JEREMY HUNT delivered a pre-Christmas lump of coal to Brits across the country yesterday as he unveiled a swathe of business and personal tax hikes.

Stealth income tax hikes are set to squeeze families, while businesses will pay more in National Insurance Contributions as the government tries to balance the books.

The Chancellor raised £55bn in his autumn fiscal statement through a mixture of tax rises and spending hikes, with Hunt saying fiscal consolidation was

needed “to tackle inflation and keep mortgage rises down”.

It came as the Office for Budget Responsibility said the UK was already in a recession and that living standards will “fall seven per cent over two years, wiping out eight years’ growth”.

The highest income earners were hit hardest as the top tax bracket was reduced from £150,000 to £125,140, while the Chancellor also froze thresholds for the two lower brackets.

The dividend allowance was slashed from £2,000 to £500, while the capital gains tax allowance was slashed from

£12,300 to £3,000 in policies described as akin to “crushing the entrepreneurial spirit” by accountancy firm HW Fisher.

The Chancellor said “we ask those with more to contribute more” and that the UK’s historic levels of Covid-19 spending has “to be paid for”.

Whitehall departments were told they would have to make “efficiencies to deal with inflationary pressures in the next two years”, while difficult decisions on spending cuts were deferred until after the next election in 2024.

The energy price guarantee will continue in targeted fashion at a higher

level beyond April’s current deadline.

The NHS and education budgets got a bump, while pensions and benefits will increase in line with inflation next year.

There were pre-statement rumblings in Westminster that the right of the Tory party would rebel against the expected tax hikes when they come to a vote next year.

One senior Tory MP said Hunt and Rishi Sunak “have killed the concept or argument of a Conservative way of an economy”.

When asked about a potential rebellion, they said: “By April, if MPs are seeing real

hardship and real problems and an economy deeper into recession then I think all bets are off.”

Labour shadow chancellor Rachel Reeves said “no other advanced economy is cutting spending or increasing taxes on working people as they head into a recession”.

“No-one was talking about cuts to public spending two months ago,” Reeves said.

The Chancellor did say he was keen to work with the City on changes to financial services regulation in an attempt to replicate the 1980s success of Nigel Lawson’s ‘Big Bang’.

LONDON’S BUSINESS NEWSPAPER ENGLAND EXPECTS QATAR AWAITS –BUT FIRST, IT’S THE ALL BLACKS P18-19 ENRON ADMINISTRATOR: FTX IS WORST THING I’VE EVER SEEN THE DAMNING VERDICT ON CRYPTO COLLAPSE P10 FRIDAY 18 NOVEMBER 2022 ISSUE 3,864 FREE CITYAM.COM

STEFAN BOSCIA

AT A GLANCE £HIGHER RATE THRESHOLD FALLS TO £125,000 IN RAID ON HIGH EARNERS £INCOME TAX THRESHOLDS FROZEN IN STEALTH INCREASE ON MILLIONS £DIVI AND CAPITAL GAINS TWEAKS TO HIT ENTREPRENEURS AND INVESTORS £NEW TAX ON ENERGY GENERATORS AND EXPANDED WINDFALL TAX £SO-CALLED ‘JOBS TAX’ THRESHOLD FROZEN IN £25BN BILL FOR BUSINESS £PENSIONERS KEEP ‘TRIPLE LOCK’ AND BENEFITS UPRATED WITH INFLATION £BUSINESS RATES RELIEF TO HELP RETAIL AND HOSPITALITY BUSINESSES £CHANGES ANNOUNCED ON SOLVENCY II REGULATIONS TO FREE UP INVESTMENT CHANCELLOR ‘FIXES’ THE FINANCES WITH TAX RAID - BUT PUSHES BACK SPENDING CUTS FULL COVERAGE PAGES: 2,3,4,14,15

STANDING UP FOR THE CITY

Tory ‘pragmatism’ looks a lot like a recipe for lower growth

What does the Conservative party stand for? It is a question that has intrigued for decades. Some Tory ‘philosophers’ opine that it’s not so much an ideology as a belief in pragmatism –of doing the sensible thing. Others argue it’s a project rooted in the free trade arguments over the corn laws. Well, this is what the Conservative party stands for at the moment. Higher taxes on aspiration, and

THE CITY VIEW

stealth taxes on the labour of ordinary people. Arbitrary windfall taxes on productive industries. Higher spending on the NHS, without any obvious requirement on it to reform. Cuts to capital spending in the long term. Tax raids on entrepreneurs

and those with small investment portfolios, or those who’ve built up share options whilst working in high-growth start-ups. It stands for hiking government spending from 39.6 per cent of GDP in 2020 to 43.4 per cent of GDP in 2028, and pushing taxes up from 36.7 per cent of GDP to 41.1 per cent over the same period. It stands for –and please do write in if you’ve clocked how this works –costly net zero commitments whilst also whacking taxes on

electric cars. It stands for millionaire pensioners. It stands for the housing status quo. It stands for a rail network that’s half nationalised and half broken. It stands, in short, for decadeshigh levels of taxation and decades-high level of dissatisfaction with public services. Perhaps this is the sensible thing –a pragmatic attempt to get markets back onside and then, assuming global factors bend in our favour, cancel

most of what was announced yesterday in a couple of years. It’s hard to shake the idea though that we are headed too far, too fast in the opposite direction to Kwasi Kwarteng et al –a disastrous hightax, low-spend economy that will strangle growth now and in the long term. The worst bit? Labour might still be even worse.

The greatest tragedy of Trussonomics is that the execution was so bad her ideas have disappeared with her.

BEST OF TWITTER

Between 2019/20 and 2027/28, the Conservatives are now planning to have increased govt spending from 39.6% of GDP to 43.4%, with receipts up from 36.7% to 41.1%.

Former City A.M. columnist and now Cato Institute wonk @MrRBourne

To ensure the markets are fully appeased, at the end of the budget we should sacrifice a junior treasury official to the Gilt Gods.

Comedian @GeoffNorcott

How many years after a ‘windfall’ can a 75% tax on profits really be called a ‘windfall tax’?

IEA Economist @JulianHJessop

On these forecasts, the Tories will be going into the next election with unemployment rising, house prices falling, taxes rising, living standards falling faster than any time since the 1950s, a recent recession. In a word: Tricky.

Telegraph journo @BenRileySmith

Funny listening to Hunt talk about energy efficiency as the wind whistles through the windows of parliament.

Politico hack @EstWebber

Stark... that it took us 8 whole years to eke out that amount of growth in the first place.

FT columnist @sarahoconnor

Markets muted as Hunt escapes fate of Kwarteng –despite low growth warning

FINANCIAL markets largely glossed over Chancellor Jeremy Hunt’s £55bn worth of tax hikes and spending cuts yesterday, a marked change from them spitting out his predecessor Kwasi Kwarteng’s mini-budget.

London’s FTSE 100 closed broadly flat, edging 0.06 per cent lower, while the domestically-focused mid-cap FTSE 250 index kicked 0.05 per cent higher.

Most of the selling was concentrated on the pound, which weakened nearly one per cent against the US dollar.

UK borrowing costs nudged higher,

but remain below the more than 20year high they hit after Kwarteng and former Prime Minister Liz Truss unleashed £45bn of unfunded tax cuts on 23 September.

Low trend growth, a swelling debt interest bill sparked by a global interest rate surge and soaring inflation have hacked the UK’s public finances, forcing Hunt into sweeping tax hikes and spending cuts.

A historic living standards squeeze of seven per cent, forecast by the Office for Budget Responsibility, will drive a year long recession, partly weakening market sentiment toward the pound.

But, analysts said bets on the US Federal Reserve sticking to its aggressive interest rate hike cycle strengthened the dollar, putting downward pressure on the pound.

“While sterling traded slightly weaker in the immediate aftermath [of the Autumn Statement], much of that was based on the broad strength of the USD, so it wasn’t necessarily sterling specific,” Ian Tew, head of G10 FX spot trading at Barclays, said.

“A lot of negativity is known and already priced in and fiscal prudence and stability has been re-instated,” he added.

Lenders breathe sigh of relief as bank surcharge cut stays

SHARES in UK lenders jumped yesterday as the government confirmed it would slash a surcharge on bank profits from eight to three per cent, in a bid to keep the UK’s finance industry internationally competitive.

Chancellor Jeremy Hunt confirmed the government would cut an existing eight per cent levy on lenders’ profits to three per cent.

The move comes after London’s financial bosses had voiced concerns that keeping the elevated levy on UK lenders would dampen the appeal of

the City on the international stage and choke off investment.

However, corporation tax is set to jump to 25 per cent from April, meaning that the overall tax rate on lenders will rise to 28 per cent from the current level of 27 per cent, though fears were for worse.

Shares in Britain’s biggest lenders surged on the news yesterday, with Lloyd’s Banking Group rising beyond three per cent, Natwest closing the day up nearly 2.5 per cent and Barclays rising over 1.5 per cent.

Richard Milnes, UK Banking Tax Partner at EY, said the move would “reassure” the sector.

CITYAM.COM 02 FRIDAY 18 NOVEMBER 2022 NEWS

JACK BARNETT

CHARLIE CONCHIE

GOODWILL HUNTING The Chancellor –the fourth this year –announces his Autumn Statement to a quieter than usual Tory party and a bloodthirsty Labour frontbench

PARLIAMENT/JESSICA TAYLOR

©UK

Solvency II reforms a ray of sunlight on otherwise grey day

CHARLIE CONCHIE AND LOUIS GOSS

THE GOVERNMENT revealed plans to overhaul Solvency II rules yesterday in a bid to unlock “tens of billions of pounds” of investment from the UK’s insurance giants.

