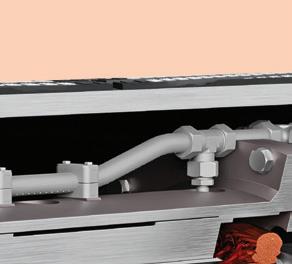

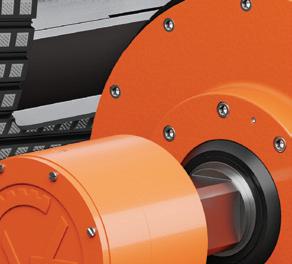

With all components enclosed and protected inside the drum, the GrizzlyDrive® Drum Motor is designed for 80,000 hours of continuous operation before maintenance, providing belt conveyors with reliability, longevity and optimal performance even in the harshest conditions. The GrizzlyDrive® with

increases performance and provides 4-5 times longer service life than standard rubber lagging. Eliminate Routine

The last few years has pushed a new wave of resource nationalism, and it is likely to grow as global demand for critical minerals continues to push countries to protect their supplies

By Kelsey Rolfe

Collaborative teamwork was required to successfully decommission the K1 and K2 shafts at Mosaic’s Esterhazy potash complex earlier than originally planned, amid the challenges of time constraints and the difficulties of the COVID-19 pandemic

By Alexandra Lopez-Pacheco

Technology is helping to improve the accuracy of information obtained from exploration drill holes

By Catherine Hercus

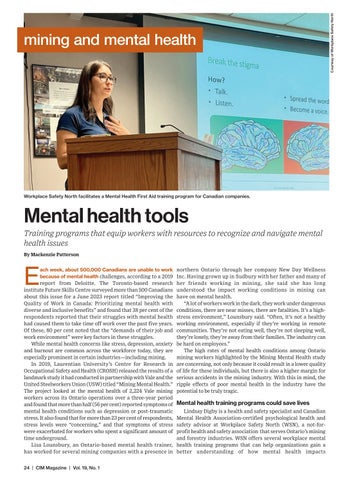

Training programs that equip workers with resources to recognize and navigate mental health issues

By Mackenzie Patterson

In each issue

6 Editor’s letter

8 President’s notes

Tools of the trade

9 The best in new technology

Compiled by Noel Ormita

Developments

10 Tailings trial

By Silvia Pikal

18 One global standard

By Kelsey Rolfe

Column

22 By taking a full business process view of resilience, operations can protect themselves from all types of outages

By Rob Labbé

Training and skills development

26 Beyond gaming and retail applications, the virtual world is showing major promise for training in the mining sector

By Rosalind Stefanac

28 An industry-backed training program is helping to boost the Indigenous workforce in Saskatchewan’s potash industry By Sarah St-Pierre

30 MiHR executive director Ryan Montpellier discusses how the Canadian mining industry must address decreasing enrolment trends in mining education and a lack of youth awareness about opportunities in the sector

By Ailbhe Goodbody

CIM news

44 Each year the CIM Vancouver Branch brings together students and industry folks to network and celebrate success

By Michele Beacom

44 Upcoming CIM Community events

Compiled by Michele Beacom

45 CIM remembers a visionary leader, a respected professional and an exceptional mentor

By Rosemary Mantini

Mining the archives

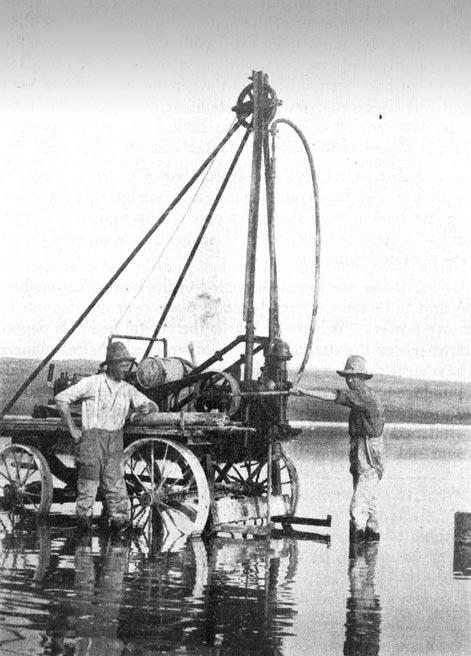

80 How a chance discovery in 1943 led to Saskatchewan becoming a leading global potash producer

By Ailbhe Goodbody

Contenu francophone

69 Table des matières

69 Lettre de l’éditeur

70 Mot du président

Les actualités

71 Le développement d’une installation hydrométallurgique au Québec progresse

Par Ashley Fish-Robertson

Exploitation minière et santé mentale

72 Des programmes de formation visant à offrir aux travailleurs des ressources pour leur permettre de reconnaître des problèmes de santé mentale et savoir comment s’y prendre pour y faire face

Par Mackenzie Patterson

Article de fond

74 Contrôle aux frontières

Ces dernières années ont été marquées par une nouvelle vague de nationalisme des ressources. Elle devrait s’intensifier en raison de la demande mondiale en minéraux critiques, qui continue d’inciter les pays à protéger leurs réserves

Par Kelsey Rolfe

The mining industry is really good at talking about safety. Mental health, not so much. When CIM Magazine decided to delve into a year-long editorial series on mining and mental health, we found that there is little data and information, and little discussion, about this serious issue.

In 2019, Vale and Laurentian University released the results of a study that asked thousands of Vale Canada workers questions about their mental well-being. The study was initiated after Vale Canada discovered that at its Ontario operations, about one in four of all disability claims were due to mental health issues. This was a landmark study. Before that, no one had collected data on the mental health of Canadian workers in mining, even though we know that work in the industry can be stressful and involves long hours, shift work and at times isolated working conditions—in other words, it is a pressure cooker for mental health issues.

Some mining companies are starting to implement mental health initiatives to support their workers. Workplace Safety North, for example, provides mental health training programs to the mining and forest products industries as part of its services. Since 2021, when it first began offering this programming, more than 4,000 workers have participated across the sectors it serves.

This is a start. But as we heard from a mine worker in the first article in our new Mining and Mental Health series (see p. 24), taking action cannot stop there. There is so much more work to do.

Canada’s mining industry is a leader on the world stage in physical safety, exploration and technological innovation and is starting to become a leader in other areas, including talent

Editor-in-chief Ryan Bergen, rbergen@cim.org

diversity—recently, big players have stepped up and implemented gender balance initiatives into their corporate goals when most other industries have not. Mental health is another area where our mining industry could be a global leader.

Over the next year, we will be showcasing the people, programs and initiatives prioritizing the mental health of mining workers. Throughout 2024, you will read about different resources available to help improve worker mental health, which is key to a safe and productive workplace.

We want to thank the people and companies that have stepped up so far and agreed to talk about this important topic: Sandor Basa, Lisa Lounsbury, Lindsay Digby and Workplace Safety North in this issue, and Agnico Eagle and Cameco in upcoming issues.

It has been difficult to find companies willing to talk to us about mental health, however. If you know one that might, please let us know. Seeing and hearing the people at the top of a company say mental health is important, and implementing initiatives to support that, is incredibly powerful. It is even more powerful when they can serve as an example to other companies.

When we normalize talking about mental health, people feel empowered to ask for help when they need it. It could save a life. Let’s try it.

