LISBON ON THAMES CHEF NUNO MENDES’ FANTASTICO NEW WEST END SPOT P20

FUND managers are struggling to sell their green investment products to financial advisers as rampant greenwashing erodes trust in the environmental, social and governance (ESG) industry, fresh research published yesterday revealed.

Just one per cent of financial advisers and wealth managers said they now “completely trust” claims made by supposedly green and ESG funds, the Association of Investment Companies (AIC) found, with a lack of evidence cited as the top reason for a collapse in faith among investors.

One wealth manager surveyed by the body said they would need money managers to cough up “real examples in the portfolio” before they believed the green claims made by funds.

The fresh findings underline a sizable trust gap facing ESG investment after a slew of greenwashing claims against top financial firms and grow-

ing concerns over a lack of regulation in the industry.

HSBC was the latest firm to face allegations this week as it was accused of raising cash via sustainability-linked bonds and channelling it into fossilfuel linked projects. The firm rejected the claims and said it was playing an “important role in the nascent SLB market”.

Watchdogs are now edging into the space and looking to clamp down on fanciful sustainability claims by fund managers.

The Financial Conduct Authority (FCA) last week revealed plans to curb the unverified use of terms like ‘green’, ‘sustainable’ and ‘ESG’ as well as ramping up disclosure requirements on firms to prove unsubstantiated claims.

It mimics a similar push by the advertising watchdog, who also found fault with HSBC’s public-facing claims.

Analysts at the AIC said yesterday that advisers and wealth managers were now “keenly aware of the risks of

greenwashing” but still backed the need for sustainable investment opportunities.

“Despite scepticism about ESG claims, financial advisers and wealth managers remain supportive of ESG investing,” Nick Britton, head of intermediary communications at the AIC said.

The survey of around 200 financial advisers in the UK also said they were more pessimistic about the performance of ESG-oriented funds than they were this time last year, with inflation and interest rates as well as geopolitical shifts affecting investment appeal.

“In the light of this, the FCA’s decision to impose stringent rules on how funds present their sustainability claims looks timely, and it’s one we fully support,” Britton added.

Fund managers are set to boost their ESG assets to almost £30 trillion by 2026, according to PwC, but the industry has faced a reckoning as investors double down on fossil fuel investment in the wake of rising energy prices.

A CAMPAIGN has been launched to save historic City lunch spot Simpson’s from permanent closure after its landlord issued a winding-up petition related to pandemic-era rent arrears. Manager Ben Duggan told City A.M. yesterday that the landlord, a Bermudan-registered holding company, had demanded immediate payment for rent arrears accrued whilst the restaurant was shut during the pandemic –rather than over the rest of the lease, as many other landlords have done with hospitality

businesses hit hard by lockdown restrictions. The locks have been changed following the demand.

A crowdfunder, Save our Simpson’s, has been launched to meet the bill.

Simpson’s, down an alleyway on Cornhill, is famed for its no-nonsense a la carte menu, its affordable wine list and its stewed cheese pudding.

Duggan –who said the business was enjoying higher revenues now than in October 2019 –said: “I’ve so many regulars who had their first City lunch at Simpson’s.

“Rubbing that all away would be a huge loss to the City.”

NICHOLAS EARLBP UNVEILED another bumper round of monster profits yesterday, powered by soaring gas prices, reigniting Labour calls for the windfall tax to be toughened up on North Sea fossil fuel producers.

The British energy giant raked in £7.1bn in underlying earnings in its third quarter this year between July

and September.

Overall, its global profits for the first nine months have jumped to £19.8 from £7.6bn in the previous year. This has been driven by historically elevated oil prices –which remain above $90 per barrel despite a recent slide – and record gas prices amid concerns of supply shortages following a Russian squeeze on European gas flows.

The hefty takings follow in the footsteps of rivals, including Shell, which have also announced mega profits yet again this year.

Leading the pack is Saudi Aramco, which has revealed eye-watering profits of £36.8bn, one of the biggest quarterly-trading performances in business history.

Labour has urged the government to strengthen the Energy Profits Levy by removing the investment relief and backdating it to January – even though it was announced by the government in May.

BP said they expect to pay around £700m this year through the already existing levy.

Labour’s Ed Miliband said PM Rishi Sunak should “hang his head in shame that he has left billions of windfall profits in the pockets of... companies, while the British people face a cost-of-living crisis”.

IS IT PRO-BIRD? Is it anti-plane?

Or is it just a bubble? That’s the question that many in the City have been asking themselves over the past few months about those three little words: environmental, social, and governance.

The rise of ESG was swift and borderline aggressive. During the pandemic, it was impossible to interview a chief executive who had not undergone either a Damascene conversion to the

cause (or, perhaps more accurately, been brow-beaten by well-meaning types elsewhere in the business to become so). One could not move for ESG initiatives, nor attain a moment’s peace from claims that firms across the Square Mile had “got

it”. Has the tide turned (no pun intended)? Today’s survey on our front page found that whilst the drive towards sustainability in all its forms hasn’t necessarily slowed, the amount of noise around it has made it more difficult to tell what is –and what is not –actually what it claims to be. Lest we sound too cynical, it’s worth stating for the record that the City, financial markets and old-fashioned capitalism are going to be the

driving force behind the drive to slow climate change. Politicians can pontificate –and if anybody seriously thinks Rishi Sunak attending Cop-27 will make one iota of difference to the globe’s effort to eliminate carbon emissions then we have a bridge to sell you –but it’s economics that will be what delivers. That’s a good thing. London needs competitive advantages –it has one in green finance, and it should hold onto it. But action

makes far more of an impact than words. Greenwashing is now an art in itself. Talking a good game on ESG does not translate, clearly, into actually delivering it. There are fund managers, too, who run ESG funds which actually invest in the heaviest carbon-polluters, arguing it’s better to be the fox in the henhouse than simply pretending the hens don’t exist. The City’s ESG conversation could do with a little more hard-headed pragmatism, and less of the guff.

“Hackers for hire” and the proliferation of sophisticated software that can be bought off the shelf are a growing threat to government and business cyber security, a top British spy has warned.

The government has “war gamed” emergency plans to cope with energy blackouts lasting up to seven days in the event of a national power outage amid growing fears over supply security.

The former boss of Aston Martin, Andy Palmer, is poised to snap up the site for an electric car battery gigafactory in Blyth if current owner Britishvolt collapses into administration.

estimate. It was also above the City’s expectations.

UK FACTORIES are in “survival mode” amid a demand slump, rising interest rates and swelling costs, a survey out yesterday showed.

The S&P Global and Chartered Institute of Procurement and Supply’s (CIPS) final purchasing managers’ index (PMI) for October tumbled to 46.2, the weakest reading in 29 months when the country was grappling with the early stages of the pandemic.

The reading fell from 48.4 in September, but was revised up from an earlier

However, the PMI’s dive illustrates how weak the UK’s manufacturing is right now, with the survey now far below the 50 point threshold that separates growth and contraction.

Households and businesses cutting spending in response to a historic inflation surge and central banks raising interest rates rapidly have cooled the world’s biggest economies.

European countries’ PMIs have also dropped steeply in the past few months, with Germany notching a 44.1 reading on the combined survey

last month.

UK factories’ decline was driven in part by “war in Ukraine and ongoing issues relating to Brexit stifling export performance,” the survey said.

Worryingly, factories shedded workers last month for the first time since December 2020, indicating the UK’s slump is starting to impact ordinary Brits.

The jobs market has held up surprisingly well amid tough inflation and slowing activity. “Many manufacturers will be in survival mode right now,” Thomas Pugh, economist at RSM UK, said.

CHARLIE CONCHIE AND REPORTERSFIFTY of the UK’s fastest growing tech firms are set to join a ‘Scale Up Club’ –and 46 per cent of them are run by women.

The fifty firms, compiled by Bay Area –London networking body Silicon Valley Comes to the UK (SVC2UK) –join a group of Scale Up Club members that in the past has included UK tech giants including Wise, Skyscanner and Elvie.

