Chinese CCTV banned on sensitive sites

STEFAN BOSCIAGOVERNMENT departments must stop installing surveillance cameras made by Chinese companies in “sensitive” sites, it was announced yesterday.

Cabinet Office minister Oliver Dowden told MPs that a review by the Government Security Group found “additional controls are required” due to “the threat to the UK and the increasing capability and connectivity” of Chinese-made surveillance systems.

Some government buildings use surveillance equipment made by Hikvision, for example, which is majorityowned by the Chinese state.

EMILY HAWKINS AND JACK BARNETTCASH-STRAPPED shoppers will take advantage of Black Friday discounts this weekend as they try to make Christmas special, before tightening their belts as the UK enters into a recession.

While retailers may see a temporary boost in sales this weekend, shoppers will pull forward Christmas spending rather than “buying twice” as in previous years, Hargreaves Lansdown’s Sophie LundYates told City A.M.

A historic trend of people “enjoying shopping sprees here, there and everywhere” in the run up to Christmas would not be on the cards this year, the analyst added.

Sales over the weekend are set to rise slightly by 0.8 per cent compared to the same period last year to £8.7bn, a forecast from Vouchercodes suggests, with shoppers relying on discounts “more than ever” to budget for Christmas.

Retail spending in the festive period would look “reasonably resilient,” but there would be a “huge pull back” in

January, Lund-Yates said.

Amazon is expected to be the most popular site for purchasing Black Friday bargains this year, while electrical goods retailers such as Currys, Argos and John Lewis will also draw clicks, according to Hargreaves Lansdown analysis.

Customers at Argos are planning “more carefully than ever” for Christmas, as well as with everyday purchases, according to the catalogue retailer’s trading director, Matt Leeser. Shoppers are “buying items on their list only when the best deals are available,” Lesser said.

Black Friday comes as consumer confidence is at an all-time low, which has mainly been dragged down by Brits worrying about rising energy and food bills eroding their finances.

Economists have bet on consumers raiding their pandemic savings to maintain spending.

However, the threat of unemployment amid the coming recession means “households will act with caution when deciding whether to draw upon the pot of savings,” chief UK economist at Pantheon Macroeconomics Samuel Tombs said.

Dowden said departments have “been instructed to cease deployment of such equipment on to sensitive sites, where it is produced by companies subject to the national intelligence law of the People’s Republic of China”.

Alicia Kearns, chair of the Foreign Affairs Committee, said the government should go further and ban Chinese-made surveillance equipment from all central and local government buildings.

A Hikvision spokesperson said: “It is categorically false to represent Hikvision as a threat to national security.”

NICHOLAS EARL

THE GOVERNMENT is set to pay billions more to support households with their energy bills this winter, after Ofgem unveiled another huge hike to the energy price cap. The energy market watchdog announced the cap will rise by £700 to £4,279 per year in January –

reflecting Russia’s squeeze on increasingly tight gas markets when demand will be at its peak as Brits heat their homes this winter.

Households will not be paying the massive price cap rate, however. Instead, their energy bills are heavily subsidised under the Energy Price Guarantee – with average use contained to £2,500 per year until

next April, and then to £3,000 per year for the following 12 months. However, the rise in the cap will grow the cost of the household support package, as the government will be providing savings of up to £1,779 per year in the JanuaryApril window before the next price cap update.

For context, the price cap was set

at £1,277 per year in March.

Energy analysts Cornwall Insight predict the cost of support for households will rise from £38bn to £42bn over the next 18 months, while Chancellor Jeremy Hunt told MPs on Wednesday that the whole support package for both households and businesses could reach £120bn by the end of 2023.

He is now reportedly preparing a £25m public information campaign to encourage people to reduce their energy bills by turning down boilers, switching off radiators and taking showers instead of baths.

The government is targeting a 15 per cent cut in the UK’s energy use, to reduce its reliance on overseas suppliers.

STANDING UP FOR THE CITY

A bleak Black Friday must be met with reform for high streets

THIS morning, as retailers prepare to open their doors or, more pertinently, process thousands of online orders, they will also be braced for one of the first significant hurdles of the winter. Black Friday is normally the start of a bumper time for high streets, signalling the kick off of the Christmas season. But only weeks after Jeremy Hunt, the Chancellor, gave a bleak economic outlook, and

THE CITY VIEW

consumers were told their energy bills will go up and the value of the pound in the pocket will go down, many may keep their wallets firmly shut. Such was the expectation of Hargreaves Lansdown, the retail stockbroker. Many of those who do go on a

spending spree today will be doing so in a bid to save at Christmas time.

Yet, noises from government on reform to regulations which would help Britain’s high streets have faded into the distance.

It’s not just a question of economics either, although, last month, retail sales totalled £8.8bn a week, £2.2bn of which were online.

It’s a question of community and connection between shop owners

and the customers they serve. Many of the measures in the Autumn Statement, such as freezing the multiplier on business rates, will save firms cash over a hard winter. But they are stopper measures, not a sign of a government planning for the future. The prospect of an Online Sales Tax was scrapped because it was too complicated. This may be true, there were myriad concerns around goods versus services, at what point in a sale the taxation

would kick in, to name but a few. Ditching one tax because it is unwieldy and unfair does not justify keeping another, with exactly the same accusations in place, namely business rates. Today, businesses will be hoping for a vote of confidence from consumers that they are still willing to spend on them. They need the same support from government, if we are to modernise our economy and abandon taxes holding us back.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE DAILY TELEGRAPH

EUTELSAT FACES SANCTIONS OVER RUSSIAN PROPAGANDA

Ukraine has threatened to sanction French satellite operator Eutelsat over claims it is broadcasting Russian war propaganda to millions of homes across Europe. The National Council for Radio and Television in Ukraine warned Eutelsat it will block its services if it continues working with Russian TV.

FINANCIAL TIMES

NET MIGRATION TO UK HITS RECORD HIGH OF 504,000

Net migration to the UK rose to a record high of more than half a million people in the year to June, according to figures published by the Office for National Statistics. The surge was driven by inflows from Ukrainian and Afghan refugees and Hong Kong residents.

THE TIMES

BELGIUM BLOCKS EXPORT OF NUCLEAR TECHNOLOGY

Belgium and the UK have become embroiled in a row after the Belgian government blocked the export of technology for maintaining the British nuclear deterrent. The Belgian government has a coalition made up of Greens who blocked the export.

Bank of England could cut rates if economy suffers tough recession

the end of its aggressive rate hike cycle to tame inflation.

THE BANK of England may have to cut interest rates if the UK economy slumps into a long, tough recession, a central bank official said yesterday.

Sir Dave Ramsden, a deputy governor at the Bank, told the Bank of England Watchers’ Conference that if households and businesses are under greater financial pressure than expected, “then I would consider the case for reducing Bank Rate, as appropriate”.

The remarks add to a growing body of evidence indicating the monetary policy committee (MPC) is coming to

Last month, Ben Broadbent, another deputy governor, told investors their expectations for borrowing costs are too high, warning if they hit five per cent, it would shave a similar amount off the economy.

At the Bank’s meeting earlier this month, it took the rare move of signalling to markets it will not send rates to the more than five per cent priced in at the time.

Governor Andrew Bailey and the rest of the MPC have kicked borrowing costs higher eight times in a row, in-

cluding a 75 basis point rise at their last meeting, the biggest move in 33 years, to three per cent.

Most investors expect the Bank to send rates up 50 basis points on 15 December.

Ramsden did concede his preference is “towards further tightening”.

Threadneedle Street has been raising rates for months despite ratcheting up its recession warning at each MPC meeting this year.

Earlier this month, it pre-

Ramsden said there is a case for reducing rates

yesterday dismissed suggestions the Bank should pay interest on a fraction of lenders’ reserves at the central bank. Doing so could reduce the cost of covering losses on the QE programme to the taxpayer, but would suck money out of the banking system.

Minutes from the latest US Federal Reserve meeting out earlier this week hinted at a slowdown in rate rises.

Details from the European Central Bank’s latest meeting released yesterday indicated it could raise rates 75 basis points for the third time in a row at its next meeting.

Binance poised to grab $1bn of crypto assets

CHARLIE CONCHIETHE CHIEF of crypto exchange Binance said he may snap up $1bn worth of distressed assets in the sector as he warned of spreading contagion in the wake of FTX’s collapse.

Changpeng Zhao, who at one stage was poised to buy FTX as it first faltered amidst a liquidity crisis, outlined his plans for an industry recovery fund that could help rescue struggling firms from collapse.