Silvia Pikal, Section Editor spikal@cim.org

by

Courtesy of Minverso

Managing editor Michele Beacom, mbeacom@cim.org

Senior editor Ailbhe Goodbody, agoodbody@cim.org

Section editor Silvia Pikal, spikal@cim.org

Editorial intern Ashley Fish-Robertson, afrobertson@cim.org

Contributors Catherine Hercus, Rob Labbé, Alexandra LopezPacheco, Rosemary Mantini, Noel Ormita, Mackenzie Patterson, Kelsey Rolfe, Rosalind Stefanac, Sarah St-Pierre

Editorial advisory board Mohammad Babaei Khorzhoughi, Vic Pakalnis, Steve Rusk, Nathan Stubina

Translations Karen Rolland, karen.g.rolland@gmail.com, Michèle Tirlemont, micheletirlemont@gmail.com

Layout and design Clò Communications Inc., communications.clo@gmail.com

Published 8 times a year by:

Canadian Institute of Mining, Metallurgy and Petroleum 1040 – 3500 de Maisonneuve Blvd. West Westmount, QC H3Z 3C1

Tel.: 514.939.2710; Fax: 514.939.2714 www.cim.org; magazine@cim.org

2020 2021 2022

Advertising sales

Dovetail Communications Inc. Tel.: 905.886.6640; Fax: 905.886.6615; www.dvtail.com

Senior Account Executives

Leesa Nacht, lnacht@dvtail.com, 905.886.6640 ext 321

Dinah Quattrin, dquattrin@dvtail.com, 905.886.6640 ext 308

Neal Young, nyoung@dvtail.com, 905.886.6640 ext 306

Subscriptions

Online version included in CIM Membership ($197/yr). Print version for institutions or agencies – Canada: $275/yr (AB, BC, MB, NT, NU, SK, YT add 5% GST; ON add 13% HST; QC add 5% GST + 9.975% PST; NB, NL, NS, PE add 15% HST). Print version for institutions or agencies – USA/International: US$325/yr. Online access to single copy: $50.

Copyright©2024. All rights reserved.

ISSN 1718-4177. Publications Mail No. 09786.

Postage paid at CPA Saint-Laurent, QC.

Dépôt légal: Bibliothèque nationale du Québec. The Institute, as a body, is not responsible for statements made or opinions advanced either in articles or in any discussion appearing in its publications

Printed in Canada

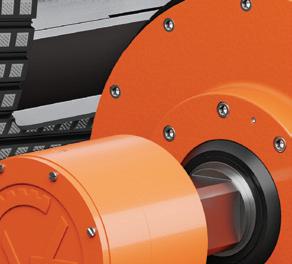

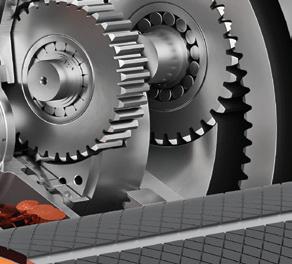

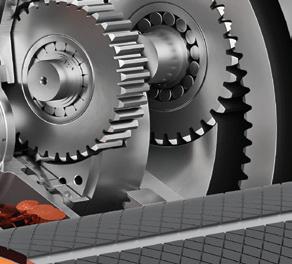

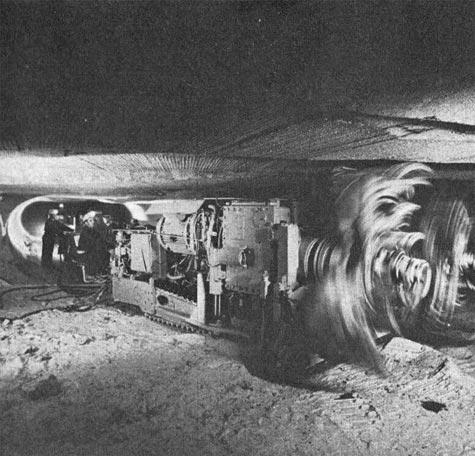

with the HPGR Pro the next evolutionary step in our market-leading HPGR technology

The HPGR Pro features are next-gen technology resulting in operational advantages versus conventional HPGR… features that are retrofittable!

Whether it’s a new machine or an upgrade for an existing unit, the HPGR Pro takes your grinding operations to the next level with the most efficient comminution product in grinding and milling!

Read more at flsmidth.com

Key benefits vs conventional HPGR

■ Increased throughput up to 20%

■ Reduce power demands by as much as 15%

■ Extend life of the rolls up to 30%

■ Maximize life of the bearings

■ On-line monitoring of roll surfaces

It is with heavy heart that I recognize the recent passing of one of our CIM past presidents, Christopher Twigge-Molecey. Chris was the epitome of what makes CIM great—hardworking and dedicated; amicable but with strong views on matters important to him and always trying to build something better. Part of the reason why CIM is where it is today is because we’ve built on the legacy Chris left after his term as CIM President [2010-2011]. His presence and support will be missed by Hatch, where he worked for 49 years, MetSoc and our wider CIM community.

Chris, like so many CIM presidents before him, set an example of what commitment to the CIM community looks like. On top of holding office as CIM President, he was president of MetSoc (1996-97) and in 2017, he published, along with three collaborators and 17 authors, the important CIM book, Metallurgical Plant Design

In recent months, other CIM presidents have demonstrated that the role of president is not a one-and-done task. For example, in November 2023, we launched the eagerly anticipated Mine Evolution educational video game, a joint venture between CIM and Science North and a passion project of Samantha Espley, our 2020-21 CIM President. This fun digital game comes with complementary educator resources and its primary goals are to

It is our CIM community working together that makes CIM such a success.

demonstrate that mining is for everyone and that it is the foundation of our future. Another of Sam’s passions is safety. As current chair of the Health and Safety Society (HSS), she and many others in the HSS are working on many initiatives, such as a Canadian severe injuries and fatalities database to promote learning from grave mining incidents.

Ian Pearce, our CIM President-Elect [2024-25], chaired our third Capital Projects Symposium in Vancouver in November 2023, with significant support from past presidents Pierre Julien [2021-22] and Samantha Espley, along with Incoming PresidentElect Candace MacGibbon [2025-26]. The conference’s goal overall was to create a forum to network, share and learn in order to enable improvement in mining industry project performance. This is very relevant and a key priority for our industry and particularly for operators and those with construction projects in the pipeline, including all of the engineering, construction and other mining-adjacent companies that support mining projects.

Unfortunately, there is not enough room here to thank everyone involved in these recent initiatives, nor to recognize all the great events and activities that our OneCIM community has undertaken over the course of 2023—activities that could not happen without the dedication of all our members and volunteers, including our presidents past and future. It is our CIM community working together that makes CIM such a success. I’m looking forward to a great 2024 and catching up with as many of you as possible in the months to come.

Mike Cinnamond CIM President

SCS Exploration is a new cloud-based application from The Coring Company that allows users to plan and execute mineral exploration projects in one platform. Fieldwork and lab data can be entered into the software and layered on topographic maps to facilitate understanding of the area, creating a centralized location for the analysis and visualization of prospecting information through its reporting tool. The product also allows for data entry directly from the field in areas with poor coverage as there is an offline app available.

Fleet Space Technologies has introduced new product features to its “space-enabled” ExoSphere mineral exploration technology, which uses a fleet of satellites and connected seismic sensors to produce 3D subsurface maps of a survey area, allowing geologists to identify mineral deposits and improve drilling accuracy. The company said its technology decreases the time it takes to create a 3D model of a survey area from months to days, while minimizing environmental impact at the site. ExoSphere’s latest features include a sensitivity model that quantifies and visualizes the confidence levels of any potential subsurface findings for each 3D model that is created, a data processing report that gives a technical summary of the ambient noise conditions of the survey area and a source data pack that allows users to download edge-processed survey data for future use.

Thermo Fisher Scientific ’s latest release, the ARL X’TRA Companion X-ray diffractometer, is designed for quantitative phase analysis and can be used in ore mining and battery material production. Unlike X-ray fluorescence (XRF) analysis, Xray diffraction (XRD) technology can determine how elements are combined together in heterogeneous ore samples. The company stated that the instrument was designed with an easy-to-use interface and analysis software to prevent the need for specialized training. The benchtop X-ray diffractometer has a six-position sample changer and can operate at 600 watts. According to the company, the product is ideally suited to assess the quality and purity of lithium carbonate, as it measures the sample for total lithium content as well as contaminants.

Compiled by Noel Ormita

By Silvia Pikal

At BHP’s Nickel West mine at Mount Keith in Kalgoorlie, Western Australia, autonomous rovers and surface manipulation machines are being put to work on an area of its tailings dam, churning up material and speeding up the process of carbon mineralization.

(continued on page 11)

Arca’s R&D scientists, Anne-Martine Doucet and Frances Jones, sampling the surface of the tailings storage facility at

The proprietary technology was developed by Vancouver-headquartered Arca Climate Technologies Inc., which announced in a press release on Nov. 29, 2023, that it is piloting its air-to-rock carbon mineralization process for the next 18 months at Nickel West with the support of a $1.25 million grant from the B.C. Centre for Innovation and Clean Energy (CICE).

