MOVE COULD CALM CONCERNS OF RESTIVE INVESTORS

BRITAIN’s biggest bank HSBC has sold its Canadian business to Royal Bank of Canada (RBC) for £8.4bn in a move that may quieten Asian investors demanding the firm be broken up.

The Canary Wharf headquartered lender said yesterday it plans to redistribute a chunk of the £4.7bn profit it will make on the sale.

HSBC has been under intense pressure from Asian investors led by Chinese insurer Ping An, the bank’s largest investor, to slim down its huge global footprint and focus on profitable areas of the business.

Its China and Hong Kong arms generate the majority of its overall profits.

The Canadian sale could help HSBC fight back against Ping An’s breakup campaign by signalling its intention to operate as a trimmer bank in the future.

Asian shareholders were starved of payouts from HSBC during the Covid-19 crisis due to UK regulators preventing banks from distributing dividends to ensure they retained enough capital to cope with rising pandemicrelated defaults.

That, in part, led Ping An to back a demerger. However, HSBC could “appease those investors still frustrated that dividends were curtailed” by handing over a fraction of the proceeds from the Canadian arm sale, analysts at Jefferies said.

The shareholder goodies will be funnelled through a one-off share buyback or dividend and will come on top of existing capital return programmes.

Western investors and politicians have slammed HSBC for failing to condemn Beijing’s crackdown on pro-democracy protests in Hong Kong.

News emerged last month that HSBC

was sizing up ditching its Canadian business.

Noel Quinn, chief executive of HSBC, said the sale was given the green light after a “review… concluded that there was a material value upside from selling the business”.

Quinn has repeatedly denied HSBC is planning to ditch its Asian arm and has argued it would erode value for shareholders.

RBC will absorb HSBC’s 130 branches and over 780,000 retail and commercial customers in Canada. The deal will complete late next year and shareholder giveaways will start in 2024.

RBC said the purchase will “add a complementary business” to its sprawling group.

The investment house recently snapped Brewin Dolphin, one of the UK’s oldest fund managers, in a sign of its intention to expand its global reach.

HSBC’s shares shot to near the summit of the FTSE 100 yesterday, gaining near five per cent.

LACK OF ENERGY Bulb buyout by Octopus could be hit by delay

NICHOLAS EARL

OCTOPUS Energy’s takeover of Bulb Energy hit another hurdle yesterday, and faces the prospect of more delays after rival suppliers tabled demands for a judicial review.

Large suppliers including British Gas owner Centrica, EON and Scottish Power are concerned about the perceived lack of transparency in the deal and the use of public funds as part of Octopus’ purchase.

The judge will decide today if he will set a timeline for Bulb’s takeover

via the Energy Transfer Scheme, which could run parallel to any judicial process, which is still pending.

This follows a previous three-week delay to Bulb’s approval process, after the rival firms successfully argued they needed more time to assess potential issues with the deal.

Bulb has already spent over a year in de-facto nationalisation, collapsing amid soaring wholesale costs and insufficient hedging.

LONDON’S BUSINESS NEWSPAPER WINE WITHOUT THE SNOBBERY YOUR GUIDE FOR CHRISTMAS P22 ENGLAND TO FACE SENEGAL THREE LIONS MAUL WALES TO REACH THE LAST 16 P26 FREE CITYAM.COM FITNESS IS A JOURNEY. MAKE YOURS WORTH IT. #TrainDays

JACK BARNETT

£ CONTINUED ON PAGE 3 INSIDE LONDON’S CANNABIS MARKET HIGH P4 EASYJET: RECESSION WON’T KILL THE HOLIDAY P6 WISE SHRUGS OFF REGULATORY WOES P8 MARKETS P19 OPINION P20

£8BN

WEDNESDAY 30 NOVEMBER 2022 ISSUE 3,899

HSBC SELLS CANADA ARM IN

DEAL

STANDING UP FOR THE CITY

Leopard Lynch won’t change his spots –so government must act

THE RESILIENCE of the West End –as captured in Shaftesbury’s results yesterday –is not surprising. Globally significant hotspots do not lose their light permanently just because somebody (in this case government) flicks the switch off for a couple of years. It’s a fine thing, too –whilst geographically separate from the City, the charms of Soho continue to be a draw for talented folk from

THE CITY VIEW

around the world, encouraging them to pursue a career here rather than somewhere else.

Frankfurt doesn’t have a Soho House, after all. As ever with anything that is envied globally, though, we seem intent on getting in our own way. Just as

the City has been held back by six years of absurd political machinations over Brexit, or as our world-leading gambling industry has been struggling to read the runes on new betting regulation, or as London as a whole is being battered by higher tax rates, so too is central London facing the vicious threat of further rail strikes. Let’s be clear –Mick Lynch, clearly enjoying the limelight, has no interest in the capital’s prosperity, nor the retail

and hospitality workers who will be hit hard by his union’s industrial action. But while he is most certainly public enemy number one, it is high time somebody in government took responsibility for breaking an ongoing deadlock. Yesterday the transport secretary declared that he was not going to get involved in negotiations, but that he would facilitate them. This is a fine technical answer, but it’s nonsense on stilts –it is the

government’s job, when militant unions and a pseudo-nationalised industry such as rail are at an impasse, to drag both sides around a table and bang their heads together until they reach a conclusion. Gentle nudges from the sidelines is simply failing to do its duty to the country’s businesses and commuters. Hoping that Mick Lynch becomes constructive is not going to work. Won’t somebody in Whitehall take charge?

THE FINANCIAL TIMES

UK READY TO RELAX RINGFENCING RULES ON SOME BANKS

Britain is poised to relax one of the biggest restrictions on the banking sector as part of “Big Bang 2.0”, the long promised liberalisation of post-Brexit financial services rules.

THE TELEGRAPH PELOTON EXECUTIVES HIT WITH INSIDER TRADING LAWSUIT

A group of Peloton executives have been hit with an insider trading lawsuit over claims they sold $500m (£416m) of shares while hiding treadmill problems that killed a child.

THE GUARDIAN ENGLAND AND WALES NOW MINORITY CHRISTIAN COUNTRIES, CENSUS SHOWS

England and Wales are now minority Christian countries, according to the 2021 census, which also shows Leicester and Birmingham have become the first UK cities to have “minority majorities”.

Brits sit pat on Covid-19 savings pile in sign of tougher recession on the horizon

BRITS are sitting pat on the mountain savings they built up over the course of the Covid-19 crisis during lockdowns, figures out yesterday revealed.

Households set aside £6.4bn in savings last month, £1.6bn higher than the average monthly deposit flow before the pandemic, according to the Bank of England.

The figures illustrate consumers are responding to the cost of living crisis by exercising greater caution with their finances.

Economists have for months been

betting people would use their savings to maintain spending as historically high inflation erodes their budgets.

Prices are up 11.1 per cent over the last year, the fastest acceleration in 41 years, outstripping pay growth.

Consumers can either borrow or use savings when inflation outpaces their income.

However, the Bank of England’s data revealed debt-fuelled spending is flagging. Brits spent just £400m on credit cards last month.

Households are seemingly shunning taking on more debt over fears they could be sacked during the coming re-

cession, which is forecast to last at least a year.

“Households have remained unwilling to draw on savings or take on more debt in order to support their level of real expenditure,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

The numbers cast “further doubt over the OBR’s view that a sharp fall in households’ saving ratio will ensure the recession is short and the subsequent recovery is swift,” he added. Home loans tumbled to 58,977 last month from 65,967 as higher rates whacked housing demand.

Coming recession and sticky prices hit London confidence

JACK BARNETT

LONDON businesses are sweating over the coming recession and sticky inflation, but they are still among the most confident in the UK, a survey out today reveals.

Optimism among the capital’s firms slumped 27 points over the last month to 22 per cent, one of the biggest falls on record, according to Lloyds Bank’s business barometer.

Despite the huge drop, London firms are the second most confident in the UK, indicating they believe Brits will continue to spend during

the economic slowdown.

Becci Wicks, regional director for London at Lloyds Bank commercial banking, said: “While it’s disappointing to see London firms’ confidence take a knock, overall they remain optimistic about their trading prospects and what the year ahead will bring.”

Hiring intentions slowed to a net balance of plus 16 per cent, down 24 points, Lloyds Bank said.

Overall UK business confidence dropped five points, a much flatter fall compared to London, down to 10 per cent.

