READ ING THE SIGNALS

LEAH MONTEBELLO

LEAH MONTEBELLO

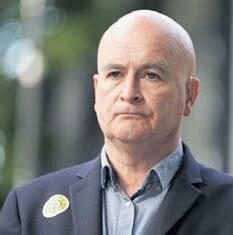

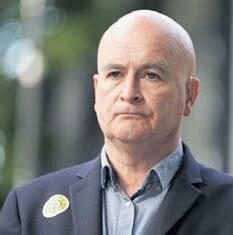

VODAFONE chief exec Nick Read will step away from the telecoms giant at the end of the year, the firm announced yesterday, bringing to an end a troubled four-year tenure.

The firm’s share price has almost halved during Read’s time at the top –despite the FTSE 100 remaining broadly flat over the same period –with activist investors including European heavyweight Cevian piling on the pressure.

Yesterday Read said he “agreed with the board that now is the right moment to hand over to a new leader”.

Vodafone was forced to cut full-year cash-flow and earnings guidance in an update last month, with the firm hit by energy costs and a poor sales performance in European markets, including Germany.

That came alongside a new pledge to make cost savings worth as much as a billion euros.

Chief financial officer Margherita Della

Valle will step in on an interim basis, with a search for a permanent successor now underway. Analysts said the move came as little surprise.

Kester Mann, a telecoms expert at CCS Insight, said investors were looking for more bang for their buck.

And Karen Egan, head of mobile at Enders Analysis, said the firm would need to look outside for the next boss in order to “bring

ILARIA GRASSO MACOLA

A LEADING City Hall politician yesterday warned ride-sharing app Bolt it could be barred from operating in the capital unless it improved its drivers’ pay and conditions.

Labour transport lead Elly Baker tweeted that Bolt should give its

workers “the rights they deserve”, otherwise it would face “serious questions over its licence to operate in London”.

“We must have a level-playing field on private hire licensing in London,” she added.

a fresh approach [and] a complete

Read is unlikely to be able to seal a merger deal for the firm’s UK mobile arm with rival Three by the time he exits, a key part of his recent merger and acquisition-focused strategy to reassert the firm’s pricing power in an ever more competitive marketplace.

Board must go at HOME REIT: Activist

CHARLIE CONCHIE

CHARLIE CONCHIE

SOCIAL housing investor

Home REIT faced calls for its board to be sacked yesterday for “significantly” inflating the value of its property portfolio, in the latest of a string of attacks on the firm in the past two weeks.

In a letter to senior independent director Simon Moore, activist investor The Boatman Capital Research levelled a series of accusations at Home REIT, including that it had “been over-optimistic in its assumptions” on property value and its portfolio could in fact be “39-51 per cent lower” than it claims.

The activist said the inflated valuations and a slew of accounting issues made the positions of the chair and the audit chair “untenable”, and it was now poised to agitate for further change if its demands were not met.

“We may… consider engaging with other likeminded investors to achieve change if it is not otherwise forthcoming,” the letter said.

The barrage follows a series of accusations from shortseller Viceroy Research over the past two weeks, in which it slammed the quality of tenants in Home REIT’s property portfolio and caused its share price to plummet by a third.

similar to those enjoyed by Uber drivers after a lengthy series of legal cases and union negotiations.

Law firm Leigh Day filed a claim in early October on behalf of more than 1,600 workers, while GMB is currently representing six people.

Baker said Bolt should adopt the standards implemented by rivals.

Baker’s words were echoed by a

spokesperson for the mayor, who said Sadiq Khan has urged “other employers in the gig economy to follow suit in order to help improve employment standards across London and the UK”.

A Bolt spokesperson told City A.M. that its operating model gives drivers “higher earnings per trip and more flexibility”.

Bolt is currently facing two class action lawsuits as drivers have called on the ride-hailing company to give them employee status –including access to paid holiday and pensions,

INSIDE BITCOIN MISERY WORSENS P3 THAMES WATER CASH IN DESPITE LEAKS P6 LAW FIRM LEASING BOOM P8 GLENCORE FACES £147M FINE P9 MARKETS P13 OPINION P14

A REIT CITY SAGA

£ CONTINUED ON PAGE 2 LONDON’S BUSINESS NEWSPAPER LYNCH THE GRINCH RMT ANNOUNCES PLAN TO WALK OUT ON CHRISTMAS EVE P3 THE GREATEST GAMBLE? WHY STOKES’ VICTORY RANKS AMONG THE VERY BEST P19 TUESDAY 6 DECEMBER 2022 ISSUE 3,903 FREE CITYAM.COM Bolt told to match Uber worker conditions –or face being driven out of London VODAFONE BOSS NICK READ TO ‘STEP AWAY’ AFTER TENURE MARKED BY ACTIVIST PRESSURE AND SHARE PRICE DISAPPOINTMENT

STANDING UP

FOR THE CITY

Those who believe in the office have a right to be heard, too

SPEAK to a lot of chief executives in private –especially once those magical words ‘off the record’ are uttered –and you’ll hear all sorts of frustrations with the state of everything from our politicians to their human resources department. But one topic that keeps coming up is scepticism about whether hybrid working is all it’s cracked up to be. In public, of course, everybody backs more flexibility. Blindingly

THE CITY VIEW

obviously, it has its benefits. But it also has its downsides. For every worker who is enjoying more work-life balance, there is a staff member whose increasing frustration with their job isn’t being noticed. For every youngster enjoying not having to

pay train fares twice a week is an up-and-comer who doesn’t have the opportunity to learn. And for every entirely legitimate complaint about the perils of presenteeism, there are as many anecdotes of suburban pubs being full at 3pm on a Friday and the never-ending use of the phrase “I can do it on my phone”. We are embarking on a radical change to the way we go to work, a shift rapidly accelerated by the pandemic. But our discourse on

the matter is horribly unbalanced. The Institute of Directors stated in a report earlier this year that the government’s move to allow staff to request flexible working on day one of their employment has “the potential to create more equitable, diverse, and inclusive workplaces”, citing absolutely no evidence. Was there a consideration for the small business owner struggling to pay the bills who now has yet another

piece of employment bureaucracy to navigate? The chair of the Business Committee yesterday warned, apocalyptically, that there might be employers “who just say no”. Guess what? They have every right to!

Remote and flexible working rightly has its supporters. But those who think an office, for five days a week, is a better way to operate deserve to be heard too –and not written off as hopeless dinosaurs.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE FINANCIAL TIMES

OIL TANKER JAM FORMS OFF TURKEY AS OIL CAP KICKS IN A traffic jam of oil tankers has built up in Turkish waters after western powers launched a “price cap” targeting Russian oil and as authorities in Ankara demanded insurers promise any vessels navigating its straits were fully covered.

THE TIMES

Ageing society and lower post-Brexit migration will leave UK economy sicker

AN AGEING population, weaker migration inflows since Brexit and a sicker society due to the pandemic have damaged the UK’s long-term economic health, City economists have warned.

A steadily rising elderly population has resulted in a jump in Brits leaving the jobs market to take retirement or due to ill health, putting the workforce on track for a sustained decline, according to investment bank Goldman Sachs.

“The share of the UK population aged 50 and above has increased meaning-

fully over the past decade from 42 per cent in 2010 to 47 per cent in 2020 and is projected to grow further going forward,” Goldman said in a note.

Weaker inflows of EU workers since the Brexit vote in 2016 have not been fully offset by a rise in people from outside the bloc, constraining growth in the UK’s working age population.

Figures from the Office for National Statistics last month revealed net migration last year hit 504,000, the highest on record, although that number was boosted by an influx of Ukrainian and Hong Kong refugees.

Britain’s workforce is still 2.7 per

cent smaller compared to pre-pandemic levels, 60 per cent of which can be attributed to pandemic-related factors, Goldman said.

However, “even without the pandemic, ageing and slowing population growth, including due to lower migration, were likely to reduce labour force growth meaningfully,” the note said.

A smaller workforce poses serious long-term problems for the UK economy. It would cut the volume of goods and services the country is able to produce, weighing on GDP growth, likely resulting in sluggish real income improvements.

Embattled investment trust considering response to letter

CONTINUED FROM PAGE 1

The Boatman letter also renewed Viceroy’s complaints over the prospect of ‘round-tripping’ revenues at Home REIT yesterday, due to the firm’s practice of indirectly capitalising its charity tenants with rent payments.

