THE NOTEBOOK BILL BROWDER ON THE NEED TO PROTECT THOSE FIGHTING THE GOOD FIGHT P12

JACK BARNETT

THE NUMBER of CEO departures among the UK’s top companies more than doubled over the last year, new data has revealed, as boards attempted to insulate their firms from rising prices and interest rate hikes with a change in leadership.

Some 38 chief executives of Britain’s largest companies left their roles in 2022, more than double the 18 that departed in 2021, according to advisory firm Russell Reynolds Associates.

The uptick in CEO turnover has been engineered by a “greater level of change and instability” in the UK economy, Luke Meynell, managing director of Russell Reynolds Associates, said.

Departures from the FTSE 350 contributed to just over one in five of every exit last year, while 13 FTSE 100 companies changed leadership. FTSE 250 companies CEO exits climbed to 25 from 10.

‘EMBARRASSING’ TOTTENHAM P20

Notable exits last year include Jonathan Akeroyd taking the helm at FTSE 100-listed luxury fashion retailer Burberry from Marco Gobbetti, and Pete Redfern being replaced by Jennie Daly at housebuilder Taylor Wimpey. Nick Read also departed as Vodafone’s CEO late last year.

“UK companies have experienced a turbulent few years, with the economy recovering more slowly from the pandemic than others in the G7 – and the nation having faced additional challenges from supply chain issues created by Brexit,” Meynell said.

“The challenges which CEOs must now address have multiplied considerably... Accordingly, boards worldwide will be considering carefully whether they have the right person in place at the top,” he added.

UK firms have been hit by a slowdown in consumer spending and hamstrung by swelling costs.

Inflation surprisingly hit 10.1 per cent in March, down slightly from February’s 10.4 per cent, but remains much higher than in the rest of the rich world.

Bank governor Andrew Bailey and co have jacked up borrowing costs 11 times in a row to 4.25 per cent and are expected to send rates to a peak of five per cent.

Those factors have squeezed companies, with a separate report out today from EY-Pantheon revealing profit warnings among UK listed firms have hit their highest level since the early days of the Covid-19 crisis. As a result, chief executives may have been at greater risk of losing their job as boards bid to help steady the ship amid the economic turbulence. Many top forecasters have since canned their recession warnings for the British economy this year, but growth is still tipped to be sluggish.

CITY A.M. REPORTER

A RECORD number of runners donned snazzy sportswear and unusual fancy dress outfits yesterday to take part in this year’s London Marathon.

Some 49,675 runners registered for this year’s 26.2 mile race, up from the previous record of 43,199 in 2019, with organisers expecting around 48,000 to have crossed the finish line on Sunday.

Kenya’s Kelvin Kiptum won the men’s elite heat in 2:01:25 – the second-fastest time in history and a course record for London – while Dutch athlete Sifan Hassan produced a remarkable performance overcoming injury to win the women’s race.

Extinction Rebellion protesters, who gathered in the streets nearby for the third day of demonstrations, stuck to their pledge of avoiding disruption to the race.

JESSICA FRANK-KEYES

BRITAIN’s biggest companies have been left wondering who will replace the CBI as the country’s top business lobby, after dozens of member firms fled the group late last week. Many major UK firms have now either suspended or ended their

membership with the group, after two women who worked at the CBI made rape allegations, which have been passed to the police.

Aviva, Natwest, Vodafone, and Virgin Media O2 were among some of the many companies that said they were terminating their membership of the business group.

Following the exodus, stand-in group BizUK emerged this weekend.

Nick Faith, director at public affairs firm WPI Strategy, wrote to FTSE 100 firms announcing the new body.

“It is clear that businesses operating in the UK need an independent, cross-sector

organisation which can ensure they can continue to meet and work constructively with political decision-makers,” Faith wrote, adding the organisation would be “hopefully temporary”.

Other ideas have also emerged, including that of the former head of the Institute of Directors Simon

Walker, who has called for a single supergroup composed of the UK’s top five business lobbies.

“It’s time for a reboot but it risks there being too many voices. I think it’s a moment for consolidation,” one senior City figure told City A.M.

£

CONTINUED ON PAGE 2

AN inordinate amount of ink has been employed discussing the future of the CBI. At the heart of it is a question: if not them, whom?

There is no question that medium to large businesses wish for a collective voice.

Regrettable though it may be, too many CEOs are wary to put their head above the parapet, perhaps wounded by the experience of the European

Union referendum in 2016.

With that in mind, either the CBI needs to reinvent itself sharpish, or another body needs to replace it.

The first horse out of the stable on the latter front is BizUK, which promises to be a leaner,

focused outfit that would inform the drawing up of Conservative and Labour manifestos, given heft by corporate bigwigs. The team behind it, Nick Faith and Sean Worth, have demonstrated they can manage such a model in the form of the Covid Recovery Commission. Their idea, embryonic though it may be, is perhaps the best form for a ‘big business’ group going forward.

Culture aside, the CBI’s mistake was becoming at once too large and too vague. Their helpful corralling of trade bodies got lost amid conferences that ranged within a single day from ESG concerns to Solvency II regulations. It would be far better for corporate Britain to focus on two or three deliverable policy changes to the benefit of all rather than get lost in special pleading and generalities alike.

EARTH DAY Extinction Rebellion also took to the streets of the capital yesterday to mark Earth Day in the first of four days of action as the group looks to soften its image

CONTINUED FROM PAGE 1

Walker has called for a merging of the CBI, the IoD, the British Chambers of Commerce (BCC), the Federation of Small Businesses (FSB) and MakeUK into a “single, overarching body” following the CBI scandal, which has since suspended key activities until June.

City commentator Bill Blain said the CBI’s absence is likely to hurt the business community, as the current government is failing to listen to companies’ concerns.

“The government is already weak in

this area – they lack any real depth on its own bench to understand this when nobody is really representing British industry and commerce to them, and that is a concern,” Blain, head of alternative assets at Shard Capital, said.

“If no one is telling them what the needs of business are then we have a zero-sum game going on in terms of setting industrial policy,” he added. But asked which of the remaining business groups might take the lobby group’s place, he said: “I don’t know what will replace the CBI. I’m sure something will… all of them are very different organisations.”

Blain’s comments come as Rishi Sunak speaks with business leaders today for “direct and detailed discussions”, according to Downing Street.

“I’m a prime minister passionate about working with business to unlock opportunity and progress,” he is expected to say at the Business Connect event.

“The UK can be proud of its business credentials. Through the creation of 162 tech unicorns, smarter regulation and world-leading universities, we’ve got the right ingredients to double down on growing the economy,” Sunak will say.

The ideal scenario, of course, would be our finest City and business leaders to speak for themselves more often.

Amanda Blanc at Aviva, L&G’s Sir Nigel Wilson and the Lord Mayor Nicholas Lyons (taking time out from Phoenix) are fine examples.

In lieu of more from leaders outside the insurance industry, a collective voice will still be required. Consider the starting gun fired.

THE TELEGRAPH

NATIONAL GRID QUITS

NORTH SEA CARBON CAPTURE PROJECT

National Grid is quitting its foray into developing carbon capture and storage in the UK, in a blow to the government’s net zero ambitions. The company is in talks to sell its Humber region project.

THE GUARDIAN MPS CONDEMN FRASERS GROUP’S USE OF FACIAL RECOGNITION CAMERAS

Almost 50 MPs and peers have written to retain tycoon Mike Ashley’s Fraser’s Group, condemning the use of “live facial recognition” cameras in the group’s stores.

THE FINANCIAL TIMES CHINESE DIPLOMAT DRAWS IRE FROM BALTIC NATIONS OVER STATEHOOD REMARKS

European governments have reacted with anger and dismay to comments by a Chinese diplomat questioning the legal status of former Soviet states and Ukraine’s sovereignty over Crimea.

NOAH EASTWOOD

WORKPLACE banter is no laughing matter, according to research from lawyers GQ Littler, which showed that jibes at colleagues landed scores of people in employment tribunals last year.

There were 66 claims in total that ended up in tribunals last year, according to the firm.

Employers have been urged to get a grip on comments that cross the line, and warned that they could be liable for claims based on incidents which occur outside of working

hours too, including comments made over messaging apps.