CITYAM.COM 02 WEDNESDAY 30 NOVEMBER 2022 NEWS

JACK BARNETT

WHAT THE OTHER PAPERS SAY THIS MORNING

NURSING A HANGOVER Wall Street got back into full swing yesterday after the Thanksgiving weekend but stocks failed to get in the spirit of things in early trading

Battered pubs should be angry with firms: RMT

ILARIA GRASSO MACOLA AND EMILY HAWKINS

ILARIA GRASSO MACOLA AND EMILY HAWKINS

MILITANT RMT bossMick Lynch has told hospitality businesses to direct their anger at rail operators for upcoming strikes which risk decimating Christmas trading.

In a letter to pub chains –who have lambasted the union –the RMT said that while “you face disruption to your business at this critical time, the private rail businesses we are in dispute with will not lose a penny”.

Strikes will take place for four days in the run up to Christmas, slap bang in the middle of the sectors’ busiest period.

The union said the government has indemnified railway companies, sparing them “from being liable for any loss of revenue arising from the strikes”.

High street bosses yesterday once more urged all parties to hash out a resolution to the dispute, with pleas that jobs and businesses were hanging in the balance.

The letter came on the same day transport secretary Mark Harper refused to get involved in negotiations.

Lynch – who is set to meet rail minister Huw Merriman and rail operators this Friday – deemed the government’s timing “astonishing”.

CEO of West End landlord Shaftesbury told City A.M. rail unions were “only looking out for themselves” while “people’s jobs are at risk”.

“Every day we go without a resolution is another day of damage to the industry.”

How we reported the Christmas strike plan

UK to buy out China’s 20 per cent share of Sizewell C nuclear plant

STEFAN BOSCIA

STEFAN BOSCIA

THE UK government yesterday announced it would pay £100m to a Chinese state-owned firm to buy out their share in the Sizewell C nuclear plant. The taxpayer buyout of China General Nuclear’s (CGN) 20 per cent share will mean the UK government and French state-owned EDF will take a 50-50 eq-

uity split for the Suffolk nuclear plant.

It will come as a part of the government’s £700m investment into the plant, which was confirmed by Chancellor Jeremy Hunt in this month’s autumn fiscal statement.

The government said the cost of the buyout was “commercially confidential”, however several sources told The Times it will come to £100m.

Octopus livid at further delays

CONTINUED FROM PAGE 1

Costs involved in Bulb’s inglorious stint in special administration have risen to £6.5bn, the biggest state bailout since RBS in 2008, according to the latest figures from the Office for Budget Responsibility.

The terms of Bulb’s takeover deal are yet to be published – but City A.M. understands the agreement includes a £100m-£200m fee paid by Octopus, a profit-sharing arrangement and potentially £1bn in hedging support.

Octopus was highly critical yesterday. A spokesperson said: “It’s now clear that other companies had many opportunities to bid, knew they could propose hedging support, and were invited to counter-bid against Octopus. Instead of doing so, they waited until a deal was announced and then launched expensive legal action which could cost taxpayers millions, even billions.”

Bulb’s collapse has hit the taxpayer hard

03 WEDNESDAY 30 NOVEMBER 2022 NEWS CITYAM.COM

CGN bought the Sizewell C stake in 2015 during the so-called “golden era” of relations

London risks slipping behind other budding legal cannabis markets

MILLIE TURNER

THE UK should capitalise on CBD goods and medical cannabis research if it wants to keep up with growing markets on the continent.

The country has the secondlargest cannabis market in Europe, behind only France, according to a white paper by investment bank Bryan Garnier yesterday.

“I wouldn’t say [London’s] the hottest market around, not for cannabis. But there is some light for the CBD market which has been well developed in the UK,” author of the paper and senior analyst Nikolaas Faes told City A.M. CBD, a derivative of cannabis, goods can now be found in retailers like Boots and Tesco thanks to new

regulation that passed in April. While medical cannabis was legalised in 2018, the market has been slow to take off. However, Franziska Katterbach, an executive at Khiron, which has the largest medical cannabis patient registry in Europe and a clinic in London, said the company is “very well positioned” in the capital.

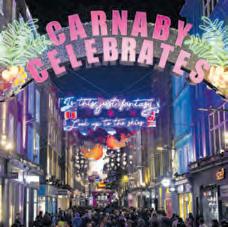

West End revival welcome news for Shaftesbury

EMILY HAWKINS

EMILY HAWKINS

WEST END landlord Shaftesbury has swung back to profit as the capital’s retail heartland bounces back from Covid19 disruption.

The landlord, which is set to merge with neighbouring property giant Capital and Counties next year, yesterday posted a £119.1m profit after tax in full-year results.

This was a strong comeback for the Carnaby, Seven Dials and Chinatown owner, which had posted a £194m loss in 2021.

Profit was buoyed due to a £99.5m revaluation gain and improved net property income as the shopping destination saw crowds of tourists and Londoners once more. It booked a £196.9m revaluation deficit in 2021.

Its occupiers reported spending ahead of pre-pandemic levels, with average sales for retail, hospitality and leisure businesses now six per cent ahead of 2019.

While London and the West End “cannot be immune from the unprecedented

range of challenges which are now dominating the national outlook,” top boss Brian Bickell said “their long-term prospects remain bright”.

A £3.5bn merger between Shaftesbury and Capco would create a sprawling real estate empire across central London destinations including the Covent Garden estate and Carnaby St. The proposed tie-up is now anticipated to take place during the first quarter of 2023. The West End was “getting back on its feet quicker than anyone expected” due to a strong recovery in international travel, boss Bickell told City A.M.

However, Bickell did dub the government’s choice to not introduce VAT-free shopping as an “own goal”, saying it would encourage tourists to London. Luckily, a weak currency had meant it was “still cheap to come shopping here”, though this was shifting slowly.

Gambling giant 888 said a consolidation of tech platforms and teams after its acquisition of William Hill would see it in a position to double revenues by 2025. However, the firm did warn that since the deal went through, the group had become more exposed to rising interest rates, and that the “operating environment” was now more challenging.

Pressure builds on Delta as Ofgem hits firm with further sanctions

NICHOLAS EARL

NICHOLAS EARL

DELTA Gas and Power is under more scrutiny from Ofgem, after the regulator slapped the supplier with two further provisional orders yesterday, Ofgem imposed a £57,000 fine on the supplier, after it failed to pay agreed funds to support renewable energy.

A further provisional order has been sent to the company for failing to respond with information needed for a customer energy supply safety net.

Delta is a non-domestic energy supplier, which currently serves 1,690 business customers in the UK.

This follows the first provisional order already issued to Delta earlier this month relating to its operational capability and financial resilience.

Ofgem said: “We have always been clear that failure to comply fully and promptly with our requests for information has the potential to disrupt the processes in place to protect consumers.”

CITYAM.COM 04 WEDNESDAY 30 NOVEMBER 2022 NEWS

TIME TO BET BIG 888 looks to double income over next three years to top cool £2 billion

Shaftesbury’s portfolio includes the iconic Carnaby Street

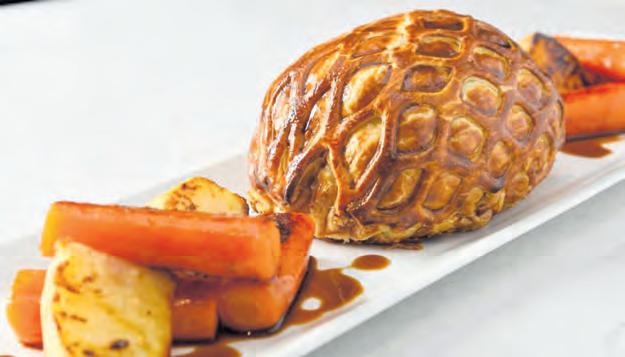

Serving suggestion shown. Off er runs until 1st January 2023. Off er includes any four items of selected party food for the price of three. Cheapest item free. Selected stores only – subject to availability. Prices may vary in selected stores. Prices correct at time of publication. Excludes any personalised customer or employee promotions that may be off ered. See individual tickets for details. © Marks and Spencer plc. WHATEVER YOU CALL THEM, THEY'RE BLOOMIN' DELICIOUS Collection 10 mini steak sandwiches £7.50 Collection 8 Reindeer steamed bao buns £7.50 12 Cornish Cruncher ™ cheese bites £5.50 Collection 12 crispy bacon, mac & cheese bites £7.50 CHRISTMAS TASTE AWARDS 2022 Hot canapé WINNER Mix and match on chilled party food 43 for THIS IS NOT JUST FOOD

Watchdog looks to boost access to financial advice for consumers

CHARLIE CONCHIE

THE FINANCIAL Conduct Authority (FCA) has laid out measures to widen access to financial advice today as it looks to allow consumers to “invest with confidence” amid a cost of living crunch.

