Froth recovery upgrade Improve Withperformancemetallurgicaladvancedfrothphasecontrol

LEVEL SENSOR ACTUATORS CROWDERSFROTH

The Froth Recovery Upgrade package enables you to better control the froth phase. The addition of the radial froth crowders adds a new dimension to the control strategy, enabling you to shift the grade recovery curve by allowing either deeper froth or faster froth removal.

Find out more at fl smidth.com

30 A promising future in la belle province

While gold continues to shine, explorers are drawn to new frontiers and the potential for battery metals

By Dinah Zeldin34 Greenstone builds on a goodneighbour philosophy

Partnerships were formed and local community buy-in was obtained before construction of the gold mine could begin

By Alexandra Lopez-Pacheco38 Planning for anything Enterprise resource planning software is finding its home in the mining industry as a flexible way to manage operations

22 net-zero challenge

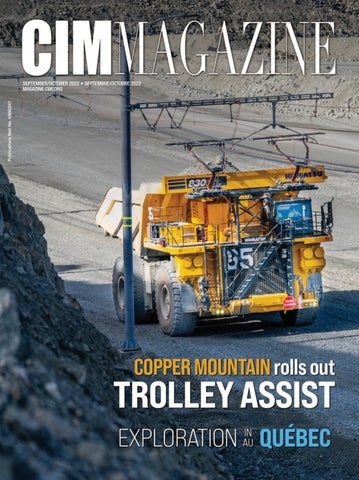

All in on trolley assist

The technology will play a key role in helping Copper Mountain reach its ambitious goal of net-zero carbon emissions by 2035

Par Dinah Zeldin soutien Alexandra Lopez-Pacheco Matthew Parizot Bjanka Korb and of mining Andrew Snook Michele Beacom

Reader engagement

Earlier this year, we reached out and asked you to tell us about yourselves and your media-consumption habits. We do this every few years to help understand who our audience is, your preferences and how we can refine the work we do to meet your needs. Our reader survey also helps equip our sales team for its communications with current and prospective advertisers.

Generally, the responses from the periodic surveys don’t change dramatically over time. However, it had been three years and a pandemic since the last time we polled our readers. Back in 2019 we didn’t even ask if webinars were part of your mining media diet. At that point, we had only begun to experiment with them ourselves. This year, nearly half of respondents said webi nars are one of their go-to sources for minerals-industry content.

So I am happy to report that, after a summer hiatus, September will see the return of the CIM Magazine Solutions Exchange webinar. We are also exploring how we might expand our webinar offerings for the future and whether this short and focused format is a winning combination to outlast the pandemic.

Thanks to all of you who took the time to complete the survey and con gratulations to the three winners of the gift cards.

1st Prize: Zoran Ivosevic

2nd Prize: David Cisyk

3rd Prize: Ernest Armitt

I was also excited, if a little roughed up, to get some unso licited feedback from a reader. Whether through surveys or let ters, your perspectives help make this a better magazine. So, I will leave the last word in this column to the letter writer:

Regarding your “Lucky strike” editor’s letter (p. 10, May 2022) and related article “Thin Edge of the Wedge” (p. 42), you call for exploration companies to actively reduce their carbon footprint. Although perhaps noble and obviously woke, I believe it is very short sighted. Specifically, your refer ence to doing it regardless of “materiality.”

Consider the magnitude of the challenge ahead of the min ing industry to provide the metals needed for the net-zero energy and transportation transition by 2050. In less than 30 years, in North America, we will have to convert some 400 mil lion vehicles to electric or other non-internal combustion engines. For EVs, each vehicle requires a ½-ton battery made of metals extracted and processed from some 250 tons of mined materials.Thatequates to 100 billion tons of mined materials. That’s just North America! Europe has a similar number of vehicles and China and India have twice as many to produce or con vert. And then we have to convert the energy sector to noncarbon fuels and connect it all to the grid – a gargantuan task.

Yes, we can cut down on the total number of future vehicles by being more efficient at transporting people and things, but they all require even more metal utilization. If we burden explo ration companies with non-material, feel-good, woke direc tives, we make exploration less efficient by spending dollars and time on things that won’t make a difference. If they make us more efficient, I’m all for it; if not, it is (at best) misguided. Exploration should spend its time and dollars being the most efficient it can be so we can find, develop and build the mines that will get us to net zero by 2050. That’s only a generation away! Let’s focus on the material things and get the job done!

–Rick Van Nieuwenhuyse, president and CEO of Contango Ore Inc.

Ryan Bergen,@Ryan_CIM_Mageditor@cim.orgEditor-in-chief

Editor-in-chief Ryan Bergen, rbergen@cim.org

Managing editor Michele Beacom, mbeacom@cim.org

Section editors Carolyn Gruske, cgruske@cim.org; Matthew Parizot, mparizot@cim.org

Editorial intern Sarah St-Pierre, sst-pierre@cim.org

Contributors Ashley Fish-Robertson, Lynn Greiner, Bjanka Korb, Alexandra Lopez-Pacheco, Rosemary Mantini, Andy Randell, Kelsey Rolfe, Peter Shepherd, Andrew Snook, Dinah Zeldin

Editorial advisory board Mohammad Babaei Khorzhoughi, Vic Pakalnis, Steve Rusk, Nathan Stubina

Translations Karen Rolland, karen.g.rolland@gmail.com

Layout and design Clò Communications Inc.,

a year by:

Canadian Institute of Mining, Metallurgy and Petroleum 1040 3500 de Maisonneuve Blvd. West Westmount, QC H3Z 3C1

Tel.: 514.939.2710; Fax: 514.939.2714

www.cim.org; magazine@cim.org

2020 2021 2022

Advertising sales

Dovetail Communications Inc.

Tel.: 905.886.6640; Fax: 905.886.6615; www.dvtail.com

Senior Account Executives

Leesa Nacht, lnacht@dvtail.com, 905.707.3521

Dinah Quattrin, dquattrin@dvtail.com, 905.707.3508 Christopher Forbes, cforbes@dvtail.com, 905.707.3516

Subscriptions

Online version included in CIM Membership ($197/yr). Print version for institutions or agencies – Canada: $275/yr (AB, BC, MB, NT, NU, SK, YT add 5% GST; ON add 13% HST; QC add 5% GST + 9.975% PST; NB, NL, NS, PE add 15% HST). Print version for institutions or agencies – USA/International: US$325/yr. Online access to single copy: $50.

Copyright©2022. All rights reserved.

ISSN 1718-4177. Publications Mail No. 09786. Postage paid at CPA Saint-Laurent, QC.

Dépôt légal: Bibliothèque nationale du Québec. The Institute, as a body, is not responsible for statements made or opinions advanced either in articles or in any discussion appearing in its publications

THE PROGRAM

LECTURERS ARE AVAILABLE FOR YOUR ONLINE OR IN-PERSON EVENTS.

The Distinguished Lecturers program is offered to 31 CIM Branches, 11 Technical Societies and 8 Student Chapters. Universities can also request a lecture.

The CIM Distinguished Lecturers program started in 1968 and has continuously provided a lineup of individuals who have shared their knowledge with the mining community for over five decades.

Every year, the lecturers are elected by their peers through the CIM Awards program and hold the title for a complete season (September to June).

CIM is privileged to count more than 260 of the industry’s finest as its lecturers. Because the motto “once a lecturer, always a lecturer” defines our pride and dedication in ensuring that the learning curve is endless, a complete list of past lecturers is available at www.cim.org, where you can benefit from the ever-growing pool of expertise that the program has to offer.

The CIM Foundation’s generous support allows the CIM Distinguished Lecturers Program to connect CIM members with leading industry expertise.

The CIM Distinguished Lecturers program is owned and operated by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

Schoeck in Born to Build, a People’s History of the Faculty of Engineering, University of Alberta. Trust and collaboration were foundational blocks that led to tremendous success at the U of A engineering faculty during Dr. Lynch’s era, including a 77 per cent increase in total undergraduate enrollment, a 341 per cent increase in graduate enrollment, $950 million raised to support special initiatives and expansions, 20 Natural Sciences and Engi neering Research Council of Canada Industrial Research chairs, and over $600 million in external sponsored research funding.