Lisa Coleman, GQ Littler, said: “Whilst humour in the workplace should be encouraged, employers should be taking active steps to foster a respectful and inclusive environment with clear boundaries. “People should be mindful to keep jokes to those they are comfortable repeating and explaining if questioned about them.”

Last month, a survey conducted by Irwin Mitchell found that one third of workers had experienced bullying disguised as banter.

JACK

UK HOUSE prices jumped again in March, driven higher by soaring rents pushing tenants to seek out their first home, but further interest rate hikes by the Bank of England could send a chill through the market, new research shows.

The average price of a property coming to market in Britain hit £366,000 last month, up £890. However, the 0.2

stimulating demand in the first-time buyer market as potential home owners seek to shield their finances. Monthly mortgage payments are typically lower than rent bills.

As a result of this demand surge, which Rightmove said increased 11 per cent, first-time buyer type properties also reached a new record of £224,000 in March.

Rightmove’s Tim Bannister has warned that the Bank of England pushing through yet more interest rate rises to deal with historically high inflation is likely to price some potential buyers out of the market, darkening the outlook for house prices.

BNY Mellon has warned employees they may face “correction action” if they do not return to the office, a move that has been met with a mixed reception from the bank’s staff, according to the Sunday Times.

In a message entitled ‘Working Together’, senior executive vice president Roman Regelman said “the number of days flex employees are expected to be in the office will change to a minimum of three days per week. Those who are not adhering to the three-day policy are subject to corrective action.” The changes came into place on 10 April.

In the UK, BNY Mellon has ten offices and 4,800 staff. Not all employees were impressed by Regelman’s missive.

The Sunday Times reported some members of staff have retaliated by consulting conciliation service Acas.

It comes after JP Morgan recently asked its senior bankers around the world to work from the office five days a week, while Goldman Sachs led the way last March when it demanded employees work in the office every day of the week.

lionesses

UK searches for “lionesses” quadrupled in February 2023 ahead of the football this summer.*

Learn more at

STRUGGLING online retailer Asos has been hit by a big short attack from the hedge fund Shadowfall as it attempts to recapture its pandemic-era lustre.

The “dark destroyer”, head of Shadowfall Matthew Earl, has built a short position in Asos worth £4m, the Sunday Times reported.

Asos is the second most shorted stock in the FTSE 250 with 10.98 per cent of its shares on loan, says S&P Global Market Intelligence.

Short selling is when an investor buys shares and then sells them on the market with the intention of buying them back later for less money. Short sellers bet on, and profit from, a drop in the share price.

Shadowfall has previously attracted attention for attacking the fraudulent payment processor Wirecard

which imploded in 2020. Other hedge funds with short positions against Asos include Citadel Advisors and Marshall Wace.

Shares in Asos have fallen over 44 per cent in the last year, bringing its market capitalisation to around £780m.

Last October, Asos posted a £32m annual loss with cash-strapped consumers cutting back spending.

Asos has been attempting to significantly restructure in an initiative called ‘Driving Change’. It said it was looking to slash 100 jobs in 2023. Yet sales slipped in the four months to December.

In February, Asos brought in Sean Glithero as interim CFO. The company also hired three quarters of its new 12-person decision-making team.

Asos has struggled since its pandemic highs

ASIAN-INSPIRED fast food chain Itsu is eyeing a global expansion with plans to sell certain offerings in supermarkets worldwide.

In an interview with The Sunday Times, founder Julian Metcalfe and chairman Justin King said that the chain is opening warehouses in France, Spain and the Netherlands in a bid to put its range on international supermarket shelves by 2025.

SUPERMARKET giant Sainsbury’s is set to report a fall in annual pre-tax profits this week, posting up to £690m, down from £730m last year.

Sainsbury’s reported a strong 12week sales growth of 12 per cent at the end of March, but fell short of rivals Aldi and Lidl, who are gaining market share as the cost of living crisis pushes

food price growth to it’s fastest level in 45 years, at 19.2 per cent.

Michael Hewson, chief market analyst at CMC Markets UK, said despite fierce competition, Sainsbury’s has maintained a reasonable performance since the dramatic lows of October, which saw a drop in shares of 40 per cent –an all-time low.

Christmas boosted sales, with help from Argos after Royal Mail strikes.

In January, wholesaler’s Bestway Group took a 3.45 per cent stake in the business, suggesting they may increase their stake. This saw a surge in Sainsbury’s share price, hitting its highest levels in a year. Ultimately, guidance for a full-year underlying profit has been kept unchanged at between £630m to £690m, despite the ‘headwinds’ of price and margin pressures.

“We are increasing our current 100 product range by 50 per cent over the next 12 months,” King said.

King put Sainsbury’s on a winning course after he took over as CEO of the supermarket chain in 2014.

Now he’s teamed up with Metcalfe and launched an ambitious plan to nearly double Itsu’s grocery sales from £60m to £100m in two years.

Since coming on board as an informal adviser in 2021, King has helped Itsu grow the supermarket arm

of its business from five per cent before the pandemic to over 30 per cent in today’s market. The chain is forecast to make a revenue of £165m in 2023.

While competitors have been forced to raise their prices in response to soaring inflation, Itsu has been able to keep food inflation low in supermarkets, at almost half of the 19 per cent figure reported in March, because its products are frozen and do not perish on supply chains.

Sainsbury’s reported a strong 12-week sales growth but fell short of rivals Aldi and Lidl

*

Learn more at

CHRIS DORRELL

HSBC faces yet more trouble at its upcoming AGM as shareholder advisory firm Pirc urges shareholders to vote against the re-election of chair Noel Quinn, according to a report in the Mail on Sunday.

Justifying its position, Pirc highlighted the bank’s alleged links to Hong Kong human rights abuses.

Pirc said: “While the full impact is yet to be ascertained, these practices are considered to be examples of a

corporate culture not aligned with the interests of all stakeholders.”

The recommendation follows a report published by the Hong Kong AllParliamentary Group in February that said HSBC had been “complicit in suppressing the human rights of Hongkongers by proactively supporting the National Security Law”.

MPs also alleged that HSBC blocked residents from accessing their pension funds which may have forced people who had left Hong Kong to return.

Pirc has also urged shareholders to

reject the bank’s pay report, arguing Quinn’s £5.6m pay packet last year was excessive. They also recommended shareholders vote against the reelection of Dame Carolyn Fairbairn, chair of the pay committee.

Other banks are facing shareholder revolts over their pay policies.

Pirc’s report adds another challenge to what is already shaping up to be a fiery AGM on 5 May, after HSBC’s largest shareholder, Ping An, confirmed it would vote to break up the bank.

PROFIT looks set to increase at the UK’s largest lenders as they report first quarter earnings over the next two weeks.

The FTSE banking giants have seen relative stability over the last few weeks following the extreme volatility in March, but this stability means investors will refocus their attention on other major issues in the sector.

Foremost among them is how banks’ profitability will be impacted by the Bank

of England’s attempts to contain inflation, with the BoE’s 11 consecutive rate hikes widening banks’ net interest margin and helping to generate bumper profits.

Last quarter, investors were disappointed by the conservative forward guidance given by banks which suggested that peak profits from interest rates had passed. But in recent weeks large US banks beat expectations, delivering substantial profits boosted by higher interest income, suggesting there could be more gains to come from higher rates.

The biggest beneficiaries are set to be Lloyds and Natwest, who have large mortgage books.

Lloyds expects to report pretax profit of £2.0bn, up 26 per cent on the same period last year. The bulk of this comes from a boost in net interest income, which analysts expect to rise 22 per cent year on year. Natwest is expected to report a 46 per cent increase in net interest income, which would help profit to grow by a third to £1.6bn.

At Barclays, analysts expect profit to be flat on last year. However, trading revenues are also likely to be fairly strong, partially offsetting the hit from investment banking.

At HSBC – who haven’t released consensus estimates for the quarter – all eyes will be on how the results influence the shareholder campaign to spin off the bank’s Asian business.

A poor performance could incentivise more shareholders to join Ping An in voting for proposals to fundamentally

restructure the bank.

