PAST THE PEAK?

dropped to 6.3 per cent annually, also below the consensus forecast.

THE CITY cheered fresh figures out yesterday that revealed this year’s historic inflation surge may have turned a corner.

Prices accelerated 10.7 per cent over the year to November, down from a 41year high rate of 11.1 per cent in the previous month, a steeper fall than expected, according to the Office for National Statistics (ONS).

The pace of price rises fell to 0.4 per cent over the last month and core inflation, seen as a more accurate measure of underlying price pressures,

The ONS’s figures signal the worst of the inflation drive could be coming to an end and that the rate is on course to steadily fall next year.

“At last! A clear slowing in the rate of core price rises,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

He added the cheery numbers indicated “the peak rate now lies firmly in the past”.

Households and businesses have been crushed by soaring prices that started to take off at the end of last year, nudged

higher by supply chains wilting under the weight of a sudden burst in demand after pandemic restrictions were scrapped. Loose monetary policy also supported spending.

Inflation was then turbocharged by Russia’s invasion of Ukraine roiling international oil and gas markets.

Wage growth has trailed far behind price rises all year, eroding Brits’ spending power at a rapid pace, prompting experts to forecast the UK will slip into a long recession steered by households cutting spending.

Chancellor Jeremy Hunt said: “Getting inflation down so people’s wages go

further is my top priority.”

Signs of inflation passing its peak raises the chances of the Bank of England opting for a smaller 50 basis point interest rate rise today after it lifted borrowing costs 75 basis points in November –the biggest move since the 1980s.

But experts warned of signs that price pressures are beginning to switch from being driven by international factors to domestic dynamics.

“There is a lot of uncertainty about how fast [inflation] will fall and whether it will settle at or above the two per cent target,” Paul Dales, chief UK economist at Capital Economics, said.

Binance tries to bring calm amid sell-off

CHARLIE CONCHIE

BINANCE founder Changpeng Zhao scrambled to reassure investors yesterday after the world’s biggest crypto exchange haemorrhaged $3.7bn in a mass investor exodus over the past week.

Data from blockchain firm Nansen revealed that Binance had shed $1.9bn in 24 hours on Tuesday in the largest slew of withdrawals on the platform since June.

The mass withdrawals caused Binance to announce it had “temporarily paused” withdrawals of stable coin USDC on Tuesday.

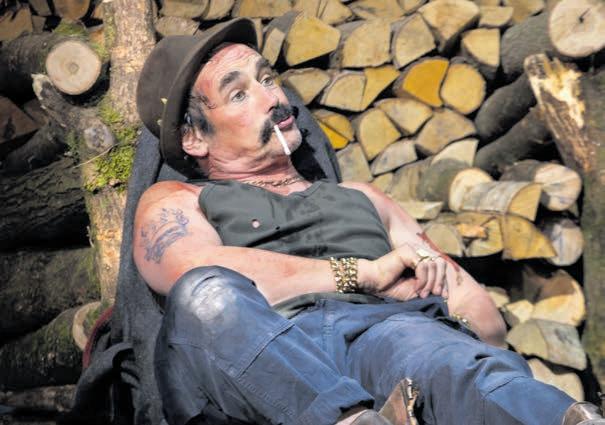

The panic prompted Zhao (pictured), known as CZ in the industry, to try to reassure investors, saying “things seem to have stabilised” and “deposits are coming back in”.

“I actually think it is a good idea to ‘stress test withdrawals’ on each [centralized exchange] on a rotating basis,” Zhao said in a tweet.

The heavy outflows underscore the nervousness of investors after Binance’s former rival FTX was brought down by a liquidity crunch when customers rushed to withdraw their assets from the crypto platform.

PASSENGERS will no longer need to consider how much toothpaste they’re bringing aboard planes as the UK government is relaxing the rules on airport liquids from the summer of 2024.

The limit will be increased from

the current 100ml to up to two litres.

The requirement to remove laptops from carry-on baggage is also set to go in the biggest shake-up of aviation security for 16 years.

“The tiny toiletry has become a staple of airport security checkpoints, but that’s all set to change,” transport secretary Mark

Harper said today. He called on major UK airports to install the latest screening technologies –which rely on 3D imagery to analyse the content of bags

– by June 2024.

Despite being announced by Boris Johnson in 2019, the technology’s rollout suffered several setbacks as a result of Covid-19.

The system is currently being trialled at

Heathrow, Gatwick and Birmingham airports.

Airport operators hailed the announcement as “a great step forward for UK air travel”.

The rules on liquids and laptops were introduced as a temporary measure after a failed plot to blow up transatlantic aircraft.

ILARIA GRASSO MACOLA

INSIDE FED SLOWS DOWN RATE HIKES P2 HOUSE PRICES START TO FEEL WINTER CHILL P4 CHINESE DIPLOMATS FLEE JUSTICE P7 POSTMAN SPAT P9 MARKETS P13 OPINION P14

CRYPTO CRUNCH

LONDON’S BUSINESS NEWSPAPER SUPER LEAGUE HAS SCHEME BEEN GIVEN

P18

THURSDAY 15 DECEMBER 2022 ISSUE 3,910 FREE CITYAM.COM

FINAL NAIL?

THAT WAS THE YEAR THAT WAS THE BEST MOVIES AND MUSIC FROM THE LAST 12 MONTHS P17

JACK BARNETT

INFLATION SLIDE SETS THE STAGE FOR BANK RATE DECISION LATER TODAY Put the plastic bag away: Airport security’s tiny bottle rule to finally be ditched

STANDING UP FOR THE CITY

Avanti continues to do damage to the reputation of business

IT’s hard to stay across the many strikes rendering Britain as functional as a loosely-set blancmange, but one announced yesterday caught the eye more than others. Drivers at Avanti West Coast –the train operator on the west coast mainline from the capital up towards Manchester, Liverpool and Glasgow –have announced they are to down tools over the imposition of new rotas which they say has occurred without

THE CITY VIEW

proper consultation. It is the latest sorry chapter of Avanti’s annus horribilis, and it may suggest the firm’s monopoly on the line is coming to an end sooner rather than later. A potted history is in order: Avanti, picked to take over the line from Virgin

Trains in 2019, relied on outdated rotas which relied on staff being willing to work on their so-called rest days. Avanti to this day insists this was a sensible arrangement, rather than acknowledging that it simply meant they didn’t have enough drivers. Sometime in the middle of this year, Avanti drivers stopped volunteering for rest day work –a move that Avanti described as effectively unofficial strike action, a critique unions resisted. Avanti have now

imposed new rotas in order to restore a seven day service, and predictably that has been followed by strike action. It is a sorry tale of corporate mismanagement and it could only happen on a monopoly operator. Without any serious competition, Avanti has grown complacent and its service delivery in the back half of 2022 can only be described as awful. It is absurd that the Department for Transport allows it to operate a

vital service that it has shown itself to be incapable of doing. And there is, too, a wider point. Most Brits’ opinions of ‘business’, or indeed ‘capitalism’, are derived from their experiences of the firms they interact with. Avanti is one such firm, and its incompetence does little for the reputation of the wider business community –and makes it easier for the nonsense calls of nationalisation to trump sensible calls for greater competition.

THE FINANCIAL TIMES

JEREMY HUNT LOOKS AT PROLONGING ENERGY AID FOR ALL COMPANIES

Chancellor Jeremy Hunt is exploring plans to keep providing all British businesses with help for their energy bills once winter has passed, in what would be a break from current policy.

THE GUARDIAN META FACES $1.6BN LAWSUIT OVER POSTS INCITING VIOLENCE IN TIGRAY WAR

Meta has been accused in a lawsuit of letting posts that inflamed the war in Tigray flourish on Facebook, after an Observer investigation found repeated inaction on posts that incited violence.

THE TIMES

NURSING UNION WARNS OF LONGER STRIKES TO COME

A fresh wave of longer nursing strikes looms in the new year as union chiefs prepare to intensify industrial action after the first nationwide walkout by NHS nurses. Tens of thousands of nurses are set to walk out today.

US Federal Reserve ushers in global rate rise slowdown with 50 basis point move

per cent and 4.5 per cent.

THE US Federal Reserve last night reined in the pace of its aggressive interest rate hike campaign, but signalled borrowing costs will eventually peak much higher than previously expected.

Chair Jerome Powell (pictured) and the rest of the federal open market committee (FOMC) backed a 50 basis point rise in the world’s most important interest rate, climbing down from four successive 75 basis point jumps. That move took the federal funds rate to a target range of between 4.25

The slowdown was sparked by the Fed’s series of jumbo rises finally cooling US inflation and concerns that tightening financial conditions too much could deal unnecessary damage to the world’s biggest economy.

The rate of price rises across the pond fell to 7.1 per cent in November, much lower than Wall Street’s expectations, building on October’s downside surprise 7.7 per cent increase.

Fed officials, includ-

ing Powell himself, signalled in the run-up to the latest FOMC meeting they would shift gear to avoid sparking an avoidable recession in the US and achieve a so-called

The average expectation among rate-setters – the so-called “dot plot” – is to send rates above five per cent next year and keep them over four per cent in 2024, much higher than they have been for more than a decade.