In the Autumn Statement, the Chancellor Jeremy Hunt said the government would look to make the UK the world's “world’s most innovative, dynamic and competitive global financial centre” by pushing ahead with plans to release cash locked up at insurance firms under the current EUera rules.

In the consultation response pub-

lished shortly after Hunt’s statement, the government outlined plans for the new ‘Solvency UK’ regime and said the “financial services regulatory framework must adapt to the UK’s new position outside of the European Union”.

Ministers are now poised to legislate to change the risk margin for long term life insurance firms and broaden the ‘matching adjustment’ eligibility criteria, in a bid to free up capital.

Andy Briggs, the boss of Phoenix Group (right), which has around £270bn assets under administration, told City A.M. yesterday that the firm “very much wel-

Budget watchdog: It’s really, really, really, really bad

ment’s debt interest bill, tripping Hunt into a big financial tightening.

THE UK is already in a recession that will burn a huge hole in the public finances, the country’s fiscal watchdog warned yesterday in forecasts published alongside Jeremy Hunt’s Autumn Statement.

The Office for Budget Responsibility (OBR) sharply downgraded its forecasts for the UK economy since its last projections just eight months ago in March.

Back then, the fiscal watchdog created by former Chancellor George Osborne in 2010 reckoned the economy would grow 1.8 per cent next year. Now, it has warned of a 1.4 per cent contraction.

The anaemic growth outlook has weakened the UK’s finances, forcing Hunt into £55bn of tax rises and spending cuts. The move means he has met his new fiscal targets of getting debt as a share of the economy falling and to have borrowing to fund day-to-day spending not exceed three per cent in five years.

Rising interest rates have also swelled the govern-

Even in five years, the UK will be repaying its creditors over £100bn, greater spending than “any single public service bar the NHS,” Paul Johnson, director of the economic think tank the Institute for Fiscal Studies, said.

The OBR reckons taxes as a share of the economy will peak at 37.5 per cent, the highest level since the late 1940s.

UK GDP will be just over two per cent smaller by the end of a year-long recession, the OBR said. Weaker growth is set to cut government tax revenues, forcing borrowing up to £177bn this year, higher than the £99bn the OBR forecast in March. The debt pile will rise £140bn next year and climb a shade under £70bn in five years.

A historic living standards shock of seven per cent – wiping out eight years of growth –triggered by raging inflation is plaguing household and business finances, prompting the economic downturn.

The Chancellor was keen to lay the blame at the door of Russia’s invasion of Ukraine, and said energy prices were the key driver.

Source:OBR

Source:OBR

comes what is being proposed” and the firm would now be in a position to pump cash into illiquid projects like

“We’ve already got £40bn of existing annuities where we’d like a higher proportion invested in these types of [assets], so the money’s absolutely there and ready to go, all of it while staying very safe and secure for policyholders,” he said in an interview.

He added that the firm would be looking to invest £40 to £50bn in “green infrastructure, levelling-up social housing-type assets” over the next five years.

Aviva boss Amanda Blanc (far left) also welcomed

the change.

Solvency II reform has been at the heart of the government’s plans to spur a ‘Big Bang’ in the financial services industry by loosening the capital buffers on the UK’s insurance giants.

The plans have been the subject of dispute with the Prudential Regulation Authority (PRA), however, over concerns it could harm policy holders.

In a statement yesterday, the PRA backed down and said it would now roll out the measures.

“Following the government’s announcements today about its plans to legislate reforms... the key decisions will now be for Parliament and we will implement those decisions faithfully.”

GROWTH

STILL NEEDS TO BE PRIORITISED

SHEVAUN HAVILAND, BRITISH CHAMBERS OF COMMERCE: In the teeth of a recession, this statement will not increase business confidence. The government must do more to improve conditions for businesses to invest and grow otherwise we will be starting from a weak base to power our recovery once global economic conditions stabilise.

KITTY USSHER, INSTITUTE OF DIRECTORS: In the longer term... [yesterday’s] Autumn Statement will be judged on whether it set the stage for a sustained period of growth once the current difficulties have eased. But [Hunt] failed to follow through on one of the key elements of that speech, namely the possibility of using tax policy to incentivise employers.

FISCAL-YEAR GROWTH RATES

PAUL JOHNSON, INSTITUTE FOR FISCAL STUDIES: The swing over a couple of months from Kwasi

Kwarteng’s fiscal loosening to a big fiscal tightening is a belated recognition of some harsh fiscal realities. The sharp and sustained increase in how much we now expect to spend on debt interest, in particular, has forced difficult decisions elsewhere.

JAMES SILVER

THE SALARY at which the top rate of tax kicks in was slashed from £150,000 to just north of £125,000 yesterday –only weeks after the Chancellor’s predecessor Kwasi Kwarteng had told Brits he would scrap the 45p rate altogether.

The move will inevitably hit

London and the South East hardest, where salaries are the highest.

The fall hits six-figure earners doubly hard as income between £100,000 and £120,000 is already taxed at an effective marginal rate of 62 per cent due to the removal of the National Insurance allowance.

Neela Chauhan, a partner at accountants UHY Hacker Young, said

yesterday the move risked “losing internationally-mobile talent overseas”.

“The £150,000 rate was only introduced as an emergency response to the Global Financial Crisis and HMRC soon came to rely on it for its normal income. Now it’s gone... further and dragged more people into that tax band.”

03 FRIDAY 18 NOVEMBER 2022 NEWS CITYAM.COM AUTUMN STATEMENT 2022

JACK BARNETT

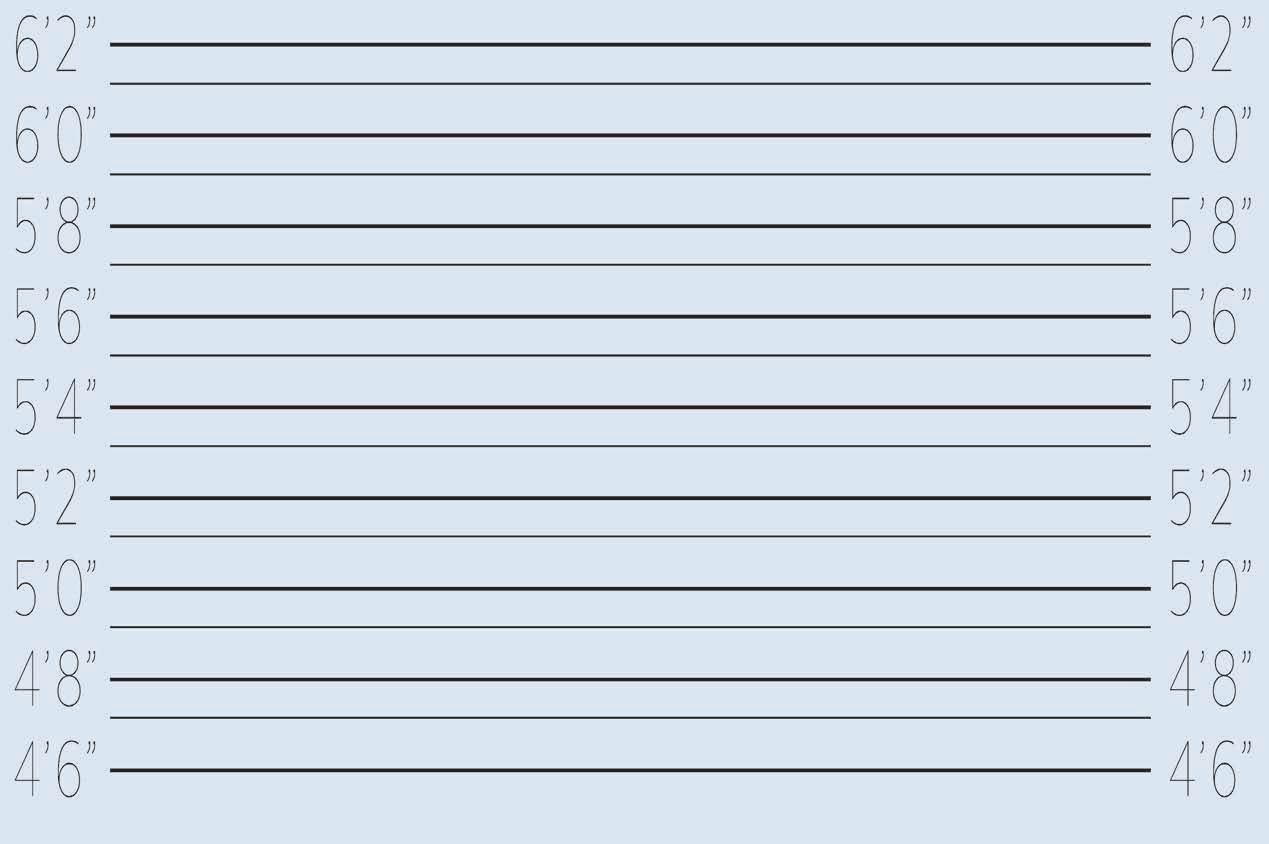

NATIONAL ACCOUNTS TAXES AS A SHARE OF GDP 19481958-59 1978-79 1998-99

26 28 30 32 34 36 38 Historical data 2010-2011 onwards, Magnified scale March 2020 Forecast March 2022 Forecast November 2022 pre-measures forecast November 2022 Forecast March 2020 Outturn Per cent of GDP REAL GDP 20182019202020212022202320242025202620272028 75 80 85 90 95 100 105 110 115 Forecast Q4 2019 = 100 March 2022 Forecast November 2022 pre-measures forecast November 2022 Forecast

10-1112-1314-1516-1718-1920-2122-2324-2526-27

1956-571971-721986-87 2001-02 2016-17 -6 -4 -2 0 2 4 6 8 10 Forecast Per cent

rate threshold slashed by £25,000 only weeks

planned scrappage

Top

after

STAMP ON IT Homebuyer relief to last until 2025 JEREMY HUNT announced that relief on stamp duty would last until 2025 –with the price at which one starts paying the house-buying tax at £250,000 rather than £125,000.