Janet Coyle, the managing director of business growth at investment promotion body London

& Partners, said the “UK is a leading global hub to grow and scale a business and this year’s (firms) demonstrate the diversity and vibrancy of the UK’s scale-up ecosystem”.

Some critics have suggested that whilst numerous start-ups find early growth in the UK, they sometimes struggle to become global players –often being picked up by foreign competitors.

SVC2UK, now run out of London and Partners, was founded in 2006 and has supported almost 900 founders.

Almost half of UK’s growing tech firms are run by women

WHAT THE OTHER PAPERS SAY THIS MORNING

‘THEY THINK IT’S ALL OVER... NO, WE’VE GOT ANOTHER BID!’ Referee’s coin from ‘66 World Cup Final set to go under the hammer ahead of Qatar tournament this month

JACK BARNETT

JACK BARNETT

THE BANK of England yesterday successfully sold hundreds of millions of pounds of government debt in the first stage of winding down stimulus that has propped up the economy in the aftermath of the financial crisis and during the pandemic.

Some £750m bonds ran off the Bank’s balance sheet yesterday, with the auction heavily oversubscribed in a sign markets are happy to swallow more UK government debt.

The bid to cover ratio –a measure of demand for UK government bonds, or gilts –topped 3, with the Bank receiving £2.44bn worth of bids for the debt. Most of the debt sold was short-dated.

UK bond markets responded well to

over £837bn of government debt.

The Bank of England –and the world’s top central banks such as the US Federal Reserve and European Central Bank –in the aftermath of the financial crisis and during the pandemic hoovered up government bonds to support spending and bring down interest rates, a scheme known as quantitative easing (QE).

The Bank has started shrinking its balance sheet in response to inflation surging to a 40-year high of 10.1 per cent. Selling bonds, known as quantitative tightening (QT), is thought to raise market interest rates and discourage bank lending, the reverse of QE.

Antoine Bouvet, senior rates strategist at ING, told City A.M. the Bank sold bonds that were in high demand, meaning it could run into trouble once longer-dated debt sales begin.

Starting QT before the budget this month was “a gamble”, he added.

CHARLIE CONCHIE

CHARLIE CONCHIE

MINISTERS have delayed plans for the roll-out of controversial ‘call-in’ powers over regulators in order to give Rishi Sunak more time to mull

minister Andrew Griffith said that in light of the appointment of the new prime minister and the need for the government to “consider all the detail carefully”, the government would not table the amendment at

CONTINUED FROM PAGE 1

Industry body Offshore Energies UK (OEUK) has written a letter to the Chancellor seeking an urgent meeting. It has warned ongoing uncertainty is “driving investment out of the UK” and is also “encouraging some companies to exit the basin”.

Chief executive Deirdre Michie said: “Companies are unable to plan future long-term investments under such uncertain conditions and shareholders, particularly in overseas headquartered companies seeing an increasing risk premium regarding the future of their operations in the UK.”

The Treasury refused to comment on expanding the windfall tax, but City A.M. understands no options are off the table.

The government forecasts that the levy will raise over £7bn in 20222023 and around £10bn in 2023-2024 based on predictions for oil and gas prices over the short-to-medium term. This would be on top of the special 40 per cent corporation tax rate North Sea oil and gas operators already pay.

INDUSTRY groups and think tanks have urged new Prime Minister Rishi Sunak to uphold planning reforms to boost onshore wind developments.

In her fleeting stint at Downing Street, former leader Liz Truss unveiled proposals to bring rules around building wind farms in line with other infrastructure projects.

However, since Truss left office, Sunak’s government has placed fracking back into its moratorium after being revived just a month ago.

The status of onshore wind remains unclear, with Sunak previously pledging to scrap any pledges to relax onshore wind planning laws.

Joe Tetlow, senior political adviser at environmental think tank Green Alliance, urged the government not to scrap planning reforms to boost onshore wind, which he believed could boost supply security and lower bills.

He told City A.M.: “Onshore wind is one of the cheapest domestic sources of energy we have, one of the most popular, and quickest to deploy. Blocking cheap clean popular energy during an energy crisis is perverse.”

Tetlow highlighted the think tank’s polling, which found that 83 per cent of the public support more onshore wind, including 80 per cent of 2019 Conservative voters.

It also revealed 87 per cent of voters would be prepared to have a wind turbine in their local area.

This outlook was reflected across the political spectrum.

Andy Mayer, energy analyst and chief operating officer at free market think tank, the Institute of Economic Affairs, slammed the UK’s “nimby premium” which prevented developments for new power supplies and undermined Britain’s energy security.

Meanwhile, trade associations also raised concerns.

Adam Berman, deputy director of industry body Energy UK, highlighted the need to boost domestic energy production to secure the country’s energy independence.

Berman said: “Reducing our reliance on expensive international gas means making it easier, not harder, to build the clean energy infrastructure that can bring down bills and ensure our energy security over the longer term.”

City A.M. has approached the government for comment.

OPEC has thrown down the gauntlet to Paris-based climate group the International Energy Agency (IEA), predicting world oil demand will not plateau until 2035.

The world’s most influential oil cartel hiked its forecasts earlier this week for world oil demand over the medium and long term in its annual outlook, challenging suggestions from the IEA that fossil fuel usage will peak within three years.

It has also increased its predictions for required investment to meet oil demand to $12.1 trillion (£10.5 trillion), despite the transition to renewables.

The IEA and Opec have an increasingly strained relationship, with Opec ditching IEA from its calculations for oil demand amid concerns over its perceived western bias earlier this year.

This follows Russia’s invasion of Ukraine in February.

Meanwhile, IEA chief executive

Fatih Birol warned last month that Opec risked pushing global markets into a recession following its swingeing 2m barrels per day cuts last month to drive up oil prices.

Another decade of growth in oil demand would be a boost for Opec and its 13 members, which have blamed persistent failures in boosting oil production on underinvestment in the oil and gas sector. It suggests the west has made the funding shortfall worse with its increasing focus on ESG issues.

coast of the UK to the south of England where it will be chiefly used.

THE UK will have to build around seven times as much infrastructure over the current decade as it has constructed in the past 32 years to meet the country’s green energy goals, warned the National Grid boss.

Chief executive John Pettigrew told the BBC yesterday that huge changes in planning and regulation were vital for the government to hit its target of a 400 per cent in offshore wind by the end of the decade.

Otherwise, it would not be possible to build the hundreds of miles of new cables and overhead pylons needed onshore to shift energy from the east

He said: “We’re going to need changes to regulation, to the planning process, but we also need to work with local communities.

They should get the benefits when they’re hosting this infrastructure.”

The UK is aiming to generate 50GW of offshore wind by the end of the decade as part of the government’s energy security strategy.

Former Prime Minister Liz Truss unveiled multiple supply side

John Pettigrew, CEO of National Gridreforms in an attempt to liberalise planning laws, however it is unclear how the new administration under Rishi Sunak will approach the issue. Pettigrew also played down the prospect of blackouts, confirming the grid’s base case was the UK having sufficient supplies this winter.

He said National Grid had thousands of engineers working across the country, to ensure that the network is ready for “whatever weather we see over the winter”.

THE UK private sector must take more bets on technology if it is to compete with its European neighbours.

Speaking to City A.M., the UK chief executive of American tech giant IBM, Sreeram Visvanathan, urged businesses to “be bolder” and “find niches” to give UK businesses an edge above other markets.

“We can’t just leave it to the startups –the billion-dollar

companies that are being created digitally. We also have to move existing big companies that have been the bellwethers for economies to be digitally native,” he said.

“Be bolder about taking risk.

“Don’t look at these technologies as being nice to have, but think of

them as being essential for future survival.”

IBM, the 111-year-old tech company behind the barcodes you see in the supermarket, has been supporting businesses looking to pursue avenues in artificial intelligence (AI), cloud and quantum computing as part of a £210m

partnership with government, announced last year.

“Every industry is going to be reinvented, reorganised in the next 10 years and we’re going to see winners and losers emerge,” he said.

“The winners will be those who have been investing in tech over the last five years.”

