STILL GOT IT: BOSSES WARM TO UK APPEAL

SURVEY OF GLOBAL CEOS: UK IS THIRD-BEST DESTINATION

THE WORLD’s business elite are set to pump billions of pounds into the UK, defying experts forecasting the country is on course for its toughest recession in a century, a new report out yesterday revealed.

The proportion of more than 4,400 global chief executives in 105 countries surveyed by consultancy PwC identifying the UK as one of their top investment locations has doubled over the last three years.

Now, nearly one in four business leaders want to grow in Britain more than anywhere else, up from nine per cent in 2020.

Just China and the US beat the UK in the global growth priority table. Germany is level with the UK. The research underscores

that the UK remains an attractive place to do business despite experts warning it is headed for the deepest recession among rich nations.

An investment boom would go a long way to boosting the UK’s economic growth at a time when the government is under pressure for a lack of forward-looking economic policy.

“CEOs don’t expand and invest on a whim –they’re choosing the UK as that’s where they expect to see returns,” Kevin Ellis, chairman and senior partner at PwC UK, said.

Others pointed out the survey shows the UK is beating away headwinds caused by the pandemic and ongoing Brexit trade disruption, with London leading the charge.

“Despite the huge challenges of

Brexit and the pandemic, it’s great to see that the UK is succeeding and London is retaining its status as a global city,” Claire Harding, research director at the Centre for London, told City A.M.

“UK business leaders’ investment plans were stronger in December than they have been at any time in the last six months, and it is good to see that this is reinforced by growing confidence in the UK at a global level,” Kitty Ussher, chief economist at the Institute of Directors, told City A.M.

Recent data has indicated the underlying strength of the economy may be better than feared, strengthening the UK’s investment case. A weak pound has also made injecting money in the country cheaper.

Figures out last week revealed output shockingly grew 0.1 per cent in November, beating a consensus forecast of a 0.2 per cent contraction.

Many of the world’s bosses are currently at Davos, the World Economic Forum’s annual summit. Rishi Sunak is not attending.

London’s flagship

JACK BARNETT

LONDON’s FTSE 100 made more tracks toward its record high yesterday, extending a bullish start to 2023.

The capital’s premier index jumped 0.2 per cent to 7,860.08 points, while the domestically-

STANSTED Airport is almost back at post-pandemic passenger levels, it said yesterday, after a bumper Christmas period.

Essex’s favourite low-cost hub saw 1.8m people pass through its e-gates in December 2022, just slightly lower than 2019 numbers.

That took the airport to 23.3m passengers across the year.

“To round the year off with another strong passenger performance in December is a great achievement, and

testament to the strength of Stansted’s route network,” Gareth Powell, the airport’s managing director, said.

Powell added that he expected the next 12 months to be “even busier”. Heathrow welcomed 61.6m visitors in 2022, with Gatwick behind at 32.8m visitors.

Aviation analyst Sally Gethin said Stansted’s numbers demonstrated potential for growth in the industry across the entire south east.

FTSE 100 index heads to new high on China reopening

focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 0.65 per cent to close above the 20,000 point mark.

The FTSE 100 kicked off another week in good style yesterday, taking its 2023 earnings so far to more than four per cent.

That new year surge has led it to near its highest level ever of just over 7,900 points, hit in May 2018.

Easing fears over the severity of a much-reported UK recession has lifted sentiment toward London-listed stocks. The prospect of global energy

and commodity prices being boosted by China, the world’s second largest economy, reopening its economy by dismantling its zeroCovid policy has also prompted traders to

flow into the FTSE 100.

A large chunk of the index is made up of industrial firms, such as BP, Shell and Glencore.

Markets also think central bankers could hint at a slowdown in rate hikes this year at the World Economic Forum’s annual jamboree in Davos this week.

LONDON’S BUSINESS NEWSPAPER TUESDAY 17 JANUARY 2023 ISSUE 3,917 FREE CITYAM.COM IT’S WELL DONE, RARE GAUCHO CHIEF ON STEAK RESTAURANT’S ‘APPROACHABLE’ DIRECTION P12 COLE IN THE ENGINE ENGLAND’S NEW –AND OLD –LOOK FOR SIX NATIONS P19 INSIDE M&S’S HALF A BILLION POUND EXPANSION P3 ASHMORE: APPETITE FOR RISK WILL RETURN P5 POWERING THE UK’S GREEN TRANSITION P12 MARKETS P14 OPINION P16

ILARIA GRASSO MACOLA

£ CONTINUED ON PAGE 3

PROGRESS Stansted

EXPRESS

enjoys a bumper 2022 rebound

JACK BARNETT

THE RACE TO 7,903

STANDING UP FOR THE CITY

Something to smile about as the weather turns more miserable

DO we spy in City A.M. today a prescription for the UK’s economic ills? Perhaps we might. On the front, a survey revealing that global investors are already looking past political turmoil to Britain’s world-leading sectors as a place to put their money –in a few pages’ time, a roadmap towards genuine supply-side reform. Elsewhere, there’s a restaurateur focusing on premium experiences and hospitality rather than cheap and

THE CITY VIEW

cheerful, and a historic British retailer doubling down on its own unique selling point in a crowded market. In each of them you can get a sense of where the more successful bits of the UK economy are headed. Britain is unlikely to be able to fight global

powers on scale or quantity; what it can do, however, is demonstrate quality, flexibility and a sensible regulatory framework. One of the industries pointed to by the PwC survey which puts the UK third in the world as a business destination is biotech –a sector that is perhaps unsexy, but exists here because of the rare confluence of intelligent scientists and a bucketload of forward-looking capital. It doesn’t feel like a financial services

success, but it is; and in there we find the seed of how the City can continue to thrive. The decision to leave the European Union will make it more difficult for the UK to cling on to the lead on trading volumes and clearing –that is obvious. But where we can find advantages are in growing the industries of the future and using the expertise, the mostlyfunctioning regulatory framework and, above all else, the capital that’s already here to find

more of them. Mix that with the supply side reforms Jack Barnett talks about in his economics column this week and you get a decent model for an innovative, forward-looking country that genuinely can beat competitors from across the world. The good news is such freedoms could soon be on the way for financial services through the Edinburgh Reforms. Something to smile about, in what we’re told is the most depressing week of the year.

A ONE-METRE high copper grasshopper with an unusual link to the City of London is soon to go under the hammer at Sotheby’s in New York. In 1740, wealthy Bostonian Peter Fanueil commissioned two of the sculptures in an homage to the grasshopper that sits atop the Royal Exchange, by the Bank of England. One still sits atop Boston landmark Fanueil Hall, but the other was feared lost until it turned up on a New Hampshire barn.

The Royal Exchange is topped with a grasshopper in tribute to its founder, Sir Thomas Gresham.

His family crest included a golden grasshopper on a green mound; the story goes he chose it to commemorate an adopted ancestor who was discovered as an abandoned baby by his family –discovered by chance when a younger member of the Gresham clan was chasing the insect.

UK to shake off mild recession by end of the year, Pantheon economist predicts

THE UK economy will experience a very mild recession and could be out of it by the end of this year, a top City economist has forecast.

International energy prices have marched back down the steep hill they climbed after Russian president Vladimir Putin sent troops into Ukraine in February last year. On some measures, gas prices are below pre-Russia-Ukraine war levels.

As a result, the outlook for the UK economy “has greatly improved”, according to Samuel Tombs, chief UK

The sharp drop in energy costs in recent weeks has blown the gloomiest predictions about the UK and European economies out of the water.

Analysts in the summer were warning of blackouts and businesses mothballing production due to sky-high bills.

However, Tombs, who has been a bit more upbeat than his peers over the last year, raised his expectations for output this year.

He now expects “GDP to hold steady” in the summer and then rise 0.2 per cent in the winter.

The revisions mean Britain will be in recession for three quarters of the year and that the economy is on course to shrink 0.8 per cent in 2023, up from Tombs’s previous forecast of a 1.5 per cent contraction.

Tumbling energy prices have also cut the cost of the government’s energy bill support package, handing chancellor Jeremy Hunt an extra £11bn or so to play with at 15 March’s budget.

That newfound kitty means “the chancellor [could] reallocate funds from limiting consumer energy prices to supporting households in other ways,” Tombs added.

FINANCIAL TIMES

US DRUGMAKERS WITHDRAW FROM NHS PRICING AGREEMENT AS COSTS SOAR

US drugmakers Abbvie and Eli Lilly have become the first pharmaceutical groups to pull out of a pricing agreement with the UK government in protest at a sharp rise in clawback payments.

THE TIMES

RAIL INDUSTRY AND RMT TO RESUME TALKS AMID HOPES OF END TO STRIKES

Talks will continue this week between the rail industry and the National Union of Rail, Maritime and Transport Workers amid renewed optimism that a deal can be reached without further strikes.

