ENERGY FIRMS WARNED ON RISING BILLS

SHAPPS TOLD STRUGGLING SMALL FIRMS NEED MORE HELP

NICHOLAS EARL

AND EMILY HAWKINS

ONE OF the UK’s leading business groups has called for more support for struggling small firms as they continue to grapple with rising energy bills, despite the launch of the government’s energy bill relief scheme.

The Federation of Small Businesses (FSB) called on business secretary Grant Shapps to step in to prevent energy suppliers “finding routes to inflate prices”.

The group yesterday said that firms were concerned about how the support package was being applied and many companies were worried about whether they could still stay open by Christmas and if they would need to let their staff go.

The group said there were examples of small firms being asked by energy suppliers for disproportionate upfront payments and told that they could be disconnected if they fall into arrears.

“The government should intervene to ensure that energy suppliers refrain from finding routes to inflate rates for

contracts,” Tina McKenzie, FSB policy and advocacy chair, warned.

“Energy firms should promise not to disconnect struggling small businesses this winter, in line with their commitments to households.”

McKenzie said it was “utterly unacceptable” for energy suppliers to ask struggling firms to cough up a large sum of deposit in advance of having any turnover or profit that can fund their energy use, particularly when dealing with record-high inflation and rising interest rates.

“This is basically kicking small firms when they’re down,” she said.

In response, a spokesperson for the Department for Business, Energy and Industrial Strategy said that only “a small minority” of businesses had reported suppliers for setting prices that “undermine the benefits” of government aid.

It added, however, that it was working with energy regulator Ofgem to confirm “licence conditions have not been breached and to ensure businesses are able to see the full effects of support of-

fered by the scheme.”

The big six energy firms were contacted for comment. Ovo said it did not have any business customers.

The concerns were raised as the government unveiled a £1bn support package for energy efficiency programmes yesterday as well as an £18m public information campaign.

The campaign, which aims to cut households energy usage by 15 per cent, includes advice to lower boiler flow temperatures, turn down radiators in empty rooms and draught-proof windows and doors.

It comes amid continued blackout fears this winter, with National Grid coming close to rolling out emergency plans for the first time yesterday.

On Monday morning National Grid said it was considering triggering its ‘demand flexibility service’ for the first time, where households are paid to cut their energy usage at peak times.

However, it later opted against invoking the early-stage blackout measures, after it reportedly managed to secure power to keep the lights on.

THE HEAD of Barclays has been diagnosed with Non-Hodgkin Lymphoma, a form of cancer, but doctors have said his “condition is curable,” he announced yesterday.

In a statement just after the market open, C.S. Venkatakrishnan, known as Venkat, said the illness “has been detected early” and that his “prognosis is excellent”.

He will continue to run the bank while undergoing an at least 12 week

treatment programme in New York.

Venkat, 56, was parachuted in to lead Barclays in November last year after former chief Jes Staley left to fight the preliminary findings of a Financial Conduct Authority and Prudential Regulation Authority probe that alleged he had not fully disclosed all details of his relationship with deceased sex offender Jeffrey Epstein.

Venkat previously led the lender’s global markets division.

Barclays shares were flat yesterday.

Khan: London firms face ‘ticking timebomb’ of increased business rates

just as the UK is predicted to go into recession.

THOUSANDS of squeezed London businesses are now facing a “ticking time bomb” in the form of coming tax hikes, London Mayor Sadiq Khan has warned.

Khan revealed to City A.M. that business rates will increase in 28 of the capital’s 32 boroughs in 2023,

The government intervened this month to stagger planned business rates increases for next year over three years, however many London firms are still facing crippling hikes.

Khan is calling for the government to more than double the rateable value threshold at which SMEs start

paying the tax.

“We need an urgent package of measures from government to support small businesses and those in the outer London boroughs who are fighting to survive in this tough economic climate,” he said.

Figures released by City Hall revealed that some London SMEs are facing 24 per cent rises in their

firm’s rateable value, which are partly based on property values, from April.

Some of the capital’s iconic sporting venues will suffer huge hikes, such as the All England Lawn Tennis Club in Wimbledon and Crystal Palace Football Club’s stadium, Selhurst Park.

Nick Bowes, chief executive of the

Centre for London think tank, told City A.M.: “Planned hikes in business rates risk tipping London businesses over the edge.”

A Treasury spokesperson said its “generous” £13.6bn business rates support package, announced in the Autumn Statement, “means that every region will see a cut to their average bill”.

TUESDAY 29 NOVEMBER 2022 ISSUE 3,898 CITYAM.COM FREE INSIDE BOOHOO UPS STAKE IN REVOLUTION BEAUTY P3 JET ZERO LANDMARK P5 WIND FARMS TO GET OK P6 CREDIT SUISSE SPIRAL CONTINUES P9 MARKETS P18 OPINION P20 LONDON’S BUSINESS NEWSPAPER RUGBY REVIEW HOW DID THE HOME NATIONS DO THIS AUTUMN P23 PRANCING HORSES THE FERRARI 330 GTC’S RUST TO RICHES REVIVAL P22

STEFAN BOSCIA AND JACK BARNETT

JACK BARNETT

GET WELL SOON Barclays chief

to undergo cancer treatment in US

STANDING UP FOR THE CITY

Strategic ambiguity on China doesn’t mean ignoring the obvious

The day after former North Korean dictator Kim Jong Il launched a nuclear missile test, The Sun’s front page simply read “How do you solve a problem like Korea?”

Alas, “How do you solve a problem like China?’ doesn’t quite scan as well, but it is a question that appears to be vexing our political and economic leadership.

First the facts –the regime is this week showing its true colours,

clamping down on dissent in the name of national harmony, reportedly giving journalists a kicking whilst they’re at it. Make no mistake –the Chinese Communist Party will act exactly the same as any other dictatorship when backs are

against the wall. Saying that does not however make it any easier for firms to navigate their relationship with China’s economy. There are certainly bad examples –HSBC’s craven backing of Hong Kong’s National Security Law should shame that otherwise fine historic institution –but there is no easy how-to in a country that, for all its faults, is not walking away from the global economy.

The UK government similarly

seems occasionally stuck between two stools, booting Huawei out of our 5G networks and banning Confucius Institutes at our universities whilst also courting investment in other areas of our economy that don’t affect our national security. There are some who will describe the City and the government’s relationship with China as accommodation. In truth it is more like sceptical awareness that ignoring them isn’t an option.

GET WELL SOON

Venkat’s tenure at the top of Barclays has, largely not through any fault of his own, been a tumultuous one already.

But all of that rather pales into comparison to the announcement of the chief executive’s diagnosis of nonHodgkin lymphoma yesterday.

All of us at City A.M. wish him well for both his treatment and his recovery over the coming weeks and months.

Rishi Sunak says ‘golden era’ of UK-China relations over as he eyes new approach

RISHI SUNAK has said the UK needs to “evolve its approach” toward China as he signals closer “diplomacy and engagement” with the burgeoning super power.

The Prime Minister told the Lord Mayor’s banquet at Guildhall last night that the “golden era” of UK-China relations pushed by David Cameron “is over”, but that the UK must not ”rely on simplistic Cold War rhetoric”.

Sunak said during his recent trip to the G20 summit in Indonesia that the UK must work with China to solve

global challenges, like climate change.

The statement was a climbdown from his tough rhetoric against the Chinese Communist Party during the Tory leadership race and may mark a thawing in British-Sino relations.

Sunak last night said China “poses a systemic challenge to our values and interests”, but “we cannot simply ignore China’s significance in world affairs.

“The US, Canada, Australia, Japan and many others understand this too.”

“So together we’ll manage this sharpening competition, including with diplomacy and engagement.”

The Prime Minister will likely come

under fire from some of his own MPs for softening his stance against China since the summer, with Tory grandee Sir Iain Duncan Smith becoming an increasingly vocal critic.

Ex-Prime Minister Liz Truss was planning on designating China as an official “threat” instead of a “systemic competitor”, however it is unlikely Sunak will make a similar move.

Number 10 yesterday said the UK government will still call out Chinese human rights abuses, like the ethnic cleansing of Uyghur Muslims, but that “cooperation” with Beijing was imperative.

THE FINANCIAL TIMES

THE CITY VIEW LME CLAIMS $20BN NICKEL TRADE CHAOS THREATENED TO TIP IT INTO ‘DEATH SPIRAL’

The London Metal Exchange claims that $20bn of margin calls would have led to the simultaneous bankruptcy of multiple clearing houses, according to its defence against a $470m lawsuit.

THE TIMES

BRITAIN SENDS TROOPS TO JOIN JAPANESE WAR GAMES

Britain has deployed troops to Japan to take part in military drills simulating a conflict on a remote Pacific Island amid mounting tensions with China. It is the first time in four years British troops have been involved in the wargaming drill.

