviser.

Magnus wrote that the failure to include the HMRC investigation in his register of interests and the failure to update it –as well as describing stories last year

on his tax affairs as “smears” –counted as “insufficient regard for the general principles of the Ministerial Code and the requirements in particular to be honest, open and an exemplary leader.”

Zahawi is the second high profile Cabinet minister to lose his seat at Sunak’s top table, with Gavin Williamson quitting in November after a series of lurid headlines over bullying.

This week Sunak will reach the milestone of 100 days in Downing Street.

Last night former Chancellor George Osborne warned that Rishi Sunak was failing to land his message with the electorate due to scandals such as Zahawi’s tax affairs.

“It’s still ‘we’ll see’ with Rishi Sunak, but he knows that as each week passes, as each new scandal unfolds, the window for action gets smaller and smaller,” he said on The Andrew Neil Show.

THEY’RE BACK CELEBRATING THE BEST AND BRIGHTEST IN THE CITY P10

AWARDS2023

PUTIN WARNING Boris claims Kremlin threatened missile strike

VLADIMIR Putin told Boris Johnson that it “would only take a minute” to hit him with a missile, according to the former Prime Minister.

“Boris, I don’t want to hurt you,” Johnson recounted the Kremlin tyrant saying to him when they spoke before the invasion of Ukraine.

“But with a missile, it would only take a minute,” Putin continued, according to Johnson’s account.

The Uxbridge MP, who has become a cheerleader for support for the Ukrainian regime since leaving office, described the conversation with the Russian leader as “extraordinary”.

It is nearly a year since Russia invaded Ukraine, expecting a quick victory and radically underestimating the strength of Ukrainian resistance which continues to this day.

Johnson recounts the conversation in a BBC programme to be shown this evening, Putin vs the West.

INSIDE FLYBE GROUNDED P3 LOOK AHEAD: RATE RISES THIS WEEK P5 LAW FIRMS AND THE PUBLIC MARKET P8 THE PRICE OF IGNORING NUCLEAR P11 SIX NATIONS EXCLUSIVE P20

ON FRIDAY of last week, the Chancellor laid out something of a growth plan –though, admittedly, we no longer use that term after it was rather ingloriously co-opted by Liz Truss and Kwasi Kwarteng. It was fine, as far as it goes, albeit without much detail.

What was far more interesting was the reaction from Britain’s business bodies. The Institute of Directors gave Jeremy Hunt both

barrels, describing the plan as “empty”. The CBI has already laid out their stall, with boss Tony Danker arguing competitors are going “hell for leather” to attract business to their shores whilst the UK remains in a rather leisurely first gear. The British

Chamber of Commerce said Hunt’s speech had “moved us no further forward”. In short, it was a barrage of criticism that reflected not the speech but a widening distance between Whitehall and the business community. Not all of this is Hunt’s or indeed Rishi Sunak’s fault. They can do precious little about energy bills and global inflation pressures. Bond markets have already had their say on any more gigantic

fiscal packages to give businesses some breathing room. But the hand they’ve been dealt is the one they have to play, and it is clear that the only trump they have in their hand is the fact that they are, in fact, in power.

Governments can do stuff –if this seems a revelatory statement, it is only because of how much stasis there has been in our politics over the past few years. Hunt and Sunak have the opportunity to push through swift supply side

PUPPY LOVE Charity Guide Dogs welcomed their first litter of the year yesterday, with eight new yellow labrador puppies born in Leamington Spa ready to report for service

reforms that whilst not paying immediate dividends will give British businesses confidence that there is at least a plan and some forward thinking going on. That may, too, be something which the trade bodies of Britain and the government can find common cause on. There is precious little time to wait –but it’s never a good thing when Whitehall and business are at loggerheads, as we learnt from Boris’ regime.

High interest rates, volatile prices and the war in Ukraine have made it significantly more expensive to finance commodity trade, forcing the industry to hunt for an extra $300bn-$500bn in working capital.

THE GUARDIAN CRESSIDA DICK SOUGHT £500,000 TO QUIT AS MET POLICE CHIEF

Cressida Dick sought £500,000 to stand down as Metropolitan police commissioner after the mayor of London, Sadiq Khan, ousted her over a litany of scandals, documents reveal.

A CLARIFICATION

BANK OF ENGLAND

A piece published last week could be seen to have given the impression the Bank of England was exploring a wholesale central bank digital currency. The Bank is not. It has however issued a consultation regarding a retail central bank digital currency. We apologise.

JACK BARNETT

LONDON businesses are increasingly confident they can power the UK out of any recession it gets itself into, a closely watched survey has revealed.

Optimism among the capital’s firms rose at the fastest pace out of any region in the UK this month, jumping 29 points to 37 per cent, according to research by Lloyds Bank.

The new figures reinforce findings from other organisations that suggest London companies are more buoyant compared to the rest of the UK about the coming year.

London is outperforming the nationwide economy, indicating the capital is on course to avoid what experts think may be a long recession in the UK, a

business index from bank Natwest earlier this month showed.

Numbers published recently by the London Chambers of Commerce and Industry revealed the capital’s jobs market is booming.

Britain is on course to tumble into a recession this year largely driven by households reducing spending in response to inflation eroding their pay, but it may not be as bad as first feared.

Just in November, the Bank of England thought the country would suffer the longest recession in a century, but rapidly falling energy prices means the central bank is certain to raise its GDP forecasts alongside Thursday’s interest rate decision.

UK-wide business confidence is also on an upward march. Lloyds said it in-

creased five points to 22 per cent this month, propelled by improving optimism in the economy.

Hann-Ju Ho, senior economist at Lloyds Bank Commercial Banking, said: “Business confidence continues to improve following the December boost. Firms are clearly more optimistic about the wider economy and this is driving the increase, helped by precursory signs that wage and other cost pressures may be easing.”

A rosier outlook on the trajectory of the economy has boosted firms’ intentions to take on more staff, with Lloyds’s hiring index also inching higher to a positive net balance of 17 per cent. Expectations on how much companies will have to hike pay to retain staff also cooled.

LONDON house prices fell over the last month, but still cost nearly £526,000 on average, new research out today reveals.

A more than doubling of mortgage rates over the last year caused by a combination of the Bank of England hiking borrowing costs nine times in a row and Liz Truss’s mini-budget rocking the financial markets has knocked demand in the capital’s housing market.

The sudden and steep rise in mortgage rates is likely to “feed into a rapid slowdown in the annual rate of price growth in coming months,” property search site Zoopla, who compiled the figures, said.

House price inflation in London has been much slower compared to the rest of the UK since the onset of the Covid-19 pandemic, mainly due to property prices already being so high in the capital.

On an annual basis London house prices jumped 3.4 per cent.

Potential buyers are being priced out of taking on a new home due to average mortgage rates doubling over the last year, according to data provider Moneyfacts.

LIVEMORE, a later life mortgage specialist, has secured a credit facility of up to £250m from Wall Street lender Citi as it seeks to hit £1bn in mortgage lending.

Cooling house price growth has not been isolated to London. Zoopla said UK property prices grew 6.5 per cent over the last year to £261,200, a slowdown from the 7.2 per cent increase posted in December.

On a monthly basis, prices also dropped across the UK.

Would-be buyers are postponing purchases until later this year when they think house prices will be much lower and mortgage costs on a downward march.

“A portion of households hoping to move in the coming year will be waiting to see whether house prices start to fall more quickly in the first quarter, as well as how much further mortgage rates are likely to fall back,” Zoopla said. “Sellers will feel under increasing pressure to reduce asking prices putting further downward pressure on headline prices,” the company said.

Experts have warned house prices could fall as much as a fifth in the UK this year. However, Zoopla said buyer demand is 10 per cent above its pre-pandemic level, indicating strong underlying demand in the housing market could avert a price collapse.