EY appoints new leaders of globally separated firms

LOUIS GOSS

EY has named two of its top leaders as heads of the firm’s soon-to-be separate audit and advisory businesses, as it pushes forwards with plans for a global split.

The Big Four firm said current chief executive Carmine Di Sibio will head the new consulting business, Newco, as it named US managing partner Julie Boland as global chair and chief executive of EY’s new audit firm, Assureco.

The appointments come as EY pushes ahead with ballots of global

partners, as it seeks approval for plans to separate its advisory business from its audit divisions.

If completed, the global split, which is aimed at freeing EY from the conflicts-of-interest rules that block it from selling advice to audit clients, is set to be the biggest shakeup to the Big Four in decades.

The appointments follow criticism from ex-EY partners over a lack of clarity around who will be leading the newly split off firm. In a letter, the former partners called on EY’s board to “move forwards with leadership decisions”.

CITYAM.COM 02 THURSDAY 15 DECEMBER 2022 NEWS

JACK BARNETT

WHAT THE

THIS

CHANNEL

Search and

efforts continued last

a boat carrying up to 50 people capsized in the English Channel, leaving at least four dead

OTHER PAPERS SAY

MORNING

TRAGEDY

rescue

night after

Avanti says sorry for poor service over past months

ILARIA GRASSO MACOLA

ILARIA GRASSO MACOLA

AVANTI West Coast yesterday apologised “unreservedly” for providing an unacceptable service to passengers over the past few months.

Richard Scott, director of corporate affairs at parent company West Coast Partnership, told a parliamentary committee hearing yesterday that the service provided “has not been good enough and I apologise unreservedly for that”.

The troubled train operator came under fire earlier this year when it was forced to slash services in August following a drop in the number of drivers willing to work on rest days.

Despite being considered an industry practice used by most train operators, overtime work is not mandatory and workers can decide to withdraw from it.

The company has since updated its timetable to increase services while not relying on staff working overtime. Introduced on Sunday, the timetable has increased the number of daily trains from 180 to 264.

The new roster has been agreed by the

majority of workers, except those working at London’s Euston station.

Members of the union Aslef are currently being balloted on whether to take industrial action and oppose the new arrangement.

An Avanti spokesperson told City A.M. that it was “disappointed” by the decision, as the new rosters had been agreed by colleagues at other depots.

Prime Minister Rishi Sunak has come under increasing pressure to revoke the government’s six-month extension for Avanti’s West Coast contract if the operator doesn’t get its act together.

Awarded by Liz Truss’ government in early October, the extension will expire in April but an increasing number of MPs have questioned whether it should be extended beyond that.

“Our immediate priority is to support the restoration of services before making any long-term decisions on the operation of the West Coast franchise,” Sunak said yesterday during Prime Minister’s Questions.

“But we will be closely monitoring Avanti’s rollout of its recovery plan, holding them to account for delivering for passengers.”

Rail minister to meet with unions and train operators to stop strikes

ILARIA GRASSO MACOLA

RAIL minister Huw Merriman is set to meet with trade union RMT and train operators today after this week’s strike action brought the UK’s rail network to a standstill.

Merriman will host the latest round of talks in a bid to solve the ongoing rail dispute after several failed negotiations.

RMT is in the middle of two different disputes over jobs and pay.

Workers at Network Rail and 14 other companies will also walk out on Friday and Saturday as well as on 3, 4, 6, 7 January after rejecting an eight per cent pay increase.

Separately, Network Rail staff will also down tools from 6pm on Christmas Eve to 6am on 27 December as they turned down a

nine per cent offer.

The Rail Delivery Group declined to comment while Network Rail and the DfT were contacted. The news comes as RMT members working at Eurostar yesterday called off strike action planned for Friday and Sunday to allow for further talks.

Mitie, which contracts the striking Eurostar workers, welcomed the union’s decision to stand down.

Boris Johnson rakes in £1m from speaker fees since leaving No. 10

STEFAN BOSCIA

FORMER Prime Minister Boris Johnson has already made more than £1m from speaking engagements since leaving Number 10 just three months ago.

Johnson made the cash from just four speeches, which included a speaking gig at a CNN event in Portugal and a keynote speech for American boutique investment banking firm Centerview Partners.

He received £261,652 from Indian newspaper Hindustan Times for eight hours and 45 minutes’ work last month, which included a keynote speech in New Delhi.

The new figures were released yesterday as a part of the latest update of Parliament’s Register of Members’ Financial Interests.

He is also expected to soon cash in from his long-awaited book on Shakespeare, as well as other potential book deals that could come his way.

03 THURSDAY 15 DECEMBER 2022 NEWS CITYAM.COM

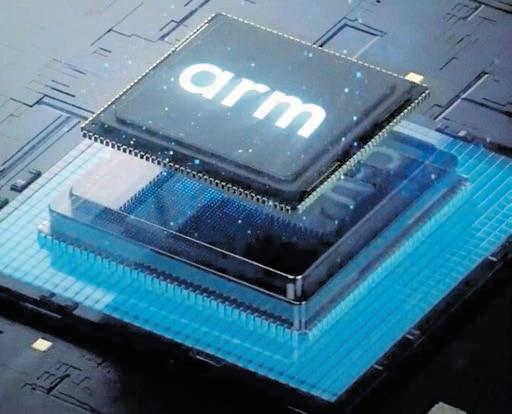

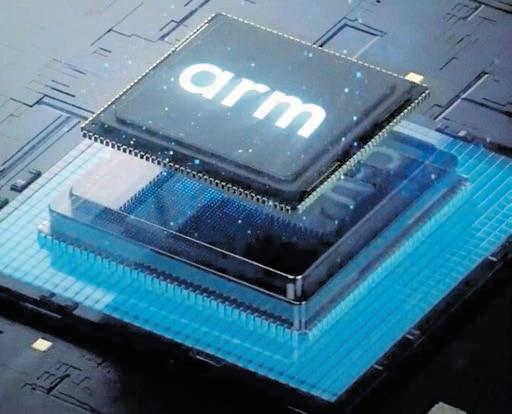

BRITISH chip firm Arm will no longer sell its most advanced semiconductors to China to abide by export controls from the US and UK, the Financial Times reported. The US has sought to block China’s access to chips which could have militaristic applications. Alibaba is said to have been hit by lack of access to Arm’s chips.

CHIPPING AWAY UK chip firm Arm shies away from China over export controls

House prices up £33k but winter chill continues

MENDEL AND MILLIE TURNER

MENDEL AND MILLIE TURNER

THE PRICE of a property in the UK has shot up by 12.6 per cent over the last year, with the average now sitting at just below £300,000.

The latest figures from the Office for National Statistics (ONS) yesterday show the monthly increase was minimal, however, at just 0.3 per cent in October.

London had the lowest annual growth in house prices across the UK, and was the only region to show a fall between September and October 2022.

The ONS stressed that the increase in annual house prices was primarily because there was a significant decrease in late 2021 after the change to stamp duty.

The jump in prices has seen the average UK property reach a record high. The average was £296,000 in October, up an eye-watering £33,000 on this time last year.

However, house price growth is beginning to feel the winter chill, according to industry experts.

“Growth is starting to slow as the statistics move closer to Christmas,” chairman of real estate agents Jackson-Stops Nick Leeming said. “Momentum is likely to remain subdued until the beginning of 2023 as part of a seasonal drop in activity levels combined with the continued effects of the mini-budget and rising interest rates. Having said that, today’s data offers an overall resilient picture for the market.”

Jason Tebb, CEO of property site Onthemarket added that although the data may be a little historic, it is yet another sign the market is rebalancing after a period of heightened activity.

“The higher cost of living inevitably impacts the confidence of the average property-seeker,” he added. “That said, there are still those who need to move, even if conditions are more challenging.”

Watches of Switzerland backs guidance as luxury demand holds

EMILY HAWKINS

WATCHES OF SWITZERLAND has said it is sticking to its full-year guidance for 2023 as demand for luxury watches remains strong.

In half-year results published yesterday, the London-listed retailer said revenue from luxury watches made up 87 per cent of group revenue, with sales growth of 31 per

cent on the previous year. Group sales hit £765m, representing a leap from the £586m posted in the first half of the 2022 financial year.

Watches of Switzerland put the uptick down to increases in average sale prices and volumes.

The retailer has opened a slew of new showrooms recently, including one at the revamped Battersea Power Station retail complex.

Profit surges for Zara owner in tough climate

EMILY HAWKINS

ZARA owner Inditex has seen its sales and profit boosted, despite a tricky economic climate for fashion firms.

The Spanish fashion giant posted a 24 per cent jump in net profit in the first nine months of its financial year, despite what chief executive officer Óscar García Maceiras described as a “challenging context”. Sales online and in stores were up 19 per cent compared to a year ago, hitting €23.1bn (£19.8bn).

It follows the world’s largest apparel-seller upping prices by around five per cent earlier this year, with retailers having been forced to grapple with rising costs.

The firm, which also owns brands Pull&Bear and Stradivarius, said that its autumn and winter collections had been very well received by customers across the globe.