“With CICE’s support, Arca is in a great position to accelerate large-scale implementation,” said Todd Sayers, CICE’s chief operating officer, in the press release.

Carbon mineralization is a natural process that occurs when certain rocks or minerals are weathered and react with CO2 in the atmosphere, storing it in a stable form as solid carbonates. According to BHP, the Nickel West tailings dam— which is one of Australia’s biggest tailings dams—already stores approximately 40,000 tonnes of CO2 from the atmosphere each year through this process, which it said is the equivalent of offsetting the CO2 emissions of 15,000 vehicles.

By accelerating this passive process, the site could potentially remove millions of tonnes of CO2 from the atmosphere and become a massive carbon sink. It is an attractive proposition, not just for mining companies looking to decarbonize their operations, but also for companies further down the supply chain. “We’re hearing directly from producers of critical metals that their customers are looking for lowcarbon or zero-carbon metals,” said Paul Needham, the CEO of Arca, in an interview with CIM Magazine. Tesla, for example, has been actively seeking out low-carbon nickel for its batteries, which led the EV giant to sign nickel supply deals with BHP and Vale in the last few years.

Needham said the company has established a control plot at Nickel West, along with a small area where it will be transforming the tailings and capturing and storing carbon using magnesium-rich ultramafic rock.

“We’re using electromagnetic radiation microwaves to selectively target components within the serpentine mineral structure, disrupting that mineral structure and liberating the magnesium,” Needham said. “The material becomes very, very reactive to CO2.”

Needham said that this is the first pilot of its kind in the world, as the testing of the carbon mineralization technology is taking place at an active mine site.

“In that area where we treat [tailings], we’ll be churning the material,” he said.

“We’ll be controlling factors like moisture level, alkalinity and surface area, and putting into practice what we’ve done on pilot sites, so we’re integrating a number of technologies that we’ve tested on other sites elsewhere in the world. This is the first time that everything’s coming together on an active mine site. And this is a very large nickel mine—the tailings storage facilities are about 16 square kilometres [in surface area]. They’ve been mining there for more than 25 years. That one site has the potential to store multiple megatonnes of carbon dioxide.”

Needham said that by using a dynamic closed chamber to measure the concentration of CO2 in the air in the sample plot of the tailings dam, Arca has found that its technology can restore the air from 420 parts per million (ppm) of CO2 to 250 ppm of CO2 in a period of five minutes. According to an article published on the Massachusetts Institute of Technology (MIT) climate portal, the ideal range of CO2 in the atmosphere to support human life is about 280 ppm to 350 ppm, which is roughly what the global levels were before the industrial revolution. Today, global levels are at about 420 ppm, according to a November 2023 measurement taken at the Mauna Loa Observatory.

“What’s happening is the CO2 is getting dissolved into the water that’s present, then mineralizing by binding with magnesium ions to form new magnesium carbonate minerals,” he said. “When you think about the speed of that… It’s something like 50 tonnes of CO2 per hectare per year, which compares very well to forests. It’s very surprising that these mine tailings, with the right minerals, are capturing carbon dioxide faster than a forest.”

The company is not currently disclosing how much carbon the 18-month pilot project is expected to sequester and said it will announce the results after the data has been verified by a third-party.

Arca is exploring pilot opportunities at other mine sites in Australia and Canada that could happen before the end of this year.

Needham said that throughout Arca’s experiments, it has found that the carbon mineralization process has helped make the tailings more stable in some contexts, an unexpected benefit it plans to further examine as it deploys its next pilot projects.

“I really think there’s an opportunity to create more stable, more safe mine tailings, while also capturing value or creating value by capturing CO2 from the

Compiled by Noel Ormita

New Gold Inc. promoted Keith Murphy, its previous vice-president of finance, to executive vice-president and chief financial officer, succeeding Rob Chausse following his retirement. Murphy, a chartered accountant with over 15 years of finance experience, has been with the company since 2013.

Vale Base Metals has announced that Deshnee Naidoo is stepping down as chief executive officer and it is searching for someone to fill the Toronto-based role, which will officially be vacant on Mar. 31. The CEO will lead mineral projects in Brazil, Canada and Indonesia with planned company investments of US$25 billion to US$30 billion into its projects in the next decade.

BHP announced multiple executive appointments, effective Mar. 1. Vandita Pant, previously chief commercial officer, will be taking over as CFO from David Lamont, who will continue to serve in an advisory role as a senior executive officer until February 2025. Rag Udd has been promoted to CCO, following his role as president of Americas, which he has held since 2020. Johan van Jaarsveld, currently the company’s chief development officer, will replace Laura Tyler as chief technical officer when she departs at the end of February. Catherine Raw, who is currently managing director at SSE Thermal, will join BHP as CDO in April 2024.

Suncor Energy appointed Kent Ferguson as new senior vice-president of strategy, sustainability and corporate development, following an executive leadership team restructuring. Ferguson brings 25 years of energy industry experience and knowledge of the Canadian market to the position, having held previous roles with the Royal Bank of Canada (RBC). His most recent role with the bank was as managing director and co-head of global energy at RBC Capital Markets.

Eldorado Gold Corporation shared that Paul Ferneyhough has been promoted from executive vice-president of chief strategy, and commercial officer, to executive vice-president and CFO, taking over from Philip Yee, who has retired.

atmosphere,” he added. “I think these tailings aren’t merely a liability. There’s also a win-win scenario here.” CIM

By Ashley Fish-Robertson

On Dec. 20, 2023, Teck Resources announced the successful start of a carbon capture pilot plant at its Trail mining operations in southern B.C. The plant captures one tonne of CO2 from the acid plant flue gas per day at its Trail operations—one of the world’s largest zinc and lead smelting and refining complexes—and is expected to operate throughout 2024 for testing and data collection. This is the first step in Teck’s Carbon Capture Utilization and Storage (CCUS) project, which aims to utilize the captured CO2. Teck is also advancing the potential development of a large electric vehicle battery recycling facility at its Trail operations.

Teck Resources and bulk shipping company Oldendorff Carriers have come to an agreement to use wind propulsion to reduce CO2 emissions in Teck’s supply chain. Oldendorff’s bulk carrier, the Dietrich Oldendorff, will be outfitted with a Flettner Rotor system later this year. The vessel carries Teck’s shipments of steelmaking coal from the Port of Vancouver to clients in Asia. According to a Dec. 7 press release, the system creates lift through wind, which is then converted into additional thrust, reducing fuel consumption on Pacific voyages. This new outfitting is expected to reduce fuel emissions by 55 per cent, which Teck stated is an annual reduction of over 17,000 tonnes of CO2 emissions. The two companies have worked together since 2021 to employ energy-efficient bulk carriers for shipments of Teck’s steelmaking coal, and Teck stated that an estimated amount of 115,000 tonnes of CO2 emissions have already been eliminated due to their efforts.

Hudbay Minerals’ Copper Mountain mine has received a new piece of equipment—the Komatsu PC8000-11 electric excavator— expanding the project’s fleet, which includes two other electric excavators currently operating at the mine. The massive piece of heavy machinery, which was delivered by SMS Equipment to the project site last fall, is considered to be the largest surface mining excavator currently available on the market. The machine will be used to load electric haul trucks at Copper Mountain. The excavator measures 9.7 metres tall and 10 metres wide and has a bucket capacity of 42 cubic metres. The Komatsu PC8000-11 operates only on electricity, thus playing a big role in reducing projectrelated emissions. In a Dec. 20 press release, SMS stated that the Copper Mountain project is one of the sole open-pit mines located in North America to run an electric trolley-assisted haulage system. The excavator was made in Germany and assembled directly at the Copper Mountain mine last year.

The University of Saskatchewan, the University of Regina and Saskatchewan Polytechnic signed a memorandum of understanding on Dec. 6 to establish the creation of a Global Institute for Energy, Mines and Society (GIEMS) in Saskatchewan to further research and innovation initiatives in the mining and energy sectors.

The agreement was signed by Jeff Keshen, president and vice chancellor of the University of Regina, Peter Stoicheff, president and vice chancellor of the University of Saskatchewan and Larry Rosia, president and CEO of Saskatchewan Polytechnic, with Saskatchewan Premier Scott Moe in attendance, at the Saskatchewan Pavilion at COP28, the United Nations climate change conference, which took place in Dubai from Nov. 30 to Dec. 12.

