BREXIT CITY SHAKEUP TO BE UNVEILED

STEFAN BOSCIA, JACK BARNETT AND CHARLIE CONCHIE

JEREMY Hunt will finally unveil the government’s plans to shred EU financial services laws today as he proposes a package to boost the City’s global competitiveness post-Brexit.

Hunt will deliver the landmark announcement in Edinburgh this morning, with the chancellor set to drop Solvency II capital requirements on insurance firms and ease current bank ringfencing laws.

The Treasury last night said more than 30 regulations would be changed as a part of the package, now dubbed the “Edinburgh reforms”, which Hunt said would “unleash the full potential of our formidable financial services sector”.

The so-called Big Bang 2.0 proposals –a phrase first coined by Rishi Sunak in a City A.M. view nearly two years ago –have long

been touted as one of the biggest potential benefits of Brexit.

“We are delivering an agile, proportionate and home-grown regulatory regime which will unlock investment across our economy to deliver jobs and opportunity for the British people,” Hunt will say.

It is also expected that the chancellor will announce a review of the EU’s wide-ranging MiFID II regulatory regime.

Hunt will also today set out plans to reshape the UK banking regime in a bid to unshackle the sector after the government tightened rules to prevent mistakes that led to the financial crisis from happening again in the future.

Lenders will be able to link their investment and retail banking arms, Hunt will say, though it is unclear whether big players such as Barclays and HSBC will still need to partially separate, or “ring fence”, the two.

The policy was designed to

stop investment errors from trickling down to the real economy, as they did over a decade ago, via consumer banking businesses.

Critics have argued it has kept cash locked up in the financial system that could have been unleashed to boost business investment and economic growth.

Hunt is set to overhaul the purpose of the City’s regulators in a bid to push growth and competitiveness up the agenda, with new mandates for both the Financial Conduct Authority and Prudential Regulation Authority to be detailed as part of the package.

Suggestion of a shake-up of the City regulators has caused some disquiet in recent months amid fears the UK’s status as a global financial hub will be threatened.

David Postings, the chief exec of trade body UK Finance, told City A.M. last night: “The banking and finance industry is the engine of our economy, delivering jobs and investment up and down the country.”

VIRGIN ATLANTIC accused Heathrow bosses of producing “undercooked and self-serving passenger forecasts” in order to justify an “excessive” passenger charge next year.

Yesterday the aviation regulator, the Civil Aviation Authority (CAA), capped Heathrow’s passenger fee at an interim level of £31.57, based on 65.2m passengers using the airport –compared to an estimated 62m this year. Carriers have argued the figure is excessive and will inflate ticket prices.

Virgin Atlantic said it was “almost

inconceivable” that Heathrow would not see a more significant bump next year, with the first quarter of the year disrupted by ‘Omicron’ restrictions.

A spokesperson said Heathrow was waiting for a final decision, while continuing to believe “in the strong plans we have put for investing in... services over the coming year”.

The CAA will consult on the fee over the coming fortnight. The charge is paid by airlines, but is typically passed on to customers.

Weiss’ comments were echoed by IAG’s chief exec Luis Gallego as well as trade body boss Willie Walsh, who called the decision “frustrating”.

Legal eagle Sir Nigel says Big Four will drive more competition in sector

LOUIS GOSS

THE BIG Four’s efforts to bolster their legal businesses could lead to a surge in the number of UK law firms listing on the stock exchange, DWF chief Sir Nigel Knowles told City A.M.

EY’s global split could see the firm

become an “aggressive” legal services behemoth, as it is freed from the conflict-of-interest rules that block the Big Four from selling advice to audit clients, said Knowles.

The Big Four accounting firm’s rise as a legal services powerhouse could in turn heighten competition in the legal sector, in a shift that

could see more UK law firms follow in DWF’s footsteps by launching initial public offerings (IPOs).

“There’ll be more firms that IPO,” Knowles (right) said, claiming the legal sector is set to see “more competition from the Big Four”.

The push could see law firms seek to raise capital on public

markets in their efforts to capture a larger share of the world’s £650bn legal market and compete with the likes of EY, KPMG and Deloitte.

Knowles explained that the hundreds of private law firms that currently make

up the UK’s legal sector will struggle to compete with the Big Four, unless they either find a niche, or expand their offerings and global reach.

Only six UK law firms, including DWF, have ever successfully completed a public float. In June, London firm Mishcon de Reya put its own IPO plans on hold.

FRIDAY 9 DECEMBER 2022 ISSUE 3,906 CITYAM.COM FREE INSIDE STARMER PITCHES TO THE CITY P2 WATER COMPANIES SLAMMED –AGAIN P3 FRASERS DIPS P6 BASEBALL LOOKS TO STRIKE IN LONDON P9 MARKETS P10 OPINION P12

ILARIA GRASSO MACOLA

‘EDINBURGH REFORMS’ TO REWRITE SQUARE MILE RULES HEATH-ROW Airlines hit back at regulator price cap decision LONDON’S BUSINESS NEWSPAPER ONCE MORE UNTO THE BREACH... ENGLAND SET OUT TO QUIETEN FRANCEAND ADVANCE TO SEMI-FINALS P18

STANDING UP FOR THE CITY

Edinburgh Reforms can put some more power in country’s engine

IT MAY be a transparent nod to the geographical spread of the UK’s financial services industry, but the fact the chancellor is delivering his thesis on the country’s post-Brexit regulatory regime north of the border is worth noting. The phrase Big Bang 2.0 has been ditched –it’s now the Edinburgh Reforms –but the potential for a regulatory rewrite to unleash growth across the country is not to be sniffed at. By the end of the year we’ll have a

THE CITY VIEW

sense of just how transformative these reforms will be, once lawyers and regulators have a chance to offer their view of the details. No doubt many will claim that this deregulatory initiative does not go far enough. It’s worth remembering however

that the first ‘Big Bang’ was not exclusively a question of deregulation –it was about a smarter rulebook, not necessarily a smaller one, and a host of other factors from the ripping up of old school ties to the rapid digitalisation and technological advances of financial services, as the journalist Iain Martin has written engagingly in his book Crash, Bang, Wallop. In truth –in a more interconnected financial world

than we saw even as recently as the 1980s –the City needs not a revolution but an evolution. Where the UK is to differ dramatically from other regimes, it should do so in such a way that the benefits are so apparent as to negate the potential downsides of difficulties around regulatory alignment. That is not an argument for the status quo –far from it –but it is a call to focus on the obvious wins rather than trying to rip up the entire thing

to make a point.

The chancellor is in Edinburgh because he cannot be seen to deliver a speech to the City about the City, especially when the City’s myriad critics need little opportunity to launch attacks on imagined cronyism. But as the engine of the country’s growth, it is the City that Hunt and Rishi Sunak are relying on to drive economic growth. A more intelligent rulebook will put some more power under the bonnet.

BT has deployed drones to catch criminals stealing broadband cables after a surge in copper prices following Russia’s invasion of Ukraine. It reported 360 metal thefts to the police this year, with 188km of cable pulled out.

FINANCIAL TIMES

WARRINGTON £202M LOAN WENT TO MATT MOULDING

Warrington Borough Council approved a £202m loan facility to entrepreneur Matt Moulding shortly after producing an internal report that erroneously said that the money was going to his ecommerce company THG.

THE GUARDIAN

PUBS AND RESTAURANTS TO BE HIT BY RAIL STRIKES

Hotels, restaurants and pubs expect more than a third of their bookings to be cancelled this month as the threat of rail strikes during the Christmas party period hits trade. UKHospitality said it will cost around £1.5bn in lost sales.

Starmer promises not to hike bank taxes if elected

departmental spending.

SIR KEIR Starmer has promised not to carry out a tax raid on the banks if he is made Prime Minister as he continues his electoral pitch to the City.

The Labour leader yesterday said he would not slap a windfall tax on City financial services firms or hike the banking surcharge during Labour’s business conference in Canary Wharf.

Starmer said he was committed to fiscal discipline during his speech and maintained that a future Labour government would not increase government borrowing for day-to-day

A minister told City A.M. that Starmer’s comments on banking taxes yesterday were “hypocritical”.

The government moved to cut the bank surcharge – an extra tax on banking profits – from eight to three per cent last month to partially offset the incoming Corporation Tax rise.