Zhao tweeted last week that Binance would set up a fund for the industry to help save distressed firms from collapse, as the industry rushed to soothe fears of a contagion in the wake of FTX’s failure.

“We are going with a

Zhao at one point was preparing to buy FTX`

loose approach where different industry players will contribute as they wish,” he told Bloomberg TV in an interview, adding that the firm will publish a blog post with more detail about the fund.

‘CZ’, as he is known, warned opportunities would present themselves as the shockwaves of FTX spread, saying there would “probably” be more collapses as contagion took hold of the industry.

However, the Binance founder said the sector was safe in the longer term and as “each time there are cascading effects, the effects become smaller.”

Zhao added that the firm was surveying the assets of BankmanFried’s collapsed crypto empire.

“They invested in a number of different projects, some of them are OK, some of them are bad, but I think there are certain assets that are salvageable,” he said.

Lynch: Strikes will still go ahead despite ‘positive’ meet with DfT

ILARIA GRASSO MACOLA

ILARIA GRASSO MACOLA

RAIL union boss Mick Lynch said yesterday the upcoming strikes will go ahead despite a “positive meeting” with transport secretary Mark Harper.

“We won’t be any closer [to calling off the strikes] until we have a reasonable offer on the table that we can put to our members,” Lynch told

journalists following his first meeting with the secretary. The RMT announced on Tuesday that over 40,000 of its members working at Network Rail and 14 other train operators will walk out between December and January.

Mark Harper confirmed the meeting’s proficuous nature, saying both parties had to work together.

Redundancies soar amid high rates and costs

JACK BARNETTSWELLING costs, rising interest rates and the threat of recession are forcing UK businesses to sack workers, official figures out yesterday unveiled.

The number of planned redundancies soared 143 per cent in the week to 13 November compared to the same period last year, according to the Office for National Statistics.

Compared to last year, the trading environment has deteriorated.

Households are likely to slash spending in response to the biggest hit to their living standards on record, while companies are having to shoulder higher interest payments after the Bank of England’s eight successive rate hikes.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: “The recession already appears to be piling up problems for businesses who are looking at ways to cut costs by slashing jobs.”

Job adverts jumped, but this was likely due to firms seeking temporary festive workers.

The union boss called on the secretary to clarify the mandate of train operating firms

Workers supplying KFC, Greene King and Burger King set to go on strike

HAWKINS

HAWKINS

HUNDREDS of workers who deliver food to chains like Burger King and KFC are to walk out this winter, as well as employees who brew and distribute Greene King drinks.

Workers for the food delivery firm behind KFC, Burger King, Pizza Hut and Wagamama are set to strike over a pay dispute, GMB union bosses have said. It comes as railway workers, posties and nurses have all also declared strike action dates this winter.

More than 400 workers for Best Food Logistics, which delivers products to some of the country’s most popular restaurant chains, yesterday announced they would take action.

Staff at brewing giant Greene King

also voted for a five-day walkout ahead of Christmas, beginning from Monday 5 December. Some 188 work-

ers in the Unite union backed strike action at Greene King’s sites in Bury St Edmunds, Eastwood in Nottinghamshire and Abingdon, Oxfordshire. The workers brew and distribute popular drinks including IPA, Old Speckled Hen and Abbot Ale.

GMB rejected a three per cent pay increase, as well as one-off cost of living payment of £650, arguing the offer was well below current inflation levels.

Food outlets would be left facing shortages over Christmas, GMB’s national officer Nadine Houghton said.

“All these workers want is a pay deal that protects them from this crushing cost of living crisis,” Houghton added.

farmers

WAITROSE

has invested £2.6m in its egg farmers, as the luxury supermarket now stands as one of the only ones without purchase limits. Waitrose said that the funds would go towards supporting farmers struggling with the cost involved in soaring energy prices from the war in Ukraine.

Eco groups call for single-use vape ban in UK

ENVIRONMENTAL groups have called for the sale of single-use e-cigarettes to be banned due to their “rapidly escalating threat”.

In an open letter to environment secretary Thérèse Coffey and health secretary Steve Barclay, 18 environment and health groups, including Green Alliance and RSPCA, argue that disposable vapes are “unnecessary electrical items” that contain single use plastic, nicotine and batteries, all of which are “hazardous to the environment and wildlife when littered”.

The demand follows research from Material Focus earlier this year that showed that at least 1.3m disposable vapes are thrown away every week, equating to two vapes per second, enough to fill 22 football pitches per year.

The letter also pointed to the rising uptake of disposable vapes among young people as “particularly concerning”, with a seven-fold in-

crease in the percentage of 11 to 17 year olds opting for disposable products since 2021.

They state that because reusable vapes are available and accessible in the UK, with brands like Juul, banning single use e-cigarettes, such as the largely popular Elf Bar, would not inhibit public health efforts to get people to quit smoking.

However, Christopher Snowdon, head of lifestyle economics at the Institute of Economic Affairs said that disposable vapes are not a health threat, but are “hugely important in helping smokers who want to quit”.

“For smokers who are trying vaping for the first time, disposables are the most appealing option,” he told City A.M., especially when they are “simple, convenient and cheap”.

Recent data from Action on Smoking and Health found that 2.4m people who vape are former smokers, making up a large majority of the 4.3m Brits who are now actively vaping.

B&Q owner sales up as Brits rush to buy energy efficiency products

EMILY HAWKINSB&Q OWNER Kingfisher yesterday shaved its full-year profit outlook, despite seeing sales boosted by customers forking out to improve their household energy efficiency.

In a trading update for the third quarter, the retail titan yesterday posted sales of £3.3bn, 0.2 per cent up on the previous year.

The Screwfix owner previously reaped the rewards of a pandemic

home renovations boom, but has seen this momentum fade in recent months, driving shares down over 25 per cent in the last year.

However, sales were still ahead of pre-pandemic levels, up 15.3 per cent compared to three years ago.

DIY sales continued to be driven by “new industry trends such as more working from home and a clear stepup in customer investment in energy saving and efficiency,” Thierry Garnier, chief executive officer, said.

The group tweaked its adjusted pretax profit outlook to a range of £730m to £760m, cutting the higher end of the range from a previous forecast of up to £770m.

“While we continue to be vigilant against macroeconomic uncertainty, we remain confident in both the resilience of our industry and in continuing to grow ahead of our markets,” Garnier said.

Kingfisher’s share price closed down two per cent yesterday.

Mothercare hires new boss in bid to rebuild

EMILY HAWKINSMOTHERCARE has named Dan Le Vesconte as its new CEO, as the retailer admitted that a recovery to pre-pandemic trading was “taking time”.

The Watford-based company is seeking to recover from a torrid pandemic, which shuttered some 79 high street stores after collapsing into administration just before the first Covid-19 lockdown.

Le Vesconte will be coming to the firm from a top job at fashion firm Abercrombie & Fitch as group vice president for its European markets.

Dr Martens shares get a kicking as inflation weighs on bootmaker

TURNERDR MARTENS shares plummeted yesterday after the iconic bootmaker issued a profit warning.

While the footwear retailer enjoyed a revenue jump of 13 per cent to £418.6m in the six months to the end of September, pre-tax profits fell five per cent.

The disappointing results spooked investors, with shares down 22 per cent at close yesterday.

Despite issuing a profit warning, the bootmaker said it was confident it

Consumer group says social media must do more to block sale fakes

LEAH MONTEBELLOCONSUMER protection groups have called on social media to do more to block fake Black Friday deals as hundreds of counterfeit items are removed from Instagram.

Facebook’s owner Meta and the Trading Standards said it had removed hundreds of items from the app yesterday in the run up to today’s

sale. Items included potentially dangerous chargers as well as fake clothing and fashion accessories, jewellery, and car parts.

Commenting on this move, head of consumer protection policy at Which? Sue Davies said: “The fact that a lot of these products found on Instagram could potentially be dangerous shows why online platforms need to do more to prevent

these items appearing.

“The government must make online platforms legally responsible for dangerous and illegal products sold through their sites.”

The Chartered Trading Standards Institute has also urged shoppers seeking to save money on Black Friday bargains to be on their guard against scams, fake reviews and potentially unsafe goods.

would be able to mitigate inflation by raising pricings.

“We have further pricing headroom for AW23 so we will offset cost inflation once again,” Dr Martens CEO Kenny Wilson said.

