ILARIA GRASSO-MACOLA

A GLOBAL economic slowdown may not seem ideal market conditions for luxury carmarkers –but Rolls Royce, Bentley and Jaguar all defied the odds with bumper years, they revealed yesterday.

Both Rolls-Royce and Bentley broke more than century-old sales records, with the former delivering over 6,000 cars for the first time in its 118-year history.

Bentley meanwhile continued with its

winning streak as it shipped over 15,100 units in the past 12 months following the introduction of new models and an increased demand for vehicle personalisation.

Jaguar Land Rover’s (JLR) wholesale volumes in the last three months went up 15 per cent on last year’s levels following an increased demand in North America and the UK.

Though all saw dampened demand in China, most saw significant growth in all

the other markets they operate in. Hargreaves Lansdown’s senior investment and markets analyst Susannah Streeter told City A.M. the luxury end of the car market “looks set to ride out the costof-living storm, as wealthier consumers have much deeper pools of resilience to dip into”.

“Wealthier consumers are clearly brushing off the rise in grocery and energy bills, like raindrops on a sturdy waterproof jacket, with sales rising 13 per cent in the

UK alone,” Streeter said.

Rolls boss Torsten Muller-Otvos said that personalisations and ‘bespoke’ commissions had also reached record levels, with significant demand in the Middle East. A personalised Rolls can run to nearly £500,000.

Muller-Otvos said that, despite headwinds in China, demand remains “exceptionally strong” well into 2023.

Much of Bentley’s growth came from new hybrid models, including the Flying Spur.

SIGN OF THE TIMES

Goldman set to slash staff in slowdown

CHRIS DORRELL

WALL STREET banking giant

Goldman Sachs will axe 3,200 workers in just days to protect its finances from a likely recession in the US and a slowdown in global deal making.

The lender is expected to shrink its staff force by around 6.5 per cent and will tell workers tomorrow if they are part of the cull.

Bloomberg first reported the news. While the redundancy drive is better than the worstcase scenario figure of 3,900 quoted by chief David Solomon at the end of last year, it is still among the deepest cuts in the bank’s more than centurylong history.

Discussing the plans in December, Solomon, 61, said: “There are a variety of factors impacting the business landscape, including tightening monetary conditions that are slowing down economic activity.”

“For our leadership team, the focus is on preparing the firm to weather these headwinds,” he added.

The redundancies are likely to be focused in the investment banking division and its consumer arm, although all divisions are expected to face some cuts.

Goldman declined to comment when contacted by City A.M. yesterday.

THE BANK of England did not understand inflation “well enough” and “underestimated” the strength of the 40-year high price surge, its chief economist admitted in a speech in the US yesterday.

Huw Pill said with “the benefit of

hindsight”, the central bank’s “own analysis” failed to foresee inflationary pressures magnified by global supply chain pressures after the pandemic.

Inflation has run above the Bank’s two per cent since the summer of 2021.

The initial burst was sparked by

trade flows struggling to keep pace with a sudden jump in global spending after governments rolled back restrictions on daily life to tame Covid-19 infections.

It was those early signs of inflationary pressures that Pill admitted the Bank overlooked. In February, when inflation was

beginning to rise, the monetary authority forecast the cost of living would peak around seven per cent.

Since then, charged by Russia’s invasion of Ukraine jolting international energy markets, inflation surged to a peak of more than 11 per cent in 2022.

It has since dropped to 10.7 per

cent and analysts think it will gradually fall this year, although it will likely still be above the Bank’s target by the end of the year.

Pill and his boss, Andrew Bailey, have backed nine successive interest rate increases since December 2021, including a 75 basis point rise, the biggest move since the 1980s.

INSIDE RISHI STEPS IN TO WOO ARM INTO LONDON LISTING P3 MILLENNIALS SNUBBED BY BOARDS P4 SANTANDER LAUNCHES BNPL FOR BIG BUSINESS P6 OPINION P16 SPORT P19

LONDON’S BUSINESS NEWSPAPER TUESDAY 10 JANUARY 2023 ISSUE 3,913 FREE CITYAM.COM

JACK BARNETT

You can say that again: Bank economist says it ‘underestimated’ inflation surge THE NOTEBOOK VICTORIA SCHOLAR ON DEFENSIVE PLAYS, TESCO AND ELON MUSK P12 RUN THE NUMBERS OUR NEW WEEKLY DEEP DIVE INTO THE UK ECONOMY P13 ROLLING IN IT RECESSION? WHAT RECESSION? ROLLS, BENTLEY AND JAGUAR ALL REPORT BUMPER SALES AND REVENUES

STANDING UP FOR THE CITY

Time to use this crisis as an opportunity to reform the tax code

IT’s not easy being Chancellor of the Exchequer at any time, let alone right now. The challenge facing Jeremy Hunt yesterdayto bring down the cost of the energy support package for businesses without condemning thousands of them to bankruptcy - was not easy. It seems, for the moment, as if he’s just about struck the right balance. Customer-facing businesses are entitled to be angry. Earlier in the winter, much political capital was

THE CITY VIEW

expended on consumer support to stave off the worst of higher energy prices, whilst businesses were forced to cling on until the last moment to find out what help was on the way. It was eerily reminiscent of the Covid-19 pandemic, when the Treasury at

points seemed to entirely forget that shutting down the economy would have an impact not just on salaried staff but on the people who paid those same salaries. Here we are in January and only now are businesses being made aware of what help they’ll have in three months.

But, better late than never. The new package should calm any remaining market jitters that the Chancellor is wont to dump his fiscal discipline and it should –

should –provide enough support to get consumer businesses through a recession. But we are approaching the point at which sticking plaster reforms and packages will no longer stop the bleeding. The key culprit in the struggle many consumer businesses are facing isn’t a lack of demand or staff shortages –though they are an issue –but good ol’ fashioned business rates. Antiquated and painful, no sane policymaker would ever design

business rates in the way they currently stand if they were starting from scratch –in that sense, they aren’t wildly dissimilar from Council Tax. The system has failed to keep pace with technological change and, of course, taxes inputs –not outputs; a bad starting point for any government cash grab. If Jeremy Hunt can use this crisis for anything, it’s to finally start reform of both. If we don’t do it now, we may never do.

FINANCIAL TIMES

UK AND EU MAKE PROGRESS IN ‘CONSTRUCTIVE’

TALKS

ON N IRELAND TRADE London and Brussels have secured a breakthrough in the corrosive dispute over Northern Ireland’s post-Brexit trading relations, clearing the way for a new push to resolve the issue.

THE TELEGRAPH

STURGEON AND BURNHAM PLOT WESTMINSTER RAID TO CONNECT HS2 TO SCOTLAND

Nicola Sturgeon and Andy Burnham are plotting to force ministers to spend at least £3bn on making HS2 services run to Scotland. Ministers culled a section of HS2 which would have benefitted it.

THE TIMES

FORMER MCDONALD’S BOSS FINED $400,000 OVER EMPLOYEE RELATIONSHIP

Former boss of McDonald’s, Steve Easterbrook, has been fined $400,000 (£328,000) by the US regulator for “concealing the extent of his misconduct” over a relationship with an employee.

Recession fears force UK businesses to park hiring plans as firms look to cut costs

RECESSION fears are forcing businesses to mothball hiring plans to keep costs at a minimum, a new survey out today reveals.

KPMG and the Recruitment and Employment Confederation’s (REC) permanent hiring index stumbled to 44.5 in December from 46.4 in November.

The reading has now been below the 50 point mark that separates growth and contraction, indicating the UK jobs market’s surprise resilience to the economic slowdown has been breached.

Official unemployment figures have held at multi-decade lows for months and vacancies have stayed around record levels despite experts warning the UK is on course for an at least year long recession.

However, KPMG and the REC’s figures reinforce purchasing managers’ indexes out last week that indicated businesses are considering shedding workers or reining in hiring.

“The challenging economic environment continues to constrain the jobs market,” Claire Warnes, head of education and productivity at KPMG UK, said.

London’s jobs market is the best performing in the UK and is actually on the mend, boosted by strong demand for financial services workers.

Nonetheless, despite a rise to 46.6 from 44.4, permanent hires are shrinking in the capital. Permanent hires do tend to soften in December, while temporary billings receive a boost due to the busy Christmas shopping period.

Despite accelerating pay, inflation is eroding households’ spending power. The Resolution Foundation warned yesterday real incomes will still be below pre-pandemic levels in 2028.

Oil rebounds as China opens borders after three years

NICHOLAS EARL

OIL PRICES have rebounded at the start of this week’s trading amid improved investor sentiment after China moved to reopen its borders for the first time in three years.

This has raised expectations of raised fuel demand from the world’s second largest oil consumer.

Brent Crude was trading at $79.54 per barrel, up 1.23 per cent in this evening's trading, while WTI Crude had climbed 1.17 per cent and was placed at $74.63 per barrel.

There are also hopes of less sharp hikes in US interest rates next month –which could potentially drive future rallies.

Nevertheless, prices remained well below last year’s peaks, when prices rose to a 14-year high of $139 per barrel in March, amid sustained expectations of a recession across global markets this year.