The City watchdog, which set out its strategy for consumer investments last year, said it is now looking to create a “separate, simplified financial advice regime” to make it cheaper and easier for firms to advise

consumers about investments.

Among the proposed measures being mulled by the FCA are streamlining the so-called ‘fact find’, so advice is more straightforward for both firms and customers, and limiting the range of investment so the advice is “easier to deliver and understand”.

Sarah Pritchard, executive director of markets at the FCA, said the proposals would help ease access to sound advice for Brits as the cost of living rises.

Easyjet: Cost of living crisis will not stop travel

last year’s £1.1bn – included £78m disruption and compensation costs for this summer’s travel chaos.

“Now more than ever, people across the UK should have access to useful and affordable financial products and services which can improve their quality of life and support the economy,” she said.

“These proposals are part of our work to deliver a consumer investment market where people can readily access support and firms aren’t deterred from providing it.”

The watchdog is now set to consult on the proposed changes before it decides whether to push ahead.

BRITS will continue to travel amid the current cost of living crisis, according to Easyjet’s boss Johan Lundgren.

The chief executive said that, despite limited visibility, the carrier is already seeing a strong demand for next year.

“We have relatively low visibility overall, but we do see in general there is a strong demand and quite [a lot of] early bookings into the peak period,” Lundgren told journalists yesterday.

Ticket yields for the Christmas period are up around 18 per cent on last year’s levels while Easyjet expects to capitalise on the first restriction-free ski season.

“Consumers will protect their holidays but look for value, and across its primary airport network, Easyjet will be the beneficiary as customers vote with their wallets,” Lundgren said.

The chief executive’s comments came as the low-cost carrier shrunk its underlying losses for the year ended 30 September to £178m.

The loss – which was down on

Nevertheless, the carrier said it was better placed than competitors to navigate the months ahead, as it had a net debt of £700m – one of the lowest in aviation – and demand rebounded 240 per cent in the last year.

Total revenue also rose nearly 300 per cent to £5.7bn, from £1.4bn in the same period a year prior – with the revenue the airline generates per seat up a third to £67.33.

“We go into this macroeconomic environment with strength and we are able to compete with all competitors thanks to our unique position in the market,” the chief executive said.

“Easyjet has the financial strength that many competitors would give their left arm to have,” he said. The carrier also said it would not rule out M&A deals, as smaller airlines around Europe feel cost pressures. Easyjet warned it was bracing for a 50 per cent increase in fuel costs.

EASYJET seems to be better equipped than most of the legacy airlines when it comes to weathering the next few months.

First of all, the carrier’s £700m net debt is one of the lowest in aviation while cash and money market deposits amount to £3.6bn.

Secondly, the low-cost airline is expecting strong demand for peak periods such as Christmas, with ticket yields up 18 per cent, as well as the winter ski season.

“We do see in general that people gravitate towards value, which clearly is going to benefit us,” chief executive Johan Lundgren told journalists yesterday. “Easyjet has always done

THE BOTTOM LINE

well in times of economic uncertainty.” Nevertheless, Easyjet’s bubble could be burst by low-cost rivals such as Ryanair, which has said several times it would perform better than rivals in times of peak inflation.

Ryanair’s boss Michael O’Leary said in October that people in a recession become more price-sensitive and “when they want to fly, they fly with Ryanair.”

The two rivals may well try to one up each other, offering the lowest fares possible. How they will manage with soaring energy prices is another story.

ILARIA GRASSO MACOLA

Supply chain ‘very complex’, says Airbus

ILARIA GRASSO MACOLA

AVIATION’s supply chain issues remain “very complex”, according to Airbus’s boss Guillaume Faury.

The chief executive told journalists yesterday he was waiting for the latest data to comment on 2022 year-end deliveries.

“I will have a clearer picture by the end of November, but as you can see the environment remains very complex and is really the main challenge we have to face,” Faury said. “So yes, we are working against a lot of tensions and difficulties, and that’s nothing new.”

According to preliminary data and sources, supply chain and labour issues would make it difficult for Airbus to reach its goal of “around 700” aircraft deliveries by the year’s end.

The company had initially said late last month that it would maintain its target despite a fragile supply chain. People close to the matter told Reuters the EU plane maker was also pushing back 2023 deliveries. Initially hit by the Covid19 pandemic, supply chains are now being impacted by the consequences of the Russian invasion of Ukraine, including its effect on energy prices, the chief executive said.

“I don’t think it’s going to get better in the short term, in the next six months,” he added. “I don’t think it’s going to get worse either.”

Airbus declined to comment.

Bailey: Treasury unaware of Truss’s tax cuts day before mini-budget

JACK BARNETT

JACK BARNETT

THE GOVERNOR of the Bank of England yesterday in a scorching attack on Liz Truss’s disastrous minibudget revealed he and other rate setters were given no heads up on what would be in the package.

Andrew Bailey said he and the rest of the monetary policy committee

(MPC) “did not know” Truss was going to launch £45bn of unfunded tax cuts and send the UK’s borrowing path on an unsustainable trajectory.

He revealed at a House of Lords Economic Affairs Committee session that a Treasury official was present at the MPC meeting the day before the mini-budget was delivered on 23 September. However, he indicated

even the official was unsure of the scale of tax cuts coming the next day.

The session yesterday saw Bank governor between 2003 and 2013 Mervyn King and Bailey clash over whether the central bank provided enough detail on why it launched a £65bn bond buying package to tame gilt market turmoil sparked by Truss’s tax cuts.

CITYAM.COM 06 WEDNESDAY 30 NOVEMBER 2022 NEWS

ILARIA GRASSO MACOLA AND MILLIE TURNER

Low-cost carrier Easyjet has seen demand rebound 240 per cent in the last year

Andrew Bailey was grilled by one of his predecessors, Mervyn King, yesterday

FCA executive Sarah Pritchard said the services were needed “now more than ever”

Easyjet boss Johan Lundren is confident in future demand

You get more when you #jointheflipside Buy a Galaxy Z Flip4 and claim a Tab S6 Lite, on us. Purchase before 30/11/2022. Claim by visiting: https://samsungpromotions.claims/tabS6lite within 60 days of purchase. UK/ROI. 18+ only. For full T&C’s, see https://samsungpromotions.claims/tabS6lite Buy online, in-store or call 0800 033 8006 today

PROFITS TRUMP WISE’S WOES

nancial crime were identified”.

However, Susannah Streeter, equity analyst at Hargreaves Lansdown said the firm was on “a report card” given the regulatory investigation and investors have therefore been “slow to applaud significant progress made over the first half of the year”.

LOOKING at the numbers yesterday, you would think it’s been an exclusively rosy six months for money-transfer firm Wise.

The London-based fintech said pre-tax profits had rocketed 173 per cent to £51.3m in the first half of the year after a record 5.5m people poured onto its platform in the second quarter – a 40 per cent increase on the previous year.

Wise says it has now reached a sustainable level of profitability which has helped it dodge troubles that have plagued many of its high-growth, lossmaking peers as recession looms.

Shares have rebounded from a midyear slump to trade down around 18 per cent over the year to date – certainly not all positive, but markedly more so than the 60 per cent discount Wise was facing in June.

But Wise, often heralded as one of London’s fintech success stories, has been dogged by troubles in the six months to September.

A regulatory investigation into its

chief and co-founder Kristo Kaarmann over a 2017 tax dodging scandal rocked it share price in June and has left questions hanging over the future leadership of the firm.

The firm’s finance chief Matt Briers insisted to City A.M. in an interview yesterday that the investigation was not front of mind for its investors. But powerful shareholder proxy groups and analysts have said they think otherwise.

Glass Lewis, one of the largest advi-

sory groups, warned in September that the Sword of Damocles hanging over Kaarmann could damage shareholder value in the longer term. While they withheld their judgement and backed Kaarmann ahead of Wise’s AGM, the unspoken warning was that they may be forced to reconsider.

Kaarmann’s troubles have not been the only of Wise’s woes. The firm’s Abu Dhabi subsidiary was slapped

with a $360,000 fine after the Abu Dhabi regulator deemed it had failed to “establish and maintain” adequate anti-money laundering systems and controls. Wise in its defence said it quickly resolved the issue and “no instances of money laundering or other fi-

CEO

SHRUGGED OFF

Still, Briers tells City A.M. that the reputational issues have not dented the bottom line and it is set for another period of bumper growth in the months ahead.