Shadow chancellor Rachel Reeves previously railed against the move, however Starmer ruled out a potential reversal of the policy if Labour wins the next election.

When asked by City A.M. whether he could rule out any plans to “soak the

banks” and hike their taxes, Starmer said: “Yes.”

He added: “Very, very clear fiscal rules have been in place for us now for 14, 15 months. We will ensure they are in place and adhered to the moment we get into government.”

Around 350 business figures attended yesterday’s event, which saw executives from Aviva and HSBC give short addresses.

It comes amid Starmer and Reeves’ so-called “salmon and scrambled eggs offensive”, which has seen the pair meet hundreds of City bosses over the past year.

CITYAM.COM 02 FRIDAY 9 DECEMBER 2022 NEWS

STEFAN BOSCIA

as PM in his pitch to the City

WHAT THE OTHER PAPERS SAY THIS MORNING

FEELING PAWLY Dog walkers brave the cold weather as they stroll across the scenic cricket pitches at South Norwood Lake and Grounds in Croydon in sunny South London

THE DAILY TELEGRAPH

BT DEPLOYS A FLEET OF DRONES TO CATCH THIEVES

Starmer said Labour would not increase borrowing to pay for day-to-day spending

GRETEL ENSIGNIA

Cumbrian coal mine generates mixed response

NICHOLAS EARL

THE GOVERNMENT’s decision to approve a new coal mine in Cumbria has divided experts, politicians and industry groups, as the UK looks to balance its environmental goals with secure supplies of essential materials.

Downing Street has granted permission to West Cumbria Mining to build and operate the first new deep domestic coal mine in over 30 years.

Levelling up secretary Michael Gove green-lit the Whitehaven site yesterday, in line with approval from the independent planning inspectorate earlier this year.

The proposed coal mine in Cumbria will dig up coking coal for steel production in the UK and across the world.

This will be used for steel production, rather than as an energy source.

The mine’s approval comes after the decision was delayed three times by Downing Street, amid sustained political volatility,

Analysis from environmental think tank Green Alliance reveals the mine would produce the same emissions as 200,000 cars each year.

The Climate Change Committee has separately calculated that 85 per cent of the coal from the proposed mine is planned for export to Europe rather than being used in the UK.

The local council has granted permission to dig for coking coal until 2049, with the mine expected to create about 500 jobs.

Andy Mayer, energy analyst at free market think tank the Institute of Economic Affairs, backed the government’s decision.

He argued the mine would be more environmentally friendly than relying on overseas imports and would boost the West’s energy independence by providing supplies across Europe.

He said: “This mine will produce coking coal for blast furnaces of the European steel industry until 2049. It will create over 500 jobs directly and over 1,000 indirectly.

“The proposition is climate neutral or positive, displacing coal produced elsewhere under less stringent environmental controls. It will not delay the transition of the steel industry to electrification, but support the industrial growth required to fund that change.”

Poor performance now the ‘norm’ for water companies, says Ofwat

NICHOLAS EARL

SERIOUS pollution incidents have increased this year, Ofwat revealed yesterday in a collection of highly critical reports on the performance of the water industry this year. The watchdog described poor performance as “the norm” for some water companies, and named five suppliers as the worst

performing companies operationally.

This included Northumbrian Water, Southern Water, South West Water, Thames Water, Welsh Water and Yorkshire Water.

Ofwat required these companies to return almost £120m to customers last month for failing to reach agreed performance targets around customer service and sewage leaks.

Despite noting improvements

across the industry, Ofwat said it was still “deeply concerned”.

The companies are now being required to explain what has led to their poor performance, and present a clear action plan to amend it.

The body also said most companies had not managed to clearly explain the link between the dividends paid to shareholders and performance for customers.

BRITISH American Tobacco’s boss yesterday said the group is on track to hit £5bn in revenue by 2025 despite the tobacco industry shrinking. The firm had thought tobacco volumes would slip even further than they did, spurred on by Covid-19. But there’s been more demand in emerging markets, the group said yesterday.

Google appoints former Unilever top brass as UK managing director

JACK MENDEL

GOOGLE has appointed the former top brass at Unilever as its new managing director for the UK and Ireland.

American tech leader and entrepreneur Debbie Weinstein will look after the technology giant’s business in Britain from March 2023.

“The UK is a tech powerhouse and I look forward to playing a part in helping people and businesses make the most of the digital economy,” she said.

Weinstein, who said it feels like “coming home”, will take over from Ronan Harris, who joined the company as MD for UK and Ireland in February.

She has been promoted from a role as vice president of global advertiser solutions for Google and Youtube, and before that was vice president of global media at Unilever.

Weinstein started her career as an investment banker at Goldman Sachs, and has previously worked for Viacom, MTV Networks, and Bolt.com.

03 FRIDAY 9 DECEMBER 2022 NEWS CITYAM.COM

SMOKIN’ British American Tobacco expects revenue boom as it doubles down on vaping

‘Web 3.0’ venture investment in freefall as crypto winter grips market

CHARLIE CONCHIE

CHARLIE CONCHIE

INVESTMENT into digital asset firms has been in freefall this year as a deep ‘crypto winter’ sends shockwaves through the sector and causes venture capital firms to turn off the funding taps.

Crypto and so-called ‘Web 3.0’ firms have attracted just $2.2bn (£1.8bn) worth of investment in the fourth quarter of the year so far, down from $4.6bn in the previous quarter and a far-cry from the

$11.5bn in the first three months of the year, according to the crypto report from investment data firm Pitchbook.

The slowdown comes as the sector is rocked by a plunge in crypto prices and a string of high-profile bankruptcies including Sam Bankman-Fried’s exchange FTX.

Analysts at Pitchbook said that while 2021 had been a breakout year for funding the sector, 2022 had seen investment go into reverse.

“While the amount of capital

Analysts warn disruptor Wise set for new fight

lysts said, but there was a risk the “disruptor gets disrupted”.

invested trended upwards each quarter in 2021, in 2022, it has been the exact opposite,” the analysts said.

“Only $4bn was invested in [the third quarter] of 2022, representing a 38.3 per cent quarter on quarter decline and the lowest amount since [the second quarter] of 2021,” the report found.”

Just 141 deals were struck during the third quarter of the year – the lowest levels since the final quarter of 2020.

SHARES in fintech firm Wise wobbled briefly yesterday after a note from investment bank Liberum told investors to dump the stock over mounting competition fears.

Wise, known for its rapid cross-border money transfer service, has enjoyed a boom in profits this year as record numbers of customers poured onto its platform in the past quarter.

But Liberum analysts yesterday downgraded the firm and told investors it will suffer from new players muscling their way into the sector and increasing competition as it grows its banking offer.

“As Wise expands from its core international transfer business into international banking while extending its product and services offering, the competition it faces increases,” the analysts said.

“The expanding competitor set includes other money transfer businesses (Western Union, Moneygram, Remitly, Xoom, Equals etc.) as well as neo banks (e.g. Bunq), super apps (e.g. Revolut), expense management startups (e.g. Pleo) and incumbent banks.”

Wise was a “great business”, the ana-

The warning from the Liberum analysts came despite the fintech firm notching a surge in pre-tax profits in the first half of the year.

The firm said profits rocketed 173 per cent to £51.3m in the six months to the end of September after 5.5m people used its services in the second quarter – a 40 per cent increase on the previous year.

However, the numbers came amid a turbulent few months for the Londonbased fintech in which bumper profits have been overshadowed by a probe from the FCA into the firm’s chief Kristo Kaarmann over a 2017 tax dodging scandal.

Kaarmann, who founded the firm and still has a stake of around 18 per cent, is currently under investigation from the watchdog to determine whether he is a ‘fit and proper’ person to be running the company.

Wise’s Abu Dhabi subsidiary has also been slapped with a $360,000 fine this year after the Abu Dhabi regulator deemed it had failed to “establish and maintain adequate” money laundering systems.

Wise was contacted for comment.

Average monthly rent now £117 higher than a year ago: Zoopla

VICKY SHAW

VICKY SHAW

THE AVERAGE rent for a new letting has jumped by £117 per month since last year, according to a property website.

This has pushed the typical rent to £1,078 per month, Zoopla said.

The website said this equates to 35 per cent of the average income of a single earner – the highest level in more than a decade.