The UK’s current tech and STEM skills shortage, however, has weighed on businesses attempting to break through into the digital sphere.

While the government has

“attractive” programmes that subsidise graduate hiring and internships, allowing businesses like IBM to “really lean in and invest ahead of demand”, the private sector could be doing more.

“Businesses need to take ownership frankly,” Visvanathan, who succeeded Bill Kelleher in the top role in 2020, continued.

“If you don’t address that skills issue at scale then the markets that do cross that skills issue are going to get the advantage.”

OCADO shares surged by more than a third yesterday after news the retailer had inked a partnership deal with South Korea’s Lotte Shopping.

The London-listed tech firm said it had agreed plans for the development of a national fulfilment network, pushing shares up as much as 38 per cent when trading closed yesterday.

While the boost will come as welcome news for the retailer, which has been hit by a slowdown in online consumer spending since Covid-19 lockdowns, Ocado shares remain some 63 per cent down on the year.

Lotte Group is one of South Korea’s largest business conglomerates and cashes in a total revenue worth £45bn annually, including from its department and e-commerce operator arm Lotte Shopping.

Ocado and Lotte will launch a net-

work of customer fulfilment centres, with six planned by 2028.

The first centre is scheduled to launch in 2025, while in-store fulfilment software will be rolled out in 2024.

The firm, which is a joint venture between Ocado and supermarket heavyweight Marks and Spencer, will see its ‘Smart Platform’ and in-store fulfilment solution launched across Lotte stores.

“With this new partnership, our unique, proprietary technology will now power the online businesses of twelve major retailers across ten countries worldwide,” Tim Steiner, CEO of Ocado Group, explained yesterday morning.

Lotte is to pay Ocado Solutions some fees upfront and during a development phase. It will then pay the British firm continuing fees associated with both sales and installed capacity across Lotte’s estate.

OCADO will be pleased to see a glowing investor reaction after news of its partnership with Lotte Shopping yesterday morning.

Shares soared by as much as 38 per cent by close of play last night.

It comes as the middle-class favourite, which operates as a tech group and online grocer, has experienced its fair share of struggle and strife over the past year.

Matt Britzman, equity analyst at Hargreaves Lansdown, said the deal was “welcome news” for the group, which had “been struggling to drum up tangible deals for the Solutions businesses”.

“Investors will be pleased to hear no additional capital raises are on the cards, with the capex spend having already been modelled into Ocado’s plans,” he added.

Jocelyn Paulley, retail partner at law firm Gowling WLG, also spoke favourably of the deal, saying the “strength” of the tie-up demonstrated “the global opportunity that exists for retailers willing to properly focus on the role of technology in the next generation of logistics and delivery”.

EMILY HAWKINSDespite a significant drop in Covid-19 revenues, Pfizer yesterday raised its yearly outlook after pocketing a quarterly revenue of $22.6bn (£19.6bn). The Big Pharma firm saw revenue from its Covid-19 vaccine Comirnaty plunge by 65 per cent to $4.4bn in the third quarter. However, the company, which is expected to hike vaccine prices, lifted its full-year sales forecast for its jab by $2bn to $34bn. Chief exec Albert Bourla told the Financial Times that despite the lower-than-expected sales outlook for its Covid-19 products, the firm believed its Covid-19 franchises would remain “multibillion-dollar revenue generators for the forseeable future”.

Uber’s shares soared over 16 per cent yesterday after the firm posted a 26 per cent rise in gross bookings yearon-year to $29bn (£25.3bn).

Defying analyst expectations, the ride-hailing giant’s revenue also jumped 72 per cent to hit $8.3bn as travel resumed and Covid-19 lockdowns lifted. Chief exec Dara Khosrowshahi said that despite the difficult macroeconomic backdrop, the core business was stronger than ever. The mobility arm grew faster than its food delivery unit, Uber Eats, which got a huge boost during the pandemic. The group posted an adjusted ebitda of $600m to $630m.

Transfer your pension to see exactly where it’s invested, and track its performance with our charts and tools.

Capital at risk. Tax treatment depends on your individual circumstances and may change in the future.

Check before you transfer. Past performance and forecasts are not reliable indicators of future performance. T&Cs apply. Transfer by 31st December 2022. Min transfer £1,000.

Open an account and transfer today.

£100 reward when you transfer a pension to usOcado and Lotte will launch a network of customer fulfilment centres

MADE.COM has announced its intention to call in administrators, as the firm inches closer to collapse.

The London-listed furniture firm said yesterday that its board had filed a notice of an intention to appoint administrators at PwC.

The company had been seeking out rescue cash but interested suitors were unable to meet a necessary timetable to save the business.

It had been looking to shore up

aggregate funding of around £45-70m over the next 18 months as a standalone public company.

The notice of intention, however, means Made.com has some headroom to explore all options, which could include a full or partial sale.

Made.com, which had around 670 staff as of last year, said it had previously received proposals from suitors to buy “certain or substantially all” of its trades, assets, and brands.

Bosses will be looking at all

WEST END landlords Shaftesbury and Capital & Counties Properties have had the valuations of their portfolios dented by economic turbulence in the last few months.

The London-listed Shaftesbury, soon to be merged with neighbour Capital & Counties, yesterday posted an update about its first summer of trading not disrupted by Covid-19 measures since 2019.

Its portfolio valuation sat at £3.2bn at the end of September, a drop from the £3.3bn over the period since the end of March. The decline represents a fall of around 3.6 per cent on a like-for-like basis.

Shaftesbury boss Brian Bickell said: “Our occupiers continue to report trading revenues, on average, above 2019 levels and demand for space in our carefully-curated, popular locations remains good across all uses, reflected in a return to pre-Covid occupancy levels and further growth in rental values.

“Valuers have reported an outward shift in commercial valuation yields, due to the impact on investment market sentiment of globally-rising finance rates and the deterioration in the macroeconomic outlook.”

Meanwhile Capital & Counties reported that Covent Garden valuations had dwindled two per cent since June to £1.78bn. Covent Garden, a top Christmas tourist destination, has been vulnerable to “volatile” eco-

Shaftesbury and Capital & Counties sealed a merger deal in June

nomic movements which have shaken asset valuations.

Ian Hawksworth, chief executive of Capital & Counties, added: “Trading activity at Covent Garden remains resilient with strong leasing demand across all uses, and positive footfall and sales metrics.

“The volatile macroeconomic environment is having an impact on asset valuations, however we are encouraged to continue to see rental growth in our portfolio.”

available options for the firm, although it may collapse into administration within the next two weeks.

It comes as the cost of living crisis pushes customers to cut back spending on pricey items.

Made.com only made its debut on the London Stock Exchange in January, with a valuation of £775m.

But since then, its share price has fallen 99 per cent since the start of the year, before they were suspended from trading yesterday morning.

MORRISONS yesterday announced that around 1,300 McColl’s workers are facing redundancy, as it prepares to shutter some loss-making stores.

The supermarket, which rescued the ailing McColl’s from collapse earlier this year, has set out its plans for the convenience store business.

Some 132 stores have been identified as having “no realistic prospect of achieving a breakeven position in the medium term”, with closures anticipated in “an orderly fashion” over the rest of the year.

While some of the loss-making stores will be able to return to profitability “over time”, the majority of the 132 will be shut.

“We are now able to begin the urgent journey to transform McColl’s into a viable, well-invested and growing operation,” David Potts, Morrisons chief executive, said. It also set out plans to bring the total number of its smaller format Morrisons Dailys stores to more than 1,000 within two years, speeding up an existing conversion programme.

BENTLEY BONANZA Bentley’s profits more than double to €575m despite industry and financial headwinds hitting marketsIN THE NINE months ended 30 September, Bentley’s earnings soared by 109 per cent, while return on sales surged to 23.1 per cent –the highest in the marque’s 103-year history. Revenue jumped 28 per cent to hit €2.5bn (£2.1bn) while year-to-date sales rose three per cent with 11,316 luxury cars sold as a result of new model derivatives and personalisation options. The UK market reported the highest sales increase and was followed by the EU, Asia-Pacific and Americas, which reported jumps of 18, 17 and seven per cent respectively. MILLIE TURNER AND EMILY HAWKINS

REFORMS to the Financial Conduct Authority (FCA) have not done enough to boost employees’ pay packets and the City watchdog is struggling to recruit top calibre staff as a result, a former regulator has claimed.