Electric vehicle tax set to send green car market into reverse, warns Nissan

ILARIA GRASSO MACOLA

NISSAN said yesterday it was “concerned” about the government’s decision to introduce a vehicle excise duty for electric car owners from 2025.

“While we are pleased to see a growing electric vehicle (EV) market in the UK, we’re concerned about the effect that withdrawing this customer incentive could have on the electric car market, just as it is accelerating,” a company

Windfall tax and new power levy bad for investors

ONE OF the leading figures in the energy industry has slammed the government’s decision to impose a new tax on electricity generators.

Keith Anderson, chief executive of Scottish Power, warned yesterday the new Electricity Generator Levy will create a “five-year long corridor of uncertainty for investors” which risks

bumper profits from across the energy sector to pay for further support for households and businesses grappling with record energy bills.

Hunt also unveiled a 10 percentage point hike and a three year extension to the original windfall tax, the Energy Profits Levy – raising a further £20bn.

Harbour Energy, the largest oil and gas producer in the North Sea, confirmed to City A.M. it was “reviewing

LUXURY

spokesperson told City A.M. Chancellor Jeremy Hunt announced yesterday morning that EVs would no longer be exempt from paying the tax as part of the government’s Autumn Budget.

Until yesterday’s announcement, the vehicle excise duty (VED) was paid by all fuel and diesel vehicles that used the UK’s public road network.

Hunt told Parliament the rate increase for EVs would be capped at one percentage point for the first three years

from 2025.

Nissan’s remarks were echoed by Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, who said the new measure would “threaten both the new and second-hand EV markets.”

“With a zero emission vehicle mandate for car and van manufacturers, we need a framework that encourages consumers and businesses to buy electric vehicles,” Hawes commented.

Hospitality: Help welcome but far more needed

EMILY HAWKINS

HIGH STREET and hospitality leaders issued bleak warnings yesterday despite the Chancellor’s announcement of changes to business rates.

Businesses had been concerned that rates would go up by inflation in April, but Jeremy Hunt yesterday froze the so-called ‘multiplier’ in a measure he said will be worth £13.6bn in total.

Rate relief will also increase for retail and hospitality businesses for 2023 to 2024.

Industry groups said the policies fell short of what would help save the sector.

UKHospitality boss Kate Nicholls said the Chancellor had failed to set out a “serious plan” for economic growth, with a blueprint urgently required.

End

undermining the UK’s green ambitions.

He told City A.M.: “In times of national crisis everyone should be playing their part. I’m deeply disappointed that renewables have been singled out – it seems it’s a recession made by gas, but a recovery to be paid for by renewables.”

The Chancellor wants to harness

the impact” on its business from “yet another change in the tax regime for UK oil and gas companies”.

A spokesperson said: “The levy, as currently designed, disproportionately impacts independent UK oil and gas companies and does not target genuine windfall profits.”

Last week trade bodies warned investment would dry up if taxes increased.

Jeremy

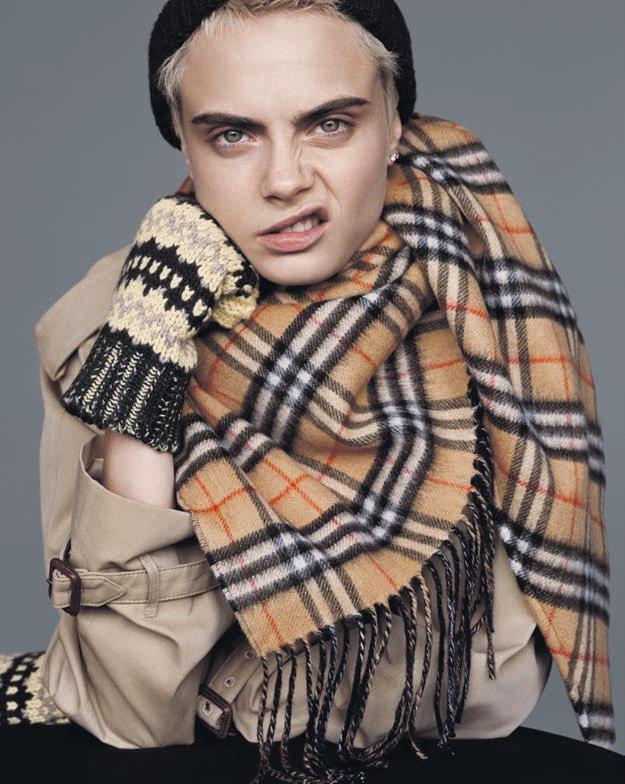

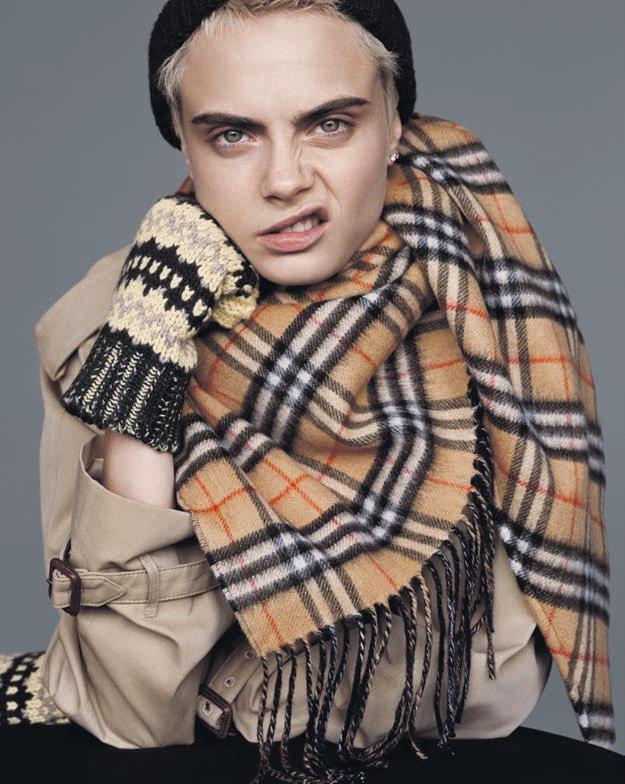

British brand Burberry, which makes the iconic trench coat, said the government’s policy had hindered the country as a shopping destination.

While there had been a boost to

Divis and gains tweak to hit entrepreneurs

CHARLIE CONCHIE

THE CHANCELLOR slashed the exemption level for capital gains tax and cut the dividend allowance in half yesterday in a move that will strike a “heavy blow” to the UK’s entrepreneurs and investors.

In the Autumn Statement, Jeremy Hunt said the government would cut the dividend allowance from £2,000 to £1,000, with a further 50 per cent cut due to come from April 2024, meaning investors will pay tax on dividends above those levels depending on their wider income.

Entrepreneurs who pay themselves via dividends are also set to be hammered by the measures announced by Hunt.

A cut in the Capital Gains Tax threshold from £12,000 to £6,000 meanwhile is set to hit those with their cash outside ISAs and pensions tax wrappers, who will now pay a higher tax rate on their returns.

Analysts say the dual tax tweaks could choke off investment and dampen returns at a time when ministers should be encouraging investors to back UK firms.

“A dividend tax that kicks in at

just £500 of earnings by 2024 could disincentivise investing at a time when it is really needed to help the economy grow, and for millions of investors who are looking to do more with their money to stay ahead of the pernicious effects of inflation,” Sam North, market analyst at Etoro, said.

Analysts at Bowmore Asset Management said the changes to capital gains tax and dividends were a “double whammy” against investors, with client director Charles Incledon adding that smaller investors would be the worst hit.

visitors from the US, it had not been to “the same degree as we used to see, as many are going into Paris and Milan and continental Europe instead,” Burberry’s finance and operating chief Julie Brown said.

“It is clearly one of the implications of the VAT [free shopping] being removed,” she said as the firm announced positive results.

The Association of International Retail’s chief executive Paul Barnes dubbed the omission as a “bitter disappointment” to retailers from Bond Street to the Bull Ring.

“There is nothing to give firms confidence, let alone invest,” Nicholls said.

Meanwhile nightclub trade body the Night Time Industries Association said the fiscal statement had “not gone far enough and still lacks clarity”.

Businesses would “remember the fourth failed attempt to deliver a budget to safeguard businesses at the sharpest end of the crisis,” the trade body’s boss Michael Kill said. The government will move ahead with a revaluation to come into force on April 1 next year.

THE GOVERNMENT said yesterday that it would not be moving forward with the online sales tax, which some high street have called for in the face of rising ecommerce competition. Hunt axed plans stating that the tax would have been too complicated and led to unfair consequences.

CITYAM.COM 04 FRIDAY 18 NOVEMBER 2022 NEWS AUTUMN STATEMENT 2022

NICHOLAS EARL

retailers and West

bosses yesterday slammed the Chancellor for not changing his mind on an introduction of VAT free shopping for overseas shoppers.

Hunt made no mention of the prospect of introducing tax-free shopping for tourists visiting London’s shopping heartlands.

FASHION FURY Burberry warns tourists going elsewhere –but no VAT relief on way

£14bn

ONLINE

SALES

SCRAP Hunt snubs plans to level tax playing field for UK retail firms

The cost of the new generators levy over the next five years

EY’s global split could undermine audit quality, warn former partners

LOUIS GOSS

EY’s plans to split in two could weaken both segments of the business and undermine the firm’s audit quality, EY’s former partners have warned.

In a letter to EY’s board, the expartners said the firm’s new standalone audit business, Assureco, would have “significantly

lower” earnings than its advisory business, as they warned Assureco may lack sufficient resources. This in turn could impact the quality of EY’s audit work, they warned.