ROYAL MAIL –AN APOLOGY

Yesterday we reported on a significant backlog of parcels at Royal Mail due to a cybersecurity incident last week. Accompanying the story we used an image of a different parcel backlog experienced by Royal Mail in the run-up to Christmas, caused by industrial action and high demand, but which bore no relation to the cybersecurity incident. We apologise to Royal Mail for the confusion.

European natural gas prices deflate to a

NICHOLAS EARL

NATURAL gas prices in Europe dropped to a 16-month low yesterday, with full stockpiles in China forcing buyers to send more supplies to the continent.

The Dutch TTF benchmark – the key European future market for trading gas – fell sixteen per cent on Monday trading at €64.80 per kilowatt hour (KWh).

This is well below historic peaks last year when prices climbed to €342.87 per KWh, but it remains above pre-crisis levels with gas

prices at €17.11 per KWh this time two years ago.

Chinese importers are trying to divert February and March shipments to Europe, while mild weather has kept liquefied natural gas storage topped up above 80 per cent.

UK gas prices also nosedived, falling 17 per cent in the evening to trade at £1.62 per therm – the lowest it has been in over a year.

This is well below last summer's record of £8.75 per therm in August, but is significantly higher than the norm of 45-50p per therm prior the energy crisis.

CITYAM.COM 02 TUESDAY 17 JANUARY 2023 NEWS

JACK BARNETT

economist at consultancy Pantheon Macroeconomics.

THE OTHER PAPERS SAY THIS MORNING

16-month low WHAT

STORM

18th-century copper grasshopper weathervane with

connection to the City expected to fetch up to $500,000 at

WEATHERING THE

An

a historical

Sotheby’s

M&S to open 20 new UK stores in £480m injection

JESS JONES

MARKS and Spencer (M&S) is to plough nearly half a million pounds into an accelerated UK-wide investment drive which will result in 20 new larger and improved stores across the UK in the next financial year.

The retailer also aims to create over 3,400 new jobs while providing shoppers with a “seamless” customer experience.

M&S yesterday said it was accelerating its fiveyear store rotation scheme, which it aimed to complete within three years.

Stuart Machin, chief executive of M&S, said: “The outperformance of our recently relocated and renewed stores, give us the confidence to go faster in our plan.

“Our investment in stores not only delivers a better experience for customers and colleagues, it boosts local communities with new job creation and will help us deliver a more sustainable estate in every sense.”

M&S has revealed plans to open eight

large stores in major city sites, including a 97,000 sq ft store in Leeds White Rose shopping centre and a 70,000 sq ft store in Liverpool ONE by this summer.

The company also intends to open 12 new food halls for UK communities.

As part of M&S’ effort to revitalise vacant sites, the new stores will be located in former Debenhams sites.

M&S has seen a faster than expected rise in sales

China re-opening to give lift-off to global aviation industry, say wonks

CONTINUED FROM PAGE ONE

Stansted’s uplift could soon be mirrored in the rest of the bruised and battered flying industry.

China’s re-opening to the world will create significant demand, according to two separate interventions by the world’s largest aircraft leasing companiesthe Dublin-based Aercap and

Chinese firm Avolon. They predicted pre-pandemic travel levels could be hit as soon as June this year.

However, there are stormclouds on the horizon - with staff shortages last summer perhaps mimicked by a paucity of narrow-body jets this year.

Aviation adviser Bertrand Grabowski told Reuters that there were significant backlogs in socalled ‘maintenance, repair and

overhaul’ plants which would frustrate efforts to get more planes in the air as the world’s aviation industry reopens.

Travel in Europe has rebounded at pace from pandemic lows, with airlines caught short by demand last year. Carriers and airports are working to avoid similar scenes during this year’s summer peak, when demand will be higher still.

at its new and recently renovated stores while also reporting strong festive sales in its recent post-Christmas trading statement.

These successful performances have given M&S confidence to move forward with its plan to renovate and update more stores. This plan will also help the company to reduce its lease liability by £309m.

Shares in the retailer closed up almost three per cent after the news yesterday.

‘No deal’ done between Boe and government on Brexit shake-up

JACK BARNETT

ANDREW Bailey, the governor of the Bank of England, said yesterday that there was no backhand deal done between the central bank and the government over a post-Brexit shake-up of the UK’s financial rules regime.

Responding to questions from MPs during a Treasury Committee meeting yesterday, Bailey, 63, said the Bank “did not trade Solvency II for the call-in power”.

The government recently shelved the so-called call-in powers, which sought to give lawmakers the power to go over regulators’ heads when setting rules governing the City’s banks and financial services firms.

If the plans did get through parliament, they would have “severely undermined” the independence of regulators, Bailey said yesterday.

Solvency II is being ditched as part of the government’s push to cut red tape on City firms after Brexit.

03 TUESDAY 17 JANUARY 2023 NEWS CITYAM.COM

Bank governor Bailey said the bank didn’t horse-trade Solvency II for the call-in power

M&S plans an investment drive which will see a raft of new shops

No bridge over troubled waters for UK suppliers

US RATINGS agency Moody’s has downgraded its outlook for the UK’s water industry due to an uncertain macroeconomic environment and regulators increasing scrutiny of British water companies’ poor performance.

In an investment note, Moody’s downgraded its investment outlook for the sector from ‘stable’ to ‘negative’.

“Ongoing regulatory and affordability pressure as well as a volatile macroeconomic environment continue to weigh against a positive outlook,” Moody’s said.

The ratings agency expects inflationary cost pressures across the industry to not be fully offset by revenue adjustments, and for underperformance in the sector to further weaken cashflow.

Sustained high inflation is typically credit positive for UK water companies, however, Moody’s considers water companies to be exposed to the mismatch between the headline inflation rate and their rising operational costs.

In particular, rising interest rates will hit companies with large funding needs as allowed returns, intended to cover companies’ cost of debt and equity capital, are fixed during each five year regulatory period Ofwat establishes under pricing reviews.

Water companies have also faced a public backlash over numerous leaks and pollution incidents, sparking calls to prosecute board members of companies that have breached regulations.

Moody’s highlighted that these pollution incidents continue to receive heightened attention from regulators.

This has increased the risk of future fines, with Ofwat and the Environmental Agency both investigating suppliers accused of discharging untreated sewage water in breach of regulations.

In an update last year, Ofwat confirmed it had opened enforcement cases against six companies including Anglian Water, Northumbrian Water, South West Water, Thames Water, Wessex Water and Yorkshire Water.

Hiring spree: Jaguar Land Rover recruits 81 per cent tech jobs in UK

JAGUAR

The luxury marque announced yesterday that 280 out of the 300 vacancies currently available are in the UK. This is in addition to the 371 jobs which have already been filled in Britain.

Ireland and China – announced the hiring drive in November.

This happened around the same time as mass layoffs started taking place at tech giants such as Twitter, Amazon and Salesforce.

According to data from layoff tracking website layoffs.fyi, almost 155,000 people working in tech firms across the world were let go in 2022.

JLR has decided to capitalise on

workers to expedite its electrification strategy, ‘Reimagine’, which plans to make all JLR models electric by the end of the decade.

“Under the Reimagine strategy, our digital transformation is happening at pace, and we need experienced specialists with skills in areas such as AI, and autonomous driving right now,” said JLR’s chief information officer Anthony Battle.