“Although there are economic challenges ahead, we are well positioned for future growth. We will continue to drive growth investment to deliver the DOCS strategy, mainly in new stores, marketing, people, technology and inventory.”

Despite the results, the board hiked its interim dividend by almost a third.

International franchise partners saw retail sales buoyed 15 per cent over the last year, booking £162.1m, despite halting sales in Russia due to the conflict in Ukraine.

The brand’s “immediate priority” was helping its franchise partners to “navigate out of this suppressed demand period, recover from supply chain disruptions and rebuild their store footfall whilst growing their digital sales”.

The retailer’s profit has taken a hammering over the past six months, taking £0.4m in profit for the period to the end of September. This was compared to a £3.6m profit last year, when the company swung back into the black after booking a multi-million pound loss amid the Covid-19 pandemic.

The company was founded in 1961, listing eleven years later.

Two-in-five Brits said they wanted

Jet2 flying high with revenue up 730 per cent

JACK MENDEL

JACK MENDEL

LOW COST leisure airline Jet2 saw a whopping 730 per cent rise in revenue and booming profits of more than £350m as Brits flocked on holiday post-pandemic.

The London-listed firm yesterday announced strong half-year results up until the end of September, with profit before foreign exchange valuation up to £505m, following a £195m loss in 2021.

Its total profit for the period after taxation was £356.0m, up from a £163.5m loss in 2021, as revenue soared to £3.6bn, up 730 per cent on 2021’s £429m taking.

Its chairman Philip Meeson said the “leisure travel business has continued its encouraging recovery following the

reopening of international travel in early 2022”.

Meeson noted that demand for package holidays had been particularly strong, helping the firm’s improved performance compared both to recent Covid-impacted summers as well as pre-Covid comparatives, with seat capacity up 14 per cent on the

Jet2 has reaped the rewards of a postpandemic holiday boom

summer of 2019.

Looking ahead to the winter with the cost of living crisis eating into people’s earnings, he said bookings for the festive season were “encouraging”, with the firm on track to exceed current average market expectations.

Shares closed up near three per cent.

SMMT: Getting automotive sector back on track is priority for 2023

ILARIA GRASSO MACOLAGETTING the automotive sector back on track is the top priority for 2023, according to the Society of Motor Manufacturers and Traders.

Chief executive Mike Hawes warned that a return to pre-Covid production levels was fundamental, “given the jobs, exports and economic contribution the

automotive industry sustains”.

“More favourable conditions for investment are needed and needed urgently –especially in affordable and sustainable energy,” he added.

Hawes’ comments come on the heels of car production returning to growth in October following a supply chain-induced slump in September, though levels remained well behind 2019.

Motor insurers to report record annual loss

ILARIA GRASSO MACOLA

THE UK motor insurance sector is set to make the largest annual loss in well over a decade due to inflationary pressures.

Analysis published today by EY forecasts that net combined ratios will reach 115 per cent this year –the worst since 2010 –going down slightly to 114 per cent in 2023.

Claims costs, already high due to pandemic-induced supply chain issues, remain on the rise this year as price increases in materials, labour and energy feed through inflation.

“There are significant challenges on the horizon for motor insurers,” Rodney Bonnard, UK insurance leader at EY, said.

According to forecasts, personal motor premiums will remain largely flat in 2022, rising by only £1 year-on-year. But in 2023, they are expected to increase by 15 per cent, or £66 per policy, as inflation feeds through claims costs.

Nevertheless, the sector will remain largely loss-making throughout 2023, Bonnard said.

Investors bail on Covid-19 testing firm Abingdon Health amid losses

MILLIE TURNERABINGDON Health, one of the UK’s major suppliers of Covid-19 lateral flow kits, has suffered heavy losses as the pandemic retreats.

Shares sank 12.5 per cent to 5.25p by close yesterday.

The London-listed diagnostic provider saw revenue plunge to £2.8m in the year to the end of

June, down from £11.6m a year prior.

Losses swelled by more than £14m in the 12 months, during which the firm wrapped up a legal battle with the government over an unpaid contract for lateral flow tests.

The government paid out £6.3m in July as part of the agreed settlement.

CEO Chris Yates warned investors in August of fast-shrinking gains, having previously been a beneficiary

of the pandemic – which prompted a more than 20 per cent share price plunge at the time.

The firm has lost over 80 per cent of its stock value in the past year.

“The last two years within the lateral flow market have been dominated by Covid-19 with little other contract development activity being undertaken by customers,” Yates said yesterday.

What3words boss says post-Brexit hiring not so bad

LEAH MONTEBELLOTHE BOSS of tech firm What3words said that the post-Brexit recruitment landscape has been “a lot slicker” than he anticipated when building a global team in London.

In an interview with City A.M., Chris Sheldrick, who heads up the global address system, said that the City continued to be a great place to build a business thanks to its rich pool of talent and international appeal.

“The new laws around visas have actually made it a lot slicker than I think we may have anticipated it would be postBrexit to grow our team,” he told City A.M.

Founded in 2013, What3words is a tool that has divided the world into three metre squares, naming each one with three words from the dictionary, making navigation much “simpler and precise”.

So rather than saying meet me at Southwark station, you can share the exact location you are at with a unique three words that are unique from any-

where else on the globe. For instance, you can say “lines.swing.crew” to show how you’re just round the corner by the bus stop.

The firm was valued £250m back in 2020, but has gone from strength to strength since then, says Sheldrick.

While navigation may have come to a standstill during the pandemic, What3words was lifted by the surge in online deliveries and more innovative uses –from the emergency services allowing ambulances to find

people in the most remote locations, to helping people find their tents at a festival.

Sheldrick told City A.M. that the main focus now was on global expansion, especially in Asia, utilising the 54 languages it has now been translated into.

“For us, it’s about taking our success from the UK and now saying, let’s replicate that abroad.”

RISING CASES Hopes dashed as China’s ‘zero-Covid’ measures set to continue

DAILY Covid-19 cases in China have hit a new record, cementing concerns that the country will not ‘open up’ after all. Wednesday saw 31,527 new cases. The figure is relatively small for the country of 1.4bn people.

Beijing’s ‘zero-Covid’ policies were hoped to be eased in the coming weeks. However, Beijing in recent days has moved to confine some residents to their homes.

Foxconn apologises for pay issue after protests at iPhone factory

LEAH MONTEBELLOAPPLE’s iPhone partner Foxconn yesterday apologised for a pay-related “technical error” when hiring new staff at the Covid-battered Zhengzhou plant.

Protests erupted this week across the world’s biggest iPhone factory, with videos circulating on social media of workers taking action against strict lockdown measures and pay issues.

Foxconn said in a statement yesterday: “Our team has been looking

into the matter and discovered a technical error occurred during the onboarding process”.

The firm apologised and said “actual pay” was guaranteed.

Analysts reckon the Zhengzhou plant makes around 60 per cent of all iPhone models.

Foxconn has seen unrest since October when some quarantine measures were re-introduced in the region, sparking a mass worker exodus, and staff members fleeing the region.

Space investment rockets despite global slowdown

MILLIE TURNERTHE GLOBAL economic slowdown has failed to ground rocketing investment in space tech, according to the latest data, as capital injections remain at a near all-time high.

Investors across venture capital and private equity have pumped $12.2bn (£10bn) into the space industry in the past 12 months, research by space investment trust Seraphim revealed yesterday.

While the quarterly figure has more than halved, falling from $3.2bn (£2.6bn) to $1.2bn (£991m) in the second and third quarters respectively, cumulative investment through 2022 remains at “the highest levels recorded”, the London-listed investment fund said.

“While we are seeing a more challenging fundraising environment, investors are looking more to seed deals where they are seeing more sensible pricing, less impacted by inflated later stage deals in the past one to two years,” Seraphim wrote.

Concerns over security and climate change have largely driven investment in recent months.

In Europe, where the space industry is

significantly smaller in comparison with North America and Asia, investors are being drawn towards pre-seed, seed and series A fundraisers.

Boris Johnson’s government outlined space as an avenue for business.

As the country preps for its first-ever satellite launch from British soil in the coming weeks, the European Space Agency revealed that the UK had snagged a record 17 per cent of its budget.

The upcoming launch will make it the first of its kind from European soil.

James Bruegger, chief investment officer for Seraphim, said: “Although larger, later stage deals have fallen, early-stage investment activity remains high, an indicator that investors continue to buy into the long-term growth potential of the sector.

“Spacetech is benefitting from strong secular tailwinds relating to both combatting climate change and boosting global security.”

