MANAGEMENT gurus, CEOs and Square Mile workers all slammed a nanny state call by the nation’s top food regulator to ban cake from the office.

Professor Susan Jebb said bringing in a tasty treat to share with colleagues didn’t create a “supportive environment” for people to cut down on food –and extraordinarily compared it to passive smoking in an interview with The Times.

Leadership expert Ann Francke, the chief exec of the Chartered Management

NEW ORLEANS TO ANGEL PAUL MESCAL’S STREETCAR A STEAMY SUCCESS P20

THE BANK of England could begin to cut interest rates as soon as early next year if inflation continues to tumble in 2023, top City analysts have predicted.

The rate of price increases is forecast to more than halve, which

Institute, said “sharing office snacks is a great way to come together as a team”.

“Subjecting team snacks to some sort of food regulator certainly won’t solve any of the core challenges facing UK businesses,” she continued.

One high-flying City legal boss told City A.M. that comparing the supply of a Victoria sponge to lighting up a Marlboro Gold was “utter tosh”.

Euan Blair, City A.M.’s entrepreneur of the year in 2022 and boss of apprenticeship firm Multiverse, said “there are hundreds and thousands of

ways to show your appreciation to a hardworking team, but we shouldn’t batter companies that indulge in the odd sweet treat.”

City workers in Leadenhall Market were in agreement yesterday.

Steph, who works in insurance, said it was “absolute nonsense”.

And Luciana, who works in the shipping industry, described the comments as “political correctness gone mad”.

“It’s one of the few joys in life –like having a few pints at lunchtime,” she told City A.M. yesterday.

would bring inflation to below five per cent by the end of 2023, according to forecasts from the Bank and budget watchdog the Office for Budget Responsibility.

Any such drop would release the upward pressure on rates.

Figures from the Office for National Statistics (ONS) showed

that inflation in December fell for the second month in a row to 10.5 per cent in December from 10.7 per cent.

Analysts said core inflation is on track to slide quickly in 2023, opening the door for governor Andrew Bailey and the rest of the Monetary Policy Committee (MPC)

to drop borrowing costs.

“With imported goods prices set to fall back, labour market slack likely to build, energy inflation having peaked and profit margins under pressure, we think core CPI inflation will be within touching distance of two per cent by the end of this year,” Samuel Tombs, chief

said.

“If so, the MPC’s fears about ingrained high inflation should fade as 2023 progresses, bringing rate cuts into play in early 2024,” he added.

INSIDE WINDFALL TAX COSTING JOBS, SAYS ENERGY FIRM P4 ADVERTISERS FLEE TWITTER P6 TUBE FARE HIKES P10 ‘PIG BUTCHERING’ CRYPTO SCAM P12 OPINION P16 LONDON’S BUSINESS NEWSPAPER THURSDAY 19 JANUARY 2023 ISSUE 3,919 FREE CITYAM.COM

JACK BARNETT

UK economist at Pantheon Macroeconomics,

£ CONTINUED ON PAGE 2

JAMES DAVIES AND STAFF

LET THEM EAT CAKE! WIN TODAY What goes up must come down: Analysts suggest rate cuts could come in 2024 WE HAVE TEAMED UP WITH LONDON'S AWARD-WINNING BAKERY CUTTER & SQUIDGE TO DELIVER NOT ONE, NOT TWO BUT THREE CAKES TO DESERVING OFFICES IN THE SQUARE MILE THIS AFTERNOON. JUST TWEET @CITYAM WHY YOU OR YOUR COLLEAGUES DESERVE A SWEET TREAT –AND CUTTER & SQUIDGE WILL DELIVER TO OUR WINNERS BY MID-AFTERNOON... HOW’S THAT FOR A ‘SUPPORTIVE ENVIRONMENT’? CITY JOINS CRITICISM OF FOOD REGULATOR’S CALL TO BAN SWEET TREATS FROM THE WORKPLACE TAPPING OUT WHAT A WRESTLING TURF WAR CAN TELL US ABOUT DUAL-CLASS SHARES P16

STANDING UP FOR THE CITY

Much of the blame for ‘Khan’s tax hikes’ lies at Whitehall’s door

SADIQ Khan is unlikely to be flavour of the month in too many London households this morning. Yesterday he announced a combination of topup charges to Council Tax and an across-the-board increase in transport costs across London. The London Conservatives are, unsurprisingly, up in arms. But much of the blame lies not at City Hall’s door, but in Whitehall. A potted history: Transport for London, pre-pandemic, was heading for financial

THE CITY VIEW

sustainability. This was important, as it was almost uniquely amongst global cities reliant on farebox revenues as opposed to central or local funding to keep moving. Once Covid-19 struck and the government introduced draconian lockdowns –which we

can now assume were too harsh and lasted too long, particularly the second iteration –those fares collapsed, but TfL had to keep much of the service running. This created a financial black hole of a not insignificant size. Sadiq Khan had little option but to go cap in hand to central government –where he was told to come back with a series of efficiency savings on the transport network. The Department for Transport gave London not one but four

emergency bailouts before it gave the capital a longer-term funding plan, but one that required fares to increase at the same rate as national train fares (a government decision) as well as £500m-worth of additional revenues or savings. The Mayor could and should have been more constructive with Whitehall, and bitten his tongue on the many occasions Boris drew him into a media spat. But how’s this for a counterfactual. What if the government had given TfL a lump

sum, no strings attached, sufficient to fill the funding vacuum caused by lockdown –recognising that a global city and the (only) engine of the UK economy needs a working transport system. It could even, frankly, have been a decades-long loan. Instead, the government and City Hall bickered for years –and the ‘long-term’ settlement finally reached only lasts for three years. Londoners will feel the pain of a failure of government.

Inflation figures suggest core inflation may be heading down –with a caveat

The slowdown was mainly driven by international energy prices collapsing after they surged to record highs following Russia’s invasion of Ukraine, a trend that is expected to continue throughout this year.

Gas prices are now lower than they were before the Russian president Vladimir Putin launched the assault on his neighbour.

Despite the fall, inflation is still running at more than five times

the Bank’s two per cent target.

Core inflation – a more accurate measure of underlying price pressures – held steady at 6.3 per cent, raising concern over an inflationary feedback loop setting in.

In theory, raising interest rates sucks demand out of an economy by making it more attractive for consumers to save and more expensive for businesses to borrow.

James Smith, developed markets economist at Dutch bank

ING, agreed with Tombs, forecasting the MPC will begin reducing borrowing costs “in the first quarter of next year”, but added cuts “could feasibly be a bit later than that” due to the risk of the UK suffering sticky inflation stemming from both a squeezed jobs market and exposure to high energy prices.

The Bank will announce its next rate decision on 2 February and investors are split over whether to back a 25 basis point or 50 basis point hike.

The latter would send borrowing costs to four per cent, a post-financial crisis high and mark the tenth successive increase.

LAST year’s inflation surge was bad. Very bad. According to the Office for National Statistics’s modelled consumer price index (CPI) going back to the 1950s, on a calendar year basis, 2022 was the worst inflation surge the UK has experienced since 1981.

There are signs that inflation will steadily decline in the coming year, mainly due to international energy prices retreating fast, but could also stick around over the long term.

Yes, headline CPI is down for the second month in a row (the first time since the early stages of the pandemic), but core inflation –what the Bank of England worries about –remaining unchanged at over six per cent isn’t good.

Higher fixed costs, like wages,

THE TELEGRAPH

OFFERS

FOR FLIGHT ATTENDANT

Netflix is hiring a flight attendant to look after senior management on one of its corporate planes, barely a year after axing hundreds of staff. The Californian tech company has offered to pay a salary up to $385,000 (£321,000).

THE GUARDIAN

ALDI INCREASES

PAY FOR THIRD TIME IN A YEAR

Aldi is increasing pay for UK warehouse workers for the third time in a year. The latest increase for warehouse workers comes after Aldi upped pay for store staff last month to at least £11 an hour – also the third increase in a year.

FINANCIAL TIMES

CHINA TO LAUNCH STATEOWNED RIDE-HAILING APP China is launching a state-owned ridehailing platform initially targeting Communist party members and employees of government-owned enterprises, in a challenge to the country’s reigning market leader Didi.

THE BOTTOM LINE

might be prompting companies to raise prices.

Given inflation is still eroding record private sector pay growth, incentives for workers to stop demanding pay rises aren’t going away, so there’s a chance that dreaded wage/price spiral dynamic springs up. But, latest inflation expectations numbers from YouGov and Citi aren’t up markedly. A return to the 1970s this is not.