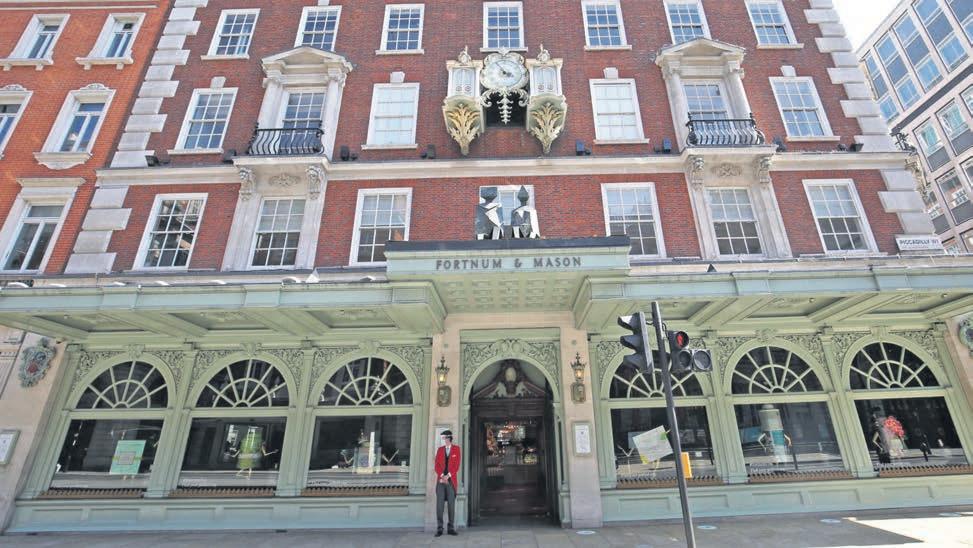

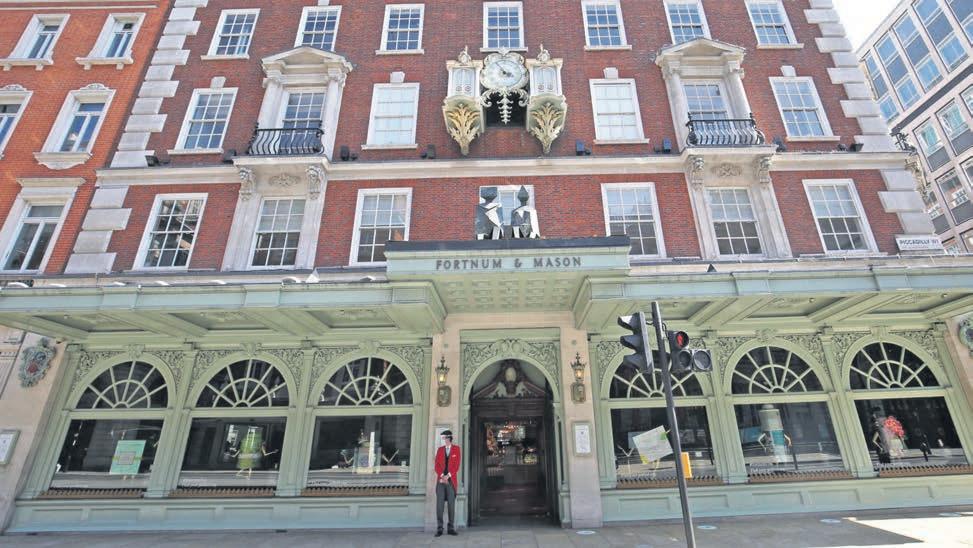

Biscuit lovers help lift Fortnum & Mason’s back from the brink as firm looks forward to coronation

JESS JONES

FORTNUM & Mason has returned to profitability following two successive years of losses.

The historic British department store and grocer reported an operating profit of £6.1m on sales of £187m when its year ended on 10 July 2022. This marks a dramatic turnaround from the £2.7m loss the luxury food store posted in its previous annual trading statement.

Biscuits including the festive Christmas orange and dark chocolate

Revolut creates ‘CultureLab’ to shake off workplace criticism

REVOLUT is putting together an internal “CultureLab” to oversee its staff’s behaviour as it looks to win over regulators and address its reputation as a cut-throat workplace.

The $33bn (£27bn) fintech firm has been beset by criticism over its poor corporate culture leading to a wave of staff exits over the past two years,

including in its executive teams. The firm has gained notoriety for a sign in its office which reads “Get Sh*t Done”.

However, bosses are now looking to strike a softer tone to employees with a package of measures designed to create a friendlier atmosphere at its workplace, City A.M. understands.

Among the measures to be rolled out are directions to “support each other individually and professionally,

across teams and departments, even if it’s not in your KPIs or goals”, as well as to “be inclusive, approachable and interested in your colleagues’ work”.

Revolut managers will also set out to be “radically honest, direct, and respectful” and “lead by doing”.

The new culture team, first reported by The Guardian, is understood to consist of two internal existing teams and feature experts.

and pistachio and clotted cream versions helped it boost year-on year sales by 30 per cent. Other festive favourites included mince pies and advent calendars.

Tom Athron, chief executive at Fortnum & Mason, also attributed the company’s success to the reopening of its stores and restaurants. He said Fortnum & Mason’s online business held its own.

Fortnum’s online retail operation accounted for 40 per cent of its sales, rising to 50 per cent during the Christmas period.

The company expects sales to increase further as it plans to begin selling products online to the EU for the first time since Brexit.

Despite the £6m profit, the luxury retailer also warned of a challenge to trading from inflated costs and wages, lower footfall and staff shortages.

Athron noted that there was “growing uncertainty” over consumer spending in 2023, but said he was confident the coronation of King Charles III would be a boon for the retailer, which has long-held ties to the royal family.

CITYAM.COM 04 TUESDAY 17 JANUARY 2023 NEWS

NICHOLAS EARL

The iconic British brand said it expected sales to continue to grow as it looks to restart selling in the EU

Revolut CEO Nikolay Storonsky wants to create a more welcoming work environment

CHARLIE CONCHIE

Land Rover has gone on a hiring spree in the UK, recruiting 81 per cent of its global positions in Britain.

Jaguar Land Rover (JLR) – which is also

How we reported on Ofwat’s crackdown on water companies

Ashmore says appetite for risk will return

CHARLIE CONCHIE

EMERGING markets specialist Ashmore expects investors’ risk appetite to roar back amid slackening Chinese Covid-19 restrictions and a rebound in developing economies.

In a trading update yesterday, London-listed Ashmore said total assets under management jumped two per cent to $57bn (£47bn) in the final three months of 2022, up from $56bn at the end of the previous quarter.

The firm’s equity holdings kicked up two per cent while its fixed income funds rose three per cent in the period.

The firm’s alternative holdings slumped 13 per cent, however.

Mark Coombs, chief executive of Ashmore, said risk appetite was returning following a tricky 18 months in which investors had fled emerging markets amid soaring inflation and sharp falls in valuations.

He said: “Emerging markets’ strong performance over the past three months reflects a positive shift in investor sentiment against a backdrop of light positioning and highly attractive valuations.”

“Some of the headwinds of 2022, such as the Fed’s aggressive policy tightening, are receding. China re-opening its economy will stimulate activity more broadly and a number of emerging countries are starting to see deflation as a consequence of effective monetary policy action over the past two years.”

Coombs added that the firm was expecting “investor risk appetite” to ramp up over the next 12 months which would bolster a resurgence in market performance and boost capital flows into emerging markets investors.

A rebound in emerging markets helped offset $2.6bn net outflows at the firm as investors continued to pull their cash from funds.

London partners paid 25 per cent more at US law firms, data finds

LOUIS GOSS

THE TOP US law firms are now paying their London partners significantly more than their British rivals, in another sign of American dominance in the UK legal sector. Partners in the London offices of the top 15 US law firms took away 25 per cent higher payouts than their counterparts in the UK’s top 15 firms

in 2022, new research from legal sector accountancy firm Hazlewoods shows.

The higher partner payouts come as the result of US firms’ sharper focus on higher-margin M&A and private equity work, the report said. The findings put US firms further ahead in the ongoing battle for talent which has seen City lawyers’ pay surge.

Knights move on Bristol firm Meade King

LOUIS GOSS

KNIGHTS yesterday acquired commercial law firm Meade King for £2.1m as the London-listed law firm pushes forwards with plans to bolster its business via mergers and acquisitions.

Under the terms of the deal, Knights – one of just six UK listed law firms – will take on 29 of Meade King’s lawyers, including four partners.

The acquisition is set to expand Knight’s reach into the wider UK by giving it a footprint in Bristol and the south-west of England.

The deal, which is set to be completed on 17 February, will see Knights pay £1.5m in cash and a further £600,000 in three instalments over the next three years.

In the financial year running up to 30 April 2022, Meade King posted annual revenues of £2.7m, generating a pre-tax profit margin of circa five per cent.

Knights’ chief executive David Beech said: “Founded in 1790, the firm provides the group with entry into the growing Bristol market and surrounding region.”

05 TUESDAY 17 JANUARY 2023 NEWS CITYAM.COM

US firms’ greater focus on more profitable work has boosted partner payouts

Fresh vote of confidence in North Sea oil with bumper licensing round

NICHOLAS EARL

OVER one hundred bids have been made for new oil and gas projects in the North Sea, in a huge vote of confidence for the embattled industry.

The North Sea Transition Authority (NSTA) yesterday revealed that 76 companies made a total of 115 bids across 258 blocks in the

UK’s latest offshore oil and gas licensing round.

This is comparable to the numbers in the previous licensing round in 2019 when the NSTA received 104 applications from 245 blocks.

The latest developments are a huge boost to the North Sea amid investor fears of a potential drop off in bids following the ramping up of the windfall tax in recent month.

This comes with Harbour Energy announcing they were pulling out of the North Sea earlier this month.

The NSTA will now study the bids, with plans to award licenses quickly and help support successful bidders go into production as soon as possible. It calculated the sites could see production in as little as eighteen months, helping to ramp up energy security and ease supply shortages.

Newmed pushes on with £277m Capricorn merger

NICHOLAS EARL

NEWMED Energy’s bid to take over British oil and gas operator Capricorn Energy has taken another dramatic turn, after the Israeli energy firm announced plans to press ahead with its proposed merger while leaving itself wriggle room “to examine alternative strategic options.”

