PREPARING YOUR FINANCES

We believe in a debt-free lifestyle! Our mortgage methods are based on helping families achieve more successful money management through Dave Ramsey’s Baby Steps.

Being a responsible homeowner starts with responsible money management. Budgeting will help you manage your money and plan for your new home.

INCOME EXPENSES PLAN

GROSS INCOME

Gross income is your earned income before taxes and deductions are removed.

Net income is your takehome income. It is the amount of your income remaining after you pay taxes and other required withholdings.

Housing payment, HOA fees, taxes, and insurance.

DEBT

Credit cards, car loans, student loans, etc.

LIVING

Bills, food, gas, clothes, fun, etc.

Plan for what you can afford every month.

INDUSTRY STANDARD

43% of your gross monthly income.

DEBT-FREE PATH

25% of your net monthly income.

To help explain the difference between your take-home pay and your full earnings, let's do a little math. It only takes a minute!

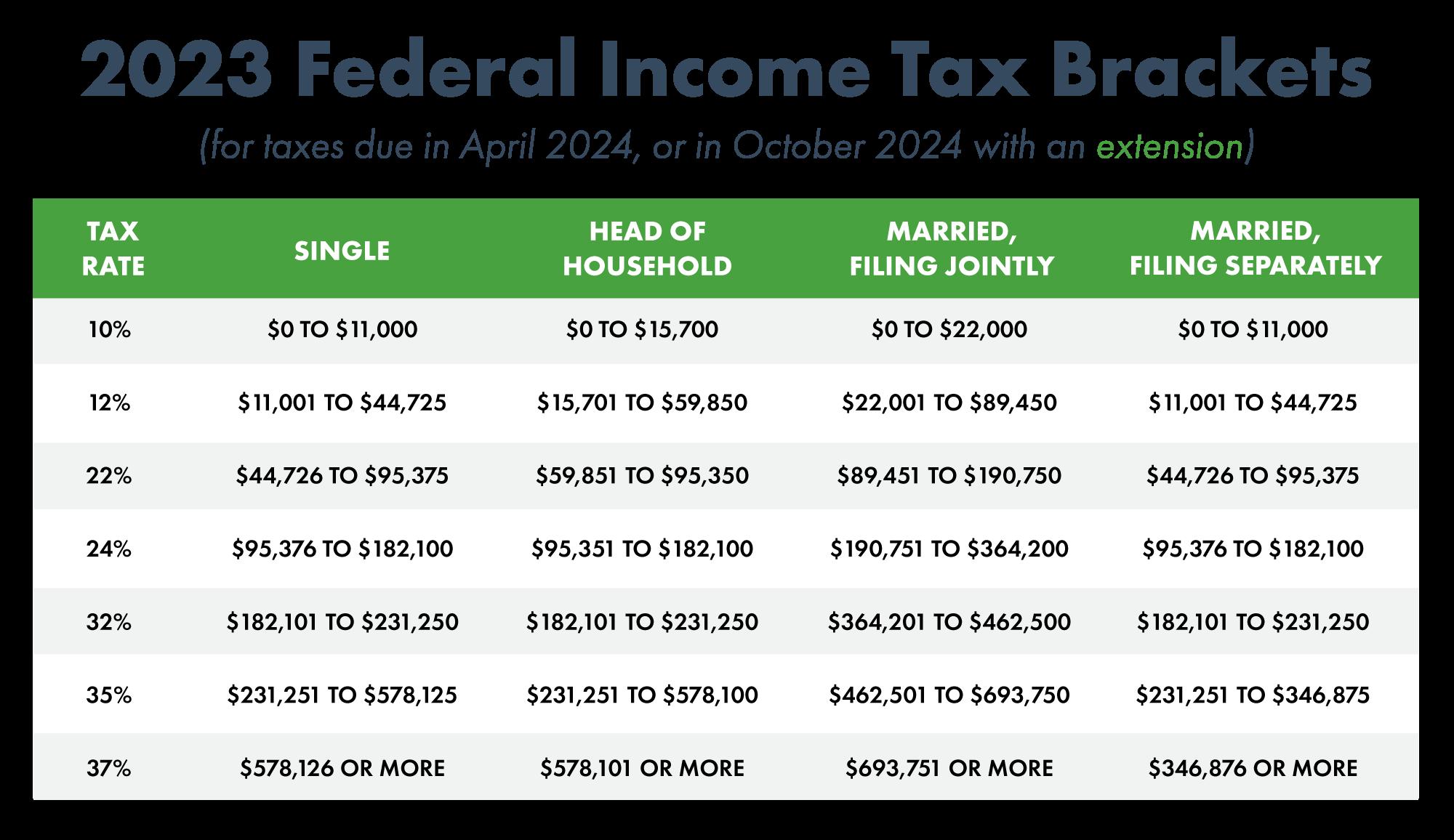

2023 Federal Income Tax Brackets

Here's a quick example based on an annual household income of $100,000:

Gross 22% Tax Net

Annually $100,000 $22,000 = $76,000

2023 IRS Tax Brackets

Monthly $8,333 - $1,833 = $6,500

Be smart and budget off your net income.