THE TELEGRAPH NHS CREATES £1.3BN POT FOR COVID COMPENSATION

The NHS has set aside £1.3bn to cope with compensation claims arising from the Covid-19 pandemic this year with claims for treatment delays, cancellations and misdiagnosis expected.

CITYAM.COM 02 TUESDAY 29 NOVEMBER 2022 NEWS

STEFAN BOSCIA

WHAT THE OTHER PAPERS SAY THIS MORNING

Prime Minister Rishi Sunak spoke at the Lord Mayor’s banquet at Guildhall last night

SOME FESTIVE CHEER The First Lady of Ukraine Olena Zelenska yesterday joined Rishi Sunak’s wife Aksharta Murty to decorate the Christmas tree at Downing Street

Boohoo doubles stake in troubled firm Revolution

EMILY HAWKINS

FAST FASHION retailer Boohoo yesterday announced it had upped its stake in Revolution Beauty to over a quarter, as the cosmetics firm announced a new chief.

The online retailer said it had amped up its strategic investment in the lipstick seller by more than double, increasing its stake from 12.85 per cent to 26.47 per cent of its issued share capital.

The investment “reflects Boohoo’s belief in the growth potential of Revolution Beauty and it intends to be a supportive stakeholder and long-term partner,” a statement said.

Boohoo, which sells Revolution cosmetics on a number of its websites and its Debenhams platform, saw its share price swell by almost three per cent in afternoon trading yesterday.

It came as Revolution yesterday said its current chief operating officer Bob Holt would be stepping into the top job, after Holt was made responsible for the daily management of the firm last month.

Its previous CEO Adam Minto quit his role earlier this month after the firm called in investigators in September when auditors flagged “serious con-

cerns” amid its transition from a private to public company.

The AIM-listed lipstick seller said no conclusions had yet been drawn by the independent investigation.

HSBC and Natwest, the brand’s main bank lenders, have recruited financial advisers at Teneo to monitor the situation, Sky News reported yesterday.

Teneo had been hired in recent weeks, a source close to Revolution said.

The probe being carried out by Forensic Risk Alliance and Macfarlanes is still ongoing, with the firm promising an update would be released to the market “in due course”.

The beauty giant saw its executive chairman Tom Allsworth voluntarily step away from duties last month, as well as top boss Minto. Revolution was unable to sign off its already delayed full year accounts earlier this autumn, meaning its shares have been suspended.

The appointment of Holt “comes at a crucial time” after what has been “a highly damaging few months,” Joshua Raymond, director at investment platform XTB.com, told City A.M. However, Holt “might well be the right person to deliver the change needed,” he added.

Crypto lender Blockfi files for bankruptcy as FTX fallout spreads

CHARLIE CONCHIE

CRYPTO lender Blockfi yesterday filed for bankruptcy as the fallout of FTX’s collapse spreads across the industry.

Blockfi and eight of its affiliate firms said they had filed for Chapter 11 bankruptcy proceedings in New Jersey, which they claimed would “consummate

a comprehensive restructuring transaction” and “maximise value for its clients and stakeholders”.

The collapse makes Blockfi the latest casualty left in the wake of Sam Bankman-Fried’s crypto exchange FTX, which has sent prices tumbling and sparked fears of contagion across the sector.

Blockfi was rescued by a hefty loan from FTX earlier this year when

the crypto sector was first gripped by a downturn.

FTX had signed a deal with Blockfi for a $400m (£335m) credit facility and an option to buy it for up to $240m.

Blockfi chiefs listed FTX as its second biggest creditor in court filings yesterday, with $275m still owed on the rescue loan paid out earlier this year.

BT reaches pay agreement with union after months of strike action

LEAH MONTEBELLO

BT HAS reached an agreement with the Communication Workers Union (CWU) over pay after months of strike action.

The union confirmed the news yesterday, stating that the total package includes pay permanently increasing by £3,000 from 1 April, with a further review from 1 September 2023 to “allow for further negotiations to resolve pay, grading and structuring issues”.

This will represent a pay rise ranging from six to 16 per cent for workers, depending on their pay grade.

The deal will now be put to a vote of the CWU’s BT membership, with the union’s executive urging members to accept the deal.

BT chief Philip Jansen said the deal “gets help to as many of our colleagues as possible, favours our lower paid colleagues and gives people the security of a built-in, pensionable increase to their pay.”

03 TUESDAY 29 NOVEMBER 2022 NEWS CITYAM.COM

The CWU is urging its members to accept the deal that includes a £3,000 pay bump in April

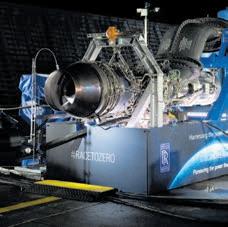

Rolls-Royce and Easyjet test first hydrogen plane

ILARIA GRASSO MACOLA

ILARIA GRASSO MACOLA

ROLLS-ROYCE and Easyjet yesterday made aviation history as they announced the first successful run of a hydrogen-powered plane engine.

The test was conducted using a hydrogen demonstrator powered by wind and tidal energy generated in Scotland’s Orkney Islands.

Rolls-Royce’s chief technology officer Grazia Vittadini told reporters it was a “landmark achievement”.

“We are pushing the boundaries to discover the zero carbon possibilities of hydrogen, which could help reshape the future of flight,” Vittadini said.

The engine powerhouse first announced the partnership with Easyjet in July.

British Steel pension scheme members set for £49m redress after advice scandal, FCA announces

CHARLIE CONCHIE

CHARLIE CONCHIE

MORE THAN 1,000 former members of the British Steel pension scheme are set to be paid £49m after the UK’s financial watchdog ruled they received wrong advice from financial advisors looking to pocket huge fees.

In a statement yesterday, the Financial Conduct Authority said

that almost half the advice given to members was “unsuitable”, which it described as “an exceptionally high level compared with other cases”.

The regulators’ executive director for consumers and competition, Sheldon Mills, said the FCA would now roll out the redress scheme so burnt scheme members can “get the retirement they worked for”.

“We’re working to get the scheme in place quickly to end uncertainty for members,” Mills said.

The redress comes after members of the pension scheme were wrongly advised to transfer their savings out of the scheme during a restructuring of the scheme in 2017. Advisors were found to have acted in their own interests and pocketed huge fees as a result.

05 TUESDAY 29 NOVEMBER 2022 NEWS CITYAM.COM

Members of the scheme were wrongly advised to move pension savings out of the scheme during a restructuring in 2017

Something special for everyone Meta Quest 2 Virtual Reality Headset 256GB

shop Explore incredibly immersive experiences, fitness titles and games 2 year guarantee included* £499.99 Product, price and availability are correct at time of going to press but may change and are subject to availability. *T&Cs apply. Both companies have committed to demonstrate the feasibility of hydrogen as a way to decarbonise aviation in time for its 2050 net-zero deadline. “We are committed to continuing to support this ground-breaking research because hydrogen offers great possibilities for a range of aircraft, including Easyjet-sized aircraft,” Easyjet’s boss Johan Lundgren said. “That will be a huge step forward in meeting the challenge of net zero by 2050.” Easyjet announced in late September it was ending its carbon offsetting scheme at the end of this year in favour of a sizable investment into new, greener aircraft. The test was praised as a “landmark” moment for aviation’s net zero goals

Scan to

Sizewell C not enough to meet UK’s domestic energy security ambition

NICHOLAS EARL

NICHOLAS EARL

THE GOVERNMENT needs to approve a pipeline of projects to boost the role of nuclear power in the UK’s energy mix, the leading industry group said yesterday.

Tom Greatrex, chief executive of the Nuclear Industry Association, told City A.M. that there was a “sense of impatience with the time it’s

taking for decisions to be taken.”

He said: “The current Prime Minister and his two predecessors have all made statements saying that we need more nuclear power, and reaffirming the energy security strategy. But there is a danger that the urgency indicated by that strategy isn’t matched by the speed of decisionmaking to make it happen.”

The industry boss warned that

proposed upcoming projects, including Sizewell C, were insufficient to meeting the government’s energy security goals, with the UK’s ageing fleet still in urgent need of replacement.

Currently, four power plants are set to be de-commissioned by the end of the decade, taking nearly 6GW of power offline, leaving the UK with less, not more, nuclear capacity.

Big wheel keep on turning: Wind turbines to get OK

NICHOLAS EARL

THE SEVEN year de-facto ban on new onshore wind projects could finally be lifted, with a leading cabinet member suggesting the government could give way to growing backbench pressure.

Business secretary Grant Shapps hinted at a possible U-turn from Downing Street yesterday, when he confirmed to Sky News there would be more onshore wind projects “where communities are in favour of it”.