Beyond rockets and satellites, there is an increasing amount of capital flowing towards the in-orbit economy – such as manufacturing in space, new space stations and lunar exploration.

Online safety bill makes comeback before Christmas, says Mordaunt

LEAH MONTEBELLOTHE GOVERNMENT confirmed that the long-awaited online safety bill would be making a comeback before Christmas.

Outlining the forthcoming parliamentary business, Commons Leader Penny Mordaunt said the remaining stages of the landmark bill are due to be provisionally debated on 5 December.

After more than four years, the bill plans to provide better protection

online, threatening social media firms and other platforms with hefty fines for non-compliance.

The bill has been in limbo since former Prime Minister Boris Johnson left office, temporarily paused during the leadership race and Liz Truss.

The online safety bill has raised eyebrows amongst free speech circles for its ‘legal but harmful’ provision. However, online safety campaigners have avidly supported the provision across social media.

Twitter triggers fresh online safety concerns with Brussels departures

LEAH MONTEBELLOTWITTER has reportedly disbanded its entire Brussels office, as Elon Musk continues to cull the workforce.

According to reports from the Financial Times, Julia Mozer and Dario La Nasa, who were in charge of Twitter’s digital policy in Europe, left the company last

week. The pair were reportedly instrumental to the social media company’s approach to the EU’s disinformation code and the Digital Services Act.

Other members of the Brussels team have left the company as a result of mass layoffs and requests for staff to embrace a “hardcore working culture”.

It is unclear whether Mozer and

La Nasa resigned or were made redundant after the billionaire entrepreneur bought the social media platform for $44bn (£36bn) last month.

Věra Jourová, the EU’s vicepresident in charge of the disinformation code, told the Financial Times she was concerned about the overarching online safety repercussions of the departures.

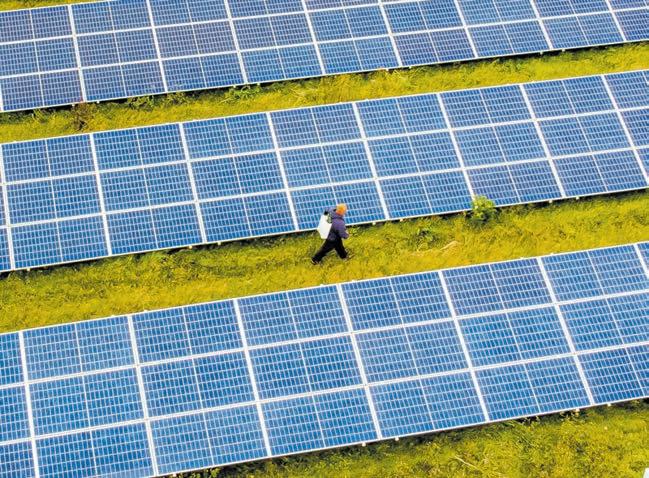

Farmers without solar panels could lose out on £1bn if limits extended

NICHOLAS EARL

NICHOLAS EARL

FARMERS without solar panels could be missing out on up to £1bn over the next two years, according to new analysis from the Energy and Climate Intelligence Unit (ECIU).

Solar panels have enabled farmers to sell energy they generate themselves to cut their own bills.

However, the vast majority of

England’s farms do not have solar panels, with only 28 per cent having the power source on their fields.

ECIU has calculated that if the remaining 78 per cent had followed their counterparts, energy savings and revenues could have almost balanced out the increase in fertiliser costs over the next two years. This would have provided an estimated saving of up to £1.1bn.

Solar panels on agricultural sites would also mean the government cutting hundreds of millions of pounds on its Energy Bill Relief Scheme support package for businesses’ energy bills.

The latest report from ECIU comes amid sustained speculation the DEFRA secretary Therese Coffey is set to extend the de facto ban on solar farms in England to more farmland.

EU fails to agree price level for Russian oil cap

THE EU is split over the price of a Russian oil cap as the West seeks to slash the Kremlin’s war revenues and tame the cost of living crisis.

Member states remain at odds over the pricing level, despite agreeing to the cap in principle – which is set to come in next month. This means Europe risks a farcical situation of a cap being green-lit and being in place on 5 December, but without a price being set.

Governments failed to reach an agreement over pricing amid extensive talks yesterday, with some member states concerned about exacerbating a global supply shock.

The G7 proposal for a cap of $65-70 per barrel was seen as far too high by some member states and too low by others.

Diplomats told news agency Reuters that six of the EU’s 27 countries opposed the price cap level put forward by the G7.

Poland wants the cap to be set at $30, a position supported by Lithuania and Estonia.

It argues that with Russian production costs that some estimate at $20 per barrel, the G7 proposal would allow Moscow too much profit.

Meanwhile, Cyprus, Greece and Malta –countries with big shipping industries that stand to lose most if Russian oil supplies are obstructed – believe the G7 cap is too low.

They want compensation for the loss of business or more time to adjust.

The European Commission, the Czech EU presidency, the US and Germany were all engaged in talks yesterday to try and close the differences.

Around 85 per cent of Russia’s crude exports are carried by tankers rather than pipelines – with the EU already agreeing to phase out seaborne oil shipments.

The idea of the cap is to prohibit shipping and insurance companies from handling cargos of Russian crude – unless it is sold for less than the price set by the G7 and its allies.

This is because the world’s key shipping and insurance firms are based in G7 countries, meaning the price cap would make it very difficult for Russia to sell its oil – which accounts for 10 per cent of supplies – at a higher price.

More talks could take place today.

The EU’s executive arm is also pushing to agree a gas price cap, with no agreement yet to be found over the proposal and talks expected in the coming days.

With turbulent financial markets and geopolitical unrest, an investment in precious metals can provide you with the stability you need to weather any storm.

To find out more about buying gold and silver bullion with us, visit sharpspixley.com or call 0207 871 0532

Water companies dumping sewage in dry weather, warn campaigners

NICHOLAS EARLWATER companies have been engaging in so-called dry spills, releasing sewage on to beaches and into rivers even when it is not raining, according to a prominent campaign group.

In its latest report on the water industry, Surfers Against Sewage (SAS) discovered that 146 dry spills were detected over a 12-month period.

Sewage spills are only supposed to happen under exceptional

circumstances: when it is raining so heavily the system cannot cope.

Southern Water was labelled as the worst offender, responsible for four times as many dry spills as the second worst, South West Water. Southern Water was approached for comment.

“It’s high time the government stepped up and took real action to curb the destructive and selfish behaviour of the water companies responsible for this literal sh*t storm,” Amy Slack, head of campaigns and policy at SAS, said.

In a sea of uncertainty, search for a brighter investment.NICHOLAS EARL The government is weighing up plans to extend restrictions on solar panels on farmland

Banks may sabotage plans to pay back victims of scams, MPs warn

CHARLIE CONCHIELAWMAKERS are set to scrutinise plans to force banks and building societies to pay back victims of scams amid concerns banks may sabotage the plans with misleading delays, a committee announced yesterday.

The Payment Systems Regulator (PSR), which oversees the UK’s payments ecosystem, has tabled proposals that will require banks to reimburse victims of scams in a bid to force lenders to ramp up their

protection of customers.

But in a statement yesterday, the Treasury sub-committee on financial services regulations said it was now set to investigate the proposals to scope out whether they could actually be implemented.

“While the regulator’s proposals are certainly a positive move in the right direction, questions remain, particularly around the interaction between the regulator and the industry body, Pay.UK,” said Harriett Baldwin MP, chair of the Sub-

London will come roaring back, says BBB

LONDON firms will be forced to weather a sharp drop-off in investment in the coming months before it rebounds in full force, a top official at the British Business Bank (BBB) has warned.

Matt Adey, senior economist at the state-backed economic development bank, said choppy markets in the UK meant that investment into London’s growing firms would slow in the period ahead, but predicted the capital would come roaring back eventually.

“I would expect to see significantly fewer deals and there are significantly fewer deals going on in quarter three by the looks of it,” Adey told City A.M. in an interview.

“But that doesn’t strike me as a long term problem. It’s just part of the volatility of these markets.

“Fundamentally, London is a strong market with lots of innovative businesses looking for finance, and lots of people looking to finance them.”

The comments come as funding begins to slow for firms this year after a frenzy of investment in 2021 that saw record amounts of capital injected into London’s businesses.

Fresh figures from the state-backed British Business Bank showed that London firms guzzled up almost half of the total equity deals in the country last year.