Speaking with the Following the Rules podcast, Sasi-Kanth Mallella, a former technical specialist in the criminal prosecution team at the FCA, claimed the transformation programme pushed through by chief Nikhil Rathi had lifted salaries at the lower level but left more senior staff underpaid.

The comments come after the regulator has been rocked by staff discontent this year and faced the first strikes in its history, with around 240 of the FCA’s 4,000 staff walking out in May over changes to pay and perks.

Mallella, who now works at consulting firm Ankura, said the overhaul by Rathi had had a “mixed impact” and the regulator’s ability to tempt in staff from the traditional talent pools in banking and legal firms was constrained by a lack of funds.

“You are not going to recruit those

sorts of people by and large with the amount of money that they’re currently offering to employees,” he said.

“So if you want people to join from industry or private practice law or accountancy, I’m not sure that the current wage scales are going to enable them to.”

Staff levels at the regulator have also been in decline despite a major hiring push this year. In its annual report in July, the watchdog said the organisation had hired nearly 500 people in 2022 and was aiming to boost the workforce by a further 500.

However, headcount figures published in the report showed that total staff numbers had fallen to 4,027 in the first six months, down from 4,194 earlier in the year.

The FCA told City A.M. yesterday it was pushing ahead with a hiring drive this year and was bringing in a range of fresh talent.

“We continue to attract top talent at all levels of the organisation with a range of skills and professional backgrounds, and by the end of this year we will have recruited around 1,000 new colleagues,” the spokesperson said.

THE GOVERNMENT is set to ban Chinese-funded Confucius Institutes from British universities, security minister Tom Tugendhat has said.

Tugendhat told MPs yesterday that Prime Minister Rishi Sunak intends to fulfill his leadership campaign pledge to ban the

institutes, which are educational organisations that allegedly suppress criticism of the Chinese Communist Party.

Sunak said during the summer Tory leadership campaign that China was the “largest threat to Britain and the world’s security” as he took a more hawkish stance on foreign affairs.

Tugendhat, a renowned China

hawk, said the institutes “pose a threat to civil liberties in many universities in the United Kingdom”. There are 30 Confucius Institutes in the UK, set up with the stated goal of teaching Mandarin and Chinese culture classes to foreign students. However, the institutes have been accused of clamping down on criticism of China and acting as political lobbyists.

FORMER health secretary and Tory MP Matt Hancock yesterday was expelled from the Conservative party after agreeing to appear on I'm a Celebrity... Get Me Out of Here! –the reality TV show which will see him competing to become King of the Jungle. Hancock said he wanted to raise awareness of neurodiversity issues, on which he campaigns.

FIVE men who allegedly defrauded investors of £1.2m via an ‘all or nothing’ investment scheme have been charged by the UK’s financial watchdog.

The five men, who are accused of using investors’ money to fund their own luxury lifestyles, allegedly convinced Brits to invest in high-risk binary options, which have been banned for retail use since 2019. Binary options are a form of fixed

odds betting that let investors gamble on the outcome of single events, through an ‘all or nothing’ deal.

If the event happens, and the investor wins, they’ll see a return, but if they lose, they’ll lose all the money they invested in the bet.

The UK’s Financial Conduct Authority charged four men linked to London firm Bespoke Markets Group with running the scheme.

A fifth man was charged with forging documents relating to the case.

A GROUP of top financial firms has ramped up pressure on the government to strike a “groundbreaking” trade deal with Switzerland today in a bid to ease the flow of cash and services between the two financial centres.

The value of trade between the UK and Switzerland hit £38.4bn last year but companies including Credit Suisse, Deloitte and UBS are now calling on ministers to go further to

strike a formal trade agreement to boost the flow of capital and services between the two countries.

Chris Hayward, policy chair of the City of London Corporation, which has convened the firms, said an enhanced Free Trade Agreement along with a Mutual Recognition Agreement for financial services between the two countries was a “top priority for the sector”.

The calls were echoed by senior chiefs in Switzerland today, with Jos Dijsselhof, chief of Switzerland’s

VENTURE capital (VC) investors in the UK and Ireland shrugged off recessionary fears in the third quarter of the year as they pumped £4.2bn into start-up firms, new research has revealed.

The bumper quarter has taken total VC funds invested into in the UK and Ireland to £18.8bn this year, putting the rate of investment on track with the record levels of cash racked up last year, according to a new report by investment data firm Pitchbook.

The figures have bucked worries of a cliff-edge drop for UK investment in the three months through September as inflation and rising interest rates choke off an easy source of cash for investors.

Analysts at Pitchbook said the figure could begin to flatten out in the fourth quarter, however, as policymakers continue to hike rates to tame inflation.

“The shift in monetary policy from historically low interest rates that promoted growth, spending, and borrowing is notable and its impact on the VC dealmaking environment will be clearer as we progress into the fourth quarter of 2022,” said Nalin Patel, lead analyst on EMEA private capital at Pitchbook.

“VC deal activity growth has been considerable year-over-year during the past decade, and we believe a flattening could take place in 2023, rather than a sharp decline.”

The resilient levels of UK investment came amid a turbulent few months across the continent, however, as total investment tumbled 36.1 per cent to €18.4bn (£16bn), its lowest quarter since the fourth quarter of 2020.

Later stage firms raising cash in the coming months are now likely to experience “haircuts”, Patel warned, as valuations plunge from the frothy highs experienced last year.

Some of the most high profile rounds across the continent have been marked by tumbling prices this year.

Buy-now pay-later giant Klarna closed a funding round at a valuation of $6.5bn, 85 per cent down from the $46bn valuation it fetched in 2021.

Patel said that the headline figure for investment could still be a yearly record at the current pace, however.

“While pace throughout 2022 appears to have kept up with 2021, the third quarter has delivered the decline in dealmaking activity that many analysts have anticipated this year,” he said.

flagship exchange SIX, telling City A.M. a formal trade deal on financial services between the UK and Switzerland made “pragmatic sense”.

“Both nations are renowned global financial centres, with a shared cultural commitment to high regulatory standards, market integrity and investor protection,” he said.

Officials from both governments are set to meet today to discuss the mechanics of a deal as part of International Trade Week.

In a statement yesterday, he said he was “proud of all that Jupiter has achieved” during his time with the firm while “maintaining what sets it apart”.

CITY law firm Gunnercooke has made its first entry into the US market following the launch of new offices in New York City.

The launch of Gunnercooke’s new offices, at the 36-story tall 1 Rockefeller Plaza building in Manhattan, comes as the UK firm’s first venture outside of Europe, following the launch of its German offices last year.

The law firm’s entry into the highly competitive US market comes as the UK’s prestigious Magic Circle law firms have so far struggled to compete with their American rivals, as the plummeting value of sterling has hindered their efforts to recruit and retain top talent.

The entry of higher paying US firms into the British market has also pushed up salaries in London’s top firms, as they face mounting pressure to offer salaries that compete with US pay packets.

Bonham Carter, who joined the fund house in 1994 steered it through its management buyout as chief executive in 2007 as well as overseeing its listing on the London Stock Exchange in 2010. He moved into the vice-chair position in 2014.

After joining as a UK fund manager, he became investment chief in 1999, joint CEO in 2000 and group CEO in 2007.

Brother of actress Helena, Bonham Carter has been focused on overseeing the firm’s stewardship and corporate responsibility work since stepping down from his board role 2021.

Most prominently, the rising competition saw salaries paid out to newly-qualified lawyers at Washington-based law firm Akin Gump’s London offices surge to heights of £179,000.

The launch of Gunnercooke’s New York office comes after the firm became the first UK law firm to take legal fee payments in the form of cryptocurrencies.

