TREASURY DITCHESCALLINPOWERS

JACK BARNETT, CHARLIE CONCHIE AND STEFAN BOSCIA

THE GOVERNMENT late last night confirmed it has scrapped controversial plans to allow MPs to “call in” City regulators as part of a post-Brexit Big Bang 2.0 blueprint.

The decision to ditch the plans marked a victory for the Bank of England and the Financial Conduct Authority (FCA), who have both previously warned that introducing the so-called call-in powers would undermine their independence.

Andrew Griffith, economic secretary to the Treasury, said last night the government was dropping the proposals in order to retain “the operational independence of the financial services regulators”.

A Treasury source told City A.M. that while there were previously concerns that regulators were not promoting economic growth and that such powers were necessary, the move to scrap EU-era Solvency II rules and potentially unlock a wave of investment

from insurers has helped put ministers at ease.

However, City A.M. understands the Treasury is still keeping the power on the table, despite not pressing ahead with it for now.

The FCA declined to comment on the decision, while the Bank didn’t immediately respond to a request for comment.

Until recently, Tory MPs were planning to introduce the powers via an amendment to the original Financial Services and Markets Bill tabled earlier this year.

Under the so-called call-in powers, lawmakers would have been able to summon the FCA, Prudential Regulation Authority and other financial watchdogs if they judged their proposed rewriting of post-Brexit laws were not up to scratch.

Giving the government ultimate oversight of reshaping Britain’s regulatory regime after Brexit was first proposed by Rishi Sunak when he was chancellor, back in November last year.

But Square Mile overseers have roundly batted away the plans as a material risk to watering down regulators’ ability to protect consumers and ensure the financial system runs smoothly.

Governor of the Bank of England Andrew Bailey told the Treasury select committee last week “we must not threaten” UK regulators’ sovereignty.

The FCA also sounded the alarm over the measures to the Treasury, with interim chair Richard Lloyd recently warning that even if used “sparingly”, the powers were of “great concern” to the regulator.

One senior Tory MP welcomed the move, adding the government will “now be able to maintain the line that the UK has the best independent regulators in the world”.

But Labour shadow City minister Tulip Siddiq said Sunak’s government “should never have been threatening the independence of the financial services regulators in the first place.”

“This U-turn is more evidence of his weakness,” she said.

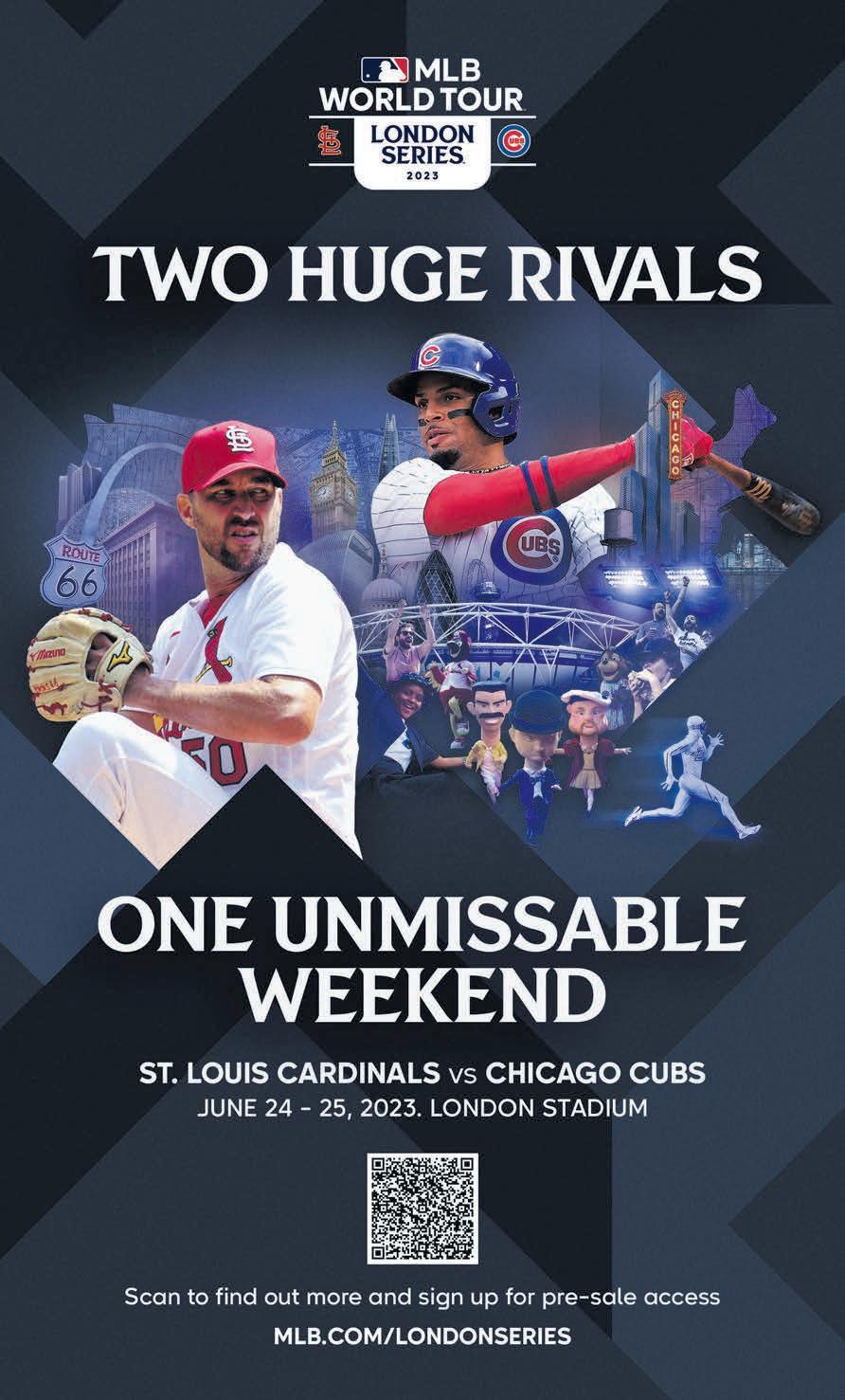

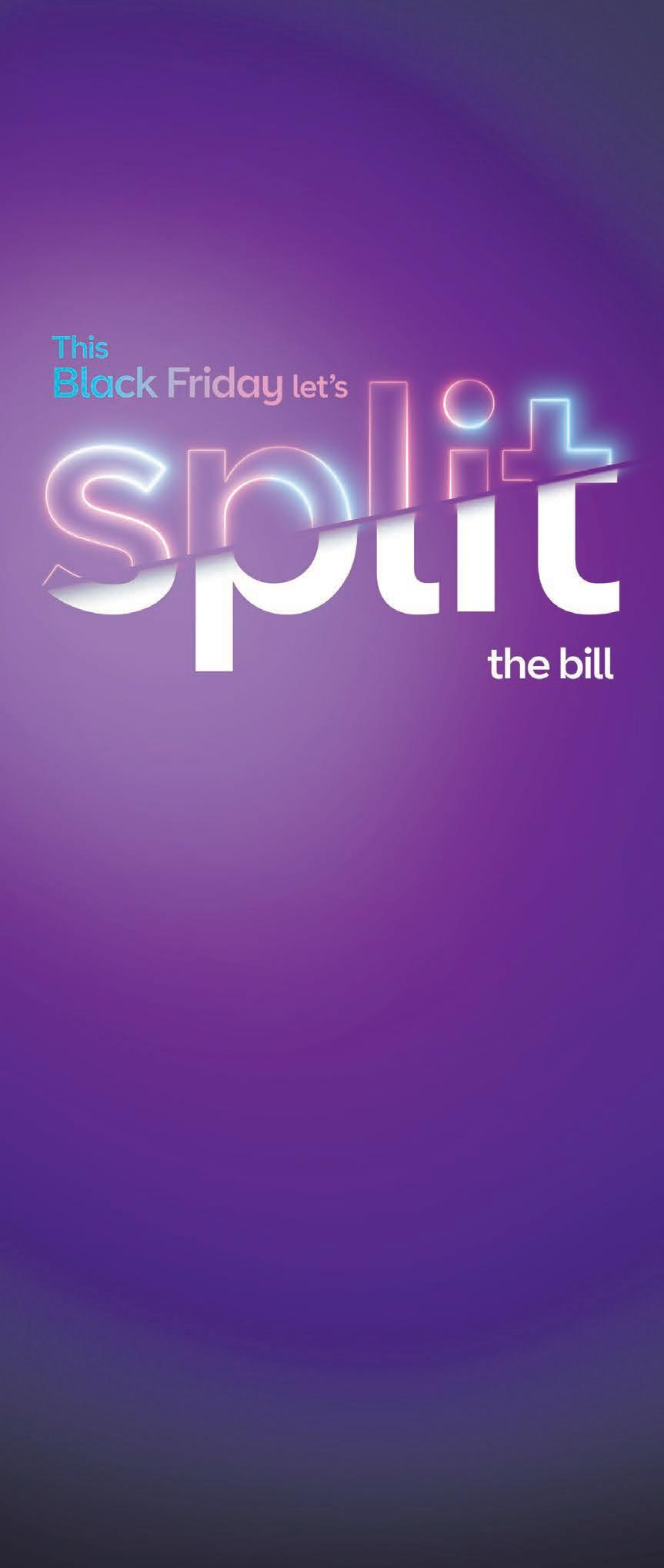

EBAY’s UK chief has slammed posties’ strike action, saying small businesses are being caught in the “crosshairs at the very time they most need support”.

