2024 Law Firm Opportunity Report

We believe every law firm can adapt

Law firms must adapt to all the ways the market is now changing and partners have good reason to be optimistic.

A changing market presents new opportunities if firms can capitalize on them with new service offerings. Legal fees for work also spiked in 2021 and have continued to rise, up 7.3% in 2023 alone. This suggests there is cash to invest.

At the same time, those changes present new challenges.

Longtime clients are building larger in-house legal teams aided by software. Automation and ever-faster AI-powered e-discovery are altering the nature of work. Meanwhile, younger lawyers are quitting the profession in protest over long hours. Then there’s the financial effect these changes are having within firms. A generational cliff looms and firms without a tight financial operation may find it difficult to sustain their existing model or navigate succession. No matter how law

firms excel at their craft, they often underinvest in business operations, finance, and technology.

In this first-ever opportunities report for law firms, we explore ways firms can adapt to the changing market. It is based on our recent survey of 1,000 private businesses, our own research, and our experience working with some of the largest private law firms.

John Fitzgerald Partner and Law Firm Industry Practice Leader Citrin Cooperman

The state of the legal industry

The world will always need legal services. Though it may not necessarily need lawyers to provide it, nor require them to provide it at the same consistency and bill rate as they did previously. As legal service providers encroach upon otherwise billable hours and more clients pull legal work inhouse, it is revealing that some firms may need to adjust how they deliver and charge for their services.

This could mean building more agile finance and operational teams to adapt to client needs or it could mean empowering younger associates to experiment with new service offerings. Very likely, all of it will rely in some way on technology.

In this section, we explore four trends in the legal services industry.

1

Many law firms are unprepared for succession. Law firms face direct competition from legal tech.

1Clients are bringing more legal work in-house

Sixty-six percent of companies say they are bringing more legal work in-house and growing the general counsel’s office. Technology is playing a key role and in-house teams are more likely to adopt it — 33% of inhouse legal teams are using AI-specific tools compared to just 19% of mid-sized law firms. It is also a matter of savings. The cost of an attorney has risen 7.7% year-over-year according to Law.com. All this work moving in-house lowers the demand for law firm services.

“As law firms have increased their prices, the biggest growth in the legal industry has been in the private sector. In many cases, in-house teams are outgrowing law firms and competing for that same work.”

John Fitzgerald

Partner and Law Firm Industry Practice Leader

Citrin Cooperman of companies say they are bringing more legal work in-house. 66%

Source: Legal Dive

Firms that have not invested sufficient capital in operational and financial talent are finding it difficult to adapt. Many are behind on bill rates, and though overall billings are up, realizations, or their profitability, is down. Many firms are also hampered by inflexible, top-heavy partnerships, pay, and governance structures. Few have modern analytics for managing the business. Just one in five say they can forecast on a monthly basis, according to our recent survey.

“Legal firms must run a business focused on meaningful metrics as well as a good practice.”

John Fitzgerald Partner and Law Firm Industry Practice Leader

Citrin Cooperman

decline in realizations among midsize law firms since 2021, down to just 91%. 1.4%

