ABN 35 001 043 910

General Purpose (SD)

Financial Report for the year ended 30 June 2023

- C tle Hill R SL GroupCastle Hill RSL Club Limited

2023

Contents Directors' report.......................................................................................................................................1 Auditor's Independence Declaration 7 Consolidated statementof profit orlossand othercomprehensiveincome 8 Consolidated statementof financial position 9 Consolidated statementof changes in equity.......................................................................................10 Consolidated statementof cash flows 11 Notesto the consolidated financial statements 12 Directors' declaration 37 Independent auditor'sreport.................................................................................................................38

CASTLE HILL RSL CLUB LIMITED

Directors' report

Your directors submit their report of Castle Hill RSL Club Limited (the "Company/Club") and its controlled entities (collectively referred to as the "Group") for the year ended 30June 2023.

Directors

Thenames ofthe Company'sdirectorsinofficeduring thefinancialyear anduntilthedate ofthisreport areasfollows. Directors were in officefor thisentire periodunless otherwisestated.

John RichardPayne (President)

MichaelYeo (Vice-President)

RickAnthony Cumming

David Bruce Wood

Annemarie Kate Christie

John Richard Hopwood

JohnJames Mason

Shubhada Gandhi

David William Hand

Robert Bruce Duncan

(Appointed: 25 October 2016)

(Appointed: 25 October 2016)

(Appointed: 29 November 1995)

(Appointed: 27 April1994)

(Appointed: 25October 2016)

(Appointed: 27 October 2020)

(Appointed: 6 October 2021)

(Appointed: 19 January 2022)

(Appointed: 25 October 2022)

(Appointed: 12 October 1993; Resigned 25 October 2022)

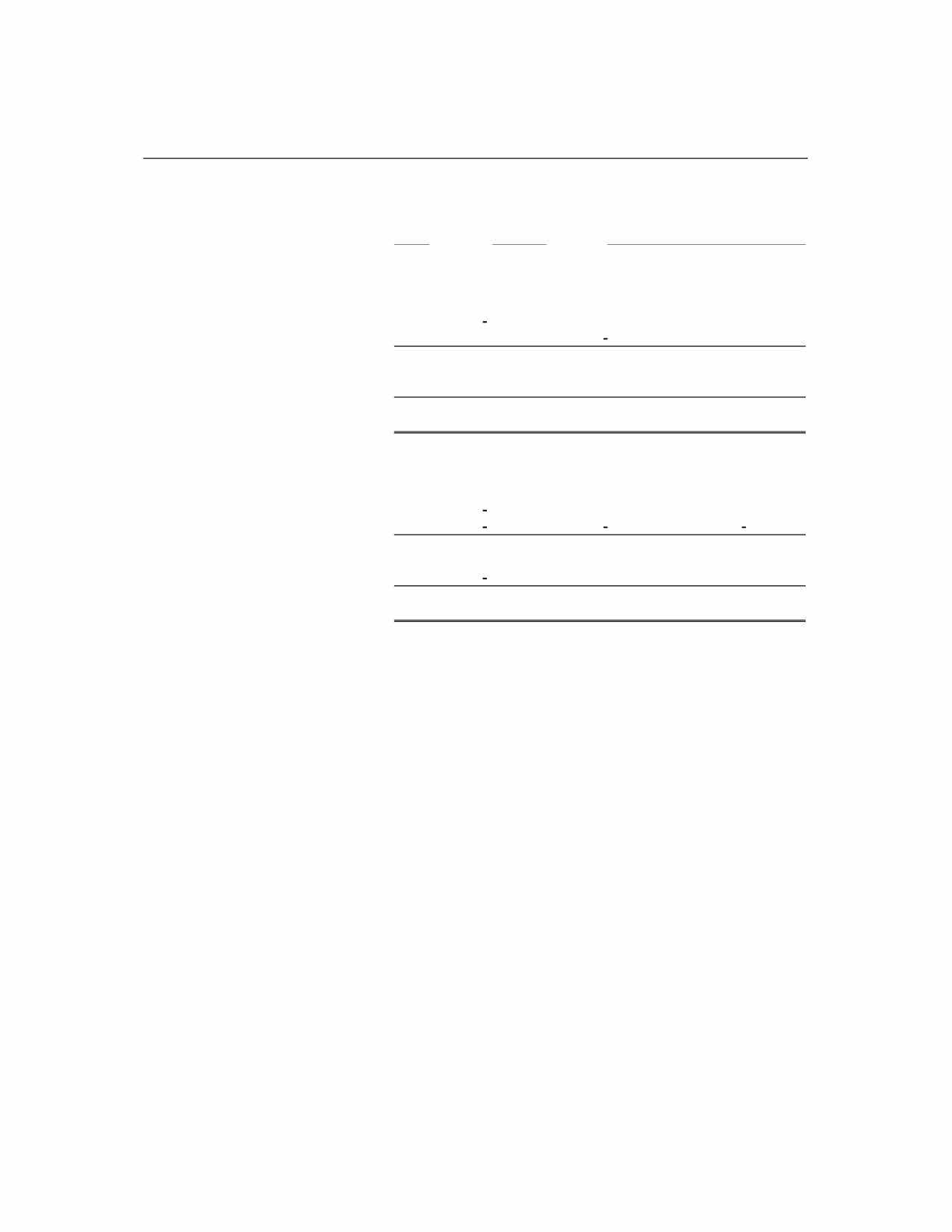

Directors' meetings

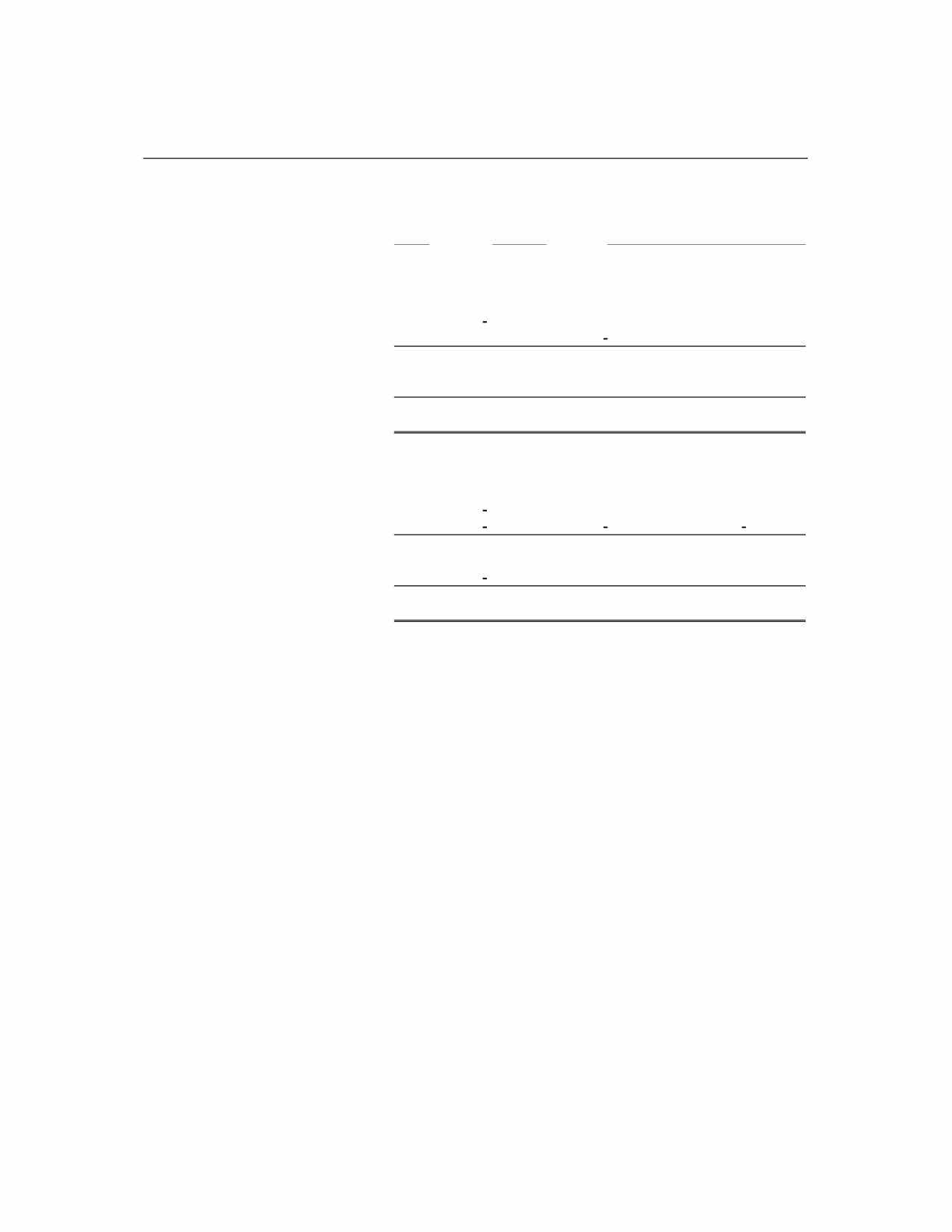

Thenumber ofmeetingsofthe Company's Board of Directors (the Board)andofeachboardcommittee meeting held during the year ended 30 June 2023, and the number of meetings attended by each director were:

Director

John Richard Payne

Michael Yeo

RickAnthony Cumming

David Bruce Wood

Annemarie Kate Christie

John Richard Hopwood

JohnJames Mason

Shubhada Gandhi

David William Hand

Robert Bruce Duncan

Board Meetings Number of Number of meetings meetings attended held 11 12 12 12 12 12 12 11 8 4 12 12 12 12 12 12 12 12 8 4 Special Meetings Number of Number of meetings meetings attended held 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2

CASTLE HILL RSL CLUB LIMITED

Directors' report (continued)

Membership

The Group includes companies limited by guarantee and are without share capital. The number of membersasof 30 June2023 and the comparisonwithlastyear isasfollows:

*Upon Amalgamation, members of Castle Hill Bowling Club were required tojoin Castle Hill RSL Club Limited and are included aboveas Category2 members.