The New York office will be headed by Noreen Weiss.

LAW FIRM DWF has launched a new company-wide policy to support women through the menopause, as it seeks to boost retainment of staff in the face of an exodus of women from the UK’s workforce.

The UK law firm’s policy seeks to support DWF employees going

through the menopause with a view to raising awareness around the issue and making it easier to access support.

The London-listed law firm’s new policy comes in response to research from the Fawcett Society showing onein-ten British women aged 45-55 have left jobs because of the menopause.

The policy launch also comes as UK law firms continue to face fierce

competition to win and retain talent.

DWF chief executive Sir Nigel Knowles has previously spoken out against the huge salaries being paid out to newly-qualified lawyers and called for more “sustainable” solutions to the sector’s recruitment crisis. The DWF chief has also advocated for “healthier workplace” environments.

CONSUMERS could be hit with price hikes of up to 35 per cent on olive oil next year, the managing director of Filippo Berio told City A.M.

Harvests in Spain have been impacted by a dry September, with worst-case scenario predictions forecasting the crop could fall to the lowest level since 2012.

In Andalusia, a main olive-growing region in Spain, the local harvest could be 49 per cent smaller this year, and the second smallest on record, the olive oil maker told this newspaper.

Inflation has added €30m (£25.8m) to Filippo Berio’s cost base, with this sum still on the rise.

The company’s managing director, Walter Zanre, said consumers were yet to see the impact of a poor harvest on the supermarket shelves.

Restaurants and other food businesses would be forced to swap out olive oil and use cheaper alternatives in recipes, such as sunflower oil, he said.

Shoppers may also opt to trade down or “completely” shun the product, he added.

It comes after research from Nielsen has already shown olive oil prices have rocketed around 20 per cent this year due to the intense inflationary environment.

When price rises are reflected on the shelves, Zanre warned his firm was “resigned to the fact” that sales would slow down, with there being “no question” that consumption would be impacted.

A 500ml bottle of oil could rise from £5 to £6.50 next year, he said.

The level of cost pressures was not a simple two to three per cent that could be absorbed by the firm, he added.

“If we don’t pass it on, we will simply go out of business,” the boss stressed.

The situation was “unprecedented”, with businesses staring down the barrel of a “very challenging year” next year.

High prices meant a “perfect storm” for Filippo Berio, as cash-strapped consumers are also facing pressure when buying groceries.

There have also been concerning harvest projections for some other olivegrowing nations, like Italy and Portugal.

However, a better harvest in 2023 could hopefully resolve the issue.

RENTOKIL yesterday revealed it has enjoyed a revenue boost of 10 per cent in its first update since it took over rival Terminix in a $8bn (£6.9bn) deal.

In a third quarter update posted yesterday, the pest control firm said its organic revenue had risen 10.4 per cent to hit £900.9m.

Despite disruption from Hurricane Ian in the last week of September, the firm said price increases had provided a boost to sales figures.

However, sales from disinfection services dropped to £3.6m, down £8.6m on the same period the year before, following the easing of Covidrelated habits.

Investors seemed to take note of this fall from pandemic highs, with

Rentokil’s share price closing down over four per cent yesterday.

Steve Clayton, fund manager at HL Select, said investors would also have been disappointed by the omission of any mention of margins in the update.

Excluding Terminix, the Londonlisted firm said it was on track to spend around £250m in 2022 on M&A investment.

NICHOLAS EARL

NICHOLAS EARL

FRANCO Manca has launched a range of supermarket pizzas, allowing Brits to take home and cook their favourite dishes from the sourdough specialist.

The pizzas will hit the shelves in over 500 supermarkets across the UK from this week.

Parent company Fulham Shore has launched a debut range of five premium cook-at-home pizzas in the Franco Manca Chef’s Selection range.

Fulham Shore also revealed trading was in line with management expectations, despite “challenging political and macroeconomic circumstances”, referencing soaring inflation, skyrocketing interest rates and Downing Street upheaval.

It argued this was “presenting trading conditions that are more unstable and unpredictable than at any time in recent memory”.

It will publish its interim results for the year next month.

THE BOSS of the UK’s advertising watchdog is –perhaps appropriately, given the industry he regulates –not afraid of grabbing attention.

The Advertising Standards Authority (ASA) made headlines last month when it banned a series of HSBC green ads for being misleading about their environmental credentials, or greenwashing, and said any future campaigns must disclose the bank’s contribution to the climate crisis.

Guy Parker, the regulator’s head, told City A.M. that this decision was “groundbreaking” and set a precedent for what would happen when firms are found to be greenwashing.

When challenged on whether the ASA had authority to make judgments over green claims, Parker said the remedy from a brand’s perspective was pretty simple: just balance your ad campaign to be honest about impact.

“We are not saying you can’t run an ad campaign that focuses on greener investments. We’re just saying that when you run that campaign, make sure that the adverts have got something in there that acknowledges a lot of them are not as green,” he said.

Parker acknowledged that if society wants businesses to transition to more sustainable initiatives, they must be rewarded by being able to brag about it.

But he said the HSBC decision has “drawn a line in the sand” for what counts as greenwashing and what does not.

Another contentious area that the watchdog has doubled down on is the promotion of cryptocurrencies and non-fungible tokens (NFT).

Pizza firm Papa John’s was forced to cut its free Bitcoin promotion last

The ASA is currently piloting online advertising guidelines in a bid to bring more accountability and transparency to online advertising, and make sure online platforms properly police adverts on their respective sites.

But despite his eagerness to work with big tech firms and social media giants, Parker won’t be afraid to name and shame online platforms if they don’t meet the standards set out in the new pilot scheme.

“Although we are working with the platforms, it doesn’t mean that we won’t hold them to account if they’re not doing enough,” he said, promising that the ASA would be publishing an interim report next month about the

year, whilst former footballer Michael Owen was told to delete a promotion for a controversial NFT scheme that he shared on his Twitter feed in May.

Parker said it was important to strike a balance on allowing people to in-

vest their money how they want, whilst flagging the risks.

For Parker, it’s all about plugging the “knowledge gap” for average punters viewing adverts about investing in crypto and NFTs.

The ASA was originally set up by the advertising industry in 1962 to deal with complaints about advertising on traditional ad spaces like billboards.

But today, the advertising landscape is completely unrecognisable.

It is dominated by what Parker calls the “biggest beasts in the playground” like Amazon and Tiktok, and the regulator is forced, for example, to grapple with Instagram influencers failing to label their posts as paid-for adverts.

Parker said that it was important to work with these tech titans to build a safe and transparent advertising landscape.

progress of the trial.

In this way, the pilot programme has similar intentions to the EU’s new Digital Services Act and the UK’s impending Online Safety Bill, which both attempt to bring US tech firms into the folds of regulation.

The ASA did admit that the increased workload across online has undoubtedly meant a greater pressure on its funding model – a voluntary levy of 0.1 per cent paid by advertisers to the regulator. For example, where an ad costs £1,000 to appear on a bus shelter, £1 of that would be collected and go towards funding the ASA.

It said, however, its income is now increasingly supplemented by direct contributions from digital-first advertisers and platforms.

With the scope of the ASA’s work seeming to balloon every year –and new headaches emerging every week –the question for the regulator now is whether it will be able to keep up with its own ambition.

Leah Montebello talks to the head of the UK’s ad watchdog about greenwashing, crypto and working with Big Tech

Although we are working with the platforms, it doesn’t mean that we won’t hold them to account if they’re not doing enough

SNAPCHAT yesterday announced a renewed content partnership with Sky Sports UK as the pair scramble to keep hold of Gen Z’s attention.

Under the new agreement, the sports broadcaster will publish highlights from every single Premier League football match, Women’s Super League highlights, behind the scenes content, clips from Soccer AM, Monday Night Football and football news on Snapchat.

Following the momentum of the Lionesses’ Euro success, the content deal, which is Sky’s largest to date with the social media firm, will also feature a new Women’s Super League talk show, The Dub.