“Our province is quickly becoming a leader in mining and energy innovation, and this new institution will add to our already impressive portfolio of research organizations,” Moe stated in a Dec. 6 press release from the province.

Saskatchewan’s mining industry saw mineral sales reach an all-time high of $19.4 billion in 2022. Uranium, potash and salt are among the province’s most valuable and mined commodities.

According to the Government of Canada, the mining and energy sector made up 22 per cent of the province’s gross domestic product in 2021.

The institute is projected to be a hub for the universities involved to collaborate on research and innovation to address projected global critical mineral demands with student engineers, scientists and

tradespeople benefiting from its learnings, according to the press release.

“Our institutions have a shared commitment to be highly responsive to the needs of the economy, including employers, industries, and growing the workforce— by providing quality post-secondary research, education and training opportunities,” Keshen said in the release.

Each institution separately invests in critical minerals sector research, but GIEMS aims to facilitate collaboration between the post-secondaries and the mining and energy industry more effectively.

“We look forward to contributing our applied research expertise as we collaborate to unlock the incredible potential for innovation in mining and energy and help train the workforce of tomorrow,” Rosia added.

The details on the institute’s structure, funding, physical location and timeline on being built have not yet been finalized.

– Noel Ormita

On Jan. 8, an independent economic impact study conducted for the Mining Association of British Columbia (MABC) was released, outlining the economic impact of 14 proposed critical mineral mines and two proposed mine extensions in B.C. These proposed mines are set to produce copper, nickel, niobium, cobalt, molybdenum, zinc and rare earth elements.

The study, which was conducted by Mansfield Consulting Inc., revealed that the long-term economic impact expected from these 16 proposals could amount to nearly $800 billion over several decades. According to the study, the proposed critical mineral mines represent $36.5 billion in near-term investment, over 300,000 person-years of employment and nearly $11 billion in tax revenues.

As Canada continues to advance its shift to cleaner energy sources, the demand for critical minerals and metals is expected to increase significantly. This sustained demand, according to the International Energy Agency, can be expected to increase by six times by the year 2040.

Of the 31 minerals that Canada deems critical, 16 of those are located or produced

in B.C., positioning the province as a key player in advancing Canada’s goal of reaching net-zero greenhouse gas emissions by the year 2050. According to the MABC, there are currently 10 metal mines, seven steelmaking coal mines and two smelters operating in B.C.

“This is a generational opportunity which must be seized and could position B.C. as a leading global supplier of responsibly produced critical minerals. We want to move forward with the governments of Canada and British Columbia, First Nations, local governments and labour to unlock critical mineral developments for the benefit of all British Columbians,” said Michael Goehring, president and CEO of the MABC, in a press release accompanying the study.

In the study, the MABC noted some actions that need to be taken by both provincial and federal governments to unlock the full power of B.C.’s critical minerals and metals supply. “The realization of benefits from these critical mineral projects is dependent on B.C. having competitive fiscal and regulatory policies that will attract the investment necessary to grow and sustain the sector,” said Goehring in the release.

The five policy areas where change is needed most, according to the MABC, include the need for competitive fiscal policy to be set in place, speeding up the mine permitting process, advancing economic reconciliation with First Nations communities, investing in the electrification of new critical mineral developments, and more support for skills training, health and safety.

Goehring further emphasized the crucial role that B.C.’s critical minerals strategy will play in further developing these 16 proposals, noting that “the provincial government’s forthcoming

16

Number of proposed critical mineral mine projects in B.C. awaiting approval

$800 billion

Estimated long-term economic impact of the 16 proposed projects over several decades

300,000

Number of person-years of employment that the 16 proposed critical mineral projects could bring if approved

critical minerals strategy is fundamental to these efforts.”

From Oct. 6 to Nov. 6, 2023, a period of engagement regarding the strategy was held by the B.C. government. Feedback from this engagement, as well as input gathered through the Critical Minerals Advisory Committee, First Nations engagement and a First Nations Energy and Mines Council event, have informed the strategy. The first phase of the strategy was released to the public on Jan. 22, which outlined key recommended actions that would play a crucial role in advancing B.C.’s critical minerals projects to development.

Of the 11 key actions shared by the B.C. government, some notable ones included the task of expediting critical minerals projects in the province and maximizing federal funding opportunities through a newly introduced Critical Minerals Project Advancement Office, a recommendation that B.C. work in collaboration with First Nations to advance critical mineral infrastructure, and the assurance that the highest environmental, social and governance standards are met.

The MABC released a statement in response to the government’s first phase of its plan, stating its support for the proposed actions, but also noting that a competitive fiscal policy is missing from this plan. Since B.C. currently pays the highest carbon tax in both Canada and the world, the MABC considers it crucial that existing and prospective critical

mineral mines in the province pay a carbon tax that is “competitive with Ontario and Quebec.”

In addition to the 16 proposed critical mineral mines, the study also examined the economic impact of five proposed precious metal mines that would produce gold and silver. According to the study, the combined long-term economic impact of these mines would total $29.5 billion, introduce over 96,000 person-years of employment and yield $5.3 billion in tax revenue. – Ashley Fish-Robertson

Mining companies need to step up and lead the way in championing neuro-inclusion, according to a discussion between panelists Nermina Harambasic, Nathan Stubina and Kelly Bron Johnson during a Nov. 29 webinar hosted by the CIM Diversity and Inclusion Advisory Committee (DIAC).

The webinar discussed DIAC’s “Neurodiversity in Mining” initiative launched in 2021, which aims to boost inclusion in the mining industry and improve employment equity and opportunities for neurodivergent individuals, and is spearheaded by DIAC committee members Harambasic and Stubina.

The term neurodivergent refers to people whose brains develop or work in different ways from people with neurotypical brains, and includes those with autism spectrum disorder, attention

deficit hyperactivity disorder, dyslexia or other neurological or developmental conditions.

The panelists discussed how adoption of DIAC’s Neurodiversity in Mining pilot program, which is designed to support mining companies to hire neurodivergent workers, has been slow.

DIAC’s pilot program assists companies with a step-by-step implementation process developed by Johnson, an inclusion, diversity, equity and accessibility advisor who runs the company Completely Inclusive and identifies as autistic and hard of hearing.

The process includes adjustments to job postings to ensure the language does not dissuade neurodivergent candidates, a modified interview process that takes the needs of the candidate into account, paid trial job experience to see if the role is a fit and an adapted hiring and onboarding process, which includes pairing the new employee with a mentor.

The pilot program includes support from Completely Inclusive as well as from organizations that assess neurodivergent workers.

“Why aren’t we leading this initiative in comparison to other industries?” asked Harambasic, a project management and advisory expert focused on mining and energy products, pointing out that industries such as IT, banking and food supply have been utilizing programs to hire neurodivergent workers for years.

Stubina, formerly the vice-president of technology at Sherritt International, said he believes there is a general lack of awareness of neurodiversity, while Johnson added that there is a widespread misunderstanding of the abilities and capabilities of neurodivergent workers. She pointed out that they are often typecast, and that companies need to do a better job of not only considering them for different types of roles, but also actively communicating the different careers available to them in mining.

“We’re not finding the sufficient candidates that we need [for the mining industry],” she said. “It has to start all the way from education. Just for neurodivergent people to be approached, and to understand, ‘hey, did you know that you could go into geology? Or did you

“Diversity is definitely not a single siloed issue. It’s not just relegated to HR. It’s gotta be everybody approaching this together, in a community sense of, how can we make inclusion our priority?”

– Kelly Bron Johnson, founder of Completely Inclusive

know that being a site manager might actually be something that you might be suited to?’ They’re not encouraged to go into those programs necessarily.”

Companies cannot wait any longer to address the labour shortage, the panelists said, as large numbers of the workforce are due to retire by the end of the decade. According to the 2021 edition of the Canadian Mining Labour Market Outlook, pub-

lished by the Mining Industry Human Resources Council, the Canadian mining industry will need to hire almost 30,000 new workers from 2021-2025 to “replace retirees and fill new positions to meet baseline production targets,” as cited in a 2023 report from the Mining Association of Canada.