Rents have been rising particularly sharply in cities such as London, Manchester, Birmingham, Glasgow,

Purplebricks shareholder seeks to boot chairman again as losses widen

MILLIE TURNER

PURPLEBRICKS’ losses have widened in the past six months, despite its boss’s turnaround plans.

Revenue dropped 16 per cent to £34.5m in the six months to the end of October, while gross profit plunged more than a third to £16.2m, the firm revealed yesterday. Operating losses also grew by five per cent to £11.7m.

But CEO Helena Marston assured that the turnaround plan was “being delivered at pace, with the financial benefits starting to come through”.

Purplebricks shareholder Lecram Holdings took the lagging financials as an opportunity to once again attempt to oust its chairman and replace with Harry Douglas Hill, the founder of online property site Rightmove.

“We are entering one of the worst housing market conditions in a generation, yet the leadership seems to have an overly optimistic view of prospects. Shareholders can’t afford to wait any longer while this business runs out of money, they need to act and act quickly to change the chairman if there is any hope of salvaging value for all investors,” Lecram said yesterday.

Bristol and Sheffield over the past year, Zoopla added.

These cities are seeing demand exceed supply, being major employment centres with large student populations, it said.

The report said there has been a modest increase in rental supply in recent weeks, as the house sales market has weakened.

“A chronic lack of supply is behind the rapid growth in rents which are increasingly unaffordable for the nation’s renters,” Richard Donnell, executive director at Zoopla, said.

Meta changes plans for new Dublin staff HQ

EMILY HAWKINS

FACEBOOK owner Meta is making changes to its plans for its European headquarters building in Dublin after laying off thousands of staff.

In the latest installment of a torrid time for tech, the social media giant is renting out all of its 375,000 sq ft site, the Irish Times reported yesterday.

It had taken out a 25 year lease on the building.

However, Meta said it was “firmly committed to the UK and Ireland” and just subletting the final phase of its Ballsbridge campus –not the full campus. It said it was “making focused, balanced investments” for the long term.

London was also not immune from the side effects of the firm laying off 11,000 people earlier this autumn. Meta will shrink its office space, with reports that it will be renting the whole of a new office in Triton Square. However, other offices in the capital, such as its main UK headquarters in King’s Cross, are seemingly unaffected.

Last month, chief exec Mark Zuckerberg said he would be reducing the global headcount by 13 per cent, regarding it as “some of the most difficult changes we’ve made in Meta’s history”.

The Silicon Valley behemoth, which also owns Instagram and Whatsapp, opened its swanky new office at Kings Cross this year.

BALFOUR Beatty yesterday said it was five per cent ahead of 2021’s £16.1bn in terms of its order book. The firm said its results were helped by major construction projects such as SCAPE Civil Engineering frameworks in the UK, worth almost £4bn. Shares closed up.

CITYAM.COM 04 FRIDAY 9 DECEMBER 2022 NEWS

CHARLIE CONCHIE

Zoopla said the typical rent was 35 per cent of the average income of a single earner

GROUNDED Branson’s UK space launch delayed 24 hours after given go-ahead

BUILD UP Shares in construction giant Balfour Beatty were up on strong profits

THE FIRST space launch from British soil was postponed yesterday. The launch was scheduled for 14 December, but has been pushed back because the regulator had refused to grant an operating licence, Virgin Orbit said. But the watchdog hit back, saying instead there were technical issues to be resolved prior to launch.

PA

In The Style owners mulls sale as founder returns to head fashion firm

EMILY HAWKINS

EMILY HAWKINS

A SALE of fashion firm In The Style is being considered while the retailer’s founder will return to head the firm next year.

Investment bankers at Lincoln International have been hired to assist with a strategic review of the firm, which may result in a sale of the firm or some of its assets.

The online fashion retailer booked a loss before tax of £3.1m in interim results published yesterday,

admitting that “consumer sentiment remains uncertain”.

It had posted a £0.9m profit in the same period last year.

Bosses also said they felt there had been “limited liquidity” for shareholders “for some time”.

The firm’s current market capitalisation does “not properly reflect the underlying growth potential of the group which may be better realised under an alternative ownership structure,” a statement on the London Stock Exchange said.

Frasers shares slump despite uptick in profit

inflation, all while shoppers themselves feel the pinch.

However, the London-listed retailer stressed it was not in talks with any suitors and had not been approached with any offers.

Sam Perkins will step down as chief executive officer at the end of this year, paving the way for Adam Frisby, who founded the women’sfocused brand in 2013, to make a return on a temporary basis.

Shares have fallen more than 86 per cent in the past year to date, after its AIM market debut in 2021. They closed slightly up yesterday.

SPORTS DIRECT owner Frasers Group was the biggest faller on the FTSE 100 yesterday despite posting a leap in profit and backing its full-year expectations.

The House of Fraser owner yesterday said it was confident in existing guidance for adjusted profit before tax of between £450m to £500m for this financial year.

The retail titan posted a 53 per cent leap in reported profit before tax, raking in £284.6m for the first-half of the year. It pointed to a disposal of £91.2m in property assets and £26.3m in US retail businesses.

Under the new helm of Michael Murray – former chief Mike Ashley’s son-inlaw – the company has snagged acquisitions including fast fashion brands Missguided and I Saw It First.

It also recently completed a takeover of iconic Savile Row tailor Gieves & Hawkes.

High streets are facing a tough winter ahead as retailers grapple with rising cost input

Frasers described the macroeconomic environment as “clearly challenging”, adding that the coming year was “hard to predict with any certainty”.

Group sales surged almost 13 per cent to £2.64bn, with the retailer thanking acquisitions, new stores for its more premium Flannels brand and continued growth online for the uptick.

However, its gross margins were slashed after the closure of some House of Fraser store closures, cost of goods inflation and its acquisition of Studio Retail.

A so-called elevation strategy spearheaded by Murray was “clearly paying off” after the company has diversified its portfolio to include more e-commerce and premium retailers, Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown said. However, a “note of uncertainty” had caused shares to tumble, she said. Shares in the company dipped 8.99 per cent yesterday afternoon, after sales slightly missed analyst expectations.

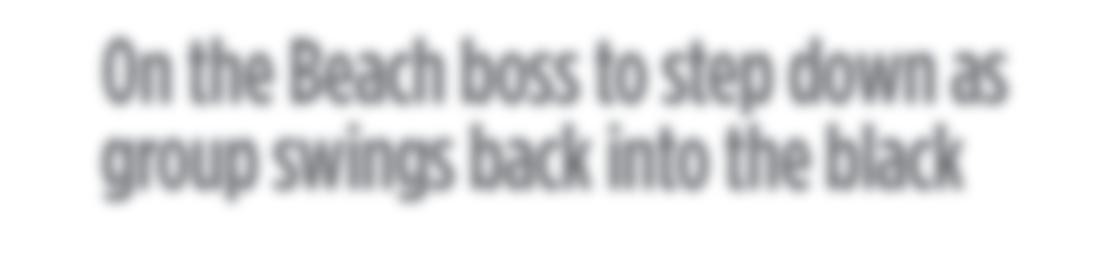

On the Beach boss to step down as group swings back into the black

ON THE Beach’s boss Simon Cooper is set to step down just as the group returns to profit for the first time since the pandemic hit.

Cooper, who founded the beach holiday retailer in 2004, will leave within the next year and will be replaced by the firm’s current chief financial officer Shaun Morton.

The outgoing chief executive will remain on the board, taking up the role

Ryanair: O’Leary’s contract extended to 2028 with

bonus on cards

ILARIA GRASSO MACOLA

RYANAIR’s boss has seen his contract extended until July 2028, in a deal that could make him an extra €100m (£86.3m).

Chairman Stan McCarthy said late on Wednesday the extension was reached following “extensive engagement with large shareholders

and proxy advisors,” but will still be subjected to shareholder approval.

As part of his 2019 package, Michael O’Leary was given the option of buying 10m Ryanair shares at around €11 per share if he increased the company’s annual profit after tax to €2bn – or €21 per share. This would have led to a €100m bonus.

The 2019 terms have now been

extended to the summer of 2028 and are dependent on the chief executive reaching a €2.2bn profit target.

“If these targets are not achieved then these share options will lapse and Michael O’Leary will receive nothing other than his basic salary,” the carrier said in a statement.

Ryanair’s shares were up 0.73 per cent yesterday afternoon.

“I am delighted that Shaun has agreed to succeed Simon as CEO of On the Beach,” said chairman Richard Pennicook.