The former partners said any threat to the quality of EY’s audit work could see regulators take a harsher stance towards the split, which is aimed at freeing EY from the conflictof-interest problems that have

troubled the Big Four for years. An EY spokesperson said they believed the split would “provide the best opportunities for growth”.The letter also called on the firm to be transparent with leadership decisions. While it is presumed EY’s current chief Carmine DiSibio will lead the consulting arm, the letter said it remained “totally unclear” who would lead the audit business.

Bulb bailout bill swells to £6.5bn, OBR reveals

NICHOLAS EARL

THE COST of bailing out Bulb Energy will hit £6.5bn, according to the latest reports from the Office for Budget Responsibility (OBR).

Documents released yesterday by the public body, accompanying the Autumn Statement, revealed that an extra £4.6bn has been spent overseeing the company’s de-facto nationalisation in 202223, bringing the total to £6.5bn.

This is a sharp uptick from March, when the OBR predicted the statebacked rescue would cost £2.2bn over two years, while more recent calculations from forecasters suggested it would cost £4bn.

The challenger supplier fell into defacto nationalisation last November, crumbling under soaring gas prices, the constraints of the price cap and an insufficient hedging strategy.

Since then, Bulb has been unable to hedge to meet the energy needs of its 1.6m customers, having to buy gas at spot prices on highly volatile wholesale markets, which has driven up the costs.

It has also endured a protracted sale

process, finally being sold to rival Octopus last month, under terms which remain opaque.

City A.M. understands the deal includes a nine figure lump sum, a profit-sharing deal and hedging support.

However, the terms around the profitshare deal and the hedging support are yet to be clearly outlined, including the potential interest rates and the percentages involved in any profit arrangements. The size of Bulb’s customer credit balances are also unknown.

Meanwhile, Ofgem’s report on the impact of the transaction on consumers is yet to be published.

The deal, however, has been delayed following a legal challenge from rival energy firms.

Energy suppliers Centrica, EON UK, and Scottish Power last week challenged the sale in court over concerns around market competition and transparency.

The next hearing in the case is scheduled to take place in two weeks’ time.

Octopus declined to comment on the new bailout cost. Teneo, Bulb’s administrator, didn’t immediately respond to a request for comment.

NOW THAT’S A CLIMATE CHANGE City rooftop installs igloos for winter drinking

UK’s nuclear ambitions lifted after Hunt grants £700m for Sizewell C

NICHOLAS EARL

THE UK’s nuclear ambitions were given a fresh vote of confidence from the government yesterday, after Chancellor Jeremy Hunt confirmed he would back the proposed Sizewell C nuclear power plant with an initial £700m investment.

Hunt announced contracts for the funding would be signed within a matter of weeks, paving the way for its eventual approval.

The funding pledge was first made by Boris Johnson this summer, in one of his final acts as Prime Minister.

There had been doubts swirling in recent weeks over the funding, amid growing concerns it could be axed by Hunt in a scramble for savings, forcing Downing Street into a denial.

Hunt said: “Our £700m investment is the first state backing for a nuclear project in over 30 years and represents the biggest step in our journey to energy independence.”

CITYAM.COM 06 FRIDAY 18 NOVEMBER 2022 NEWS

JEREMY HUNT may be doing his best to batter disposable incomes but Wagtail, a new rooftop bar overlooking London Bridge, is hoping to tempt punters through the winter months with two igloos and a heated terrace bar, in partnership with Johnny Walker Blue.

Computer chip bosses slam sluggish Nexperia national security probe

TURNER

COMPUTER chip bosses have criticized the government’s handling of a national security review, which ordered a Chinese-backed firm that owns Britain’s largest semiconductor factory to sell most of its stake in the business over potential security concerns.

The government on Wednesday night ordered Nexperia, owned by Chinese firm Wingtech, to sell its 86 per cent stake in Newport Wafer Fab after it ruled that Nexperia’s control

of the UK firm could “undermine UK capabilities.”

Graham Curren, CEO and founder of a freshly London-listed chip designer and producer Sondrel told City A.M. yesterday that the ruling was “too much stick and not enough carrot”.

“What does concern me is the idea that everything technology should be blocked without putting an alternative plan in place. It’s very easy just to say no all the time but if they’re not going to get investment

Royal Mail asks government for fewer letter days

LEAH MONTEBELLO

ROYAL Mail has asked the government to cut its letter delivery service from six to five days as the beleaguered firm attempts to claw itself out of financial crisis.

The former state-owned company, now known as International Distributions Services (IDS), called on ministers to reduce the number of delivery days to ensure the “long-term sustainability” of the universal service –the legal guarantee to offer the same price for deliveries across the country.

IDS posted an operating loss of £163m in the half year, 152.4 per cent down from the previous year, where it had a profit of £311m. Revenue was also down nearly four per cent to £5.8bn, with Royal Mail’s delivery arm dragging the firm down.

Chief executive Simon Thompson told City A.M. he would do “whatever it takes” to turn the company around, confirming

plans to shrink the workforce by 10,000 by next August, with around 5,000-6,000 redundancies required this year.

Royal Mail estimates that the Communication Workers Union (CWU) strike has already cost the firm £100m.

The company entered into pay discussions with the CWU earlier this year over the company’s 5.5 per cent pay rise. Deeming this offer “inadequate” against soaring inflation, the union has held eight days of industrial action this year, with four further days coming. Thompson said conversations with the union were ongoing, but suggested that further action over Black Friday – the biggest shopping day for online retailers and delivery partners – was still set to go ahead.

The Royal Mail boss said the firm was working on contingency plans.

Hargreaves Lansdown’s equity analyst Matt Britzman said battles with unions are “never good for business”.

from China then where does the investment come from?”

The chip founder said he hoped the decision – more than a year in the making – would not deter businesses from seeking investment in the UK.

Dr. Simon Thomas, CEO and founder of graphene-based chipmaker Paragraf, also warned that the drawnout investigation could make backing UK tech firms look less appealing.

“Of course, we need to protect national security, but not to the detriment of businesses,” Thomas said.

STRIKE NO MORE Train drivers’ union cancels planned November 26 walkout

ASLEF bosses yesterday said they had received an offer from operator Arriva Rail London and put it to members, who will decide whether to take it.

Arriva, in turn, said it was hoping for a positive outcome.

MITIE FEELS THE PINCH AS LUCRATIVE COVID-19 CONTRACTS DROP OFF

Outsourcing firm Mitie said a drop-off in high-margin Covid contracts had dented profits in the first half of the year despite new contract wins and price inflation helping lift revenues.

Operating profit before other items came in at £68m for the six months to the end of September, down 20 per cent on last year. However, revenues jumped to £1.92bn, up from £1.912m on the back of new contract wins, acquisitions and price inflation.

Group chief Phil Bentley said the firm’s results reflect “good underlying performance across all divisions”.

“New contract wins, recent acquisitions and pricing have more than replaced the short-term revenue boost from COVID-related contracts in the first half of last year,” he said.

CREST NICHOLSON HALTS OPENING OF NEW DIVISION AS FORWARD SALES SLOW

British housebuilder Crest Nicholson has halted the opening of its third new division as rising interest rates dampen the desire to buy a home.

Forward sales in the past three months have fallen behind the rate seen a year ago.

MILLIE TURNER

GPE, formerly known as Great Portland Estates, is continuing to inject £1.1bn into feeding a “starved” central London office market despite blows from rising interest rates.

The London-listed firm, which yesterday secured a record leasing of the City’s 2 Aldermanbury Square to Clifford Chance, is one of the largest office leasers in the capital.

However, the firm has suffered a dent to its portfolio valuation, which tumbled 3.4 per cent to £2.6bn, led by

a decline in its range of offices.

Chief executive Toby Courtauld said: “The central London office market is prospectively starved of new Grade A supply and we plan to deliver our £1.1bn capex programme into this shortage and a recovering economy.

“Over the past six months, property values in our markets have come under pressure, given the challenging macro-economic and geopolitical environment. However, demand for best in class spaces remains robust, driving strong leasing activity.”

The FTSE 250 firm booked £526.2m in orders as of last week –the equivalent of 2,038 units –as opposed to £623.9m and 2,502 units 12-months prior.

Chief executive Peter Truscott said: “Given the well-publicised economic conditions we believe it is the right decision to defer the planned opening of a third new division and adjust the pace of growth in our existing ones until a more stable environment returns.”

Shares closed down 2.89 per cent yesterday.

Lidl’s profits quadruple as shoppers switch to cheaper supermarkets

ANNA WISE

PROFITS at the British arm of supermarket chain Lidl have more than quadrupled as it expanded the number of stores and attracted more customers over the year.

Pre-tax profits reached £41.1 million in the year to February 28, surging 319 per cent from the £9.8 million posted

the same time last year.

Over 770,000 more people shop with the supermarket each week compared with last year as people switch shops to save money, Lidl said.

The discounted chain opened 53 new stores over the year to February –reaching a total of 918 across Britain

Lidl, which was named the UK’s cheapest supermarket this month by

The Grocer, stressed that it would continue to meet its promise to customers of offering the lowest prices in the market.

Ryan McDonnell, Lidl Great Britain’s chief executive, told the PA news agency: “There is no doubt that there is inflation in the market, but relative to that difficult situation, we remain to offer the best value.”

CITYAM.COM 08 FRIDAY 18 NOVEMBER 2022 NEWS

Lidl was crowned the UK’s cheapest supermarket this month

Shares in one of London’s biggest property owners closed down 1.9 per cent yesterday

MILLIE

GPE

injects £1.1bn into ‘starved’ city office market despite rates hit

PA

NEWS IN BRIEF

Government aid

‘close to zero’, says Fuller’s CEO

EMILY HAWKINS AND MILLIE TURNER

EMILY HAWKINS AND MILLIE TURNER

THE GOVERNMENT has not issued any “meaningful support” for the pub sector, the boss of Fuller, Smith & Turner, told City A.M., following the budget.