García Maceiras lauded the strength of the firm’s “unique” business model, which is focused on “fashionable collections, an appealing shopping experience and a team highly committed to achieving profitable and more sustainable growth”.

CITYAM.COM 04 THURSDAY 15 DECEMBER 2022 NEWS

The luxury retailer said watch sales had ticked up 31 per cent since last year

JACK

Hard-hit cinemas bank on Avatar 2

ANALYSTS have warned against cinema chains pinning too much hope on upcoming blockbusters like Avatar 2, which is set to be released this week.

Although Imax’s chief exec said the science-fiction sequel had “one of the highest pre-sale levels we’ve ever seen” for tickets, big screens may need to do

this year.

Executive director at research firm Edison Group Neil Shah warned cost of living woes meant households are looking to streaming services instead of cinema trips.

“In the long term, any potential short and sharp stimulus provided by

reduced consumer spending in the New Year,” he told City A.M. Cineworld has forecast box office sales to remain below pre-pandemic levels until 2025.

However, media analyst at Enders Analysis Jamie MacEwan said cinema continues to be relatively “recession

Whereas blockbuster hits made up around 35 per cent of box office revenues pre-pandemic, they now account for over 50 per cent, says the BFI.

MacEwan said this was likely to bolster “higher-end” experiences, such as Imax or Curzon, with movies being seen as more of a “treat”.

BBC must boost digital to stand up to Netflix

LEAH MONTEBELLO

THE BBC must boost its digital leadership if it wants to keep up with US streaming giants, a new report has said.

The National Audit Office said that although the broadcaster had made strides in establishing its online presence with iPlayer, the tech was lagging behind the likes of Netflix.

While Netflix has a budget of around £1.7bn a year, the Beeb’s spend has dropped to £98m.

“The BBC is seeking to attract the same audience as other media providers and has significantly lower funding for developing its digital products,” the government’s independent spending body said.

The BBC’s licence fee was frozen earlier this year for two years, leaving the broadcaster scrambling for cash and forced to make cuts.

Some of these cuts have been made across local radio, as well as plans to merge news programmes.

BBC director general Tim Davie has set out plans to make the BBC a digital first broadcaster over the coming decades.

GIFT CARDS THAT GIVE JOY

From gourmet delights to cashmere jumpers, they’ll always find a gift they really love with an M&S gift card

DOWNLOAD OUR APP TO SHOP NOW

SHOP

BUY IN STORE

SCAN TO

ONLINE OR

CITYAM.COM 06 THURSDAY 15 DECEMBER 2022 NEWS

China diplomats flee justice after consulate attack

STEFAN BOSCIA

STEFAN BOSCIA

SIX CHINESE diplomats have been removed from Britain by Beijing, just months after a protester was beaten at a Manchester consulate.

Consul general Zheng Xiyuan was among the group to leave the country, which came after police last week said they wanted to interview the six diplomats over the incident.

Foreign secretary James Cleverly said he was disappointed the six would not face justice, after a Hong Kong pro-democracy protester was allegedly beaten by consulate staff two months ago.

Bob Chan claims he was pulled into the grounds of China’s Manchester consulate and beaten by

staff on 16 October. Video evidence of the incident shows a group of men landing blows on Chan.

Cleverly summoned the Chinese ambassador to the UK over the incident.

“Images carried on social media showed what appeared to be completely unacceptable behaviour by a number of individuals near the entrance to the consular premises,” Cleverly said.

“It is right that those responsible for the disgraceful scenes in Manchester are no longer – or will shortly cease to be – consular staff accredited to the UK.”

Tory MP and Foreign Affairs Committee chair Alicia Kearns said that “China’s diplomats who attacked protestors have fled the UK like cowards, making clear their guilt and denying justice to those protestors grievously assaulted”.

Northern Ireland Protocol deal in sight as UK-EU relations thaw

STEFAN BOSCIA

UK AND EU officials are hoping to seal a deal on the post-Brexit Northern Ireland Protocol by February, after more than a year of wrangling. Talks over a deal have intensified over the past month, as relations have thawed between London and Brussels under Rishi Sunak’s premiership.

Foreign secretary James Cleverly and European Commission vice president Maros Sefcovic will have their first meeting in person today in Brussels, according to Bloomberg. The UK wants to re-write the protocol to scrap almost all checks on goods crossing the Irish Sea, while the EU has said it will only change the way the post-Brexit treaty is implemented.

SUNAK CALLS ON KHAN TO SCRAP ULEZ EXPANSION

Prime Minister Rishi Sunak yesterday said Sadiq Khan should “listen to the public” and scrap the planned expansion of the Ultra Low Emission Zone (ULEZ) to all of London. Sunak said during Prime Minister’s Questions that it was the “overwhelming” view of London residents that the levy should not be expanded. A poll out last month from YouGov found that 51 per cent of Londoners did not want ULEZ expanded any further. ULEZ is planned to extend to every London borough from August next year, which will mean a daily charge of £12.50 for non-complying vehicles.

OPENREACH TO CUT RATES FOR WHOLESALE CLIENTS

BT’s Openreach said it plans to offer cheaper rates to its wholesale clients like Sky and Talktalk as it tries to lure in more customers. Under wholesale fixed telecoms market review rules, Openreach must notify Ofcom of certain offers 90 days before they come into effect. This allows the watchdog, as well as the wider industry, to assess the offer and where necessary intervene. VMO2 chief Lutz Schüler said it was “vital” the proposals were thoroughly scrutinised to “safeguard fair competition” and ensure Openreach does not misuse its market power. Ofcom said it expects to publish a consultation on its provisional view by early February and stakeholders will have 30 days to respond.

07 THURSDAY 15 DECEMBER 2022 NEWS CITYAM.COM

IN BRIEF

Donelan yesterday revealed she is expecting her first child, and will take “short” maternity leave from DCMS in the new year. Announcing the news on Twitter, Donelan wrote that she would reduce her number of constituency visits during the period but would “still be on hand throughout”. The law was changed last year to allow cabinet ministers to go on maternity leave.

EXPECTING Michelle Donelan to take short maternity leave in new year

James Cleverly said he was disappointed

UK must bridge ‘valley of death’ for home science

MILLIE TURNER

THE UK must bridge the ‘valley of death’ in which prize-winning British innovation risks falling into if it isn’t properly commercialised, a new report has warned.

The Global Britain Commission said in a report today that the UK should match Germany’s Fraunhofer programme, which helps businesses turn their research into marketable intellectual property.

Britain’s fiscal and policy support of R&D should be being consistently ranked within the top 10 per cent of OECD countries from 2030 onwards, the report added.

The lack of commercialisation of British innovation is weighing on the economy, as the UK teeters on the edge of a recession and races to keep up with rival markets on technology such as semiconductors, electric vehicle batter-

ies and quantum computing.

“R&D is an essential precondition for economic growth. Getting the UK into the top-tenth of countries for R&D intensity will ensure that UK innovation is more competitive,” the group said.

“The future of the UK’s prosperity will be inexorably linked to how effectively it can produce new ideas, innovate and translate those innovations into new products and services.”

Supporting the commercialisation of British ideas will also help attract overseas investment, which the commission hopes will compete with US levels of venture capital funding by the end of the decade.

The government yesterday unveiled a nearly £120m fund to support science research into challenges like climate change and nuclear fusion.

Science minister George Freeman said it was critical for the UK to invest if it is to be a science superpower.

White-shoe law firm to give new London lawyers £160,000 a year

LOUIS GOSS

CLEARY Gottlieb has become the latest US law firm to boost salaries in the UK’s legal market after upping pay for newly-qualified (NQs) lawyers in its London office to £160,000 a year.

The white-shoe law firm has given its City NQs a 14 per cent pay rise, offering to boost their salaries by

£20,000 from 1 January 2023.

The pay rises put Cleary Gottlieb in the top ranks of the City pay scale, which is now entirely dominated by US firms.

Law firms have continued to increase NQ salaries in the face of worsening economic conditions. The UK’s weak currency has also bolstered US law firms’ salary offerings.

SRA shuts four of Metamorph’s UK law firms

LOUIS GOSS

LOUIS GOSS

THE UK’s legal watchdog has forcibly closed four law firms owned by national conglomerate Metamorph following reports of directors resigning and staff being left unpaid.

The Solicitors Regulation Authority (SRA) also seized cash and documents from the law firm group, which was set up by British entrepreneur Simon Goldhill in 2016 with the aim of “revolutionising legal services”.

Metamorph operates under the SRA’s Alternative Business Structure (ABS) model, which was created by the regulator in 2007 to let nonlawyers run UK law firms.

The national firm had intended to grow its business by acquiring high street law firms across the UK, through deals that saw it build a network of 15 offices and 650 staff.

In September, it was revealed Metamorph’s chief executive Tony Stockdale would be stepping down from his position after the law firm failed to pay staff for two months in a row. The SRA said it decided to act to “protect the interest of clients”.

CITYAM.COM 08 THURSDAY 15 DECEMBER 2022 NEWS

NEW YORK firm Milbank has poached almost 30 lawyers from Dickson Minto after snapping up the firm’s coveted, City-based private equity division, in another sign of US dominance in the UK legal market.