The protracted takeover saga has dragged on for four months since the deal was first unveiled last September, after Newmed gazumped rival Tullow Oil – which had been pushing for its own merger with Capricorn last summer.

Shareholders are set to vote on whether to approve the deal on 1 February, while an activist ballot to oust Capricorn’s leadership will also take place later in the day.

This would include removing seven directors and appointing six new ones.

In a press statement, Newmed confirmed it was “continuing to work to advance the merger and to obtain all needed approvals in Israel and England” and that it would push for shareholder approval this quarter.

It argued the proposed deal was “the most compelling option for all

relevant stakeholders”.

The merger would create a “differentiated, gas-led business of scale, offering growth, regular returns to shareholders and a path through the energy transition, with a longer-term position in renewables and the hydrogen economy”.

The mooted merger values Capricorn at $338m (£277m) alongside a $620m special dividend – with the firm’s market capitalisation estimated at $940m at the close of last week.

The Capricorn-Newmed merger would create an Israel-Egypt focused gas producer, including Newmed’s stake in Israel’s giant Leviathan offshore field

However, the deal has faced a sharp backlash from some of its biggest shareholders over concerns it does not represent full value for investors – with the company’s third largest stakeholder Palliser arranging a ballot to remove Capricorn’s senior team.

Legal & General Investment Management and VR Global Partners have also both announced plans to vote against the New Med merger, with the firms having 3.8 and 2.1 per cent stakes in Capricorn respectively.

Sika sells admixture assets to Ineos to clear way for MBCC deal

JOHN REVILL

SIKA has agreed to sell part of its admixture business to UK-based Ineos, the Swiss construction chemicals maker said yesterday, clearing the way for its 5.5bn Swiss franc ($5.94bn) acquisition of the former BASF Construction Chemicals business (MBCC).

Sika sold MBCC’s admixture assets in the United States, Canada, Europe and Britain, and the entire MBCC business in Australia and New Zealand to satisfy the

concerns of competition authorities.

“The agreement with Ineos Enterprises marks a milestone in Sika’s acquisition of MBCC Group,” said Sika chief exec Thomas Hasler in a statement.

“Sika has taken a tremendous leap forward on its path to joining forces with MBCC Group,” he added.

No cash amount was disclosed for the sale, although Sika said the businesses sold were less profitable than the rest of the MBCC business it is keeping.

CITYAM.COM 06 TUESDAY 17 JANUARY 2023 NEWS GET IT ON Southeastern has a range of season tickets to suit you. Buy your ticket direct via our app or visit: southeasternrailway.co.uk/commuteyourway No booking fees apply. when you do that work t ickets Season

Reuters

Sika will offload its admixture business to clear the decks for its acquisition of MBCC

When the chips are down... shares slump in semiconductor maker IQE

CHRIS DORRELL

IQE SHARES dropped nearly 20 per cent yesterday after the semiconductor wafer maker warned that demand is expected to fall in the new year because existing customers have already built up large stocks.

In a pre-close trading update, IQE warned that destocking in the industry will “impact upon demand from existing customers” in the new year.

IQE, which is listed on AIM, makes semiconductor wafers for chips used in smartphones, including Apple iPhones.

The global semiconductor industry was hit by supply chain issues in the pandemic and has faced a slowdown as demand for smartphones cools.

While its outlook for 2023 is fairly bleak, it “remains confident in its diversification strategy”.

The Cardiff-headquartered firm said that trading in 2022 had been “largely resilient”.

Crypto regulation to be hot topic at Davos this week

THE FUTURE of global crypto regulation is set to come under the spotlight at Davos this week as regulators and policy makers scramble to shore up the industry in the wake of FTX’s collapse last year.

The failure of FTX, founded by disgraced former billionaire Sam BankmanFried, has lit a fire under the push for tailored rules for the market, after customers were left billions of dollars out of pocket and its leadership team were slapped with charges of defrauding investors.

A host of crypto chiefs are now set to take to the stage for the World Economic Forum in Davos to debate the future of crypto rules including the boss of blockchain and crypto firm Ripple, Brad Garlinghouse, who will appear alongside regulatory officials including Netherlands central bank chief Klaas Knot and European Commissioner for financial stability Mairead McGuinness.

Regulatory analysts at KPMG yesterday told City

High time: Medical cannabis firm Celadon given regulatory go-ahead

JACK MENDEL

SHARES in AIM-listed firm Celadon yesterday spiked after production of its high-THC product was approved by the regulator.

Celadon, which focuses on the research, manufacturing and sale of cannabis-based medicines, said production of its UK-made drugs had been registered by UK

authorities yesterday.

The UK Medicines and Healthcare Products Regulatory Agency agreed the Good Manufacturing Practice of the Active Pharmaceutical Ingredient by the firm.

The approval marks what the firm believes is the first registration of production for the treatment since the law was changed in 2018 by the then-secretary of state for

health Sajid Javid.

In jumping over the regulatory hurdle, it brings the UK a step closer to maximising what is thought to be a £1bn-plus industry.

Celadon, which is the first cannabis firm to be listed on AIM since GW Pharma in 2011, saw shares jump 10 per cent after the announcement, though they settled to close up around two per cent.

A.M. that discussions will likely hone in on how to draw up rules for the trading of crypto assets and the integration of blockchain technology into traditional financial services.

“Many [attendees] will be discussing if, and how, the trading and investments in crypto assets should be regulated. Some participants will be looking for the crypto asset industry to comply with a very similar set of regulations as the existing traditional finance industry,” Kate Dawson, sector lead of capital markets at KPMG UK’s Regulatory Insight Centre, told City A.M.

Davos comes after a push from regulators to draw up rules in the past 12 months, with EU and UK lawmakers alike looking to move in on the sec-

Ripple EMEA policy chief Andrew Whitworth, who acknowledged the need for robust regulation, said he expected discussion to be nuanced. Introducing regulation “doesn’t mean starting from scratch,” he told City A.M

SBF’s fall from grace has sparked regulation calls

CITYAM.COM 08 TUESDAY 17 JANUARY 2023 NEWS

CHARLIE CONCHIE

Diversification could be the key to guiding IQE through what is expected to be a tricky 2023

PIC strikes £400m Amey pensions deal after House of Fraser buy-in

LOUIS GOSS

THE SPECIALIST insurer that bought out House of Fraser’s pensions fund for £600m last year has completed a £400m deal to take over UK engineering firm Amey’s retirement scheme.

Pension Insurance Corporation’s (PIC) deal will see the firm take responsibility for paying out 3,473

pensions, covering £400m worth of liabilities.

Bulk purchase annuity (BPA) deals see pensions funds pay a lump sum to hand liability for their schemes over to specialist insurers. In return, the insurer takes responsibility for ensuring the scheme’s members get paid.

The deal follows London private equity firm Buckthorn Partners’

acquisition of Amey in December and comes as pension funds have pushed to de-risk their schemes, in a shift that has driven a boom in buyout deals.

Peel Hunt analysts previously forecast higher gilt yields and volatile markets could see £200bn worth of BPA deals over the next three years –compared to £200bn worth of deals over the past decade.

Matalan rescue deal confirmed but founder gone

CITY A.M. REPORTER

A LONG-AWAITED debt-for-equity swap which will save retailer Matalan has been confirmed – but founder John Hargreaves, who has been around the business for 40 years, will not be part of the new management structure.

But a host of the company’sdebtors – including Invesco, Man GLG, Napier Park and Tresidor – have agreed a recapitalisation deal that the group says will result in £100m of new capital to “support delivery of our strategy and exciting growth ambitions”.

The deal will reduce the firms’s gross debt by more than £250m – leaving the debt pile at a more manageable £336m.

A source close to the Hargreaves family told the Sunday Times at the weekend the deal would lave the firm in the hands of inexperienced leadership.

Matalan chief financial officer Stephen Hill attempted to smooth over

Hargreaves’ frustration yesterday.

“As we transition to new ownership and having worked with John and the Hargreaves family for over 20 years, it would be remiss not to emphasise the contribution they have made to building the great business we have today and the many opportunities that lie ahead. On behalf of the Matalan team, I would like to express our sincere thanks and appreciation,” he said in a statement.

Matalan said that the strategy would see the “ongoing developments of our stores, logistics network and website”.

Like many high street retailers, Matalan has faced a series of tough headwinds, compounded by the ongoing cost of living crisis and serious recessionary pressures.

The newly confirmed deal was first reported on Sunday.

No Amigos: Beleaguered lender unable to raise much needed cash

CHARLIE CONCHIE

SHARES in beleaguered credit firm Amigo plunged 24 per cent yesterday after the firm said it was struggling to raise cash from investors ahead of a planned full return to lending this year.