There’s equal arguments for a 25 or 50 basis point rise at the Bank’s next meeting on 2 February. Over to you Andrew Bailey.

JACK BARNETT

JACK BARNETT

CITYAM.COM 02 THURSDAY 19 JANUARY 2023 NEWS

CONTINUED FROM PAGE 1

WHAT

THE OTHER PAPERS SAY THIS MORNING

KYIV TRAGEDY Firemen work at debris near a nursery in a suburb in Kyiv following a helicopter crash that killed eighteen people including minister Denys Monastyrsky

NETFLIX

£300,000

Davos bankers agree to need for crypto regulation

CHRIS DORRELL

SOME OF the world’s top central bankers yesterday emphasized the need for introducing basic regulations for cryptocurrencies, but they remained equally wary that new rules could lend legitimacy to an industry that has been very unstable over the past year.

The central bank chiefs agreed on the need for a basic level of crypto regulation, covering antimoney laundering and ‘know your customer’ checks on crypto assets, but were sceptical about going further.

Tharman Shanmugaratnam, chairman of the Monetary Authority of Singapore, said that regulation might legitimise something “inherently speculative and, in fact, slightly crazy”.

He said it was better to warn potential investors that investing in cryptocurrencies “is a risk you take at your own expense”.

This sentiment was shared by François Villeroy de Galhau, the governor of the Central Bank of France, who said the basics of regulation – including anti-money laundering and investor protections – “should be applied to all cryptos”.

The discussion echoed similar debates taking place in Britain, where City minister Andrew Griffith said he was concerned about the potential for regulation to

A senior Singaporean regulator described crypto as “slightly crazy”

create a “halo effect” around crypto assets.

“That is a big concern, and it is one reason why we are taking our time and trying to get the balance right,” he told the Treasury Committee last week.

Concerns around the stability of crypto have intensified since the dramatic collapse of crypto exchange FTX.

Founder Bankman-Fried is to face trial in the USA for several counts of fraud.

UBS chair says that regulators need to act on shadow banks

CHRIS DORRELL

COLM KELLEHER, chair of banking giant UBS, has warned of the need for regulators to spend more time policing so-called shadow banks, or non banks.

He made the stark warning during a panel discussion on the risks facing the financial system at the World Economic Forum in

Davos yesterday. He said regulators had “taken their eye off the ball” when it came to shadow banks, Shadow banking is a term used to refer to entities such as lenders operating outside of the remit of the traditional banking sector They have increasingly become an area of concern among regulators with risk migrating from the more stringently regulated traditional

financial sector. Although bullish about the position of traditional banks, the panel was less positive about the regulatory position of shadow banks.

Indeed, the panel agreed that as a result of the regulatory reforms that had taken place since the global financial crisis, traditional banks were in a far more stable condition than in 2008.

THE GUARDIAN reported that documents in a US court accuse Staley of observing the sexual abuse of women trafficked by Jeffrey Epstein. The woman is suing JP Morgan. Staley and JP Morgan declined to comment when approached by City A.M. Staley has previously denied any involvement.

Credit Suisse to offer upfront bonuses to stem banker outflow

CHRIS DORRELL

CREDIT Suisse is considering offering its senior executives upfront bonuses as it seeks to incentivise its top performing staff to stay at the bank.

An internal memo seen by City A.M. said that managing directors and directors “in most locations” will be awarded the cash component of their variable compensation upfront.

The memo said upfront payment allows the bank “to recognise the

contribution of its senior leaders and to reward loyalty”.

Those in line for the early cash bonus, however, would be required to repay some or all of the bonus if they leave the bank within three years.

While the bank admitted that the “compensation pool will be lower than in previous years”, the scheme is an attempt to “reward individual and collective performance”, the memo said.

Credit Suisse declined to comment.

03 THURSDAY 19 JANUARY 2023 NEWS CITYAM.COM

JES STALEY The former boss of Barclays has been accused of observing sexual abuse

Great British Nuclear lacks strategy and direction, warns leading advisor

GREAT British Nuclear (GBN) is in need of an overarching strategy and lacks a clear role in securing the UK’s energy independence, the state-backed initiative’s boss has warned.

Simon Bowen, the UK’s nuclear industry advisor, yesterday raised concerns over the lack of clear direction for GBN at a committee session with a body of MPs in Westminster.

Speaking to the Science and

Technology Committee, he said: “The piece that is missing for me at the moment is the overarching strategy.

This is where [former] Prime Minister Johnson started, which is ‘We need energy security in the UK full stop.’

“If we accept we need energy security: what is the quantum of nuclear that you need to secure that?

If I reflect on where we are now, that is the piece that needs to be reinjected into the conversation.”

He argued it was essential for the government to establish a plan with

Harbour Energy says new tax will cause job losses

THE NORTH Sea’s biggest oil and gas producer is planning a raft of job cuts in response to the windfall tax, as the backlash to the new levy intensifies.

Harbour Energy has told staff about its redundancy plans, with jobs set to be cut from its headquarters in Aberdeen.

City A.M. understands that the extent of the firing spree, first reported by Reuters, is yet to be determined and will be subject to consultations.

Harbour recently pulled out of the latest licensing round for future North Sea exploration and development amid concerns over the domestic investment climate.

This follows Chancellor Jeremy Hunt hiking the Energy Profits Levy (EPL) 10 percentage points last November, raising the windfall tax on North Sea oil and gas operators from 25 to 35 per cent. The levy comes on top of the 40 per cent special corporation tax domestic fossil fuel producers already pay – taking the overall tax take to 75 per cent.

City A.M. understands that Harbour is also looking to restructure after several ownership changes in recent years to

make the business operations more coherent. When approached for comment on the planned job cuts, Harbour explained that the latest developments did not mean it was abandoning any current projects but it was reassessing future plans.

“Following changes to the EPL, we have had to reassess our future activity levels in the UK,” a spokesperson for Harbour told City A.M.

“We will continue to support investment on the many attractive opportunities within our existing portfolio, but we are scaling back investment in other areas such as new exploration licensing. As such, we have initiated a review of our UK organisation to align with lower future activity levels.”

The North Sea recently enjoyed a fresh boost from the figures in the latest licensing round, with the number of bids clocking in at comparable numbers to the previous auction process in 2019 – despite fears firms would back out from exploration after the windfall tax was toughened.

However, Harbour is not the only firm smarting from the levy, with Total Energies recently confirming it will have to fork out £810m ($1bn) in the fourth quarter from UK windfall taxes.

GBN for which technologies it invests in and over what timeframe.

Bowen, who previously oversaw, Babcock’s nuclear business, was tasked with overseeing the UK’s nuclear ramp-up last May by Johnson.

Downing Street is targeting a ramp up in generation from 7GW to 24GW over the next three decades as part of its energy security strategy.

However, there are concerns over significant delays, with projects such as Hinkley Point C running two years late and 45 per cent over budget.

Currys shares bounce after Christmas boost

CHRISTMAS proved a tale of two countries for electronics retailer Currys as the business said a betterthan-expected performance in the UK and Ireland managed to offset its struggles in Scandinavia.

The company told shareholders yesterday that trade in the British Isles had improved during the 10 weeks to 7 January – its so-called “peak” period – when compared with the rest of the financial year to date.

Shares surged 11 per cent off the back of the update.

Sales of appliances and mobile phone equipment were strong, although that was offset by weaker sales of computing products.

Thanks to a stronger performance in store than online, and as Currys cut costs to improve margins, the business achieved better-thanforecast profits in the UK and Ireland, it said.

Like-for-like sales dipped five per cent against last Christmas, but improved compared with the eight per cent drop during the year to date. The company’s international business saw a seven per cent dip.

The company said that, barring any unexpected deterioration in the economy, it expects pre-tax profit to reach between £100m and £125m in the financial year.

“Our transformation is visibly succeeding,” chief executive Alex Baldock commented.

Antofagasta posts bullish outlook for 2023 amid soaring copper prices

NICHOLAS EARL

CHILEAN miner Antofagasta yesterday said it was optimistic going into 2023 after navigating higher input costs and an ongoing drought in Chile.

The group, which is listed on the London Stock Exchange, showed signs of recovery towards the end of 2022, with Antofagasta producing 646,200

tonnes of copper at a cash cost of $1.61 per pound. This was in line with the lower end of earlier guidance, despite a 10 per cent drop on last year’s copper haul of 721,000 tonnes.