Writing in City A.M. today, Murray Lambell said smaller e-commerce firms were the “lifeblood” of the economy and must be protected during this festive season.

“The last two festive trading periods were overshadowed by Covid-19 restrictions and lockdowns, and this year firms have inflationary pressures and supply chain issues to contend with too,” he said.

“We now have no choice but to come

out fighting for small businesses up and down the country who will be devastated by this interruption of service,” he added.

His comments come as the Communication Workers Union , which represents 115,000 Royal Mail workers, confirmed that postal strikes will go ahead today and on Black Friday, after snubbing Royal Mail’s “final and best” offer yesterday.

The Federation of Small Businesses told City A.M. that both sides must find a “landing zone for compromise”, warning that further action will cause more damage to small businesses.

Home REIT shares tank after short seller report claims firm misled investors

CHARLIE CONCHIE

SHARES in property investor Home REIT tanked nearly 25 per cent yesterday after it came under attack from short seller Viceroy Research, who questioned the financial strength of the charity tenants in its property portfolio.

Viceroy said in a report that the property investor’s tenants in many cases cannot afford rent, are simply not paying or run by bad actors.

FTSE-250 Home REIT buys up property and leases it to social housing organisations and charities to provide accommodation for homeless people.

However, Viceroy said its tenants are not in a position to service 25year leases offered by the firm and were lured into signing contracts with the promise of financial incentives and properties.

“If the management were running an ethical and decent business, why was there a need to give incentives to

charities –that are newly formed –in [the form of] £3m or properties,” Fraser Perring, who runs Viceroy, told City A.M.

He claimed his investment firm was now preparing to file a complaint with the police on the grounds it “fundamentally misled investors” and there were

“suspicions it may be fraudulent”.

Home REIT said the report was “inaccurate and misleading” and based on “mistaken assumptions, misinformed comments, and disputable allegations”.

The firm added it was preparing a “full and detailed response” to disprove allegations.

THURSDAY 24 NOVEMBER 2022 ISSUE 3,868 CITYAM.COM FREE INSIDE CREDIT SUISSE ROCKED P3 BOOHOO REPORTS A ‘WAKE-UP CALL’ P4 SUPREME COURT BLOCKS SCOTTISH REFERENDUM P6 MARKETS P21 OPINION P22 SPORT P26 LONDON’S BUSINESS NEWSPAPER

OWN WORDS ON PAGE 22

£ READ MURRAY LAMBELL IN HIS

CITY REGULATORS PROTECT

FOR NOW EBAY FIGHTS BACK Ebay stands up for firms hit by postal strikes DAVID HAREWOOD A SIT DOWN WITH THE HOMELAND STAR P25 CRYPTO’S BEST GATHER TO KICK OFF OUR SUMMIT P18

INDEPENDENCE

We can help end our economic misery by supporting our youth

While it is understandable that workers across a range of different industries feel the need for actions such as strikes to improve their living conditions, collectively it is putting businesses — and our country as a whole — in a serious bind. The combination of rocketing inflation, labour shortages and the long-term challenges posed by an ageing population are creating an

THE CITY VIEW

explosive set of conditions. With commuters and holidaymakers set to be affected by train strikes throughout the holiday period, online retailers are now being hit by strikes over the Black Friday period from postal workers. A well-functioning public transport

system is key to keeping London’s high streets shops filled with customers, while our army of online entrepreneurs desperately need to keep afloat in what are proving to be difficult times for the country as a whole.

Wage inflation creates a spiral where workers in other industries in turn demand pay packet increases just to keep up with the cost of living. One way to improve the situation is to find a way to engage the increasing number of

over 50s who have taken early retirement, and who have the potential to retrain in a variety of different industries.

However our youth are also a key to developing our nation’s full potential, which is why the education system needs to do far more to build closer links with industry, showing our young men and women the opportunities of a variety of different possibilities and not pushing them into careers that may not be as in

demand as shortage areas such as in the sciences, as well as technical trades such as plumbing, electrics and skills that can be utilised for our energy sector. While high house prices and inflation are a difficult challenge, the prospect of unlocking an army of talented young workers through connecting them to industry would help to kill two birds with one stone. Strikes, however, won’t help solve either of these issues.

PURPLEBRICKS CHAIRS WINS SHAREHOLDER SUPPORT

Online estate agency Purplebricks has secured the support of its largest shareholder as it looks to face down a brewing investor revolt. Shareholders are set to vote on whether or not to oust Purplebricks chairman Paul Pindar.

FINANCIAL TIMES

FEDERAL RESERVE BACKS SLOWER RATE RISES ‘SOON’

A substantial majority of Federal Reserve officials support slowing down the pace of interest rate rises, even as some warned that monetary policy would need to be tightened further, according to their recent meeting.

THE TIMES

MADE.COM COLLAPSED OWING CREDITORS

£187M

Made.com, the online furniture retailer, collapsed while owing customers £17.1m, new documents revealed. A report on the finances published by administrators at PwC calculated the company owed a total of £186.6m.

Gas prices rise as Gazprom threatens cuts to pipeline amid dispute with Ukraine

siting gas via Ukraine.

GAS PRICES spiked yesterday after Gazprom warned it could further limit supplies into Europe next week, putting pressure on the continent and escalating the looming possibility of blackouts this winter.

UK and Dutch benchmarks were up 9.2 per cent and 8.3 per cent respectively in yesterday evening’s trading on the spot market.

Kremlin-backed gas giant Gazprom threatened to reduce gas flows through the one remaining pipeline providing supplies into Europe, tran-

It accused Ukraine of guzzling 52m cubic metres of gas contracted to Moldova, over an unspecified amount of time. This is slightly more than one day’s supply through the pipeline –with around 43m cubic metres travelling through Ukraine from Russia into Western Europe via the remaining pipeline on a daily basis.

The Gas Transmission System Operator of Ukraine denied the accusations, and argued Russia was manipulating facts to put more pressure on the country.

Olga Bielkova, Director of Govern-

ment and International Affairs, said: “Gazprom deliberately interprets the introduction of European business rules of operation at interstate interconnection points as a violation of contractual obligations, obviously for political rather than commercial purposes.”

Gazprom systematically reduced flows into Europe over several months this summer amid perceived maintenance and sanctions issues.

The EU has scrambled to top up supplies to near full capacity ahead of winter through vast LNG imports from the US and Middle East.

BoE’s Huw Pill says more rate hikes ready in the pipeline

JACK BARNETT

THE BANK of England will need to keep lifting interest rates to prevent inflation embedding in the UK economy, the central bank’s chief economist predicted yesterday.

Huw Pill, successor to former top wonk Andy Haldane, said “there is still some more to do with Bank Rate” before Threadneedle Street stops its hiking cycle.

The Bank has already tightened borrowing costs eight times in a row to three per cent, with its latest rise, a 75 basis point move, the

biggest in 33 years.

Inflation has skimmed to a 41 year high of 11.1 per cent, forcing governor Andrew Bailey and the rest of the Monetary Policy Committee (MPC) into the aggressive round of hikes.

While Pill signalled he backed another rise at the Bank’s next meeting on 15 December, he said he does “not anticipate” borrowing costs hitting the 5.25 per cent prices into financial markets when the MPC carried out its economic forecasts in late October. Most think a 50 basis point rise will come next.

CITYAM.COM 02 THURSDAY 24 NOVEMBER 2022 NEWS

NICHOLAS EARL

WHAT THE OTHER PAPERS SAY THIS MORNING

ROTTEN Dogs being walked over London Bridge sport a fetching set of jackets to keep them warm and dry in the late November weather by their loving owners

SPOILED

THE DAILY TELEGRAPH

STANDING UP FOR THE CITY

Credit Suisse rocked by mass cash withdrawal

CHARLIE CONCHIE

BELEAGUERED lender Credit Suisse said it expects to haemorrhage up to 1.5bn Swiss Francs (£1.32bn) in its fourth quarter after a flood of clients pulled cash from the firm amid fears over its stability.

The Swiss bank, which last month revealed a sweeping cost-cutting plan including 9,000 job cuts, said around six per cent of its total $1.47 trillion assets were yanked in early October as reports spread the bank was teetering on the edge.

“Credit Suisse began experiencing deposit and net asset outflows in the first two weeks of October 2022 at levels that substantially exceeded the rates incurred in the third quarter of 2022,” the firm said in a trading update.

The rush of outflows included nearly ten per cent of total assets held by its wealth management business and

caused the firm to dip into emergency liquidity buffers, bosses said.

The scale of outflows shocked analysts yesterday and fuelled concern over the uphill battle the lender faces to recover confidence from the market.

“Today’s update confirms our concerns that the CS ship is yet to stabilize, and it’ll get worse before it potentially gets better,” said Flora Bacahut, an equity analyst at Jefferies. She added that the scale of the exodus was “significant and concerning”.