“Seeking to minimise this issue by claiming the payments are indirect is disingenuous at best and reflects an attitude of hiding behind ‘form’ rather than reflecting the ‘substance’ of the matter to shareholders,” the letter said.

City A.M. understands that Home REIT is currently reviewing the contents of the letter.

The property investor has been scrambling to get into a defensive position since the first attack by Viceroy on 23 November.

Home REIT issued a full rebuttal of Viceroy’s criticisms on November 30, calling the criticisms “baseless and misleading”. However, bosses delayed the publication of its fullyear results last week to allow auditor BDO to deep dive into its accounts, and shares have continued to fall.

CITYAM.COM 02 TUESDAY 6 DECEMBER 2022 NEWS

DONALD TRUMP TRAILS RON DESANTIS BY 20 POINTS FOR REPUBLICAN NOMINATION Donald Trump lags 20 points behind Ron DeSantis in polling of Republicans for their next White House candidate in a sign of the former president’s weakening grip on the party.

THE GUARDIAN EXPLOSIONS ROCK TWO RUSSIAN AIRBASES FAR FROM UKRAINE FRONTLINE Explosions have rocked two Russian airbases far from the frontlines as Kyiv appeared to launch a pre-emptive strike on bombers that the Kremlin has used to try to cripple Ukraine’s electrical grid.

JACK BARNETT

IN THE SPOTLIGHT Pigeons are also finding innovative ways to keep themselves warm, with these London Bridge dwellers taking turns to warm up on the lights of Tooley Street

Ofgem reforms hurt competition, says Good Energy

EXCLUSIVE NICHOLAS EARL

OFGEM’s recent reforms and reviews of the energy sector risk making the market less competitive and could prevent innovation, the boss of challenger energy supplier Good Energy told City A.M.

Chief executive Nigel Pocklington feared the energy watchdog was “overcompensating” following heavy criticism over its handling of the energy crisis, which has seen 30 suppliers collapse in the past 18 months.

“There is a real risk that in reacting to lax regulation, we do things that return the energy supply market to an oligopoly, which is bad for innovation and bad for customers,” Pocklington said.

He argued that Ofgem was “trying to show they are a tough regulator”, but in doing so were “generating headlines without engaging properly”.

In particular, the energy boss criticised Ofgem’s latest compliance report on the energy sector, where the watchdog found Good Energy had “severe weaknesses” in its handling of vulnerable customers alongside four other firms.

“There is a risk that as Ofgem attempts to demonstrate publicly that it is a very active regulator, it favours very large suppliers with big regulatory and compliance teams and a revolving door between them and Ofgem,” Pocklington said.

“We’ve always heavily focused on outcomes and we’re obviously having to improve our documentation, which is what these reviews call out. We’ve never been called out for a poor outcome.”

Ofgem has unveiled multiple reforms in recent months in response to the energy crisis and collapse of multiple firms, including rolling out quarterly price caps, fit and proper person rules and financial stress tests.

Pocklington’s comments come after fellow challenger firm Utilita made similar complaints last week, arguing that Ofgem’s policies, such as the new capital adequacy requirements, benefit the biggest players and risk squeezing smaller firms out of the market.

A spokesperson for Ofgem said: “We believe our decisions deliver the right balance and both protect consumer interests and choice while also being fair for suppliers of all sizes.”

Bitcoin to sink further as investors flee to safe havens, analysts warn

CHARLIE CONCHIE

BITCOIN could plunge by a further 70 per cent next year as investors scramble for safe havens like gold amid continued turmoil on the markets, analysts have predicted.

In a note to investors, analysts at Asia and African-focused bank Standard Chartered said the most valuable crypto currency could

plunge to $5,000 (£4,100) next year, after already shedding more than 70 per cent of its value from a November 2021 peak.

The sharp fall in prices comes amid a so-called ‘crypto winter’ in which soaring inflation and rising interest rates have sparked rapid sell-offs and led to a string of highprofile bankruptcies, including crypto exchange FTX.

Analysts at Standard Chartered said the downturn would continue and gold, regarded as a safe-haven asset in times of turmoil, would see a boost in prices. “Gold makes a staggering recovery in 2023, rallying 30 per cent to over USD 2,250/oz as cryptocurrencies fall further and more crypto firms succumb to liquidity squeezes and investor withdrawals,” the analysts predicted.

More rail misery on way as RMT announces further Christmas strikes

ILARIA GRASSO MACOLA

THE RMT last night announced further rail strikes over the Christmas period –but also confirmed they would put an improved pay offer to a member vote.

Workers are set to walk out from 6pm on Christmas Eve to 6am on December 27. This will be in addition to the planned strike on December 13, 14, 16, 17 and January 3, 4, 6, 7.

The strike action will batter retail and hospitality companies, who rely on

trade in the run-up to Christmas.

Yesterday the boss of UK Hospitality Kate Nicholls said pubs and restaurants would lose around £1.5bn in revenue thanks to cancellations caused by the industrial action.

RMT boss Mick Lynch last night said he would allow members a vote on the offer, with the union recommending workers rejected the deal.

Transport secretary Mark Harper said the news of more Christmas strikes was “incredibly disappointing”.

03 TUESDAY 6 DECEMBER 2022 NEWS CITYAM.COM

PREMIER INN owner Whitbread announced yesterday that boss Alison Brittain would step down as planned on January 17, handing over to current Domino’s Pizza boss Dominic Paul. Brittain will step away from full-time roles though is set to join Dunelm’s board.

GREAT BRITTAIN Whitbread boss confirms January departure as part of Paul handover

Profits jump for Thames Water despite leaks

LEAH MONTEBELLO

LEAH MONTEBELLO

THAMES Water posted nearly £400m in profits for the six months to September, despite the firm grappling with a jump in leaks during the scorching summer.

The UK’s biggest water company said half-year pre-tax profits were £398m, swinging from a pre-tax loss of £581m for the same period in 2021.

Thames Water said it experienced an “exceptionally high level of operational incidents resulting from drought”, with the number of burst pipes up almost 40 per cent in the half year because of the hot weather and dry ground.

The company was widely criticised for imposing a hosepipe ban across London and the Thames Valley in August, impacting 15m people.

Only lifting the restrictions last month, Thames Water said the team

had fixed over 1,000 leaks a week, promising to spend £55m to help reduce leakage in the next three years.

However, chief exec Sarah Bentley said the difficult landscape made the company’s turnaround plan “more challenging”. The eight year turnaround plan, which was introduced last year, sets out to improve water quality and the number of complaints.

The Reading-based firm, which supplies around a quarter of the population of England and Wales with water, warned that the impact of inflation across energy and labour was likely to weigh down on results.

Despite these challenges, Thames Water said it had given 280,000 homes a 50 per cent bill reduction.

Water companies will be able to hike bills in line with inflation next April, although regulator Ofwat will determine exactly how much this will mean.

WORKER RIGHTS Shein pledges $15m into improving standards at suppliers’ sites

Sainsbury’s invests £50m to keep prices low

EMILY HAWKINS

SAINSBURY’s has announced it will pump an additional £50m into its cost of living value plan by March.

Announcing the investment, Sainsbury’s chief executive Simon Roberts said the firm was committed to doing “everything we can to help with the rising costs of living”.

The supermarket said it had invested in a Christmas roast dinner at less than £4 a head as part of a £15m investment plan to keep prices affordable on festive staples.

Sold! Irn-Bru owner snaps up Boost energy drinks for £20m

EMILY HAWKINS

BEVERAGE giant AG Barr yesterday announced it had acquired energy drink maker Boost Drinks for £20.

The Irn-Bru and Rubicon owner said it was acquiring Boost from its founder Simon Gray and his wife Alison, who will continue to lead the business.

The London-listed drink firm said

there was “significant potential” for additional growth and product portfolio development.

Boost posted £42.1m in unaudited statutory revenue and £1.9m profit before tax for the year ended 31 December 2021.

AG Barr’s shares were elevated by the news, climbing over six per cent yesterday afternoon.

While Brits are anticipating their first Christmas free of Covid-19 restrictions in three years and are keen to celebrate, this comes against the backdrop of 41-year-high inflation and a cost of living crunch.

It comes after the supermarket in September invested £65m into the business to keep prices competitive for shoppers.

The new investment means that by March the retailer will have pumped more than £550m into keeping prices down. This represents its largest value investment into tackling price inflation over a twoyear period.

