NEWJOULES IN CROWN FOR NEXT

EMILY HAWKINS

HIGH STREET behemoth Next bought fashion retailer Joules out of insolvency yesterday, saving 100 stores.

Joules called in administrators a few weeks ago, with 1,600 jobs hanging in the balance.

Stalwart Next confirmed it had emerged victorious out of a bidding war, forking out £34m for the midmarket retailer.

It has teamed up with founder Tom Joule, who will own 26 per cent of the company, with Next taking the remainder.

The Next deal sees around 1,450 jobs maintained.

However, 19 stores are not part of the transaction and will be closed immediately, resulting in 133 job losses.

The retail giant won out over the Hobbs and Whistles owner, the South African Foschini Group.

Joules founder Tom Joule said he was looking forward to returning to leading the charge to “recapture the imagination of the customer again”, returning to an executive role.

Simon Wolfson, head of Next, said he was “excited to see what can be achieved” through the combination of Joules’ products and brand with Next’s Total Platform infrastructure.

Joules is set to go live on Next’s platform in early 2024, with Next providing warehousing and distribution services for Joules’ physical stores.

Next has been on a high street shopping spree in recent weeks, snagging the Made.com brand shortly after the furniture firm collapsed earlier this autumn.

Global interest in the Joules brand over the last few weeks “just goes to show what reach Next may be able to achieve internationally as well as at home,” John Coldham, retail partner at law firm Gowling WLG, noted.

Joules was hammered by subdued sales and heavy headwinds this year, while a mild autumn dampened demand for its jumpers and boots.

The high street faces a tough winter as consumers are expected to tighten their purse strings after Christmas, in order to battle rising energy and grocery bills.

The news came on the same day that markets received confirmation the iconic Savile Row tailor Gieves & Hawkes has been bought out of administration by Sports Direct owner Frasers Group.

THE SQUARE Mile has swung into the festive spirit this week as the first Christmas period without any restrictions gets off to a smashing start.

City bars are welcoming post-work partygoers as the hospitality trade looks to take advantage of the festive season coinciding with the World Cup.

Publicans are excited about the industry’s first full Christmas trading season in three years void of Covid-19 restrictions. Young’s said Christmas

bookings were “significantly ahead of last year”, while its City pub sales are already up 11 per cent versus last year.

London remains a region home to a particular Christmas spirit, wth 73 per cent of London workers saying their company will be providing a staff Christmas party this year, way above the national average of 50 per cent, according to a survey by Moneypenny.

Meanwhile, a looming recession is failing to dampen optimism in the City, with 56 per cent of London workers expecting a Christmas bonus.

Go Charlie Go? Sterling bounces to months-long high against the dollar

JACK BARNETT

THE POUND has climbed to its highest level against the US dollar since early August driven by investors betting on slower interest rate rises across the pond.

Sterling bounced above $1.22 and was up over 1.6 per cent against the

dollar heading into evening trading yesterday.

US Federal Reserve chief Jerome Powell earlier this week said the world’s most powerful central bank will likely slow the pace of rate rises to 50 basis points from 75 basis points at its meeting on 14 December.

It has lifted borrowing costs 75 basis points four times in a row, making US assets relatively more attractive than UK and European bonds and stocks.

Higher interest rates strengthen currencies by increasing returns on assets denoted in said currency.

The Fed’s rate rises have sent the

dollar on a tear against nearly all the world’s top currencies this year.

Sterling’s upward move comes after its biggest monthly gain against the greenback in November since July 2020, up around five per cent, building on October’s 2.7 per cent fuelled by Rishi Sunak wiping away the legacy of Liz Truss’s

disastrous premiership.

Sterling has defied analysts’ bets on it sliding below parity with the dollar. Those predictions were made in the immediate aftermath of Truss and Kwasi Kwarteng’s minibudget, which rocked financial markets by launching a round of potentially inflationary tax cuts.

ISSUE 3,901 CITYAM.COM FREE INSIDE PEEL HUNT PROFITS PLUMMET P3 BARCLAYS HIT WITH £8.4M FINE P6 RYANAIR TO BUY GREEN FUEL P7 BIRD & BIRD HIKES PAY P9 MARKETS P13 OPINION P14 LONDON’S BUSINESS NEWSPAPER TGIF YOUR GUIDE TO THE CAPITAL’S FILM AND THEATRE OFFERINGS P16 SENEGAL ON SUNDAY ALL YOU NEED TO KNOW ABOUT THE ‘OTHER’ LIONS P20

BEN JAGLOM

HIGH STREET GIANT SNAPS UP BRUISED CLOTHING FIRM

‘TIS THE SEASON Workers get ready to party as City gets festive

STANDING UP FOR THE CITY

The implications of bone-headed windfall tax begin to be felt

WHO COULD possibly have predicted that the windfall tax on energy companies might just have unintended, negative consequences? Well, everybody. The Treasury was warned, over and over again, that launching a tax raid on firms operating in the North Sea would damage investment prospects.

Lo and behold, a few weeks after the original Energy Profits Levy was extended, and we can see

THE CITY VIEW

the results.

Shell has said it is now reconsidering each investment in the area on what is effectively a case by case basis. Yesterday, it was reported that Totalenergies was paring back its investment plans by 25 per cent. The trade

body representing offshore operators says the industry was ready to put some £200bn into a range of projects, including lowcarbon operations, before the windfall tax was instituted. It is hardly a surprise they now say that that investment is jeopardised. Windfall taxes are a bad idea –not least in the feast or famine world of energy generation, where costly investments can take years to pay off. Firms pumping oil when the

price of a barrel fell to zero during the pandemic can hardly have then been said to be raking it in –and nor, by the way, were they given any support at the time. But it’s dumb as an ox to introduce a windfall tax on energy companies right now, when our overarching foreign policy priority is to reduce our dependence on foreign energy supplies. Whilst we were not beholden to Russian energy in the same way that the wilfully

naive Germans were at the outbreak of the war in Ukraine, we are still of course affected by the price of mobile, global energy supplies. Using the energy sources here in this country is a no-brainer. Instead, we’re taxing both the largest and the smallest operators in the North Sea and making investing in our offshore energy less appealing. Businesses want predictability in their tax regime and Britain used to be known for such things.

WHAT THE OTHER PAPERS SAY THIS MORNING

CHINA CLAMPS DOWN ON INTERNET AS IT SEEKS TO STAMP OUT COVID PROTESTS

China’s internet watchdog instructed tech companies to expand censorship of protests and moved to curb access to virtual private networks this week, amid a government crackdown on protests.

FINANCIAL TIMES

FCA WRONG ON CASH HOARDING SAYS AJ BELL

The FCA’s proposal to simplify financial advice is the “wrong solution” to the problem of savers hoarding cash, according to the head of AJ Bell.

Michael Summersgill said it risks savers ending up in more expensive products.

THE TIMES

LLOYDS PENSION FUND WAS IN FIRE SALE DURING CRISIS

Lloyds Banking Group’s £52bn staff pension fund was forced into fire sales of equities and faced collateral calls of billions of pounds at the height of the gilts market crisis, according to unusual evidence tabled in parliament.

Britain’s factories already in recession as economy enters early stages of slump

BRITAIN’s factories are already in recession, sparked by demand receding as the country’s economy slumps, a survey out yesterday revealed.

S&P Global and the Chartered Institute of Procurement and Supply’s final purchasing managers’ index (PMI) inched higher to 46.5 last month from 46.2 in October.

The number was revised up from an earlier estimate.

Despite the slight rise, the survey remained far below the 50 point threshold that separates growth and

contraction, meaning the UK’s manufacturing has now shrunk for several months in a row.

Businesses are cutting spending on manufactured goods as they brace for a slowdown in consumer demand caused by inflation eroding real incomes at the quickest pace on record.

Firms typically rein in investment during recessions due to weaker spending squeezing returns.

Normally, policymakers would cut interest rates to stimulate business spending. However, the coming recession is being driven by elevated inflation, running at a 41 year high of 11.1

per cent, meaning the Bank of England is unlikely to loosen financial conditions any time soon.

“Demand for industrial goods will likely be hit again early next year as real incomes are squeezed by the watering down of government support for energy bills and higher unemployment, as businesses are forced to consolidate costs,” Gabriella Dickens, senior UK economist at consultancy Pantheon Macroeconomics, said.

The PMI also indicated factories are curbing hiring plans and may even be considering shedding workers to protect their finances.

