MARCH/APRIL 2024

• MARS/AVRIL 2024

MAGAZINE.CIM.ORG

MARCH/APRIL 2024

• MARS/AVRIL 2024

MAGAZINE.CIM.ORG

The GrizzlyDrive® Drum Motor, designed for harsh, abrasive, and demanding belt conveyor applications, provides 80,000 hours of continuous operation before maintenance, reducing operational and maintenance costs while increasing throughput.

ELIMINATE external drive components

REDUCE energy consumption

INCREASE workforce safety

The innovative Belt Cleaner is a VDG Drum Motor that has a replaceable spiral brush mounted on the drum and effectively cleans the conveyor belt without wear or damage to the belt.

ELIMINATE belt wear and damage

EXTEND the life of the belt

REDUCE belt maintenance

Tap into your resources with SiteConnect, the mobile app that provides remote visibility from any mobile device. The sensors that are already in your pumping systems can help you increase the reliability, lower the production cost per ton and significantly reduce the carbon emissions of your mineral processing operation. In addition, SiteConnect opens the door for FLSmidth product experts to provide regular reports and optimization recommendations.

■ Optimize all pumping systems to lower power and reduce downtime

■ Improve equipment performance visibility

■ Increase expert support

Mining and Mental Health

An employee-led initiative at Agnico Eagle’s Detour Lake mine encourages workers to open up about mental health

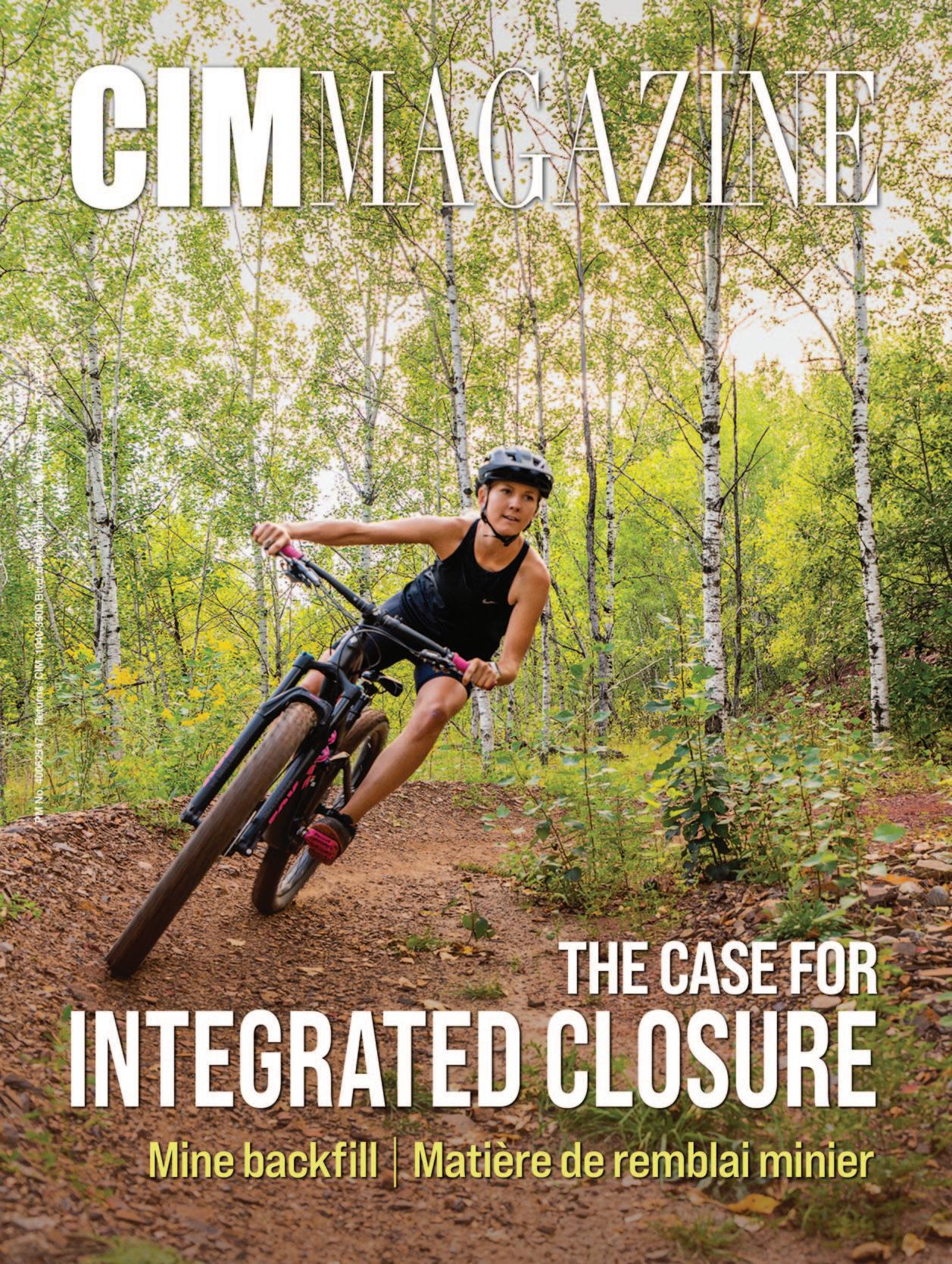

By Mackenzie PattersonIntegrated approaches to mine planning that include sustainable closure and reclamation plans and consider the potential for shared value for various stakeholders are becoming increasingly important

By Alexandra Lopez-PachecoMining at the McClean Lake uranium mine in Saskatchewan, which has been suspended since 2009, will restart in 2025 using technology developed to extract high-grade ore from small ore bodies

By Trish SaywellAs equipment manufacturers embrace automation and data-driven decisionmaking, development drilling at underground mines is becoming safer, greener and more efficient

By Nathan Munn21 A watershed moment for Indigenous financial independence

By Ashley Fish-RobertsonColumns

33 Moving away from controlsbased cybersecurity

By Rob Labbé36 Adding a new comparables section to the NI 43-101 framework could boost investor confidence in project studies

Advancements in mine backfill

42 Backfill specialists are turning the challenging conditions of mining in the Arctic into opportunities for innovation By Sarah St-Pierre

46 Lowering the carbon footprint of cemented paste backfill can contribute to lower CO2 emissions from underground mining operations

By Lynn Greiner48 Paterson & Cooke’s Maureen McGuinness discusses the evolution of backfill and the key role it has to play in mine planning

By Ailbhe Goodbody

CIM news

63 Outgoing CMP representative on CIM Council Stuart McTavish is ready to pass the torch

By Ashley Fish-Robertson63 Upcoming CIM Community events

Compiled by Michele Beacom

Mining the archives

72 The development of Sudbury as a Canadian nickel hub, which later became an example of how pollutionimpacted lands can be reclaimed successfully

By Ailbhe GoodbodyContenu francophone

68 Les immigrants sont sousreprésentés dans l’industrie minière

Par Silvia Pikal

Les progrès en matière de remblai minier

70 Réduire le bilan carbone du remblai en pâte cimenté permettra de diminuer les émissions de CO2 des exploitations minières souterraines

Par Lynn Greiner L’actualité

Axioscan 7 Geo multi-polarization slide scanner. Olivine gabbro with plane polarization (PPOL), circular polarization (CPOL), cross-polarization (XPOL)

Digitize your thin sections with Axioscan 7 – the reliable, reproducible way to create high quality, digitized petrography data in transmitted and re昀 ected light. Uniquely designed for petrographic analysis, ZEISS Axioscan 7 Geo combines unique motorized polarization acquisition modes with unprecedented speed and a rich software ecosystem for visualization, analysis, and collaboration.

• Ultra-fast high-resolution transmitted, re昀 ected, plain and cross-polarized image acquisition

• Fast throughput for up to 100 thin sections at a time

• Enabling remote collaboration and AI analysis

Scan for whitepapers and more zeiss.ly/424-cim

At last year’s Society for Mining, Metallurgy and Exploration (SME) annual conference MINEXCHANGE in Denver, Colorado, the panel of speakers at the big opening day session engaged with the topics of our times: environmental, social and governance (ESG) and decarbonization. While a speaker on the panel representing a mine operator noted the constraints miners must deal with when trying to reduce their use of fossil fuels, no one rejected the premise that doing so was a worthwhile goal. The response to a question from the audience about the growing number of Republican party-governed states enacting anti-ESG legislation dismissed such obstruction as short-sighted.