Former Liz Truss cabinet member Simon Clarke tabled an amendment last week to the Levelling Up Bill to allow new onshore wind projects in England which has commanded backbench support.

Shapps said: “There will be more, over time, particularly where communities are in favour of it. That is, I think, the key test of onshore wind – is it of benefit to communities locally? That has always been the principle for us, for quite some time now.”

Such a pledge would require the end of planning rules established under former Prime Minister David Cameron, indicating the government will concede to

a Tory MP rebellion.

Since entering Downing Street last month, Prime Minister Rishi Sunak has failed to clarify if he was prepared to back his predecessor’s push to liberalise planning rules around domestic turbines.

Liz Truss wanted to bring onshore wind planning rules into line with other existing infrastructure projects as part of her ‘Growth Plan’.

While Shapps insisted that his comments were “exactly what we’ve [Sunak] said all along”, Sunak took a much more hostile view of onshore wind during the leadership campaign this summer.

He promised to scrap plans to relax onshore wind developments and also wanted to prioritise rooftop solar over panels on farmland.

Writing in The Telegraph in July, Sunak said: “Wind energy will be an important part of our strategy, but I want to reassure communities that as Prime Minister I would scrap plans to relax the ban on onshore wind in England, instead focusing on building more turbines offshore.”

He has also re-imposed the moratorium on fracking.

Shares jump for Yu Group as it scores record monthly bookings

LEAH MONTEBELLO

LEAH MONTEBELLO

BUSINESS energy supplier Yu Group smashed revenue expectations yesterday as it cashed in on bookings.

Record average monthly bookings from new and renewed customer contracts over the last three months bolstered the company, with the board now expecting revenue of approximately £260m for the full year, a 67 per cent annual growth rate.

Shares jumped over 12 per cent for

the independent supplier of gas, electricity and water to UK businesses, with adjusted ebitda and operational cashflow now anticipated to significantly exceed current market expectations for the year to 31 December. It said “exceptional” performance is expected to continue.

YuGroup recently urged the government to clarify future support for businesses beyond this winter to guarantee pubs, restaurants and bars can make plans for their future.

CITYAM.COM 06 TUESDAY 29 NOVEMBER 2022 NEWS

Onshore wind turbines are becoming popular as an answer to UK energy requirements

Official Tailor. Designed For The England Teams

SHOP ONLINE & IN STORE

You get more when you #jointheflipside Buy a Galaxy Z Flip4 and claim a Tab S6 Lite, on us. Purchase before 30/11/2022. Claim by visiting: https://samsungpromotions.claims/tabS6lite within 60 days of purchase. UK/ROI. 18+ only. For full T&C’s, see https://samsungpromotions.claims/tabS6lite Buy online, in-store or call 0800 033 8006 today

Home REIT shares continue spiral

CHARLIE CONCHIE

SHARES in social housing investor Home REIT plunged yesterday after the firm delayed the publication of its accounts following an attack by a short seller last week.

Viceroy Research, which was among the first investors to take aim at the now-collapsed payments firm Wirecard, said last week that Home REIT’s charity tenants in many cases could not afford rent, were simply not paying or were run by bad actors.

The scathing report led Home

REIT to announce after market close on Friday it would delay the publication of its accounts due yesterday, which sent shares spiralling beyond seven per cent.

Shares in the FTSE 250 firm are now trading down over 26 per cent since the publication of the critical report last Wednesday, trading at around 55.8p per share, down from around 75.8p per share last Wednesday.

Home REIT claimed it was “standard practice” that a company that has had “material allegations” made against it is

“subject to an enhanced set of audit procedures”.

“The results, having been audited by BDO, were on track for release on Monday 28th November as previously announced, until the Viceroy report was published on Wednesday morning,” Home REIT said on Friday. “Only due to the additional procedures now required, they have been delayed.”

Viceroy partner Fraser Perring said he has reported the quality of Home REIT’s leases to the Met Police and the Financial Conduct Authority.

CHARLIE CONCHIE

SHARES in embattled Swiss lender

Credit Suisse plunged beyond nine per cent yesterday as fears over the banks’ stability spread in the wake of a loss warning last week.

Credit Suisse’s share price has been in freefall since it revealed last Wednesday that it expected to make a pre-tax loss of up to 1.5bn Swiss Francs, following a £74bn flood of withdrawals which caused it to breach some liquidity buffers.

Credit Suisse has been hit by a slowdown in the past months and said a “challenging” economic environment had also hit client activity across its divisions, with its investment banking suffering a sharp slump in fees as capital markets activity dried up.

The announcement spooked investors, with Credit Suisse shares now trading down over 14 per cent since the announcement.

Five-year credit default swaps, which investors use to insure themselves in the event of a default, also rocketed by 53 basis points yesterday

to a record high of 398bps, according to data from S&P Global Market Intelligence.

It comes after Credit Suisse chiefs looked to soothe investor fears over the weekend. Boss of the bank’s Swiss unit said “some customers have withdrawn some of their money, but very few have actually closed their accounts”.

The Swiss bank has been scrambling for steadier ground after a string of crises in the past two years, including the ousting of chief Tidjane Thiam

over a corporate espionage scandal in early 2020.

The bank was then rocked by the twin implosions of Archegos Capital and Greensill Capital in 2021 which left it nursing billions of dollars of losses. The crises have shattered the lender’s status as a bastion of the European banking landscape and forced bosses into a major turnaround effort. Chief Ulrich Körner announced in October he would push ahead with splitting up the investment bank and cutting around 9,000 jobs globally.

CRYPTO exchange Coinbase yesterday appointed four new executives to its top team in Europe as it doubles down on expansion amid one of the “most challenging” periods in the history of the market.

The San-Francisco-based exchange, which in July announced plans to ramp up its expansion across the continent, said it had appointed Elke Karskens to the role of UK country director and Cormac Dinan as director of Ireland, in a spate of senior appointments.

Patrick Elyas, previously director

of market expansion at Coinbase for EMEA and Americas, will now shift into a role to focus solely on European expansion, while Michael Schroeder takes over as director of controls for Germany.

In a statement, Coinbase bosses said they believed Europe, the Middle East and Africa were “leading the way in creating a safe and secure regulatory environment for crypto”.

“We consider it a gold standard setter and an example of what can be achieved when the political will is there,” said Nana Murugesan, vice president of international and business at Coinbase.

SAVERS will see the rate on a fixed-rate account jump from one per cent to five per cent from December, HSBC UK announced yesterday.

The rate on HSBC’s Regular Saver account is fixed for 12 months from the time of opening the account, under the bank’s terms.

But HSBC UK said that from 1 December, it will increase the rate to five per cent, and the rise will apply automatically to existing accounts.

Tom Wolfenden, HSBC UK head of retail, said the change was made “to help with the increased cost of living”.

CITY of LONDON

The PLANNING ACTS and the Orders and Regulations made thereunder

This notice gives details of applications registered by the Department of The Built Environment

Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

2 King’s Bench Walk, London, EC4Y 7DE 22/00046/LBC

Alterations in association with refurbishment of basement accommodation for commercial use, including removal of stud partitions, ventilated dry-lining to combat damp penetration, relocation of telecoms hub.

St Mary Abchurch House, 123 - 127 Cannon Street, London, EC4N 5AU 22/01030/FULL & 22/01031/LBC

The conversion of the existing commercial x serviced apartments (Class C1), internal alterations associated with the change of use, the creation a new lobby space with waste and bicycle storage space at

the provision of replacement plant and machinery and a single storey lounge area with associated terrace space, and other associated works.

4 Staple Inn, London, WC1V 7QH 22/01044/LBC

Fit safety line wire above the central gutter of 4 - 6 Staple Inn.

9A Devonshire Square, London, EC2M 4YN 22/01046/LBC

installation of plasterboard and glazed partitions installation.

Finsbury House, 23 Finsbury Circus, London, EC2M 7EA 22/01047/FULL & 22/01048/LBC

The erection of a new roof terrace, associated lift overrun and extension of stair core, the extension of panels on roof, replacement of windows, alterations to existing entrances to create level access, internal alteration to mezzanine and new external staircase for basement access for commuters.

4 - 5 Devonshire Square, London, City of London, London, EC2M 4YE 22/01065/LBC & 22/01071/FULL

Installation of 6 projecting neon letter boxes (Illuminated), 3 new bronze canopies with recessed lighting to the entrance of Building 5, a dome awning to the Building 4 entrance and some repainting work on the doors and windows on the existing building.

Stationers Hall, Stationers Hall Court, London, EC4M 7DD 22/01076/TCA

Pruning works to 1 x London Plane Tree (Platanus x acerifolia).

4 - 5 Devonshire Square, London, City of London, EC2M 4YE 22/01077/FULL & 22/01078/LBC

Change of use from a Private Members Club (Sui Generis) to Hotel (C1).