A SPRINKLE OF TWINKLE

Offer applies to Shortbread, Luxury Gold Tea and Hot Chocolate Light-Up Lanterns only. Subject to availability, while stocks last. Not to be used in conjunction with any other offer. In store only. M&S Stores only. Cheapest item free. Valid from 25 Nov to 25 Dec 2022. Prices may vary in selected stores. Prices correct at time of publication. Excludes any personalised customer or employee promotions that may be offered. See individual tickets for details. © Marks and Spencer plc.

32 for

THIS IS NOT JUST FOOD

GIFTS

Make their Christmas even brighter with our tea, hot chocolate and shortbread light-up tins, available in three festive colours LIGHT-UP

CITYAM.COM 04 TUESDAY 6 DECEMBER 2022 NEWS

FAST fashion giant Shein has vowed to invest $15m into improving its factories after admitting its hours for workers at two sites breached regulations. It came in response to allegations made in a C4 documentary.

Allica Bank bags £100m for SME growth push

CHARLIE CONCHIE

DIGITAL lender Allica Bank yesterday said it had bagged a £100m cash injection as it bucks a slowdown in venture capital investment and looks to guzzle up more of the UK’s small business banking market.

Allica, which was founded in 2020 and provides savings, lending and payments services for small businesses, said growth technology investor TCV provided most of the equity in the latest funding round, followed by backing from existing investors Warwick Capital Partners and Atalaya Capital Management.

The cash injection for Allica comes amid a slowdown in the investment landscape this year as sharp interest rate hikes make cash harder to come by and cause investors to place a premium on profitability rather than rapid growth.

Allica boss Richard Davies told City A.M. the fundraise was made easier by

the firm’s swing into the black in June and said it was now angling to take more market share from the UK’s traditional lenders.

“Our timing was certainly good, because there had been this massive shift [toward profits] on the back of the higher inflation, higher interest rate environment kicking in early summer,” Davies said.

“What we are trying to do is combine high growth and profits.”

Davies said the approach had paid off in 743 per cent year-on-year growth, putting the firm in a position to double down on investment into its product and expansion of its loan book, after it swelled past the £1bn mark earlier this year.

He added that Allica was braced for a rise in defaults, however, as the firm’s SME client base is buffeted by recessionary pressures.

The funding will see Allica join a list of firms such as Revolut, Nubank and Zepz that have also had TCV’s backing.

Credit Suisse shares jump after reports of Saudi cash injection

CHARLIE CONCHIE

SHARES in beleaguered lender Credit Suisse were given a boost yesterday after reports that Saudi Crown Prince Mohammed Bin Salman is poised to snap up a stake of its spun out investment banking division.

Credit Suisse is set to separate the unit as part of emergency restructuring plans, after a string of

scandals and heavy losses.

Mohammed Bin Salman is now planning to inject as much as $500m (£410m) into the new unit, the Wall Street Journal first reported.

The former chief of Barclays Bob Diamond is also reportedly eyeing a stake in the firm via his investment vehicle Atlas Merchant Capital.

Credit Suisse shares jumped beyond five per cent yesterday on the news.

Investment in supply chain tech weakens

MILLIE TURNER

VENTURE capital investment into supply chain-focused tech has significantly slowed in the past few months, after a pandemic-era boom.

Startups around the world added $3.3bn (£2.6bn) to the industry in the third quarter, down more than 77 per cent compared with the same period a year ago, according to data published by research firm

Pitchbook yesterday. The number of deals in the sector has also halved.

As geopolitical tensions rise, a trend of onshoring and localising supply chains has swept the globe.

The pandemic highlighted the risks of diverse supply chains, as Covid-19 driven disruptions led to rising costs. Funding in supply chains had been boosted by Covid-19 restrictions, with a raft of businesses rushing to ease their logistical woes.

“For several years we have been following a theme of reshoring and deglobalisation,” said David Jane, of London-based asset manager Premier Miton Investors. “Whilst reshoring may make sense from a security of supply point of view, labour costs, regulation and energy costs mean it may inevitably lead to cost increases,” he cautioned.

Conviction to float in London to cash in on undervalued UK science market

MILLIE TURNER

INVESTMENT fund Conviction Life Science will float in London in an £100m IPO to capitalise on a stream of undervalued biotech and pharma firms, the fund’s investment chief told City A.M. yesterday.

While the UK is home to Nobelwinning science, the industry gets a bad rap for being overly risky and

loss-making.

The company had mulled a Luxembourg-based SICAV and called a Nasdaq listing too expensive, but said London made sense in terms of value.

“It’s the valuation point. Because we have amazing science and we don’t value it,” Andrew Craig said.

“We’re not very good at commercialising it... a lot of these businesses are really struggling.

Struggling to raise capital, struggling to get the oxygen of attention from the investment community.”

Conviction is planning on growing smaller firms in the UK and Australia, which get far less attention from even the more specialist investors.

“If our thesis plays out, as I suspect it will, you’re going to get five or six new midcaps in the UK and in Australia,” he added.

CITYAM.COM 06 TUESDAY 6 DECEMBER 2022 NEWS

Credit Suisse is set to spin out its investment banking division after a series of scandals

Conviction is hoping to capitalise on UK science firms often overlooked by investors

Some train services will be affected as we work to improve the railway. So, check before you travel.

SERVICE CHANGES: 25 DEC – 2 JAN

Christmas?

BEFORE YOU TRAVEL nationalrail.co.uk/Christmas

Heading for a train over

CHECK

Faith in housing market to grow in the new year

MILLIE TURNER

FAITH in the UK housing market is expected to be restored in the new year, as mortgage rates and cancellation rates start to cool.

According to research at brokerage Jefferies, a rise in mergers and acquisitions (M&A) within the sector may also be on the horizon.

In a note yesterday, researchers said they were “too aggressive” with downgrading the pre-tax profit forecasts of some of the biggest housebuilders in the country by an average of 70 per cent in October.

“Consensus has started to follow suit. However, we would argue we are now starting to see signs that suggest these downgrades were too aggressive,” researchers wrote.

Share prices have bounced around 10 per cent since the broker’s last downgrade report.

Interest and mortgage rate rises following September’s mini-budget have tested the demand for developers, but have not brought too much financial stress to housebuilder’s doors, researchers said.

“The combination of mortgage rates beginning to abate and a normalisation of cancellation rates, we believe could bring improving confidence of underlying demand for UK residential new build in the first quarter of 2023,” they wrote. “Given the lumpy nature of contracts it may take longer to see in other asset classes.”

It puts residential developers like Berkeley, Taylor Wimpey, Bellway and Vistry in a good position. The broker hiked the target share price of all five FTSE developers yesterday.

“Value opportunities during/after a market downturn could offer meaningful roll-up M&A for those with strong balance sheets,” the researchers added.

Law firm hiring spree helps to bolster London office market

Smith and Clifford Chance, data from Knight Frank shows.

Tech firm Levin signs for HQ at 155 Bishopsgate

EMILY HAWKINS

BRITISH Land has signed an agreement with tech recruitment giant Levin to let its entire Storey space at 155 Bishopsgate for its new London HQ.

Levin, which has had a footprint at the development since 2020, will take up 23,000 sq ft of space, after previously leasing on the same campus at 1 Finsbury Avenue and 100 Liverpool Street.

Levin will consolidate its office space within a single location, joining Maven Securities, Marex and Sumitomo Mitsui in the building.

British Land has recently carried out a full refurbishment of the 155 Bishopsgate building, including a new lounge and an upgrade of the 160,000 sq ft of workspace.

BRITAIN’s top law firms are driving a surge in demand for City office buildings in their efforts to win over talent and meet their ESG goals.

Law firms have taken up a record 1.5m sq ft of office space in 2022, following a series of big deals involving top firms including Reed

The boom has seen law firms account for 59.6 per cent of the City’s pre-lets since the start of 2020.

Reed Smith’s London managing partner Andrew Jenkinson told City A.M. the uptick was being driven by law firms’ efforts to “attract and retain the best talent in the market”.

The Broadgate campus is home to many big names, such as McCann Worldgroup and Peel Hunt.

Global chief commercial officer at Levin Alex Horner said features like breakout areas in the development have enabled the complex to have “achieved an informal tech-type vibe which is quite unusual to find in the City”.

CITYAM.COM 08 TUESDAY 6 DECEMBER 2022 NEWS

London’s top law firms are doing all they can to attract and retain talent

LOUIS GOSS

Glencore to pay £147m over DRC bribery scandal

LOUIS GOSS

LOUIS GOSS

GLENCORE has agreed to pay $180m (£147m) to the Democratic Republic of Congo (DRC) to settle “all present and future” lawsuits arising from the large-scale international bribery scandal involving the firm.