“The jobs need to be done,” Johnson said. “It’s a matter of attracting the right

candidates and getting them as early as possible, and maybe even training them to fit the industry.”

Johnson explained that traditional, pressure-based job interviews are not always the best way for a candidate to demonstrate that they possess the skills needed for the role, especially when the

interviewer asks abstract questions such as: “Which fruit would you be? Are you a banana or an apple?”

She continued, “It seems almost like it’s entertainment for the people hiring, rather than giving you the actual information—can this person do the job you need them to do, and do it well?”

Johnson said that ditching the “hugely intimidating interview process” and trying alternative interview formats, such as paying candidates to complete tangible tasks over several days, would take the pressure off from the process and give a better sense of how they work and problem solve.

Stubina discussed Sherritt International’s participation in DIAC’s pilot program in 2022, which involved permanently hiring a worker for Sherritt’s technology division through Inclusion Alberta.

“It was successful and then other people were looking at duplicating it for their own divisions,” he said.

Stubina spoke to the importance of workplace accommodations for people with sensory sensitivities, which could include providing noise-cancelling headphones, or a dark, quiet room to focus in. He added that while companies may have balked at these suggestions prior to the pandemic, “the paradigm has shifted.”

In an email to CIM Magazine, Harambasic said that a few companies have expressed interest in the pilot program, but so far Sherritt is the only mining company that has gone through the hiring and employment process.

“We are still working with potentially a few others, but there is still lots of misunderstanding [about] what neurodiversity is and how to go about it,” Harambasic said in the email. “The fact is that neurodivergent people are already working for mining companies, so [the] pilot will help every mining company achieve full human potential.”

The speakers concluded the webinar by inviting the mining community, and decision makers, to implement the pilot program into their organizations.

“There’s no shortage of people who say they’re interested [in the pilot program], but it kind of lags or slows down [when] getting mining companies to start the initiative,” Stubina said. “It could be [hiring] one person as a pilot.”

Johnson stated the importance of making sure that all levels of the company are pushing for neuro-inclusion: “Diversity is definitely not a single siloed issue. It’s not just relegated to HR. It’s gotta be everybody approaching this together, in a community sense of, how can we make inclusion our priority?”

Interested companies should reach out to diac@cim.org for further details.

– Silvia Pikal

Canadian private equity firm Kinterra Capital announced on Jan. 10 that its portfolio company, NiVolt Technologies Inc., had successfully produced mixed hydroxide precipitate (MHP) from nickel concentrate that contained over 45 per cent nickel plus cobalt with low impurities.

This recent update will allow Kinterra to progress to conducting a feasibility study for a potential hydrometallurgical facility in Quebec. The facility, if constructed, would convert nickel concentrate into MHP and nickel sulfate, which would then be used for electric vehicle (EV) batteries.

In a press release, Kinterra added that greater than 97 per cent nickel and cobalt pressure oxidation leach recoveries had been reached.

“Our test results have demonstrated that a high nickel and cobalt leach recovery can be achieved and that a high-quality

MHP can be produced,” said Cory Kosinski, vice-president of projects and evaluations for NiVolt, in the release. “We look forward to advancing to the pilot plant campaign to validate the process conditions on a continuous basis and generate the necessary process design data for the commercial plant.”

This announcement comes almost two months after Kinterra Capital closed its US$565 million investment fund that will be used to acquire critical mineral assets for EV battery development projects. Kinterra shared that this fund would be used to obtain critical mineral asset investments in North America, Western Europe and Australia over the span of eight to 10 years.

The fund is targeted towards securing investments in lithium mines, embarking on exploration projects for cobalt, nickel and graphite, while also zoning in on developing technology for extracting, processing and recycling critical minerals. The company stated it already holds a stake in the undeveloped Dumont Nickel project, located in the Abitibi region of Quebec.

On Jan. 18, a press release shared by Nion, a Toronto-based private equity firm under the management of Kinterra, announced that NiVolt plans to assess Dumont’s nickel concentrate as part of its feasibility study for its proposed hydrometallurgical facility. As the feasibility study progresses, Nion will conduct a data collection field program during the first half of this year. When constructed, the Dumont project is estimated to produce nickel for over 30 years, and is expected to rank among the top-five largest nickel sulfide operations globally

by annual production with an average annual production of 39,000 tonnes of nickel in sulphide concentrate.

NiVolt is reportedly finalizing its search for the location of its proposed hydrometallurgical facility in Quebec, with “proximity to product offtakes, availability of infrastructure and utilities and access to suitable labour markets” being prime considerations for where the company decides to construct it.

Cheryl Brandon, co-managing partner of Kinterra, explained in the Jan. 10 press release that Kinterra’s upstream nickel sulfide investments, in tandem with NiVolt’s hydrometallurgical facility, could result in a “first of its kind” integrated battery raw materials solution in Quebec.

“NiVolt will help to address the scarcity of critical minerals processing infrastructure in North America and Europe to meet the forecasted EV demand,” added Kamal Toor, co-managing partner of Kinterra, in the release.

– Ashley Fish-Robertson

General Motors and Komatsu announced they will work together to develop a hydrogen fuel cell power module for Komatsu’s 930E electric drive mining truck.

The haul truck has a nominal payload of about 290 tonnes and an operating weight of over 500,000 kilograms.

“Mining trucks are among the largest, most capable vehicles used in any industry,” said Charlie Freese, executive director of GM’s Global Hydrotec business, in a joint statement from the two companies. “We believe hydrogen

fuel cells are best suited to deliver zero emissions propulsion to these demanding applications.”

Since the expansion of the Electric Vehicle and Alternative Fuel Infrastructure Deployment Initiative (EVAFIDI) in Canada, which provides funding to establish hydrogen refuelling sites, some companies are looking to hydrogen fuel cell vehicles (FCVs).

Hydrogen fuel cells can store a large amount of energy and be refuelled in minutes, which fuel cell proponents say makes them preferable to electric vehicle batteries in certain cases, which are heavy and require more time to charge.

Komatsu and GM wrote in their joint statement that since hydrogen-powered technology is lightweight and refuels quickly, it is an ideal alternative to electrifying mining vehicles traditionally powered by diesel engines.

The first prototype is projected to be tested by the “mid-2020s” at Komatsu’s Arizona Proving Grounds using over two megawatts of Hydrotec power cubes, a hydrogen propulsion product that can be used for large vehicles such as aircrafts and mining haul trucks because of its transportable and durable features.

In an email to CIM Magazine, Komatsu said that the power cubes comprise two main components, a fuel cell stack made up of hundreds of individual cells, and the “balance of the power plant, which includes the compressor, H2 control, power electronics, and other supporting sensors and systems.”

Excess fuel cell power can be stored to recharge the battery for future consumption. If successful, the technology has the potential to scale to operate an entire mine’s fleet. “An entire mine could be operated with hydrogen fuel cell-powered

Honey Badger Silver Inc. announced the appointments of Dan O’Brien and Ben Meyer as CFO and corporate secretary, respectively. O’Brien holds a CFO position with other publicly listed exploration companies and brings more than 20 years of experience to the role. Meyer, who became a paralegal in 2019, brings 10 years of corporate compliance experience with knowledge of TSX-V and TSX stock exchange listed mineral exploration companies.

Osisko Development Corp. announced the departure of Luc Lessard as COO to become the CEO of Falco Resources Ltd. Éric Tremblay, who is currently on its board of directors, will assume the role in an interim position as the company searches for a permanent replacement.

Sherritt International Corporation has promoted Elvin Saruk to COO, where he will provide operational leadership to the metals division of the company in addition to the power and oil and gas divisions. Saruk brings more than 30 years of experience to the role and was previously senior vice-president of the power and oil and gas divisions, and head of growth projects. The company added that Dan Rusnell, senior vice-president of metals, has left the organization.

trucks,” Komatsu said in the email. “Hydrogen infrastructure such as production, distribution, storage and refuelling would also need to be scaled to support the fleet, but there is no limitation on size (small to large fleets are feasible).”

Komatsu has committed to reducing its global emissions by 50 per cent by 2030 and to carbon neutrality by 2050. The specific timeline for testing the prototype has yet to be announced.

