VOLT FARCE

MUCH-HYPED ELECTRIC VEHICLE BATTERY FIRM GOES INTO ADMINISTRATION

NICHOLAS EARL

ELECTRIC vehicle battery maker Britishvolt has collapsed into administration, costing almost 300 jobs and putting in jeopardy Britain’s hopes of building a green automotive industry.

The much-hyped start-up filed for administration yesterday after its board reportedly ultimately decided there were no viable bids to keep the company afloat.

The future of Britishvolt has been

in doubt for months, after it failed to secure further government funds last October to build its £3.8bn gigafactory in Northumberland.

It had asked for an advance of £30m on a promised £100m in support announced by the government, but Downing Street refused because Britishvolt had failed to hit construction milestones for the factory nor met private funding milestones.

Shadow business secretary Jonathan Reynolds laid the blame at the

government’s door, dismissing its industrial strategy as a “failure”. He warned the UK was “losing the global race for electric vehicle battery manufacturing, putting our worldfamous car industry at risk”.

Britishvolt’s collapse reflects a sharp fall from grace for the company, which was set up in 2019 to deliver a gigafactory site and sustainable low-carbon batteries to the UK’s motor industry.

Michael Naylor, managing director of battery material specialist EV Metals, was

saddened by Britishvolt’s collapse.

He told City A.M.: “It has suffered from the UK electric vehicle supply chain being disconnected and underinvested. It shows that government and private capital need to work together to integrate the supply chain if the UK car industry is to be protected and have a key role in the transition to electric vehicles.”

EY has been appointed joint administrators of Britishvolt, and will now implement a closure and winding down of the company’s affairs.

London Metal Exchange’s top lawyer quits

NICHOLAS EARL

THE EMBATTLED London Metal Exchange (LME) announced its top lawyer was walking yesterday –a second high-profile departure of the young new year.

Tom Hine, the group’s general counsel, is leaving to set up his own business.

His departure comes with the LME facing an impending lawsuit brought by Elliot Advisers over a March 2022 decision to suspend nickel trading amid unprecedented price volatility.

That call has been the subject of a blistering internal review by consultancy Oliver Wyman, and the Bank of England and the Financial Conduct Authority is also reviewing the exchange’s actions and safeguards.

Hine’s departure comes hot on the heels of chairman Gay Huey Evans earlier this month, who said she would not be seeking re-election.

His duties will now be overseen by the LME Group legal management team, which has been temporarily assuming his responsibilities during a period of extended leave which began last September.

Wall Street giant pledges to ‘coach’ staff if productivity falls working from home

AMERICAN banks have been pushier than most of their international rivals in getting their staff back to work –and now even one of the firms with a more gentle approach appears to be hardening its line.

Citibank boss Jane Fraser told a Bloomberg event at Davos yesterday that workers wouldn’t be able to get away with taking it easy while working from the spare bedroom.

“You can see how productive someone is or isn’t and, if they’re not being productive, we bring them back to the office,” she said.

“And we give them the coaching they need until they bring the productivity back up again.”

Fraser said there was an “important balance” to be struck on

the return to work.

One City recruiter told City A.M. recently that firms insisting on bringing people back in five days a week were struggling to retain even well-paid staff.

“We’re going to have to keep listening to our people and getting that balance right but, if you don’t

listen to them, you’re in danger of havings some problems,” she said.

Fraser’s comments strike a different tone to that of some of her Wall Street rivals.

Goldman CEO David Solomon was a vocal opponent of hybrid working in the aftermath of the pandemic, as was JP Morgan’s Jamie Dimon.

INSIDE PAPERCHASE ON LIFE SUPPORT P3 CARILLION: FIVE YEARS ON P6 OCADO SALES FALL P7 CHINESE ECONOMY RUNS OUT OF STEAM P9 LONDON DONE RIGHT P17

MORE DRAMA IN THE RING

leaves the LME after 17 years WEDNESDAY 18 JANUARY 2023 ISSUE 3,918 FREE CITYAM.COM

Hine

CHRISTOPHER DORRELL

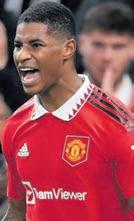

FROM RASHFORD TO RATCLIFFE? SIR JIM ENTERS THE RACE FOR UNITED P20

CHIEFTAIN O’ THE PUDDING RACE OUR GUIDE TO BURNS NIGHT IN THE CAPITAL P16 LONDON’S BUSINESS NEWSPAPER

Market forces remain the best way of allocating scarce capital

THE NAME of the Department for Business, Energy and Industrial Strategy can leave economists of a certain ilk cold –particularly the last two words. In the UK’s political zeitgeist, industrial strategy has been closely tied to the dreaded concept of picking winners –with the government standing accused of picking individual sectors and indeed companies to succeed, rather than letting the (more

THE CITY VIEW

efficient) powers of market forces decide who should thrive in the dog-eat-dog world of corporate battle. There is good reason for scepticism –markets, after all, have been the defining force of human progress for centuries. Such criticisms will come into

sharp focus again today, with the collapse of the politically wellloved Britishvolt. On paper, it seemed an example of innovation and ingenuity, and that it happened to be (in theory) located in the north east gave it an obvious appeal to Tory politicians. The firm’s troubles appear to have begun when they agreed to a host of conditions for taxpayer funding. Private injections of cash then became dependent on the government

handing over the cash, and when Britishvolt couldn’t meet those conditions, the whole thing began to unravel. It is not the first time a Whitehall favourite has gone pop. Satellite firm Oneweb, which the government bailed out in hopes of creating a global superpower, was recently taken over by a French rival. The only return to taxpayers is a ‘golden share’ which the UK can exercise in matters of national security.

Britain’s real problem though is

not the winners it tries to pick, but that we never truly commit to either leaving market forces to themselves or getting involved. As one academic writes, our approach is “somewhat schizophrenic, with habitual appeals to the virtues of free markets accompanied by selective state intervention to support specific firms and sectors”. Government would be advised to pick one, and stick with it. It’s little surprise we’d prefer the former.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE GUARDIAN

OWNER OF UK CARE HOME GROUP PAID HIMSELF £21M DESPITE SAFETY CONCERNS

A multimillionaire dementia home boss paid himself at least £21m in five years despite inspectors finding multiple breaches of staffing, safety and leadership rules.

THE TIMES

OXFORD NANOPORE FAILS TO HIT FORECASTS FOR REVENUE

Investors in Oxford Nanopore Technologies, the company known for its innovative gene-reading devices, were yesterday left feeling miffed that its full-year revenues will miss forecasts.

THE TELEGRAPH

MAJOR BANK CUTS RATES ON 100 MORTGAGE DEALS IN ESCALATING PRICE WAR

Rival lender HSBC reduced rates on 100 of its deals by up to 0.1 percentage points today, while Yorkshire Building Society cut its fixed-rate mortgages by up to 0.75 percentage points

Bank of England may have to hike interest rates to lessen price impact

THE BANK of England will have to hike interest rates 50 basis points again next month to prevent scoring pay increases from kneading high inflation into the UK economy, analysts warned after yesterday’s Office for National Statistics (ONS) jobs figures.

Workers bagged a 6.4 per cent pay rise over the three months to November, the highest rate outside of the pandemic since records began over two decades ago, according to the ONS.

Despite the bulging pay packets, Brits are suffering one of the sharpest hits to their take home pay ever.

Spending power tumbled 2.6 per

cent in the quarter to November, underscoring the strength of the current inflation surge gripping the UK economy. On a monthly basis, real pay dropped a steeper 3.7 per cent.

Although the labour market is loosening, with unemployment up slightly to 3.7 per cent and around 70,000 returning to the workforce, private sector pay growth topped seven per cent, a record increase, posing problems for the Bank of England.

Governor Andrew Bailey and co are worried workers are chasing rising prices by demanding bumper pay increases. That could incentivise businesses to hike prices to protect margins, raising the risk of a 1970sstyle inflationary spiral emerging.

“The worry is that, if wage growth exceeds productivity gains, firms may seek to pass on some of these extra costs via future price increases, thereby prolonging the bout of inflation,” Sandra Horsfield, economist at Investec, said.

The Bank will announce its next interest rate decision on 2 February, with analysts signalling a high risk of a second successive 50 basis point jump.