The latest increases follow a sharp drop last week of more than eight per cent for both benchmarks, the biggest weekly declines at the start of a year since 2016.

CITYAM.COM 02 TUESDAY 10 JANUARY 2023 NEWS

JACK BARNETT

WHAT THE OTHER PAPERS SAY THIS MORNING

BRAZIL NUTS Pro-Bolsanaro crowds storm the National Congress in Brasilia in a dramatic protest against president Luiz Inacio da Silva’s inauguration last week

Astrazeneca strikes $1.8bn deal for Cincor

NATALIE GROVER

NATALIE GROVER

ASTRAZENECA yesterday said it had struck a deal to buy US-based drug developer Cincor Pharma for up to $1.8bn (£1.4bn) to increase its stock of heart and kidney drugs.

Core to the deal is Cincor’s experimental therapy baxdrostat, which is in development to treat conditions including high blood pressure and chronic kidney disease.

Astrazeneca aims to combine baxdrostat with its own Farxiga, a diabetes drug whose sales ballooned after it was also shown to benefit patients with heart failure and kidney disease.

Farxiga, whose sales jumped by almost 50 per cent during the first nine months of 2022 to reach $3.2bn, belongs to a highly competitive class of drugs that includes rivals such as Boehringer Ingelheim.

Astrazeneca gets about a third of its revenue from cancer drugs, but its heart, kidney and diabetes medicines

are its second most lucrative business by sales, generating roughly $6.9bn of the drugmaker’s total revenue of more than $33bn in the first three quarters of 2022.

Farxiga and the oncology drugs Lynparza and Calquence could face generic competition as early as 2024, BMO Capital Market analysts said in a note last week.

In theory, a combination of baxdrostat with Farxiga could enable Astrazeneca to prolong its Farxiga franchise, Mene Pangalos, executive VP of biopharmaceuticals research and development at Astrazeneca, said.

The Anglo-Swedish drugmaker on Monday agreed to pay $26 per Cincor share in cash, or $1.3bn in total, a premium of nearly 121 per cent to the USbased company’s closing price on Friday. The offer also includes a nontradable contingent value right of $10 per share in cash payable upon a specified regulatory baxdrostat submission.

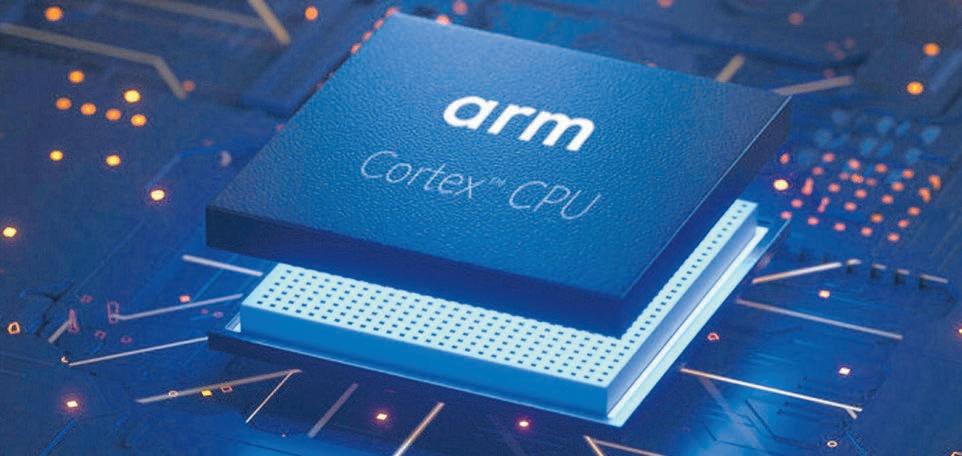

Prime Minister’s move to sweet talk chipmaker Arm into London listing cheered by tech chief

CHARLIE CONCHIE

CHARLIE CONCHIE

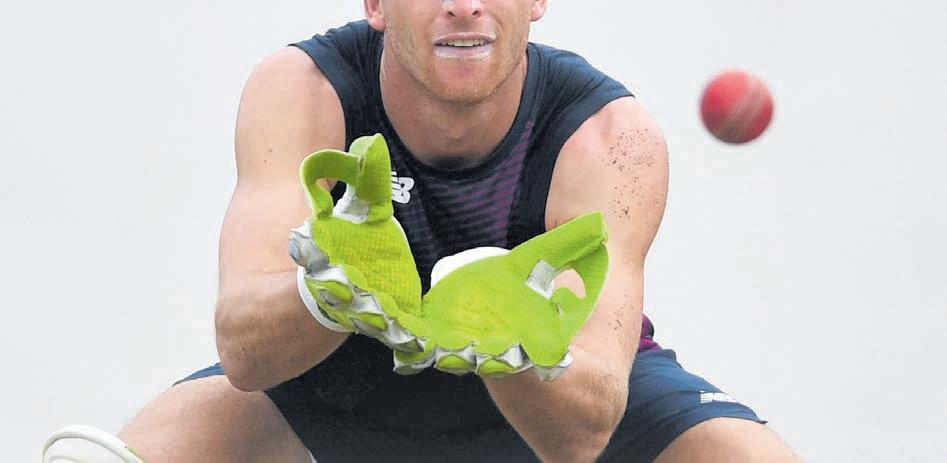

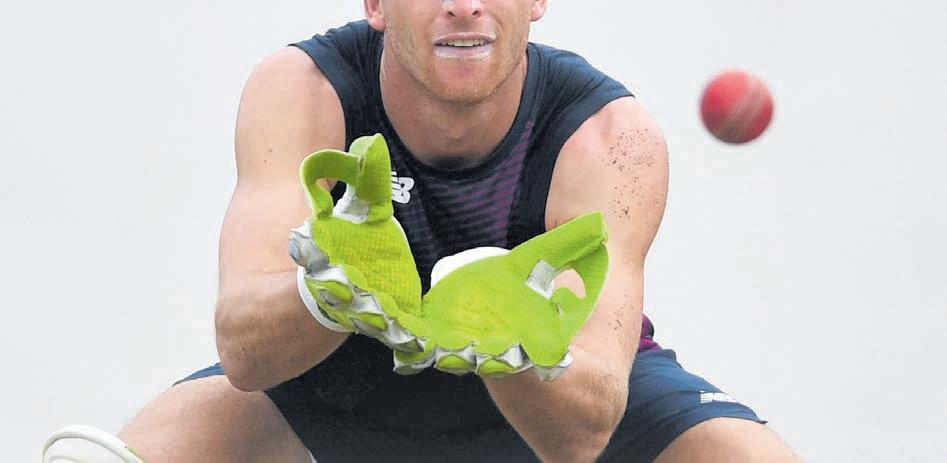

RISHI SUNAK’s move to restart efforts to woo Arm into a London listing were yesterday cheered by a top tech chief, who said winning the chipmaker’s listing would be a “significant vote of confidence in the UK market”.

Sunak reportedly met with Arm’s chief Rene Haas last month in a bid to secure London a role in the Cambridge-

based firm’s much anticipated shift onto the public markets, the Financial Times reported.

Boris Johnson’s government desperately tried to charm Arm and its owner, Japanese investment giant Softbank, in a bid to tempt the firm into a ‘home’ listing in London. But discussions were reportedly scuppered by his resignation.

However, sources told the Financial

Times that Sunak’s meeting with Haas were “very constructive”.

Softbank chief Masayoshi Son has publicly favoured a New York listing, but a dual listing could also reportedly be under consideration.

TechNation chief Gerard Grech yesterday cheered the news. “To have a listing in London would be seen as a significant vote of confidence in the UK market,” he said yesterday.

HOLLY WILLIAMS

VODAFONE has finalised a deal to sell its Hungarian business for £1.5 billion amid an ongoing overhaul.

The group just confirmed a binding agreement to sell Vodafone Hungary to local tech company 4iG and the Hungarian state for 660bn Hungarian forints (£1.5 bn), with the sale proceeds being used to pay down debt.

It comes as Vodafone searches for a new chief executive after former boss Nick Read was ousted at the end of last year, with reports suggesting the board was unhappy with his progress in boosting the firm’s performance.

During Mr Read’s four-year tenure, Vodafone has been focusing on its core Euro and African business.

But it is also slashing costs, with the former chief executive last month

warning over price hikes for customers as it trimmed its profit guidance range for the full-year and posted a 3 per cent drop in interim earnings.

Chief financial officer Margherita Della Valle has taken over as interim chief exec while the group hunts for a permanent replacement at the top.

Ms Della Valle said the deal “establishes a scaled operator across mobile and fixed communications.”

03 TUESDAY 10 JANUARY 2023 NEWS CITYAM.COM

Reuters

Number 10 has been doing its best to woo Cambridge-based Arm into a home listing, despite owner Softbank favouring the Nasdaq

Vodafone has finalised selling its Hungarian phone division to refocus the business PA

Vodafone is Hungary for less as the mobile giant offloads its division

BARRING YOUNG PEOPLE FROM BOARDS IS POOR PLANNING

NEW research from EY showing there were no board members under 40 in the UK’s financial services firms last year raises the question of whether we are laying the groundwork to develop and prepare our future leaders.