There were signs of recovery in the fourth quarter, however, as group copper production climbed 195,700 tonnes, 7.6 per cent higher than the previous three month trading period.

For 2023, Antofagasta anticipates production of 670,000 to 710,000 tonnes of copper – up from 2022 but still down from 2021’s output.

Copper is currently enjoying a sharp resurgence, trading at $4.33 per pound, according to Marketwatch.

The metal is essential to renewable technologies such as wind turbines and EV batteries.

CITYAM.COM 04 THURSDAY 19 JANUARY 2023 NEWS

NICHOLAS EARL

The Chilean miner reported a surge in gold production

NICHOLAS EARL

Bowen warned the UK must work out a clearer plan to achieve energy security

AUGUST GRAHAM

BURBERRY BASHED Burberry reported it was hit hard by a slump in Chinese sales

HEAVY Covid-19 restrictions in China weighed down sales for luxury British fashion giant Burberry. In the 13 weeks to December, the UK firm reported £756m in retail revenue, a one per cent increase on the previous year, while sales in China were down 23 per cent. PA

Cazoo reins in ambitions as CEO quits

CAZOO has halved its sales ambitions for the year and is now looking to sell between 40,000 and 50,000 cars, rather than the predicted 80,000 to 100,000.

The online car retailer yesterday told analysts and investors it was shrinking its ambitions to a “more modest” top line, as it sought to return to profitability without the need for further funding from investors over the next 18 to 24 months.

Cazoo said that reducing the volumes of cars sold would allow it to focus on higher value vehicles and improve its growth per

unit from the current £600 to £1,500 by the end of 2023.

Cazoo boss Alex Chesterman –who founded the New York-listed company in 2018 – also announced he would be stepping down as chief executive from 1 April. Chesterman will remain on board as full-time executive chairman and hand the CEO reins to Cazoo’s chief operating officer Paul Whitehead.

The company said the splitting of operations would allow Chesterman to focus on the retailer’s “strategic direction”.

The change in management comes after a difficult year for the firm, which has seen

its shares collapse 93 per cent. Shares continued to tumble yesterday.

Cazoo was forced to revise its business plan after reporting a £243m half-year loss in August. As a result it offloaded its European operations – cutting 750 jobs –and focused solely on the UK.

The company warned yesterday it would be making “further headcount reductions” to rein in costs.

“Whilst 2022 was a challenging year in many respects, our continued strong growth, notable improvement in unit economics during each quarter and market-leading consumer feedback gives

us strong confidence in the long-term opportunity for Cazoo,” Chesterman said.

“We also remain on track and on budget with our withdrawal plan from the EU, having disposed of our Italian and Spanish businesses and largely wound down our French and German operations in the fourth quarter 2022,” he added.

There was some good news for the firm, with the retailer reporting a 100 per cent increase in sales in the three months to 31 December.

In the fourth quarter of last year, the used-car retailer sold around 17,750 vehicles for a total of around £315m.

WH Smith sales propelled by travel rebound

CHARLIE CONCHIE

CHARLIE CONCHIE

WH SMITH yesterday said revenues had surged in the first few months of its financial year as its airport and train station-based shops reaped the rewards of a rebound in travel.

In a trading update for the 20 weeks to 14 January, the stationery stalwart said revenues were up 40 per cent after bumper growth in its travel division across the UK and North America.

Bosses said UK revenues in its travel business jumped 70 per cent compared to the prior year and were up 18 per cent on pre-pandemic levels in 2019, after a strong performance in airports, hospitals and train stations.

However, the group’s high street division slumped two per cent on last year amid a wider decline in high street footfall and a tightening in consumer spending. Revenues were down 14 per cent on prepandemic numbers in 2019.

Carl Cowling, group chief executive, said it had been a “strong start” to the year for the firm and it was now targeting growth in new products.

05 THURSDAY 19 JANUARY 2023 NEWS CITYAM.COM

ILARIA GRASSO MACOLA

London prices remain on top despite house price inflation starting to cool

LONDON continues to have the highest house prices in the country, with the average UK house price increasing by more than 10 per cent in the year to November, according to new data released yesterday.

The latest figures from the Office for National Statistics (ONS) show that house prices went up across the nation by 10.3 per cent in the year to November, but this was down from 12.4 per cent in October.

Gateley boss welcomes end of legal pay war

LOUIS GOSS

AN EASING of the pay war between law firms has already begun to benefit Gateley’s balance sheet, the listed law firm’s chief executive told City A.M. yesterday.

Gateley boss Rod Waldie said the “whole sector is benefiting” from the calming of the legal sector pay war that has seen lawyers’ salaries surge over the past two years.

The law firm chief said the slowdown in wage inflation has seen Gateley’s salary to revenue ratio return to what he said were “normal” levels.

Gateley’s spending on salaries as a proportion of its overall revenues dropped down to rates of 61.7 per cent in the six months ending 31 October 2022 – from highs of 64.1 per cent in the first half of 2022 – as wage growth began to slow, the law firm’s financial results show.

Waldie said: “We have to match market expectations,” as he claimed the “frothy market” seen over the past two years had increased Gateley’s costs.

Gateley is one of just six UK listed law firms, having launched its initial public offering (IPO) on London’s Alternative Investment Market (AIM)

in 2015.

The Gateley boss noted that the UK’s legal sector has not seen layoffs of the scale seen in the US, including those at top US firms such as Cooley and Goodwin Procter.

Waldie was adamant that Gateley has “no intention whatsoever of doing anything to our headcount” as he argued the “interchangeability” of its staff’s skillset means the firm is able to shift lawyers around to ensure it is “adequately” resourced.

The cooling of the battle for talent comes as Gateley’s fee earner headcount hit highs of more than 1,000 for the first time in its history, as the AIMlisted company continued its M&A expansion spree.

Waldie said Gateley will continue with its expansion plans in its bid to further diversify its business and grow its geographical reach, as he noted the company has £23m ready to deploy on making mergers and acquisitions.

The legal chief noted that all of Gateley’s M&A activity so far has been selffunded, using cash and shares.

Waldie, however, noted that being listed on the AIM gave it another “tool” to raise money for any potential large-scale acquisitions.

JUBY BABU

MORE THAN 500 of Twitter’s advertisers have paused spending on the micro blogging site since Elon Musk’s takeover last year, The Information reported yesterday, citing a person familiar with its ad business.

The social media company’s daily revenue on 17 January was 40 per

cent lower than the same day a year ago, the report added.

The drop in the company's revenue was first reported by technology newsletter Platformer on Tuesday.

Twitter did not immediately respond to a Reuters’ request for comment on both the media reports.

Since Musk took over Twitter last October, corporate advertisers have fled in response to the billionaire

laying off thousands of employees and rushing a paid verification feature that resulted in scammers impersonating companies on Twitter.

The social media platform recently reversed its 2019 ban on political ads and said that it would relax advertising policy for “cause-based ads” in the United States and align its ad policy with TV and other media outlets.

The average property price in England came in at just under £300,000 in November, about £28,000 more than at the same time the previous year.

Prices in England went up almost 11 per cent with the North West experiencing the highest annual percentage increase in the year, at 13.5 per cent, the ONS said.

London had the slowest rate of change at 6.3 per cent, down from 6.7 per cent in October, but average house prices remain the most

expensive, reaching an eye-watering £542,000.

There was good news for residents of the capital, however, with London being the lowest region in England when it came to House Price Inflation.

Nathan Emerson, Propertymark chief executive, said: “Estate agents in London are reporting buyers agreeing sales at under the asking price, however, agents in the North West are seeing properties sell for asking price very quickly after being marketed, sometimes in a matter of days.”

CITYAM.COM 06 THURSDAY 19 JANUARY 2023 NEWS

MICROSOFT yesterday became the latest tech giant to announce job cuts, with the firm set to lay off 10,000 workers globally. The cuts represent up to five per cent of the company’s workforce.

JACK MENDEL

Over 500 advertisers have paused spending on Twitter –reports The average UK house price has risen to around £300,000

LEFT THE

TECH CUTS Microsoft to cut 10,000 jobs in latest round of tech redundancies

ELVIS HAS

CITY An unusual

Square Mile

commuter joined workers crossing a sunny London Bridge yesterday

Data watchdog to shift from issuing big fines to focus on prevention

LOUIS GOSS

THE UK’s data watchdog has vowed to shift away from simply hitting companies with big fines for breaching data privacy rules and instead will look to adopt a more preventative approach.