“We are thrilled to receive this credit facility from Citi, which will support our growth and expanded product offering, so we can

MAEVE CULLINAN

EUROPE’s once-largest independent regional airline Flybe ceased trading this weekend, cancelling all flights to and from the UK.

Flybe’s appointed administrators Interpath Advisory said that 276 employees have been made redundant and approximately 75,000 customers will see future bookings cancelled.

Flybe’s collapse comes for the second time in three years, after falling into administration due to the effects of the

pandemic on air travel in March 2020.

Purchased by US hedge fund Cyrus Capital in October 2020, the airline was relaunched in April last year with a significantly scaled down operation in the UK.

Interpath said “the company had to withstand a number of shocks since its relaunch, not least of which was the late delivery of 17 aircraft, which it needed for its schedule, and which has severely compromised both the airline’s capacity and its ability to remain competitive.”

continue to serve the often forgotten 50 to 90+ segment of the market,”

Leon Diamond, Livemore chief executive, said today.

The facility will be used to support the company’s expanded product offering, such as retirement interestonly mortgages, term mortgages and a soon-to-be-released equity offering. It brings the total amount of funding Livemore has received close to £600m.

Livemore was established in 2020 to support older borrowers, which it says are underserved by high street lenders. The later life mortgage market is growing in importance as people work and live longer. A study released by Key Group with AKG Financial Analytics in June suggested that the UK market for later life lending was worth approximately £153.9bn at the end of 2021.

ALCOHOL-FREE beer brand Lucky Saint is to open its first pub after securing £10m to supercharge its ambitious growth plans.

The pub, which will also operate as the group’s headquarters, is due to open in Marylebone in March 2023.

Luke Boase, founder of the business, said that for now the opening will be “the only one” – but added that he would “never say never” to further venues in the longer

term if it proves a success.

The planned opening of The Lucky Saint pub, which was formerly the Mason Arms, comes more than two years after the company first set out its ambitions to open a hospitality venue.

“We needed somewhere that could be a home for the brand as well as a pub, so it took a fair amount of time to get it right,” Boase said.

It comes weeks after the brand raised £10m in a funding round led by consumer investor Beringea and

CHARLIE CONCHIE

INVESTORS in UK firms are facing a drop-off in dividends this year as rising costs cause firms to rein in their payouts following a bumper 2022, according to new data.

Dividend payments last year jumped eight per cent on a headline basis to £94.3bn despite a major slowdown in frothy one-off special dividends that surged during the pandemic, according to the latest UK dividend monitor from Link Group.

Banking dividends accounted for nearly a quarter of the underlying increase during the year as lenders raked in bumper profits on the back of rising interest rates.

Booming energy prices also pushed oil payouts a fifth higher, despite firms rolling out major share buybacks presenting an alternative route for surplus capital to reach shareholders.

However, bosses at Link said that shareholders would now suffer a slowdown this year as the “economic skies” darken and costs for most firms surge.

“Company margins in most sectors are already under pressure from higher inflation and squeezed household budgets,” said Ian Stokes, managing di-

rector of corporate markets UK & Europe at Link.

“Soaring interest rates are now crimping profits by raising debt-service costs too. This will leave less money for dividends and share buybacks in many sectors.”

Stokes said there was some cause for optimism though, with underlying dividends, excluding special dividends expected, to nudge upwards.

“Even with lower mining payouts, there is good growth coming through from the banks and oil producers and across the wider market, cuts made during the pandemic mean payout ratios are conservative on the whole,” he added.

Mining firms have been at the forefront of a dividend frenzy in the past two years as surging commodity prices pushed up profits and sparked a wave of payouts. Mining firms Rio Tinto and Glencore were offering a potential yield north of 10 per cent last year, according to analysts at investment platform AJ Bell.

Link said the sector had reached an inflexion point, however, despite being the largest dividend-paying sector for the second year running, as payouts began to slow by the end of last year.

Jamjar investments, the fund set up by Innocent smoothies’ founders.

Emma McClarkin, chief executive officer of the British Beer and Pub Association, said: “Lucky Saint are a business full of brilliant ideas, with a passion for people, so it’s a natural fit for them to invest in and support the pub industry.

“It’s great to see the old institution, The Mason’s Arms, given a new lease of life as The Lucky Saint,” the industry trade body’s chief said over the weekend.

TED HENNESSEY

BARCLAYS has announced the closure of 15 branches across the country, meaning over 100 banks are slated to shut down so far this year.

The bank is set to close 14 branches across England and one in Wales from late April to the first few days on May. Sites in London, Gosport, Bridgwater and St Helens are among those shutting down over just a few days.

Barclays already announced 15 closures earlier this month and has been approached for comment.

CHRIS

IKEA reportedly paid out a £90m dividend from its UK business to its parent last year – the first in six years – as the Swedish furniture giant continues to rake in bumper profits.

The dividend, reported by The Sunday Times, reflected the £62.4m profit made in 2021, a year interrupted by a series of lockdowns which forced Ikea to close its stores for about a third of the year.

The dividend points to the strength of Ikea’s UK business after the

pandemic impacted its traditional business model based around large out-of-town stores.

The majority of dividends will be reinvested to help the group grow, Ikea said, while the remainder will go to the Ingka Foundation, which was established by Ikea’s founder Ingvar Kamprad, according to the report.

Ikea’s 2022 results, published in December, saw UK total sales grow by 13 per cent to £2.2bn over the year to 31 August 2022, compared with the same period last year, while profit surged 41 per cent to £88.1m.

It comes days after Natwest said it is closing 23 branches, and over a week since Lloyds Banking Group said it is shutting 40 Halifax and Lloyds sites.

At the time the company blamed footfall, which has been rapidly decreasing since the onset of online banking and dropped further during the pandemic. Lloyds said the number of customers visiting the branches it plans to close had dropped by 60 per cent on average over the last five years.

It means the total number of high street bank branches closing this year is already at 103.

Jenny Ross, Which? money editor, said while many have embraced digital banking, it was “vital” the millions of customers, “including the elderly, vulnerable and isolated”, who aren’t yet ready to make the switch are protected. PA

JACK BARNETT

PROFIT warnings issued by companies on London’s £4 trillion stock market surged over the last year, propelled by swelling costs squeezing margins, a new report out today reveals.

Against a backdrop of skyrocketing energy prices and slowing demand, businesses have had to tell

shareholders to brace for profits to come in under forecasts some 305 times over the last year, a 50 per cent increase from the 203 profit warnings in 2021, according to EY-Parthenon.

The company scrutinises the entire London Stock Exchange, which lists over 1,190 companies worth around £3.8 trillion, for profit warnings.

In 2022, nearly a fifth of London’s

entire stock market alerted investors of a profit shortfall, the same proportion during the financial crisis in 2008. Nearly half, 152, were caused by swelling costs.

Big consumer-focused firms were among the sectors with the highest profit warning tallies, with over one in three London-listed retailers sounding the alarm last year.

CITY traders are gearing up for a week in which the world’s top central banks will heap even more pain on households and businesses by hiking interest rates to tame inflation – but they could send the first signal indicating they will stop doing so soon.

Bank of England governor Andrew Bailey and co are expected to lift rates 50 basis points on Thursday to four per cent –a post financial crisis high and the tenth successive rise.

But markets think this will be the Bank’s final “forceful” rate rise, a word it has used to describe its response to inflation for many months.

“We expect the [Monetary Policy Committee] to lay out the groundwork for a downshift in the pace of hikes going forward,” Sanjay Raja, senior economist at Deutsche Bank, said.

Bailey’s press conference starting around 12.30pm on Thursday will be closely watched in the City for any com-

ments on whether the MPC thinks further rate hikes are necessary. Similarly, Fed chair Powell’s remarks are set to shed light on whether Wednesday’s expected 25 point move is either the final or penultimate hike.