Members' limited liability

Castle Hill RSL Club Ltdis incorporatedanddomiciledinAustralia. The Club isanot-for-profitentity. In accordance with the Constitution of the Company, every member of the Club undertakes to contribute an amount limited to $5.50 per member in the event of the winding up of the Company during the time that he/she is a member or within one year thereafter. The registered office and the principal place of business of the Club is: 77 Castle Street, Castle Hill NSW 2154.

Principal activities

The principal activities of the Group during the year were to provide sporting, social and entertainment activities, and amenities to the members of the Group and guests from conducting the business of a licensed social club. The Group's activities enhance, support, and continue to develop and promote a range of sporting and social activities that have assisted the general club membership and broader community. These activities have not been limited to the provision of sporting infrastructurebut also to the development and promotion of a wide range of activities including all forms of sport from novice to an elite level.

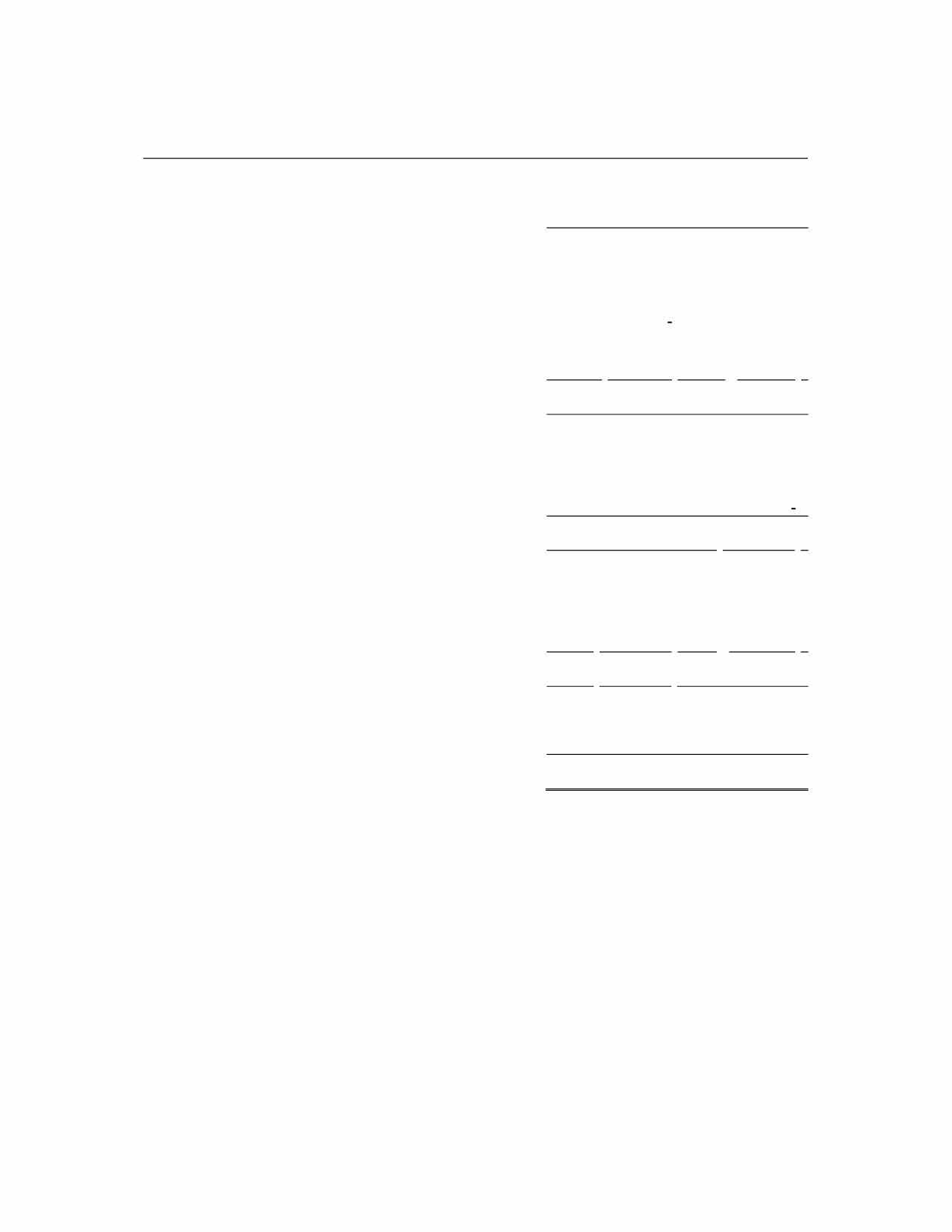

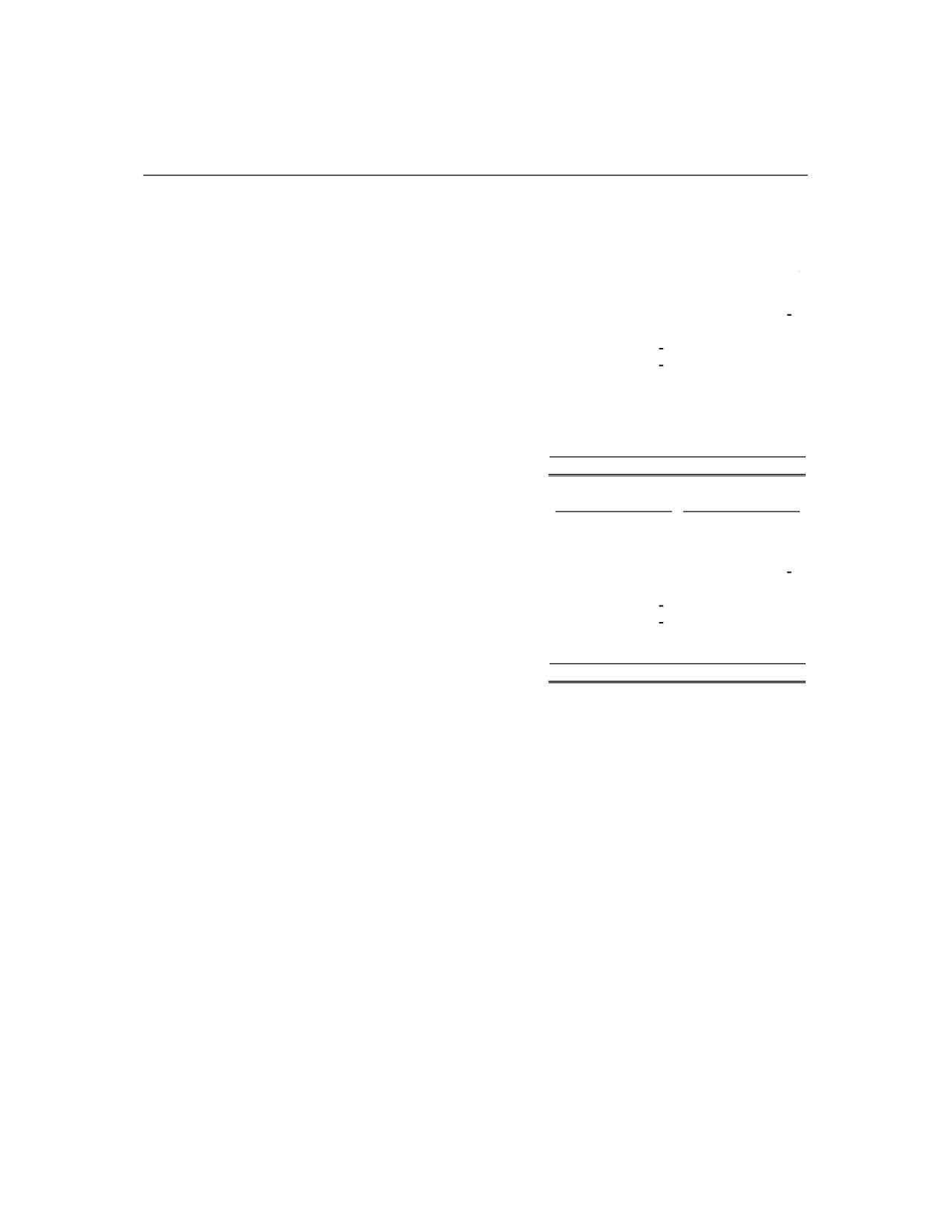

Operating result

Thenet profit after taxfor theyear amountedto $21,378,122 comparedwith $4,006,039 profit after tax fortheprioryear,anincreaseof $17,372,083 (434%). Thisresultwasachievedafterrecognisingagain on disposal of assets of $15,922,792 (2022: $4,917) as well as $10,287,633 (2022: $9,211,164) for depreciationandamortisation,$2,359,088(2022: $1,237,021)forfinancecosts and$2,460,383(2022: $1,852,852)fordonations. Theincreasein netprofitaftertaxfortheyear in 2023inadditiontothegain ondisposalwasduetoa13-weekCOVID-19government-imposed Clubshutdowninthepreviousyear, whereas2023wasafulltradingfinancialyear. TheGroupalsorecognisedothercomprehensiveincome of $6,845,190 in relationto a gain on amalgamation with Castle HillBowling Club whichcontributedto overalltotalcomprehensive incomeof $28,223,312.