“We’re growing healthily in many jurisdictions,” he says. “[The] cost of living and inflationary trend is really a global problem. We’re seeing benefits in the amount of money customers are moving.” He adds that “when money gets tight” consumers “pay as you can”, which is leading more consumers and firms to lean on the money transfer firm’s products.

Analysts too say they see significant upside ahead for Wise. Barclays wonks wrote in a note yesterday that their previous income estimate of £48m for the second half of the year “now looks relatively conservative”.

Reputational and regulatory issues at Wise have therefore not yet disrupted its performance. Kaarmann and co will be hoping the bulls are right.

CITYAM.COM 08 WEDNESDAY 30 NOVEMBER 2022 NEWS

Regulatory issues have not hit Wise’s numbers, writes Charlie Conchie

Kristo Kaarmann, Wise

Everyone loves a speedy journey Still London's fastest airport from A to B and 32 other destinations From Canary Wharf <11 mins and Bank <21mins <12 mins average security time Boarding to take off in <8mins Ranked fastest and best in the UK by you* *Which? Passenger survey, Condé Nast Readers Choice Award & Daily Telegraph 2022. Book now at londoncityairport.com eEvve dy j oy yo er e lon ev ve oe l s a e s a till LS spe s f'ondontill L dy jespe t airporsetass f ourndy j t frt airpor ourn om A tt fr ye ey o B om A t other de tinationssther de tinations airpor <21mi anarom C Fr harf <11 y Wanar <12 mins av y ecurit ageer o tding t Boar ff in e oako t ed stest ed be t y ybou*y y as? P *Which Wh Book no ondé Nas , C y urvey, ve enger ss w at londoncit s Ch eaderrs t R d arrd Aswe Choic omct.airpor aph 2 elegrra y T Te

Chinese police begin search for virus protestors

MARTIN QUIN POLLARD

CHINESE authorities have begun inquiries into some of the people who gathered at weekend protests against Covid-19 curbs, people who were at the Beijing demonstrations told Reuters, as police remained out in numbers on the city’s streets.

Two protesters told Reuters that callers identifying themselves as Beijing police officers asked them to report to a police station yesterday with written accounts of their activities on Sunday night. A student also said they were asked by their college if they had been in an area where a protest happened and to provide a written account.

“We are all desperately deleting our chat history,” said another person who witnessed the Beijing protest and declined to be identified. The person said police asked how they heard about the

protest and their motive for going.

It was not clear how authorities identified the people they wanted to question about their participation in the protests, and it was also not clear how many such people the authorities aimed to question.

Beijing’s Public Security Bureau did not respond to a request for comment. A spokesperson for China’s foreign ministry said rights and freedoms must be exercised within the framework of the law.

Simmering discontent with stringent Covid-19 prevention policies three years into the pandemic ignited into protests in cities thousands of miles apart over the weekend.

Mainland China’s biggest wave of civil disobedience since President Xi Jinping took power a decade ago comes as the number of Covid-19 cases hit record daily highs and large parts of several cities face new lockdowns.

SLOWING DOWN Shipping growth to slump due to economy woes

Reuters

Reuters

CITYAM.COM 10 WEDNESDAY 30 NOVEMBER 2022 NEWS

ACCORDING to research published yesterday by UN agency UNCTAD, the shipping industry’s expected growth will slump to 1.4 per cent this year, down from 1.8 per cent in 2021. For the wider 2023-2027 period, trade will expand at the annual rate of 2.1 per cent, 1.2 percentage points lower than the average for the last thirty years. The agency blamed the macroeconomic climate for the slowdown.

FTSE 100 indexer rolls out crypto asset equivalent

CHARLIE CONCHIE

THE FIRM behind the FTSE 100 rolled out a series of crypto indexes yesterday as it doubles down on a push into digital assets despite extreme volatility in the market.

FTSE Russell, part of the London Stock Exchange Group, said yesterday that the new Global Digital Asset Index Series would cover the whole “investable digital asset market” and would boost transparency in the sector at a time of turbulence.

The indices will monitor round-theclock data and hundreds of exchanges to define the investable universe, FTSE Russell said. Research firm Digital Asset Research has worked alongside the indexer to help define the new range which spans eight areas from large to micro-cap.

Bosses at FTSE Russell said the launch comes at a pivotal point for the sector,

as it is buffeted by the collapse of crypto exchange FTX.

“We are pleased with the progress the FTSE Global Digital Asset Index Series launch represents for our digital asset capability, as transparency in this asset class becomes more important than ever,” said Arne Staal, boss of FTSE Russell.

City A.M. first revealed last year that the indexer was plotting a move into the space with a series of dedicated indexes to sit along its flagship equity offerings.

However, the industry has been plunged into a ‘crypto winter’ since then and prices have been dealt a fresh blow in recent weeks after the implosion of FTX.

Bitcoin, the most valuable cryptocurrency, has plummeted more than 23 per cent in the past month and is down nearly 70 per cent over the past year.

BANKRUPT crypto lender Blockfi is suing the founder of collapsed crypto exchange FTX in a bid to claim Robinhood shares which were allegedly pledged as collateral, according to numerous reports.

Blockfi on Monday revealed it had filed for Chapter 11 bankruptcy in New Jersey after suffering a liquidity

In separate court documents filed by the bankrupt lender, the firm revealed it is looking to scoop up BankmanFried’s 7.6 per cent stake in online trading firm Robinhood, which he apparently agreed to stump up as collateral, the Financial Times reported.

The recovery attempt comes after Blockfi admitted in filings that its ex-

Credit Suisse saw its shares fall to a record low yesterday after a further near-three per cent sell-off. The firm began a cash call last week but investors appear to be distinctly unimpressed, and shares in the once venerated Swiss institution have tumbled by more than 60 per cent this year alone –not helped by a years-long litany of scandals and a recent profit warning.

Blockfi had been rescued by Bankman-Fried’s firm earlier in the year with a $400m (£335m) credit facility, and filings revealed it’s still owed $275m on a loan.

Bankman-Fried had been regarded as a saviour for the sector at the time after swooping in with rescue packages to shore up ailing firms.

CITYAM.COM

EMBATTLED lender

Miner GreenX Metals pockets £740m in damages from Poland

MILLIE TURNER

AUSSIE miner GreenX Metals is set to pocket £737m in damages from the Polish government, following a two-week long hearing in London.

The company, which digs for metals critical to the green transition, had filed a lawsuit against Poland in 2020 for profits lost in relation to two coal mines

based in the country.

The development of both projects was blocked by the government, which “deprived GreenX of the entire value of its investments” and went against Poland’s obligations under the Energy Charter Treaty and AustraliaPoland Bilateral Investment Treaty, the firm wrote yesterday.

London-listed GreenX first sought negotiations with the government

over the dispute in February 2019.

With the years-long spat wrapped up, the miner’s share price jumped over 45 per cent yesterday afternoon.

GreenX added that its investment dispute with Poland was “not unique, with international media widely reporting that the political environment and investment climate in Poland has deteriorated since the change in government in 2015.”

Wood shares dive on cashflow woes and $200m loss

MILLIE TURNER

SHARES in Wood Group plunged yesterday after the engineering and consultancy group warned investors it would not return to positive free cashflow next year.

In a statement yesterday, the Londonlisted group said its cashflow would return to the black from 2024 onwards, with recent exchange rate movements carving out a revenue loss of around $200m (£166.3m).

Volatile markets have also spelled an around $10m loss in ebitda for the company.

Bosses at the group now expect adjusted ebitda to be “flat in the nearer term” as the company reinvests its cash to “secure growth”.

Shares sank more than 16 per cent yesterday afternoon on the news. The group has lost a third of its stock price in the year to date.

Wood said it would seek to improve its margins in the medium term after “historical underperformance”, citing project discipline and low-risk contract work as areas of focus.

CEO Ken Gilmartin said the group’s

turnaround was “progressing well” nonetheless, and added that the $1.8bn sale of Wood’s built environment consultancy business in September had accelerated the rebound.

“We have addressed legacy issues and our strong balance sheet will allow us to deal with the defined schedule of resulting cash outflows,” Gilmartin said.

“Our strategy will deliver returns for our shareholders and today we have set out new financial targets, including to grow ebitda by mid to high single digit constant annual growth rate over the medium term, with momentum building over time as our strategy delivers.”

On top of cashflow woes and the financial impacts of the economic downturn sweeping the globe, Wood and subsidiary company Amec Foster Wheeler Energy (AFWE) were ordered to fork out $115m to settle a legacy litigation case with US energy services provider Enterprise earlier this month.

Enterprise filed a lawsuit against London--headquartered AWFE in 2016 over alleged cost increases and delays on a Texas-based contract signed in 2013.