Standard Chartered kicks off on Wednesday and is expected to report a pretax profit of £1.4bn, down slightly on the £1.5bn it reported last year.

Although the banks are expected to report healthy earnings, their reports will be scrutinised for signs that UK consumers are faring less well.

Barclays will release earnings on Thursday and Natwest on Friday. Lloyds report on Tuesday 2 May and HSBC round things up on Wednesday 3 May.

CHRIS DORRELL

OUTSTANDING bank loans to small and medium-sized businesses (SMEs) in the UK fell by £14bn in the year to March with concerns that it could fall further due to banking turmoil and mooted regulatory changes.

In the year to March, outstanding bank loans fell to £195bn from £209bn,

according to Bank of England data.

This data suggests banks started to rein in funding about a year ago when interest rates began to rise.

Altenburg’s Will Senbanjo suggested the collapses of Credit Suisse and Silicon Valley Bank could further reduce lending as banks focus on reducing risk in their lending books.

Although reduced risk appetite has

stymied SME lending, lending to large businesses increased by £14bn in the same period to £337bn from £322bn. Regulators in the UK are considering Basel 3.1 regulations to remove existing incentives for SME lending. This would force SME lenders to hold a higher level of capital against loans to the sector. The proposals have been heavily criticised by business groups.

SME

there’s more pain on the wayHSBC is gearing up for a ‘fiery’ AGM on 5 May as the bank fights multiple fires CHRIS DORRELL

OXFORD Street is on the cusp of something “really special” and “exciting”, the chief of the New West End company has said, as store development and a boost in international tourism signals a return to better times for the district.

Dee Corsi (pictured), who oversees operations for the retail strip, told City A.M. the West End is “changing” and the stores which survived the pandemic are investing to create unique experiences to entice customers.

Oxford Street’s reputation has been damaged over the past few years amid store closures like Topshop’s, an invasion of illicit American Candy sites and lowered footfall.

However, Corsi said the shopping district is on track to make £10bn by 2025, largely thanks to

international tourists.

While footfall remains around 20 to 30 per cent below pre-pandemic levels, Corsi noted this was outperformed by the rebound in sales.

“The footfall that is coming is spending and that is a really important point to note,” she said.

“Average transaction value is really strong at the moment. In March, we were around six per cent higher in terms of sales than [in] 2019.”

Corsi also reiterated her calls for a relaxing of Sunday trading restrictions, which could rake in an estimated £350m a year and keep the capital “competitive”.

“If you look at a growth measure that doesn’t cost the government anything, you would like to think that that is something that they will consider very seriously,” she said.

LUXURY goods company Kering is set to pay a record rent for the UK, after agreeing a lease for Bond Street’s Yves Saint Laurent store.

Market sources told The Sunday Times that Kering will cough up £13m a year for the six-storey West London store. Plans are reportedly also in the works for a sale of a 150,000 sq ft Bond Street property nearby, which may be turned into a luxury hotel.

The luxury group pipped competitors Richemont and LVMH, owned by Europe’s richest man, to the purchase. The deal comes as the luxury goods sector shrugs off cost of living concerns, which have less of an effect on their customers. Despite this, the industry has faced criticism for using record levels of inflation as an excuse to raise prices.

In January, data from consulting firm Bain and Co revealed that spending in the luxury sector had grown by the same amount as the previous year, despite retail sales falling. In November, LVMH and Kering reported a 28 per cent and 14 per cent annual rise in sales respectively.

REUTERS REPORTERS

BED BATH & Beyond yesterday filed for Chapter 11 bankruptcy protection after the home goods retailer failed to secure funds to stay afloat.

HENRY SAKER-CLARK

PUBS are set for a “much-needed” coronation boost after facing a challenging start to 2023 amid soaring energy bills, according to the boss of Greene King.

The pub giant, which runs 1,600 managed sites across the UK, has said the coronation bank holiday “provides a great opportunity” for pubs to show why they are at the heart of British communities.

Nick Mackenzie, chief executive of the Suffolk-based business, said it comes amid a “challenging backdrop” for the industry, with consumer finances also coming under pressure.

Research conducted for a new report from Greene King showed that more than a quarter of people (27 per cent) aged 1834 expect to go to the pub during the coronation weekend.

The group expects to pour around 1.8m pints over the bumper weekend.

“We as a business have got behind these events in the past and it will be exciting... [It’s] a much-needed boost for industry right now,” Mackenzie said.

Now is a challenging period for the sector after energy bills rocketed following the Russian invasion of Ukraine.

Earlier this month, fresh figures revealed that 153 pubs disappeared for good from English and Welsh communities over the first three months of 2023.

Greene King said one of its pubs has seen its annual energy bill rise to £100,000 from around £15,000 a year ago.

Mackenzie said he hopes the government will recognise “the huge value” of the sector over the coronation.

“We need the government to create a regulatory environment which encourages investment – particularly through fundamental reform of business rates, which represent the highest regulatory cost burden for pubs.” PA

It comes after the home goods retailer sounded the alarm in January after a quarter of significant losses and a flailing share price –despite intermittent rallies in the so-called ‘meme stock’.

The company finally filed for bankruptcy yesterday, listing both its estimated assets and liabilities in the range of $1bn and $10bn, according to a court filing.

While the retailer has begun a liquidation sale, it intends to use the Chapter 11 proceedings to conduct a limited sale and marketing process for some or all of its assets, according to the statement.

THE GOVERNMENT is reportedly struggling to attract investors to the £20bn Sizewell C nuclear power station.

Hunt proposed giving the project sustainable status to attract green-minded investors, and ministers have already rejigged nuclear plant funding models to offer more of an up-front reward to investors.

But fund managers at Legal & General and Aviva both said Chancellor Jeremy Hunt’s plans in the spring budget had not altered their positions, the Telegraph reported.

“Our stance hasn’t changed,” a Legal & General Capital spokesperson told the paper.

An Aviva spokesperson told the paper the firm had “nothing to add” to chairman George Culmer’s recent comments that there was “ongoing debate” over nuclear waste environ-

mental issues.

Natwest and the BT Pension Scheme previously told pressure group Stop Sizewell C that they would not support the project.

Nuclear plant Hinkley Point C is set to open in 2027, at the earliest, when all bar one of the UK’s existing nuclear power stations will have shut.

Developer EDF is also working on Sizewell C, which is set to cost between £20-30bn, with the government contributing £800m so far.

The hunt for investors stepped up after China General Nuclear was bought out by the UK government over security fears surrounding Chinese investments in major UK infrastructure.

A Department for Energy Security and Net Zero spokesman told the paper: “New nuclear is key to our longterm energy security… we are working closely with the project company to attract new finance.”

LUKE THOMAS

DOZENS of North Sea oil and gas platforms could be brought to a standstill today as hundreds of workers down tools as part of a 48hour strike.

Some 1,300 workers, including technicians, deck crew, crane operators, and riggers, are set to take part in the strike.

Around 700 of the striking workers

are employed by Bilfinger UK, while 350 construction workers at Stork Technical Services and 200 staff from Sparrows Offshore Services will join them.

John Boland, Unite industrial officer, said it was set to be “the biggest offshore stoppage in a generation” adding that it will cause “severe problems for contractors and operators.”

Boland stressed the strikes are

“not exclusively about pay but also working rotas, holidays, and offshore safety.” Bilfinger, Stork, and Sparrows didn’t immediately respond to requests for comment.

The sector could be hit with further strikes, after Unite workers at Petrofac, BP and Wood Group voted in favour of strike action, while ballots have been sent out to offshore workers from Totalenergies.

BREEZY DOES IT

Gnow scrambling to win over the Canadian miner’s shareholders with promises of a third bid for the company.

Its initial two offerings for Teck – the first totalling £19bn and the second including a £6.6bn cash sweetener – were knocked back by the miner’s senior leadership, including top shareholder Norman Keevil.

Now, Glencore has gone to extreme measures, urging Teck shareholders in a public letter to reject the company’s own plans to spin off its critical minerals business from its coal operations at a crunch demerger vote this week.

The FTSE 100 company’s offer for Teck, which represented a 20 per cent premium on both its share classes, would have seen both parties merge their minerals businesses and separately spin off their combined coal assets into a new listed company.