Euro jobs market defies bets after record low joblessness

JACK BARNETT

THE EUROPEAN jobs market is defying expectations and holding up well despite experts expecting the bloc to tip into a tough recession, figures out yesterday showed.

The proportion of people unemployed in the 19 countries using the euro dropped to a record low 6.5 per cent from 6.6 per cent, according to Eurostat.

Joblessness in the eurozone continued to fall despite countries such as Germany, Italy and France suffering from a historic energy

crisis that is cooling economic activity.

Analysts said unemployment is likely to rise in the coming months as consumers cut spending in response to raging inflation knocking their living standards.

“The currency bloc’s economy is faced with a mounting set of economic challenges,” Benjamin Trevis, an economist at the Centre for Economics and Business Research, said.

Inflation cooled to ten per cent in October, raising hopes the ECB will slow interest rate hikes.

CITYAM.COM 02 FRIDAY 2 DECEMBER 2022 NEWS

JACK BARNETT

TANDEM LOVE A cycling duo riding down by Monument in the City. Tandems have been used since the 1880s, with tandem cycling events remaining a niche yet adored sport.

THE WALL STREET JOURNAL

We’ve ‘moved on’ from Asia sale row: HSBC

JACK BARNETT

HSBC’s board has “moved on” from exploring selling its Asian business in a move that would have kowtowed to its largest shareholder, the bank’s chief executive said yesterday.

Speaking at the Financial Times’s banking summit, Noel Quinn yesterday doubled down on his conviction that HSBC should continue to operate as a global bank.

Investors “want an international bank,” Quinn, 61, who worked his way up HSBC’s hierarchy after joining Midland Bank, which the high street lender acquired in 1992, to take the top spot, said.

Ping An, a Chinese insurer and HSBC’s largest shareholder, has for over a year been lobbying the lender to carve out its Asian business to stop it from continuously being dragged

down by underperforming arms elsewhere.

Pretty much all of HSBC’s profits are generated by its Hong Kong and Chinese activities. Its UK arm actually is loss-making, according to the bank’s latest set of results.

Quinn said the board had given splitting up the bank “serious consideration” but concluded there was “not an economic case” for signing off a demerger.

During the Covid-19 crisis, UK regulators stopped banks distributing dividends.

That ban stemmed a flow of cash to Asian retail investors, sparking calls from the East for HSBC to sell the Asia arm.

Quinn said he does not believe Chinese politicians are secretly orchestrating Ping An’s breakup campaign.

Quinn said a split was given “serious consideration”

‘No reason’ Brussels should block London clearing for EU lenders

JACK BARNETT

THERE is “no reason” the European Union (EU) should block London clearing houses from servicing customers in the area, the UK’s City minister said yesterday.

Tory MP Andrew Griffith, who succeeded John Glenn, told an event hosted by finance lobby group TheCityUK that clearing firms should

Peel Hunt profits plunge 99 per cent amid slowdown in London floats

CHARLIE CONCHIE

PEEL HUNT saw profits plunge by 99 per cent in the first half of the year as the investment bank was hammered by a slump in initial public offerings and volatility on the markets.

In its half year results posted yesterday, the firm reported pre-tax profits of just £0.1m, down from £29.5m last year, after revenue

tumbled to £41.1m from £71.4m in the same period last year. Peel Hunt’s cash levels plunged by nearly half to £41.4m.

Peel Hunt chief Steven Fine said “challenging market conditions” continued to have an “adverse impact on markets and investor sentiment”.

“Equity capital markets activity has been at a multi-decade low and market volumes have reduced

materially during this period,” he said.

“This is due to several factors including investor redemptions, institutional investors building up cash positions and retail investors being more cautious as equity markets responded to rising inflation, the cost-of-living crisis and the possibility of a lengthy UK recession.”

“continue to provide clearing services for countries in the EU, indeed around the world”.

Brussels and London are still yet to reach a deal that would allow Britain and the EU to trade financial services seamlessly.

The UK formally severed all ties with the EU in January 2021 after the end of the so-called Brexit transition period.

KPMG to boost legal offering with Zico deal

LOUIS GOSS

KPMG has struck a deal to incorporate one of South East Asia’s biggest law firms, Zico Law, into its global partnership.

The deal will see Zico Law’s more than 275 lawyers join KPMG’s 2,900strong legal team.

The merger is set to expand KPMG’s footprint in the Asia Pacific region, by extending its legal services offerings throughout the ASEAN countries.

Zico Law currently has 18 offices in all 10 of the ASEAN countries, including Cambodia, Indonesia, Laos, Malaysia, Myanmar, Brunei, Singapore, the Philippines, Thailand and Vietnam.

Zico traces its origins back to the Kuala Lumpur-based law firm Zaid Ibrahim & Co, which first began operating out of offices above a bicycle shop in 1987.

Over the past three decades, Zico has expanded throughout South East Asia to become a leading network of firms.

KPMG’s global head of legal services said the deal will help the firm capitalise on the “increasing strategic and economic importance of the Asia Pacific region.”

03 FRIDAY 2 DECEMBER 2022 NEWS CITYAM.COM

Andrew Griffith said London clearing houses should continue to serve the world

Peel Hunt saw profits plunge amid a dip in IPO issuance

JP Morgan eyes up bid for stock app Freetrade

LEAH MONTEBELLO

BANKING giant JP Morgan is reportedly gearing up to buy stock trading app Freetrade in a grand push to expand its fintech offering.

According to initial reports from Mark Kleinman for Sky News, the City titan has been in talks with the British stock trading app, which allows customers to buy British, American and European stocks and funds without trading fees.

It comes after The Telegraph reported last month that Freetrade was preparing to hire Bank of America to help explore its strategic options, mulling either a sale or a merger.

Freetrade has over £1.4bn assets under management and in its latest accounts had revenues of £12.7m in the year to September 2021, with a loss of £18.2m.

JP Morgan and Freetrade declined to

comment on the reports.

Freetrade was founded in 2016 and announced a £30m funding round back in May. However, it was reported that Freetrade called off plans to raise external funding earlier this year at a £700m valuation.

Echoing a similar sentiment to many tech firms, Freetrade also said it would be cutting around 15 per cent of its roughly 300 staff in June , with a company spokesperson saying the action was “taken to reduce costs and extend Freetrade’s cash runway”.

Meanwhile for JP Morgan, snapping up Freetrade would add to its increasingly diversified offering.

The US firm agreed to buy the digital wealth platform Nutmeg in June 2021, complementing the group’s UK digital bank launch under its Chase brand.

Sources told Sky News that it was unclear whether the weeks of discussion would result in a deal.

Ford ramps up UK EV production after £600m government loan

ILARIA GRASSO MACOLA

FORD is set to ramp up production of electric vehicles (EV) in the UK following a £600m government loan.

Through the UK Export Finance funding, the marque will increase its electric range from the current two models to nine models within the next four years.

The loan will boost a £125m investment into Ford’s EV powertrain facility in Merseyside, increasing volume from 250,000 units to 420,000 per year and securing 500 jobs.

It will also protect the carmaker’s ability to deliver engineering services at its plant in Dunton, Essex, enabling a continued focus on research and development.

Brewdog gives up its B-Corp certification

JACK MENDEL

BREWDOG has given up its B-Corp certificate recognising its social and environmental impact.

In an internal statement seen by City A.M., the beer-maker said: “We have decided to step aside from our B Corp certification for the time being.” The brewery giant said it gave up the label because “B Lab had requested additional measures from Brewdog and the Brewdog board decided that these were not something we could do at this time.”

B-Corp is a designation awarded by B Lab to show that a firm meets high standards of performance, accountability and transparency on everything from employee benefits and charitable giving to supply chain practices and input materials.

Brewdog, which prides itself on being a carbon negative brand, said that it was committed to its ‘blueprint’ of ethical values, placing people and the planet very highly.

When contacted by City A.M., B Lab said it would not comment on the news, as it “does not comment on companies that are no longer in the B Corp community”.

CITYAM.COM 04 FRIDAY 2 DECEMBER 2022 NEWS

Ford’s focus in the UK comes as BMW moves Mini’s EV production from Oxford to China

Ofgem reforms to benefit Big Six most: Utilita boss

EXCLUSIVE NICHOLAS EARL

EXCLUSIVE NICHOLAS EARL

OFGEM risks stifling innovation and preventing energy firms from making a profit in its attempts to clean up the sector, warned the boss of Utilita Energy.