LONDON CALLING Milbank boosts private equity business in deal with City law firm

Union boss says posties to work with business

TRADE union baron Dave Ward has said posties will need to adopt a more business-focused approach to industrial action in the new year.

The man behind both the Royal Mail and Post Office strikes said the Communication Workers Union (CWU) was currently “weighing up other ways we can put other pressure on Royal Mail” as opposed to just walkouts in 2023.

“We are not walking away, but we have to be open to the way of winning disputes,” Ward told City A.M in an interview yesterday.

The CWU is due to meet with Royal Mail shareholders in the coming weeks, where the focus will be on how it can limit further damage to smaller companies who rely on the service.

previously slammed posties’ strike action, telling City A.M. small businesses were being “caught in the crosshairs... at the very time they most need support”.

The union boss said he was “sympathetic” to businesses caught up in the strikes, and would engage with them more closely in the coming year.

The comments come as the CWU continued its fifth day of strike action this month, with over 100,000 of Royal Mail’s 140,000 workers taking part.

Although talks have been ongoing since the summer, CWU has drawn attention in recent weeks with strike days over the crucial shopping period of Black Friday, as well as upcoming dates throughout December and Christmas Eve.

ROYAL MAIL’s headache looks set to continue as we head into the new year, with the union showing no signs of backing down. The delivery giant insists that it has given workers the “best and final pay offer”, which it says is worth up to nine per cent over 18 months. However, the CWU deems it a real-terms pay rise of three per cent next year, as well as an additional two per cent if workers agree to company changes, which it immediately rejected.

Meanwhile, chief exec Simon Thompson continues to put on a brave face, insisting that he will do “whatever it takes” to turn the company around. This includes shrinking the workforce by 10,000 by next August and pushing ahead with structural change, focusing less on letters and more on the lucrative packages market.

Although the union bosses were able to settle a pay deal with telecoms giant BT, whose pay dispute started at a similar time, the situation seems to be going from bad to worse for Royal Mail –from violence on the picket lines to stunted negotiation talks.

Losses are likely to widen for the delivery firm in the coming year, with Christmas feeling a lot less merry than previous years.

LEAH MONTEBELLO

LEAH MONTEBELLO

09 THURSDAY 15 DECEMBER 2022 NEWS CITYAM.COM

LINE

THE BOTTOM

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC 250 300 400 450 500 207.9 ROYAL MAIL SHARES THIS YEAR

HRH The Princess Royal, opens Opportunity Bank in Uganda

OOpportunity International and its partners have been working in Nakivale settlement since 2019 to help promote self-reliance among refugees, build their resilience and stimulate local economic activity in the settlement and the surrounding host communities. To date, the programme has enabled over 3,800 refugees to open bank accounts. More than 848 loans have been disbursed and over 6,900 refugees have received financial literacy training.The Princess Royal also met with members of the Wenzetu Women’s Group, a group of women supporting families with people living with disabilities. These women are being supported to develop a sustainable income for their families through small businesses that they can run alongside their caring responsibilities. She then met the Unleashed Youth Entrepreneur Group, a refugee-led organisation that is enabling young people to develop entrepreneurial skills and launch their own business. Opportunity International are working with Unleashed to pro-

vide a combination of training and support, plus access to financial services via Opportunity Bank, to 10,000 young people creating 450 businesses and over 1,100 jobs in the community.

HRH The Princess Royal, who has been Patron to Opportunity International UK for over 20 years, said: “Last month I had the privilege of visiting Opportunity International’s work in Uganda and meeting some of our clients. I heard first-hand the powerful impact Opportunity International programmes are having on people’s businesses, their families and their wider communities. Access to financial services changes lives. I’ve seen it

for myself.

Whilst visiting the Nakivale Refugee Settlement I met Sephora, a remarkable young woman who, thanks to the support from Opportunity International, is now part of a thriving youth enterprise producing products and raising awareness around women’s health. Sephora is one of the many clients who told me how access to financial training, loans and savings have transformed her life.”

MEET SEPHORA…. A RESILIENT REFUGEE ENTREPRENEUR

Sephora is 18 years old and lives in the Nakivale Refugee Settlement with her parents.

She is a member of the Unleashed youth entrepreneur group who have received support from Opportunity International to develop and build sustainable livelihoods. Financial trainings, loans and savings are helping members work towards a more secure future.

Along with other members of the group, Sephora has developed several treatment and awareness-raising prod-

ucts around women’s health issues. Sephora says: “I have personally learned many new skills, including design, manufacture, mixing of cosmetic and medical ingredients and marketing. I have many hopes for the future. I would like to establish a foundation for our products and offer efficient delivery services in the future too.”

UNLOCK POTENTIAL THIS CHRISTMAS…

Times are tough for many of us but The City is tremendously generous, and people like Sephora need our support now more than ever. Any donation you give will make a huge difference. Thank you.

Will you give the gift of opportunity to someone like Sephora this Christmas?

OPPORTUNITY INTERNATIONAL –LUKE DRAY CITYAM.COM 10 THURSDAY 15 DECEMBER 2022 PARTNER CONTENT

WWW.OPPORTUNITY.ORG.UK/UNLOCK

pictured: Sephora

More than 848 loans have been disbursed and over 6,900 refugees

COPYRIGHT: ARETE/ LUKE DRAY

HSBC confirms plans to stop funding new oil and gas developments

NICHOLAS EARL

HSBC has revealed it will stop funding new oil and gas fields, as part of a wider update of its environmental policies.

The banking giant will also push energy clients to provide more information over their plans to cut carbon emissions –such as production levels beyond 2030.

This follows calls last year from the International Energy Agency for no new fossil fuel projects to ensure the world reaches net zero carbon emissions over the next three decades.

HSBC will continue to finance energy companies at the corporate level pro-

vided they overhaul their businesses towards cleaner projects, and will also support existing oil and gas fields, with supplies falling with demand.

Celine Herweijer, HSBC’s chief sustainability officer, told news agency Reuters: “It’s not no new fossil

HSBC will finance energy firms provided they shift towards cleaner projects

fuel investment as of tomorrow. The existing fossil fuel energy system needs to exist hand-in-hand with the growing clean energy system. The world cannot get to a net-zero energy future without energy companies being at the heart of the transition.”

THE GERMANS ARE COMING UK Steel calls for

more support

INDUSTRY group UK Steel has urged the government to match the financial support offered to rival markets such as Germany during the energy crisis.

It fears the steel sector risks falling behind the German market without expanded support.

Brits to face energy saving advertising blitz

NICHOLAS EARL

BRITS face an advertising blitz over Christmas from the government, urging them to save energy by turning down boilers and radiators.

Downing Street will kickstart a nationwide advertising campaign this weekend, with messages in

newspapers, posters on the side of buses, and commercials on television, according to The Telegraph.

The campaign will cost around £20m in taxpayer funds, but ministers believe the money will be more than made back in savings.

It will be built around the slogan

“It All Adds Up” – with the motto designed to convince the public they can make financial savings through reducing energy consumption.

The government will advise people to lower their boiler flow temperature to 60 degrees, with Downing Street estimating it could save households up to £100 per year.

City of London update

Good pr actice makes per fect f or the Square Mile

THE City of London Corporation has launched a new Code of Good Practice, to help licensed premises achieve the very best of outcomes for their patrons and their business, as footfall continues to rise following the pandemic.

Police found €1.5m in cash stuffed into suitcases and bags

Kaili set for Christmas at court over Qatar scandal

THE MOST high-profile suspect in the EU corruption scandal had her first court hearing postponed yesterday, after being hit with money laundering and corruption charges this week.

Eva Kaili’s pre-trial hearing was postponed until 22 December last night due to strikes in Belgian courts.

It came as MEPs yesterday called for an investigation into whether Qatar influenced a controversial agreement that gave Qatar Airways unlimited access to the EU market.

Kaili, who has been stripped of her position as European Parliament vice president, was arrested during raids which saw the police recover €1.5m in cash stuffed into suitcases and bags.

Police found €900,000 of the €1.5m at Kaili’s home and in a hotel room being rented by her father. The pair claim the money “was not from Qatar and was not any kickback from Qatar”.

Her lawyer claims the Greek MEP did not need to take bribes from Qatar as the EU is already cosy with the Middle East nation.

Police also found bundles of cash at the home of arrested ex-MEP Antonio Panzeri.

It has been alleged that Kaili, Panzeri and others were given the cash by

Qatari officials in a bid to influence decisions made by the parliament –a charge that has been denied by all involved. Belgian authorities say four people have been charged with “taking part in a criminal organisation, money laundering and corrup-

In a statement issued via her lawyer, Michalis Dimitrakopoulos, Kaili said: “It is absolutely false that I had any personal agenda in promoting Qatar’s interests.

There were discussions from 2019 that the EU establish trade relations with Qatar, Kuwait and Oman.”

At the Code’s heart is a commitment to boosting the Square Mile’s 24/7 economy by ensuring that pubs, clubs, bars and restaurants can flourish.