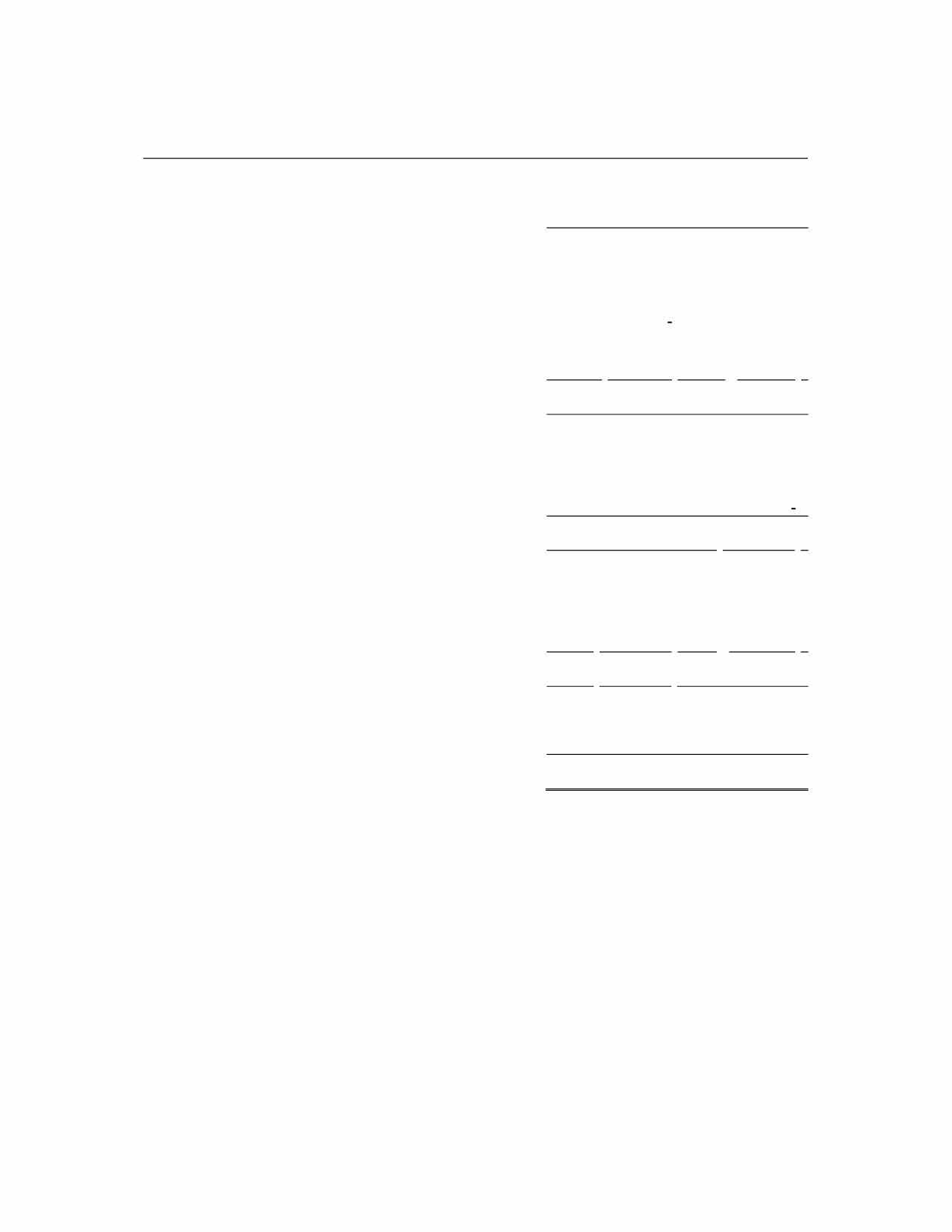

2023 2022

Financial Members: Category1 208 215 Category 2* 40,152 29,694 Junior Members 469 1,119 40,829 31,028 Club Parramatta Sub-Branch Members 148 277 Service, Association andSocial 18,543 14,110 18,691 14,387 Lynwood Country Club Junior Members 91 61 Social Members 7,006 5,742 Golf Members 608 644 7,705 6,447 67,225 51,862

Castle Hill RSL Club Limited

2

Directors' report (continued)

Operating result (continued)

Revenue and Other operating income, excluding gain on disposalof Club Parramatta Car Park

Earnings before other comprehensiveincome, depreciationandamortisation, finance costs, income taxexpense, donations (EBITDAD), excludinggainon disposal of Club Parramatta Car Park

Gain on disposalof Club Parramatta Car Park

Profit/ (loss)beforeincome tax expense

The Clubshave departmentalandorganisationalbusinessplansandcorporate strategicplans andthe documented KPls are reviewed by executive management and the Board of Directors at monthly meetings.

These KPlsarereviewedonaregularbasistoensurerelevanceatanypointintime.Businessactivities arereviewed and altered to adhere to these documents.

Earningsbefore interest, tax,depreciation and amortisation and donations (EBITDAD) percentage- ConsolidatedRevenue and Other Income, excluding gain on disposalof Club Parramatta Car Park

Earningsbefore interest, tax,depreciation and amortisation (EBITDA) percentage- Consolidated Revenue and Other Income, excluding gainon disposalof Club Parramatta Car Park

"Earnings before depreciation and amortisation, finance costs, income tax expense, donations" (EBITDAD) is a non-lFRS measure. A reconciliation to the statutory profit before tax is included in the above table.

Operating

expenses

Decommissioned

Impairment expense Depreciation and amortisation Finance costs Donations

onamalgamation Totalcomprehensiveincome forthe year attributableto members 2023 $ 76,235,931 (55,331,978) 20,903,953 15,992,792 (411,519) (10,287,633) (2,359,088) (2,460,383) 21,378,122 6,845,190 28,223,312 Performance measurement

2022 $ 54,575,839 (38,012,326) 16,563,513 (12,313) (244,124) (9,211,164) (1,237,021) (1,852,852) 4,006,039 4,006,039

assets

Gain

and key performanceindicator (KPls)

2023 27.4% 24.2% 2022 30.3% 27.0%

3

Objectives

The Club's short-term andlong-term objectives andstrategy

ThestrategicobjectiveoftheGroupistoconductitsbusinessaffairsinasoundandresponsiblemanner ensuring relevance to the membership and community. Providing premium hospitality, sports and leisure facilities and services whilst maintaining the objectives of the Club and RSL movement. The Club continues its long-term strategy of solid financial investment in the building infrastructure, operations, and business investment and diversification driving the Club forward for the long-term viabilityand prosperity of the group by reducingthe reliance on gaming.

The club operates a structured local community support program focusing on the needs of the communitiesinwhichweoperate, sport, arts, disability, youth, seniorsandveteranservices. Thisisand will continue to be an important partof our shortand longtermstrategy.

Significant changes in thestateof affairs

In2022/23 wecontinuedto reviewandrestructure our business, making changestoourreportinglines of authority, venue management, major capital improvements and facilities upgrades. We have continued our proactive upgrading and refurbishment strategies and during the year we have seen severalareasrenovatedandrepositionedtomeetthechangingneedsofourmembersandcommunity. We have rejuvenated the physical premises and replaced a considerable amount of plant and equipment at Castle Hill RSL Club, Lynwood Country Club, Castle Hill Bowling Club and Castle Hill Fitness andAquatic Centre. The upgrades sawthese assets rejuvenated without a need for significant expenditurefor several years.

A significant project was delivery with the opening of the new 550 space multi-story underground car parkmid-2023atParramatta, thisdevelopmentwillprovidesignificantopportunitiesandbenefitstoClub Parramatta and the local community for decades to come. The opening of the new carpark at 2 Macquarie Street also finalised the sale of 7 Macquarie Street car park, consolidating all club and auxiliaryactivitieson the2 Macquarie Street site.

Castle Hill RSL Group (CHRG) has recently lodged Development Application for the construction of a multi-storey environmentally sympathetic above ground car park for the members and community at the Castle Hill site, this development will provide members and the community with a safe and secure purpose-built facility providing protection from the elements servicing the club and Sports and Aquatic Centre, reducing the impacton neighboursfrom the current expansive on grade parking facilities.

CHRG's commitment to sport and community is at the forefront of what we do and in early 2023 the amalgamation of Castle Hill RSL Club Ltd. and Castle Hill Bowling Club Ltd. was finalised. This is an extremelyexcitingamalgamation, not only our abilitytosupport our closestneighbourbut to work with themtorejuvenatetheclubandpositionthemwellforthefuturewhilstgrowingthesportofbowlsinour community. Thesupportwillseecapitalinvestmentintothefacilitiesoftheclubaswellasaninvestment into the promotion ofbowls and the growth ofthesport. Itwill also providetherespectivememberships with additional hospitality and leisure activities and choices.