Glencore’s shareholders would own 76 per cent of the combined entity whereas Teck incumbent investors would hold the remaining 24 per cent.

Theoretically, Glencore is the perfect suitor for Tech.

Its takeover attempt is a cool, rational attempt to diversify its business and shift towards future-facing minerals, which will be in high demand for wind turbines, solar panels and electric vehicle batteries as the world moves towards a greener future.

As Teck has vast copper resources and zinc deposits in the Americas, it’s a credible

Glencore’s sheer size and leading position in the commodities market.

Last year, Teck made £3.92bn earnings with shareholders clawing back £3.28bn.

By contrast, Glencore posted pre-tax profits of £28bn over the same period, and handed almost £6bn to shareholders amid widespread volatility in the economy and soaring fossil fuel prices.

However, Teck has proposals of its own to turn its business into two publicly listed companies.

This would include Teck Metals, focused on metals production, and Elk Valley Resources, built around its steelmaking coal assets.

Teck predicts its proposals could see its shares trade at a 55 per cent premium on its latest closing price.

Yet, the debate is not solely around contrasting valuations – a matter that would typically come to a resolution, with Glencore’s bigger size and revenue streams enabling it to present a figure that would finally appeal to Teck’s shareholders.

Instead, investors are highly divided over the proposed deal, because the true nature of the impasse is not finances, but coal.

Climate conscious Legal and General Investment Management (LGIM) has lent its support to Teck’s proposals, alongside Bluebell Capital Partners and Norway’s

plans but stopped short of backing the Swiss firm’s proposed takeover.

Coal giants raked in massive profits last year, with the world’s top 20 companies raking in £77.8bn of collective earnings – but there are concerns with the long-term sustainability of such bumper numbers.

After all, this was an outcome driven by the pandemic and Russia’s invasion of Ukraine, with the International Energy Agency still expecting coal consumption to plateau around 2025.

Coal is also the world’s dirtiest fossil fuel, and with companies looking to divest to achieve net zero targets, it appears Teck’s board and many of its shareholders have seen the scale of Glencore’s large thermal coal business and oil trading businesses and opted against any negotiations.

Glencore has pledged to shift away from

The company faces scrutiny not just from Teck shareholders, but also its own investors over its climate ambitions.

Shareholders will vote at Glencore’s annual meeting next month on a resolution urging the company to explain how its thermal coal business aligns with efforts to limit the increase in global temperatures to 1.5 degrees Celsius – in line with the Paris Agreement.

HSBC Asset Management and LGIM are among signatories to the document.

While the company has previously pledged to cap coal production at 2019 levels and reach net zero emissions by 2050, banking group Credit Suisse’s does not expect a material decrease in Glencore’s coal production until 2036.

Coal is not the only headwind Glencore has to navigate in its bid to buy Teck.

The Canadian miner maintains a byzantine dual-shareholder structure –dominated by its A-shareholders.

This means Glencore will also have to coax the Keevil family, the company’s primary A-shareholders, into changing their mind over a deal.

With their dominant position in Teck’s corporate composition, doing this may be enough to push through a deal for Glencore.

However, with increasingly climate conscious B-shareholders, Glencore is going to need to resolve investor concerns over coal, unless it wants every push for growth to be a painful battle.

Pay people to drop their opposition to wind farms close to their homes, suggests the National Infrastructure Commission in a new report to the government published last week. It backs “proximity-based payments” for households or funding for local projects. NIC further warns that onshore wind energy should not be left to the local planning system because hardly anything is getting through – we agree.

What can we do to improve energy security? Email energy editor Nicholas Earl at nicholas.earl@cityam.com

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his weekly column

Theoretically, Glencore is the perfect suitor for Teck. But this impasse is about coal, not finances.

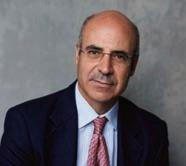

LASTMonday, my friend Vladimir Kara-Murza, a dual British-Russian national, was sentenced to 25 years in Russian prison. His crime? Simply speaking out against Putin’s murderous war in Ukraine.

According to the Russian prosecutor, Vladimir was guilty of treason because of a speech he gave at the Arizona state legislature where he described the bombings of Ukrainian schools and hospitals by the Russian military as a war crime.

Vladimir won’t survive five years in prison, let alone 25. In the one year he’s been in detention, he has already lost 22 kilos. He is also suffering from the after-effects of two assassination attempts in 2015 and 2017 when he was poisoned with an unknown nerve agent. As a result of the nerve damage, he can no longer feel his feet and is now losing sensation in his left arm, among other things.

The reason Putin has come down so hard on Vladimir is that Vladimir was one of the most effective advocates of the Magnitsky Act, a piece of legislation that freezes the

assets and bans the visas of human rights violators in Russia and around the world.

Since he got involved in the campaign, 35 countries have passed versions of the act. Putin is one of the worst human rights violators and one of the richest men in the world, therefore Vladimir’s work was unforgivable.

Sadly, while he has dedicated his life to campaigning for a free Russia – some in the West, including the United Kingdom, have been deficient in their support for him. While Canada has been swift to act, introducing sanctions against those involved in his arrest, the UK waited a full year before five individuals involved with Vladimir’s case were sanctioned.

There is evidence of the involvement of 34, this means there are still 29 left untouched. It astounds me that the UK is failing in its duty to protect its citizens.

The government must do more to stand up for those who have dedicated their lives to fighting for a better world – such as Vladimir.

In addition to Putin committing atrocities, there is one major atrocity being committed by another state that we must keep paying attention to. And that is the genocide of the Uighur people committed by the Chinese government.

Above and beyond sanctioning the people who have put Vladimir away for 25 years, we need to find a way of getting him out of jail.

How do we go about doing that? In the US, the government has an office that specialises in hostage situations. Last week, I

PATRICK DALY

NEW POWERS that the home secretary wants added to the Illegal Migration Bill will not give ministers “carte blanche” to overrule European court orders, the new deputy prime minister has said.

Home secretary Suella Braverman said she needs the “crucial power” of being able to stop European judges from intervening in the deportation of would-be asylum seekers who have arrived in Britain via unauthorised routes.

Oliver Dowden, the newly-appointed deputy to Prime Minister Rishi Sunak, said it was “right” for the leader of the Home Office to have discretional powers when considering interventions from the European Court of Human Rights (ECHR).

However, he said the ability for Britain to block Strasbourg judges’ rulings would not apply to all its verdicts.

Braverman has laid an amendment to the Illegal Migration Bill — legislation aimed at preventing migrants from crossing the English Channel on small boats and crushing the human trafficking trade — to allow

ministers “broad discretion” to decide whether or not to accept a human rights ruling from Strasbourg. It comes after the ECHR was able to use what is called a Rule 39 order to block the inaugural deportation flight taking asylum seekers to Rwanda last year.

“The home secretary will be given a discretion and ability to look at the circumstances of that order (Section or Rule 39) from the ECHR and will, for example, cover factors such as the timeliness of the imposition of the order – so, for example, if it is done at last minute – and also the transparency of it,” Dowden told Sky News.

Pressed on whether the amendments would allow the Home Office to ignore Strasbourg rulings, Dowden added: “There will be a Section 39 discretion.

“Now, I’m not saying that will give the home secretary carte blanche to overrule rulings. What I would say is that we are engaging very closely with the European court, we are making very good progress.”

visited that office with Vladimir’s wife, Evgenia. Once the US gets going, they make things happen. They have helped get over two dozen freed in the last few years. The UK does not have such an office. This case should prompt parliament to set up something similar and use all the power of

the UK government to get Vladimir out of jail.

We’ve done a remarkable job at supporting Ukraine. We need to do a similarly impressive job supporting the Russians that are standing up to Vladimir Putin and against the war – like Vladimir Kara-Murza.

JESSICA FRANK-KEYES

DIANE Abbott has had the Labour Party whip suspended following remarks suggesting Irish, Jewish and Traveller people are not subject to racism “all their lives”.

Abbott made the claims in a letter responding to an article in the Observer which reported that Gypsy, Traveller and Roma communities and Jewish people were most likely to say they had experienced “racist abuse”, while “40 per cent of white Irish people reported experiencing some

form of racist assault in their lives”.