To overcome the challenges looming in 2023 – from making progress towards net zero to redefining the future of work – we need to make use of the diverse talent and perspectives across the workforce. Ensuring the next generation is board-ready now will be critical in this endeavour.

Our experience shows that

implementing effective sponsorship programmes that champion and support younger workers’ career progression is one of the most effective ways to foster leadership and increase diversity at the executive level.

Chartered Management Institute research finds that, while 86 per cent of senior leaders report formal mentoring programmes in their companies, just 21 per cent report having formal sponsorship schemes.

This is a particular gap for younger women;

only 3 per cent of female managers report being sponsored and just 19 per cent

Financial firms have much to gain from developing their pipeline of young leaders. Supporting them today will pay dividends

BY ANN FRANCKE, CHIEF EXECUTIVE OFFICER OF CHARTERED MANAGEMENT INSTITUTE

Millennials are ignored by UK company boards

LOUIS GOSS

THE BOARDS of London banks, asset managers and fintechs are outstripping their European rivals when it comes to female representation but are failing to take on any millennials, according to new research.

A report from EY found that there were no board members under 40 in any of the UK’s top financial services firms.

The report on board diversity shows that, in 2022 more than half (58 per cent) of board appointments in UK banks, asset managers, fintechs, and insurance companies were women, compared to just 50 per cent of their European rivals.

The high levels of appointments of female board members meant the UK took a slight lead over the rest of Europe, with women making up 43 per cent of UK board members compared to 42 per cent of European ones.

The insurance sector had the greatest gender diversity, according to the EY survey of 300 UK and European financial sector companies; the poll showed 43 per cent of insurance firm board members are female, compared to just 41 per

cent on UK bank’s boards.

UK financial services firms however lagged behind French and German ones in promoting younger board members. The report showed there was not a single board member under 40 in any UK financial services firm monitored by EY.

By contrast, 22 per cent of French financial services companies and a third of German ones had at least one board member under 40.

At the European level, 10 per cent of financial services firms had an under-40 on their boards, with one-fifth of those appointments made in 2021

In the UK, the average man sitting on the board of a financial services company is 61, while the average female board member is 58, EY’s research shows. In Europe, the average male board member is 60 while the average female exec is 57.

The report however shows that the UK is not alone in its lack of under-40 board members, as it notes Finland, Italy, Spain, Sweden, Switzerland and the Netherlands are in the same position.

Anna Anthony, EY’s UK financial services managing partner, said: “Leaders across the financial sector are responding to the need for change.”

Jefferies posts lower quarterly profit in bad sign for US banks

MEHNAZ YASMIN

INVESTMENT bank Jefferies Financial Group posted a 52.5 per cent decline in fourth-quarter profit yesterday, hit by lower underwriting fees and volatile markets that dented income from its trading desks.

Still, investment banking revenue saw their second-best year and was substantially above 2019 levels, chief executive officer Richard Handler and president Brian Friedman said.

The New York-based financial institution’s results are often viewed as a prelude to earnings at Wall Street titans such as JP Morgan, Goldman Sachs and Morgan Stanley, since the bank reports ahead of its rivals.

Investment banks are buckling under pressure from a dearth of deals as companies refrain from M&A activity due to higher borrowing costs and geopolitical uncertainties.

Jefferies’ total net revenue was down 18 per cent at $1.44bn.

CITYAM.COM 04 TUESDAY 10 JANUARY 2023 NEWS GET IT ON Southeastern has a range of season tickets to suit you. Buy your ticket direct via our app or visit: southeasternrailway.co.uk/commuteyourway No booking fees apply. when you do that work t ickets Season

Lower underwriting fees and market volatility have dented profit at Jefferies

Reuters

Up against it: Firms fear after Hunt cuts energy package

SMALL BUSINESS bodies, pub campaigners and the mayor of London all criticised Chancellor Jeremy Hunt last night after he announced a significant cut to the energy support package.

Jeremy Hunt effectively replaced a cap on prices with a discount, with the new scheme coming into place in April this year.

The aim of the new package is to help businesses locked into contracts signed before recent substantial falls in gas prices, while helping them face the new reality of higher energy bills from precrisis levels.

Martin McTague, national chair of the Federation of Small Businesses (FSB) said last night he feared that companies would struggle to "survive on the pennies" offered in the latest package.

The latest round of industry criticism over support packages follows polling

showing that over half (51 per cent) of businesses with customer-facing premises such as shops, hairdressers, nurseries, cinemas and gyms will be forced to raise prices if the Energy Bill Relief Scheme scheme is not extended.

The research from Uswitch also revealed that one in five (20 per cent) public-facing businesses such as hotels, beauty salons and gyms, believe they will needed to take equally drastic action such as closing some operations, downsizing or restructuring the business.

More than one in seven (13 per cent) argued they will have no option other than to reduce overall staffing.

Sadiq Khan said cutting support would hurt those businesses “especially at risk as households cut their spending.”

And the British Beer and Pub Association boss Emma McClarkin said the change could be the “last straw” for businesses which have been struggling for three years to remain solvent.

UK’s top bank names are now in the sights of new class-action lawsuits

LOUIS GOSS

THE UK’s top banks are increasingly being targeted with class-action lawsuits as litigation funders back claims against some of Britain’s largest lenders in their pursuit of high returns.

Banks listed on the FTSE 100 index are currently facing at least 109 classaction lawsuits in multiple countries

around the world, according to analysis by law firm RPC.

London-headquartered Barclays is bearing the brunt of the class actions wave facing at least 41 separate claims, RPC’s analysis shows.

HSBC is subject to 31 collectiveaction cases, while NatWest is facing 28 actions of its own, the law firm said.

The spate of class actions signals litigation funders are increasingly

looking towards wealthy big banks in their efforts to generate greater returns from the cases they bankroll.

Litigation funders, who are generally backed by hedge funds, generally take a cut of any winnings.

RPC partner Daniel Hemming warned “banks are likely to face a rise in class actions” as he claimed litigation funders are now “front of the queue to back” collective claims.

The only package Jeremy Hunt could have announced yesterday which wouldn’t have been immediately shot down as insufficient would have been to leave things as is –but he couldn’t do that, because the hastily put together package from last year is simply too expensive. It’s oft-forgotten that it wasn’t necessarily Liz Truss’ mini-Budget that spooked markets, but the far more expensive energy package announced on day one of her premiership. Hunt has rolled back the domestic programme, and it was inevitable that the business side would be set for some kind of shrinking too. What surprised yesterday was the severity –even with discounts for industrial users of energy like manufacturers, it’s hard to see prices falling to levels that would make UK firms competitive against European and global rivals. As for small businesses, it’s yet another cross to bear. The saving - of around £13bn - is significant even in the context of Britain’s balance sheet. Whether that looks like a smart move will depend on whether high street staples up and down the land can survive this year.

ANDY SILVESTER

05 TUESDAY 10 JANUARY 2023 NEWS CITYAM.COM

NICHOLAS EARL

Barclays Bank, headquartered in London, bears the main brunt of these new lawsuits

BOTTOM LINE

Inflation wipes out Christmas sales as UK stumbles toward recession

JACK BARNETT

INFLATION is forcing Brits to rein in spending, prompting experts today to warn of a rise in high street bankruptcies as the country stumbles into a recession.

Retail sales fell in real terms over the Christmas period, when consumers tend to splash the cash on food and new clothes, according

to two surveys out today.

While spending jumped 6.9 per cent over the year to December, accounting for inflation, real sales actually dropped, according to the British Retail Consortium and KPMG.

The Office for National Statistics will release its December estimates for inflation on 18 January and most analysts think they will come in around 10 per cent, indicating real

retail sales dropped around three per cent last month.

Paul Martin, UK head of retail at KPMG, warned the spending slowdown risks driving high street bankruptcies higher.

“The strong demand across certain categories that has protected some retailers will undoubtedly fall away so we can expect high street casualties as we head into the spring,” he said.

Santander to let big business buy now, pay later

CHARLIE CONCHIE

SANTANDER has launched a business-tobusiness (B2B) buy now pay-later (BNPL) service which claims to be the first of its kind.

The Spanish lender’s corporate division has struck a deal with credit firm Allianz Trade and B2B payments platform Two to launch the first global B2B BNPL platform for multinational corporates.

The new product will provide a platform for big firms to defer payments at checkout while allowing suppliers to pocket their cash.

The launch follows last year’s flurry of investment into the B2B BNPL market as investors looked to tap into surging demand from cash-strapped firms looking to take greater control of their cost base.

Smaller firms have also been struggling with payment terms since the pandemic when many corporates stretched the times of their payments and left sellers strapped for cash.

Santander’s global head of receivables said easing the transfer of payments between firms could be a “game changer” for sellers.

“The fact that buyers have to use per-

sonal or corporate credit cards is still hindering B2B transactions,” he said in a statement.