“The latest labour market data maintain the pressure on the [monetary policy committee] to raise interest rates by another 50 basis point[s] next month, rather than slow down,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

CITYAM.COM 02 WEDNESDAY 18 JANUARY 2023 NEWS

JACK BARNETT

LEVEL HEADED Sadiq Khan tried his hand at bricklaying in east London yesterday. Today he will announce changes to Londoners’ council tax bills as well as TfL fares

STANDING UP FOR THE CITY

WAGE GROWTH ACCOUNTING FOR CPI INFLATION -5% -4% -3% -2% -1% 1% 2% 3% Nov21 Dec21 Jan22 Feb22 Mar22 Apr22 may22 Jun22 Jul22 Aug22 Sep22 Oct22 Nov22 -3.7% Source: ONS

Administrators put on standby at stationery staple

CITY A.M. REPORTER

STATIONERY outfit Paperchase has put administrators on standby should a planned sale process fail to come up with a new owner.

The retailer, a staple of high streets and train stations, has endured a miserable two years since the pandemic.

It was forced into a rescue deal in 2021, then picked up by retail grandee Steve Curtis –who promptly put it back on sale earlier this year, via PwC.

Yesterday Paperchase confirmed reports that it had retained Begbies Traynor as it looks for a future.

“We have retained Begbies... and PwC to advise Paperchase on strategic options, including the sale of the business as a going concern to new owners.

“Talks are continuing with a number of interested parties,” the firm said.

Sources told Sky News’ Mark Kleinman, who first reported the news, that a pre-pack administration was “likely” but not guaranteed.

The firm has been struggling since the second lockdown in 2020. The greeting card-hawker enjoyed around half of its sales in November and December, trading periods which were all but wiped out by Covid-19 restrictions.

At the time of the rescue deal in early 2021, Paperchase said in a statement that “the cumulative effects of lockdown one, lockdown two –at the start of the Christmas shopping period –and now the current restrictions

Paperchase is looking for sources of new funding

have put unbearable strain on retail businesses across the country.”

It is not the only bricks and mortar retailer to be struggling against the changing tides of consumer habits, though.

Earlier this week Matalan was forced into a debt for equity swap in order to secure a capital injection, while the last two years have seen high street names including Topshop –as part of the Arcadia Group –fade into history.

Microsoft readying to cut 11,000 jobs globally according to reports

ILARIA GRASSO MACOLA

MICROSOFT is likely to become the latest tech giant to slash thousands of jobs worldwide after reports emerged yesterday.

Sources told Sky News’ Mark Kleinman the Seattle-based powerhouse could announce plans to cut five per cent of its global workforce within the next fewdays.

This means that over 11,000 people would be made redundant, even though it’s still unclear how many UK jobs would be cut.

Microsoft is expected to announce the cuts before 24 January, when it will announce its second-quarter results.

When approached for comment, Microsoft said it did “not comment on rumour”.

Microsoft is the latest tech company to lay off a significant proportion of its workforce, following in the footsteps of the likes of Amazon, Twitter and Salesforce.

According to data from layoff tracking website layoffs.fyi, over 154,000 people working at tech firms across the world were fired in 2022.

THE RAIL strikes continue.

Despite new offers from the rail bosses, the unions have rejected this latest round of pay proposals.

Two new dates for strike action have been confirmed for 1 and 3 February unless a resolution can be reached by then.

Lendinvest gets boost from Lloyds for UK mortgage market entry

CHARLIE CONCHIE

LENDINVEST yesterday secured a new £120m funding boost from Lloyds Bank as it prepares a push into the UK’s £1.2 trillion homeowner mortgage market for the first time.

The London-listed property fintech firm said Lloyds had now offered up a credit facility worth £300m after striking a deal for an initial £180m in October to fund its buy-to-let offer. Lendinvest said the deal would now

boost its funds under management to more than £3.6bn.

The funding boost comes as bosses prepare to roll out its homeowner mortgage product to the market after a period of initial testing in December.

Rod Lockhart, Lendinvest chief, said the “complexity” of the UK mortgage market made it “ripe for disruption” for digital lenders.

“There’s a huge number of manual processes, even for the most simple mortgages,” Lockhart told City A.M.

03 WEDNESDAY 18 JANUARY 2023 NEWS CITYAM.COM

STRIKING OUT RMT and Aslef have anounced two new strike dates in February

Morgan Stanley and Goldman hit by economy

CHRIS DORRELL

CHRIS DORRELL

TWO WALL Street giants confirmed to markets yesterday that they had felt the sting of economic headwinds.

Morgan Stanley’s profits have nearly halved due to intense US recession fears and rising interest rates chilling deal making activity.

The lender has become the latest casualty of businesses and investors parking their money in safer places to ride out the worldwide economic slowdown.

Morgan Stanley’s profits tumbled 41 per cent over the final months of last year compared to the same period in 2021.

The firm has shed more than 1,000 staff, while rival Goldman Sachs has also engaged in what management consultants call ‘right-sizing’.

More than 3,000 staff are expected to

be asked to leave at Goldmans.

In its own market update, Goldman missed analyst estimates amid a near halving in investment banking revenue and an expansion in loss provisions.

Chair and CEO David Solomon told investors that the results were “disappointing” and said its business mix had been “particularly challenging”.

The bank recorded revenue of $10.6bn ($8.6bn), down from $12.6bn last year and undershooting analyst estimates of $11.1bn as revenue in its asset and wealth management and global banking and markets divisions fell.

Investment banking fees fell 48 per cent due to a decline in dealmaking. The firm also confirmed it was to cease offering loans on its loss-making consumer banking arm, Marcus.

Fink slams critics as trying to ‘demonise’ Blackrock strategy

CHRIS DORRELL

US FINANCE legend Larry Fink hit back at “personal” attacks on his asset manager Blackrock’s ESG policy.

The world’s largest asset manager has become a lightning rod for criticism, with billions of dollars being withdrawn from the supposedly “woke” investor by right-

wing Republicans while Democrats have attacked the fund for not doing enough to stop fossil fuel funding.

Speaking at Davos, Larry Fink said that debates about ESG have led to “huge polarisation”.

“For the first time in my professional career, attacks are now personal. They’re trying to demonise the issues,” Fink said.

Bonus payouts to be smaller this year: Suisse

CHRIS DORRELL

CHRIS DORRELL

CREDIT Suisse’s own chair, Axel Lehmann, described 2022 as “a horrifying year for Credit Suisse” as he warned that it doesn’t “look great” for bonuses at the bank in an interview with Bloomberg yesterday.

“When you suffered huge losses, it is clear that the budget gets cut also on bonuses”, he said.

Lehmann was not wrong that 2022 was a difficult year for the Swiss bank.

Credit Suisse’s share price dropped by over 60 per cent during 2022 as the lender faced yet more scandals and at one point saw rumours spreading across European banking about its capital reserves.

In February, it became the first major bank to face criminal trial in Switzerland for being involved in money laundering by a Bulgarian cocaine trafficking gang. It was found guilty and fined £1.7m.

In October, it said it would be slashing 9,000 jobs. It announced major restructuring plans in October –including a £3.5bn capital injection from the Saudi National Bank.

DAVOS

Many of the world’s CEOs are stuck in traffic jams at the gridlocked Davos summit

CITYAM.COM 04 WEDNESDAY 18 JANUARY 2023 NEWS

Fintech bubble burst ‘weeded out the weak’

CHARLIE CONCHIE

CHARLIE CONCHIE

SLASHED valuations, mass layoffs, a funding drought and shuttered IPO market. For most, 2022 won’t be remembered as a stellar vintage for the fintech sector.

But it wasn’t all doom and gloom, according to new analysis from investment bank Peel Hunt. A new note from the firm yesterday said the spectacular bursting of the fintech bubble in 2022 has helped “weed out the weak business models” in the sector and shifted the market towards an ultimately more sustainable emphasis on profitable growth.

Analysts at the firm have now urged investors not to take a “myopic” view of the market and have doubled down on the “compelling long-term investment thesis” of the fintech sector.

“We liken the development of the fintech sector to that of the internet sector, with 2022 reactions mimicking the dotcom crash of 2000,” fintech analysts Gautham Pillai and Advika Jalan said in a new report.

“However, as we saw with the internet sector in the following two decades, we believe 2022 has helped to weed out the weaker business models in the fintech

space and showed the resilience of the rest of the vendors, which are focused on profitable growth.”

The analysis comes despite a sharp downturn in valuations last year as venture capital funding dried up after a decade-long funding frenzy.

Prices slumped across nearly every stage of fundraising in 2022 as investors soured on high-growth loss-making business models that had tempted in bumper rounds over the past decade.

Series D and later funding rounds saw valuations fall by 27 per cent in the third quarter of the year, bringing them down to nearly 2020 valuation levels, a recent report from data firm CBInsights found.

UK fintech funding dipped eight per cent to $12.5bn (£10.19bn) last year but held up more strongly than rival markets, with global funding contracting by around a third.