Chief executive Bill Bullen told City A.M. that the watchdog needs to “join the dots” between its various policies, slamming its decision to impose capital adequacy requirements while maintaining the restrictions within the price cap.

He argued Ofgem’s policies risk benefitting the biggest players in the industry ahead of challengers with creative propositions to offer to the market.

This could lead to challenger suppliers being squeezed out of the industry.

Bullen said: “This latest round of capital adequacy just doesn’t chime with the price capping regime that they’ve put in place unless of course you’re Centrica or EON or Scottish Power or EDF. These are massive energy companies. They are coming up with a set of rules in which only the massive ones can survive.”

The current Big Six will have a 90 per cent hold of the energy market, if Octopus’ takeover of Bulb is greenlit, accord-

ing to recent calculations from Cornwall Insight.

Bullen was speaking to City A.M. ahead of the launch of Utilita’s white paper today, outlining measures to avoid excess deaths this winter from soaring energy bills and cold weather.

The white paper, submitted to both the government and Ofgem, calls for an urgent intervention to avoid excess winter deaths associated with energy self-disconnection.

The energy firm has called for five measures to alleviate the crisis this winter including smart installations in households and removing standing charges from pay-as-you-go customers.

It also urges the government and the wider industry to clamp down on stopping misinformation, end the stigma over PAYG to ensure customers who need the service use it and for suppliers to work more closely with the Department for Work and Pensions and BEIS to help reduce self-disconnecting.

Utilita is home to around 850,000 customers – with the vast majority signing up to pre-paid and PAYG models.

Ofgem has been approached for comment.

EDF secures further funding for Hinkley Point C in new settlement

NICHOLAS EARL

EDF HAS secured 14 years of funding for the UK’s upcoming nuclear plant Hinkley Point C in case of the risk of further delays.

The French energy giant has agreed a new contract ensuring its funding even if it does not start operating until 2036.

It confirmed to City A.M. the

project is still on course for completion in 2027, following an approximately two year delay driven by the pandemic and supply chain disruptions.

The plant is also roughly 45 per cent over budget – having initially been projected to cost £18bn, but now expected to be priced at £26bn.

The new subsidy contract still includes clauses in the former deal,

which was set to expire just three years earlier in 2033.

This includes stipulations such as shortened payments to EDF if Hinkley Point C fails to start generating power by May 2029.

If the plant is up and running by that date, EDF receives a guaranteed £92.50 per megawatt hour for its electricity for the first 35 years of its life.

Total Energies slashes investment as new windfall tax hits North Sea

NICHOLAS EARL

TOTAL Energies plans to cut its investments by a quarter next year, after the UK government tightened the windfall tax last month.

The boss of the French super-major confirmed to Energy Voice yesterday it will slash £100m from its North Sea investment plans for 2023.

The group is concerned about the tax and lack of a price floor, meaning the Energy Profits Levy stays in place

even if oil and gas prices recede close to conventional trading levels.

Offshore Energies UK told City A.M the latest changes to the windfall tax have made rates “so high that it threatens to drive investment out of the UK altogether”.

The latest gloomy warnings come as Harbour Energy is booted off the FTSE 100 this week, after its share price plummeted over 20 per cent in the past six months with investors concerned over the effects of the windfall tax.

05 FRIDAY 2 DECEMBER 2022 NEWS CITYAM.COM

Total Energies has announced it will reduce its UK investment plans by £100m next year

Barclays hit with £8.4m fine over payment failings

CHARLIE CONCHIE

CHARLIE CONCHIE

BARCLAYS was slapped with an £8.4m fine from the payments regulator yesterday after failing to comply with rules governing the cost of card transactions with retailers.

In a statement yesterday, the Payment System Regulator (PSR) said the bank had failed to provide retailers with the full information on the cost of card services, and retailers were “unable to easily understand the transaction fees” as a result.

The failings left retailers unable to shop around for better deals and fully understand the cost of their deal, the PSR said.

“It’s vital that retailers and consumers get value for money on payment services – the interchange fee rules are an important part of making sure this happens,” added Chris Hemsley, the PSR’s managing director.

“Barclays’ failure to be

could have been missing out on better deals”.

The watchdog’s investigation found that Barclays failed to comply with the IFR for over three years in total, from December 2015 to December 2018. Barclays processed a third of all card payment transactions in the UK during the period, meaning “thousands of retailers and transactions were affected”, the PSR said.

Barclays is understood to have been going through a large-scale system upgrade when Article 12 – which details the rules – was passed, causing a delay to the availability of transaction level reports.

A Barclays spokesperson said: “Barclays has reached a resolution with the PSR following an investigation into its historic compliance with Article 12 of the Interchange Fee Regulation.

Customers to service suppliers’ debts as Ofwat shirks reforms

NICHOLAS EARL

CUSTOMERS are coughing up £80 or 20 per cent of their water bill towards servicing debt and paying out shareholders, according to the Competition and Markets Authority (CMA). Ofwat is refusing to limit the rising debts run up by water companies, even as research from the watchdog reveals

firms have outstanding borrowing of £54bn accrued since privatisation.

They have been running ratios of debt to capital value from 60-80 per cent, according to Ofwat data.

The CMA has proposed limits on the debt a supplier can take on from high levels of borrowing to protect the public, but Ofwat has rejected the idea. Ofwat was approached for comment.

Google appeals record EU antitrust penalty

LEAH MONTEBELLO

LEAH MONTEBELLO

GOOGLE filed an appeal with the EU’s top court yesterday over a record €4.13bn (£3.5bn) fine.

The tech giant said it will be challenging the commission’s largest ever anti-trust penalty handed down in 2018 that took aim at its Android operating system, suggesting that it restricted mobile competition and consumer choice.

In the original decision, the commission said that Google, which is owned by Alphabet, broke EU rules by requiring smartphone makers to take a bundle of its own apps –including Google Search, Chrome and Youtube.

Google has filed the latest appeal because “there are areas that require legal clarification from the European Court of Justice,” it said.

“Android has created more choice for everyone, not less,” Google said in a statement.

The fine is one of three anticompetition fines, totalling more than £6.9bn, handed to the Silicon Valley firm by Brussels.

The European Court of Justice can notably only rule on points of law.

have been running up ratios of debt to capital value of 60 to 80 per cent

Suppliers

Something special for everyone Meta Quest 2 Virtual Reality Headset 256GB

shop Explore incredibly immersive experiences, fitness titles and games 2 year guarantee included* £499.99 Product, price and availability are correct at time of going to press but may change and are subject to availability. *T&Cs apply.

Scan to

with retailers

fees

for card services

retailers

transparent

about the

they pay

meant

CITYAM.COM 06 FRIDAY 2 DECEMBER 2022 NEWS

Ryanair to buy green fuel from Shell until 2030

ILARIA GRASSO MACOLA

RYANAIR is set to buy sustainable fuels from Shell between 2025 and 2030 as part of its green push.

The low-cost carrier yesterday signed a memorandum of understanding, pledging to purchase as much as 360,000 tonnes of sustainable aviation fuel (SAF) by the end of the decade.

According to Ryanair, the agreement will save up to 900,000 tonnes of CO2 emissions – or the equivalent of 70,000 flights between Dublin and Milan.

“SAF plays a key role in our ‘Pathway to Net Zero’ strategy, and also our commitment to a target of 12.5 per cent SAF by 2030,” said Ryanair’s sustainability director Thomas Fowler.

“Today’s agreement with Shell helps Ryanair secure access to circa 20 per cent of this ambitious goal.”

Christopher Surgenor, editor of trade publication Greenair News, told City A.M. the move, “while significant”, might not be enough.

“By 2030, airlines have set a goal of having 10 per cent of their jet fuel coming from sustainable sources but given SAF is currently around 0.1 per cent of total sup-

ply, a big ramp up will be required over the coming decade,” he said.

Surgenor’s words were echoed by Ryanair’s chief executive Michael O’Leary, who told journalists the airline’s target could be too ambitious.

“I’m not sure we’ll get there but by signing up more partnership agreements with Shell, with Neste and with the other fuel suppliers, I think that gives us our best chance of maybe getting to 8, maybe 10, maybe 11,” O’Leary said yesterday.

The low-cost company has struck deals with Finnish biofuel producer Neste as well as Australian oil and gas group OMV. “Who knows, hopefully we will get to 12.5 per cent by 2030,” O’Leary added.

