NO ROOM FORTAXCUTS IN BUDGET

JACK BARNETT

JEREMY Hunt and Rishi Sunak will likely hold fire on tax cuts at the 15 March budget despite being handed an estimated £11bn windfall from energy prices falling to pre-Russia Ukraine war levels, according to top economists’ predictions gathered by City A.M. Brits will have to wait until the run up to the next general election, which has to happen before January 2025, for the taxman to put money back in their pockets, experts reckon.

A stalling UK economy, compounded by soaring inflation and the government’s debt interest bill swelling due to the Bank of England’s aggressive interest rate hikes, has squeezed the country’s finances.

As a result, the Chancellor “really doesn’t have much room to manoeuvre,” Carl Emmerson, deputy director at the economic think tank the Institute for Fiscal Studies, told City A.M. James Smith, research director of another think tank, the Resolution Foundation, which focuses on lower and middle income families, agreed.

“With crowd-pleasing tax cuts likely to come far closer to the election, and further away from our current period of high inflation, the upcoming budget is not likely to be one where tax policy shifts markedly,” Smith told City A.M.

Speculation about what tax and spending decisions Hunt will announce in under two months has grown recently, driven by a rapid fall in gas prices reducing the cost of the govern-

ment capping energy bills at £2,500 by around £11bn.

But hopes of a tax giveaway are fading as the government seeks to maintain the confidence of the financial markets, which was lost after Liz Truss and Kwasi Kwarteng’s £45bn tax-cutting mini-budget in September.

“It is far too early for the government to swing back into a major give-away budget, just a few months on from the fallout from Kwasi-nomics,” Smith said.

Hunt reversed nearly all of Truss and Kwarteng’s mini-budget on 17 November, putting the tax burden on course to its highest level since the end of World War Two and tightening the cost of living crisis’s grip.

John O’Connell, chief executive of the Taxpayers’ Alliance, told City A.M.: “Taxpayers are fed up of their record high tax bills, with no end in sight.”

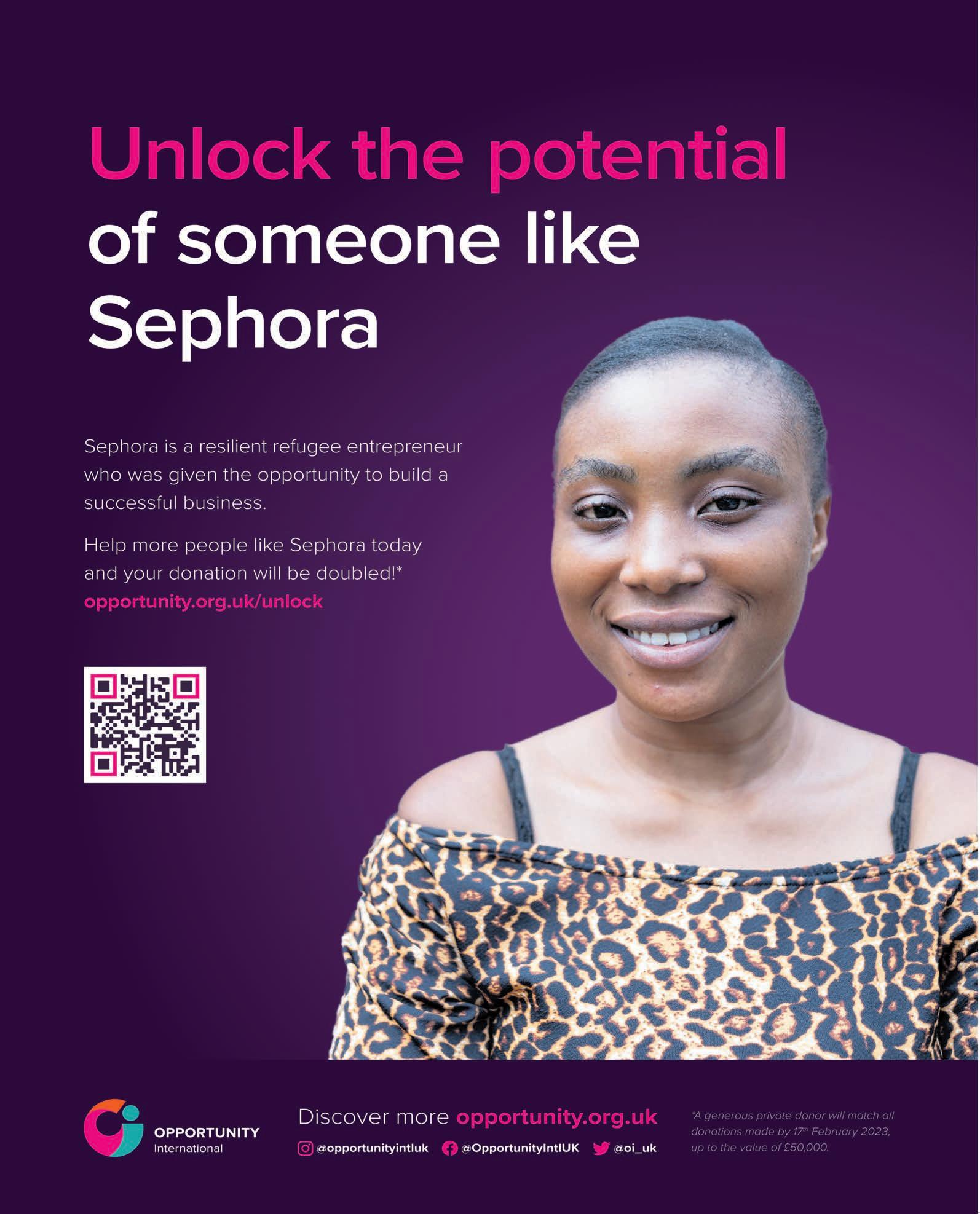

THOUSANDS of Londoners yesterday lined the city’s streets to watch this year’s colourful Chinese New Year celebrations and welcome in the Year of the Rabbit.

Hundreds of performers took part in a parade involving traditional costumes, lion dances and floats.

The parade made its way from Chinatown towards Trafalgar Square, where performances took place in front of the National Gallery.

The Lunar New Year is the most important annual holiday in China.

Each year is named after one of the 12 signs of the Chinese zodiac in a repeating cycle, with this year being the Year of the Rabbit.

City workers switching firms trouser more than 20 per cent pay bump

JACK BARNETT

CITY bankers, brokers and insurers

switching to a rival firm trousered a more than 20 per cent pay bump last year, new research reveals.

The Square Mile’s best and brightest are switching companies in a bid to capitalise on rapid wage

inflation in the financial services sector.

According to recruiter Morgan McKinley, the number of people looking for a new job in the City surged 36 per cent over the last year.

Firms have been offering juicier pay packets to lure talent amid a smaller workforce.

Higher living costs have also incentivised workers to demand existing and future employers hike pay to protect their spending power.

“The competition for talent clearly remains and combined with higher costs of living, candidates continue to demand premiums for their commitment,” Hakan Enver,

managing director at Morgan McKinley UK, said.

The number of available jobs in the sector climbed 16 per cent over the last year.

Strong hiring in the Square Mile indicates it could withstand the coming UK recession better than other sectors.

But a string of sweeping job cuts at some of the world’s biggest banks indicates they are now moving to protect their bottom lines.

Wall Street lender Goldman Sachs is set to cut 3,000 jobs – its biggest since the financial crisis – while Morgan Stanley and Nomura are also shedding staff.

MONDAY 23 JANUARY 2023 ISSUE 3,920 CITYAM.COM FREE INSIDE COLD SNAP TRIGGERS NATIONAL GRID PRECAUTIONARY MEASURES P3 ASDA EXPLORES EG GROUP MERGER P4 ZAHAWI SCANDAL P5 MARKETS P13 OPINION P14 LONDON’S BUSINESS NEWSPAPER

CITY A.M. REPORTER

£ CONTINUED ON PAGE 2 ECONOMISTS SAY TAX CUTS UNLIKELY IN MARCH BUDGET DESPITE £11BN WINDFALL FROM FALLING ENERGY PRICES ALL ABOARD FROM PARIS TO THE ALPS ON THE ORIENT EXPRESS P16 YEAR OF THE RABBIT City enjoys Chinese New Year celebrations GUNNING FOR THE TITLE ARSENAL FIVE CLEAR AFTER WIN OVER MAN UNITED P20

STANDING UP FOR THE CITY

Supply side reforms and tax cuts should be in the March budget

Budgets, like Christmas, seem to come around earlier every year. Fiscal statements are rarely festive, however, particularly under the new regime of Rishi Sunak and Jeremy Hunt. If there is one abiding mantra at the heart of the government it’s that risks are best kept to a minimum. Much of that is a reflection of the two men –technocrats in an almost European sense, rather than tub-thumping ideologues.

THE CITY VIEW

They also entered Downing Street numbers 10 and 11 at a time when sense and sensibility were very much the order of the day. Sunak and Hunt’s challenge, however, is finding the middle ground between sensible economic policy that doesn’t

spook markets and a broadly unimaginative path towards managed decline. The first step was to ditch the ruinously expensive energy price guarantee for households, cooked up in a hot minute by Liz Truss and Kwasi Kwarteng. Hunt has already done that and deserves credit for it.

