The information contained in this marketing brochure is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Commercial Integrity, NW and should not be made available to any other persons or entities without written consent of Commercial Integrity, NW. The information contained herein has been prepared to provide summary, unverified financial and physical information to prospective purchasers to establish a preliminary level of interest in the Subject Property. THE INFORMATION CONTAINED HEREIN SHALL NOT BE A SUBSTITUTE FOR

A THOROUGH DUE DILIGENCE INVESTIGATION.

Commercial Integrity, NW has not made any investigation, and makes no warranty or representation with respect to the income or expense for the Subject Property, the future projected financial performance of the Subject Property, the size or square footage and improvements, the presence or absence of contaminating substances, PCBs or asbestos, the compliance with local, state and federal regulations, the physical condition of the improvements thereon, or financial condition or business prospects of any tenant, or any tenant’s plan or intentions to continue to occupy the Subject Property. The information contained herein has been obtained from sources we believe to be reliable; however, Commercial Integrity, NW has not verified and will not verify, any of the information contained herein, nor has Commercial Integrity, NW conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential purchasers must take appropriate measures to verify all of the information set forth herein.

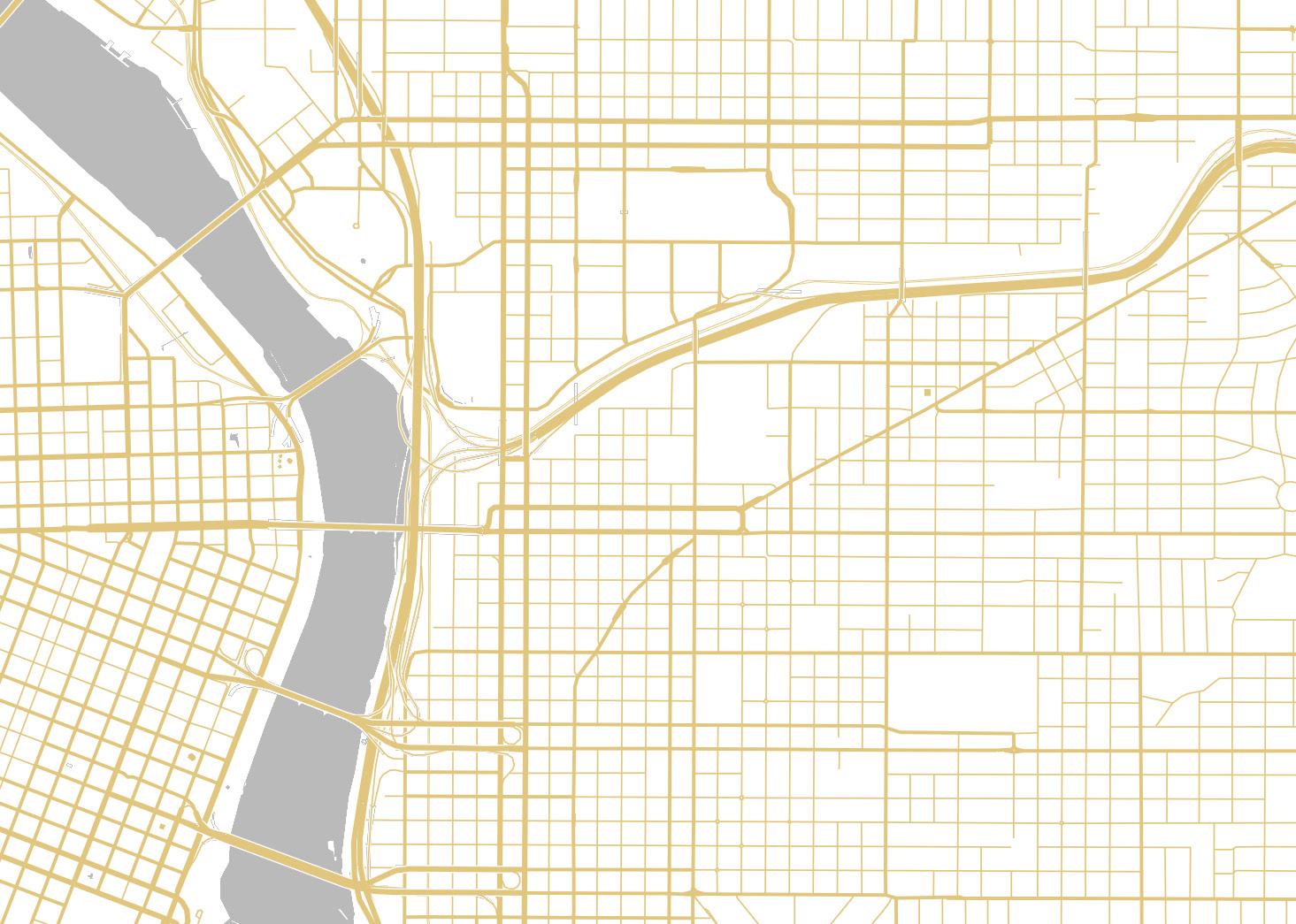

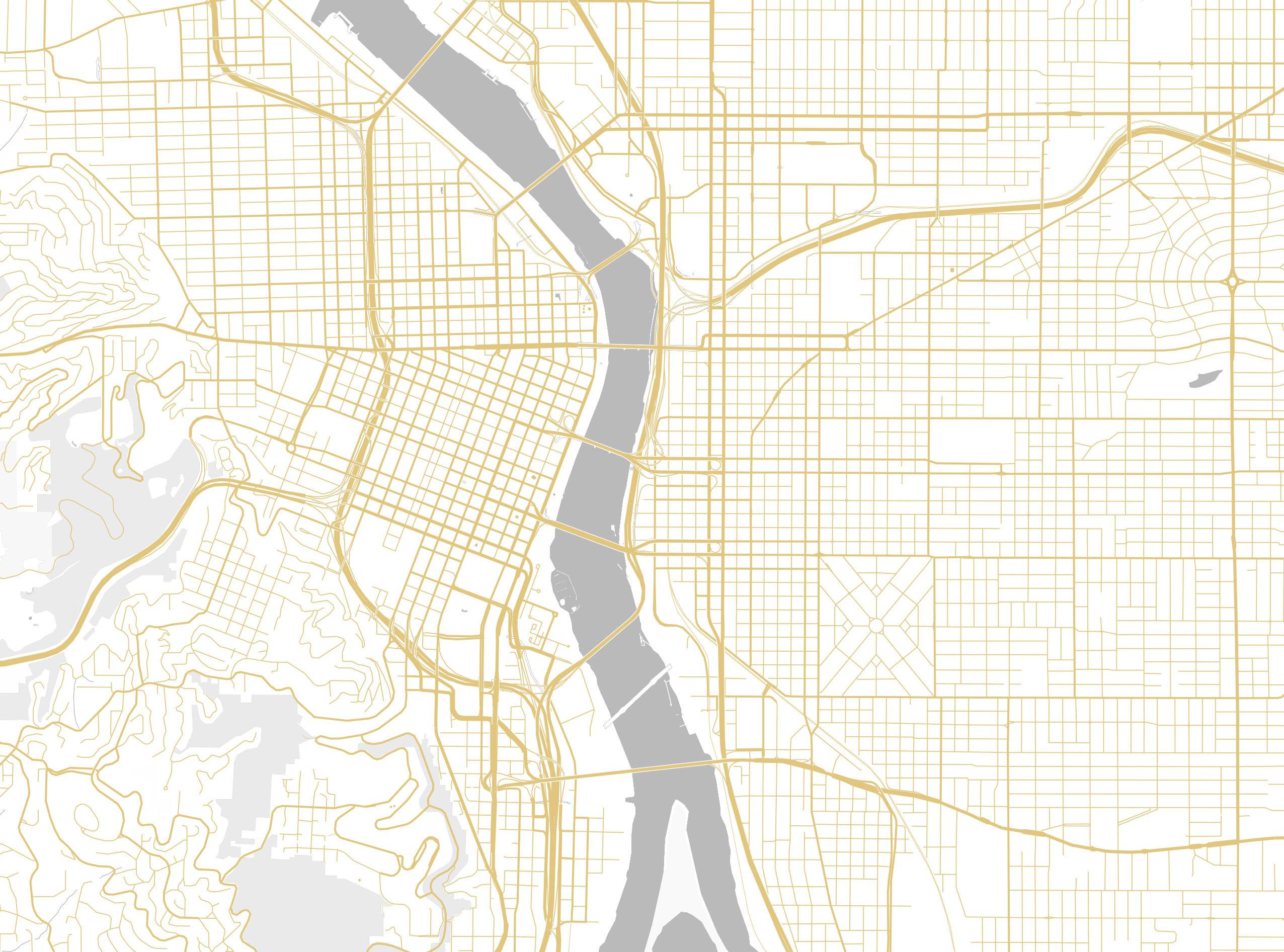

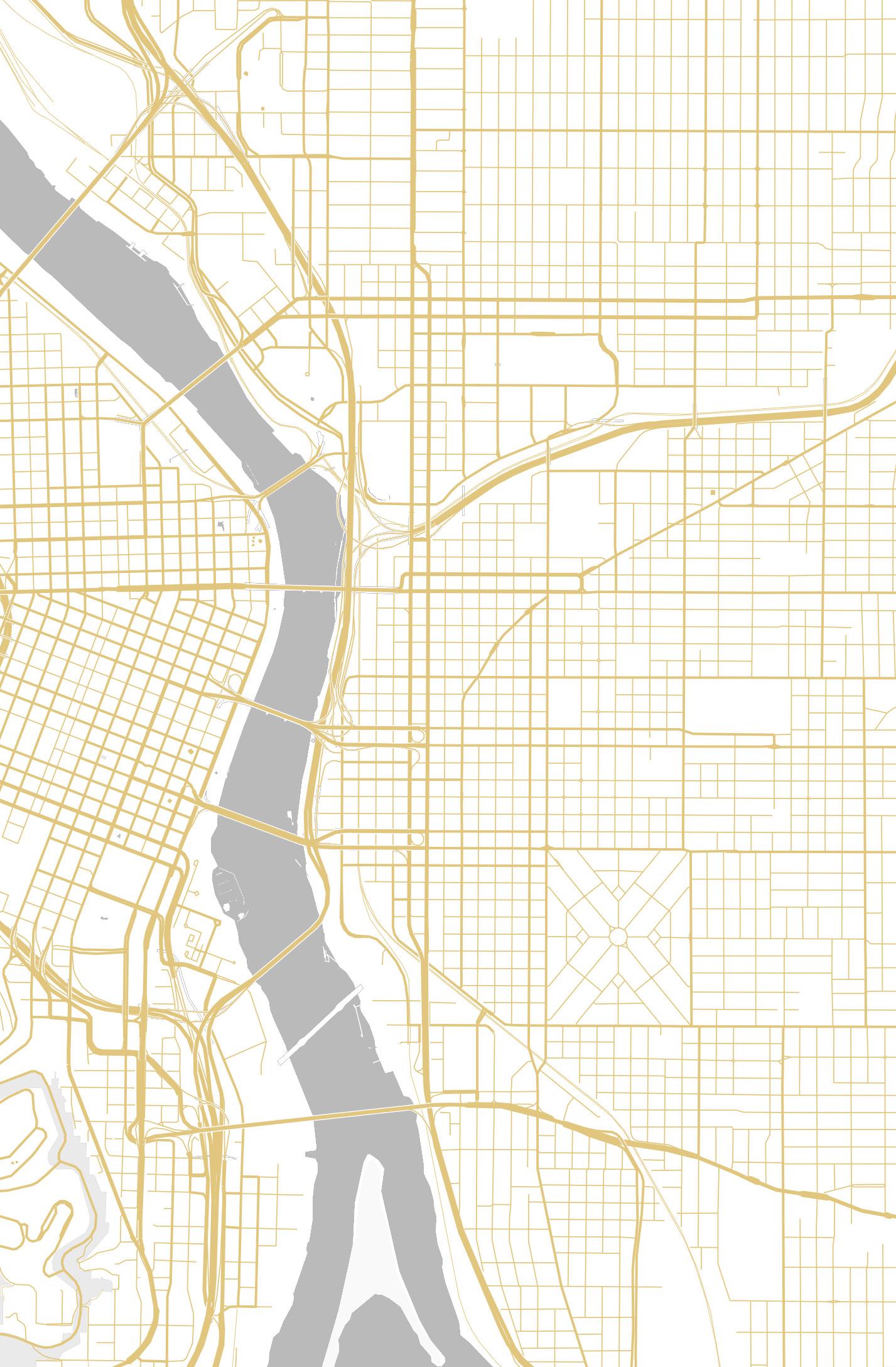

CLOSE PROXIMITY TO MAJOR THOROUGHFARES 99E WITH 51,573+ VPD AND I-5 WITH 159,781+ VPD. EASE OF ACCESS TO MAJOR ARTERIALS AS WELL AS DOWNTOWN

Corporate Commitment

The subject property serves as one of four Retail storefronts as well as the Corporate Headquarters for Mr. Formal Inc.