Amigo, which in October got the greenlight from the Financial Conduct Authority to resume operations following a loan mis-selling scandal, has been looking to raise £45m in equity investment as part of its restart efforts.

Nonetheless, in a statement yesterday, the firm said it had struggled to tempt in investors to fund its return.

“It is disappointing that we have so far been unable to identify the requisite equity backers for the business,” said Amigo chief Danny Malone. “However, we are continuing with our efforts to put together an equity investor consortium as soon as possible.”

He added that a number of investors were exploring a potential minority investment in the firm.

09 TUESDAY 17 JANUARY 2023 NEWS CITYAM.COM

Controversial credit firm Amigo has seen its shares plunge with uncertainty about its future

Matalan has struck a deal to save the chain but its founder will be absent

THE NOTE BOOK

The Met cannot ask for the trust of Londoners

Afailure of leadership? A broken culture? An abject lack of responsibility? All three seem evident at the Metropolitan Police –an organisation which has lost the trust of Londoners.

Yesterday’s lurid details of the crimes of David Carrick -–a serial rapist who used his warrant card to win the trust of his victims –was shocking only because they were so similar to the other tales of the foulest behaviour from those who in theory are there to protect our city.

Last week it was revealed more than 150 officers across the force are prevented from public-facing roles due to allegations of sexual misconduct or racism. There have been ample reports of horrific messages being sent between Met coppers –be they the bodies of dead girls or racist, sexist and homophobic drivel doing the rounds of the now-infamous Charing Cross station.

Dame Cressida Dick, who was fired last year, oversaw much of the Met’s decline, but you cannot fix a diseased plant anywhere but at the root.

It is abundantly obvious that people within the Met knew that Carrick should have been nowhere near a uniform –his nickname was “Bastard Dave” because he was “mean and cruel”. The thin blue line appears more a trade union than a protective force.

It’s not the first time, of course. Some within the Met expressed deep concern about Wayne Couzens, who came to the public’s knowledge when he raped and murdered Sarah Everard in 2021. Nothing happened. The Met said sorry then, too.

Of course, the Met lost the trust of some of London’s communities long ago. Ask the black community whether they fear a few ‘bad apples’ or whether they –after years of evidence –feel the force is institutionally racist.

Ask the LGBTQ+ community what they think of the police botching an investigation into the murder of four gay men in Barking –with the Met originally declaring the death of two young gay men, propped up in the same position in the same graveyard miles away from their homes three weeks apart, to be non-suspicious?

The new commissioner, Sir Mark Rowley, has promised reform. It was in precious little evidence yesterday, with the assistant commissioner wheeled out to say ‘sorry’ to his victims –whilst also saying, extraordinarily, that “he has devastated colleagues”.

If the Met was a corporate organisation it would have been wound down. The new boss must demonstrate, with far more urgency than we have seen so far, why the Met deserves the respect of Londoners.

SYDNEY STUNNER

ANNOUNCEMENTS

LEGAL AND PUBLIC NOTICES

Eddie’s

He’s a turnaround specialist, and that’s what the Aussies need. Jones’ appointment is a healthy reminder that a CEO who might have outlived a welcome in one place can serve a very real purpose in another.

£ It’s called the ‘fly and flop’ –the new trend that emphasises zoning out on a beach rather than hoping the hotel has sufficient wifi to allow you to check your emails. New research from Expedia suggests around one in five of us feel guilty for just putting our feet up when we’re away from the office –feeling the pressure of social media as well as worrying about the inbox. My advice? Find somewhere to go on holiday without decent 4G coverage. Like, say, most of the UK.

£ Trivia question: which is the busiest RNLI lifeboat station in the UK? You’d be forgiven for thinking it was on the coast –but actually it’s on the River Thames. The Tower Lifeboat station was set up in the aftermath of the Marchioness disaster and has just moved to a temporary site whilst a new permanent location is built. It was –as the rest of the RNLI is –funded by volunteers. It is a scandal the organisation is not properly funded, but it’s easy to lend your support on the RNLI’s website.

I QUOTE YOU ON THAT?

A PAEAN TO THE WONDERS OF MARKETS

Now here’s a book title that’s got my attention –“In Defence of Capitalism,” the new tome from economist and semi-regular City A.M. columnist Rainer Zitelmann. The book grabs 10 of the most regular objections to capitalism from alleged growing inequality to encouraging rampant and wasteful consumerism –and turns them deftly on their heads. Zitelmann’s book is a bible for all of those who find themselves occasionally wondering who is making the case for the free markets that have propelled quite literally billions of people out of poverty across the world. It is an intellectual tour de force and one that would be well-served as required reading for our political class.

Harper Collins secures a book

-

the

Indeed it builds on John O’Connell’s recommendation yesterday, “How the World Became Rich” by Matt Koyama and Jared Rubin. As they and Zitelmann note, it is the animal forces of capitalism that do most of the hard work –with the cold dead hand of the state the most powerful force holding back progress across the planet. Let’s hope that it changes the dial on our public discourse.

Sainsbury’s is latest to strike deal with Just Eat

JESS JONES

SAINSBURY’s shoppers can prepare for groceries at the doorstep in just 30 minutes after Britain’s second largest supermarket struck a deal with delivery app Just Eat.

With the Just Eat app, customers will be able to order items from Sainsbury’s and have them arrive at their doorstep in under half an hour.

The on-demand service will be available in over 175 stores by the end of February, and rolled out nationwide throughout 2023.

Sainsbury’s already has its own “Chop Chop” delivery service which promises to deliver up to 25 items in under an hour.

This comes after a number of outlets signed up with Just East, with the Co-op partnering in December, while other agreements

have been penned with Asda, Booker and Greggs.

Sainsbury’s released a positive third-quarter trading statement last week saying they experienced a yearon-year grocery sales growth of 5.6 per cent in the 16 weeks leading up to 7 January.

The supermarket firm’s sales were buoyed by the World Cup as more customers celebrated at home, chief exec Simon Roberts said.

CITYAM.COM 10 TUESDAY 17 JANUARY 2023 NEWS CITY of LONDON The PLANNING ACTS and the Orders and Regulations made thereunder This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission 2 Middle Temple Lane, 2nd Floor North, London, EC4Y 9AA 22/01163/FULL 1 Appold Street, London, EC2A 2UU 22/01200/FULMAJ

Delivery app Just Eat has signed a deal with the UK’s second largest supermarket to offer swift delivery service to its customers

The notebook allows City A.M. staff and those beyond our walls to blow off some steam. Today, it’s our editor Andy Silvester

CAN

coup

whether

firm’s editors will be so thrilled, however...

We are pleased... to have acquired Boris Johnson’s memoirs

How’s that for a surprise appointment? Eddie Jones taking the Australian head coaching job just a few weeks after being booted out by the England hierarchy certainly livens up the potential quarter final clash between the two in this year’s World Cup.

time had come to an end here –his leadership methods (tough love and high standards, amongst others) had seemingly begun to alienate players after seven long years.

ASK regular restaurant-goers what their biggest bugbear is at the moment and you’re unlikely to hear complaints about the overuse of celeriac or the exponential costs of going through a small plates menu. Chief amongst the complaint is the ‘get out’ time –an irritating, growing phenomenon which effectively involves dining against the clock, with the maitre d’ telling you when you need to leave almost before you’ve sat down.

Such will not a problem in Martin Williams’ restaurants. The Rare Restaurants boss –the man behind Gaucho and M Restaurants –has no time for them.

Get-out times are, he reckons, “fundamentally wrong.”

“It’s the opposite of hospitality,” he tells me over lunch at M on Threadneedle Street. “I hate them. They’re greedy, and if you’ve been told three times before you’ve sat down that the restaurant needs the table back, how’s that for a welcome?”

A TURNAROUND SUCCESS STORY

Hospitality is one thing Williams, evidently, knows. A former actor, he became managing director of Gaucho restaurants for a decade before branching out on his own, with M Restaurants.

In 2018, with the Argentinian steakhouse brand facing administration, he bought back in alongside his partners.

It and (judging from the Wednesday lunchtime crowd around us) the rest of the group is now thriving.

“The key thing with Gaucho was that it was always profitable. But businesses were seeing growth in casual dining so they tried to create secondary brandswith Guacho it was Cau, with (rival) Hawksmoor it was Foxlow. In all cases, it hasn’t worked,” he said.

The problem was –per Williams - the management. “The team were really good at premium dining; they weren’t

STEAKING

good at casual dining. You need a lot of people through the door at low margins,” he says.

“I’m not good at that either. It’s not what makes me as a restaurateur passionate. Gaucho had been neglected –been through too many private equity deals –and had lost its imagination, and had poorer quality service. And I recognised that.”