“It is now clear that we are heading into the final stages of that fight, with less aggressive blows needed to coax inflation lower. We envisage two final rounds before the fight concludes, starting with a smaller 25bp interest rate hike at next Wednesday’s announcement at 7pm GMT, taking the Federal funds target range to 4.50-4.75 per cent,” Ellie Henderson, economist at Investec, said.

Although a 50 point rise is pencilled in by investors on Thursday, the European Central Bank (ECB) has lagged behind its international peers, meaning it is playing catch up.

President Christine Lagarde told investors last week not to price in any let up on rate rises soon, saying the ECB intends to “stay the course”.

In light of the cumulative tightening of monetary policy

affects

with

inflation, the Committee decided to… step-down from the 75 basis point pace seen over the previous four meetings

CHARLIE CONCHIE

CHARLIE CONCHIE

UK OIL and gas firms, including BP, could be on the receiving end of a wave of takeovers this year as investors swoop on historically cheap London-listed companies, a top analyst has predicted.

London firms were the target of a wave of takeover deals last year as foreign buyers took advantage of a

weak pound and valuations that remain weighed down by the prospect of a lengthy recession and the lingering effects of Brexit.

But the bargain hunt in London looks set to continue this year, according to Michael Stiasny, head of UK equities at M&G, who warned that high-profile companies could leave UK indices.

“We would not be shocked to see a

big name in the oil and gas or mining sectors subject to a bid, with companies like BP trading at a significant discount to their US peers, even after a strong year of performance,” Stiasny said in a note. The warnings come after a host of big name companies were picked off last year by foreign firms including iconic fashion brand Ted Baker and Newcastle-based Go Ahead.

I am not endorsing 4.5 per cent, but what you may have noticed in December is that we did not include the comment that we made in November about the market being in our view rather out of line

ANDREW BAILEY

Governor of the Bank of England

We shall stay the course until such a time when we have moved into restrictive territory for long enough so that we can return inflation to two per cent in a timely manner

CHRISTINE LAGARDE President of the European Central Bank

and the lags

which monetary policy

economic activity and

JEROME POWELLChair of the

Federal Reserve

MIKE Ashley’s Frasers Group is finalising a move to roll out its own buy-now, pay-later (BNPL) scheme which will allow shoppers to borrow up to £2,000, according to reports.

The new payments product is set to form part of a range of new financial products rolled out by new chief Michael Murray under a scheme called Frasers Plus, the Telegraph reported. Under the new offer, shoppers will reportedly be able to split and defer

payments or take a loan through the group’s app that can be spent across its retailers, which include Sports Direct, House of Fraser and Jack Wills. Customers will be rewarded with points when shopping with the group’s new financial products. The group is reportedly hoping to replicate the triumph of Tesco’s Clubcard loyalty programme.

Ashley is “really excited about credit” and reckons the firm’s “bottom line could be boosted”, a source told the Telegraph.

ALAN JONES

A STRIKE by up to half-a-million workers in bitter disputes over pay, jobs and conditions this week should send a clear message to the government that it cannot continue to ignore the causes of the unrest, according to the head of the TUC.

Teachers, train drivers, civil servants, university lecturers, bus drivers and security guards from seven trade unions will walk out on Wednesday in what will be the biggest day of industrial action in over a decade.

Protests will be held across the UK on the same day against the government’s controversial plans for a new law on minimum service levels during strikes. Unions have dubbed it the “anti-strike bill”, saying it could lead to workers who vote legally to strike being sacked.

The TUC will hand in a petition to 10 Downing Street, signed by more than 200,000 people, opposing the new legislation on strikes.

TUC general secretary Paul Nowak said Wednesday will be a “really important day” for workers and members of the public to show support for those taking action to defend pay, jobs and services, as well as for the right to strike.

He told the PA news agency: “I hope it will send a clear message to the government that they cannot continue to ignore the demand for fair pay.”

The National Education Union (NEU) has announced seven days of strikes in England and Wales in February and March, with the walkout on Wednesday expected to affect over 23,000 schools.

Nowak said the government should be worried about the level of support for workers taking strike action.

“I think the government has been taken by surprise at the level of public support for the strikes, because the issues cut across political boundaries,” Nowak said.

Nowak said the Prime Minister and Chancellor now had to get involved in trying to resolve the long running disputes in the health service, education, civil service and other parts of the public sector.

Wednesday, involving members of the NEU, Aslef, Rail, Maritime and Transport union, University and College union, Public and Commercial Service union, Unite and the IWGB, will see the biggest day of strikes since 2011 when a national day of action was held by public sector unions over pensions.

Consumer loans will be facilitated through Studio Retail, a Financial Conduct Authority (FCA) regulated firm acquired out of bankruptcy by Frasers last year, whilst tech created by fintech startup Tymit, in which the retail group holds a 28 per cent stake, will facilitate the BNPL payments. Murray is reportedly hoping Frasers Plus will have an edge on competitors due to the oversight of the FCA, setting it aside from unregulated products offered by firms like Klarna and Clearpay.

OPINION

The sun continues to shine on the blossoming relationship between the City of London and Tokyo’s financial services industries

British Museum workers have announced seven days of strike action in February

ALAN JONES

FRESH strikes have been called by the biggest civil service union in its long-running dispute over jobs, pay and pensions.

Members of the Public and Commercial Service union (PCS) at the British Museum will take industrial action during February half term. More than 100 members of the museum’s visitor services and security teams will take seven days’ action from February 13.

The same day sees more than 60 PCS

LORD MAYOR NICHOLAS LYONS ON A TALE OF TWO CITIES WITH SIMILAR ASPIRATIONS

PAGE 14

members start five days of action at the Driver and Vehicle Licensing Agency (DVLA) in Wales.

PCS general secretary Mark Serwotka said: “We warned ministers that our action would spread if they ignored our demands, and we’re good to our word.

PCS general secretary Mark Serwotka said: “If the government was serious about resolving the dispute, ministers could resolve it tomorrow. Instead, they’re shamefully hiding their heads in the sand, hoping we’ll go away. We won’t.

ALAN JONES

MORE than half a million more people are out of work due to long-term sickness than before the pandemic, new research suggests.

Rest Less, a group which offers advice and support to older people, said there are 1.6m over-50s out of work due to long-term sickness, a 20

per cent increase in the three years from July to September 2019 to July to September 2022.

Rest Less chief executive Stuart Lewis said government action on this issue was “well overdue”.

He said: “Not only is this a national health issue with thousands of people suffering silently, but it’s increasingly an economic issue too – not least

because many of these people want to work in some capacity, if the right opportunities were available to them.”

A Department for Work and Pensions spokesperson said the department was “thoroughly reviewing workforce participation to understand what action should be taken on increased economic inactivity.”

intervention powers in order to prevent harm and intervene before problems become systemic or practices become entrenched,” he said. “Once the consumer duty goes live in July, this areas seems ripe for early preventative supervisory interventions as distinct from enforcement, at least initially.”

THE Financial Conduct Authority (FCA) is expected to take swift action against firms that fail to comply with new rules to protect savers and retail investors, City lawyers have warned.

The City watchdog announced a major overhaul to consumer regulation last summer in the new Consumer Duty, which is set to shift greater onus onto companies to deliver “good outcomes” for consumers. The move has been described as the biggest shake-up to financial services regulation for a decade.

Changes to the rules are set to take effect at the end of July this year but the regulator warned last week that many firms were lagging behind and there was a “risk that they may struggle to apply the Duty effectively once the rules come into force”.

The FCA said last week that some companies’ plans to implement the new duty were still “lacking in detail” and

“contain limited information about how the duty will be embedded”.

Naomi Seward, partner and head of retail finance at law firm Eversheds Sutherland, told City A.M. that she ex-

pects the FCA “to take swift and comprehensive enforcement action” against firms if they fail to fall in line.

Peter Bevan, global head of financial regulation at Linklaters, told City A.M. it

was clear that consumer protection would be the regulator’s “number one priority this year”.