“The way fans experience sports has evolved – with many fans using their phones to chat with friends, celebrate wins and access behind the scenes content during matches,” Jamie Hunt, head of digital and social at Sky Sports said.

Reaching more than 90 per cent of

13-24 year olds in the UK, Snap is further cementing its position as the home for football and sport for Gen Z.

This ambition was also echoed by former Liverpool FC CEO Peter Moore, who told City A.M. that live sports must evolve if it wants to keep the attention of youngsters.

“The Tiktok generation just wants to see the touchdowns. They just want to see the goals. So we’ve got to find ways to be able to deliver sports to this generation,” he said in an interview last month.

THE LEADING journalist trade body has slammed the BBC’s ambitions to invest more into its local digital news. Chief exec of The News Media Association Owen Meredith has criticised the broadcaster’s plans to cut back its latenight local radio, which will see 139 audio roles axed.

All local shows after 10pm are set to be replaced with an all-England programme during the week and on Sunday afternoons and evenings.

It comes after the BBC already said it would cut regional TV news bulletins for Oxford and Cambridge, as well as merge BBC News and BBC World News.

As part of this shift, the Beeb will create a fund to commission original local programmes and podcasts, driving digital growth.

It is understood that the changes will move around £19m from local to online services. The BBC said it was creating 131 jobs in local online news.

However, Meredith said in a statement that the plans were “unwelcome and unwarranted”, forcing local radio output to directly compete with local news publishers in the online space.

“The BBC is already dominant in on-

line news, which adds to the well documented challenges for publishers to build truly sustainable business models for digital news,” he said.

“This move overreaches the BBC’s remit, as set out in the Charter, and threatens rather than complements commercial news publishers’ local offer.”

He said Ofcom should step in and force the Beeb to go back to the drawing board.

An Ofcom spokesperson told City A.M. “We are examining whether the BBC’s local plans might harm fair and effective competition. We are considering views from the BBC’s competitors, and expect to make a decision next week.”

Regional papers have taken a battering in recent years, with Covid-19 and the testing economic backdrop chipping away at shrinking ad budgets.

Former culture secretary John Whittingdale said the proposed changes were “a mistake”.

It is understood that the decision is largely driven by the BBC’s need to make cuts as a result of the licence fee, which has been frozen for two years.

There is also the pressure to attract and retain younger audiences with online content.

A US JUDGE has blocked Penguin Random House’s planned $2.18bn (£1.89bn) purchase of Simon & Schuster, after finding the move would hurt competition for anticipated best sellers.

A US district court said that the combination of Penguin and Simon & Schuster would “substantially” lessen competition, with a merger of the two possibly making up around 49 per cent of the blockbuster book space.

The US government argued the deal

would result in less competition, reduced author compensation and would ultimately drive up prices.

“Consolidation is bad for competition,” Stephen King, author of It and The Shining, said whilst giving evidence during the three-week trial this summer.

However, the argument from the publisher’s lawyers was that the merger would drive savings and allow for more time to be spent on more books and talent. Penguin Random House said in a statement it would request an expedited appeal.

THE GOVERNMENT should focus on promoting tobacco alternatives rather than cigarettes bans, according to a leading think tank.

In a new report published today, the Institute of Economic Affairs (IEA) has urged policymakers to focus on promoting vapes and e-cigarettes rather than looking towards bans, which has been the preferred strategy in countries such as New Zealand.

In Britain, where 9.3 per cent of adults now vape, the smoking rate has dropped from 20 per cent to 14 per cent since 2012.

IEA’s head of lifestyle economics Christopher Snowdon, who authored the report, said the barriers to consumers for tobacco alternatives should be removed, allowing for greater access to lowrisk nicotine products. He also said more should be done to stamp out the misinformation surrounding the risks of e-cigarettes.

The IEA argued that so long as demand exists (only 53 per cent of British smokers say they want to quit), neo-prohibitionist policies will result in endemic black market activity, crime and secondary poverty without coming close to eradicating smoking.

A parliamentary debate on the independent review of smokefree 2030 policies is due to take place tomorrow.

SONY has been buoyed by its music division this quarter, with the group’s profitability countervailing the Japanese giant’s reduced gaming success, it revealed yesterday.

Music revenues climbed from JPY 217bn (£1.2bn) to JPY 359bn (£2.1bn), with higher sales across recorded

music and publishing thanks to new music releases from big hitters like Harry Styles.

Although gaming revenue also rose from JPY 645bn (£3.7bn) to JPY 721bn (£4.3bn), Sony said the division’s revenue suffered from weak sales of third party games software and higher software development costs.

Sony also posted extra costs with its $3.6bn (£3.1bn) acquisition of video game studio Bungie, which completed this summer.

The firm said it expects similar trends to continue as it heads into the next quarter.

The weakening Japanese Yen against the US dollar also boosted the value of Sony’s overseas earnings.

LATE in October, Elon Musk completed his acquisition of Twitter – sealing the move by carrying a physical sink into the company’s headquarters and tweeting “let that sink in”. It marked the end of a saga that saw the unconventional Tesla CEO make a buyout offer of $44bn, withdraw the offer, and get sued for withdrawing the offer, before finally reverse-ferreting and agreeing to press ahead with the acquisition.

What this means for Twitter going forward has been debated for months.

More straightforward may be the impact it has had on Tesla. YouGov BrandIndex data shows that the electric car company has seen public perception drop across several metrics since Musk made his initial offer.

Stephan ShakespeareReputation scores, which ask the public whether they would be proud or embarrassed to work for a company, deteriorated from 19.9 to 15.2 (-4.7) –which may well have been affected by other factors such as layoffs.

Impression scores (a metric that tracks overall sentiment towards a brand) for the automaker nearly halved between the beginning and end of the purchase process. This could be explained by the fact that Buzz scores, which measure whether consumers have heard anything positive or negative about a brand recently, also slipped from positive to negative territory.

Tesla’s misfortunes this year – which most recently saw the brand miss quarterly revenue expectations – cannot be solely attributed to Elon Musk. Slowing demand, global supply chain issues, and semiconductor shortages can all partially explain why the electric automaker has had a challenging year. But our data shows that Musk’s back and forth over Twitter has corresponded with a souring in public opinion towards Tesla. The car company’s shareholders may hope he gets the message – and lets it sink in – as soon as possible.

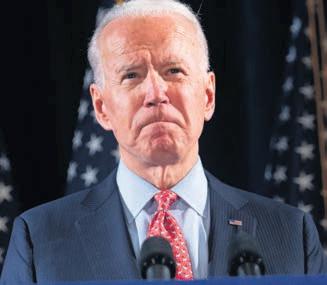

US PRESIDENT Joe Biden will go on a one-week campaign blitz before next week’s US midterm elections, with the Democrats in line to lose their grip on the US Congress.

The President delivered a speech in Florida yesterday, which is the site of a key battleground Senate race, and talked up America’s improving economic performance.

Biden (pictured) has been asked by some candidates in key states to stay away from the campaign trail, due to his low approval ratings, but will still visit several states before polling day on 8 November. Polling shows the Republicans are likely to win back the House of Representatives, while the race to control the Senate is neck and neck in the wake of the US’ 40-year-high inflation.

The party of the incumbent President generally struggles in midterm elections.

The Democrats have held a majority in both houses for the past two years, allowing Biden to pass trillions of dollars worth of government spending.

Congress will likely descend into gridlock for the next two years if the Republicans manage to win back control of either the House of Representatives or the Senate.

The Republicans have blamed the US’ high inflation rate, which is now beginning to dip, on Biden’s near $2 trillion package of stimulus spending in 2021.

Biden also saw his approval ratings crater after the shambolic Afghanistan evacuation in summer 2021.

The Democrats began to pick up some momentum this summer thanks to the backlash against the Supreme Court’s decision to overturn Roe v Wade, a 1973 ruling which made abortion legal in every state.

Biden’s party has also benefited from the Republicans choosing several Donald Trump-endorsed candidates in key states, who have underperformed and run poor campaigns.

Former President Barack Obama will speak in several key battleground states, like Pennsylvania and Wisconsin, over the next week to try and get people to the voting booths.

influx of advertisers to its Tubi streaming service.