Source: Thomson Reuters

The demographic shift will constrain talent

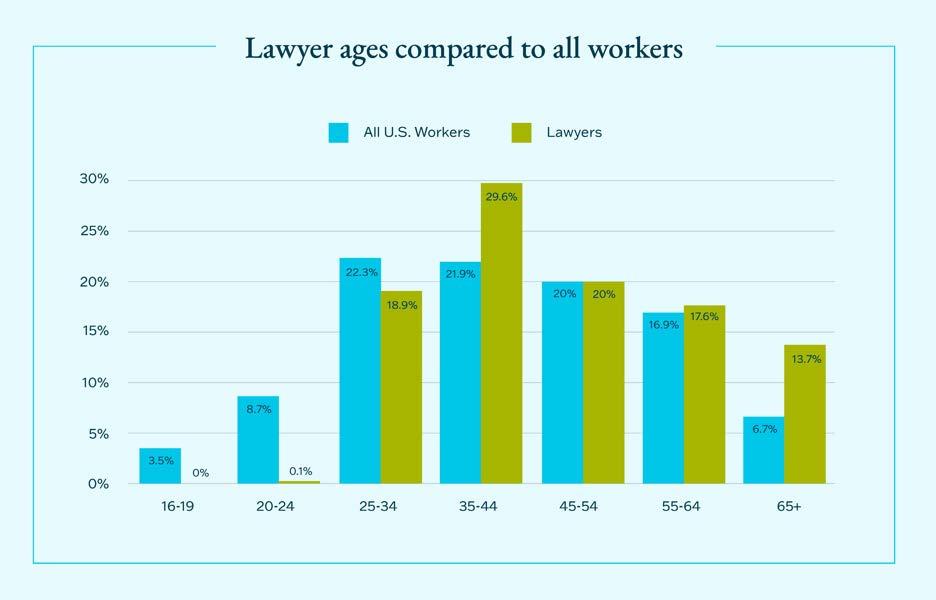

Many lawyers will soon retire or reduce their workload, which will further overburden an aging profession. Today the median age for a lawyer is 46 years, up from 39 in 1980. Although the total number of lawyers has only ever grown as a percentage of the population over the last century, law firm structures have not changed to invite younger lawyers into leadership, while partners stay put for longer.

Source: The American Bar Association, 2022

Meanwhile, one in five lawyers under 40 are choosing to leave the profession. Younger generations are in pursuit of a career where the scales of work and life are balanced. They expect flexibility and a generous work environment, and watch many of their peers enjoying such benefits in other industries and through nontraditional career paths.

Burnout becomes a cycle. When associates leave a firm in search of a better work-life balance, and leadership asks their colleagues to pick up the slack, those colleagues may burn out as well. A firm that isn’t careful can continuously lose its youngest attorneys, paralegals, and administrative staff.

Based on our conversations, these issues are unlikely to correct soon.

Source: IBA

Many law firms are unprepared for succession

Few firms have prepared for this changing future by invigorating management with younger talent. They have not conducted adequate succession planning nor considered the challenge of transitioning client relationships and firm management.

As a result, we are seeing a rise in consolidation among firms lacking the foresight to identify or groom new leaders until it is too late. The flurry of

merger activity has attracted the attention of private equity, and we’re observing non-lawyer ownership of more law firms in Utah and Arizona, which permit such structures. This change in ownership structure does not appear to be a siloed trend, as other states are also reviewing ways to permit greater fee sharing with non-lawyers.

“For the greatest continuity, start emphasizing a culture where clients have a relationship to the firm, not just to an individual. The stronger the brand, the more stable the firm.”

John Fitzgerald Partner and Law Firm Industry Practice Leader

Citrin Cooperman

Law firms face direct competition from legal tech

“While the future will need the law, it won’t necessarily need lawyers to provide it,” wrote Bree Langemo, J.D., an accountant and attorney, in a perceptive ABA article that foretold the coming conflict of interests between legal tech companies and their law firm clients. Many of these tech companies that once courted lawyers now seem more interested in, at least partially, replacing them.

We will not overstate the case — the legal support sites LegalZoom and Rocket Lawyer did not appreciably eliminate attorney jobs or reduce fees; they simply made legal information more widely available. And recent stories about the

AI service ChatGPT passing the bar exam were exaggerated. (It passed, but less spectacularly than advertised, and with caveats.)

Increasingly, tech law services are looking to cannibalize billable activities. In 2023, Thomson Reuters spent $650 million acquiring Casetext, a legal AI research assistant that reviews documents, prepares depositions, and analyzes and compares contracts. Analysts expect the market for so-called “alternative legal service providers” to double to $33 billion over the next decade.

The more case law is digitized, the better legal tech will become

The Harvard Law School recently digitized 334 years of legal history around both state and federal decisions.

Source: Harvard

“For all but the top firms, AI and new features will come in first through software vendors.”

John Fitzgerald Partner and Law Firm Industry Practice Leader

Citrin Cooperman

How are firms adapting? Historically, law firms have invested just 1% of revenues in technology, compared to 3.5% among businesses generally. However, our research suggests that may be changing. When we surveyed law firms, 67% said they were using AI for some amount of process automation. Although 67% sounds high, the cause is fortuitous, as AI is now available through legal software already in use.

In our conversations, partners acknowledge the importance of technology, particularly AI. They are formulating policies, are curious about how to set up guardrails to protect confidentiality, and are interested in closed-source large language models (LLMs) that don’t expose sensitive information to the open internet.

What can law firms make of all this?

Many established law firms lack the agility and resources required for chasing new forms of business or attracting and retaining the young talent who’ll grow into future partners. Yet there is no reason they cannot change. We explore what law firms can do to evolve.

OPPORTUNITY 1 / OUTSOURCING

Strategically outsource your finance and acquire tech skills

Law firms have not traditionally embraced outsourcing, unless subcontracting work to other firms.