“But that will not happen unless we have a dramatic revolution in supply of production of SAFs and availability at our airports.”

The Irish businessman is not the first to call for higher investment into SAF, with both airline veteran Willie Walsh and Rolls-Royce boss Warren East also having called for increased production.

It comes as the aviation industry welcomes a rebound in travel demand, with O’Leary noting Christmas bookings are running ahead of pre-pandemic levels.

SAFs have been at the centre of talks around green flying for a few years now but questions around their nature and use persist.

WHAT ARE SAFS?

Sustainable aviation fuels – also known as SAFs – are greener fuel derived from the production of solid waste and food scraps. They reduce CO2 emission by 80 per cent over their life cycle.

ARE SAFS THE WAY FORWARD TO DECARBONISE AVIATION?

SAFs are considered the main tool aviation has available to reach its

Q&A

target of net-zero by 2050. Many aviation stakeholders believe SAFs are the way forward in the mid-term because their production is already under way while the development and adoption of greener alternatives such as hydrogen or electric planes is still several decades away.

HOW CAN THE INDUSTRY PROMOTE SAF

PRODUCTION?

SAF production is still underdeveloped, with only a handful of companies producing it around the world.

Manufacturers believe SAF production could be incentivised through government funding, as it would give firms the confidence to take risks and ramp up production without fear of losing significant amounts of capital.

Airlines, SAF producers say, could also play their part and help demand grow by including SAFs in their sustainability targets and offering SAFonly flights to consumers, who may wish to choose to ‘go green’ on their ticket purchase.

Airline industry racked up £180bn in net losses since the pandemic

ILARIA GRASSO MACOLA

THE AIRLINE industry has racked up a collective net loss of almost $220bn (£180bn) since the Covid-19 pandemic began, according to recent research.

Analysis published yesterday by analytics firm Cirium showed that revenues for the world’s airline groups dropped by more than 50 per cent in 2020, with levels still 40 per cent below pre-pandemic levels at the end of 2021.

Despite several carriers including

British Airways’ owner IAG and Lufthansa returning to black in the past few months, the industry overall is expected to post another loss for the whole of 2022.

Carriers such as Easyjet have been hampered by disruption and compensation costs for this summer’s travel chaos, when thousands saw their journeys halted due to inadequate levels of staffing. That disruption, some have argued, has put people off booking trips for fear of being caught in delays.

07 FRIDAY 2 DECEMBER 2022 NEWS CITYAM.COM

Global airlines could begin to break even if there are no further disruptions to travel

Budget cuts and poor health are hurting the economy, say doctors

MILLIE TURNER

MILLIE TURNER

THE poor health of the British public is weighing heavily on the economy as the country dives into a recession.

An additional 400,000 Brits are currently out of work due to long-term sickness since the start of the pandemic, according to official data, with over 600,000 having left the labour market since then.“The high rate of ill health is already affecting our economic prosperity, as more and more people leave the labour market, the

productivity of those in work falls,” said a report by the British Medical Association (BMA).

“The inability of the government to ensure financial security for people is also harming the economy.”

The BMA has urged the government to “properly” fund public services and to push ahead with policies that protect public health.

“Poor housing, lack of good-quality employment, and money worries are all social determinants of poor health,” the union wrote. “While doctors can

Weather events to cost insurers $115bn in 2022

LOUIS GOSS

LOUIS GOSS

THE GLOBAL insurance sectors’ losses from natural catastrophes are set to surpass $100bn (£81.5bn) for the second year in a row, new data from Swiss Re shows.

Natural catastrophes will cost insurers an estimated $115bn this year, after Hurricane Ian and a series of “secondary perils” caused $260bn worth of economic damage in 2022, the Swiss Re data shows.

Hurricane Ian, which hit the densely populated southwest coast of Florida this September, is set to cost insurers between $50-65bn alone.

The Category 4 storm is set to come as the largest ever loss to insurers after Hurricane Katrina, which cost the sector $65bn in 2005.

However, an uptick in “secondary perils” – including floods, hailstorms, and wildfires – is also set to increase insurers losses to $115bn, Swiss Re said.

The 2022 figure sits well above the $81bn a year average sums paid out by the global insurance sector over the previous decade.

The higher-than-average natural catastrophe costs sit in line with continuing trends that have seen insured

losses increase at rates of 5-7 per cent over the past ten years.

The uptick comes as a combination of climate change, inflation, and the accumulation of wealth in disasterprone areas has increased insurers’ losses in recent years.

Swiss Re’s head of catastrophe perils

Martin Bertogg noted that “when Hurricane Andrew struck 30 years ago, a $20bn loss event had never occurred before – now there have been seven such hurricanes in just the past six years.”

Higher levels of mid-sized weather events also pushed up insurers losses this year, as flooding in Australia, storms in Europe, and a series of hailstorms in France and the US, caused billions worth of damage.

Swiss Re warned the rise of “secondary perils” means insurers must begin using forward looking forecasts to predict losses, with a view to using data based on future trends in models.

However, Swiss Re’s chief underwriting officer Thierry Léger warned higher natural catastrophe losses will see the cost of insurance premiums increase, as the sector factors in the hit.

“Pricing needs to reflect the effective risk,” Léger said.

treat the symptoms, they are often powerless to address the underlying causes.”

Professor Martin McKee, president of the BMA, cautioned that doctors are already struggling to cope with the rising number of patients. “What we have seen from doctors across the UK here is a cry of pain,” he said, adding that services were in need of better funding.“Not only is a sick population more expensive to treat, but it is also a major barrier to the economic growth we all agree is needed,” he said.

THE BOTTOM LINE

Who would have thought that insurance companies and Extinction Rebellion might have common cause? Perhaps, that’s pushing it, but there’s no question that extreme weather events are causing insurers to sit up and notice.

That means massively bumping up investment in meteorological tech which can give insurers a future-facing view on where risks might emerge - and price premiums accordingly.

And it also means the stars of the show are getting noticed.

Take Gallagher Re’s recent hiring of Aon’s senior meteorologist Steve Bowen, which they were sufficiently chuffed about to send out a press release.

Or look at Axa’s Head of Risk Renaud Guidée, who told a magazine last year that the worst case scenario for the climate would make vast portions of the global economy effectively uninsurable.

Big bosses are getting involved, too. Insurance bigwig Dominic Christian, the global chair of Aon’s Reinsurance Solution business, leads a climate initiative on a new Resilience UK programme.

In short - insurers are getting wise to the risk of more catastrophic events resulting in higher premium payouts. So the next time you see insurers shouting about climate change at a Cop-27 event, you can probably guess why.

LOUIS GOSS

Ofcom probes unclear in-contract phone and broadband price spikes

LEAH MONTEBELLO

LEAH MONTEBELLO

OFCOM launched an industry-wide probe into whether in-contract price rises were set out clearly enough by big telecom firms.

After analysing customer complaints and preliminary evidence, the watchdog expressed concern that some companies had

not been transparent enough about price spikes during customer contracts.

Under Ofcom rules, providers must set out any future changes “prominently and transparently” when the person first signed the contract. The new enforcement programme will scrutinise providers’ sales practices and customer contract

information.

"As millions of people are having to deal with rising household bills, it is more important than ever that telecoms companies don’t shirk their responsibilities and keep customers fully informed about what they are signing up to,” Ofcom's Networks and Communications Group Director Lindsey Fussell said.

CITYAM.COM 08 FRIDAY 2 DECEMBER 2022 NEWS

Ofcom will analyse current practises by big telcos

he BMA argues that a large population of sick people is a barrier to economic growth

HURRICANE IAN $50-65bn FRENCH HAILSTORMS $5bn AUSTRALIAN FLOODS $4bn

Bird & Bird hikes new lawyers pay twice in one year

LOUIS GOSS

LONDON law firm Bird & Bird has given its newly qualified (NQ) lawyers a pay hike for the second time this year, in the latest sign of pay inflation and a war for talent in the legal sector.

The law firm has given its NQ lawyers a five per cent pay rise –upping their annual pay to £92,400 per year, a Bird & Bird spokesperson told City A.M.

The pay hike comes as the second salary increase handed out to Bird & Bird’s NQs this year, after the London firm gave its new lawyers a 24 per cent pay rise to £88,000 per year in February.

Bird & Bird’s pay hikes, which come into effect today, put it ahead of London rivals Fieldfisher and Pinsent Masons, who both offer their NQs £92,000 a year, Legal Cheek analysis shows.