John Edwards, head of the Information Commissioners’ Office, yesterday said that he will

focus on preventing data breaches from happening in the first place by making the UK’s privacy laws clearer.

The New Zealander, who started his five-year stint as the UK’s information commissioner in January 2022, vowed to stop the “money-go-round” by turning away from simply fining companies. Edwards said he will not seek to match EU regulators in racking up a “stack of fines”.

“It’s less spectacular but more effective to prevent those harms at the start than it is to go around and beat people up afterwards and fine them into insolvency.”

Speaking at law firm CMS’ London headquarters, Edwards set out plans to provide clear guidance on the UK’s data laws, as he warned that uncertainty has an “enormous cost on the economy”.

Asset managers on the rebound as assets tick up

CHARLIE CONCHIE

LONDON-LISTED asset managers Liontrust and Rathbones showed signs of a rebound yesterday as assets under management ticked upwards and the volume of investors pulling their cash from funds began to slow.

London’s big money managers have suffered a torrid 12 months as markets descended into turmoil in the wake of war in Ukraine and soaring inflation.

A string of London’s investment giants reported slumps in the value of their holdings in the third quarter last year as investors fled the market.

However, Rathbones said yesterday it had notched a jump in the amount of cash injected into its funds in the final three months of the year, as total net inflows hit £145m, up from £67m in the previous quarter.

Liontrust meanwhile said outflows had slowed significantly on the previous quarter despite a “year of negative investor sentiment”.

The London investor reported net outflows of £0.6bn, a marked slowdown after £1.6bn was pulled in the prior quarter.

Holdings of both firms ticked upwards, with Rathbones reporting a rise in total funds under management and administration (FUMA) to £60.2bn, compared with £57.9bn at the end of September.

Liontrust said the value of its assets rose three per cent to £32.6bn despite the sustained outflows.

John Ions, chief executive of Liontrust, said investors’ outlook had continued to be weighed down in the final quarter by the “the ongoing macroeconomic and geopolitical concerns”.

“Liontrust was not immune to the continued volatility in stock markets, leading to net outflows of £632m in the last three months of the year,” he added.

Assets under management as of 16 January were at £33.8bn.

Liontrust said it has now planned a month-long roadshow around the UK next month in a bid to court financial advisers and tempt in cash from new channels, Ions announced yesterday.

Volatility over the past 12 months has dented the value of Liontrust, with shares trading down almost 30 per cent on the year from January.

LONDON PRIDE New details released on the redevelopment of Liverpool Street

THE SCHEME is set to include a multi-storey hotel that will be built on top of the station, with an office block also mooted. There will be a new station entrance, while the plans by architect Herzog & de Meuron include a publicly accessible roof garden and swimming pool. The plan is for the work to commence in 2025 and will be submitted by March.

FRC investigates Shipleys over its audit of Russian fintech firm

LOUIS GOSS

THE UK’s accounting regulator has launched an investigation into London accounting firm Shipleys over its audit work for the UK-listed holding company of Russian fintech firm Zaim Express.

The Financial Reporting Council (FRC) yesterday said it has decided to open an investigation into the firm’s audit of Zaim Credit Systems’ 2021 accounts. The FRC’s investigation comes after the London Stock Exchange

suspended trading of shares in Zaim Credit Systems’ last September, following the launch of a separate investigation into the control of its wholly-owned subsidiary Zaim Express.

The UK accounting watchdog said its investigation is solely aimed at Shipleys, as it said the investigation is not into any other “persons or entities” involved.

Zaim Credit Systems and Shipleys LLP were approached by City A.M. for comment on the probe.

CITYAM.COM 08 THURSDAY 19 JANUARY 2023 NEWS

Just Eat shares jump despite drop in orders

SHARES in Just Eat Takeaway.com rose yesterday morning after the food delivery company reported a positive outlook for the year ahead.

Shares in the firm jumped despite the fact the Amsterdam-headquartered firm reported a fall in orders towards the end of last year.

The total value of orders placed on Amsterdam-based Just Eat’s platform

globally in the fourth quarter was €7.11bn (£6.22bn), down from €7.23bn notched up in the same quarter in 2021.

In the UK and Ireland, the total value of orders dropped to €1.695bn for the fourth quarter, down from €1.74bn in 2021.

The firm said, however, that it was expecting positive adjusted ebitda of €225m in 2023.

Jitse Groen, CEO of Just Eat Takeaway.com, said: “Our focus on profitability resulted in a material

improvement in adjusted ebitda, from minus €134m in the first six months of 2022 to approximately €150m positive in the second half of the year.”

“Our improved profitability and strong capital position strengthen our business for further growth and underpin our ability to both deliver on our adjusted ebitda targets and invest in food and nonfood adjacencies,” Groen said.

The firm also said that its senior management, together with advisors,

“continues to actively explore the partial or full sale of Grubhub” – an idea it first floated early last year.

The results come off the back of a new deal negotiated with supermarket giant Sainsbury’s.

With the Just Eat app, customers will soon be able to order items from Sainsbury’s and have them arrive at their doorstep in under half an hour.

The on-demand service will be available in over 175 stores by the end of February,

and rolled out nationwide throughout the year.

This comes after a number of outlets signed up with Just East, with the Co-op partnering in December, while other agreements have been penned with Asda, Booker and Greggs.

Shares in Just Eat, which is dual-listed, closed up around four per cent on the London Stock Exchange and almost five per cent on the Euronext off the back of the news yesterday.

QUALITY

HOMES

09 THURSDAY 19 JANUARY 2023 NEWS CITYAM.COM Gold, Silver or Bronze Home Insurance John Lewis Finance, John Lewis Home Insurance and John Lewis & Partners are all trading names Specialist Home Insurance John Lewis Finance, John Lewis Insurance and John Lewis & Partners are all trading names of John Lewis plc.

of protection,

service to

Unique properties and treasured possessions deserve an extraordinary level

and

match.

we

At John Lewis

offer bespoke Specialist Home Insurance to protect the things you value most.

COVER FOR EXTRAORDINARY

here or visit johnlewisfinance.com/home to get a quote or speak with one of our experts on 03331 304584 We also offer 5 star Defaqto Gold and Silver Home Insurance for standard homes.

HOME INSURANCE Scan

BEN LUCAS

Council tax and tube fares to rise this year

CITY A.M. REPORTERS

CITY A.M. REPORTERS

LONDONERS are set to be hit with across the board increases in their transport costs as well as an almost £40 jump in the average council tax bill, the Mayor of London revealed yesterday.

Sadiq Khan said the top-ups to local council taxes –known as ‘the precept’ –were his only option to balance the books.

A £15 top-up will go to the Met Police to hire 500 additional community support officers, a £20 charge will go towards Transport for London and a £3.55 addition will be banked by the Fire Brigade.

The tax hikes come alongside a 5.9 per cent increase in Transport for London fares.

The transport-related tax hike and the fare increase are tied to the TfL funding settlement agreed by central government and City Hall last year, which mandated a fare increase in exchange for emergency funding.

Khan said there was “no viable alternative” to “plug the gap” left by central gov-

ernment

The

the government’s refusal to provide the funding our city needs means I’ve been left with no viable alternative but to help plug the gap by raising council tax by £3.21 a month.

“This will ensure we can protect and further improve our vital frontline public services, including the police, transport and the London Fire Brigade.”

The Mayor has consistently criticised Whitehall for a lack of funding for what remains the country’s economic engine.

“This is a challenging time for our city, with a government that is not fully funding our public services, but I’m determined to step up so that we can continue building a greener, safer and fairer London for everyone,” Khan said.

Figures from City Hall last year suggested London has received £76 per person from a series of Levelling Up initiatives worth billions of pounds, which is well below the England average of £384 per person.

Khan also announced that a temporary ban on the use of the over-60 freedom pass before 9am would become permanent. Age UK said the decision came at the “worst possible time”.

City of London update

Homelessness and r ough sleeping - have your say

THE City of London Corporation has launched a public consultation on its new draft Homelessness and Rough Sleeping Strategy.

We want to hear your views to make sure we deliver the best support for people who are at risk of homelessness, already homeless or rough sleeping. We aim to ensure that they are supported in a swift, effective, compassionate, fair, and respectful way.