Asset manager Vontobel similarly said the firm “needed to restore trust as fast as possible” yesterday, but acknowledged it was “easier said than done”.

Client activity has also slumped across Credit Suisse’s divisions in the final quarter of the year, bosses said.

The profit warning marks the latest blow to the firm as it scrambles to turn around after a string of scandals.

SBF accepts the blame as firms scramble for trust

CHARLIE CONCHIE

THE FOUNDER of failed crypto exchange FTX has apologised to his former employees for his role in its downfall but claimed the firm would have been salvageable had he not been forced into filing for bankruptcy.

In a letter to former staff, formerbillionaire Sam Bankman-Fried said

he had not grasped the extent of the firm’s exposure.

“I never intended this to happen,” he wrote to staff. “I did not realize the full extent of the margin position, nor did I realize the magnitude of the risk posed by a hyper-correlated crash.”

He claimed investor interest poured in just after its bankruptcy

and could have saved the firm, however.

The collapse of FTX and allegations of customer fund misuse have sparked a scramble from firms to try and restore trust in the sector.

Crypto exchange OKX yesterday revealed the state of its balance sheet in a bid to prove to customers it holds their cash on its books.

03 THURSDAY 24 NOVEMBER 2022 NEWS CITYAM.COM

Halfords to focus on key items as spending is cut

EMILY HAWKINS

HALFORDS must shift its focus to more essential products as shoppers trim back discretionary purchases, bosses said yesterday morning.

The cycling specialist said that a switch-up to selling more “needs-based” items was key as the firm must become less “reliant and exposed to the volatility of more discretionary product markets”.

It warned it was expecting its full year underlying profit before tax to be at the lower end of its £65m-£75m range.

The retailer had continued to see “resilient” sales in its more needs-based categories but had clocked a “softening” in less essential areas, it said yesterday.

While it was “challenging” to predict what consumer confidence would be like for the rest of the 2023 financial

year, Halfords said it didn’t expect that the challenges facing businesses would “dissipate soon”.

In results for the six months until the end of September, Halfords said earnings had slipped after rampant inflation and softer retail spending.

In addition to revealing

The cycling specialist saw shares fall seven per cent after the update

financial results, Halfords said it was launching a recruitment drive to hire 1,000 new automotive technicians across its autocentres business over the next 12 months.

Chief executive Graham Stapleton said he wanted to rewire the company’s workforce to meet increased demand for vehicle servicing.

Shares closed down over seven per cent yesterday after the update.

Former JD Sports boss Peter Cowgill makes retail comeback

EMILY HAWKINS

FORMER head of JD Sports Peter Cowgill has been named by online perfume seller The Fragrance Shop as its new chairman.

Cowgill departed the sneaker seller earlier this year after a slew of controversies, following decades at the helm. He is to take on the job of nonexecutive chairman at The Fragrance

MPs say report on Boohoo worker conditions should be a ‘wake-up call’

EMILY HAWKINS

EMILY HAWKINS

MPS HAVE dubbed reports of worker mistreatment at a Boohoo warehouse as a “wake-up call”.

The fast fashion firm said a report in The Times newspaper was not reflective of the working conditions at its Burnley warehouse. After a reporter spent a month working at the site this summer, the newspaper

claimed there were “gruelling targets, inadequate training and illfitting safety equipment”.

Workers described targets for their picking roles as “extortionate” and “impossible”, the newspaper reported.

The reports were “shocking” and should “be a wake-up call” for government ministers, according to Justin Madders MP, shadow minister

for employment rights and protections.

The government had “repeatedly failed to deliver” a promised employment bill that would “tackle conditions in warehouses run like Victorian workhouses,” Madders said.

Deputy Labour leader Angela Rayner said that instead of the government’s levelling up agenda, “it’s a race to the bottom”.

Shop immediately, as the e-commerce retailer looks to expand.

“I feel very privileged to take on this role at an exciting time for the business as it continues to execute its growth strategy,” Cowgill said.

Earlier this year Cowgill stepped down following several brushes with the competition watchdog. JD Sports agreed exit terms that included a £3.5m payment over two years.

De La Rue jobs under threat after profit alert

HOLLY WILLIAMS

BANKNOTE printer De La Rue yesterday warned over possible job cuts as it looks to ramp up cost savings after swinging to a loss and warning over full-year results for the third time this year.

Chief executive Clive Vacher told the PA news agency that moves to strip out another £12m in costs under an ongoing overhaul will impact its workforce.

He said it was too early to say how many roles would be impacted or give further details. But he said the cost savings would be “global and right across the cost base”. “It will have an effect on employment and that will, again, be on a global basis.”

Vacher added that he would also look at “optimising” the group’s manufacturing sites further in the UK and worldwide, but stressed there were no immediate plans for closures, having already trimmed its banknote print locations from five down to four.

Crystal Amber, which has a 10 per cent stake in the business, reiterated its call for chair Kevin Loosemore to resign. The currency business saw underlying earnings plunge 47.6 per cent to £4.3m in the first half. PA

CITYAM.COM 04 THURSDAY 24 NOVEMBER 2022 NEWS

£36

Peter Cowgill left JD Sports this year following a string of controversies

Workers described conditions in warehouses as “extortionate” and “impossible”

You get more when you #jointheflipside Buy a Galaxy Z Flip4 and claim a Tab S6 Lite, on us. Purchase before 30/11/2022. Claim by visiting: https://samsungpromotions.claims/tabS6lite within 60 days of purchase. UK/ROI. 18+ only. For full T&C’s, see https://samsungpromotions.claims/tabS6lite Buy online, in-store or call 0800 033 8006 today

Supreme Court blocks Scottish independence

STEFAN BOSCIA

NICOLA Sturgeon has said the next UK general election will be a “de facto referendum” on Scottish independence after the Supreme Court yesterday blocked a fresh vote.

The Scottish First Minister said she “accepts” the court’s decision, but added that “democracy won’t be denied”. The Supreme Court yesterday ruled that the Scottish government could not hold a second independence referendum without the consent of Westminster.

The court said another independence referendum would have “important political consequences relating to the union” and that the UK’s central government must be involved in that process. Sturgeon wanted to hold a second independence vote on 19 October next year, however the UK government has been clear that it will not grant an-

other vote any time soon after Scots voted to stay in the union just eight years ago.

Prime Minister Rishi Sunak yesterday said he respected the “clear and definitive ruling of the Supreme Court”, while calling for the Scottish National Party (SNP) to work “on fixing the major challenges that we collectively face”.

Sturgeon told a press conference in Edinburgh that “we will find another democratic, lawful and constitutional means by which the Scottish people can express their will”.

Scottish polling shows that opinions are split on the issue of independence, however the majority of polls over the past year show people in favour of staying in the union. SNP leaders argue that the party’s dominance in Scottish elections shows that it has a mandate for another referendum, after Scots rejected independence in 2014.

Well, now what? That’s the question that Scottish independence supporters and unionists alike will be asking themselves after yesterday’s Supreme Court decision. Nicola Sturgeon has said the next general election will be a “de facto” referendum on independence, but it’s very difficult to see what that means in practice. If Sturgeon’s Scottish National Party once again dominate north of the border, where the party currently holds 44 of 59 Scottish seats, in 2024,

THE BOTTOM LINE

then what will a claimed “de facto” independence mandate look like? This is something that Sturgeon has yet to explain, most likely because she doesn't know herself.

To unconstitutionally claim independence would throw the entire UK into crisis. There also remains questions as to whether or not Sturgeon has properly articulated the costs involved in independence to her voter base.

Hunt says he is concerned over UK tax burden

STEFAN BOSCIA

CHANCELLOR Jeremy Hunt yesterday said he is “very concerned” about the UK’s soaring tax burden and that he “absolutely” wants to cut it.

Hunt told MPs on a Westminster committee yesterday that “if taxes are too high it makes it difficult to be a modern, dynamic economy”, while also backing his decision last week to hike taxes for everyone.

The UK’s tax burden is now at its highest level since World War II, with the chancellor arguing last week that hikes were needed to pay back the Covid-19 debt.

Stealth income tax hikes are set to squeeze families, while businesses will pay more in National Insurance Contributions as the government tries to balance the books.

Hunt told the Treasury Select Committee that he wanted to cut personal and business taxes, but that “we weren’t going in that direction in that Budget”.

The chancellor also denied he was the source of a leak over the weekend that suggested the government wants to trash Boris Johnson’s Brexit deal and move closer to the EU.

The Scottish First Minister warned that “democracy won’t be denied”

CITYAM.COM 06 THURSDAY 24 NOVEMBER 2022 NEWS

Twitter’s top 100 advertisers leave the site en masse following Musk

LEAH MONTEBELLO

TWITTER’s top advertisers are leaving the social media giant en masse, as Elon Musk’s grand plans scare away marketeers.

More than a third of Twitter’s top 100 marketers have not advertised on the site in the last two weeks,according to analysis from the Washington Post.

The analysis from Pathmatics data reckons that 14 of the top 50 advertisers have fled the Twitter nest, with a number of blue-chip firms not posting ads since the billionaire formally took over the company on 27 October.