– Noel Ormita

By Kelsey Rolfe

Four major mining organizations are working to consolidate their individual voluntary responsible mining codes and standards into a single standard for the industry.

The consolidation effort by ICMM, the Mining Association of Canada (MAC), Copper Mark and the World Gold Council (WGC) came in response to feedback from investors, civil society, policymakers and downstream customers, as well as from members of the industry itself, for one consistent standard.

“Having been involved in the industry and standards development in the past, we’ve seen real organic growth in responsible mining standards initiatives. It’s like a thousand flowers blooming, and in many respects that’s a good and healthy thing until it isn’t,” said Aidan Davy, cochief operating officer at ICMM, in an interview with CIM Magazine. “Things are too complex and hard to navigate for different stakeholder groups, and that was the thing that motivated us to go down this route.”

The organizations said that the consolidated standard could have the widest coverage of any voluntary responsible mining standard so far, with initial implementation by more than 80 mining companies with roughly 700 operations across almost 60 countries if everyone in their collective memberships participated. Davy said the “bigger prize” is the potential ability to affect change at scale by reaching companies that have not participated in the past.

“If you think about the ability to implement any of these [four standards], they’re hidden behind a paywall of membership today,” he said. “Imagine a future where the standard is housed within an independent entity and membership is no longer a barrier: it opens up an ability for a much wider group of companies to be part of this endeavour.”

Pierre Gratton, MAC’s president and chief executive officer, told CIM Magazine that ICMM initially approached the other partners in early 2023, and the four organizations put together an initial draft for a unified standard last year. That was sent out to two advisory groups of indus-

try members and stakeholders for their thoughts, which generated “lots of comments,” he said.

“This is not a small undertaking, and it’s going to take some time,” he said. “I think the potential of a unified, broadbased standard with the backing of so many companies is very attractive for many, not just for the industry itself, but it’s going to be a lot of work. It’s not just what it looks like [in the end] but how we get there, and that there are lots of opportunities for stakeholders to be involved in its development.”

Davy said the associations expect to release a draft, with feedback incorporated from the advisory groups, for public consultation sometime in 2024.

The organizations said they are using the best components from each individual standard—ICMM’s mining principles, MAC’s Towards Sustainable Mining (TSM) performance system, Copper Mark’s assurance framework and the WGC’s responsible gold mining principles—as the foundation for the new standard.

ICMM’s mining principles set out environmental, social and governance (ESG) requirements for its members through 39 performance expectations on ethical busi-

ness practices, health and safety, risk management and more, as well as nine position statements from the council on industry challenges, including mineral revenue transparency, climate change, water stewardship and tailings governance.

“We’ve seen real organic growth in responsible mining standards initiatives. It’s like a thousand flowers blooming, and in many respects that’s a good and healthy thing until it isn’t.”

– Aidan Davy,

co-chief operating officer at ICMM

MAC’s TSM program evaluates companies’ social and environmental performance at a mine site level against 30 performance indicators, including for Indigenous and community relationships, preventing child and forced labour, managing biodiversity and conservation, and crisis management. Every three years companies must have their results validated by an independent auditor

recognized by MAC, as well as give communities near their mine one month’s notice so that they can participate in the audit if they want to. Companies must also disclose their performance. Eleven mining associations around the world have adopted the TSM program since it launched in 2004.

Copper Mark is a set of standards for responsibly mining copper, nickel and zinc, covering stakeholder engagement, responsible supply chains, collective bargaining, health and safety, climate action and greenhouse gas reduction, human rights and more. Participating companies conduct site-level evaluations and then must have them independently verified. More than 20 per cent of global copper is

In case you missed it, here’s some notable news since the last issue of CIM Magazine, which is just a sample of the news you’ll find in our weekly recap emailed to our newsletter subscribers.

On Jan. 18, Canada gave the territory of Nunavut (pictured) control over its public lands, freshwater and nonrenewable resources, which include gold, diamond, iron, cobalt and rare earth metals reserves. Alongside Nunavut Premier P.J. Akeeagok, Prime Minister Justin Trudeau signed an agreement in Iqaluit, the territory’s capital, allowing it the right to collect royalties from its mined resources, that would have previously been sent to the federal government. Up until now, Nunavut remained the sole northern territory without a devolution agreement.

A research paper published in Nature’s Communications Earth & Environment journal details what its authors believe was the primary cause of the failure of the tailings dam at Vale’s Córrego do Feijão iron ore mine in Brumadinho, Brazil, in January 2019. The research suggested that some initial slip surfaces

currently produced by Copper Markassured operations.

WGC’s responsible gold mining principles cover ESG criteria for gold mining operations, including ethical conduct, labour rights and land use and mine closure, which participating companies must report publicly on and obtain independent assurance of their conformance.

Davy said all four partners are committed to a multi-stakeholder governance system for the standard, like TSM and Copper Mark currently have. In terms of the standard itself, he noted that both ICMM and WGC are principles-based standards covering a broader array of cri-

had already appeared in the tailings during construction of the second of the upstream dam’s 10 steps, and they increased in length as construction progressed. Following the decommissioning of the dam in 2016, they continued to expand due to creep deformation, and when they reached critical length in 2019, this triggered the collapse of the entire dam. The findings could help identify risks at existing tailings dams, according to the study authors.

Indigenous opposition in Canada to online claim staking continues to grow. First Nations leaders in Ontario want a year-long moratorium on the staking process. The Mining Lands Administration System (MLAS), introduced in 2018, allows anyone to register and stake an Ontario mineral claim online. The Chiefs of Ontario urged a pause on the practice, stating that the current system bypasses Indigenous consent, consultations and accommodations. This follows a decision last fall from the B.C. Supreme Court, which ruled in favour of two First Nations that argued that the province’s online claim staking process did not satisfy the government’s duty to consult.

A majority of global mine sites and exploration zones are undocumented, according to new research in Nature. About 67,000 square kilometres, or 56 per cent, out of 120,000 square kilometres of mining land has missing documentation about production, according to data collected through satellite imaging.

COP28 countries have pledged to “transition away” from fossil fuels. The international conference focused on climate change concluded on Dec. 12, 2023,

teria, while TSM and Copper Mark have fewer performance areas but are much more prescriptive in their approach. He said he believes the consolidated standard will combine both approaches to ultimately be more prescriptive, while covering a broader scope of issues.

He also expects the standard will have an assurance process that involves independent third-party organizations, in line with TSM, Copper Mark and the WGC’s principles, rather than the self-assessments ICMM’s principles allow for.

One question still to be answered is how to ensure the assurance process is “sufficiently robust” without being costprohibitive for smaller companies to participate, Davy said.

with a non-binding commitment to move away from coal, oil and natural gas over the next few decades to reach net zero goals, without a clear timeline.

The federal government will follow through with COP28 commitments and introduce emissions cut targets for oil and gas companies. It announced that oil and gas companies will be required to reduce emissions by 35 to 38 per cent below 2019 levels in the next six years through a cap-and-trade system. The Canadian Association of Energy Contractors, the Explorers and Producers Association of Canada and politicians in the oil sands-rich province of Alberta have voiced opposition to the new emissions cap.

Hidden for thousands of years, woolly mammoth remains were uncovered by North Dakota coal miners. The initial discovery, a seven-foot-long tusk, weighing in at over 50 pounds, was found in May 2023 buried 40 feet deep at North American Coal Corporation’s Freedom mine near Beulah, and is now estimated to be anywhere from 10,000 to 100,000 years old. A later dig around the site revealed over 20 more bones, which may make it the most complete mammoth skeleton ever found in the state.

Stay up to date on the latest mining developments with our weekly news recap, where we catch you up on the most relevant and topical mining news from CIM Magazine and elsewhere you might have missed.

Davy declined to name participants on either the multi-stakeholder or industry advisory groups until the standard is available for public consultation, but said that the multi-stakeholder group is comprised of representatives from the investment community, buyers of mined products, civil society and international organizations. The industry advisory group has representation from various geographies, commodities and companies that have participated in each of the four standards.

Barrick Gold Corporation announced in a Nov. 28, 2023, press release that it was “actively involved” in the development of the standard, with a seat on the industry advisory board, as well as being a member of three of the organizations.