This year’s edition of our sister society’s flagship meeting in Phoenix, Arizona, had a very different tone, as CIM Magazine editor Silvia Pikal reported in her coverage of the event “SME panelists debate net-zero goals” (see p. 30). The event organizers gave the responsibility of framing the flagship panel discussion to a writer and commentator who has made a career for himself as a contrarian, touting the moral imperative of unfettered fossil fuel use. His argument: fossil fuels have made modern life in the developed world possible and only fossil fuels can offer something close to that quality of life to the vast majority of people on earth who can only dream of the comforts we take for granted. In his opinion, the risks of cutting out fossil fuels are far greater than the risks of continuing to use them unabated.

This message on the stage of a major mining conference comes as investors, particularly U.S. investors, continue to pull their money out of ESG-oriented funds, which take cutting carbon emissions as a fundamental goal. I have heard some celebrate this fact as confirmation that the trend of ESG investing was nothing more than marketing.

Editor-in-chief Ryan Bergen, rbergen@cim.org

Yes, there are certainly plenty of examples of greenwashing as companies, responding to the hot market, misled investors about their commitment to sustainable practices. And the great mass of sustainability rating agencies and indices that have blossomed to provide guidance have created more noise than clarity.

Accepting the argument, however, that was presented at MINEXCHANGE—that we are foolish to try to do better than we currently do—will not serve the mining industry very well. At its core, it suggests that human ingenuity won’t get us much farther. I am ready to take the other side of that bet. But, more specific to this industry, it ignores the reality that if investors and proponents discount the environmental and social risks inherent in mining—particularly in Canada and the United States—it means their projects don’t get built.

I am happy to report the discussions being planned for the CIM Connect Conference in May in Vancouver under the theme “Brand Canada: Our Critical Advantage” will engage with this reality.

Ryan Bergen, Editor-in-chief editor@cim.org @Ryan_CIM_Mag

Managing editor Michele Beacom, mbeacom@cim.org

Senior editor Ailbhe Goodbody, agoodbody@cim.org

Section editor Silvia Pikal, spikal@cim.org

Editorial intern Ashley Fish-Robertson, afrobertson@cim.org

Contributors Lynn Greiner, Dan Kappes, Rob Labbé, Alexandra Lopez-Pacheco, Tijana Mitrovic, Nathan Munn, Mackenzie Patterson, Trish Saywell, Sarah St-Pierre

Editorial advisory board Mohammad Babaei Khorzhoughi, Vic Pakalnis, Steve Rusk, Nathan Stubina Translations Karen Rolland, karen.g.rolland@gmail.com

Layout and design Clò Communications Inc., communications.clo@gmail.com

Advertising sales

Dovetail Communications Inc.

Tel.: 905.886.6640; Fax: 905.886.6615; www.dvtail.com

Senior Account Executives

Leesa Nacht, lnacht@dvtail.com, 905.886.6640 ext 321

Dinah Quattrin, dquattrin@dvtail.com, 905.886.6640 ext 308

Subscriptions

Online version included in CIM Membership ($197/yr). Print version for institutions or agencies – Canada: $275/yr (AB, BC, MB, NT, NU, SK, YT add 5% GST; ON add 13% HST; QC add 5% GST + 9.975% PST; NB, NL, NS, PE add 15% HST).

Print version for institutions or agencies – USA/International: US$325/yr. Online access to single copy: $50.

Copyright©2024. All rights reserved.

ISSN 1718-4177. Publications Mail No. 09786.

Postage paid at CPA Saint-Laurent, QC.

Dépôt légal:

The year is still young, but the 2024 mining event calendar is already well under way. We’ve had AME Roundup in Vancouver and PDAC in Toronto, where the best and brightest of the exploration companies gathered and showcased their prospects. It’s not easy—and hasn’t been for quite some time—being an exploration-stage company, so let’s applaud their tenacity and remember that exploration is the lifeblood of our industry. I’m lucky enough to work at a company that has grown its way into the senior producer ranks. But B2Gold was an exploration-stage company as recently as 2007, and in our shop, we remember that. Hats off to all the companies who are doing it. Keep it coming.

Another keystone industry event was CIM’s Canadian Mineral Processors (CMP)’s 56th annual conference, held in Ottawa in mid-January. Hats off again to the dedicated CMP executive team and volunteers who make this conference such a success every year. Special mention, too, to Stuart McTavish (see p. 63). Nobody is quite sure how old Stuart is—we may have to check some geological records to establish that—but everyone believes that Stuart was there at the start of the CMP. He has been a stalwart member of that technical society, and also of

CIM Council, over many years. Thank you, Stuart, for your service and dedication.

The final panel session of the CMP conference focused on renewable energy sources. Thanks to Scott Martin for moderating such a great discussion. I left feeling optimistic. Focusing our attention on making power sources more greenhouse gas (GHG)emission friendly is something all mining companies must make a priority. All of the panelists agreed that a continued focus on innovation and collaboration between all stakeholders is needed if companies are to achieve their GHG-emissions goals. But sharing information, new technologies and best practices with each other requires an ongoing venue. What better forum than the CIM Connect conference to continue that conversation, both this year and into the future? Just sayin’.

I’m also feeling very optimistic about the direction CIM is headed. As an organization, I think CIM has come a long way in the last couple of years, putting in the IT and other infrastructure needed to support all of its constituents, increasing its number of individual and corporate members and putting together and sharing a much better picture of what we are doing at all of our branch, society and national events.

This is my last President’s note to appear in the magazine before Ian Pearce steps in as 2024-25 President in May. Thanks, everyone, for the opportunity to act as President this year. It has been wonderful meeting so many of you during my travels and learning about all of the great things you do as part of our OneCIM community. Keep up the good work.

Mike Cinnamond CIM President

Mike Cinnamond CIM President

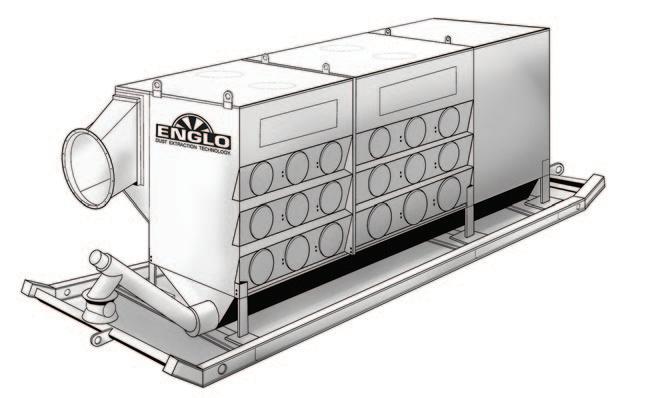

Englo’s line of de-dusters for underground mining and tunnelling work to provide cleaner air while trapping dust particles. The company’s Dry De-duster, which can be powered either by diesel or electricity via a motor-fan combination, uses easy-to-replace filters. The product was created for environments where the usage of a Wet De-duster may not be suitable. According to Englo, the Dry De-duster’s filters efficiently collect up to 99.99 per cent of particles, while its Wet De-duster collects up to 99.9 per cent of particles and is recommended for the collection of hazardous or combustible material. The Wet De-duster is self-cleaning, has low water consumption and, thanks to the product’s scrubber box, can reduce static loss. Its compactness makes it a suitable option for smaller spaces.

ABB’s Ability Ventilation Optimizer is a ventilation-ondemand system used in underground mining operations. The environmental and flow sensors, which are attached to mining vehicles, signal when fresh air is needed, and trigger fans to run for several minutes following a vehicle’s departure from an area to ensure that residual gases and exhaust from diesel vehicles and blasting have been cleared underground. Data gleaned from the system’s sensors can then be monitored through mobile devices, ensuring that fans throughout the mine are well coordinated. According to the company, the use of this system can extend the life of a mine’s ventilation system, result in energy savings of up to 50 per cent and provide workers with a healthier working environment that is free from dust, CO2 emissions and high humidity levels. The system has been developed for ease of maintenance and to be scalable due to standardized components.