Wood inherited the litigation when it bought AFWE for £2.2bn in 2017.

Astrazeneca snaps up Neogene for $320m in boost for cancer offering

MILLIE TURNER

ASTRAZENECA has bought cancer cell therapy company Neogene Therapeutics for $320m (£266m), in the company’s latest investment in its oncology offering.

The deal, which is set to close in the coming months, will see Astrazeneca pay $200m as cash in hand, and another $120m if Neogene meets certain milestones.

The British-Swedish pharmaceutical

giant earlier this month had three new cancer drugs recommended for approval in the European Union as it shifts efforts away from tackling the Covid-19 pandemic.

Susan Galbraith, executive vice president of Astrazeneca’s oncology research and development, said the acquisition was a “unique opportunity” to tackle cancer, fusing Tcell receptor biology and cell therapy manufacturing together with its internal oncology cell therapy team.

CITYAM.COM 12 WEDNESDAY 30 NOVEMBER 2022 NEWS

COBRA KING Lord Bilimoria joins board of International Chamber of Commerce UK

LORD Karan Bilimoria, the founder of Cobra Beer, has joined the board of the International Chamber of Commerce United Kingdom. “Through the ICC I look forward to helping the UK go from strength to strength in trade, business and investment globally,” Bilimoria said.

Everyone loves a speedy journey Still London's fastest airport from A to B and 32 other destinations From Canary Wharf <11 mins and Bank <21mins <12 mins average security time Boarding to take off in <8mins Ranked fastest and best in the UK by you* *Which? Passenger survey, Condé Nast Readers Choice Award & Daily Telegraph 2022. Book now at londoncityairport.com eEvve dy j oy yo er e lon ev ve oe l s a e s a till LS spe s f'ondontill L dy jespe t airporsetass f ourndy j t frt airpor ourn om A tt fr ye ey o B om A t other de tinationssther de tinations airpor <21mi anarom C Fr harf <11 y Wanar <12 mins av y ecurit ageer o tding t Boar ff in e oako t ed stest ed be the t y ybou*y y as? P *Which Wh Book no ondé Nas , C y urvey, ve enger ss w at londoncit s Ch eaderrs t R d arrd Aswe Choic omct.airpor aph 2 elegrra y T Te

John Lewis ramps up Christmas campaign with its annual advert

THERE are a few recurring elements of John Lewis’ Christmas ads: a character-driven story to tug on the heartstrings; some gentle humour; a slowed-down cover of a popular song; a mascot. No mascot this year, and less emphasis on “Christmas magic and fun” in light of the cost-of-living crisis. But the 2022 ad “The Beginner” (featuring a man learning the skateboard to bond with his foster daughter) otherwise follows the time-honoured formula,with some key tweaks.

BrandIndex UK shows that following the ad’s release on 10 November, it has already gone down well with the nation. Ad Awareness scores, which measure whether consumers have recently seen an advertisement for a brand, saw a 24-point jump between 9 and 26 November, from 14.4 to 38.4.

Stephan Shakespeare

Given that the brand is spending less on primetime slots, it’s good news for John Lewis that the ad is winning eyeballs. But it’s also getting people talking. Buzz scores, which track whether the public have recently heard anything positive or negative about a brand, jumped from 9.3 to 15.8 (+6.5), and Word of Mouth scores increased from 13.3 to 22.0 (+8.7).

Overall Impressions, which measure general sentiment, also saw a 5.5-

point rise from 45.5 to 51.0.

John Lewis’ parent company has said it wants to be the “employer of choice” for young people leaving care – and with Reputation scores (which ask if Britons would be proud or embarrassed to work for a brand) rising from 41.5 to 45.9 (+4.4), it may have burnished its credentials in this area.

YouGov Profiles data shows that, by 39 per cent to 33 per cent, the public agree that they “like brands that get involved in social issues”, and by 63 per cent to 23 per cent, they agree that they “like seeing real looking people in ads”. “The Beginner” might have benefitted from its emphasis on ground-level concerns – moving away from aliens falling from the sky, dragons and snowmen coming to life in favour of addressing an issue that affects families across the country.

Streamers get the OK as regulator says let the music play

mpetiti n by the CMA w re m uld help artists

market, deeming the industry valuable to both artists and consumers.

In its final report published yesterday morning, the Competition and Markets Authority (CMA) found that consumers actually benefitted from digitisation and competition between music streaming services.

Prices for consumers have fallen by more than 20 per cent in real terms between 2009 and 2021 – with many services also offering music streaming for free with ads.

The CMA said that the concerns raised by artists are not being driven by the level of concentration of the recording market.

Analysis found that neither record labels nor streaming services, including the likes of Apple Music and Spotify, are likely to be making significant excess profits that could be shared with creators.

While acknowledging that the concerns of artists were “understandable”, CMA’s interim chief Sarah Cardell said: “Our findings show that these are not the result of

Digitisation has led to a major increase in the amount of music people have access to and to large increases in the number of artists releasing music (up from 200,000 in 2014 to 400,000 in 2020) partly by opening up new direct routes to listeners.

This has also meant that there is greater competition to reach listeners and for the associated streaming revenues. The study found that an artist could expect to earn around £12,000 from 12m streams in the UK in 2021, but less than one per cent of artists achieve that level of streams.

The CMA chief said streaming has transformed how music fans access vast catalogues of music, “providing a valuable platform for artists to reach new listeners quickly, and at a price for consumers that has declined in real terms over the years”.

The BPI, which is the representative voice of independent and major labels across the UK, welcomed the report, stating that it “reinforces our view that the most effective way to

r labels

The study found that there were around 39m monthly listeners in the UK, streaming 138bn times a year. However, there has been some backlash from the creator side.

The Musicians’ Union general secretary Naomi Pohl told City A.M. that the CMA have primarily focused on how music streaming works for consumers, rather than artists.

She explained that cheap prices, although good for consumers in the short term, was actually a risk to music in the long term.

“In time, this could lead to less musicians making a living from music, or at least a less diverse range of musicians. We do not want a career in music to become the preserve of the rich,” she said.

The Intellectual Property Office is currently looking at whether a fair share of streaming revenue reaches different artists.

According to the CMA’s own analysis, over 60 per cent of streams were of music recorded by only the top 0 4 per cent of artists.

Epic Games backs Musk’s dig at Apple calling firm a ‘menace to freedom’

MONTEBELLO

EPIC GAMES, the maker of popular online video game Fortnite, has backed Elon Musk’s criticisms of Apple, calling the company a “menace to freedom”.

Musk took aim at the iPhone maker on Monday evening, stating that the company had cut its advertising

ties with Twitter and threatened to pull it from the app store without explanation.

Epic Games boss Tim Sweeney later took to Twitter to attack Apple.

Responding to a thread, he wrote: “Apple blocked Fortnite within a few hours of Epic defying their policy.

Would they nuke Twitter? Spotify?

Facebook? Netflix? At what point does

the whole rotten structure collapse?

“Apple is a menace to freedom worldwide. They maintain an illegal monopoly on app distribution,” he said in a separate tweet.

The rivalry between the firms runs deep, as Epic continues to fight Apple in a US court after it put restrictions on apps, including Epic’s, that have other in-app purchasing methods.

CITYAM.COM 14 WEDNESDAY 30 NOVEMBER 2022 NEWS

Fornite, made by Epic Games, is one of the most popular online video games in the world

LEAH

YouGo Brandindex: Which of the following retailers have you seen an advertisement for in the past TWO WEEKS? - John Lewis (2 week moving average) JOHN LEWIS CHRISTMAS CAMPAIGN MORE THAN DOUBLES THE BRAND’S AD AWARENESS SCORES YouGov Brandindex 9-26 November 2022 09 Nov 40 0 5 10 15 20 25 30 35 13 25 23 21 19 17 15 11

Motor industry calls for investment relief as car sales set for acceleration

ILARIA GRASSO MACOLA

ILARIA GRASSO MACOLA

THE UK automotive industry last night called on the government to “take rapid action” to encourage investment, which has the potential to unlock £14bn worth of growth.

According to analysis published yesterday by the Society of Motor Manufacturers and Traders (SMMT), the sector’s recovery is expected to gain momentum next year after two years of pandemic and supply chain shortages. Forecasts expect the new

car and van market to grow 15 per cent in 2023 to £10bn, with an additional £15bn a year later.

“In the most testing of times, growth finally beckons for the UK automotive industry, and as recession looms, that’s growth that should be nurtured,” said chief executive Mike Hawes. “We need a framework that enhances competitiveness, enables investment and promotes UK automotive’s strengths.”