In a statement, Glencore said the $180m deal acts to settle any existing or future claims relating to the corruption allegations surrounding the firm’s actions in the DRC between 2007 and 2018.

The settlement comes after Glencore paid $1.1bn to US and Brazilian authorities and a further £281m to Britain’s Serious Fraud Office (SFO) over claims

its staff paid millions in bribes to officials across Africa and South America in a bid to win favourable treatment in oil deals.

In May, Glencore admitted paying $27.5m to third-party intermediaries with the intention of gaining a competitive advantage by bribing DRC officials.

Glencore’s settlement comes as the commodity trader faces a potential flurry of lawsuits against it brought forward by those countries in which it paid bribes.

Solicitors’ tribunal chief steps down following lease fiasco

Shut that door! PwC closes sites over Christmas

HOLLY WILLIAMS

ACCOUNTANCY giant PwC is shutting most of its offices over Christmas and New Year for the first time to save energy as UK power supplies come under mounting pressure this winter.

The group – which employs around 24,000 staff and has 19 sites across the UK – said it would shut its main London office at Embankment Place, while a number of regional offices will close between December 23 and January 3.

PwC said there would be workspaces in nearby offices for staff who want to go into the workplace during those times.

In a statement, Glencore chairman Kalidas Madhavpeddi said: “Glencore is a longstanding investor in the DRC and is pleased to have reached this agreement to address the consequences of its past conduct.”

LOUIS GOSS

LOUIS GOSS

THE HEAD of the Solicitors Disciplinary Tribunal (SDT) has stepped down from her position following news the tribunal is being forced to exit its Farringdon offices.

towards the tribunal’s new premises after its landlord decided to sell the building for £17.5m last month.

Kevin Ellis, chairman and senior partner at PwC UK, said the group wanted to “do our bit to reduce energy consumption”.

He said: “Office life is hugely important to our culture and business — but having all our offices open over the holiday period doesn’t make sense at a time of energy scarcity.”

SDT chief executive Geraldine Newbold’s exit follows news solicitors will be forced to pay an extra £1.2m

Newbold’s exit comes after Legal Services Board chair Helen Phillips later called on the SDT’s leadership to “learn lessons” from the situation, and “consider what it might do differently next time such as getting a lease agreed in writing”.

Its rivals are also shutting offices over the period, with KPMG and Deloitte closing their UK sites. PA How we reported on Glencore’s SFO case

09 TUESDAY 6 DECEMBER 2022 NEWS CITYAM.COM

Newbold’s exit comes after the tribunal was forced to leave its Farringdon offices

Online safety bill makes return as concerns over fraud adverts mount

LEAH MONTEBELLO

THE ONLINE safety bill returned to parliament yesterday after five months in limbo.

The bill aims to better regulate big tech firms and threatens hefty fines for non-compliance, covering illegal and harmful content, as well as fraudulent advertising.

Although consumer group

Which? praised the inclusion of online scam ads into the bill, it said any further delays would put consumers at immense risk.

In new research today, Which? and charity Demos Consulting published their findings after designing algorithms to uncover risky ads. The research found Meta-owned sites Facebook and Instagram continue to show potentially fraudulent

investment ads, including property and cryptocurrency paid-for scam advertising.

Calling the findings extremely worrying, Which? director of policy and advocacy Rocio Concha said: “If a consumer group and another charity can design algorithms and uncover these adverts then tech giants should be able to create effective systems to do the same job on a bigger scale.”

Tiktok rides out ad slowdown at Meta’s expense

LEAH MONTEBELLO

LEAH MONTEBELLO

TIKTOK is expected to ride out the advertising slowdown, with the Chineseowned social media titan becoming an outlier to the wider industry slowdown.

According to a new report published by GroupM, the media buying agency owned by WPP, Tiktok doubled its advertising revenue in 2022.

“This has likely been another driver of the advertising deceleration or ‘pullback’ noted at Meta and Snap over and above macroeconomic factors given that we see less deceleration across other digital platforms where Tiktok would be a less obvious alternative (such as Microsoft),” the report said.

However, GroupM reckons that although marketeers may choose to view the platform as a good way to reach younger audiences who are becoming increasingly difficult to target via linear TV, there was a caveat “with increased risk of the platform being banned in additional markets”.

Despite boasting over a billion users,

Tiktok remains banned in India, and continues to receive scrutiny from the UK, US and European Union over data access from China.

GroupM revised its 2023 forecast for total ad spending growth down 0.5 per cent to 5.9 per cent.

Tech analyst at PP Foresight Paolo Pescatore echoed this sentiment, telling City A.M.: “As [Tiktok’s] dominance grows this will only draw further attention among regulators and competition authorities.”

He said that this market prevalence was unlikely to vanish anytime soon, with brands following eyeballs, which continue to have an increasing focus on shorter form content via Tiktok.

Nonetheless, the GroupM estimates come after reports that Bytedanceowned Tiktok cut its global revenue targets for 2022 by at least 20 per cent in September after it struggled to keep up momentum in the face of tightening advertising spend and wider macroeconomic instability.

Foxconn faces revenue slump after iPhone factory fallout over Covid-19

LEAH MONTEBELLO

LEAH MONTEBELLO

REVENUES have slumped for Foxconn as the iPhone manufacturing partner feels the sting on ongoing unrest over Covid19 restrictions and pay.

The company reported NT$551bn (£14.7bn) in revenue last month, tumbling 29 per cent from October, and 11 per cent on the year before.

November is usually a prosperous period for the firm, as it gears up for a Christmas boom in sales for Apple.

However, Foxconn has been plagued by worker disruption after a coronavirus outbreak at its Zhengzhou plant. The plant employs around 200,000 people for the region that produces around four in five of the latest-generation handsets for Apple.

Foxconn said it had started to employ new staff and the “epidemic situation has been brought under control”.

Investment bank Jefferies said iPhone sales to consumers were down 46 per cent annually.

CITYAM.COM 10 TUESDAY 6 DECEMBER 2022 NEWS

A continued buzz around short form content has seen Tiktok double its ad revenue

Energy firms told to delay issuing winding up notes

NICHOLAS EARL AND EMILY HAWKINS

ENERGY firms have been urged to look for compromise solutions if business customers are struggling, by the hospitality trade body’s chief.

British Gas, owned by Centrica, has issued 37 winding-up petitions so far this year, with 13 businesses ultimately being wound-up, The Daily Telegraph revealed Sunday.

Elsewhere, rival E.ON issued 21 petitions, resulting in seven firms being liquidated.

Monster energy price increases “could not have come at a worse time” for venues, UKHospitality boss Kate Nicholls told City A.M.

Winding up petitions “come at the expense of livelihoods and jobs” and

“should be avoided at all costs,” Nicholls added.

E.ON, which has hundreds of thousands of business customers, said customers considered for a petition could afford to pay but were choosing not to.

The firm stressed it had not “changed approach or [introduced] harsher policies.”

British Gas said it did not treat such actions “lightly” and only considered them “where there is clear liability.”

For some “very energy hungry players” it was not realistic to ask firms to reduce utility consumption, Nigel Pocklington, CEO of Good Energy told City A.M.

“All we can do is maintain a very clear dialogue” with customers, he added.

Serica shares slide after latest exploration comes up short

NICHOLAS EARL

SERICA Energy’s shares plummeted on the London Stock Exchange yesterday after it reported underwhelming findings from its exploration well in North Eigg, off the coast of Scotland.

The independent oil and gas trader’s share price dropped 8.7 per

Seven climate activists found guilty of

JACK MENDEL

SEVEN female Extinction Rebellion activists have been found guilty of causing criminal damage to Barclays Bank’s London headquarters.

The defendants, aged between 28 and 64, were charged with £100,000 worth of criminal damage at Barclays

HQ in Canary Wharf last year. They will be sentenced in late January next year and could be facing a maximum penalty of 18 months in jail.

Extinction Rebellion said its activists caused the damage to protest Barclays’ investment in the fossil fuel industry, and the convictions of the seven members was “vindication”.

Defendant Lucy Porter told the jury, according to XR, that while “we are not above the law... I cannot accept that I am a criminal, while companies like Barclays continue to break legally binding agreements”. Barclays and the Crown Prosecution Service were not available for comment.

cent on the FTSE AIM UK 50 Index in today’s trading, after chief executive Mitch Flegg announced the prospect “has not delivered the result we had hoped for”.