Although the country now had a “very strong” Prime Minister and “very solid” Chancellor in place, the pub sector had been offered “close to zero support” amid a worsening economic environment, CEO Simon Emeny said.

Structural reform of the business rates system had seemingly been “put in a ‘too difficult’ box”, he said.

While Fuller’s, which recently celebrated its 177-year birthday, had a business model that could withstand “shocks”, Emeny was concerned about the wider industry.

The chain was not seeing any impact of the cost of living crunch on consumer behaviour “at the moment”, he said.

With a pub estate in the south

of England and a relatively affluent customer base, the pub boss was optimistic that going to the pub would be an “affordable treat” for its customer base amid the tough winter ahead.

Emeny said the “most discernible” factor had been the easing of a “postCovid, stay-at-home hangover”, with after-work drinkers pushing up sales in cities once more.

The pub chain and former brewer revealed yesterday its numbers had been boosted by commuters returning to cities after a working from home era.

The London-listed chain saw sales in central London jump 20 per cent in the seven weeks to mid-November – fuelling a nearly 70 per cent jump in the first six months of the year.

Revenue rose to £168.9m from £116.3m a year ago, as the pub chain said it was ready for an uptick in bookings over Christmas. Large office party bookings had also returned with a bang.

Brits ready to splash £300m in World Cup flutter

BRITISH punters are set to splash over £300m during the Qatar World Cup, according to new data from gambling titan Flutter.

As owner of Paddy Power, Sky Bet and Betfair UK, Flutter said the tournament would undoubtedly be the biggest betting

Investec rolls out £350m share buyback as revenues rise despite market turmoil

CHARLIE CONCHIE

CHARLIE CONCHIE

BANKING and wealth management group Investec yesterday announced it would buy back up to R$7bn (£350m) shares and hike its dividend payout as it reported an 18.9 per cent boost in revenues in the first half of the year.

Bosses at the South African Londonlisted firm said they continue to “successfully navigate” uncertainty in

the macroeconomic backdrop, as revenues at the investor jumped 18.9 per cent, with rising interest rates helping push up takings across its loan book.

The firm, however, said it had suffered a slide in its assets under management, as turmoil in the markets in the first half of the year rocked

its investment portfolio.

Funds under management fell 7.6 per cent to £59bn, which the firm said reflected the “year to date decline in global markets”.

Bosses told reporters on a call that market turmoil in the markets would be most pronounced in the UK as interest rates are hiked fast to try and tame inflation.

event of the year and was on track to surpass the 2018 World Cup figures, which saw €136bn (£119bn) staked based on FIFA-led analysis.

Aside from the hopeful England and Wales fans, Flutter is also banking on a wider international reach, with surges expected in Australia, as well as the USA thanks to its prized Stateside arm Fanduel. However, at 100/1, the Yanks winning the

World Cup trophy represents the biggest overall liability in the outright book.

At 4/1, the Irish bookie has priced the five-time champions of the world, Brazil, as current favourites to lift the Cup, with England captain, Harry Kane, 7/1 favourite to win the Golden Boot for top goal scorer.

Rival firm Entain, which owns Ladbrokes and Coral, is also predicting a record number of bets and stakes next month.

CORPORATE restructuring firm Begbies Traynor yesterday said it was on track for double digit growth as it cashes in on rising insolvencies. The firm said it expects revenue to rise 12 per cent to reach £58.5m.

09 FRIDAY 18 NOVEMBER 2022 NEWS CITYAM.COM

EXCLUSIVE LEAH MONTEBELLO

EVERY DARK CLOUD... Begbies Traynor on track for growth as insolvencies rise

UK law firms hit harder by economic headwinds than US counterparts

LOUIS GOSS

LOUIS GOSS

WHILE law firms around the world have seen demand for their services slow over the first half of 2022, US law firms are seeing stronger growth than their British and Australian rivals, according to new research from Thomson Reuters.

While demand for UK law firms’ services levelled off over the first half of this year, US firms saw demand continue to grow over the same period of time.

US firms saw demand increase 1.1 per cent in the first six months of 2022, following 4.3 per cent growth in demand over the last half of 2021.

By contrast, UK law firms posted higher growth of 8.3 per cent in the second half of last year, before seeing demand for their services plateau over the past six months.

Thomson Reuters analyst Bill Josten explained that “a strong last half of 2021 turned into a much tougher half 2022 as interest rates and inflation impacted global economies”.

The levelling off of demand for legal services comes as law firms continue to face problems in hiring and retaining staff, with firms increasingly upping pay packets in a bid to lure talent.

The survey showed 20.7 per cent of UK law firms still expect higher than average staff turnover this year, compared to 13.2 per cent of their US rivals.

The research comes as law firms have largely resisted layoffs and continued hiring.

New FTX boss says never seen ‘such a failure’

situation is unprecedented.”

THE NEW chief of FTX slammed a “complete failure of corporate controls” at the collapsed crypto exchange yesterday in court filings, which laid bare the scale of the firm’s governance failings.

John Ray III was parachuted in last week to take over from ousted founder Sam Bankman-Fried and oversee the winding up of the firm after it collapsed amid a liquidity crisis.

Ray has over 40 years of legal and restructuring experience and is known as a veteran of corporate insolvencies, having overseen the winding up of fraudulent energy firm Enron –one of the biggest bankruptcies in history.

However, in court filings he claimed FTX was the worst governance failure he had ever encountered.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” he said.

“From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this

FTX is facing an $8bn (£6.7bn) hole in its finances after using customer funds to fuel bets at its sister trading firm Alameda Research. Bankman-Fried and the firm’s remaining employees have been racing to raise emergency cash to pay back out-of-pocket customers.

The filings also revealed that the firm did not have an accounting department, lent billions to Bankman-Fried personally and did not have any centralised control of its cash.

“Cash management procedural failures included the absence of an accurate list of bank accounts and account signatories,” the filings said.

The revelations came after BankmanFried told a reporter at Vox that he and executives “basically forgot” about an account that users wired $8bn onto.

He also said his past courting of regulators and lawmakers was “just PR”, adding “f*ck regulators”.

“They make everything worse. They don’t protect consumers at all,” he said.

Singapore’s Temasek yesterday wrote down its mammoth $275m investment in the exchange, following suit with FTX’s other big name backers like Softbanks’ Vision Fund, which wrote down a loss of just under $100m.

JOHN RAY III SPELLS OUT THE FAILURES OF FTX

this balance sheet was produced while the debtors were controlled by Mr Bankman-Fried, I do not have confidence in it, and the information therein may not be correct as of the date stated.”

submitted payment requests through an online chat platform where a disparate group of supervisors approved disbursements by responding with personalised emojis.”

Embracer slashes earnings forecast amid ‘darker’ economic climate

EMILY HAWKINS

SWEDISH video gaming group Embracer cut its earnings forecast yesterday and admitted it was looking at spinning off some divisions.

The firm slashed its earnings guidance for the next year to $758m$948m (£639m-£799m).

Shares plunged some 19 per cent after the holding firm said it was reviewing its business and mulling a spin-off of a number of its companies. However, such moves would only be taken if “deemed to be the best for its employees, create higher shareholder value and improve our strategic flexibility,” the firm said in its halfyear results yesterday.

The largest European gaming group acknowledged that the macroeconomic environment had become even “darker in recent months”.

In August, the firm bought the intellectual property rights to ‘The Lord of the Rings’ and ‘The Hobbit’ literary works, as well as five other firms in a £645.7m deal.

CITYAM.COM 10 FRIDAY 18 NOVEMBER 2022 NEWS

CHARLIE CONCHIE

Embracer recently bought the intellectual property rights to ‘The Lord of the Rings’

UK law firms have seen demand for legal services level off over the past six months

“Because

“Employees…

“Corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors.”

‘Never in my career have I seen such a complete failure of corporate controls,’ said John Ray III, who oversaw the winding up of Enron

CATEGORY

COINBASE

This year, Coinbase announced the single largest deal between a crypto platform and an asset management provider. We finalised a deal to begin offering institutional crypto access to BlackRock’s Aladdin platform. BlackRock is the world’s largest asset manager. The creation of the new access point saw the providers connecting the dots between Aladdin – an end-to-end investment management platform – and Coinbase Prime, which offers crypto trading, custody, prime brokerage, and reporting capabilities.

CHAINANALYSIS

Chainalysis is the blockchain data platform used by government agencies, exchanges, financial institutions, and insurance and cybersecurity companies in over 70 countries. Chainalysis data platform powers investigation, compliance, and risk management tools that have been used to solve some of the world’s most highprofile cyber criminal cases. The business is now one of the key industry leaders helping to grow consumer access to cryptocurrency safely and build trust in blockchains to promote more financial freedom with less risk.

FIDELITY DIGITAL ASSETS

Fidelity Digital Assets℠ is a subsidiary of Fidelity Investments, dedicated to building products and services that help institutions adopt digital assets. The business offers a full-service enterprisegrade platform for securing, trading and supporting digital assets, . Established in 2018, Fidelity Digital Assets combines the operational and technical capabilities one of the world’s largest and most diversified financial services providers with deep and dedicated blockchain expertise to deliver a differentiated offering for institutional investors.

COPPER

Founded in 2018, Copper provides a gateway into the crypto asset space for institutional investors by offering custody, trading, and settlement solutions across 500 crypto-assets and more than 45 exchanges. It is committed to providing flexible solutions for institutional investors that can adapt to the changing crypto asset space, while enabling far greater transparency and control for asset managers.