FOX CORP reported better-thanexpected quarterly revenue yesterday, as the Fox News parent benefitted from an uptick in advertising spend ahead of the US midterm elections.

The company has been investing in growing its digital footprint, while also focusing on live news and sports.

Fox Corp’s revenue was also buoyed by higher affiliate fees and an

BUS MAKER Wrightbus yesterday bagged £26m in government-backed funding to expand its operations into Europe and South-East Asia.

Under the agreement’s terms, the UK Export Finance would indemnify an £18m Green Trade loan as well as an £8m Green Bank guarantee

provided by Barclays.

“It’s fantastic to see Great British companies like Wrightbus take full advantage of the opportunities exporting opens up,” trade secretary Kemi Badenoch said.

“I am proud the government is supporting British firms to go further, exporting their cutting-edge clean technology to new markets,

cutting emissions and boosting jobs across the United Kingdom.”

Based in Ballymena, Wrightbus made the headlines in 2020 when it manufactured the world’s first hydrogen-powered double decker. The Northern Irish firm aims to produce 3,000 net-zero buses by 2024, expanding operations into the likes of Italy, Spain and France.

Fox Corp is also deciding on whether to combine with News Corp after the companies said earlier this month that Rupert Murdoch had started a process that could reunite his media empire.

Fox Corp’s total revenue rose to $3.19bn (£2.78bn) in the first quarter ended 30 September, from $3.05bn a year earlier.

Analysts were expecting $3.17bn, according to IBES data from Refinitiv.

Advertising revenue increased eight per cent in the quarter, primarily due to higher political advertising revenue at its TV stations, the company said.

Net income attributable to shareholders fell to $605m, or $1.10 per share, in the quarter, from $701m, or $1.21 per share, a year earlier.

On an adjusted basis Fox earned $1.21 per share.

posted an operating

of 562.7bn

(£3.3bn) for the three months ended 30 September. This was down on the 750bn yen reported last

The New-York headquartered media giant saw its quarterly revenue hit $3.19bn as it enjoyed an uptick in demand for political ads

EVA MATHEWS

The New-York headquartered media giant saw its quarterly revenue hit $3.19bn as it enjoyed an uptick in demand for political ads

EVA MATHEWS

FTSE 100 was kicked higher yesterday, driven by middle class favourite and online supermarket Ocado being goosed after it said it was partnering with a South Korean retailer.

capital’s premier index climbed 1.29 per cent to 7,186.16 points, while the domestically-focused midcap FTSE 250 index, which is more aligned with the UK economy, added 1.71 per cent to 18,195.90 points.

Investors piled into Ocado after it announced it has struck a deal with Lotte Shopping to build robotic warehouses, used to select items for delivery ordered by customers online.

The deal sent its shares skyrocketing more than 38 per cent yesterday to the top of the FTSE 100.

“Ocado’s fulfilment tech is world class and plans to develop a network of cen-

tres gave its investors some much needed cheer,” Danni Hewson, financial analyst at AJ Bell, said.

Under the terms of the Lotte tie-up, Ocado cannot partner with other major supermarkets in South Korea. Analysts also said it will take some time before the partnership yields meaningful profits.

Its shares are still down more than 60 per cent this year.

Just a handful of companies listed on the premier index notched losses yesterday on a good day of trading in the City.

Miners led the way, with Anglo American, Glencore, Antofagasta and Rio Tinto all up more than 4.3 per cent.

Yields on UK debt dropped yesterday despite the Bank of England successfully selling £750m of government bonds as it started shrinking its balance sheet.

CALCULUS

Investment firm Calculus has appointed a fresh investment director who will bolster the firm’s relationships in the life sciences sector.

Elizabeth Klein brings a wealth of experience to the role having advised C-suite level executives in several organisations, including Grant Thornton, Radnor Capital Partners and the Bio-Industry Association, on their

investment and funding strategies.

A change in reporting techniques has shrouded sales figures at Wetherspoons, analysts at Peel Hunt said yesterday. A 10.1 per cent rise in sales last month skips the fact its comparative period was 8.7 per cent below pre-pandemic levels. With costs set to soar, they have cut their profit forecasts and say there is “better value elsewhere at this stage”. Still they say buy with a cut target price of 600p.

Women are just 14 days away from the breadline if they lose their jobs... If women already have less money and then are hit harder in the current cost-ofliving crisis, it means they are far less likely to be able to put money away for the future in their pensions or investments.

LAURA SUTER, AJ BELLRentokil has kept pesky inflationary pressures under control this year and has closed 40 acquisitions with around £95.1m of combined annualised revenues. The pest control specialist is on track to spend around £250m this year, while its US subsidiary Terminix delivered its best quarter since 2014. Analysts at Peel Hunt say hold the stock with a target price of 525p.

“Her breadth of knowledge, agility, and impressive network will undoubtedly be a key factor to our success in the coming months,” CEO and founder John Glencross said.

Law firm Lawrence Stephens has built out its family practice, part of its private client division, with four senior hires.

Naheed Taj yesterday stepped in as head of family law at the firm, bringing a decade of experience from across international referrals, particularly in the Middle East

and Southeast Asia. Corinne Park and Ben Castle have joined as directors, while Bethan Hills Howels has been hired as an associate.

The latest appointments form part of a long line of hires this year, with the firm ushering in 27 new lawyers since January.

“We are confident that Naheed will continue to drive the expansion of this department and we look forward to welcoming Naheed, Corinne, Ben and Bethan to the firm,” senior director Steven Bernstein said.

Financial regulation consultancy Bovill has promoted a

managing consultant to head up its payments practice. Ben Arram, who first joined the firm as a prudential regulation consultant in 2017, is set to be responsible for a team that supports payment service providers through all stages of development.

The incoming lead brings over 15 years of experience to the role, having previously worked at Bank of America Merrill Lynch, Barclays, RBS and Lloyds Banking Group.

“In his six years at Bovill, he has shown that he knows this industry and our clients incredibly well, and that he is perfectly placed to help the company grow,” CEO Rebecca Thorpe said.

ONE consistent low hanging fruit for politicians when it comes to economic growth is innovation policy, which consists of spending public money to fund new research and development of new technologies.

While the public and different political parties might see its purpose as slightly different, it is broadly perceived to be unproblematically valuable for both society and the economy. Innovation policy is uniquely politically expedient. It’s remarkably easy to attach it to numerous other major policy priorities, and so it resonates with everyone differently. I recently wrote about innovating mental health care to improve treatment - but innovation means a swathe of different things. It could also be foundational to building self-sufficient regional economies. Others would argue it is critical to addressing climate change or revolutionising healthcare.

All this is compounded by the fact it is also essential to remaining competitive in the global marketplace, thus pretty easily satisfying both sides of the political spectrum.

This is especially unique at a time when many policies conducive to growth are often perceived as coming at the expense of policy that improves public services. The prospect of spend-

ing considerable amounts of public money on innovation seemingly transcends this conundrum, as it clearly offers both the improvement of our societies and our economies.

Across the board, the public feel that innovation has made their lives better, rather than worse, according to research done by Nesta. No doubt, rapid discovery of the Covid-19 vaccine and Dexamethasone during the pandemic helped to bolster this perception.

As we edge closer to what will presumably be a less provocative, but similarly significant budget, the government’s approach to innovation should hopefully be forthcoming. It is particularly pertinent as revised calcu-

lations from the Office for National Statistics show that previously, they and the government severely underestimated private business expenditure on research and development (R&D). This essentially means that, because of these new calculations, the UK is already spending 2.4 per cent of GDP on R&D, a target the government set for 2027.

However, as with many other policy areas, the conversation may end up focusing disproportionately on how much money the government spends, versus how it is best used. Here, as with indeed virtually every other policy area, the term ‘spending’ is often misleading. Money spent well – to pro-

duce financial or social returns in the future – is investment.

Which leads nicely onto my second point: investment in and of itself could be meaningless without a reform agenda to complement it. And increased investment will mean increased scrutiny and so it is essential that government is able to deliver tangible output.