The exodus of marketeers has been an issue since Musk took the reins, with household names like General Motors, Merck, Kellogg and

Mondelez all pausing their adverts on the site, as fears over potential content moderation changes, blue tick verification and mass staff layoffs mount.

In a bid to boost confidence in the floundering tech firm, Musk-owned SpaceX snapped up a Twitter package earlier this month to test the social media advertising in Australia and Spain.

Openreach scales back UK ultrafast fibre broadband

LEAH MONTEBELLO

LEAH MONTEBELLO

OPENREACH is to limit its investment in the rollout of ultrafast fibre broadband as BT pushes forward with an intense cost-cutting scheme.

The telecom giant’s networking division has contacted suppliers to say it will build the network “narrower and deeper” and tighten timeframes, according to a letter seen by the Financial Times.

“This will by necessity include an element of cancellation or suspension of a job you have received and/or validated”, the letter said. “It is clear that there will be a financial impact to you as we implement these plans.”

It comes after the FTSE 100 firm earlier this month announced a fresh cost-cutting target from £2.5bn to £3bn by the end of 2025 as a result of inflationary pressure.

Chief executive Philip Jansen said that whilst he backed the current push for efficiency, the firm needed to take “additional action on our costs to maintain the cash flow needed to support our network investments”.

The firm saw energy bills climb £200m this year, and ongoing pressure from the

Communication Workers Union (CWU) with strike action.

Boris Johnson’s government promised to “level up” the nation by providing next-generation-speed broadband to most homes by 2025 in the hope of addressing gaps in rural areas.

The decision to limit expansion plans could work in the favour of major rivals like Virgin Media O2, who may be able to capitalise on a BT slowdown.

A spokesperson for Openreach said: “We expect to build ultrafast full fibre broadband to more homes and businesses next year, not fewer, so we’re speeding up not slowing down.

“As our recent results show, we’re investing £200m more than we expected to this year on the build, and orders for Full Fibre services are at record levels. In fact, nine million homes and businesses can already order our Full Fibre service from a large range of service providers, so it makes sense for us to put more resources into upgrading customers and fulfilling orders as quickly and smoothly as possible.

“We’ve also partially built the new network to a further six million premises, so we’re focussed on completing that work.”

Covid concerns in China: Protests erupt at biggest iPhone factory

LEAH MONTEBELLO

PROTESTS broke out in the early hours of yesterday morning at the world’s biggest iPhone factory in the Chinese city of Zhengzhou.

According to reports from Bloomberg, workers at the Foxconn Technology plant started to protest overnight over unpaid wages and fears of Covid rates.

Footage has circulated online, showing hundreds of workers

marching, with riot police present.

Tensions have been growing in the region after lockdown started in October amid growing infection rates.

Around 200,000 people work at the plant, and there were reports last month that many had tried to flee the region.

The Zhengzhou plant announced a fresh recruitment drive earlier this month, in a bid to lure back staff.

Foxconn and Apple were not immediately available to comment.

CITYAM.COM 08 THURSDAY 24 NOVEMBER 2022 NEWS

Tensions have grown in the Zhengzhou region amid growing Covid-19 infection rates

Camelot reports record half year amid Lotto boom

LEAH MONTEBELLO

OUTGOING National Lottery operator Camelot posted its highest half-year sales yesterday as soaring online sales continue to save the day.

The company said that the rising number of online players offset the dwindling in-store ticket and scratchcard demand, with sales topping £4bn for the first time in its history.

Despite the “difficult” retail landscape and cost of living woes, the gambling giant said draw-based games, such as the Euromillions, had performed particularly well during the period, up 7.5 per cent to £2.4bn for the half year. It said it now has around 10.7m digital players.

Camelot chief executive Neil Railton said the National Lottery had enjoyed a “record half-year” when it came to good causes, with returns of almost £1bn.

The news notably comes days after Camelot was sold to its National Lottery licence successor Allwyn, which was awarded the lucrative government contract back in March by the Gambling Commission. A 10-year licence is projected to generate up to £100bn in sales for Allwyn.

Camelot, which was owned by the On-

tario Teachers’ Pension Plan Board, initially challenged this decision, arguing that the gambling watchdog did not properly evaluate the risk of its rival’s proposals, and questioned the processes behind the competition. This delayed the beginnings of the licence handover .

Although legal action was eventually dropped in September, with the pair working together on the change, a crossparty group of MPs said this week that the process was “poorly managed”.

The House of Commons digital, culture, media and sports committee has called on the Gambling Commission to “review its licence competition design process” with a focus on protecting good causes.

Nevertheless, both Allwyn and Camelot have promised “a smooth transition”. Camelot will continue to operate separately and is expected to close in the first quarter of 2023.

The Czech-based conglomerate is due to operate the National Lottery from 1 February 2024.

It is understood that Allwyn, which is headed by chief Robert Chvatal, has plans to slash ticket prices from £2 to £1 and has promised to hike the amount of money put to good causes.

National World pulls out of hefty bid for Daily Mirror publisher Reach

LEAH MONTEBELLO

MEDIA firm National World pulled out of a potential bid for the Daily Mirror owner Reach yesterday, ending weeks of speculation surrounding the deal.

The news publishing investor said although there would have been “considerable industrial and financial advantages” to the deal, circumstances were “not aligned” to proceed any further.

National World, which publishes

titles like the Scotsman and Yorkshire Post, is valued at around £50m, whilst Reach boasts a much heftier price tag of £340m.

Despite this disparity, National World said in a statement that it had received financial backing to go forward with the deal, but did not elaborate on what this looks like.

Reach, which has seen its stock plunge nearly 60 per cent in the year to date, saw shares jump over two per cent yesterday afternoon following the news.

CITYAM.COM 10 THURSDAY 24 NOVEMBER 2022 NEWS

Reach publishes newspapers Daily Star, Daily Express, Sunday Express and the Sunday Mirror

One in five data breaches in the UK hit health sector, ICO analysis reveals

MILLIE TURNER

THE HEALTH sector is the biggest culprit for data breaches, with one in five affecting the UK industry, according to new analysis.

Data from the Information Commissioner’s Office (ICO), analysed by data breach solicitors Hayes Connor, found that businesses and bodies in the health sector typically take more than 72 hours to report nearly 40 per cent of their data breaches, which is against ICO regulations.

“What’s concerning is the public sector puts a lot of trust [in the health sector]... With the expectation that their data is being handled securely,” legal director at Hayes Connor Christine Sabino said. “With so many of these data breaches being caused by human error, it’s very clear that these industries are in dire need of data handling training, at the very least.”

Across all UK industries, there have been over 32,500 data breaches since 2019, analysis also found. Most were not cyberrelated, suggesting a lack of GDPR training.

CBI: Investment in public health will boost UK GDP

INVESTMENTS in healthcare and wellness are investments in the economy, according to the Confederation of British Industry (CBI).

The UK loses 131m working days a year to ill-health, costing the nation around £180bn in GDP, data from the CBI’s new Work Health Index revealed yesterday.

“Labour market resilience is a precondition to growth,” CBI president Brian McBridge explained.

“Without healthy, productive employees, the UK economy will be unable to achieve the growth it sorely needs.”

The Index comes at a time when the government is looking to ramp up productivity, following an over decade-long slump.

“With the UK staring down a fiscally constrained period, the moment to boost the UK’s preventative health model is now,” McBridge continued, adding that “with workforce health higher than ever before on the business agenda in the wake of the pandemic, the CBI believes this is the ideal time to launch this partnership between industry, government and the health service”.

A string of the largest businesses operat-

ing in the UK, including Aviva, Pfizer, and Rolls Royce, helped the CBI create the Index. Neil O’Brien, the minister for primary care and public health, added: “A healthy and resilient workforce is vital for the economy of our nation, and any steps employers make to improve the health and wellbeing of their staff are commended.

“We are committed to doing everything we can to level up health and care across the country.”

In August, president of the Association of British Pharmaceutical Industry Pinder Sahota told City A.M. that an ailing healthcare industry was jeopardising the UK’s already low productivity levels.

The pharmaceutical industry, like many others in the UK, has been wrestling with staff shortages, inflation and dwindling investment.

“If we can encourage more research and manufacturing to be done here in the UK... Then that has a positive impact on improving the health of the nation and workforce productivity,” Sahota said.

The government realising its ‘science superpower’ pledge and tackling illnesses such as cancer, cardiovascular disease and obesity will inevitably have a “knock on effect on productivity”, he added.

11 THURSDAY 24 NOVEMBER 2022 NEWS CITYAM.COM

MILLIE TURNER

The data found the health sector took over 72 hours to report nearly 40 per cent of data breaches

Discoverie weathers UK economic storm with record order book size

MILLIE TURNER

MILLIE TURNER

BRITISH electronics designer and manufacturer Discoverie is hoping the size – and cost – of its products will be key to weathering the UK’s economic storm.

The London-listed company has seen its underlying operating profit rise more than a third to £25.6m in the past six months,

while pre-tax profit boomed over 130 per cent to £14.8m, according to the group’s interims yesterday.

Raging inflation has eaten into the profits of most companies operating in the tech industry, as consumers stow cash into savings.

However, industry-facing Discoverie banked a record order book of £275m in the second half this year.