Abbott wrote in response: “They [Irish, Jewish and Traveller people] undoubtedly experience prejudice. This is similar to racism and the two words are often used as if they are interchangeable.” Abbott quickly retracted her comments and apologised “for any anguish caused”.

The chief whip has removed the whip from her pending an investigation, the party confirmed.

A Labour Party spokesperson said the party “completely condemns” the comments.

I had an opportunity to meet the reporter who first exposed the genocide, her name is Gulchera Hoja. As a result of her reporting more than 30 members of her extended family were detained in Chinese concentration camps. She has since written a book exposing the genocide and her experience called, A Stone is Most Precious Where It Belongs; it’s a harrowing and compelling story that everyone needs to read.

JESSICA FRANK-KEYES

JESSICA FRANK-KEYES

THE GOVERNMENT’s civil service adviser is considering plans to increase the “politicisation” of Whitehall in the wake of Dominic Raab’s resignation following a report into bullying claims.

Writing in the Observer, Tory peer and ex-Cabinet Office minister Francis Maude said the government should be “more robust and less mealy mouthed about ‘politicisation’”.

Maude, who is working on a Whitehall governance review and set to report into Rishi Sunak, suggested ministers could have greater powers to appoint their own civil servants, including those with public political links.

It comes after the deputy prime minister and justice secretary resigned with a scathing letter warning of a “dangerous precedent” which will “encourage spurious complaints”.

Independent lawyer Adam Tolley KC’s report upheld two of the eight allegations against Raab and said he had engaged in “abuse or misuse of power” and had been “intimidating and insulting”.

Raab denies bullying and said the bar for what amounts to this was too low.

Parliament’s standards commissioner is now facing calls for an inquiry into Raab’s conduct as an MP, the Observer reports.

A PAINFUL TALE THAT EVERYONE MUST READdeputy PM Oliver Dowden

BRITAIN is tipped to have borrowed nearly £23bn last month to help pay for capping energy bills, according to City analysts’ consensus forecast.

Fresh numbers out from the ONS tomorrow are expected to show the gap between what the government generates in revenue from taxes and spends on public services widened from £16.7bn in February.

Chancellor Jeremy Hunt and Prime Minister Rishi Sunak have been covering the difference between what energy suppliers pay to supply homes with gas and electricity and the cost of keeping typical bills at £2,500 for several months.

While that has averted a hit to families’ living standards, but meant the UK had to borrow tens of billions of pounds.

In what is teed up to be a quieter week

for the markets, Bank of England deputy governor Ben Broadbent will deliver a speech on Tuesday at the National Institute of Economic and Social Research think tank.

Investors will likely be combing through his remarks for signs on whether the Bank agrees with the market’s assessment that borrowing costs are still on an upward path.

Across the pond, Wall Street is bracing for first quarter GDP data that will indicate whether the US economy is headed for a recession.

On the corporate front, supermarket Sainsbury’s tops the billing with final results out on Thursday. UK bank earnings season kicks off on Wednesday with Asia-focused lender and FTSE 100-listed Standard Chartered updating markets.

Barclays and Natwest will also post first quarter results this week.

The biggest stories direct to your inbox

Persimmon “is our least-preferred house builder,” came the damning words of Peel Hunt analysts in a note to clients last week ahead of the firm’s trading update on Wednesday. The sector is being crushed by the Bank of England’s 11 straight interest rate rises, which have chilled demand in the housing market. Peel Hunt reckons you should trim your exposure to Persimmon.

Breaking news, exclusives, scoops, interviews, blogs, opinion, sports, life & style, travel and more.

Premier Inn owner and FTSE 100-listed Whitbread’s exposure to a stronger-thanfeared UK consumer means it’s in a decent place, according to brokers Peel Hunt. The firm could also capitalise on an “option of real growth in Germany. The German business has grown from just six hotels pre-Covid to 45 operational currently,” Peel Hunt said. Buy the stock, they reckon. Full year results are out tomorrow.

A POST-DATA BREATHER “A quiet one for markets this week after the hustle and bustle of the ONS’s monthly data dump last week. Top of traders’ minds will be UK bank earnings. They’ll be looking to see if all the SVB and Credit Suisse volatility has knocked their lending.”

JACK BARNETT, ECONOMICS EDITOR

WHEN it comes to prime ministerial quotations, Sir Tony Blair is very much in the premier league: “Education, education, education”, “the hand of history upon our shoulder”, “New Labour” itself. But the former PM showed an early, uncanny gift for distillation when he was shadow home secretary and in 1993 wrote about his approach in The New Statesman. The Labour Party had to be “tough on crime and tough on the underlying causes of crime”. The word “underlying” has fallen away over the past 30 years but the phrase remains potent.

It was a brilliant slogan because it bundled so many notions and nuances into one phrase. At a time when public confidence in the police’s ability to address everyday crime was falling and there seemed to be a disproportionate concern with the rights of criminals rather than victims, its opening, “tough on crime”, was a bold strike by the Labour Party to seize the law and order agenda from the Conservatives and adopt it as its own.

The follow-up, “tough on the causes of crime”, was meant to reassure liberals, like the Howard League for Penal Reform, and JUSTICE, that the party’s platform was more nuanced and pro-

gressive than a Tory hang-’em-andflog-’em prospectus: New Labour understood the role of poverty, poor education and political disengagement in encouraging criminal behaviour. This skilful piece of triangulation, appealing to all sides of the debate, was hugely successful for Blair, defusing an issue on which they had traditionally tailed the Conservative and placing them squarely in the debate.

Now another Left-leaning lawyer, eager to end his party’s long period in opposition, is looking to law and order to give him an electoral advantage. Sir

Keir Starmer should be very much in his comfort zone: from 2008 to 2013, he was director of public prosecutions, England’s senior prosecutor after the government law officers, and he had worked closely with the authorities in Northern Ireland on policing issues.

Crime and punishment are as close as Labour’s leader gets to a home fixture. Last week, visiting one of the Brexit fortresses of Stoke-on-Trent, Starmer made a speech which shone a light on his ideas for dealing with crime. It took place in the wake of the Casey Report into the Metropolitan Police. Laying out his party’s nostrums, Starmer

relied heavily on targets which are ambitious at best: halving the level of knife crime and violence against women and girls, providing 13,000 extra police officers and driving public confidence in the police to its highest levels ever.

Starmer is not a fool. He knows two things: firstly, that crime is something which has a direct and substantial effect on the lives of voters, with everyone having a view on the matter and that view profoundly affecting the way they interact with the world in every other context. He also sees an opportunity. Building on the smash-and-grab

OSCAR Wilde said America and Britain have everything in common, apart from the language. As President Biden made his way back to the States after a historic trip to Ireland and Northern Ireland last week, I travelled to the USA and Canada and found a confluence between our financial and professional services sectors Wilde would be proud of.

My trip to San Francisco, Chicago and Toronto was designed to ignite conversations about funding the growth economy, and to promote the UK’s investment management sector.

In San Francisco in particular, there was a real appreciation for the leadership that the UK is establishing in AI and crypto, and a recognition that our regulators are at the forefront in looking at this.

The UK can create long-standing business relationships because of the innovative nature of our financial services sector. But those partnerships wouldn’t exist without the diplomacy

Nicholas Lyons

of our government ministers and ambassadors.

Tomorrow evening, I’ll bring Ambassadors and High Commissioners accredited to the Court of St James together for the annual Easter Banquet at Mansion House. Dinners like these are an opportunity to recognise the integral role diplomacy plays in the UK’s success, set out the state of play in the UK, and outline the role financial services can have in tackling global challenges.

It’s no exaggeration to say that the UK has been in a state of flux for some years now, with Brexit and political turmoil creating a febrility

some predicted would mark our downfall. But the Square Mile demonstrated its strength through the pandemic and the current economic challenge. And stability - the foundation for prosperity - has, to a large extent, been restored.

Last week, the International Monetary Fund predicted interest rates will fall once inflation is brought under control. While this won’t offer immediate relief to homeowners, what could improve our economic position is an all-out focus on growth. Which is where our global partnerships come in.