Reform is crucial in the UK because innovation is about effective systems as well as available funding. Our country has a chronic problem with overly bureaucratic processes for applying for innovation support. Funding often goes to people already established in their field trying to make marginal

THE PRIME minister and the Chancellor are struggling to “balance the books”. Around £50bn might be needed from a combination of cuts to spending plans and increases in taxation. This has led to a chorus of voices squealing about austerity creating a major economic recession.

The argument goes back to Keynes, writing in the aftermath of the Great Depression in the early 1930. His revolutionary new idea was something which he called the “multiplier”. An increase in public spending means that more people are employed - in the public sector itself or in something like building infrastructure, for instance. Tax cuts mean that individuals have more money to spend and create jobs in the companies whose products they buy. The newly employed people in turn spend more money and the effect ripples across the economy. The final impact is a multiple – hence the word multiplier – of the initial increase in spending. The whole argument can readily be

Paul Ormerodreversed. The effects of cuts in spending or tax increases are enhanced by the multiplier. This seems a nobrainer, but common sense can often lead us astray. It seems to be common sense that the Sun goes round the Earth - it goes round the sky after all.

Keynes thought that the multiplier might have a value of between 2 and 3. So if the government now takes £50bn out of the economy, the eventual impact would be between £100 and £150bn.

The one thing which modern economists agree on is that the multiplier is considerably lower than Keynes’s estimate: the upper bound of the various estimates is around 1.5.

A key reason for this is that the UK, like other Western economies, is much more open than it was in the 1930s. So a big portion of any increase in spending goes on imports. Equally, if cuts are made, the impact on the UK is muted because part of the reduction in spending will be on imports rather than on domestically produced goods. Now comes some even better news. There is a school of thought which argues that, in certain circumstances, the multiplier could be negative. In other words, cuts to spending may boost the economy rather than cause a recession. This concept was introduced by the Harvard economists Alberto Alesina and Silvia Ardagna in the aftermath of the financial crisis of the late 2000s. The idea came under fierce attack from self-styled Keynesians. But the experience of the shortlived Truss government provides strong evidence in support of this thesis. The Harvard economists were not claiming that expansionary fiscal policy ends up always being contractionary – and vice versa. They were

stating that in some circumstances this would be true.

The energy price subsidy proposed by Truss and Kwarteng was like an enormous tax cut. The explicit tax cuts proposed by the duo were a relatively small part of the package.

In the short term, if orthodox Keynesian thinking is correct, these measures should have provided a massive boost to the economy. However, interest rates soared and both business and consumer confidence collapsed. These factors would have more than offset the potentially expansionary impact of the fiscal boost, large though it was.

Rishi Sunak and Jeremy Hunt have so far succeeded in bringing interest rates down and restoring confidence, at least in part. This will largely mitigate any negative impacts of spending cuts and tax increases. The apparent contractionary fiscal stance may even prove to be expansionary.

£ Paul Ormerod is an author and economist at Volterra LLP

gains at already existing technological frontiers, not people with ideas that are exploring new fields and new tech frontiers.

It is a strange spectacle that the party that gave us Brexit – a movement motivated by improving the UK’s competitive advantage and economic resilience – has also given us a confusing cacophony of science ministers with a similarly puzzling set of organisations for researchers to navigate. There were a dozen strategies across government between 2017 and 2021. None of these add up to anything coherent enough to make the UK an established policy or funding environment, in comparison to other international leaders in R&D.

For businesses, innovation for its own sake is pointless – firms want a pathway to a market, not just in the UK but globally. Right now, the best UK firms are being bought up and the ideas or capabilities are being exploited abroad. While the UK has an excellent academic research base - UK papers are more likely to be highly cited than any of our peer group - the UK exports fewer high tech manufactured goods by value than France, Japan and Korea, let alone Germany, US and China, according to Onward.

Just because we know we’ve been investing more in R&D, that doesn’t make the UK any more prosperous or immediately solve our levelling up challenges. The UK must stay ambitious, not just in setting stretching targets for R&D spend, but also in reforms that help get more economic bang for our buck.

Matt Hancock has lost the Tory whip after announcing he’ll follow in Nadine Dorries’ footsteps and appear on “I’m a Celebrity”. Maybe - just maybe - if he had stuck to his constituency he wouldn’t have been the victim of a wave of memes about his penchant for being filmed…

[Re: Why does Cop27 seem to be the party no one wants to go to?, Oct 31]

It’s disappointing that our new prime minister, Rishi Sunak, doesn’t consider attending COP27 a priority. I appreciate his government has to deal with the UK’s cost of living crisis, but now is not the time to retreat from our environmental pledges. By addressing climate change head on, Sunak would be ensuring our society is resilient to future cost-of-living crises. Renewable energy sources cost virtually nothing to run, they are secure and not dependent on Russia, and with the support of flexible demand, like electric vehicles, they can be slotted into the grid quickly. If the UK had embraced renewable energy earlier consumers

would not be facing such high energy costs - and we'd have cleaner air and less emissions too.

Mr. Sunak might end up attending the conference, but his hesitancy suggests he will not give climate matters the attention they deserve. The 2030 petrol and diesel car ban is around the corner, and it’s pivotal that policies are enacted to enable the UK to adapt successfully.

The worrying reports from the UN means every nation must show how they are making progress and taking action to reduce emissions. We need concerted action, not dithering.

If we’re to stand a chance of a net zero future then we need a committed government. Sunak thinking about snubbing COP27 sends out all the wrong messages. The world’s environmental health must be a priority. He must realise this and step up to the plate.

Nick WoolleyRISHI Sunak’s in-tray is overflowing with crises: from the cost of living to supporting Ukraine, from settling the UK’s long-running dispute with the EU about Northern Ireland to the fate of his controversial home secretary.

But the prime minister also needs to address long-running issues which his predecessors have neglected. Among these is how to protect the UK tech industry.

Global upheaval is underway. The US has unleashed restrictions to crimp China’s semiconductor sector, but these could harm many Western tech firms too. The EU has a strategy to cope. It will spend billions of euros boosting Europe’s chip ecosystem and is implementing stricter digital competition rules to support EU-based tech start-ups. The UK government, however, is asleep at the wheel.

If Sunak is to protect British tech, he must show the UK government is open to business. Previous business secre-

it to being a “mis-managed, undercapitalised start-up”.

A new study has found that as rhinos with long horns became the favourite choice for hunting, those with shorter horns had more chances of survival and of passing their genes to their offspring - thus leading in the evolving phenomenon of horns shrinking across all species.

Three more vessels carrying grain left Ukraine yesterdaydespite Russia’s withdrawal from the deal that was allowing stocks to leave through the Black Sea. Russia has exited the deal claiming Ukraine is using the safe corridor to attack its ships. Ukraine, the UN and Turkey are left with coordinating new shipments, in the hope that Russia won’t interfere or attack the ships carrying the grain.

Ukrainian President Volodymyr Zelensky accused the Russian

government of “blackmailing the world with hunger”. The deal, brokered in July, ensured food for thousands who would have otherwise gone hungry, especially in African countries.

Ethiopia is already at risk of famine. Global wheat prices rose sharply on Monday after Russia’s exit from the deal. Putin’s decision risks re-destabilising a global supply chain that’s been continuously shaken to the core since the war started.

ELENA SINISCALCOSt Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900

tary Jacob Rees-Mogg delayed for a third time the government’s decision on whether a Chinese firm should be forced to reverse its purchase of Newport Wafer Fab, a UK chip-making plant. The appointment of a new business secretary, Grant Shapps, means further delays. The deal has been in limbo for 18 months now.

Scrutinising Chinese investment is sensible, but reversing the deal now would send a chilling warning to other potential foreign investors. Newport Wafer Fab’s chips could be made in the US and EU, both of which are subsidising new chip-making capacity. While some in the industry claim that Newport Wafer Fab could become a global leader, its employees have begged the government not to return

Our country needs to move onto important questions. The first is how to get digital competition working better.