“Enabling businesses to maintain their payment habits within 30 or 60 days of their invoices, in an e-commerce environment, will be a big differentiator for sellers, while adding a major game changer: all concerns about non-payment risk are now removed, and their cash flow is preserved at all times.”

The three-way partnership will see Allianz Trade assess credit requests while Santander Corporate Investment Banking makes financing decisions on the spot, with Two providing the technology to facilitate the payments.

“All this process is streamlined and set up through Two’s BNPL technology. Everything happens in a fraction of a second, without the end user even realising it,” the firms said in a statement.

Santander’s deal marks an expansion of its BNPL offering after the bank announced the launch of a consumer product Zinia last year.

Banks have been increasingly edging into the consumer space in a bid to eat the lunch of the fintech first movers like Klarna and Clearpay.

Lidl toasts record Christmas sales helped by viral Tiktok prosecco fad

LOUIS GOSS

LIDL has reported a bumper Christmas period, achieving its busiest day of trading in its 28-year history, as Brits trade down from more expensive rivals.

Lidl won over an additional 1.3m UK customers this Christmas as shoppers switched almost £63m worth of spending over to the budget supermarket.

The extra customers saw Lidl achieve 24.5 per cent higher sales over the

Christmas period compared to 2021.

Lidl’s trading figures were bolstered by a surge in sales of prosecco, which the retailer partly attributed to a viral Tiktok fad on making Negroni Sbagliato cocktails started by English actress Emma D’Arcy.

It comes as discount supermarket sales have been boosted by the downturn in the economy that has seen customers seek bargains, with Lidl’s rival Aldi also reporting record sales of more than £1.4bn over December.

CITYAM.COM 06 TUESDAY 10 JANUARY 2023 NEWS

Lidl said a viral Tiktok fad about making Negroni cocktails had helped boost sales

Future could be very chilly for Bitcoin values

CHARLIE CONCHIE

CHARLIE CONCHIE

THE NUMBER of Bitcoin millionaires has plunged and scammers have filled their boots in the past year as the market is gripped by a ‘crypto winter’ brought on by soaring inflation and a string of high-profile bankruptcies.

Nearly £1.15 trillion ($1.4 trillion) was wiped from the value of the market in 2022 as soaring inflation and rate hikes sent investors scrambling for steadier ground. The sector was dealt a fresh blow in November when Sam Bankman-Fried’s exchange FTX imploded amid allegations of fraud.

Bitcoin, the most valuable crypto currency, plunged more than 54 per cent across the year and is trading at £14,168 ($17,249) – down from over £30,000 at the beginning of 2022 and 75 per cent down from an all-time high in 2021.

New blockchain data analysed by Coinjournal has revealed the amount

of crypto millionaires – those with over $1m worth of value in their wallets –fell by around 73 per cent from 90,000 to 24,000 in the period.

The data points to the scale of the carnage wreaked on retail investors with cash tied up in crypto. Analysts at Coinjournal said millionaires had “dropped like flies”.

“The on-chain data sums up what is glaringly obvious from looking at a Bitcoin price chart – that the party is over and investors are no longer dreaming of retirement off their Bitcoin holdings,” said Coinjournal analyst Dan Ashmore.

“Nearly three-quarters of Bitcoin millionaires losing that status is perhaps the best piece of data of all to summarise how ugly 2022 was.”

The statistics came as separate data from the firm revealed that scams had surged in the past 12 months as fraudsters picked off investors amid the downturn.

ANALYSIS: CRYPTO’S GRIM PROSPECTS?

IT’s hard not to think of the implosion of Sam BankmanFried’s exchange FTX as the defining moment in the crypto market last year. The scale of the 30year-old former billionaire’s fall from grace and the revelations of corporate mismanagement will mark it out as one of the greatest business scandals in history.

But the eye-catching collapse can almost shroud the fact that investors had already seen billions of dollars wiped from their wealth in the 10 months prior, as sharp rate hikes plunged the market into a deep ‘crypto winter’.

Investors could also now face grimmer times ahead. In a research note last month, analysts at Standard Chartered said flagship currency Bitcoin could tumble as low as $5,000 next year as investors flee digital assets to take shelter in gold.

The predictions will not make pleasant reading for investors who may have had half an eye on cryptofunded retirement. Traders may be forgiven for seeking some comfort in the predictions of former Bitcoin billionaire Tim Draper, who says Bitcoin will rally 1,400 per cent to reach $250,000. Dare to dream.

CHARLIE CONCHIE

Close Brothers’ Prebensen will head up Enra

CHARLIE CONCHIE

CHARLIE CONCHIE

A SPECIALIST property lender owned by feared investment firm

Elliott has snagged former Close Brothers chief executive Preben Prebensen as its chair, the firm announced yesterday.

Enra Specialist Finance, which offers property finance and specialist lending, was snapped up by Elliott for a reported £350m in March last year and has now appointed Prebensen to oversee the firm as it targets a period of bumper growth.

Prebensen led Close Brothers between 2009 and 2020 and tripled the size of its specialist lending business.

In a statement yesterday, he said he would throw his weight behind chief Danny Waters as the pair look to turn the firm into a major player in the non-bank lending sector.

“I’m joining Enra at an exciting time as the business continues to establish itself as the UK’s leading non-bank specialist lender,” he said.

“My role will be to advise and support Danny and the team on to even greater success.”

CITYAM.COM 08 TUESDAY 10 JANUARY 2023 NEWS

P Jun 2022 Jan 2022 Nov 2022 BITCOIN

Jan 2023 40,000 35,000 30,000 25,000 20,000

15,000

10,000

Investors look to rescue troubled UK battery firm

NICHOLAS EARL

A CONSORTIUM of investors are in talks to buy a majority stake in Britishvolt, potentially offering the troubled battery start-up a much-needed lifeline.

The company has been scrambling to secure fresh funds for months and only just avoided administration last year, after raising several million pounds from mining group Glencore and slapping staff with temporary wage cuts. This has tided the company over the new year, but its future prospects depend on securing long-term funding.

In a statement, Britishvolt revealed that it was currently “in discussions with a consortium of investors concerning the potential majority sale of the company”.

A spokesperson explained: “The discussions aim to secure legally binding terms that would provide Britishvolt with the long-term sustainability and funding necessary to enable it to pursue its

current plans to build a strong and viable battery cell R&D and manufacturing business in the UK.”

The much-vaunted battery specialist’s travails in recent months reflect a sharp downturn in the company’s reputation.

In 2021, the company managed to secure a funding promise of £100m from the government – contingent on beginning construction work on its Blyth, Northumberland plant.

So far, it has failed to unlock the funding – with the £3.8bn battery gigafactory hammered by delays and construction still in its infancy.

City A.M. understands it requested £30m in advanced funding last November from the government when it first fell into financial difficulties, but it was rejected by Downing Street.

City A.M. contacted the government for comment on the latest funding talks but wasn’t immediately available for comment.

IBM UK appoints first female CEO to replace veteran of two decades

JACK MENDEL

IBM UK and Ireland has appointed its first-ever female chief executive following the departure of its existing general manager after 22 years.

Dr Nicola Hodson will take over from Sreeram Visvanathan at the tech giant’s UK arm, arriving from Microsoft.

Hodson was Microsoft’s vice president of customer and partner solutions, transformation, and a member of its global leadership team for commercial business.

The entrepreneur and tech expert, who is the deputy president of trade association TechUK,

formerly worked at Siemens, CSC (now DXC) and as a management consultant for EY. She joined Microsoft in 2008. Her arrival was welcomed by IBM Europe chair Ana Paula Assis, who called her “an accomplished leader”.

Shell to reasssess its future North Seas energy investments

NICHOLAS EARL

NICHOLAS EARL

SHELL is still considering whether to cut back on future energy projects in the North Sea, after Chancellor Jeremy Hunt hiked the windfall tax last year.

A spokesperson from the energy giant confirmed to City A.M. that the so-called Energy Profits Levy will factor into its decision making and that it was now assessing projects on a case-by-case basis.

This comes after Shell announced last week that it would be paying tax in the

UK for the first time since 2017, with an estimated $2.4bn (£2bn) hit in liabilities.

It confirmed an earnings slide ahead of its fourth quarter results next month, following three bumper windows of trading including a monster £9.2bn second quarter of trading.

However, the spokesperson explained this did not mean the UK and EU have received a sudden boost to their coffers from their respective levies because payments will not be made until later this year.