Alongside it, the City Corporation is now encouraging more information-sharing on events in the Square Mile to help premises make the most of increased footfall, and to ensure that people can

‘T is the season...

Make the most of the City of London during the festive season and into the new year with a wide range of fun activities that you can do with colleagues, friends or family.

Find Christmas trees and light installations, Christmas markets, shopping, carol services, concerts, craft workshops, family days out, festive walks and much more - all in one Square Mile!

For more details check this page:

always find their ideal – and often, nearby - choice of pub, bar or restaurant.

The Code will enable the City’s daytime and night-time economy to grow, while ensuring potential impacts on residents, visitors, workers, and emergency services are minimised.

cityoflondon.gov.uk/things-todo/christmas-in-the-city throughout December or follow us on Instagram, Facebook and Twitter. And don’t forget the huge variety of bars, restaurants and cafes available too.

News, info and of fer s at www.cityof london.gov.uk/eshot

11 THURSDAY 15 DECEMBER 2022 NEWS CITYAM.COM

STEFAN BOSCIA

Eva Kaili was arrested during police raids

Come Fly With Me: Tui Group revenues take off

TOURISM specialist Tui Group has begun to show signs of recovery from the pandemic, recording a four-fold increase in revenues powered by robust takings across its core businesses.

The strong headline numbers contributed to a bumper uptick in

ANNOUNCEMENTS

revenues from €4.73bn (£4.06bn) last year to €16.54bn over the same period.

This reflects the return of customers in the first post-pandemic year with minimal travel restrictions.

The number of summer customers climbed to 13.7m, reaching 93 per cent of levels achieved before the pandemic.

Nevertheless, the Europe’s largest travel group remains in the red, recording

LEGAL AND PUBLIC NOTICES

an overall loss of €212.6m, with earnings per share also in minus figures.

The company still also holds €3.4bn of debt on its books from the pandemic.

Despite the summer uptick, Tui is struggling to attract the same number of holidaymakers for its packages that it managed prior to the pandemic with the company making losses on Northern Region and Western Region customers of

€101.6m and €31.5m respectively. Shares in the company closed down 7.99 per cent on the FTSE 250 yesterday afternoon, with traders concerned over future headwinds.

Tui faces multiple challenges to its business in the coming months including inflation and reduced demand amid a cost of living crisis, which is eating into people’s wallets.

Amazon festive lights found to pose fire hazard

AZANIA PATEL

TESTING by consumer group, Which? has revealed that 10 out of 12 Christmas lights sold on Amazon do not meet UK electrical equipment safety regulations.

The consumer group tested Christmas lights under £15 sold on both Ebay and Amazon and found that the majority were dangerous for household use and posed a fire risk.

Responding to the reports, an Amazon spokesperson said: “Safety is a top priority at Amazon and we require all products offered in our store to comply with applicable laws and regulations.”

Amazon and Ebay delisted the items after the findings were made public. Sue Davis, head of consumer protection policy at Which?, said that consumers were “putting themselves in danger” by buying cheap holiday lights.

Mercedes invests €1bn to support electric shift

MERCEDES yesterday announced it was investing over €1bn (£859m) to realign its global network for the production of electric vehicles (EV) from 2024.

The German carmaker has pledged to become fully electric by 2030 “wherever market conditions allow”.

As part of the realignment, plants in Germany and China will continue to assemble batteries for models coming into Mercedes’s new EV platforms MMA and MB.EA.

The two platforms – which will be launched respectively in 2024 and 2025 – are the core structure on which models are built.

They are usually shared between a variety of models. The marque’s factories will also focus on the production of electric drive units – the actual motors that make each electric vehicle move. Mercedes’ plant in Untertuerkheim, Germany will double its electric drive unit capacity to produce one million units. “The path towards sustainable, all-electric mobility has begun,” said Ergun Lumali, deputy chairman of Mercedes’s supervisory board.

“We are committed to shaping this change, which is both a challenge and an

opportunity, in a fair and socially just manner.”

The announcement comes a day after Mercedes was forced to put on hold its joint venture with electric van maker Rivian.

The US firm announced on Monday it was pressing pause on building electric vans with Mercedes as it wanted to focus on its North American businesses. Rivian’s boss RJ Scaringe said the company remained open to revisiting the opportunities “at a more appropriate time for Rivian”.

MINTED Oligarch seeks to block fraud case over sanctions

A HIGH PROFILE Russian oligarch is seeking to block an $850m (£685m) fraud lawsuit over claims the Russian banks suing him could use proceeds from the case to “fund the war in Ukraine”.

Lawyers acting on behalf of Putin critic Boris Mints called for the High Court lawsuit to be put on hold, arguing any money won could not be paid, as one of the banks suing him, Bank Otkritie, is subject to UK sanctions.

CITYAM.COM 12 THURSDAY 15 DECEMBER 2022 NEWS THE

(NOTICE OF VARIATION) (ON-STREET

PLACES) (BUSES) ORDER 2023 1. The City of

Corporation gives notice that it intends to increase the charges for using the Regulation Act 1984. varied as follows: Vehicle fuel type and date of registration

Affected streets are as follows:

CITY OF LONDON

PARKING

London

charge for periods of: for periods of: 15 minutes1 hour15 minutes1 hour £1.65 £2.25£9 £1.65 £2.25£9 £2.25£9 £1.25 £1.65

Ian Hughes

ILARIA GRASSO MACOLA

NICHOLAS EARL AND ILARIA GRASSO MACOLA

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

City shrugs off cheery inflation print as FTSE inches lower at close

LONDON’s FTSE 100 shrugged off upbeat figures yesterday that indicated the UK’s inflation surge may have finally passed its peak.

The capital’s premier index edged 0.09 per cent lower to 7,495.93 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell 0.25 per cent to 19,037.92 points.

Investors seemingly sat pat on new numbers from the Office for National Statistics that suggested inflation has finally turned a corner.

Prices climbed 10.7 per cent over the year to November, down from a rate of increase of 11.1 per cent in the previous month, a much steeper fall than the City expected.

High inflation is crushing household incomes and raising fears of a spending

slowdown triggering a long recession which could squeeze corporate profits. The Bank of England has lifted interest rates eight times in a row in response and is likely to make it nine successive hikes today with a 50 basis point rise, adding to pressure on stocks.

“Prices are still seeing double-digit increases and, in some areas, inflationary pressures are proving worryingly sticky,” Russ Mould, investment director at broker AJ Bell, said.

Housebuilders dragged the FTSE 100 marginally lower, likely on fears of a home price correction in the coming due to higher mortgage rates pricing people out of the market.

Taylor Wimpey and Barratt Developments each dropped more than 1.3 per cent. The pound strengthened more than 0.5 per cent against the US dollar on bets the Fed will tame rate hikes.

CITY MOVES WHO’S SWITCHING JOBS

PKF LITTLEJOHN

Canary Wharf-based accountancy firm PKF Littlejohn has appointed an insolvency, credit and debt veteran to lead its new creditor services team.

James Linton, who brings over 15 years of experience to the role, will help the team serve credit managers, local authorities, debt purchasers and lawyers with lodging claims, proxy votes and

While Peel Hunt said it was “rooting” for the Frontier Developments’ video game F1 Manager 2022 , stating that it would show the firm’s ability to “tap into green space within its expertise”, it said it should perhaps “tread with caution” moving forward. The broker gave the gaming giant a buy recommendation with a target price of 2,030p yesterday.

INTEGRAFIN HOLDINGS

providing representation at creditor meetings.

“James’ experience, contacts and entrepreneurial approach make him the ideal person to launch our new offer to creditors,” head of advisory Stephen Goderski said. “James is also one of those individuals who is able to quickly build a rapport with others, which is a major asset in insolvency situations.”

NUMIS

Investment bank Numis has built out its financial institutions group with two senior hires.

Former RBC investment banker Daniel Werchola, who has spent the last two decades in the City M&A space,

joins as managing director and co-head of the group.

While ex-Barclays senior representative Gregoire Pennec joins as director of growth capital solutions in the fintech market.

“We think there is a great opportunity for our financial institutions group and under the combined leadership of Dan and Stephen, the team brings real strength of experience and capability to our clients,” co-CEOs Alex Ham and Ross Mitchinson said.

BROWN RUDNICK

Law firm Brown Rudnick has bolstered its energy transition practice with a fresh partner, as part of the

NOT

IN THE CLEAR YET “There will be much debate about whether the slight dip is a sign that the relentless price rises that households have endured over the last 18 months might finally be coming to an end, but one drop doesn’t signify a trend. Look back just a couple of months when August’s cooling breeze quickly gave way to an autumn which delivered a 40-year inflation high.”

DANNI HEWSON, AJ BELL

firm’s plans to expand its technology investment focus. Paul Doris will focus on joint ventures and M&A transactions within the energy transition and infrastructure space, including onshore and offshore wind, solar, floating solar and energy storage.

Doris, who joins from Dentons, brings experience from across complex, cross-border transactions in Europe and Latin America.

“His experience with cross-border transactions for clients across the UK, Europe, and Latin America will ensure that Brown Rudnick continues to be the go-to advisor for clients in this sector,” CEO and chair Vince Guglielmotti said.