The industry is lobbying for a targeted government approach to

Germany bets on Qatar to meet energy needs

energy rationing policies.

attract investment in vehicles and cell fuel production, as well as support the transition to electric vehicles. Such an approach, the SMMT said, would help bolster the industry’s attractiveness in the face of economic uncertainty.

A government spokesperson, drawing attention to the Automotive Transformation Fund and £2.7bn Apprenticeship Levy, said: “We are determined to ensure the UK remains one of the best locations in the world for automotive manufacturing”.

TO RUSSIA WITH LOVE China pushes for energy ties with Russia as price cap looms

Centrica tops up gas storage at Rough facility

NICHOLAS EARL

THE UK has enjoyed a much needed supply boost, after Centrica revealed it has refilled the UK’s biggest gas storage site to its maximum potential capacity for the winter.

GERMANY is gambling on Qatari gas supplies to meet its energy needs as it shifts from pipelined Russian gas.

The country has secured liquefied natural gas (LNG) from a new mega-deal between Conocophillips and Qatarenergy.

Germany will enjoy a hefty supply boost from 2026, after Qatarenergy and Conocophillips agreed two new sales and purchasing agreements yesterday, covering a 15-year period.

A Conocophillips subsidiary will purchase the agreed quantities to be delivered to the German receiving terminal in Brunsbuettel, which is currently under development.

It is the first deal of its kind to Europe from Qatar’s North Field expansion project, and will provide Germany with 2m tonnes of LNG annually.

Since Russia’s invasion of Ukraine in February, global competition for LNG has intensified with sanctions and policy changes causing the West to pivot from Kremlin-backed fossil fuels.

Germany used to rely on Russia for over half its gas needs and 40 per cent of its oil demand – but has pivoted to LNG, coal and Norwegian gas supplies to meet its needs, alongside nationwide

It aims to replace all Russian energy imports as soon as mid-2024.

Europe’s biggest economy has mainly relied on natural gas to power its industry, with the German government forced to bail out utility giant Uniper amid soaring wholesale gas prices.

The cost of nationalising the firm has risen to over €50bn, with the company reporting one of the worst loss-making periods in the history of business, recording €40bn in net losses over nine months of trading this year.

Germany’s shift from Russian gas reflects Europe’s general move away from Kremlin-backed supplies

REPowerEU is the European Commission’s plan to make Europe independent from Russian fossil fuels well before the end of the decade.

The EU is currently looking to finalise oil and gas price caps, with the bloc holding extensive talks over pricing in recent weeks as it looks to slash Russian war revenues and ease the cost of living crisis.

It has topped up supplies to nearly 95 per cent of capacity ahead of winter, which has seen wholesale costs ease and reduced fears of blackouts this winter.

The owner of British Gas confirmed it has installed enough infrastructure and secured sufficient supplies to hold up to three days of average UK winter gas demand.

Centrica confirmed to City A.M. that it had now reached its target of 30bn cubic feet of gas.

This follows the partial reopening of the Rough gas storage site last month, which sits 18 miles off the coast of Yorkshire, five years after the ageing facility was closed amid a dispute over funding.

The total amount of gas is only a fifth of Rough’s original capacity of 150bn cubic feet.

However, the UK has minimal remaining gas storage, and the reduced Rough storage site is expected to boost the UK’s total capacity by around 50 per cent.

Centrica is also pushing the government for minimum revenue guarantees to invest the £150m required to double Rough’s capacity to 60bn cubic feet by next winter.

In the long term, Centrica is looking for financial support to back its £2bn plan to turn the site into a hydrogen storage facility in line with the UK’s green ambitions.

Nestle raises year sales outlook as it mulls sale of peanut allergy business

EMILY HAWKINS

NESTLE yesterday raised its 2022 sales outlook, while announcing that it was considering the future of its allergy treatment business.

Nestle nudged its outlook for organic sales growth to between eight and 8.5 per cent, up slightly from last month’s projection at the

lower end of that range.

The Kitkat maker also said it had “decided to explore strategic options” for its peanut allergy treatment, Palforzia.

It cited “slower than expected adoption by patients and healthcare professionals” and said the review was anticipated to be completed in the first half of 2023.

Nestle chief Mark Schneider said the firm would “continue to invest for future growth” despite the present “turbulent times” for consumer-facing businesses.

Schnedier added that it would also hike profit margins but pointed to the “impact of a sharp increase in cost inflation” over the past two years.

15 WEDNESDAY 30 NOVEMBER 2022 NEWS CITYAM.COM

NICHOLAS EARL

to

The Kitkat maker said it would look

hike profit margins

The government should focus on attracting automotive investments, the SMMT said

CHINA is prepared to strengthen its relationship with Russia on energy issues to ensure “international energy security”, confirmed President Xi Jinping, as the G7 prepares to impose price caps on Kremlin-backed oil exports to slash the country’s war revenues.

PROTECT YOUR HEALTH THIS WINTER

As the nights draw in, it’s time to think about protecting our health this winter.

We are preparing for a tough few months - with the potential for a further Covid-19 wave and a difficult flu season - and of course not everything can be prevented. But we can reduce the risk of Covid-19 and flu through vaccination.

Millions of Brits are eligible for the flu vaccine and Covid-19 booster vaccinations - through age, long-term health conditions, pregnancy or a host of other criteria. Some people may not realise they’re eligible - or why - but the list has been drawn up to ensure those most at risk from serious harm from either Covid-19 or the flu are given protection that will help them and those around them.

WHO IS ELIGIBLE?

The largest cohort of those eligible for a booster jab or a flu vaccine are those over 50, where we know the risk of serious harm from Covid-19 or is higher.

But many people between the age of 6 months and 50 are also at higher risk than the rest of the populationand they’re encouraged to get booked

in for their flu vaccine to boost their protection.

That includes people with long-term health conditions, including diabetes or asthma, as well as pregnant women at any stage in their pregnancy.

WHO IS ELIGIBLE FOR THE TWO JABS?

Those eligible for NHS influenza vaccination and Covid-19 boosters in 2022/23 are:

£Individuals aged 50 years and over

£Individuals under 50 in clinical risk groups (From 6months old for flu and from 5 years old for Covid-19

£ pregnant women – at any stage in their pregnancy

£Older adults in long-stay residential care homes

£ Carers who receive a carer's allowance, or who is the main carer of an elderly or disabled person who is at an increased risk from flu

£Close contacts of immunosuppressed individuals

£ Frontline health and social care workers- are eligible for the covid-19 vaccine and should be offered a flu vaccine through their employer.

£ As well as people living with:

£ Chronic (long-term) respiratory

CASE STUDY: ADAM SMITH

Adam Smith is a familiar face to sports fans, as one of the presenters on Sky Sports. He’s one of 8.8m people in the country with a longterm health condition that means he’s at greater risk from Covid-19 and the flu.

“As a type 1 diabetic, I’m fully aware that the potential side effects of contracting flu or Covid-19 can be more severe and play havoc with my blood sugar levels,” he says.

Adam wants to be on top form for a busy sporting year, including the World Cup.

“I don’t want to take any chances, which is why I will be getting my Covid-19 and flu jabs this winter.”

disease, such as asthma (requires continuous or repeated use of inhaled or systemic steroids or with previous exacerbations requiring hospital admission), chronicobstructive pulmonary disease (COPD) or bronchitis

£ Chronic heart disease

£ Chronic kidney disease at stage 3, 4 or 5

£ Chronic liver disease

£ Chronic neurological disease, such as Parkinson’s disease or motorneurone disease

£ Learning disability

£ Diabetes

£ Asplenia or splenic dysfunction, such as coeliac syndrome

£A weakened immune system due to disease (such as HIV/AIDS) ortreatment (such as cancer treatment)

£And those with severe mental illness, such as bipolar disorder or schizophrenia, are eligible for a COVID-19 booster only

£Individuals eligible for the flu vaccine only: Children aged 2-3 year olds on 31st August 2022, primary school children and some secondary school children, through the use of Nasal Spray

ISN’T COVID-19 OVER? AND IS THE FLU REALLY THAT BAD?

Living with Covid-19 isn’t the same as living without it. The virus continues to be a real threat, especially to the unvaccinated in high-risk groups. You are up to three times more likely to be hospitalised with Covid-19 if you have not had a booster dose for over six months. By contrast, within 14 days of receiving your booster, your immunity against Covid-19 will be increased to about 90 per cent protection against serious illness.

Getting your booster doesn’t just protect you - but protects those around you, as well as reducing the pressure on the NHS.