The salary increases also push Bird & Bird’s NQ salaries above those offered by ‘Silver Circle’ law firm Mishcon de Reya.

A Bird & Bird spokesperson said: “We are constantly looking at our employee salaries, wider offerings and packages to ensure we remain competitive”.

Bird & Bird’s decision to increase NQ pay for the second time in 2022 comes

after the firm froze its trainees’ salaries in 2020 at rates of £40,000 in their first year and £44,000 in their second year.

A Bird & Bird spokesperson said that although the firm is “conscious of the economic headwinds” facing UK businesses, the law firm “continues to grow strongly”.

The majority of UK law firms have continued hiring new lawyers, despite recessionary pressure in the economy.

Legal sector analysts have claimed law firms have continued to hire due to fears of repeating the mistakes made during the 2008 financial crash, after which firms struggled to rehire.

The approach is likely to see a continuation of the ongoing battle for talent, that has seen the City’s top law firms offer increasingly high salaries in their efforts to win over talent.

The City talent war comes as a result of the past two years’ boom in demand for legal services as a result of the economic impacts of Covid-19.

The arrival of higher-paying US law firms into the UK market has further intensified the City’s talent war, with the weakness of the pound strengthening US firms’ salary offerings.

Future criminal solicitors won’t get ‘reasonable’ pay, Law Society says

LOUIS GOSS

THE UK government’s refusal to hike solicitors’ legal aid fees by 15 per cent means it’s “highly unlikely” those coming into the job will be able to make a “reasonable” income from their work, the Law Society has warned.

The body’s president Lubna Shuja yesterday said justice

secretary Dominic Raab’s refusal to increase criminal solicitors’ legal aid fees by 15 per cent puts the future of the profession in “serious peril”.

“It is highly unlikely that you will be able to generate a reasonable professional income from this work,” Shuja warned.

The warning comes after the MoJ hiked criminal barristers’ pay by 15 per cent in October.

However, criminal solicitors will see their fees increase by 11 per cent.

In 2021, an independent report by Lord Bellamy warned a 15 per cent pay hike is the minimum needed to nurse the criminal justice system back to health after what he called “years of neglect”.

Shuja warned Raab’s “reckless decision puts many of our members’ futures in jeopardy”.

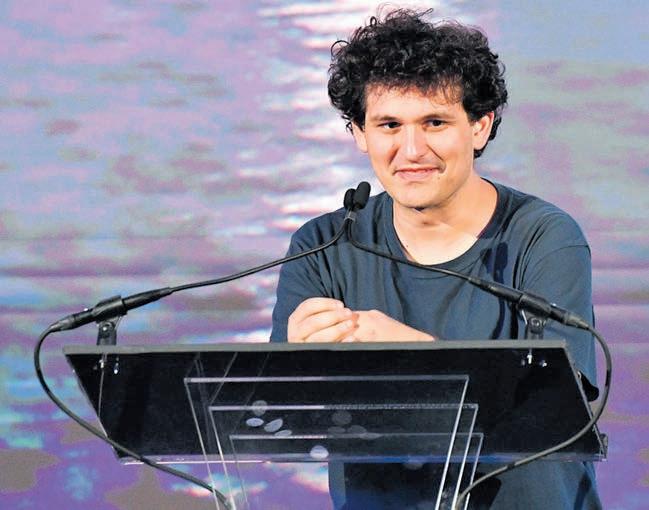

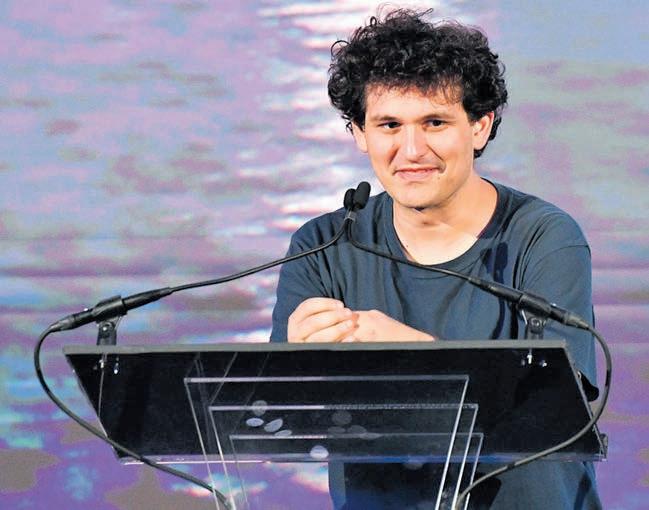

Bankman-Fried claims he didn’t ‘try to commit fraud’ after FTX failure

CHARLIE CONCHIE

SAM BANKMAN-FRIED tried to reject allegations he had committed fraud in the collapse of FTX late on Wednesday as he mounted his first public defence over the implosion of the crypto exchange.

Speaking at the New York Times’ Dealbook Summit, Bankman Fried said he had not knowingly gambled with customer funds via FTX’s sister trading firm Alameda Research.

“I didn’t ever try to commit fraud,” Bankman-Fried said in the interview.

The 30 year-old former billionaire told a Vox journalist earlier this month that he and other bosses “basically forgot” about an Alameda account holding $8bn (£6.5bn) in customer cash.

Bankman-Fried claimed that users could still see some cash withdrawn in the US, however.

“The US regulated platform with American users –to my knowledge, that’s fully solvent,” he said.

09 FRIDAY 2 DECEMBER 2022 NEWS CITYAM.COM

The crypto darling-turned-demon went public to defend his record as boss of FTX

EU ready to ‘double down’ efforts on Northern Ireland Protocol talks

BOSCIA

BRUSSELS is ready to “double down on efforts” to broker a deal on the postBrexit Northern Ireland Protocol, according to the European Commission’s Vice President.

Maros Sefcovic said there is now a “clear window of opportunity” to come to an agreement with the UK, after he spoke with foreign secretary James Cleverly yesterday afternoon.

Cleverly tweeted that the UK remains “committed to finding a

durable solution for the benefit of all”, after more than a year of fruitless negotiations.

Both sides agree that checks on goods going from Great Britain to Northern Ireland need to be reduced in the face of economic and political disruption.

The UK wants to completely rewrite the Brexit treaty, while the EU wants to tweak the way it is implemented.

Brussels has indicated that UK-EU relations are improving since Rishi Sunak became Prime Minister, after

they hit rock bottom under Boris Johnson.

The Prime Minister said during his first major foreign policy speech this week that the government is “evolving our wider post-Brexit relations with Europe”.

“We’ll foster respectful, mature relationships with our European neighbours on shared issues like energy and illegal migration to strengthen our collective resilience against strategic vulnerabilities,” he said.

Biden opens up White House for Macron dinner

STEFAN BOSCIA

JOE BIDEN hosted Emmanuel Macron for a White House state banquet last night as a part of the French President's three-day US trip.

The pair had a four-course meal at the lavish dinner, which came after tensions flared between Paris and Washington on Thursday.

Macron hit out at America's "very aggressive" Inflation Reduction Act (IRA), which the EU and UK have complained will hurt companies this side of the Atlantic.

The legislation sees almost $400bn of subsidies given to low-carbon businesses, with a large portion of it earmarked for US firms.

Macron yesterday said before a bilateral meeting between the pair that the Ukraine war will be the "first topic of discussion".

Biden said: "Things are changing rapidly, really rapidly. And it’s really important that we stay in close communication. It doesn’t mean that every single solitary thing we agree on, but it does mean we agree on almost everything."

Macron said "we want to build peace, and sustainable peace means full respect of sovereignty and territorial integrity of Ukraine, but at the same time a new architecture".

It is the first state banquet Joe Biden has hosted since becoming President in January 2021 due to Covid-19 protocols.

Waze partners up to tackle women’s safety fears as nights grow longer

MILLIE TURNER

SAT NAV app Waze has partnered with a community safety organisation to ease women’s fears of travelling in darkness, as nights grow longer in the UK. The partnership with SafeUP will see nearly 130 registered businesses flagged as ‘safe places’, which offer shelter for women, non-binary and

genderqueer people feeling vulnerable when travelling solo.

Some 63 per cent of women ‘always’ or ‘often’ feel unsafe when walking by themselves, according to research by YouGov.

The ‘safe places’, which will appear as location pins for both drivers and commuters, will be available until the end of February next year.