For me, however, the cornerstone of Dr. Lynch’s legacy was set at the end of his tenure as dean, and the benefit of which will endure for many years. Dr. Lynch and his wife Joan, together with many colleagues, friends and supporters, generously provided more than $6 million for the establishment of the David and Joan Lynch School of Engineering Safety and Risk Management.

This generosity enabled the full realization of a vision shared by many including long-time CIM’er Gord Winkel, threetime recipient of the CIM Distinguished Lecturer Award and the 2019 CIM National Safety Leadership Medal. In 2010, as a retired Syncrude executive having spent more than a decade as a guest lecturer in the program from which the Lynch School arose, Gord joined the faculty as an industrial professor with a vision for expanding the delivery and reach of the program. In 2016 this vision was realized with the establishment of the Lynch School, which instituted a senior-year course in risk management as a mandatory core-competency requirement for all undergraduate engineering students in every engineer ing discipline at the university.

Taking managementrisk to the next level

The Right Honourable Mary Simon, Governor General of Canada, announced appointments to the Order of Canada, one of our nation’s highest awards, on June 29, 2022. Among those honoured was David Thomas Lynch of Edmonton Alberta, who was appointed an Officer of the Order “for his contributions to the science and technology of environ mental engineering in Canada, and for his visionary leadership in engineering education.”

Dr. Lynch served four consecutive terms as dean of engineer ing at the University of Alberta, from 1994 through 2015, with his approach having taken “a different path than other deans. [He] focused on government and industry, serving on more than 30 Alberta-based, national and international advisory, management, government and corporate boards and agencies. He established trust with many people through this service,” noted Ellen

The trust-building and collaborative approach is alive and well at the Lynch School today, where a growing team of aca demic leaders engage with corporations, agencies, associations and other organizations regularly to improve risk-management effectiveness on many fronts through research, education, work shops and keynotes, leveraging the school’s industry executive board and working across many industry sectors. In 2022, the Lynch School will reach a milestone wherein 5,000 engineering students will have graduated with a fundamental grounding in safety and this number is expected to double in the next five years. The ripple effect of graduating 10,000 engineers in engi neering safety and risk management means lives saved, harm prevented, the environment protected and businesses spared from tragic loss. That is an enduring legacy indeed congratu lations to all who are involved in this work.

I can’t help but wonder what will be possible by leveraging this work through the CIM Health & Safety Society and CIM Canadian Mining Schools’ Committee. What is clear and certain is that technology, collaboration and improved risk management are key enablers for a sustainable mining future in Canada.

Anne Marie Toutant CIM PresidentThorough mapping

Sandvik’s AutoMine Mapping Solution is a new product that captures 3D scans of mine areas, creating an environment with routes that can then be navigated by automated equipment. Intended to minimize production downtime, the mapping kit allows for other equipment to operate within the area while it is being mapped.

“With this 3D mapping tool, [the 3D scan] can be done in less than an hour, potentially, as far as impacting on the production area goes,” said Eddie Bilborough, business manager, automation and digitalization at Sandvik.

Detailed muckpile analysis

The BMX Fragmenter is the new post-blast fragmentation analysis software resulting from a collaboration between 3GSM GmbH and RAM. The platform converts high-resolution drone images into 3D renderings of the muckpile, colour-coding different particle sizes, all done without the need for ground reference markers – or an internet connection. “This thing is a completely autonomous standalone program that allows you to operate in the middle of nowhere and get that job done with very, very high accuracy,” said Robert McClure, president of RAM. After a 15-minute flight, a model showing the width, throw and height of the muckpile is generated and can be refined with editing tools.

Portable digital twins

Clirio, Inc. has developed a software solution for 3D field data capture, dubbed Clirio. “Once these 3D captures are made, in about 30 seconds to a minute using your AR app and your iPhone or an iPad Pro, they are then synced up to our cloud in a private workspace for you and your team,” explained Ron Klopfer, Clirio CEO. The map-based workspace allows field observations to be automatically georeferenced, letting users build a digital twin of worksites that their remote collaborators can then interact with and even visit through virtual and augmented reality tools.

Compiled by Sarah St-Pierre ClirioofCourtesyDevelopments

Russia’s war raises ESG questions for miners

A new report shows that companies looking to fill the critical minerals supply gap resulting from western sanctions will have to contend with unforeseen ESG risks

Russia’s invasion of Ukraine has been a significant contributor to the chaos affecting metals markets over the past months, and as a result, it might be time for some mining companies to make some tough decisions.

Heavy sanctions have made operat ing in Russia and its ally Belarus near impossible, but demand for critical min erals needed for the green energy transi

tion – copper, nickel and cobalt, for example – is expected to grow signifi cantly over the next decade, and Russia is a major producer for several of them. According to a new report from Verisk Maplecroft, in order to try and bridge that supply gap, mining companies will be required to operate in lesser-known markets that can be prone to higher lev els of ESG risk.

The report used Verisk Maplecroft’s Industry Risk Analytics data, which measures 51 different risks across 198 different countries, but specifically focused on four that are critical to ESG in the mining industry: water pollution, biodiversity, Indigenous Peoples’ rights, and land, property and housing rights. According to Will Nichols, head of climate and resilience at Verisk

By Matthew Parizot lesser the have the resources to help fill the gap left by Russia, but come with their own ESG risks.MaplecroftVeriskofCourtesy

Maplecroft, those areas were chosen specifically for a future-facing mining industry.“With our Industry Risk Analytics data, there’s a whole host of different things we could have potentially looked at, but these ones we thought were most prevalent to the coming mining indus try,” Nichols said. “But ESG can encom pass corruption, modern slavery and other aspects as well that could poten tially impinge on operators, especially if they’re unaware of the levels of these risks in these new markets.”

For instance, Russia contains seven per cent of the world’s copper reserves and provided most copper exports to the European Union in 2020. Without that supply, operators might instead look towards countries like the Democratic Republic of Congo, Zambia and Indone sia, which are characterized by the report as having high environmental and social risks compounded by high levels of corruption. As such, to avoid possible ESG risks, it is imperative that compa nies are aware of these risks ahead of time and try to address them.

“It’s difficult to find any major mining company that doesn’t have a code of con duct, and obviously they have investors holding their feet to the fire as well,” Nichols said. “But that doesn’t mean you don’t see ESG issues happen.”

It might be tempting for some compa nies to put ESG considerations to the side as they establish themselves in new mar kets to address the desperate need for these materials, but according to Nichols, that would be a mistake.

“I personally think that investors are taking a longer view. I think there is certainly still plenty of people who are looking quarter-to-quarter, but my expe rience with the clients that we speak to is that people are looking at ESG and sus tainability in a kind of longer-term con text,” Nichols said. “So if there is that kind of supply chain dip that is hitting profitability, if investors are convinced that a company is dealing with it in the right way and maintaining its ESG integrity, there is less of an issue. If a com pany was to throw off its ESG policies for short-term gain, I’m not sure many investors would be convinced by that.”

Unless new deposits in less risky mar kets are found, it will lead to a sort of unavoidable Catch 22 for companies look ing to take advantage of the upcoming demand. While an end to Russia’s war with Ukraine might seem to the opti mistic as a possible return to normalcy, according to Nichols, it’s unlikely that Russia will be a potential destination for American and European miners ever again. Rather, companies will instead have to quickly and carefully assess their risk profiles while building supply chains.

“It’s going to be difficult to return to Russia as a market. It’s a difficult ques tion for companies, because they’ll have supply chains built there, they’ve got all sorts of infrastructure already there, so the difficulty for them is starting anew in some of these other countries, which is what we’ve mentioned in terms of build ing up those relationships and finding out the risks in those markets,” Nichols said. “It’s ultimately a balance. Which risk are you prepared to deal with, and which are you not prepared to deal with? I think for each company, that’s going to be a slightly different calculation.” CIM

Your partner in the field and beyond

FROM THE WIRE

Compiled by Sarah St-Pierre

Vivien Janvier stepped in as Radis son’s new director of geology, bring ing with him over a decade of professional geology and research experience. Janvier has been involved with projects ranging from grassroots exploration to mature min ing Glencoreprojects.appointed

Liz Hewitt as an independent non-executive director. Hewitt has over 30 years of business experience in executive and nonexecutive positions, having previously worked in private equity.

