Editor’s Message

Cross border economic activity Canada & U.S. Trade

S

pecific to construction, ongoing economic indicators in the United States, based on management and investment consultancy FMI Corporation, are predicting that total engineering and construction spending in 2018 will increase 7%, nearly double the 4% rise seen in 2017. This increase in the 2018 spending growth is being primarily driven by residential improvements, single-family residential and office construction, accompanied by healthcare, education, transportation and communication projects. Whilst many have been looking forward to benefitting from a strong increase in infrastructure improvements, a pre-election priority of President Trump, changing interest rates could discourage public-private-partnerships and lead to a decline in the spending predicted for this sector.

Arif Ghaffur, PQS

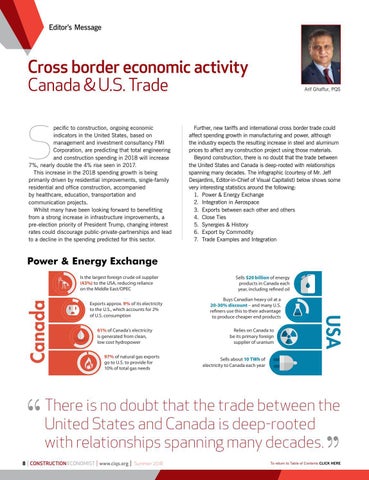

Further, new tariffs and international cross border trade could affect spending growth in manufacturing and power, although the industry expects the resulting increase in steel and aluminum prices to affect any construction project using those materials. Beyond construction, there is no doubt that the trade between the United States and Canada is deep-rooted with relationships spanning many decades. The infographic (courtesy of Mr. Jeff Desjardins, Editor-in-Chief of Visual Capitalist) below shows some very interesting statistics around the following: 1. Power & Energy Exchange 2. Integration in Aerospace 3. Exports between each other and others 4. Close Ties 5. Synergies & History 6. Export by Commodity 7. Trade Examples and Integration

Power & Energy Exchange

Exports approx. 9% of its electricity to the U.S., which accounts for 2% of U.S. consumption 61% of Canada’s electricity is generated from clean, low cost hydropower 97% of natural gas exports go to U.S. to provide for 10% of total gas needs

Sells $20 billion of energy products in Canada each year, including refined oil Buys Canadian heavy oil at a 20-30% discount – and many U.S. refiners use this to their advantage to produce cheaper end products

USA

Canada

Is the largest foreign crude oil supplier (43%) to the USA, reducing reliance on the Middle East/OPEC

Relies on Canada to be its primary foreign supplier of uranium Sells about 10 TWh of electricity to Canada each year

Integration in Aerospace Like automobile manufacturing, aerospace is another industry with heavy integration between U.S. and Canadian suppliers.

There is no doubt that the trade54% between the United States and Canada is deep-rooted with relationships spanning many decades. Supply Chain

50%

80%

of Canada’s aerospace sales are exports, and the majority of these go to the U.S.

8 | CONSTRUCTION ECONOMIST | www.ciqs.org | Summer 2018

Engines

2015

Aerospace Exports

To return to Table of Contents CLICK HERE

16%

Avionics