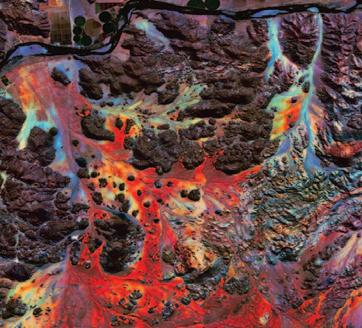

HyperWATCH, a new digital service developed by Stantec, relies on the highest-resolution satellite-based hyperspectral imagery (HSI) available to delineate important data points that can aid in the exploration of valuable mineral deposits, track tailings storage facilities for toxicity, and more. According to Stantec, HSI is more detailed than traditional imagery systems, as traditional systems rely on just a few wide portions of the electromagnetic (EM) spectrum. HyperWATCH uses HSI information that is comprised of dozens to hundreds of individual, narrow channels from across the full EM spectrum, resulting in hundreds of detailed data points. The increased number of points drastically increases image fidelity and spectral precision. HyperWATCH generates targeted signatures of minerals, chemicals and vegetation health across an entire project area.

JENNMAR designs and manufactures a wide range of dependable ground control products, from bolts and beams to channels and trusses, resin, rebar, and more. We’re proud to make products that make the mining, tunneling, civil, and construction industries safer and more efficient.

Because we understand the ever-changing and demanding conditions above and below ground we have built the richest portfolio of diverse and complementary brands. JENNMAR sets the bar in every industry we serve and as we continue to grow, our focus will always be on the customer.

We feel it is essential to develop a close working relationship with every customer so we can understand their unique challenges and ensure superior customer service. Our commitment to the customer is guided by three words: SAFETY, SERVICE, and INNOVATION

It’s these words that form the foundation of our business. It’s who we are.

Compiled by Silvia Pikal

Winsome Resources announced that it will update its mineral resource estimate at its Adina lithium project in the Eeyou Istchee James Bay region of Quebec in the first half of 2024. It stated in a March press release that the core

(continued on page 15)

from its five drill rigs have delivered “strong assay results” and it is simultaneously conducting development and environmental studies for the project. In

its maiden inferred mineral resource estimate released last year, it declared 59 million tonnes at 1.12 per cent lithium at Adina, and that the estimate places it in

one of the top five largest lithium resources in North America. Initial project studies are anticipated to be published in the latter half of this year. CIM

Phase one of the strategy is a promising start but is missing key fiscal support, mining associations say

By Tijana MitrovicWhen B.C. Premier David Eby spoke at the opening keynote on Jan. 22 at the Association for Mineral Exploration (AME) Roundup conference, he made a strong statement after unveiling the first phase of the province’s new critical minerals strategy.

“The world needs a stable, free, democratic, high-standard producer of the metals and minerals needed to battle climate change,” Eby told the crowd. “That gives B.C. a generational opportunity to seize, one where we can be prosperous and protect the planet for our kids at the same time.”

As a mining jurisdiction that has reserves of, or produces, 16 of Canada’s 31 critical minerals, and is Canada’s largest copper producer, the province stated that phase one of the critical minerals strategy is its attempt to take advantage of the clean energy transition.

The first phase includes 11 action points, such as the creation of a B.C. critical minerals atlas to provide “world-class geoscience data,” and an alignment of the provincial strategy and the First Nations Energy and Mining Council’s critical minerals strategy, which was released on March 4 of this year. In addition, it includes continuing a commitment to engage with First Nations across the province and also to ensure what it calls “the highest” environmental, social and governance (ESG) standards. The strategy comes after the provinces of Quebec, Ontario, Saskatchewan and Manitoba— as well as the federal government—have all launched respective critical minerals strategies over the past few years.

In a Jan. 22 news release, Josie Osborne, the B.C. energy minister, said that securing critical minerals will help “drive growth

and create new jobs for people across the entire value chain of critical minerals.” The steps outlined in phase one go beyond development to also focus on growing downstream opportunities, such as processing, manufacturing and battery recycling, which will recycle mined materials and reintegrate them into the supply chain. No further details on these initiatives have been released so far.

While phase one of the strategy emphasizes the province’s commitment to First Nations on critical minerals development through partnerships and engagement, it stated that the next steps of the strategy will include specific actions such as support for First Nations’ capacity building to develop and refine policy actions, and ensure that the strategy aligns with the UN Declaration on the Rights of Indigenous Peoples. This is particularly important

following the ongoing legal developments regarding the province’s mineral staking system and Indigenous consultations.

But miners have raised concerns about phase one of the strategy, and feel that it does not do enough to ensure the province’s critical minerals supply is competitive. Keerit Jutla, president and chief executive officer of AME, told CIM Magazine in an interview that the provincial government must recognize that B.C. is competing not only with mining jurisdictions outside of Canada but within the country’s borders as well.

“We’re competing internally with Quebec, Ontario and other jurisdictions, so it’s essential that we get a critical minerals fund that matches that type of investment, if not exceeds it,” he said. “We’ve heard domestically and internationally that countries [in Europe and Asia] are looking

to Canada for the critical minerals supply chain. So we need to ensure that we have those key drivers there to ensure that we remain competitive on the world stage.”

Much of this concern from the B.C. mining industry has been around the lack of regulatory and financial incentives included in phase one of the strategy. Some want to see a clear focus on fiscal measures from the provincial government to deliver on a robust strategy.

“In 2023, B.C.’s contribution to the national mineral exploration expenditure decreased by 33 per cent for a total contribution lagging at 17 per cent, [compared to] Ontario and Quebec at 24 per cent and 23 per cent, respectively,” Jutla said. “We believe an investment of at least $50 million over three years is required to sufficiently fund and implement a strategy that’s at the same level as our provincial peers. We see what’s working in other jurisdictions here in Canada and we need to take note and apply those best practices.”

The Mining Association of B.C. (MABC) has similar concerns and noted that the government needs to put a competitive fiscal policy in place, which it said phase one of the strategy fails to

address. MABC president and CEO Michael Goehring expressed concerns about the province’s current fiscal policies, specifically its new output-based carbon pricing system (OBPS), which is slated to come into effect in April. In a Jan. 22 statement from the MABC, Goehring pointed out that while B.C. currently pays the highest carbon tax in Canada and also globally “while having the lowest GHG emissions globally,” the technology needed to help reach decarbonization goals—zero-emission haul trucks—will not be available until the end of the decade at the earliest.

“Changes to B.C.’s tax regime over the past 10 years have significantly increased operating costs across the sector,” Goehring stated. “It’s imperative existing and prospective critical mineral mines in B.C. pay a carbon tax that is competitive with Ontario and Quebec. If not, the OBPS will negatively impact investment decisions in B.C. and undermine the goals of the provincial government’s critical minerals strategy.”

Mining industry associations believe that improving fiscal competitiveness could not only bolster the province’s

In case you missed it, here’s some notable news since the last issue of CIM Magazine, which is just a sample of the news you’ll find in our weekly recap emailed to our newsletter subscribers.

Indonesia’s approach to nickel production (pictured) has given it a major market advantage at a steep environmental cost. Today, nearly half of the world’s nickel operations are struggling to make a profit due to a

price slump resulting from Indonesia flooding the market with low-cost nickel. It is in this market that Fortescue’s chairman and founder Andrew Forrest is urging the London Metal Exchange to distinguish “clean” nickel contracts from “dirty” ones to carve out a niche for “clean” nickel producers.

The Canadian government announced in February that it plans to reduce the amount of time it takes to construct new critical minerals mines by almost a decade thanks to what it promises will be a faster permitting process. The government intends to do this

standing among Canadian jurisdictions, it could also help unlock billions of potential revenue in new mining developments.

This comes on the heels of a new study by the MABC that estimated that 14 proposed critical minerals mines, along with two proposed mine extensions, could generate nearly $800 billion over several decades. According to the study, the proposed critical minerals mines represent $36.5 billion in near-term investment in development and construction, $10.9 billion in tax revenues and more.

Mining industry associations are already looking ahead to phase two of the strategy, with the hopes that it will address some of the perceived gaps. The province has not released a timeline for phase two.

“I think all of us are looking at the phase one announcement as a good first step and a good demonstration of intent to provide strong support for the critical minerals industry here in B.C.,” Jutla explained. “But that is really hinging on the expectation of a solid delivery: [that] will be key to honour and to validate [that] optimism. Now that’s back in the government’s court and we hope they’ll deliver something strong for B.C.” CIM

by boosting funding to the regulatory agency to help remove paperwork backlogs and by simultaneously running permitting and environmental assessment processes.