Teck’s Don Lindsay will be retiring as president and CEO effective Septem ber 30, 2022, after 17 years at the company. Current executive vice president and CFO Jonathan Price will transition into the role of CEO fol lowing Lindsay’s departure while Harry “Red” Conger, executive vicepresident and COO, will be stepping in as president while remaining COO.

Peter Richardson is the incoming executive managing director at Nevada Gold Mines, with incumbent Greg Walker planning to retire at the end of December of this year. Richard son has a background in process engineering, project management, strategy and business development, and mining operations leadership.

Claude Schimper was appointed executive vice-president and COO of Kinross after being with the company for 10 years. Paul Tomory, former executive vice-president and CTO, has left the company as of August 31.

At Newmont, Peter Toth was announced as chief strategy and sus tainability officer. His appointment fol lows the retirement of Stephen Gottesfeld, who was with Newmont for 25 years, serving most recently as chief sustainability and external affairs officer.

Christian Milau is leaving Equinox Gold after six years, succeeded by Greg Smith as CEO and director. Smith was previously president of the company since 2017, when Equi nox was founded, and has a back ground as a chartered professional accountant.

Using geophysical data to “see through” glaciers

The University of British Columbia Mineral Deposit Research Unit (MDRU) has devised a new project that makes use of Geoscience BC’s existing geophysical data to help identify new critical miner als deposits in British Columbia’s north central region.

The area targeted by the project includes a portion of the Quesnel terrane situated between Williams Lake and Mackenzie. The Quesnel terrane, a deposit belt that spans the length of B.C. and is best known for porphyry coppergold with silver and/or molybdenum deposits, is host to a number of known mines, including Centerra Gold’s Mount Milligan, Imperial Metals’ Mount Polley and Taseko’s Gibraltar.

In the area of interest for the project, however, the terrane is largely buried under thick sediments left behind by gla ciers. This has made mapping and sam pling the bedrock at its surface hard to achieve. Using existing data, the MDRU is aiming to “look” past the sand and gravel, into the bedrock.

As the province strives to discover new deposits of critical minerals, the project will provide updated geological interpretations for the central Quesnel terrane. The new models will help facili tate the identification of settings that may be more likely to host economic min eralization for geologists and explorers.

The data used by the project was first compiled by Geoscience BC’s QUEST project in 2007, which conducted geo

chemical and geophysical surveys on the Quesnel terrane in that area. The MDRU will use the electromagnetic and gravity data from the surveys to help define the nature of the bedrock and differentiate between volcanic domains. It will also aim to find potential host mineralized zones by identifying intrusive structures andAccordingbodies.

to Geoscience BC, the data targeted by the project have been under used in interpreting the area’s bedrock that is covered by glacial till but shows promise with the MDRU’s methods.

“This project will build on the data and interpretations developed in a number of previous Geoscience BC-supported proj ects, including QUEST and CICGR [Cen tral Interior Copper-Gold Research],” said Christa Pellet, Geoscience BC vicepresident, minerals, “thereby continuing to improve our understanding of an area that is considered highly prospective.”

Sarah St-PierreGCM Mining and Aris Gold join forces in merger deal

GCM Mining and Aris Gold announced on July 25 that the two companies will be combining into a single entity, retaining the name Aris Gold Corporation. Once the transaction goes through, the new company will become one of the largest gold companies in Colombia, while also retaining assets in Guyana and Canada.

GCM already holds an approximate 44.3 per cent of Aris Gold shares and will acquire the outstanding shares at a ratio

The Quesnel terrane, a part of which is included in the project, is home to numerous mines, including Centerra Gold’s Mount Milligan mine (pictured).of half a common share of GCM for one common share of Aris Gold. Upon the transaction’s completion, GCM share holders are expected to own roughly 74 per cent of the group, while Aris Gold’s shareholders will own the remaining 26 perCombinedcent. cash and committed fund ing for the joint Aris Gold figures at US$657 million, complemented by cash flow generation from GCM’s Segovia operations in Colombia, which produced 206,389 ounces of gold in 2021. An esti mated US$10 million is expected in yearly general and administrative costs savings from eliminating redundant expenses through the merger.

Ian Telfer, Aris Gold chair, will serve as the merged company’s chair of the board, and Aris Gold CEO Neil Woodyer will be the new entity’s CEO and director. GCM’s Lombardo Paredes and Mike Davies, respectively CEO and CFO, will retire from their roles at the company.

“We are building a gold mining busi ness with scale, cash flow, a strong finan cial position with US$397 million of cash and US$260 million of additional com

mited funding, and a high-quality growth pipeline,” Woodyer said.

While the main source of revenue at the time of the transaction will be the Segovia operations, the joint portfolio will also include Aris Gold’s Marmato mine, also located in Colombia, which is

currently undergoing modernization and expansion efforts. Two advanced-stage open-pit projects, GCM’s Toroparu in Guyana and Aris Gold’s Juby project in Ontario, also figure among the combined assets, along with Aris Gold’s Soto Norte feasibility-stage project in Colombia.

For the merger to be realized, approval by Aris Gold and GCM share holders is still necessary. That is antici pated to happen in mid-September of this year at the respective shareholders’ meetings of the two companies. Govern

mental and regulatory go-aheads will also be “Therequired.combined group creates a topin-class company with multiple tier one assets,” said Telfer. “After Aris Gold became operator of the Soto Norte joint

venture, joining forces with GCM became a logical next step. Our increased scale will also broaden our future opportuni ties to continue building a [greater than one-million-ounce] producer over the next few years.” Sarah St-Pierre

Baffinland issues termination notices at Mary River mine

By Sarah St-PierreOn July 31, Baffinland sent termina tion notices to over 1,100 employees at its Mary River iron mine in Nunavut, preparing to shut down its operations for the remainder of the year if it fails to receive governmental re-approval to maintain its annual limit of ore extrac tion and shipment of six million tonnes.

Since 2018, Baffinland has shipped this amount of iron ore, receiving renewed permissions for one year in 2019 and for two years in 2020 from the Nunavut Impact Review Board (NIRB) to exceed the originally permitted limit of 4.2 million tonnes. This year’s applica tion for renewal with revisions was com pleted on May 30, shortly after the NIRB advised that Baffinland’s plan to expand Mary River, which involves raising out put to 12 million tonnes per year, among a number of measures, should be rejected.

In its initial renewal request from May 20, the company stated it did not file the request earlier because it expected its expansion plans to be approved in time to make the request unnecessary. Currently, the decision on the expansion project from Dan Vandal, the federal min ister of Northern Affairs, is expected in mid-November.

The termination notices, over 200 of which were filed for Inuit workers, will take effect on Sept. 25 and Oct. 11, when Baffinland expects it will hit its 4.2 mil lion tonne volume limit of iron ore extraction and shipments, respectively. Some employees will be kept on for care and maintenance if the shutdown goes through.TheInternational Union of Operating Engineers, Local 793, which represents over a thousand workers at the mine, is urging the NIRB and Minister Vandal

to act to protect the workers’ jobs and consider their voices in the matter.

“The people that are making [these] decisions, their jobs are not in jeopardy. The impact is on the workers, and they seem to be the ones that are least consid ered,” said Mike Gallagher, Local 793 business manager. “It’s very frustrating to deal with constant delays and post poning deadlines. If you decide to ignore them and create a new deadline, the process that everybody has agreed to kind of lacks credibility.”

A decision on the expansion of the Mary River mine was expected by mid2021, but was delayed due to pandemic safety measures extending the review process. In its May 2022 report on the project, the NIRB discouraged approval

of the expansion as it was proposed, cit ing adverse environmental and socioeconomic consequences. Now, after asking for an additional three months in July, Minister Vandal must decide whether to proceed with the project despite these concerns.