Meanwhile, flu hasn’t left us. In an average year the flu virus kills around 11,000 people and hospitalises tens of thousands more in England.

Both flu and Covid-19 can be lifethreatening - and research has shown that you’re more likely to be seriously ill if you get flu and Covid19 at the same time. Vaccinations are the best protections from both viruses.

IN PARTNERSHIP WITH HM GOVERNMENT

I’M PREGNANT AND CONFUSED AS TO WHAT I’M ALLOWED TO HAVE?

All pregnant women are eligible for both flu and Covid-19 jabs, and those jabs have been shown to be safe at every stage of pregnancy - as well as protecting you and your unborn child from the effects of flu. The flu vaccine can reduce the risk of serious complications such as pneumonia, particularly in the later stages of pregnancy.

Additionally, Flu infection increases the chances of of pregnant women and their babies needing intensive care. And women who were not vaccinated for Covid-19 while pregnant were more likely to give birth prematurely and at higher risk of the baby being born with complications.

Further recent research published in a respected American health journal suggests that even mild cases of Covid-19 during pregnancy ‘exhaust’ the placenta and damage

CASE STUDY: MUM-OF-TWO NICOLE RATCLIFFE

Mum-of-two Nicole Ratcliffe has lived with ulcerative colitis since she was in her 20s and, like many other people with a weakened immune system, she says keeping up to date with her Covid19 and flu vaccinations is vital.

“Ulcerative colitis is like Crohn’s disease – it attacks the immune system and if I have a flare-up I can get quite poorly, with inflammation, bleeding and going to the toilet 30 or 40 times a day. You can’t live like that, so I have regular doses of immunosuppressants,” says Nicole, 41, from Manchester, who’s mum to Sofia, six, and two-year-old Alyssia.

Nicole runs her own business and has all the duties of a mum, too. When Covid-19 hit she was on the shielding list

- so the development of a vaccine was vital to getting back to normality.

Nicole was waiting for a message from her GP to call her for the Covid-29 vaccine – and when she was also offered the flu jab on the same day she was happy to take both. “I had two sore arms, but I was so relieved to get my vaccinations. I always make sure I’m up to date and have a flu vaccine every year,” she says.

Now Nicole feels relieved to be able to live life to the full, knowing she’s protected. “Everybody in our family has had their vaccinations, so we’re able to go and visit grandparents.

“People say: ‘The vaccine doesn’t stop you getting Covid,’ but it does stop you from getting very ill with it, which is what’s important to me.”

its immune response.

If you’re pregnant, the best way to protect yourself and your baby is to get your flu and Covid-19 booster jabs.

IS THE VACCINE SAFE?

Over 53 million people across the UK have received at least one Covid19 jab since the uptake of vaccination, whereas the flu vaccine has been a part of our healthcare armoury for years. Both jabs have good safety records, and both are the best protection against these viruses this winter.

Vaccines are only made available to the public after satisfying strict safety and effectiveness checks, and the UK’s independent MHRA has authorised all Covid-19 vaccines used in the UK for safety, effectiveness and manufacturing quality.

Whilst there are side effects for some, these are generally mild and usually don’t last for long.

WHAT ARE THE RISKS?

Vaccines are your best protection against flu and COVID-19, which spread more quickly in winter and can both cause serious illness. To find out if you are eligible and book your appointment visit nhs.uk/wintervaccinations

People with long-term health conditions are at higher risk from Covid-19 and flu than othersespecially if unvaccinated. For example:

£If you have liver disease, you are 48 times more likely to die from flu and are also at high risk of serious illness from Covid-19

£If you are immuno suppresssed, you are over 47 times more likely to die from flu and are also at high risk of serious illness from Covid-19

£Those with heart disease are 11 times more likely to die from flu and are also at high risk of serious illness from Covid-19

£Those with diabetes are 6 times more likely to die from flu and are also at high risk of serious illness from Covid-19

WHAT DO I NEED TO DO?

Visit nhs.uk/wintervaccinations to check your eligibility, and book in. Remember - these jabs are the best way to protect yourself and the ones you love this winter. ]

RESTAURANT REALITY

Emily Hawkins chats to the man behind Searcys about the champagne events firm’s past and future

LONDON restaurants face a “real reality check” come January and February, as consumers will pull back from dining out after Christmas, the boss of champagne bar chain Searcys has warned.

Diners will “want to batten down the hatches” next year after enjoying their first Christmas free of Covid-19 measures in three years, with the cost of living crisis spelling concern for a lot of businesses, Paul Jackson told City A.M.

Despite the gloomy headlines, the business - which recently turned 175 years old - has a lot of good news to raise a glass to, with its revenues now back at pre-pandemic levels. In fact, sales are now around six to eight per cent higher than in 2019.

This year alone, Searcys has poured 156,000 glasses of the sparkling stuff and served more than 54,000 afternoon teas.

“You have to stay positive,” Jackson, who stepped into the role heading the chain amid the height of the pandemic in autumn 2020, said.

“Sometimes in business, it is an individual business challenge but this is not, it’s an industry challenge.”

While the hospitality sector faces a torrid winter ahead, Jackson was optimistic businesses like his would “work through it, adapt and evolve –and sometimes make difficult decisions”.

While customers had typically booked events at Searcys’ portfolio of venues –which boasts iconic locations such as The Gherkin and St Pancras International –around six months in advance, the industry was now much more “reactionary”, Jackson said.

After years of disappointment due to the pandemic cancelling plans, consumers have a certain level of “nervousness” around Covid-19 potentially returning. Disruption from rail strikes

and the Queen’s passing also led to some cancellations, the boss said.

However, on the restaurant side of operations, diners are eager to book in advance, with reservations now “very important” to the sector.

With the capital lurching into the teeth of a recession, is Searcys hesitant

about the future?

If so, Jackson does not let on, speaking unflinchingly down the telephone line.

“We have spent a lot of time this year ensuring the business is ready for growth next year,” he said.

The business’s operations have diversified in nature as well as location, with an e-commerce channel selling champagne and venue experiences, plus a recent pop-up in Battersea Power Station.

Retaining staff is at the heart of the company’s growth plan, with bosses bringing in a new director of recruitment to solely fight the battle for talent being waged across the capital right now.

Recruitment has been “very hard,” Jackson admitted.

“You have to make sure to invest in the business, the culture and the benefits,” he reck-

ons.

“Service awards are invaluable for me, in regards to recognising the teams,” he added. “While money is important, and pay is front and centre, it's only part of a job requirement.”

While future-proofing the firm, Jackson is keen for Searcys to remain true to its roots –the firm was created in 1847 by Searcy, a chocolatier for the Duke and Duchess of Northumberland. To do that he’ll need to ensure Brits are still willing to spend a little on a glass of champagne –or perhaps, in the tradition of the firm’s fine British hospitality, a cold flute of one of England’s sparkling wines.

Media bosses band together to call on Raab to back ‘anti-Slapp law’

LEAH MONTEBELLO

“as soon as possible”

A GROUP of senior UK journalists have banded together to call on the justice secretary Dominic Raab to back a proposed law to tackle “abusive legal tactics to shut down investigations”. Editors of a host of papers, including The Times’ Tony Gallagher and The Sun’s Victoria Newton, have

signed a letter urging the government to address the “endemic” use of strategic lawsuits against public participation (Slapps).

Slapps are often used to silence media investigations into wealthy individuals, with the coalition arguing they can also hamper “law enforcement’s ability to investigate wrongdoing promptly and effectively”.

A recent example includes Roman Abramovich suing Catherine Belton over her book ‘Putin’s People’.

The group said Raab should “move swiftly” to enshrine an anti-Slapp law. A Ministry of Justice spokesperson said: “This issue is of the utmost importance and is being given urgent consideration. We intend to introduce legislative proposals as soon as possible.”

CITYAM.COM 18 WEDNESDAY 30 NOVEMBER 2022 NEWS

The MoJ said it will introduce proposals to tackle the issue

Paul Jackson remains optimistic

Sometimes there are challenges for individual businesses but this time it’s an industry challenge

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

HSBC Canada business sale seals strong day for London’s FTSE 100

LONDON’s FTSE 100 was boosted yesterday by investors pouring into HSBC after it confirmed it has ditched its Canadian business for £8.4bn.

The capital’s premier index jumped 0.51 per cent to 7,512 points, while the domestically-focused midcap FTSE 250 index, which is more aligned with the health of the UK economy, fell 0.55 per cent to 19,186.16 points.

Britain’s largest lender HSBC yesterday said it has sold its entire Canadian business consisting of 130 branches and over 780,000 retail and commercial customers to Royal Bank of Canada.