Whether you follow the debt-free path or the industry standard (or maybe something in between) seeing a side-by-side comparison allows you the freedom to see things clearly and make a decision that is best for you.

75%

After you pay your mortgage, HOA, taxes, and insurance, you still have 75% left of your take-home income after taxes on the debt -free path.

Collateral is the amount of money you have easy access to, but more importantly it is the percentage of money you plan on bringing to the table on closing day, also know as your down payment.

MATH TIME: Example is 5% down on a $200,000 purchase price

$200,000 X 5%

$ 10,000 Down Payment

Making Your Loan Amount $190,000

IMPORTANT: How much collateral you have will determine the loan type. Plan for a minimum down payment of 3% .

Get an easy-to-understand Total Cost Analysis from your trusted loan professional. It’s important to know the full financial costs of your loan up front. Compare loan options, down payment amounts, interest, and repayment terms.

Your Mortgage Strategy Meeting Includes:

• Easy-to-understand loan comparisons and options

• A clear illustration of how to become mortgage-free over time

• A cost breakdown, so you know exactly what is expected at the closing table

• At-a-glance APR, interest rates, and monthly payments

Credit score is a number determined by many factors and is calculated by the three credit bureaus.

The calculation of taxable income measured against the amount of debt you carry. This determines your ability to pay back the loan.

Is two-fold, it’s the down payment as well as the available money, savings, investments, properties, and other assets that could be sold to secure the repayment of the loan.

• Governed by Fannie / Freddie Guidelines

• 3% - 20% Down Payment Required

• 620+ Credit Score

• Multiple Choices on Private Mortgage Insurance (PMI)

• Governed by Department of Veterans Affairs Guidelines

• 0% Down Payment

• 620+ Credit Score

• No Private Mortgage Insurance (PMI)

• 2.15% - 3.3% Upfront Fee

• Governed by Federal Housing Administration Guidelines

• 3.5% Down Payment

• 580+ Credit Score

• 0.85% Monthly MIP

• 1.75% Upfront Fee

USDA LOANS

• Governed by USDA Guidelines

• 0% Down Payment Required

• 620+ Credit Score

• 0.35% Monthly Private Mortgage Insurance (PMI) & 1% Upfront USDA Guarantee Fee

The Home Buyer Edge benefits home buyers AND sellers by backing up both sides.