13 THURSDAY 15 DECEMBER 2022 MARKETS CITYAM.COM

P 14 Dec 1,056 12 Dec 9 Dec 8 Dec 14 Dec FRONTIER

1,060 1,070 1,080 1,090 1,100 13 Dec Peel Hunt gave Integrafin a buy rating

after the firm posted

of recently

the

challenging

and heightened market

The

of Transact, an investment platform used by UK financial

and

also

target price of 385p

the

To appear in Best of the Brokers, email your research to notes@cityam.com P 14 Dec 312.40 12 Dec 9 Dec 8 Dec 14 Dec

DEVELOPMENTS

yesterday

profits ahead

upgraded expectations, despite

more

conditions

volatility.

owner

advisors

clients,

nabbed a

from

broker.

290 295 300 305 310 13 Dec

To appear in CITYMOVES please email your career updates and pictures to citymoves@cityam.com

GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION

EDITED BY SASCHA O’SULLIVAN

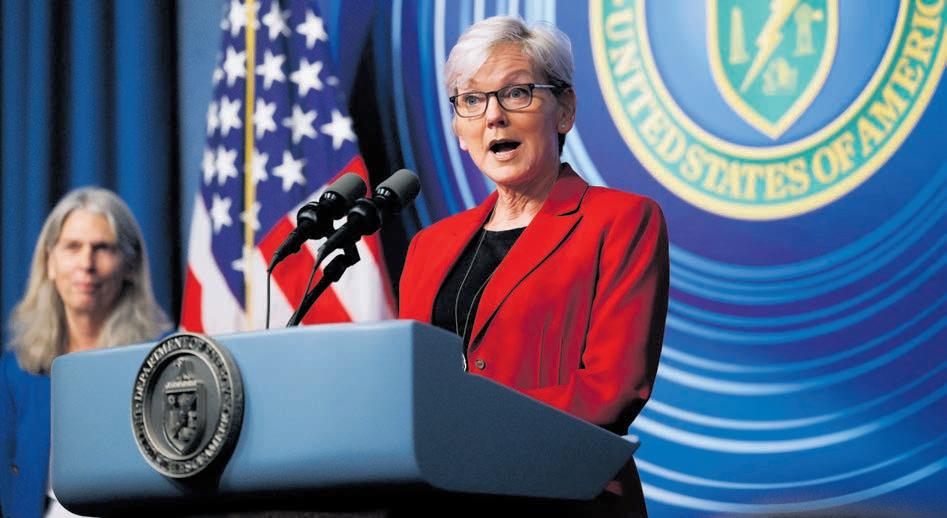

Fusion energy may only heat a kettle but it will power future investment

Josh Williams

FOR seventy years, nuclear fusion has always, and only, been the next big thing. Its promise is tantalising: near limitless, zero-carbon energy. Unlike fission, its cousin which powers today’s nuclear plants, it also leaves no longlasting radioactive waste.

We have long known it is theoretically possible. In the most over-simplified terms, two light elements (like hydrogen) are smashed together, releasing a huge burst of energy. We know this can be done because without nuclear fusion, none of us would be alive. All the light and heat of the sun is generated this way.

Down here on earth, we have generated energy this way before, but only with limited success. Critically, the energy used to power a nuclear fusion experiment has never been more than the energy generated by one.

That was, at least, until this week.

First reported in the FT, and since confirmed by the US government, researchers at the National Ignition Facility at the Lawrence Livermore National Laboratory in California have found their holy grail. A man-made fusion experiment has, for the first time ever, given more than it has taken. 2.1 megajoules of energy powered a fu-

sion reaction. 2.5 megajoules of energy was generated as a result.

Caution is required. That gain of 0.4 megajoules is only enough to boil a few kettles. We are still many years away from generating energy at scale in fusion power plants.

But this does appear to be a Promethean moment, and it should be celebrated. This is not only true because of what it prophesies for our future, but also because of a more prosaic lesson it teaches us about

how great scientific breakthroughs happen.

The US government has been funding research into nuclear fusion since the 1950s, now spending some $700 million each year. This investment, which once looked quixotic, now looks far-sighted.

Investments like these are indeed vital to our future, and the role of the state is critical. No private company could possibly sustain investment like this for so long and for so little imme-

Let’s be honest, we’re still squandering post-Brexit opportunities for Britain

IS BREXIT a proven failure? Remainers latching onto the associated costs of leaving the customs bloc certainly think so. Some recent polls even indicate a majority for rejoining the European Union. Meanwhile, evidence of the benefits of taking back control appears scant. The government delivered a faster vaccine programme, signed trade deals and talked the big talk about taking advantage of our newfound freedoms.

Yet the regulatory divergence so far is minimal. EU legislation which applied to the UK was retained in domestic UK law on Brexit day, 31 January, 2020. Most of this, with some small technical changes, remains in place –whether or not in Britain’s interest.

There are notable exceptions, like rules that will enable British farmers to use gene-edited crops and the “Edinburgh reforms” for financial services. There is also a plan to “sunset” retained EU law by the end of next year, but with the risk that this is simply transferred to UK statute unchanged. This state of affairs should be disappointing to everyone. For Brexiters, it

Matthew Lesh

Matthew Lesh

is squandering an opportunity to upend the bureaucratic stranglehold of EU rules. But even Remainers, particularly those who accepted the result of the referendum, won’t welcome the government’s inertia towards seizing opportunities that could make the UK more prosperous.

Opponents of deregulation often insist that there really isn’t much capacity for the UK to diverge, either because EU law protects necessary rights or because changing rules will make things harder for UK businesses that want to trade with the continent.

But the truth is a little more convoluted. There are plenty of potential beneficial changes; it’s just that these are often relatively small or industry-

specific and unlikely to make headlines. This reflects how the EU created millions of words of red tape, pertaining to every facet of the economy. Taken separately, they have little impact. Taken together, repealing and replacing these rules will add up to a lot. Consider, for instance, net neutrality rules. The principle is that internet service providers, like BT or Vodafone, should treat all web traffic equally. This, we are told, will ensure users can access all content and services while enabling new innovative web applications. There’s just one, pretty central problem. The regulations are unnecessary and damaging to innovation. The UK has only adhered to net neutrality since 2016, as a result of the EU’s Open Internet Access Regulations. Previously, the UK relied on a mixture of competition, transparency and self-regulation to safeguard an open internet. This was widely acknowledged by politicians, regulators, and independent analysts, to be sufficient. A 2015 analysis by Wix, found that “almost all UK internet users have virtually full access to the internet”.

Net neutrality limits the ways in which internet service providers can manage congestion on their network during peak times. It will make it difficult to prioritise data-intensive timesensitive applications, such as hazard and collision information to self-driving cars or special services for the metaverse.

The rules also prevent innovative product offerings, including zero-rating or a package that priorities gaming. These regulations also forbid network operators from reaching deals with large content providers, like Netflix, to pay for network maintenance and upgrades – slowing investment in 5G and full-fibre broadband.

It's hard to imagine that anyone voted Leave to unshackle the UK from the constraints of net neutrality. But this niche rule is one of many that restrict businesses' room for manoeuvre. Remove them, and we might finally be able to talk about Brexit as something other than a failure.

£ Matthew Lesh is head of public policy at the Institute of Economic Affairs

diate reward. It is only now, building on seventy years of state funding, that private sector investment is crowding in. In the last twelve months, fusion companies raised a further $2.83bn to push fusion to the finish line.

The United States is often lauded for its culture of private-sector investment, while to travel on America’s pitiful public transport is to witness a paucity of good, everyday public-sector spending. Yet, when it comes to longterm research, the Americans have long understood the critical importance of government backing.

This can be dated to a moment in 1957 that terrified American policymakers. That year, the Soviet Union launched the first ever satellite to orbit the earth, Sputnik I, catching the Americans unprepared. In 1958, the US government launched its response: the Advanced Research Projects Agency (ARPA), since renamed DARPA (the “D” standing for “Defence”).

DARPA's initial mission was to place a man on the moon, an achievement that took just eleven years, before adding defence to both its name and mission.

In the process, it funded breakthroughs that have made the modern world, not least the development of the internet. Long after man first stepped on the moon, DARPA continues to fund long-term research.

DARPA’s moon-shot investments won the space race. Now the US government’s investments in nuclear fusion could be the earth-shot required to win the race for clean energy too.

£ Josh Williams is a London-based writer

CITYAM.COM 14 THURSDAY 15 DECEMBER 2022 OPINION

OPINION

US Energy

Secretary Jennifer Granholm called the fusion breakthrough ‘game-changing’

CULLEN THE SHOTS Pat Cullen, the head of the nurses union the RCN, is in the limelight today as nurses across the UK go on strike for the first time in the history of the union. She was warned by top medics ‘not to let the strikes cost lives’ after the union’s plan for ‘night staffing’ was branded unsafe

It is a prosaic lesson about how great scientific breakthroughs happen

WE WANT TO HEAR YOUR VIEWS › E: opinion@cityam.com COMMENT AT: cityam.com/opinion

LETTERS

TO THE EDITOR

A windless day for energy

[Re: A new coal mine in Cumbria won’t save the burning problems for the UK, Dec 9]

The danger of the UK’s overreliance on wind and solar is reflected in the recent hike in electricity prices, as challenging weather affected supply. Presently, coal and other fossil fuels disproportionately dominate the energy mix to make up for any shortfalls in terms of renewable output.