Scottish Provident Building, 1 - 6 Lombard Street, London, EC3V 9AA 22/01082/FULL

External work comprising of: (i) the introduction of revolving doors to main entrance in place of existing double doors and the reactivation of existing side door; (ii) the installation of louvres in the northern and southern elevations; and (iii) the installation of a replacement skylight.

Scottish Provident Building, 1 - 6 Lombard Street, London, EC3V 9AA 22/01083/LBC

Internal and external works comprising of: (i) the introduction of revolving doors to main entrance in place of existing double doors and the reactivation of existing side door; (ii) the installation of louvres in the northern and southern elevations; and (iii) the installation of a replacement skylight; (iv) the opening up of the arch in reception and the reorganisation of the existing entry sequence; (v) the reinstatement of heritage cornices and skirting to reception and breakout spaces; (vi) the installation of stone wall linings to opened reception space to match existing stone; (vii) the installation of new kitchen area and glazed meeting rooms to breakout space; (viii) the installation of

area; (ix) the refurbishment of all stair lobbies, carpets, lighting and lift surrounds; (x) the refurbishment of existing heritage doors; (xi) the refurbishment of rear escape stair and improved lighting; (xii) extended cycle storage to existing north-east basement vaults; (xiii) extension of shower facilities to existing cycle storage; (xiv) the installation of WCs to existing basement under the reception breakout area; and (xv) all associated works.

You may inspect copies of the application, the plans and any other documents submitted with it on-line

Anyone who wishes to make representations about this application should do so online:

date of this notice (unless otherwise stated) and will be taken into account in the consideration of this application.

In the event that an appeal against a decision of the Council proceeds by way of the expedited procedure, any representations made about the application will be passed to the Secretary of State and there will be no opportunity to make further representations.

09 TUESDAY 29 NOVEMBER 2022 NEWS CITYAM.COM

Perring claimed Home REIT used cash kickbacks to incentivise charities to sign contracts

VICKY SHAW

CHARLIE CONCHIE

Suisse shares dive

concerns grow in wake

loss warning last week Coinbase leans into Europe expansion with five new chiefs HSBC raises rates on saver accounts to five per cent ANNOUNCEMENTS LEGAL AND PUBLIC NOTICES P 28 Nov 3.01 Dec 2021 Jan 2022 Feb 2022 Mar 2022 Apr 2022 May 2022 June 2022 Jul 2022 Aug 2022 Sept 2022 Oct 2022 Nov 2022 CREDIT SUISSE GROUP 4.00 5.00 6.00 7.00 8.00 9.00 PA

Credit

as

of

Liquidators say KPMG to blame for Carillion fall

LOUIS GOSS

KPMG’s incompetence in its audits of Carillion played a core part in the construction giant’s 2018 collapse, Carillion’s liquidators have said, as part of a £1.3bn lawsuit against the Big Four accounting firm.

KPMG’s 2016 audit of Carillion lulled the construction firm’s board into a false sense of security that saw the firm make a series of financial decision that plunged Carillion into bankruptcy in 2018, the lawsuit says.

The audits, through which KPMG missed a series of “red flags”, gave Carillion’s board a wrong understanding of the firm’s financial situation that in turn saw it take on unsustainable debts, Carillion’s liquidators said in High Court filings.

The auditor’s “incompetent” work in turn saw Carillion’s board agree to pay out a £210m dividend to shareholders,

that would not have been lawful to pay if the true state of Carillion’s accounts had been known, the filings say.

The 2016 audit also saw Carillion pay out millions in professional services fees that would not have been paid out if the audit had been carried out properly, Carillion’s liquidator said.

The allegations come after Carillion’s liquidators sued KPMG for £1.3bn in February over claims the auditor’s incompetence contributed directly to the construction firm’s collapse.

KPMG received £29m in fees for its audits of Carillion, before the construction firm collapsed in 2018, leaving £7bn worth of debts.

A KPMG spokesperson said: “We believe this claim is without merit and we will... defend the case. Responsibility for the failure of Carillion lies solely with the company’s board and management, who set the strategy and ran the business.”

Birketts merges with Batchelors in legal tie-up

LOUIS GOSS

LOUIS GOSS

UK LAW firm Birketts yesterday announced it had struck a deal to merge with its London rival Batchelors Solicitors amid forecasts of a surge in consolidation in the UK’s legal sector.

The deal will see the two firms join forces in a merger that is set to combine their long-standing social housing practices to create a market-leading team.

told

Embrace AI to navigate volatile economic climate, auditors

LOUIS GOSS

LOUIS GOSS

DATA analytics tools will play a “key” role in helping auditors navigate the volatile economic conditions that currently face the world, one of the UK’s largest audit trade bodies has said.

The Chartered Institute of Internal Auditors (CIIA) called on auditors to “embrace” technology as it called on

them to consider whether they are keeping up with competitors.

It noted 60 per cent of auditors currently use data analytics tools, while seven per cent are already using AI.

“Given the warp speed at which risks can emerge and wreak havoc, embracing data-analytics is nonnegotiable,” former CIIA president Richard Chambers said.

The merger, which is set to be complete in March 2023, will also expand both firms’ geographical reach, in giving them access to offices across London and the South East of England.

The deal comes amid analyst forecasts of an impending boom in M&A activity in the legal sector.

Legal sector analysts have predicted the current economic downturn will cause a surge in M&A activity as larger law firms seek to capitalise on the dip by buying up smaller rivals.

The surge in M&A activity is set to reverse the lull in mergers and acquisitions the UK market has experienced over the past two years.

Seven per cent of auditors currently use AI in their work

CITYAM.COM 10 TUESDAY 29 NOVEMBER 2022 NEWS

Legal but harmful provision axed in

Safety Bill

LEAH MONTEBELLO

THE “legal but harmful” provision has been formally scrapped from the Online Safety Bill, in a push to water down moderation and put a greater focus on free speech protection.

The provision, which would have allowed tech firms to ban content that was not actually illegal, sparked controversy among free speech advocates when it was first introduced, raising concerns surrounding censorship.

However, the government confirmed this morning that these measures will be replaced with new duties that strengthen the free speech requirements on major online platforms to make them more accountable for their policies. It will now only require firms to remove content accessed by adults based on the company’s own terms and services, or if the content they are posting is illegal.

A key tenet of this will be about requiring firms to have clear, easy to understand and consistently enforced

terms of service.

There will also be a greater focus on children, with a new amendment forcing social media platforms like Tiktok and Instagram owner Meta to publish their risk assessments on the dangers their sites pose to children. Previously, the bill required platforms to carry out these assessments but not to proactively publish them.

As part of this push, the bill will focus on age verification and ensuring Big Tech has a better grasp on who is accessing its content.

It comes after a new survey by the Advertising Standards Authority found that more than 1.6m social media accounts owned by children are falsely registered with an adult age.

Some 93 per cent of young people aged 11 to 17 said they have an account with Facebook, Instagram, Snapchat, Tiktok, Twitch, Twitter or Youtube, with almost a quarter (24 per cent) misreporting their age when doing so.

The bill is due to return to Parliament next week.

City workers ignoring calls to return to the office

LOUIS GOSS

LOUIS GOSS

CITY workers are ignoring calls from ‘C Suite’ executives for staff to come into the office for a minimum number of days each week, according to a new report.

Workers and managers in the financial and professional services sectors are instead employing their own “bespoke” working models that align with their specific operational needs, the LSE study says.

The study – which is based on

Pensionbee managed assets rise over £3bn

LEAH MONTEBELLO

PENSIONBEE yesterday announced it had over £3bn assets under administration as of this month.

The online pension provider said despite the macroeconomic volatility, it has been able to reach this “milestone” through high customer retention and strong net inflows.

“The ongoing growth in our Assets under Administration results from our commitment to delivering outstanding customer service and helping more people prepare for a

ANNOUNCEMENTS

happy retirement,” chief executive Romi Savova said.

“We are growing the business in line with our ambitions while helping to meet the country’s ever greater need for long term retirement planning and preparedness.”

The update comes after the fintech firm doubled down on its goal of profitability by next year as it yesterday reported a 24 per cent jump in assets in the nine months to September.

The London-listed online pensions provider said that invested

LEGAL AND PUBLIC NOTICES

customers increased 68 per cent to 174,000, up from 104,000 last year, as assets hit £2.8bn in the period.

Revenues in the nine months to September jumped 44 per cent on last year’s levels from £9m in the nine months to September 2021, with the firm saying it was on track to reach profitability before deductibles by late 2023.

Shares in the London-listed group –which began trading in April 2021 –shot up over five per cent in early morning trade after the news, and settled to close up over one per cent last night.

interviews with 100 workers in major companies including Goldman Sachs, Blackrock, Natwest, and PwC –suggested remote-first policies had no detrimental impact on productivity.