The Board of Directors and Management are planning today for tomorrow and the future opportunities are extremely exciting. Each of our facilities are situated in significant growth development areas with market demographics that are evolvingrapidly. Weare continuing to examine opportunities to develop and promote sport within our local communities and are continually developing strategies in relation to this, including, but not limited to amalgamations withother sportingrelated clubs.

During the past couple of decades, we have developed an extremely strong asset base and we are very well placed to realise the value oftheseassetsbuildinga very strong future for the Group.

Directors' report (continued)

4

Directors' report (continued)

Events after the reporting period

Therehasnotariseninthe intervalbetweentheendofthefinancial yearandthedateof thisreportany item, transaction or event of a material and unusual nature likely, in the opinion of the directors of the Club, to affect significantly the operations of the Club, the results of those operations, or the state of affairsof the Club, in futurefinancialyears.

Indemnification and insurance of directors and officers

No indemnities have been given or insurance premiums paid during, or since the end of the financial year for any person who is, or has been, an officerof the Company.

Auditor indemnification

To the extent permitted by law, the Company has agreed to indemnify its auditors, Ernst & Young Australia, aspartof thetermsof itsauditengagementagreement againstclaimsbythird partiesarising from the audit (for an unspecified amount). No payment has been made to indemnify Ernst & Young during or since the financial year.

5

Directors' report (continued)

Auditor'sindependence

The directors have received a declaration from the auditor of Castle Hill RSL Club Limited. This has been included onpage 7 of the report.

Signed in accordance with a resolution of the directors.

·, ard Payne Director Castle Hill, 27 September2023

, 27 September2023

6

Consolidatedstatement of profit orloss andothercomprehensive income

The above consolidatedstatement ofprofit or loss andother comprehensive income shouldbe readin conjunction with the accompanyingnotes.

Fortheyear ended30 June2023 2023 Notes $ Revenue fromcontractswithcustomers 5 74,196,281 Expenses Other operating income 5 18,032,442 Rawmaterialsand consumables used (3,268,384) Employeebenefitexpense (19,230,376) Pokermachine license and taxes (13,069,667) Marketing and entertainmentexpenses (1,120,949) Membersbenefitsand promotions (5,236,239) Occupancy, property and rentalexpenses (9,020,197) Decommissioned assets Other expenses (4,386,166) Depreciationand amortisation 6 (10,287,633) Impairment expense 10 (411,519) Finance costs 6 (2,359,088) Donations (2,460,383} Profitbefore incometaxexpense 21,378,122 Income taxexpense Net profitaftertaxexpense attributableto members 21,378,122 Othercomprehensiveincome Gain on amalgamation 4 6,845,190 Total othercomprehensiveincome 6,845,190 Total comprehensiveincomefortheyear attributabletomembers 28,223,312 2022 $ 51,448,599 3,127,240 (2,057,269) (13,753,987) (9,043,986) (613,729) (2,837,653) (6,560,055) (12,313) (3,145,647) (9,211,164) (244,124) (1,237,021) (1,852,852} 4,006,039 4,006,039 4,006,039

8

Consolidatedstatementoffinancialposition

Asat30June2023

The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

Assets Currentassets Cashandshort-termdeposits Tradeandotherreceivables Inventories Assetsheldforsale Prepayments Totalcurrentassets Non-currentassets Property,plantandequipment Intangibleassets Right-of-useassets Totalnon-currentassets Totalassets Liabilitiesandequity Currentliabilities Tradeandotherpayables Employeebenefitliabilities Interest-bearingloansandborrowings Leaseliability Otherliabilities Totalcurrentliabilities Non-currentliabilities Employeebenefitliabilities Interest-bearingloansandborrowings Leaseliability Otherliabilities Totalnon-currentliabilities Totalliabilities Members'funds Equityattributabletoequityholdersofthe parent Reserves Retainedearnings Totalmembers'funds Totalliabilitiesandmembers'funds Notes 7 8 9 10 10 11 15 12 13 14 15 16 13 14 15 16 17 2023 2022 $ $ 16,738,943 23,558,986 751,531 363,409 507,764 389,592 6,808,252 1,439,686 1,399,735 19,437,924 32,519,974 165,913,849 148,829,931 6,831,693 6,575,026 141,565 155,555 172,887,107 155,560,512 192,325,031 188,080,486 7,416,420 7,875,036 2,720,782 2,226,885 5,889,271 27,203,459 73,120 71,876 677,921 2,779,503 16,777,514 40,156,759 181,705 160,838 46,671,919 47,144,128 70,764 87,373 129,059 260,630 47,053,447 47,652,969 63,830,961 87,809,728 31,129,176 24,283,986 97,364,894 75,986,772 128,494,070 100,270,758 192,325,031 188,080,486

9

Consolidated statementofchanges in equity

The above consolidated statement of changes in equity should be read in conjunction with the accompanyingnotes.

Forthe year ended30 June2023 Reserve (Note17) $ At 1 July 2022 24,283,986 Profitfortheyear Othercomprehensiveincome 6,845,190 Totalcomprehensiveincomeforthe year 6,845,190 At30 June 2023 31,129,176 At 1 July 2021 24,283,986 Profitfortheyear Othercomprehensiveincome Totalcomprehensiveincomeforthe year At30 June 2022 24,283,986 Retained Earnings Total $ $ 75,986,772 100,270,758 21,378,122 21,378,122 6,845,190 21,378,122 28,223,312 97,364,894 128,494,070 71,980,733 96,264,719 4,006,039 4,006,039 4,006,039 4,006,039 75,986,772 100,270,758

10

Consolidatedstatementofcashflows

suppliersand employees

government

Fortheyearended30June2023 Operatingactivities Receiptsfromcustomers Paymentsto

Receipt of

grants Rent received Interest received Interest paid Netcashflowsfromoperatingactivities Investingactivities

Proceeds fromdisposal of assets Payments for purchase of property, plant and equipment

on Amalgamation Netcashflowsusedininvestingactivities Financingactivities

purchase repayments Payment of principal portion of lease liabilities Proceeds from borrowings Repayments of borrowings Netcashflowsfromfinancingactivities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at 1July Cashandcashequivalentsat30June Notes 7 2023 2022 $ $ 81,233,899 57,828,037 (67,322,000) (45,676,930) 1,200,000 1,692,652 932,160 416,998 18,163 {2,831,143} {1,709,076} 13,190,406 12,592,354 20,661,044 82,953 (20,314,067) (18,136,301) 48,999 395,976 (18,053,348} (990,240) (1,012,469) (76,579) (91,264) 8,341,697 25,492,487 {27,681,303} {12,547,690} (20,406,425} 11,841,064 (6,820,043) 6,380,070 23,558,986 17,178,916 16,738,943 23,558,986

Proceeds received

Hire

11

The above consolidatedstatement ofcash flows shouldberead in conjunction with the accompanying notes.

Notes to the consolidated financial statements

For the year ended 30 June 2023

1. Corporate information

The consolidated financial report for Castle Hill RSL Club Limited (the "Company/Club") and its controlled entities (the "Group") for the year ended 30 June 2023 were authorised for issue in accordancewith aresolution of the directors on 27 September2023.

Castle Hill RSL Club Limited is a not-for-profit company limited by guarantee, incorporated and domiciled in Australia.

The Group's registered office and principal place of business is 77 Castle Street, Castle Hill, NSW, 2154. The nature of the operations and principal activities of the Group are described in the directors' report.

2. Summary of significant accounting policies

2.1 Basis of preparation Statement of compliance

The financialreportis a general purpose financial report, whichhas beenprepared in accordancewith therequirementsof the Corporations Act 2001, AustralianAccounting Standards- Simplified Disclosures made by theAustralian Accounting Standards Board, and theGaming Machine TaxAct 2001.

This financial report is a general purpose financial reportprepared in accordance withAustralian Accounting Standards -Simplified Disclosures. The financial reporthas been prepared on a historical costbasis, unless otherwisestated. Both the functional and presentation currency is Australian dollars (A$).

Parent entity information

In accordance with the Corporations Act 2001, these financial statements present the results of the Group only. Supplementary information aboutthe parententity is disclosed in note 24.

Going concern

The financial report has been prepared on a going concern basis, which contemplates continuity of normalbusinessactivitiesandrealisationofassetsandsettlementof liabilitiesin theordinarycourseof business.

12

Notes to the consolidated financial statements

For the year ended 30 June 2023

2. Summary of significant accounting policies (continued)

Changes in accounting policy, disclosures, standards and interpretations

(i) New and amended standards and interpretations

Thenew and amendedAustralianAccounting standards and Interpretationsthatapply forthe firsttime in 2023 do notmateriallyimpactthe financial statementsof the group.

(ii) Accounting Standards and Interpretations issued but not yet effective

Certain Australian Accounting Standards and Interpretations have recently been issued or amended butarenotyeteffectiveand havenotbeenadoptedbytheGroupfortheannualreportingperiodended 30 June 2023.

TheGroup intendstoadoptthese newand amendedstandards andinterpretationswhen theybecome effective.

Basis of consolidation

The consolidated financial statements incorporate the assets and liabilities of all entities controlled by Castle Hill RSL Club Limited as at 30 June and the results of all controlled entities for the year then ended. Castle Hill RSLClubLimitedanditscontrolledentitiestogetherarereferredtointhesefinancial statements as the 'Group' or the "Club".