The government along with policy makers should ensure that the energy mix is diversified to a far greater degree, which is a key part of the country’s longterm energy security.

Renewables alone cannot help us achieve a sustainable power system. Of

course, wind and renewables will play a part in the net zero transition and therefore the UK’s energy strategy, however they are intermittent and cannot deliver fully sustainable solutions by themselves.

Further, other global governments must recognise that wind and solar power can play a crucial role only when deployed alongside other technologies such as carbon capture and storage used in more conventional sources of energy.

Governments need to champion these solutions, as well as the likes of the future role of hydrogen in the power mix to ensure the issue of wind intermittency in power generation doesn’t drastically affect prices, particularly during the transition away from fossil fuels.

Richard Lum Victory Hill Capital Advisors

STATELESS EU Commission eyes looser state aid rules for next year

London is triumphing over its reputation as the weird cousin of US tech successes

Alex Cheatle

NEXT year will mark twentyfive years since the dot.com boom that took place between 1998 and 2001. It was a time of huge creativity. Capital, talent and enthusiasm flowed into new ideas and young start-ups. What can London in 2023 learn from those heady days?

We were there in 1998 with the lofty ambition of becoming “the world’s most trusted service” – from a spare bedroom near Oxford Street. We met internet investors, and our first customers, at “First Tuesday” networking events. We hired from blue-chips like McKinsey and Mars, recruiting bright managers keen to take 50 per cent pay cuts to join the promising London start-up scene. The zeitgeist was exhilarating and not a little crazy. I remember in early 2000, Boo.com, the innovative but heavily loss-making ecommerce platform, justifying their eye-watering valuation on a multiple of their cash burn-rate. The argument ran that because Boo were using up a lot of capital, they must be commensurately valuable.

the US

up support for climate-friendly companies based stateside, the European Commission is looking to relax its own rules at the beginning of next year in a bid to prevent green companies from being tempted to leave.

EXPLAINER-IN-BRIEF: HOW TO SOLVE A PROBLEM LIKE THE UNIONS?

Yesterday Keir Starmer branded the nurses strike “a badge of shame” on the Conservative government.

The Labour leader held little back in Prime Minister’s Questions as the country faces industrial action today. But it was also a distraction technique for an opposition party gripped with indecision over the strikes.

Rishi Sunak rightly called Starmer’s demands that he “get around the table” with the RCN, the nurses union, a “political formula for avoiding taking a

decision”. It’s unclear what exactly Labour would do differently.

They have said they would pump more money into the health service by scrapping nondom status, but in almost the same breath Starmer called the 19 per cent pay rise nurses are demanding “unaffordable”.

And in return for extra money, Wes Streeting has called for considerable changes to the quality of the service offered. He said he wouldn’t make “promises he can’t keep” on higher pay.

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900

Email: news@cityam.com

Certified Distribution from 30/5/2022 till 01/07/2022 is 79,855

Perhaps unsurprisingly by mid-2001, the party was over, the money had left and most internet companies, Boo included, had gone bust. Many would-be entrepreneurs returned, bowed, to the relative safety of established firms, the City and the professions.

It’s now worth looking back and considering why the boom and bust worked out better in the USA than here.

In the USA there is a positive legacy. The founders of Amazon, Paypal and Tesla, and Google were all business babies of the dot.com boom. They founded some of the world’s ten most valuable companies and are just a few of the tech leaders in the USA who established themselves during the dot.com years.

China can also claim similar successes. Li Qiangdong set up the e-commerce giant JD.com in 1998. Jack Ma launched Alibaba, China’s E-bay, in 1999. Robin Li created Baidu, China’s Google, in 2000.

In contrast, the UK looks like it has little to show for that vibrant scene 25 years ago. It’s true that Ocado, set up in 2000, is valued at a respectable £5.6bn and Lastminute.com founders (est. 1998), Brent Hoberman and

Martha Lane-Fox, are still both active in the UK tech scene. But London hasn’t enjoyed a comparative legacy. That’s for two reasons, people-based and capital-based – both of which we have fixed, or are fixing, for the future success of “UK PLC”.

Firstly, the American entrepreneurs learned from their peers, helping them survive the dot.com bust. Formidable groups of entrepreneurs and former founders in California and New York would meet to share experiences, advice and contacts. This is now common-place in London but barely existed in 2001. Helm (formerly The Supper Club) has been supporting scale-up founders to learn from each other since 2003 and Brent Hoberman’s Founders Forum started shortly afterwards with a tech focus, inspired by the lack of effective support when he ran Lastminute.com.

Secondly, capital for loss-making growth companies in the UK disappeared entirely in 2001, but capital flow continued in the USA, albeit at reduced levels, because they had a robust

investment eco-system. That allowed companies like Amazon to struggle through to colossal success; it enabled entrepreneurs to exit their companies with some value and self-belief rather than going under, enabling them to consider going again. In the UK we have this investment challenge partially fixed – there is a lot more cash available for early stage companies today. Alliott Cole of Octopus Ventures says investor confidence is encouraged by the 17 venture-backed UK businesses who exited with valuations of over £1bn. And a Beauhurst report states that there are a further 44 privately-held unicorns with a UK HQ. Success is solving the capital issue.

So as Londoners gear up for 2023, it’s great to see that, unlike twenty five years ago, we now have the right people, ingredients and the capital opportunities to create and grow great technology-led businesses from this city.

£ Alex Cheatle is founder and chief executive officer of Ten lifestyle group

Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com

Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions

Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP

Editorial Editor Andy Silvester | News Editor Ben Lucas Comment & Features Editor Sascha O’Sullivan

15 THURSDAY 15 DECEMBER 2022 OPINION CITYAM.COM

Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Digital Editor Michiel Willems Commercial Sales Director Jeremy Slattery

Google’s headquarters in London

As

ramps

LIFE&STYLE

The best theatre and films of 2022

ances and more camp flourishes than a magician at a caravan park, this is a toe-tapping whirlwind of hairspray and sequins, all delivered with an evangelical zeal.

7. WUTHERING HEIGHTS (NT)

Emma Rice’s take on Wuthering Heights is more of a riff on Emily Brontë’s novel than a direct adaptation. A deeply strange production, Rice introduces musical numbers, meta jokes and contemporary expletives to create a singularly punk version of this timeless classic. Unlike anything else out there.

8. I, JOAN (SHAKESPEARE'S GLOBE)

I, Joan, a new adaptation of the story of Joan of Arc, is a history-making piece of theatre for transgender and non-binary people, being the first major London theatre production where a trans person took centre stage in a main role. From the script to the performances to the staging, there’s a triumphant energy to I, Joan that will be remembered for years to come.

9. OTHELLO (NT)

1.

1. CRUISE (APOLLO)

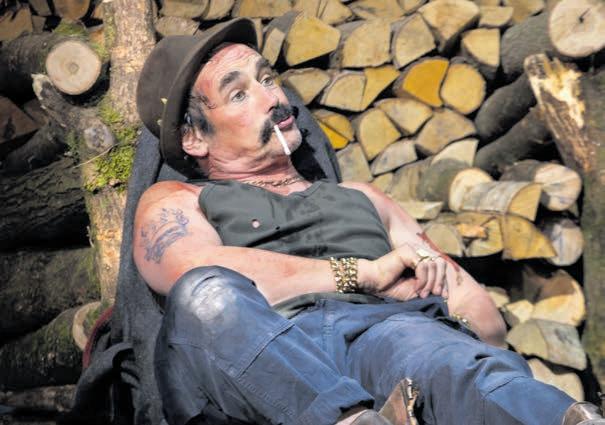

Jack Holden’s incredible one-man show explores the fallout of the AIDS crisis in a spectacularly contemporary way. Having opened in May 2021, it earned a well-deserved transfer to the Apollo this summer, with its combination of heart-heartststring-tugging drama and live house music more than filling the bigger space. It’s an ode to queerness, Old Compton Street, joy, resilience and escapism.