In its report today, Peel Hunt advised investors to shrug off the slump and back the largely unlisted sector via Londonlisted venture vehicle Augmentum.

The firm also reiterated its buy rating on a smattering of listed fintechs including Alfa Financial Software, Eckoh, Equals and Network International.

JANUARY is always a data-heavy month. Just as bloated Brits sit back after Christmas and assess the mistakes and learnings of the past year, near enough every industry body likes to survey the numbers and take stock of where they are. And this year in the world of investment, that data has been universally miserable.

Fintech and tech funding in the UK is well down amid a wider global sump in investment, brought on by soaring inflation, public market turmoil and more expensive borrowing costs. The boom-time post-pandemic venture blizzard of 2021 has also cast this year’s figures

THE BOTTOM LINE

in a particularly unflattering light.

But the read from Peel Hunt analysts strikes a markedly more measured and upbeat reading of those grim numbers.

They make the salient point that tumbling valuations can be an opportunity to get into a market at cheaper prices while the opportunity of massive returns remains.

While the next year may be tricky for the sector, an approach of investing in firms with sustainable models and a route to profitability

looks to be a sensible one in the long run.

Just as the internet sector roared back after the dotcom crash in the early 2000s, they reckon a rosy future for UK fintech still beckons.

As Augmentum chief Tim Levene told this newspaper over the weekend, the view that inexperienced fintech investors could somehow pump cash into small firms and “hack” the route to hyper growth is now dead.

The funding frenzy has cooled and FOMO is drifting out of investors’ mindset, it may be a good thing in the longer run.

CHARLIE CONCHIE

CHARLIE CONCHIE

Wise hikes guidance but falling transactions see shares take a hit

CHARLIE CONCHIE

CHARLIE CONCHIE

MONEY transfer firm Wise hiked its guidance for the full year yesterday as rising interest rates caused a surge in the amount of cash it is making on its customer deposits.

The London-listed fintech said the net income it was making on its customer balances roared up 148 per cent on the previous quarter to £43.5m, pushing total income up to £268.7m.

Revenues for the firm also bumped

upwards six per cent to £225.2m.

However, the firm reported a dip in cross-border transactions on the previous quarter, sending shares tumbling 10 per cent yesterday.

Wise chiefs revised their outlook for the year and said they were now expecting to post total income growth for the year of 68-72 per cent.

Kristo Kaarmann, CEO and Wise cofounder, said that the firm was now also looking to share the profits reaped from rate hikes with customers.

05 WEDNESDAY 18 JANUARY 2023 NEWS CITYAM.COM

Money transfer firm Wise has altered its yearly guidance in the light of increased income

AVOIDING ANOTHER CARILLON COLLAPSE

ON THE fifth anniversary of the collapse of outsourcer Carillion, MPs and audit sector leaders have united in calling on the UK government to push forwards with plans to overhaul the country’s audit sector.

MPs said a shake-up of the country’s accounting industry is needed imminently to ensure that audit failures, such as the one surrounding Carillion’s collapse, are not repeated.

Labour shadow chancellor Rachel Reeves told City A.M. that Carillion’s catastrophic collapse had a major impact on the UK economy in causing thousands of jobs losses and costing taxpayers a “fortune”.

However, following Carillion’s implosion in 2018, eyes quickly turned to the construction firm’s auditor, KPMG, over its failure to spot any red flags when screening the firms accounts.

KPMG still faces a £1.3bn lawsuit brought forward by Carillion’s liquidators over claims its “incompetent” work contributed to the firm’s collapse.

The UK’s accounting watchdog in July also fined KPMG a record £14.4m last year, after the firm and five of its auditors were found to have misled investigators during inspections of its audits of Carillion.

An investigation, opened in 2018 by the UK’s Financial Reporting Council (FRC), into KPMG’s 2014, 2015 and 2016 audits of Carillion is still ongoing.

KPMG declined to comment on the ongoing probe.

Nonetheless, the anniversary of the scandal today has led to renewed calls for an overhaul of the UK’s audit sector.

A series of high-profile accounting scandals in the years following Carillion’s collapse, involving major companies including Thomas Cook and BHS, have only strengthened the argument for change.

The UK government is, however, yet to complete its planned overhaul, despite having pledged to “revamp” the country’s audit sector and “restore trust in big business”.

The planned reforms are set to see the FRC watchdog replaced with a new, more powerful regulator – called the Audit, Reporting and Governance Authority (ARGA).

The overhaul will also see the government seek to “tackle” the Big Four’s dominance over FTSE 350 audit work, by forcing them to share those jobs with smaller, challenger firms.

Speaking to City A.M., Darren Jones MP,

chair of the UK parliament’s business, energy and industrial strategy (BEIS) committee, called on the government to hurry up with its planned reforms.

“Five years on and we still don’t have the promised legislation to give the regulator the powers it needs to prevent this from happening again,” the Labour MP said. “The regulator is waiting. Parliament is waiting. What are ministers waiting for?” Jones said.

Conservative MP Mark Pawsey told City

DCMS plays down privacy concerns regarding popular connected tech

JESS JONES

THE UK’s data watchdog has played down potential privacy concerns linked to connected technology, arguing that strong demand for devices like the Amazon Alexa and Google Nest suggest British consumers are not that worried.

MPs from the Digital, Culture,

Media and Sport Committee (DCMS) yesterday quizzed the Information Commissioner’s Office, as well as Amazon and Google execs, about the risks posed by connected tech devices such as smart toys, doorbells and speakers.

Asked whether tech companies suffer from an inherent lack of trust from consumers, John Edwards,

information commissioner, said: “People are flocking to these devices.” Edwards, however, said he was unsure “whether this enthusiasm for these devices is based on an ignorance of the data issues that they represent or, conversely, whether it is based on an expectation among consumers that organisations like mine are there to watch their back”.

A.M. “action on audit reform is overdue” as he called for progress to be made on the draft bill to ensure the UK’s new watchdog has the “the legal powers it needs to do its job effectively”.

Michael Izza, chief executive of the Institute of Chartered Accountants in England and Wales (ICAEW), said there was a lack of urgency in parliament to address the issue. “Right now, I don’t have a good sense that political will is there,” Izza said, as he warned the draft bill is currently in “limbo”.

Izza, however, said audit reform is not exactly a “vote winner”, assuming the government has ignored plans to overhaul the sector in favour of other priorities. The ICAEW chief explained the lack of continuity in the UK government has also hindered progress on

audit reform, as he noted the country has had six business secretaries since audit reform first appeared on the agenda following Carillion’s collapse.

Either way, Izza warned the delays to the planned overhaul threaten to hinder growth. “Is this good for UK Plc? No it isn’t,” the ICAEW chief said.

Outlining the government’s position, business minister Lord Callanan told City A.M. reform was “already underway”, as he noted the UK government has given the FRC “more powers to ban auditors from reviewing large companies’ accounts where necessary”.

An FRC spokesperson said it had “made great strides since Carillion” and become a “high-performing regulator”. The FRC “eagerly await” new legislation, they added.

CITYAM.COM 06 WEDNESDAY 18 JANUARY 2023 NEWS

Demand for devices like Amazon Alexa and Google Nest has outstripped privacy worries

The regulator

waiting. Parliament

waiting. What

ministers

Five years on from Carillion collapse, MPs call for audit reform, writes Louis Goss

is

is

are

waiting for?

ISSUE 3,041 CARILLION’S COLLAPSE @ojngill emergencyCobra metlast pile, second-biggestcontractor shortlybefore without CabinetOffice Carillionappointment, work hours on. Marketinsiders contracts. insisted week.The OfficialReceiver appointment, failed. thegovernment bells” corporate headRoger does theyare MINISTERS HOLD EMERGENCY COBRA MEETING AFTER FIRM’S DEMISE FEARS GROW FOR THOUSANDS OF JOBS AS STATE BACKS PAYROLL QUESTIONS RAISED OVER STRING OF CONTRACTS GIVEN RECENT MONTHS ANGER MILLION POUND PAY PACKETS DISHED OUT TO FORMER EXECS How we reported on the collapse of Carrilion five years ago

Ocado sales fall for first time as inflation bites

AZANIA PATEL

SHARES in Ocado were dragged down yesterday after the online grocery retailer revealed annual sales had dropped for the first time ever.

Shoppers pulling back spending under inflationary pressures saw annual revenue at Ocado fall 3.8 per cent to £2.2bn in 2022.

The online grocer managed to claw back some growth with positive Christmas and New Year trading updates and revenue was up 40 per cent on pre-pandemic levels in 2019.

However, signs of shoppers buying less spooked investors, with shares dropping nine per cent yesterday. Shares are now down almost 50 per cent on the year.