ControlledentitiesareallthoseentitiesoverwhichtheCompanyhascontrol. TheCompanycontrolsan entity when it is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power to direct the activities of the entity. Controlled entities are fully consolidated from the date on which control is transferred to the Company. They are de-consolidatedfrom the date that controlceases.

The name of the controlled entity is Reltsac Pty Limited with 100% ownership interest held by the Company. Thecontrolledentity isa dormant company incorporated inAustralia.

Allinter-groupbalancesandtransactionsbetweenentitiesintheGroup, includinganyunrealisedprofits or losses, havebeen eliminated on consolidation.

a) Current versus non-current classification

The Group presents assets and liabilities in the consolidated statement of financial position based on current/non-current classification. An asset is current when it is:

• Expected to be realised or intended to be sold or consumed in the normal operating cycle held primarily for the purposeof trading

• Expected toberealised within twelve months after the reporting period, or

• Cash or cash equivalent unless restricted from being exchanged or used to settle a liability for at leasttwelvemonthsafterthereportingperiod

Allother assets are classifiedas non-current.

13

Notes to the consolidated financial statements

For the year ended 30 June 2023

2. Summary of significant accounting policies

(continued)

a) Current versus non-current classification(continued)

A liability is current when:

• Itisexpectedtobesettledinthenormaloperatingcycle Itisheldprimarilyforthepurposeoftrading

• Itis due to be settled within twelve months afterthereporting period, or

• There isno unconditionalrighttodeferthe settlement of theliabilityfor atleasttwelvemonthsafter the reporting period

The Group classifies all other liabilities asnon-current.

b) Cash and short-term deposits

Cashandshort-termdepositsintheconsolidatedstatementoffinancialpositioncomprisecashatbanks and on hand and short-term deposits with a maturity of three months or less, which are subject to an insignificantrisk ofchanges in value.

Forthepurposeoftheconsolidatedstatementofcashflows, cashandcashequivalentsconsistofcash andshort-termdeposits, as defined above.

c) Business amalgamations and goodwill

Club amalgamations are accounted for in accordance withAASB 3 Business Combinations using the acquisition method, with transaction costs directly attributable to the amalgamation forming part of the amalgamation related costs

This method involves recognising the fair values of the identifiable assets acquired and liabilities assumed. The difference between the above items and the fair value of the consideration represents either goodwill or gain on amalgamation in other comprehensive income.

d) Trade and other receivables

A receivablerepresentsthe Group'srightto an amount ofconsiderationthat isunconditional (i.e., only thepassageoftime isrequiredbeforepayment oftheconsideration isdue). Theyaregenerally duefor settlement within 30-60 days and therefore are all classified as current. Trade receivables are recognised initially at the amount of consideration that is unconditional. The Group holds the trade receivables with the objective to collect the contractual cash flows and therefore measures them subsequently at amortised cost using the effective interestrate (EIR) method.

Fortradereceivables and other, the Group applies a simplified approachin calculating expected credit losses (ECLs).Therefore, the Groupdoesnottrackchangesincreditrisk, butinsteadrecognisesaloss allowancebasedonlifetimeECLsateachreportingdate.The Grouphasestablishedaprovisionmatrix that is based on its historical creditloss experience, adjusted for forward-lookingfactors specificto the debtors andthe economicenvironment.

e) Inventories

Inventoriesaremeasuredatcost.Costshavebeenassignedtoinventoryquantitieson handatbalance date using the weighted average cost basis.

f) Financial instruments - initial recognition and subsequent measurement

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

14

Notesto theconsolidated financial statements

Fortheyearended30 June2023

2. Summary of significant accounting policies (continued)

f) Financial instruments - initial recognition and subsequent measurement (continued)

i) Financial assets

Initialrecognitionandmeasurement

Financial assets are classified, at initial recognition, as subsequently measured at amortised cost, fair value throughother comprehensive income (OCI), and fairvalue throughprofit orloss.

The classification of financial assets at initial recognition depends on the financial asset's contractual cash flow characteristics and the Group's business model for managing them. With the exception of trade receivables that do not contain a significant financing component or for which the Group has applied the practical expedient, the Group initially measures a financial asset at its fair value plus, in the case of afinancialasset not at fair value throughprofit orloss, transactioncosts.

Subsequentmeasurement

Forpurposes of subsequent measurement, financial assetsareclassified in four categories:

• Financial assets at amortisedcost (debt instruments)

• Financial assets at fair value through OCI with recycling of cumulative gains and losses (debt instruments)

• Financial assets designated at fair value through OCI with no recycling of cumulative gains and losses upon derecognition (equity instruments)

• Financial assets at fair value through profitor loss

Financialassetsatamortisedcost (debt instruments).

Thiscategoryisthemostrelevanttothe Group. The Groupmeasuresfinancialassetsatamortisedcost ifboth of the following conditionsare met:

• The financial asset is held within a business model with the objective to hold financial assets in order to collectcontractual cashflows; and

• Thecontractualtermsofthefinancialassetgiveriseonspecifieddatestocashflowsthataresolely paymentsof principal and interest on the principal amount outstanding

Financialassetsatamortisedcostaresubsequentlymeasuredusingtheeffectiveinterest(EIR)method and are subject to impairment. Gains and losses are recognised in profit or loss when the asset is derecognised, modified or impaired.

The Group's financial assets atamortised cost includes trade and other receivables.

Financialassets designated atfair value through OCI (equityinstruments)

Upon initial recognition, the Group can elect to classify irrevocably its equity investments as equity instruments designated at fair value through OCI when they meet the definition of equity under AASB132 Financial Instruments: Presentation and are not held for trading. The classification is determinedon an instrument-by-instrument basis.

Financialassetsat fair value throughprofit or loss

Financial assets at fair value through profit or loss include financial assets held for trading, financial assets designated upon initial recognition at fair value through profit or loss, or financial assets mandatorily required to be measuredat fair value. Financial assets are classified as held for trading if they areacquiredforthe purpose of selling orrepurchasingin the nearterm.

15

Notes to the consolidated financial statements

For the year ended 30 June 2023

2. Summary of significant accounting policies (continued)

f) Financial instruments - initial recognition and subsequent measurement (continued)

Financial assets at fair value through profit or loss are carried in the statement of financial position at fair value with net changes in fair valuerecognisedin the statementof profit or loss.

This category includes derivative instruments and listed equity investments which the Group had not irrevocablyelectedtoclassifyatfair value through OCI.

Derecognition

A financial asset (or, where applicable, a part of a financial asset or part of a group of similar financial assets) is primarily derecognised (i.e., removed from the Group's consolidated statement of financial position)when:

• The rights to receive cash flows from the asset have expired, OR

• The Group has transferred its rights to receive cash flows from the asset or has assumed an obligation to pay the received cash flowsin full without material delay toa thirdparty under a 'passthrough' arrangement; and either

• The Group has transferred substantially allthe risks andrewards of theasset, or

• The Group has neither transferred nor retained substantially all the risks andrewards of the asset, but has transferred control of the asset

Impairment of financial assets

The Group recognises an allowance for expected credit losses ECLs for all debt instruments not held atfairvaluethroughprofitorloss. ECLsarebasedonthedifferencebetweenthecontractualcashflows dueinaccordancewiththecontractandallthecashflowsthattheGroupexpectstoreceive, discounted at an approximation of the original effective interest rate. The expected cash flows will include cash flows from the sale of collateral held or other credit enhancements that are integral to the contractual terms.

For trade receivables and contract assets, the Group applies a simplified approach in calculating expected credit losses (ECLs). Therefore, the Group does not track changes in credit risk, but instead recognisesalossallowancebasedonlifetimeECLsateachreportingdate. The Grouphasestablished a provision matrix that is based on its historical credit loss experience, adjusted for forward-looking factors specific to the debtors andthe economic environment

ii) Financialliabilities

Initial recognition and measurement

Financial liabilities are classified, at initial recognition, as financial liabilities at fair value through profit or loss, loans and borrowings, payables, or as derivatives designated as hedging instruments in an effectivehedge, as appropriate.

All financial liabilities are recognised initially at fair valueand, in the case of loans and borrowings and payables, netof directly attributable transaction costs.

The Group's financial liabilities include trade and other payables, loans and borrowings including bank overdrafts.

Loans and borrowings

This is the category most relevant to the Group. After initial recognition, interest-bearing loans and borrowings are subsequently measuredat amortisedcostusing the EIR method. Gains and losses are recognisedinprofitorlosswhentheliabilitiesarederecognisedaswellasthroughtheEIRamortisation process.

16

Notes to the consolidated financial statements

For the year ended 30 June 2023

2. Summary of significant accounting policies {continued)

f) Financial instruments - initial recognition and subsequent measurement (continued)

Amortised cost iscalculatedby taking into accountanydiscount orpremiumon acquisition and feesor costs that are an integral part of the EIR. The EIR amortisation is included as finance costs in the statement of profit or loss.

This category generally applies to interest-bearing loans and borrowings. For moreinformation, refer to Note14.