Soon after filing its 2022 production limit request, Baffinland also submitted a request for an emergency order to Min ister Vandal, stressing there would be layoffs if the NIRB failed to approve the request. Minister Vandal requested the NIRB complete its review by Aug. 26.

“For a number of reasons, the regu latory process is moving slowly. As a result, Baffinland must continue to take preparatory steps to rescale its opera tion in the event that it is not successful

Baffinland submitted a request for an emergency approval for its production increase in May, warning of potential terminations if it was not granted in time.Operations at Mary River will be suspended starting in September if it does not receive approval to raise its production limit to six million tonnes for 2022BaffinlandofCourtesy

in renewing its permit,” said Peter Akman, head of stake holder relations & communications at Baffinland. “It is our hope that the expedited NIRB process… will result in a positive response to our renewal application that can prevent employee termination.”

A letter from Alan Cormack, mayor of Clyde River, to the executive director of the NIRB, criticized the NIRB and Baffin land for its handling of the timeline following the news of the potential

“Thereterminations.wasonly14 working days between NIRB’s formal announcement of the process and the deadline for written com ments. It is well known that Nunavut’s municipalities and hunters and trappers organizations lack the staff to review the documents associated with NIRB processes, and often depend on consultants on an ‘as-needed’ basis to facilitate our participa tion,” wrote DocumentsCormack.obtained from NIRB’s registry show that, earlier in the renewal proceedings, the Qikiqtani Inuit Association and the Ikajutit Arctic Bay Hunters and Trappers Association both formally requested more time to review the material from the NIRB, also citing lack of time and resources to comply with the tight deadlines. However, according to Akman, there were valid reasons why the proposal was submitted when it was.

“The expiry date of the Production Increase Proposal was intended by the Minister and NIRB to fall after the completion of the Phase 2 Proposal regulatory process,” said Akman. “Our decision to wait was based on our concern around ‘project split ting’ and at the time we would have needed to make a decision moving into the new year [when] the decision on Phase 2 was imminent, unlike previous years.” CIM

Umicore invests $1.5 billion in Ontario EV battery materials plant

On July 13, Umicore revealed that it will be investing $1.5 bil lion in an electric vehicle (EV) battery materials manufacturing plant in Loyalist Township in eastern Ontario, further bolstering the province’s bid on developing a vertically integrated EV sup ply chain. The Belgian multinational’s plant will manufacture cathode active materials and precursor cathode active materials.

Cathodes make up roughly half of the value of EV batteries, containing critical minerals such as nickel, cobalt, manganese and lithium. At full production, the plant is expected to produce enough cathode materials to provide batteries for one million vehicles per year. According to current estimates, this would mean contributing to nearly 20 per cent of North American EV production by the end of the decade.

“This giga factory will be the first of its kind in North Amer ica, because it’s going the full way,” said Umicore CEO Mathias Miedreich. “It’s not only doing the end product, which is the cathode material. It’s integrated, as we say, from mine to bat tery, including all the upscale steps.” Umicore is considering not only refining but also recycling activities for the plant down the road to close the supply chain loop.

The plant will be running on renewable energy from the start, which was one of the criteria the company was looking for in selecting a location along with the availability of resources and talent. “Investments recently in greener steel, in a grid that is already over 80 per cent renewable for energy and electricity: these are things that are drawing [attention] and comparing

very favourably to other jurisdictions around the world,” said Prime Minister Justin Trudeau at the press conference, commenting on the government’s efforts in attracting such investments.

Construction for the 350-acre plant is targeted to begin in 2023, with opera tions projected to kick off by the end of 2025. The new plant will further connect the mineral sector in northern Ontario to

the EV manufacturing capacity in the south. Ontario Minister of Economic Development, Job Creation and Trade Vic Fedeli travelled to Belgium in late July to link Umicore with key local, regional and provincial suppliers.

Minister Fedeli anticipates that min eral production in the province will need further support to meet the ever-grow ing critical minerals demand from the EV

Letting microbes do the work

By Sarah St-PierreIn her new book, Mine Wastes and Water, Ecological Engineering and Metals Extraction, Margarete Kalin, president of Boojum Research, presses the mining industry to consider a paradigm shift when it comes to handling mining waste.

While ecological processes have been mostly ignored by the industry, she believes they hold the key to meeting envi ronmental sustainability objectives. In this book, Kalin and co-editor Dr. William N.Wheeler, research biologist at Boojum, have put forward sustainable means to retaining and reducing the harm potential of acid and alkaline mining waste.

Water is integral to most mining oper ations, used for dust control, drilling, transportation of solids, furnace cooling, refining and more. While mining is less water-intensive than other industries such as agriculture and manufacturing, its reliance on freshwater and its ensuing contamination of groundwater and sur face water are a source of concern for environmental sustainability. When bearing in mind global concerns around water scarcity, the importance of access to clean water is highlighted – as is the value of more efficient wastewater treat ment, which, if done right, could allow water

Therecycling.bookidentifies another looming challenge for mining: land use. Arable land is already being lost at a rapid pace, while tailings ponds and waste rock piles are bound to take up yet more space as the industry contributes to decarbonization efforts. However, that trend is on a colli sion course with the needs of the agricul tural industry, which will need both land and water to sustain a growing global

population. A mine’s effect on land is not restricted to the grounds it is set up on as it also can lead to dust storms, silt streams and contaminated water, creating a broader area of land ill-suited for farming. That is why Kalin and her collaborators are asking the industry to reconsider how it approaches water and land use. With the help of ecological engineering, new means of approaching waste from the exploration stage onward could allow mining to meet the challenge head on.

“When you see how big those pits are in the world, and the waste piles, it’s mind boggling,” said Kalin. “Sometimes I felt I was driving through a little Switzer land. Waste rock piles are huge.”

Kalin’s life’s work is that of implement ing ecological engineering processes to counter the negative effects that mining waste generates on the environment, and she is no stranger to fieldwork. Torontobased Boojum Research was founded in the late 1980s with her at the helm, devel oping its self-sustaining microbial waste decommissioning and remediation tools ever since. She has since received the Noranda Land Reclamation Award for outstanding achievement in the field of land reclamation, awarded by the Cana dian Land Reclamation Association, and was a CIM Distinguished Lecturer in 2004-2005. Kalin has also received an honorary PhD from Laurentian University for her work in the field.

Co-authoring the book are Dr. Bryn Harris and industry veteran Michael P. Sudbury. Harris has longstanding experi ence when it comes to extractive metal lurgy, and is a past chair of the Hydrometallurgy section of MetSoc of

sector, including Umicore’s. “None of this is going to happen overnight. We need to develop our critical minerals,” he said.

“There’s a lot of work to do. That’s why we’ve developed our critical minerals strategy and why we’re meeting with mining companies, producers, everybody that we can. Because we all understand just how important this is.”

Sarah St-PierreCIM as well as a recipient of the CIM Sherritt Award for Hydrometallurgy. He has authored or co-authored over 80 technical publications. Sudbury worked at Falconbridge for 44 years before run ning a consulting service focusing on metallurgical and environmental chal lenges. He has authored or co-authored some 20 technical papers and received in 2014 the CIM Syncrude Award for Excel lence in Sustainable Development.

If left alone, pyritic mining waste will generate acidic drainage in perpetuity. The book, after contextualizing waste management, highlights three ecologi cal engineering tools: acid reduction using microbiology (ARUM), biological polishing and growing oxygen consum ing biofilms, all three of which involve

Based on 40 years of field research, a new book explains how ecological engineering can help remediate mining waste sustainably

microbes to restore the balance between oxidation and reduction in the extreme ecosystems found in mining waste.

ARUM relies on phytoplankton and root extracts below floating islands of reeds or cattails to feed organics to anaer obic microbes in the sediments. This, in turn, precipitates the metals due to the concurrent pH level increase in the water where it meets the sediment. Biological polishing, promoted through underwater plant meadows rooted in the sediment, consumes the oxygen above the sedi ment. This stops the metals from recy cling during seasonal water turnover and from re-oxidizing into the water body, keeping them stable in a layer of sedi ment at the bottom of the water.