You can view our draft strategy and respond to the survey by visiting: www.cityoflondon.gov.uk/ homelessnessconsultation

New year, new you

WHY not start the New Year as you mean to go on - Smokefree?

Giving up is hard but with support and nicotine replacement therapy or a vape, you are three times more likely to quit successfully.

After 72 hours of being smokefree, you will feel more energetic and alive. On average smokers spend £40 a week on tobacco - so you could have £2,000 more a year. Thousands of people have quit smoking with Smokefree City &

Together with our partners, the City Corporation is already helping more people than ever before.

This work includes our High Support Hostel, opened in November 2022, assisting some of the Square Mile’s most vulnerable rough sleepers with complex needs.

IF THE Labour Party really was in the pockets of the unions, they should ask that any strikes going forward always fall on a Wednesday. Maybe it’s a perverse kind of home advantage, but the nurses on picket lines yesterday inspired a Keir Starmer seen only once a blood moon.

The strike laws, known by their drier name of “minimum service legislation”, sounded perfectly reasonable last week, but they address the symptom of the problem, not the cause.

Hackney. You can quit too.

Feel fitter and breathe more easily, quit smoking this New Year. Contact 0800 046 9946 smokefreecityandhackney.org

london.gov.uk/eshot

And Starmer knows this. Even on days when nurses and ambulance staff are working as normal, people suffering from chest pains are waiting 90 minutes for help. The wait time should be 18 minutes.

Yesterday’s Prime Minister’s Questions was an exercise in the emotional narrative versus the managerial response.

Starmer used his time to chart the journey someone with a suspected heart

attack would go on after dialling 999.

“Someone who fears a heart attack is waiting more than two and a half hours, that’s not the worst-case scenario, that’s the average wait,” he told the Commons, running through how long the clock ticks before an ambulance arrives in Peterborough, Northampton and Plymouth.

In the 40 minutes it takes for the Prime Minister to answer MPs’ questions, 700 people call an ambulance, the Labour leader called from the opposite benches.

Of those, two are heart attack patients

and four are stroke victims.

Sunak, in comparison, relied on last week’s news and a sterile deflection by pointing to the health service in “Labourrun Wales”.

Faced with the story of 26-year-old Stephanie who died for lack of medical attention, answers about “practical steps” the government is taking fell flat and hardly helped Sunak’s image of disconnection from voters.

The Prime Minister’s political gamble right now is that people want a competent manager, not another Boris Johnson or Liz Truss. The risk with this strategy is that the country is in chaos, and anyone presiding over that is unlikely to win any “best boss of the year awards”.

All Starmer has to do then is keep telling the story of a Britain unravelling in a way which grabs attention –and pull on Britain’s NHS heartstrings.

CITYAM.COM 10 THURSDAY 19 JANUARY 2023 NEWS

News, info and of fer s at www.cityof

YESTERDAY IN PARLIAMENT

funding.

Mayor of London, Sadiq Khan, said: “The last thing I want to do is increase council tax at a time when many household budgets are stretched, but

Khan said the increases were his only option

SKETCH Sascha O’Sullivan Starmer will ride NHS troubles to the election as competent Rishi struggles in face of chaos THE BATTLE LINES DRAWN A testy exchange in Parliament RISHI

JOURNEY CURRENTMARCH 2023INCREASE Single bus ride £1.65£1.75 6.10% Single Zone 1-2 off-peak tube ride£2.60£2.80 7.70% Single Zone 1 peak tube ride£2.50£2.80 12% Daily Zone 1-2 tube cap £7.70£8.10 5.2% HOW MUCH FARES WILL GO UP

SUNAK struggled to bat away criticisms of NHS care in his weekly joust with Labour leader Keir Starmer yesterdayand he will face further difficulties in parliament after the announcement of further industrial action. The union GMB announced six further ambulance walkout dates, with other unions setting up for a national ‘day of action’ on 1 February. Tory insiders continue to say the demands being placed on the public purse already mean that further pay rises for public sector staff would boost inflation and leave a financial black hole.

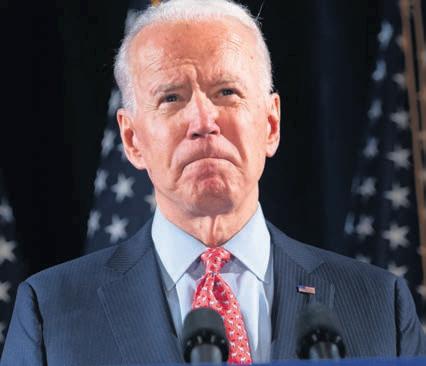

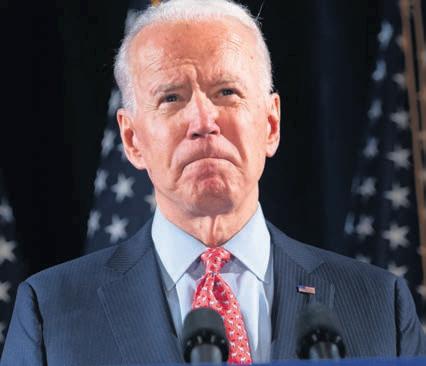

THE UK and the European Union are set to lose out on potentially lucrative green energy projects to the US –if they fail to match a generous new stateside investment environment.

The so-called ‘Inflation Reduction Act’ –signed into law by President Joe Biden last year –has committed almost $400bn towards clean energy projects, a potential windfall that is forcing entrepreneurs to reassess their investment plans. It also includes a bucketload of tax credits which should help accelerate production of solar panels and wind turbines. Clean energy storage specialist Zenobe Energy has been establishing roots in the US over recent months, signing a memorandum of understanding with JERA Americas, the US subsidiary of Japanese power company JERA, to jointly develop utility-scale battery storage projects in New York and New England.

The company mission statement is

UK COULD MISS OUT ON GREEN WINDFALL AS BIDEN OPENS DOOR TO THE USA

“to make clean power accessible across the world”.

So far, it has secured funding to pursue e-buses and charging infrastructure, alongside large-scale battery facilities in the UK –which aim to provide renewable energy in response to wind farms being switched off, as an alternative to gas supplies.

A STUDY IN CONTRASTS

Nils Aldag, chief executive of German hydrogen technology experts Sunfire, was also weighing up the possibility of pivoting projects and investment stateside if the EU failed to provide more support.

“We will have to con-

sider the US if we do not see Europe respond in time,”

By contrast to the generous investment climate now on offer in

the States, the UK has imposed a fresh levy on electricity generators, snatching 45 per cent of revenues for legacy operators that have provided clean power to meet the country’s energy needs for decades.

The EU, meanwhile, has failed to get regulatory frameworks in place to advance green energy, reck-

Air France drops bid for Italian flag carrier –but Lufthansa set to step in

AIR FRANCE confirmed yesterday lunchtime that it would not be pursuing a bid for ITA Airways –the successor brand to Italian flag carrier Alitalia –with Lufthansa expected to step in instead.

The German carrier said it had offered to buy an initial minority

stake, saying Italy was its most important market outside of its home markets and the US.

ITA is in the process of being privatised, with a December decree dictating the sale of a minority stake ahead of a larger transaction.

Elsewhere on the continent, Amsterdam’s Schiphol Airport will end passenger number limits in

March –ahead of the busy Easter getaway period.

It cut capacity by a fifth last year amid chaotic scenes at a host of European airports as staffing failed to keep up with increased ‘rebound’ demand post-pandemic.

Airlines are pushing airports to staff up ahead of what is expected to be a record summer.

ons Aldag.

He said: “It’s... not yet sufficiently in place for this target to actually be met. The US has basically given a whack to the whole industry, and European regulators understand they have to act quickly now.”

In his view, the EU and US were not just competing for projects and

could be each other’s second market if an attractive investment environment was created across the West.

This would ensure a strong market to compete with the growing influence of China and India in the renewables sector.

SIGNS OF A RESPONSE

The EU has initiated plans to take on Biden’s legislation, through loosening subsidy restrictions and speeding up permits across the bloc for green energy projects.

EU Commission President Ursula von der Leyen announced this week at the World Economic Forum in Davos that Brussels would also water down state aid rules and offer more funding support to strategic industries that were climate friendly.

She said: “To keep European industry attractive, there is a need to be competitive with offers and incentives that are currently available outside the European Union.”

In the UK, the response has so far been more muted despite its own highly aggressive generation targets for domestic renewable production over the coming decades.