The news sent its shares to near the top of the FTSE 100, gaining 4.44 per cent.

The sale is being seen by analysts as a possible route to appeasing Asian investors led by Chinese insurer Ping An

who have been demanding HSBC carve out its Chinese and Hong Kong businesses, the group’s profit engine.

“The recent decision to cancel the dividend after pressure from UK regulators did not go down well with Asia shareholders,” Michael Hewson, chief market analyst at CMC Markets UK, said.

The sale could be “an arbiter of things to come,” he added.

Industrial firms also led the FTSE 100 higher after commodity prices rebounded.

Miners Anglo American, Rio Tinto and Antofagasta all added more than 2.7 per cent.

Oil giant BP climbed 1.76 per cent and Shell jumped 1.69 per cent.

Commodities had suffered at the beginning of the week after investors fretted over Chinese authorities responding forcefully to protests against lockdowns.

UK-based private equity group Bridgepoint has maintained its ‘Buy’ rating from analysts at Peel Hunt while it is in talks to buy Energy Capital Partners, the US private equity firm currently buying Biffa. The pair, merged, would make a “good fit strategically”, said analyst Andrew Shepherd-Barron. “Any deal would carry risk but... We believe it could add value,” he added. Bridgepoint’s target price is 340p.

BOXING DAY BLUES

Victoria, the London-listed flooring specalist, has also been marked as a stock to ‘Buy’, despite Peel Hunt analysts dowgrading its target price to 800p yesterday. The company has been “performing well in tough markets”, analyst Charles Hall said. However, markets are forecast to only grow tougher. While Victoria reported revenue growth of 7.7 per cent, analysts have dialled back pre-tax profit outlooks.

19 WEDNESDAY 30 NOVEMBER 2022 MARKETS CITYAM.COM

P 29 Nov 203.8 23 Nov 29 Nov 28 Nov 25 Nov BRIDGEPOINT 200 24 Nov 205 210 215

To

470 P 29 Nov 414 23

29

430

440 450 460 480 490

appear in Best of the Brokers, email your research to notes@cityam.com

Nov

Nov 28 Nov 25 Nov VICTORIA

24 Nov

“There’s no doubt shoppers are hunting for ways to make the cash they’ve set aside for gift buying go further and the sound of tills ringing will be soothing to the ears of retailers. But they’ll also be thinking about those margins and wondering how much inventory they’ll have to mark down once the last of the Christmas wrapping has been shifted to the recycler.”

GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION IT’S FINALLY HERE RIVALRIES RENEWED AS THE SIX NATIONS RETURNS FOR 2022 8-PAGE PULLOUT 2022 SIX NATIONS ENERGY D-D Households LONDON’S BUSINESS NEWSPAPER FREE CITYAM.COM THURSDAY 10 FEBRUARY 2022 CITYAM.COM COOL RUNNINGS ALL THE GEAR FOR AN OVERDUE MOUNTAIN BREAK P20 STATE SET MAN IN THE KNOW MARK KLEINMAN GETS THE CITY TALKING P13 LONDON’S BUSINESS NEWSPAPER LONDON’S BUSINESS NEWSPAPER CITYAM.COM Climate noise blocking out THROUGH THE DRINKING GLASS THE LATEST FROM OUR WINE GURU P22 ISASU W ER PUT MONEYTHIS YEAR WEDNESDAY FEBRUARY 2022 ISSUE 3,677 THE ULTIMATE SAVINGS GUIDE ALL YOU NEED TO KNOW ABOUT YOUR ISA P19-21

EDITED BY SASCHA O’SULLIVAN

did

Rosie Beacon

simply accept fraud as

FRAUD is both everywhere and nowhere. Everywhere in that fraud has become part of daily life – Black Friday has historically seen cyber attacks soar by 275 per cent. And it is also nowhere in that, given the scale of the problem, astonishingly little is actually being done about it. Fraud has almost become par for the course: it is largely perceived to be an irritating and – providing you don’t fall for it – inconsequential crime.

But even if you don’t “fall for it”, the notion that fraud is simply a part of daily life is deeply problematic. This perception it is an invisible crime means it is consistently underestimated - a sentiment echoed by the HM Inspectorate of Constabulary, Fire and Rescue Services in 2019: “fraud does not bang, bleed or shout”.

And yet, it is the single largest category of crime in the UK according to the Office for National Statistics (41 per cent), as well as being under investigated and charged. There were 987,000 recorded offences of fraud in the years 2021 - 2022, and only a shocking 4,816 of those ended up with a charge – that’s a 0.4 per cent sentencing rate.

When you’re mugged, the only person responsible is the person that mugged you. It’s obvious, it’s physical and no part was played by the victim in en-

abling the mugger to take their bag. Whereas the equivalent with fraud is that the victim may not have asked the mugger to turn up, but when asked to, they opened their bag up for them to take all of their money.

While finding out how to ignore fraud is an important part of modern, tech driven lives, avoidance will never be as effective as prevention.

This is because firstly, fraud that involves victims being tricked into handing over their money is just one of many, many types of fraud. So assuming this “onus on the consumer” framework is not only misguided in principle, but also practice, as there’s not always an obvious “consumer”. This

was evidenced in the recent discovery that the government was defrauded by about £6.7bn during the pandemic. Second, fraud is quickly growing in sophistication and avoiding it will soon no

longer be as simple as ignoring a fraudulent text.

Third, fraud involves considerably more calculating techniques than many imagine. Before they even get to consumers they’ve already broken the law and pursued methods that are noticeably invasive. If you are a recipient of a fraudulent text or email, this is not just a fraudster simply trying their luck with every phone number they can find. Even relatively unsophisticated fraud requires fraudsters to circumvent telecoms companies, web hosting providers and tech platforms.

The progenitor of this meteoric rise of fraud? Technology. 80 per cent of reported frauds are cyber enabled, accord-

ing to Action Fraud. Fraud has emerged to be one of many problems that has ballooned with the rapid digitisation across society, and the policy response has been mediocre at best. Tech not only increases the instances of fraud, but the complexity too.

The longer I work in policy, the more I think that the relationship between government commissioned reports and policy delivery is inversely proportional. Essentially, the more government reports there have been, the less policy has been delivered. Fraud is a glaring example of this. Since 2016, there have been at least eleven reports by committees and publicly funded organisations that focus on fraud in some way. And yet since 2016, the number of fraud offences has risen by over 50 per centfrom 605,949 to 936,276, according to the ONS.

The policy oversights are structural, regulatory and technical. The confusing labyrinth of organisations resposible for fraud has led to a responsibility vacuum in government. While there does need to be clearer accountability and more enforcement capacity, this can only get them so far: there also needs to be a better strategy to incentivise the plethora of private industries that enable fraud to act.

It should be impossible for policymakers to consider the future of safe societies without considering the gargantuan problem of fraud. It is another policy issue that due to the technological revolution, needs a fundamental rethink, not just organisational tinkering and reports.

If we want Britain to be the next Silicon Valley, we need an Open University for skills

THE UK has a proud history as a technology pioneer: from the steam engine to the worldwide web, British inventors have been at the forefront of technologies that have transformed lives across the world. But today our status as one of the world’s leading science and technology hubs is under threat.

Digital skills shortages, which put the UK at a competitive disadvantage, have been a long-standing concern of business leaders. But now that concern is shared by their employees. New research commissioned by Salesforce has found a major contradiction at the heart of the British digital economy.

UK workers rank digital skills as the most important skill for the current and future workplace. But more than a quarter of UK workers still do not feel confident in any digital capabilities. There is an economic cost to this, with research last month warning that the UK’s digitally unskilled population is costing its economy £12.8bn.

In the autumn statement, the Chancel-

Zahra Bahrololoumi

Yet, training is available. Industry already offers a plethora of online opportunities, from basic digital skills to courses on technological developments. For example, our online digital learning platform Trailhead is accessible to all for free. But not enough people know about these types of resources or have the confidence to take them up.

lor rightly identified digital technology as one of the UK’s five growth industries and pledged to make the UK “the world's next Silicon Valley”. Standing in the way, is the skills gap.

This is more than a financial issue. It also impacts the prospects of our workforce. According to our survey, current UK workers blame their poor digital confidence on a lack of training, with a third saying their job does not provide digital upskilling opportunities. Access to training and continued learning were rated as more important than pay bonuses and wellbeing benefits at work. Put simply, UK workers want - and need - to upskill.

The digitally unskilled need help understanding that technology is an accessible gateway into so many roles, not just coding and app design. And tech savvy individuals need retraining opportunities in high-demand areas like AI and Blockchain.