When drainage gets too acidic to sus tain these solutions, biofilm becomes an alternative. Microbes, in a very thin biofilm, attach to the mineral surface, providing a rate of oxidation one million times higher than that of the waste. Therefore, as the rain carries both oxy gen and substances that feed the microbes to the mineral surface, the biofilm consumes it all, slowing or halt

ing the waste’s oxidation and therefore its generation of acidic drainage.

“There are biofilms which are thou sands of years old,” said Kalin. “So it’s not a reversible thing if you do it right.”

While the book backs up Boojum’s research into these tools, it also offers insights into how more efficient metal extraction practices would combine well

Costs grow at Côté Gold

Iamgold released its 2022 technical report for its Côté Gold project in Ontario on Aug. 3, updating its economics and lifeof-mine plan. The project is now expected to be more expensive and to begin produc tion in early 2024, as opposed to the previ ously forecasted late 2023, with an 18-year mine life. Côté Gold is a joint ven ture between Iamgold and Sumitomo Metal Mining, with Iamgold controlling a 70 per cent stake.

A project review and risk analysis were undertaken earlier this year to update Côté Gold’s costs, schedule, exe cution strategy and risk assessment.

with ecological engineering and stresses the need for a sustainable shift in mineral extraction practices that promotes envi ronmental stewardship.

“It’s a big piece, but it’s not written for scientists. It’s written for mining peo ple,” stressed Kalin. “It’s all preventable, the damages… but you have to under stand nature in order to control it.” CIM

Estimated remaining project costs are now US$1.9 billion, with a little over US$1.3 billion attributable to Iamgold. The remaining costs to completion were estimated at around US$710 million to US$760 million at the start of the year, and previously increased to between US$1.2 and US$1.3 billion in early May.

Côté Gold’s after-tax net present value at a five per cent discount rate now fig ures at US$1.1 billion on a 100 per cent basis, with an internal rate of return of 13.5 per cent at a gold price of US$1,700 until 2025 and US$1,600 for following years. The numbers have gone down since the previous expectations from the 2021 technical report, where after-tax net

present value stood at US$1.6 billion with an internal rate of return of 19 per cent.

Côté Gold is now expected to produce 495,000 ounces of gold annually through its first six years of production and then 365,000 ounces over the remaining life of mine. Previous forecasting placed the annual average production at 489,000 ounces for the first five years and 367,000 ounces for the life of mine. All-in sustaining costs are predicted to ring in at US$854 per ounce of gold sold.

Mineral resource estimates were left unchanged by the new report, with meas ured and indicated resources at the Côté Gold deposit figuring at 365.5 million tonnes containing 10.2 million ounces of gold grading at 0.87 grams per tonne.

While its costs have increased, according to Maryse Bélanger, Iamgold chair of the board and interim president and CEO, this is partly due to events beyond the company’s control.

“The project today is over 57 [per cent] complete and the updated project costs and schedule gives us greatly improved visibility towards comple tion,” Bélanger said. “Côté Gold is a proj ect that is being advanced in an environment with significant head winds, including COVID-19, inflation and other global events – and their impacts on global supply chains, labour availability and the associated costs of doingBélangerbusiness.”also noted the project’s potential for future expansion, starting with the adjacent Gosselin deposit.

According to her, Côté Gold’s construc tion is critical to the company’s aims.

“Given the importance of Côté Gold to achieve our goal of becoming a leading high-margin gold producer, we are actively pursuing various alternatives to increase liquidity to complete construc tion and deliver Côté on the updated schedule,” Bélanger said. “We expect to address these near-term challenges to advance Côté and better position [Iamgold] as a more resilient, agile com pany for the current environment.”

Sarah St-PierreGiga Metals and Mitsubishi agree to new joint venture

On August 15, Martin Vydra, president of Giga Metals Corporation, announced that the Vancouver-based company would enter into a binding agreement with Japan’s Mitsubishi Corporation. The intent of this partnership is to form a new joint venture company, which will be known as the Hard Creek Nickel Corpora tion. The joint corporation will develop the Turnagain nickel deposit located in northern British Columbia.

“We are excited about partnering with [Mitsubishi] due to their excellent reputa tion, expertise in mining, extensive financing capabilities, experience in mar keting, and the values that they share with Giga regarding environmental, social and governance issues,” said Vydra.

The joint partnership will result in Mitsubishi acquiring a 15 per cent equity interest in Hard Creek in exchange for cash consideration of $8 million. Giga Metals will maintain an 85 per cent equity interest in Hard Creek in exchange for their contribution of all related assets for the Turnagain project.

Giga Metals’ May 2021 resource state ment places measured and indicated resources for the Turnagain project at 5.2 billion pounds of nickel and 312 million pounds of cobalt from 1.07 billion tonnes grading at 0.22 per cent nickel and 0.013 per cent cobalt.

Due to the low carbon nature of devel oping the Turnagain nickel deposit, the two companies foresee this project to be one of the most eco-friendly nickel proj ects in the world and stated that the new joint venture will explore the viability of using tailings to sequester CO2 from the atmosphere to achieve carbon neutrality.

Additionally, Hard Creek aims to work in conjunction with local communities and First Nations residents to pursue the Turnagain project in a sustainable man ner, one that will benefit all stakeholders in B.C.Apre-feasibility study for the project is expected to be completed within the first half of 2023. Ashley Fish-Robertson

Forging the pathway to net zero

For the Conference of Metallurgists 2022, the first to be held in-person since the COVID pandemic, the Metallurgy and Materials Society of CIM – or MetSoc –focused the event’s content on a theme critical to the future of metallurgy: the “Pathway to Net Zero.”

Held in Montreal’s Bonaventure Hotel from Aug. 21 to 24, the conference fea tured numerous technical sessions, workshops and social events, all focusing on Canada’s and the metallurgical com munity’s ability to affect the quest to lower emissions and reach the net-zero target by 2050. This theme extended to the conference’s keynote and plenary speeches as Monday’swell.opening keynote was given by Andrew Ghattas, director of Natural Resource Canada’s (NRCan) Critical Min erals Centre of Excellence. In his talk, he outlined the government’s role in strengthening the supply chains of the 31 critical minerals outlined in the strategy released by the federal government this year. According to Ghattas, the landscape has shifted to the point where these min erals represent a “generational opportu nity” and that developing these value chains will protect Canada from future risk as “Fullywell.recognizing that the push into greener technology requires looking at value chains in their entirety,... it’s really the mining and the processing end of the chain where the bottlenecks will create the greatest pressure on our ambitions of ramping up overall manufacturing. Current mineral supply and investment plans fall short of what’s needed to trans form the sector, and to meet demand forecasts, so this is an area where we need to encourage more overall activity,” he said. “The other aspect of this is that the production of these minerals is more geographically concentrated than oil or natural gas, which makes supply

extremely vulnerable to geopolitical, eco nomic and other risks. There are a variety of factors at play in critical minerals, but in short we have become highly reliant on other countries for almost all aspects of entire value chains.”

The afternoon’s plenary session included a mix of speakers from govern ment, industry and academia. Hosted by NRCan senior policy analyst Nadim Kara, the panel included Marie-Pierre Ipper siel, president and CEO of PRIMA Que bec; Ann Masse, global head of health, safety, environment and security at Rio Tinto; Hani Henein, professor in the department of chemicals & materials engineering at the University of Alberta; Martin Tyrawskyj, acting program direc tor of Materials for Clean Fuels Challenge Program, National Research Council Canada; and Marie-Pierre Paquin, chief advisor, office of the chief scientist at Rio Tinto. During the panel, the speakers dis cussed what they believe the metallurgy community needs to meet the challenges of the“Netmoment.zerochanged everything, [and] I think we have to change our mindset. We used to be, in the last 30 years, in an emissions reduction paradigm. Now, because of the goals and emissions tar gets, we have to think and work more in an emissions elimination paradigm,” said Ippersiel. “Every part of the econ omy has to contribute to the future, and I invite the metallurgy community, as much as the materials science commu nity, to play a role and propose solutions. I think you have something to bring to this journey.”