09 TUESDAY 10 JANUARY 2023 NEWS CITYAM.COM

Shell’s future North Sea energy plans may be cut back in the light of the new windfall tax

batteryfirmBritishvolt on lifesupport running pile in signthe fallingbehind internationalcompetitors therace become leadinglightin vehicle Thecompany,which developing massive£3.8bn gigafactory north-eastEngland, hasbeenlockedinemergency fundraising severalweeks raise£200m, sellthe outright. aregi scenarios therequired stability.Wehave further comment thistime,” response toreports firm’sstruggles, publishedintheFinancialTimes. This justmonths secured£100m fundingfrom governmentforthegigafactory. However, sofarnot able accessthe withthe resources constructiondependent targets hasnot A.M. und theUK “sciencesuperpower” 2030,followingDavid Cameron’s“jewel crown”investmentdemand British been lagging. governmentannounced record boost homegrown research daysago,but share globalresearchand development investmentremains downbyafifthsi th of LLS TH GOLDEN AGE P18 E P16 BER 2022 ISSUE LOW BATTERY BRIT TECH DARLING BRITISHVOLT IN HUNT FOR CASH AS FEARS GROW FOR EV BATTERY FIRM How we reported on the firm’s struggle to stay afloat

Dr Nicola Hodson will head up IBM UK and Ireland

Lloyd’s syndicate launches world’s very first ‘cyber catastrophe bond’

LOUIS GOSS

LLOYD’s syndicate Beazley has launched the world’s first ‘cyber catastrophe bond’.

The insurer’s catastrophe bond protects Beazley’s balance sheet in the event it is forced to pay out more than $300m (£246m) in insurance on any cyber risk policy.

Catastrophe bonds have

traditionally been used to protect insurers from natural disaster risks through deals that see investors cover the costs of rare, highly-expensive and seriously damaging events.

The launch of the new bond is set to let Beazley expand its cyber insurance offerings, by protecting the insurer from large-scale losses.

The bond comes as a step towards the development of a fully-fledged

cyber insurance market, with insurers having struggled to cover cyber risks due to concerns over prohibitive costs.

In September 2022, Lloyd’s of London told its members to stop providing coverage for state-backed cyberattacks in warning such a hack could expose the City insurance marketplace to “systemic risks”. According to research, 2022 was a record year for cyberattacks.

Nuclear boss says UK must pick up pace on reactors

NICHOLAS EARL

THE HEAD of the UK’s leading nuclear body has urged the government to pursue small modular reactors (SMRs) with “pace and urgency”, amid reports of a funding delay with ministers squabbling over the cost of the country’s energy ambitions.

Tom Greatrex, chief executive of the Nuclear Industry Association (NIA), told City A.M. that the UK needed to develop a pipeline of projects to ramp up nuclear power in line with the government’s energy security projects.

He said: “Proceeding with pace and urgency will not only make power more reliably and predictably priced, but it will also mean that UK technology will create long-term, high quality jobs and export opportunities from which the country will benefit.”

“There is no doubt that the UK can be a global leader in SMRs,” he added.

Downing Street is targeting a ramp up in nuclear generation from 7GW to 24GW over the next three decades, with former Prime Minister Boris Johnson

establishing plans for the UK to build eight new reactors this decade.

Currently, the UK’s ageing nuclear stock makes up around 15 per cent of the country’s energy generation, but the remaining five power plants are set to be shut down by the middle of the next decade.

The industry boss has previously urged the government to speed up announcements for new projects, with Sizewell C still awaiting a final investment decision and Hinkley Point C’s completion delayed two years to 2027.

Geatrex’s latest comments follow reports, first covered in The Times, that ministers have so far not been able to agree a funding deal for SMRs.

The government is now not expected to confirm funding plans for at least another 12 months, with Whitehall concerned about the spiralling costs involved in Britain’s wider nuclear ambitions. Hinkley Point C, originally projected at £18bn, is expected to come in at £26bn, while the fee for Sizewell C has been estimated between £20-35bn.

Cut VAT on public chargers to up electric vehicle uptake campaign

ILARIA GRASSO MACOLA

THE RAC has called on the government to cut the VAT rate at public electric vehicle charging points following a 50 per cent increase in charging costs over the past eight months.

Data published today by the motoring group will show that it now costs 70.3p per kilowatt hour (kWh) to rapidly charge an electric vehicle (EV) on a pay-as-you-go basis.

This is up from the 63.3p reported in

September, meaning that it now costs £36 to charge a family-sized electric car enough to cover 188 miles.

This is more than double the cost of charging electric cars at home, which costs around £17.87 to fully charge an average family car.

Commenting on the RAC’s demands, Top Gear’s former co-host Quentin Wilson called the VAT policy “archaic” because it means that those “without home charging pay four times the rate of tax as those charging at home.”

CITYAM.COM 10 TUESDAY 10 JANUARY 2023 NEWS EVERYONE NEEDS AN ARMY The Salvation Army Canada and Bermuda Territory presents... 12-24 JANUARY 2023 Weekdays 8am - 4pm A free COVID-19 documentary exhibition. Open to the public. Gallery 101 at The Salvation Army International Headquarters 101 Queen Victoria Street London UK EC4V 4EH

Charging infrastructure continues to be the brake on wider takeup of electric vehicles

Tom Geatrex, Nuclear Industry Association chief

Further strike action inevitable after day of failed roundtable talks

CITY A.M. REPORTER

A WAVE of further strike action is expected after crisis talks between ministers and unions failed to resolve industrial disputes involving nurses, teachers and rail workers.

Talks between NHS unions and health secretary Steve Barclay were branded “bitterly disappointing” and an “insult”, while education unions warned Gillian Keegan it was “now or never” to prevent teachers going on strike.

The Royal College of Nursing (RCN) and Unite criticised the meeting with Mr Barclay, accusing ministers of “intransigence”.

The health secretary suggested that improvements in efficiency and productivity could “unlock additional funding” for the 2023/24 pay settlement, but

unions want workers paid more now, raising the possibility of a one-off lump sum to help with the soaring cost of living.

Joanne Galbraith-Marten, director of employment relations and legal services at the RCN, said in a statement: “There is no resolution to our dispute yet in sight.

“Today’s meeting was bitterly disappointing – nothing for the current year and repeating that ‘the budget is already set’ for next year.

There was also little progress in talks on rail strikes.

Rail minister Huw Merriman called in train workers after sustained action crippled services, with only one in five trains running between Tuesday and Saturday. RMT boss Mick Lynch said that further discussions would take place.

Channel 4 staff reap benefits of u-turn with loyalty bonus

CITY A.M. REPORTER

CHANNEL 4 has said it will pay retention bonuses to staff that were announced before the government scrapped plans to privatise the broadcaster.

Staff had been told about the payments, which will vary in size

between employees, amid the proposal to take the broadcaster out of public ownership.

On Monday, Channel 4 confirmed it will still reward eligible employees’ “commitment” during an “extraordinary and difficult period”. The bonus will be paid in June of this year.

ANNOUNCEMENTS

Curious goes for a walk on the Wild side

CITY A.M. REPORTER

Luke Johnson’s Curious Brewery is set to expand after snapping up the brands of the Wild Beer Co brewery which collapsed last month.

Curious Brewery, which had been owned by wine firm Chapel Down until it was sold to the hospitality entrepreneur’s Risk Capital Partners private equity firm in 2021, said it will double in size as a result of the deal.

Mark Crowther, chairman of Curious, said the move will bring “impressive distribution” in retail and hospitality as well as “a significant direct-to-consumer e-commerce operation.”

The Wild Beer Co business was founded in 2012 and raised £1.8m through crowdfunding in a process which valued the firm at £25m in 2017, but entered administration last month blaming trading conditions.

LEGAL AND PUBLIC NOTICES

CITY of LONDON

The PLANNING ACTS and the Orders and Regulations made thereunder

This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

7 Newgate Street, London, EC1A 7NX 22/00987/FULL

Court.

College of Arms, 130 Queen Victoria Street, London, EC4V 4BT 22/01157/FULL & 22/01158/LBC

Salisbury House, 31 Finsbury Circus, London, EC2M 5SQ 22/01183/LBC

Centennium House, 100 Lower Thames Street, London, EC3R 6DL 22/01185/FULL

Northcliffe House, 26-30 Tudor Street, 16-22 Bouverie Street, London, EC4Y 0AY 22/01160/LBC

Russia launches fresh assault on eastern Ukraine, says Kyiv Saco Bank eyes Danish listing after failed SPAC

PAVEL POLITYUK

Russia has launched a new "powerful assault" led by the Wagner contract militia on Soledar in eastern Ukraine, Kyiv said on Monday, describing a difficult situation for forces repelling the attacks on the salt mining town and nearby fronts.

Soledar, in the industrial Donbas region, lies a few miles from Bakhmut, where troops from both sides have been taking heavy losses in some of the most intense trench warfare since Russia invaded Ukraine nearly 11 months ago.

Ukrainian forces repelled an

earlier attempt to take the town but a large number of Wagner units quickly returned, deploying fresh tactics and more soldiers under heavy artillery cover, Ukrainian deputy defence minister Hanna Malyar said.

Russia's defence ministry did not mention either Soledar or Bakhmut in a regular media briefing on Monday, a day after facing criticism for an apparently false claim of a missile strike on a temporary Ukrainian barracks.

Wagner, founded by an ally of Russian president Vladimir Putin, has taken a prominent role in Russia’s war effort.

SAXO BANK could give its external investors a new chance to cash in, including via an initial public offering, as early as this year, CEO Kim Fournais told Reuters, after plans to merge with a blank-cheque company collapsed last month.

"There's always been a wish to eventually do a listing of Saxo," said Fournais, adding that the bank is in no rush to float while market turmoil persists. Nasdaq Copenhagen would likely be the preferred venue for a float, he said.