“Shaun’s diligent approach to the group’s finances through the pandemic has ensured we exited Covid with a strong balance sheet and this stands us in good stead as we look to the next growth phase,” he added.

Cooper’s exit comes after On The Beach

last year’s loss of £18.4m.

Despite coming slightly lower than prepandemic figures, revenue soared by 78.8 per cent to £144.3m as the average value of bookings was 31 per cent higher than 2019.

Looking forward, despite ongoing macroeconomic headwinds, On the Beach said it had started the new financial year “with a healthy forward order book for summer 2023”.

CITYAM.COM 06 FRIDAY 9 DECEMBER 2022 NEWS

EMILY HAWKINS

The chief executive has said several times he is not looking to retire anytime soon

€100m

Shares in the group have plummeted by almost 90 per cent in the last year

CEO Murray has made a number of acquisitions

Wonks demand clarity for UK’s wind ambitions

EXCLUSIVE NICHOLAS EARL

ENERGY experts have urged the government to reveal more details about its proposed consultation to revive onshore wind.

Downing Street announced earlier this week it will launch a technical consultation to explore how local authorities can demonstrate support for projects.

It has also proposed overhauling national planning rules to remove rigid requirements for councils to designate specific land for renewable developments in local plans – with any potential decisions expected to be announced by April 2023.

However, until it determines how local support will be established, analysts believe it is unclear whether the government is providing a pathway for boosting onshore wind developments.

Adam Bell, head of policy at Stonehaven, noted the current de-facto ban onshore wind faces was also built on the premise of establishing local support for new projects.

He told City A.M.: “It does mean we are alas waiting for detail, unfortunately! My worry is that the very vague requirement for local support could end up repeating the mistakes of the mid 2010s in a new guise. We will be looking to see what the government comes out with.”

Andy Mayer, energy analyst at the Institute of Economic Affairs, noted that the government’s latest position on onshore wind is the consequence of political pressure rather than policymaking.

Mayer said: “People shouldn’t get too excited, reacting to political pressure rather than creating a functioning competitive market to facilitate a low carbon transition is how the ban arose in the first place.”

PRICE

CMA slaps BMW with £30,000 fine

ILARIA GRASSO MACOLA

ILARIA GRASSO MACOLA

THE COMPETITION and Markets Authority (CMA) yesterday slapped BMW with a £30,000 fine for not complying with an information request.

The watchdog, which also added a daily penalty of £15,000, believes the German marque is withholding information regarding a probe from earlier this year. Launched in March, the investigation focused on

Trafigura gives £1.4bn to shareholders after unveiling monster £5.7bn profit

NICHOLAS EARL

NICHOLAS EARL

TRAFIGURA will hand over £1.4bn ($1.7bn) to traders and shareholders after its net profit more than doubled from last year’s record levels, powered by Russia’s invasion of Ukraine and the escalating energy crisis.

The Swiss-based commodities trading company announced yesterday that net profit had soared

to £5.7bn ($7bn) for the year ending in September.

The monster earnings are more than the previous four years combined, with market volatility and investor uncertainty driving gas prices to record highs and oil prices to 14-year peaks within the past 12 months.

The £1.4bn payout reflects how trading houses have been one of the

big winners from the energy crisis, benefitting Trafigura’s 1,100 shareholders which are mainly made up of executives and traders at the privately held firm.

Trafigura has established itself as a profitable organisation through shifting raw materials around the globe, with assets ranging from mines and ports to energy infrastructure across more than 150 countries.

suspected anti-competitive practices related to the recycling of old and written-off vehicles.

“The CMA believes that important aspects of the suspected conduct were agreed outside the UK and implemented in the UK,” it said in a statement.

According to the regulator, BMW “failed to comply fully” with its legal request, claiming the CMA doesn’t have jurisdiction – an argument that was rejected by the watchdog.

Tullow names Miller as new permanent CFO

NICHOLAS EARL

TULLOW Oil has appointed interim chief financial officer Richard Miller to the position permanently and named him as an executive director.

Miller is currently interim chief financial officer and group financial controller at the FTSE 250 company, which focuses on projects in Africa and South America.

He will begin his new roles at the start of next year.

Miller has been with Tullow for over 11 years, and has previously led the Tullow Finance team, supporting a number of acquisitions, disposals and capital markets transactions.

He also played a significant role in the continued turnaround of Tullow with the rebasing of its cost structure, the resetting of the balance sheet and the change to a more focused capital allocation.

Miller first joined Tullow from Ernst and Young where he worked in the audit and assurance practice.

Phuthuma Nhleko, chairman of Tullow Oil, commented yesterday: “I would like to warmly welcome Richard to the Board and look forward to working with him and Rahul in the years ahead.”

07 FRIDAY 9 DECEMBER 2022 NEWS CITYAM.COM

Trafigura will hand £1.4bn to traders and shareholders after unveiling a £5.7bn profit

ASDA

Supermarket challenges rivals with cost-cutting for petrol at the pumps

ASDA HAS slashed petrol prices at the pumps over the past two days, opening up the possibility of a price war with its supermarket rivals. This follows the Competition and Markets Authority’s (CMA) decision earlier this week to deepen its probe into fuel retailers. Motoring group RAC has since reported that Asda has shaved 4.5p per litre off the cost of unleaded petrol and 5.5p off diesel across its 320 sites nationwide.

City brokers hit with fines from FCA over market abuse control failings

CHARLIE CONCHIE

THE UK’s financial watchdog yesterday announced it had slapped three City brokers with £4.7m fines for failing to roll out proper risk controls.

In a statement, the Financial Conduct Authority said it had fined inter-dealer brokers BGC, GFI Brokers and GFI Securities for failing to ensure they had “appropriate controls to detect market abuse”.

“Between July 2016 and January

2018, BGC/GFI had manual, automatic and communications surveillance processes that were deficient, and therefore, inadequate in properly addressing the risk of market abuse,” the FCA said.

“Additionally, BGC/GFI’s systems for monitoring market abuse did not have proper coverage of all asset classes which are subject to MAR.”

The failings meant that both BGC and GFI breached Article 16 of market abuse regulation and Principle 3 of the FCA’s Principles

DS Smith put up £100m to handle pension crisis

as of the end of October “remained in place but was undrawn”.

for Businesses.

The FCA’s Mark Steward, executive director of enforcement and market oversight, said gaps in a firm’s ability to monitor and detect abusive trading “poses direct risks to market integrity”.

BGC and GFI had agreed to resolve the case at an early stage in return for a 30 per cent discount, without which the fine would have hit £6.8m.

The watchdog said in the statement that the two City firms had since upgraded their systems.

BOX MAKER DS Smith revealed it was forced to pump £100m into its pension scheme in September as the market was shaken by the fallout of Liz Truss’s disastrous mini-budget.

Pension funds deploying so-called liability driven investment (LDI) strategies were rocked as yields on government bonds soared, amid concerns over the scale of uncosted tax cuts and borrowing announced by Truss and Chancellor Kwasi Kwarteng. DS Smith, which yesterday said revenues had jumped 28 per cent in the first half of the year, said it had been forced to set aside a chunk of cash to support its pension scheme in the wake of the crisis.

“In response to the market turmoil following the UK ‘mini- budget’ in September 2022, the group made funding support of up to £100m to the main UK defined benefit pension scheme,” the firm said in its half year results.

“This took the form initially of a cash advance in anticipation of potential margin calls and latterly a liquidity facility.”

The firm said the funding was “fully repaid within days of being made” and

The size of the contribution from the packaging firm underscores the strain placed on the sector, as highly-leveraged LDI funds were hit by hefty margin calls from their counterparties.

Scores of corporate sponsors were forced to stump up cash amid the worst days of the crisis in anticipation of a cash squeeze. Experts told City A.M. the move helped shore up funds and avoid an emergency sell-off of assets.

“It was simply to avoid a situation where pension schemes had to fire sale other assets – particularly illiquid assets,” Raj Mody, global head of pensions at PwC, told City A.M

“But it might also have been that funds didn’t want to sell at a time and at a price they didn’t want to sell at.”

The industry has been deep-diving into the LDI crisis in recent weeks in a bid to understand how highly-leveraged LDI strategies were allowed to proliferate under the nose of regulators.