Average orders per week for the online-only retailer during the quarter showed 1.9 per cent year-on-year growth, while the company said it had 940,000 active customers by the end of

December, growth of 12.9 per cent year on year. However, customers purchased fewer items, with the average basket value dropping 1.3 per cent.

Ocado also disappointed shareholders with its earnings forecast for the current year, which fell far short of analyst expectations.

Ocado Retail CEO Hannah Gibson, in an attempt to show optimism, said: “The year ahead will set us up to deliver strong sales and profit growth over the mid-term.”

AJ Bell investment analyst Russ Mould said: “While Ocado is winning new customers, people are buying less. This has an outsized impact on online deliveries which cost roughly the same to make whether the order is two potatoes and a block of cheese or a full weekly shop.

“Pointing to a strong rebound in 2024 requires investors to take a lot on trust and it doesn’t look like the market is willing to extend Ocado this courtesy.”

A RUM FOR YOUR MONEY Diageo buys Don Papa Rum for £230m

ALCOHOL giant Diageo has swooped in for super-premium brand Don Papa Rum for £230m. The London-listed drinks company is putting up the cash with a possible £157m consideration through to 2028, subject to performance.

Diageo Europe and India president John Kennedy said he was excited about the acquisition, which aligned with the group’s strategy to acquire brands with “attractive margins” that allow it to participate in the “super-premium plus segment”.

It comes after Diageo last year snapped up Casa UM, Mezcal Union and Balcones Distilling. Diageo shares closed up 1.76 per cent on the news.

07 WEDNESDAY 18 JANUARY 2023 NEWS CITYAM.COM

Market slowdown starts to hit British housebuilders...

JAMES SILVER

JAMES SILVER

THE SLOWDOWN in the housing market long predicted by analysts appears to be already biting.

Yesterday housebuilder Crest Nicholson said the number of homes sold on each of its sites was as low as 0.35 –compared to 0.8 as recently as the latter half of 2021. It is the latest sign of stress in the housing market, with a combination of recessionary headwinds, runaway inflation and rising interest rates all contributing to a significant cooling in demand for homes.

Market indexers including Rightmove, Zoopla and Halifax have all predicted price falls in 2023 of as much as eight per cent.

Yesterday consultancy Oxford Economics predicted a double-digit fall in

“A drop in new buyer demand was a predictable consequence of the marked deterioration in mortgage affordability in the autumn, but the scale of the fall in activity is surprising,” it said of new Bank of England data released earlier this month.

Crest Nicholson boss Peter Truscott said of results published yesterday, to the end of October last year, that demand had remained “resilient for much of the trading period.”

However he added that the firm was forced to “navigate operational disruption throughout the year and faced increased economic uncertainty in the final quarter”.

Shares fell more than two per cent yesterday, now down 23 per cent on last year. That fall has been mirrored across the sector –with Barratt also down 31 per cent and Persimmon down 45 per cent.

... but rents in central London continue spike

JAMES SILVER

RENTS in the most desirable parts of the country continued to spike last year despite rising interest rates and a cost of living crisis.

So-called ‘prime rents’ ended 2022 up more than 10 per cent on the year, according to research by Savills, with growth expected to slow slightly this year to just five per cent and then three per cent in 2024.

Smaller properties at lower price bands were outperforming larger homes in rental growth, the property firm said.

“Our agents agree that young professionals and corporate demand continue to make up the bulk of demand, and we can expect these ‘needs-based’ tenants to continue to drive up competition in the early part of 2023,” said the firm’s Jessica Tomlinson.

London areas which outperformed the market include Marylebone, Earls Court and Islington –while previous pandemic-era stars including Wimbledon and Barnes have begun to see signs of slowing growth.

CITYAM.COM 08 WEDNESDAY 18 JANUARY 2023 NEWS Months of research need months of donations to keep scientists, doctors, nurses and volunteers working every day until cancer is beaten. 1 in 2* of us will get cancer in our lifetime. Give £3 a month and help us fund long-term research that saves lives. Without regular donations we couldn’t continue our ground-breaking research that saves lives every day. Easy ways to set a direct debit donation Visit cruk.org/givemonthly Scan the QR code on the right to complete an online donation form Just give a month *Ahmad AS et al. British Journal of Cancer, 2015 22MSPAPRS 8 Cancer Research UK is a registered charity in England and Wales (1089464), Scotland (SC041666), the Isle of Man (1103) and Jersey (247). MaeserfoshtnoM nomdeenhcra f oshtn G 1 i d n d nahtnoma3£evi elgliswfu*on21 i ecnaclitnuya ulovdnasesru ekot snoitano noldnufsuplehd efirlunoriencat c .netaebsir nikrowsreetnu d,stsitneicspee m ret-gn .meite y revegn , srotcod evitgsuJ e W t a deosstyaywsa aesegrnikaerb-nduor tanordalugetruohtiW s levatsahhtcraese ylhtnomevig/gro.kurc tisiV tanotdibetdcerit a d s eevislevatsahhtcra otc’ndluoecswnoit .sevis l noit .yaydrevs e r ueounitn sle o tland (SC041666), the I ch UK is a r esearerRancC htnoa m 47).sey(2er f Man (1103) and J ales (1089464 ngland and W ed charity in E er ), oedlinnnoeatelpmoc n teodoRceQhntacS mronfoitano o t thgierhn t

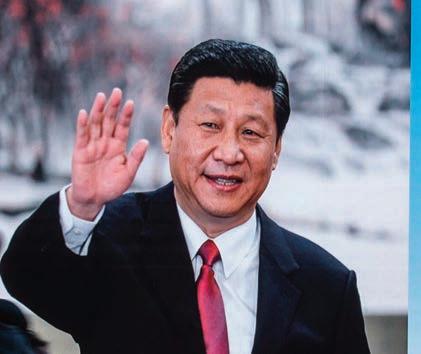

Chinese economy grows at slowest pace in 50 years

JACK BARNETT

CHINA’s economy is growing at the slowest pace since the 1970s, barring the pandemic, due to tough zero-Covid restrictions hitting spending, figures out yesterday reveal.

The world’s second biggest economy grew three per cent in the last quarter of 2022 compared to the same period in 2021, far below the 5.5 per cent growth target set by policymakers at the start of the year. This did, however, beat the consensus forecast of just 1.6 per cent growth.

Despite the upside surprise, a big fall in consumer spending dragged headline expansion lower.

Retail sales slumped 1.8 per cent in the quarter to December, again beating analysts’ bets, but still weighing on output.

Separate data yesterday also revealed China’s population shrank for the first time since 1961.

The world’s most populous country had 1.41175bn

people at the end of last year, compared with 1.41260bn a year earlier, the National Bureau of Statistics said yesterday, an 850,000 decline.

China’s one child policy – introduced in 1979 and raised to a two child-policy in 2016, leading to a short jump in birth rates – coupled with higher living costs and a widening middle class has disincentivised people from having children.

Beijing’s policy resulted in gender selective births in which couples prioritised having boys over girls. That has now tipped the gender balance toward men, narrowing opportunities to have children. Uncertainty over Beijing’s future birth rules has also put people off widening their family, despite policymakers trying to incentivise couples to have children by offering tax reliefs and better parental leave.

The drop in population raises questions about whether it can continue to clock in more than five per cent annual GDP growth rates in the coming years.

ON THE face of it, China’s onechild policy has done exactly what it set out to do.

Beijing implemented the diktat back in the late 1970s to help manage the distribution of the country’s limited resources.

It lasted until the mid 2010s when it was raised to a two-child policy. How generous.

The multi-decade long state intervention is now bearing fruit. Yes, there was a very, very small bump in births after the regime was loosened, but the downward population trend has now set in.

That means China can’t rely on a

THE BOTTOM LINE

great big mass of workers to generate output. It needs to be smarter.

Productivity growth is the key to the country’s long-term economic success.

Endowing workers with better capital to allow them to produce more things per hour would cancel out its shrinking population.

India is on course to become the world’s most populous country soon. And, according to Goldman Sachs, will overtake China’s economy. Soon the world’s gonna run out of

country’s undergoing population booms. What happens after that is murky.

A slowing Chinese economy poses problems for the rest of the world. The UK and other rich Western countries have relied on cheap imports from China to keep a lid on living costs for years.

A slowdown in production would raise the risk of goods becoming more expensive. China’s growing middle class also means firms will have to pay their workers more, raising final production costs. That could bump inflation higher globally.

JACK BARNETT

PwC steps down from Evergrande as auditor following disagreements

LOUIS GOSS

PWC HAS resigned as Evergrande’s auditor following a series of disagreements with the heavilyindebted property developer over its audit of the firm’s 2021 accounts.