Ease of Access

Well maintained parking lot with 2 ingress/egress accessing SE 7th Ave with 5,647+ VPD, SE Taylor with 427+ VPD. Situated just 2 blocks from OR-99E with 51,573+ VPD and 4 blocks from I-5 with 159,781+ VPD.

Vibrant Retail Area

Nestled in the midst of Close-In Southeast Portland. The subject property is surrounded by restaurants, pubs, breweries, home furnishing stores, and more. Southeast is Portland's largest district, and the businesses in this area boost the local population of 459,721 to 577,020 workday population.

Parking On Thoroughfare

The subject property has 8 customer parking spaces and 2 private spaces inside a secured section of the lot (1.7/1000 sf) in dedicated lot.

Excellent Signage Visibility

The property has a highly visible pylon sign that overlooks SE 7th + SE Taylor with direct exposure to 6,074+ VPD.

Close-In Southeast Portland

Blending industrial Portland with new restaurants, microbreweries and riverside recreation. Criss-crossed with train tracks and lined with old industrial factories, some of Portland’s favorite restaurants, boutiques and event venues. This district draws $817.1M in consumer spending annually.

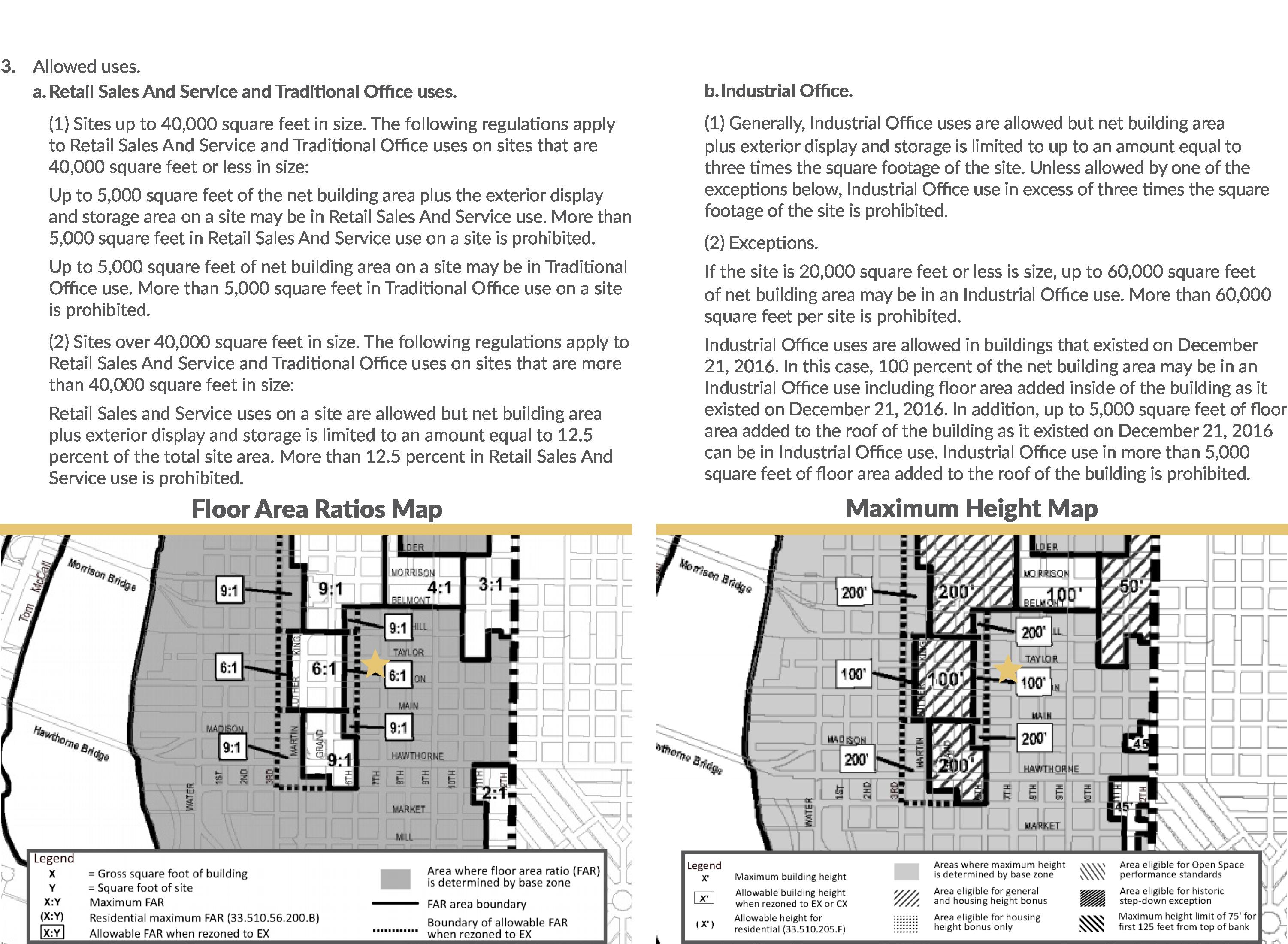

Flexible Building and Zoning

The subject property has 8 customer parking spaces and 2 the building’s configuration and the zoning (including the overlay) is applicable to a variety of uses from Retail, industrial, warehouse or office space.

INDUSTRY HIGHLIGHT

THE GLOBAL FORMAL WEAR MARKET SIZE IS EXPECTED TO GROW FROM USD 3.4 BILLION IN 2021, REPRESENTING A CAGR OF 6% DURING THE FORECAST PERIOD OF 2021-2030. THE DEMAND FOR FORMAL WEAR HAS INCREASED GLOBALLY DUE TO RAPID URBANIZATION AND MODERNIZATION IN DEVELOPING COUNTRIES. HOWEVER, THIS GROWTH IS CONSTRAINED BY HIGH PRICES AND LIMITED AFFORDABLE OPTIONS AVAILABLE IN THESE REGIONS.