A select committee hearing heard last month that the crisis had caused “around £500bn” in assets to disappear as firms shed their assets to boost liquidity.

Hargreaves appoints Dan Olley as new chief executive officer

CHARLIE CONCHIE

HARGREAVES Lansdown (HL) yesterday announced that Dan Olley would take over the reins of the trading platform from next year as Chris Hill prepares to step down after six years in charge.

The retail investment firm said that Hill, who announced he would step down in October, will remain in his role until November next year to ensure an “orderly transition” between the two chiefs.

Olley has been on Hargreaves’ board as a non-executive director since June

2019 and currently heads up analytics firm Dunnhumby, where he was appointed CEO in January this year.

Chair Deanna Oppenheimer said she was “delighted” Olley was taking on the role.

While the investment platform saw its assets soar during the pandemic, Hargreaves Lansdown and its peers are now facing up to a slide in their assets as investors grow more cautious and the ripples of war in Ukraine shake markets.

Shares bounced around two per cent on the news yesterday.

Silver Circle law firm ups office requirements

LOUIS GOSS

TRAVERS Smith has become the latest City law firm to call lawyers back into the office after telling staff to spend 60 per cent of their time at work.

The law firm’s new “agile working” policy calls on Travers Smith’s lawyers to come into the office for six days across every two working weeks.

Lawyers at Travers Smith had previously been required to come in 50 per cent of the time, for five days out of every two working weeks.

In a bid to ensure juniors get faceto-face training, the Silver Circle firm is also calling on its paralegals, trainees, and new joiners to come in four days a week, the law firm told City A.M.

The calls follow Travers Smith’s summer review of its hybrid working policy, after it put in place a formal work-from-home policy in the wake of Covid-19.

Travers Smith’s new mandate comes after Magic Circle law firm Freshfields Bruckhaus Deringer upped its requirements in calling for lawyers to spend three days a week in the office, having previously let its staff work half of their time from home.

Keystone Law founder James Knight told City A.M. this summer that a downturn in the UK economy could put greater pressure to work from the office.

Former Theranos chief sentenced to 13 years in prison over fraud charges

MILLIE TURNER

THE FORMER president of Theranos was sentenced to nearly 13 years in prison for defrauding investors and patients before the defunct healthtech firm’s collapse.

Ramesh “Sunny” Balwani, the former chief operating officer of the blood testing group, faces a longer jail

term than founder and former girlfriend Elizabeth Holmes.

The 155-month prison sentence for Balwani, 57, was granted over his role in deceiving investors into believing Theranos had successfully created machines that could accurately run a broad array of medical diagnostic tests from a tiny amount of blood. Holmes, 38, was sentenced to 135

months – over 11 years – last month.

With Balwani as Holmes’ top deputy, the pair defrauded investors including Rupert Murdoch on the promise of ‘ground breaking’ blood testing technology.

During her trial, Holmes, accused Balwani of manipulating her through years of emotional and sexual abuse, allegations his lawyer has denied.

CITYAM.COM 08 FRIDAY 9 DECEMBER 2022 NEWS

CHARLIE CONCHIE

Olley, who currently heads up Dunnhumby, has been on Hargreaves’ board since June

Former Theranos president Ramesh Balwani faces a 155 month prison sentence

City brokers BGC, GFI Brokers and GFI securities were all hit with FCA fines

TIME FOR LONDON TO PLAY BALL

Once a fortnight during the football season, the Emirates Stadium fills up with 60,000 committed Arsenal fans cheering on the Gunners. Online, millions of supporters across the world tune in for highlights and videos - with more to shout about this year than most.

One could imagine that Ben Ladkin, who spent 11 years masterminding content at the north London powerhouse, was happy with his lot. But he finds himself now with a new challenge - bringing baseball to a new British audience as managing director of MLB Europe.

“What was really interesting about MLB was this challenge that we don’t automatically get the eyeballs. We have to work quite hard to get that attention,” he tells me. Signs of what he means are all around us - from a fairly nondescript staircase in an office building near Oxford Circus, we’ve

emerged into a flashy MLB ‘locker room’, with jerseys, caps, memorabilia and even a games console. Part of what the brains behind baseball’s UK invasion are trying to do is make the link between some of the world’s biggest brands - who doesn’t know what a Yankees cap looks like? - and the sport that spawned them. To that end they invite influencers up to try on the merch themselves, spreading the message to their follow-

“We have to do things a bit differently.”

Ladkin has his hands full: in seven months, Major League Baseball will return

to the capital for the first time since 2019, with two regular season games between Midwest rivals the Chicago Cubs and the St. Louis Cardinals. The series had been planned for 2020, a year after the Yankees and the Red Sox made the first trans-Atlantic leap. Ladkin’s pleased that - at least according to ticket sales - the momentum hasn’t dried up.

“It’s stored up demand. We saw real enthusiasm (when we announced the teams) and now we’ve got games confirmed for 2023, 2024 and then 2026, we’ll have that momentum” going forward.

Baseball is a difficult sell in the UKin a crowded sports market, Ladkin’s challenge is cutting through the noise. Ticket sales are going swimmingly, but the challenge for Ladkin - and for his

Discount at the disco: Hipgnosis boss bemoans firm’s flagging share price

CITY A.M. REPORTER

THE MUSIC impresario behind the Hipgnosis songs fund –which has bought up back catalogues from a host of major artists –bemoaned his outfit’s lagging share price in a market update yesterday.

“I share the disappointment of shareholders that the true value of

our iconic songs is not being reflected in today’s share price,” Merck Mercuriadis said in a statement yesterday, saying the fund was being valued at a 12 per cent discount rate –“a deep discount compared to multiples currently being paid in the market”.

Mercuriadis’ complaints appeared to garner something of a positive

response, with the share price jumping around three per cent by the close.

The fund, which has spent millions of dollars buying up music from artists including Mariah Carey and Barry Manilow, showed royalties jumping 4.2 per cent and overall gross revenue up 7.5 per cent compared to last year.

bosses in New York - is turning a soldout weekend into a lasting legacy for the sport here.

“What we look to do is what’s unique about baseball. It’s got rich history, but there’s also a real connection with the cities that they play in - the Yankees are a great example of that. So what we’ll do is play off the cities, the culture, the ballpark experience,” he says. Followers of MLB’s various social channels will have seen London-based chefs visiting St Louis and Chicago for an insight into the ballpark food of both cities (think deep dish pizzas and pulled pork) as part of a series called Home Plate.

It’s all part of what Ladkin thinks not just baseball but all sports need to do to keep audiences invested and engaged.

“You’ve got to give people the content how they want it, in the way they want

it,” Ladkin says, in response to a question about whether or not a world of short attention spans can sit neatly alongside a sport that can at times drag its feet. It’s not a problem unique to baseball - even football bosses have complained about the difficulty of getting people to watch a 90-minute football game - but Ladkin remains optimistic.

“You have to give people content that’s short and snappy, that’s entertaining, and that’s on (social media) platforms. Hopefully then you can draw them in to the longer-form.”

Major League Baseball is certainly committed in the longer-term. Perhaps encouraged by the success of the NFL in bringing American football to the UK, League bosses seem invested in London’s success. Ladkin may have to work harder to get those eyeballs, but all signs suggest they’ll be at least 120,000 pairs of them at the converted London Stadium next summer - and who knows where baseball in the UK might go from there.

09 FRIDAY 9 DECEMBER 2022 NEWS CITYAM.COM

Hipgnosis has spent millions on the catalogues of older rockers

Baseball is big business - and Europe boss Ben Ladkin tells Andy Silvester why the capital is the sport’s next frontier

Ben Ladkin joined MLB from Arsenal Football Club

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

FTSE dogged down by Ashley’s Frasers Group on spending warning

LONDON’s FTSE 100 was yesterday dogged down by retail tycoon Mike Ashley’s Frasers Group sinking to the bottom of the index.

The collection of the capital’s top companies dropped 0.23 per cent to 7,472.17 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell 0.56 per cent to 18,824.01 points.

In results out yesterday, Frasers missed revenue expectations and warned the outlook for its collection of fashion firms was uncertain due to fears of a spending pull back amid the cost of living crunch.

That warning sent its shares nearly nine per cent lower and to the bottom of the FTSE 100 last night.

Analysts said some of its companies such as upmarket fashion brand Flan-

nels showed Brits are still keen to update their wardrobes.