Those interviewed instead claimed flexible working policies have the potential to boost productivity significantly in providing greater efficiency at the team level.

The report, sponsored by some of the UK’s largest companies, argued firms that offer greater flexibility firms have an opportunity to reduce

staff turnover related to burnout and stress.

It warned firms that fail to let staff work from home risk losing out in the battle for talent, as women in particular begin flocking to employers that offer flexibility.

Dr Grace Logan, an economist at LSE, warned demands from top level executives that workers come in for a minimum number of days each week are “ego driven rather than having the best interests of the business in mind”.

DALLERES AHEAD OF WALES VERSUS ENGLAND TONIGHT

Online

CITY of LONDON undermentioned streets made several Orders on 24 November 2022 under Section 14(1) of the Road Fenchurch Street (Mark Lane to Fenchurch Buildings) ---- Mobile Crane Minories India Street (Vine Street to Minories) ---- Utility Works Minories Utility Works Philpot Lane Carriageway Works St Mary Axe (Leadenhall Street to Undershaft) ---- Utility Works Swan Lane Mobile Crane Whitefriars Street Building Site 29 November 2022

LEGAL

PUBLIC

ANNOUNCEMENTS

AND

NOTICES

11 TUESDAY 29 NOVEMBER 2022 NEWS CITYAM.COM CITY of LONDON Notice is hereby given that the Common Council of the City of make several Orders on 8 December 2022 under Section 14(1) New Street Square Mobile Crane 29 November 2022

SPORT If Wales are to avoid World Cup elimination, only a win against England will do –and even then, they must do so by four goals or rely on a draw between the USA and Iran

PAGE 24

FRANK

Carlyle unveils $3bn fund for European tech

MILLIE TURNER

US ASSET manager Carlyle has rallied together over €3bn for a European fund to help grow mid-market firms on the continent.

The fund, known as Carlyle European Partners and headed by two former investment bankers, has exceeded its €2.5bn (£2.2bn) fundraising target in less than a year, the co-heads told Reuters.

The pair are looking to capitalise on “pockets of life” in the European economy, targeting business-facing tech companies operating in cybersecurity, digital transformation and cleantech –three tech sectors with particularly attractive growth prospects in the current climate.

Demand for tighter cybersecurity has soared since Russia invaded Ukraine earlier this year and global geopolitical tensions have risen.

Meanwhile the push for cleantech –such as renewable energy, electric ve-

hicles, as well as water and energy usage metres –has grown increasingly popular among businesses looking to meet net zero commitments and bypass some of the pain served up by scaling energy costs.

Software applications across the financial services, healthcare and infrastructure industries will also be pursued, according to the Londonbased co-heads of the fund, Michael Wand and Vladimir Lasocki.

Carlyle is aiming to invest in 20 to 30 companies, with the goal of acquiring a majority stake in most and working with businesses to upgrade management teams.

Around 15 per cent of the fund will be reserved for growth equity transactions, Wand and Lasocki said.

The fund has already made two investments: one in telecoms equipment distributor Euro Techno Com, which was sold to London-based private equity giant Cinven in June, and another in digital marketing agency Incubeta.

VW boss ‘very concerned’ about EU attractiveness

ILARIA GRASSO MACOLA

VOLKSWAGEN’s (VW) boss Thomas Schafer yesterday said he was very concerned about the EU and Germany losing their industrial attractiveness due to surging energy costs.

“We are treading water,” he wrote yesterday. “I am very concerned about the current development regarding investments in the industry’s transformation.”

According to Schafer – who has been at the helm of the German

marque since September – Europe lacks price competitiveness in several areas, but especially when it comes to energy.

Following Russia’s invasion of Ukraine, the EU has been the centre of the worst energy crisis since WW2. Germany was particularly hit due to its pre-invasion dependence on Russian oil and

natural gas. “Unless we manage to reduce energy prices in Germany and Europe quickly and reliably, investments in energy-intensive production or new battery cell factories in Germany and the EU will be practically unviable,” Schafer wrote. VW has plans to build six cell gigafactories by 2030, as it aims to replace Tesla as the world’s largest EV producer. The European Commission was approached for comment.

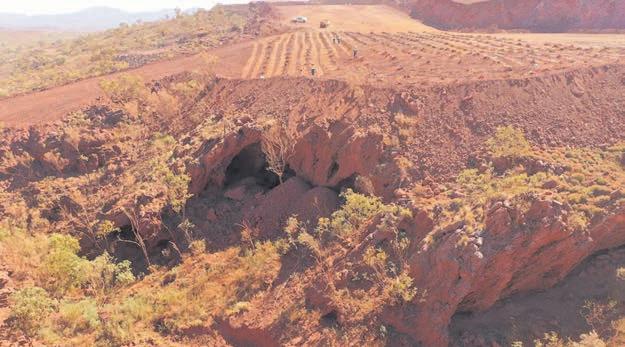

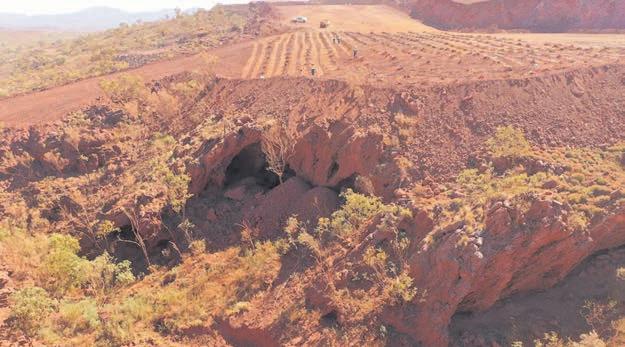

Rio Tinto to set up Juukan Gorge fund in attempt to heal battered reputation

MILLIE TURNER

RIO TINTO is to create a foundation to support cultural projects in Western Australia, as it seeks to heal its reputation following the fallout of the Juukan Gorge controversy.

The mining giant has agreed with traditional landowners within the Puutu Kunti Kurrama and Pinikura (PKKP) Aboriginal Corporation that it

will fund new projects in the area.

Juukan Gorge, a sacred ancient cave system in Pilbara, had shown continuous signs of human activity for more than 46,000 years – but was destroyed in 2020 for sitting atop £75m worth of high-grade iron ore.

CEO Jakob Stausholm, who was brought in to restore trust in the miner last year, said yesterday: “We fell far short of our values as a

company and breached the trust placed in us by the PKKP people by allowing the destruction of the Juukan Gorge rock shelters.”

A parliamentary inquiry in 2020 found Rio Tinto to have gone against the wishes of traditional landowners despite knowing of the cultural value.

The report said: “Rio knew the value of what they were destroying but blew it up anyway.”

CITYAM.COM 12 TUESDAY 29 NOVEMBER 2022 NEWS

Juukan Gore, a sacred ancient site in Australia, was destroyed by Rio Tinto in 2020

Schafer took the reins of VW in September

Finance boss at Inchcape steps down after ‘personal behaviour falls short’

ILARIA GRASSO MACOLA

INCHCAPE’s chief financial officer yesterday stepped down with immediate effect after the firm said his behaviour fell short of company standards at a recent event.

Gijsbert de Zoeten quit over the revelations yesterday morning, in a statement put out by the company, forfeiting his long-term incentive plans as well as any bonuses.

By contract he will still be paid for the next 12 months for a total

of £608,000.

“This follows an incident at a recent event where, through a lapse in judgement, he displayed personal behaviour falling short of the high standards expected of the leadership of the group,” Inchcape said.

The firm declined to give a further details, and his bio was removed from the company’s website.

According to the car retailer, de Zoeten’s decision was not related to the company’s performance or its decision to press ahead with the

acquisition of Latin American auto distributor Derco.

Inchcape’s group financial controller Adrian Lewis will take over from de Zoeten on an interim basis until a successor is found.

The company reported a strong performance in the third quarter of 2022, posting a group revenue of £2.1bn – 16 per cent up on an organic basis. It also said it was expecting to meet or exceed its profit forecasts for the year, which are between £350m and £370m.

Aircraft orders take off amid sector recovery

THE NUMBER of aircraft ordered has risen globally this year in what can be seen as a positive sign for the aviation industry’s post-pandemic recovery.

Data published yesterday by aerospace trade body ADS shows that October orders jumped to 299 aircraft – the biggest order since 2019. Meanwhile orders for the last 10 months were the largest since 2014.

“Stronger order and delivery books coupled with a rising backlog seen throughout 2022 continue to be a welcome indication that long-term recovery from the Covid19 pandemic is progressing,” said ADS’s chief executive Kevin Craven.