“It intends to intervene earlier and to make greater use of its supervisory and

Simon Morris, a financial services Partner with law firm CMS, said the watchdog would be monitoring the “market for early indications of consumer disadvantage” and requiring firms that are not up to scratch to “halt business immediately”.

“This policy reflects the FCA’s invigorated approach to preventing the widespread damage that can be caused by smaller firms with which it otherwise has little regulatory contact,” he told City A.M. “The introduction of the new Consumer Duty is likely to increase the use of this procedure as the FCA focuses even more on limiting unwarranted consumer detriment.”

The changes follow a slew of warnings from the regulator last year amid fears that credit firms and lenders were not providing property protection to consumers.

Mortgage lenders, credit checkers and insurance firms were among the sectors to feel the FCA’s sting as it fired preliminary warning shots over consumer protection.

Watchdog ready for crackdown as new ‘consumer duty’ comes in, writes Charlie Conchie

nesses, while at the same time giving them a new means of poaching talent.

Fenton Burgin, the head of Deloitte’s M&A advisory business, explained “that in an increasingly competitive environment”, firms will need “scale” to win the most lucrative work. He explained law firms are increasingly opting to either become “niche” specialists in a particular area of the law or “large, gorilla players” able to win top tier work.

“Where you don’t want to be is in that middle ground,” Burgin said, as he noted it’s the medium sized firms that are “likely to IPO”.

Zindani noted that private equity funds are also driving a push for legal sector IPOs as he explained some funds have begun employing “buy-to-build” strategies. The strategy sees PE funds pick up law firms with a view to expanding them through M&A activity in a bid to eventually cash-out via an IPO. For investors, listed law firms offer predictable returns that are resilient against economic volatility.

Knight, however, warned that IPOs are not without their risks. He noted that “unless you’re going to build up and become much bigger and more profitable than you were before, then you’ve basically sold the family silver”.

The Keystone boss also warned that the fact law firms’ main assets are their lawyers leaves them vulnerable, particularly if top partners leave.

“If you buy a 20-partner law firm for £20m and two years later those 20 partners decide to go their separate ways”, the acquisition is made almost worthless, he explained.

Burgin said this is a real risk noting how big US law firms have been “aggressively poaching” partners in the London market.

Btionally stayed away from public markets. Yet following a series of initial public offerings (IPOs) over the past eight years, there are now six UK law firms listed on the stock exchange.

Gateley became the first UK law firm to launch an IPO in 2015 after floating on London’s alternative investment market (AIM). In the following years, five other British law firms have listed on the stock exchange.

However, since DWF’s listing in 2019, not a single UK law firm has floated on public markets and Mishcon de Reya’s recent decision to shelve its IPO plans for the “foreseeable future” due to “volatile” market conditions seemed to

scupper the last major hope for a significant law firm float. The Silver Circle firm spent £11.7m on its IPO plans, before calling it off following conversations with investors.

Moreover, just two of the UK’s six listed law firms’ share prices currently sit above the price at which they floated (Gateley and Keystone Law), while shares in all six of Britain’s listed firms have significantly dropped in the last year.

Legal sector M&A broker Jeff Zindani said while there were a “lot of positive noises” around law

firm IPOs in the first half of 2022, but law firms are now “waiting to see how the market plays out” as the looming economic downturn kills off appetite to float on London’s stock

Simon Olsen, a partner in Deloitte’s Equity Capital Markets Group, noted that UK markets “haven’t seen many IPOs full stop” in recent months. James Knight, founder and chief executive of Keystone Law, said since Gateley’s 2015 IPO, the “market has never looked as bad as it currently does”.

Despite this, optimism around the potential of law firm listings persists.

“As some of the economic conditions stabilize and become more certain… we may see an IPO window open in the autumn of this year,” Olsen said.

Those in favour of law firm IPOs argue listing on the stock exchange gives publicly floated firms new access to cash that can be used to grow via M&A activity. Particularly in the current climate, they argue law firms will have to expand in order to compete, as mid-market law firms face increasing competition from larger rivals including the Big Four accounting firms.

IPO supporters also argue M&A offers a means of hedging law firms’ busi-

Olsen agreed investors would be keen in law firms’ retention measures, but remained bullish on the prospect of more law firm IPOs, arguing we will inevitably see more mid-market listings.

While “conventional law firms” are not well-suited to launching IPOs, public listings could provide gains for tech driven, highly scalable, “factory type law firms” that carry out high volumes of low value work, Knight added.

In Zindani’s view, we’re likely to see a “few black swans… particularly on the consumer facing side,” while Burgin said law firms in the mid-market will “face inevitable pressure to grow”.

Thus, while the legal sector IPO market is currently in the doldrums, there is still significant potential for law firms to list on public markets. The question now is who will be willing to take the jump.

whether law firms could still be tempted by the public marketJames Knight, chief exec of Keystone Law

It was another year of strong trading for last year’s winner of this award, despite a challenging economic climate. The newly slimmed-down Aviva delivered growth across all markets and the acquisition of Succession Wealth bolstered the firm’s offering in the UK wealth market - all the while delivering increased returns to shareholders under the impressive leadership of CEO Amanda Blanc. Aviva Investors continued to perform despite market volatility.

More than £1 billion of new business cashgeneration in 2022 - through organic growth - is nothing to be sniffed at. The giant’s Standard Life business continues to attract new customers and the firm’s M&A strategy continued with the cashfunded pick-up of Sun Life UK. A new ‘brand building’ strategy has put the firm on the frontfoot and boss Andy Briggs has become a trusted City figure on all things retirement.

The UK’s largest specialist pension insurance firm completed de-risking transactions with four pension schemes in the first half of 2022 alone, delivering new business premiums of a cool £1bn in a buoyant bulk annuities market the firm is perfectly placed to deliver on. The firm now has more than £50bn under management and won particular plaudits for a Ukraine crisis donation scheme, with employee contributions matched 3:1 by the insurer.

The City-headquartered international insurance broker was on an M&A spree last year, picking up no fewer than 12 firms in the course of 2022, highlighted by the ‘transformation’ acquisition of US-based TigerRisk Partners. The firm has tripled turnover in the last three years despite mounting pressures in the reinsurance market exacerbated by the untimely arrival of Hurricane Ian. A series of impressive bosses including analytics chief David Flandro and boss David Howden gives the firm an edge in the competitive London market.

Since the formation of Inigo in 2021 it has built the largest insurance and reinsurance portfolio from scratch that the Lloyd’s market has ever seen. The underwriter successfully priced its second catastrophe bond despite a toppy market. The ambitious firm founded by a series of London insurance veterans looks set to continue growing at pace and eye-catching hires in financial and cyber lines have impressed.

risky business

The insurance sector has had an extraordinary year, not just coming out of a pandemic but amid a host of natural disasters. This year we’re looking not just at insurers who are delivering for shareholders but at the wider insurance and pension funds industry.

Texposed last week, when the National Grid paid households to turn off their tumble dryers, television sets and electric ovens as it scrambled to shore up energy supplies to ease the threat of blackouts amid frosty winter weather.

Suppliers across the sector offered discounts on Monday and Tuesday evening to households using smart meters who were prepared to slash their energy usage at peak times in exchange for discounts on their electricity bills.

This shed a stark light on the neglect of the UK’s nuclear industry, which would have been able to provide ample power if repeated governments had not repeatedly failed to support the sector.

Experts also warned MPs last week about the consequences of the government’s inability to properly support nuclear power.

Engineering expert Dame Sue Ion told the BEIS Select Committee last week that approving and building one nuclear power plant at a time rather than developing a real pipeline of projects jeopardised the country’s supply security ambitions.

“We have lost the plot in terms of what we need to run a viable, vibrant nuclear

be doing things,” Ion said.

“What we need is commitment to a fleet, even if it’s a small fleet to give investors the opportunity to have confidence in government policy.”