“There are still deep pockets of resilience in the fashion retail sector, as shoppers’ spending holds up, particularly on ranges viewed as offering value. But despite its strong record the company is still unlikely to be immune to the recessionary headwinds whipping up,” Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said. Pub giant and All Bar One owner Mitchells and Butlers dropped to the depths of the FTSE 250 yesterday, losing more than 10 per cent despite earlier this week posting a solid set of results.

The pound strengthened around 0.6 per cent against the US dollar, while UK borrowing costs nudged higher ahead of what is expected to be a 50 basis point interest rate rise next Thursday.

CITY MOVES WHO’S SWITCHING JOBS

WILMERHALE

Law firm Wilmerhale has built out its London-based whitecollar defence and investigations practice with a new partner.

Richard Burger, a former enforcement lawyer and prosecutor at the Financial Conduct Authority’s predecessor the FSA, brings experience co-heading practices within his 25-year career.

Infrastructure company Balfour Beatty, which built the London Aquatics Centre, is in an “ideal position” to deliver growth over the medium term, according to analysts at Peel Hunt, who said the construction firm’s shares remain “materially undervalued” given the company’s market position. Peel Hunt’s analysts gave Balfour Beatty a Buy rating with a price target of 400p.

THE BEACH

A boom in demand for 5* holidays should offset a drop in demand for 3* ones, according to analysts at Peel Hunt, who said shares in package holiday seller On the Beach are still worth buying, after sales of value holidays fell 18 per cent as sales of luxury ones jumped 82 per cent. Peel Hunt’s analysts gave On the Beach a Buy rating with a price target of 300p.

COLD SETS IN

Starting in January, Burger will advise corporates and senior executives in their defence of regulatory investigations and prosecutions, as well as on close supervisory enquiries and non-financial misconduct.

“Richard is a first-rate lawyer, whose extensive regulatory and investigations experience complements our existing market-leading transatlantic capabilities,” partner and head of the practice, Stephen Pollard, said.

OSBORNE CLARKE

Law firm Osborne Clarke has poached its latest partner from Big Four firm PwC.

Tom Lewis, who brings more than a decades’

experience, is set to lead the corporate structuring and simplifications division.

The incoming partner will focus on corporate structuring in M&A activity, having been a director within PwC’s legal services group for five years.

Lewis is the second partner to join from PwC since last month, following Carol Dick in the pensions team.

“I am excited to see how Tom grows out this part of the business,” partner and head of business transactions, Greg Leyshon, said.

4PB

Family chambers 4PB has found the pair to jointly lead

its chambers at its base in St Pauls.

Joint head of chambers Barbara Mills KC and Charles Hale KC will be taking over from Alex Verdan KC, who has been in the role for over 10 years.

Both are top family silks with expertise in dealing with the most complex cases across family law.

“In the last three years that I have worked with Alex, we have successfully navigated our way through a pandemic,” Furhana Mallick, chambers manager said.

“Through this intense period, Alex had shown incredible leadership... He planted the seeds for us to continue to evolve under the guardianship of Barbara and Charles.”

P 6 Dec 5 Dec 2 Dec 8 Dec BALFOUR BEATTY 8 Dec 337 325 7 Dec 330 335 340 345

To appear in Best of the Brokers, email your research to notes@cityam.com P 8 Dec 119 6 Dec 5 Dec 2 Dec 8 Dec

110 7 Dec 115 120 125 130

ON

To appear in CITYMOVES please email your career updates and pictures to citymoves@cityam.com

“Gas prices have hit their highest levels in two months as wintry temperatures hit Europe. In reality the respite provided by a mild autumn was set up to be short-lived. Relatively limited European storage capacity meant there was always a risk of the continent moving from feast to famine when it comes to gas supplies.”

RUSS MOULD, AJ BELL

CITYAM.COM 10 FRIDAY 9 DECEMBER 2022 MARKETS GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION

EDITED BY SASCHA O’SULLIVAN

A new coal mine in Cumbria won’t save the burning problems for the UK

Elena Siniscalco

Elena Siniscalco

AFTER years of political pingponging, the decision has been made: we’ll have the first new coal mine in thirty years in the UK. It will be located in Whitehaven, in Cumbria, and it’s meant to bring 500 direct jobs to an impoverished area that has often felt forgotten by central government. The indirect jobs in the supply chain could be between a thousand and 1,500, depending on who you ask.

West Cumbria badly needs jobs. The local population is broadly divided between those who work at Sellafieldthe historic nuclear plant - and have quite secure jobs, and those who are on minimum wage salaries or unemployed. Young people look around and all they see is a lack of opportunities. Yesterday, the mood music in West Cumbria was positive. The local mayor, Mike Starkie, said he was “absolutely delighted” at the prospect of hundreds of new jobs. A champion of the mine, he has reiterated his support for the project in every single interview I did with him over the past year.

The first important clarification to be made is that the mine will produce coking coal for steel production, not for power generation. The business case, according to the government, is that demand for this type of coal is

still high.

The final call on the mine was made by Michael Gove, accepting the recommendations of the Planning Inspectorate, which amalgamated years worth of reports on the prospect of a new mine. Good at reading the electorate and his party’s concerns, he was aware he had to satisfy opposing views on the party, between job creation and the environmental impact.

His main argument, to which he came back again and again yesterday in the House of Commons, is that this coal will be produced anyway, so it’s better if we make it here rather than if

China or Russia make it. As we’ve seen, this leaves us beholden to regimes operating outside of our political norms or sphere of influence. The mine, he insisted, is a “net zero compliant project”, although that doesn’t take into account the subsequent burning of coal in the steel-making process.

Around 85 per cent of the coking coal produced is set to be exported to Europe, while 10 to 15 per cent will go into domestic production. Here, the government is betting on an incredibly volatile commodities market. Even if demand for coking coal stays high for the next couple of years, we don’t

know where it will be in ten years’ time. Building a coal mine is a longterm project while coking coal might prove a shorter-term product - and it’s in this time gap that the cracks begin to emerge.

The second core question is how to “level up”, to use jargon favoured by Gove, an area affected by growing poverty and isolation. Campaigners say this should be found in green jobs, as Cumbria’s coastal areas have huge potential in terms of marine and tidal energy. But the considerable investment and effort required for an industry still relatively nascent isn’t a simple fix either. It would require a long-term plan on how to transform the area. The coal mine, from this perspective, is the quick fix. It will create jobs to build and to run. But correcting the errors of successive governments that refused to look local hardship in the eyes won’t be that easy.

How much our international partners will respect us and follow us on our path to a greener future after this decision remains to be seen. Lord Deben, the chairman of the Climate Change Committee, has already warned the mine’s approval would damage our leadership on climate change.

Ultimately, on top of the environmental question, there’s a point to be made about long-term thinking - or the lack thereof - when it comes to local communities. The sentiment behind a push for new local jobs is welcome, but when these jobs expire, we’ll be back at square one. And people in Cumbria will have all the right reasons to be upset at the government, all over again.

Inheritance tax shows just how antiquated our system is and how much we’re losing

BRITAIN is failing to tackle an epidemic of tax fraud, so said the National Audit office last month. In some cases, there is no stopping fraud being committed, but a simpler tax system with fewer arcane rules would surely provide the best incentive for individuals to comply.

For inheritance tax, for example, only a small number of people pay it, but a far greater number of people worry about it. Many only seek advice when a loved one has died but many more require particular assistance with lifetime gifting which is not reported on death.

Rishi Sunak and his chancellor Jeremy Hunt are keen to maintain the current rules. In the Autumn Statement, the nil-rate band will remain at its current level of £325,000 until at least April 2028. This stagnation is not just a question of economics, but a lack of innovative thinking to simplify a system causing distress at a time which, by its nature, is fraught with emotions.

Merry Abbott

Research from the Office of Tax Simplification (OTS) shows that a third of bereaved families spend over 50 hours navigating complicated inheritance tax rules and systems. Penalties for reporting incorrectly can total up to 100 per cent of any tax due and executors bear the burden of payment. Simplification of gift taxes would allow individuals to benefit from the allowances, and it would also ensure that executors are not caught by penalties and tax payments on gifts that were made many years before they had any involvement in an estate.

In particular, the taxation of lifetime gifts is widely misunderstood, admin-

istratively burdensome and will often only be considered on death meaning that proper records have not always been kept. Thirteen per cent of the UK population are “gifters”, meaning they regularly gift amounts of over £1,000 in a tax year.