Adey said the slowdown would be felt more sharply due to the lofty deal value last year.

“I think there’s an underlying strength in London markets, [which means] you actually might have a difficult period compared to the very high number of deals and investment values that we’ve seen,” Adey said.

However, analysts are warning of a slowdown in funding globally in the coming months, as rising interest rates make cash harder to come for investors and so-called ‘dry powder’ raised prior to the downturn this year dwindles.

“The shift in monetary policy from historically low interest rates that promoted growth, spending, and borrowing is notable and its impact on the VC dealmaking environment will be clearer as we progress into the fourth quarter of 2022,” said Pitchbook in a recent report.

However, they added that a “flattening could take place in 2023, rather than a sharp decline”.

Committee on Financial Services Regulations.

“We are worried that banks could attempt to delay reimbursing their customers.”

The sub-committee asked the PSR last month how it would prevent banks from delaying payments by routinely alleging that consumers have been grossly negligent.

Concerns have also been raised over whether the Financial Ombudsman Service has capacity to rule on these decisions.

Standard Chartered starts hunt for new CFO as veteran retires

BEN JAGLOMFTSE-1OO heavyweight Standard Chartered has kicked off the search for a new CFO due to the plans of its experienced finance boss Andy Halford to retire in 2023.

Sky News reported that Halford — who has been at the role for over a decade — is to be replaced by someone that executive search firm Russell Reynolds Associates is currently on the lookout for.

As well as serving in the CFO position at Standard Chartered, Halford holds a role as a senior

executive director at retail giant Marks & Spencer. Halford previously served at Vodafone for 15 years, where he was also in the CFO position.

An appointment is expected to be made in the coming months.

As a result of the departure of Halford, CEO Bill Winters is likely to stay at the emerging markets goliath for another two years as the board wouldn’t want two senior departures in quick succession, according to a source that spoke to Sky News.

Standard Chartered has enjoyed a strong year amid rising interest rates.

London VC Pact launches £30m seed fund

CHARLIE CONCHIEFEMALE-LED venture capital (VC) investor Pact yesterday revealed its first £30m seed fund as it looks to pump cash into early-stage startups across Europe.

The London-based investor –led by Abu Dhabi investment fund alumni Reem Mobassaleh Wyndham, former investment banker Tong Gu and early-stage investor Monik Pham –said it would be honing in on small firms across Europe tackling issues like financial exclusion, poor personal and professional well-being, and climate destruction.

In a statement yesterday, Gu said the fund’s investment thesis stemmed from the founders’ “passion for improving the future”.

“These areas are full of commercial opportunities within global markets we’ve invested in across our careers,” Gu said. “We’re launching a dedicated vehicle based on our experiences and understanding of the early-stage founder journey.”

Pact is the first firm to be founded by three female partners but comes at a tricky time on the capital markets as venture capital funding slows amid soaring inflation.

A recent report by KPMG found that $4.6bn (£4bn) of VC investment was pumped into UK firms across the quarter, down from the $9.2bn invested in the previous three months.

Pension watchdog mulls penalty plan for dashboard errant schemes

CHARLIE CONCHIETHE PENSION watchdog is mulling how heavily it should clamp down on errant schemes as it prepares to push ahead with the digitisation of the industry via the so-called ‘pensions dashboard’.

The Pensions Regulator yesterday called for evidence from scheme

chiefs and the wider industry as it prepares to draw up rules and guidelines on how it should police compliance with the new regime.

Calls to the industry come as ministers push for the simplification of complex pension pot structures in which savers lose track of cash saved up for retirement.

The new regime will see pension

providers forced to offer customers all their information in one place.

In a statement yesterday, the watchdog said it will be “pragmatic” in its approach to regulating the dashboards and would not be looking to heavily dish out fines.

However, it warned it would take a “dim view” of “wilful or reckless non-compliance”.

Demand ‘shifting to rental homes as would-be buyers wait for stability’

VICKY SHAWRENTAL sector inquiries have jumped as some would-be home buyers take a pause, according to a property website.

The number of people inquiring about homes to rent was 23 per cent higher in October compared with the same month in 2021, Rightmove said.

Mortgage rates jumped following the mini-budget in September, but there have been some signs of rates edging back down recently.

Earlier this week, Moneyfacts.co.uk

reported that the average five-year fixed mortgage rate had dropped below six per cent for the first time in seven weeks.

Bank of England base rate hikes are also pushing borrowing costs up and rising prices generally may also make it harder for people to raise enough cash for a deposit to buy a home.

Some potential home buyers may also be sitting it out for a while to see what happens with mortgage rates and house prices in the months ahead.

A Rightmove survey found twofifths (42 per cent) of aspiring first-time buyers with plans to get onto the ladder in the next few years already had their total deposit saved.

The website said this indicates there is a group of future first-time buyers waiting in the wings to enter the market once they feel like they have more financial certainty.

A survey among letting agents meanwhile found that on average they are managing 36 inquiries per property.

Puttshack boss: Only so much the state can do

THE GOVERNMENT can only do so much to help hospitality amid turbulent times, with firms needing to “get creative”, the boss of the Puttshack and Bounce brands told City A.M.

Pub and restaurant bosses had hit out at the government following its autumn budget last week, calling for further support in the form of a VAT cut and business rates reform.

But ministers could only help firms to a certain extent in such “unprecedented times,” Adam Breeden, founder and chief executive officer of Kindred Concepts, said.

“I’m never one to be thinking about state aid, I’m always one to [say] get your head down.”

“I’ve never had a mentality where [I’m thinking] what can other people be doing to make my business better,” he added. “It’s up to you, frankly.”

Tough times “always create opportunities” and operators often “need to just get better at operating” and look at cutting costs in their businesses.

“A lot of hospitality businesses, I can

just see inefficiencies everywhere,” he said.

However, Breeden said he would also like to see more support from the Treasury, as the sector battles soaring costs and a consumer slowdown this winter.

After the hospitality sector had veered from Brexit to Covid to a succession of rail strikes amid economic uncertainty, many in the sector were “feeling punchdrunk”, he said.

The operator has opened a new concept, F1 Arcade, with the first site near St

The Puttshack boss said businesses should find opportunities in the crisis

Paul’s, aimed at fans of the sport –complete with a cocktail that “tastes like burnt rubber”.

The UK was ahead of other nations when it came to competitive socialising, Breeden said, in terms of quality and variety, with experiential hospitality venues “exploding” with popularity.

He added that strikes were “debilitating” London’s venues and posed the biggest challenge to the sector, even with the economic turmoil.

Met arrests 100 in ‘biggest ever fraud operation’

JACK MENDELMORE THAN 100 people have been arrested in what the Met Police described as the UK’s biggest ever antifraud operation.

The force led the bid to take down the ‘one stop spoofing shop’, iSpoof, which had more than 200,000 possible victims in this country alone.

Fraudsters contacted people posing as representatives of banks including Barclays, Santander, HSBC, Lloyds, Halifax, First Direct, Natwest,

Nationwide and TSB, before conning them into handing over details.

According to the Met, iSpoof allowed users, who paid for the service in Bitcoin, to disguise phone numbers so it appeared they were calling from a trusted source.

In the 12 months until August 2022 around 10m fraudulent calls were made globally via iSpoof, with around 3.5m of those made in the UK.

The operation, which was led by Scotland Yard’s Cyber Crime Unit along with international law

enforcement, Europol, Eurojust, the Dutch authorities and the FBI, among others, dismantled the website this week.

Victims are believed to have lost tens of millions of pounds. In the UK alone, 100 people have been arrested, the vast majority on suspicion of fraud.

Commenting on the news, Met Commissioner Sir Mark Rowley called the exploitation of technology by organised criminals “one of the greatest challenges for law enforcement in the 21st century”.

Oxford Street to welcome fashion brand Reserved in district revamp

MILLIE TURNERLONDON’s Oxford Street is welcoming a new retailer to the block, with fashion brand Reserved having signed up for its second London store.

GPE, formerly Great Portland Estates and one of the biggest property leasers in the capital, has signed a letting with Reserved for a

more than 19,600 sq ft space, which is expected to be unveiled in 2023.

Polish retailer Reserved made its London debut in 2017, when it opened a store on Oxford Street West. Now on the main parade, the fashion retailer will join Boom: Battle Bar, an activities-based bar which is due to open its 15,600 sq ft space in the coming months.

“Together both brands will help create a day-to-night destination on the doorstep of the Elizabeth line station at Tottenham Court Road,” senior portfolio manager at GPE, Sarah Goldman said.