The industry has been supportive of the government’s efforts to revive the country’s ageing nuclear fleet, with a target of ramping up generation from 7GW to 24GW by 2050 and eight new reactors approved by the end of the decade.

Nevertheless, it has become increasingly concerned over the pace of progress.

Alistair Evans, government and corporate affairs director for Rolls-Royce – which has proposed its own small, modular reactors (SMRs) with a consortium of investors – told MPs last week that the government’s commitment to transform the nuclear sector was “meaningless without a plan”.

Sizewell C is unlikely to receive a final funding decision until next year, while ministers are squabbling over the costs involved in greenlighting more of RollsRoyce’s SMRs, raising the prospect that a decision to approve the small reactors might not be reached until the next

construction is Hinkley Point C, which is not set for completion until 2027 at a cost of £26bn, making it two years late and 45 per cent over budget.

Nuclear power now represents just 15 per cent of the UK’s mix – well below its peak of 26 per cent capacity in 1997.

All five power plants and nine reactors operating across the UK are set to be decommissioned by 2035 at the latest, meaning new plants are essential to boosting generation.

The UK is now on course to record three entire decades without a new nuclear plant, with Sizewell B the last to finish construction domestically in 1995.

The appeal of nuclear power is obvious. It provides a low-carbon, continuous output and is a baseload power source not dependent on either the weather or unfavourable geopolitical conditions.

This was understood in the 1950s and 1960s when the UK was a global leader in the nuclear sector, establishing the world’s first civil nuclear programme and developing innovative reactors such as

governments across the political spectrum, the nuclear industry has been, and continues to be, left to decline.

The West is currently paying the price for being highly dependent on unpredictable regimes for fossil fuels to meet its consumption needs. Some say renewables will be able to plug the gap as we reject Russian oil and gas, chase net zero targets and shore up domestic energy supplies.

Much was made of wind power generating over half the UK’s energy mix over the Christmas window, and while the advancing role of renewables is clear to see, wind generated less than 15 per cent of the country’s required power during last week’s cold snap.

Alongside concerns over its intermittency on windless days, there also remain questions over long-term storage of the power it generates, with clean energy specialists struggling to store power in batteries for more than a handful of hours. There is every reason to believe renewable generation will continue to advance over time – yet the need for a proven, continuous, low carbon power source has never been more urgent, and the only viable option for that is nuclear power.

Chevron opened the curtain on the latest round of mega profits from oil and gas traders last week – posting a record £29.5bn ($36.5bn) earnings over its full year. However, the firm’s results still fell short of analyst forecasts with oil and gas prices sliding over the autumn trading window. It is highly likely Chevron’s numbers will kick off a nosebleed in earnings for global energy suppliers, with rivals Shell, Aramco, BP, Equinor, Exxonmobil and Total set to announce their full-year results in the coming weeks.

£ David Collard is set to make a £30m bid for Britishvolt through registered business Recharge Industries. However, it turns out his main money-making venture has been selling PPE during the pandemic to Australia and US, as first reported by The Sunday Times. With questions raised over the lack of experience Britishvolt’s former owners had in the EV space, there may be fresh concerns Recharge is now one of four suitors left in the running to buy the collapsed company. Administrators EY have reportedly set a deadline of Wednesday for final offers as Britishvolt is close to running out of cash.

What can we do to improve energy security? Email energy editor Nicholas Earl at nicholas.earl@cityam.com

NICHOLAS EARL

MOMENTUM is growing in the energy sector for a ‘social tariff’, with Good Energy becoming the latest supplier to call for more targeted support for vulnerable customers.

Good Energy boss Nigel Pocklington told City A.M. that “a social tariff is the route to go” if the government wants

to shelter lower-income households from sky-high energy bills.

He said: “A social tariff seems to be the most effective way of dealing with what is an affordability crisis for vulnerable, poorer households.”

Pocklington believed the government should pivot from the Energy Price Guarantee, and instead focus support on households that will

be most exposed by high prices. In his view, it would be a mistake to be “offering people like me a subsidy on their energy bills for forever in a day” – through the current support package for the next 15 months. Ovo Energy has also backed the idea, and Ofgem has announced it is also considering the viability of a social tariff.

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his new weekly column

WHAT have poorly performing train companies, holding patterns on customer service helplins and your broadband speed got to do with the rise of socialism?

Quite a lot, I posit.

Bear with me. To inform his new book In Defence of Capitalism, the German economist Dr Rainer Zitelmann conducted polling of vast swathes of the public across the world. The UK results are fascinating –the nation of Adam Smith and John Stuart Mill is now no more in favour of capitalism and economic freedom than Italy. Zitelmann has little choice but to describe the British public as predominantly anti-capitalist.

Now, this polling was conducted even before Liz Truss and Kwasi Kwarteng’s misjudged battle with global debt markets. It’s hardly likely the sentiment towards capitalism red in tooth and claw has gone up.

So what’s happening? It is too obvious to point at ‘left behind’ places and say something trite like ‘tell someone without any capital that capitalism works’, though there is probably a nugget of truth in there somewhere.

Rather it’s the businesses that

people interact with on a regular basis that shape these opinions. Private polling I’ve been shown by another group bears this out –while most people are sympathetic to their boss or the business that employs them, at large the idea leaves them cold.

So what’s that got to do with a train company? Well, it is difficult to imagine that the time to argue for more market freedoms would be on a cold platform at Euston as yet another Avanti West Coast train is cancelled. Similarly, few are minded to extol the works of Freidrich Hayek when they’re on their second hour of a frustrating call to their broadband provider. Those poor experiences –and they are too legion –do little for those of us who believe that freer markets lead to better outcomes for consumers and society.

What they have in common, of course, is that these ‘markets’ are often anything but. Heavily regulated, with significant barriers to entry for disruptors and in some cases state-run competitors, they are best described as corporatist markets. That, though, is probably too technical an argument to change that polling.

Aimlessly scrolling through the BBC Sport website, I found myself reading about Aberdeen’s recent miserable run of form –and manager Jim Goodwin being sacked after a 6-0 thrashing. At the bottom of the piece were two links to a special Aberdeen FC hub. “Our coverage of Aberdeen is bigger and better than even before,” promises the site. That’s all well and good, but that’s the job of the excellent Aberdeen Press and Journal newspaper, which isn’t funded by a three-figure tax on every British household. How can local papers compete if the BBC, better funded and without commercial pressures, is allowed to fight them on their own territory? Auntie needs to stay in her lane.

£ Mick Lynch has certainly made himself a prominent figure in British life, but he must look at the power of union barons in France with some envy. Emmanuel Macron, trying to drive through pension reforms which would raise the retirement age to 64 (God forbid!), is running into waves of obstruction wherever he turns. For the sake of his country’s finances, he best hope that he’s able to win –and let’s hope Lynch et al don’t take lessons from the continent.

ROSS COLVIN

A TOP Republican in the US Congress yesterday said the odds of conflict with China over Taiwan “are very high”, after a US general caused consternation with a memo that warned the United States would fight China in the next two years.

In a memo dated 1 February but released on Friday, General Mike Minihan, who heads the Air Mobility Command, wrote to the leadership of its roughly 110,000 members saying, “My gut tells me we will fight in 2025.”

“I hope he is wrong... I think he is right though,” Mike McCaul, the new chairman of the Foreign Affairs Committee in the US House of Representatives, told Fox News Sunday.

The general's views do not represent the Pentagon but show concern at the highest levels of the US military over a possible attempt by China to exert control over Taiwan, which China claims as a territory.

Both the United States and Taiwan will hold presidential elections in 2024, potentially creating an opportunity for China to take military action, Minihan wrote.

McCaul said that if China failed to take control of Taiwan bloodlessly then “they are going to look at a military invasion in my judgment. We have to be prepared for this.”

He accused the Democratic administration of President Joe Biden of projecting weakness, after the bungled pullout from Afghanistan, that could make war with China more likely.