As the Asia-Pacific region continues to play an increasingly important role in the world economy, the UK has become the first European country to join the CPTPP, a powerful trading bloc. A landmark agreement that will allow exporters to seize opportunities for new jobs, growth and innovation, with access to 500 million consumers across 11 nations.

Elsewhere, we’re improving our dia-

logue with the EU after the Windsor Framework, and there’s a sense of optimism as we prepare for the coronation of our new King. Meanwhile, support is growing for a private sectorled “future growth fund” that will give defined contribution pension savers the chance to invest in fastgrowing businesses - an idea I’ve been championing.

But, of course, the UK does not exist in a vacuum. And all this is happening against an increasingly fragmented and fractious global backdrop, marked by war, economic shock, poverty and climate change.

We are at the forefront of developing green finance solutions that will help countries meet their climate commitments.

The City has shown it is resilient and resourceful - now, we must demonstrate how responsible the Square Mile is, too.

Nicholas Lyons is the Lord Mayor of the City of London Corporation

raid which Blair used in the 90s, Starmer knows that the Conservatives have once again opened themselves to a vulnerability on crime. Conservative home secretaries may still like to pose with police officers in daring and dynamic dawn raids, but few of their tough sound bites have transformed the everyday experiences of voters. Starmer knows he will get a hearing from the voters. It is nearing 15 years since we last had a Labour government, memories have blurred and softened, and dissatisfaction with the current administration is accompanied by curiosity about the alternatives. Starmer’s headline offer will attract a lot of support, even if it is only born of desperation. What catches the eye, however, also offers a hostage to fortune.

Targets are real, living beasts in politics, and sometimes not amenable even to the most skilful manipulation or interpretation. In short, sometimes it’s obvious you’ve failed. They also need a believable origin story. If a Labour England will have 13,000 more police officers, where will they come from? Who will they be? Will they be honest and ethical? Who will pay for their training and salaries?

This is part of a wider project which faces Sir Keir Starmer. When the general election finally comes, probably in the second half of next year, he will have to engage in a conversation with the electorate, in which he will show what he wants to do and how he will achieve it. That will be the final test. The voters will have to believe him.

£ Eliot Wilson is co-founder of Pivot Point and a columnist at City A.M.

A BITTERSWEET PILL Last week, celebs and politicians alike were mourning the loss of something very dear: their blue ticks on Twitter. But it was Alan Sugar who took the cake, complaining that Elon Musk was taking the explosion of SpaceX out on users by forcing them to cough up for $8 ticks

[Re: Is Britain too squeamish for OnlyFans, April 18]

Britain has long been known for its stiff upper lip and OnlyFans has been viewed with suspicion. But with a digital diet of instant gratification, OnlyFans’ popularity has skyrocketedas have parental concerns.

With unsupervised internet access via mobile devices, it’s very difficult for parents to keep tabs on the content their children are accessing online. It’s also increasingly difficult for media platforms to accurately verify the identities of users.

One in 10 children have watched pornography before the age of nine and four out of five children had seen pornography involving violence before they turned 18, according to the Children’s Commissioner. This is doing

untold damage to the country’s youth and change is needed. Several US states have introduced legislation making it illegal for adult content websites to publish or distribute content deemed harmful to minors without having the appropriate barriers in place.

The Online Safety Bill is a unique opportunity to protect minors online. There are simple and effective technologies to verify identity. But too many platforms aren’t integrating these approaches. The Bill needs to force the tech sector to take the protection of kids more seriously.

By increasing the regulatory burden on tech companies, awarding Ofcom additional powers over such platforms and demanding the introduction of effective age verification processes, the UK can effectively tackle an everincreasing threat preying on our children.

Fergal Parkinson TMT Analysis

THE internal composition of a large fund manager in 2023, compared with 20 years ago, is radically different. Revenue generation strategies are far more complex, and their global footprints have grown exponentially. While this has driven major gains for the front office, there has been a significant knock-on-effect on the volume and variety of activities falling on the shoulders of those beavering away in the back-office. The plethora of different assets that are being invested in by many large-scale asset managers are, more often than not, reflected in a complex spiderweb of different internal systems that hold the whole operation together.

Built into this spiderweb are old, faltering strands that simply cannot be relied upon to uphold the integrity of the internal infrastructure. Many firms are still reliant on legacy technology that has been installed for decades, with layer upon layer of slight “tweaks” and “improvements” being made over the years. On top of this, for global businesses, there is often a striking lack of harmonisation across the middle and back-offices –both jurisdictions and departments.

Britain’s seas may be filled with sewage, but that won’t stop the ambassadors and high commissioners from all 27 member states heading to a coastal retreat in the south of England to discuss the outstanding issues from Brexit.

In Britain, there’s three sure things: life, death, and fights over bias at the BBC.

At the end of last week, Conservative MPs piled in to accuse the broadcaster of bias after they hired a political factchecker who said people should “never trust a Tory”.

Oscar Bentley, 25, has appeared on Politics Live, the flagship politics show, canvassed for Jeremy Corbyn and in 2019, said voters shouldn’t trust the Conservatives.

You might remember Andrew

Neil also caused quite a fuss for working for the broadcaster while being Chairman of the Spectator, a right wing magazine. Robbie Gibb, who sits on the board of the BBC, also has deep ties to the Tories.

Jess Brammar, the news editor of the BBC, who once edited HuffPost, faced relentless accusations of being biased before her appointment.

It’s almost as if there are people of all political creeds working for the publicly funded broadcaster.

At the time that these systems were set up, it made more sense. The environment was very different then, there was a distinct lack of vendors, and it was a very different data environment. But this simply isn’t reflective of the current reality. Fintech founders and their teams learnt their trade from the very side they are trying to help – having experienced the frustrations that legacy systems can cause themselves.

2023 is a year that is being punctuated by major mergers, such as the recently announced Rathbones/Investec deal in the private wealth space, and now, the proposed acquisition of Swiss fund house GAM by Liontrust. Deals of this size and complexity will need to be supported by long-term integration and consolidation projects.

It’s an especially challenging time for fintech firms who might fill this gap between closing the deal and actually merging. Just imagine if you will, the unbelievable confusion that can come with merging companies that have two sets of back offices, each layered with so many different

overlapping legacy systems. The effect of this on operational efficiency is staggering, and the period immediately post-merger is where financial institutions need to be able to rely on modern technology solutions in order to harmonise and stabilise their core processes.

But for those firms who can focus their efforts on a part of business which is perhaps less glitzy than creating the best new banking app, the rewards will be rich.

This is all set against a backdrop of an era where data is being consumed at levels not seen before. With various

areas of the middle and back-office relying on different tech, it is easy for essential information to be caught up in the web of legacy systems which greatly affects operational efficiency.

Just as you wouldn’t build your own oil refinery, it doesn’t make sense for asset managers to take the load of complete system overhauls onto their own backs.

The operational headache that comes with reliance on outdated systems is well understood by the middle and back-offices, and the potential for it to become a long-term migraine in the form of an extended integration project is clear.

Giving this headache to a managed service provider, someone whose business it is to live and breathe posttrade, is the way out of that spiderweb of complexity. That is why, when it comes to major M&A deals, the buyside needs to be able to rely on market expertise alongside modern tech in order to ensure efficient and effective integration.

£ Neil Vernon is chief technology officer of Gresham Technologies

In the abandoned town of Kayakoy, the streets are dusty and thyme grows tall and wild, scenting the air with a sweet piquancy. Derelict houses have gaping windows; ancient churches are in ruins, their frescoes faded and mosaics crumbling. Glance into the distance, however, beyond the pine forests on the hills below, and you can see the bright turquoise glimmer of Turkey’s south-west coastline. In this ghost town, the eeriness has a captivating quality, transporting you far away from the merriment of the seaside.

Kayakoy is a 30-minute meandering drive uphill from the sun-baked, coastal town of Fethiye, and a morning spent here gives a meaningful snapshot into the region’s past. Originally called Levissi, Kayakoy has been abandoned since 1923, as a reminder of a dark patch of Turkey’s history. It was once home to some 6,000 Greeks who were forced to leave following the ‘population exchange’ which was the result of the war between Greece and Turkey. Preserved in ruins, a visit here is a poignant one.