Mark Bristow, Barrick’s president and chief executive officer, stated in the release that the company supports the initiative and has long been an advocate for standards consolidation.

“Having one standard for responsible mining will not only provide clear direction on what good should look like but would reduce the complexity that exists with the numerous standards currently in circulation,” Bristow said. CIM

Graphite, which has generated renewed interest for its role in battery applications, is among the non-metallic minerals addressed by the updated industrial mineral guidelines.

Raiseboring Raise

Underground

Mechanical

Engineering

Specialty

The CIM Mineral Resources and Mineral Reserves (MRMR) Committee recently updated the CIM Industrial Minerals Leading Practice Guidelines for the first time in 20 years. The refresh covers all the same concepts as the 2003 version, and includes updates to reflect current industry practices in exploration, mineral resource estimation and mineral reserve estimation for practitioners working with industrial minerals in Canada. The document also provides enhanced clarity on the guidelines for working with certain industrial minerals.

Deborah McCombe, technical director of the global mining advisory at SLR Consulting and co-chair of the MRMR Committee, said that the update was needed because there are particular product specifications that only apply to industrial minerals and would not necessarily be covered in detail in the 2019 MRMR Best

Practice Guidelines for preparing mineral resource and mineral reserve estimates.

“We still refer to the MRMR industry guidelines that were updated in 2019, but there’s some more specific aspects that only apply to industrial minerals,” she said. “For example, the product quality specifications are really important, as well as you have to have a market to sell the mineral. The market might be rather small, and it might be very specific to the quality that you need, so those things need to be taken into consideration far more when you’re preparing a resource estimate and the reserves [for industrial minerals].”

The other reason for the update was to provide additional guidance on the various types of common industrial minerals, their properties and which categories they fall into. The document defined industrial minerals as being “generally considered to include non-metallic minerals, mineral products, or materials that provide raw material inputs for the construction, chemical, and manufacturing industries.”

However, it also stated that one of the key challenges of the industrial minerals sector today is “to define a commonly accepted listing of which types of minerals, materials or mineral deposits can be considered as industrial minerals.” To help address this challenge, the guidelines include a summary list of the most common industrial minerals.

“More people are looking at materials like graphite in more detail today, and so when that happens, it’s good to have an update on industry practices to get everyone up to speed and so they can keep their disclosures consistent,” McCombe said.

“Experience has shown that over time leading practices become industry accepted practices,” the document reads. “Current industry accepted practices are context specific and continually evolve as industry experience is gained, new technologies are adopted, and public expectations, market expectations and government legal frameworks change. All of CIM’s Leading Practice Guidelines are intended to be updated on a periodic basis.”

Led by Reno Pressacco, associate principal geologist at SLR Consulting Ltd. and an active member of the MRMR Committee focusing on best practices, the update took roughly a year and a half to complete. The process involved circulating a first draft to the MRMR Committee for comments before sharing it with members of the public, specifically those who are cur-

rently working in industrial minerals. Once those comments were incorporated, the document was sent to regulators for their review, and finally, to CIM council.

McCombe said the update will be particularly useful for industrial minerals practitioners who have just begun working with a new material. “It’ll be helpful for people that are maybe new to preparing, or newly involved with, say, something like graphite, and they’re getting up to speed on it,” she said.

Looking ahead, McCombe said that the Canadian Securities Administrators have advised the MRMR Committee that they are working on an update to National Instrument 43-101, which means there will be more work ahead for the committee as they collaborate to update some of their other guidelines in tandem.

“We’ve also heard from the regulators—the Canadian Securities Administrators—that they’d like to incorporate these guidelines into the companion policy to National Instrument 43-101 Standards of Disclosure for Mineral Products, so we’d like to keep those as up to date as possible,” she said. “And because these are incorporated by reference, it’s part of the guidelines that the regulators look to when they’re reviewing companies’ disclosure about their projects.”

– Mackenzie Patterson

On Jan. 11, Vale Base Metals announced on LinkedIn that the company’s Integrated Remote Operating Centre (iROC) has now begun to service all five of its underground mines in Ontario. The centre will officially service the Coleman mine, the Copper Cliff mine, the Creighton mine, the Garson mine and the Totten mine. Vale’s Ontario operations produce nickel, copper, cobalt, platinum group metals, gold and silver.

The centre, located at Vale’s North Atlantic Operations Centre in Sudbury, relies on digital technology to act as an “air traffic controller of sorts,” Vale explained in the LinkedIn post. The centre monitors underground mining activities on a continual basis, such as the use of company equipment and daily production, while offering direct feedback and, if needed, support. “It’s another way we’re leveraging technology to ensure we’re a safe, reliable, best-in-class operator,” Vale stated.

In an article published on Jan. 11 by International Mining, Vale told the pub -

lication that its “integrated remote operating centre combines proprietary and off-the-shelf technology to provide a comprehensive view of productivity and overall mine performance.” Vale added that through the centre’s updated location awareness, and the constant monitoring of hazards such as seismic activity, it expects emergency response times to be reduced.

This news comes after Epiroc’s Jan. 9 announcement, in which the equipment manufacturer stated that it had entered into a non-binding memorandum of understanding with Vale to collaborate on applying and upgrading Epiroc’s solutions for automation, electrification and digitalization in underground mining. The two companies will develop, test and utilize equipment and techniques in areas that include long-hole drilling, blasting, face drilling, bolting, mucking and hauling. This partnership will see Vale continue to use Epiroc’s technology in underground mining activities to remove employees from higher-risk areas, such as the rock face, production drilling locations and ground support areas, ultimately supporting safer mining activities.

“We are excited about our shared commitment with Vale Base Metals to accelerate the transformation of the mining industry through innovation that will keep pushing the benchmark of safety for workers, without compromising on productivity,” said Sarah Hoffman, vice-president of sales and marketing at Epiroc’s underground division, in the release.

– Ashley Fish-Robertson

Courtesy of Rob Labbé

By Rob Labbé

Part 2 of a four-part series on cyber resilience in the mining and metals industry

n the December/January issue, I discussed transitioning from cybersecurity-based approaches to protect operations towards a more holistic cyber resilience approach. While cybersecurity relies on deploying security controls to protect critical systems and technology, cyber resilience focuses on business objectives and how an organization can ensure those objectives are met.

Effective cyber resilience consists of three critical domains of equal weighting: operational resilience, resilient cybersecurity and resilient cyber communications. This article will dig deeper into operational resilience and how mining organizations can build more resilient operations.

While there are many potential causes of crucial technology and system outages, cyber resilience focuses on reducing the impact of those outages on production, ensuring continued operations for the time necessary to restore those services. As operations rely more on technology for basic operations, work to ensure operational resilience becomes even more critical.

Planning is a prerequisite for building cyber resilience. From the inventory of all systems and technology used, the “heartbeat” systems—those systems and technology without which operations cannot continue—must be identified. Disaster recovery and business continuity plans must be completed for the critical applications, network components and infrastructure that support the heartbeat systems.

Disaster recovery plans (DRPs) contain the processes necessary to restore systems to a functional state. Most importantly for cyber resilience planning, the DRPs must contain recovery time objectives (RTOs) indicating how long technology teams will take to restore the systems.

In contrast with DRPs, business continuity plans (BCPs) are focused on the business processes and how they can continue without those critical technology systems. The BCP documents the processes necessary to continue that critical business function without the technology. MM-ISAC defines a resilient operation as one where the BCP allows business to continue 50 per cent longer than the expected time to recover from technology and systems outages.

Of course, both these sets of plans must be continually tested, rehearsed and updated to ensure that all key teams involved in both business continuity and disaster recovery know their roles and so that performance assumptions in those plans continue to be accurate over time.

To illustrate how an operation can establish and maintain operational resilience, let’s look at one function in a typical mine: haulage. For this example, let us assume a traditional open-pit operation, utilizing a fleet of haul trucks moving

material from the pit to the plant for processing. In order to safely co-ordinate the movement and assignment of those haul trucks, the operation has deployed a computer-based dispatch system used by the mine dispatchers to track the location of trucks, assign trucks to their destination and resolve any routing conflicts that will impact the efficiency of the haulage operation, providing guidance and directions to the operators through their in-cab computers connected to the mine’s wireless network.