However the publication of Tory

In his report, Skidmore labelled net zero as the “economic opportunity of the 21st century’ and called on the government to boost investment in green energy projects. Business select committee member Alexander Stafford told City A.M. the “global race to net zero is well and truly on”.

The first step, in his view, was to offer clean energy firms an investment allowance in line with the windfall tax for oil and gas firms, so that the Electricity Generator Levy does not “deter investment and push firms overseas”. He said: “The US hopes to lure electric car manufacturers and renewable energy firms into crossing the pond through its Inflation Reduction Act’s generous tax credits. If the UK is going to compete, ensuring these new industries and better-paid jobs come here, we need to back these clean enterprises wholeheartedly.”

11 THURSDAY 19 JANUARY 2023 NEWS CITYAM.COM

Air France has dropped an ITA Airways bid, leaving Lufthansa in pole position

JAMES SILVER

Joe Biden’s green stimulus bill is forcing investors to sit up and pay attention, writes Nicholas Earl

The tax regime deters investment and is pushing firms overseas

The global race to net zero is well and truly on

MP Chris Skidmore’s net zero review last weekend suggests there could be more pressure in Westminster on the government to compete with the US.

A CRYPTO SCAM NIGHTMARE

WHAT do a dark human trafficking industry in South East Asia, pigs and crypto have to do with you? More than you think. After all, the first rule of successful scams is that anyone could fall for it. And people across the world are.

Those who created it call it Shāzhūpán –“pig butchering”. The victim, like a pig, is lured in, fattened with the promise of fast cash, and then “butchered” when the scammer leaves with all their money.

Flocks of young, tech-savvy people are falling for it.

“Pig-butchering” originated in Asia and is still little known in Europe. Yet it has found ripe conditions here in the UK: amid a cost-of-living crisis, investment scams are on the rise. UK Finance defines the current level of fraud in the UK as “a national security threat”. And according to research from Marcus by Goldman Sachs, Brits aged 18-34 are twice as likely as other age groups to fall victim to financial scams. Blend this all, and you get a dangerous cocktail of online insecurity. A country full of pigs to butcher.

The consequences on people’s finances and wellbeing are dire. “Karen”, a UK-based victim, shared her story with City A.M. but asked to remain anonymous as her family and friends know nothing about it. She says that after being scammed she had suicidal thoughts. She had lost a quarter of a million pounds.

It all starts with a message. It could be on a dating app, on Linkedin, or via email. For Karen, it was on Facebook. It’s from someone who thinks you were at school together, who shares your love for puppies, or who’s interested in your professional life. The scammer is polite, asks you about your day, and sends you pictures of the food they’re eating.

COMPOUND INTEREST

Most of the scammers are based in compounds in South East Asia, but as they increasingly target Westerners, they have developed manuals on how to communicate and build a relationship. They seem to think that sending pictures of food to each other is all we do online. Cyber scams experts say this feature of the scam is recognisable in almost all cases of “pig butchering”.

The conversation goes on for months, and turns into a romantic, friendly or professional one. For Karen, it was a friendship that lasted from January to April of last year. Not once in those four months did her scammer talk about money. Then, one day, he mentioned crypto. He told her about a specific crypto app; one on which, in theory, she could make quick easy gains. He suggested she should down-

load it. Karen was lured in. She took money out of her account and invested it on the app. A week later, all her money was gone. She never got any of it back.

TRAPPED ON BOTH SIDES

Karen’s scammer was different from the others. After weeks, he contacted

her again to tell her the full story. He revealed he was not an affluent British adult like he claimed to be, but a twenty-seven-year-old trapped in a scam compound in Myanmar. “My scammer told me they have targets, and if they don’t complete them they slap you and leave you without food and drinks,” Karen says. Accord-

ing to the scammer, millions of dollars are made in these compounds. Many of the people there have been trafficked or attracted by the promise of a real job.

The scammer’s account is corroborated by several reports from international organisations like Global Anti-Scam Org (GASO). Founded by a pig butchering victim, GASO now focuses on supporting people like Karen, as well as investigating the scam compounds. They have already rescued 190 human trafficking victims. Grace Yuen, a communications officer at GASO, wishes financial institutions and crypto platforms were doing a bit more to help prevent this.

“If they see somebody wiring a big amount of dollars and they’ve never done a wire transfer, I feel more than one question should be asked before that wire goes through”, she says. She adds some cryptocurrency platforms like Coinbase have been doing some good work on flagging fraudulent wallet addresses, but clearly more needs to be done. Given the fraudsters are mostly located outside the UK, the National Crime Agency often doesn’t have the resources to trace them.

“Ultimately, this is all social engineering. That’s what all of these attacks are based on”, says Sherrod DeGrippo, VP of threat research and detection at Proofpoint.

The scammers are trained in putting the victim in a “new” emotional state –pressuring them, hitting them in their weak spots –to cause them to do something they wouldn’t normally do. They often target people who’ve had a recent life change or bereavement.

“In 12 months we’ve got £14.473m back. Out of that, £11.5m was from crypto investment pig butchering scams,” says Paul Hampson, managing director at CEL Solicitors, a Liverpool-based firm.

Partners at Madison Legal also said there was a rise in young men being lured into “pig butchering” scams from users pretending to be young women in bikinis or on private jets.

Of the international victims surveyed by GASO, more than 75 per cent lost more than half their net worth, and a full third were driven into debt. Like Karen, many feel too ashamed to speak to their friends or family, let alone the authorities.

Scams are fuelling a worldwide industry of crime and violence. New platforms and lies are already in the making, as scammers play a cat and mouse game with the authorities. “Trust but verify”, advises Yuen. And never be so complacent to think it won’t be you.

CITYAM.COM 12 THURSDAY 19 JANUARY 2023 NEWS

New lies are already in the making, as scammers play a cat and mouse game with the authorities

People around the world are losing millions through a “pig butchering” scam - but it’s got more to do with crypto than it does our porcine pals, writes Elena Siniscalco

THE SQUARE MILE AND ME

WHAT WAS YOUR FIRST JOB?

My first job was a statement clerk at a Barclays branch in Bletchley in 1978, back when everything was in paper form. Banking was very local and traditional then and it was difficult to make progress with my kind of background. I was born in Wolverhampton and educated at a comprehensive school.

WHAT WAS YOUR FIRST PROPER ‘CITY’ JOB?

After passing the banking exams I was accepted onto the management development programme at Barclays. This took me to London and my first job in the City was in St Paul’s churchyard in 1985. The management development programme moved you about, so I first worked for the group head of marketing, but not long after that I was made a lending manager with responsibility for some big commercial clients in the West End. I seem to have something of a curse on the buildings as they have all either changed use or been demolished after I worked in them!

WHEN DID YOU THINK THE CITY WAS THE PLACE FOR YOU?

Right from the moment I arrived in the 80s. There was a real buzz and energy about the place, especially compared to where I’d worked before. I love the intricate medieval street patterns and the unique institutions that have developed over centuries. Ever since those early days I’ve had a real affection for the City and the people who work here and I’m really proud to be able to represent the banking and finance sector now in my role as chief executive of UK Finance.

ANY FAUX PAS?

I remember going to an important job interview and I must have been nervous as I managed to pour an entire cappuccino all over my suit just before it started. I was completely soaked, but it was too late to do anything about it, so I had to do the whole interview covered in coffee. Amazingly I still got the job.

FAVOURITE PUB?

My favourite has to be the Jamaica Wine House on St Michael’s Alley.

It’s got amazing history and always has such good atmosphere.

It was a regular watering hole for me when I started working in London.

AND YOUR DEFAULT SPOT FOR LUNCH?

I’ve got two. Sweetings is a City institution with amazing food and you often bump into someone you know. Or there’s a fantastic little Japanese restaurant called Kurumaya on Watling Street.

WHAT’S ONE THING YOU LOVE ABOUT THE CITY OF LONDON...

I love the fact the place evolves and is always innovating. It’s amazing to think about the history all around you, but at the same

time to see how fast things change as the City is constantly reinventing itself to deal with new challenges or opportunities.

... AND ONE THING YOU’D CHANGE

Our offices are near Bank station and these days it’s virtually impossible to get a taxi to pick you up, so I’d relax those rules a bit. And I even say that as a keen cyclist.

WHERE’S HOME DURING THE WEEK?

Home is Bournemouth, but I also have a flat in London where I stay during the week. You can do a lot on video calls, but you can’t beat the value of face-toface meetings.

AND WHERE WILL WE FIND YOU ON THE WEEKEND?