At least nine people were trapped when the wall of a heap leach pad failed and sent an estimated 10 million cubic metres of material flowing down slope at the Çöpler gold mine in Turkey on Feb. 13. The TSX-listed miner SSR Mining has an 80 per cent stake in the mine. Rescuers searched for the workers through the cyanide-soaked soil of the mine, and there are concerns the cyanide could contaminate the watershed. The Union of Chambers of Turkish Engineers and Architects said that it had previously issued warnings about a potential disaster that ultimately went ignored. The mine has had its environmental permit rescinded and is not operating.

Energy and Natural Resources Minister

Jonathan Wilkinson announced at the PDAC convention that took place from March 3 to 6 that Canada will be allocating $15 million in funding for projects to aid the country’s growth of its critical minerals industry, along with projects to boost Indigenous involvement in mining. Prior to the convention, he expressed unease about market manipulation and dumping practices of

As part of Fasken’s 2024 Global Mining Group Seminar Series, a recent episode held on Feb. 29 titled “Indigenous Community Engagement in the Changing World” explored the importance of effective engagement between mining companies and Indigenous community rights holders, and discussed how thoughtful engagement can lead to a deeper understanding of Indigenous traditions and knowledge and promote healthier relations between mining companies and communities. The session, led by Peter Mantas, co-managing partner at Orion Legal Group, featured three speakers from different parts of the world, including Canada.

Chief Nkandu Beltz, the founding director of Beltz Mining Limited, a copper exploration company with locations in Australia and Zambia, explained that Indigenous engagement is crucial prior

critical minerals in a conversation with The Globe and Mail. The minister suggested investigating an alternative pricing model to decrease Canada’s reliance on China when it comes to obtaining the key metals needed to advance the energy transition. Wilkinson has also suggested that Canada and other Western countries think about implementing tariffs against Indonesia and China as a way to target market manipulation stemming from an oversupply of low-cost nickel.

Canada and Australia announced on March 5 that the two countries will work together with the goal of improving transparency within global critical minerals supply chains and will also advocate for the importance of having firm environmental, social and governance (ESG) standards in place. The non-legally binding partnership is being led by Canada’s Natural Resources Ministry and Australia’s Critical Minerals Office and will look into prospects pertaining to the research and development of critical minerals.

First Quantum Minerals is aiming to secure US$20 billion through international arbitration after losing over half of its market value following Panama’s order to shut down its Cobre Panama copper mine. The mine has been closed since late last year after Panama’s Supreme Court ruled that First Quantum Minerals’ contract with the government was

to commencing a mining project, especially because it could prevent miningrelated destruction inflicted on historical sites. “Those are sacred grounds for us, so it is painful,” she said. “When such things happen…it creates distrust among traditional owners of the land. I think with continued positive engagement, we can create a win-win scenario for investors, lenders and the local people.”

Beltz said that when mining companies enter a new community, they should be considering the knowledge that locals can offer. “When companies come in, it’s just a matter of sitting down and explaining who you are, creating that bond and also seeing if there’s anybody in that community that can add value to what you’re doing,” she said. Beltz added that locals can also learn more about modern technologies and education related to mining, ultimately advancing mining knowledge within a given community.

The conversation turned over to Sheldon M. Wuttunee, president and CEO of the Saskatchewan First Nations Natural Resource Centre of Excellence, which supports and collaborates with Indigenous

unconstitutional, a move that followed months-long nationwide protests against the massive copper mine.

Canada has risen to the top of the fourth edition of energy research organization BloombergNEF’s recent global lithium-ion battery supply chain ranking, which is the first time China has not topped the list. The ranking examines 30 countries’ potential to develop a secure, reliable and sustainable supply chain for the production of lithium-ion batteries, using 46 different metrics across five categories to guide the rankings. BNEF said that Canada’s rise to first place was due to its consistent manufacturing and production advances, as well as its ESG credentials.

Stay up to date on the latest mining developments with our weekly news recap, where we catch you up on the most relevant and topical mining news from CIM Magazine and elsewhere you might have missed.

One of the seminar’s panelists, Sheldon M. Wuttunee, shared his experiences as former chief of Saskatchewan’s Red Pheasant Cree Nation (pictured), offering advice on how stronger connections between companies and communities can be forged.

communities to generate opportunities for innovative and environmentally sustainable development of natural resources located on Indigenous land.

As former chief of Saskatchewan’s Red Pheasant Cree Nation, Wuttunee expanded on Beltz’s beliefs about the importance of appreciating local knowledge, sharing how valuable the knowledge he has gained from elders within his community has been when it comes to improving engagement between mining companies and local communities in Red Pheasant, as well as better communicating the importance of spiritual context in natural resource development.

He encouraged mining companies to better educate themselves, not only by consulting policies relating to Indigenous lands, but to also make an honest effort to engage firsthand with the locals, learning more about their traditional beliefs tied to the natural environment, and to first build a relationship with locals before jumping straight into business.

“[Having these conversations] is the only way you’re going to…be able to develop that strong relationship with the community and to better understand what their needs are,” he said. “Then I think at some point, once there’s…a better understanding of environmental impacts, spiritual impacts and so forth, then perhaps there’s an opportunity to start to talk about the economic opportunities associated with a project.”

Rafael Vergara, partner of Carey, a Chile-based law firm, and co-head of the firm’s natural resources and environment group, reiterated Wuttunee’s sentiments around the importance of mining

companies taking the time to cultivate a relationship to better understand the connections that local communities have with their environments, while also being mindful of how a new mining project may impact their lands.

“What I have experienced is that sometimes Indigenous communities do not know how the mining project can affect them,” he said. “So, the first issue here is to approach the communities to know what their concerns are.”

He added that ongoing discussions regarding undeveloped projects with locals are imperative, so that they can get a better sense of what to expect, while also being able to voice potential concerns. “You have to discuss and plan as carefully as possible,” he said. “Create places of communication…constant, permanent communication. You have to go there… bi-weekly or once a month [to] have open discussions with the people.”

Wuttunee emphasized the importance of mining companies preparing to have what he considers to be “difficult conversations” with Indigenous communities. He said that in order to better integrate into a new community, companies need to recognize that these communities have a deep spiritual relationship with the lands they inhabit, and that this connection often gets overlooked.

“We have our natural laws and cultural laws and cultural protocols that we all need to adhere to,” he said. “As you go into a community, it’s extremely fundamental to understand that it’s not only an economic opportunity, [but] there’s a whole spiritual component.”

– Ashley Fish-RobertsonThe second episode of the Mission Critical webinar series from CIM Magazine and SGS Natural Resources took place on Feb. 22 and zoned in on the development of Canada’s store of critical minerals. Cohosted by Ryan Bergen, editor-in-chief of CIM Magazine, and David Anonychuk, global vice-president of metallurgy and consulting at SGS, the latest episode engaged several panelists in discussions surrounding the background and outlook for the battery recycling market, particularly in North America.

Anonychuk kicked off the episode by highlighting why battery recycling is such an important area of focus in the mining industry. “In order to meet the long-term battery raw materials supply challenge, and to meet those net-zero goals we think about for the long term, mining is not going to bring enough units to the market,” he explained.

Anonychuk turned the attention to Electra Battery Materials as a prime example of how black mass is being recycled within Canada, noting that the company is constructing North America’s sole cobalt-sulfate refinery.

Mark Trevisiol, vice-president of project development at Electra Battery Materials, explained that the company’s decision to shift to battery recycling came about when the company was putting together the proposal for its cobalt-sulfate plant. During presentations delivered before automotive manufacturers, such as Ford and General Motors, Trevisiol noticed that senior level management employees were posing questions about how the company would use recycled materials in its final product.

“There was that push, and we were also sitting on an asset that was operated as a hydrometallurgical site that produced cobalt and nickel products through hydrometallurgical processes,” he said. “There was the opportunity there to utilize some of the existing system processes

in place to start taking things like black mass and see if we could profitably put the metals through processing.”

So far, Electra Battery Materials has processed approximately 40 to 50 tonnes of black mass and made its first customer shipment of nickel-cobalt produced from recycled battery material in 2023.

As for hurdles related to battery recycling within Canada and North America in general, Trevisiol outlined overseas shipments of black mass material as being one of the biggest current challenges in the market.

“[Right now], there is nothing preventing people who recycle and make a black mass product from shipping that product overseas to be refined,” he said, adding that this was a sort of paradox considering that “our [federal] government is pumping billions into critical metal supply and encouraging investment in mines and processing facilities…and then on the recycling side, some of that [black mass material] is going overseas and ending up in China because there’s no regulatory framework to prevent that from happening.”