Derecognition

A financial liability is derecognised when the obligation under the liability is discharged or cancelled or expires. Whenan existing financial liability is replaced byanotherfromthesamelender onsubstantially different terms, or the terms of an existing liability are substantially modified, such an exchange or modification is treated as the derecognitionof the original liability and the recognition of a new liability. Thedifference in the respective carrying amounts is recognisedin the statementofprofitor loss.

g) Property, plant and equipment

Capital work in progress, plant and equipment are stated at cost, net ofaccumulateddepreciation and accumulated impairment losses, if any. Such cost includes the costs of replacing part of the plant and equipment and borrowing cost for major capital development if the recognition criteria are met. When significantpartsof plantandequipmentare required to be replacedat intervals, the Group depreciates them separately based on their specific useful lives. Likewise, when a major inspection is performed, its cost is recognised in the carrying amount of the plant and equipment as a replacement if the recognition criteria are satisfied. All other repair and maintenance costs arerecognised in profitor loss as incurred.

Freehold land and buildings are shown at historical cost less accumulated depreciation for buildings and accumulated impairmentlossesforland and buildings.

Thedepreciationrates used foreach classof depreciable assetsare:

Buildings and improvements

Plantand equipment

Motor vehicles

Leased plant and equipment

Poker machines

2.5% -10%

7.5%-40%

20%-25%

7.5%-20%

20%-25%

An item of property, plant and equipment and any significant part initially recognised is derecognised upon disposal or when no future economic benefits are expected from its use or disposal. Any gain or loss arising on derecognition of the asset (calculated as the difference between the net disposal proceeds and the carrying amount of the asset) is included in the consolidated statement of profit or lossandothercomprehensiveincomewhentheassetisderecognised.Theresidualvalues, usefullives and methods of depreciationof property, plant and equipment are reviewed at each financial year end and adjusted prospectively, if appropriate.

17

Notes to the consolidated financial statements

For the year ended 30 June 2023

2. Summary of significant accounting policies {continued) h) Leases

The Club assesses at contract inception whether a contract is, or contains, a lease. That is, if the contractconveysthe right tocontrol the use of an identifiedasset for a period of time in exchangefor consideration.

Club as alessee

The Club applies a single recognition and measurement approach for all leases, except for short-term leases and leases of low-value assets. The Club recognises lease liabilities to make lease payments and right-of-useassets representing the right to use the underlying assets.

The Club assesses at contract inception whether a contract is, or contains, a lease. That is, if the contractconveysthe right tocontrol the use of an identifiedasset for a period of time in exchange for consideration.

Club as alessee

The Club applies a single recognition and measurement approach for all leases, except for short-term leases and leases of low-value assets. The Club recognises lease liabilities to make lease payments and right-of-useassets representing the right to use the underlying assets.

(i) Right-of-useassets

The Club recognises right-of-use assets at the commencement date of the lease (i.e., the date the underlying asset is available for use). Right-of-useassets aremeasuredatcost, lessanyaccumulated depreciation and impairment losses, and adjusted for any remeasurement of lease liabilities. The cost of right-of-use assets includes the amount of lease liabilities recognised, initial direct costs incurred, and lease payments made at or before the commencement date less any lease incentives received. Right-of-use assets are depreciated on a straight-line basis over the shorter of the lease term and the estimated useful livesof theassets, as follows:

• Equipment 3 to 5 years

If ownership of the leased asset transfers to the Club at the end of the lease term or the cost reflects theexerciseofapurchaseoption, depreciationiscalculatedusingtheestimatedusefullifeoftheasset.

The right-of-use assets are also subject to impairment. Refer to the accounting policies in section U) Impairment of non-financial assets.

(ii) Leaseliabilities

At the commencement date of the lease, the Club recognises lease liabilities measured at the present value of lease payments to be made over the lease term.The lease payments include fixed payments (including in-substance fixed payments) less any lease incentives receivable, variablelease payments that depend on an index or a rate, and amounts expected to be paid under residual value guarantees. The lease payments also include the exercise price of a purchase option reasonably certain to be exercisedbythe Club and paymentsofpenaltiesfor terminating the lease, iftheleasetermreflects the Club exercising the option to terminate. Variable lease payments that do not depend on an index or a ratearerecognisedasexpenses(unlesstheyareincurredtoproduceinventories)intheperiodinwhich the event or condition that triggers the payment occurs.

18

Notes to the consolidated financial statements

For the year ended 30 June 2023

2. Summary of significant accounting policies (continued)

h) Leases (continued)

In calculating the present value ofleasepayments, the Clubusesits incremental borrowingrateat the lease commencement date because the interest rate implicit in the lease is not readily determinable. After the commencement date, the amount of lease liabilities is increased to reflect the accretion of interest and reduced for the lease payments made. In addition, the carrying amount of lease liabilities is remeasured if there is a modification, a change in the lease term, a change in the lease payments (e.g., changes to future payments resulting from a change in an index or rate used to determine such lease payments) or a change in the assessment of an option to purchase the underlying asset.

(iii) Shortterm leases andleases oflow-valueassets

TheClubappliestheshort-term leaserecognition exemption to itsshort-term leases (i.e., those leases that have a lease term of 12 months or less from the commencement date and do not contain a purchase option). It also applies the lease of low-value assets recognition exemption to leases of equipment that are considered to be low value. Lease payments on short-term leases and leases of low-valueassetsare recognised asexpenseon a straight-linebasisover theleaseterm.

i) Assets held for sale

Assetsareclassifiedasheldforsaleiftheircarryingamountwillberecoveredprincipallythroughasale transaction rather than through continuing use. Thiscondition is regarded as met only when the asset isavailableforimmediatesaleinitspresentconditionsubjectonlytotermsthatareusualandcustomary for salesfor such asset and itssaleis highly probable. Assets classified asheld for sale are measured at theirprevious carrying amount.

j) Impairment of non-financial assets

Non-financial assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amountby which theasset'scarryingamount exceedsitsrecoverableamount.Recoverableamountis the higher of an asset's fair value less costs to sell and value-in-use. The value -in-use is the present value of the estimated future cash flows relating to the asset using a pre-tax discount rate specific to the asset or cash-generating unit (CGU) to which the asset belongs. Assets that do not have independent cash flows are grouped together toform a CGU.

k) Intangible assets

Pokermachineentitlements

Pokermachineentitlementsarenotamortisedandhavebeendeterminedtohaveindefiniteusefullives. Instead, poker machine entitlements are tested for impairment annually or more frequently if events or changes in circumstances indicate that it might be impaired and are carried at cost less accumulated impairment losses.

Waterlicenses

Waterusagelicensesarenotamortisedandhavebeendeterminedto haveindefiniteusefullives.They are tested for impairment annually or more frequently if events or changes in circumstances indicate that itmight be impaired and are carried at cost lessaccumulated impairment losses.

I) Interest-bearing loans and borrowings

All loans and borrowings are initially recognised at the fair value of the consideration received less directly attributable transaction costs.

Afterinitialrecognition, interest-bearingloansandborrowingsaresubsequentlymeasuredatamortised cost using the effective interest rate method. Fees paid on the establishment of loan facilities that are yield related are included as partofthe carrying amount ofthe loans and borrowings.

19

Notes to the consolidated financial statements

For the year ended 30 June 2023

2. Summary of significant accounting policies (continued)

I) Interest bearing loans and borrowings (continued)

Borrowings are classified as current liabilities unless the Group has an unconditional right to defer settlement ofthe liability for aleast 12 months after the reporting date.

m) Borrowing costs

Borrowing costs directly attributable to the acquisition, construction or production of an asset that necessarilytakesa substantialperiodoftimetogetreadyforitsintendeduseor salearecapitalisedas part of the cost of the asset. All other borrowing costs are expensed in the period in which they occur. Borrowing costs consist of interest and other costs that the Group incurs in connection with the borrowing offunds

n) Provisions and employee benefit liabilities

General

Provisions are recognised when the Group has a present obligation (legal or constructive) as a result ofapastevent, itisprobablethatanoutflowofresourcesembodyingeconomicbenefitswillberequired to settle the obligation and areliable estimate can be made of the amount of the obligation. When the Group expects some or all of aprovision to bereimbursed, for example, under aninsurancecontract, the reimbursement is recognised as a separate asset, but only when the reimbursement is virtually certain. The expense relating to a provision ispresented in the consolidated statement ofprofit or loss and othercomprehensive income net ofanyreimbursement.

Wagesandsalaries

Liabilities for wages and salaries, including non-monetary benefits, which are expected to be settled within 12 months of the reporting date are recognised in respect of employees' services up to the reportingdate. Theyaremeasuredatthe amounts expected to be paid when the liabilities are settled.

Longservice leave andannual leave

The Groupdoesnot expectitslongserviceleaveorannualleavebenefitstobesettledwhollywithin 12 monthsofeach reportingdate. The Grouprecognisesaliabilityforlongserviceleaveandannualleave measuredasthepresentvalueofexpectedfuturepaymentstobemadeinrespectofservicesprovided byemployeesup to the reporting date using the projected unitcredit method. Consideration isgivento expected future wage and salary levels, experience of employee departures, and periods of service. Expected future payments are discounted using market yields at the reporting date on national government bonds with terms to maturity and currencies that match, as closely as possible, the estimated futurecash outflows.

o) Revenue from contracts with customers

Revenue from contracts with customers is recognised when control of the goods or services are transferred to the customer at an amount that reflects the consideration to which the Club expects to be entitled in exchange for those goods or services. The Club has generally concluded that it is the principalinitsrevenuearrangementsandthatittypicallycontrolsthegoodsorservicesbeforerevenue transferringthem to thecustomer.