The bank is valued at £2bn.

Creechurch House, 24 Creechurch Lane, London, EC3A 5JX 22/01164/FULL

311 High Holborn, London, WC1V 7BN 22/01169/FULL

26 Ludgate Hill, London, EC4M 7DR 22/01171/FULL

41 Lothbury, London, EC2R 7HF 22/01229/LBC

41 Lothbury, London, EC2R 7HF 22/01230/LBC

Various Locations In The City of London: (i) Riverside Footpath Underneath Blackfriars Road Bridge; (ii) Ludgate Hill Junction With Ludgate Circus; (iii) Holborn Viaduct And Holborn Circus; (iv) Farringdon Street Junction With Charterhouse 22/01159/FULL

11 TUESDAY 10 JANUARY 2023 NEWS CITYAM.COM

The channel learnt last week it will not now be privatised by the government

PABLO MAYO CERQUEIRO

Dog walkers watch water drifting down the Derwent Dam ahead of expected rainy weather this week. Much of Britain will see a yellow warning for downpours, though London is expected to escape the worst of it.

WEATHER WARNING Britain set for downpours this week Reuters Reuters

PA PA PA

A tough new year gives defensive plays the edge

T HAS been widely reported that the UK is on the brink of a recession while a third of the global economy will face a similar fate according to the IMF. Double-digit inflation, costly energy bills, rising mortgage rates and a softening consumer are hampering demand causing reverberations for companies and the markets as well as individuals, households and government tax receipts.

2022 was a torrid year for investors after the punch bowl of cheap money was removed with central banks desperately U-turning on rock bottom interest rates in an attempt to curtail spiralling price levels. The pound suffered its worst year against the US dollar since 2016, the FTSE 250 fell nearly 20 per cent, weighed down by economic and political uncertainty, and the MSCI index of global stocks suffered a similar sized slump, its largest since the global financial crisis in 2008. However the FTSE 100 held up, outperforming many global indices thanks to its favourable sectoral mix of energy, mining and banks.

As we come into 2023, investors are battening down the hatches, braced for an economic downturn, and are shifting portfolios accordingly.

Consumer discretionary stocks that sell goods we want rather than need may suffer as household budgets get squeezed. Housebuilders which logged a dire performance last year are facing continued headwinds from

rising mortgage rates and falling house prices. So what investments are market participants turning their attention to?

In an inflationary environment, companies which are price makers tend to fare better than price takers given that they can pass on their additional costs to consumers through higher prices without seriously denting demand.

On top of that, many investors are on the hunt for those stocks that outperform when times get tough such as consumer staples or pharmaceuticals which offer goods we simply cannot live without. Recently, pharma giant GSK for example was added to Interactive Investor’s list of most popular stocks in December, demonstrating this shift towards defensive stocks.

After an unfortunate year in which both equities and bonds were punished, some analysts are pinning their hopes on a bounce back for credit and government debt as aggressive interest rate hikes and inflationary pressures ease. Plus 2023 could be the year that gold and silver finally start to regain their shine, having disappointed amid the turmoil last year, weighed down by a strong US dollar. A combination of the global economic downturn and the potential for King Dollar’s reign to end could help spur gains for the precious metals.

TAKING FLIGHT

£ Chocolate coin bonuses. It is a rather sad state of affairs when Christmas bonus season comes around and instead of a nice paycheck bump to help with the cost of living, you are landed with a box of Quality Street. It is a race to the bottom on price among the Big Four who are desperately trying not to give away market share to the extremely price competitive German discounters Aldi and Lidl. Tesco is clearly looking for innovative ways to cut costs, perhaps sadly at the expense of its workers.

£ Much to his dismay, Elon Musk has won himself a Guinness world record for the largest loss of personal fortune in history. He is estimated to have shed somewhere between $182bn and $200bn dollars, outpacing the previous record by more than $120bn. His has suffered under the weight of Tesla’s share price which has tumbled around 65 per cent over the last year. Musk is no longer the world’s richest man, surpassed by luxury goods mogul Bernard Arnault. Although I can’t see Musk garnering much sympathy.

CAN I QUOTE YOU ON THAT?

CITY SLICKERS SWITCHING ON TO MENTAL HEALTH

Jonah Hill, who is best known for his comedic roles in films such as The Wolf of Wall Street and Superbad, has shown a more intimate side to himself in the Netflix documentary ‘Stutz’ about his therapist, Phil Stutz. Hill says his life is ‘immeasurably better’ thanks to therapy. The movie attempts to guide viewers through Stutz’s methods, which include visual aids and exercises designed to help patients with their mental struggles. However, the twist is that while the film initially focuses on Stutz himself, it later flips into a look at some of Hill’s own mental health struggles including his insecurities when he was young. The poignant documentary even includes a discussion with Hill’s mother about how the actor felt pressured to lose weight as a child and the impact this had on his relationship with women in his adult life.

Mexi-go-go: Tortilla sees post-pandemic boost

HENRY SAKER-CLARK

MEXICAN restaurant chain Tortilla has revealed that sales jumped by a fifth over the past year despite the impact of strikes and poor weather. Shares in the group rose yesterday morning after the 85-strong chain revealed that revenues grew 20 per cent to £57.7m over the 12 months to 1 January, compared with the same period last year.

It said it was boosted by the opening of 18 new restaurant sites, including in Durham, Canterbury and Coventry.

Tortilla’s growth plans were also buoyed by its takeover of smaller rival Chilango in May last year.

The hospitality firm told investors it has a “strong pipeline” of new venues to open next year, including sites in Derby and Greenwich, southeast London.

It also hailed a 16 per cent rise in like-for-like sales over the latest quarter compared with prepandemic levels.

Bosses said this came “despite challenging trading conditions in December due to the combined impact of poor weather and

multiple train strikes”.

Tortilla said it benefitted from favourable changes in some costs, actions taken by management and “strong trade” for most of the period and therefore expects profits for the year to be in line with previous targets.

Chief executive Richard Morris said: “We have a proven and highly popular customer proposition.

“During difficult economic times, restaurants that offer great, consistent food at competitive price points will be the winners, and we sit comfortably in this space.”

CITYAM.COM 12 TUESDAY 10 JANUARY 2023 NEWS CITY of LONDON undermentioned streets will make several Orders on 19 January 2023 under Section 14(1) of the Basinghall Street Carriageway Works Carthusian Street Charterhouse Street Resurfacing Works Creed Lane COL Scheme Works Finch Lane Carriageway Works Gophir Lane Carriageway Works Little Trinity Lane COL Scheme Works Moorgate Mobile Crane Ian Hughes 10 January 2023

boost –despite ongoing industrial action ANNOUNCEMENTS LEGAL AND PUBLIC NOTICES THE NOTE BOOK It’s where the City’s biggest names get a few things off their chest. Today, it’s Victoria Scholar, head of investment at Interactive Investor

Burritos, tacos and a healthy side of guacamole have given Tortilla a healthy

Shopify COO Kaz Nejatian on his firm’s new meeting policy

From jump seats to jumpsuits. In the first major sartorial revamp for two decades, British Airways has unveiled a brand new uniform for its workforce worldwide. Created by British fashion designer, Ozwald Boateng, who was previously creative director at Givenchy, the new line includes a modern jumpsuit, a hijab and a tunic. This isn’t Boateng’s first foray into the airline sector, having previously designed Virgin Atlantic’s amenity kits. BA’s swanky new collection is set to be rolled out this spring.

I

Meetings are a bug. We’re cancelling meetings with more than two people

PA

City A.M.s’ economics editor Jack Barnett takes a deep dive into the state of the economy in his new weekly column

JACK BARNETT

Rishi Sunak and Keir Starmer offer little new year cheer for ailing UK growth outlook

IN FUTURE editions, this weekly column will drill down into the stories behind the numbers to reveal what makes the UK –and global –economy tick.

But, today, inspired by what resembled soon-to-be-broken new year’s resolutions by political leaders last week, it will make the case for why a stable government economic strategy needs to be established to prevent another decade of lost growth.

Last week illustrated how an incumbent leader (Rishi Sunak) can be bogged down by a flailing economy, handing their rival, in this case Keir Starmer, an advantage.

Sunak’s speech was a sombre assessment of Britain’s woes. Listing off strikes, enormous NHS waiting lists and high inflation, he pinpointed the headwinds buffeting the economy.

The speech’s tone was initially glum before becoming repentant. For all his honesty on Britain’s economic plight, Sunak, as a leader, won’t wash with the public if they still feel markedly worse off by the end of 2023.

The Conservatives have made it clear they’re unwilling to let the money flow any time soon. And so did Labour chief Starmer in his first speech of 2023. The government “cheque book” will be back in the drawer if Labour wins the next election, he promised. His remarks were aspirational and used the years of economic sluggishness as bait to ask whether Britons feel better off after more than a decade of Tory rule.

What united Sunak and Starmer was a regrettable lack of concrete policy.

Sunak wants young people to study

maths until 18, but what’s more urgently needed is for him to show his workings on how to get the economy growing again.