The second step is to set out a path to growth. That requires supply side reform, the likes of which Britain has seen very little

of in recent years, and a path to an economy which rewards work and endeavour. It is disarming how little flag-flying there has been from Downing Street on everything from childcare to industrial strategy. New ideas remain in shorter supply than you would like from the thinktank community. Labour have few of their own ideas that aren’t reheated from the Blairite/Cameron era. The upshot of all this is that radicalism is

evidently not the order of the day. So, whither tax policy? There is a bigger window than some might think. The election is two years (ish) away: Sunak must come forward with a plan to bring taxes down before then, not least to give investment a boost. If that’s too much, then ditching the horrendous windfall tax would be a welcome first step back from the high-tax, highregulation Britain we have sleptwalked into.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE TELEGRAPH

TESCO SAYS FOOD PRICES UNFAIRLY INCREASED

Tesco’s chairman has suggested food companies might be using inflation as an excuse to put up prices further than necessary as household staples hit price highs that have not been seen for several decades.

THE TIMES

REVOLUT TELLS WORKERS

TO

SWEAT AND STRETCH

Revolut has told employees it expects “sweat and stretch” in their approach as it battles to gain a banking licence and is overdue in filling its financial accounts. It has had a rise in applications since cuts at tech firms.

FINANCIAL TIMES

UNICREDIT CHIEF EXECUTIVE SLASHES CONSULTANT BILLS

UniCredit’s Andrea Orcel has halved the bank’s bill for external consultants since he took over as chief executive, slashing it by at least € 75m as part of his aggressive strategy to cut costs.

Recession

THE MUCH touted coming recession in Britain will be twice as bad as first feared, new forecasts out today reveal.

Soaring prices coupled with the Bank of England’s efforts to tame them are set to deal a heavier blow to GDP than projected just a few months ago.

According to the EY Item Club, the economy will shrink 0.7 per cent this year, worse than the 0.3 per cent the organisation forecast in October.

The cumulative lost GDP will be about the same amount shed during the recession in the early 1990s that

forecasters warn

saw house prices collapse and the UK crash out of the European Exchange Rate Mechanism.

The recession will be a lot shallower than the ones sparked by the financial crisis and Covid-19 pandemic.

The UK economy unexpectedly grew 0.1 per cent in November, ONS figures earlier this month revealed, raising hopes that the country narrowly avoided a technical recession - two back-to-back quarters of contractionat the end of 2022.

But, the government reining in energy bill support and raising taxes has put the economy on a weaker long

term path. The EY Item Club slashed its forecasts for each of the next three years, down to 1.9 per cent from 2.4 per cent in 2023 and to 2.2 per cent from 2.3 per cent in 2025.

Inflation is on track to decline quickly this year, pushed lower by international energy prices falling back to their pre-Russian invasion of Ukraine levels, to under four per cent, still nearly double the Bank of England’s two per cent target.A series of nine successive interest rate rises by the Bank to take them to 3.5 per cent has tightened the screw on household finances.

CBI to outline group’s wishes ahead of Hunt’s next budget

CONTINUED FROM PAGE 1

The March budget is instead expected to further slim down cost of living support packages to target those most in need to rein in government spending.

However, Sunak and Hunt are set to keep motorists’ petrol bills lower by freezing fuel duty again, preventing what would have been an “increase of 23 per cent,” Emmerson said, adding it will cut the government’s revenues by £6bn a year.

The head of Britain’s biggest

business lobby group the Confederation of British Industry Tony Danker, will call on the government today to implement a permanent successor to the 130 per cent investment relief at the budget.

“The government have said they believe in this policy but can’t afford it. That’s because they don’t want the hit to their annual accounts. I don’t think that’s good enough and nor do Britain’s investors,” he is set to say today.

The treasury said: “We do not comment on speculation around tax changes outside of fiscal events.”

CITYAM.COM 02 MONDAY 23 JANUARY 2023 NEWS

JACK BARNETT

to be more than twice as bad as orginally feared,

ON YOUR MARKS, GET SET, BAKE! Team South Korea prepares a buzzing creation at the renowned Bocuse d’Or pastry competition, which took place in Lyon this weekend

National Grid to pay households to save energy

NICHOLAS EARL

HOUSEHOLDS will be paid to cut their energy use this evening for the first time as a precaution, as frosty weather and expectations of low winds put pressure on the country’s creaking energy grid.

National Grid’s electricity system operator (NGESO) has triggered its demand flexibility service between 5pm and 6pm today, as an early measure to ease pressure on the UK’s energy network.

This will mean energy firms will tell selected households to reduce their consumption levels by cutting back on using power-intensive products.

The National Grid has notified energy providers it needs to find savings of 659MW to maintain its preferred energy security margins.

It has also turned to coal to meet the UK’s energy needs, and has requested three coal power units – owned by Drax and EDF – are warmed up to boost electricity production in case of a potential supply crunch.

This follows the Met issuing a weather warning of icy conditions and poor visibility, with renewables such as wind and solar dropping to less than 20 per cent of

the country’s energy mix.

Instead, gas is meeting 47 per cent of the UK’s energy needs, with the country also relying on imports from the continent for nearly 15 per cent of its supplies, according to the latest tracking data.

Despite the latest developments, National Grid insisted there was no risk of blackouts today.

A NGESO spokesperson yesterday said: “Our forecasts show electricity supply margins are expected to be tighter than normal on Monday evening. We have instructed coal-fired power units to be available to increase electricity supplies should it be needed tomorrow evening.

“We are also activating a live demand flexibility service event between 5-6pm tomorrow. This does not mean electricity supplies are at risk and people should not be worried. These are precautionary measures to maintain the buffer of spare capacity we need.”

National Grid has managed to stave off blackouts so far, including its worst-case scenario in its winter outlook published last year of rolling power cuts in January. However, it did trigger and row back early stage emergency measures on two separate occasions in November.

Aviva is ‘very happy’ with UK’s Solvency II reforms, says top exec

LOUIS GOSS

LOUIS GOSS

AVIVA is “very happy” with the current state of the UK’s plans to overturn EU rules that govern the amounts of capital insurers must hold on their balance sheets, one of the firm’s top execs told City A.M. Adam Winslow, the chief executive of Aviva’s UK & Ireland general insurance business, said

Aviva is “very happy with where the reform landed” after the UK government set out its plans for the overhaul in November last year.

The EU’s Solvency II directive governs the amounts of capital insurers must hold on their balance sheets to reduce the risk of bankruptcy. In November, the government outlined its final plans to overhaul the EU directive and

replace it with a UK equivalent that is set to free up billions of pounds on insurers’ balance sheets for investment in British infrastructure.

Winslow claimed that in Aviva’s case the reforms will unlock an extra £25bn over the next decade alone, as he explained that the newly freed-up cash could be invested in boosting Britain’s resilience towards threats such as climate change.

Activist shareholder Caius Capital takes stake in troubled Metro Bank

CHRIS DORRELL

LONDON-BASED activist shareholder Caius Capital has taken an £11m stake in embattled Metro Bank.

The investment brings Caius Capital’s stake to five per cent, making it one of Metro Bank’s ten largest investors.

The stake from Caius Capital, an alternative investment manager focused on “distressed and special situations”, comes a month after Metro Bank was fined £10m by the Financial Conduct

Authority (FCA) over an accounting scandal in 2018.

According to the FCA, in October 2018 the lender knowingly published inaccurate information regarding its risk-weighted assets. Metro Bank was hit with a £10m fine by the FCA as a result of the failures last month.

Shares in the firm have plummeted 96 per cent since 2018.

City A.M. understands Metro Bank is not concerned by the investment.

03 MONDAY 23 JANUARY 2023 NEWS CITYAM.COM

Metro Bank was last month fined £10m over an accounting scandal in 2018

Asda owners explore merger with petrol forecourts business EG Group

CHRIS DORRELL

ASDA’s owners are exploring merging the business with petrol forecourts business EG Group before EG’s 2025’s £7bn refinancing, The Times reported over the weekend.

The two businesses are both jointly owned by Mohsin and Zuber Issa and private-equity company TDR Capital.

The paper said the merger would create a business worth between £11bn and £13bn, with 581 supermarkets, 700 petrol forecourts

and over 100 convenience stores.

By combining the two businesses –both of which are profitable – the billionaire owners hope to refinance EG Group’s debt on more favourable terms, The Times reported. EG Group has £7bn of debt falling due in 2025.

The brothers bought Asda two years ago in a £6.8bn deal. Since then 70 ‘Asda On the Move’ convenience stores have been opened in EG petrol stations. The Issa brothers rapidly expanded their business as interest rates remained low. However, as rates

rise, they will face a heavy refinancing bill, the newspaper reported.

Citing Moody’s Roberto Pozzi, The Times said operating profit will only just cover EG’s interest expenses, which are likely to rise by near $120m to reach $800m (£645m) this year.

The Times reported that the competition regulator’s view is unclear at this stage, although last week the regulator launched an inquiry into Asda’s acquisition of 129 Co-op forecourt sites made last November in a £611m deal.