It comes after Westminster Council last month said it would focus spending in the area on revamping London’s main shopping drag.

MARK KLEINMAN

@MARKKLEINMANSKYBREAKING BUSINESS STORIES AND ANALYSIS

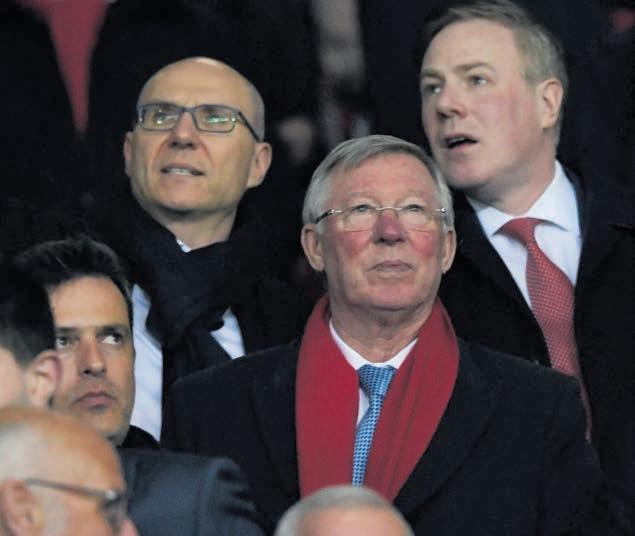

Glazers could see biggest ever football club sale

IT WASSir Alex Ferguson who coined the phrase “squeaky bum time” in reference to those anxious moments at the end of seasons when Champions League and Premier League titles and FA Cups hung in the balance.

Fergie’s employers for the last eight years of his reign, the Glazer family, are about to undergo their own version of that classic phrase. My exclusive revelation on Tuesday that Manchester United’s board was preparing to announce a decision to explore “strategic alternatives” – followed hours later by confirmation to the New York Stock Exchange – paves the way for the richest football club sale in history.

The launch of a formal process means that during the course of 2022, half of the English members of the ill-fated European Super League (ESL) will have initiated auctions. Chelsea’s was, of course, triggered by the imposition of sanctions on former owner Roman Abramovich, but it is no coincidence that Fenway Sports Group, Liverpool’s owner, and the Glazers have decided that now is the time to cash in on the two most successful clubs in English football history.

The ESL’s failure is one of the reasons for

that –FSG and the Glazers were determined to build a new powerhouse in the sport that would guarantee virtually perpetual income for the sport’s most powerful teams.

The backlash against that idea, and the arrival of a weakening global economy, may mean that the high watermark for football club valuations is imminent, or might already have passed.

Chelsea’s sale for £2.5bn represented a stellar price in what was effectively a firesale. It’s hardly surprising, therefore, that Manchester United’s board has turned to Joe Ravitch and Colin Neville of The Raine Group to lead its strategic review.

Ravitch was quoted in one newspaper this week as saying that “United is not just a football club when it has such a huge global fanbase.”

That supporter base, estimated at 1.1bn in United’s announcement this week, underlines the fact that it sees itself as a global media company. Indeed, Twitter’s $44bn valuation in its recent takeover by Elon Musk, would imply that United could trade for even more than some of the figures bandied about in recent months. Squeaky bum time indeed.

Bink struggles reflect a tough climate for early stage companies

MOREon the travails of Bink, the fintech company struggling to secure new funding amid the deteriorating environment for backing early-stage companies.

Two weeks ago here, I reported that Loyalty Angels, Bink’s holding company, was scrambling to raise the cash it needs to continue operating until February 2023.

Bink boasts Barclays and Lloyds Banking Group among its investors, but

both seem to have ruled themselves out of stumping up any more capital – not a great sign for Bob Wigley, the start-up’s chairman who also happens to chair UK Finance, the banking industry lobbying group which counts Barclays and Lloyds as two of its leading

members.

Since then, Bink’s urgency seems to have intensified.

I’m told a deadline of this Wednesday was set for existing investors to participate in the emergency funding round, which is expected to be in the order of £6.5m.

“It is of critical importance that a significant number of

existing investors take the opportunity to invest at this discounted price. If this proves not to be the case it could lead to the failure of this funding round and the business”, said an investor memo circulated last week.

Bink has also signalled plans to cut its cost base by 20 per cent –a decision it acknowledges will affect the pace of its rollout – and announce changes to its board. Whether those involve its illustrious chairman remains to be seen.

Kwarteng’s mini-budget battered housebuilders

FEW LISTEDcompany sectors have been more bombed-out by Britain’s economic crisis than its housebuilders. Barratt Developments, Persimmon and Taylor Wimpey have all seen their shares slump by between one-third and just over half in the last 12 months.

Kwasi Kwarteng’s short-lived and disastrous mini-budget was among the catalysts: accelerating interest rate rises, pushing up borrowing costs for property buyers, are creating the gloomiest

prospects for the industry for years.

A recent research note from HSBC forecasting that average house prices outside London would fall by 7.5 per cent from autumn – with the figure in the centre of the capital running at twice that level – looks moderate, based on the mood of many industry executives.

The answer, according to some, is likely to be more sector consolidation among both listed and private housebuilders.

One target is the housebuilding arm of

property developer St Modwen, which Blackstone took private last year in a £1.3bn deal. Among the suitors is rumoured to be Avant Homes Group, which is owned by Berkeley DeVeer and the investment giant Elliott Advisors. There are, apparently, no formal talks, but given that

Jeff Fairburn, the former Persimmon chief whose gargantuan pay package sparked a furore before his departure in 2018, chairs Avant, the speculation is unsurprising.

Fairburn is said to be keen on a second act at building a major housebuilding industry player – so even if St Modwen’s operation doesn’t get swallowed up by Avant, it will have other bids shovel-ready before too long.

MPs lambast English rugby bigwigs over financial instability of game

HARDYRUGBY bigwigs were scolded yesterday at the hands of the DCMS committee.

Premiership Rugby chief Simon Massie-Taylor was lambasted by the committee, led by the chair Julian Knight MP, while Rugby Football Union chief Bill Sweeney, was also held to the fire over the state of English

rugby at the moment.

The committee convened over the situation surrounding the fallout following the administration processes which is ongoing at Premiership clubs Worcester Warriors and Wasps.

Warriors fell into financial woes when former owners – Colin Goldring and Jason Whittingham – failed to pay tax to HMRC and pay wages to players.

“I’ve dealt with football, but I’ve barely ever come across something as shambolic – a lack of care, a lack of thought of people in your own game –as this is my entire time as a select committee member since 2016,” committee chair Knight said.

Sources close to Worcester told City A.M. that they will function with ease next year if new ownership is found.

The stars came out for an amazing night at the Crypto A.M. Awards

LAST night’s third Crypto A.M. Awards brought some of the biggest and brightest names in the industry together under one roof.

Despite the ongoing turmoil in the crypto markets, the community felt more optimistic than ever. James Bowater, founder of Crypto A.M. said there was a “palpable feeling of positivity” in the room in the face of the turmoil shaking the market.

“But there is an overriding feeling the industry is here to stay and some sense that the bad actors are being swept away.”

Some of the biggest trophies of the night were handed to the Head of Digital Policy at Barclays Nicole Sandler, the CEO of Team Blockchain Jonny Fry and Blockchain and public policy influencer Loretta Joseph, who have all made their mark. Sandler told Crypto A.M. the industry was at a crucial moment and that the argument for tighter regulation was stronger than ever.

Meanwhile, New York firm Chainalysis snapped up the Outstanding Industry Contribution Award, and Zumo Money scooped best ESG application.

Nick Jones of Zumo told Crypto A.M. that the conversation around environmental impact in crypto had “evolved” in the past 12 months, citing the 99 per cent slashing of emissions in ethereum as a key win for the industry.

Left to right: Sam Kopelman of Luno, Charles Hayter and Alyssa Ostrove of Crypto CompareYOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

Retailers climb ahead of Black Friday giving FTSE 100 needed boost

LONDON’s FTSE 100 was bumped higher yesterday by investors heading into retailers ahead of Black Friday today. The capital’s premier index inched 0.02 per cent higher to close at 7,466.60 points, while the domestically-focused mid-cap FTSE 250 index, which is more responsive to the health of the UK economy, jumped 0.2 per cent to 19,540.34 points.

London-listed retailers received a kick from investors betting on consumers shaking off recession blues by snapping up deals on the annual discount day today.

