Top 1 0 10 I n s u r T e c h InsurTech leaders to watch in 2022

Top 1 0 10 I n s u r T e c h InsurTech leaders to watch in 2022

The state of the insurance industry has come under deep

scrutiny, particularly as the pandemic revealed new risks and weaknesses against a backdrop of market volatility. The future of the industry depends upon modern insurance leaders who have the visionary traits to disrupt and innovate within their organizations.

Sometimes leadership sneaks up on us. It starts out with our volunteering on a committee or speaking up at a meeting. Someone may nudge us at first, giving us encouragement. Or perhaps we raise our voice out of frustration or in defiance, challenging conventions, shattering the established way of doing things.

The insurance industry has unique challenges and opportunities. Navigating these well is the key to success in the insurance world. Your team needs great leadership to help them manage these challenges and opportunities. One important aspect of being a good leader is to nurture your team. As their leader, your team looks to you for guidance, strength, motivation, and support.

You essentially take on the parent role for your team, and it is your responsibility to make sure that your team is healthy and happy. A good leader recognizes what makes each team member great. By realizing each member’s strengths, leaders can better organize their team and projects based on each person’s ability.

Innovation is essential to the survival of your insurance business. If your company doesn’t innovate well, your business will plateau. What’s more, competitors who are innovating will pass you by.

Innovation starts at the team level. The more you empower your team to innovate, the more innovative you will become as a company. Fortunately, innovation can be cultivated.

Keeping the company’s overall mission in mind is an essential skill of a good leader. Without this vision, teams can quickly lose their direction and get off course. Seeing the big picture and implementing it into projects helps your team stay in alignment with company goals.

Embracing the journey of the leaders who are enabling novelties in the modern insurance industry with a unique approach while showcasing significant traits, CIOLook features the “ Top 10 InsurTech leaders to watch in 2022,” who are enabling betterments in the niche.

Flip through the pages and comprehend the leadership traits that are enabling new advancements in today’s insurance industry.

Have a Delightful Read!

Abhishek Joshi AbhishekJoshi

CONTENT

Senior Editor Alan Swann

Executive Editors Abhishek Joshi

FOLLOW US ON www.facebook.com/ciolook www.twitter.com/ciolook

DESIGN

Visualizer Dave Bates

Art & Design Director Revati Badkas

Associate Designer Ankita Pandharpure

SALES

Vice President Operations Kshitij S.

Senior Sales Manager Prathamesh Tate

Sales Executives Rohit, John

TECHNICAL

Technical Head Prachi Mokashi

Technical Consultant Victor Collins

SME-SMO

Research Analyst Eric Smith

SEO Executive Sagar Lahigade

CONTACT US ON

WE ARE ALSO AVAILABLE ON Email info@ciolook.com For Subscription www.ciolook.com

Copyright © 2022 CIOLOOK, All rights reserved. The content and images used in this magazine should not be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission from CIOLOOK. Reprint rights remain solely with CIOLOOK.

sales@ciolook.com

November, 2022

AV8 Ventures av8.vc

AV8 Ventures is an early stage partner in helping founders build their companies.

Slide slideinsurance.com bsurance bsurance.com

Auto-Owners Insurance accelins.com

Slide believes in leveraging technology and deep insurance expertise to hyper-personalize, optimize, and streamline every part of the home insurance process.

bsurance helps businesses to scale-up, by digitalising and embedding insurance products directly at the Point of Sale.

Auto-Owners Insurance is among the top insurance providers in the U.S., offering a wide variety of discounts and coverages to meet your needs.

Nitin Anand Director

Qatar Insurance Group is the largest insurer in the Persian Gulf region. Qatar Insurance Group qicgroup.com.qa

Abu Dhabi National Insaurance Company adnic.ae

SoCoCare sococare.com

ADNIC offers both commercial and consumers insurance products that are customisable and scalable.

SoCoCare delivers the market's most intelligent and highly evolved Social Engagement solution for customer service and sales organizations.

WTW wtwco.com

WTW povides data-driven, insight-led solutions in the areas of people, risk, and capital that make your organization more resilient, motivate your workforce, and maximize performance.

Guidewire guidewire.com

Guidewire is the P&C platform that supports the entire insurance lifecycle for leading insurers in 38 countries.

Aflac Inc aflac.com

Aflac provides supplemental insurance to help pay out-ofpocket expenses your major medical insurance doesn't cover.

A Catalyst in Intuitive and A�ordable Insurance

QIC has made great strides in integrating technological advancements that address some of the ine�ciencies that exist along the value chain.

We as humans have access to limited

resources for risk management when it comes to a situation where we dip into accidents or similar consequences. What cannot be provided, we try to obtain. Insurance is one such instance that comes into play when we cannot manage the casualties that we face; it gives us reassurance and a stance to regenerate on the contrary.

Unpredictability and predicament are fundamental to life; hence insurance is a prerequisite today. The arbitrariness of life these days has no covenant, even more than before. This brings the rise of the InsurTech Industry today. The insurance industry is predominantly backed by federal service providers, with privately held enterprises holding a minor stake. Ever-changing customer behavior, digital disruption, regulatory pressures, and the competitive marketplace leaves this industry to be a very volatile one.

Owing to the same, the Property and Casualty Sector, P&C, of the InsurTech market is not any different; challenges faced here are the same, if not more. But the ability of P&C carriers for protection has continuously increased over the last few years. The insurance business is adding capacity because of the prominent companies offering newly developed online services. These shifting dynamics have heightened price-based competition, fueled market development into new geographies, and compelled insurers to provide enhanced services.