“The odds are very high that we could see a conflict with China and Taiwan and the Indo Pacific,” McCaul said. US defense secretary Lloyd Austin said earlier this month he seriously doubted that ramped up Chinese military activities near the Taiwan Strait were a sign of an imminent invasion of the island by Beijing.

On Saturday, a Pentagon official said the general’s comments were “not representative of the department’s view on China”.

£ High speed two –three little words that have become associated with mismanagement and Britain’s inability to build anything. The project’s business case looks shaky in the extreme but with work already begun it would now be an even stupider decision to pull the plug. The news last week that there was still confusion about whether or not the train line would actually terminate at Euston or at Old Oak Common sums up the ongoing confusion at the heart of the project.

Are regulators what gets you going? Have we got the podcast for you. Lucy McNulty, a former City editor at Financial News, cast out on her own last year with the excellent Following the Rules podcast. Compliance is rarely a headline grabber but McNulty has certainly made it very interesting, and her last episode on the rising use of Whatsapp across financial services was enough to give me pause. But that’s not it –her interview with Tom Hayes, the ‘LIBOR’ banker who continues his fight to clear his name, is also well worth a listen.

George Osborne on why Rishi Sunak may struggle to land his election message

Between Following the Rules, Graham Ruddick’s Off to Lunch and Jimmy McLoughlin’s Jimmy’s Jobs of the Future, we are certainly not shy of interesting business content in our ears and on our computer screens –and, hopefully, in this paper too!

A PRIVATE museum in the United Arab Emirates unveiled on Saturday a Torah scroll that survived the Holocaust, the latest sign of what Israel and its new Arab allies describe as a new approach to understanding Jewish history in the Middle East.

Tensions are once again high in Jerusalem amid a wave of violence

MAAYANK LUBELL

ISRAELI police sealed off the Jerusalem family home of a Palestinian gunman two days after he killed seven people outside a synagogue, as fears grew of further escalation in the deadliest unrest for years in Jerusalem and the West Bank.

Prime Minister Benjamin Netanyahu announced plans on Sunday to make it easier for Israelis to carry guns after the synagogue attack, the deadliest against Jews in the Jerusalem area since 2008.

It came a day after the deadliest Israeli military raid for years in the West Bank city of Jenin.

Since then, a 13-year-old Palestinian boy opened fire on a group of Israeli passers-by in Jerusalem on Saturday, wounding two before one of the civilians shot and wounded him.

On Sunday, residents of a Palestinian village outside Ramallah in the West Bank said a group from a nearby Israeli settlement had burned one house and smashed doors and windows of another.

Ten died in the Jenin raid.

Ahmed Obaid Al Mansoori, founder of the Crossroads of Civilizations Museum in Dubai’s historic district, said the display, unveiled for International Holocaust Remembrance Day would help combat “big denial” of the Holocaust in the region.

“For us peace is a complete peace,” Al Mansoori said. “Many people have forgotten the Jews are part of the region. So here, we’re trying to show... the good days between the Jews and the Arabs in the past.”

The scroll is on permanent loan to the museum from the Memorial Scrolls Trust, which looks after more than 1,000 Czech scrolls saved from the Holocaust and later sent to London.

“I lived in the Arab world when I was young, and the term Holocaust does not exist... So this is a huge step,” said Edwin Shuker, an IraqiJewish businessman and vice-president of the Board of Deputies of British Jews, who facilitated the loan.

The UAE will also soon include Holocaust education in schools.

in charge of the notebook pen

As each new scandal unfolds, the window for action gets smaller

FOLLOWING THE RULES HAS NEVER BEEN SO INTERESTING

To appear in Best of the Brokers, email your research to notes@cityam.com

LONDON traders are gearing up for a big week of corporate results, with UK giants Shell, BT Group, Glencore, GSK and Vodafone Group updating markets. Shell is due to announce its final results for 2022 on Thursday and is expected to post record profits as oil giants continue to benefit from the global energy boom.

Newly appointed chief executive Wael Sawan will front the announcement this week in which he is expected to announce the huge profit take of $28bn (£22bn).

Michael Hewson, chief market analyst at CMC Markets UK, said the decision to buy back billions of dollars of their own shares, rather than increase investment in renewable sources of energy, is likely to draw criticism.

However, the company has been exposed to a windfall tax by the UK gov-

ernment designed to help partially pay for cost of living support.

Shell’s dividend has also been lifted by 15 per cent, likely to please shareholders. The oil megacap’s shares are already up more than a quarter over the last year.

BT will announce third quarter results on Thursday. Despite a short lived rally in December, its shares are still down 30 per cent from their peak. Glencore publishes a production stock take for 2022 while GSK announces full year results on Wednesday.

Vodafone is set to release third quarter results on the same day and investors will be eyeing whether inflation and higher energy bills have kept squeezing earnings.

The FTSE 100 is also likely to be wobbled by rate rise decisions from the Bank of England, Federal Reserve and ECB, all out this week.

Peel Hunt has downgraded Close Brothers and slashed its target price by 18 per cent after the London-listed merchant banking group posted a smaller than expected loan book and a weak securities performance. Close Brothers also revealed last week it would set aside an additional £90m to deal with bad loans from legal-finance specialist Novitas Loans, which it acquired in 2017.

Direct Line Group is facing choppy waters after chief Penny James stepped down with immediate effect on Friday after the firm issued a second profit warning in recent weeks and scrapped its final dividend. Analysts at Peel Hunt have predicted the firm will bounce back however and said they “maintain [their] long-term positive view on the stock”. They rate it a buy stock with a target price of 240p.

BARNETT, ECONOMICS EDITOR“We’re nearing peak interest rates, but it won’t feel like it this week. The Bank of England, Fed and ECB will pile more pressure on household finances with a mixture of 50bps and 25bps hikes. The moves could be Bailey and Powell’s last. But, don’t expect any let up from the ECB’s Lagarde.” European rates could hit 3.5 per cent by the middle of the year.

JACK

forming “above expectation”.

DOMINIC Cummings may have left Downing Street in 2021, but his shadow in politics is long. Last week, the research and innovation minister, George Freeman, announced the formal creation of the Advanced Research and Invention Agency (ARIA), an independent, government-sponsored body designed to fund high-risk, high-reward scientific research.

It was one of the pet projects of Boris Johnson’s former senior adviser, modelled on the US’s Defense Advanced Research Projects Agency (DARPA), an organisation founded during the Space Race of the 1950s to foster leadingedge, sometimes bleeding-edge research and development for the armed forces. For anyone who has ever had the misfortune to end up reading Cummings’s Substack, both DARPA and ARIA are frequent guests.

ARIA will bring together expertise from across the disciplines of science and research, with a high level of innovative freedom and creative thinking, to support the government’s plans “to build a better future with innovation at the heart of growing the economy and improving lives”. While it has the ring of Pollyanna-ish jargon about it, the organisation has been given an ini-

tial budget of £800m over four years and its primary purpose is to work at speed to provide seed funding for research, then follow up with larger grants for successful projects.

This is the kind of agile, dynamic, creative approach to research that encapsulated Dominic Cummings’s vision of the future state, while also, by implication, underlining his criticisms of the existing public sector. When Dr Ilan Gur, an engineer educated at Berkeley and the founder and chief executive officer of Activate, a California research hub, was announced as ARIA’s chief executive last summer, Cummings was cock-a-hoop. He tweeted en-

thusiastically “Fantastic to see efforts from so many officials, scientists, deep state, & misfits pay off with something left/right/remain/leave can all support.” This supports the belief of Cummings and others that science and research must be the government’s overriding priority. He went on that “science funding must become much more diverse with much less friction”, cherishing this notion of innovation as a magic bullet to our many post-pandemic, post-Brexit challenges, and ministers have been encouraging the idea of the UK as a “science superpower” since at least 2021. For many, the success of the vaccine taskforce in

developing and deploying the Covid-19 inoculate was an illustration of the potential on this area, and it is no coincidence that Dame Kate Bingham, the taskforce chair, is a director of ARIA. But putting funding behind it and making it a successful venture is a different story, as anyone in venture capital will tell you. Dr Gur certainly has an encouraging track record in the field: his Activate organisation has sponsored more than 100 science-related start-ups. Meanwhile, the UK has been ranked fourth in the Global Innovation Index in 2021 and 2022, so this is a field in which we have some considerable strength. This placed us as per-

THERE are some cold winds of economic challenges facing the world, but the UK can look towards one of many bright, sunny spots: our trading relationship with Asia.