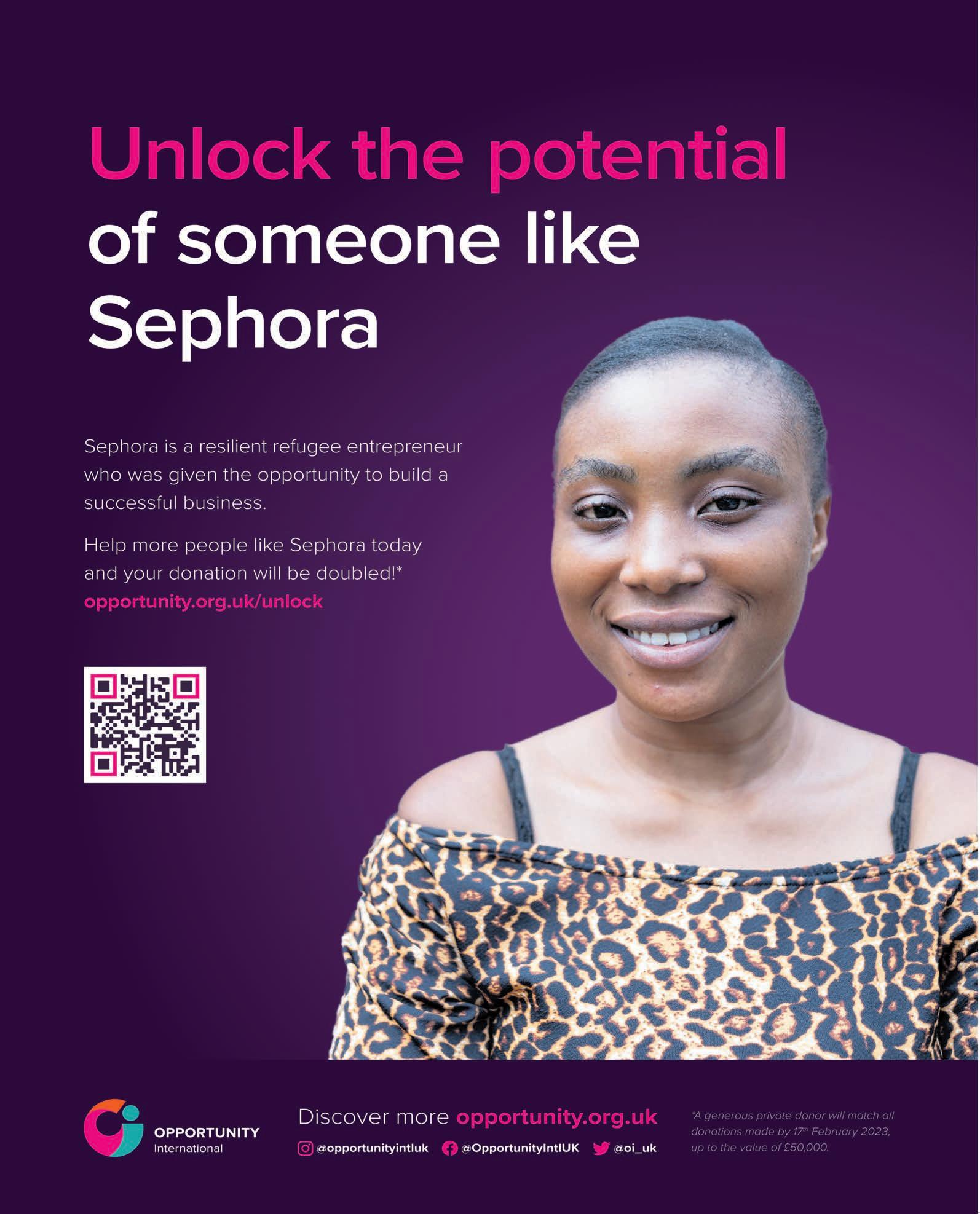

Retailers turn to second hand to lure the thrifty

JESS JONES

RESALE and repair is all the rage among retailers as environmentally aware consumers steer clear of fast fashion and hunt for bargains to save cash, a report has found.

On Friday, Therealreal released its 2023 Luxury Consignment Report, which found a 23 per cent increase in shoppers purchasing resale items last year.

The second-hand clothing market has exploded over the last decade to an estimated £6.5bn last year, largely thanks to online sites like Ebay, Vinted and Depop. That figure is expected to double by 2027.

In 2022, Ebay saw a 24 per cent increase of circular fashion businesses join their site, and searches for pre-loved clothing on Ebay UK have skyrocketed 1,600 per cent since last summer.

Rati Sahi Levesque, co-CEO and president of Therealreal, said: “A potential recession, the climate crisis and global unrest are all reasons that, going into 2023, consumers are making shopping

decisions based on value – with 66 per cent saying they shop resale primarily to get a good deal – as well as personal values”.

Kirsty Keoghan, Ebay UK’s global fashion general manager, told City A.M. that shoppers’ changing habits are down to two factors: “The first is related to consumers’ growing awareness of their individual environmental footprint, and the second is related to their expectation of highquality products at great

value, which is more important than ever as we grapple with the cost-of-living crisis.”

Now mainstream retailers want a slice of the pie and have been steadily introducing resale schemes.

Last week J Crew Group announced the launch of a resale programme ‘J.Crew Always’ which will sell curated vintage styles in select stores and customers’ pre-owned threads online in return for credit.

£240m fake meat fund to disrupt industry

MILLTRUST Ventures and Earth First Food Ventures are set to launch a new $300m (£242m) Smart Protein Fund to back alternative proteins and decarbonise the food industry, City A.M can reveal.

Over $600m was invested in total in the cultivated meat sector last year, and the alternative protein market, which includes imitation meats made from plants, fungus and meat grown in a lab, is only set to grow as consumers are predicted to move away from eating meat for environmental reasons.

The new fund aims to “disrupt” the food industry by directing climate capital towards scaling up new alternative meat companies.

“By 2035, alternative proteins will very likely capture 11 per cent of the global protein market, as consumers, companies, and investors push the values of ESG,” Brian Ruszczyk, CEO of Earth First Food Ventures, told City A.M.

“We predict the market for alternatives to meat, especially chicken and seafood, will increase significantly, rising from two per cent of total protein consumption in 2020 to more than 20 per cent by 2035,”

Ruszczyk continued.

Alexander Kalis, ,managing partner at Milltrust International, told City A.M.: “It’s often conveniently forgotten that the food industry represents 26 per cent of global greenhouse gas emissions – more than all forms of transport combined.”

“Time is of the essence if we are to reach our net-zero imperatives”, Kallis added. Milltrust Ventures, the venture investment arm of Milltrust International, is an investment organisation co-headquartered in London and Singapore, while Earth First Food Ventures is a food tech venture capital platform.

Supermarkets forced to hike wages further as staff shortages bite hard

JESS JONES

SUPERMARKETS are coming under increasing pressure amid a tightening labour market.

A government report, published last week, has found that the current labour market is tight due to “low unemployment rates and high vacancy levels”. Recruitment is more challeng-

ing than usual because most people are already in work, says the report.

The Bank of England attributed this to the faster recovery of labour demand compared to that of labour supply since the pandemic.

Brexit has exacerbated the short supply of labour, especially unskilled workers. A new commentary produced by the UK in a Changing Europe and the

Centre for European Reform thinktanks finds that the ending of free movement has “disproportionately” contributed to the shortage of non-UK workers in less-skilled occupations, such as retail assistants.

Aldi announced on Wednesday that warehouse workers can expect a pay rise from £12.66 to £13.18 an hour, starting 1 February.

CITYAM.COM 04 MONDAY 23 JANUARY 2023 NEWS

The merger would create a business worth between £11bn-£13bn

The food industry is said to make up 26 per cent of all global greenhouse gas emissions

CHRIS DORRELL

There was a 23 per cent increase in purchases of resale items last year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Wage in £ Tesco Asda M&S Waitrose Lidl Sainsbury’s Aldi Outside London Within London HOURLY WAGE BY SUPERMARKET 10.3 10.95 10.1 11.27 10.2 11.45 10.3 11.5 10.9 11.95 11 11.95 11.9 12.75 Source: CityAM

Zahawi will still survive, insists foreign secretary

SOPHIE WINGATE

NADHIM Zahawi will survive as Conservative Party chairman beyond Wednesday, James Cleverly said as he insisted tax affairs are “private matters”.

But critics said Zahawi’s political survival is “difficult” after he admitted paying a settlement to HM Revenue & Customs following a tax error related to a shareholding in YouGov.

Pressure is also growing on Rishi Sunak to reveal what he knew about the unpaid taxes and when, with Labour demanding that No 10 publish any warnings received.

Foreign secretary Cleverly stressed Zahawi’s error was “careless” and not deliberate, amid allegations he avoided tax and had to pay it back as part of a seven-figure sum to HMRC.

The embattled Tory chair released a

statement on Saturday to “address some of the confusion about my finances”, but it raised further questions, including whether Zahawi negotiated the dispute while he was serving as chancellor.

He did not disclose the size of the settlement – reported to be an estimated £4.8m including a 30 per cent penalty – or confirm whether he paid a fine.

Cleverly denied any knowledge of the details when pressed during media ap“I don’t know more than is in his statement,” he said.

Asked whether Zahawi should reveal this information, the foreign secretary said: “People’s taxes are private matters. I know that as politicians we, quite rightly, are expected to have a higher level of disclosure than perhaps other people might do.”

Labour urges probe into BBC chair amid Johnson loan claims

PA REPORTERS

LABOUR has asked for an investigation into the appointment of the BBC chairman amid claims he helped Boris Johnson secure a loan – weeks before the then-Prime Minister recommended him for the role.

Shadow culture secretary Lucy Powell has written to the Commissioner for Public Appointments asking him to

Energy suppliers told to stop forcing customers onto prepayment meters

NICHOLAS EARL

NICHOLAS EARL

BUSINESS secretary Grant Shapps has told energy suppliers they must stop forcing vulnerable households to switch to prepayment meters.