Group chief executive Nick Jefferies said the company was “well positioned in a changing world”.

“Our products are essential in customers’ applications and amount to a small proportion of their spend, providing us with revenue visibility and stable margins,” he added.

The performance caught the eyes of investors, with shares up over four per cent yesterday afternoon.

Johnson Matthey profits chipped away by inflation

MILLIE TURNER

JOHNSON Matthey’s profits have been eaten into by soaring inflation and ongoing supply chain disruptions.

The British chemicals maker had its operating profit dive a quarter to £222m on an underlying basis in the six months to the end of September, according to the group’s latest results released yesterday.

Supply chain constraints hit the group’s clean air division, which it expects to improve in the coming months.

In a statement yesterday, chief executive Liam Condon said the company was focused on navigating “significant cost inflation”. Cost-cutting measures include plans to cut about 15 per cent of senior

management jobs.

“We are confident of delivering a stronger performance in the second half as we apply the enhanced commercial focus and efficiencies that I outlined back in May,” Condon added.

In May, the company warned of a hit to its operating profits this year, as China’s lockdowns and component sourcing from Ukraine hurt its auto customers.

Johnson Matthey’s share price initially fell on the news, but clawed back losses in the afternoon.

Analysts at brokerage Jefferies said they had anticipated the “muted” share price reaction given the group’s “weak mix and wide outlook”, but nonetheless maintained their ‘buy’ rating.

City of London update

Free cour se t o help SMEs measure carbon footprint

Do you run an SME in the City and want free support to help measure your carbon footprint and prepare to reach net zero?

Apply for Climate for SMEs: 4 Steps to Action – a free course from responsible business charity Heart of the City, funded by the City Corporation.

Businesses taking part will learn how to measure their carbon footprint, understand what net zero means for their firm and how to reach it by 2040. Net zero has lots of business benefits; help future proof your business, reduce

costs, and win work by signing up.

The next course starts on 16 January and focuses on measuring your carbon footprint.

theheartofthecity.com

Wholesale mar ke ts relocation

THE City of London Corporation has approved plans for a major regeneration programme, which will see London’s historic wholesale markets relocated to a purpose-built site in Dagenham Dock, bringing thousands of jobs to the area.

The Court of Common Council – the City Corporation’s principle decision-making body – has voted to deposit a Private Bill in Parliament to relocate Billingsgate and Smithfield wholesale markets.

The City Corporation will invest nearly one billion pounds directly into Barking

and Dagenham to regenerate 42 acres of industrial land into a modern, sustainable wholesale food market, stimulating the local economy and ensuring resilience in the food supply of London and the southeast.

News, info and of fer s at www.cityof london.gov.uk/eshot

CITYAM.COM 12 THURSDAY 24 NOVEMBER 2022 NEWS

Why the postal strikes are delivering big problems for small businesses

The UK is one of the most advanced e-commerce markets in the world. Small businesses in particular have started and scaled their retail operations thanks to a sophisticated online economy which gives shoppers what they need, when they need it.

But right now in the midst of peak trading the ongoing postal strikes are causing further enormous damage to these businesses, who rely on an efficient mail service for so much of their trade. These strikes are delivering a body blow to UK small businesses, many of whom are already fighting to survive.

While we understand and respect the perspectives on both sides, more must be done to support small businesses caught in the crosshairs, and especially as these strikes are taking place during the most important trading period of the year.

For our part, we as organisations who represent the interests of small businesses, are doing everything we can to support online sellers through the peak trading season. But the most important thing right now is to keep Britain trading.

We implore Royal Mail and the Communications Workers Union to find a way through the impasse to agree a deal.

So many small businesses depend on Royal Mail and its dedicated workforce. Let’s not let them down.

Yours faithfully,

Murray Lambell, VP and General Manager, eBay UK

Michelle Ovens, Founder, Small Business Britain

Martin McTague, National Chair, Federation of Small Businesses

Murray Lambell, VP and General Manager, eBay UK

Michelle Ovens, Founder, Small Business Britain

Martin McTague, National Chair, Federation of Small Businesses

The recent Cop27 summit in Egypt has further reinforced the urgency of the climate threat. As countries, as organisations, and as individuals, we need to do far more to combat climate change, and act much faster than we’re acting today.

I believe that finance professionals can play a crucial role in the collective effort to halt climate change and help accelerate the transition to a more sustainable future. To fulfil this role, however, they will need to evolve and expand their core skillsets and many need to rethink their approach to planning, budgeting and forecasting.

BROADER VIEW OF PERFORMANCE

New global research by ACCA and Chartered Accountants Australia and New Zealand (CA ANZ), in association with PwC, highlights the scale of the challenge. Planning and performance are integral activities for finance functions, with budgeting and planning cycles consuming considerable amounts of time and effort. Yet these cycles remain largely financially focused – despite sustainability being a global priority and many organisations having resource-related constraints.

The transition towards a more sustainable economy demands that finance teams take a broad view of performance and value. Nevertheless, just 16 per cent of respondents surveyed for the research said environmental, social and governance (ESG) forecasting was ‘fully integrated’ into their financial planning and performance process. What’s more, little over half (56 per cent) said they currently give ‘equal’ focus to financial and nonfinancial areas, such as sustainability and supply chain issues.

Fortunately, finance professionals recognise the impetus for change. A significant majority (82 per cent) agreed that new forms of performance measures – as opposed to purely financial measures – are needed to meet the expectations of investors, analysts and the capital markets.

FUTURE FOCUS

As well as taking a broader perspective, finance teams must shift their focus away from purely historic performance. While it is important to tell the story of the past, this should not come at the expense of understanding the drivers of future performance, the likely risks and opportunities their organisation may encounter, and the actions needed to ensure success.

The research shows that some cultural change is needed to bring about this shift. Today, the key focus area for financial planning and analysis (FP&A) activity in organisations is still understanding the performance of ‘actuals’ against budget, cited by 57 per cent of respondents. In contrast, just 24 per cent focused on robust ‘what if’ scenarios, even though scenario analysis would help their organisations to better understand the potential impact of climate-related risks and opportunities.

There is also a need to revisit processes. Looking into the future re-

WHY BETTER BUSINESS PLANNING CAN HELP US SAVE THE WORLD

teams continue to rely heavily on spreadsheets, however. In fact, the research found that 82 per cent of respondents relied mainly on spreadsheets to help manage planning and performance in their organisation.

these targets, they will need a plan –an integrated plan that incorporates operational and financial considerations while drawing on the expertise of every internal team.

DIGITAL TRANSFORMATION

If organisations are to become more agile at budgeting and forecasting, finance teams must have the right technologies and methodologies at their disposal. These include tools and processes that support constantly changing assumptions and macroeconomic factors, such as inflation and employment levels. Finance teams also need access to both internal and external sources of data.

Despite the plethora of purpose-built planning tools and enterprise planning modules that exist today, finance

In contrast, just 34 per cent made use of next-generation tools, such as extended planning and analysis (xP&A) applications that feature inbuilt artificial intelligence and machine learning. These tools – which are both business and finance tools – should be an important component of organisations’ digital transformation strategies.

FAIL TO PREPARE, PREPARE TO FAIL

Over the coming months and years, organisations will come under increasing pressure, from their investors as well as other stakeholders, to hit their net zero targets. If they are to achieve

As an organisation, we are supporting the journey the accountancy profession needs to take through integrating the necessary knowledge in our qualification and providing CPD opportunities and research, such as this latest report, that will help drive the changes needed.

Already, finance teams are recognised as valuable business partners by their colleagues within their organisations. So, we must call on them to play an instrumental role in this planning process while taking an organisationwide and value-based view of performance that embraces purpose and people, as well as profit. By transforming the way that organisations approach business planning, the finance function can help to save the world.

ACCA

Helen Brand

CITYAM.COM 14 THURSDAY 24 NOVEMBER 2022 FEATURE

If organisations are to become more agile, finance teams need the right technologies at their disposal

UK private economy arrests decline but recession still seems a certainty

JACK BARNETT

THE UK economy has arrested a decline, but it still looks likely to tip into a long recession, a closely watched survey out yesterday showed.

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) flash purchasing managers’ index (PMI) for November inched up to 48.3 points from 48.2 in October.

It is the first time the PMI has risen for months. The reading was far

above the City’s consensus forecast of 47.5 points.

The small rise was driven by businesses clearing backlogs of work that swelled due to worker and input shortages and Covid-19 restrictions.

The UK economy is also faring better than the eurozone’s, according to the PMIs. The currency area’s reading inched up this month to 47.8 points.

However, the UK’s composite PMI reading has been beneath the 50point growth threshold for four

months, meaning the private economy still contracted in November and suggesting the economy is in the early stages of a recession.

New order growth slumped to its lowest level since January 2021, when the UK was in the throes of the third pandemic lockdown.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said: “A further steep fall in business activity in November adds to growing signs that the UK is in recession.”