FTSE 100 listed and Primark owner Associated British Foods climbed 1.47 per cent, while online fashion retailer and mid-cap incumbent ASOS added more than two per cent.

Analysts cautioned that strikes at Royal Mail may keep a lid on con-

sumers’ appetite for deals. Today “should be one of the busiest days for UK retailers but concerns about constrained budgets and the added issue of a strike by Royal Mail workers are both expected to make the affair a rather damp squib,” Dannie Hewson, financial analyst at broker AJ Bell, said.

The pound strengthened to its highest level in three months against the US dollar yesterday, meaning it has now wiped out all the losses sustained under Liz Truss’s disastrous premiership.

UK borrowing costs were broadly flat.

Wall Street was closed for the Thanksgiving holiday. “Markets as a whole have been fairly upbeat with Wall Street closed for Thanksgiving and European investors gnawing over central bank comments rather than a bit of turkey,” Hewson added.

AFC Energy was once again awarded a Buy recommendation after it was announced that one of its fuel cell PowerTowers was being operated on HS2 Euston station construction. Fuelled by bottled hydrogen, the tower provides net-zero power to the construction’s telehandlers as well as lighting towers. AFC, the analysts said, is demonstrating market leadership.

To appear in Best of the Brokers, email your research to notes@cityam.com P 18 Nov 24 Nov 23 Nov 22 Nov

Analysts at Peel Hunt have picked Marston’s numbers and decided to cut forecasts for 2023 and 2024 to reflect a 10 per cent increase in the national living wage. “In the New Year, it will likely bring a reduction in market supply, even if trading is good during the World Cup and Christmas,” they said. “Marston’s should survive and eventually thrive through sales growth and debt reduction.”

RISERS AND FALLERS “There was some positive momentum for retail stocks yesterday with ASOS the big winner and M&S bringing a touch of pre-Christmas sparkle to the day’s leader boards. B&Q owner Kingfisher seemed to get off lightly after lowering its full year profit outlook with that word ‘challenging’ making a now familiar appearance in its update.”

DANNI HEWSON, AJ BELL

Starmer wants blue collar progressives to rebuild the Red Wall vote in 2024

Stefan BosciaIT HAS been a good 12 months for Labour. Sir Keir Starmer’s party began 2022 with a small polling lead over the Tories and will finish it looking like a government-inwaiting, thanks largely to the risible collapse of two Prime Ministers and economically crippling stagflation.

Pressure will now come onto the opposition leader to give away more of himself and to show the public how he will govern if he wins the next election. Anyone wanting a preview need only look at his speech at the CBI’s annual conference this week.

Starmer slaughtered another of the party’s sacred cows on Tuesday, something he is increasingly comfortable with, as he decried the UK’s “dependence on immigration” for economic growth. He said the UK has been “more comfortable hiring people to work in low paid … contracts than we are investing in the new technology that delivers for workers” in a message perfectly curated toward ex-Labour voters in working class towns.

He spoke about how Britain needed "growth from the grassroots" and to be "a nation where working people succeed and where aspiration is rewarded", while also touting Labour's newly earned pro-business credentials.

It was the latest iteration of a blue collar centre-leftist economic vision, which sees Starmer adopt Tony Blair-

like triangulations in policy and rhetoric.

It’s a vision built on embracing Brexit, promoting British manufacturing, committing to fiscal responsibility, boosting public services, talking tough on crime and railing against untapped low-skilled immigration. All this is buttressed by a pro-business, pro-aspiration promise that closely mirrors Joe Biden's economic strategy in the 2020 Presidential election.

The perfect embodiment of Labour’s new blue collar progressivism is its plan, a copy of Biden's, to spend £28bn a year on reindustrialising the UK through green manufacturing subsi-

dies. The policy aims to help usher the UK’s transition away from fossil fuels, while also appealing to a working class

Starmer’s vision is buttressed by a probusiness promise that mirrors Joe Biden’s manifesto

section of the electorate that has abandoned Labour by creating new manufacturing jobs.

Labour’s political obituary was written by many pundits after the 2019 election as long-term voting trends, away from the left, among the suburban working class deepened. Labour had lost touch with this demographic over the last 20 years as it abandoned its beer and sandwiches aesthetic of old and instead became a party of metropolitan university graduates.

The oft-heard phrase in towns like Bassetlaw and Bolsover during the 2019 Christmas election was that "we haven't left the Labour party - the

Labour party left us".

Starmer's politically shrewd efforts to remedy this decline may just work, with the party now holding large polling leads over the Tories in the party's traditional northern heartlands. Who would have thought the man to win back the northern working class for Labour could be Holborn and St Pancras MP Sir Keir Starmer KCB KC?

Starmer has been painted as a Blairite by the left, the worst possible pejorative for many Labour members, and they're right in one crucial sense. While the policies Labour are putting together now are very different from the progressive free market-ism of Blair, he has injected them with a kind of pragmatism and cunning that would make the former PM proud.

Make no mistake - Starmer has become utterly ruthless in his drive for power and is desperate to become Prime Minister. This has opened the door to attacks from Rishi Sunak, who has begun to paint the Labour leader as a craven opportunist that will say anything to win.

Starmer has done a commendable job of creating a viable blueprint to stitch together an election-winning coalition, but the real question is if he can sell it. He has two years to patiently herd the electorate toward his vision of Britain, while also proving his leadership qualities to those who see him as a boring technocrat.

Former Barack Obama strategist David Axelrod once said there comes a time in every political campaign where a candidate has to show he can "close the deal". It won't be long until we find out if Starmer has it in him to wrench open the door to Number 10 and slam it shut behind him.

Our climate guilt is a weapon for fraudsters promising to help us help the environment

FRAUD moves with the times. This summer we experienced more sweltering heatwaves and droughts. Coupled with this month’s Cop27, climate change is again a regular feature in our daily news intake. While others saw a rise in phishing attempts and cost-of-living based scams, we’ve seen climate fraud cases grow exponentially, now involving millions of pounds and spanning multiple jurisdictions.

From Amazon Rainforest investment proposals to solar panel fittings, fraudsters are exploiting individual desires to invest in clean climate solutions. Not only do these complex crimes take the life savings from thousands of investors, but they erode public trust in climate progress and legitimate sustainable investments.

Earlier this year, our investigation into Global Forestry Investment resulted in the two fraudsters behind the scheme sentenced to 11-years each. They used a promotional video show-

Mick Gallagherness to swindle pensioners of their hard-earned savings and, in the judge’s words, caused “prolonged stress” to thousands of victims.

ing wide-angled, aerial shots of the vast Amazon rainforest to encourage their victims to invest in a “high-reward, low-risk” asset that “outperforms traditional investments” – trees.

Global Forestry Investments won investors over with their claims of support from politicians local to the featured plantations, and told investors that they could “rest assured” knowing that they are investing and caring for the planet.

In truth, there was little-to-no planetcaring taking place, with both fraudsters misleading their victims from the get-go. They showed a crude willing-

The SFO has had signs of a rise in green fraud for some time. In one of our earliest cases of green fraud, two brothers built a fraudulent web of multiple organisations, selling solar panels across the North West of England. Alongside four accomplices, the pair crafted a sales script that promised full returns on a guaranteed investment, and told homeowners they were in the “optimal” position to have solar panels installed, regardless of their financial situation.

For the 1,500 victims of the scheme, many who parted with their life savings, the harsh reality soon hit. The guarantees that had been made were entirely false. Instead of reinvesting the funds as promised, David and Ludovic Black – the two ringleaders –bought sports cars and took private flights across Europe.

The pair and their accomplices were found guilty of running the £17m scam in 2018 after a four-year investigation. They were collectively sentenced to over 30-years imprisonment. Whether it’s the likes of the Black brothers making false promises about a much needed and sought-after climate solution, or Global Forestry Investments offering ultra-low risk investments in climate projects, we can expect more opportunists to take advantage of the trend as our climate woes rise. No doubt more will lie about how they can help quell our concerns by helping us “to do our bit” in tackling this enormous challenge.

Both of these cases have provided our organisation with a growing understanding of how fraud continually evolves, manipulating consumer and investor behaviour through social conditioning.