• Get a lightning-fast pre-approval

• Compete with cash offers as a Certified Home Buyer

• Protect your interest rate through Rate Secured

• Sweeten the deal with a $10,000 Seller Guarantee

• Close faster and with less stress

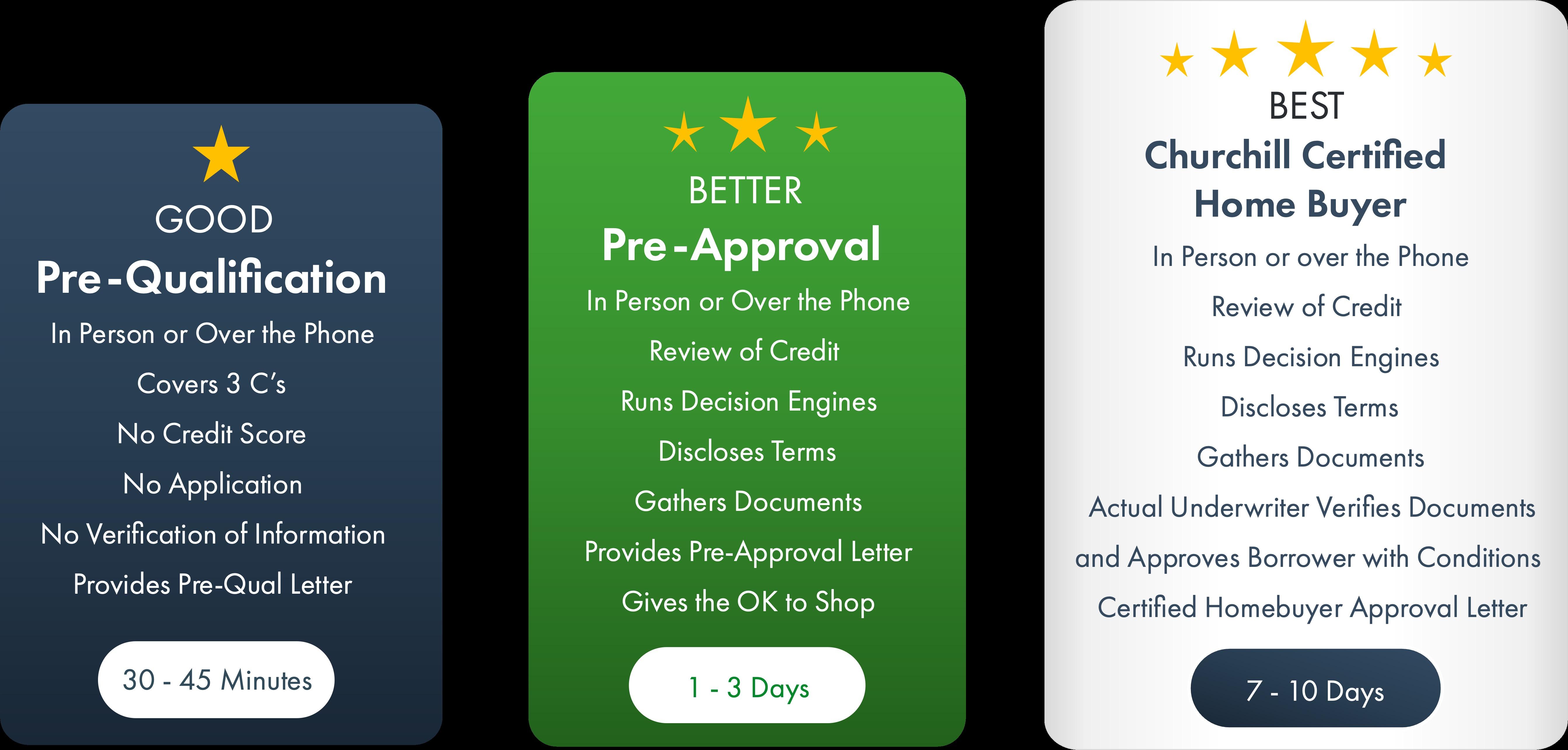

The type of approval you have could be the difference maker when you’re ready to make an offer on a new home.

One less puzzle piece in the home buying process!

With the Rate Secured program by Churchill Mortgage, you can protect yourself from fluctuating interest rates.

• Cap your interest rate for 90 days while you shop for a home.

• Reset the rate for another 90 days if you don’t find a home in the initial 90-day period.

• If rates go up, your rate stays the same. If rates go down, you get the lower rate.

Whether you’re a first-time home buyer or a seasoned homeowner, this step-by-step guide contains everything you need to get a loan you love and a home that fits your budget.

Get everything you need to know about down payments and how to navigate them during the home buying process.

Ads are literally everywhere but how do you cut to the chase and find the very best offer?

Your real estate agent has a responsibility to you fully. That means you have an expert who is looking out for your best financial interests and is contractually bound to do everything in their power to protect you.

• Your Realtor® and Home Loan Specialist must work well together. Their professional relationship is crucial to your home buying success.

• Your Realtor® should be a master negotiator and contract writer. From negotiating a powerful offer and counteroffer to managing the home repair wish list.

• Signing an agent agreement protects both you and the agent you choose. Other paperwork consists of offer forms and real estate transaction documents.

Do take advantage of the Home Buyer Edge program before you start to shop, so you can set your budget.

Do respond to your Home Loan Specialist within 24 hours when information is requested.

Do be transparent on your application and include all income sources.

Do tell us about all loans you have outstanding and don’t co-sign for any loan until after funding.

Do make your Home Loan Specialist aware of any major financial transactions.

Do not add any new credit during the loan process.

Do not make late payments of any kind.

Do not alter any of the documents you send to underwriting.

Do not change employment until after your loan has funded.

Do not make any make any major purchases, sales, or other financial decisions until after closing. This includes home appliances and furniture.

Final Walk-Through

Sign Documents

Prepare Funds

You will receive all documents for your loan, called the Closing Disclosures (CD), a minimum of 3 DAYS before your closing date. This ensures you are always aware of what you are signing before the official signatures are required! Review Closing

Get Your Keys!