The firm revealed that only noncommercial volumes of gas had been discovered, with Serica now set to reevaluate operations in the region.

Scientists: Stop burning trees for energy

NICHOLAS EARL

COUNTRIES must stop burning trees to make energy because it undermines the world’s climate and nature goals and destroys valuable wildlife habits, urged 650 scientists in a group letter to world leaders.

In the build up to Cop15 – the UN’s biodiversity summit – scientists have called on countries to stop using forest bioenergy to create heat and electricity, which they believed had been “wrongly deemed ‘carbon neutral’”.

The letter, published yesterday on activist site ‘Cut Carbon, Not Forests‘, says: “The best thing for the climate and biodiversity is to leave forests standing – and biomass energy does the opposite.”

Instead, the scientists have called for renewable energy sources such as wind and solar to make up the deficit from biomass generation.

The letter was sent to Prime Minister Rishi Sunak alongside dozens of world leaders.

Kings College Maughan Library, Chancery Lane, London, WC2A

11 TUESDAY 6 DECEMBER 2022 NEWS CITYAM.COM

Exploration across the North Eigg well will be suspended pending investigations

yesterday

of

The PLANNING ACTS and the Orders and Regulations made thereunder This notice gives details of applications registered by the Department of The Built Environment

FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

The seven climate activists pictured outside Southwark Crown Court

CITY

LONDON

Code:

1LR 22/00991/LBC windows and the installation of an acoustic Guildhall,

Yard,

5AF

22/01023/LBC 9 Bridewell Place,

22/01070/FULL 80

LEGAL AND PUBLIC NOTICES CITY of LONDON undermentioned streets made several Orders on 1 December 2022 with the exception of Copthall Avenue (order made on 17 February 2022) which has been extended under Section 14(1) of the Road The effect of these Orders will be to prohibit vehicles (or pedestrians where stated) from entering Copthall Avenue (Langthorn Court to Great Swan Alley) ---- Building Site Dukes Place (St Botolph Street to Bury Street) ---- Scheme Works Long Lane (Cloth Street to Lindsey Street) ---- Christmas Trading Christmas Trading 6 December 2022 ANNOUNCEMENTS LEGAL AND PUBLIC NOTICES

Guildhall

London, EC2V

22/01022/FULL &

London, EC4V 6AW

Houndsditch, London, EC3A 7AB 22/01084/FULL ANNOUNCEMENTS

criminal

Barclays HQ SPORT Jude Bellingham has a Godgiven talent but he is also determined to grab his moment on the big stage TREVOR STEVEN ON ENGLAND VS FRANCE PAGE 18

damage at

OPEC+’s production cuts expose unsteady markets, say oil experts

NICHOLAS EARL

NICHOLAS EARL

OPEC+’s decision to maintain its hefty output cuts reflects a lack of stability in global oil markets, analysts have argued.

The world’s most influential oil cartel alongside countries including Russia (together called OPEC+) decided last Sunday to stick to their October plan to cut output by 2m barrels per day from November through to 2023.

This comes against an uncertain backdrop of China’s zero-Covid

approach and sustained sanctions on Russia from the West.

Craig Erlam, senior markets analyst at OANDA, told City A.M. that while OPEC’s decision was predictable, its consequences and the future direction of oil markets were not.

He noted China and its direction of travel on zero-Covid, which is “promising from a demand perspective”, and the contrasting issue of higher interest rates, “the peak of which is still unclear”.

This meant OPEC was essentially

Germany unveils £2.5bn gas deal with Trafigura

GERMANY has secured a long-term gas deal with commodities specialist Trafigura to shore up its energy supplies over the coming winters.

The four-year £2.48bn ($3bn) loan arrangement has been jointly underwritten by Trafigura, Deutsche Bank and another undisclosed bank, with the support of over 25 banks participating through syndication.

Richard Holtum, head of gas and power trading for Trafigura, said: “We are proud to be contributing to Europe’s energy security by supplying this significant volume of gas to Germany backed by our extensive portfolio and long term US liquefied natural gas contracts.”

The loan will support a new commitment by Trafigura to deliver substantial volumes of gas into the European gas grid, and ultimately into Germany, over the next four years.

Trafigura will supply the gas to Securing Energy for Europe (SEFE), which was recently recapitalised by the German government.

The first gas delivery took place at the start of last month, and Trafigura will use existing quantities from its global gas and liquefied natural gas (LNG) portfolio to help secure gas sup-

plies to SEFE.

The deal also included a review of Trafigura’s environmental, social and governance (ESG) policies and performance.

Germany is scrambling to boost its supplies through long-term agreements for gas and LNG from overseas vendors and has managed to top up its storage to 97 per cent of capacity.

This comes as European Union countries managed to cut gas demand by a quarter in November despite declining temperatures.

Data from commodity analytics company ICIS shared with The Financial Times revealed gas demand in the EU was 24 per cent below the five-year average last month, following a similar fall in October.

EU nations have been trying to cut their dependence on Russian fossil fuels by finding alternative sources or making changes to curb demand.

Prior to Russia’s invasion of Ukraine, the bloc relied on Russia for around 40 per cent of its gas and a third of it oil needs.

The bloc is looking to establish a price cap on Russian gas supplies, having finally agreed with the G7 to contain Russian oil prices to $60 per barrel in an effort to slash the Kremlin’s war revenues.

delaying any further policy shifts until the dust had settled and the direction of energy markets was clearer.

Ole Hansen, head of commodity strategy at Saxo Bank, said he believed OPEC+ should wait to see the effect of their oil output cuts before taking further action.

“There is volatility expected due to the EU sanctions and a G7 price cap on Russian crude which will go into effect this week, and further changes in China’s zero-Covid policy are also set to continue,” he said.

Toyota launches new strategy for carbon neutrality by 2040

ILARIA GRASSO MACOLA

TOYOTA yesterday launched a new strategy to achieve carbon neutrality in Europe by 2040 at the latest.

The Japanese marque said it will focus on driving down the environmental costs of its operations as well as ramping up production of its electric vehicles.

It aims for its European and UK fleet to become net-zero by 2035.

To do so – and abide by both EU and UK regulations – the world’s largest

manufacturer will continue to make hybrids but will also focus on electric vehicles. Toyota chief scientist Gill Pratt said the ongoing supply chain issues and high material costs did not allow for the production of electric vehicles only.

“We call this the ‘power of And’ because rarely does one size fit all, especially when you consider the diversity of customer needs and infrastructure readiness,” added Kylie Jimenez, vice president for corporate affairs.

VW to present new software roadmap

ILARIA GRASSO MACOLA

VOLKSWAGEN is set to present its new software roadmap later this month, according to reports.

People close to the matter yesterday told German business newspaper Handelsblatt that Volkswagen’s chief executive Oliver Blume will present the strategy at a supervisory board meeting on 15 December.

The €1bn (£861.6m) software roadmap will lay the foundation on how to best keep Volkswagen’s current software competitive and market ready for 2030.

In recent months, the carmaker has been plagued by unsatisfactory results, reshuffles in the boardroom and production issues.

Blume’s predecessor Herbert Diess stepped down earlier this year after software delays set back the launch of VW’s new electric models.

According to Handelsblatt, the new chief executive – who took over from Diess in September while also remaining at the head of Porsche –will initially focus on perfecting the software instead of developing the car models.

Blume recently made the headlines when he voiced his concerns about the EU losing its industrial attractiveness due to soaring energy costs.

“We are treading water,” he wrote in a Linkedin post last week. “I am very concerned about the current development regarding investments in the industry’s transformation.”

London City Airport on track for year end as passenger levels skyrocket

LONDON City Airport is on track to reach its year-end goal of three million passengers by the end of 2022 after November numbers soared 187 per cent.

Figures published yesterday said that around 272,000 passengers passed through the airport’s gates last

month after BA expanded its Cityflyer schedule to Scotland, with daily flights to Aberdeen.

December numbers are also expected to be three times higher than last year, with 245,000 flyers forecast to the end of the year.

To capitalise on the increasing numbers during the Christmas and ski seasons, the airport on Monday

launched two new routes to the French Alps and Salzburg.

City Airport aviation director Anne Doyere said the airport was perfect for passengers wishing “to go straight from the office to the Alps for a quick ski trip this winter”, with 40 minute city-to-gate turnaround times meaning workers could go from their desks to the Alps in under three hours.