I grew up in Wolverhampton and I’m still a Wolves season ticket holder, so try to get to as many of the games (home and away) as I can. Otherwise, I’m a

QUICKFIRE ROUND

FAVOURITE... BAND: PINK FLOYD –I USED TO BE THEIR BANK MANAGER, WHICH AS A FAN WAS AMAZING

ARTIST: TURNER

DAY OF THE WEEK: A SATURDAY, WITH WINE AND A WOLVES WIN TEA OR COFFEE?: I GAVE UP CAFFEINE YEARS AGO

keen cyclist and my wife and I own a tandem – there’s definitely no hiding when you’re out on that.

OPTIMISTIC FOR THE CITY IN

2023?

I am actually very optimistic. It’s clearly going to be a challenging year, but I think the economy is going to be more resilient than some commentators might think. The banking and finance industry has a key role to play here. It’s such an important part of the overall economy in its own right, but also drives growth across all other sectors. And that’s not just in London, but up and down the UK.

We’ve got a huge amount of work to do with government and regulators in 2023 – everything from changes to capital requirements to help drive growth and investment to supporting customers with the cost of living pressures.

I think the City will do better than people expect – after all we’ve just not seen the vast numbers of jobs moving from London to the EU that many doomsayers predicted. It is a resilient

place and I think it will continue to thrive.

WHO’S THE CITY FIGURE YOU MOST ADMIRE?

Sir Peter Middleton. He was the permanent secretary to the Treasury before joining the board of Barclays, initially as group deputy chairman and ultimately group chairman. He had such clarity in his thinking and approach and I was very fortunate to work directly for him. He helped me when I became more senior in later years too.

YOU’VE GOT A WEEK OFF –WHERE ARE YOU GOING AND WHO ARE YOU GOING WITH?

Right now I’d want to escape the cold weather and head down to the south of Spain. It’s such a relaxing place and the area around Estepona is fantastic with the beach and mountains so nearby.

13 THURSDAY 19 JANUARY 2023 NEWS CITYAM.COM

We dig into the memory bank of the City’s great and good: this week, UK Finance CEO David Postings tells us about Barclays in the 80s, the Jampot and being Pink Floyd’s bank manager

DCG says it may offload assets to maintain liquidity

SHAREHOLDERS of troubled venture capital outfit Digital Currency Group (DCG) have been warned the company may be forced to sell off portfolio assets.

DCG, which owns a slew of crypto companies, including revered industry publication CoinDesk, has found itself in a public spat with twins Tyler and Cameron Winklevoss.

The brothers became famous after successfully suing Mark Zuckerberg for $65m in 2004, claiming he had “ripped off” their idea with Facebook.

The pair, who are now worth a reported $3bn, run a crypto exchange called Gemini which had partnered with Silbert’s lending platform Genesis to offer their own lending product.

However, the Winklevoss’ offering was severely compromised when Genesis suddenly halted customer withdrawals in November.

The move caused a breakdown in the partnership which eventually triggered Cameron Winklevoss into penning an open letter on social media last week calling on DCG’s board to remove Silbert as CEO.

Winklevoss spelled out plainly that Genesis owed $900 million for loaned funds, and went on to allege a total of $1.675 billion was owed to Genesis – a claim Barry Silbert was quick to deny.

The public showdown soon attracted the attention of the United States Securities and Exchange Commission (SEC) which, on January 12, swiftly charged both Gemini and Genesis with offering unregistered securities.

Things took another twist this week when a letter to shareholders set more

alarm bells ringing.

In the statement, Silbert spoke fondly of years of building up DCG and the company’s successes before changing the tone.

“In contrast, this past year has been the most difficult of my life –both personally and professionally,” he lamented.

“Bad actors and repeated blow-ups have wreaked havoc on our industry, with

ripple effects extending far and wide.

“Although DCG, our subsidiaries, and many of our portfolio companies are not immune to the effects of the present turmoil, it has been challenging to have my integrity and good intentions questioned after spending a decade pouring everything into this company and the space with an unrelenting focus on doing things the right way.”

He added: “While we still believe in

the HQ concept and its outstanding leadership team, the current downturn is not conducive for the near-term sustainability of that business.”

The letter then details the company believes it only owes $525m to Genesis, rather than the figure quoted by Winklevoss. But even at $400m less than the original figure, the news has done little to appease DCG’s concerned shareholders.

Markets offer hope that crypto drama is over

IT’S BEENa bright start to the year in the crypto markets, as hope continues to rise that industry drama is being left in 2022. This is possibly an unlikely scenario in crypto, but there will be at least a flicker of a smile returning to investors’ faces as we inch deeper into the year.

While 2022 saw many unwanted records, Bitcoin this week clocked 13 days of consecutive positive price action – its longest run of consecutive ‘green’ days since November 2013 and the second longest run in its history.

The leading cryptocurrency by total value has posted a price increase of more than 22 per cent since this time last week to more than $21k.

The strength shown this week means that Bitcoin’s market capitalisation has once again surpassed that of Tesla – a particularly bullish moment in the bull run of 2021, although this is perhaps equally reflective of the electric car giant’s own issues this time around.

Other cryptocurrencies have also performed strongly over the past

seven days, with the price of Ethereum also up around 20 per cent gains. All coins in the top 50 have seen positive seven-day returns, as the Fear and Greed Index that measures market sentiment hits highs not seen since last April.

Trading volumes have been pushed to highs not seen since the FTX collapse in November. It’s promising to see that growing trading volumes accompany the current strong momentum in the spot market. Over the last seven days, the average daily

trading volume has soared by 114 per cent to $10.8bn.

The primary catalyst again seems to be inflation news, with last week’s Thursday Consumer Price Index print of -0.1 per cent preceding the surge above $20k. Still, Bitcoin was showing strength before the CPI release. The big question now is, will it continue?

ECO TUKTUK PROJECT LAUNCHED ON CARDANO

THE world’s first automotive project built on Cardano was unveiled at the World Economic Forum in Davos yesterday. Designed to address sustainability and pollution issues, the project will be making electric TukTuk vehicles, beginning with the Sri Lankan capital of Colombo which is home to almost a million petrol and diesel-fuelled TukTuks which each emit more CO2 than a family car.

Drivers and adopters of eTukTuk will be able to utilise the Cardano blockchain’s secure transaction system to pay for services without the need for either cards or cash.

INVESTORS UNAWARE OF TAX REQUIREMENTS

ONE in five UK crypto investors are in the dark when it comes to tax requirements governing the asset class, according to research from social investing platform eToro.

In a survey of more than 1,000 UK adults holding crypto, 22 per cent said they were unaware that investors were required to pay tax after selling crypto assets if profits exceed a certain threshold.

The research comes just a week ahead of the January 31 deadline for self-assessment tax returns. According to the current rules, individuals pay capital gains tax on total gains above an annual tax-free allowance of £12,300.

CRYPTO.COM TO SLASH WORKFORCE

GLOBAL exchange Crypto.com has become the latest big digital asset name to cut its workforce, announcing a 20 per cent loss of staff.

Company chiefs have cited “ongoing economic headwinds and unforeseeable industry events” as the financial factors threatening its future.

Announcing the slashing of staff, co-founder and CEO Kris Marszalek said it had been a “difficult decision to reduce our global workforce”.

Marszalek was quick to state all impacted personnel had already been notified, and the cutbacks were not related to performance.

SHIB SHINES ON

POPULAR meme coin Shiba Inu has been the week’s surprise package after posting some strong positive returns.

In step with the wider crypto market which has seen a steady rise over the last seven days, Shiba Inu not only followed suit but continued its upward trajectory when most of the top 20 cryptocurrencies hit a line of resistance yesterday afternoon.

The Ethereum-based Dogecoin alternative was settled on $0.000009 last week, but last night found itself some 38 per cent in the green on $0.000012 with a 24-hour buying volume exceeding 300 per cent.

FOR ALL THE LATEST NEWS, VIEWS AND ANALYSIS HEAD OVER TO CRYPTOAM.IO Connecting the Community CITYAM.COM 14 THURSDAY 19 JANUARY 2023 FEATURE

CRYPTO NEWS IN BRIEF

Divorce day? No magic recipe for relationships

The beginning of January is traditionally when there is a marked increase in divorce enquiries. Many couples are left feeling fraught and fatigued by the emotional and financial pressures of Christmas. The willingness to try to keep it all together for the sake of the children wears out, as smiles slowly morph into smirks. The introduction of no-fault divorces in April last year means that divorce can now be a quicker, cheaper and possibly less painful and protracted process. In turn, this means that divorce may now seem like a viable option, especially for those who are in long-established marriages.