Copper’s fully integrated products are unique in the crypto-asset space. Underpinned by multi-award-winning custody, Copper has built the comprehensive and secure suite of tools and services required to safely acquire, trade, and store cryptocurrencies.

SIX DIGITAL EXCHANGE

SDX operates an Exchange and a Central Securities Depository (CSD), licensed by Switzerland’s financial market regulator, FINMA. SDX went live in Q4 2021, and continues to work with partners, its current members (UBS, Credit Suisse, Zürcher Kantonalbank, CM Equity) and future clients offers issuance, listing, trading, settlement, servicing, and custody of digital securities. SDX is committed to working with partners, members, and clients to promote and build out a new market structure for digital assets globally.

COINBASE

This year, Coinbase announced the single largest deal between a crypto platform and an asset management provider. We finalised a deal to begin offering institutional crypto access to BlackRock’s Aladdin platform. BlackRock is the world’s largest asset manager. The creation of the new access point saw the providers connecting the dots between Aladdin – an end-to-end investment management platform – and Coinbase Prime, which offers crypto trading, custody, prime brokerage, and reporting capabilities.

OUR PARTNERS

CATEGORY IN PARTNERSHIP WITH 11 FRIDAY 18 NOVEMBER 2022 CITYAM.COM

IN PARTNERSHIP WITH

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

FTSE slips after budget while miners drag on Europe’s STOXX 600

THE FTSE 100 index slipped yesterday after briefly hitting a one-week low, while midcap stocks cut losses sharply after the government set out plans to cut spending and raise taxes, reversing course after a market plunge over unfunded tax cuts.

The exporter-heavy FTSE 100 closed 0.1 per cent lower after dropping as much as 0.8 per cent as the pound briefly pared some of its losses following the budget yesterday.

Miners weighed on the commodity-heavy main index tracking weak metal prices.

UK’s energy index slipped 0.5 per cent after Hunt said the government would increase a windfall tax on oil and gas firms and extend it to power generation firms. Power companies such as Drax, SSE and Centrica rose between 1.5 per cent and 5.4 per cent after

sliding briefly on the news.

Britain’s economy is forecast to shrink next year, Hunt said, with GDP projected to contract by 1.4 per cent.

Meanwhile on the continent, Europe’s STOXX 600 index yesterday closedlower as declines in miners and healthcare stocks offset gains in shares of engineering and technology group Siemens that helped Germany’s DAX outperform regional peers.

The continent-wide STOXX 600 dipped 0.4 per cent, but was still up 3.9 per cent this month and on pace for its second straight month of gains on several factors including better-than-feared earnings despite worries of a recession in the eurozone.

Data showed eurozone inflation in October was marginally lower than previously reported in year-on-year terms but still at a record high becauseof surging energy prices.

Close Brothers had a mixed bag of results, with its banking division’s numbers meaning it is tricking “slightly behind”’ full year estimates for loan book growth. However, net interest margin “remained strong” while its bad debt ratio “remained stable”, amid the tumultuous macroeconomic environment. Peel Hunt analysts dubbed the stock an ‘Add’ recommendation, with a target price of ,.

Housebuilder Crest Nicholson marked weaker trading in recent weeks, with sales lagging. It opted to defer an opening of its third new division until further notice, it said in a pre-close update yesterday. Peel Hunt analysts rated the stock as an ‘Add’ recommendation, while setting a target price of 250p for the Surrey-based firm. Adjusted profit before tax is set to be within a guided range of £135m-£140m.

Reuters

P 17 Nov 1,033 16 Nov 15 Nov 14 Nov 11 Nov CLOSE BROTHERS 1,020 17 Nov 1,040 1,060 1,080 1,100 1,120

To

P 17 Nov 214.8 16

appear in Best of the Brokers, email your research to notes@cityam.com

Nov 15 Nov 14 Nov 11 Nov

215 17

220 225 230 235

CREST NICHOLSON

Nov

OH, BOTHER Just six weeks after the doomed minibudget, the Tiggers have relinquished control of the public purse, and the Eeyores are now back in charge... The new Chancellor’s steady, calculated approach will help keep global investors on side.

LAUTH KHALAF, AJ BELL

CITYAM.COM 12 FRIDAY 18 NOVEMBER 2022 MARKETS GET YOUR DAILY COPY OF DELIVERED DIRECT TO YOUR DOOR EVERY MORNING SCAN THE QR CODE WITH YOUR MOBILE DEVICE FOR MORE INFORMATION IT’S FINALLY HERE RIVALRIES RENEWED AS THE SIX NATIONS RETURNS FOR 2022 8-PAGE PULLOUT 2022 SIX NATIONS ENERGY D-DAY Households LONDON’S BUSINESS NEWSPAPER FREE CITYAM.COM THURSDAY 10 FEBRUARY 2022 CITYAM.COM COOL RUNNINGS ALL THE GEAR FOR AN OVERDUE MOUNTAIN BREAK P20 STATE SET MAN IN THE KNOW MARK KLEINMAN GETS THE CITY TALKING P13 LONDON’S BUSINESS NEWSPAPER LONDON’S BUSINESS NEWSPAPER CITYAM.COM Climate noise blocking out THROUGH THE DRINKING GLASS THE LATEST FROM OUR WINE GURU P22 ISASUNWR WHERE PUT MONEYTHIS YEAR WEDNESDAY FEBRUARY 2022 ISSUE 3,677 THE ULTIMATE SAVINGS GUIDE ALL YOU NEED TO KNOW ABOUT YOUR ISA P19-21

Hunt plots an ‘OK, but’ budget to spread the pain and fling it to the future

Sascha O’Sullivan Comment and features editor at City AM

Sascha O’Sullivan Comment and features editor at City AM

YESTERDAY was a big day for Britain. Neighbours, the much-loved Australian soap opera, cancelled in August this year to much fanfare and nostalgia, was brought back. Amazon had come to the rescue.

Beyond hopes of bringing back the 1980s and the fiscal measures of Nigel Lawson, Margaret Thatcher’s chancellor for the better part of the decade, the theme song provides an unlikely summary of what Jeremy Hunt wanted to achieve with his Autumn Statement.

“With a little understanding, you can find the perfect blend,” trills the opening tune, with a somewhat sinister jingle in the background.

Hunt was hoping to find enough funds for the Treasury coffers through tax hikes and spending cuts but fling them far enough into the future that he avoids a situation where any one particular group is so aggrieved, their cries become an unbearable cacophony.

In other words, everyone is going to hurt. In every corner, except perhaps the pensioners, there will be those saying “OK fine, but”. This is intentional: it means none of them will be loud enough or large enough to cause too much of a migraine for the chancellor. Not for now, at least.

Those concerned about the impending decline of the national health service, will be relieved to hear the NHS

has been given just enough more spending to appease its chief executive Amanda Pritchard.

But this will come in the form of higher taxation. The National Insurance hike, first implemented by Rishi Sunak and then culled by Kwasi Kwarteng, will be replaced by a freezing of the threshold for an extra two years until 2028. If Hunt wants “Scandinavian services”, we might be looking at Scandinavian taxes.

Local councils will also be able to hike council tax, an incredibly regressive policy, to 5 per cent without a local referendum. But the departmental budgets for housing and communities will face future cuts.

There will be significant business rates relief for the retail, hospitality and leisure sectors and bills won’t go up with inflation. But also frozen will be the VAT thresholds for more firms. According to the Federation for Small Businesses, one in four companies are held back by the VAT threshold.

Plans to reform business rates have not so much been thrown into the long grass as thrown in and set on fire. The Online Sales Tax, which was billed as a challenger to business rates, has been ditched. This leaves our economy clinging onto an outdated system which hurts our high streets, our communities and ignores the realities of a digital world.

The headline rate of R&D credits will jump from 13 per cent to 20 per cent. But this will be paid for by cutting the credits available for small firms, landing a heavy blow to those wanting to start their own business and contribute to the competitive market Hunt and Sunak claim to be loyal to.

There will be continued investment into the net zero agenda, but a windfall tax will be extended even for electricity generators, including those who rely on renewables.

Hunt promised to ensure “the broadest shoulders carry the heaviest load”, an echo of George Osborne, and brought welfare payments up in line with benefits. But households up and

down the country will see a significant fall in living standards, with household disposable income falling by more than 7 per cent over the next two years, bringing incomes in real terms down to 2013 levels. In other words, eight years of growth will be wiped out.

But pensioners, even those one in four over 65s couples who are millionaires, will see their incomes go up with inflation - 10.1 per cent.

Inflation will mean the cost of servicing government debt takes up almost the biggest chunk of cash, second only to the budget for the department of health and social care.

All of these plans come with a colossal OK, but. They bring down inflation, but only to 7.1 per cent by mid next year. They might, for now, reassure the markets, but most spending cuts won’t happen until 2028, leaving significant room for uncertainty and political manoeuvre in the next election. They fill the blackhole, but at the cost of any meaningful plans for growth. They keep the NHS and education systems afloat, but with more promises for bureaucratic “reviews” of the workforce and of the skills offering.

They make everyone miserable, for a prolonged period of time, but, as Jeremy Hunt was at pains to say: there are those that have it worse.

The entire speech was couched in terms of, Britain has it tough, but Germany has it worse. Our taxes are high, but they are not as high as Canada.

Just as neighbours do, Jeremy Hunt is hoping the web of measures will allow everyone to rub along without too much friction to hold the economy, and the politics of his party, together until the next election.

Tesla tax? We need a road pricing scheme for a modern congestion-free future

GIVEN the plethora of misery that accompanied yesterday’s Autumn Statement, it might have been possible to overlook a significant measures namely that electric vehicles will no longer be exempt from Vehicle Excise Duty from April 2025. This is a glimmer of good news.