Many partners prefer to have a finance manager or accountant “just outside their door.” Yet for many reasons, it is increasingly vital that they outsource more finance and accounting work.

We find most law firms are not able to fill the needs of their finance department. Firms often lack the expertise to determine which digital skills they require and lack

the accounting and tax skills necessary to properly evaluate candidates. Furthermore, many firms may need the high-level, CFOtype financial expertise for restructuring the firm, but only for a limited time.

“As the finance and accounting talent shortage drags on, it is harder than ever to find in-house talent with experience in the legal profession. It is no wonder that so many law firms are turning to external support.”

Melissa Davis Partner, Business Process Outsourcing Citrin Cooperman

Emerging legal roles to prepare for:

• Legal technologist

• Legal process analyst

• Legal data scientist

• Legal research and development worker

Source: American Bar Association

If that firm outsources its finance needs, it gains:

• Immediate access to key financial skills

• Immediate access to key tax insights

• A team size that flexes to meet its need

• Strategic advice from rotating experts

• No employment overhead (+20% cost)

• No added management overhead

Outsourcing business operations can free law firms to focus on the skills their people already excel at, which command high fees. Those skills will only grow more valuable. Lawyers will need to continue to “hone in on their human skill sets” and develop new ones as technology produces a need for entirely new legal roles. In this way, outsourcing their finance could mean both cost savings and the freedom and flexibility to pursue new lines of business.

Action:

Outsource key tech skills

According to our recent survey, 90% of firms outsource to access advanced tech skills. It is often easier for firms to “buy” than to build this talent, given they do not tend to already have technology expertise in-house, and less risky. Some 40% of firms that train employees on novel technologies like legal AI say they thereafter struggle to retain those individuals.

Learn how we can help with tech

Action:

Deputize younger workers to experiment with technology

Initiate a culture of experimentation. Allow younger attorneys and paralegals to experiment with offering legal services in new, more cost-effective ways to create new service lines. For example, 71% of in-house legal teams have implemented, or plan to implement, contract review software. What expertise might a firm like yours offer those companies around that implementation?

Action:

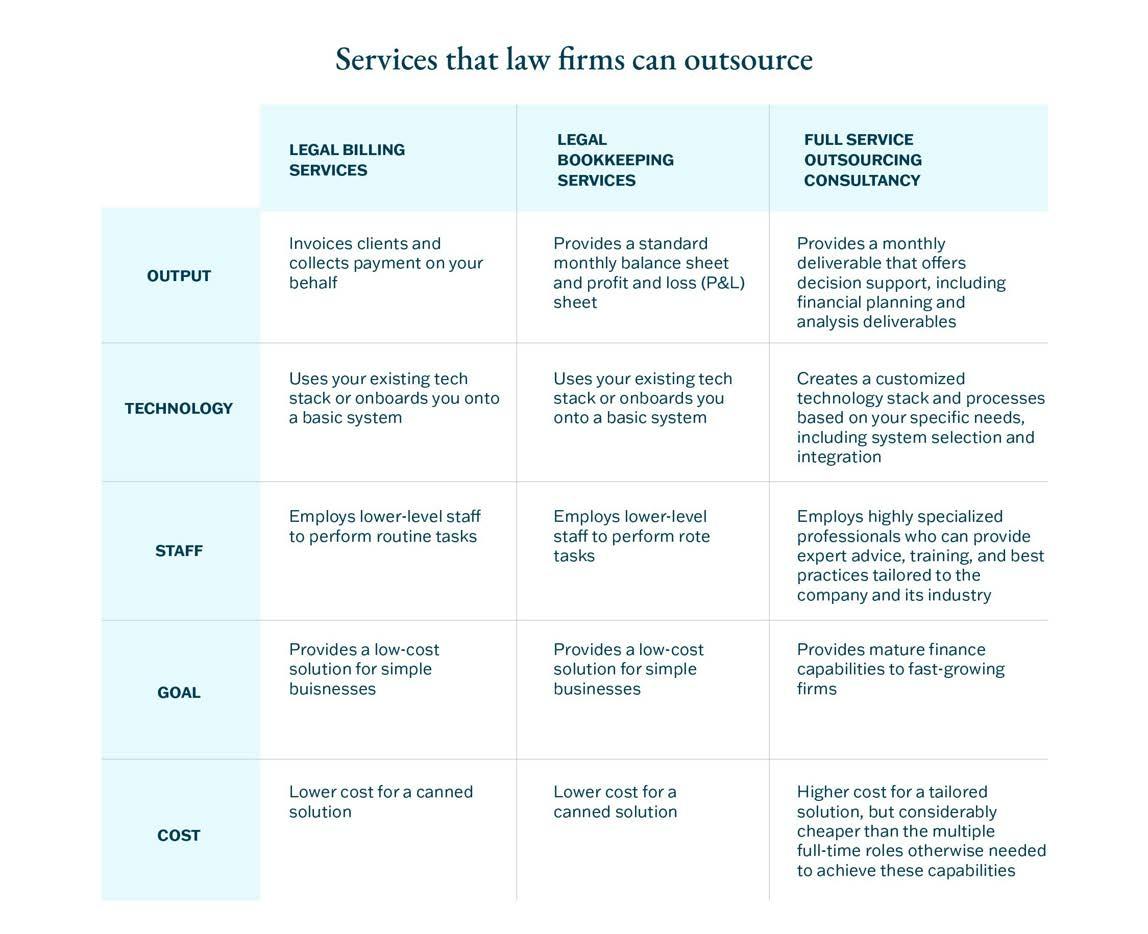

Outsource (and improve) billing

Many legal firms we speak with struggle to produce timely partner compensation reports, making it difficult to report quarterly taxes. They are also struggling to collect payments as “clients hold onto payments longer” and draw out receivables cycles, reports Law.com. These difficulties are a major reason 38% of companies say outsourcing finance is one of their biggest financial opportunities, according to our survey.

An outsourcing partner that handles your billing will also likely be able to help the firm track financial metrics like service-level profitability. This can provide a consistent, up-to-date valuation should a partner leave or the firm needs to restructure.

Seek out a financial and accounting outsourcing partner that:

• Is familiar with legal billing formats (LEDES, hourly, fixed-fee)

• Is familiar with your case management platform

• Can offer robust weekly reporting

• Can offer up-to-date equity status report

• Can integrate new reporting technology

• Can prepare tax projections

• Can advise on tax compliance

• Has tight cybersecurity and data protection

Consider requesting the following weekly metrics:

• Benchmarking—Insights into how your firm compares

• Budgeting—Report on progress against an annual budget

• Profitability—Insights at a case or client service level

• Cash management—Report on cash with recommendations

3 ways to begin outsourcing

Selecting the right finance firm

A good case management integration is essential

If your firm uses MyCase, LeanLaw, Clio, TimeSolv, Juris, or a similar case management software, it is essential that your finance team connect this to the firm’s general ledger. If these two remain disconnected, it creates added work, invites human error, creates tax risks, and can cost more to manage.

OPPORTUNITY 2 / SUCCESSION

Build a succession plan or explore laterals

Firms that don’t plan for succession may lose the ability to control the firm’s succession.

Today, few firms have this plan in place with written consensus from all the stakeholders. This makes it far more difficult and contentious to negotiate that succession, and can jeopardize the firm as a going concern.

A significant consideration regarding succession is whether or not it will require a new infusion of capital. If so, has the firm prepared for that? Partners must think through scheduling payments, sources of capital, and how they’ll manage a “lateral” merger without losing money. This requires them to model cash flow and plan for scenarios.

Succession planning goes beyond financial considerations for the firm. It extends to all aspects of the business and the attorneys. Any planning committee will need to understand and consider the expectations of the equity and non-equity partners, their abilities, contributions to the firm including who brings in new business, expected time to retirement, and who has retirement commitments.

Even if aging partners plan to continue with the firm, their peer referral sources may retire and referrals will dwindle. Partners may resist lowering their pay, even though they may have to sacrifice some earnings in the transition. The earlier your firm has these conversations, the better.

“Firms that don’t plan for succession lose control eventually. It is really about deciding whether they want to do it in an orderly way or not.”

Christopher Imperiale

Citrin Cooperman

“The key to any firm is who’s on the compensation committee. If you control compensation, you control behavior. It is essential to get that structure right.”

John Fitzgerald Partner and Law Firm

Industry Practice Leader

Citrin Cooperman

Firms must also consider who will be the next managing partner. The managing partner role should be in planning at least five years out, which allows enough time to cultivate the talent capable of growing into that position. To start, consider expanding the executive committee now to give younger partners a seat, and begin the search.

Opportunities:

Action:

Begin building that partner talent pipeline now

Partner talent is not unlike a farm system in baseball, where pro teams watch “feeder” teams for up-and-coming talent. Law firms that create a plan to actively recruit and groom talent are more likely to attract a future star early, at a base-level salary.