Often people have heard of some of the rules, but without an overview of all them opportunities can easily be missed, and executors are at risk of non-compliance. Individuals have an annual exemption of £3,000, a small gift allowance of £250, allowances for cash gifts for weddings and if that isn’t enough to give you a headache, these allowances sit on the backdrop of the seven year rule which states that any large gifts, over an individuals’ nil rate band, can potentially become chargeable to inheritance tax. The rules are piecemeal and without advice it is difficult to manoeuvre them.

A recent survey by the OTS showed that most respondents regarded these gift rules as either “complex” or “very complex”. Why not increase the annual

allowance and give a conclusive figure allowed for gifts every year, thereby streamlining the process?

Not only would this provide an equalised allowance for all, but it would also demystify rules and give individuals a chance of correctly applying them. The OTS has already suggested a similar approach but so far, this has been ignored.

Ultimately, the UK tax system remains rooted in 19th century principles. It requires modernisation as well as simplification. But it’s not a priority for government, HMRC’s latest “tax gap” data, which estimates the difference between tax collected and how much tax should have been collected, showed the gap standing at over £32bn. If this tax gap spirals any further out of control, perhaps political pressure will ensure that tax reform does reach the top of the agenda.

INTO A BLACKHOLE

£

Merry Abbott is a private client solicitor in the London office of law firm JMW

CITYAM.COM 12 FRIDAY 9 DECEMBER 2022 OPINION

OPINION

The entrance to Woodhouse Colliery, the former mine in Cumbria

Is where hopes of a British space mission this year are going after the launch of Virgin Orbit, Richard Branson space venture, was delayed. It has been set to launch on December 14, but now will be retargeted “for the coming weeks”. It had initially been set to take off for the Queen’s jubilee.

Building a coal mine is a long-term project, while coking coal might prove a short-term product

LETTERS TO THE EDITOR

Still clinging on to Bitcoin

[Re: Bitcoin ‘on the road to irrelevance’, says ECB, November 30]

Recent comments by the ECB and other banking stakeholders show that many central banks along with the regulators are missing the key point: Bitcoin is already being used to pay for goods while they are still debating whether crypto is an asset class or a currency or a farce.

Right now, regulators aren’t willing to join hands globally to form a strong common regulatory crypto framework. It is literally “to each their own” and we

are seeing the results of that outlook. It was recently reported that over £500m was lost to crypto fraud in the last three years, but Bitcoin didn't lead these scams, the copycats of the Bitcoin concept did.

Global regulators and central banks need to get up to speed on the fact that bitcoin is already being treated as a store of value and users are already using Bitcoin as an investment asset. Deep pocket investors who are in for the long term aren’t really bothered if Bitcoin has arrived at a new low because they know that at some point hysteria will reign and there will be a new high for them to cash out.

Francis Souza ACI Worldwide

A COLD SNAP Freezing temperatures trigger heating dilemmas at home

Britain’s social infrastructure is depleted and we need a blueprint for local success

Tracey Crouch

After weeks of mild weather, the frost has set in with snow forecast in London next week. It means many households who refrained from turning their heating on have acquiesced and flicked on the thermostats.

BRITAIN’S BABY CHALLENGE

The UK is seeing out the perils of an ageing society already. We have a social care system stripped down, which, in turn, is preventing the NHS from functioning as elderly patients stay in hospital beds because of lack of adequate care elsewhere.

And Britain is only set to get older with the average age for women having their first baby at 30.7 years. The risks are a smaller workforce, with less tax receipts, holding up an increasingly larger population reliant on the state. The problem, according to the

women’s health ambassador Professor Dame Lesley Regan, is that people simply don’t know they won’t be fertile forever.

It’s not of course, the out of reach childcare costs, inaccessible housing and uncertainty in a tumultuous economic climate.

For the former president of the Royal College of Obstetricians and Gynaecologists, we need TikTok videos to remind women their fertility drops off steeply at the age of 35 and men at 45.

SASCHA O’SULLIVAN

WHEN Theresa May appointed me as her Minister for Civil Society, I was struck by an enormous sense of purpose. After all, she was the Prime Minister who had entered office promising to tackle the “burning injustices” that are a sad fact of life for so many in the UK – and my role was at the heart of her efforts to deliver on that ambition.

How to define “civil society”, an undeniably vital but slightly nebulous concept? I took it to refer to individuals and organisations when they act with the primary purpose of creating social value, independent of state control. Social value meant enriched lives and that most elusive of goals – a fairer society for all.

By the time we put pen to paper on our Civil Society Strategy, published in 2018, it had become clear that a fairer society must be built upon five foundations of social value: people, places, the social sector, the private sector and the public sector.

We identified that the dormant assets scheme, which has already made hundreds of millions of pounds available to good causes, was a relatively untapped opportunity to direct vital funding towards local community projects, civil society organisations and social enterprises. £135m was allocated to Big Society Capital to be distributed to people who needed it most, and a further £145m was dedicated to tackling youth employment and financial exclusion.

Four years on, some welcome progress has been made but significant gaps remain. In left-behind neighbourhoods from Kent to Cornwall to Cumbria and back again, social capital is depleted. Social infrastructure is fractured. It is high time we created a focal point for the betterment of communities, through initiatives with the potential to transform the lives of local people.

The proceeds of the expanded dormant assets scheme could provide that focal point. Earlier this year the government launched a consultation seeking views on which community projects and other good causes should benefit from another £880m, untouched for 15 years or more, that will be made available in the years ahead. It laid out eight criteria that must be met by any worthy

recipient. The creation of a Community Wealth Fund ticks every box.

Fundamentally, it would channel investment directly to the communities that need it most. Funds would be distributed at the hyper-local level to neighbourhoods suffering from both the highest levels of multiple deprivation and the lowest levels of social infrastructure. The investment would be long-term in nature – patient capital, providing certainty and clarity for communities over decades, rather than months or years.

The evidence suggests that this funding, though relatively small in monetary terms, would be utterly transformational: rebuilding social capital, revitalising civic pride, and altering the community landscape for the better. There would be a local multiplier effect, too, generating £3.2m in economic benefits for every £1m of investment.

To rebuild those vital civic foundations, a Community Wealth Fund would bring together local people, the

public sector and the private sector to restore pride in place and improve residents’ prospects.

The impact would be localised but repeated time and again, nationwide. Research has already identified 225 neighbourhoods the length and breadth of England as initial candidates for investment. Well targeted, and well timed.

Successive governments have been too timid in their efforts to reinforce the foundations of civil society. The Culture Secretary is due to communicate her decision on the dormant assets scheme in January, and she has in her grasp the opportunity to establish a vehicle for long-term, societal change in the shape of a Community Wealth Fund.

It is a ready-made mechanism to rebuild our frayed social fabric, which is in urgent need of repair. All that is needed is the political will to do so.

£ Tracey Crouch is the Conservative MP for Chatham and Aylesford

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900

Certified Distribution from 30/5/2022 till 01/07/2022 is 79,855

Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com

Email: news@cityam.com Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP

Editorial Editor Andy Silvester | News Editor Ben Lucas

Comment & Features Editor Sascha O’Sullivan

13 FRIDAY 9 DECEMBER 2022 OPINION CITYAM.COM

Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Digital Editor Michiel Willems Commercial Sales Director Jeremy Slattery

COMMENT AT:

WE WANT TO HEAR YOUR VIEWS › E: opinion@cityam.com

cityam.com/opinion

EXPLAINER-IN-BRIEF:

Michelle Donelan will decide on the dormant assets scheme in January

TIMELESS LUXURY

Chimes is a collection of 39 exclusive one, two and three bedroom apartments. With facilities to rival the world’s best hotels it’s your time to discover a luxury residence that’s ready to call home. Prices from £1,550,000 Arrange your private viewing 02079808702 | chimes@lifestory.group chimeswestminster.com

WINTER WONDERLANDS

With the temperature predicted to fall as low as minus six this week, you can add freezing weather to the seemingly endless list of things that are making the UK feel like a miserable place to live right now.

But for those with a big enough nest egg, or perhaps an eye for an investment, cold winters and brussels sprouts could be banished forever, replaced with golden sunsets, a steady 26 degrees, and fresh lobster on the beach.