“The onset of the Christmas party season will see millions of revellers return to the streets to celebrate. We know that women, non-binary, and gender-nonconforming individuals often put their lives on hold during the winter months in favour of staying home, and staying safe,” said Ulyana Guseva, a senior industry manager at Waze.

CITYAM.COM 10 FRIDAY 2 DECEMBER 2022 NEWS

The partnership will see 130 businesses flagged as “safe places” for women

STEFAN

Sefcovik said there is now a “clear window of opportunity” to come to a deal

M E N U Butter poached lobster from Maine * American Osetra caviar * Beef and potatoes * Cheeses from Oregon, California and Wisconsin

Foxconn hikes efforts to lure in staff as iPhone supply concerns mount

LEAH MONTEBELLO

APPLE’s iPhone supplier Foxconn has boosted efforts to lure new employees as unrest continues in the crucial Zhengzhou region.

Foxconn is now offering a 1000 yuan award (£117) to any employee that successfully refers a friend or family member to work at the plant.

This new employee will need to work at the company for more than 15 days for the referee to get a payout, the BBC reported.

It comes after protests erupted last week across the world’s biggest iPhone factory, with videos circulating on social media of workers clashing with security over strict lockdown measures in the region and overdue pay.

Foxconn later apologised for a “technical error” in its payment system, adding that “actual pay” was guaranteed for staff.

It is estimated that around 200,000 people work at the Zhengzhou plant, with the region producing around

four in five of its latest-generation handsets for Apple.

Morgan Stanley predicted earlier this month that the iPhone Pro model shortfall could hit as high as six million this year, even before the unrest broke out in the region.

An insider told Bloomberg this week that Apple and Foxconn expect to make up for these losses as they head into the new year.

Apple’s share price continues to tumble as uncertainty batters the key Christmas period.

Hotel Chocolat in the red amid ‘challenging’ time

CHOCOLATE maker Hotel Chocolat yesterday posted a £9.4m loss but remained confident, saying people were “still treating themselves with affordable luxury” despite the cost of living crisis.

The full-year results came in contrast to last year’s, when the London-listed firm posted a £3.7m profit after tax.

“It goes without saying that the current

environment is challenging on multiple fronts,” Angus Thirlwell, co-founder and chief executive officer of

yesterday.

The chocolatier’s UK sales increased 35 per cent on the year, with bosses saying they were confident in the brand’s reputation despite the slowdown.

However, the business has been hit hard after the collapse of its Japanese business, writing off around £22m from its joint

venture, only set up in 2018.

The firm said it was “adopting a deliberately prudent approach to the outlook on trading”, given the volatile macroeconomic situation.

It said that it would be focusing on “quality over quantity” while “manufacturing controlled levels of seasonal inventory”.

Investors have been left with a bad taste in their mouth but the company was

confident its reputation would help it boost sales this Christmas, in stores and online, according to Sarah Riding, retail partner at law firm, Gowling WLG.

“The business’ new stores showcase a revamped format and are looking to capitalise on the recovery of physical retail, while CEO and co-founder Angus Thirlwell will be hoping the cost management implemented mitigates the recent inflationary pressures,” she said.

Alexa, cut jobs: Amazon culls jobs en masse

LEAH MONTEBELLO

AMAZON has started to cut its key hardware teams as the ecommerce giant is forced to slim down operations in the face of slowing growth.

Sources told the Financial Times that staff working on the Alexa voice assistant, Kindle ereader and Halo health tracking device were amongst the first to be laid off by the company.

It comes after reports that Amazon plans to dump 10,000 jobs amid a torrid tech tumble in recent months, which has battered share prices and consumer confidence. Layoffs would represent around three per cent of corporate staff.

It comes after recent news of a hiring freeze at the firm, set to stay in place for the next few months.

The Seattle-based firm warned its growth would slow down as consumers face a cost of living crunch and businesses are whacked with upped costs.

The cuts would mark the biggest jobs culling in the US tech giant’s history and comes shortly after the announcement of mass cuts at Silicon Valley rivals Twitter and Meta last month.

Facebook owner Meta announced a culling of more than 11,000 roles, representing 13 per cent of its total workforce, whilst Elon Musk announced he was laying off half of staff at his newly-acquired Twitter.

EU big dog tells Musk to watch out with Twitter changes to free speech

LEAH MONTEBELLO

TOP EUROPEAN officials have warned Elon Musk to play by their rules as concerns around hate speech and disinformation amplify.

EU commissioner for digital policy Thierry Breton told the new social media owner that he would need to boost efforts to protect users.

The bloc recently introduced the Digital Services Act, which is due to come into force next year and aims to modernise regulation around advertising and disinformation.

The Brussels big dog held a video call with Musk this week, with Breton tweeting: “Huge work ahead still –as Twitter will have to implement transparent user policies,

significantly reinforce content moderation and tackle disinformation”.

The meeting comes as the UK’s own online safety bill is set to return to parliament next week.

The government recently removed the contentious ‘legal but harmful’ provision, noting its potential threats to free speech.

11 FRIDAY 2 DECEMBER 2022 NEWS CITYAM.COM

Concerns have been raised about how Musk’s Twitter job cuts will impact moderation

China has adopted a strict zero-Covid policy since the start of the pandemic

EMILY HAWKINS

Hotel Chocolat, said

Boss’s surprise exit sees shares fall at Salesforce

EVA MATHEWS AND AKASH SRIRAM

SHARES of Salesforce fell about 10 per cent yesterday after co-CEO Bret Taylor’s sudden exit caught Wall Street off guard and raised concerns about the merit in having two leaders.

His departure after just a year in the role coincides with slowing revenue growth at the software company as it faces stiff competition from the likes of Microsoft, a stronger dollar and businesses cutting spending amid red-hot inflation.

At least 17 brokerages slashed their price targets on the stock, with the steepest cut coming from JP Morgan analysts, who lowered their target by $45 to $200.

Jefferies analysts said the surprise exit indicated that the “co-CEO model is not working with two departures in three years”.

Taylor, a tech veteran who has worked at Facebook parent Meta as

technology chief and served as Twitter’s chairman, departs San Franciscobased Salesforce after six years, leaving co-founder Marc Benioff as top boss.

Benioff tapped Taylor as co-CEO in 2021, to replace Oracle executive Keith Block who stepped down from the role just before the pandemic began.

Taylor was involved with Salesforce’s software which helps businesses effectively manage customer interaction, and was a key driving force behind the company’s $27.7bn (£22.6bn) takeover of workspace messaging platform Slack Technologies.

He was previously chief operating officer and chief product officer of the company.

“We view this leadership change as a significant blow given his leadership role on product,” Needham analysts said in a note.

EU’s Michel urges Xi to use China’s ‘influence’ on Russia over war with Ukraine at Beijing meeting

MARTIN QUIN POLLARD, ETHAN WANG AND RYAN WOO

EUROPEAN Council President Charles Michel once again urged Chinese President Xi Jinping to use the country’s “influence” on Russia over its war in Ukraine during a visit to Beijing yesterday.

Beijing’s Great Hall of the People, where trade, climate, human rights, Covid-19 recovery, Xinjiang and Taiwan, were also discussed, Michel told reporters via video link from Beijing.

China is not providing weapons to Russia and that nuclear threats are not acceptable, the European Council president said.

Shares of the company are down about 37 per cent this year.

Reuters

The war took up “a lot of time” during their three-hour meeting at

Poles apart? EU’s $60 price cap on Russian oil awaits Poland’s approval

NICHOLAS EARL

NICHOLAS EARL

THE EU has settled on a $60 price cap for Russian seaborne oil shipments.

An EU diplomat told Reuters yesterday that an adjustment mechanism to keep the cap five per cent below market value will also be included.

The settlement is a breakthrough for the bloc after weeks of stalled

talks and disagreements over the price rate.

The arrangement now depends on Poland’s approval, with the price needing to be approved by all EU governments by Monday.

The cap will take effect from December 5th if the price is agreed, and is meant to slash Russian revenue following its invasion of Ukraine.

The cap is below the number put

forward by the G7 last week, of $65-70 on Russian oil.

Poland had pushed for the cap to be as low as possible, with diplomats continuing to hold talks with EU officials over the mechanism.

Oil prices have slid in recent months from a 14-year peak of $139 per barrel in March amid recession fears, with both major benchmarks now trading well below $90.

“I urged President Xi, as we did at our EU-China summit in April, to use his influence on Russia to respect the UN charter,” Michel said.