“If you’re focusing on 2050, and we all know the timeline it takes from invention in the lab to testing a proto type to going to a pilot plant to full pro duction, it takes a long time in our profession. 2050 is not that far away,” said Henein. “In Canada we have a fund ing scheme that partners very well aca demics to governments to industry. We’ve done very well over the years with these kinds of programs. However, to reach 2050, we are going to need to collaborate far more than we’ve ever done before in a far greater accelerated period of time, and we’re going to need far greater investments.”

The next day featured a talk from widely influential metallurgist and Canadian Mining Hall of Fame inductee Phillip Mackey to discuss some of the technology being developed to help the transition to green energy. The after noon also featured a “Big Ideas Ses sion,” where nine representatives were given the opportunity to present their technological innovations and the opportunities each represents to reduce emissions. According to Mackey, how ever, these technologies will require more

“Canadasupport.has sources of critical metals and can build on this for the export mar ket and, as we heard yesterday, the Cana dian critical minerals strategy identified 31 minerals and six top ones, but it won’t happen without more R&D. We need it from the large mining companies, who, notably, are not very active in R&D, pub lic universities and government sup port,” he said. Matthew Parizot

From left to right: Nadim Kara, Marie-Pierre Ippersiel, Hani Henein, Martin Tyrawskyj, Marie-Pierre PaquinAll in on trolley assist

The technology will play a key role in helping Copper Mountain reach its ambitious goal of net-zero carbon emissions by 2035

By Kelsey RolfeIn early April, seven massive haul trucks were suddenly zip ping up a steep one-kilometre haul ramp of Copper Mountain Mining’s flagship open-pit mine at twice the speed – and a mere fraction of the diesel usage.

It’s the result of the new trolley assist infrastructure at the southern British Columbia copper mine. A trolley assist system enables electric-motor haul trucks to bypass their diesel gener ators and receive clean power directly from the overhead power line. While going up the ramp, the truck’s engine is idle – still technically running, but not consuming nearly the same amount of fuel. Copper Mountain worked with ABB on the power infrastructure, with SMS Equipment and Komatsu on the haul trucks, and received some funding for the project from Clean BC and B.C. Hydro.

The trolley assist system will play a key role in helping Cop per Mountain reach its ambitious goal of net-zero carbon emis sions by 2035. Gil Clausen, Copper Mountain’s president and chief executive officer, said he and chief operating officer Don Strickland quickly pinpointed the site’s diesel-generated haul trucks as its largest source of emissions.

“We started putting together this [emissions reduction] plan and trolley assist became a big part of it,” Clausen said. “How do we lay the groundwork for the future? We have to take away the highest energy-consumptive part now, which is haulage uphill.”

Only a few months in, the pilot phase has already been a major success. According to Clausen, the pantograph-equipped haul trucks climb the mine’s toughest haul ramp at more than twice the speed of the company’s regular trucks, and at one-twelfth the diesel cost. The company also completed a study that estimates it is cutting 79 kilograms of carbon dioxide equivalent per truck

cycle on the installed trolley section, and it expects trolley assist will help it slash its overall emissions by at least 30 per cent.

The project represents a major milestone for the industry: Copper Mountain is the first open-pit mine in North America to install trolley assist, though the technology has been available for decades. Clausen said he thinks it may also mark a turning point as mining companies seek to rapidly decarbonize to reach net-zero emissions.

“I think there’s a real opportunity here for this technology to become much more pervasive in our industry,” he said. “So we’re trying to stay one step ahead of the game. We’re assuming the trol ley assist will be a successful test, we have a strong sense that it will, and we’re working on the next phase of evolution of haulage here that’s going to get these large haul trucks to carbon zero.”

Powering ahead

Copper Mountain first started discussions about implement ing trolley assist in 2019, and launched a feasibility study looking at what electrical infrastructure would be necessary, how to out fit the trucks and the quality of mine haul road necessary for a successful implementation. By late 2020, the study showed “positive results” and the company and its partners decided to power ahead, said George Shehata, project development for process industries at ABB.

The company is starting with seven trucks, outfitted with pantographs that connect to the trolley assist infrastructure, with plans to eventually expand the number of trucks capable of using the system. Shehata noted Copper Mountain had a built-in advantage: it already owned haul trucks with electric drive motors, which require less modification than introduc

In a studied section, haul trucks connected to the trolley assist system reduced their carbon dioxide equivalent per truck cycle by 79 kilograms.net-zero challenge

ing a trolley assist system with only traditional diesel-pow ered

Thetrucks.trial

is taking place on the haul ramp that will see the majority of Copper Mountain’s ore transport for the next 10 to 15 years, making it a logical choice, Clausen said. He also noted the ramp is the mine’s toughest duty cycle, at a 10 per cent incline, and one of the most energy-intensive stretches of road on site. While the trolley assist saw less action in the summer months as Copper Mountain developed some of the open pit’s upper benches, Clausen said the company is heading into a period of heavy testing this fall.

Within the first few months, the company “knocked some of the bugs out,” Clausen said. The truck’s pantographs are exposed to the risk of falling rock from the loading operations above, caus ing a potential maintenance issue, and needed to be made more robust. With the modifications, he said, the company has been able to maintain high availability of the trolley-assisted trucks.

Clausen noted it has also been crucial to keep the haul road smooth and level so the pantographs stay properly connected to the overhead wires.

A slow climb

Trolley-assist technology has long been available. During the 1970s energy crisis, when the Yom-Kippur War in 1973 and the 1979 Iranian Revolution disrupted oil supplies, creating short ages and price spikes for western countries that relied on energy exports from the Middle East, numerous mining companies commissioned studies on trolley assist as they sought to reduce their diesel reliance.

Even though trolley assist is a win-win, speeding up cycle times and improving productivity while slashing emissions, the technology never quite took off. To date, according to ABB, there have been some installations at African mines. Eldorado Gold partnered with Hitachi Construction Machinery in 2012 to install trolley assist at its Kışladağ mine in Turkey.

Most recently, in 2018 Swedish miner Boliden worked with ABB to introduce trolley assist infrastructure at its Aitik copper mine in northern Sweden to power four mine trucks over a 700-metre stretch of haul road, which saved the mine 830,000 litres of diesel per year. The company spent US$31.2 million in 2020 and 2021 to install an extra three kilometres of trolley line and convert 10 additional trucks at Aitik, as well as to install 1.8 kilometres of road and convert 13 trucks at its Kevitsa nickel mine in Lapland, Finland. Boliden has said trolley assist can cut its transportation-related GHG emissions by 80 per cent along the routes where the technol ogy is Sachinimplemented.Jari,general manager of mining North America at ABB, said there are numerous reasons why trolley assist hasn’t reached widespread adoption. After the energy crisis, the cost of diesel has been historically lower than it is today, and until recently there was no urgency within the industry to reduce the environmental footprint of mining. He noted that electric drive train technologies for haul trucks and power technology have also evolved significantly in the past decades.

Jari said ABB conducted its first study of trolley assist with a copper mining company roughly five years ago, and at the time, the business case didn’t make sense. “With today’s condi tions, it makes business sense, as well as sense on the human side,” he said.

Since Copper Mountain commissioned the system in April, Clausen said his team has been giving tours regularly to other companies that want to understand how the system works. Jari and Shehata also said ABB has seen an influx of inquiries.

There are a few key elements that need to be in place for trol ley assist to be a viable option with a reasonable payback period, Shehata said, with the longevity of the haul roads being among the most important. If a mine plan builds in regular changes to the haul road, it becomes harder to justify installing the trolleyassist infrastructure. The stretch of road where trolley assist is installed also needs to be a decently steep incline, he said, to result in meaningful fuel cost and usage savings. The mine also needs to have an available clean power source at a reasonable cost; operations that are drawing on on-site diesel generated electric power won’t make much of a dent in their GHG emissions by switching from one carbon-emitting power source to another.

At Boliden’s Aitik and Copper Mountain, environmental con ditions were a factor in designing the electrical infrastructure, Shehata said. The pantographs and overhead electrical work had to be built to withstand the cold winters in both Sweden and B.C.