MR. FORMAL

MR. FORMAL IS THE GO-TO RESOURCE FOR CUTTING EDGE FASHION, SERVING OREGON AND WASHINGTON FOR OVER 40 YEARS. WE HAVE A LOCAL WAREHOUSE THAT SERVES THE 4 SHOWROOMS. THAT MEANS LAST-MINUTE STYLE CHANGES, FIT ADJUSTMENTS OR EVENT ADDITIONS ARE ALWAYS A BREEZE. THAT’S THE SORT OF PEACE OF MIND YOU WON’T FIND IN TYPICAL SHOPS OR WHEN ORDERING ONLINE.

LOCATIONS

4 FOUNDED

1976

$19M

REVENUE STAFF

62+

532281

HEADQUARTERS

EMPLOYEES

NAICS CODE

PORTLAND, OR

TENANT PROFILE: MR. FORMAL Industry Highlights sourced from Data InteloReal Estate Taxes

In addition to base rent, Tenant shall pay 100% of all real property taxes and assessments levied, assessed or imposed during the Term upon the Property.

Insurance

In addition to base rent, Tenant shall pay 100% of all costs of insurance required by Landlord. Tenant shall procure and maintain $2,000,000 general liability, per occurrence and general aggregate.

Additional Rent/ Operating Expenses: This is a triple net lease. Tenant is responsible for its pro rata share of property taxes, and operating expenses, including but not limited to utilities, janitorial, reasonable admin, management fees, security, property insurance, permits for all operation and maintenance of mechanical systems and annual amortized capital improvements.

Tenant R&M

Tenant is solely responsible for provision and payment of all repairs and replacement including structural and nonstructural, ordinary and extraordinary, necessary to maintain the building.

Expense CAP

Administrative charge not to exceed 10% of operating expenses & direct admin costs.