Sean De Vries, executive director at the Battery Metals Association of Canada, who has a background in electronics recycling, shared that when the country began introducing electronics recycling programs 25 years ago, Canada’s recycling market did have some existing recycling

infrastructure in place, but it was still considered to be at a nascent stage. “I think electronics recycling and those programs came about as a result of some of the regulatory push, so that helped to really spark the boom of the industry and processing technologies,” he said.

De Vries offered an example of when electronic products would be recovered through smelters during these early days, and the challenges companies had to face when complex products were being sent into these smelters. “A whole TV can’t necessarily be recovered through one single process, so we have to divide the process up…and get [the products] to the right smelter so that you can recover the copper and the lead,” he explained. “You see this need to have specific recovery technology.”

Niels Verbaan, director of technical services (hydrometallurgy) at SGS, expanded further on the need for specific recycling technology, noting that there needs to be a key distinction made between scrap and end-of-life material.

“It is important to know that scrap recycling involves the reprocessing of

materials that were produced now, today, or yesterday. It is today’s chemistry,” he said. In comparison, end-of-life material deals with chemistries that were produced a decade prior, which can result in feed material quite different from scrap. Verbaan noted that an argument could be made that scrap material is easier to reprocess than end-of-life material. “If you want to process that back into the current battery chemical producers, that means you’re going to have to separate these into their individual components, and that leads to an additional degree of difficulty.”

Trevisiol underpinned the important role that the Canadian government plays in the country’s battery recycling processing, noting that there needs to be more regulations set in place to address materials being shipped offshore. “Otherwise, it’s a paradox,” he said. “You’re pumping money into extracting these critical minerals and then they’re being sent [to be processed] elsewhere.”

He referred to the U.S.’s Inflation Reduction Act as an example of how Canada can improve its recycling regulations, explaining that the Act requires

North American electric vehicle (EV) manufacturers to have most of their battery components processed, refined and manufactured within the continent.

A recording of the webinar can be found on CIM’s YouTube channel.

– Ashley Fish-Robertson

David Francis Lyon, founder and president of engineering company Zero Nexus, spoke about the gaps in specialized training needed to prepare the mining workforce for electrification at the Battery Electric Vehicle Safety in Mines Symposium in Sudbury on Feb. 15.

“Canada is by far the leader in [battery electric vehicle] adoption, but there’s still a long way to go,” Lyon said.

The one-day event, hosted by Workplace Safety North (WSN), was attended by hundreds of people at Cambrian College and virtually through live streaming.

In Lyon’s presentation titled, “Plugged In and Prepared: Understanding Training

Needs for Electric Mobile Mining Equipment,” he outlined the results of a Zero Nexus qualitative research project that involved more than 100 virtual and onsite interviews with battery electric vehicle (BEV) machine operators, shift managers, mine planners and other industry stakeholders at operating mines in Canada that are trialling BEV equipment.

“We were really looking for information, both good and bad, to help us assess the needs,” he said.

Lyon said the research showed that there is a need to develop a collective base of knowledge on best practices for operationalizing BEVs. Some of the training opportunities identified included general BEV safety, as well as charging and maintenance safety.

In a follow-up statement to CIM Magazine, Lyon wrote that while visiting mine sites to conduct the research, the Zero Nexus team found that a mining company trialling BEV equipment is usually forced to develop its own training program for its workers, which is a process that takes several years; BEVs are not generally a plug-and-play solution.

“Despite best efforts to coordinate between mining companies, each operation ended up making their own version of site-specific training,” Lyon wrote. “We see this as a hurdle for miners at early stages since this data collection activity for finding best practices is lengthy.”

As part of its research, Zero Nexus also

“There’s no playbook that exists right now in the industry for how to operate [BEV] machines as a fleet.”

– David Francis Lyon, Zero Nexus

CIM Convention and Expo and CIM’s Maintenance, Engineering and Reliability/Mine Operators Conference (MEMO 2023) to gather feedback from mine operators, OEMs and other service providers currently using BEVs or interested in adopting BEVs. Lyon stated that a recurring theme from participants was a desire to learn more about battery chemistry and the full life cycle analysis of BEVs from a third-party, unbiased source.

“The other thing that we heard a lot was that people are looking for more applications and case studies as BEVs grow in popularity,” he said. “A big one was that there’s no rule of thumb. There’s no playbook that exists right now in the industry for how to operate [BEV] machines as a fleet.”

Lyon’s presentation emphasized that the different roles within mining operations involved in adopting BEV equipment also require job-specific training, from operators that are responsible for battery user-interface and charging, to electricians that must service BEV-specific highvoltage electric equipment.

He said that while there are some institutions in Canada that offer training programs, they tend to focus on skilled trades or are part of engineering programs that focus on the development of BEVs.

•

•

•

•

•

•

•

•

•

•

•

“There exists a gap in addressing the planning stages for BEVs,” he said. “By planning stages, I mean, everyone who isn’t an operator. I think that gap exists globally. Just understanding the nuances of the technology and the terminology, that’s very important. From the operator’s side, it felt like [text-book based and online] training may not be as critical; hands-on experience tends to be the most effective and addresses challenges more effectively than anything in a book. And on the mine maintenance side, there’s a steep learning curve…it necessitates a much more comprehensive training approach.”

Zero Nexus is currently working on designing and developing courses that cover battery technology fundamentals, safety principles, fleet management and the broader landscape of BEV integration in mining for CIM Academy.

“How to use EVs is the gap we hope we can help fill,” Lyon wrote.

The workforce research is segmented into mine maintenance, operations and planning, and mine management, and Zero Nexus will soon release a white paper publicly sharing the results of the research.

– Silvia Pikal

David Francis Lyon presented new research on BEV training opportunities at the Battery Electric Vehicle Safety in Mines Symposium.Once formed, Nations Royalty will be Canada’s largest majority Indigenous-owned public company

By Ashley Fish-RobertsonAn agreement inked on Feb. 1 between B.C.’s Nisga’a Nation and Vega Mining Inc. will see Canada’s largest majority Indigenous-owned public company form over the coming months. Vega Mining, which will be majority owned by the Nisga’a Nation and will eventually be renamed as Nations Royalty Corp., will acquire the rights to five annual benefit payment entitlements stemming from projects located in B.C.’s Golden Triangle region in

exchange for common shares in Vega Mining’s capital.

The five projects involved in the Nations Royalty holdings are Ascot Resources’ Premier gold project and Red Mountain project, Newmont’s Brucejack mine, Seabridge Gold’s KSM project and New Moly LLC’s Kitsault project.

“One of the [significant] things with this agreement is that since it’s the first Indigenous-owned royalty company in Canada, it allows us to be a bigger player

in the mining industry; it gives us the ability to build a lot of capital through what we’re doing with this company,” said Charles Morven, secretary-treasurer of Nisga’a Lisims Government, in an interview with CIM Magazine.

Morven explained that the Nisga’a Nation already has an existing alliance with the province of B.C. and several mining companies within the province— including Skeena Resources and FPX Nickel Corp—known as the B.C. Regional

Mining Alliance (BCRMA). The BCRMA represents a partnership between the province’s Indigenous groups and industry and provincial government representatives. The BCRMA currently makes it a priority to draw in international investment to the province through its partnerships, especially in the Golden Triangle region, and Morven foresees that Nations Royalty will be able to bring in further investment.

Over the last two years, the Nisga’a Nation and its partners were occupied with signing numerous agreements, as well as locating a company that would agree to house Nations Royalty. “We also had to communicate with mining companies that we had benefit agreements

with and had to get their permission to be able to include them in the royalty company,” he added.

Morven explained that the genesis of the company began with a discussion between the Nisga’a Nation and mining financier and CEO of Fiore Group, Frank Giustra, who asked about the aspirations of the Nisga’a Nation in mining. “One of the things that we wanted to do was to be more knowledgeable of the whole mining industry, especially mining operations, and how we could begin to have a bigger say by investing [into mining operations] ourselves,” Morven said.

Morven considers the formation of Nations Royalty to be a big step towards the Nisga’a Nation’s ability to become completely self-governing, emphasizing how a reduced reliance on current funding agreements would ultimately lead to greater economic independence for B.C.’s Indigenous communities.

Robert McLeod, who is serving as Nations Royalty’s interim chief executive officer (CEO), considers the new company to be a significant step in the right direction towards granting B.C.’s Indigenous communities financial independence.