Getting ambitious

Copper Mountain hasn’t technically finished its pilot period yet, but Clausen is already looking to the future. He said the com pany hopes to move to the “next phase” of the technology by purchasing battery-electric haul trucks once those are available and using the trolley infrastructure to charge them.

One of the sticking points around battery-electric haul trucks for open pits has been the size of battery needed to power a large machine for the long duty cycles required, Clausen noted. “It’s hard to get a battery size that’s efficient enough to run a full pro duction shift and recharge between shifts,” he said. Trolley assist could close that gap, allowing a smaller battery to be con tinuously used by charging it during the duty cycle.

The company has also been evaluating trolley, truck and con veyor options – the latter of which would be all-electric – for its New Ingerbelle deposit, which Clausen said will be announced in the updated feasibility study and new life-of-mine plan released in the third quarter of this year. New Ingerbelle, which will eventually supplant Copper Mountain, is located roughly one kilometre away.

Clausen said going all in on trolley assist was due to the sense of “urgency” the company feels about meeting net-zero goals. Copper Mountain wants to work with others and share what it is learning to get the industry to move more quickly towards decarbonization, he added.

“Everyone has concepts of getting to carbon neutral by 2050, but there’s a much greater sense of urgency that we have to have. We can’t afford to miss these goals, there’s too much at stake not to be successful,” he said. “We’ve got to take action, and the only way to do that is tangible plans and putting the energy and resources behind them. If you don’t do that, you’re selling everybody else short.” CIM

Net-Zero Challenge will run throughout 2022. It will examine the challenges involved with reducing greenhouse gases and eliminating carbon footprints, and it will also look at the opportunities those actions can represent. If you have something to contribute, reach out to us at editor@cim.org

Sponsored byCascading benefits

By Bjanka Korb and Peter ShepherdThe mining sector’s drive towards ambitious water conservation targets means recycling more – so that less fresh water needs to be procured. There is also a financial benefit to recycling, as having to treat water before use or discharge is an expensive exercise. That treatment can be kept to a minimum if mines are clear about what level of water cleanliness is required by its different on-mine processes.

Clearly, a mine does not want to be using potable water to mix with tailings for pumping to a tailings storage facility. Most of a mine’s water will generally be used in the process plant, and these applications can usually manage with much lower water qualities.Thatsaid, there would be specific phases of the plant that require cleaner water – for the mixing of reagents and chemi cals, for instance. There is also a need for water that is low in sediment particles for use in the gland seals of pumps.

Mines can optimize the reuse and recycling of their water through developing a water quality “cascade.” A cascade will detail the minimum water quality demanded by each process, so that water is not treated to higher levels of quality that are needed at the point of use.

This approach opens the door to increasing the volumes that can be reused and recycled. The accumulation of water in the system and resultant discharge of low-quality water into the environment is thereby also minimized.

An additional benefit is that the mine would be able to reduce its reliance on treated municipal water and would, therefore, decrease the mine’s operational cost. Where untreated dam water can be procured from a municipal source, the mine could use this directly in the plant – and only treat water to potable standards for use in bathrooms, kitchens and for Withdrinking.more extensive reuse of water, however, the water quality within the mine system can deteriorate to the point where regular intervention is required. This is a consequence that must be carefully managed. Fortunately, most regions have seasonal rainfall, which assists with keeping the water quality cleaner, but regardless of this, a concentration of salts will occur over time. The reality is that mines may need to consider water treatment for recycled water in the later stages of the life of theDevelopingmine.

the cascade approach needs a good understand ing of the water and salt balance within the broader system –including the mine workings, the processing circuit, the tailings dam, the fresh-water supply and the receiving watercourses.

By identifying the major drivers of water use, a mine can bet ter target its recycling efforts. For instance, if the water being returned from the tailings dam is sediment-laden or there are other elements within the water that do not easily settle out, then it may not be usable in certain key plant processes.

Achieving the best results from a water-quality cascade relies on good communication between the management of the

mine’s process plant and its tailings facility. Plant managers, who know the water volumes and qualities required from day to day, are important players in determining whether the processwater demand can be fulfilled by return water from the tailings dam. The communication is vital as the tailings-return-water dams are often where most of the mine’s water is stored.

The process plant and tailings teams together can assist sig nificantly in managing the mine’s water balance, and in helping reduce the volumes of water being procured externally.

Leading mining companies have recently begun appointing dedicated experts to focus on water stewardship, to ensure that strategies are implemented and coordinated mine-wide to con serve water use. This is a positive step towards balancing a mine’s need for optimal recoveries in the plant, with the need to reduce water consumption from external sources. CIM

Voting advice

Proxy advisory firms shape mining companies, affecting how they are managed and how they treat ESG issues

By Andrew Snook and Carolyn GruskeWhen it comes to the world of shareholder activism and corporate governance, there are three major players. The first two are the companies and the activists. The third are the shareholder advocates, also known as proxy advi sory firms. The two largest firms in the proxy advisory sector are ISS and Glass Lewis, and their reports and recommendations can hold substantial weight.

“Between the two of them added together, it can come to about 35 per cent of your shareholder base that will be sub scribers to either ISS or Glass Lewis. If they make a recommen dation against, that can be the difference between a director getting elected at an annual general meeting or not getting elected at an annual general meeting,” explained Fred Pletcher, partner and chair of the mining group at the law firm Borden Ladner

Traditionally,Gervais.

proxy advisory firms focused on matters related to corporate governance in Canada such as executive compensation, return on investment and board independence. But more recently, the environmental and social components of ESG have come into the spotlight, and ISS and Glass Lewis now review companies’ ESG performances.

Advise and recommend

Proxy advisory firms typically serve institutional investors such as pension funds, mutual funds or commercial banks that hold shares in publicly traded companies. They analyze publicly available data and draw conclusions as to how well they think a company is being managed. Based on those conclusions, they make recommendations for actions shareholders can take – typ ically voting for or against resolutions or director nominees at annual general meetings – and those recommendations are quite faithfully followed.

According to the Harvard Law School Forum on Corporate Governance, “114 institutional investors voted in lockstep align ment with either ISS or Glass Lewis in 2020.” These “robovot ing” investors collectively managed US$5 trillion in assets.

Competing currents

In April, Glass Lewis made waves across the mining industry when Bloomberg reported that the firm urged Glencore share

holders to “vote down the commodity trader’s climate progress report at an investor meeting.” The news agency said that it had seen a report from the proxy advisory company indicating “the lack of board oversight for the company’s climate program and insufficient clarity on how Glencore may interpret support for its strategy-setting process meant investors should vote against the motion.” Nearly one quarter of the shareholders followed the advice and voted against the plan.

“We’re not historically an E&S [environmental and social] ratings provider, but, in the most recent year, we have expanded our coverage of those issues to include collecting data on certain social and environmental parameters,” said Oren Lida, Glass Lewis’ UK-based lead analyst for the Canadian market. He added, however, that the company has “a long record of advising shareholders on E&S-related proposals (whether brought by management or shareholders).”

Activist investors are looking to have a “Say on Climate” (sim ilar to what the Glencore shareholders were offered) in much the same way they pushed to have a “Say on Pay.” That is where larger companies were asked to detail how they compensate their exec utives and then permit shareholders, through a non-binding vote, to approve or disapprove of the compensation structure. In 2019, the law firm Blake, Cassels & Graydon, reported that 220 compa nies, “including more than 71 per cent of companies in the TSX Composite Index and 52 of the TSX60 Index,” voluntarily pre sented shareholders with a Say on Pay advisory vote.

According to Pletcher, these ESG campaigns make up about 20 per cent of the efforts of activist investors, whereas in years past, they only accounted for roughly 10 per cent.

Elizabeth Freele, co-founder and managing partner of Sym pact Advisory, said the number of ESG-related shareholder pro posals that have been put forward year over year has been growing. Based in Vancouver, the company helps businesses develop and implement management strategies to achieve ESG performance. “This year, we saw over 500 proposals set for ward,” said SympactFreele.regularly looks at ESG proposal trends in a broad scope. Freele said these types of proposals do not normally show up first in the mining sector but, like clockwork, usually make their way to mining in subsequent years.