CITYAM.COM 12 TUESDAY 6 DECEMBER 2022 NEWS

NICHOLAS EARL

Both the UK and EU have established that by 2035 all new cars should be net-zero

ILARIA GRASSO MACOLA

London City’s passenger numbers soared by 187 per cent in November

OPEC+ will stick to its plan to cut output by 2m barrels per day through to 2023

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

FTSE 100 buoyed by speculation of China Covid-19 rules easing

LONDON’s FTSE 100 was bumped higher yesterday as investors were buoyed by signs Beijing is reeling back its tough zero-Covid policy.

The capital’s premier index jumped 0.15 per cent to 7,567.54 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, dipped 0.17 per cent to 19,329.58 points.

Chinese officials are set to announce a further easing in strict virus prevention as soon as today, according to reports by news agency Reuters.

Beijing has stuck to snap lockdowns, shutting trading hubs and factories to stem sudden Covid-19 flare ups since the start of the pandemic.

The rest of the world has largely reverted to normal socialising due to suc-

cessful vaccine rollouts, whereas China has maintained draconian measures to tackle the pandemic. Investors have been betting on China reopening to lift global economic growth.

“It’s been a mixed start to the week as investors look towards the recent change of emphasis on a reopening of China’s economy away from its zero-Covid approach,” Michael Hewson, chief market analyst at CMC Markets UK, said.

“This more pragmatic approach to Covid by the Chinese government appears to be prompting optimism about the pace of a possible reopening with the likes of Prudential seeing further gains on top of last week’s strong performance, and helping to provide an uplift to the FTSE 100,” he added.

The insurer, which has a sprawling China business, topped the index, climbing 5.34 per cent.

CITY MOVES WHO’S SWITCHING JOBS

RUSSELL-COOKE

Law firm Russell-Cooke has built out the French desk within its London-based private client practice with a new partner.

Nicole Gallop Mildon brings expertise to all aspects of private wealth including estate planning, wills, probate and incapacity, specialising in French property issues and transaction structuring, especially in relation to effective tax planning.

Peel Hunt backed Tharisa as a ‘buy’ stock yesterday after it posted a record set of results for the South African miner. The London-listed firm posted a better than expected ebitda, which helped to drive “substantially better cash flows”, the broker said. It also noted that management indicated that sea freight costs are easing. Peel Hunt gave the stock a target price of 245p.

National

Mildon brings almost two decades of experience practising in the UK and France, and joins the firm’s cross-border team.

“We are seeing continued growth in demand from individuals and families for cross-border advice and services, particularly between the UK and continental Europe,” said senior partner John Gould. “Our French team have been a real source of value for clients in this regard and Nicole brings further depth of expertise.”

CARTER JONAS

Carter Jonas has appointed a new head of sustainability into the property consultancy’s London headquarters.

Tom Roundell Greene is set to lead the firm’s ESG strategy, bringing 20 years’ worth of sustainability experience at national and international levels to the job.

The incoming lead joins from professional services and investment management giant JLL, having previously advised the Cabinet Office on its sustainability strategy.

“His track record, pioneering sustainability initiatives in the private and public sector, complements our activity and will be invaluable as we strengthen our sustainability credentials and expertise across all asset classes and client areas,” head of business development Iain Mulvey said.

British investment firm Nextenergy Solar Fund has posted a new non-executive director to its board, who will eventually succeed its chairman.

Helen Mahy CBE, who joins at the beginning of April next year, is set to succeed Kevin Lyon as chairman from the next AGM in August.

Lyon has been chairman since the company’s initial public offering in 2014.

Board veteran Mahy, who recently retired as chairman of the Renewables Infrastructure Group and served as general counsel and company secretary at National Grid, also sits on the board of SSE.

13 TUESDAY 6 DECEMBER 2022 MARKETS CITYAM.COM

P 5 Dec 165.9 29 Nov 5 Dec 2 Dec 1 Dec NATIONAL EXPRESS 166 30 Nov 170 172 174 168

To appear in Best of the Brokers, email your research to notes@cityam.com P 5 Dec 102.5 29 Nov 5 Dec 2 Dec 1 Dec

102 104 106 108 110 30 Nov

Express nabbed a buy rating from Peel Hunt yesterday after its interim CFO James Stamp was appointed as CFO. Stamp joined the coach operator in July 2017 having worked as a partner at KPMG, leading its transport practice. Peel Hunt gave the share, which has been down over 35 per cent in the year to date, a target price of 270p.

THARISA

NEXTENERGY SOLAR FUND

To appear in CITYMOVES please email your career updates and pictures to citymoves@cityam.com

A RACE AGAINST THE STOCK “After several weeks of investors asking, ‘will it, or won’t it?’ about China relaxing its Covid restrictions, the balance of opinion seems to be positive at the start of the new trading week. Asian stocks were off to the races including a 4.5 per cent jump in the Hang Seng index.”

RUSS MOULD, AJ BELL

GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION

EDITED BY SASCHA O’SULLIVAN

Cocaine Bear, a drugged up warning for Netflix & co in the streaming wars

Elena Siniscalco

TWO ambulance workers rush inside a house where furniture is all over the place, and the walls are stained with blood. One of them opens a door, only to be attacked by a giant brown bear whose face is covered inwe quickly figure - human blood. These are the first 20 seconds of the trailer of the upcoming movie Cocaine Bear. Watching it, you can’t help but think it can’t be real - that it must be one of these Twitter memes taken a bit too far. But Cocaine Bear is real and coming to our theatres in 2023.

The storyline is as absurd as it gets: a bear chows down on cocaine which fell from the sky, goes bonkers and starts terrifying everyone in a village tucked away in Tennessee. It’s a horror comedy: it’s meant to be funny, but there’s also a lot of blood. The movie is vaguely based on a real story - a drug smuggler in the ‘80s dropped $20m of cocaine from a plane over a forest in the state of Georgia, killing a bear who ate it all and died of overdose. It’s the kind of story your uncle would tell you at Christmas dinner after too many glasses of wine - but instead, director Elizabeth Banks has decided to turn it into a movie.

Cocaine Bear will be in British cinemas from February 24 - and for all we

know, it might prove a blockbuster. For now though, it begs the question of why there are so many bad movies out there. Why would you pay to go and see something so unhinged?

Cocaine Bear - and its cheap humour - speak volumes about the film industry. The bottom line is that it is too easy to make a film, so there are too many of dubious quality. This is a problem both for Hollywood and for streaming. Netflix has been repeatedly accused of making tonnes of low-quality movies just for the sake of having new content on its platform. It is now

trying to save face by investing in wellthought-out documentaries, but the feeling that there are a lot of simply awful films on the platform lingers. The same goes for Amazon Prime or HBO. The result is that the audience is simply overwhelmed by the amount of choices available. The market for streaming is overcrowded, subscription costs are on the rise, and in some cases subscriber bases are shrinking as we firmly leave two years of lockdowns behind and people spend less and less time at home. It’s been a bad year for streaming services. Growth has slowed

at Youtube and Netflix, with Disney’s streaming services surpassing the latter in number of viewers during summer.

The result of more competition in the streaming market is people increasingly sign up to multiple services. At Netflix, this has been followed with the advent of a “basic” subscription for £4.99, but with advertising. It’s almost as if it’s just regular television. Elsewhere, YouTube has done the opposite, with paid-for access to ad-free videos.

Streaming was framed as the new

Done well, devolution could leave our terrible politicians with nowhere to hide

CONSTITUTIONAL reform is in the air and,but for the cost-ofliving crisis, would be commanding far more attention. Yesterday saw the publication of the report by Gordon Brown’s Commission on the UK’s Future, which sets out a vision of “a New Britain founded on a new relationship between our government, our communities, and the people.”

Brown’s proposals deserve careful consideration because they address some major problems with the institutions of central government. The UK is one of the most centralised states in the developed world. We pay more for less, and see an ever-encroaching state consume more of our economic output and take on ever more responsibilities. It’s how we’ve ended up with taxation at a 70-year high while the performance of public services continues to slide.

Does the Brown report address these problems? There are certainly positive ideas. Chief among them is the plan to move civil servants out of London.

Elliot Keck

Shifting government out of the capital would ease the burden on taxpayers by freeing up expensive office space and reducing London weighting, and may even help to address regional inequality.