Sustaining these changing dynamics of the market is Qatar Insurance Group . Qatar Insurance Company (QIC) is a publicly listed flagship insurer with an outstanding performance history of over 50 years. Since its establishment in 1964, QIC has demonstrated its ability to consistently navigate individuals and businesses through economic cycles by offering a diverse portfolio of both personal and business lines of insurance products, combining distribution with excellent service delivery. And today, the firm stands even more successful because of the never give up attitude of its CEO,

Salem Al MannaiTo know his achievements and the sector better, CIOLook had an interview with the radical of the InsurTech Industry.

Below are the highlights of the interview:

Brief our audience about your journey as a business leader until your current position as CEO of Qatar Insurance Group. What challenges have you had to overcome to reach where you are today?

Being a postgraduate of the University of South Wales in the UK, I have held various key positions within Qatar Insurance Group, the most recent being the Deputy President & CEO of the Group. I started my career in the retail department of QIC in 2001. Subsequently, I was appointed as the Head of Energy, Marine, and Cargo Insurance. And in 2013, I assumed the responsibility of Deputy CEO of QLM. In 2015, I was appointed as Deputy Group CEO of the MENA region. Later, based on my knowledge and experience, I was assigned the position of Deputy Group President & CEO of the QIC Group in 2019. And in January 2020, I was appointed QIC Group CEO.

Tell us something more about Qatar Insurance Group and its mission and vision.

Our mission is to be recognized as the world's largest and most trusted insurance group while continuing to meet our obligations to shareholders, customers, employees and society.

Our vision is to maintain our drive for growth and excellence through innovation, diversification, and responsible leadership. Through existing and new strategic alliances and partnerships, we aim to create the optimum framework for continuous profitable development.

The insurtech ecosystem is still in its early stages in the MENA region. Our goal is to play a leading role in boosting innovation and entrepreneurship.

For example, in 2022, QIC Global, the subsidiary of Qatar Insurance Group, announced its intention to align its core companies under the Antares name (the name of QIC Global's London and Asia-based Lloyd's business, a well-known and well-regarded brand that has been chosen to reflect the international nature of the wider group's client base and global operations.), creating a single identity to unify the brand across respective entities.

Enlighten us on how you have impacted the insurtech industry through your experience in the market.

QIC has made great strides in integrating technological advancements that address some of the inefficiencies that exist along the value chain. For example, we were among the first in the last 10 years to implement new digital propositions in the mobility space and health insurance, such as, using AI modules in claims handling to improve processing efficiency and reduce operational costs.

This digital transformation has evidently resulted in efficiency gains and better service provision; however, the sheer pace of the change created a skills gap. That's why companies must invest in finding and onboarding

people with the right skills and mindset who can come in and challenge traditional approaches and test the limits.

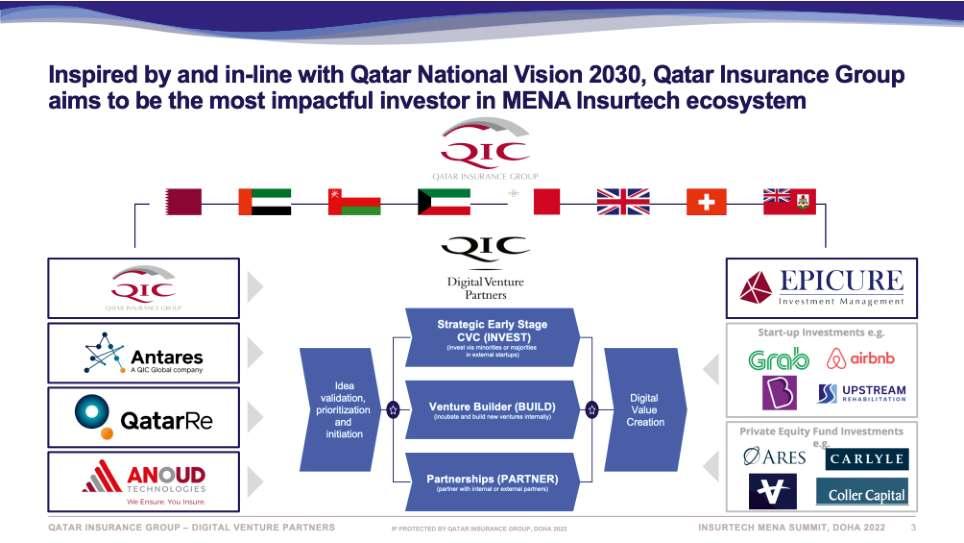

With this in mind, we launched QIC Digital Venture Partners (QIC DVP): a unit that is tasked with fostering a culture of innovation and accelerating our activities in insurtech, through building new ventures, partnering with BigTech and investing in insurtech startups.

QIC DVP marries the different capabilities of QIC Group, specifically (Anoud Tech and QIC Global/Antares) together with insutech's entrepreneurial mindset to boost the MENA insurtech ecosystem and to become the risk book of future digital MGAs while helping provide the right management tools and tech capabilities.

Describe in detail the values and the work culture that drives Qatar Insurance Group.

Innovation, diversity, and excellence are some of our main values. We believe that a diverse workplace that brings together people from different backgrounds, nationalities, and genders who can draw upon their unique experiences and perspectives, leads to

increased innovation, strategic thinking, and problemsolving.