The holiday home has long been a staple of British life, but with our housing market teetering and many landlords considering selling up and moving to pastures new, there could be a renaissance in Brits packing up for the winter and enjoying some borrowed rays. Just don’t blame us when you turn up for work in January with a hearty tan and nobody wants to talk to you.

THE COVE SPRING HOUSE

THE GARDEN, ST. JAMES, BARBADOS

ASKING PRICE: $40M

ONECARIBBEANESTATES.COM

The Cove Spring House sits at the top of a coral cliff overlooking the Caribbean Sea, and at its base is a secluded beach with private access from Cove Spring.

It is built from coral stone, once the hallmark of the Caribbean aristocracy. Its castle-like Palladian/Georgian openarchitecture is designed to maximise natural light and allow the trade winds to blow through the property, cooling the interior spaces down and cutting on the need for air conditioning. The interior design, meanwhile, is classy and expensive.

The entire property is surrounded by greenery, offering privacy as well as beauty. It is positioned mid-way between historic Holetown and Speightstown, offering a number of world-class restaurants and luxury

boutiques.

CAS EN BAS BEACH RESORT

CAP

ESTATE, ST. LUCIA

ASKING PRICE: $660,000

CASENBASBEACHRESORT.COM

Located between Cas en Bas Beach and St Lucia Golf and Country Club, this is a dream holiday home resort, with each residence meticulously designed to feel like a home-from-home.

Currently under construction, the resort will comprise two low-rise buildings bordering one of the longest swimming pools in St. Lucia. There

will be a champagne terrace and rooftop bar to kick back in the winter sun, a restaurant, poolside dining, gym, spa, and a beach bar and grill on the 1km Cas en Bas beach. Nearby you can find a tapas-style wine bar, café, convenience store, sports bar and business centre, meaning that you’re catered for here no matter what your interests are.

All in all there are 90 units for sale, all with en-suite bedrooms, expansive living areas, air-conditioning, kitchens, and premium fittings. Each one has 2.5m ceilings and full height

sliding

SOTHEBYSREALTY.COM

If you dream of really getting away from it all, Turtle Drive may be for you. Encompassing 2.3 acres with more than 300ft of private ocean frontage, this property really is a picture-postcard getaway. The house itself consists of three bedrooms, three and a half bathrooms, a media room and garage, spread over two floors. It comes fully furnished and is mere steps to the beach.

The surrounding area is made up of lush vegetation and “mature nurtured landscaping”, with meandering pathways through a botanical garden.

Nearby you have marinas with watersports on offer, as well as supermarkets, fine and casual dining restaurants, spas, shopping and golf. It will benefit from the cooling south easterly trade winds and is a perfect spot to soak in spectacular sunrises and sunsets.

LILY PAD ABACO, BAHAMAS $2,650,000 CHRISTIESREALESTATE.COM

Fleeing the cold to the Bahamas is a cliche for a reason. The perfect combination of wild and luxurious, this island has been catering to wealthy visitors for decades, and boy has it got good at it.

For an additional cost, the residence can be fully kitted out and ready for you to jet in.

TURTLE TAIL DRIVE PROVIDENCIALES, TURKS AND CAICOS ISLANDS ASKING PRICE: $3,975,000

Located right beside the sleepy Hope Town and a stroll from Turtle Hill, Lily Pad is a four bedroom, four and a half bathroom palace to tranquillity. The living area is open with a chef's kitchen ready to entertain and a grand dining area. The living room overlooks the Atlantic Ocean, which you can gaze wistfully at from the sun deck, which leads directly to the beach.

Lily Pad comes with a downstairs area that could be transformed into a full gym or an additional bedroom, depending on how much company you want while you’re out there. Probably go for the gym.

15 FRIDAY 9 DECEMBER 2022 PROPERTY CITYAM.COM

doors, allowing you to bask in those Caribbean sunsets from the comfort of your own sofa. Or if you prefer to go al fresco, you can retire to the private balconies for a glass of fizz as you try to remember what the subzero weather was like back home.

Caribbean, where you can snap up a veritable palace for the cost of a two-bed flat in Leyton.

from top left: The Cove Spring House; Turtle Tail Drive; Cas en Bas and Lily Pad

Clockwise

GOING OUT

EDITED BY STEVE DINNEEN @steve_dinneen

MOVIES

year.

BY JAMES LUXFORD

Oscar winning Mexican filmmaker Guillermo Del Toro’s vision of the story of Pinocchio has been long awaited. The outcome is a film with no connection to the Disney cartoon or the live action remake that also came out earlier this

There have been countless adaptations over the years, but any time the Shape of Water filmmaker - one of the best at his craft in the world - brings his eye to something, it’s worth paying attention.

Set in fascist Italy during the Second World War, this stop motion take on The Boy Who Wished To Live is a lot darker.

Gepetto (voiced by David Bradley) is grieving his son who has died as a result of the war, and drunkenly crafted a puppet

one night that is brought to life by a wood sprite.

What follows is far from the 1940 Disney film, which itself has its own dark moments. Pinocchio confronts death, quite literally, and the horrors of war as he is conscripted into Mussolini’s youth army.

Many talented actors are enlisted for the voice cast. Bradley is far darker as Gepetto than Tom Hanks’ pizza box stereotype, while the recognisable tones of Tilda Swinton - playing Death as well as the

THEATRE

BY ADAM BLOODWORTH

The National Theatre’s Christmas show isn’t exactly a Christmas show. Hex is a modern interpretation of Sleeping Beauty, a boldly imaginative spectacle that is more than a touch macabre.

In terms of the plot, a fairy lives deep in a forest and one day a palace worker running from a baby-eating ogre stumbles upon her and asks the magical being to cast a spell on a royal princess.

Yes, there's a baby eating ogre. It’s a bellwether for how

Hex struggles to find a tone that’s appropriate for children and their parents. To be fair, Victoria Hamilton-Barritt plays the ogre well, stomping around the stage like, well, an ogre in pursuit of a small child. But it’s too weird and uncomfortable a premise to feel like a passable idea.

It’s one of a few tonal misfires. At the end of the first act, a character shouts “shit” as the last word in the act which in context is neither funny nor appropriate for the audience. It’s also overlong, feeling its two-and-a-half hours.

That isn’t to say that most kids won’t enjoy the spectacu-

lar look of the show - there are brilliant costumes by Katrina Lindsay and it looks a million dollars - and the swearing probably goes over the smaller ones’ heads. Still, parents with older children were twitching. There are some memorable songs and dance pieces, best of all from the villainous set of ‘thorns,’ a troupe of literal thorns brought to life by performers in spiky outfits.

And Fairy is a decent heroine you end up willing to end up on top. She’s brought to emotional life by Lisa Lambe, in an especially gorgeous costume. There's some brilliant weirdness here, but it doesn’t quite all add up.

UNMISSABLE

GARRICK

wood sprite - and Ewan McGregor’s Sebastian The Cricket create depth that mirrors what’s unfolding visually.

Guillermo Del Toro had fought since the early 2010s to get Pinocchio off the ground, and the end result is a rousing vindication.

It’s been a long time since animated movies had the nerve to go to very dark places, and the celebrated master of macabre shows just what can be done with the medium.

PANTO

For 21 years, the Mighty Fin has been producing hilarious, joyful and curiously moving Christmas Shows inspired by stories, plays and historical events, including Cinderella and the Treaties of Versailles. This year award winning writers Robbie Hudson and Susannah Pearse have penned a love story between two robot sharks. The sharks are played by a series of guest star alums of the company including John Finnemore (Cabin Pressure) and Carrie Quinlan (The News Quiz). All the profits will go to the Motor Neurone Disease Association.

At The Network Theatre, Waterloo from 14-17 December, prices from £10. For tickets go to themightyfin.com

THEATRE

BY ADAM BLOODWORTH

If you’re feeling lost as conversations around transness and gender continue to invade the news cycle, this gentle production of Orlando reminds how disarmingly simple it all is. “Isn’t it really just an ode to freedom and love?” director Michael Grandage asked about Virginia Woolf’s satirical novel. And Grandage proves that point across this poetic reimagining of her text that’s been adapted for the stage.

Written as an ode to Woolf’s lover Vita Sackville-West, Orlando is part Sackville-West, part buccaneering lothario galloping through literature’s past. Orlando begins in the Elizabethan Age and ends up in 1928, nine years after women gained the vote.