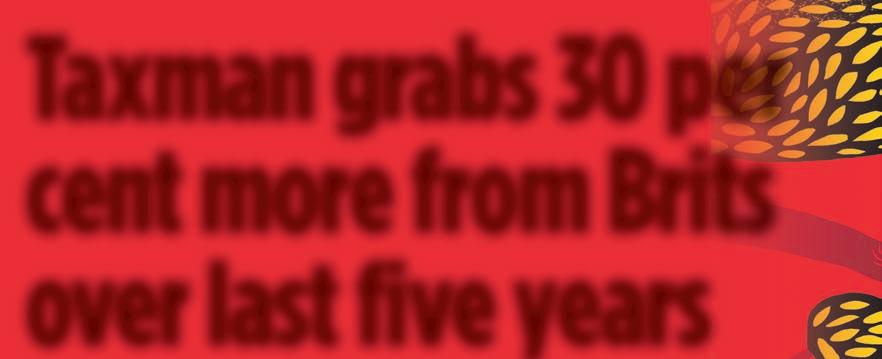

Taxman grabs 30 per cent more from Brits over last five years

JACK BARNETT

THE AMOUNT of money the taxman takes away from Brits has climbed 30 per cent over the last five years, City A.M. analysis of figures shows.

In the year to 31 October this year, HMRC collected £757bn in taxes, up from £584bn in 2015/16, stats out this week reveal.

The rise in tax revenues has been driven by the government needing to generate cash to pay for an increase in public spending, mainly on health to deal with an ageing society and to cushion the economic blow from the Covid-19 crisis with packages such as the furlough scheme.

But, taxes are on course to rise even further after Chancellor Jeremy Hunt’s Autumn Statement last week.

The Office for Budget Responsibility estimates the tax burden is on track to swell to its heaviest level since the second world war. Total government national account tax revenues will top £1 trillion in three years.

The Bank of England has warned

the UK will suffer the longest recession on record at two years, if interest rates top five per cent, knocking nearly three per cent off of GDP.

Typically, when economies enter a slump, policymakers slash taxes and borrowing costs. However, a 41 yearhigh inflation surge of 11.1 per cent and Liz Truss’s disastrous minibudget has forced the Treasury and Bank into squeezing households and businesses, possibly making the

recession worse.

Hunt raised overall taxes to around £25bn to hit his new fiscal rules.

Businesses have been hit by a £6bn national tax grab and a looming corporation tax hike, prompting analysts to warn the UK could suffer yet more years of underinvestment that will hold back the economy.

“Maintaining UK tax competitiveness will now be more important than ever… If the UK were able to stimulate business investment back to pre-pandemic levels, it would generate an estimated £11bn to the economy,” Jon Richardson, head of tax policy at PwC, told City A.M.

Others said slimming down the tax regime would reduce waste.

“The sad reality is that the tax system lacks coherence. New taxes and reliefs are overlaid on existing measures, with complex rules bolted on to prevent avoidance. The result is a system of such dizzying complexity it’s hardly surprising that so many businesses and individuals get it wrong,” Paul Falvey, tax partner at BDO, told City A.M.

UK science industry holds wages above inflation to lure in workers

MILLIE TURNER

THE UK’s science industry has kept its wages above steadily rising inflation in a bid to lure workers into the chronically understaffed industry.

The UK faces a shortage of skilled workers for sectors such as pharmaceuticals

Typically, wages in the UK have risen at a slower pace than the cost of goods, according to the Office for National Statistics yesterday.

However, the science industry is one of three sectors in the country to have hiked pay above inflation, even before the Covid-19 pandemic.

Since July, the industry has been the only one where regular wage growth has exceeded inflation, sitting at 10.1 per cent in July to September.

The industry has suffered heavily under a science, technology,

engineering and maths (STEM) skills shortage in the UK in recent years.

The UK Commission for Employment and Skills revealed earlier this year that 43 per cent of STEM vacancies were hard to fill due to a shortage of applicants, leaving gaps in employment across pharmaceutical, aerospace and defence sectors.

15 THURSDAY 24 NOVEMBER 2022 NEWS CITYAM.COM

New order growth slumped to its lowest level since January 2021, the PMI found

0 100 Bank surcharge £3BN Source: HMRC, year-end 31 October 2021/22 Capital gains £15BN Stamp duty £16BN Corporation tax £73BN VAT £157BN National insurance £172BN Income tax £235BN 200 300 400 500 600 700 800 £ Billion Total tax take £757BN

HMRC CASH RAISERS

A Fresh Approach to Equity Diversification

Henry Cobbe CFA, Investment Director at Elston Consulting, looks beyond regional equity diversification to consider sectors, factors and themes

The most traditional approach to world equity diversification is a regional approach. This gives investors the ability to overweight or underweight particular markets, on the outlook of their economies.

Whilst this is straightforward, cheap and aligned with fund sector classifications, it is restrictive and increasingly dated.

A lot of what drives share price performance is based on which sector they are in (Energy stocks are having a great time now, Consumer Discretionary less so), the factors that drive their returns (Value is currently outperforming growth), or long-term structural themes (like food production or cyber security).

Indeed many managers talk sectors, factors or themes, but invest by region. This doesn’t make much sense. So sector, factor and thematic ETFs can help.

HOW DO WE DIFFERENTIATE BETWEEN THESE CATEGORIES?

Sectors group companies by their business activity. These industry classifications are long- standing and relatively stable enabling research as regards sector performance in different economic regimes.

Factors group equities with similar style characteristics. Factors are the broad persistent explainers of return explored in academia. Examples of factors include Value (companies whose price is cheap relative to their fundamentals), Size (small cap vs large cap), Quality (higher ROE and gross margin), Momentum (companies with rising share prices) and Minimum Volatility (less volatile share prices).

Themes group companies by exposure to a structural long-term theme that could act as a tailwind for growth. Examples of themes include food security, cyber security, medical cannabis & life sciences, to name a few.

By allocating according to sectors, factors, or themes, investors can capture investment style while minimizing idiosyncratic risk.

WHAT ARE THE OPTIONS?

£Sector ETFs: State Street Global Advisors offer 11 world equity sector ETFs. For example, SPDR MSCI World Health Care UCITS ETF (LSE:HEAW). Physical replication, 0.30% TER, largest holding of 142 is United Health Group Inc (7.34%).

£Factor ETFs: iShares offers 5 main world equity factor ETFs, for example iShares Edge MSCI World Value Factor UCITS ETF

(LSE:IWVF) provides exposure to a sub-set of world equities on low valuations relative to their fundamentals. Physical replication, 0.30% TER, largest holding of 397 is Intel Corp (2.19%).

£Thematic ETFs: Rize offers 8 thematic ETFs focused on structural themes. Their largest is Rize Sustainable Future of Food UCITS ETF (LSE:FOGB) which focuses on sustainable food producers in any geography. Physical replication, 0.45% TER, largest holding of 43 is SIG Combibloc Group (4.94%) Sectors, Factors and Themes offer a more coherent grouping of companies than the region of their headquarters. This provides a more nuanced way to implement tactical

Onshore wind essential to Europe’s energy aims, argues Wartsila boss

EXCLUSIVE NICHOLAS EARL

ONSHORE wind should “absolutely” be part of Europe’s green ambitions, as the continent looks to overhaul its energy infrastructure to meet net zero goals and reduce its reliance on overseas gas supplies, the boss of a leading Finnish power group has argued.

Hakan Agnevall, chief executive of Wartsila, argued that ramping up domestic renewable generation over the decade was essential, and that onshore wind turbines were cheaper and quicker to assemble than offshore wind projects.

He also rejected suggestions that green projects would undermine food security in Europe – which has been used as a justification for rejecting new developments across the conti-

nent.

Agnevall said: “I don’t see that an increased share of renewables and an increased land use for renewables will lead to starvation or lack of food.”

The Wartsila boss declined to comment specifically on the UK’s onshore wind sector, but the domestic industry has faced continued uncertainty over potential domestic planning reforms to boost the flagging sector.

Former Prime Minister Liz Truss announced proposals in her Growth Plan to bring planning for onshore wind projects into line with other infrastructure developments.

However, her replacement Rishi Sunak has not clarified whether he will go through with the reforms.

Agnevall also recognised Europe has become increasingly reliant on overseas vendors to meet its gas needs.

This included securing vast quantities of the highly carbon intensive liquefied natural gas (LNG) from the US and Qatar.

He said: “We need to be realistic. There are investments being made now with LNG terminals, and I think we have to live with it.

However, Agnevall argued this increased short-term dependence on gas had to be married with plans to quickly ramp up renewables.

He called on the EU to double wind power installations from 15GW per year to 30GW. He said: “I think this is a political issue. It’s not a technical issue that we need to resolve and I would say the biggest challenge for Europe right now in terms of decarbonising the energy system is permitting planning. Because everybody wants green energy, but not in my backyard.”

views and a more targeted approach to equity

ABOUT IG

IG was established in 1974 and offers UK investors the opportunity to buy and sell shares, investment trusts and exchange traded funds (ETFs) at low commission rates in a share dealing or ISA account, as well as ready-made, expertly-managed Smart Portfolios. For research purposes only.

Nothing in this article constitutes a personal recommendation, endorsement or financial promotion. Any trademarks cited are the property of their respective owners.

Elston Consulting was established in 2012 and provides portfolio, fund and index research and investment solutions to wealth managers and financial advisers

NOTICES

All ETFs mentioned are London-listed ETFs and available on the IG share dealing platform.