We value every employee and acknowledge their distinctive contribution, effort, and opinions. Our Group is being built on teamwork, respect, and mutual trust, and each person at whatever level she or he may operate is empowered and encouraged to be responsible for their actions. We acknowledge innovation and reward excellence.

We encourage a safe workplace, comply with all laws and regulations, and strive to meet the expectations and requirements of our customers, whom we regard as trusted partners, whose constructive feedback and candid critique are valued, and we endeavor to integrate into our business model.

Undeniably, technology is playing a significant role in almost every sector. How are you leveraging technological advancements to make your solutions resourceful?

These days people expect to be able to acquire services on the go through their mobile phones; therefore, in order to address this consumer demand, we launched qic. online: the market-leading digital insurance offering where you can directly contract insurance in 2 minutes. We are proud to be the reference here for many regional players.

And to expand those capabilities beyond QIC, we launched Anoud Tech in March 2020, a wholly owned

IT services subsidiary of QIC Group. Its best-in-class insurance IT platform called Anoud+ provides insurers with an efficient and comprehensive way to manage all aspects of their insurance programs.

With fifteen international insurers as clients, Anoud Tech has become an insurtech infrastructure player. It is also the first Qatari company to export internally developed IT solutions to insurance companies in Europe and the Caribbean. Those achievements have earned Anoud Tech placement in ACORD and Alchemy Crew's list of top 10 leading companies with great current and future ability to change the industry through insurtech.

To better work with our regional partners, we exposed most of our insurance products and services via APIs and have developed client management platforms and interfaces to facilitate communication and workflow between our organizations.

What change would you like to bring to the Insurtech industry if given a chance?

The insurtech ecosystem is still in its early stages in the MENA region. Our goal is to play a leading role in boosting innovation and entrepreneurship by connecting the different market players, such as insurance incumbents, regulators, venture capital and insurtech new founders.

We also aim to bring more insurance product innovation and digital proposition innovation through

QIC DVP's new ventures and by leveraging our Lloyd's London and reinsurance capacity (Antares) and QIC's dominant presence in the GCC region.

What according to you could be the next significant change in the insurtech industry? How is Qatar Insurance group preparing to be part of that change?

Enabled by smart phone and internet penetration rates globally and within the region, consumer browsing and purchasing patterns have witnessed a paradigm shift from offline to online. A shift that was further accelerated by a pandemic that forced corporations, retailers, and users to embrace digitization.

Insurtechs worldwide followed a pattern of disruption similar to what we saw with Fintechs. The first wave happened on the distribution side of the value chain where the rise of marketplace, comparison sites and aggregators helped users quickly compare between insurers and obtain a quote.

The second wave of disruption, which is currently underway, is in the Direct to Customer (D2C) space, where incumbents are either innovating towards online offerings or working with insurtech companies that are providing digital capacities that enable incumbents reach online users, particularly, digital native generations (Millennials and Gen Zs).

The third wave will see insurtechs leveraging digital and data to provide an entirely new experience to the customer, one that offers sustainable pricing and profitability through better underwriting and risk management, on-demand, or usage-based insurance

propositions, and embedding insurance into an extended ecosystem around the customer's lifestyle and daily activities to offer ubiquitous insurance protection.

There are three strategic mechanisms by which QIC is able to innovate, expand and impact the insurtech ecosystem: Anoud Tech provides insurance incumbents with a software and licensing delivery model called "software-as-a-service" or "SaaS" that enables them to adopt and integrate digital insurance solutions; QIC DVP builds new ventures and invests in insurtechs and; Antares our specialty reinsurance subsidiary that offers a broad range of reinsurance and alternative risk transactions, as well as commercial and retail insurance products distributed through a network of respected insurance intermediary partners and Lloyd's of London.

Where do you envision yourself to be in the long run and what are your future goals for Qatar Insurance Company?

As we progress further into the digital age, the demand for digital solutions that improve speed, efficiency and simplicity will continue to increase. Our goal is to become a digitally enabled and technology-driven insurance company that enables different propositions and expands the MENA insurtech ecosystem. Our specialty reinsurance, Antares, could provide us with greater flexibility to add new corporate entities and insurance-related services that will help facilitate a future where we are the standard defining tech platform for insurance incumbents in the region.

Also, with QIC DVP, we will have built leading insurtechs in several verticals and expanded the MENA insurTech ecosystem by creating, investing in and nurturing insurtechs.

What would your advice to budding entrepreneurs who aspire to venture into the insurtech industry?

The best solutions and innovations are born out of a deep knowledge of the insurance space, so it is important to talk to customers and to truly understand their pain points. Also, partnering with the right players is critical. Approach our QIC DVP team and get valid feedback and to potentially partner and get financed. My other suggestion would be to participate in the second MENA InsurTech Startup Challenge.

Our newly launched- QIC Digital Venture Partners, builds its ventures, invests in insurtech start-ups, and partners with BigTech to boost the whole MENA Insurtech Ecosystem.

Insurance was designed centuries ago to protect investments, like homes, from the financial impacts of unexpected loss. The financial security insurance provides, was and still is, fundamental to homeowners’ way of life. However, the value chain became broken when the industry did not evolve at the pace of its consumers. This has left modern insurance buyers dissatisfied with the customer experience, the pricing, and the products.

The first InsurTechs sparked a movement toward digital-first insurance experiences that are more in line with what consumers have come to expect from the providers they choose to do business with. This disruptive approach has garnered the interest of consumers and investors alike over the past decade. While these insurance innovators made significant strides in the digitization of the industry, they did not understand the complexities of insurance and not one has achieved the profitability or financial strength needed to fulfill their purpose.