Contractliabilities

A contract liability is the obligation to transfer goods or services to a customer for which the Club has received consideration (or an amount of consideration is due) from the customer. If a customer pays consideration before the Club transfers goods and services to the customer, a contract liability is recognised when the payment is made or the payment is due (whichever is earlier). Contractliabilities arerecognised asrevenue when the Club performsunder thecontract.

20

Notes to the consolidated financial statements

For the year ended 30 June 2023

2. Summary of significant accounting policies (continued)

o) Revenue from contract with customers (continued)

Interestincome

Interestincome isrecorded using the effective interestrate Interestincome isincluded inother income in the consolidated statement of profit or lossand other comprehensive income.

Rentalincome

Rental income arising from operating leases is accounted for on a straight-line basis over the lease terms andis included in revenue due to its operating nature

p) Taxes

No charge has been made for an income tax expense as the Company received an exemption from Income Tax under Section 50-45 of the Income TaxAssessmentAct (1997).

Goods andservicestax(GST)

Revenues, expensesand assets are recognised net of the amount of GST, except:

• Whenthe GSTincurredonasaleorpurchaseofassetsorservicesisnotpayabletoorrecoverable from the taxation authority, in which case the GST is recognised as part of the revenue or the expense itemor as partof the costof acquisition of the asset, as applicable

• When receivablesand payables are stated with the amount of GST included

The net amount of GST recoverable from, or payable to, the taxation authority is included as part of receivables or payables in the consolidated statement of financial position. Commitments and contingencies, if any, are disclosed net of the amount of GST recoverable from, or payable to, the taxation authority.

Cash flows are included in the consolidated statement of cash flows on a gross basis and the GST component of cash flows arising from investing and financing activities, which is recoverable from, or payable to, the taxation authority is classified aspartof operating cash flows

q) Other income Government Grants

Inresponsetothe COVID-19 pandemic, the Club assesseditseligibilitytoaccessandreceive Federal. Government stimulus measures. These measures were received during the financial year. In respect of future measures, as these are announced by the Australian Government the Directors will assess the Club's eligibility and consideration will be given to the potential benefit from accessing these measures. These measures may have a material financial effect on the financial report should the assumptions underpinning the eligibility change or in the unlikely event of an independent review refutingtheClub'sentitlementtothesemeasures. Atthedatethefinancialreportisauthorisedforissue, the Directors consider the Club eligible for the stimulus measures and accordingly the assets of the Club are recoverable in the ordinary course of business.

The JobKeeper and JobSaver Payment schemes are accounted for in line with AASB 1058 Income of Not-for-ProfitEntities. The Club hasrecognised a receivable and income when it obtainedcontrol over the funding.

r) Comparatives

Certainnumbersoftheprioryear have beenreclassified to beconsistent with currentyear'sdisclosure presentation.

21

Notes to the consolidated financial statements

For the year ended 30 June 2023

3. Significant accounting judgements, estimates and assumptions

The preparation of the Group's consolidated financial statements requires management to make judgements, estimates and assumptions that affect the reported amounts of revenues, expenses, assets and liabilities, and the accompanying disclosures, and the disclosure of contingent liabilities. Uncertainty about these assumptions and estimates could result in outcomes that require a material adjustment to the carrying amount of assetsor liabilities affected infuture periods.

Estimates and assumptions

The key assumptions concerning the future and other key sources of estimation uncertainty at the reporting date, that have a significantrisk of causing a material adjustment to the carryingamounts of assets and liabilities within the next financial year, are described below. The Group based its assumptions and estimates on parameters available when the consolidated financial statements were prepared Existing circumstances and assumptions about future developments, however, may change duetomarketchangesorcircumstancesarisingthatarebeyondthecontroloftheGroup Suchchanges are

reflected in the assumptions

when they occur.

Estimation of useful lives of assets

TheGroupdeterminesthe estimatedusefullivesandrelateddepreciationandamortisationchargesfor its property, plant and equipment and finite life intangible assets. The useful lives could change significantlyasaresultoftechnicalinnovationsorsomeotherevent. Thedepreciationandamortisation charge will increase where the useful lives are less than previously estimated lives, or technically obsolete or non-strategic assets that have been abandoned or sold willbe writtenoffor written down.

Impairment of non-financial assets

An impairment exists when the carrying value of an asset or CGU exceeds its recoverable amount, which is the higher of its fair value less costs of disposal and its value in use The fair value less costs of disposal calculation is based on available data from binding sales transactions, conducted at arm's length, for similar assets or observable marketprices less incrementalcosts for disposing ofthe asset. The value in use calculation is based on a discounted cash flow (DCF) model. The cash flows are derived fromthe budget forthe nextfiveyearsanddonot include restructuring activities thattheGroup is not yet committed to or significant future investments that will enhance the asset's performance of the CGU beingtested. The recoverable amount ismost sensitive to the discountrate used forthe DCF modelas wellasthe expectedfuturecash-inflowsandthe growth rateused forextrapolationpurposes.

Intangible assets

As discussed above, impairment of poker machine entitlements is recognised based on a value in use calculations and is measured at the present value of the estimated future cash inflows available to the Group from the use of these licenses. In determining the present value of the cash inflows growth rate andappropriate discountfactorhavebeenconsidered Waterusage licensesare testedforimpairment annuallyormorefrequentlyifeventsorchangesincircumstancesindicate thatitmightbe impairedand arecarried at cost lessaccumulated impairment losses.

Customer loyalty program

The Group has a loyalty points programme which allows customers toaccumulate points that can be redeemed for free products. The loyalty points give rise to aseparate performance obligation as they provide a material right to the customer. A portion of the transaction price is allocated to the loyalty points awarded to customersbased on relativestand-alone selling price and recognised as an unearnedrevenueuntil thepointsareredeemed. Revenue is recognised upon redemptionofproducts by the customer. When estimating the stand-alone sellingprice of the loyalty points, the Group considers the likelihood that the customer willredeemthe points. The Group updates itsestimatesof the points that will be redeemed and any adjustments to the deferred income in advance are charged against revenue.

22

Notestotheconsolidated financialstatements

Fortheyear ended30 June2023

4. Amalgamations

Amalgamationsin2023

On 3 February 2023, the Groupacquired the assets and liabilities of Castle Hill Bowling Clubthrough amalgamation. Castle Hill Bowling Club is based in the Castle Hill, NSW. The Group is deemed to be 'mutual entities' (as opposed to 'investor owned') with Castle Hill Bowling Club. Therefore, as acquirer in the combination of mutual entities, the Group recognises the difference between any consideration paidandthenetassetsacquired atfairvalueasa directaddition toequity in consolidatedstatementof financialposition. The consideration paid for the Amalgamation was nil.

Assets acquiredand liabilities assumed - Castle Hill Bowling Club

The fair values of the identifiable assets and liabilities of Castle Hill Bowling Club as at the date of amalgamation were:

Assets

Freehold land (Note10)

Building, improvementsand other buildings (Note10)

Poker machineentitlements (Note11)

Cash and cash equivalents

Inventories

Prepayments

TotalAssets

Liabilities

Trade and other payables

Employee benefit liabilities

Total Liabilities

Totalidentifiable netassetsatfairvalue

Gainrecognised as an amalgamation reserve

Analysis ofcash flows onamalgamation:

Cash received(included in cash flowsfrom investingactivities)

Netcash flowonamalgamation

Fair value recognisedon amalgamation $ 6,500,000 500,000 256,667 48,999 16,440 1,610 7,323,716 414,720 63,806 478,526 6,845,190 6,845,190 48,999 48,999 23

Notesto the consolidated financial statements

Fortheyear ended 30 June 2023

5. Revenue

5.1 Disaggregated revenue information

AllrevenuesfromcontractswithcustomersareearnedwithinNewSouthWales,Australia

5.2 Other income

Barsales Pokermachines-netclearances Fitnesscentreincome Functionscentreincome Golfincome Bowlingclubincome Proshopincome Members'subscription Commissionreceived Sundryincome Totalrevenue from contractswith customers Totalrevenue Timing ofrevenue recognition Transferredatapointintime Transferredovertime 2023 2022 $ $ 9,275,162 5,605,752 51,304,255 36,360,875 8,438,254 5,299,649 767,245 355,824 1,385,634 1,408,699 46,731 641,183 415,282 579,661 642,642 555,834 399,836 1,202,322 960,040 74,196,281 51,448,599 74,196,281 51,448,599 63,792,731 44,097,609 10,403,550 7,350,990 74,196,281 51,448,599

Rentalincome Interestreceived Gainondisposalofassets Governmentgrants Gainoninterestrateswap Totalother income 1,692,652 416,998 15,922,792 18,032,442 932,160 18,163 4,917 1,200,000 972,000 3,127,240 24

Notes to theconsolidated financial statements

Fortheyear ended 30 June 2023

6.

Profit before income tax includes the following specific expenses:

Duringthe year, property, plant and equipment amountingto $393,800 (2022: $201,650) was acquired by the way of hire purchase transactions. These transactions are not reflected in the consolidated statementof cashflows. 8.

Tradereceivables are non-interestbearing and arenormally settled within 30 days 9.