In a filing to the Hong Kong stock exchange, Evergrande said its board had decided to replace PwC as the company’s auditor after the two parties failed to agree a way of completing the Chinese firm’s 2021 accounts audit.

PwC claimed, according to the filing, its inability to obtain sufficient “information and evidence” on various “significant matters” had prevented it from setting out a timeline on its ability to complete the audit.

The auditor pointed to Evergrande’s failure to provide information on matters including the value of the developer’s property portfolio, its compliance with loan agreements and the financial status of its subsidiaries, the filing said, citing PwC’s letter.

09 WEDNESDAY 18 JANUARY 2023 NEWS CITYAM.COM GET IT ON Southeastern has a range of season tickets to suit you. Buy your ticket direct via our app or visit: southeasternrailway.co.uk/commuteyourway No booking fees apply. when you do that work

t ickets Season

Beleagured Hong Kong property firm Evergrande has to find a new auditing company

Chinese premier Xi has overseen a slowdown in the country’s economy

Ukraine winning the Davos PR battle

AM in Davos this week to host a panel for my firm H/Advisors on the daunting task of rebuilding Ukraine once there is peace. That may seem a long way off, but it is vital that the planning starts now on how the West and the business community can help the country emerge from this devastating conflict stronger and better. Our panel has three senior Ukrainian business leaders who will be at the forefront of any reconstruction programme. There is Sergiy Tsivkach, the CEO of UkraineInvest and an adviser to the Prime Minister; Volodymyr Lavrenchuk, CEO of Neqsol, a major investor in the country’s energy and telecoms sectors and Andrey Zdesenko, an energetic entrepreneur who has created Ukraine’s leading household products group.

The panel (which will be taking place as you read this) will focus on the scale of the investment needed; where such vast amounts can come from; how Ukraine and the international community can attract capital; and how, to use an already overused phrase, they can Build Back Better. We are hoping to stimulate the debate and do it early, since the post-war task will be enormous, but there will be great

opportunities for anyone sufficiently farsighted to invest

Whatever is happening on the ground, Ukraine is certainly winning the PR battle at Davos particularly as the Russians aren’t allowed in any longer. Last year it scored a coup when it converted the building that was the Russia House since time immemorial into the ‘Russian War Crimes House’. This year its pavilion has a life-sized video screen of two children walking down the street of newly liberated Kherson.

Generating support and attention for Ukraine and ensuring it has access to the most powerful political and economic levers is a great example of what Davos should be about – away from the everpresent commercialism (all the tech giants have vast pavilions here).

Interestingly it is clear there are two Davoses. There is the official one in the conference centre where the WEF works through its agenda diligently. Then there is Fringe Davos – all the events that take place outside the conference centre in the cafes, shops and restaurants along the Promenade (the town’s main street) which are rented out for the week.

Increasingly Fringe Davos is more vibrant, younger and frankly more interesting than the main event.

STRETFORD TO SWITZERLAND

£ Davos has always had its detractors, who see it as a liberal elite pow-pow, where smug group-think reigns supreme. The nay-sayers have been delighted this year that only one G7 leader is turning up, Olaf Scholz from Germany, citing it as proof that the WEF Summit has had its day, especially after the disappointing turnout last May.

So I asked Sir Martin Sorrell, Founder of S4 Capital, former

head of WPP and a 30-year veteran of the event, whether we have indeed passed ‘peak Davos’.

“Well there is a lot more competition these days from organisations like Google and the Milken Institute, so its market share is under pressure,” he accepted. “And the conference is perhaps less global this year and more European – the Chinese delegation is smaller and there are no Russians for obvious reasons.

“But it is still a tremendous place to learn a lot and meet a lot of people in a very short space of time.”

There is nowhere like it that brings politicians, economists and business people together to discuss global issues, he continues. “And this year there is a lot to discuss.”

With war, inflation, recession and increasing global tension on the menu, he is not kidding.

PwC's Annual Global CEO Survey is always worth a read for anyone trying to get into the heads of our business leaders. This year's version, published just in time for Davos, is no exception.

It shows that CEOs are worrying a lot about the state of the world and the prospects for their businesses.

A stark 40 per cent say their companies will be economically unviable in ten years time unless they make radical changes. Three quarters of them believe that global economic activity will decline this year.

And confidence in their own business’s ability to deliver growth this year has also slumped. Chewy reading for any delegate here.

BYRON Burger recently announced that it would close nine restaurants as part of a “prepack” administration deal. The closures will see 218 job losses and have been blamed on rising costs and lower consumer spending.

But digging into the data shows that the brand has also been underperforming the rest of the casual dining sector.

YouGov BrandIndex UK shows that, between 1 January 2022 and 1 January 2023, Byron’s Impression scores – which measure overall sentiment – saw a slight decline from 6.5 to 6.1 (-0.4). But the same period saw average scores for the casual dining sector shift from 9.9 to 10.0 (+0.1).

Other metrics tell a similar story. Quality scores for Byron didn’t change between the start of 2022 and the start of 2023 (6.7), and even though the sector av-

erage got worse, seeing scores decline from 7.8 to 7.1 (-0.7), it still slightly outperformed the burger chain. Satisfaction scores saw a slight improvement, inching up from 4.9 to 5.2 (+0.3), with the casual dining sector slumping from 8.4 to 8.1 (-0.3) - but still remaining ahead.

We could attribute part of this to a lack of marketing; Byron’s Ad Awareness scores barely changed – going from 0.3 to 0.2 (-0.1) – while the sector crept up

from 1.2 to 1.4 (+0.2). With Value for Money measures moving from mildly positive (0.6) to mildly negative (-0.3) territory, rising costs may well also have played a role in the brand’s underperformance. The casual dining sector saw a larger decline from 3.4 to 1.9 (-1.5), but still stayed ahead of Byron. Summarising the chain’s woes, Index scores – which measure overall brand health dipped from 4.1 to 3.9 (-0.2); leaving it some way behind the rest of the industry (which saw scores fall from 6.7 to 6.0).

Whatever the external reasons, Byron’s last year tells a story of a brand that is showing minor improvements in some areas, minor deterioration in others, and all the while coming up short compared to other brands in its industry.

Stephan Shakespeare is the co-founder and CEO of YouGov

CITYAM.COM 10 WEDNESDAY 18 JANUARY 2023 NEWS

Burger’s in a right pickle – but does it deserve to be? January 1, 2022 - January 1, 2023 Casual dining sector average 0 2 4 6 8 10 Byron JanFebMarAprMayJunJulAugSepOctNovDecJan Casual dining sector average Byron YouGov Brandindex: Average of Impression, Quality, Value, Satisfaction, Recommend and Reputation scores (4 weeks moving average)

BRAND HEALTH CONSISTENTLY UNDERPERFORMED THAT OF THE CASUAL DINING SECTOR OVER 2022

Byron

BYRON’S

THE NOTE

interesting people say interesting things: today it’s Neil Bennett, global co-chief exec of communications giant H/Advisors

Stephan Shakespeare

BOOK Where

One of the odder sights at Davos this year is the Manchester United pavilion. Why on earth is a football club here? Think twice and it makes smart sense – Man Utd is really a £5bn media group and it is here to cosy up to sponsors, real and potential. And with the sale talks continuing, who knows? Maybe someone walking down the Promenade will fancy some shopping.

I

ACCOUNTING FOR DIFFICULT TIMES THE CITY’S MOST HOTLY-ANTICIPATED AWARDS EVENING - AND AFTERPARTY - IS BACK CITYAM.COM/AWARDS-2023 IN PARTNERSHIP WITH FOR TABLES AND TICKETS: Please contact Darren.rebeiro@cityam.com

NSURANCE COMPANY OF THE YEAR

The insurance sector has had an extraordinary year, dealing with natural disasters and climate change on the one hand and investing at pace on the other. This year we’re looking not just at insurers who are delivering for shareholders but those looking to take the lead in greasing the wheels of the British economy.

ACCOUNTANCY FIRM OF THE YEAR

Auditors and accountants have spent plenty of time in the spotlight in recent years, but some firms are leading the way in putting audit and accountancy’s reputation back on the right track - and some are choosing innovative ways to respond to today’s challenges.

2ND MARCH 2023 THE GUILDHALL

LAW FIRM OF THE YEAR

The City’s legal sector continues to lead the world even in the face of great global changes and an occasionally difficult political climate. We’re looking not just at the biggest players in the market but those that are looking to innovate through both acquisition and technological innovation and disruption.

BANK OF THE YEAR

Lenders might have expected things to calm down postpandemic, but the cost of living crisis put paid to that. We recognise those banks that are going above and beyond to support British business.