In a letter to firms across the industry, Shapps warned he would “name and shame” suppliers who were doing “nowhere near enough” to help vulnerable customers amid

record energy bills.

However, the government will stop short of an outright ban due to concerns over a subsequent increase in bailiff action if firms are unable to opt for prepayment meters.

Alongside calling for suppliers to stop the practice of forced prepayment meter installations, Shapps is requesting the release of supplier data on the number of warrant

applications they have made to forcibly enter homes to install meters.

It comes amid reports huge batches of warrants are being approved in a matter of minutes as courts become overwhelmed with applications.

Energy minister Graham Stuart has asked to meet with energy firms next week, along with Energy UK, which represents the energy industry, regulator Ofgem and Citizens Advice.

investigate the process by which Richard Sharp got the job.

Labour has also written to the Parliamentary Commissioner for Standards calling for an investigation.

The Sunday Times reported Sharp was involved in arranging a guarantor on a loan of up to £800,000 for Johnson in 2020. Sharp said he had “simply connected” people. Johnson dismissed the reports as “rubbish”.

Barclay insists union talks ‘constructive’

AINE FOX

THE HEALTH secretary yesterday insisted he has had “constructive talks” with unions after one leader accused the government of not being an honest negotiating partner.

Steve Barclay said further strike action by ambulance workers this week is “hugely disappointing”.

Thousands of members of Unison, Unite and the GMB unions are set to walk out across England and Wales today as part of continued industrial action in the health service.

The government has been in talks with unions but Unite general secretary Sharon Graham said the issue at the heart of the problem –pay – has not been on the table.

Barclay yesterday issued a statement insisting he had had “constructive talks with unions about this coming year’s pay process for 2023/24”.

However, speaking to Sky yesterday, Graham said: “They’re not pay talks and this is the problem... There is not a problem about paying, we’re the fifth richest country in the world. There is something going on here. Otherwise they are at a level of incompetence not known because it’s unreal.”

05 MONDAY 23 JANUARY 2023 NEWS CITYAM.COM

Johnson pictured with Ukraine premier Zelensky on his visit to Ukraine yesterday

Business secretary Grant Shapps warned he would “name and shame” suppliers

PA PA

PA

Falling gas prices could slash the price of propping up Bulb Energy

biggest state bailout since the financial crisis in 2008.

THE BILL for propping up Bulb Energy for over a year could be slashed significantly, following a sharp drop in wholesale prices over the winter.

If gas prices remain low, the government could recoup hundreds of millions of pounds from the sale of Bulb to Octopus Energy.

This could eventually trickle down to billpayers –who are currently expected to shoulder the costs of the

Bulb has been forced to buy gas at spot prices, which has driven up the costs of its stint in de-facto nationalisation.

However, it has also benefitted from gas prices easing in recent weeks. Warmer winter weather and Europe’s successful scramble for supplies saw prices drop as low as £1.36 per therm last week on the UK benchmark.

This is well above pre-crisis levels

Chinese trade to boost copper prices in 2023

COPPER prices are set to boom this year, analysts have predicted, as China’s reopening looks set to drastically boost demand for the metal.

Forecasts have become increasingly optimistic, as the orange metal’s recent surge in price has been driven by an expected rebound of the Chinese economy moving away from its strict zero-Covid-19 policy and expectations of less aggressive fiscal policy from the US Federal Reserve.

Copper finished trading last week at $,9,305 per tonne for its threemonth trading price on the London Metal Exchange – down 0.19 per cent on the previous day, when it hit its six-month high of over $9,500 per tonne. Last summer, copper was trading at around $7,000 per tonne.

London-listed Chilean copper miner Antofagasta also posted a bullish outlook for the year last week, as it also expected demand to jump on China’s reopening.

Boris Mikanikrezai, head

research and strategy at Fastmarkets, told City A.M. that in 2023, “China and the Fed will become macro tailwinds” in contrast to being hurdles for any potential price rallies last year. “These factors together are expected to contribute to firmer copper prices.”

China is a significant player in the copper market, accounting for 42 per cent of the global refined output produced worldwide, and 55 per cent of its overall consumption.

of around 45-50p per therm but well below the £8.75 per therm peak recorded last summer.

Estimates for the total cost of Bulb’s bailout have varied wildly –with Downing Street setting an upper limit of £4.5bn while the Office for Budget Responsibility calculated a potential cost of £6.5bn.

The recent drop in energy prices could scythe up to £840m from the overall bill, according to estimates from officials shared with The Financial Times.

of metals

Mikanikrezai said that to ramp up economic growth, the Chinese government is “inclined to provide policy support to its property sector, which could further boost demand for copper”.

This outlook was shared by Ole Hansen, Saxo Bank’s head of commodity strategy, who argued that China’s reopening was the “main driver impacting the commodity sector.”

BP,

The

The

the

“hypocrites”

The

fuel giant has however failed

off its 19.75 per cent stake in Russia’s state-owned oil firm Rosneft,

Meanwhile, Pepsico has pledged a combined sum of $15m to Ukraine, despite continuing to sell products in Russia. In the case of Siemens, the Germany multinational has given $13m to Ukraine, but has refused to pull its medical device company from Russia. Mark Dixon, who founded the MRA following Russia’s invasion of Ukraine, said: “The companies who donate to Ukraine and stay in Russia are hypocrites.”

BP, Siemens and Pepsico were contacted.

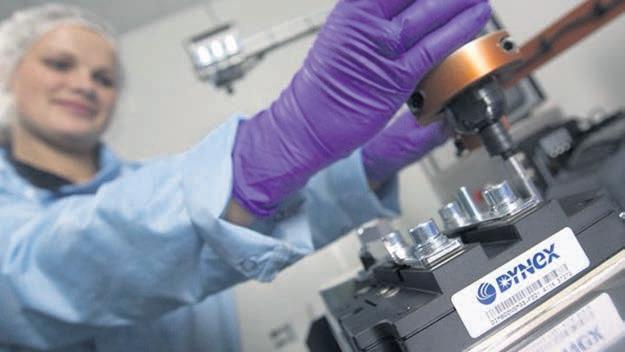

NICHOLAS EARL

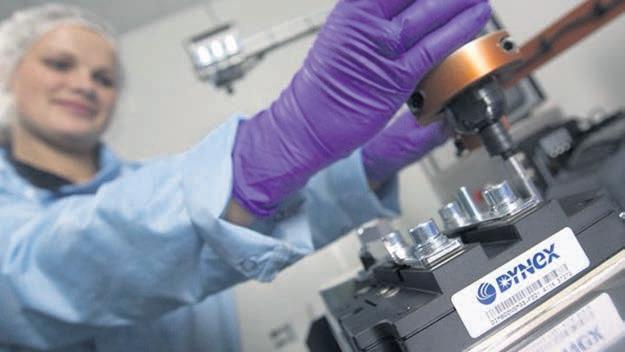

A BRITISH microchip-maker whose owner has alleged links to the Chinese military has reportedly been handed £3m in government support over the last decade.

Lincoln-based Dynex Semiconductor – a company ultimately owned by Beijing-headquartered CRRC

Corporation – has applied for and been given millions of pounds in research grants from the government, according to The Telegraph.

Most of the funds were awarded by the Innovate UK agency, which receives taxpayer cash.

It also secured multiple research contracts with UK universities to study new types of semiconductors for

electric vehicles, batteries and renewable power generation.

Dynex-owner CRRC is majority owned by the “Assets Supervision and Administration Commission”, an arm of the Chinese state, according to Chinese company filings analysed by Datenna and shared with The Telegraph. The UK government and Dynex were approached for comment.

CITYAM.COM 06 MONDAY 23 JANUARY 2023 NEWS

NICHOLAS EARL

Dynex’s technology includes high power semiconductors used in electric cars

SIEMENS and Pepsico have all donated millions to Ukraine while at the same time failing to fully exit Russia, new research shows.

three multinationals have been branded

and sit alongside 13 other top firms that have both given aid to Ukraine while also retaining their links to the Russian Federation.

research from the Moral Ratings Agency (MRA) shows 38 companies

wake of Russia’s invasion, including Tesco, Unilever and BP.

However, 16 of those firms that made donations have failed to properly cut ties with Russia following the start of the war in Ukraine. In BP’s case, the British oil major donated $20m to Ukraine in May 2022, including $10m in donations towards humanitarian organisations.

fossil

to actually sell

NICHOLAS EARL

government gives millions to

chip firm in Lincoln BP, Siemens and Pepsico branded hypocrites for business with Russia while donating to Ukraine

UK

China-backed

Hundred of millions of pounds could be recouped the sale of Bulb to Octopus

The surge has been driven by a rebound in the Chinese economy

Court to rule on location of Tuna Bonds hearing

LOUIS GOSS

BRITAIN’s top court will this week hear a long-running dispute between Mozambique and a Lebanese shipmaker over whether a case relating to the ‘Tuna Bonds’ should be heard in London’s courts.

The UK’s Supreme Court will decide whether the dispute between shipping company Privinvest and the Republic of Mozambique over the $2bn (£1.6bn) scandal should be heard in Britain’s courts.

Privinvest is seeking to have the case heard in the International Court of Arbitration in Paris, while Mozambique is calling for the case to be heard in London’s more transparent High Court. For Mozambique, having the case heard in Britain would offer it a better chance of exposing any wrongdoing to public scrutiny.