Last year, combined trade with Asian markets amounted to £281bn, and with negotiations ongoing with India and the UK’s membership into a powerhouse Pacific-trading bloc worth £9tn, these figures are expected to climb even further.

This is what I’ll be discussing with the Governor of Tokyo, Yuriko Koike, at Mansion House this week at the launch of the London-Tokyo finance seminar. Our financial services links are a crucial part of our trading relationship with Japan. In the middle of last year, these were the top exports from the UK to Japan, accounting for thirty-five percent of service exports, with insurance and pensions making up another seven per cent. These are huge trading export figures, accounting for £2.5bn – which works out to about £19 per person in Japan.

Nicholas Lyons

This relationship is also helped by the long-standing friendship between the United Kingdom and Japan; at the end of last year, we agreed a new digital partnership to aid collaboration on infrastructure and technologies. Indeed, just this month the UK Prime Minister chose the Tower of London to be the site of a historic defence agreement, co-signed by the Japanese Prime Minister Fumio Kishida, allowing UK forces to be deployed to Japan. If the UK and Japan’s relationship is close, then the relationship between the City of London and Tokyo Metropolitan Government is closer still.

The Japanese Prime Minister spoke at the City’s Guildhall to announce his

new economic plan and the City of London signed an agreement with Tokyo’s Metropolitan Government to ensure that we can support each other’s development. Indeed, our two cities share significant similarities: sites of worship that have stood for hundreds of years, world-renowned cultural institutions and a financial services sector dedicated to innovation.

On this last point, Tokyo has been outspoken about its aspirations: to create a Fintech city and turn Tokyo into a stronger and more international financial centre. There are many other opportunities for our two cities – indeed, our two countries – to collaborate on this goal.

Take asset management for example, a specialism where there is great collaboration between our two countries.

We know that many large Japanese investors – like Sumitomo and Nomura –invest in UK asset managers, mainly through private investments. They are right to do so, as the UK is a world leader here, accounting for fifteen per cent of global assets under manage-

ment – managing eleven-trillion pounds of assets.

A crucial part of the seminar will be discussing barriers and opportunities to greater collaboration with Tokyo.

Hiroshi Nakaso, the chairman of the project, known as FinCity Tokyo, has highlighted many priorities we need to address, including greater coordination between services and ensuring they can act as a gateway to global markets. The City of London has worked hard to connect its financial centres across the country and ensure regulators and innovators are equally welcomed into the market. We have much to offer and much more to learn.

The sun continues to shine on the blossoming financial and professional services partnership between Tokyo and London. I know that both the UK and Japan are working hard to ensure the rising sun of that relationship never sets.

£ Nicholas Lyons is the Lord Mayor of the City of London Corporation

It is innovation which marks out some of the world’s most successful businesses: Apple, Amazon, Tesla and Moderna are among the most innovative companies globally, and they have not only considerable commercial success but also great influence. If ARIA can prove itself a flexible, agile and successful sponsor of research, it will be building on the country’s existing strengths. The hope is that success will breed further success and allow the UK to grow its way to restored prosperity. But we cannot afford to reach for the rose-tinted spectacles when it comes to ARIA. It is ambitious but success needs more than that. While its leadership will have £200m per year to play with, DARPA, its US counterpart and inspiration, spends around $3.5bn, clearly on a different level of investment.

Professor John Womersley of Oxford’s Department of Physics has warned that the new body must have a culture of openness and honesty, and must create an active communications strategy so that the public will understand ARIA’s purpose but also its approach to risk. It is easy to be cynical: indeed, Britain would increase its medal haul if wary fatalism were an Olympic sport. Let us be cautious, of course: magic bullets are rarely as magic as we hope, and £200m per year is not going to transform our international standing. But perhaps ARIA can at least begin to nudge us forward, and give more strength to an area in which we already perform impressively.

£ Eliot Wilson is co-founder of Pivot Point and a columnist at City A.M.

After appearing on ‘I’m a Celebrity’, Nadine Dorries is coming back to your screens with her own talk show on TalkTV. ‘Friday night with Nadine’ promises to be an “irriverent” look at the news of the week. It starts on Friday: find yourself a sofa and some wine to soften the blow

[Re:Anti-money laundering and crypto fines surge to £4bn in regulatory crackdown, Jan 22]

The issue with cryptocurrency is anonymity and the movement of money cross-border without institutions’ oversight. It’s really easy to move currency globally without entering regulated bodies.

We’re seeing the same problem with anonymity across social media, with people creating multiple or fake accounts. And, with the tech industry focused on customer acquisition, putting anti-money laundering checks is seen as a barrier. Take Twitter. They have massive bot problems that could be easily solved by customer verification. But they choose not to, because it affects the

key metrics in terms of how many accounts are created. To combat the issue of money laundering in cryptocurrency, it’s crucial to examine the “on and off ramps” of crypto - the exchanges where individuals convert traditional currency into cryptocurrency. Regulators should implement strict regulations on these exchanges. We’re starting to see this, with Coinbase reaching a $100m settlement with New York regulators for violating anti-money laundering laws. It’s also vital for financial institutions handling crypto transactions to convert it back into fiat currency, to verify origin and purpose. The cryptocurrency industry knows more regulations are coming. In the US, there may be an integration of crypto into the Bank Secrecy Act. The industry needs to be ready.

Bion Behdin Chief Revenue Officer and Co-Founder of First AML

IHAVE travelled around the world meeting issuers, strategists, and clients a lot this year. Most people agreed with me that the world has changed. But then I ask them, what have you done about it? How have you responded to a change in markets, a change in volatility, a change in the way we all work and live? And the answer is usually very little. Investors must think and act differently in 2023 and beyond.

It has been volatility that has led us to this limbo. So, let’s look at this. For me, volatility starts with central banks. Post-global financial crisis, when one word was changed in the statements issued by central banks, everyone would pile on to analyse what it meant, even if often the answer was nothing.

Following this, we have gone from a period of “we are not even thinking about thinking about raising rates”, to “is it going to be 50, 75 or 100 basis points?” Uncertainty in how central banks will act leads to rate volatility, which then leads to curve volatility, and credit volatility. We’ve seen evidence of this, with the number of mortgage products on offer in the UK plummeting. This then feeds through to equity markets. This is the way I think those concentric circles of volatility flow through. For an active manager, volatility is not something to fear, it is something that produces great opportunities.

Britain is a country of many things, but right now, its railway is known for all the wrong reasons. HS2 was meant to be a revolutionary connection between the capital, the Midlands and the north. Instead, it’s been sucking the money out of the government’s back pockets for as long as we can remember. The original project was set to stop at Euston station. Now, because of rising costs, the terminus could be delayed until 2038 or scrapped altogether. Instead, passengers would have

to get off at a West London location in the suburbs and hop on the Elizabeth Line to get into central London. This change to the plan could save billions - but misses the point of connecting other cities to London. At a speech at Bloomberg last Friday, Jeremy Hunt played down the rumours of another change. But he gave himself some wiggle room, saying he doesn’t see “any conceivable circumstance” in which the HS2 couldn't reach Euston.

ELENA SINISCALCOAs the concentric circles move through, volatility is certainly elevated. One of the concerns is there is an additional impact from volatility on liquidity. Just as we have gone through quantitative easing into quantitative tightening, there has been a structural change in the world that has led to higher inflation. The key thing for investors to note is that market structure is fundamentally different now, and market structure is something investors do not spend enough time thinking about.