Enter Slide. Slide was introduced to this dynamic market in 2021 as a disruptor to the disruptor – its approach is so unique that it is being lauded as the next generation of InsurTech. In its first year, Slide has grown to be one of the largest P&C InsurTechs in the nation by revenue and is the first to be profitable. Propelled by the never give up attitude of its Founder and CEO, Bruce Lucas, the company marries deep technology, data science, and insurance expertise to achieve what was previously perceived as impossible.

Bruce is recognized as a leading InsurTech influencer for his expertise in using Big Data and cutting-edge technology to revolutionize all facets of the insurance process, including operations, claims, underwriting, and the experiences of customers and agents. We, at CIOLook, had the privilege to have an interview with this maverick of the InsurTech industry.

Below are the excerpts from the interview.

Bruce, please brief our audience about your journey as a business leader until your current position at Slide. What challenges have you had to overcome to reach where you are today?

My career has been full of twists and turns. I started in the insurance industry ten years ago with no experience. I had to learn insurance, reinsurance, risk management, claims, underwriting, customer service, managed repair, public markets, capital management, hurricane management, and how to function with little to no sleep. The biggest obstacle for me was learning how to empower and trust my senior team to make the right decisions.

In my early days, I was a roadblock, and everything had to flow through me, which made rapid growth difficult. When I adopted a collaborative management process, I not only empowered the management team to be leaders, but I was also able to scale the company at an incredible rate. You have to learn the balance between grabbing the reigns and letting go.

Tell us more about Slide and its mission and vision in the modern InsurTech sector.

I want to change the face of insurance as we know it. The future of every business is technology-driven, especially insurance. The industry has been slow to modernize, and it no longer fits the wants and needs of the consumer.

Slide strives to create a modern user experience, using Big Data-driven underwriting, at a fair price for our customers. I want to make insurance intuitive and affordable.

Enlighten us on how you have impacted the InsurTech sector through your expertise in the market.

My niche is homeowner’s insurance. Throughout my career, I’ve changed the perceptions related to growth, profitability, risk management, and M&A. In just a few short years at Heritage Insurance, my last start-up venture, I created the fastest growing insurer in the U.S. two years in a row. During my tenure, I did more M&A than any other coastal CEO, took the company public in two years, grew revenue to over $1 billion per year, and was profitable every year. Slide is off to an even faster start and we are proving that insurance does not need to be slow-paced and unprofitable

Describe in detail the values and the work culture that drives your Slide.

Slide has five core values that are lived out daily:

• Slide it Forward. We adopt a charitable cause every quarter and the Slide team around the country participates supporting the cause.

• Keep it Real. Our team members are encouraged to always be honest and forthright. We believe that trust must be earned and maintained – whether it be a fellow team member or a policyholder.

• Be an Intrapreneur. Every team member is empowered to take charge of their domain and get creative in the solutions they bring to the table. We operate with a “best idea wins” philosophy.

• Empower Differences. We hire for diversity of thought and give space for everyone to learn, grow, lead, and unite around our vision.

• Enjoy the Journey. Work should be fun! We invest in events and celebrations to ensure our employees have time to do what they love and love what they do.

Undeniably, technology is playing a significant role in almost every sector. How are you leveraging technological advancements to make your solutions resourceful?

We are using a $5 Trillion TIV data set and 20 years of historical claims information to better understand risk selection and pricing. Our industry-leading data gives Slide an insurmountable advantage over our InsurTech peers, and sets is the foundation upon which we built our proprietary underwriting AI. The combination of Big Data and underwriting AI allows Slide to make

better-informed decisions relating to risk selection and pricing.

What change would you like to bring to the InsurTech sector if given a chance?

Prospective-based underwriting! I’m not afraid to be contrarian, the entire industry has it wrong. They are using retrospective data from as much as two years ago to price a policy today. In an inflationary market, you are always underwriting at a loss and the old underwriting methods no longer work. The future of insurance is prospective underwriting that looks at loss costs for the next 12 months and adjusts the price of each policy accordingly.

What, according to you, could be the next significant change in the InsurTech sector? How is Slide preparing to be a part of that change?

The next significant step forward is AI-based underwriting and decision-making. Slide is at the forefront of this trend and has developed cutting-edge underwriting AI that is capable of making point-of-sale underwriting and pricing decisions.

Where do you envision yourself to be in the long run, and what are your future goals for Slide?

My five-year goal is to have $1 billion in premium and continued profitability. My long-term goal is to make Slide a household name in the insurance industry, where we are known for ease of use and fair prices.

What would be your advice to budding entrepreneurs who aspire to venture into the InsurTech sector?

If you want something bad enough, you have to work and hustle to make it happen. Take the time to learn the business and what is required to be successful. There is a lot of ground to cover - Dream BIG and swing for the fences.

Any relationship needs clarity of communication. Errors in communication and comprehension can lead to mistakes or substandard functioning. In such a scenario, a person who can bridge the communication gap is vital and plays a crucial role in maintaining effective communication with coherency.

Such is the expertise that Hermann Fried brings to the table as the Managing Director of bsurance . Hermann helps drive innovative digital solutions for insurance companies and sales partners using his expertise and knowledge of the insurance and IT field.

Hermann is a top insurance expert and former Member of the Managing Board of Wiener Städtische Versicherung. At bsurance, he is responsible for the

expansion of the company’s insurance partnerships. In addition, he has developed innovative insurance products together with sales partners from retail, telecommunications, banks, energy suppliers, mobility providers, and start-ups.