Mozambique has accused Privinvest of bribing officials to secure contracts from Mozambique’s government to

supply ships, aircraft, and infrastructure for use in policing the East African country’s waters. The African country had sought to use the ships and infrastructure to develop its coastline and marine resources, with a view to building a tuna fishing industry and exploiting its oil and gas resources.

Privinvest, which was approached by City A.M. for comment, denies any wrongdoing.

The ‘Tuna Bonds’ scandal saw three Mozambican state-owned companies take on more than $2bn of governmentbacked debt to pay for the Privinvest supply contracts.

An independent audit by Kroll later showed $500m worth of loans could not be accounted for and that Privinvest may have inflated its prices by more than $700m.

Mozambique’s former finance minister Manuel Change is accused by the country of illegally guaranteeing the sovereign-backed loans in secret, court documents show.

SAGA looks to sell off insurance business to pay off £721m debts

LOUIS GOSS

SAGA is reportedly seeking to sell its in-house insurance business in a bid to raise £90m to help pay down its huge £721m debt.

The London-listed company, which offers cruises, package holidays, insurance and financial services to the over-50s, is looking for buyers for its underwriting arm, according to The

Sunday Times.

Any sale of Saga’s underwriting business would see the firm continue to sell home and motor insurance products but instead transfer any risks over to another company. Proceeds from the sale would go towards paying off the huge debts Saga has accrued over the previous decade, particularly after its cruise and travel business was decimated by the pandemic.

Russell Group loosens hold on consulting firms

LOUIS GOSS

LOUIS GOSS

BRITISH consulting firms are no longer dominated by Russell Group university graduates, according to new research from the Management Consultancies Association (MCA).

Instead, the proportion of graduates from Russell Group universities – a group of 24 of the UK’s “leading” research universities, including Oxford and Cambridge –working in consultancies has more than halved over the previous decade, down from 73 per cent in 2011 to just 35 per cent in 2022, according to data from the MCA.

The research signals consulting firms are ditching their reputation as training grounds for elite university graduates and expanding the reach of their recruitment efforts.

In August last year, accountancy giant PwC got rid of rules requiring all new recruits on its graduate scheme to have achieved a minimum 2:1 in their degrees.

Santander this month also decided to end its requirement that graduates have a 2:1 degree or higher, arguing the shift would open the doors to “over 64,000 more graduates”.

FINANCIAL services companies that are structured as privately-owned partnerships have significantly fewer women in leadership positions than their publicly-listed rivals, new research shows.

Fewer than one-sixth (15.1 per cent) of partners in privately-owned finance firms are women, according to research from employment law

firm Fox & Partners.

By comparison, women account for 43 per cent of people sitting on the boards of the UK’s top listed banks, asset managers, fintech companies and insurance firms, recent EY research shows.

Catriona Watt, a partner at Fox & Partners, said the growing division comes as listed firms have faced pressure from investors to increase diversity, while privately owned firms

have not.

Britain’s partnerships have made shockingly little progress in promoting women over the past five years, despite long-standing sectorwide diversity drives.

The proportion of female partners in the UK’s privately-owned hedge funds and private equity funds has increased from just 14.7 per cent in 2019/20 to 14.8 per cent in 2020/21 and 15.1 per cent in 2021/22.

07 MONDAY 23 JANUARY 2023 NEWS CITYAM.COM

LOUIS GOSS

The British conglomerate offers cruises and package holidays to the over-50s

Fewer than one-sixth of partners in privately-owned finance firms are women

Privately-owned finance firms have fewer women in leadership positions compared to listed rivals

German minister says China split must be gradual

CITY A.M. AND AGENCIES

CITY A.M. AND AGENCIES

GERMANY must reduce its dependence on China gradually as decoupling from the Chinese market would costs jobs in Europe’s biggest economy, German finance minister Christian Lindner was quoted as saying yesterday.

Germany is working on a new China strategy that takes a more sober view of relations and aims to reduce dependence on Asia’s economic superpower, which has been the country’s top trading partner since 2016.

“Decoupling our economy from the Chinese market would not be in the interest of jobs in Germany,” Lindner was quoted as saying by the Welt am Sonntag newspaper.

He said that gradually other world regions and markets would have to become more important for German business over the coming years and

decades, Welt reported.

“The political conditions must be improved for this,” Lindner said.

CNBC reported that at Davos last week French finance minister Bruno Le Maire said that the European Union would not be sharing the USA’s confrontational approach to trade with the Asian giant.

“China cannot be out, China must be in. This is the difference of view we have between the US and Europe.”

“We don’t want to oppose China, we want to engage with China, we want China to obey by the same rules,” he said, “this is our policy.”

President Macron is said to be planning a trip to China in the coming weeks to discuss trade and energy cooperation as well as the ongoing war between Russia and Ukraine.

China was the third-largest partner for EU exports in 2021 and was the largest partner for imports.

Brazil and Argentina to begin planning for a common currency

JYOTI NARAYAN

JYOTI NARAYAN

BRAZIL and Argentina will announce this week that they are starting preparatory work on a common currency, the Financial Times reported yesterday.

The plan, set to be discussed at a summit in Buenos Aires, will focus on how a new currency which Brazil suggests calling the “sur” (south)

could boost regional trade and reduce reliance on the US dollar, the FT reported, citing officials.

“There will be a decision to start studying the parameters needed for a common currency, which includes everything from fiscal issues to the size of the economy and the role of central banks,” Argentina’s economy minister Sergio Massa told the Financial Times.

ECB set to raise rates in Feb and March by 50bp

BART MEIJER

BART MEIJER

THE EUROPEAN Central Bank (ECB) is set to raise interest rates by 50 basis points in both February and March and will continue to raise rates in the months after, ECB governing council member Klaas Knot said in an interview with Dutch broadcaster WNL yesterday.

“Expect us to raise rates by 0.5 per cent in February and March and expect us to not be done by then and that more steps will follow in May and June,” Knot said.

In a separate interview with Italian newspaper La Stampa published yesterday, Knot said it was “too early to tell” if the ECB could slow down the pace of its rate increases by the summer.

“At some point, of course, the risks surrounding the inflation outlook will become more balanced,” he said.

“That would also be a time in which we could make a further step down from 50 to 25 basis points, for instance. But we are still far away from that.” Reuters Reuters

CITYAM.COM 08 MONDAY 23 JANUARY 2023 NEWS

Reuters

The name of the new proposed currency is sur, which means south in Spanish

ENERGY

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his new weekly column

Another challenge for wind power is keeping turbines on in blundery conditions. Last month, National Grid forked out £82m to operators of wind farms to constrain supplies and reduce output in stormy weather, to prevent the energy network being overwhelmed. This is on top of £122m it has paid out over the first 11 months of 2022 – as part of £1.34bn it spent to manage supplies last year. Contrary to belief, wind turbines do not thrive in overly windy conditions.

Bentrepreneurs Orral Nadjari and Lars Carlstrom, who founded the battery start-up in 2019.

Neither had experience in electric vehicles (EVs), but both embraced the ‘go for growth’ approach of nascent technology businesses, amassing nearly £2bn in funding promises over just three years.

Its war chest included £100m from the government to help finance a £3.8bn gigafactory in Blyth, Northumberland – with Britishvolt aiming to produce hundreds of thousands of lithium-ion batteries every year, while supporting 8,000 jobs for a burgeoning British motor sector.

The company even secured memorandums of understanding with Aston Martin and Lotus last year to build batteries for their new EVs.

Currently, the UK has one Chinese-owned plant next to the Nissan factory in Sunderland, while 35 plants are planned or under construction within the European Union.

Meanwhile, China dominates the battery sector – which is home to six of the top 10 battery companies, and produces 77 per cent of total production capacity.

If the UK could become a mass producer of

hybrid car sales by 2035 and net zero carbon emissions by 2050.

NORTHERN DREAMS

Britishvolt’s factory could also have enlivened the North East’s flagging postindustrial economy, and also reduce the UK’s reliance on overseas partners to prop up its green ambitions

When it was in talks over funding for the gigafactory last July, former business secretary Kwasi Kwarteng argued the site would “turbocharge” the UK’s plans to “embed a globally competitive electric vehicle supply chain in the UK”. Once funding was unveiled last summer, thenPrime Minister Boris Johnson later described the gigafactory as “a strong testament to the skilled workers of the North East and the UK’s place at the helm of the global green industrial revolution”.

Fast forward seven months and Britishvolt has collapsed into administration – with the majority of its 232 staff losing their jobs.

Its fate contrasts sharply to

largest steel producer.

The Treasury is set to unveil a £300m aid package for the company, as first reported by Sky News, with strings attached concerning its carbon footprint and its Chinese owner Jingye Group investing £1bn over the current decade.

The money is expected to be used to replace British Steel's blast furnaces at its Scunthorpe site with a greener electric arc furnace. Nevertheless, this means Downing Street is effectively subsidising a Chinese company to continue steel production.

Considering the funding is to ensure the UK retains sovereignty over a strategic asset, this reflects a continued lack of coherence in the country’s industrial policies.

It is also, presumably, motivated by a desire to save 4,000 jobs in key Red Wall seats, with the Tories over 20 points behind in the polls.

recently by ultra-high energy prices eating into margins, while cheaper labour and subsidies have enabled China to flood global markets with its own steel supplies for decades. British Steel is not the only steel producer in trouble, as rival Tata Steel has also requested support from the government in the past year.