When McLeod was CEO of IDM Mining Ltd., which was later acquired by Ascot Resources, the company employed many members from the Nisga’a Nation

In the opening commodity outlook keynote on March 3 at the annual Prospectors and Developers Association of Canada (PDAC) 2024 conference in Toronto, Rio Tinto CEO Jakob Stausholm highlighted how the need to produce metals sustainably is becoming more critical as the world shifts towards renewable energy, which presents opportunities for mining companies as core markets grow and new trends emerge.

The theme of the keynote was “In a world in transition, metals matter,” and Stausholm noted that political, social, economic and energy transitions are all affecting the global mining industry. “We are seeing heightened international tensions and risks to global security… We are also seeing a greater influence from

for its Red Mountain project. McLeod stayed in contact with Eva Clayton, president of Nisga’a Lisims Government, and recounted initially discussing the idea of Nations Royalty with her, along with Morven, and Brian Tait, the Nisga’a Lisims Government executive chairperson.

“We thought, wouldn’t it be a cool story if First Nations [across] Canada pooled their royalties together to crystalize that value and you would have one of the largest royalty companies in Canada,” McLeod said.

The Nation soon engaged with finance committees and held community meetings to discuss the idea, along with further nurturing the relationship it had with its key partner, Giustra, who is now an advisor to Nations Royalty.

Trading is set to happen on the Toronto Stock Exchange in the spring. Once the company is set up, both McLeod and Morven hope to see it expand to include Indigenous nations across Canada, and potentially even expand into different countries across the globe.

“Hopefully [Nations Royalty] can set the example that Indigenous people all over can access the public markets, and that Canada has a wonderful system of venture capital out there that can support many ideas,” said McLeod. CIM

carbon in industrial policy, particularly around energy and supply chain security,” he said. “We are in economic transition— I am optimistic we are moving away from a period of high inflation, and I believe costs will stabilize this year, but the global economic outlook remains uncertain and commodity prices have been volatile.”

Stausholm highlighted that “decades of extraordinary globalization” have left the world with a serious dislocation between geology, processing, manufacturing and consumption, and many governments are now seeking to close this gap. “In the last two years, we have entered a new era of industrial policy characterized by government intervention, subsidies and policy support,” he said. “This is aimed towards de-risking supply chains and supporting the energy transition. It means industrial and climate policies are increasingly influencing commodity prices, premiums and project economics.”

Stausholm noted that to avoid supply bottlenecks, governments are also promoting the development of new mining

and processing projects via financing and regulatory support. “This creates new growth opportunities for existing producers,” he said. “It also incentivizes competition that could result in risks such as trade barriers and resource nationalism as value chains adjust. Considering these trends, we anticipate robust growth in world demand for key commodities of around 3.7 per cent a year until 2035 in copper equivalent terms.”

He added that society’s expectations of how the mining industry will provide the materials needed for the renewable energy transition are evolving. “Decarbonization and the journey to net zero are a huge opportunity, but also a deeply physical and complex challenge,” he said. “We estimate [that] China’s renewable electrification and uptake of EVs will require four megatonnes in annual copper demand by 2035. As other countries work towards their own decarbonization goals, another 10 megatonnes of annual copper demand could be added.”

He pointed out that customers are increasingly expecting sustainable, traceable materials with security of supply.

“They want us to help them decarbonize by providing low-carbon materials, and they want support in decarbonizing their own processes and reducing Scope 3 emissions,” he said.

Stausholm stated that Rio Tinto’s operations in North America are a prime example of how the company is positioning itself to capture these opportunities. For example, he pointed to the full transition to renewable diesel that the company achieved in 2023 at its mine in Boron, California, and its plans to fully transition the Kennecott mine in Utah to renewable diesel starting in 2024.

“We are heavily invested in Canada, which plays a significant role in our global portfolio of aluminum, iron ore and minerals,” said Stausholm. He added that Canada’s incredible wealth of hydropower makes it a world leader in low-carbon aluminum; last year, Rio Tinto invested $1.4 billion to expand its low-carbon AP60 aluminum smelting technology in Saguenay–Lac-Saint-Jean, Quebec. “Our hold of [AP60 technology] is an essential bridge to meet our customers’ demand for lowcarbon materials,” said Stausholm.

“In this developing and opportunity-rich world, metals and the way we provide them to society really matters. At Rio Tinto, we are absolutely convinced that Canada is a vital part of how we would drive the energy transition and create a low-carbon future together.”

– Jakob Stausholm, Rio Tinto CEO

The company is working with Alcoa, Canada’s federal government and the government of Quebec to develop its ELYSIS technology, which aims to move towards zero-carbon aluminum smelting, and Stausholm said there were significant

Compiled by Ashley Fish-Robertson

In response to Sayona Mining Limited’s operational review of its North American Lithium project, Guy Belleau, chief executive officer of the company’s Quebec subsidiary, has stepped down from his position as of Jan. 24. Sylvain Collard, Sayona’s chief operating officer for Quebec, assumed direct management of Sayona’s Quebec operations following Belleau’s departure. Collard has 19 years of experience in the mining industry, which has included the management of copper and gold mine projects in Quebec, Ontario and the U.S.

François Vézina has been hired by Nion Nickel Inc. as COO of its undeveloped Dumont nickel project in Quebec. Vézina’s role involves guiding the company through Dumont’s next development phase, which is anticipated to lead to a construction decision in 2025. Vézina, who has more than 25 years of practical experience both in Canada and internationally, will bring extensive knowledge in mine construction and operations to the new role, having contributed to the engineering, construction and development of six mines, the majority of which are located in Quebec.

Fleet Space Technologies announced that it has formed a new experts-in-residence program, which relies on the expertise of an internal group of industry leading experts to offer support to the company and advise it on how to tailor its technology to global mineral exploration customers amidst the mining industry’s rapid transformation. The company’s first appointed advisor, Keenan Jennings, joined Fleet Space in February. Among his previous roles, Jennings held the position of vice-president of metals exploration at BHP.

Scott Monteith will be stepping into the role of CEO at Avalon Advanced Materials Inc. after serving in the interim role since May 2023. Monteith has guided Avalon through the acquisition of a site in Thunder Bay, Ontario, for its future lithium processing facility, as well as its joint venture with SCR-Sibelco NV.

Wesdome Gold Mines Ltd. has appointed Fernando Ragone as its new chief financial officer. Ragone brings with him nearly three decades of global experience in the mining industry. Prior to this new role, Ragone was the CFO for Bear Creek Mining Corp.

steps planned for this year in its development towards commercial maturity.

Stausholm also cited the BlueSmelting technology that Rio Tinto is developing in Sorel-Tracy, Quebec, including a demonstration plant that started last year. “[BlueSmelting] could enable the production of titanium dioxide, steel and metal powders with a significantly lower carbon footprint,” he said. “Since then, we have demonstrated that BlueSmelting works on an industrial scale, and that we can achieve the quality levels we’re looking for. The next step will be to incorporate hydrogen in the process.”

Stausholm said that as the world’s biggest iron ore producer, Rio Tinto has a key role to play in decarbonizing the entire steel value chain, which he called an industry-wide and global challenge. “By scaling our capabilities, we can accelerate our progress,” he said.

On Feb. 27, Canada’s federal government awarded $18.1 million to Rio Tinto’s Iron Ore Company of Canada (IOC) to help decarbonize iron ore processing at its Labrador West operations. In Australia, Rio Tinto recently announced a partnership with BHP and BlueScope Steel for an electric smelting furnace pilot (see article below), and the company is also developing a low-carbon ironmaking process called BioIron.

“I have no doubt that we can crack the code for green steel, [and] it will be the material that builds the future,” said Stausholm. “Still, it’s a huge challenge, and it will take years to progress the technology. We need to keep working in collaboration with our customers, peers and governments to accelerate lowcarbon pathways.”

He said that working in partnership with governments and getting help, particularly in subsidies for research and development, is very important. However, he added, “what really matters is to have a country and a government [that] has an overall mindset towards the future we are looking into. I travel around, and it is not very often that I see the clarity of thought that I see here in Canada.”

Stausholm told the audience that in his opinion, “there is not a single western country which is better placed than Canada [for decarbonizing the mining industry]. You are definitely a decade, if not more, ahead of the rest of the world because of your hydropower, [and] you will have a unique opportunity to electrify societies faster than other western coun-

tries. And we, Rio Tinto, would like to be part of that.”