President Xi made it clear that

Michel’s visit comes just a few weeks after Chinese authorities pulled a major trade expo opening ceremony address in which he was set to criticise Russia’s “illegal war” in Ukraine and call for reduced EU trade dependency on China.

CITYAM.COM 12 FRIDAY 2 DECEMBER 2022 NEWS

Charles Michel discussed situations including human rights in Xinjiang and Taiwan with the Chinese president

The EU’s deal relies on Poland’s approval –as it needs approval of all member states

Reuters

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

London markets post mixed performance as banks take a tumble

LONDON markets posted a mixed performance yesterday as big industrial firms and banks dragged the FTSE 100 lower. The capital’s premier index dropped 0.19 per cent to 7,558.49 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 1.28 per cent to close at 19,409.42 points.

London’s biggest high street banks led the FTSE 100 lower yesterday, driven by investors reining in expectations for the scale of future interest rate hikes by the Bank of England.

Barclays, Natwest and Lloyds all finished 1.65 per cent lower.

Traders think the Bank will lift borrowing costs 50 basis points at its meeting later this month, taking them to 3.5 per cent. Higher interest rates boost

banks by allowing them to charge more for loans.

Some investors were booking profits on the sector’s shares “after the strong gains seen in the past two days,” Michael Hewson, chief market analyst at CMC Markets UK, said.

HSBC fell more than two per cent despite chief executive Noel Quinn telling the Financial Times he is committed to cutting costs at the UK’s biggest lender.

Oil giants BP and Shell also tumbled despite oil prices rising.

Hewson said “recent strength of the pound may be a factor here, acting as a drag on those big US dollar earners”.

The pound reached its highest level against the US dollar since early August yesterday. A stronger pound acts as a drag on the FTSE 100 by making exporters’ products relatively less competitive.

CITY MOVES WHO’S SWITCHING JOBS

HEATHROW EXPRESS

Heathrow Express has appointed a new director and business lead, who rejoins after a three-year hiatus.

Daniel Edwards previously led the Heathrow VIP commercial team before becoming head of retail categories.

Edwards, who launched his career at Flybe and British Airways before moving into rail, replaces current Sophie

Manufacturer Essentra has snagged a £29.5m acquisition of The Wixroyd Group, which supplies industrial components for engineering businesses. Analysts have welcomed the takeover, which broadens the The Milton Keynes-based company’s capabilities in hardware components. Peel Hunt analysts rated the stock as under review, noting the macroeconomic backdrop “remains uncertain”.

ITM POWER

Chapman in the role, who has been promoted to surface area director of Heathrow Airport and will remain on the board of Heathrow Express.

HAMBRO PERKS

Investment firm Hambro Perks has built out its London office with a fresh investment associate.

Sam Marchant will focus on growing the firm’s portfolio by focusing on early stage and primary investments for the firm’s flagship £100m venture fund, known as HP Leaders Fund, and the Hambro Perks Growth EIS.

The incoming associate, who previously co-founded a

cereal bar brand, joins from Ascension Ventures where he focused on pre-seed and seed stage investment opportunities.

“Sam brings a wealth of knowledge and first-hand experience as a founder that will be an asset to Hambro Perks as we are seeing significant opportunity among early-stage companies,” partner Tom Bradley said.

“Sam’s investment experience with innovative companies across sectors and relationships with commercial experts will help drive value in our portfolio.”

firm Brown Rudnick has posted a new partner to its

London-based intellectual property (IP) practice.

David Knight is set to lead the Firm’s UK and European IP practice, working closely with the firm’s US team to serve clients across the pond.

The incoming partner, who advises on both offensive and defensive patent litigation, structuring, transactions, and licensing, will work with clients in the technology and life science sectors.

“David’s deep experience in these areas further enhances our ability... His stellar reputation for patent litigation in the UK, Europe, and the US also complements our market-leading litigation practices,” CEO and chairman Vince Guglielmotti said.

13 FRIDAY 2 DECEMBER 2022 MARKETS CITYAM.COM

P 25 Nov 1 Dec 30 Nov 29 Nov ESSENTRA 1 Dec 252 242 28 Nov 244 246 248 250 252 254

To appear in Best of the

email your research to

P 25

1 Dec

ITM Power welcomed new CEO Dennis Schulz to the top job yesterday, after boss Graham Cooley resigned with immediate effect. To allow Schulz to settle into the role, ITM has delayed a trading update set for 8 December. However, Peel Hunt analysts said neither of the announcements impact its forecast or valuation, ranking the stock a Buy with a target price of 200p.

Brokers,

notes@cityam.com

Nov

30 Nov 29 Nov

1 Dec 104.55 96 28

102 98 100 104 106 108

Nov

BROWN RUDNICK Law

To appear in CITYMOVES please email your career updates and pictures to citymoves@cityam.com

GRIN AND BEAR IT

“The last two months have been a welcome respite for stock markets after a year that at one point saw the likes of the DAX and S&P500 firmly in bear market territory. The bigger question now is whether this is a bear market rally, or the beginning of a move to new highs.”

MICHAEL HEWSON, CMC MARKETS

GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION

Only clear thinking will put the UK’s scientific agenda on the right track

Geoffrey Owen

MONEY is short. Across the board, government departments are under extreme pressure to spend less, and the new Business Secretary, Grant Shapps, finds himself in a difficult situation. In recent months his department has been bombarded with requests for funding from a range of industrial companies, most of which can make a plausible case for support.

Andy Street, the West Midlands mayor, is urging the government to help fund the construction of a battery plant to serve the local auto industry.

Two big steel makers have asked for aid to finance the replacement of their blast furnaces. The leading manufacturer of green hydrogen has warned that the UK will fall behind in this technology unless the government matches the support that other countries are providing. These are just three of the many supplicants who are banging on Shapps’s door.

In some cases, the requests are linked to a government-set objective – in particular, the need to reduce carbon emissions - which ministers evidently believe cannot be achieved by the private sector acting alone. But that does not make it any easier for the business secretary to choose between different applicants, while also satisfying himself that the favoured projects cannot

be financed from commercial sources.

The immediate pressures on Shapps stem from the urgent need to put the nation’s finances in order, but they illustrate a wider problem. Most governments want to support technologies which they regard as important, perhaps even critical, to their country’s future. But how important does a technology need to be to justify government support? What makes one technology more critical than another?

In 1990 the US Congress passed the National Defence Authorisation Act, which defined critical technologies as those that are essential “to further the long-term national security or economic prosperity of the US”. But this

definition is too general to be of much help to policy makers. It also leaves out other objectives - for example, protecting the nation’s health – which are no less critical than national security.

In the US, according to Erica Fuchs, a leading expert on science policy, there is no agreement on what makes a technology critical, even less on how the extent of criticality should be measured; the government lacks the capacity to answer these questions. What is needed, she suggests, is the creation of a monitoring group at the Federal level, made up of experts from government, industry and academia, which would undertake what she calls critical technology analysis, identifying missions that go beyond the purview

of any individual agency.

Some might think the management of UK technology policy is confusing enough as it is, without the need for another committee. When Boris Johnson was Prime Minister, he set up the National Council for Science and Technology, a Cabinet-level committee whose remit covers all government departments; it is supported by a new Office for Science and Technology Strategy. Liz Truss planned to abolish the council, but Rishi Sunak has kept it alive, and he will be the chairman. How the council will interact with the Business Department and with the government’s research funding agency, UK Research and Innovation, is far from clear, but part of its role has

been sketched out. The council, according to a paper on government innovation strategy, will determine “a suite of ambitious and inspiring missions”, designed to tackle “big, complex societal challenges”.

We have to be realistic: the UK cannot expect to be a world leader in every technology. Prioritisation is crucial, and the council will need to say why it is giving priority to some technologies and not others. As a starting point, the paper listed seven technology families, including robotics, advanced materials and engineering biology, which might be seen as worthy of government support.

What now has to happen – if the current government sticks to the programme set out last year – is for the council to announce what missions it has chosen and to spell out in some detail the criteria on which its decisions are based.

Short of a total withdrawal from activist industrial policy, which seems improbable under either Conservative or Labour governments (Labour has recently set out its plans in this area, which include the creation of an Industrial Strategy Council), missions in one form or another will remain part of the government’s armoury. The fewer of them there are, the more likely they are to be more successful. We need clear rationale, rather than the product of lobbying by interested parties, or wishful thinking.