If Britishvolt’s collapse is raising questions around the UK’s viability as an EV powerhouse, then surely the same questions can be asked of the steel sector?

There is a perfectly fair argument that the government should not be supporting either, with businesses needing to be credible market players before expecting taxpayer support. Certainly, there is a case for reforming industry conditions to allow a raft of competitors to fight for market share, rather than picking winners.

But, if the government is going to back steel as a strategic asset, then the same case can certainly be made for Britishvolt.

If it only had sufficient resources to revive one industry, then selecting the beleaguered steel sector with a track record of failure over the potential future face of the green energy sector could be one Downing Street comes to regret.

£ The ravaging effects of inflation could soon be felt in the renewables sector, with Cornwall Insight predicting wind power could become more expensive with cagey investors fearful of driving down prices at the upcoming auction round for new developments in March. It fears higher prices for technology and supply chains essential for future wind projects, while the sluggish pace of REMA reform (separating gas prices and renewable prices from each other) means it expects backers of green projects to be more cautious than before. This is a grave concern for one of the UK’s real success stories in the sector.

The

energy editor Nicholas Earl at nicholas.earl@cityam.com

UK on track to hit target of 300,000 public electric car chargers by 2030

of demand for electric vehicles.

THE UK government is on track to hit its target of delivering 300,000 public electric vehicle chargers by 2030, a new report out today reveals.

A study by the transport organisation New Automotive shows the goal will be met despite the car industry’s scepticism over the strength

According to recent data from the Society of Motor Manufacturers and Traders, the transition towards electric vehicles has recently slowed down.

The number of electric cars sold increased by 20.7 per cent last year, down from the 74 per cent growth registered the previous year.

“This more steady, less rapid growth

has affected the domestic charging industry, which feels the effect of slower growth first, through a decrease in demand for home charging units,” the report said.

Other barriers to growth include a lack of support from local authorities, supply chain pressures and grid connection issues, such as securing planning consent and wayleave.

transition towards electric cars has recently slowed down

ILARIA GRASSO MACOLA

US YOUR

SEND

THOUGHTS

What can we do to improve energy security? Email

11 MONDAY 23 JANUARY 2023 NEWS CITYAM.COM How we reported on Britishvolt’s collapse VOLT FARCE Lo Ex law ISSUE 3,918 OR UNITED P20 NICHOLAS vehiclebattery Britishvolt collapsedinto administration, almost300jobs puttinginjeopardy hopesof building automotiveindustry. Themuch-hyped filedfor administrationyesterday boardreportedlyultimatelydecided werenoviable keepthe companyafloat. Thefuture hasbeen doubt months,afteritfailed securefurthergovernmentfundslast buildits£3.8bngigafactory Northumberland. askedfor £30m promised£100m announced government, DowningStreet because Britishvolt failed hit milestones factorynormet fundingmilestones. businesssecretaryJonathanReynoldslaidtheblameatth government’s dismissing industrialstrategy “failure”. warnedtheUKwas the globalrace electricvehiclebattery manufacturing, world- famous industryatrisk”. Britishvolt’scollapsereflects graceforthe whichwas set todeliver site sustainable batteries UK’smotor MichaelNaylorindustry. saddened Britishvolt’scollapse. CityA.M. from the electricvehiclesupply being disconnected underinvested. showsthatgovernment private capital toworktogether integrate thesupply UKcarindustry protectedand keyrole the transition vehicles.” EYhasbeenappointedjoint MUCH-HYPED ELECTRIC VEHICLE BATTERY FIRM GOES INTO ADMINISTRATION Metal annou high-p young general set up the LME decision trading That subject o Wyman, England Conduct reviewing the hee Huey Evan who seeking reoverseen leg UK ALLOWS VOLT TO DIE YET SAVES STEEL £82M

IT’S WINDY PLEASE

NOT WHEN

INFLATION HITS WIND POWER

2ND MARCH 2023 THE GUILDHALL THE CITY’S MOST HOTLY-ANTICIPATED AWARDS EVENING - AND AFTERPARTY - IS BACK FOR 2023 VISIT: cityam.com/awards-2023 FOR TABLES AND TICKETS: Please contact Darren.rebeiro@cityam.com NOMINATIONS FOR THE BEST OF THE BEST ARE OPEN NOW - GET YOUR ENTRY IN SOON IN PARTNERSHIP WITH OUR SPONSORS

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

Recession signals to flare up in fresh PMI as borrowing to hit £18bn

INVESTORS this week will be eyeing fresh surveys for more clues on whether the UK economy has slipped into recession.

London’s premier FTSE 100 index’s strong start to 2023 came off the boil slightly last week, shedding nearly one per cent to close at 7,770.59 points, while its mid-cap domestically-focused peer the FTSE 250 dropped 1.25 per cent to 19,702.63 points.

Top of traders’ minds this week will be a new purchasing managers’ index (PMI) on Tuesday, with most expecting activity to have inched up marginally in December after businesses and consumers passed “peak pessimism” in the early winter, Sanjay Raja, senior economist at Deutsche Bank, said.

The consensus forecast is for the services index to have nudged closer to the

50 point mark that separates growth and contraction. The manufacturing industry will fare worse with its index still firmly below the threshold.

The Office for National Statistics will on the same day issue its monthly government borrowing estimates, the penultimate check in before the 15 March budget.

Pegging consumers’ energy bills at £2,500 to help shield them from the cost of living crisis is likely to have kept the gap between the government’s tax revenues and spending wide.

A weakening UK economy caused by inflation surging to a 40year high is also squeezing the government’s tax revenues. A stronger than expected November GDP print of 0.1 per cent growth means the UK may have narrowly escaped a recession at the tail end of 2022.

While underlying banking and asset management divisions were broadly in line with Peel Hunt expectations, there was poor news from Novitas loans and Winterflood. The merchant banker set aside £90m for Novitas loans, much higher than expected. Winterflood has continued to be impacted by slowdown in trading activity too. The analysts rate it an ‘add’ with a target price of 1,264p.

COST OF LIVING DEFICIT WOES

JACK BARNETT, ECONOMICS EDITOR

13 MONDAY 23 JANUARY 2023 MARKETS CITYAM.COM

P 20Jan 937.50 16 Jan 20 Jan 18 Jan CLOSE BROTHERS 900 19 Jan 17 Jan 1,100 1,050 1,000 950

The Works’ first half loss was in line with expectations but Peel Hunt analysts described the trading update as a ‘curate’s egg’. In-store sales remained strong but online was down 14 per cent meaning group sales was down six per cent in total. Nevertheless, the company is making “decent progress” and the share price is “overly harsh”. The analysts rate it a ‘buy’ with a target price of 75.0p. To appear in Best of the Brokers, email your research to notes@cityam.com P 16 Jan 20 Jan 18 Jan THE WORKS.CO.UK 20 Jan 34.2 19 Jan 17 Jan 46.00 44.00 42.00 40.00 34.00 36.00 38.00

CITY DASHBOARD

“The 15 March budget preamble started in earnest last week and is likely to gather pace after new government borrowing figures tomorrow set out the health of the UK’s finances. The cost of living support is almost certain to make last month’s deficit one of the biggest ever for December.”

GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION IT’S FINALLY HERE RIVALRIES RENEWED AS THE SIX NATIONS RETURNS FOR 2022 8-PAGE PULLOUT 2022 SIX NATIONS ENERGY D-DAY Households LONDON’S BUSINESS NEWSPAPER FREE CITYAM.COM THURSDAY 10 FEBRUARY 2022 CITYAM.COM COOL RUNNINGS ALL THE GEAR FOR AN OVERDUE MOUNTAIN BREAK P20 STATE SET MAN IN THE KNOW MARK KLEINMAN GETS THE CITY TALKING P13 LONDON’S BUSINESS NEWSPAPER LONDON’S BUSINESS NEWSPAPER CITYAM.COM Climate noise blocking out THROUGH THE DRINKING GLASS THE LATEST FROM OUR WINE GURU P22--ISASUNWR – WHERE T PUT MONEYTHIS YEAR WEDNESDAY FEBRUARY 2022 ISSUE 3,677 THE ULTIMATE SAVINGS GUIDE ALL YOU NEED TO KNOW ABOUT YOUR ISA P19-21

The deja vu of Nicola Sturgeon shaking her fists at

in the courts

Eliot Wilson

chances of a successful judicial review were “very low”.

WE HAVE been here before.

Nicola Sturgeon, the UK Supreme Court, bloated appeals to “the will of the people”, a sheepish lord advocate: yes, it could be last November’s one-sided clash over the competence of the Scottish Parliament (or lack of it) to hold a referendum on breaking up the United Kingdom. This time, however, it is another part of the Scotland Act 1998 in the spotlight.

The Scottish government’s Gender Recognition Reform (Scotland) Bill, which the Holyrood parliament passed just before Christmas, had always promised to be controversial. Essentially, the bill would make it easier to obtain a gender recognition certificate in Scotland, lowering the age at which people can change their legal gender from 18 to 16, removing the requirement of a medical diagnosis of gender dysphoria and reducing the waiting time from two years to six months of living in an acquired gender.

Last week, the Secretary for Scotland, Alister Jack, announced that he would invoke section 35 of the Scotland Act to deny the bill Royal Assent. This provision can block the passage of a legally competent bill if the UK government believes it would affect matters of reserved competence, in this case

the Equality Act 2010. This is the first time that section 35 has been used, though it has been a provision of the devolution settlement for a quarter of a century.