It reveals something deeply encouraging as half of new vehicles will be electric by 2025. This means that drivers are switching from the more polluting energy sources such as petrol and diesel and towards much cleaner forms of energy, and they are doing so without massive incentives from government. The pollution caused by petrol and diesel vehicles is what economists call a negative externality. It damages our health – especially of children and vulnerable people –while it also contributes to climate change which endangers all our lives and the fate of our planet.

Fuel duty is expected to raise a whop-

Ben Ramanauskas

ping £26.2bn in the 2022/23 financial year. However, as people switch to electric vehicles this would leave a significant hole in the public finances. This takes a step to prevent this from happening, while ensuring our public services will be funded in the future, as our economy adapts.

Exempting electric vehicles from excise duty also ignores the fact that pollution is not the only negative externality associated with driving. For example, all vehicles cause wear and tear and damage to the roads. Money for the repairs has to come from somewhere and while excise duty receipts

now just go into the Treasury’s coffers as opposed to a dedicated fund, this cost should be borne by all motorists. The other impact of driving is congestion. High car usage is incredibly damaging to the economy. It sounds almost impossibly simple, but traffic increases our stress levels, which damages our health. Clogged roads also prevent our enjoyment of our community. All of which impacts productivity. We’re not talking small amounts here either, research from the Centre for Economics and Business Research found that from 2014 to 2030 the overall cost of congestion to the UK economy will be a staggering £300bn.

It also paves the way for a more ambitious scheme: road pricing. This would help simplify the tax system by levying a single charge on motorists. Given that our tax system is incredibly complex, this is surely a good thing. Doing so would also, over time, reduce congestion. Letting the price mechanism work would see fewer people

travelling at the busiest time of the day or car pooling or using public transport.

The second half of this equation is investment in reliable public transport. From buses and trains to trams, we need more of all of them. We also need to liberalise the planning system to allow far more homes to be built near tube and railway stations.

We need far fewer cars on our roads and the reforms set out in yesterday’s Autumn Statement pave the way for this.

Ultimately we need to move towards a system of road pricing, investment in good quality public transport, and a planning system which allows us to build more homes. Doing so will help the planet, reduce the burden on the public finances, reduce congestion, increase productivity, and boost economic growth.

CALL ME MAYBE

£

Ben Ramanauskas

is an economist at Oxford University and former trade adviser

CITYAM.COM 14 FRIDAY 18 NOVEMBER 2022 OPINION

EDITED BY SASCHA O’SULLIVAN

OPINION

The Neighbours theme was unlikely inspiration for Jeremy Hunt

Oops! Tom Tugendhat, the securities minister, wasn’t so secure while driving his car through central London in April. The Tory MP was caught with phone in hand and slapped with a ban from being behind the wheel for six months. A spokesperson said he apologises unreservedly.

LETTERS TO THE EDITOR

Tech giants need to get flexible

[Re: Elon Musk fends off daily losses with jobs and ticks, Nov 6]

The latest series of lay-offs from Big Tech companies and Twitter show that the tech bubble is bursting. Many more businesses may follow suit. The pandemic called for companies to hire tech talent in swathes as they raced to adapt. That digital race has not only slowed, but been stalled by a recession putting the brakes on tech spending. This means most businesses no longer have the capital to retain all the employees they brought on board. It’s worrying that large businesses like Amazon have been so short-sighted with their hiring, particularly of tech staff. Hiring and firing is not only expensive, but can damage morale for

remaining employees and carry reputational damage for future recruitment. To avoid making the same mistakes, businesses have to be less rigid with how they manage their workforce. Certainly, an over-reliance on teams exclusively made up of permanent employees is a recipe for disaster.

That’s not to say that having permanent, retained staff is not important for business continuity. But it should be supplemented by an ondemand workforce made up freelancers, that can be scaled up and down as required and in line with market disruption, without needing to cut ties with valuable employees. Until businesses find more flexible ways to engage talent, they will always be vulnerable to economic headwinds and risk needing to make lay-offs.

Callum Adamson Distributed

BETTER CALL BORIS Arrest for posession of live pangolin in Botswana

We will all feel the squeeze, but squeeze too hard and tax receipts will dry up

DOOM and gloom was the name of the game in the runup to the Autumn Statement. Yet the measures delivered by the chancellor ended up being more positive for hospitality businesses than many had feared.

It was a pragmatic response to a turbulent economic market. Crucially, it delivered stability.

The one important part missing, however, was a long term economic plan for growth.

There are difficult decisions to be made in order to steer the country through these challenging times; that much was clear. But the role that businesses can play in driving economic growth should not be overlooked. At the despatch box, the chancellor recognised the importance of such a plan. Unfortunately, nothing meaningful was forthcoming.

Businesses create jobs, deliver higher wages and generate billions in revenue to fund vital public services. These are all key components of economic

It was Boris Johnson’s favourite campaign, and his favourite t-shirt: save the pangolins. But in Botswana a man was arrested for possessing one of the scaly creatures, which are believed to have medicinal qualities and illegaly traded.

FRENCH READY TO GO DOWN UNDER FOR SUBMARINES

French president Emmanuel Macron said this week that the submarine deal with Australia was “still on the table”, following conversations with Australian prime minister Anthony Albanese at the G20.

The $90bn deal fell through last year - sparking a diplomatic crisis of sorts between the two countries - when Australia ditched it to form a deal with the US and the UK to manufacture nuclear-powered submarines. The decision was perceived as a key breach of trust at the time.

Macron even recalled his ambassadors from Canberra and Washington. But now, the French president seems to be willing to go back on his steps and has ensured that the submarines would be constructed in Australia. “It is up to the Australians to choose, we are consistent”, he said. Yet it’s unclear whether a FrancoAustralian deal would be compatible with AUKUS, the defence pact between Australia, the UK and the US.

ELENA SINISCALCO

growth. But they can’t do that if they go out of business or have no margin to invest in people, wages and innovation, which is an all too real prospect for hundreds of hospitality venues across the country.

Our pubs, bars, restaurants, hotels, night clubs and coffee shops, to name a few, are fighting energy costs that have reached levels never seen before. They’re also grappling with enormous food and drink inflation, and are still finding it difficult to fill vacant roles. Throw in consumers tightening their spending, and it’s clear why hospitality businesses are struggling.

Despite all of this, Britain’s hospitality sector still has an enormous appetite to grow and build on our already world-class offering. Despite working in

hospitality all my life, I’m still blown away by the passion I hear from the talented business leaders in our sector.

They want to invest. They’re desperate to innovate further, open more venues, and offer more fantastic experiences for the public.

At the moment, though, they are in limbo. They’re desperate for a clear plan from the government.

The chancellor talked about his growth priorities of energy, infrastructure and innovation. Hospitality businesses will be left scratching their heads about where they fit into this.

There was no steer on the labour market or how businesses will be able to recruit much-needed people to work in their venues. There was little on skills, training existing staff or bringing new people through. Reform of the apprenticeship levy would be music to the sector’s ears.

Businesses will be caught in the increasing squeeze we saw forecast yesterday. But the chancellor needs to be mindful. Squeeze too hard and the tax revenues they’re relying on to fund these priorities may dwindle.

Yet there was some positive news for

hospitality businesses. UKHospitality has been warning about the looming £900m business rates bill that faced the sector, if current relief ended in April as expected and rates were hiked in line with inflation. Fortunately, the chancellor has heeded our warnings and has delivered for hospitality a freeze in the multiplier, no downward transition cap and extended relief.

This was a vital intervention, providing some certainty for businesses over the next 12 months.

We now need to see the government deliver on its manifesto commitment to deliver root and branch reform of the business rates system. The current system is outdated and not fit-for-purpose, with hospitality overpaying by 300 per cent. The review should be part of a long-term economic growth plan. We need to understand the big picture thinking, so that businesses can see the way forward, feel some much-needed confidence and invest in the sector.

At the moment, that is the missing piece of the puzzle.

£ Kate Nicholls is the chief executive of Hospitality UK

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900

Email: news@cityam.com

Certified Distribution from 30/5/2022 till 01/07/2022 is 79,855

Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com

Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions

Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP

Editorial Editor Andy Silvester | News Editor Ben Lucas

Comment & Features Editor Sascha O’Sullivan

15 FRIDAY 18 NOVEMBER 2022 OPINION CITYAM.COM

Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Digital Editor Michiel Willems Commercial Sales Director Jeremy Slattery

Kate Nicholls

Businesses create jobs, but they can’t do that if they have no margin to invest in people or wages

WE WANT TO HEAR YOUR VIEWS › E: opinion@cityam.com COMMENT AT: cityam.com/opinion

EXPLAINER-IN-BRIEF: THE

Hospitality businesses contribute the majority of business rates

GOING OUT

EDITED BY STEVE DINNEEN @steve_dinneen

RALPH FIENNES SIMMERS IN THIS DELICIOUSLY DARK SATIRE OF EXTREME WEALTH

MOVIE OF THE WEEK

UNMISSABLE

THE MENU DIR. MARK MYLOD BY JAMES LUXFORD

The self-absorbed world of the rich foodie is taken to task in this comedy/drama from Mark Mylod, producer and director of TV hit Succession.

The story takes place on Hawthorne, an island containing a restaurant so exclusive that just 12 diners at a time are shipped in, paying $1,250 a plate. Among the clientele of obnoxious critics and desperate celebrities is Margot (Anya Taylor-Joy), accompanying culinary geek Tyler (Nicholas Hoult) when his date drops out.

They’re all there for the latest creations from celebrated chef Julian Slowik (Ralph Fiennes), who promises an experience like no other with a themed menu that slowly reveals itself. However, Slowik’s contempt for his clientele emerges as the dining experience becomes something quite unexpected.

The direction of the story is pretty clear-cut, taking aim at privilege and

PTSD stemming from his violent past.