What he did then was relatively revolutionary for a steakhouse chain that to that point had revelled in its meat credentials –modernising the “brand away from steak,” as he puts it –while tucking into a black cod fillet cooked and served in a banana leaf, as if to prove the point (your correspondent had a superb iberico pork dish, though Williams assures me his carbon-neutral steak remains the best in London).

“We had to redesign the menu, reimagine the decor, revitalise the brand, and bring in high quality people. The majority of those came from M –they’d all been part of that journey.”

The point, Williams says, is to remove the “intimidation” factor of steak restaurants. He is inspired by Argentina –he admits to being torn watching the World Cup final in December, despite a French sweepstake entry –and more than that, modern Argentina.

“A gaucho isn’t any longer a rugged man on

a horse who has lived on the farm his entire life,” he says. His last visit saw him encounter a female architect who worked four days a week in the city and managed her farm on the weekend from a polished concrete, modern house.

“That’s Argentina now.” The new Gaucho outpost in Liverpool is a testament to that.

“The changes we made have made it attractive cross-gender, cross-generation,” says Williams, and a recent City A.M. visit during the restaurant’s soft

launch saw a young, predominantly female crowd in a well-lit, stunningly appointed former banking hall, that is as far away from the stereotype of medium-rare-and-a-malbec middle-aged men as could be imagined. It’s part of a “move away from monochrome and mirrors –we wanted to make it bright

and colourful.”

“If you go into our competitors now, they haven’t evolved. They’ve become quite stuffy, intimidating dining rooms.” He declines to name names.

TOUGH CLIMATE

But for all Williams’ success –turnover is up some £18m on five years ago, with EBITDA last year above £10m –he still sees plenty of stormclouds on the industry’s horizon.

“I couldn’t recommend it,” he says, when I ask him if he’d tell a young entrepreneur to start a business in the hospitality industry. The headwinds are much discussed –energy costs, recessionary pressures, business rates, the knock-on effect of pandemic-era restrictions and, perhaps most frustrating of all, ongoing rail strikes.

Williams says there is a risk of the industry becoming seen as a “whinging” one but it would be remiss not to point out that the busiest week of the hospitality industry’s year, in the run-up to Christmas, was wiped out by industrial action. He doesn’t assign blame, but his frustration is obvious.

“I hope the government and the unions are aware of the impact of their striking –and that that’s not disassociated with restaurants closing, people losing their jobs, entrepreneurs losing their homes and the mental health impact that comes with that.”

He’d like to see a rebuilt business rates system –“it’s more suited to the 1970s and 1980s than it is now” –and thinks the changes to energy support for businesses could be catastrophic. But as an entrepreneur, he’s insistent on not dwelling on the difficulties.

FUTURE-PROOFED?

Rare appointed Clearwater International in December of last year to look at funding options –which could include current investors exiting.

“They’re financial institutions. They’d naturally like to see a return having been in the business since 2018,” he says.

“But any investors or equity holders in the business would be excited by our growth plans –we’re opening three new restaurants this year, and continue to have steady growth.”

“We’re self-funded, our new restaurants have been paid for by growth, and we’ve not needed to re-finance. We’re excited about our profitability over the last year.”

Williams has a glint in his eye as he discusses what might be next –which includes a new restaurant in Covent Garden, opening in June, which he says will take inspiration from the dramatic tango halls of Buenos Aires.

With business concluded, a good City lunch can resume –with no chance of being booted out.

Now, that’s hospitality.

11 TUESDAY 17 JANUARY 2023 NEWS CITYAM.COM

INTERVIEW Our rivals haven’t evolved. They can be quite stuffy and intimidating

A CLAIM

A NEW AUDIENCE QUICKFIRE ROUND FAVOURITE FILM: COCKTAIL WHAT ARE YOU DOING ON A SATURDAY?: WALKING THE DOG, WATCHING SUNDERLAND OR DINING BEST RESTAURANT THAT ISN’T YOUR OWN?: TRINITY IN CLAPHAM COMMON FAVOURITE HOLIDAY DESTINATION: MIAMI FOR THE SOCIAL SCENE, SOUTH AFRICA FOR THE VINEYARDS, SAN FRANCISCO FOR THE RESTAURANTS FAVOURITE LONDON VIEW? A BUSY RESTAURANT M’s new Canary Wharf site has gone down well in the banking hub The man behind Gaucho and M Restaurants, Martin Williams, tells Andy Silvester about hospitality gone wrong, making his restaurants approachable and what might be next

TO

The worst pandemic in nearly a century, Russia’s invasion of Ukraine and a global economic downturn have caused historic volatility across the energy sector.

Such a spiral of dramatic events has made it difficult to keep track of stories that don’t flare up in 24-hour news cycles or trend easily on Twitter, such as renewables’ steady rise in the UK’s energy mix.

This was confirmed only last week by the National Grid’s electricity system operator – which revealed wind power provided 21GW of generation for the first time ever over a half-hour window on 10 January.

Ambitious government targets have followed. They include ramping up solar power from 14GW to 70GW by 2035 and boosting offshore wind from 11GW of assets to 50GW by the end of the decade – alongside an ambition to reach 10GW of hydrogen over the same time period.

The challenge now for the Government is harnessing that potential rapid expansion – making the possibility of storing that energy to meet the UK’s future needs increasingly vital as the country shifts away from fossil fuels.

BATTERY STORAGE: THE PLUSSES AND NEGATIVES

The European Union and the UK has staved off blackouts this winter with the aid of vast top-ups of liquefied natural gas – chiefly from the US –with supplies stored in containers for weeks at a time on the continent.

By contrast, the current timeframe for lithium-ion batteries storing renewable energy is a matter of hours.

Meanwhile mechanical options, such as pumped hydrogen and socalled liquid air have clocked in at around a day of storage.

Adam Bell, head of policy at Stonehaven, and former head of energy at BEIS, was optimistic these challenges would be resolved – with electrical stores like lithium and vanadium flow batteries providing more short-term charging options such as for EVs, while longer-term storage needs would be provided potentially by chemical stores where energy was stored as molecules, such as hydrogen.

He expected both continued innovation in the sector and wide array of

Green firm ITM Power’s shares take a tumble after latest profit warning

SHARES in ITM Power nosedived more than 12 per cent on the London Stock Exchange yesterday, after the energy storage firm announced a third profit warning in less than eight months.

The company is forecasting lower revenues and deeper losses than expected, with results for the full

year ending April 2023 now expected to be “different from the current guidance.”

This comes after ITM uncovered more delays to deliveries on customer contracts, extra costs and inventory write-downs.

The company has issued three profit warnings since last June, with problems including losses related to delays to its major

project at the Leuna chemicals complex in Germany.

The Sheffield-based company produces electrolysers – separating hydrogen from water – which are central to the country’s ambitions to develop green hydrogen.

Downing Street is targeting 10GW of hydrogen generation by the end of the decade as part of its energy security strategy.

energy sources to be available to meet the UK’s energy needs alongside –with nuclear in the mix as a baseload alternative.

Bell said: “Each have a different role to play – electrical stores tend to be optimal for intraday solutions, mechanical for intraweek and chemical for intraseasons. Getting the mix of these assets right is a challenge for both Government and the system operator [National Grid], who will need to design the right markets to bring forward the right mix of assets at the right time.”

But that doesn’t mean gas is going

anywhere quickly, either. James Baden, founder and director of storage specialist Zenobe Energy, expected gas to have a continued role in the next two decades.

In his view, the West would have to maintain gas reserves not just for the renewable transition but for future emergency situations after Russia's invasion of Ukraine.

"Everybody became somewhat complacent, having had no war in Europe for 70-80 years," he concluded.

PUTTING FAITH IN BREAKTHROUGHS

There are reasons to be optimistic. One example of innovation in the energy sector is clean energy specialist Zenobe’s battery storage plans to deal with the embarrassing situation where National Grid has to pay wind and solar operators to reduce generation during periods of peak sun and wind power, while also paying gas operators to come online.

For the first 11 months of 2022, National Grid forked out £1.34bn constraining energy supplies –including £122m on wind power –to prevent the grid being overwhelmed.

off wind turbines in the past month

In the past month, £82m was spent turning off –as first reported by Kona Energy –even amid periods of record generation.

When approached for comment, a spokesperson for its electricity system operator said: "Like many system operators across the world, we make constraint payments to help us keep the electricity network in balance at all times.

"These payments to temporarily reduce generation output are more economical than to over-build expensive new infrastructure. We constantly analyse the balance between constraint costs versus the cost of building new assets and are working with industry to reduce the impact of network constraints while building a greener system.”

Zenobe has commercial contracts to develop large 200-300 MW battery facilities which would store power for multiple hours every day, and would be available for the grid during surges – meaning National Grid would no longer have to turn to fossil fuels to deal with shortcomings in renewable power. Something to cheer, at least.