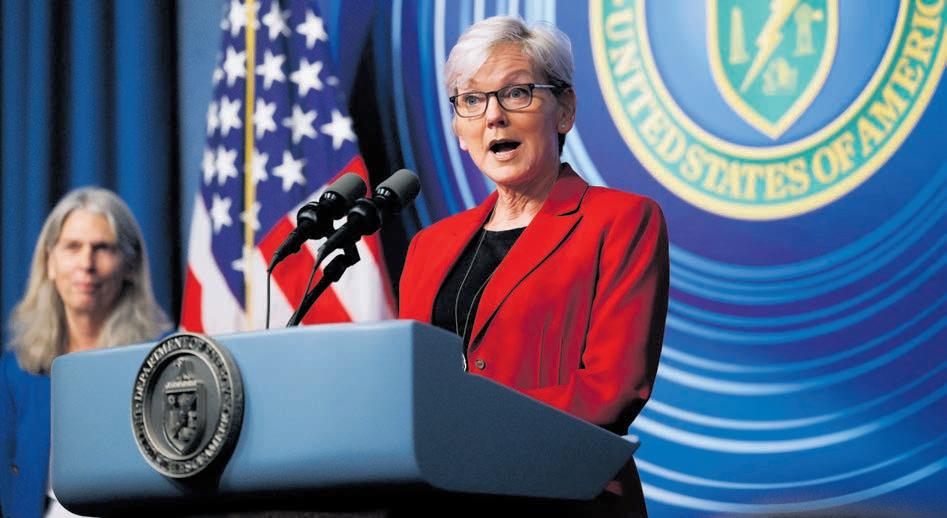

2. JERUSALEM (APOLLO)

Mark Rylance returns after a decade to the role that landed him the best actor gongs at the Olivier and Tony Awards in 2010 and 2011. And ten years later it continues to justify its reputation as a modern-day classic. Jez Butterworth’s meandering, hypnotic play has rightly been labelled one of the best works of the 21st century, and Rylance once again shows he’s one of the top leading actors of his generation.

3. PRIMA FACIE (HAROLD PINTER THEATRE)

Perhaps the single most arresting performance of the year came from Jodie Comer in Prima Facie. She plays a young barrister who defends men in sexual assault cases, until she is dragged into one of her own. Comer’s performance is exhaustingly energetic, full of charisma and heartbreakingly raw. Prima Facie cements her as one of the most versatile young actors out there.

4. PATRIOTS (ALMEIDA)

With Putin dominating headlines across the world, it was an apt time for Frost/Nixon writer Peter Morgan to drop his new play Patriots, which tells the story of Russia’s lurch from communism to gangster capitalism in the wake of Perestroika. Tom Hol-

lander is magnetic in a stylish play that unfolds like a fascinating and brutal soap opera.

5. ORLANDO (GARRICK THEATRE)

Virginia Woolf’s satirical novel Orlando was, in 1928, asking the same questions around gender identity that society is still grappling with today. Non-binary actor Emma Corrin plays the many iterations of the lead character with humour and conviction, evoking real star power.

6. TAMMY FAYE (ALMEIDA)

James Graham, Rupert Goold, Jake Shears and Elton John were the dream team behind this new glitterball of a musical, which stands shoulder to shoulder with the very best. Full of great songs, great perform-

Clint Dyer, recently appointed deputy artistic director of the National Theatre, becomes the first black man to direct Othello at the institution, having already been the first black man to direct any play there. He responds with a super-stylish production that tackles the play’s themes of racism, domestic abuse and toxic masculinity head-on.

10. GOOD (HAROLD PINTER THEATRE)

David Tennant plays a reluctant Nazi in this restaging of CP Taylor’s 1981 play. His Prof Halder is a bumbling academic who’s descent into evil is incremental, and Tennant’s natural charisma keeps the audience on-side for long enough to question themselves when his actions eventually become utterly indefensible. A timely reminder of how extremism can creep up on a nation, especially during times of economic strife.

EVERYTHING EVERYWHERE ALL AT ONCE

This surreal comedy-drama stars Michelle Yeoh as a busy working mother who must stop an almighty force from destroying the Multiverse. Whether she’s required to be serious, do comedy, or kick ass, the legendary Malaysian star never disappoints in the most unusual, unpredictable and enjoyable film of the year.

1. THE BANSHEES OF INISHERIN

Director Martin McDonagh returns five years on from his Oscar-winning Three Billboards Outside of Ebbing, Missouri. He takes a small local drama –two friends falling out –and spins it in a centrifuge until it has the density and power of a collapsing star. Featuring pitch-black humour and moments of gratuitous violence, it’s elevated to classic status by Colin Farrell and Brendan Gleeson, both on the form of their lives.

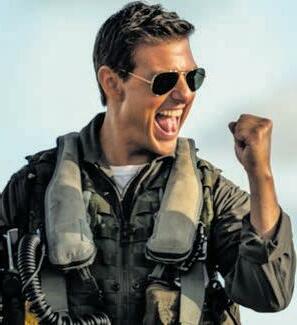

3. TOP GUN MAVERICK

Tom Cruise creates the perfect blockbuster movie, mining just the right amount of nostalgia for the 1986 original and adding 36 years of movie-making experience. Gripping from start to finish, it’s quite simply unmissable.

4. HIT THE ROAD

One of the funniest films of the year, Hit the Road follows a family journeying to the northern border of Iran. Like Little Miss Sunshine with life-ordeath stakes, it echoes the situation of refugees across the world with warmth and humanity.

5. FLEE

This animated documentary is the most sincere and graceful film you’re likely to see this year. Director Jonas Poher Rasmussen interviews Amin Nawabi, his close friend from his school days in Denmark, about his past as a refugee from Afghanistan. What follows is a startling tale of suffering, ingenuity, and courage.

6. BELFAST

In Belfast, Kenneth Branagh set out to

tell a story of “the people who left, the people who stayed, and the ones who were lost”. He does it with aplomb in this beautiful, heartbreaking modern classic.

7. LIVING

Living is a stylish rumination on old age, dying and living life to the fullest, with Bill Nighy putting in the performance of a lifetime. Rewritten by Kazuo Ishiguro from the 1952 Akira Kurosawa film Ikiru, this story of a man breaking out of his daily routine is essential watching.

8. PARALLEL MOTHERS

Penelope Cruz teams up once more with director Pedro Almodovar to create a movie that features everything that’s too often absent from American cinema, from compelling female leads to nuanced moral dilemmas.

9. LICORICE PIZZA

A new film from Paul Thomas Anderson, one of the great auteurs of modern cinema, is always a treat and Licorice Pizza doesn’t disappoint. A giddy, gaudy coming of age story, it’s the kind of film that makes you glad to be alive, filled with sentimental –but never saccharine –moments of teenage love and loss.

10. THE SOUVENIR PART 2

A well-earned follow-up to the 2019 art house favourite, this drama about recovering from trauma and navigating toxicity is a showcase for the quality of alternative British filmmaking.

After two years of Covid, London theatre returned this year with a vengeance. Here are a few of our favourite plays. Words by Steve Dinneen and Adam Bloodworth

17 THURSDAY 15 DECEMBER 2022 LIFE&STYLE CITYAM.COM

While not a classic vintage, 2022 still offered some real cinema gems, say James Luxford and Steve Dinneen

Above: Mark Rylance in Jerusalem; Below: Jodie Comer in Prima Facie

Above: Michelle Yeoh in multiverse drama Everything Everywhere All at Once; Below: Tom Cruise in Top Gun Maverick, the “perfect blockbuster”

SPORT

ALLEZ LES BLEUS France topple gutsy Morocco to book tie with Argentina in final at 16pt

SECURITY GUARD DIES FROM FALL AT WORLD CUP

£ A 24-year-old Kenyan security guard has died in Qatar having fallen at the Lusail Stadium – which will host Sunday’s final. Qatari organisers say they “are investigating the circumstances leading to the fall”. John Njau Kibue was reportedly in a stable but critical condition but he died after three days in hospital – the incident took place after Argentina’s win over the Netherlands.

HARLEQUINS’ BIG GAME IN DOUBT OVER RAIL STRIKES

£ Harlequins’ annual showpiece Premiership fixture, Big Game, has been thrown into doubt over the fallout following the upcoming train strikes. Trains are not due to stop at Twickenham station on 27 December. The club did not deny the speculation in a statement last night but said they’re working with stakeholders to explore possibilities. The scheduled match would have been the 14th instalment.

NEXT WEEK MAY BE LAST FANS SEE OF MURRAYS

£ Next week could be the last time fans see the Murrays playing together, according to older brother Jamie. “It’s certainly possible [it could be the last time they play together],” Murray said. “It’s not like we get loads of opportunities to do it. That was one big reason for putting the event on in the first place.” The duo will compete in the Battle of the Brits event next week in Aberdeen. “I still enjoy getting out there, competing against the best players, playing the biggest tournaments,” Jamie added.

LIV GOLF CIRCUIT TO DO THREE MORE US EVENTS

£ The Saudi Arabia-backed LIV Golf league has added three further dates to its calendar –all of which are in the United States. The tour –which recently announced it would go to Adelaide –will compete in Tucson, Arizona, Tulsa, Oklahoma and Greenbrier in West Virginia in March, May and August respectively.

Greenbrier is one of three courses to have hosted both the Ryder Cup and Solheim Cup. The first season of LIV was won by Dustin Johnson.

SUPER LEAGUE REBELS GET

ABANDONEDby most of its supporters in the face of widespread outcry, tied up in red tape, and then undermined by the financial problems of its remaining backers, the European Super League has never looked more dead.

But the controversial breakaway football competition could be dramatically resurrected today when an advocate general delivers their recommendation in a landmark legal case at the European Court of Justice.

If they side with the three rebel clubs – Real Madrid, Barcelona and Juventus – and the ECJ rubber-stamps their opinion in the coming weeks, it could fracture the sport and make a

European Super League “just a matter of time”, says lawyer Darren Bailey.