Back in the welcoming arms of Fethiye, it is easy to fall back into the carefree ways of this corner of the Mediterranean. A stroll around the marina means you can gaze at the luxury yachts, and have a pitstop at one of the seaside tavernas for a bite to eat. Look out for Menemen, found on most menus it is a variation on shakshuka, made with eggs, tomato, green peppers and spice, while pide is a flatbread topped with ground beef and melted cheese – delicious washed down with a glass of sweet black tea. The bustling bazaar (on Tuesdays and Fridays) is also fun to wander around, taking you into the heart of the old town, where you brush shoulders with locals buying groceries and haggling over freshlycaught fish.

The stretch of coastline is spectacularly pretty – dramatic rocks and vertiginous forests shielding the impossibly cerulean waters, which are dotted with secret bays and hidden coves. There are enough ancient sites to keep history buffs happy, from the Lycian rock tombs, dating back to the 4th Century BC, found high above Fethiye, to the Temple of Artemis in Selçuk, one of the Seven Wonders of the World (not only that –it was the best of the bunch according to Antipater of Sidon, the ancient Greek poet who devised the list). The Lycian Way, a hiking trail that stretches some 300 miles from Fethiye to Antalya, is ideal for those wanting an active break, taking you past the area’s highlights.

A 20-minute drive south from Fethiye brings you to Hillside Beach Club, found camouflaged in the hills over Kalemya Bay. Just before you arrive you’ll drive through a shipyard, where local carpenters work on the bones of towering ships. It’s an insight into the fact that the seafaring heritage of this area is still strong. As well as a thriving fishing industry, Fethiye has long beckoned visitors from afar to arrive by boat, including the ancient Greeks who arrived in the 5th century BC to make this their home.

These days, of course, most travellers arrive by plane into Dalaman Airport, and within an hour can check into the whitewashed rooms at Hillside Beach Club. Set along a wide arc of a beach, the resort has been inspired by a local village, the pink roofs of the rooms peeking out from pine

Wanting to get out of London on Coronation weekend?

6 May –the date of the big day –is the first day of the Brighton Festival of music, theatre, dance and comedy brightonfestival.org

and carob trees, and adorned with tumbling, shocking-pink bougainvillea.

On the main beach, there is a huge selection of sporting activities to choose from, such as paddle boarding, tennis and volleyball. You can learn to sail, try knee-boarding or go sky-skiing. Every morning and evening there is a choice of yoga classes, from Iyengar to Vinyasa, and at Artside, you can try your hand at a number of creative pastimes, such as silk painting or marbling.

There’s a strong line-up of annual events, with the resort teaming up with the British Film Institute (in May to June) to offer a week of summer screenings, as well as interactive workshops, talks and cinema-themed activities. Hillside also hosts an offshoot of the London Jazz Festival (29 September to 2 October) and, in August, there’s an annual classical music concert, which sees the Antalya Sym-

phony Orchestra play on a floating stage. For those wanting to kick back and do nothing, Silent Beach is just the place. You reach it by following a winding path cut into the cliffs, wandering past floating sun-platforms bobbing in the water, and by a little ‘beach library’– a cabinet filled with books for you to borrow – found on the path. The clue is in its name. With no phones or children allowed, it is blissful.

To wind down even more, you can book into Thanda Nature Spa, which, as its name suggests, immerses you in the natural world. Tucked behind Silent Beach, it is built over a running stream and has an organic design, with sea-grass matting lining its walls and pebbles inlaid into floors. Traditionally-inspired treatments include the Turkish hammam and the Aegean Seeds Massage, which uses essential oils of grape, fig and pomegranate extracts.

Authenticity is key at Hillside, with local

cuisine championed at the Main Restaurant where chefs serve zeytin piyazi salads, made with diced tomatoes, onions, chopped herbs and dukka (a mix of herbs, nuts and spices), and the Turkish flatbread Gozleme, stuffed with herby minced lamb, delivered straight out of a stone-bake oven.

There’s also freshly-caught local fish, from Eskina to Bream; Cipura to Bluefish, cooked to order and delivered to your table with Lahmacun bread and haydari (garlic yoghurt with mint). For dessert, you can indulge with syrupy baklava, pistachio cakes and Künefe, which is made with spun pastry and layered with melted, unsalted cheese.

For something special, the Pasha On The Bay restaurant offers a seemingly endless series of Turkish mezze dishes, served at tables by the water’s edge. Or, at the beachside Italian Restaurant, you can

tuck into a seven-course menu, which changes daily according to what produce is available. Think misto fritto; artichoke salad; Linguine with lobster tail and seabass cooked with rosemary and Aegean vegetables.

One of the highlights at Hillside is a trip aboard a traditional three-masted, wooden gulet boat. The sunset sailing takes you to the effervescent Aquarium Cove, named so because of its rich marine life. You can dive in and snorkel with stingrays and clownfish. As the sun dips low, the sky is streaked with pink, copper and gold. It truly feels like this is one of the last undiscovered corners of the Med.

Nightly rates at Hillside Beach Club start from £322 based on two people on a full board basis. Hillsidebeachclub.com

Fancy yourself as an artist, or want to perfect your painting skills?

The Villa Lena Art Foundation in Tuscany has announced its artist residency program for 2023, with activities and residencies with arts organisations including My Queer Blackness, My Black Queerness, She CURAtes, W/ and Artists at Risk.

You’ll stay on site at the beautiful 19th century Villa Lena. Visit Villa-lena.it for more information and to book

THE WEEKEND: With its hundreds of beaches and picturesque fishing towns, Cornwall more than earns its reputation as the “English Riviera.” Taking the train from Paddington to Falmouth takes just over five hours, the journey, with its rush of green and sudden glimpses of the unspoilt coastline, adds to the delicious sense of embarking on a home-turf adventure.

WHERE: A fifteen minute cab ride from Falmouth town, Hotel Meudon is an elegant blend of modern amenities and old English charm set deep in the Helford Valley. Presiding over a lush subtropical garden, which in late Spring can be found bursting with flowering rhododendrons and camellias, and fuschias and hydrangeas in summer, it’s a calming oasis from the stresses of ordinary life. Following one of the many winding garden paths shaded by wild, and often gigantic, tropical plants will lead you down to Bream Cove, the hotel’s own private beach. It feels perfectly secluded, but has the perk of having a small shack that sells a broad range of ice creams and beverages. The hotel is proudly dog-friendly, too.

THE STAY: The bedrooms are mostly located in the modern extension. Each room is well-appointed, and decorated in a way that marries a traditional Cornish aesthetic with modern freshness. Some of the rooms have balconies that are perfect for watching the sun rising and setting, and for having in-room breakfast. And there are many other places to relax within the hotel: an oak-panelled lounge filled with velvet armchairs, modern art and an open

fireplace beside which you can enjoy a generous afternoon tea. You may want to imbibe a pre-prandial drink at Freddie’s, a speakeasy-style bar in the adjoining room that boasts an impressive cocktail selection (I had a rosemary-spiked negroni, a good primer for dinner).

Don’t miss the series of fabulous events Meudon has planned. Some weekends it's a concert on the lawn as part of the hotel’s “Sunday Live Lounge”, others it's a botanical drawing workshop, or wild swimming classes

THE FOOD: Of course, given the location there’s an emphasis on seafood, but don’t expect the usual coastal offerings of whitebait or fish & chips (I’d reserve an evening in Falmouth for this sort of grub). Instead Meudon’s restaurant serves Frenchinfluenced “nouvelle cuisine”, featuring ingredients like gurnard, plaice, pork, crab and scallops. The desserts are a particular triumph, hits including the creme brulee, and the blueberry souffle, a wonderfully light, tangy cloud of desert, accompanied with a miniature saucepan of melted white chocolate. It’s a real showstopper. The hotel keeps things hyperlocal: a Cornwall-based Dutch family provides the Gouda; the gin is hand-delivered from the brewery up the road, infused with Bream Cove seaweed; all meat and vegetables are procured from nearby fields. Breakfast and dinner are served in the hotel’s beautiful dining room, with beclothed tables situated in the glass extension beneath a ceiling decorated with trailing grapevines, from which you can enjoy views over the garden. One breakfast was animated by the sight of a peacock preening itself on the hotel’s roof.