Hermann Fried, in an exclusive interview with CIOLook, describes the changes that technology is bringing to the insurance industry:

Brief our audience about your journey as a business leader until your current position at your company. What challenges have you had to overcome to reach where you are today?

I was born in Vienna in 1964. After completing my studies at the Vienna University of Economics and Business, I gained experience working for social security and the hospital sector. In 1998, I joined the Wiener Städtische insurance group, where I held various management positions.

Key milestones in my career include the management of health and personal insurance lines, management of the Vienna regional HQ, and responsibility for Marketing, Sales, Advertising, and Property Insurance as a member of the board of directors.

I also served on several supervisory boards and as a lecturer at the Vienna University of Economics and Business. Always interested and engaged in digital insurance, I finally quit my job at the insurance company and made courses about digitalization at Chicago Booth and Oxford University. For the last three years, I have been working for an InsurTech company, bsurance.

My role is best understood as an interpreter. Being able to understand both insurers and techies and speak both languages, it is my task to bring together those opposites and develop innovative, client-orientated insurance solutions.

Tell us something more about your company and its mission and vision.

bsurance is a leading B2B2C; white-label InsurTech focused on Embedded Insurance. As an enabler with both SaaS and MGA capacity, bsurance provides Insurance-as-a-Service, including product development, onboarding and real-time policy issuing, FNOL, claims handling, and settlements.

Our mission is focused on simple, relevant, and fair embedded insurance products, which adds value to customers, businesses, and insurers alike.

Enlighten us on how you have impacted your niche through your expertise in the market.

My role is best understood as an interpreter. The insurance industry is very conservative and has its difficulties understanding and implementing digital solutions. Techies have their own difficulties in understanding the basic needs and functionalities of insurers. Being able to understand both sides and speak both languages, it is my task to bring together those opposites and develop innovative, client-orientated insurance solutions. At the basis, those solutions are still insurance coverages, but due to our technology, it is unparalleled, available, easy, and fast for the customer.

Describe in detail the values and the work culture that drives your organization.

Our culture is rooted in our diversity and collaboration. We have nationalities within our team and are of 9 varied backgrounds– from insurance specialists to technology entrepreneurs. Our power lies in our ability to brainstorm new solutions according to our partners’ needs and bring them to fruition in a short time frame. Comparing it to my work in a big corporation – everything is focused on our projects with a fast, high-quality implementation.

Undeniably, technology is playing a significant role in almost every sector. How are you leveraging technological advancements to make your solutions resourceful?

Our solution combines the power of data and the simplicity of online product offerings to create realtime and relevant offers of insurance policies to the right customer at the right time.

One example is our short-term ski insurance which we created for a major bank in Austria. Based on purchase data (and in the future, also location data), our shorttime ski insurance product is offered by push notification within the bank’s app. This way, the customer can buy, with a few clicks, the insurance directly in the appno need to contact the insurer.

What change would you like to bring to your industry if given a chance?

We will be part of changing the insurance industry and making it fit for a more and more digital world.

What, according to you, could be the next significant change in your sector? How is your company preparing to be a part of that change?

This might sound funny, but we do not believe in B2C insurance sales on a web page. But we do believe that the current offerings are much too complicated and not as available as people are used to these days. So, the only chance to bridge that gap is by offering insurance contextual. Sounds easy but has a lot of consequences on product design, sales journey, and distribution channels.

B2B2C is one of the ways to offer insurance contextual. And the industry has just started! Currently, this kind of insurance is offered for a manageable number of products. In the near future, we will see that kind of insurance dominating all end consumer insurances like car and house insurance. The instruments are ready; we just have to find partners who also see a big opportunity in this.

Where do you envision yourself to be in the long run, and what are your future goals for your company?

In the long run, I will be the Managing Director of one of the market leaders of B2B2C insurance solutions in Europe.

What would be your advice to budding entrepreneurs who aspire to venture into your sector?

Look for innovative insurance people!

As the digital economy continues to mature and

customers grow more tech dependent, “digital” is no longer just the trendy front of a corporation. The move towards digitizing existing industries will only continue to grow. The insurance industry is no different, that’s why long-established companies like QIC are recognizing the need for talent that can come in and drive digital transformation and innovation. That’s the primary role of a Chief Digital Officer (CDO), it’s to combine a digital mindset with existing insurance capabilities that speed up digital transformation. By bringing in teams equipped with skill sets that can innovate towards new digital business models, companies can shift organizational structures, capture new markets and provide better services to their clients and partners while maximizing efficiency gains.

In recent years, the Middle East and North Africa (MENA) region has seen major shifts towards digital insurance by both insurance incumbents and insurtechs, however, compared to other global insurance ecosystems, the region is playing catch up. Although, QIC has been working on digital propositions for the last 10 years, has piloted several product innovations and has one of the highest shares of digital insurance sales in the region, QIC wanted to take the leap into becoming the leading digital insurance company in the region. QIC’s very own QIC Digital Venture Partners (QIC/DVP) is helping to accelerate the ecosystem by building insurtech related ventures, investing in early stage insurtechs and partnering with leading companies that will enter the region. While contributing thought leadership and playing an active part in the MENA Insurtech Association.