Your capital is at risk. The value of shares, ETFs and ETCs can fall as well as rise, which could mean getting back less than you originally put in.

Sadiq Khan announces £25m last-minute funding to save 53 London bus routes from being scrapped

routes to achieve savings equivalent to four per cent of the bus network.

OVER 50 London bus routes were saved yesterday after London mayor Sadiq Khan announced £25m worth of annual funding.

The extra cash will be used to prevent 53 routes from being withdrawn following concerns from thousands of Londoners.

Announced in June, the cuts were set forth due to the pandemic’s impact on TfL’s coffers, which forced the public body to rely on government money.

In return, ministers asked City Hall to scrap or adjust 70 bus

Yesterday’s announcement confirmed that only three bus routes –numbers 11, 16 and 521 –would be scrapped from next year.

Khan said he was “furious on behalf of Londoners that TfL was having to consider reducing the bus network due to conditions attached by the government to the funding deal.” He also said he explored “every avenue available” to save “as many buses as possible”.

“This will mean tough decisions elsewhere, but I am very pleased that the vast majority of bus routes proposed to be cut to the

government’s funding conditions can now be saved,” Khan added.

While Labour members at City Hall rejoiced, London Tories accused the mayor of using the threat of bus cuts “to score political points against the government”.

“Londoners have had the threat of their services being cut dangled in front of them completely unnecessarily for months, so I am glad Sadiq Khan has finally backed down and changed course,” GLA Conservatives’ transport spokesperson Nick Rogers said.

Following a string of short-term deals, the government agreed to support TfL until Spring 2024.

ILARIA GRASSO MACOLA AND JACK MENDEL

CITYAM.COM 16 THURSDAY 24 NOVEMBER 2022 NEWS

IG PARTNER CONTENT

The London mayor’s announcement confirmed that only three bus routes will now be cut –numbers 11, 16 and 521

Sectors, Factors and Themes offer a more coherent grouping of companies than the region of their headquarters

diversification.

CRYPTO A.M. SUMMIT & AWARDS KICKS OFF

The third Crypto A.M. Summit & Awards is well underway with a whole host of keynote speeches and panel discussions from revered speakers in the cryptocurrency and blockchain fields.

Taking place at the Royal Leonardo St Paul’s, it has been a valuable gathering for the crypto community, offering insights from advances in cryptocurrency regulations and updates on the latest market trends.

William Ralston-Saul, COO at Jade City, underscored the sense of optimism circulating the summit, shedding light on the reality that “people may be financially affected, yet they are still building in the bear market”.

Meanwhile Amélie Arras at Zumo Enterprise applauded the “perfect timing” of these crypto leaders mobilising in full force to drive the transition to “stronger governance, consumer protection and global renewable energy”.

Crypto A.M. editor James Bowater remarked that “the FTX scandal is yet another destructive industry growing pain, but it will not hinder the continued drive of development and refinement”. He added that London “continues to be the epicentre of innovation” of future finance.

CITYAM.COM 18 THURSDAY 24 NOVEMBER 2022 NEWS CRYPTO SUMMIT 2022

Max Rangeley from the Cobden Centre, Jasmine Birtles of Money Magpie and Jannah Patchay of the Digital Pound Foundation with Jonny Fry

Jade City COO William Ralston-Saul with colleagues Otto Burney and Tom Wright

Amelie Arras from Zumo

Left to right: Lord Holmes of Richmond, Jean Paul Tarud-Kuborn from Deca4 Advisory, Toby Norfolk-Thompson of Matrixport, VJ Angelo from Inspira Wealth, and TeamBlockchain’s Jonny Fry

Sky Mobile says Brits are holding on to old phones to save more cash

EXCLUSIVE LEAH MONTEBELLO

THE BOSS of Sky Mobile has said people are keeping their mobile phones for double the time as usual as the cost of living crunch sets in.

Speaking with City A.M., managing director Paul Sweeney said that customers are increasingly holding onto older devices for as long as three years rather than the more standard year and a half when it comes to signing on to new contracts.

“People are looking to any bill possible to try and get value on it,” he said, adding that people were more inclined to fish around for better deals.

His comments come as Sky Mobile, which launched in 2017, today reveals that it has reached three million customers in the UK, making it one of the fastest-growing mobile providers in the country.

Sweeney explained that Sky first entered the “inflexible” mobile market to provide a respite from the “confusing contracts”.

Sky’s service allows users to carry forward any unused data, and offers one of the cheapest annual plans in the market, with 2GB for just £6. It also has a piggybank tool, which means households can share data with other sim cards.

Unlike many mobile phone companies, Sweeney said that the pandemic was a help rather than a hindrance to the online-first firm’s growth. This puts it in contrast to firms like the Carphone Warehouse, which shut its doors during Covid.

Hope at end of tunnel for Joules as suitors circle

HAWKINS

COLLAPSED lifestyle retailer Joules can be revived with the help of a high street stalwart, according to one retail voice yesterday.

The beleaguered fashion firm was plunged into administration earlier this month after struggling with a slowdown in sales, leaving 1,600 workers in the lurch.

After a deadline for the first tranche of bidders passed on Tuesday evening, analysts were hopeful of the possibility of a successful suitor being able to bring the brand back to life.

Household name Next teamed up with Joules founder Tom Joule, who launched the company in 1989, according to a report in The Sun.

It has been speculated a list of other interested parties includes supermarket heavyweight Marks & Spencer and Sports Direct owner Frasers.

The Foschini group, which is run by South African billionaire Michael Lewis, is also reportedly mulling snapping up the ailing firm, alongside Hovis bread owner Endless group.

Joules was “at the centre of many local high streets and a popular choice for customers,” Wizz Selvey, retail ex-

pert and founder & CEO of Wizz&Co told City A.M.

Support infrastructure, operations and distribution in the form of a helping hand from “a big retail player” would help get Joules back on track, Selvey added, though he said this must come alongside “a clear design and product direction going back to the brand’s core values for the future consumer.”

Should a multi-brand retailer such as Next or M&S succeed in poaching the retailer, it would be “interesting to see if they continue to keep the brand so widely distributed in the long term,” Selvey said.

A takeover would mean a larger firm had an opportunity to use its ownership to have exclusive distribution of the Joules brand or stock a wider range to gain a competitive edge over their rivals, Selvey said.

Will Wright, Ryan Grant and Chris Pole from Interpath Advisory were appointed joint administrators for the 132-store strong high street firm.

Administrators from Interpath were also appointed for Joules’ development arm as well as Joules subsidiary The Garden Trading Company earlier this month.

A FRIEND FOR LIFE Pets at Home top dog says owners continue to splash out on their pets despite rising cost of living pressures

J20 and Robinsons maker Britvic sees sales growth after hot summer

HENRY SAKER-CLARK

HENRY SAKER-CLARK

SOFT DRINKS giant Britvic has revealed a jump in sales and profits as it benefitted from the easing of pandemic restrictions and a hot summer.

The Robinsons and J2O maker said revenues grew by 15.5 per cent to £1.62bn over the year to September 30, compared with the previous year, amid

increases in both price and sales volumes.

As a result, the firm saw pre-tax profits jump by 45.3 per cent to £140.2m for the year. The company said strong growth was “in part due to the soft comparable in the first half of 2021 when lockdown restrictions impacted the hospitality channel and the good weather this summer”.

It therefore saw an improvement in hospitality as well as better retail sales.

Britvic told shareholders that Pepsi, 7UP and Tango saw double-digit sales growth over the year, led by low and no sugar products. With high inflation predicted for 2023, the company said it will continue to seek to mitigate any impact through cost efficiency work to boost its pricing and

19 THURSDAY 24 NOVEMBER 2022 NEWS CITYAM.COM

EMILY

The J20 maker said the good summer weather had boosted sales

promotions. PA

Sky Mobile said people were now holding onto their phones for twice as long as usual

FTSE 250-LISTED Pets at Home yesterday reported a 9.3 per cent slip in underlying profits before tax of £59.2m for the six months to 13 October. Profits were said to have slipped due to heightened freight and energy costs, though the company said its customers continue to splash out on luxury products for their pets. Analysts have warned the firm may see a squeeze as inflation hits a 41-year high.

Pub and restaurant bosses have accused suppliers of “deliberately profiteering” off the energy crisis, with huge hikes to other costs despite government support.

While the government unveiled a six month business support package in September, the country’s boozers and eateries are far from feeling out of the woods as temperatures drop and the nights draw in.

However, operators have complained they are still being whacked with extortionate prices, as well as sky-high fees such as management costs, standing charges and security deposits.

There is also growing pressure on Downing Street to confirm future support from next spring.

This comes as businesses are facing a cocktail of rampant costs this winter, with margins under pressure all while consumers themselves are feeling the pinch.

Gas prices have soared to all-time highs this year, powered by a Russian supply squeeze on Europe following the country’s invasion of Ukraine.

Average energy costs for venues have risen this year by 258 per cent while half of venues have seen bill increases of 400 per cent, according to UKHospitality survey data.

Hikes to management fees and standing charges have seen bills leap in some cases up to 700 per cent in comparison to 2021, the British Institute of Innkeeping’s research also found.