NEED TO KNOW: Rooms cost from £129 per night, based on two people sharing, including breakfast. For more information and to book, visit meudon.co.uk.

GOLF

TALOR Gooch admitted his relief after almost blowing a 10-shot overnight lead on the way to a first individual LIV Golf League victory in Adelaide yesterday.

Gooch, who carved out a huge advantage with back-to-back rounds of 62, saw his lead cut to just two shots by two bogeys and a double in the first 10 holes of his final round. But the American responded with two birdies on the back nine to card a one-over-par 73 and finish the week on 19 under, three clear of India’s Anirban Lahiri.

“Golf is just really hard. It’s hard to

put back-to-back days together like I did and even harder to do it three times in a row,” said Gooch. “I actually played fine out there today. The golf gods, I think, said, ‘We don’t want this first win to be easy on you.’ It was cool to dig deep and get the job done.”

Home favourite Cameron Smith was one of four players another shot back, while Dustin Johnson’s 4Aces, last

the damp cloud of the regular season now being almost redundant, Saracens managed to show their class in dismantling a strong Irish side and confirming their status as league leaders.

Prop Eroni Mawi scored a brace for the hosts in north London while hooker Theo Dan and backs Sean Maitland and Alex Goode bagged five-pointers.

year’s LIV Golf champions, won the team competition.

Patrick Reed shot 65, Peter Uihlein 66, and Johnson and Pat Perez 67 as 4Aces finished on a combined 47 under and tightened their grip on the team championship.

The RangeGoats, captained by Bubba Watson and featuring Gooch, Thomas Pieters and Harold Varner III, were a

shot behind in second.

Gooch also praised his Australian caddie Malcolm Baker for his local knowledge – and keeping cool when the pressure was on.

Gooch led by 10 shots but only won by three

“His green-reading ability out here is incredible,” Gooch said. “I leaned on him more this week than I have in a long time. He did a really good job of not wavering and just being himself and acting like this is another round of golf, even though it was a huge round of golf for us.

“His constant mentality, how he conducts himself in those moments are huge for me for keeping me calm and making things easier than what they feel like in the moment.”

IT IS a shame that in a Premiership rugby season praised so highly for its competitiveness and unpredictability that no matter any result in the final round of fixtures, in a fortnight’s time, we already know the top four, who plays who and where they play.

Saracens’ 45-21 demolition of London Irish yesterday ended the Brentford club’s slim chances of climbing from fifth and into the top four before the end of the season.

As a result of yesterday’s fixture, Saracens have earned themselves a semifinal at home to Northampton Saints on the weekend of 13 May while fellow home semi-finalists Sale Sharks will play hosts to defending champions Leicester Tigers.

The only way Leicester and Northampton can switch places is if the current title holders lose by more than 60 points at home to a Harlequins side with nothing to play for.

With relegation currently banished in the Premiership, the final weekend of fixtures has lost two of its three jeopardy discussions – the lack of a top four race and no relegation means only the battle to qualify for the top-tier European Champions Cup remains.

So how, on the same day Charles III is crowned at Westminster Abbey, do teams persuade fans to attend, tune in and remain remotely interested in the rugby when there’s so little to play for?

Premiership Rugby would have wanted this season to go the distance but when fixtures have no tangible meaning, it’s difficult to fire up fanbases. But among

Irish captain Matt Rogerson and hooker Mike Willemse were the only points of resistance for the away side.

Having secured Champions Cup rugby for the first time in a decade last season, Irish have now demonstrated their model and style was not a flash in the pan. Their rise over the last three seasons has been admirable and there’s no doubt they will hope to make that final step to the play-offs next season.

For now, though, the season is all but over. It has been a competitive season and one of many ebbs and flows.

One of Saracens, Sale Sharks, Leicester

Tigers or Northampton Saints will become the champions of England next month, and Premiership chiefs will hope that the league has saved its magnum opus for then.

Londoners, Tigers, Sharks or Saints will lift the title, writes Matt HardyAlex Goode scored one of Saracens’ five tries on Sunday

The Premiership will hope the final is league’s magnum opus with semis sorted

FRANK DALLERES

TOTTENHAM captain Hugo Lloris accused his team-mates of lacking pride after their Champions League hopes suffered a major setback in a 6-1 defeat at Newcastle United.

Spurs shipped five in a wretched opening 21 minutes that saw Alexander Isak and Jacob Murphy score twice and Joelinton hit another. Harry Kane pulled one back for the visitors just after half-time but Callum Wilson restored the hosts’ five-goal lead.

The result lifted Newcastle into third place in the Premier League, six points ahead of fifth-placed Tottenham, whose prospects of Champions League

ATHLETICS

qualification are dwindling.

“It’s very embarrassing. The first thing is we should probably apologise to the fans who travelled to watch the game,” said Lloris.

“We could not fight. Newcastle were very aggressive and offensive every time they got the ball. It is difficult to analyse the performance, but the first thing was a lack of pride.

“We can try to find excuses, but we missed the fight. If you go on the pitch without the desire to win the battle, it makes things very hard. It was a bit of a mess.

“We cannot hide behind the club’s problems. We are professionals and every time we go on the pitch we try to

FRANK DALLERES

KENYA’S Kelvin Kiptum smashed the course record to win the men’s London Marathon race as Mo Farah bowed out of the 26-mile distance.

Olympic 5,000m and 10,000m champion Sifan Hassan also provided fireworks in the women’s elite race, the Dutchwoman overscoming cramp to win in her first ever marathon.

Kiptum’s time of two hours, one minute and 25 seconds beat compatriot Eliud Kipchoge’s London Marathon record by more than a minute and finished just 18 seconds outside Kipchoge’s world

record. Fellow Kenyan Geoffrey Kamworor finished second, almost three minutes adrift, with Ethiopia’s Tamirat Tola third.

Farah was ninth in a time of 2:10:28 as he ran his home course for the last time, more than two minutes behind Emile Cairess, the first British man to cross the line.

Phil Sesemann was eighth.

“I gave it my all but my body just wasn’t responding and that’s when you know it’s time to call it a day,” said Farah, who will retire after September’s Great North Run.

“Part of me was wanting to cry. The people were amazing, even in the rain. I will miss that feeling.”

deliver our best, but today it was too much slack in all the aspects.”

Tottenham caretaker manager Cristian Stellini said he had been wrong to try different tactics but was at a loss to explain their collapse.

“It was my responsibility to decide the system and we decided to do it differently because we had many injured. It was wrong,” said Stellini.

“It is very difficult to understand why the first 25 minutes were so bad. We were not prepared to play this type of tough game, to suffer, control the space, fight, win duels.”

Tottenham’s 11th league defeat of the season followed their 3-2 home loss to Bournemouth last week. An-

other reverse at fourth-placed Manchester United on Thursday could be the final nail in their hopes of a Champions League spot next season.

West Ham United, meanwhile, eased their relegation concerns – and rounded off a superb week – with a 4-0 win at Bournemouth.

Michail Antonio, Lucas Paqueta and Declan Rice put them firmly in control at half-time and Pablo Fornals rounded off the scoring with a scorpion kick.

It lifted them to 13th in the Premier League, one point above Bournemouth and six clear of the relegation zone, having played one game fewer than their rivals.

RUGBY UNION

MATT HARDYTHEFA Cup final will be contested between the Premier League’s two Manchester clubs for the first time ever after United beat Brighton and Hove Albion 7-6 on penalties yesterday following a goalless 120 minutes at Wembley.

In a match where neither side took their opportunities, both Manchester United and Brighton enjoyed 15 shots on goal. The Seagulls had five shots on target to United’s six but the goals failed to come in both the regulation 90 minutes and extra time.

The two sides exchanged penalties to conclude the initial shootout 5-5 but Solly March missed Brighton’s seventh penalty –the 13th overall –in what was the first penalty shootout to go to sudden death in an FA Cup semifinal.

Victor Lindelof made the most of the Brighton error with goalkeeper Robert Sanchez unable to save the Sweden international’s decisive spot kick to hand United their first ever FA Cup penalty shootout win.