According to Pletcher, as activist shareholder initiatives become more popular, there will be more reliance on proxy advisories. “As the number of environmental-related share holder proposals and environmental issues arise in connec tion with proxy fights, ISS and Glass Lewis are increasingly being asked to provide their views on those ESG issues and become a flashpoint for proxy fights and shareholder activist campaigns.”Whileimproving ESG performance is still top of mind in min ing, the support from institutional investors’ for ESG activist campaigns peaked in 2021.

“Institutional investors voted 40 per cent in favour of ESG campaigns in 2021,” Pletcher said.

So far, that number has declined in 2022, partially because the heavily influential BlackRock (the world’s largest asset man ager, which does not rely on companies like ISS and Glass Lewis) was concerned about micromanagement.

“We are starting to see more conservative, especially politi cally conservative, shareholder groups that are pushing against these main ESG topics that have emerged in the last couple of seasons,” said Freele. “It’s a new trend, but it is important to note as this anti-ESG movement is something that’s happening broadly in the ESG space. So, of course, it’s also happening in the proxy voting space.”

Still, for the mining companies that are involved in efforts such as carbon-cutting exercises or improving board diversity, explaining their actions is a key to earning support from share holders of all political persuasions.

Women on boards

According to Lida, one of the factors that Glass Lewis consid ers when making its recommendations is board composition. “In the coming year, the aspiration will be 30 per cent gender diver sity across TSX-listed boards.”

That growing diversity is in line with what Charlotte May, corporate secretary of Talisker Resources, expects securities regulators will soon require. “I know that in 2021 NASDAQ adopted a diversity policy that requires companies to not only report on their board composition but will eventually mandate compliance with the policy, which includes guidelines on the number of female directors and/or underrepresented individu als including racial, ethnic, Indigenous, cultural, religious or lin guistic identity or LGBTQ, and I anticipate this will be adopted by Canadian regulators at some point.” She also expects there will eventually be regulatory requirements to disclose how a company’s practices affect climate change.

Finding the signal in the noise

A big challenge for issuers is the multiplicity of ESG-related voting requirements to consider.

“You’ve got ISS, you’ve got Glass Lewis, then you also have large investors that don’t subscribe to their services that have their own ESG policies: BlackRock, Vanguard, State Street, the big Canadian pension funds,” Pletcher said.

There is also an array of sustainability indexes that mining firms must contend with.

“You can take a single company and look at four different rat ings and they will be all over the shop,” said Freele. “You can see very clearly these four entities that are all rating the same com pany, with access to the exact same publicly available data, are using completely different methodologies.”

Then there are accounting professionals and international organizations that have their own suggested requirements for disclosure.“Itisvery difficult for companies to keep all this stuff straight, and it’s a lot of work. One of the areas that we hope will emerge from the ESG industry is a more straightforward and universally accepted series of disclosure criteria,” Pletcher said. “Right now, they aren’t out there. Looking at ISS’ and Glass Lewis’ criteria is probably a good place to start, but it isn’t the be-all and end-all right now.”

Beyond being overwhelmed by the sheer number of organiza tions that rate company performance, both investors and min ing companies could be forgiven for being confused about how proxy advisor firms actually operate. Even Lida admits that their workings could have been seen as opaque in the past.

“There used to be a perception that we were kind of a black box, whispering in the ear of institutional shareholders, and that there was no way to engage with us,” said Lida. “In the past five years, we’ve done a lot of work to refute that. We’ve started talk ing to public companies much more openly about our method ologies, we’ve started having engagement calls with them, including plenty of Canadian companies.”

That effort appears to be working. Or at least Pletcher believes that ISS and Glass Lewis are “fairly transparent” in terms of what they review. Pletcher suggests that companies research what the proxy advisory firms are looking for before preparing their annual reports and then make sure that their corporate disclosures match those expectations.

At Talisker, May said that there has been little difficulty in presenting shareholders’ proposals that would earn approval of proxy advisory companies.

“You make sure that you aren’t offside. We are cognizant and mindful of the governance oversight that ISS and Glass Lewis undertake,” she said.

The view on – and from – the mining industry

As much as Glass Lewis looks at specific companies, the proxy advisory firm also has the advantage of seeing industries as a whole and of comparing them with other business seg ments, in large part because of the way it conducts its analyses.

“There’s a place for sector expertise in covering governance issues, but all of the filings relating to governance ultimately look quite similar no matter which company they come from,” saidFromLida.that perspective, he said mining is weaker than other sectors when it comes to board-level gender diversity, and per haps a bit stronger when it comes to executive compensation. “We generally are quite supportive of them on the compensation front. They have much higher-than-average support from us as a sector when they bring Say on Pay proposals.” With regard to board independence, Lida described the sector as “middle of the road,” but added that the size of the mining company is the biggest factor as to how it compares to businesses in other sec tors. Small mining companies, for example, have more in com mon with other small businesses than they do with large mining companies.Assomebody

working at a smaller mining company, May said that proxy advisory companies are helpful to the industry.

“I think that having the watchdogs, as I want to call them –ISS and Glass Lewis – is important. Companies are mindful because of them.” CIM

Shining a light on the world of coloured gems

Michael Valitutti reflects on the state of the jewellery industry

Although Michael Valitutti is a graduate gemologist work ing at Nathan Hennick & Co. Ltd., that title fails to describe exactly how involved he is with every step of the jewellery business. From visiting mines, to buying parcels of exotic gems at trade shows, to developing new processes to manipulate gemstones and metal, to selling finished pieces on a company website (GemsEnVogue.com) and on television shop ping channels around the world, he takes a hands-on approach to the jewellery business. CIM Magazine dropped by his office in Toronto to talk about the jewellery industry, the effects of COVID-19 on gemstone mining and the curious shopping habits of millennial Australians.

CIM Magazine: Would you tell us a bit about the company?

Valitutti: This company has been around since 1946. It’s a family-owned company. We manufacture jewellery here. This is the original building, but it will be condos in a couple of years. We’ll be moving and getting a place locally, but because the zon ing got changed, some of the manufacturing [we do], like the heavy casting where there is burnout, we have to transfer that overseas. We’ll bring in the pieces semi-finished and finish them up. We’ll do setting, polishing, finishing, sizing, plating, things like that where there are no fumes. The casting will be in Asia or India – India, basically.

CIM: What’s your favourite mine to visit?

Valitutti: The most exciting mines are where you get to go underground. I love them all, but I’d have to say Belmont, which is an emerald mine near Itabira, Brazil, because of the scale of operation and the level of professionalism that I witnessed there. It’s schist and they first mined it open pit, then they went underground. They have safety, they have escape rooms with food and water and air. Not all gemstone mines are like that. And the equipment they have they even have machinery that will take the rough and determine the colour of the stones.

One of the most interesting mines I went to was Golconda. It is a tourmaline mine [in Brazil]. They took us to a farm, and I said, “What are we doing at a farm?” I was told, “This is who owns the mine and does the mining. In Brazil, all these mines are run by farmers and they do this as a part-time job.” When we had to go down into the mine, it is a long cylindrical [shaft] that is all cement. They strap you into a belt and lower you down. I’ve got no safety stuff [on]. There are no safety standards. The mine is just like in the movies. The earth is soft and sandy. There are crystals and quartz. Quartz is a precursor of other gemstones, and I’m pulling out garnets and tourmaline. That was very excit ing. Even on the rock formation, I could see amethyst and mor ganite. It is one thing to study it and another thing to see it. The level of dedication of these individual men – so much of what I do

Michael Valitutti displays rough (uncut and unpolished) samples of gemstones that Nathan Hennick & Co. turns into jewellery. From left to right are citrine, prasiolite, aquamarine, morganite, amber and amethyst.and what we offer depends on these artisanal miners. They’re just local people working for themselves, and the entire exotic gem business relies on them.

CIM: Let’s talk about the business aspects of the industry. How have they changed recently, especially in light of the pandemic?