In April 2022, QIC, QIC DVP, Google Cloud and Deloitte Digital, together with other partners organized the first MENA Insurtech startup challenge. Inviting startups globally to pitch and compete for the title of best business models and technology. Following active mentoring by internal and external mentors and partners like Prifina, Plug&Play, Qatar Financial Center, Qatar Life & Medical Insurance Company, over 140

Lars Gehrmann is the Chief Digital Officer at Qatar Insurance Group (QIC). His role focuses on leading QIC Digital Venture Partners (DVP), a unit that aims to reshape the digital insurance landscape by building new digital ventures, leveraging exis�ng assets, partnering with Big Tech and corporates, and strategically inves�ng in high poten�al early-stage startups while transforming the way QIC operates digitally. Lars is a board member of Anoud Technologies, a wholly owned IT services subsidiary of QIC Group. He has twenty years of extensive experience in building and managing digital companies in insurance, financing, leasing, automo�ve and educa�on. He has a passion for new digital business models, pla�orms and ecosystem, and is the strategic advisor to several digitalstartups.

participating startups went through several selection rounds until the top 10 were selected. All were given the opportunity to present at the MENA Insurtech Summit in Doha earlier this year. Yielding co-building and investment opportunities for the startups. Additionally, we are proud to have arranged for four of the top ten startups to present their innovations at Insurtech Connect (ITC) 2022, the world’s largest insurtech event that took place in Las Vegas, USA in September 2022.

Capitalizing on the success of the first challenge and seeing the positive outcome for the MENA insurtech ecosystem, we are now working with partners including the MENA Insurtech Association on the 2023 cycle of the challenge for seed-stage companies that are either currently in the region or aim to build here. The winners of the regional competitions will be present at our next insurtech summit in 2023, providing them with an opportunity for exposure to international insurtech conferences, where QIC occupies a place as a go-to digital insurance partner and thought leader.

Lars Gehrmann

Lars Gehrmann

In March 2020 Antares went from an office-based

organisation with managed IT in centralised locations to running over three hundred remote offices around the globe overnight. Although not seamless, the transition to an environment where business was done via virtual meetings, online synchronous collaboration and messaging replacing email, was quickly adopted alongside millions of other companies. The companies that provided the technologies that supported this global change poured money into development of the tools that help us run our business today.

The lessons learnt from that accelerated use of technology are now being applied throughout organisations and form the basis of our digital strategy. Our strategy aims to deliver operational excellence and the adoption of innovation, both through internal change and working with partners to extend our own capabilities. This global revolution focusing on operational excellence is driving the transformation of our internal processes using automation, artificial intelligence and data management technology.

The pace of innovation in our market such as real time flexible products or AI driven claims assessment, present additional opportunities if we can adopt and integrate them into our business efficiently. There is obvious value in using AI to make a claims assessment quickly and accurately, but the full value comes from automatically processing the data from the assessment, carrying out all the fraud checks and making payments for the claim as well as feeding and enhancing our risk and pricing models. This also results in changing the roles of our people to provide management and oversight of these

processes and it is this change which must be managed to truly realise the value of digital transformation.

The ability of our IT functions to quickly integrate new innovations into our IT landscape has several challenges and solutions, both technological and people. By adopting a composite approach to solutions, we can make the most valuable components of our systems modular so they can be reused, as well as investing in API technology to support new services. The customer engagement model is changing, and these technologies will enable new digital products such as claims portals and chatbots that can hook into these modules.

The pace of change and opening of IT services also brings increased cyber risk and this will remain high on the CIO and Board’s agenda for the foreseeable future.

The pandemic also brought about a change in the IT workforce with many experienced IT professionals leaving the workforce at a time when demand is surging. This shortage of skilled IT resources is unlikely to be resolved in the short to medium term so we must look to attract, retain and train our IT teams to support the transformation of our business and we see this as an ongoing challenge.

Ultimately, successful digital transformation is a combination of people, process and technology and we believe this can only be achieved by using a combination of our own people and partnerships with other companies to benefit from their specialist expertise and systems.

Ÿ The digital office has been adopted at an unprecedented rate due to Covid, we’re seeing ten years of evolu�on in workplace technology over the last three years.

Ÿ New ways of working digitally with automa�on, AI and data management is now driving opera�onal excellence.

Ÿ The ability to adopt new innova�ons, o�en working with partners, into an ever-changing IT landscape demands a new approach to digital transforma�on.

Ÿ he pace of change across all industries combined with the drain of experienced IT professionals leaving the workforce throughout Covid makes a�rac�ng and retaining talent a significant challenge.

Background: QLM Life and Medical Insurance is considered as the largest health insurance company in Qatar and the only specialised company that leads the health insurance sector through its advanced services and flexible insurance programs that suit all segments of society in Qatar.

W e live in a world that has become highly dependent on information technology in management, especially with managing a large volume of data as is the case in health insurance. Therefore, our vision in this field was to develop a system capable of absorbing any volume of data and managing it effectively in the most efficient way possible. This will in turn positively reflect on the speed of responding to the requirements of our customers and the requirements of medical service providers at the same time.

The advancement of technology

benefit both insured members and insurance companies, QLM is no exception. QLM is constantly innovating and growing, we capitalized on the extensive data, experience, and technology advancement to build an outstanding insurtech to guarantee excellence in our services, and at the same time gives us a real time feedback on operations. The

development of our solutions was highly sophisticated as it involved many parties internally as well as externally. We've invested in developing a highly sophisticated solution involving both internal and external parties.

We managed to build a system through an interactive electronic platform that automatically approves without the need for human intervention except in rare cases, which shortens the time for issuing approval to a record time where the patient experiences a seamless process. This electronic platform helps health centers communicate, get the right information, and make the whole transaction an easy journey for both parties. All this is in the interest of the client/patient who will feel that they are receiving prompt and a high standard service.