A focus on devolution could also reap benefits, with power and decision making more localised, helping to link tax and spend decisions more closely in the minds of voters. Residents notice when bin collections switch from weekly to fortnightly, despite yet another hike in council tax. But when taxes go into a trillionpound pot, it becomes more difficult to track. If fiscal decisions are made locally, taxpayers may find it easier to

scrutinise, with local politicians finding fewer places to hide. What’s more, the evidence tends to show that more decentralised tax systems help generate higher rates of economic growth. That’s the best case scenario. The worst case scenario is one in which these reforms lead to yet more layers of expensive, opaquely-managed bureaucracy with new and cunning levies and charges to prop up an increasingly bloated state. That’s the last thing that this country needs, given the already heavy burden of government. Our research found that in 2022/23, total managed expenditure is projected to rise to £1.2tn, or £41,831 annually per household. Less cost of living crisis, more “cost of government crisis.”

The same could be said for the proposed reforms of the House of Lords. Nobody is happy with the current situation. There are too many peers, with a daily allowance which some don’t justify. But to create yet another class of professional politicians, another set of elections, and a further wage and

staff bill is not the taxpayer-friendly proposal that it may sound.

And conspicuously absent from the paper is a serious policy platform to ease the cost of living crisis. Given the paper’s title includes “rebuilding our economy”, this is concerning. The paper mentions devolution, “an economic growth or prosperity plan for every town and city” and tweaks to the UK Infrastructure Bank and British Business Bank. But given what caused this mess, i.e. a government that spends too much and taxes too highly, this simply isn’t enough.

A succession of damaging tax rises has placed a millstone around the necks of working taxpayers. Politicians from all parties need to demonstrate how they will help ease that weight ahead of the next election. They must ensure that their proposals won’t simply lead to yet another layer of wasteful bureaucracy, with taxpayers picking up the tab.

£ Elliot Keck is head of investigations at

the Tax Payers’ Alliance

the Tax Payers’ Alliance

success story of the movie industry, but clearly, it is in flux. Interestingly, alongside the rise of streaming, the number of films being released in cinema has in fact been trending upwards for some time, counter to what you might imagine.

In 2019, there were 1.2 million tickets sold in the US. This number collapsed during the pandemic, but has ticked back to around 800,000 this year, so far. Pre-pandemic, 47 per cent of Brits went to the cinema a year, with action movies and superhero films dominating the most popular spot. Almost all of the top films of the last few years have been revivals or part of a series, like the Marvel movies. Movies like James Bond and Spiderman have a wide audience, while horror is not for everyone. You might be a Jordan Peele fan when you can stream Get Out from your laptop’s small screen, but not everyone wants to be exposed to jump scares and gory scenes in the dark, in front of the big screen. The comedy - and novelty - of a bear high on cocaine is meant to make up for that.

But by any stretch of the imagination, it is neither a movie with a preexisting large fan base, nor a work of cinematic genius. And yet, its makers have justified a launch in theatres, rather than to a streaming service. By the current economics of the film industry, it doesn’t make sense. But right now, with the streaming services vying for the top place, Cocaine Bear could be a symptom of a wider malaise, with movies execs reluctant to pick a horse (or any other drugged up mammal) by releasing it with just one platform.

ON YER BOAT

Suella

CITYAM.COM 14 TUESDAY 6 DECEMBER 2022 OPINION

OPINION

Cocaine Bear will be in cinemas in February next year

Braverman has backed a report to stop any migrants who come to the UK by illegal means from ever settling in Britain. It’s a bid to show she, unlike her predecessor Priti Patel, can seize the unwieldy reins of the Home Office as record numbers of asylum seekers land in the UK

LETTERS TO THE EDITOR

We can win AI, if we invest right

[Re: UK set to become next AI superpower says new report, Nov 22]

The UK has a strong tradition of research and innovation, a capability that continues to help drive advances in the application of high-end computing and AI. While the US, China, and EU have larger budgets for supercomputing, the UK can differentiate itself and lead by leveraging its strong academic and research base to address specific challenges.

Britain far outpaces other major European countries on most metrics of AI success. This is true in terms of the research taking place in its universities, and the important role being played by UK-based organisations like the Alan

Turing Institute in shaping global AI standards. The UK is also home to numerous AI innovators like DeepMind. Maintaining this pace of innovation will require refocusing and an increase in HPC/AI funding in the UK. To date, HPC and AI have shared “best practices,” but there remains a separation. HPC continues to focus on fundamental models in science while AI is being leveraged in more creative activities. Many other commentators have long been warning about the “end of Moore’s Law”. In the future, different strategies for architecture and software will be essential to continue scaling performance to address new challenges.

Silicon Valley and Shenzhen may be the homes of Big Tech, but the UK’s already established position as an AI innovation hub is a golden opportunity.

Alex White SambaNova Systems

NOTHING’S BETTER UK smartphone provider aims to fight Apple dominance

Harry and Meghan, welcome to the Monochrome Set of black and white puff pictures

PICTURE Editor; not a real job, is it? Paid to study snaps! How hard can it be? It's not as if you're run ragged in A&E, or toiling down a coal mine. I agree wholeheartedly. Even so, life as a Picture Editor is far more stressful than you might imagine. After a certain number of hours at the helm of the picture desk, the urge to simply swear relentlessly is often unbearable.

A soft steady rhythm - phut, Phut, PHUT, the sound of expletives uttered under my breath growing louder until sounding like some spluttering Seagull outboard-motor. Of course, you dream of truly letting off steam, which in its way, is a release valve. Yet, the stress of avoiding the rocks has one urging to vent like some exasperated ship's foghorn. Then along comes an image that pushes you too far and makes you want to explode like Mr Creosote from Monty Python's The Meaning of Life. So, at the risk of sounding like an

Start up smartphone maker Nothing, which has launched in the UK, Europe and Asia, is setting its sights on the US to disrupt the iOS supremacy. Cofounder Carl Pei told CNBC they were ‘in discussions’ for stateside moves.

KEIR STARMER’S PRIVATE SCHOOL PROBLEM

KEIR STARMER’S PRIVATE SCHOOL PROBLEM

Students at Eton let out a sigh of relief yesterday. They wouldn’t be forced to join the other 94 per cent of kids who don’t attend private school if Keir Starmer becomes Prime Minister. Well, as long as their parents can afford to cough up extra fees that is. Keir Starmer insisted he wasn’t at war with the private education sector, and his plans to end tax breaks for fee-paying schools was simply a common-sense approach to finding the cash to fund extra resources in state schools.

He said “there are very good private schools” which add “a huge amount” to Britain.

Its another marked shift from Jeremy Corbyn’s leadership, who made abolishing private schools by “integrating” all institutions into the state sector part of his plans for government. Scrapping the tax break would raise some $8bn, Starmer says. But critics fear it is a move which would make private school unaffordable, and push more students into busy state classrooms.

angry old man, which is precisely what I am, I need to get this off my chest before I detonate, frightening the newsdesk.

It's been said that you can't polish a turd, but even so, that's not stopped many a charlatan from making a nice little earner rolling them in glitter. Nowadays, it would seem instead of bling, we are at the mercy of the latest gimmick, as a new panacea has become the latest comprehensive solution to an age-old problem - a lack of talent.

I've lost count of the number of times that after spending hours, hassling, schmoozing, pleading, sometimes begging, a PR agency or company for an image only, to curse with a word that (almost) rhymes with

PHUT, on opening the email. Phut this, phut that, it's always the phutting same.

You see, a fad has sprung forth among agencies; a trend set at the corporate HQs of the trendy young things that issue such images from exalted heights like Papal commands. And that craze is this: rather than send out a nicely composed, nicely exposed, and nicely thought out portrait or photo, now you can send out any old crap, all you have to do is make it monochrome.

Now, some folks can carry a tune, others bring us to tears, and some may even make us cry for the right reasons. It's the same with photography, especially black and white. Its creation is a true art, one that in the right hands will have the spine-tingling with as much frequency as Meat Loaf battering out "Bat Out Of Hell" or Ian Curtis electrifying you with "Love Will Tear Us Apart".

That's because Black & White is not black and white. It's not easy; its cre-

ativity inhabits the world of shades of grey. It's simply not as simple as taking a colour file and changing its mode. To the visually tone-deaf, that fundamental lack of understanding is why we suffer so many bum notes.

Consequently, opening an email is like pulling a creative cracker. Instead of the anticipation of discovering it holds a brilliant blast of visual inspiration, too often it's a damp squib, inside, nothing but mediocrity, invariably in monochrome, no jokes, and it's not funny.

So, come on Harry and Meghan, I've got news for you and the rest of the monochrome set, converting an image to greyscale is not like running it through some Photoshop Cartier Bresson filter. You can't just dial in Eamon McCabe, James Nachtwey, Ian Berry or Tom Stoddart like it's some special effect. It's both naive and disrespectful.