The moves from active management to passive, and from public markets to private, have fundamentally changed how people invest. This is not active versus passive or public versus private debate, it is a question of fact. The changes have had a massive impact on market liquidity, which has created a feedback process that develops into

further volatility, which then feeds back into liquidity again. In my mind, credit markets are at risk because the liquidity premium that is priced in is still not sufficient for the reality of public markets today.

The illiquidity of markets is something we all need to deal with. We are probably at a point over the next few months where we are going to find out the outcome of this. Using fixed

income terminology, we are probably at the point of maximum convexity. This means we are in an unstable equilibrium. Something must happen. We are either going to get a meltdown in credit markets like in 2008, or we get a big, big rally. While market performance in the last quarter of last year looks like the latter so far, looking at liquidity and the quantitative tightening situation, it could still look like 2008.

Ultimately, investors all end up becoming asset allocators. We all want to put different assets together to end up with a better combination. The important thing to remember, is that the best players do not necessarily make the best team. Doing nothing though? Think back to the returns in fixed income assets in 2022. It is a very dangerous, and conscious decision.

£ Arif Husain is head of international fixed income at T. Rowe Price

An active manager shouldn’t fear volatility, as it can produce opportunitiesThe Bank of England is expected to raise interest rates again Donald Trump was campaigning in two battleground states over the weekend as he launches his currently uncontested bid for the Republican’s party presidential nomination.

The Grand Hotel Kronenhof is like a Wes Anderson movie brought to life. You join me in Pontresina, in Switzerland’s Eastern Alps, a pretty little mountain town of 18th century villas and Belle Epoque buildings. The hotel itself is large and neobaroque, crowned with a jaunty green dome, and was opened in 1848 before being expanded fifty years later when winter sports began to take off.

The English didn’t invent skiing – that claim goes to the Norwegians – but we did invent the ski holiday, and the charming Kronenhof, and fellow grande dame The Kulm Hotel in nearby St. Moritz, were at the heart of pre-war high-society’s snowbound tourism boom.

My party and I have arrived by rail. The Glacier Express line runs from Chur, south of Zurich, gripping the sides of the mountains and speeding past tranquil lakes, over stone viaducts, through narrow tunnels and reaching Pontresina at 1,800 metres. We’re met by a Mercedes at the station and two minutes later swing into the cour d’honneur of the Kronenhof. Many areas of the hotel have been recently refurbished. My junior suite – one of 112 bedrooms - blends classic and contemporary elegance, while the pale and calming lobby features majestic ceiling frescoes and is filled with light via the panoramic vista of the Roseg Valley. The cocktail bar, cigar lounge and billiards room are each cosy and sumptuous; tailormade by designer Pierre-Yves Rochon for sophisticated après ski conviviality. The Grand Restaurant is a jacket and tie affair, with our hosts keen to preserve sartorial standards and the sense of occasion that greeted guests in previous centuries.

There is a maze of corridors in the bowels of the hotel leading to hidden treasures, such as a traditional pine-panelled stübli for intimate gourmet dining (where we make use of a table-side silver-plated duck press), a 19th century bowling alley where one can enjoy fondue, and a rustic party room/tavern filled with reminders of the past. This cellar was originally home to a wine shop, as well as stabling for horses that transported wine over the Bernina Pass. It was thanks to this trade that the hotel was able to survive the two World Wars, yet many of its British guests weren’t so fortunate. The basement space, filled with barrels, mismatched furniture, candles stuck atop wax-dripped champagne bottles and dozens of chandeliers hung inches apart overhead, is haphazardly lined with hundreds of old pairs of skis and poles, most unclaimed since 1914. The leather bindings are stiff with age, and each has a curling paper label attached with the owner’s name written in cursive. ‘Mon. Allen – 1 pair skis 2 sticks’; ‘Ralph Walter, 16 Thorney Court, Palace Gate, London. To be kept for future use’; ‘R. Blacker Douglass, Irish Guards’.

I did some Googling and found a handsome black and white photograph. Lieutenant Robert St John Blacker-Douglass, alumnus of Hazelwood, Wellington and Sandhurst, member of Guards, Queens and the Royal Automobile Club, won the Military Cross in the trenches at Cuincy in February 1915, aged 22, after he was wounded by a grenade while rushing the enemy barricade. Despite his injuries, he picked himself up and carried straight on, only to be shot and killed moments later.

After a bad start to the ski season, a decent amount of snow is finally predicted to fall this week in Switzerland - here’s hoping it’ll improve the rest of the season

The pistes are a short minibus ride away, but what Pontresina is most noted for is cross-country skiing.

I’d never done it before, and came here to learn a new skill. You slide when your feet are together, but the narrow skis grip when you lift your heel and push. In downhill sections you stand in grooves, bent at the knees, and ski as if on train tracks. It takes concentration because it’s easy to lose balance, especially on the flats, and a backwards tumble left me with an aching coccyx.

Enter one of the Kronenhof’s trump cards – its 2,000 square-metre spa. This modern facility includes a 20m indoor infinity pool, Jacuzzi, a saltwater grotto, saunas, steam rooms, and a relaxing floatation room with underwater music.

It makes me cringe whenever that 21st

century Californian pseudo-word ‘wellness’ comes up.

In 1900, people here called it ‘the cure’ instead. The idea that Alpine air and some high-altitude activity could mend all your ailments. Pontresina was one of Switzerland’s first ‘cure stations’. Of course, after a few hours, spas can get very boring – and I suspect that’s why the sport of bobsledding was born.

A nine-minute train ride (or five-mile drive) away from Pontresina lies its much more famous cousin, St. Moritz. Our destination is the Kronenhof’s sister hotel, the 166-year-old Kulm, which in addition to 164 luxurious guest rooms (also undergoing refurbishment by Pierre-Yves Rochon) is home to the Cresta Run’s clubhouse – the Gunter Sachs Lodge –filled with boisterous photos of brave

The Glacier Express Train grips the sides of the mountain, speeding past tranquil lakes, over stone viaducts and through narrow tunnels

Hooray Henrys and wealthy adrenalin addicts through the decades.

Sachs was an aristocratic German playboy, sportsman, art collector, photographer, one-time husband to Brigitte Bardot, scion of the Opel car company, and founder of the jet-set Dracula Club. Between 1969 and his death in 2011, he was the chairman of the St. Moritz Tobogganing Club. But the club itself dates back far earlier, to 1887, and it was established by the English, led by Major William Henry Bulpett.

Britain’s ardour for the Engadine Valley’s winters was first prompted by an invitation from the Kulm Hotel’s founder, Johannes Badrutt, whose son later established the nearby Badrutt’s Palace. One summer in 1864, joined at the Kulm by four English gentlemen, he enthused

Grand Hotel Kronenhof winter rates start from £500; kronenhof.com.

Kulm Hotel St. Moritz winter rates start from £785; kulm.com.

One-way fares from London to Zurich on SWISS start from £76, and include one piece of checked luggage and one piece of hand luggage; swiss.com.

For more information on Switzerland:MySwitzerland.co m; holiday packages, train and air tickets: sales@stc.co.uk

about the snow-blanketed landscape, sunny skies and mild temperatures of the quiet off-season. The guests, typically accustomed to dark, cold winters, thought he was pulling their legs. Badrutt laid down a bet: Return in December for a trip away from the UK and if they didn’t like it they’d be fully reimbursed. They came back to the Kulm and stayed until Easter, returning home tanned and full of enthusiasm. Soon, the Engadine was full of Brits and they started to seek new diversions, such as sledding. Our sporting adventurers kept crashing into each other, so steering apparatus was invented. Soon after, the visitors, together with hotel heir Casper Badrutt, carved a steep, twisty, perilous run out of the ice and the rest is history.