Today, our systems are all online and fully integrated with healthcare providers inside as well as outside Qatar, the provider can at a fingertip verify eligibility, obtain approval, and submit a claim all online without the need for any direct interaction with our team. The secret behind this is the claims autoapproval/auto-adjudication, our systems are equipped with all medical international coding that are mapped together in the back end of the system. Therefore, any

coding the provider is using is mapped and auto adjudicated in the back end and the decision is communicated to the provider by the system.

The crown jewel of our IT platform is the Artificial intelligence (AI) that we have developed. Underwriting in health insurance is always seen as risky and needs extra attention, our AI module analyzes the data provided by the client and at same time analyzes the existing QLM data measuring behavior, trend, frequency, etc. Thus, suggesting an appropriate premium with prediction of loss ratio based on the suggested premium. Our AI is constantly monitoring behavior of providers in real time and alerting our team of any abnormal behavior that is taking place, it is monitoring the auto-adjudication module and correcting any errors that may exist during the process.

We are constantly evolving and growing as the leading Medical and Life insurer in Qatar, as we rely heavily on tech, we will continue investing where appropriate to maximize the satisfaction of all our partners. In QLM we believe that insurtech is the present and future. We will continue playing our role and assessing the markets worldwide while simultaneously be at the forefront when it comes to tech and for others to follow.

It is no secret that a person’s life and possessions are exposed to the risk of tragedy, impairment, and some circumstances at any given time. These circumstances can invite themselves on any occasion, whether you are prepared or not.

Although, one cannot avoid a situation but can surely minimize the after-effects of the occurrence. Insurance is one such reasonable strategy to transfer such risks to a third party, as it provides coverage acting as a protection plan to subjugate the condition.

Such a significant attribute, for decades, was regarded as a luxury rather than a need. This concept against insurance has faded with the advancement of time.

However, in certain parts of the world, insurance is still viewed as something that can be acquired only after achieving a particular level of financial stability and hence not viewed as a necessity.

To obliterate this belief, Nonso Opurum , a social entrepreneur, has undertaken the initiative to provide quality insurance by accepting cash or recyclables as premiums to ensure health inclusion and environmental sustainability. Nonso has been fascinating to build on excellent ways to bridge the gap in poor healthcare and financing in Africa.

SOSO CARE , the InsurTech venture by Nonso, provides Low-Cost Health Insurance that aims to enable millions of million to access care nationwide and ensures everyone in Africa owns a health plan irrespective of their financial status.

Nonso was approached by Insights Success to provide a brief understanding of such an entrancing approach without previous instances in the InsurTech industry. Below are the excerpts from the interview.

Brief our audience about your journey as a business leader until your current position at SOSO Care. What challenges have you had to overcome to reach where you are today?

For us, we had to pivot from telemedicine (JARA CARE) to micro health insurance (SOSO CARE). We had to make the tough decision when we realized that millions of low incomes could not afford data to connect with a doctor online, and most times internet connection wasn’t really stable. We figured out that what people

SOSO CARE is an affordable health InsurTech which accepts cash or recyclables as a premium to enable people to access care across over 1000 hospitals in Nigeria.

need is inpatient and outpatient care, not just convenient healthcare access like telemedicine, so we launched the operation.

Tell us something more about SOSO Care and its mission and vision.

As less than 10% of Nigeria’s 200 million population have health insurance, millions of people are pushed into poverty yearly as a result of no safety net and high out-of-pocket health financing. Again, Nigeria generates over 20 billion pet plastics, of which less than 5% is collected and recycled, leading to substantial environmental and public health problems.

SOSO CARE is an affordable health InsurTech which accepts cash or recyclables as a premium to enable

people to access care across over 1000 hospitals in Nigeria.

Enlighten us on how you have impacted the InsurTech industry through your expertise in the sector.

What we have done at SOSO CARE is to change how thousands of people view insurance. We have worked really hard to eliminate the trust gap around insurance.

Describe in detail the values and the work culture that drives SOSO Care.

One of the things that drive us is the ability to be ahead in our industry; as a pioneer in alternative ways of financing health insurance premiums without cash, we’re constantly searching for excellent ways of

improving the value of recyclables as a means of insurance premiums.

Undeniably, technology is playing a significant role in almost every sector. How are you leveraging technological advancements to make your solutions resourceful?

Technology is a strong layer of our work. By leveraging technology, we reduce the cost of micro insurance plans and monitor our decentralized agents across communities.

What, according to you, could be the next significant change in InsurTech Industry? How is SOSO Care preparing to be a part of that change?

I think embedded insurance as a way of distribution and awareness would continue to be the biggest change

that would happen to microinsurance. For us, we’re positioning recyclable fragments as a premium or payas-you-like model to give more people options for financing their premium.

Where do you envision yourself to be in the long run, and what are your future goals for SOSO Care?

We want to be able to replicate our solution in other countries in Africa and Asia where there is an urgent need for health care intervention and environmental management.

What would be your advice to budding entrepreneurs who aspire to venture into InsurTech Industry?

Insurance is complex insurance, as most low-income people consider it an expensive luxury; take your time to find a niche.

Rao leader motivates, challenges, and develops

Avarious skillsets to stretch people's imagination & creativity and enhance their contributions resulting in positive outcomes.

In recent years, transformational leadership has risen to the surface. Organizations in all industries are seeing a rapid change in today's digital era. Transformational leaders know how to encourage, inspire, and motivate employees to perform in ways that create meaningful change. From time to time, every industry finds talented leaders that are responsible for transforming the industry.