ANALYST OF THE YEAR

City watchers are more valuable than ever, and these analysts have consistently got the big calls right. We recognise those who put the hard yards in to know their businesses and sectors.

DEALMAKER OF THE YEAR

Getting deals across the line in a global climate that is ever more volatile is no mean feat. London remains at the heart of global M&A –and we look at the rainmakers who are still doing the business.

INNOVATIVE COMPANY OF THE YEAR

The City has always thrived on the back of innovation and these firms have it in their DNA. We honour the big ideas and fast-moving firms who are helping to define the future of the Square Mile.

ENTREPRENEUR OF THE YEAR

London has always been a home for risk-takers, and that hasn’t changed. We look at the driving forces behind growing and established companies alike, looking not just at the bottom line but highlighting those who are using markets and business to solve global problems.

INVESTOR OF THE YEAR

Never have markets been more difficult to predict - but even in a tough environment there are gains to be had. It’s those investors that still raise the eyebrows of City professionals in admiration.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE AWARD

‘ESG’ has never been more in focus than it has been over the past year, with the City going green at pace.

But it’s not just about saying the right things, but doing them – and using innovative new products to finance them, too. From big to small, businesses are on the sustainability march.

BUSINESS OF THE YEAR

We’re looking for the best of the best - the companies that have navigated economic headwinds and come out ahead. We’re looking for smart management, growth, and a willingness to do things differently.

PERSONALITY OF THE YEAR

The final and arguably most prestigious category will see City A.M. recognise the very best of the best in the Square Mile and beyond. The City remains a global financial leader - and it does so on the back of its people. Who will be this year’s big winner?

AWARD CATEGORIES THE CITY’S MOST HOTLY-ANTICIPATED AWARDS EVENING - AND AFTERPARTY - IS BACK FOR 2023 VISIT: cityam.com/awards-2023 FOR TABLES AND TICKETS: Please contact Darren.rebeiro@cityam.com NOMINATIONS FOR THE BEST OF THE BEST ARE OPEN NOW - GET YOUR ENTRY IN SOON IN PARTNERSHIP WITH

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

Ocado’s share drop puts pay to FTSE 100 recordbreaking run

THE capital’s premier index closed 0.12 per cent lower yesterday at 7,851.02 points, while the domestically-focused and mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell by a steeper 0.69 per cent to below the 20,000 point mark.

Results out yesterday morning from Ocado showed the firm’s revenues tumbled to £2.2bn over the last year, mainly caused by Brits returning to physical supermarkets after the end of pandemic restrictions. Sales also fell short of expectations.

However, its income is up compared to pre-Covid levels, signalling a greater proportion of consumers could have adopted online shopping in the long run.

Its shares tanked to the bottom of the

FTSE 100, shedding nearly 10 per cent. Ocado’s drop partly arrested the FTSE 100’s strong start to 2023. It has gained around four per cent, sending it close to its highest level ever of just over 7,900 points.

Investors will be eyeing remarks from the world’s economic and business leaders at the World Economic Forum’s annual jamboree in Davos all week.

The world is teetering on the edge of a recession, the findings of a survey of the globe’s chief economists released earlier this week by the WEF showed.

Fresh jobs data from the Office for National Statistics yesterday morning showed private sector pay is rising at the fastest pace on record at over seven per cent, raising the risk of further interest rate hikes by the Bank of England and knocking risk sentiment.

Global car dealers Inchcape has snapped up a 60 per cent stake in CATS, the leading distributor of luxury cars in the Philippines. The company now expects to add around £120m of annualised revenues. Peel Hunt considers the acquisition to be “strategically valuable” adding a new market. The investment analyst has made no change to its estimate, with a ‘buy’ stance at a target price of 1,200p per share.

RENOLD

UPS AND DOWNS

FTSE 100

MICHAEL HEWSON, CMC MARKETS

P 11 Jan 17 Jan 13 Jan INCHCAPE 17 Jan 933.86 660 16 Jan 12 Jan 680 900 920 940 UK manufacturer of chains, gears and couplings Renold has secured a major £8.7m contract with Royal Australian Navy. It is to be delivered over a seven-year period and represents a significant extension of the company's collaboration with BAE Systems. Peel Hunt was impressed with the deal and has included Renold of one of Top Small Cap picks for 2023, and has maintained its ‘buy’ stance with

To appear in Best of the Brokers, email your research to

P 17 Jan 24.55 11 Jan 17 Jan 13 Jan

a target price 49p.

notes@cityam.com

22 16 Jan 12 Jan 27 26 25 24 23

“The

has underperformed despite briefly pushing up to a new four year high, with the record high at 7,903 remaining tantalisingly just out of reach. The main drags on the UK benchmark were the more defensive sectors of health care, with some underperformance from some big caps like Unilever, Astrazeneca, and HSBC.

CITYAM.COM 12 WEDNESDAY 18 JANUARY 2023 MARKETS GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION IT’S FINALLY HERE RIVALRIES RENEWED AS THE SIX NATIONS RETURNS FOR 2022 8-PAGE PULLOUT 2022 SIX NATIONS ENERGY D-DAY Households LONDON’S BUSINESS NEWSPAPER FREE CITYAM.COM THURSDAY 10 FEBRUARY 2022 CITYAM.COM COOL RUNNINGS ALL THE GEAR FOR AN OVERDUE MOUNTAIN BREAK P20 STATE SET MAN IN THE KNOW MARK KLEINMAN GETS THE CITY TALKING P13 LONDON’S BUSINESS NEWSPAPER LONDON’S BUSINESS NEWSPAPER CITYAM.COM Climate noise blocking out THROUGH THE DRINKING GLASS THE LATEST FROM OUR WINE GURU P22--ISASUNWR – WHERE T PUT MONEYTHIS YEAR WEDNESDAY FEBRUARY 2022 ISSUE 3,677 THE ULTIMATE SAVINGS GUIDE ALL YOU NEED TO KNOW ABOUT YOUR ISA P19-21

EDITED BY SASCHA O’SULLIVAN

Lessons from the Met Police: We should give power to those who least want it

Williams

AFEW in society are handed power over the many. The recent revelations about Met Police officers - just the latest in a long and lamentable series - offer a stark reminder: those drawn to power are often those least fit to assume it.

While power attracts some for the opportunity to serve, it draws others for the chance to rule. One solution is to remove the question of attraction entirely. The precedent for doing so is as old as democracy itself. In Ancient Athens, public officials were chosen by ‘sortition’. Drawing from the admittedly small category of ‘free men’ (thereby excluding slaves, women and children), citizens were chosen at random to govern their communities and judge their fellow citizens.

Sortition lives on. Modern juries are, of course, selected in this way. Today we would think it odd and unfair to be judged by anyone other than twelve of our peers. More radically, organisations like the Sortition Foundation now call for wider applications of the approach. They propose tossing out the desiccated duffers in the House of Lords, for instance. Doing so would be no affront to democracy. Only China can boast of a larger chamber of unelected representatives than

our peerages.

In Britain, when we choose our politicians, we like them to at least feign reluctance. There is a long-established expectation that, if asked about their desire to become Prime Minister, MPs will deny that the ambition is theirs. There was, of course, a notable exception in the ample shape of Boris Johnson. Asked the question in 2013, the then Mayor said: “if the ball came loose from the back of a scrum,” he would “have a crack at it.”

In this, he only said what others thought because true reluctance in politics is vanishingly rare. The pole is slippery and it takes some climbing. So again, it is to antiquity that we must

turn for precedent. In Ancient Rome, Cincinnatus was the archetype of the reluctant ruler. His first dictatorship lasted 15 days. Once he’d saved the

state, he handed back power and returned to his farm. Called to serve once again, he repeated the trick, this time holding power for just 21 days.

Johnson referred to Cincinnatus on the steps of 10 Downing Street on the day he left office. “I am returning to my plough,” he said then, full of ominous hints at a possible return. The comparison was otherwise anything but apt. For one thing, Johnson’s humble “plough” is the lucrative speaking circuit, where he is said to earn £250,000 per speech. For another, he did not “return” to anything; he was returned, kicking and screaming. Most importantly, Johnson and Cincinnatus had markedly different attitudes to

power. The Roman wanted none of it. Johnson, as a boy, wanted to be “world king”.

If power accrues only to those who desire it, and believe it is their due, a certain cast recurs: those emboldened with the confidence of England’s public schools.

But politics is, like all public service, often a calling. There is much more to be done to ensure that everyone can hear the call. Civic Future, a new organisation founded by one of Johnson’s own former advisors, is doing just that, attracting a new generation, drawn from different backgrounds, to politics, and training them to serve.