“There is still a long way to go to achieve a full recovery, and it is important that we see continued support for manufacturers to invest in R&D to build a strong foundation for the future.”

Deliveries also increased by 51 per cent on last year’s levels, with 75 single-aisle and 20 wide-body planes shipped last month.

According to aviation analyst Sally Gethin, the recovery could be threatened by the global economic turbulence, including rising costs of oil and the dollar’s strength.

Additionally, plane manufacturers such as Airbus and Boeing continue to face disruption and delays due to ongoing supply chain issues.

Boeing’s October deliveries fell to 35, down from September’s 51, while Airbus is reportedly pushing back 2023 deliveries.

In a trading update published late last month,

Aircraft orders over the last 10 months have been the highest since 2014

the EU plane maker said the supply chain remained fragile.

“The supply chain remains fragile resulting from the cumulative impact of Covid, the war in Ukraine, energy supply issues and constrained labour markets,” said Airbus chief executive Guillaume Faury.

A company spokesperson told City A.M. Airbus would not comment on “intermediate number speculations”.

Rail Partners calls on government to give train operators more freedom

ILARIA GRASSO MACOLA

ILARIA GRASSO MACOLA

RAIL Partners yesterday called on the government to give train operators more freedom to lure back customers.

According to the rail association, the contractual system –introduced during the pandemic to avoid the collapse of the wider rail network –needs to evolve through an increased

harnessing of the private sector.

Rail Partners has called for a renewal of National Rail contracts, including giving rail operators more freedom when it comes to timetables and ticketing.

If implemented, the measures could unlock as much as £1.6bn, which the Treasury is currently missing out on due to the system

in place.

Rail Partners chief executive Andy Bagnall said operators must have more respite to “secure the financial sustainability of the sector, encourage sector innovation and investment and ultimately protect service levels and jobs.”

The Department for Transport was approached for comment.

13 TUESDAY 29 NOVEMBER 2022 NEWS CITYAM.COM

ILARIA GRASSO MACOLA

The UK has moved away from a franchising railway model to the creation of GBR

Inchcape said de Zoeten’s behaviour fell short of the company’s “high standards”

NOT READY YET The majority of people around the world say they wouldn’t feel safe in a self-driving car, according to research

FIGURES from a report published yesterday by Lloyd’s Register Foundation showed that only 27 per cent of the global population believe they would be safe in a driverless car. The countries where the most people feel safe are Denmark –where 45 per cent of the population felt comfortable –the UAE and Afghanistan, while people in Indonesia, Zambia and Gabon felt the least safe.

Cerillion reaches new heights as it cashes in on 5G telecoms boost

LEAH MONTEBELLO

SOFTWARE provider Cerillion yesterday posted record revenue as demand continued to surge thanks to a 5G boom and digitisation.

The British firm said revenue climbed 26 per cent to £32.7m in the 12 months to 30 September, driven by major new customer implementations and strong

demand from existing customers.

The year was bolstered by big customer wins, including the largest ever contract won in July 2022 (£15m), with Cable & Wireless Seychelles, a full-service network operator.

The back-order book also reached a new high of £45.4m at the year-end, up from £42.1m last year. Meanwhile new customer sales pipeline climbed 43 per cent to a record £209m.

Cerillion chief Louis Hall said: “The roll-out of 5G and digitisation, and the need to be able to react rapidly to changing market conditions, means that telecom companies continue to drive investment in enterprise software. These tailwinds should help to support Cerillion’s continued expansion over the longer term.”

Shares are up over a quarter in the year to date for the AIM-listed firm.

Semiconductor sector braces for economic spiral

MILLIE TURNER

THE SEMICONDUCTOR sector is bracing for slipping demand next year, as the grip the industry has on consumer and industrial-facing businesses loosens.

Global revenue generated by computer chips, crucial bits of tech used in most of today’s electronics, is expected to fall 3.6 per cent in 2023, according to tech research and consulting giant Gartner yesterday.

While the industry is still anticipated to bank $596bn (£492bn) next year, Gartner has revised down its forecast from $623bn (£515bn) in the latest sign the industry is rebalancing after a period of booming activity.

“The short-term outlook for semiconductor revenue has worsened,” Richard Gordon, practice vice president at Gartner, said. “Rapid deterioration in the global economy and weakening consumer demand will negatively impact the semiconductor market in 2023.”

The economic downturn sweeping the globe is already beginning to act like an anvil on demand for consumer electronics, squashing down the industry’s pandemic-era uptick.

The semiconductor sector boomed during the pandemic, when consumers flocked towards the latest tech during successive lockdowns, despite the supply chain being plagued by restrictions and illness from Covid-19.

Onlookers have long said the industry is cyclical in nature, due in part to the relatively short lifespan of tech, which is quickly replaced by newer models.

Bloated inventories will also be an issue for the sector, after semiconductor companies ramped up production to meet flying demand to the point of oversupplying.

However, Gordon said the uptake of working from home, as well as the ongoing digitisation of businesses, will see the corporate world continue to pump cash into the sector.

“While the deterioration in the macroeconomic environment will weaken consumer demand, we expect relatively better semiconductor consumption from business investments,” added Gordon. “Consequently, markets such as industrial, telecom infrastructure and data center will be less impacted by consumer sentiment and spending in the short term.”

C4X shares fly after securing new licensing deal with Astrazeneca

MILLIE TURNER

DRUG developer C4X Discovery (C4XD) has signed an exclusive licensing agreement worth up to $402m (£334m) with pharma giant Astrazeneca to develop oral therapy to treat inflammatory diseases.

London-listed C4XD’s shares rocketed on the news, and were trading almost 10 per cent up yesterday afternoon.

As part of the deal, C4XD will receive pre-clinical milestone payments worth

up to $16m ahead of the first clinical trial, including $2m upfront – and the rest after commercialising a product. The pair will use findings from C4XD’s research into anti-inflammatory molecules to produce a product that treats respiratory diseases.

C4XD inked a similar deal with French drugmaker Sanofi in April last year. The developer found a molecule that targets autoimmune diseases which Sanofi has been using to develop an oral therapy.

CITYAM.COM 14 TUESDAY 29 NOVEMBER 2022 NEWS

JOIN TODAY THIRDSPACE.LONDON

#TrainDays

FITNESS IS A JOURNEY. MAKE YOURS WORTH IT.

Demand for semiconductors, used in most of today’s tech, boomed during lockdowns

Mayhem at China’s key iPhone hub could cost Apple six million units

LEAH MONTEBELLO

MAYHEM at Apple’s key iPhone hub could mean that six million Pro models are lost this year, in a major blow to the tech firm in the run up to the all-important Christmas period.

Production has been stunted by protests at Foxconn Technology’s Zhengzhou production factory over the past few weeks, as well as impending lockdown measures that could sweep across the whole of China as a result of its strict zero-

Covid policy.

It is estimated that around 200,000 people work at the Zhengzhou plant, with the region producing around four in five of its latest-generation handsets for Apple.

Morgan Stanley predicted earlier this month that the iPhone Pro model shortfall could hit six million, even before the unrest broke out in the region.

Sources told Bloomberg that because the situation was up in the air, the number of models impacted

could change.

The sources did say, however, that Apple and Foxconn do expect to be able to make up for these losses as they head into the new year.

Nonetheless, Apple shares dipped following the reports, adding to its 20 per cent tumble in the year to date amid wider macroeconomic uncertainty and the tumultuous sell-off that has battered the techladen Nasdaq.

Foxconn and Apple were not immediately available to comment.

THE BOTTOM LINE

CHINESE lawmakers have backed themselves into a corner.

A terrible vaccine rollout due to Beijing refusing to buy medication that’s proven to be effective against Covid-19 means China’s population is poorly protected against the virus.

If they scrap lockdown measures now, it would almost certainly result in a surge in deaths, eroding Beijing’s claim to responding to the virus effectively.

Sticking with the status quo is not much better. Doing so would severely damage the economy.

Cities experiencing outbreaks now would almost certainly be hit with snap lockdowns. But, these areas generate around two thirds of the country’s GDP.