With weary predictability, the first minister, Nicola Sturgeon, has reacted with affront-to-democracy fury. She has accused Whitehall of a “fullfrontal attack on our democraticallyelected Scottish Parliament and its ability to make its own decisions on devolved matters”, and vowed that the matter will “inevitably” end up in court. This means that the Scottish government would have to seek judicial review of the use of section 35, dependent on leave from the High Court

of Justice, and the logical conclusion is that the case may well end up in front of the Supreme Court.

Jack justified the use of section 35 on the basis the bill would create two parallel but distinct regimes within the UK under which gender recognition certificates could be issued and interpreted. This, he said, would increase the potential for the fraudulent issuing of the certificates with an impact on safeguarding of women and girls, and would have a direct effect on the definition of sex, a protected characteristic under the Equality Act.

It would take a charitable attitude to argue that the Scottish government

has engaged with the legal minutiae of the argument. The minister responsible, Shona Robison, a close ally of the first minister, has simply affirmed “This is legislation that is completely devolved, it is within the competence of the Scottish Parliament”. But the competence of Holyrood is not in dispute; section 35 allows the secretary of state to strike down competent legislation on grounds of incompatibility with other, reserved matters.

The auguries are not good for the Scottish government. A former deputy president of the Supreme Court, Lord Hope of Craighead, said last week that the Scotland Office’s statement of reasons was “devastating” and that the

There is a clash of motivation here. As with the referendum case in November, the SNP knows its legal case is shiveringly weak. In the case of the referendum bill, the lord advocate, Dorothy Bain KC, could not declare that it was within the competence of Holyrood and so could only refer the issue to the Supreme Court. Her expression when arguing in front of the justices spoke volumes about the strength of the case.

This is a wholly political strategy. The first minister wants to pit the legal proprieties of the devolution settlement against a notion of popular sovereignty, and portray the ‘Westminster Establishment’ as acting to frustrate the will of the Scottish people. It is a high risk move, with a majority of Scots opposing a relaxation of rules for gender recognition, but it is also unclear why the UK government decided to pick this particular fight, on this particular bit of legislation.

The Scottish government wants to make this a fight about independence. Certainly, when your only tool is a hammer, everything looks like a nail. But legally this challenge is likely to fail, and it is far from clear that the verdict of the court of public opinion will be favourable either. It does not require an overactive sense of mischief to observe that a Florida court has just fined former US president Donald Trump $1 million for bringing legal cases “intended for a political purpose”.

£ Eliot Wilson is co-founder of Pivot Point and a columnist at City A.M.

Westminster might quarrel with Scotland, but the City and Edinburgh get on just fine

ON Wednesday, people across the country but particularly in Scotland will be celebrating Burns Night. It comes at a time when the future of the union is under close scrutiny. Despite political tensions in Westminster and Holyrood, the City’s partnership north of the border remains strong.

Financial services in Scotland have a long and proud history, from the very origins of banking and marine insurance through to the modern, full-service sector you see today in Edinburgh, Glasgow, and other centres.

A recent report by TheCityUK found that there are 145,000 financial and professional services jobs in Scotland, £690bn of assets under management, and the sector contributes nearly ten per cent of gross value added to Scotland’s economy.

Such figures underpin the fact that even though the City of London is synonymous with financial and professional services, two-thirds of the 2.3 million people employed in the sector

Chris Hayward

ingham, Edinburgh to Leeds – by building awareness of how London can act as a springboard for regional firms to export their products and services across the globe.

are outside London. It was significant in this regard that the chancellor chose to launch his flagship reforms to financial regulation last month in Edinburgh. The sector is a national asset as well as a local one.

We should embrace these close ties and look to work together on the shared challenges we face.

The City Corporation has long recognised the immense value of Scotland’s contribution to the entire United Kingdom’s position as a leading global financial and professional services centre. Our domestic strategy is helping to increase inward investment across the UK – from Belfast to Birm-

The City’s relationship with our Scottish counterparts is at the heart of this strategy. Scotland has an exceptional record at attracting foreign direct investment, and its strengths in sectors like asset management and banking are globally recognised.

There are also meaningful opportunities for the sector to sit at the vanguard of change: in transitioning to net zero; in skills, the wider talent pipeline and social mobility; and as an enabler of the wider economy which it does so much to enable and support.

Green finance and delivering a just transition are areas where the Scottish financial cluster has a huge role to play, building on the legacy of Cop26 in Glasgow. Scotland’s National Strategy for Economic Transformation, Green Investment Portfolio, and the net zero mission of the Scottish National Invest-

ment Bank are all designed to help mobilise the public and private sector towards driving this transition.

Alongside London and the rest of the United Kingdom, Scotland is creating the right environment for a greener finance sector, and it is up to all of us to help to support that mission.

I will be meeting with Scotland’s First Minister, Nicola Sturgeon, in Edinburgh to discuss sustainable finance and tackle other shared challenges later this week.

Together, the City and Scotland’s complementary offers help us to remain competitive in this challenging global economic outlook.

The City and Scotland must look forward to new frontiers in our partnership, as well as reflecting on our shared history. To draw on one of the most famous poems by Scotland’s bard, Robert Burns, old acquaintance should never be forgotten.

£ Chris Hayward is Policy Chair of the City of London Corporation

CITYAM.COM 14 MONDAY 23 JANUARY 2023 OPINION

EDITED BY SASCHA O’SULLIVAN

OPINION

Westminster

Nicola Sturgeon’s new gender laws were overruled by the UK government

THE POLITICAL FIGHT OF THE CENTURY We’re looking forward to Lee Anderson, the controversial MP for Ashfield, and antiBrexit protestor Steve Bray ‘take it outside’ after the Tory challenged him to a boxing match to settle their differences Anderson provoked Bray by stealing his hat.

LETTERS TO THE EDITOR

Tech’s climate challenge

[Re: UK risks missing out on ‘growth opportunity of the century’ due to climate action delays as it falls behind in ‘net-zero race’, Jan 14th]

Nicholas Earl’s recent article paints a rightly bleak picture of the conclusions from Chris Skidmore’s report, driving home the message that the UK government’s current commitment to green innovation is insufficient if we want to meet the 2050 net-zero emissions target.

However, what is missing in Earl’s article is a sense of the urgency of the situation. It’s time we think bigger and prioritise the radical solutions designed to make an immediate impact. We can no longer afford to ignore the climate crisis.

The tech industry faces critical sustainability challenges that often go forgotten. Datacentres, for example, are currently projected to generate 1.8 gigatonnes of CO2 and use 8 per cent of global electricity by 2030. The UK is leading the charge to tackle this problem, with companies like Heata even looking at solutions that re-use waste heat from datacentres to provide free hot water in people’s homes.

If we hope to build a better future, we must be ambitious in our innovation and devise solutions that resolve our problems in new and creative ways. What’s needed now is more organisations taking the plunge and backing sustainable ideas. If we hope to make net-zero a reality, we cannot be afraid to walk untrodden paths. We must be confident in UK tech and use it to stride into a greener future.

Mark Boost Civo

Britain needs to run in circles, at least when we buy new clothes and other goods

Elena Siniscalco

In case you didn’t know there were Antipodeans running these pages, we’ve been keeping a close eye on London sunrise and sunset times. From today, the sun will set at 4.33pm, marking an extra half hour of sunlight from January 1.

EXPLAINER-IN-BRIEF: ANOTHER DEADLINE FOR NORTHERN IRELAND

There are six weeks left to find a solution for the political stalemate in Northern Ireland; after that, the government is technically obliged to call a snap election on the 5th of March. The Northern Ireland secretary Chris Heaton-Harris has however said he’ll “use the next few weeks to carefully assess all options”. He might decide to delay the ballot as he’s done before.

The Democratic Unionist Party refused to enter the power sharing agreement at Stormont over the handling of the

Northern Ireland Protocol that defines post-Brexit trade relationships. The DUP won’t end the stalemate until a deal on the protocol is reached. The Stormont boycott meant the normal functioning of politics in Northern Ireland was impossible - and still is. Deputy premier Micheal Martin has said the people of Northern Ireland deserve a functioning assembly and the DUP should go back to Stormont regardless of whether the UK and the EU reach a deal on the Protocol.

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900 Email: news@cityam.com

Certified Distribution from 30/5/2022 till 01/07/2022 is 79,855

IT MIGHT not make a dent in the cost-of-living crisis, but soon people will be able to get a small cash sum for every plastic bottle they recycle. The scheme, lauded by environmental campaigners, was finally approved last Friday.

A rare slice of positive news, however, was overshadowed by a familiar problem in this Broken Britain we’re living in: delays. Michael Gove first suggested the scheme five years ago. It also broke a manifesto pledge of including glass bottles in the recycling effort.

Countries that already have glass and plastic bottles return schemes - like Norway or Germany - have far better recycling rates than us, according to Sarah Webster, director of sustainability at Britvic. A bottle for a coin is one of the most basic examples of how a circular economy works. Yet eightyseven per cent of British adults don’t know what the circular economy is, according to a survey commissioned by YoungPlanet.

Moving to a circular economy would mean shaking up the way we consume, going from a linear model in which objects are produced, used and then thrown away, to a circular one based on repair and re-use. This reduces emissions, waste generation and the exploitation of natural resources. This model makes sense not only because it’s more sustainable, but also based on economic value. Between 2014 and 2019 it created 90,000 new jobs in the UK, according to Green Alliance. On top of that, circularity “builds economic security, as there is less reliance on imports from other countries”, says Heather Plumpton, policy analyst at Green Alliance. It could have a huge impact on industries like electronics, where we’re still addicted to the Chinese supply chain.