At worst, divorce is a shock that leaves us feeling dejected and in despair. At best, divorce is difficult.

Even when it is a mutual decision, divorce is an ending. Endings are dispiriting, regardless of the fact that it may well be the right choice, at the right time, for the right reasons. Eventually, new beginnings bring hope. In retrospect, divorce may feel liberating and empowering. We are not starting from scratch but, rather, from experience. In the process of a relationship ending, hopefully we have shed behaviours that we now know are hurtful. We become

unwilling to accept intolerable attitudes, finding a shield of self-esteem that we may have lost along the way. We may have lost a partner but gained important insights.

There is, of course, no magic recipe that guarantees a cheerful, ever-lasting relationship. Awareness is a good starting point, though.

Awareness of self and awareness of how you communicate in your relationship is key.

The words you use matter. Your tone, in turn, impacts how your words are received. Your body language precedes whatever message you are aiming to convey.

In other words, how you communicate with your loved one is fundamental to a happy and healthy relationship. This is especially true when conflict arises.

The Gottman Institute, set up by the husband-and-wife team of Dr. Gottman and Dr. Julie Schwartz Gottman, has been researching marriage and relationships for almost 50 years. Their divorce prediction, which has over 90 per cent accuracy, is based on 4 main types of negative communication patterns. These are known as “The Four Horsemen of the Apocalypse:” contempt, criticism, defensiveness and stonewalling. Luckily, Gottman offers

antidotes to these in order to best safeguard our relationships.

The antidote to contempt is appreciation. Criticism is diluted by understanding that there is a real need wrapped under the

harshness. Therefore, we must take personal accountability of our needs. Defensiveness is often a means to deflect blame and can be dissolved by taking responsibility for our own behaviours.

Finally, we need to proactively learn to selfsoothe so that we do not withdraw in moments of tension, creating an impenetrable wall between us and our loved ones.

ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

OF THE BROKERS

Ocado emerges as top dog in 2023, but index pulls away from record

LONDON’s FTSE 100 finished slightly lower yesterday, dragging it further away from its record and signalling traders are looking through signs UK inflation has passed its peak and could be on a downward trend this year.

The capital’s premier index dropped 0.27 per cent lower to 7,830.71 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, jumped 0.23 per cent to 19,902.80 points.

The drop came despite middle-class favourite and online supermarket Ocado’s best efforts. It jumped to near the top of the FTSE 100, adding a shade under three per cent.

Ocado has been a bit of a tear in this year and is now by far the best performer in 2023, helping to arrest last year’s dismal performance caused by

shoppers returning to physical supermarkets after the worst of the pandemic passed.

Fashion retailers led the premier index lower, with Next, JD Sports and Mike Ashley’s Frasers Group all shedding more than one per cent.

New numbers from the Office for National Statistics yesterday showed the rate of price increases in the UK fell to 10.5 per cent in December from 10.7 per cent.

It is the second month inflation has dropped and the first time back-to-back decreases have been registered since the early months of the Covid-19 pandemic.

Markets seemingly shrugged off the news, cooling the FTSE 100’s strong start to the year which has pushed it close to its highest level ever of just over 7,900 points.

The pound strengthened 0.54 per cent against the US dollar on the prospect of another BoE rate hike.

Analysts at Peel Hunt have picked the numbers of Diploma and they reiterated their ‘buy’ recommendation due to technical products supplier’s “resilience, spread, momentum and delivery”. After reporting a 30 per cent increase in revenue, the firm is expecting its turnover to go up six per cent in the first half of this year, while margins are forecast to be between 18 and 19 per cent – in line with expectations.

HEAD IN THE CLOUDS

DANNI HEWSON, AJ BELL

LONDON

REPORT BEST

P 12 Jan 18 Jan 16 Jan DIPLOMA 18 Jan 2,856 2,750 17 Jan 13 Jan 3,000 2,950 2,900 2,850 2,800 Legal services bigwig Gateley was once again awarded a ‘hold’ rating. Revenue was up nine per cent, while the company’s adjusted profit before tax and adjusted earnings per share increased by 13 and 6.8 per cent respectively. Revenue per fee earner was nevertheless down 3.3 per cent due to inflation rates. “Much

on

to which management looks with “cautious confidence”, analysts

To appear in Best of the Brokers, email your research to notes@cityam.com P 12 Jan 18 Jan 16 Jan GATELEY 18 Jan 191 175 17 Jan 13 Jan 195 190 185 180

depends

2H23E,

said.

DASHBOARD

CITY

YOUR

“Investors have been pretty bullish since the start of the year, ready to bask in the chinks of sunlight sneaking between those economic black clouds. But the sun has a habit of vanishing, and those black clouds can herald a deluge that will dampen sentiment pretty quickly.”

15 THURSDAY 19 JANUARY 2023 MARKETS CITYAM.COM

HEAD SPACE

Each month our mental health expert, Alejandra Sarmiento, shows us how to stay sane in a busy world

WWE failed to wrestle back control and delivered a warning in dual class shares

PROFESSIONAL wrestling might not be what you were expecting in a business paper. But nonetheless, here it is. Two weeks ago, the industry was rocked by the sudden return of Vince McMahon to power in World Wrestling Entertainment. The man who turned his father’s regional touring promotion into a multinational media powerhouse had been persuaded to “retire” last summer after a series of allegations of sexual impropriety. Unsurprisingly it turns out that a man who calls his yacht “Sexy Beast” and keeps a Tyrannosaurus Rex skull in his office, is not the retiring type.

The world of professional wrestling may seem cartoonish, but the reach of WWE is vast. Every week it produces nine hours of programming that airs across the world, routinely being amongst the most watched shows on American cable and network television. Its American rights deals alone see it clear more than $700m a year from NBC Universal and Fox. Not for nothing is it currently worth approximately double the value of Manchester United.

McMahon’s return as WWE’s executive chairman therefore should not be dismissed as a frivolous story, but one that has some profound lessons about

life and business. It is, for one, yet more evidence that the energy behind “MeToo” is fading, with powerful men being able to quickly recover from being “cancelled” (news to Jeremy Clarkson’s ears, no doubt). McMahon’s return comes in spite of an ongoing investigation which alleges he failed to properly declare numerous payments made to female workers within WWE in return for their silence. The payments in itself is one thing, but it also means much of the damaging information about McMahon is not yet in the public domain, a point the WWE board was keen to point out. His return also meant his daughter, Stephanie, was turfed out of the position - hardly a win

for women in wrestling.

McMahon’s comeback also illustrates an important point about American regulation of public companies. This is especially acute with a Prime Minister who favours dual-class share structures.

McMahon took over the company in 1999 to capitalise on a resurgence of popularity fuelled by superstars such as “Stone Cold” Steve Austin and Dwyane “The Rock” Johnson. He and his family became rich beyond their wildest dreams after they sold 60 per cent of WWE to outside investors. But it was corporate cakeism at its finest: any share not owned by McMahon or his family is automatically relegated to

a lower class of stock, with no voting power. Although he owns less than 40 per cent of the company, McMahon is the controlling shareholder because he owns 80 per cent of the shares that matter.

From a corporate governance perspective, this is a disaster. WWE’s board is legally responsible for protecting all shareholders investment in the company, but effectively answerable only to McMahon. In a bizarre paradox fitting for corporate America, they’re legally tasked with thinking beyond just McMahon's wants and desires, but if they dare ignore his demands, they're at risk of being fired. This once hypothetical risk materialised when the

wrestling boss removed three directors after the board initially rejected his return. Two associates and McMahon took their place. WWE is far from the only US company where decisions are distorted by structures which disenfranchise ordinary shareholders and allow founders to indulge themselves. And the stock market reaction to all of this shows us the days of casino capitalism are far from over. McMahon has ignored a vote from the board that his return was not in the interest of the company, threatened to veto any future rights deals if he’s not allowed to return, two directors have quit in protests and the company’s chairwoman and co-chief executive abruptly retired only days after they personally promised investors there would be no changes to management structure. Such erratic behaviour should have caused investors to flee in terror. Instead, McMahon’s talk of linking his return to a sale of the company has caused investors to ignore the drama and gamble on a windfall. In other words, the stock price is currently surging.