PROPERTY

1103 SE 7th

Portland, OR

Tenant

Mr. Formal Lease

1/1/18-2/28/25

Leased Area

6,000 SF Exclusive Use For Retail

$109,800

NNN Annual Lease

DEDICATED PARKING LOT WITH 10 SURFACE STALLS AND PARKING RATIO OF 1.7/1000 SF

SE 7TH RETAIL | PORTLAND, OR THE NUMBERS VALUATION

SALE OFFERING: 1103 SE 7TH, PORTLAND, OR

ACRES: 0.26 BLDG PSF: $266

PRICE: $1,600,000 LAND PSF: $160

BUILDING(S): 6,000 SF ON MARKET

DESCRIPTION: RETAIL

$102,101.61 NOI

6,000 SF FREE STANDING BUILDING WITH PARKING LOCATED IN THE HEART OF CLOSE-IN SE PORTLAND

6,000 SF FREE STANDING BUILDING WITH PARKING LOCATED IN THE HEART OF CLOSE-IN SE PORTLAND

$160 PSF LOT | $266 PSF BUILDING

WORKDAY POPULATION WITHIN 5-MILES

577,020

ABOUT PORTLAND, VANCOUVER, HILLSBORO MSA

IN 2020, OVER 2.4 MILLION RESIDENTS CALLED THE VIBRANT PORTLAND-VANCOUVER-HILLSBORO, OR-WA AREA HOME. WITH A MEDIAN AGE OF 38.3 YEARS OLD AND A MEDIAN HOUSEHOLD INCOME OF $77,511, THIS EXCITING REGION BOASTS GROWTH NUMBERS ACROSS THE BOARD, INCLUDING A 1.1% INCREASE IN POPULATION AND A 3.64% INCREASE IN MEDIAN HOUSEHOLD INCOME FROM 2019-2020. AMONG THE TOP EDUCATIONAL INSTITUTIONS IN PORTLAND-VANCOUVER-HILLSBORO, ORWA ARE PORTLAND STATE UNIVERSITY, PORTLAND COMMUNITY COLLEGE, AND CLARK COLLEGE. ADDITIONALLY, WITH A MEDIAN PROPERTY VALUE OF $392,000 AND A HOMEOWNERSHIP RATE OF 62.3%, THIS AREA IS ON THE RISE. BOASTING AN EMPLOYMENT RATE OF 1.28 MILLION, THE TOP-PERFORMING INDUSTRIES IN PORTLAND-VANCOUVERHILLSBORO, OR-WA INCLUDE HEALTH CARE & SOCIAL ASSISTANCE, MANUFACTURING, AND RETAIL TRADE, WITH THE PROFESSIONAL AND TECHNICAL SERVICES INDUSTRY OFFERING SOME OF THE HIGHEST-PAYING POSITIONS.

ABOUT PORTLAND, OR

Portland is an attractive location for businesses seeking to expand due to its thriving economy and transportation options. It has strengths in industries such as athletics & outdoor, technology, manufacturing, and green city services and technologies. Portland also has projections for employed population and median household income growth being 1.64% and 3.03%, respectively, making it ranked number 17 on Forbes' list of America's Fastest-Growing Cities in 2018. Additionally, Portland is known for its green spaces, eco-friendliness, microbreweries and coffeehouses, cultural amenities, yearround recreational access, and opportunities for growth.

Central Eastside sits across the Willamette River from downtown, this area blends industrial Portland with new restaurants, microbreweries and riverside recreation. Crisscrossed with train tracks and lined with old industrial factories, some of Portland’s favorite restaurants, boutiques and events call the Central Eastside home.

Portland Convention Center

Hawthorne Asylum

Image: wikimedia.org

Image: en.wikipedia.org

Bagdad Theatre

Image: wikimedia.org

Portland Convention Center

Hawthorne Asylum

Image: wikimedia.org

Image: en.wikipedia.org

Bagdad Theatre

Image: wikimedia.org

CENTRAL EASTSIDE ASSET

1103 SE 7TH AVE

LIST: $1,600,000

BLDG: 6,000 SF

LAND: 0.26 AC

NOI: $102,101.61

CAP: 6.38%

BLDG: $266 PSF

LAND: $160 PSF

5,647+ VPD ALONG SE 7TH AVE

427+ VPD ALONG SE TAYLOR DR

51,573+ VPD ALONG OR 99

159,781+ VPD ALONG I-5

WALKSCORE: 92 (WALKER’S PARADISE)

BIKESCORE: 100 (BIKER’S PARADISE)

TRANSITSCORE: 75 (EXCELLENT TRANSIT)

AIRPORT: 38 MIN DRIVE TO PDX

PORTLAND INTERNATIONAL AIRPORT