Rio Tinto does not currently produce lithium, but last year the company signed agreements with other companies that own lithium properties in Canada. “Lithium is fascinating, and we are trying to build a lithium business,” Stausholm said, noting that Rio Tinto is following battery technology quite closely. “We have not gone into cobalt, not gone into nickel, but we have gone into lithium…because we believe that it is difficult to predict what batteries will win, but the likelihood is that the future will have lithium in it. Two thirds of the batteries produced in China are actually LFP [lithium ferrophosphate] batteries, so [they have] lithium but no nickel or cobalt.”

He added that it is clear that lithium is abundant, “therefore, you’ve seen very volatile and sometimes very high prices, and now the prices have come down somewhat,” he said. “How do we make sure that we only get into resources of sufficient scale where we can build a real tierone business that is low cost? I would love to be a lithium producer in Canada, but it has to be the right resource.”

Stausholm concluded his keynote presentation by saying that while we do not yet have all the necessary technology and infrastructure to achieve net-zero emissions in the mining industry, partnerships can help in the acceleration of decarbonization pathways. “In this developing and opportunity-rich world, metals and the way we provide them to society really matters,” he said. “At Rio Tinto, we are absolutely convinced that Canada is a vital part of how we would drive the energy transition and create a low-carbon future together.”

– Ailbhe GoodbodyMajor iron ore producers BHP and Rio Tinto have partnered up for the first time on a downstream project with BlueScope Steel, Australia’s largest steelmaker, with the intent of developing a green steel pilot project that could significantly reduce carbon emissions for global steelmakers relying on Australia for iron ore.

If constructed, the facility will be used to demonstrate how the production of molten iron from iron ore sourced from BHP and Rio Tinto’s mines in the Pilbara region of Western Australia is possible through the combined use of

renewable power and direct reduced iron (DRI) technology.

The first step of this project requires the two mining giants and BlueScope to produce a pre-feasibility study (PFS) centred on developing a pilot ironmaking electric smelting furnace (ESF). The PFS is planned to be completed by the end of this year. If constructed, this furnace would be the first of its kind in Australia, and if the project progresses, the pilot facility operations could start sometime in 2027.

Once running, the pilot plant will require several years of operation before it progresses to commercial production. Potential locations for the project are being assessed by the companies.

In a Feb. 9 joint statement, the companies stated that the ESF allows for greater flexibility when inputting raw materials, as other low CO2 emissionintensity production approaches—such as electric arc furnaces—rely on scrap steel and DRI produced from high-grade iron ores. Most of the iron ore currently produced in the Pilbara region is not of a high enough grade for DRI-based green steel production; howeve r, the ESF would enable the use of lower-grade iron ore. The companies stated that the ESF could address one of the key barriers to

wider adoption of low-carbon emissions technology for steel production.

“If we can crack it, it’s going to be a significant uptick for the mining industry for Australia in general and the globe,” said Tim Day, BHP’s incoming Western Australia iron ore asset president, at a Feb. 9 press conference announcing the project, as reported by Reuters.

The project will build on previous work done by Rio Tinto and BlueScope back in 2021, where the companies first began to zone in on how carbon emissions could be cut during an early phase of processing iron by using clean hydrogen for direct reduction instead of metallurgical coal. This then converts the iron ore to DRI.

The companies stated in the recent project announcement that DRI-ESF technology could replace the traditional blast furnace, which uses metallurgical coal as feedstock in the steel production process, which could reduce emissions by more than 80 per cent when processing Pilbara iron ore.

This would help to reduce the global carbon footprint for steelmaking, the companies said in the Feb. 9 joint statement.

“We need to ensure that iron ore from Australia is well-positioned for a green steel future,” said Simon Trott, Rio Tinto’s iron ore chief executive, during the press

“We know we can’t solve this issue alone, we need to partner with others to find a solution.”

– Simon Trott, Rio Tinto

conference. “We know we can’t solve this issue alone; we need to partner with others to find a solution.”

According to the World Economic Forum’s Net-Zero Industry Tracker, steelmaking production was responsible for eight per cent of global energy-related greenhouse gas emissions in 2023.

In response to the announcement, Simon Nicholas, lead analyst for the global steel sector at the Institute for Energy Economics and Financial Analysis (IEEFA), expressed in a Feb. 12 article that with the shift to using hydrogenbased DRI plants over coal-fed blast furnaces for low-carbon steelmaking, “it is becoming even clearer that CCUS [carbon capture, utilization and storage] will not play a meaningful role in steel decarbonization.” On the same day, Fortescue executive chairman Andrew Forrest voiced concerns around the ineffectiveness of CCUS in reducing global CO2 emissions from fossil fuels while speaking at the 50th anniversary meeting of the International Energy Agency.

In the Feb. 9 announcement, the companies stated that they would consolidate the work each party has completed to date in ESF technology.

– Ashley Fish-RobertsonNewmont Corporation has announced that Rob Atkinson will officially depart from the company as COO on May 2 and transition his remaining responsibilities to incoming COO Natascha Viljoen after a five-month handover period. Viljoen was previously the group head of processing at Anglo American.

Several changes to SSR Mining’s executive leadership team have taken place after the company was ordered to cover the clean-up costs following a massive leach pad landslide on Feb. 13 at its Çöpler mine in Turkey. Most notably, Michael J. Sparks, the company’s executive vice-president and chief legal and administrative officer, will be stepping into the role of CFO. Sparks is succeeding Alison White, who will step down from the role to explore other opportunities.

This year’s 34th edition of the Canadian Mining Games took place from March 7 to 10 at Sudbury’s Laurentian University and offered post-secondary mining engineering students from across Canada the opportunity to showcase a variety of skills through 24 unique theoretical and practical challenges related to mining.

The schools that participated in this year’s games included the University of British Columbia (UBC), the British Columbia Institute of Technology, the University of Alberta, the University of Saskatchewan, the University of Toronto, Queen’s University, Laurentian University, McGill University, Polytechnique Montréal, Université Laval and Dalhousie University.

Mining engineering students from UBC took first place in this year’s games, with the University of Alberta claiming second and McGill University claiming third. Each of the students who placed first were gifted with an all-expenses paid trip to Barrick and Newmont’s joint venture Nevada Gold Mines, where they will have the chance to tour the joint venture’s mine sites and operations.

Ian Berdusco, chair of the Canadian Mining Games, told CIM Magazine that in addition to the games’ cornerstone events such as the mine design and mine

rescue challenges, there were also new challenges introduced this year, which focused on innovation in mining and challenges related to sustainability in mining. For example, the tailings/closure management challenge required students to design a tailings management facility and develop a mine closure plan.

In addition, a livestream of the jackleg competition, in which students drill various patterns using a jackleg drill while being graded based on safety, technique, accuracy and speed, was made available to those who could not attend the games, a feature introduced this year.

All 24 events were sponsored by different mining companies that helped develop the challenges. Berdusco explained that some challenges were weighted more than others, such as the mine rescue challenge that lays out a simulation where students must respond to a hypothetical emergency, requiring participants to use first aid and firefighting skills.

“Mine rescue is a pretty intense fourhour competition with four people, so it should be worth something more than a competition that only requires one person,” Berdusco said.

This year, students had the chance to work with actual mine rescue equipment, which Berdusco said was not done with past editions. Students also had the chance to try out their rappelling skills and use specialized equipment during this essential mine safety skill.

Other components of the challenge included a task where students had to open a door using a pry-bar, ascend a rope and use air lifting bags to move a ball through a large-scale maze.

As a former Canadian Mining Games national champion himself, Berdusco recalled his experience as a student representing Laurentian University in 2012 and how beneficial it was for him at the time.

“You get to meet representatives from companies that you’ll likely bump into at different parts of your career, and you get to meet students from other schools,” he said. “This event has typically been a pretty good place for recruitment and, just in general, there’s some really good networking opportunities.”

At a time when enrolment in postsecondary mining programs has decreased significantly, posing a concern for many in the industry, the Canadian Mining Games stated on its website that it will continue to unite mining companies and suppliers with new talent, playing an important role in fueling the industry’s growth.

The 35th edition of the games is set to be hosted in Quebec City next year by Université Laval.

– Ashley Fish-RobertsonThe introduction of a new program focused on mineral exploration and development within B.C. was announced in late January by Geoscience BC. The program will involve a province-wide study that will zone in on possible concentrations of critical metals and minerals located in mine tailings and waste rock facilities around B.C.