Starmer wants people to believe Labour is now a party of sound finances. Does that mean more spending cuts or tax rises?

It’s worth setting out the scale of the problem facing Britain to illustrate why we

have to avoid a repeat of the malaise we’ve been stuck in since the financial crisis.

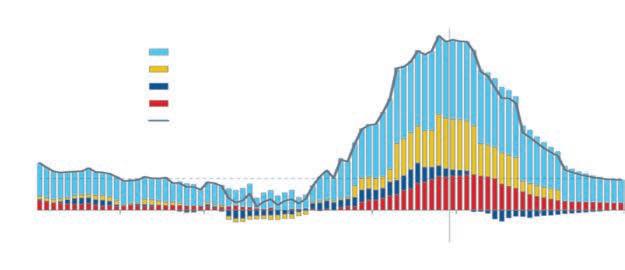

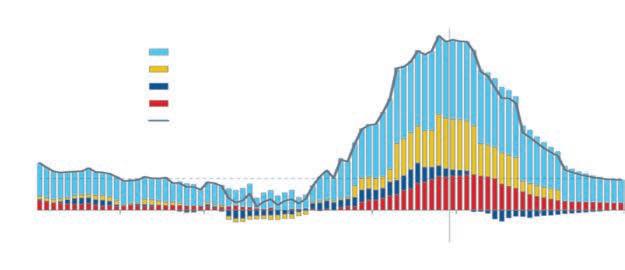

According to the Resolution Foundation, real incomes will not recover to their prepandemic levels until 2028 and over the next two years, some £2,100 will be swiped from Brits’ pockets by inflation (see graph). This is not the fault of Liz Truss scrapping

the top rate of income tax or Boris Johnson hiking national insurance on a random day in September in 2021.

It’s a function of awful economic growth for more than a decade. Andy Haldane, former Bank chief economist, dismissed the government as having no blueprint to revive UK growth over the weekend.

Robust annual GDP growth should improve living standards over time. It should spur investment. It should strengthen households’ resilience to economic shocks. These are all things that Britain is now left wanting.

It seems policymakers will choose from two options to try to turn Britain’s fortunes around. A return to David Cameron and George Osborne’s book balancing: the Sunak route. Or a closer partnership between the state and private business: what Starmer hinted at.

Any leader that picks one and sticks to it for more than a year would be welcomed with open arms.

SUNAK’S INFLATION PROMISE

The Prime Minister over the weekend set out more detail on his promise to halve inflation. He said it will fall as a result of the plans the government has put in place.

That’s a bit harsh on the Bank, who in December 2021 became the first major central bank to raise interest rates. Andrew Bailey probably deserves some credit. We’re quick to blame governor Andrew Bailey when inflation takes off. Maybe we should give him some credit when it cools, as it’s expected to (see graph).

YOU MIGHT HAVE MISSED

People have grumbled at the Bank of England jacking up interest rates, mainly because it seems counterintuitive to do so when the UK economy is wilting. But it’s a necessary response to a slowdown sparked by high inflation. 2023 will see the effects of higher rates surface.

The ONS said yesterday nearly 800,000 mortgagors’ bills will double this year, eating up money that could’ve been spent down the pub.

ARE WE IN A RECESSION?

£ You’d be forgiven for thinking the UK is already in a recession. But, officially, we’re actually not. An economy is said to be in a technical slump when it suffers two consecutive quarters of contraction.

Latest figures show GDP fell 0.3 per cent in the three months to September. The ONS is likely to confirm the recession on 10 February.

A good deal, Sergey: Compare the Market owner puts cash into insurer

LONDON-BASED insurance fintech Superscript announced yesterday it had bagged a £45m funding round led by the owner of Comparethemarket, in a boost to the UK’s burgeoning ‘insurtech’ sector after a flurry of investment in the past two years.

Superscript, which offers insurance

to smaller firms and high growth tech outfits, said the round had been led by Comparethemarket-owner BHL UK, an existing backer, alongside Fortune 500 insurer The Hartford.

The fresh capital comes after a bumper period of growth for the firm that has seen it deliver a fivefold increase in customers base and bag partners including Amazon Business

and Virgin Money Bank.

Superscript became the first UK insurtech to land a Lloyd’s of London broker licence in 2020, and launched the first Lloyd’s-backed insurance product for digital asset businesses last year.

The raise places it alongside other insurtechs including Old Street-based unicorn Marshmallow.

Compare the Market has become synonymous with its advertising meerkats

CHARLIE CONCHIE

ECONOMICS

13 TUESDAY 10 JANUARY 2023 NEWS CITYAM.COM SEND US YOUR THOUGHTS ON SUNAK AND STARMER’S PLANS What steps do you think the leaders should table to revive the UK economy? Email jack.barnett@cityam.com 12 Other % Forecast Energy Petrol Food CPI 2018201920202021202220232024 10 8 6 4 2 0 -2 INFLATION IS ON A DOWNWARD PATH Source: Oxford Economics ANNUAL CHANGE IN REAL INCOMES -8 -6 -8 -2 0 2 4 6 8 10 12 % 1962197219821992200220121922 RF Projection Source: Resolution Foundation

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

FTSE extends new year gains as reopening of China boosts miners

LONDON’s FTSE 100 yesterday extended its robust start to the new year, fuelled by mining giants clinching gains on investors betting commodity prices are on the rise as China dismantles pretty much all of its Covid-19 restrictions.

The capital’s premier index jumped 0.33 per cent to close at 7,724.93 points on the opening day of a new trading week.

The domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, slipped 0.13 per cent to 19,479.39 points.

Commodity firms received a welcome boost after Beijing scrapped quarantine rules for inbound travellers in a sign the world’s second largest economy is on course to return to pre-Covid health. The move sent some raw material

prices to six month highs, lifting London-listed miners, who make up a big chunk of the FTSE 100.

Chilean miner Antofagasta topped the index, adding 4.32 per cent.

“The FTSE 100 has pushed up to its best level since August 2018 driven by resilience in commodity prices after China relaxed covid travel restrictions, helping to push the likes of Glencore and Antofagasta higher as copper prices push to 6-month highs,” Michael Hewson, chief market analyst at CMC Markets UK, said.

Yesterday’s gain extended a new year rally that has pushed the FTSE 100 up more than two per cent.

The London index was the only top index to notch a gain last year.

Pound sterling, which last week briefly kissed a November low, strengthened over 0.7 per cent against the US dollar.

ASOS’s balance sheet will be scrutinised by investors when it releases a trading update on Thursday. Analysts at Peel Hunt said the online retailer needs to show signs of sustainable free cash flow generation in the medium term as cash burn is expected to rise to £100m this year. Strategic process is more important than trading at this stage. They rate it a ‘hold’ with a target price of 750p.

Analysts at Peel Hunt were impressed with Taylor Wimpey. In its last report in November, the housebuilder said it expects to deliver profit for the year in line with consensus despite reporting a fall in net sales rate. An update due on Thursday is unlikely to change the picture given the usual seasonal slowdown over Christmas. The analysts rate it at a ‘buy’ rating with a target price of 130p.

P 5 Jan 4 Jan 3 Jan 9 Jan ASOS 9 Jan 594 520 6 Jan 540 560 580 600

To

email your research to

P 5

4

3

9

appear in Best of the Brokers,

notes@cityam.com

Jan

Jan

Jan

Jan

9

106.9

6 Jan 104 106 108

TAYLOR WIMPEY

Jan

102

110

CLIMBING THE WALL OF WORRY

“There may be plenty of gloomy headlines out there, but the markets continue to climb the wall of worry. The FTSE 100 and other European indices followed from Friday’s gains on Wall Street and positive trading in Asia earlier on Monday.”

RUSS MOULD, AJ BELL

CITYAM.COM 14 TUESDAY 10 JANUARY 2023 MARKETS GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION IT’S FINALLY HERE RIVALRIES RENEWED AS THE SIX NATIONS RETURNS FOR 2022 8-PAGE PULLOUT 2022 SIX NATIONS ENERGY D-DAY Households LONDON’S BUSINESS NEWSPAPER FREE CITYAM.COM THURSDAY 10 FEBRUARY 2022 CITYAM.COM COOL RUNNINGS ALL THE GEAR FOR AN OVERDUE MOUNTAIN BREAK P20 STATE SET MAN IN THE KNOW MARK KLEINMAN GETS THE CITY TALKING P13 LONDON’S BUSINESS NEWSPAPER LONDON’S BUSINESS NEWSPAPER CITYAM.COM Climate noise blocking out THROUGH THE DRINKING GLASS THE LATEST FROM OUR WINE GURU P22--ISASUNWR – WHERE T PUT MONEYTHIS YEAR WEDNESDAY FEBRUARY 2022 ISSUE 3,677 THE ULTIMATE SAVINGS GUIDE ALL YOU NEED TO KNOW ABOUT YOUR ISA P19-21

EDITED BY SASCHA O’SULLIVAN

For Gove to make a dent in the housing crisis, he has to look back on Grenfell

Elena Siniscalco

EVERY death in the blaze at Grenfell Tower in June 2017 was avoidable, an inquiry into the fire at the tower block found last year. The government, for its part, said it was “truly sorry” for its failures. And Michael Gove, the Levelling Up Secretary, spearheaded a colossal piece of legislation to prevent another tragedy.