Their proficient knowledge combined with the emerging technologies gives them an advantageous edge in the given volatile insurance market. Rao Tadepalli is one such leader who brought transformational leadership with a proven history of success in the insurance industry as an experienced executive.

Rao is currently a Strategic consultant to Guidewire on Mergers & Acquisitions and Insurtech investments. Rao is also an Insurtech advisor/mentor to PlugNPlay, a Silicon Valley-based Startup Incubator and Innovation platform. Rao was a judge for several hackathons and works with the selected winners in introducing them to venture funding.

Let's indulge in the remarkable Journey of an Innovative Leader

After completing graduate studies in Computer Science, Rao Tadepalli started his journey as a Management Trainee with Tata Consultancy Services in India. Early in his career, Rao worked in Australia, Malaysia, and Europe before coming to the United States.

Initially, Rao worked for consulting companies and helped many clients successfully implement systems. Rao's first project in the US was with an insurance

company based out of Santa Barbara, CA. After spending a few years in middle Management with a leading National Insurance carrier, Rao became CIO and Sr. Vice President in 2007.

As an advisor for several Silicon Valley startups, he helps the firms prepare the Go to Market Strategy and product design, along with helping with the pitch deck. Rao is the Founder and CEO of DigiTran Technologies , a company that focuses on helping Insurance companies digitally transform by partnering with Insurtechs and replacing legacy systems that are becoming an impediment to digital transformation and innovation.

Rao is also an advisor for the Design Thinking Executive program at the University of California, Riverside in, USA.

Rao is an award-winning CIO who drives innovation throughout the entire value chain by partnering with Insurtechs and combining the deep insurance industry knowledge with technology expertise to improve efficiencies, cost savings, customer experience, and competitive advantage. He can leverage his vast knowledge of the InsurTech ecosystem to capitalize on digital transformation and value creation opportunities. Rao is a recognized leader in the insurance industry and the Insurtech world, a thought leader, visionary, author, and a sought-after speaker.

Rao is known for aligning IT with business to lockstep with business strategy, reducing Combined Operating Ratio (COR) by implementing technology solutions that focus on increasing premiums, reducing losses, and lowering expenses. He also creates a transformational impact by proactively solving problems with innovation as a priority and a collaborative approach with Insutech partnerships.

Rao is known for aligning IT with business to lockstep with business strategy, reducing Combined Operating Ratio (COR) by implementing technology solutions that focus on increasing premiums, reducing losses, and lowering expenses.

Rao Tadepalli, Digitran Technologies Strategic consultant to Guidewire

Rao Tadepalli, Digitran Technologies Strategic consultant to Guidewire

Rao believes that Embedded Insurance is going to play a significant role in disrupting the insurance industry. He expresses, “We already see that companies like Tesla sell auto insurance at the time of purchasing the vehicle and this model is most likely going to expand to other insurance lines like home and some commercial lines.”

Moreover, he adds, “Telematics and other computer vision insurtechs will bring pay-for-what-you-use models into the insurance industry. Insurance for many years was based on subscription-based models, and now with telematics and IoT devices, the new model will be the consumption-based model instead of the subscription-based one. Rao recommends creative adoption of Insurers striving to become successful leaders should be flexible and be open to ideas from other industries.

Having worked with a company close to Hollywood, Rao has been able to take inspiration from television production procedures in the form of a “runner” role. Rao explained, “A runner is someone who does most of the odd jobs,” In large projects, teams tend to act as silos and neglect things that don't belong neatly within their responsibilities. To close the gaps, Rao applied the runner concept to keep projects on track.

Rao advises Insurtech founders that a clear message of the value proposition is critical. The carriers are looking at three things, either increase the premium or decrease the losses or lower the expenses. So, making sure there is a clear value proposition and at least the value proposition should focus on one of these three things.

Rao says, “If you can do all three, fantastic, but at least one of them should be there. And then assembling a diversified leadership team is extremely critical. That should be multigenerational, and the team should have challengers and enablers with networking connections to the industries. Also, don't underestimate the capital needed. Finally, one has to understand emotion and not always the reason that drives most decision-making.”

Rao calls it two ECs; they stand for Economic Connection and Emotional Connection. These are extremely important. “If you don't have a story, someone

else will make up a story, and that could be your competitors,” he concludes.

Ÿ As an advisor, facilitated the acquisition of an insurtech that is focused on identifying the safest route for auto insurance.

Ÿ During covid, helped companies introduce digital payment solutions at an accelerated pace.

Ÿ Advisor for worker's compensation return to work startup using IoT.

Ÿ Implemented full suite of Guidewire Products, including Policy Center, Claims Center, and Billing Center, on time or ahead of schedule, realizing implementation cost savings of 20% against budget.

Ÿ Increased new business submissions by 25% by implementing an AI and ML-driven electronic quoting system that enabled Straight Thru Processing (STP).

Ÿ By collaborating with Insurtechs, propelled customer retention levels to 90% by deploying digital portals with Analytics and Omnichannel capabilities that dramatically enhanced user experience.

Ÿ Chosen to be part of the US delegation that attended GES2017 led by Ms. Ivanka Trump in India.

Ÿ Judge at several Insurtech and Fintech startup competitions at both national and international levels, including the Kids Shark Tank competition.

Ÿ Published many articles on Insurance and Insurtech and part of several podcasts on the insurtech subject area.

Ÿ As a CIO, Rao won the Celent Model Insurer award for successful transformation.