£ Andy Blackmore is picture editor at City A.M.

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900

Certified Distribution from 30/5/2022 till 01/07/2022 is 79,855

Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com

Email: news@cityam.com Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP

Editorial Editor Andy Silvester | News Editor Ben Lucas Comment & Features Editor Sascha O’Sullivan

15 TUESDAY 6 DECEMBER 2022 OPINION CITYAM.COM

Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Digital Editor Michiel Willems Commercial Sales Director Jeremy Slattery

Andy Blackmore

Now you can send out any old picture, all you have to do is make it monochrome

WANT

› E: opinion@cityam.com COMMENT AT: cityam.com/opinion

WE

TO HEAR YOUR VIEWS

EXPLAINER-IN-BRIEF:

Prince Harry and Meghan Markle released stills for their Netflix documentary

MOTORING

THUNDERBALL!

Tim Pitt -drives the Wiesmann Project Thunderball, an old-school sports car with an electric heart transplant

IMAGINEif TVR had upped sticks and moved from Lancashire to Münsterland, switched to brawny BMW engines and discovered Teutonic build quality. The result might look something like Wiesmann. Founded in 1988, Wiesmann remains little known outside its native country. As charismatic new British CEO Roheen Berry explains: “We’ve been around for decades, but 90 percent of our cars were sold in Germany, so we never gained international recognition.” Now Wiesmann plans to go global.

Leading the charge (yes, literally) is Project Thunderball – arguably the first dedicated electric sports car since the 2008 Tesla Roadster. The vehicle seen here is a prototype, but the finished product should reach a network of new boutique Wiesmann dealerships in early 2024. Beyond that, Berry talks of a coupe version, a second sports car (probably also electric) and “maybe even an SUV”.

Unlike Wiesmanns of yore, Project

Thunderball – an internal codename, but don’t be surprised if it sticks – doesn’t raid the BMW M parts store. Instead, its bespoke 92kWh battery comes from Munich-based Roding Group, which also helped engineer the Mars Rover.

With two electric motors driving the rear wheels, the headline numbers are impressive: 680hp, 0-62mph in 2.9 seconds and a 310-mile range.

Before we unplug and play, I’m offered a chance to drive two of Wiesmann’s ‘heritage’ models. The GT MF5 coupe looks a bit like the bonkers Morgan Aeromax and has the thuggish 550hp twin-turbo V8 from a BMW X5 M. But the smaller MF4-S roadster is more exciting still. Its 420hp naturally aspirated V8 hails from the E90 M3 and feels emancipated here, racing to the 8,400rpm limiter with an adrenalising metallic scream.

Frankly, no electric car offers such bombast and sense of occasion – and that includes Project Thunderball.

WIESMANN PROJECT THUNDERBALL

PRICE: £260,000 POWER: 680HP 0-62MPH: 2.9SECS RANGE: 310 MILES KERB WEIGHT: 1,700KG CO2 EMISSIONS: 0G/KM

Here, though, you get your kicks in different ways: savage and relentless acceleration, or the elastic effect of 811lb ft of torque, available the instant the twin axial-flux motors start spinning. Conversely, you might also enjoy the calm refinement, or the challenge of driving with one pedal to boost the batteries.

This hard-worked development hack is some 200kg heavier than the production car (target kerb weight is 1,700kg), yet it changes direction with alertness and confidence-building poise. While

many EVs feel desensitised, the Wiesmann offers real tactility and finesse.

It’s not perfect. I’d like more steering feedback and I’ll wager the current suspension setup, tuned on the smooth roads of North Rhine-Westphalia, would feel quite brittle on British tarmac. The soundtrack, a shrill whistle of energised electrons, is due some finetuning, too. I’m told Wiesmann is working on an “authentic” EV noise, augmented via the car’s speakers.

Elsewhere, Project Thunderball feels close to showroom-ready. Its carbon fibre panels fit together flawlessly, while its stance looks perfect on custom 21-inch wheels. The cabin is also far more accommodating than cramped Wiesmanns of old, combining hand-stitched leather and analogue dials with exposed carbon weave and a motorsport-style digital display. Overthe-air updates are promised for the touchscreen media system, along with the option to swap the entire battery

pack – for more power or a longer range – at a later date.

As Berry reveals via the Wiesmann configurator, each Project Thunderball will also be a blank canvas, ready to be tailored to the owner’s taste. “It can be Bruce Wayne or Batman,” he says, showing me one virtual car inspired by luxury yachts, with red leather and mahogany trim, then another that resembles a pared-back road racer. The starting price is €300,000 (circa. £260,000), but rest assured you could spend a lot more.

If you want classic styling with the performance of a modern supercar, plus a side order of social acceptability, Project Thunderball (available to reserve now) should be worth waiting for. And that’s something we can’t, in good conscience, say for Elon Musk’s nevergonna-happen second Tesla Roadster –or indeed the ‘new’ TVR.

Pitt writes for motoringresearch.com

DANISHmarque Zenvo has revealed a final, ‘low-drag’ version of its TS hypercar. The luxurious, less track-focused TSR-GT is a last hurrah after six years in production and only three will be made – all sold in advance. The price hasn’t been published, but reckon on at least £1.5 million.

The mid-mounted, twinsupercharged V8 of the TSR-GT develops 1,379hp, up from 1,193hp in a ‘standard’ TSR-S. Driving the rear wheels via a brutally quick sequential gearbox with helical-cut dog gears, it blasts the Zenvo to 62mph in less than three seconds. A new rear spoiler is hand-made from pre-preg carbon fibre, replacing the tilting ‘centripetal’

wing of the TSR-S. The GT’s wing is fixed and designed to reduce drag –helping towards a headline-grabbing 263mph top speed.

Inside, the GT swaps the raw, racecar feel of its siblings for more comfort. There’s leather instead of Alcantara on the seats, dashboard and steering wheel, along with ‘noise reducing’ mats to cover the carbon fibre floor.

Zenvo chairman Jens Sverdrup, who joined from American hypercar brand Czinger in 2021, said: “A new era for Zenvo beckons, but before then, we’ve created our interpretation of a GT variant of the TS platform. We’ll make just three models, all of which are allocated to global collectors, much like Tim Burton’s [YouTuber Schmee150’s] TSR-S,

which he took delivery of in August.”

Speaking to Motoring Research, Zenvo founder Troels Vollertsen confirmed the follow-up to the TS is a hybrid, rather than fully electric. “It will be an ultra-lightweight car for road or track use,” he explained. “It’s a clean-sheet design, albeit with recognisable Zenvo DNA.

“We are running a test mule with a hybrid gearbox at the moment, and working on rear- and four-wheel-drive versions of the platform. Our aim is a power-to-weight ratio of one horsepower per kilogram.”

We’ll be following the Zenvo story closely in 2023. One thing seems certain, however: this small company from Praesto, near Copenhagen, certainly isn’t slowing down.

BY MOTORINGRESEARCH.COM FOR CITY A.M.

Tim

17 TUESDAY 6 DECEMBER 2022 LIFE&STYLE CITYAM.COM

HYPERCAR

OUT WITH 263MPH TSR-GT

ZENVO

BOWS

SPORT

TODAY’S THE DAY England head coach Jones’s fate set to be confirmed at 16pt

SPORT DIGEST

WALES DITCH PIVAC AND BRING BACK GATLAND

£ The Welsh Rugby Union yesterday confirmed the departure of coach Wayne Pivac and the re-hiring of former boss Warren Gatland –who led them to the third-place play-off at the 2019 Rugby World Cup. Pivac had the fourth-worst winning record in charge of Wales. “There is little time for sentiment, professional sport is all about preparation, values and results,” Gatland said.

AGASSI TENNIS COACH

BOLLETTIERI DIES AGED 91

£ American tennis coach Nick Bollettieri – who was behind 10 world No1 singles players including Maria Sharapova, Boris Becker and Andre Agassi – has died aged 91. “Our dear friend graduated from us last night,” Agassi said. “He gave so many a chance to live their dream.”

ASHLEY THREATENS COVENTRY WITH EVICTION

£ Championship football club Coventry City have been served a notice of eviction from Mike Ashley’s Frasers Group after the retail tycoon took over the stadium following the downfall of Premiership rugby club Wasps. Frasers says Coventry have no continuing right to use the ground until a new licence is agreed – the licence was due to expire in 2031.

COWAN-DICKIE LATEST TO JOIN EXODUS TO FRANCE