CITYAM.COM 12 TUESDAY 17 JANUARY 2023 NEWS

ITM has seen a downturn from lost customer contracts and warranty provisions

NICHOLAS EARL

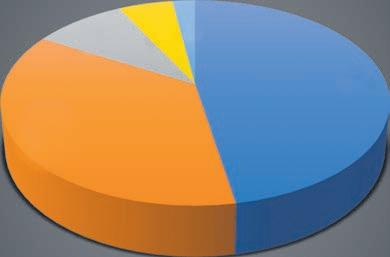

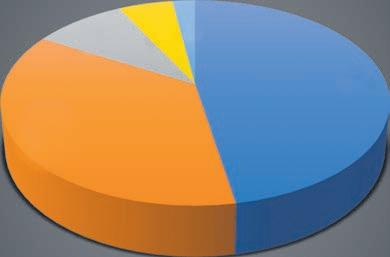

Nicholas Earl looks at whether going green might require further investment in UK energy storage CONSTRAINT COSTS BY ENERGY SOURCE (£m) How much the National Grid has paid to increase and reduce energy generation from Jan-Nov 2022 Source: National Grid Interconnectors 47% Gas 36% Wind 9% Coal 6% Others 2% £633.7m £122m £72m £30.1m £484.8m Wind, Wind, all around, and not a drop to store

The UK spent £82m turning

Productivity problem? Supply side reforms may be the answer in the long term

HEN financial academics write essays, they begin with an abstract that captures the causes, effects and outcomes of the economic policy change they are examining.

Boosting the supply side has a pretty simple argument. Either increasing the volume or productivity of resources used to produce things makes a country richer. That’s it.

Let’s take a look at one of those precious resources: workers.

Living standards are drawing close attention at the moment because they’re tanking at a historic rate.

Inflation has returned with a vengeance, eroding pay. It’s unclear whether we’re headed into an era of structurally higher inflation and out of the “Great Moderation”, when the pace of price increases was low and steady for decades.

One thing is true. Countries can get away with anaemic living standards when inflation is low. When the latter enters double-digits, problems spring up.

That real income erosion has sparked a wave of strikes disrupting the UK economy.

What’s essentially happened over the past 18 months is that the rate of increase in energy prices has far outstripped the rate of increase in the UK’s exports. We’re a net importer of energy, so those higher costs have swept through the economy.

But there are deep-rooted problems that have made households more vulnerable to sudden bursts in prices.

UK worker productivity growth has stalled. That presents companies with a few tough choices.

Scale back unprofitable production. Take a margin hit and hand workers a pay rise.

Borrow to cover short-term losses.

Now, in the real world, firms have picked a mixture of all three. However, weak

productivity growth is among the main causes for why people feel like they’re not any better off compared to a decade ago.

There’s a number of reasons why this has happened. Top of the list is dismal private and public investment.

Over the last decade, according to OECD and World Bank data, investment as a share of the UK economy has actually grown at an average of one per cent per year. This is largely because the economy’s growth pace has slowed since the financial crisis.

In fact, in 2011, proportional business investment hit a record low of 15.6 per cent. Greece, Luxembourg and Poland are the

only other OECD members that have a lower level than the UK’s current level of 17.4 per cent.

Luxembourg actually has one of the higher per capita GDP rates in the world, possibly because its ratio of workers to machines and other productive tools is pretty strong.

All else equal, jolting business investment will raise the UK’s long-term growth potential, to everybody’s benefit.

According to Oxford Economics, Ireland has the highest growth potential in the OECD at nearly six per cent. The UK is second last.

Policymakers need to be a bit more

nuanced about how to get firms investing.

Cutting headline corporation tax rates will help. But, a more effective policy tool could be offering reliefs on the best productivityenhancing investments. That should incentivise firms to channel money into areas where we’ll get the best return. Identifying those things is tricky though.

Another area the UK is fast emerging as a laggard is its workforce. Some 565,000 labourers have disappeared since the start of the pandemic, an anomaly in the developed world.

Early retirement, possibly caused by the Cameron/Osborne administration allowing older people to access their pensions earlier, has shrunk the workforce, according to a report last month from the House of Lords’s economic affairs committee called ‘Where have all the workers gone?’.

Tackling the supply side of an economy is tough. It takes years if not decades to bear fruit.

Arguably, the effects of Margaret Thatcher’s reforms in the 1980s didn’t emerge until Tony Blair seized power. It’s unclear what policies introduced by the current government will surface in 10 years.

The UK economy doesn’t need to be restored to pre-pandemic strength. It needs its long-term health foolproofing to prevent further living standards crises. 2023 will be the year of the supply side.

DAVOS GOES OFF PISTE

This year’s annual jamboree in Davos put on by the World Economic Forum is the first normal one since before the pandemic. It’ll be noticeable for the absence of the world’s political and economic bigwigs.

Prime Minister Rishi Sunak won’t be in the Swiss mountains, nor will his chancellor Jeremy Hunt.

Labour leader Keir Starmer will be though. Food for thought.

RUSSIANS ‘RUNNING OUT’ OF BALLISTIC MISSILES: KYIV

ITALIAN authorities agreed yesterday to hand over a second woman suspected of being involved in the Qatar bribery scandal which has brought down MEPs including Greece’s Eva Kaili (right).

Russia is stepping up its use of S-300 and S-400 air defence systems to conduct strikes on ground targets, suggesting that Moscow’s stocks of ballistic missiles are running low, Ukraine’s Air Force spokesman said yesterday.

The official, Yuriy Ihnat, cited Ukrainian intelligence as claiming that Russia had fewer than 100 modern Iskander ballistic munitions left. He said Russia was, instead, using its S-300 and S-400 systems because of an abundance of munitions.

“The enemy is trying to use their potential, because there are many S-300 missiles already manufactured, [Russia] is a manufacturer of these missiles, and they are already using them in this way,”

he told a briefing in Kyiv by video link.

Britain’s Ministry of Defence said last month that Russia had likely expended a large portion of its stocks of SS-26 Iskander short-range ballistic missiles, which can carry a 500kg warhead up to 500 km (310 miles).

CHINA COVID-19 WARNING

The World Health Organization (WHO) said yesterday it recommended that China monitor excess mortality from Covid-19 to gain a fuller picture of the impact of the surge in cases there.

China said on Saturday that nearly 60,000 people with Covid-19 had died in hospital since it abandoned its zeroCovid policy last month, a big jump from the figures it reported prior to facing international criticism over

We’re much less productive than our peers, the ONS said last week. France, Germany and the US are streets ahead.

We’re slightly further ahead than Italy and Canada, but not by much.

Must. Do. Better.

WHAT I’M READING

£ Labour and the Conservatives’s track record managing the economy is broadly the same. Vicky Redwood and Paul Dales, economists at consultancy Capital Economics, examined how the UK economy has performed during Tory and Labour administrations since the 1960s, including that of Ted Heath (right). The former just about wins on GDP growth, but real wage growth has been better under the latter.

Email economics editor

Jack Barnett at jack.barnett@cityam.com

itsCovid-19 data.

“WHO recommends the monitoring of excess mortality, which provides us with a more comprehensive understanding of the impact of Covid-19,” the UN agency told Reuters in a statement when asked about China.

SOMALIA BREAKTHROUGH

Somalia’s government-led forces have captured an al Shabaab stronghold on the Indian Ocean coast, the defence minister said yesterday, in one of their most significant victories since launching an offensive against the Islamist group last year.

The forces took the port town of Harardhere as well as the nearby town of Galcad in central Somalia’s Galmudug region, the government said.

13 TUESDAY 17 JANUARY 2023 NEWS CITYAM.COM Reuters WORLD NEWS

ECONOMICS

City A.M.’s economics editor Jack Barnett takes a deep dive into the state of the economy in his new weekly column

Source: Oxford Economics

Mexico UK Japan S. Africa Italy Spain Finland Brazil Austria Germany Argentina France Eurozone Chile Swiss Czech Rep Neths Greece Canada Australia Portugal Slovak Rep Norway S Korea NZ Belgium Lux Denmark Sweden Lithuania Latvia Columbia Israel Australia Estonia Slovenia Romania Hungary Poland Turkey Indonesia India China Ireland 0 1 2 3 4 5 %y/y (2020-2024) 1960s1970s1980s1990s2000s2010s 0 1 2 W

POTENTIAL OECD GROWTH RATES

IT’S NEVER EVA OVER Brussels-Qatar graft scandal fallout widens once more

YOU MIGHT HAVE MISSED

SEND

US YOUR THOUGHTS

ON WHAT’S HOLDING BACK THE UK

ECONOMY

What measures do you think would lift productivity growth out of the mire?

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

FTSE 100 getting close to a record high while traders wait for Davos

LONDON’s FTSE 100 was closing in on its record high yesterday as traders braced for the world’s business and finance elite to deliver their verdict on the global economy in Davos this week.