The Building Safety Act put the burden for remediation works on buildings affected by the combustible cladding on owners and developers.

Gove was instrumental in opening up the dialogue with tenants, making clear the government was finally taking the issue seriously. But after all the political psychodrama of 2022, what has the government actually achieved?

In June last year, it was estimated that at least 10,000 buildings were still covered in the inflammable cladding responsible for the disaster at Grenfell. The combination of an unregulated industry ignoring or hiding the result of safety tests on its materials, and a series of governments unwilling to meddle with the private sector made this possible. The result was so devastating there was little dissent on the need for strong new laws.

The legislation focuses on “high-risk

buildings” - residential buildings at least 18 metres high, with some provisions also affecting buildings over 11 metres. It establishes a new regulator in charge of ensuring every stage of the process from planning to construction is done following safety regulations. It also creates a 30 year liability principle: builders and developers are now responsible for any defects on all the buildings they worked on in the past thirty years.

There’s no fooling ourselves: all of this comes too late, and many tenants living in hazardous flats are still haunted by the possibility that they’ll have to pay to make their homes safe.

But the sentiment behind these regulations is welcome. Yet the construction industry, as you would expect, is not thrilled.

Industry insiders lament the assumption that all developers make extortionate sums of money. Smaller developers, they say, might simply not be able to afford major remedial work on buildings they have long since removed from their portfolio. The complexity of the whole process is another major concern: specialist tribunals and courts will be required to decide the scope of appropriate remediations, and they’ll have to wade through a huge amount of technical

expert evidence. “The facade of a building is a funny beast, a cross-over of lots of different specialisms”, says Nick Pinder, partner in construction and engineering practice at law firm Eversheds Sutherland. He worries about all the delays this long process might cause.

The building industry has a lot to catch up with. But to its credit, some of the builders have shown serious willingness to engage and put money aside to address building safety issues, such as Taylor Wimpey. They are right in saying the government has a responsibility not only to draw up legislation, but also to make it feasible.

Yet all sides are still pointing the finger at each other: the freeholders blame the developers, the developers say they were following the regulations the government had approved at the time, and the government says it is the industry’s fault. A Building Safety Fund is in place to pay for cladding replacement works that would otherwise fall on the leaseholders. But Mick Platt, director of the Residential Freehold Association, says remediation works are slowing down because many freeholders can’t access this fund. On top of that, because of the many insolvencies that have plagued the sector, many of the firms operating over the past 30 years no longer exist, so landlords and developers might end up being the ones footing the bill more often than not.

Looking into these complexities should be Gove’s priority this year. Making a real dent in the building safety crisis will be crucial to ensure tenants can sleep at night, but it will also have a broader impact on the housing crisis. There is tension between building as much as we need and making sure buildings are compliant with the regulations. This has already emerged with the Health and Safety Executive - the government agency responsible for creating the new building regulator - already raising concerns over 349 high-rise planning applications. The delays in remediation works will also have an impact.

Ultimately, the government’s task will be to hold the industry to account while ensuring it can do what it has been asked to. Not an easy task, but the least the government can do to tackle a crisis long in the making.

Richard Burge

BRITAIN’S business community has been desperate for a new relationship with the government since Boris Johnson famously thought Brexit would provide a de facto reset.

Johnson’s government behaved as if sovereignty exercised in the international arena was simply about imposing conditions unilaterally. In reality, nations interact through consensus, compromise, and making binding international agreements.

In completing Brexit, the UK agreed to the conditions of the Northern Ireland Protocol, which the UK’s business community knew would produce bureaucratic chaos and logistical headaches for commerce.

Today, nearly two years on, the real threat of a UK-EU trade war casts a long shadow over Britain’s economy at the worst possible time.

Irish Taoiseach Leo Varadkar started the year with a belated gift to Rishi Sunak, a golden opportunity to solve

A breakthrough in Northern Ireland will build bridges with businesses as well as in Europe

the Northern Ireland Protocol issue. This would be a statement of intent to business leaders and a reason for hope amid a dashboard of otherwise depressing economic indicators.

Rishi Sunak swept into Downing Street with a promise to restore competence and trust in No10 and put the UK back on a path to prosperity. Resolving the dispute with the EU over the Northern Ireland Protocol would be an early win for the new PM, one emphatically applauded by UK businesses. Boris Johnson’s narcissism and Liz Truss’s zealotry made a workable solution on the Northern Ireland Protocol impossible. But in the more rational hands of Rishi Sunak, one can envision a path to an agreement.

It would be unconscionable for the government to let this opportunity slip. A failure to resolve the Protocol

dispute risks three major blows to the UK at a time when we can least afford them.

First, there is every chance that a failure to reach an agreement on overhauling the NI Protocol results into a spiralling trade war with the European Union. Such an outcome would put 42 per cent of all UK exports at risk. Since the early days of the Covid-19 pandemic, British businesses have dealt with huge uncertainty, weighing down on investment. Indeed, the level of business investment in the UK remains well below what it was in December 2019. Investment decisions, growth plans, and hiring strategies would remain frozen by the chaos of a UK-EU trade dispute.

Second, much has been made by Conservatives of Britain’s so-called “soft power” and international influ-

ence. While the recent political and market turmoil will not have helped global perceptions of the UK, an escalation of the NI Protocol dispute that results in the UK breaking international law will be catastrophic for Britain’s global standing. This dispute has been going on for too long, without any real reward.

London’s position as a top-tier global city for business rests on Britain’s incorruptible courts and our reverence for the rule of law. That reputation – which many of our most high-value sectors like professional, financial, and legal services depend on – would be deeply damaged, possibly irreparably, should the government break international law. In the current geo-political turmoil, “my word is my bond” is a precious national commodity.

Finally, and most fundamental, a

failure to resolve the NI Protocol impasse carries a very real risk of a return to political violence on the island of Ireland.

Peace and security are the foundation on which prosperity is built. As we approach the 25th anniversary of the Good Friday agreement, we must remember that it stands as a testament to reconciliation, peace, and prosperity.

The Northern Ireland peace process was an archetype of mediation and peacebuilding. I have witnessed the alternative first hand. I have also witnessed the extraordinary power of reconciliation and forgiveness, and the positive impact that produces. In all those cases, the courage was not in regretting what might have happened in the past but imagining what could be in the future. Brexit has happened; the EU has changed as a consequence.

There is (and never was) a pathway to return to the European Union. We must focus on what a new relationship with the third largest economic market in the world could look like for both of us, to share that ambition, and trust each other to work with positive intent towards it.

£ Richard Burge is CEO of the London Chamber of Commerce and Industry

CITYAM.COM 16 TUESDAY 10 JANUARY 2023 OPINION

OPINION

The Building Safety Bill will force developers to fix tower blocks with combustible cladding

LETTERS

Digging us out of a recession

[Re: Recession in “full swing” as inflation puts small businesses in “critical” state, Jan 4]

TO THE EDITOR

The British Chambers of Commerce research last week highlighted the impact of the current economic climate on the UK’s small businesses.

Mastercard’s own research shows that small businesses need more support –not just financially, but with technology, skills and advice.

The Prime Minister used his first speech of 2023 to say that innovation should be at the heart of everything we do as a nation. While small businesses are some of our greatest innovators, both the government and big businesses can do more to support them.

The government has announced that its

Help to Grow Digital scheme – which helped businesses with digital skills –will soon end, but big businesses can step up and fill the gap. Mastercard’s Strive UK programme funds support for small businesses to learn digital skills and build their digital capabilities and resiliency – whether it’s a sole trader setting up an online shop or helping a start-up with advertising on social media. So far, we’ve reached more than half a million businesses, 50 per cent of which are owned by women, and 40 per cent are ethnic-minority led.

Just like it did during the pandemic, technology can help the UK’s small businesses weather tough economic conditions, grow and thrive.

Programmes and partnerships across the private and third sectors, supported by the government, are essential to help them access it.

Kelly Devine President, UK&I at Mastercard

CREDIT WORTHY Shoppers face record high interest rates on bills

Rishi Sunak’s investment in innovation must challenge our appetite for taking risks

Tris Dyson

Tris Dyson

AS FAR as New Year’s resolutions go, recommitting the government to increasing R&D funding and supporting innovation is one I applaud. But Rishi’s New Year speech trod ground well-worn by his predecessors. In such difficult economic times, 2023 needs to be the year we turn ambition into results.

Through a decade of designing and delivering challenge prizes that foster innovation, we’ve learnt that the obstacles to becoming a science superpower aren’t simply financial. More money does not necessarily equal better results. How we direct that money matters just as much.

Our national approach to innovation needs a seismic shift. We need to direct the pledged increases in funding to the myriad British start-ups capable of delivering the science powerhouse the Prime Minister is after.

We need our leaders to be brave and pursue alternative approaches to traditional grant funding and move away