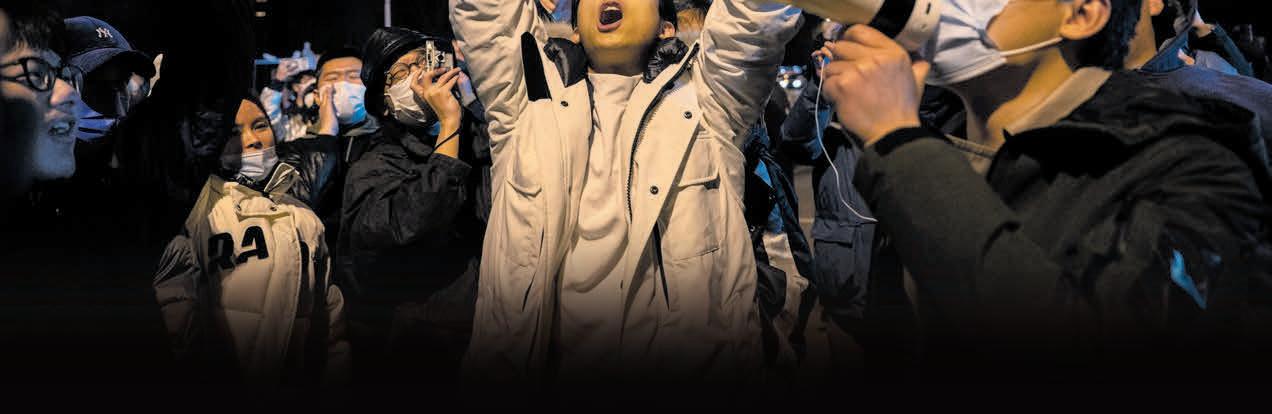

Protests fail to shake China’s Covid policy

opposition to the ruling Communist Party in decades.

CHINESE authorities have affirmed their commitment to a severe “zero-Covid” strategy after crowds demanded the resignation of President Xi Jinping during protests against measures that confine millions of people to their homes.

The government made no comment on the protests or criticism of Xi following the most widespread display of

There was no official word on how many people were detained after police used pepper spray against protesters in Shanghai and struggled to suppress demonstrations in other cities including the capital, Beijing.

Officials have eased anti-virus rules in some scattered areas, such as Urumqi and the city of Korla in Xinjiang.

In Beijing, the city government announced it would no longer set up gates to block access to apartment compounds where infections are found.

It made no mention of a deadly fire last week that triggered the protests following angry questions online about whether firefighters or victims trying to escape were blocked by locked doors or other anti-virus controls.

China’s zero-Covid strategy, which aims

to isolate every infected person, has helped to keep the country’s case numbers lower than those of the United States and other major countries. But people in some areas have been confined to their homes for up to four months, and say they lack reliable food supplies. Public acceptance is now wearing increasingly thin after a recent spike in infections prompted cities to tighten controls.

The world’s second largest economy is very clearly wilting under the weight of Beijing’s heavy hand, a property market meltdown and a slowdown in Western consumer demand for its exports.

There could be one silver lining. Lockdowns will curb consumer spending and business activity in China, curbing demand for commodities. That should offset inflationary pressures in the UK, US and Europe.

Doubt people confined to their homes in China will care about that much, though.

A reduction in Chinese exports could also result in a return of product shortages seen just after the pandemic unlocking.

JACK BARNETT

Number 10 hits out at China over ‘shocking’ arrest of BBC journalist

STEFAN BOSCIA

THE ARREST of a BBC journalist by Chinese authorities in Shanghai was yesterday branded as “shocking and “unacceptable” by Number 10.

Rishi Sunak’s official spokesman said “journalists must be able to do their jobs without fear or intimidation” and that the Foreign

Office was making inquiries.

BBC journalist Ed Lawrence was arrested and reportedly beaten by Shanghai police on Sunday, while reporting on anti-government protests against China’s zero-Covid policy.

Lawrence was released after several hours, with Chinese authorities first claiming he was arrested for not presenting his press credentials and

then later saying he was detained to protect him from catching Covid-19.

A BBC spokesperson said these claims by the Chinese government were not “a credible explanation”. Number 10 said: “The arrest of this journalist… is shocking and unacceptable. Journalists must be able to do their jobs without fear of intimidation.”

15 TUESDAY 29 NOVEMBER 2022 NEWS CITYAM.COM

Ed Lawrence was arrested while reporting on anti-government protests in Shanghai

Videos have circulated on social media of unrest at Foxconn’s China factory

JOE MCDONALD

PA

Great resignation? For many, it’s far more like a breakup from burnout

Over the past couple of years

companies have been going through a workforce revolution. As a hangover from the Covid-19 pandemic, employees have been showing their discontent with the workplace via The Great Resignation, The Great Redirection and Quiet Quitting. More recently, The Great Break Up is raising the alarm on the state of women in Corporate America. Women leaders are leaving their companies at higher rates than ever before. For every woman at the director level who gets promoted, two women directors are choosing to leave their company. To be precise, these women are not leaving the workforce but rather they are breaking up with their current employers, in search of better opportunities.

Closer to home, here in the UK, postal workers, teachers, ambulance staff, waste workers, rail staff, bus drivers, barristers and British Airways staff have already had, or have announced dates, for strike action.

Last month, BT Broadband workers went on their first national strike in 35 years. The Royal College of Nursing, a nursing union representing hundreds of thousands of nurses, has voted to hold its first nationwide strike in their 106-year history. Industrial action is expected to take place before the end of the year and they are planning to organise strike runs until early May 2023.

Hundreds of ground staff at London Heathrow are also set to go on strike. This will, of course, affect all those flying in and out of Heathrow but potentially will also affect any football fans flying out to the World Cup in Qatar.

For many, the sense of professional dissatisfaction further exacerbates a personal feeling of emotional overwhelm.

On a collective level, we are living in the era of The Great Exhaustion, a term coined in Australia by researchers at the University of New South Wales. In other words, we are at serious risk of burnout.

To be clear, we are not just witnessing everyday strains and tensions. Not all stress is equal and not all stress will lead to burnout. More specifically, burnout is characterised by a sense of cynicism, emotional exhaustion and a paralysing fear of Imposter Syndrome. Its trademark can be seen in the cognitive and emotional overload reflected in our mental health, as we struggle with feelings of languishing,

stagnation and emptiness.

So, what is the solution? Although there is no magic wand and no one-size-fits-all response, we can support our employees, friends and family by remembering that the absence of mental illness does not mean the presence of mental health.

Time and energy are limited, precious commodities and, consequently, we must strongly commit to flexibility, work-life

balance, alignment of values, recognition, connection and community in a way that truly embraces diversity, equity and inclusion, both in the workplace and at home.

Each month City A.M.'s mental health columnist Alejandra Sarmiento writes about the Square Mile's often-taboo subjects – and how you can deal with them

CITYAM.COM 16 TUESDAY 29 NOVEMBER 2022 NEWS GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION IT’S FINALLY HERE RIVALRIES RENEWED AS THE SIX NATIONS RETURNS FOR 2022 8-PAGE PULLOUT 2022 SIX NATIONS ENERGY D-DAY Households face hike in energy bills NICHOLAS EARL OFGEM will announce its latest LONDON’S BUSINESS NEWSPAPER CITYAM.COM THE HAWKS ARE IN CHARGE THURSDAY 10 FEBRUARY 2022 CITYAM.COM FREE COOL RUNNINGS ALL THE GEAR FOR AN OVERDUE MOUNTAIN BREAK P20 STATE SET TO BLOAT SCRUM DOWN New Zealand set to enjoy sizable private equity boost MAN IN THE KNOW MARK KLEINMAN GETS THE CITY TALKING P13 LONDON’S BUSINESS NEWSPAPER LONDON’S BUSINESS NEWSPAPER GOING GREEN Climate noise blocking out real solutions MICHIEL WILLEMS Greenpeace activist and now Stanford University fellow has said “panic” over climate THROUGH THE DRINKING GLASS THE LATEST FROM OUR WINE GURU P22 W ISAS UNWRAPPED – WHERE PUT YOUR MONEY THIS TAX YEAR ISSUE 3,677 THE ULTIMATE SAVINGS GUIDE ALL YOU NEED TO KNOW ABOUT YOUR ISA P19-21 HEAD SPACE

Alejandra Sarmiento on staying sane in a busy world

The brains behind the O2 says Brits back ‘good times’ in the face of recession

LEAH MONTEBELLO

THE MAN behind London’s The O2 says that despite cost of living concerns, people are still spending big on events , with the consumer mindset shifting to “having good times”.

Paul Samuels, who heads up global partnerships at events giant AEG, told City A.M. that the arena is yet to see a dip in visitors amid record inflation and the energy crisis.

“I think people just need a release, and with all the stuff going on around them, they want a good night out now,” he said, adding that spend per head is actually up at the North Greenwich haunt.

High-value shows like comedian Peter Kay’s upcoming tour have also nearly sold out until 2025, with Samuels explaining how most Brits view bigticket events as “the event of the year”.

The top exec explained there had actually been a spike in premium seating being snapped up in the past year too, as well as corporate boxes being reserved.

Samuels said this was largely symptomatic of a post-Covid realisation that “value of face-to-face contact” was crucial for client relationships –attracting top City firms.

However, the O2’s journey to being a London go-to venue has not been a simple one, with Samuels acting as the bold twenty-something that was trying to convince the telcos giant O2 to sponsor the ‘Millenium Dome’ back in the early noughties.