Geoscience BC, a not-for-profit engaged in publicly available geoscience research, will bring together the provincial government, mining industry and other partners for its Critical Minerals and Metals in British Columbia Mine Tailings and Waste Rock program. The first phase of the program will see data

on both active and inactive mining sites being collected. The data will then be used to create a map of all the possible sites that could contain critical mineral and metal resources.

Potential sources of the resources that were once deemed irrecoverable or invaluable but may now prove useful will be identified by Geoscience BC. “After we put the data altogether on one map, we can then connect everything to it so we know what’s there—like the geology, what was produced at the site, how much was produced—and then we can tie it into infrastructure and anything else we can find,” explained Brady Clift, manager of minerals at Geoscience BC, in an interview with CIM Magazine.

Clift added that once the map is created, phase two of the program will involve matching potential projects to specific mining sites following data collection and the mapping of possible sites during the first phase. Some potential projects that Clift mentioned could include biological extraction techniques aimed at removing ore from a tailings pond, or projects aimed at treating water.

“The big thing about this program is that it hasn’t been done before,” said Clift. “We can use the data to try new research, innovate techniques and methods, and we’ll know where to apply them.”

In addition to this, when all the data is compiled, it will offer a list of exploration targets, which could include areas where environmental remediation may be considered, for example. “After talking with the abandoned mines groups, we know that there’s more than 2,800 sites that will be included [in the data] just from them, so each one of those could be an exploration target.”

Another reason that this program could greatly benefit the mining industry, Clift added, is the fact that the collected data will grant companies the opportunity to test out new ideas: “There’s lots of things that could happen in B.C. that we just don’t have a good sense of where we could apply them, but then everything we learn from phase two and beyond can then be applied across the world. So, we could be a leader in getting this going, and then other people can look at this model and use it for their own jurisdictions.”

Along with Geoscience BC, the program’s first phase research funders include Arca Climate Technologies Inc. and New Gold Inc., though Clift noted that there is still time for other miners to get involved in this groundbreaking program. The program will also receive support from the Abandoned Mines Branch of the

Ministry of Energy, Mines and Low Carbon Innovation, along with the Association for Mineral Exploration and the Mining Association of BC.

“We’re very proud to be involved in this program,” said Paul Needham, CEO of Arca, in an interview with CIM Magazine. Arca is a carbon mineralization company that is currently piloting its technology at BHP’s Nickel West mine in Western Australia. “I think this is part of a broader imperative to look very closely at mine waste and to find ways of capturing more value there.” Needham explained that for many mines, only one per cent of the target mineral is considered usable, leaving behind 99 per cent of what is mined in the waste. He considers it exciting to think that valuable minerals are just waiting to be discovered in these active and historic sites.

“A lot of work needs to be done in B.C. and then globally to map the legacy tailings, and I hope that by contributing to this study, we will get smarter about how to identify valuable minerals and how to map the resources,” he said.

It was later announced by Geoscience BC on Feb. 29 that research it conducted revealed potential locations and concentrations of lithium in northeast B.C. Its recent project, NEBC Lithium – Formation Water Database, examined brines located below the ground and found that extracting lithium alongside natural gas development in this area of B.C. could be economic. More analysis on the brine

samples is needed, but it considers the early results to be encouraging.

Any mining companies wanting to get involved in the initiative are encouraged to reach out to Geoscience BC at info@geosciencebc.com

– Ashley Fish-RobertsonHighly educated newcomers to Canada with transferable skills beneficial to mining employers still face multiple barriers to entering the workforce and require support with integration, according to a Jan. 25 webinar hosted by the CIM Diversity and Inclusion Advisory Committee.

Panelists from the Mining Industry Human Resources Council (MiHR) and the Immigrant Employment Council of B.C. provided an overview of the supports available to employers that could help boost employment of newcomers and help with the industry’s labour shortage.

The MiHR panelists drew from a new report from their organization called “Support for Newcomer Integration into Canada’s Mining Sector,” which provides an overview of challenges faced by newcomers and outlines the various resources, programs and supports available for employers looking to hire them.

Victoria Burnie, manager of equity, diversity and inclusion at MiHR, said that while the immigrant population in Canada is growing at a faster rate compared to the rest of the population, immigrants are still underrepresented in mining.

Using data compiled from a Statistics Canada labour force survey from January 2007 to September 2023, Burnie said that in 2023, immigrants represented only 13.3 per cent of the workforce in mining, while they represented 31.5 per cent of the workforce across all industries. She added that immigrant representation in all industries had grown in the time period that the data was collected, while in mining it remained relatively flat.

“Unlike women in mining, where we see some pockets of promise—such as in HR and finance—immigrants are underrepresented across the board when we look at specific occupations,” Burnie said.

As an example, in the professional and physical science category, immigrant representation in all industries is 42 per cent, compared to 23 per cent for mining.

“This means for immigrants that it is a mining industry problem,” she said. “Immigrants are just not choosing mining or mining isn’t choosing immigrants in the job market competition stage.”

Burnie described the multiple barriers that prevent newcomers from entering the workforce in Canada.

“Understanding and adapting to the local workplace culture can be challenging to newcomers,” she said. “For example, different countries might have distinct expectations regarding communication styles and professional norms.”

Additional challenges include building professional networks without local contacts, getting foreign credentials recognized in Canada, and a lack of familiarity with the local job market that can prevent newcomers from understanding job trends in Canada and knowing where to look for job openings.

Glencore Canada’s Nickel Rim South mine, part of its Sudbury Integrated Nickel Operations. The federal Rural and Northern Immigration Pilot aims to bring skilled foreign workers to communities like Sudbury that are experiencing labour shortages.

Furthermore, newcomers may have a limited knowledge of available support services, such as career counselling, mentorship programs and job placement services. They may also be unfamiliar with

local hiring practices and resumé formats while job hunting, and once they reach the interview stage, might face discrimination or bias based on race, ethnicity, cultural or linguistic differences.

Our approach to mine closure is simple – we partner with clients to develop and implement tailored solutions that streamline reclamation and meet project objectives – all while considering stakeholder needs. Stantec is a world leader in the closure of operating, inactive, historic, and abandoned mines.

stantec.com/mine-closure

“Immigrants are just not choosing mining or mining isn’t choosing immigrants in the job market competition stage.”

– Victoria Burnie, MiHR

Finally, newcomers with a limited proficiency in the local language would struggle with everything from job interviews to daily interactions with colleagues once they are in the workplace.

“Overcoming these challenges often requires a combination of cultural adaptation, language enhancement, networking efforts and access to support services,” Burnie said. “Employers and communities can play a crucial role in facilitating the integration of newcomers into the workforce by providing resources and creating inclusive environments.”

Leslie Woolcott, director of equity, diversity and inclusion at MiHR, said that there is no shortage of resources available to support employers with recruiting and hiring newcomers.

“Part of the problem or challenge relates to understanding this complex of programs and navigating through the different eligibility criteria for both employers and newcomers,” she said. “While a limited number of programs specifically target mining, most are available to the sector and have relevance for the sector.”

One of the examples she pointed to was the Express Entry immigration program, which offers a faster pathway to permanent resident status for immigrants and includes a skilled trades stream. Two other examples are the Atlantic Immigration Program and the Rural and Northern Immigration Pilot, both of which were launched in 2022 and create a path to permanent residence for skilled foreign workers who want to live and work in communities that have a need to attract more workers. Some of the communities eligible for the Rural and Northern Immigration Pilot, for example, are known to be hotbeds of mining activity, including Sudbury, Timmins and Thunder Bay in Ontario.

Patrick MacKenzie, chief executive officer of the Immigrant Employment

Council of B.C., said that Immigrant Employment Councils of Canada (IECC) has 12 partner organizations across the country that support employers in recruiting, hiring and retaining immigrants into jobs that make the best use of their skills. Some of the services they offer employers include curated strategies for recruiting immigrant workers, cultural competency training, mentorship programs and initiatives to enhance workplace diversity and inclusion.

“We know that resource industries, extractive industries, are really important to the Canadian economy,” he said. “And it’s an area where more newcomers need to be made aware of the opportunity that’s there.”

MiHR’s report is available on its website at mihr.ca/resources in English and French and the IECC offers employer resources online through iecc.network.

– Silvia PikalA theme that emerged from the Feb. 26 keynote session that kicked off MINEXCHANGE, the 2024 SME Annual Conference and Expo in Phoenix, Arizona, was the pressure that net-zero greenhouse gas emission goals are exerting on the global energy sector and whether it can meet ambitious energy transition targets without compromising on affordability and reliability.