The capital’s premier index jumped 0.19 per cent to 7,859.52 points, while the domestically-focused midcap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 0.57 per cent to over the 20,000 point mark.

The FTSE 100 kicked off another week in good style yesterday, taking its 2023 earnings so far to around four per cent.

That new year surge led to near its highest level ever of just over 7,900 points, hit in May 2018.

Easing fears over the severity of a much-touted UK recession has lifted sentiment toward London-listed stocks.

The prospect of global energy and commodity prices being boosted by China, the world’s second largest economy, reopening its economy by dismantling its zero-Covid policy has also prompted traders to pour into the FTSE 100.

A large chunk of the index is made up of industrial firms, such as BP, Shell and Glencore.

“With British consumers flexing their spending muscle over the Christmas period and the country looking more likely to have escaped falling into recession in 2022, the waves of optimism have been lapping over the London market,” Susannah Streeter, senior markets analyst at Hargreaves Lansdown, said.

House builder Taylor Wimpey supported the FTSE 100, adding more than one per cent after data from search site Rightmove yesterday morning revealed house prices are rising once again.

Centamin benefitted from a favourable constitutional court ruling in Egypt yesterday which confirmed that third-parties are prevented from lawfully challenging contractual agreements between the Egyptian government and investors. This enables Centamin to challenge a ruling from 2011. Analysts at Peel Hunt said a final ruling would be welcome and maintained a ‘buy’ rating with a target price of 135p.

SYNCONA

Astrazeneca completed its acquisition of Neogene Therapeutics, which is part owned by Syncona, for $320m (£262m). Peel Hunt analysts said Syncona’s £16m upfront cash from the deal represents a 1.1x multiple of cost with the potential to receive further downstream milestone payments to come. Peel Hunt maintained a ‘buy’ rating with a target price of 220p.

RUSS MOULD,

RUSS MOULD,

P 16 Jan 118.95 10 Jan 16 Jan 12 Jan CENTAMIN 118 13 Jan 11 Jan 126 124 122 120

P 10

16

To appear in Best of the Brokers, email your research to notes@cityam.com

Jan

Jan 12 Jan

170 16

175

176 174 172

Jan

13 Jan 11 Jan

FTSE AT THE RACES “Like a sturdy old thoroughbred clearing hurdle after hurdle, the FTSE 100 continues to press on towards a new record level despite the uncertain backdrop. Asia-focused insurer Prudential was among the gainers as shares in China and other markets in the regions, bar Japan, enjoyed gains.”

AJ BELL

CITYAM.COM 14 TUESDAY 17 JANUARY 2023 MARKETS THE GUILDHALL THE CITY’S MOST HOTLY-ANTICIPATED AWARDS EVENING - AND AFTERPARTY - IS BACK CITYAM.COM/AWARDS-2023 FOR TABLES AND TICKETS: Contact Darren.rebeiro@cityam.com NOMINATIONS FOR THE BEST OF THE BEST ARE OPEN NOW - GET YOUR ENTRY IN SOON IN PARTNERSHIP WITH

EDITED BY SASCHA O’SULLIVAN

Britain’s forty-something-year-olds are in the sweet spot of working adults

Elena Siniscalco

LAST week, the government started considering plans to give tax breaks to people over the age of 50 who want to come back to work. Predictably, it started a Twitter war with under-35s lamenting their sky-high student debt, extortionate rent and lower salaries - with no one offering them any tax relief. Besides the usual stereotype fight between “avocado-eating” young workers and “stuck in their ways” over-50s, both age groups are clearly not happy with what they’re getting from the labour market.

If you ask what’s the best age to work in the UK, the most likely answer you’ll get is “not the age I am currently”. Young and older workers are facing new and old problems. The one group that seems to be in the sweet spot is the squeezed middle: those in their forties.

Think of young people first. Those entering the workforce now are not having it easy. True, vacancy levels are very high, meaning a multitude of jobs out there. But this doesn’t mean that Gen Z has the right skills for these jobs: the labour market is plagued by a mismatch between what we learn at school and the skills we need in many of the jobs available.

Young people’s salaries tend to be

lower but expenses tend to be high. According to data released last summer, four in ten people under 30 are spending more than 30 per cent of their pay on rent. London, of course, sees the highest prices in the country. Putting money on the side to buy property feels impossible for “generation rent”.

For the older bracket of this age group, there’s one additional concern: the cost of childcare vis-a-vis their salary. It’s the highest in Europe, three times higher than what couples spend in Germany. This has deep socio-cultural implications: if previously people were making life deci-

sions - like when to have a baby - based on age, now they’re making them based on salary. Fifty-eight per cent of Gen Z and 57 per cent of millennials say they are keen to achieve a particular income level before making those decisions, according to research by wealth manager Evelyn Partners.

Things don’t look much brighter for older workers. In the year from April 2021 to March 2022, almost 16 per cent of people aged 50 to 54 years were economically inactive and 24 per cent of those aged 55 to 59 years were, according to ONS data. The reasons for this drop-out are various: long-term illnesses, disabilities which

make it harder to find a job, caring responsibilities.

Millions of people have left the labour market since the pandemic: at the end of last year, there were around 88,000 more inactive Londoners aged between 50 and 64 years than in early 2020. Because of the lack of flexible opportunities, many of those are unable to re-access this market.

“When they’ve been out of work, they can often only return to jobs which are beneath the level they were at previously”, says Dr Adrian Wright of the University of Central Lancashire. This productivity problem explains why the government is looking at incen-

tives for this age group.

Now look at those in their forties. Last year, men aged between 40 and 49 were the highest full-time earners in the UK. The median weekly pay for employees in their forties was the highest at £727, compared to £678 for those between 30 and 39 and £681 for those between 50 and 59. This group is more likely to own a house already, having been able to buy one before the housing crisis reached its current peak. And it’s more likely to be in lucrative senior positions. A recent EY report found that there were no board members under 40 in any of the UK’s top financial services firms. Being over the age of 40 didn’t automatically mean you would land a top jobthe average age for a board member was still 58 - but if you were younger, you’re almost guaranteed not to be appointed. While millennials have a lower income in their 30s than previous generations did, those in their forties are more likely to be saving up money for a nice, early retirement. This picture is problematic in so many ways. More and more younger workers risk finding themselves in debt and struggling to get to the end of the month. Those in their thirties might be giving up on much-desired life opportunities because they don’t earn enough - accelerating the rise of the ageing society. And those in their fifties who have jumped out of work to take care of their health or their relatives’ will feel more and more forgotten. Things might be great for those in their forties, but until employment is better for everyone else, the UK is unlikely to solve most of its social and economic woes.

Daniel Korski

We need a Swedish-style civic duty to stop division being baked into our politics for good

THE UK is one of history’s most successful multicultural and cohesive societies. A country that has been knitted together from different nations, which over centuries has narrowed the divisions between rich and poor.

But things could be about to change.

After years of divisive post-referendum politics, large-scale immigration, a pandemic that affected rich and poor very differently, the death of a unifying monarch and now a recession, a more permanently divided society is now at risk of emerging.

Polls speak to the risk. Those aged 75 and over are much more likely to believe their local area is a place where people from different backgrounds get on well with each other than most of the younger age groups - including those aged between 50 and 64.

The percentage of Britons who agree that people can be trusted in their

local neighbourhood has steadily declined from 48 per cent in 2013/2014 to 40 per cent in 2019/2020.

English proficiency is key to social cohesion; if you can’t speak to your neighbours, it’s harder to do things together. But as Lousie Casey’s review for the government found, Pakistani and Bangladeshi ethnic groups have the lowest levels of English language proficiency – and women in those communities are twice as likely as men to have poor English.

Our country can address its problems with the right mix of policies. We need better education in economically-deprived areas and greater efforts to teach English - especially to those who need it most. We must eliminate discrimination against women and launch new initiatives to help young black men in employment, and young, poor white boys

into higher education.

Many initiatives have sprung up to make a difference. Take the 10,000 Black Interns campaign helping young Black students into hard-to-access jobs. I chair the Welcoming Committee for Hong Kongers which seeks to integrate Hong Kongers into the UK. Other citizens-led initiatives are also making a

difference, with the sign-ups to NHS Volunteer Responders during the pandemic showing a reservoir of support for civic action.

But something bigger is needed that can cut across the different communities. Here Sweden may have shown the way. The new Swedish government has decided to introduce a “civic duty” alongside the military conscription which already exists. Young people will be required, when they turn 18, to either join the military or perform civic duties. The idea is not only to provide public services, from health to local government, manpower but to instill in younger people a sense of social cohesion. As a friend remarked to me twenty-five years after his military conscription, his time wearing fatigues was the only moment he truly met his generation - rich and poor, thin and fat. The rest of his life, he