As former head of sponsorships at O2, Samuels told City A.M. that when he was first approached by the dome’s owner AEG in 2004 about a potential deal, “I kind of laughed and put the phone down”.

As a “PR disaster” at its launch, with

former Prime Minister Tony Blair calling the dome “too ambitious” for the government and costing about £800m to build, Samuels said he had to fight hard to get the telcos’ backing.

“They [the board of O2] didn’t want some huge PR disaster and huge debt on

their books of something that could be really negative,” he told City A.M.

The firm, which has now merged with Virgin Media to become VMO2, was previously the sponsor of Arsenal football club, following suit of many other firms who were banking on sports sponsorships.

On this, Samuels said: “My answer [to the board] was if every one of our competitors sponsors football clubs, that’s the reason we shouldn’t sponsor clubs –even if I am an Arsenal supporter. We need to be different from the competitors. So we did the deal.”

The O2 arena was redeveloped and reopened in 2007, but again, not without its critics –from people saying that nobody would come to the Greenwich Peninsula to watch a gig to people suggesting the rogue sponsorship wasn’t going to pay off.

But, fast forward 15 years and the

20,000 capacity arena has become a landmark in itself, attracting some of the top artists in the world and the biggest indoor sporting events.

As well as being voted as the best sponsorship deal of the last 25 years in 2019, The O2 is regarded as one of the most popular gig venues in the world –with even US rapper Drake giving it a namesake in his hit single‘ God’s Plan’: “You know me, turn the O2 into the O3”. AEG runs a number of London events, including BST Hyde Park and All Points East, and has global presence, with iconic festivals like Coachella in California.

Nonetheless, Samuels regards the arena’s transformation as the highlight of his career.

“I knew it was going to make me or break me,” he said.

By the looks of it, it seems to have been the former.

Retail sales fall off cliff in November in sign of Christmas spending slump

BARNETT

RETAIL sales have fallen off a cliff, pushed by consumers reining in spending as scorching inflation eats away at their finances, a new survey out today reveals.

18 per cent in October, according to the Confederation of British Industry (CBI), the country’s largest business group.

Brits are cutting discretionary spending to ensure they can afford necessities

A net 19 per cent of retailers said spending fell over the year to November, down from a net rise of

The data did not capture last week’s Black Friday sales, which are likely to have boosted this month’s figure. Data from Nationwide and Barclaycard revealed consumers continued to take advantage of deals

despite the cost of living squeeze.

Nonetheless, Brits are clearly cutting discretionary spending in a bid to protect their budgets so they can afford basic necessities. Office for National Statistics numbers also show retail sales softening.

A net 17 per cent of firms cut staffing levels, the first drop since August 2021, the CBI said.

17 TUESDAY 29 NOVEMBER 2022 NEWS CITYAM.COM

JACK

I think people just need a release, and with all the bad stuff going on, they want a good night out

DASHBOARD YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

China crackdown hits FTSE as housing stocks fall on soaring rates

LONDON’s FTSE 100 was yesterday weighed down by fears Chinese authorities could drag down global growth by responding forcefully to protests against the country’s zero-Covid policy. The capital’s premier index dropped 0.17 per cent to 7474.01 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, dipped 1.3 per cent to 19,292.35 points.

Over the weekend, protestors lined the streets of major Chinese cities to express their distaste toward Beijing lawmakers pushing on with imposing tough measures on daily life to tame the virus.

While most of the rest of the developed world are enjoying few if any Covid-19 prevention measures, an awful vaccine rollout has meant Chinese offi-

cials have had to keep launching snap lockdowns to tame outbreaks.

“European markets have started the week on the back foot as sporadic unrest across China sparks a selloff in global equities. With the rest of the world enjoying life and learning to live with Covid, China continues to double down on a strategy that has little chance of success without an accompanying vaccine program,” Michael Hewson, chief markets analyst at CMC Markets UK, said. Many investors have bet on a Chinese reopening boosting global economic growth. FTSE 100 listed housing stocks fared poorly yesterday after data from search site Zoopla revealed demand is collapsing under the weight of higher rates.

Persimmon, Taylor Wimpey and Barratt Developments all fell more than 1.8 per cent.

Inchcape’s chief financial officer Gijsbert de Zoeten has stepped down over a ‘lapse of judgement’ where the company revealed he displayed personal behaviour falling short of the high standards expected of the leadership of the group. Peel Hunt has retained its estimates, as its unrelated to Inchcape’s strategic direction, including the Derco acquisition – with a buy stance at a target price of 1,000p per share.

CONTAGION

DANNI HEWSON, AJ BELL

LONDON REPORT BEST OF THE BROKERS P 28 Nov 844.5 22 Nov 28 Nov 25 Nov 24 Nov INCHCAPE 840 23 Nov 880 870 860 850 Superdry

with

the

net cash

for

the 2023

2024

375p

share. To appear in Best of the Brokers, email your research to notes@cityam.com P 28 Nov 104.8 22 Nov 28 Nov 25 Nov 24 Nov SUPERDRY 105 23 Nov 110 115 120 125

is reportedly close to agreeing a deal

Bantry Bay Capital to replace

group’s current £70m asset-backed lending facility, which expires at the end of January. It expects to be in a

position

a large part of

and

financial years, with the facility required to fund the working capital peak of AugustSeptember. Peel Hunt has kept its buy position at a price of

per

CITY

“There’s more instability in the ‘cryptoverse’ as ripples from FTX’s collapse push crypto lender Blockfi to file for Chapter 11 bankruptcy. Die-hard crypto fans will say that a sector still in its infancy will inevitably face teething problems, but for investors licking their wounds this is a sector which needs to be gripped quickly and deftly by regulators.”

CITYAM.COM 18 TUESDAY 29 NOVEMBER 2022 MARKETS NOW AVAILABLE AT 600 STATIONS STANDING UP FOR BUSINESS

China has become a bio-police state, but finally its citizens have had enough

Sophia Gaston

Sophia Gaston

THE Chinese people have taken to the streets, and their message is clear: their government has lost the argument on its draconian zero-Covid strategy. Citizens would rather live alongside the rest of the world with the risk of the virus than continue to surrender their freedoms in a bio-police state. The sight of thousands of international football fans celebrating in stadiums in Qatar, without a face mask or testing station in sight, has broken the spell of the Chinese Communist Party’s propaganda. We are now in a new era.

The sight of these rare moments of social unrest in a deeply repressive state has been welcomed in the West. While they are significant and unusual, it is important to note the motivations behind the protests vary. This is not yet a democracy movement. That said, history tells us that grievances around specific government policies or economic conditions do have the potential to become wider movements coalescing around more abstract, vital human needs. Certainly, these protests will draw a response from the authorities commensurate with the risk of escalation to a more centrally organised and cohesive movement.

The disquiet about the seemingly in-

terminable restrictions has been gathering pace over recent months. In October, a brave man unfurled a banner over a Beijing overpass, challenging President Xi Jinping to end the relentless cycle of Covid-19 lockdowns and restore freedom to the Chinese people. Protests of increasing violence have broken out in factories enforcing mandatory isolation on their workers, who already toil under challenging conditions to make consumer goods.

At one of the largest factories making iPhones, workers climbed over fences to escape the factory compound. They

are now being offered lucrative compensation from the factory owners and local authorities to return.

The Chinese authorities have created an intractable dilemma for themselves. The West excelled at creating highly effective vaccines at a record pace. China has refused to allow the provision of Western vaccines to its population and its Sinovac product remains vastly inferior, and with strikingly low coverage amongst the elderly. This is not helped by a rapidly ageing population. In 2019, 28 per cent of people in China were over the age of 60.

The CCP’s zero-Covid strategy has kept infections low, but also prevented the spread of immunity to the virus. Tearing off the zero-Covid plaster without any community resistance could create a short-term health crisis in a population made deeply fearful of the virus by government messaging. But as the Chinese people begin to push back against the deprivation of their freedoms, the government must choose between two pathways of social disorder.

Liberal nations have become attuned in recent years to the security risks posed by an increasingly confident China, and the friendship between President Xi and President Putin has become a source of greater alarm since Russia’s invasion of Ukraine. The West has watched the evolution of these autocratic regimes with deep concern, and at times we have not felt entirely convinced of the future of our mature democracies.

As with Putin’s miscalculations in the early stages of its Ukrainian campaign, this colossal tactical failure of the Chinese regime, which has caused untold misery for its population, makes a convincing case for the structural weaknesses inherent in authoritarian regimes. The strong hand with which Xi Jinping will seek to suppress these protests reflects the powerful and credible fear he perceives in free and open societies.

As the Chinese people take to the streets to champion these principles, we should draw confidence from their yearning to defend their future in the international order.