The good news is that a shift does seem to be occurring in British politics.

After Johnson’s showmanship, and Truss’s brief and clownish performance, our politics is taking a turn for the serious.

George Osborne noted recently that in Sunak, Hunt, Starmer and Reeves there are “two sets of people who are sensible and have integrity.” The political battle now is for competence, not showmanship. This is a time for administrators, not politicians. It is a time, perhaps, for those who will serve and not rule.

At the next election, expect voters to turn to those least likely to pursue politics for personal gain, and most likely to do so in the interests of others. It is a standard that we should set all of those we entrust with power over us, whether they assume high office or keep our streets safe.

£ Josh Williams is director of communications at Labour Together and a monthly City A.M. columnist

WHEN I grow up, I want to go viral.” So said 40 per cent of 16-24-year-olds, according to Mastercard.

Facebook has all but lost this generation, Instagram too is flagging, but TikTok and BeReal are two new social media apps vying for the attention of a generation.

The race to go viral is not new, and has been around in its current incarnation since the days of Tumblr, albeit to a lesser degree. When I was kicking around on the quasi-blog quasi-social media site set up by David Karp, having upwards of 15,000 followers was considered, certainly in limited circles, quite a flex.

Now the measurements are in hundreds of thousands if not millions, and it's not just each other influencers are competing with to go viral, it’s big business.

At the end of last year, Lidl recorded its busiest day of sales ever. It put its success not simply down to people swapping to cheaper products in a Christmas blighted by a cost-of-living crisis, but also to the curious case of

Big Business needs to check its screen time and stop throwing money at trying to go viral

the Negroni Sbagliato. If you haven’t heard of it, you’re probably over the age of 35 (commiserations).

The classic cocktail with a twist found fame after Emma D’Carcy, actor in the House of the Dragon, said the drink, made with a splash of Prosecco, was their poison of choice.

The discount supermarket said they recorded a surge in sales of Prosecco after 32.9 million people watched the 20 second clip. And that’s just the original video. By its nature, TikTok encourages users to make their own spin offs of viral videos, creating a snowball effect.

And brands want in.

From Odeon to Specsavers, businesses are throwing huge amounts of time and money into social media fame. In early 2021, Weetabix went viral for putting baked beans on their cereal. More than 25 other brands piggybacked off of the frankly disgusting

looking combination, and even Jacob Rees-Mogg, the then Leader of the House of Commons, weighed in on the virtues of baked beans and how best to eat Weetabix.

While Lidl claim the TikTok video helped them with a very tangible metric - sales - the virtues of these campaigns are more ephemeral.

Dom Boyd, managing director of Kantar Insights, says it’s about creating “positive currency”, so while it may not directly turn into more sales, if people have to choose between Weetabix and an alternative, going viral might mean they pick the former.

But he admits, “like all great creativity”, it is “very, very hard” to create something organically viral.

It could also be money wasted. According to Alex Payne, former Sky Sports host and co-founder of Room Unlocked, an agency geared towards creating relationships between brands

and influencers, a decent amount of the successful viral campaigns have been down to luck.

For example, in 2020, Nathan Apadoca was trying to get to his job at an Idaho potato warehouse. His car broke down, so he jumped on a longboard and skated the rest of the way, all the while chugging a bottle of Ocean Spray cranberry juice. A video of his trip to work, overlaid with Dreams by Fleetwood Mac, went viral, along with the fruity drink.

Ocean Spray hadn’t put any money behind Apadoca, but they benefited from more than 27 million views in a few days.

Payne says the value of going viral is being part of a cultural conversation. In other words, brands are trying to buy access to The Zeitgeist.

It won’t happen, however, with glossy Instagram posts. It’ll happen with videos like Apadoca and that

can’t necessarily be bought.

One household frozen food name wanted a highly-curated new social media campaign with pictures of their product at a 45 degree angle. Payne turned them down, because to go viral, it has to be “authentic”. Another elusive concept.

In comparison, Odeon reached millions of people by ceding control to a movie lover with a decent Instagram following who posted blurry videos of him at different screenings.

Often going viral means being funny. But as any comedian will tell you, jokes come with a risk.

Tampax, for example, thought they were funny when they tweeted: “You’re in their DMS. We’re in them. We’re not the same.”

They were accused, rightly, of misogyny and ultimately faced an embarrassing climb down.

The value of virality can be quickly obscured by a highly-shareable bungle. Businesses are always going to want to jump on the Cool New Thing. But the rule of thumb is they’re almost always a few steps behind the 20something-year-olds they want to reach. Going viral might be great for their street cred, but the best videos will be #unfiltered (which, by the way, is not a thing anymore). So maybe it is time for firms to check their screen time.

CITYAM.COM 14 WEDNESDAY 18 JANUARY 2023 OPINION

OPINION

Josh

Sir Mark Rowley apologised for the failure of the Metrpolitan Police to stop the crimes of David Carrick

Sascha

O’Sullivan Comment and features editor at City AM

In Britain, when we choose our politicians, we like them to at least feign reluctance

LETTERS TO THE EDITOR

One green light bulb at a time

[Re: Goldman Sachs warns EU risks clean energy exodus, 10 Jan]

Goldman Sachs’ proposed European inflation reduction act plan may be key to keeping clean energy investment in NTT DATA UK&INTT DATA UK&Ithe EU, but for UK energy generation companies looking to develop their renewable sources, targeted governmental support will be essential.

Government support will enable them to maintain clean energy investment in the UK and reach net zero targets. Electrification is just the beginning. Energy generation companies have commitments to low carbon, to customers, to shareholders, and to regulators. Each of these

commitments carries a demand, and if the UK Government aims to make the UK a ‘clean energy superpower’ as it has previously stated, then it must lay the groundwork for the total transformation of operations.

If we would like every streetlight, refrigerator, and computer monitor to be powered by wind, solar, and nuclear energy, then we must invest in the requisite technological groundwork. This involves helping energy generation companies to forecast and optimise production, transforming asset management to maximise the life expectancies of generators, and integrating distributed sources of energy, like household solar panels.

Generators of renewable energy can’t afford a single ounce of fat. For that a digitalised view of operations will not be a luxury, but a necessity.

Eduardo Fernandez NTT Data

GREEN WITH ENVY Ursula von der Leyen tells US: fight with China, not us

A miniscule bit of growth in November is unlikely to save us from a recession this year

Ormerod

IN November last year, the economy grew by 0.1 per cent, according to the Office for National Statistics (ONS) last week. The news, in the midst of many a miserable headline, was greeted with great excitement. Most City economists had predicted a fall by around 0.2 per cent. Cue animated performances on the TV news channels, with presenters waving their arms at complicated graphs. And the news lifted the stock market because it reduced the chances of a technical recession.

Of course, in the current circumstances we should be grateful for anything which has even the palest tinge of rose. But the overall economic picture is still bleak. Comparing the September to November period, output fell by 0.3 per cent. Even more starkly, UK output is still slightly below what it was just before the pandemic, almost three years ago now.

Far too much weight is being placed on miniscule differences in economic numbers as they appear.

For most of the post-war period we

becomes available to the national accounts statisticians.

A WESTMINSTER VS HOLYROOD SHOWDOWN

Did you think you would get a month without the culture wars? Think again. This week, Holyrood and Westminster went head to head over Scotland’s gender recognition legislation. The Scottish parliament voted in favour of a bill that would lower the age at which individuals can change gender to sixteen and make it easier to obtain a gender recognition certificate.

The bill has sparked tensions over the past weeks, but came to a head on Monday, when the Scottish legislation was

overridden by the UK government in Westminster.

Scottish Secretary Alister Jack used Section 35 of the Scotland Act for the first time, an infamous bit of legislation giving the UK government the power to block laws if they could have an impact on the functioning of other nationwide laws.

Sturgeon now has to choose a course of action: she can amend and reintroduce the bill, or she can fight through the constitutional avenue, asking for a judicial review. She’ll probably choose the latter.

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900

Email: news@cityam.com

Certified Distribution from 30/5/2022 till 01/07/2022 is 79,855

had to be content with new GDP estimates appearing every quarter. It is only over the past few years that the ONS has started to publish monthly estimates. Before the decision to implement this change was taken, the ONS noted that the proposal to change publication timings was partly a response to two major reviews on the subject. These concluded it was “important for the ONS to strike a balance between the timeliness of GDP estimates to aid policy makers and the available data –and therefore the potential for revisions.”

The final phrase is significant. Estimates of how much the economy has grown in any particular month or quarter, and even year, are almost invariably revised as more information

The economy cannot be put onto a set of scales and weighed. Its size has to be estimated from a variety of sources which vary enormously in their timeliness and reliability.