We believe every person should be empowered to pay off debt and build wealth. We encourage you to get a smarter mortgage plan that leaves you in a solid financial position with less stress.

We provide a yearly mortgage review for our current clients to ensure your financial goals are being met.

Monthly updates on home values in your area and recent homes that have sold, to keep you aware of the value of your neighborhood.

We educate you with regular market updates and potential property investment opportunities.

The Churchill Certified Home Buyer program is not a commitment to lend funds and is not an approval but is a conditional approval subject to your acceptance of the terms and the conditions being fully satisfied prior to closing. All conditions are subject to final underwriting and final investor approval. The certification is subject to the financial status and credit report(s) of everyone on the application remaining substantially the same until closing, an acceptable contract of sale on a suitable property, collateral (the appraisal, title, survey, condition, and insurance) satisfies the requirements of the lender and loan selected is still available in the market. All closing conditions of the lender must be satisfied including the clear transfer of the title, acceptable and adequate title and hazard insurance, flood certification, and any inspections that are required by the real estate contract

In the initial 90-day period. Rate Secured is available on Conventional Conforming (primary and secondary homes), High Balance and No Score fixed-rate products. Not available on investment, government or jumbo. Seller Guarantee is for qualifying borrowers and select loan types only and are not available in all states or locations. Offer only valid on home loans closing on or before December 31st, 2023.

Rate reduction credit amount may not exceed program allowances. Rate reduction refinance loan must use Churchill Title to qualify for full credit amount. Offer is not transferrable and may not be combined with other offers from Churchill Mortgage or any of our affiliates Purchase loan must close by 12/31/2023 Rate reduction refinance may not close within the first 6 months of the purchase closing date and must fund 2 years/24 months from original purchase loan closing date. Rates, terms and conditions offered are subject to change without notice. Void where prohibited or otherwise restricted by law. Subject to underwriting and loan qualification of the lender. Not all applicants will qualify.

Company NMLS ID # 1591 (www.nmlsconsumeraccess.org); AL-20934; AK-AK1591; AR-32094; AZ BK# 0926494; CA-4131256 & 60DBO-140687, Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, under Churchill Mortgage Corporation, which will do business in California as Churchill Mortgage Home Loans; CO-Mortgage Company Registration, Churchill Mortgage Corporation, 1749 Mallory Lane, Suite 100, Brentwood, TN 37027, Tel 888-562-6200, Regulated by the Division of Real Estate; CT-ML-1591; DE-033845; DC-MLB1591; FL-MLD1264; GA-23146; ID-MBL8038; IL-MB.6760685, Illinois Residential Mortgage Licensee, Illinois Department of Financial and Professional Regulation (IDFPR), Division of Banking, Bureau of Residential Finance, 555 West Monroe Street, 5th Floor, Chicago, Illinois 60661, All Inquiries: 1-888-473-4858, TYY: 1-866-325-4949, Website: https://idfpr.illinois.gov, IN-10930 & 10931; IA-2009-0009; KS-MC.0025136, Kansas Licensed Mortgage Company; KYMC19522; LA- Residential Mortgage Lending License; MA-Massachusetts Mortgage Lender License #ML1591; MD-18840; ME-Churchill Mortgage Corporation, Supervised Lender License NMLS # 1591; MI-FR0019728 & SR0014889; MO-19-2136, 2300 MAIN ST STE 900, Kansas City, MO 64108-2408; MN-MN-MO-1591, MN-MO-1591 1 & MN-MO-1591 2; MS–1591; MT-1591; NC-L-144110; ND-MB103110; NE-2037; NH-Licensed by the New Hampshire Banking Department 21382-MBS; NJ-Licensed Mortgage Banker by the NJ Banking and Insurance Department; NM-03780; NV-5187; OH-RM.850178.000; OK-MB002527, ML002574, ML014679; OR-ML-5134; PA-41761, Licensed by the PA Department of Banking and Securities under Churchill Mortgage Home Loans; RI-20173440LL & 20234577LB; SC-MLS-1591, MLS - 1591 OTN #1 & MLS - 1591 OTN #2; SD-ML.05137; TN-109305; TX-Mortgage Banker Branch Registration; UT-11711076; VA-MC-5222, Churchill Mortgage Corporation of TN; VT-7009 & LS-1591; WA-CL-1591; WV-ML-34919 & MB-1591; WI-1591BA & 1591BR; WY-2516; Tel 888-562-6200; 1749 Mallory Lane, Suite 100, Brentwood, TN 37027; All other states, Churchill Mortgage Corporation; For licensing information go to: www nmlsconsumeraccess org