THE RAPE OF LUCRETIA ROYAL OPERA HOUSE BY TACITA QUINN

THE RAPE OF LUCRETIA ROYAL OPERA HOUSE BY TACITA QUINN

The Rape of Lucretia at the Royal Opera House is almost a great success. Director Oliver Mears’ intense staging possesses moments of pure violence and raw emotion, impressively pulled off by a cast drawn exclusively from operatic young artist programmes. However, it’s not quite a win for The Linbury Theatre, with the sexual politics of Britten’s opera feeling uncomfortably oppressive and Mears’ production never quite figuring out exactly what it’s trying to say.

Set just before the establishment of the Roman Republic, Tarquinius Superbus is Britten’s tyrannical villain. Having been cuckolded by his entire harem, he’s driven mad by his obsession with the noblewoman Lucretia, with her chastity and commitment to her husband Collatinus being the root of his fixation. Tarquinius vows to prove her chastity himself, and rides to Rome.

The set is very far from ancient Rome, with much of the action taking place in a beige, nondescript living room. The Linbury’s tight space, combined with a twelve-piece orchestra, is a good fit for the production’s claustrophobic feel.

Mears’s production ties violent warfare and toxic masculinity to Lucretia’s rape and eventual suicide. Tarquinius, sung with brazen confidence by baritone Jolyon Loy, is clearly plagued with

Lucretia herself is sung by Anne Marie Stanley, a completely mesmerising performance. Using her mezzo low notes to hold Lucretia’s rage, she holds you there in her pain. Collatinus is played somewhat sternly by Anthony Reed, but he balances the ferocity and tenderness of his bass to complement Lucretia’s haunting melody. Collatinus and Lucretia’s reunion in Act II is handled with the utmost care by Stanley and Reed, making the moment Collatinus hears of Tarquinius’s barbarity beyond heartbreaking.

The entire piece is held together beautifully by the Aurora orchestra in the hands of conductor Corinna Niemeyer. However, even the tightest of musical turns can’t make up for a production that, at its core, can’t quite make sense of itself.

Mears hasn’t managed to find a way to make Britten’s opera work alongside his own contemporary ideas. The omnipresent religious narrators stick out awkwardly in this almost psychothriller production, although they are both sung beautifully and tenderly performed by Sydney Baedke and Michael Gibson. Their closing narration, where they remind the audience that God promises redemption in heaven, strikes entirely the wrong note, feeling like a disservice to contemporary understandings of sexual violence.

There are moments of brilliance in this production, but once the dust settles it leaves you thinking about how far opera has yet to go.

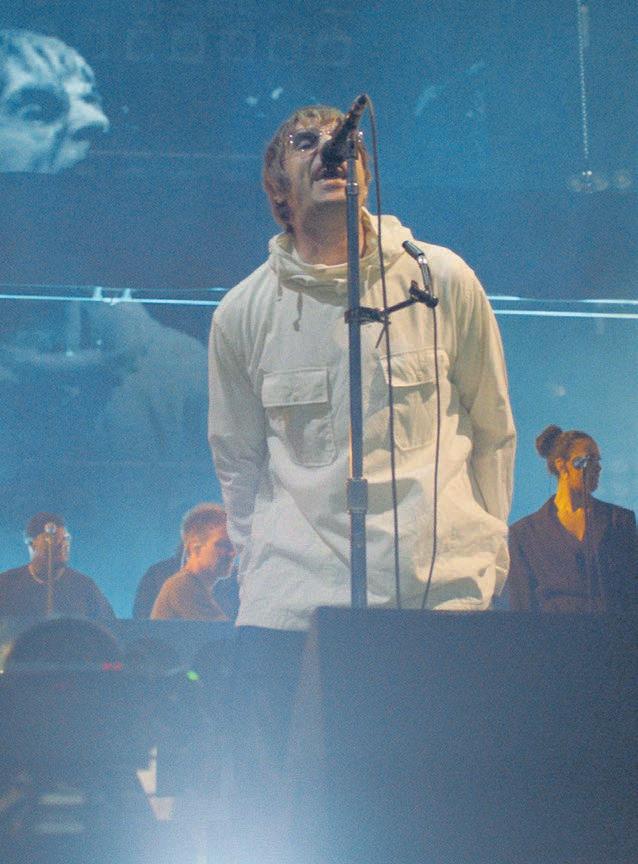

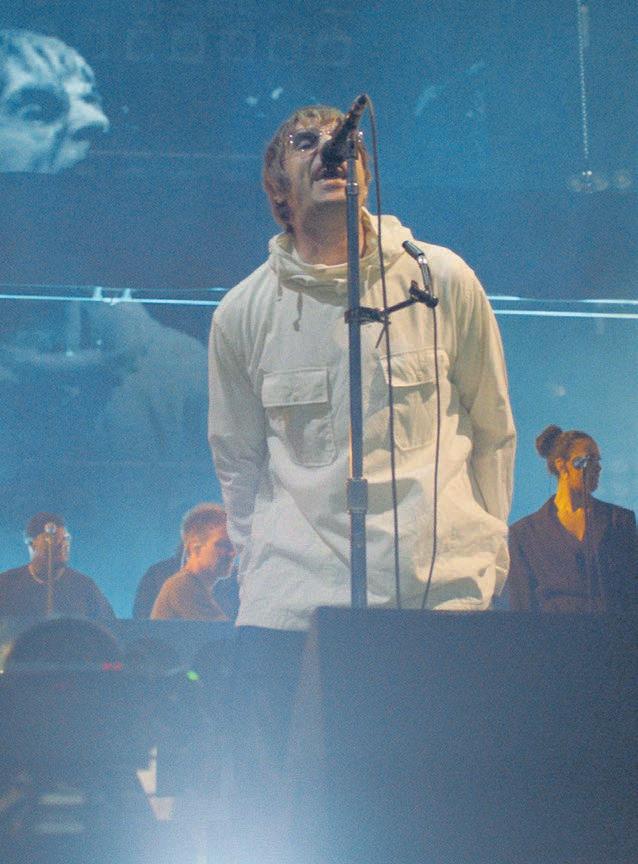

LIAM GALLAGHER KNEBWORTH ’22 DIR. TOBY L

BY JAMES LUXFORD

This summer, Liam Gallagher returned to the scene of one of his greatest triumphs. Two sold out nights at Knebworth, 26 years after Oasis played there, was a marked achievement for the ageing rocker, who has been performing solo since 2016.

exclusivity. The dishes become increasingly pretentious, and the tension builds nicely to the pièce de résistance, which I won’t spoil.

It’s not subtle, and this type of satire has been done more elegantly recently by Ruben Östlund’s Triangle of Sadness, but there is a vindictive passion to The Menu that makes it extremely watchable.

The film is masterfully cast, full of actors who nail the script’s bone-dry humour. Anya Taylor Joy adds to an increasing list of career highlights, slicing through Hoult’s Millennial pretensions (“please don’t say ‘mouth feel,’” she snaps during one of the early dishes).

Hong Chau’s front of house manager is inspired, but it’s Fiennes’ energy that ties it all together. With a natural expression that always seems scornful, he’s the perfect fit for this role. It’s a little strange to hear him with an American accent, but his heightened portrayal of artistic mania is something to behold.

The Menu could have done with slightly more nuance, but it’s a gripping black comedy that grills its characters to perfection.

There are no shortage of fans eager to let cameras into their homes, or in one man’s case a converted annex called ‘Champagne Su-bar-nova’. It’s not all middle-aged men in bucket hats, however – there are testimonials from an Oasis-mad priest, a young child following in her mother’s fandom, and a Belgian fan who chose to go to Knebworth instead of her exams. They’re all endearingly passionate, seeing the music as an escape from their troubles.

Love him or loathe him, you can’t accuse Gallagher of softening with age. Now 50, the swagger remains. But you also get the impression he really wants nothing more than to get on stage and belt out the old songs. As he puts it, he has no desire to go through an “acid jazz” phase (likely a dig at his brother).

Noel Gallagher is an unseen antagonist, mostly referred to as “him” by his brother. Liam recently tweeted that Noel blocked any Oasis songs from being used in the doc, a hilarious act of pettiness that renders this ultra-nostalgic film rather impotent. There are impressively shot performances of Liam’s solo material, but the absence of the hits makes is all seem a bit farcical.

Despite the absence of the big tunes, even Liam’s staunchest critics will leave with a grudging admiration for the rock ‘n’ roll star who refuses to change.

CITYAM.COM 16 FRIDAY 18 NOVEMBER 2022 LIFE&STYLE

RECOMMENDED OPERA

MORE TO DO...

THE BEST PUBS TO WATCH THE WORLD CUP

IMMERSE YOURSELF

IN

WATER

THERAPY WITH THE NUE CO. Wellness company The Nue Co. is launching an immersive pop-up space at Brick Lane’s Truman Brewery, where you can explore the powerful effects water can have on our bodies and brains. The interactive experience will combine scent, sound, sight and touch to discover the restorative properties of water, as well as promoting the brand’s new fragrance Water Therapy. Go to uk.thenueco.com

JAZZ OUT AT THE JAZZ FESTIVAL

More than 300 musicians are warming up for live jazz this weekend as the EFG London Jazz Festival celebrates its 30th anniversary. Strings will be plucked at venues including Barbican, Koko and Cadogan Hall. For tickets go to efglondonjazzfestival.org.uk

THE LOWDOWN ON A TOP NEW CABARET SHOW

WHAT’S THE LOWDOWN ON YOUR NEW SHOW?

La Clique is a cabaret institution. Imagine seven of the sexiest performers you have ever seen presenting immeasurable talent in a beautiful Spiegeltent, a venue so intimate that if you stuck out your tongue you could lick a performer. Although that is not encouraged as we taste like cigarettes and questionable life choices.

WHICH ACTS AND CABARET STYLES INSPIRE YOU?