In fact, the extent of elevated costs such as these mean that, for many operators, the government’s relief scheme was only having “a limited impact”, according to BII’s chief Steve Alton.

“Unsustainable” bills are threatening to devastate businesses that are “at the heart of their communities,” Alton said.

Chris Yates is one such restauranter who is staring down a quadruple increase to energy bills at his Italian restaurant chain Cafe Murano.

It was not possible to pass on the full impact of increases to customers, leaving the chain, which has restaurants in Covent Garden, St James’s and Bermondsey, in a perilous position.

Bewildered by a “huge difference” be-

tween the government’s published wholesale prices for gas and electricity and the rates being offered by energy suppliers, Yates is among many who feels that there is a “complete lack of transparency”.

Yates had been readying himself for bills to double, yet is now looking at a 500 per cent increase. “You can argue there is still a discount on the rates suppliers are providing,” he acknowledged. Yet the operator said he was “not sure suppliers are co-operating in the way the government envisaged”.

Some businesses are also facing being quoted pricey deposits while shopping around for a new deal with a different supplier, with hospitality firms sometimes considered high risk customers.

With the country hurtling towards a recession as inflation surpasses 40-year highs, a recipe of rising labour, food costs and hefty energy bills would make for “a really dangerous recession,” Yates warned.

As consumer footfall is also set to dip, venues faced “a really concerning year

or two ahead,” the restauranter said.

Energy bill aid was simply “not filtering through” to businesses, Merlin Griffiths, First Dates bartender and pub owner, said in a social media rant.

“It’s rampant profiteering, poor legislation, blinkered thinking and psychopathic presumption that we are suffering,” he said.

UKHospitality, which represents hundreds of firms that operate around 100,000 venues, has urged ministers to recommend that regulators urgently investigate whether suppliers are deliberately profiteering from the government’s intervention.

“I believe more can be done and will continue to apply pressure to ensure companies are charging fair prices for energy to our sector,” UKHospitality

boss Kate Nicholls told City A.M.

Market watchdog Ofgem has teamed up with the department for business, energy and industrial strategy (BEIS) to ensure businesses are receiving the full support they are owed under the support packages, it said.

Ofgem was aware that “some businesses are having problems in getting fixed-rate energy deals and also that some are being asked to pay large deposits by some suppliers,” a spokesperson told City A.M.

It was working to “determine if further action or assistance is needed” to help firms, they said.

BEIS said it was working with Ofgem to confirm “licence conditions have not been breached and to ensure businesses are able to see the full effects of

support offered by the scheme.”

The department also stated that “a small minority” of businesses had reported some suppliers had set prices that “undermine the benefits” of government aid.

Business energy supplier Yu Group urged the government to clarify future support for businesses beyond this winter to guarantee pubs, restaurants and bars can make plans for their future.

It recognised the UK’s recovering hospitality sector was facing “difficult market conditions” and encouraged businesses to use smart metering services to provide certainty over their energy usage, especially with uncertainty over future government aid.

The energy firm called on Downing

Street to guarantee that “they are not leaving businesses without the muchneeded support that will keep our hospitality sector running” when the scheme tapers off in April.

Swelling bills were “unsustainable, threaten viability and, when coupled with people and recruitment challenges, place unbearable pressure on the sector,” UKHospitality’s Nicholls added.

Many venues have started to slash opening hours or close for certain days of the week owing to elevated energy bills, according to official data from the Office for National Statistics.

As bosses desperately seek out clarity in a tumultuous economy, one thing is for sure: this is set to be a tough winter for the nation’s vulnerable venues.

20 THURSDAY 24 NOVEMBER 2022 NEWS

Restaurants are afraid energy firms are profiteering in crisis, write

and Nicholas

are headed

really dangerous recession FEELING THE CHILL?

Emily Hawkins

Earl Venues

for a

CITY

DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

FTSE 100 squeezes out gains despite yet more recession warnings

LONDON’s FTSE 100 finished higher yesterday despite yet more data signalling the UK is on a sure path to recession.

The capital’s premier index climbed 0.17 per cent to 7,465.24 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, jumped 0.4 per cent to 19,500.5 points.

Traders seemingly shrugged off a fresh purchasing managers’ index yesterday that revealed the UK private sector economy is still shrinking.

The flash PMI for November inched ever so slightly higher to 48.3 points from 48.2 in October, meaning it has now been below the 50 point growth threshold for four months in a row.

FTSE 100 retailers posted a strong day ahead of Black Friday this week.

Mike Ashley’s Fraser bumped 3.99 per cent higher, while Primark owner Associated British Foods added 2.63 per cent.

Analysts also said betting groups listed on the index such as Flutter Entertainment and Entain could receive a boost from punters laying bets on the World Cup.

“The scope for shock results like the Argentina, Saudi Arabia game potentially has the scope to drive an increase in betting patterns as the tournament progresses,” Michael Hewson, chief market analyst at CMC Markets UK, said.

Short haul airlines Easyjet and Wizz Air propped up the midcap FTSE 250, climbing 2.85 per cent and 5.47 per cent respectively.

The pound strengthened sharply against the US dollar, adding 1.2 per cent. UK borrowing costs slipped over 12 basis points to nearly three per cent.

Wall Street opened higher.

Bakkavor saw its ebit forecast reduced by around two per cent yesterday after it said it was expecting its full year result to be at the lower end of consensus, currently between £88.6m and £91.7m. While third quarter performance was as expected, September volumes slowed down as the cost-of-living crisis started to bite. US margins were hindered by inflation and operational issues.

HOSTELWORLD

Analysts at Peel Hunt have picked Hostelworld’s numbers and reiterated their ‘Buy’ recommendation following yesterday’s trading update. Predicted net revenue and ebitda – respectively around €70m and €1m – were in line with analysts’ expectations. Analysts said Hostelworld has been its strongest performer over the past year, “as it laid to rest concerns that it would struggle for relevance post-Covid”.

21 THURSDAY 24 NOVEMBER 2022 MARKETS CITYAM.COM

P 23 Nov 88.9 18 Nov 17 Nov 23 Nov 22 Nov BAKKAVOR 88 21 Nov 89 90 91 92 93 94 95

To

P 18

17

23

appear in Best of the Brokers, email your research to notes@cityam.com

Nov

Nov

Nov 22 Nov

23 Nov 96.1 90

91 92 93 94 95 96

21 Nov

A LACKLUSTRE SESSION “Having got off to an initially positive start, with the FTSE 100 getting to within touching distance of 7,500, it’s been a fairly lacklustre session as investors weigh up the release of tonight’s FOMC minutes against a backdrop of a weakening economic outlook.”

MICHAEL HEWSON, CMC MARKETS

GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION IT’S FINALLY HERE RIVALRIES RENEWED AS THE SIX NATIONS RETURNS FOR 2022 8-PAGE PULLOUT 2022 SIX NATIONS ENERGY D-DAY Households LONDON’S BUSINESS NEWSPAPER FREE CITYAM.COM THURSDAY 10 FEBRUARY 2022 CITYAM.COM COOL RUNNINGS ALL THE GEAR FOR AN OVERDUE MOUNTAIN BREAK P20 STATE SET MAN IN THE KNOW MARK KLEINMAN GETS THE CITY TALKING P13 LONDON’S BUSINESS NEWSPAPER LONDON’S BUSINESS NEWSPAPER CITYAM.COM Climate noise blocking out THROUGH THE DRINKING GLASS THE LATEST FROM OUR WINE GURU P22 ISASUNWR WHERE PUT MONEYTHIS YEAR WEDNESDAY FEBRUARY 2022 ISSUE 3,677 THE ULTIMATE SAVINGS GUIDE ALL YOU NEED TO KNOW ABOUT YOUR ISA P19-21

EDITED BY SASCHA O’SULLIVAN

It could be said the EU was never going to offer Britain a Switzerland-style deal

response causes the EU to insist upon greater safeguards against non-compliance. Such worries are of course magnified by Britain having been an awkward partner for decades, always looking to walk back things it had agreed, or seeking exemptions to what everyone else wanted to do.

IT IS often said that Britain is a nation divided by our relationship with Europe, but British people are in fact united in their disinterest as to how the European Union works. To most it will always come across as a byzantine mixture of commissions, councils, and competencies presided over by a rather grey cadre of foreigners, of whom, a suspiciously large number get to call themselves President.

The purest expression of this ignorance is the repeated failure by nearly everyone within the Brexit debate to argue for the relationship they want with Europe from first principles. Instead, other nations are used as a crude shorthand for the type of relationship that they believe is best for Britain. As Brexit Secretary, David Davis championed the EU’s free trade deal with Canada as an example of how you could secure close economic ties without staying in the Single Market. Likewise, Theresa May would often be said to be trying to pursue a Swiss-style relationship with the EU, one where Britain would get to pick and choose which bits of the European project it participated in. Meanwhile those who wanted to stay inside the Single Market would talk about following Norway’s example.

The problem with all this is that the

EU wasn’t willing to offer those countries’ deals to Britain. Alarmingly that is clearest with respect to Switzerland, which makes the angst over suggestions Jeremy Hunt is pursuing a route to follow Geneva all the more bizarre.