Above all, we need to play to our strengths, our industrial capacity and the global opportunity.

£Geoffrey Owen is head of industrial strategy at Policy Exchange, formerly the editor of the Financial Times

This Saturday is a chance to support the small businesses livening up our streets

AS FEWER lights twinkle on Britain’s high streets, and individuals tighten their belts anticipating tough times ahead, small businesses are unsurprisingly fearful of what winter will bring.

It’s not the backdrop we’d hope for to mark a decade of Small Business Saturday tomorrow, but it underlines the ongoing importance of supporting the UK’s 5.5 million small firms.

As the word “recession” becomes embedded in our plans for the future, businesses and individuals are asking how they are going to weather the storm. The answer has to be found in our communities, looking at what can be done to help ease the burden.

For policy makers, this means addressing the crushing costs of business rates. The extra relief for retail and hospitality announced recently was a welcome step in the right direction here. It must also mean local business support hubs, connected communities, peer to peer support and more recognition of the value small busi-

Michelle Ovens

Michelle Ovens

nesses bring locally.

Small businesses power communities. They provide employment, drive local economies and supply chains, help the vulnerable and innovate to solve problems. There is not only a strong argument for the public to invest in them, but for local and central government too. The huge contribution small firms make across everything from jobs, to culture, to social care should be encouraged and rewarded, both fiscally and in the approach to business support.

More broadly in society, it means putting small businesses at the heart of solving our major challenges. Take climate change - small businesses are dis-

proportionately engaged in the sustainability conversation, embracing innovative approaches to reducing emissions and responding fast to new opportunities and information. Innovation from small business will be key to achieving net zero, reducing reliance on Russian energy, and building future economies. So supporting R&D for small business should remain a priority for government and the private sector, not pushed down the list due to concern over the efficacy of the system in place. We need more innovation, not less, and we need it from the brightest, tiniest of firms.

We also need to remove more obstacles for small businesses. Unlocking export opportunities should be a top priority for businesses and policy makers. With a stagnant home market, small businesses naturally look abroad to grow. But the barriers to trading with the EU are significant –transport delays, painful forms, returns challenges, limited delivery options – all add cost and complexity which businesses struggle to absorb. If we can

open up more markets for small business, we can open up optimism and confidence – the two key factors in getting through difficult times.

And make no mistake, this will be a difficult winter. The campaign’s research with American Express shows two thirds of business owners see rising costs as their biggest challenge over the next six months, with 61 per cent citing rising energy costs and half naming economic uncertainty. But the game is not over. A decline in GDP of 0.2 per cent is not the end of the road – in fact, the economy is essentially still the same size and that means there are still opportunities out there. If we can help small businesses maximise these, we can start on the road to recovery.

We all have a role to play. Tomorrow, Small Business Saturday is a moment to focus on putting small businesses first. It isn’t just one way to drive economic recovery – it’s the only way.

£Michelle Ovens is the founder of Small Business Britain

CITYAM.COM 14 FRIDAY 2 DECEMBER 2022 OPINION

EDITED BY SASCHA O’SULLIVAN

OPINION

Rishi Sunak has supported the National Council for Science and Technology

FROM SCOTLAND, WITH LOVE For even the casual watchers of Prime Minister’s Questions, Ian Blackford has been a staple with his bellowing monologues from the green benches. But the Westminster leader of the SNP will now step down after five years in the job

LETTERS TO THE EDITOR

Support for small business

[Re:Exclusive: Business rates hike a ‘ticking time bomb’ for London economy, Mayor warns, November 29]

The nation’s small and independent retailers are often described as the backbone of our high streets because of their important role in local communities and how much they contribute. While it’s rarely an easy environment for small businesses to trade, the challenges facing them this year are especially tough. Tougher even than when American Express founded and first supported Small Business

Saturday in the UK ten years ago.

The good news is that research we’ve undertaken shows that the public remain hugely supportive of independent businesses – and those that run them. People recognise and value what small businesses bring to local communities and 4 in 10 Brits even say they dream of starting their own small business at some point. That’s why we are doing all that we can to encourage people to shop small this festive season and beyond.

Small businesses may be resourceful and resilient, but they can’t survive without our support. If we all bought even one gift from an independent shop, imagine the difference that might make.

WHY IS IT ALWAYS THE MINK? Avian flu spreads to mink farm in Spain

Britain could be getting high on the benefits of a full-scale medical cannabis industry

James Short

James Short

ONE in five of the world’s bestselling prescription drugs are developed in Britain. And, with the legalisation of medical cannabis in 2018, the UK has an opportunity to capitalise on a new market. But while the regulatory framework is being developed, and patient studies are underway, there is a significant way to go to deliver on the promise of these life changing medicines, even with our reputation for bestin-class pharmaceutical research.

In the UK, there are eight million people who report chronic pain. The majority of these are prescribed opioids, a situation that some are referring to as an epidemic. A further 600,000 have epilepsy and millions more struggle with an anxiety disorder. All these conditions – and many more – can be treated with cannabis products. Yet, as things stand, the medicine is not yet making its way to patients.

In 2021, just 20,000 people were prescribed cannabis products for medicinal use in the UK. Contrast that with the 220,000 Australians prescribed sim-

funded prescriptions are much too difficult to come by. And there still exists a concerning lack of awareness of the uses of these medicines, with a recent study finding that little over half of the UK population were aware that they are legal.

Dominic Raab is under the spotlight - again. After facing complaints of bullying from senior civil servants, he’s now accused of having led a failed prisons policy as Secretary for Justice. It emerged this week that prisons are so full that the Justice Department had to ask to use 400 police cells for inmates. Raab tried to make several changes to the system. He suggested prisoners should be hired by companies with staff shortages, a progressive stance that was welcomed by

campaigners and experts. But he also pushed for changes to the parole system without giving enough notice to the Parole Board, according to officials. The Board is responsible for the decision of releasing specific categories of offenders. When in post, Raab announced plans to create 20,000 additional prison places by 2025 to fight the overcrowding plaguing British prisons. That’s starting to look like, perhaps, a fairly optimistic goal.

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900

Email: news@cityam.com

Certified Distribution from 30/5/2022 till 01/07/2022 is 79,855

ilar medicines, or even the estimated 1.8 million Brits who acquire black market cannabis for medical reasons every year.

There are three main factors impeding access. First, all cannabis products currently available in the UK are imported from abroad. As a controlled drug, importing is costly and slow. Domestic growing of pharmaceuticalgrade medical cannabis is essential to removing this bottleneck. The medicines regulator in the UK has recently provided clarification on the licensing process, giving more certainty to the level of scrutiny which UK cultivators and manufacturers will be subject to across every stage of the supply chain. This will help.

But, the process for patients to access cannabis products is prohibitive – NHS

In addressing these challenges, businesses must take a truly pharmaceutical approach to these medicines to ensure products made in the UK are at the front of the pack in terms of quality. That means operating to Good Manufacturing Practice, the internationally agreed standard for pharmaceutical products, which the NHS requires.

Plants must then be processed with something known as “active pharmaceutical ingredients”, usually in oil form, ready for manufacturing into finished medicinal products with easily measured dosages.

According to a report by investment bank Bryan Garnier released earlier this week, just three licences to grow commercial medical cannabis have been issued by the Home Office. As things stand, the high-quality pharmaceutical businesses that the UK sector so badly needs are few and far between.

Ensuring we are growing these prod-

ucts to the standard required is just one step. Companies investing in the development of medical cannabis should also allocate money to R&D, including clinical trials. The more robust data we have, the more confidence doctors will have to prescribe them and regulators to pay for them.

Of course, the government has a role to play, too. More active engagement will help in understanding the sector’s needs. This must be supplemented by grants and R&D support, especially to help fund more clinical trials. Additionally, educating clinicians on cannabisbased medicines is critical to driving prescription rates, and is best led by the state.

There is a huge opportunity here for both patients and British business – but we must be patient-first, innovative and collaborative. A pharmaceutical approach, high quality UK-production, clinical trials, the support of the NHS and our world-class universities, and forward-thinking regulators - all need to play their part to ensure this industry flourishes and delivers for patients.

£ James Short is the chief executive officer of Celadon Pharmaceuticals

Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com

Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions

Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP

Editorial Editor Andy Silvester | News Editor Ben Lucas

Comment & Features Editor Sascha O’Sullivan

15 FRIDAY 2 DECEMBER 2022 OPINION CITYAM.COM