Action:

Engage outside help for succession planning

An unbiased third party can often guide your firm through a succession process more smoothly than someone internally. They can bring insights from other firm successions and offer a method to arrive at a succession plan that is consistent with those of best-in-class peer firms.

Succession options:

• Internal succession: Sell or transfer the business to one or more partners or key attorneys.

• External succession: Merge with another firm or bring on a lateral partner who can run the firm.

Learn more about succession planning

OPPORTUNITY 3 / TECHNOLOGY

Use technology to increase billings

Digital technology is now vital for attracting new business.

Many companies, especially those in sensitive industries like finance, government, pharmaceuticals, and healthcare, require law firms to process information digitally and safeguard it. If a firm purchases software to meet these requirements, it introduces new risks — digitized documents create opportunities for cyber thieves, which requires yet more technology and digital policies.

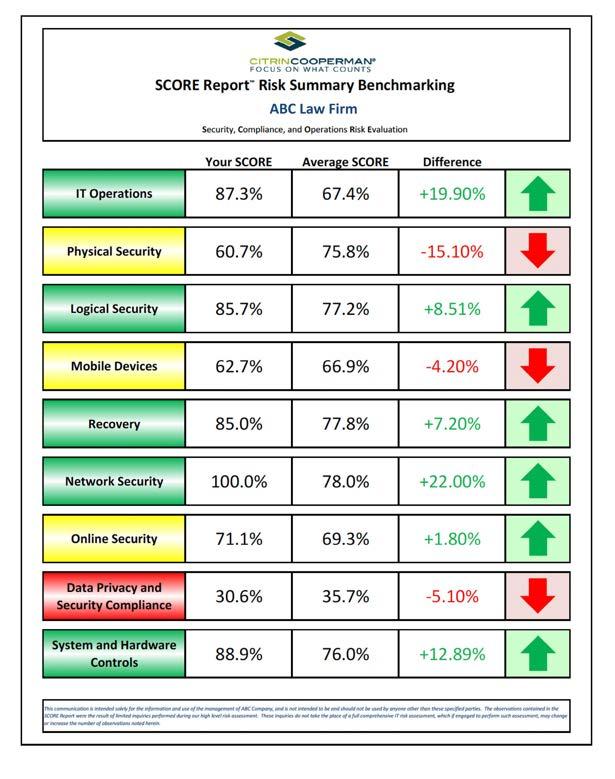

Twenty-two percent of law firms experienced a cybersecurity incident in the past two years according to our research. While that is lower than most businesses, the reputational impact is higher for law firms.

“Cyberattacks are a huge risk. These days, you can’t obtain certain work without certain levels of technology. The last thing you want is to be deselected upon rebid because you didn’t have the adequate technology measures in place.”

Kevin Ricci Partner, Risk Advisory and Compliance Practice Citrin Cooperman

the number of cyber attacks globally since 2020.

Source: IMF 2x

Uses for law automation software:

• Reduce manual work

• Manage documents, especially with versioning

• Collaboration, calendars, messaging

• Better leverage knowledge

• Discovery

• Automate processes

• Automatically update cited sources

• Scan documents for errors

• Scan and compare contracts

• Predict case outcomes

Source: American Bar Association

Where they can, law firms should also explore all the ways to stay competitive with automation. Whereas in the past, software largely relied on attorneys to enter information, large-language models (LLMs) can now answer questions, generate their own inputs, and save far more time with a variety of conversational tasks. The technology is still nascent — sometimes, reviewing the AI-generated information takes as much time as it would to produce it — but in some areas, like e-discovery, it already excels.

As firms adopt more technology that is also available to in-house legal teams, they’ll be faced with a question: Where does their firm add value? Likely, it will be that they can be trusted. Even if a machine helps your team generate an answer, clients will pay for your expertise, and to know for certain they can confidently act upon it.

As your firm adopts more software, where will it add unique value?

Action:

Have a specialist audit your ERP for AI readiness

Enterprise resource planning (ERP) system data is essential to run a profitable, stable business that will succeed as partners move on. Firms need accurate billings and forecasts. In addition, this repository for operational and financial information is essential if your firm is going to experiment with AI, which relies on your own datasets. If your firm’s ERP system hasn’t been upgraded in years, it may be time.

Learn how we can help

Action: Take measures to increase firm diversity

Decades of research attest to the idea that diverse organizations are better at solving problems. You can measure diversity in a number of ways, including age, gender, and experience. Firms facing challenges of profitability and succession would very likely benefit from more diverse perspectives, especially at the leadership level.