For example, the PAYE returns which employers submit give a pretty good idea of how many employees there are and how much they are being paid. But what about the self-employed?

Their tax returns are only filed with a lag of many months. So any estimate of how much people in work have earned may be revised as more information comes in.

These revisions can be large, completely dwarfing the 0.1 per cent figure which caused so much excitement.

As with many aspects of economic data, the United States leads the way on making the size of revisions to GDP accessible.

We can look back, for example, at the fourth quarter of 2008, when the impact of the financial crisis really

started to take hold. At first, the Americans thought that GDP had fallen by 3.8 per cent at an annual rate in that quarter. That was pretty bad - but nowhere near as bad as the 8.5 per cent drop which they finally settled on.

The recovery after the crisis was also substantially overestimated. The first estimates of growth between September 2009 and March 2010 put it at over 12 per cent. Now, a much more modest 7 per cent has been settled on.

None of this is intended as criticism of the national accounts statisticians, as they face a difficult and challenging task. What’s concerning is the lack of awareness of the political classes when it comes to the uncertainties inherent in these numbers.

Ultimately, the potential for erroneous decisions being taken on the basis of the monthly ONS estimates seriously outweighs the benefits of publishing them.

£ Paul Ormerod is an author and economist at Volterra Partners LLP

Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com

Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions

Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP

Editorial Editor Andy Silvester | News Editor Ben Lucas

Comment & Features Editor Sascha O’Sullivan

15 WEDNESDAY 18 JANUARY 2023 OPINION CITYAM.COM

Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Commercial Sales Director Jeremy Slattery

Paul

The economy unfortunately cannot be simply put onto a set of scales and weighed

› E: opinion@cityam.com COMMENT AT: cityam.com/opinion

WE WANT TO HEAR YOUR VIEWS

EXPLAINER-IN-BRIEF:

A boost for pubs during the World Cup helped the UK economy grow

The EU Commissioner has tried to calm fears of a green subsidy spat with the US and unite allies against Beijing at Davos. She announced a European alternative to US plans to incentivise climate friendly firms based in America.

LIFE&STYLE

WHERE TO CELEBRATE BURNS NIGHT IN LONDON

Ahead of Burns Night on 25 January, Steve Dinneen finds the best spots for haggis and whisky

Burns Night, the birthday of the great Scottish bard Robert Burns is one of the highlights of the London restaurant scene, with venues across the capital laying on special spreads and keeping the city’s bagpipe community in work. Expect a lot of readings of the tonguetwisting Address to a Haggis as well as the consumption of much whisky. Here are a few of our favourites.

BISTROT GALVIN

Bistrot Galvin will celebrate the bard with a six-course tasting menu made up of traditional Scottish fare including cullen skink; haggis, neeps and tatties, Isle of Mull cheddar and raspberry cranachan trifle. The tasting menu is priced at £60 per person with additional wine or whisky pairings also available. Places are limited and can be reserved via

£ galvinrestaurants.com

ROSEWOOD LONDON

On Burns Night itself Glenfiddich and Rosewood London will host an indulgent evening at the newly launched Time:Capsule terrace. Ticket holders can expect spoken-word performances including an Address to the Haggis and various specially penned poems from collective I Am Loud. A selection of Burns Night cocktails and small plates prepared by Holborn Dining Room will be served, including a Stornoway black pudding and quail scotch egg; haggis with neeps and tatties and a Glenfiddich whisky treacle pudding.

£ rosewoodhotels.com

LOCAL & WILD

Local & Wild restaurant group, helmed by brothers Oliver and Richard Gladwin, will partner with Bruichladdich Whisky on a two course menu to mark the occasion, available only on 25th January across all Local & Wild restaurants including The Shed, Notting Hill and Sussex Soho. Expect baked haggis, neeps and tatties, designed for sharing between two and priced at £28. This will be followed by a pudding of cranachan, heather honey and raspberries, priced at £7. Also on offer will be a limited edition cocktail featuring Bruichladdich’s finest blends.

£ gladwinbrothers.com

THE SUN TAVERN

East London bar, The Sun Tavern will be raise a glass to Scotland in a collab-

oration with Aberfeldy Whisky, with a limited edition cocktail menu and free haggis bites from Broadway Market stalwarts Deeney’s. There will be an Address To The Haggis and a rendition or two of Burns’ best work. To round the night off, Rennie of Scottish indie band The View will be on the decks until 12am. No news as to whether they’re taking requests for bagpipes.

£ thesuntavern.co.uk

CAROUSEL

The Botanist Gin is hosting a special night at Carousel. Some of the country’s most acclaimed chefs will be creating a multi-course tribute to the bard, with talent from Edinburgh’s Heron and Taisteal and Ardnamurchan’s Mingary Castle. The menu will feature five courses of contemporary Scottish fine dining, accompanied by cocktails from The Botanist Gin, distilled on the isle

of Islay.

£ carousel-london.com

MOUNT ST RESTAURANT

Mount St Restaurant on the corner of Mayfair’s Mount Street - no surprises there - and South Audley Street will be serving a Burns Night special menu for one night only on 25 January. Alongside the regular a la carte menu guests will have the choice of a three-course

Address to a Haggis

Fair fa' your honest, sonsie face, Great chieftain o the puddin'-race! Aboon them a' ye tak your place, Painch, tripe, or thairm: Weel are ye worthy o' a grace As lang's my arm.

The groaning trencher there ye fill, Your hurdies like a distant hill, Your pin wad help to mend a mill In time o need,

While thro your pores the dews distil Like amber bead.

His knife see rustic Labour dight, An cut you up wi ready slight, Trenching your gushing entrails bright, Like onie ditch; And then, O what a glorious sight, Warm-reekin, rich!

Then, horn for horn, they stretch an strive: Deil tak the hindmost, on they drive, Till a' their weel-swall'd kytes belyve Are bent like drums; The auld Guidman, maist like to rive, 'Bethankit' hums.

Is there that owre his French ragout, Or olio that wad staw a sow, Or fricassee wad mak her spew Wi perfect scunner, Looks down wi sneering, scornfu view On sic a dinner?

Poor devil! see him owre his trash, As feckless as a wither'd rash, His spindle shank a guid whip-lash, His nieve a nit; Thro bloody flood or field to dash, O how unfit!

But mark the Rustic, haggis-fed, The trembling earth resounds his tread, Clap in his walie nieve a blade, He'll make it whissle; An legs an arms, an heads will sned, Like taps o thrissle.

Ye Pow'rs, wha mak mankind your care, And dish them out their bill o fare, Auld Scotland wants nae skinking ware That jaups in luggies: But, if ye wish her gratefu prayer, Gie her a Haggis

special menu to mark the occasion. Executive chef Jamie Shears has shipped in the finest Scottish ingredients, including smoked haddock, haggis wellington, and venison from the Invercauld Estate, which is home to sister property The Fife Arms in Braemar. The menu is priced at £80 per person and based on a minimum of two people sharing.

CITYAM.COM 16 WEDNESDAY 18 JANUARY 2023 LIFE&STYLE

mountstrestaurant.com

£

✄ ✄ CUT-OUT-AND-KEEP BURNS DAY KIT –JUST ADD WHISKY

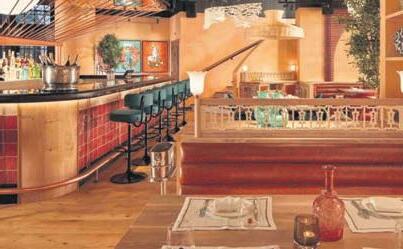

WHY LEICESTER SQUARE IS THE LATEST DINING DESTINATION

Londoners balk at the very idea of Leicester Square, let alone actually going anywhere near it. Terrifying things are found there, not least M&Ms World, Bella Italia, men offering to draw caricatures of you and beat boxers that once made it to the Group stages of X Factor. Thousands of lost people from the suburbs wander around adding to the chaos.

Newsflash - stay with me here - but Leicester Square has undergone a quiet renaissance. Well, one corner of it has: the southerly bit that houses the Londoner hotel. The hotel launched in September 2021 and is the sort of place you walk into and feel as if you’ve been transported far, far away from the chaotic vibes of the tourist heartland.

It was an arguably brave, arguably bonkers decision for a lovely hotel to open in Leicester Square, but it seems to have paid off. Awards dinners frequent the plush gold-trimmed ballroom and paparazzi are often hanging about outside to catch the Love Islanders popping in for a glass of fizz. The hotel certainly attracts the reality TV crowd, but it also has a refined restaurant that pleases ardent Michelin star chasers.