£ Mick Gallagher is Chief Investigator at the Serious Fraud Office

£ Mick Gallagher is Chief Investigator at the Serious Fraud Office

LOVE IN A HOPELESS

PLACE Mick Lynch, the RMT union boss, had an unlikely gatecrasher at his press conference yesterday as the country braced for more rail strikes. It was a protestor, of sorts, demanding we ‘follow Jesus’ to avoid going to hell. Let’s hope the train to heaven runs on time

LETTERS

TO THE EDITOR

Reading into the data of

AI

[Re:UK set to become next AI superpower says new report, Nov 23] Amidst the hype about the UK as the “next AI superpower”, the WPI Economics Report should be seen as a much bigger call to action to improve how the UK public sector approaches data.

Having enhanced AI capabilities is all very well and good, but it has no value for citizens if public sector workers don’t have the tools or knowledge to maximise its effect. With more data available than ever before, the public sector must adapt to be able to use the data to improve public services and the lives of citizens.

Beneath the headlines of the UK as a future AI superpower, the report is full of signs that data maturity is lacking across the public sector. Suppose the UK is to burnish its status as a tech superpower. In that case, the government must ensure that civil servants and public sector workers have access to the tools that make maximising value from data simple, efficient, and effective. We need to see a more joined up approach in government to data, focusing on solving complex problems by combining augmented analytics, AI and machine learning, and data exploration. This help drives faster and more informed decision-making – an outcome that will benefit citizens and public sector professionals alike.

Tom Warren Pyramid AnalyticsEMPTY NESTERS ON BOARD EasyJet targets over 45-year-old for cabin crew

Top down targets won’t resolve regional divides as inflation shrinks spending

OVER the past year, politics has been incredibly uncertain and unpredictable. Both Rishi Sunak and Jeremy Hunt have committed to reviving the levelling up agenda, in a bid to prevent the ideology of the 2019 election falling by the wayside in the midst of fierce economic headwinds.

But to date, the successes of levelling up policy have been almost non-existent. Indeed, the way the funding has been allocated has actually accentuated regional divides in some cases. This only encourages the lopsided growth which persists across the country. The North East received just £4.9m whilst the South East received £9.2m in 2021-22. There are some areas in the South East which need levelling up; London has some of the highest levels of deprivation in the whole country. But the South East is also the most affluent area of the UK and historical imbalances in our economy have prevented many of those in the North East from catching up.

government might as well give up the ghost and change tack. Typical measures such as building bridges and railways are important but fundamentally the government should focus its efforts on helping local businesses get on with what they have already been doing; creating growth.

communities who need it most. Many previous attempts, including those under Tony Blair, have been topdown plans.

EXPLAINER-IN-BRIEF: TORY ROW PUTS HELP FOR SOCIAL HOUSING ON HOLD

This week, the government pulled a vote on the Levelling Up and Regeneration Bill to avoid an internal rift with Tory rebel MPs. The point of contention? The idea of top-down housing targets to be decided by central government.

A total of 50 Conservative MPs have signed an amendment to the bill which would have made the targets “advisory not mandatory”. They say they want to protect their constituencies from unchecked urban development. The other side

accuses them of nimbyism. This is a mess that Sunak will want to fix with the help of Levelling up Secretary Michael Gove. The latter has been busy dealing with the question of rogue housing associations. Yesterday on BBC Radio 4 he admitted the government “should have moved faster” to improve social housing conditions after the Grenfell fire. Gove also said that new legislation, to come next year, will ensure tenants’ voices are “heard more clearly”.

ELENA SINISCALCOThis is a question of raw politics as well. The Tories need to level up to maintain their hold on the red wallproviding voters with jobs, thriving high streets and homes to repay the votes they were lent at the last election. Labour need to promise a vision which actually delivers levelling up to regain those same constituencies. Yet for both parties, one of the challenges they face is that in truth many of us in the North have never fully understood exactly what what levelling up means. Neither have we grasped what successive Conservative governments have been trying to do.

The solution can’t involve just throwing money at the problem. With public spending pressures and existing funding being devalued by inflation the

When local businesses are thriving they don’t just provide jobs to local people and a boost to the local economy, they give back to their communities. These local businesses are often just as effective, if not more, than the government at knowing where support should be targeted. Not only do they have a more direct stake in the success of their local communities than central government ever can, but they know their areas and the people that need help most.

There are many of us in the private sector who take this seriously. True Potential for example has set up the Harrison Centre for Social Mobility to help thousands of unemployed or young people gain confidence and qualifications to secure good jobs in the local area. Partnerships with Sunderland and Newcastle United Football Clubs has been essential to working with the

Instead, the best way for the government to create more equality in the North is to empower local leaders and businesses, restore public services and restore a sense of community in deprived areas. The appointment of Onward founder Will Tanner, who has advocated for bottom up policies, to Downing Street is a hopeful sign such an approach will get a hearing.

Whether politics settles down in the coming months or years is uncertain and there are undoubtedly tough economic times ahead. If the government has less to spend, it needs to focus on other ways of helping businesses help their communities. This might be reducing regulation, targeted tax breaks, or simply providing some much needed policy clarity. It’s time that the government had a conversation with business and empower us to get on with what we’ve always been best at; levelling up.

£ Daniel Harrison is chief executive officer of True Potential

£ Daniel Harrison is chief executive officer of True Potential

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900

Email: news@cityam.com

Certified Distribution from 30/5/2022 till 01/07/2022 is 79,855

Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com

Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions

Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP

Editorial Editor Andy Silvester | News Editor Ben Lucas Comment & Features Editor Sascha O’SullivanIf the government has less to spend, it needs to focus on other ways of helping businesses

WE WANT TO HEAR YOUR VIEWSRishi Sunak in Hartlepool last year Adopting a baby monkey for a day was once touted as a solution to empty nest syndrome to remind parents why they don’t want babies. EasyJet probably wasn’t wanting to compare its passengers to apes as it aims to help empty nesters get a job, but if you’ve ever been on a lads trip to Malaga...

GOING OUT

EDITED BY STEVE DINNEEN @steve_dinneenA CHRISTMAS CAROL CASTS ITS SEASONAL SPELL ON LONDON

PLAY OF THE WEEK

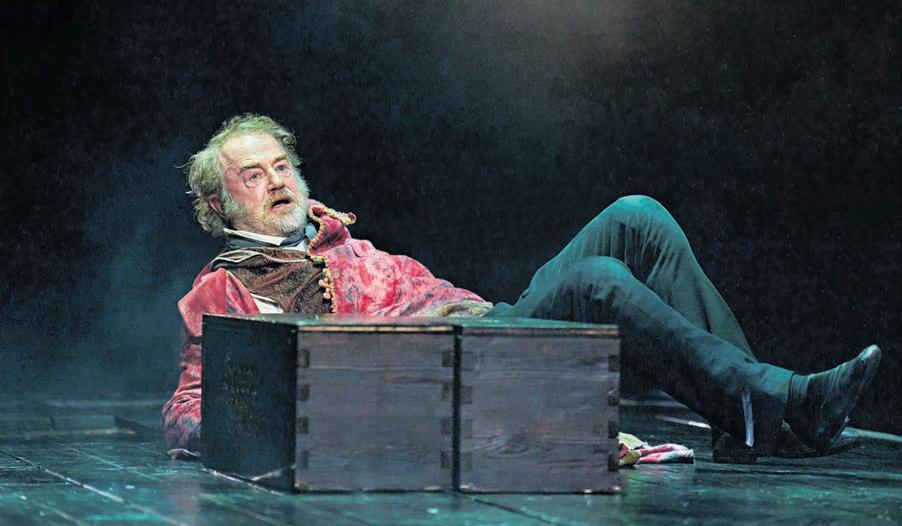

UNMISSABLE A CHRISTMAS CAROL OLD VIC THEATRE BY ADAM BLOODWORTHJoy to all - including you Scrooges out there - it’s Christmas! We’ve collectively spent weeks ignoring the Christmas cards and wrapping paper that appears pointlessly early in shops, but now that it’s December it’s actually time to start getting in the mood for the festive season - and the best way to do that, bar none, is booking a ticket to A Christmas Carol at the Old Vic.

The theatre has run iterations of this seasonal classic before, but this year it’s back better than ever, offering a barmstorming night at the theatre that’ll convince even the most steadfast Scrooges. There’s a brilliant lead performance by Owen Teale, who wears Scrooge’s emotions on his sleeves like open wounds as he tears from Christmas past to Christmas present and Christmas future.

There’s a touch of Santa about Teale, from his booming voice to the way he jesticulates about the stage. It’s hard to put a fresh stamp on such an overplayed character as Scrooge, but Teale reaches for new life. Staged in-theround, the stage is like a giant cross, with actors running on from four di-