Action:

Get a cybersecurity audit

Anything digital is now vulnerable. Pair your technology initiatives with equivalent measures to understand your cybersecurity risk level, posture, policies, and response.

Learn how we can help of law firms experienced a cybersecurity incident in the past two years. 22%

Get back to finance and tax basics

In many ways, our most important recommendation for law firms is the least revolutionary: Get back to finance and tax basics.

Run a solid, cash-flow-positive organization able to service its debt and taxes. We have seen far too many firms neglect these operations to their detriment.

Here is a fictional tale that is broadly representative of what we see: A mid-sized law firm, well- respected in its industry, was eager to grow. However, its finance team was running on outdated systems and using an inefficient accounting process that couldn’t answer questions about bill rates, job-level profitability, or

partner pay. The firm’s CFO struggled to get timely financial information, they missed billings, and partners fell behind on paying quarterly taxes. They never revisited their tax efficiency. But because it was profitable, partners tolerated it. The firm grew. Then, when billings rose but realization fell and they unexpectedly lost two important rebids, they faced a financial shortfall and had to seek outside capital.

“A firm that invested in a stronger financial foundation would be better equipped to scenario plan, fund technology investments and succession planning, and forge its own path.”

Brian S. Lomasky Partner

Citrin Cooperman

The resulting firm:

• Struggles to close its books on time

• Has low and unpredictable cash flow

• Has trouble meeting tax deadlines, resulting in penalties

• Must retroactively refile and pay fees

• Issues partner distributions late

• Is reactive rather than proactive

The firm built an excellent law practice but did so on unstable financial footing. Whereas a firm that invested in a stronger financial foundation would be better equipped to scenario plan, fund technology investments and succession planning, and forge its own path.

Action: Create a culture that attracts and retains top financial talent

Firms that invest more in mentoring and coaching can help attract and retain the right financial talent for your firm. Consider recruiting from more diverse channels, devising more rewarding career paths so non-lawyer employees have more reasons to stay, investing in mentorship programs, and using outside financial consultants to create a strong financial culture. Where that culture exists, it will help attract top talent. Whereas firms with a poor “employer brand” must pay 10% more to attract qualified candidates.

Action: Reevaluate your income taxes and filing process

Revisit your firm’s financial basics and analyze the structure for tax efficiency. If it has been a long time, much may have changed both in the firm structure and in the tax codes for the regions you operate in.

Several examples:

• The Unincorporated Business Tax (UBT) — Firms with remote workers may be able to lower their New York City allocation percentage and save significantly on this tax. The apportionment is based on place of performance, so if a firm’s employees have been providing legal services outside of the five boroughs, they may not count.

• The pass-through entity tax — An elective tax whereby partnerships pay based on the entity and not the partners.

• Sales tax refunds on software — Different states and localities have different laws on whether firms can claim tax refunds on software licenses.

A year-end checklist

How to act on these opportunities

Law firms have many reasons to be optimistic about the future: Billings are up and changes in the market may generate new opportunities. For example, as general counsel teams grow, and those teams use more technology, will it create a new dependence upon true legal specialists in that technology? This may be advice your firm can provide. Or can your firm’s partner-potential associates explore ways to use new legal tech software to create new services?

Inside Citrin Cooperman’s Law Firm Industry Practice

Our dedicated team uses our deep industry expertise to provide a full range of professional services to help our law firm clients achieve their goals. We help leaders like yourself make informed decisions, find new lines of business, increase tax efficiency, manage technology, reduce cost, and improve the bottom line.

Subsectors we serve:

• Forensic and Litigation Advisory Services

• Professional Services

• Transaction Advisory Services

• Valuation Advisory Services

About Citrin Cooperman

Citrin Cooperman is one of the nation’s largest professional services firms, helping companies and high net worth individuals find smart solutions. Whether your operations and assets are located around the corner or across the globe, we can provide new perspectives on strategies that will help you achieve your short- and long-term goals.

citrincooperman.com

Citrin Cooperman” is the brand under which Citrin Cooperman & Company, LLP, a licensed independent CPA firm, and Citrin Cooperman Advisors LLC serve clients’ business needs. The two firms operate as separate legal entities in an alternative practice structure. The entities of Citrin Cooperman & Company, LLP and Citrin Cooperman Advisors LLC are independent member firms of the Moore North America, Inc. (MNA) Association, which is itself a regional member of Moore Global Network Limited (MGNL). All the firms associated with MNA are independently owned and managed entities. Their membership in, or association with, MNA should not be construed as constituting or implying any partnership between them.