To establish resilience, the heartbeat technology must be identified, and DRPs must be developed to guide the restoration of those systems. In this case, the heartbeat systems and their RTOs are identified as:

System Description Recovery time objective (RTO)

Dispatch Software and hardware 5 days system that run the dispatch function, including the dispatch office PCs and the in-cab mobile computers

Mine Mine wired network, 2 days wired switches and routers that network connect to the mine dispatch PCs and servers

Mine Mine wireless network 10 days wireless connecting mobile network equipment to the larger mine network

To ensure the mine haulage function is operationally resilient, the BCP developed is a set of processes and procedures to manually dispatch vehicles, utilizing radio communications with dispatchers, for 15 days. To validate this plan, a tabletop exercise is conducted, followed by a live test over the course of one shift. This test identifies that, while operations can continue in this manual mode, there is a 15 per cent loss in efficiency. The operation leadership views that loss as acceptable for a maximum of 15 days and signs off on the plan.

Fast forward to the future, and in this case study this operation has decided to deploy an autonomous haulage system (AHS) to replace the fleet of operator-driven haulage vehicles. The deployment of the new AHS will replace the dispatch system, resulting in a change to the list of heartbeat systems as follows:

System Description Recovery time objective (RTO)

AHS Software and hardware 10 days system that run the AHS system both on the network and in the haulage vehicles

Mine Mine wired network, 2 days wired switches and routers that network connect to the mine dispatch PCs and servers

Mine Mine wireless network 10 days wireless connecting mobile network equipment to the larger mine network

Notice that due to the increased complexity of the AHS system over the previous dispatch system, the recovery time to restore functionality has increased to 10 days. In developing a BCP to cover the 15 days necessary, the operation hits a snag. While the existing manual dispatch procedures would remain effective, there is no possible solution to staff all the trucks with drivers. The best-case scenario would have only 15 per cent of the trucks manned with qualified, current drivers who can safely operate the trucks. This would lead to a loss of 85 per cent in haulage efficiency for the 15 days. That level of mine performance would result in the plant being starved for input and a plant shutdown. Operation management identifies that the site can only absorb an 85 per cent loss of mine productivity for one day before production must stop—the operation is no longer resilient.

This scenario illustrates the challenges operations face as they deploy new technology; be it automation in the mine or machine learning and artificial intelligence in the plant, often, resilience is lost.

To restore resilience in this scenario, the operation must reach a point where the plant will no longer be starved for input material should an outage occur. A full process view of cyber resilience will help the operation solve this issue. Teams at the site propose solutions to the problem:

Technology team: Deploy fully redundant systems for the AHS, wired and wireless systems. This will include developing a complete “warm standby” system that can be activated in the case of a failure, stocking critical spares for all network equipment for immediate replacement and ensuring that the necessary technical capabilities are always available on short notice. This will reduce the RTO for all systems to less than 24 hours. However, the cost will be significant, nearly doubling the operational expenses of the AHS system.

Mine operations: Ensure sufficient trained drivers at the site to operate the haulage fleet in case of an AHS outage by cross-training staff as haul truck operators. This, however, poses other challenges: first, there is a cost to train and maintain skills in that group of operators, and testing shows that if deployed, their lack of practice will result in an increased efficiency hit. In addition, union contracts do not currently allow union staff to be used this way, so an agreement with labour unions will need to be secured.

Plant team: Increase the ore stockpile from one day to 15 days to maintain plant operations while the AHS systems are recovered. This solution will require sufficient space for the stockpiles and a further increase in mining rates to establish that stockpile.

In isolation, each of these solutions to re-establish resilience is costly and potentially disruptive to the operation. By taking an overall view of the business process, the operation can combine lower cost options to achieve resilience. For example, the operation can implement a handful of lower-cost, high-value redundancy options that reduce the RTO from 10 days to six, thus reducing the period that needs to be covered by the BCP to nine days. To ensure the plant has sufficient feedstock for that period, the site decided to take advantage of an upcoming maintenance shutdown at the plant to build a stockpile to buffer any AHS outage.

By taking a full business process view of resilience, operations can protect themselves from all types of outages. This is a more effective and easier-to-manage approach than the traditional approaches of applying excessive cyber controls to cover cyber risk, redundancy to take care of technology risk and separate business process changes for other risks. Rather than focusing on individual risks and domains, the operation eliminates the impact of the outage by focusing on the result—in this case, maintaining ore supply at the plant.

In the March/April issue, I will focus on resilient cybersecurity. CIM

By Mackenzie Patterson

Each week, about 500,000 Canadians are unable to work because of mental health challenges, according to a 2019 report from Deloitte. The Toronto-based research institute Future Skills Centre surveyed more than 500 Canadians about this issue for a June 2023 report titled “Improving the Quality of Work in Canada: Prioritizing mental health with diverse and inclusive benefits” and found that 38 per cent of the respondents reported that their struggles with mental health had caused them to take time off work over the past five years. Of these, 80 per cent noted that the “demands of their job and work environment” were key factors in these struggles.

While mental health concerns like stress, depression, anxiety and burnout are common across the workforce today, they are especially prominent in certain industries—including mining.

In 2019, Laurentian University’s Centre for Research in Occupational Safety and Health (CROSH) released the results of a landmark study it had conducted in partnership with Vale and the United Steelworkers Union (USW) titled “Mining Mental Health.”

The project looked at the mental health of 2,224 Vale mining workers across its Ontario operations over a three-year period and found that more than half (56 per cent) reported symptoms of mental health conditions such as depression or post-traumatic stress. It also found that for more than 23 per cent of respondents, stress levels were “concerning,” and that symptoms of stress were exacerbated for workers who spent a significant amount of time underground.

Lisa Lounsbury, an Ontario-based mental health trainer, has worked for several mining companies with a presence in

northern Ontario through her company New Day Wellness Inc. Having grown up in Sudbury with her father and many of her friends working in mining, she said she has long understood the impact working conditions in mining can have on mental health.

“A lot of workers work in the dark, they work under dangerous conditions, there are near misses, there are fatalities. It’s a highstress environment,” Lounsbury said. “Often, it’s not a healthy working environment, especially if they’re working in remote communities. They’re not eating well, they’re not sleeping well, they’re lonely, they’re away from their families. The industry can be hard on employees.”

The high rates of mental health conditions among Ontario mining workers highlighted by the Mining Mental Health study are concerning, not only because it could result in a lower quality of life for these individuals, but there is also a higher margin for serious accidents in the mining industry. With this in mind, the ripple effects of poor mental health in the industry have the potential to be truly tragic.

Lindsay Digby is a health and safety specialist and Canadian Mental Health Association-certified psychological health and safety advisor at Workplace Safety North (WSN), a not-forprofit health and safety association that serves Ontario’s mining and forestry industries. WSN offers several workplace mental health training programs that can help organizations gain a better understanding of how mental health impacts

performance, and how to recognize the signs of a mental health issue in colleagues.

“We tie in the concept of being fit for duty to this conversation, because mental health—you can’t leave home without it,” she said. “When you show up to work, whether you’re having a good day or bad day, it’s going to impact performance.”

“We need to make mental health as important as physical health.”

– Sandor Basa, underground supervisor and miner at Vale Canada

WSN’s training programs cover a broad range of crucial topics related to mental health, including definitions of mental health, mental harm and mental illness, and why it is important to distinguish among the three. They also leverage the Mental Health Continuum Model (MHCM), developed by the Mental Health Commission of Canada, to help participants recognize signs and indicators of declining mental health. The sessions help to arm employees with various tools and resources to navigate mental health concerns in the workplace, including a lesson on how to implement a “personal action plan” if you do notice that your mental health symptoms are worsening.

Since the launch of its mental health related programming in 2021, 4,217 people in the sectors that WSN serves have participated. Of these, 87 per cent said that their mental health knowledge had increased from the training, while 81 per cent said they now feel comfortable talking about mental health in the workplace. What is more, 87 per cent of participants said they have changed their own practices or behaviours since participating in the training.

Although Digby emphasized that arming employees with mental health awareness and training is crucial for all industries, she said that it can be especially life-saving in industries like mining.