It might sound complicated but it’s not. We already entered the circular economy without knowing it. We’re doing it when we buy second-hand clothes in a vintage shop. They’re doing it in Prague, where you can bring back glass beer bottles to the pub in exchange for a euro - another example of successful deposit return schemes.

Circular models are linked to emissions targets. Emissions reporting - especially scope 3, the indirect emissions in a company’s value chain - drives the

supply of, and demand for, circular goods and services. Through reporting, companies see how much they cut on the causes of scope 3 emissions - like waste disposal - by embracing circular practices.

This progress can begin with voluntary disclosure, but “ultimately will require that governments provide structure for greenhouse gas emissions reporting”, says Dan Esty, Hillhouse Professor at Yale University. This is the main issue: scope 3 emission reporting is not compulsory.

There is growing demand from stakeholders through international organisations, according to Philippe Pernstich from carbon-reporting startup Minimum. Yet it is naive to think that companies of all sizes will do serious scope 3 emissions reporting without being compelled to do so.

The UK is one of the leading countries when it comes to scope 3 emissions, but that’s only because the bar is set so low. And we are lagging on initiatives which rely on a circular econ-

omy, far behind Belgium, the Netherlands and Scandi countries.

This is partially because the UK “has a culture of ownership rather than usership”, says Anthony Burns, chief operating officer at ACS Clothing, a company enabling brands to rent and re-sell second-hand clothes. But the biggest reason is the lack of incentives. Many companies don’t yet have the data and expertise to calculate their scope 3 emissions. They don’t have the language and the numbers to sell the idea to their audience.

This can all change. Consumers can step away from the throw-away economy. It’s a no-brainer economically too, as reused products are almost invariably cheaper. For companies, solutions like scrapping the value-added tax on sustainable fashion would accelerate change.

This transition is already underway. All stakeholders - from consumers to investors and the government - would be better off riding the wave rather than chasing it when it’s too late.

Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com

Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions

Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP

Editorial Editor Andy Silvester | News Editor Ben Lucas

Comment & Features Editor Sascha O’Sullivan

15 MONDAY 23 JANUARY 2023 OPINION CITYAM.COM

Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Commercial Sales Director Jeremy Slattery

WE WANT TO

YOUR

› E: opinion@cityam.com

HEAR

VIEWS

COMMENT AT: cityam.com/opinion

Michael Gove announced plans for cash-back recyclying of plastic bottles

HUGE NEWS Today the dark will recede a bit further with a 4.30pm sunset

TRAVEL

As the legendary train goes to the French Alps for the first time, Adam Bloodworth has the ultimate 1920s experience

The train is careering through the darkened outskirts of Paris when oysters are placed at my table to pair with my last glug of champagne. I’m eating from an embroidered armchair more accurately described as a throne. Someone presents another dish prepared by the Michelin starred French chef Jean Imbert, the current wonderkid of Parisian dining, and we raise a toast as the train sways past the high rises and out into the depths of the vast French countryside.

It’s a hostile winter evening, the type of jet black I can’t see through even when I cup my hands to the train windows, but the outside doesn’t matter: within these hallowed century-old metal walls, the world’s greatest immersive theatre show has just raised its curtain. It’s dinner time and we’re starting on truffle chicken and beaujolais as a guitarist in a dinner jacket takes a pew next to us. A saxophonist and a male baritone singing in a tux rock up too and put on one hell of a show in the few feet of space between tables.

Society types call it “The Train.” The ‘Venice Simplon-Orient Express' sounds ostentatious, plus there’s just something ridiculous and fun about referring to something so special in a banal way, like calling Claridge’s “a bed for the night”.

It was a historic journey, the first time the Grand Dame of rail travel had traversed to the French Alps from the capital city. The one-night journey is on sale now for trips departing from this December.

Back on board, it’s past mealtime and in another carriage mixologists in white dinner jackets are performing the second act. The bar is tiny but they put on the most spectacular display as they shake cocktails at a speed as fast as the train moves. To make the most of the space, the bar people’s limbs seem to move robotically, knowing every inch of the counter and how to exploit it without taking up too much room. They don’t break a sweat, but the pressure is on: a queue cannot form as there is no room. When someone passes through the bar carriage you do your best lizard impression, squeezing against the wall with arms up high to let others pass. It’s quite something, especially with everyone dressed in their finery. There’s a menu but I just ask for a dry gin cocktail to see what happens. Something exquisite turns up.

We’d been hurtling along at an unnervingly fast pace for a hundred-year-old train, but as I retire to the depths of the royal blue armchairs in the bar car, we reach Dijon and slow to a stop. The image of train travel in our heads, certainly if you haven’t done much, is of perpetual motion, but the reality is more stop and start. “Think of her like an old lady,” one worker tells me. What did he mean? The Venice-Simplon Orient Express is so old that it needs to take continual rests so the strain of motion doesn’t cause the engine and carriages too much decay.

Carriages were constructed from the mid1920s and go through a painstaking annual refurbishment. Wood panneling in sleeping cabins is re-varnished and measured to the milimetre. Once the wood gets too thin, it’s replaced, but most of the fixtures on the train are original. Carriage 3309 bookends the train. It is the actual carriage that in 1929 got marooned in a snowstorm outside Istanbul. Agatha

PARIS TO THE SNOWY ALPS ON THE VENICE SIMPLONORIENT-EXPRESS

THE TRAVEL HACK

Take a decent pair of headphones on the train when you travel, as the century-old cabins aren’t sound proof and noise can be heard if your neighbours rise earlier than you

Christie took the train and heard about the incident which inspired a novel you might have heard of: Murder On The Orient Express. It’s totally surreal wandering through that carriage, not only because of the obvious history, but because of its modern use. It is the only carriage that has been gutted and redesigned to suit a modern audience. Three suites now fill the entire length of the carriage. They are Prague, Vienna and Budapest - all destinations of the train - and for the forthcoming Paris to Courchevel trip, rates start from around £15,000 per night. Inside they are resplendent, each with its own antique sofa to watch the view as low-lying hills turn into mountains the following morning when the train reaches the foothills of the Alps.

I’m awakened by acceleration in the morning, when rays of sunlight threaten the safety of the darkness of my cabin, pro-

tecting me from my encroaching hangover. I’d not been in bed long. The dry gin cocktails had kept flowing, and some friends had been singing beside the piano until halfway through the night. “No one goes on the train to sleep,” train manager Pascale tells me with a provocative smile when

I tell him about my night at brunch.

But first I raise my cabin shutter while lying in bed, appreciating the calmly repetitive sound of the rails on the track, observing the forests, lakes and towns we go by.

It’s a welcome opposition to the human clatter of the night that had been, back when we were sinking martinis like they like they were going out of fashion.

There is one toilet per carriage on the train as there always had been. Patrons romanticise that its carriage structures have remained exactly as they were last century rather than pandering to new trends. Soon, the safety of my hangover duvet is no more: it has been removed, my bed transformed back into a sofa, the plush cushions plumped. In front of me, a small wardrobe and washing basin - again, from the eracan both be touched from the sofa. At 6 foot 2, I’m too tall for the bed, but as Pascale says, who comes on here to sleep?

Staff evoke the romance of the Roaring Twenties. As well as making great drinks, they’re actors recreating the past

CITYAM.COM 16 MONDAY 23 JANUARY 2023 LIFE&STYLE

Soon I’m dressed again for brunch in the unfathomably gorgeous dining carriage watching the mountains rush by. There’s snow, and we’re careering towards Alpine towns replete with their ski chalets and powdery slopes without the stress of an airport polluting my thoughts. There was a seafood soup, brilliant pasta, more wine, more champagne, more genial banter. It was sublime to dine during the daytime. In the evening the carriage itself was the artwork, but this morning the windows frame the natural world outside.

At its essence, the Venice Simplon Orient Express is really 1920s cosplay, with the staff and guests dressed to evoke the romance of The Roaring Twenties. Everything’s highly performative, the bar staff aware that as well as crafting a crushable Manhattan, they’re also on duty as actors of a sort. It’s a thought to ponder on that no one takes the train for travel purposes

anymore; there are simply easier ways of getting from A to B. So if the trip hasn’t changed physically, the most profound way it has adapted is going from a practical travel experience to a touristic one. That, of course, changes the vibe on board. It does feel like a show is being put on and after a while, the novelty might wear off, but for a special few evenings, or the ultimate five-day trip to Istanbul, it’s exactly the bucket list experience you hope for. What everyone’s parents dream of doing but most never do.

Private shuttles were organised by the train and soon I had arrived in Courchevel 1850. I had a fresh glass of sparkling waiting for me at the Hôtel Barrière Les Neiges. There, where I could ski in and ski out, I became a part of the picture-postcard snowsports scene synonymous with the area. When I wasn’t skiing, I was in the outdoor hot tub surrounded by snow, peering at the mountains beyond.

The hotel is one of a prestigious line of properties on the fringes of the slopes in Courchevel, next door to the Aman. On the Les Neiges terrace, guests sunbathed as they watched relatives ski past. I had eschewed the pomp of the Aman for something more cosy, as the Les Neiges touts an Alpine-chic vibe, with gorgeous thick warm throws in the rooms and a winter cabin feel throughout, the rooms with impressive mountain and ski views.