Expenses

Finance costs Bankloans andoverdrafts Hirepurchasecharges Finance charge -leases Depreciation Buildings and improvements Plant and equipment Pokermachines Motor vehicles Right-of-usedepreciation Leased plant and equipment

Cash and short-term deposits Cash at bank and on hand Short-termbank deposits Non-cash investing activities 2023 $ 2,252,423 102,518 4,147 2,359,088 4,253,920 3,613,167 1,199,116 16,568 75,203 1,129,659 10,287,633 4,587,312 12,151,631 16,738,943 2022 $ 1,131,960 97,646 7,415 1,237,021 3,734,874 3,252,098 844,132 18,152 90,524 1,271,384 9,211,164 4,459,018 19,099,968 23,558,986

7.

Trade and other receivables Current Otherdebtors and deposits 751,531 751,531

Inventories Finished goods-at cost 507,764 363,409 363,409 389,592 25

Notesto theconsolidated financial statements

Forthe year ended 30 June 2023 10. Property, Plant and equipment Leased Capital plant works in Freehold Buildings and Plantand Poker and progress land imerovements eguiement machines Motor vehicles eguiement (CWIP) Total $ $ $ $ $ $ $ $ Cost At1July2022 13,650,000 116,619,262 58,613,951 21,602,864 222,951 14,299,662 29,261,799 254,270,489 Additions 1,115,210 1,803,023 2,561,187 91,050 393,800 14,743,597 20,707,867 Additionsthrough 6,500,000 500,000 7,000,000 Businesscombination Disposals CapitalisationfromCWIP 31,601,221 5,247,993 51,074 968,067 (37,868,355) Impairment (411,519) (411,519) At 30June 2023 20,150,000 149,835,693 65,664,967 24,215,125 314,001 15,661,529 5,725,522 281,566,837 Depreciation At1July2022 33,758,988 42,298,183 18,805,534 170,246 10,407,607 105,440,558 Depreciationexpense 4,253,920 3,613,167 1,199,116 16,568 1,129,659 10,212,430 Depreciationondisposals At 30June 2023 38,012,908 45,911,350 20,004,650 186,814 11,537,266 . 115,652,988 Net bookvalue At30June2022 13,650,000 82,860,274 16,315,768 2,797,330 52,705 3,892,055 29,261,799 148,829,931 At 30June 2023 20,150,000 111,822,785 19,753,617 4,210,475 127,187 4,124,263 5,725,522 165,913,849 26

Notes to the consolidated financial statements

For the year ended 30 June 2023

10. Property, plant and equipment (continued)

Referto Note14 fordetails of securityoverproperty,plantand equipment.

Hire purchase contracts

The carrying value of equipment held under hire purchase contracts at 30 June 2023 was $4,124,263 (2022: $3,892,055). Additions during the year were $688,414 (2022: 201,650) under hire purchase contracts. Leased assets under hire purchase contracts are pledged as security for the related hire purchase liabilities.

Capitalised borrowing costs

During the current year, construction of the new carpark on the Club Parramatta site completed. This construction is being funded by a commercial bill facility. The amount of borrowing costs capitalised during the year ended 30 June 2023was $486,335 (2022: $472,055).

Assets classified as held for sale

In June 2019, the Group entered into a Put and Call Option Deed for the sale of the Club Parramatta Car Park which was held at a value of $6,808,252 at 30 June 2022. The call option fee of $2,070,000 (excluding GST) was paid on execution of the Deed was recorded as income received in advance in 2022. This asset was soldin 2023 and a gain of $15,922,792was recognised on sale.

Valuation

Theindependentvaluation ofthe Group'slandandbuildings (locatedat Castle Hill)carriedoutasat30 June 2023 by Global Valuation Services Pty Limited on the basis of the market value for existing use resulted in a valuation of land and buildings of $121,500,000. As land and buildings are recorded at cost,the valuation has not been brought to account.

The independent valuation of the Group's land and buildings (located at Parramatta) carried out as at 30June2023by GlobalValuation Services PtyLimitedonthebasisofthe marketvalueforexistinguse resulted in a total valuation of $89,500,000. As land and buildings are recorded at cost, the valuation hasnot been broughtto account.

The independent valuation of the Group's land and buildings (located at Lynwood Country Club at Pitt Town) carried out as at 30 June 2023 by Global Valuation Services PtyLimited on the basis of market valueforexistinguseresultedinavaluationoflandandbuildingsof $19,600,000. Aslandand buildings arerecorded atcost,the valuation has not been broughtto account.

The independent valuation of the Group's land and buildings (located at Castle Hill Bowling Club at Castle Hill) carried out as at 4 November 2022 by Global Valuation Services Pty Limited on the basis ofmarketvalueforexistinguseresultedinavaluationoflandandbuildingsof$7,000,000. Thevaluation hasbeen broughtto accountasfair value uponamalgamation.

The independent valuation of the Group's total land and buildings, across all four locations, resulted in acombinedvaluationof land andbuildingsof $237,600,000.

The directors do not believe that there has been a material movement in the fair value since the valuation date.

27

Notesto the consolidated financial statements

For theyear ended 30 June 2023

10. Property,plant andequipment (continued) Core properties

Thefollowingarecoreproperties:

•77CastleSt,CastleHillNSW2154(PhysicalbuildingoftheRegisteredClubandCHFAC)

•2MacquarieStreet,ParramattaNSW2150

•253PittTownBottomsRoad,PittTownNSW2756

•79CastleStreet,CastleHillNSW2154

Thefollowingarenon-coreproperties:

•7MacquarieStreet,ParramattaNSW2150(soldduringFY23)

•77CastleSt,CastleHillNSW2154(Carparkandgrounds)

•2MacquarieStreet,ParramattaNSW2150(Carparkongroundsofformerclub)

11. Intangible assets

Asat30June2023,theseassetsweretestedforimpairmentandtherewasnoimpairmentcharge.

2023 $ Pokermachines entitlements Cost(grosscarryingamount) 6,576,693 Net carrying amount 6,567,693 Waterusage license Cost(grosscarryingamount) 255,000 Net carrying amount 255,000 Total intangible assets Cost(grosscarryingamount) 6,831,693 Net carrying amount 6,831,693 2022 $ 6,320,026 6,320,026 255,000 255,000 6,575,026 6,575,026

Movement Pokermachines entitlements Openingnetbookamount Additionsthroughbusinesscombinations Closing carrying value Waterusage license Openingnetbookamount Closing carrying value 6,320,026 6,320,026 256,667 6,576,693 6,320,026 255,000 255,000 255,000 255,000 28

Notestotheconsolidated financial statements Fortheyear ended30 June2023

12. Tradeand other payables

Tradepayablesare non-interest bearing and are normally settled within60 days

13. Employeebenefitliabilities

The Group is under a legal obligation to contribute 10.5% of each employee's base salary to a superannuation fund.

14. Interest-bearingloans and borrowings

Current Trade payables Goods and servicestax

payable Other creditors and accruals 2023 2022 1,638,924 1,748,036 345,219 215,835 5,432,277 5,911,165 7,416,420 7,875,036

(GST)

Current Employeebenefits Non-current Employeebenefits Superannuation plans Contributions 2023 $ 2,720,782 181,705 2022 $ 2,226,885 160,838

Current At amortised cost Secured Commercial billfacility1 Commercial billfacility2 Commercial billfacility4 Commercial billfacility5 Hire purchase liabilities Unsecured Insurance premiumfunding Non-currentSecured Commercial billfacility1 Commercial billfacility2 Commercial billfacility3 Commercial billfacility5 Hire purchase liabilities 2023 $ 3,000,000 900,000 1,017,609 4,917,609 971,662 5,889,271 37,695,380 4,988,736 2,477,605 1,510,198 46,671,919 2022 $ 3,000,000 20,684,877 1,560,000 971,770 26,216,647 986,812 27,203,459 40,695,380 2,477,605 2,020,000 1,951,143 47,144,128 29

Notes to the consolidated financial statements

For theyear ended30 June 2023

14. Interest-bearingloans and borrowings (continued)

Commercialbillfacility1isbasedonavariableinterestrateofwhichatyearendwas5.96%, repaymenttermsare$250,000permonth.Thefacilitymatureson30September2024.

Commercialbillfacility2isbasedonavariableinterestrateofwhichatyearendwas6.16%, repaymenttermsare$75,000permonth.Thefacilitymatureson30September2024.

Commercialbillfacility3isbasedonavariableinterestrateofwhichatyearendwas5.97%,which ispaideverymonth.Thefacilityamountowingispayableatthematuritydateon30September2024.

Commercialbillfacility4relatedtotheClubParramattaCarParkConstruction.Uponsettlementof thesaleoftheoldcarparkthisfacilitywasfullyrepaid.Commercialbillfacility5wasalsofullyrepaid during2023.

Duringthecurrentyear,loanarrangementswereamended,withthematurityofcommercialbill facilities1,2and3beingrenegotiatedto30September2024.

Asset/equipmentfinancefacility1and2

TheGrouppurchasescertainplantandequipmentunderhirepurchasearrangementsfromthebank. ThesefacilitiesarealsosecuredbyafixedandfloatingchargeoftheassetsoftheGrouptogether withthecommercialbillfacility.Themarginsonthesefacilitiesaretailoredtothegoodsandtypeof transactiontheGroupselects.Facility1hasnomaturitydate.Facility2hasaterminationdateof20 February2025.

Financingfacilities Total facilitiesavailable. Commercialbillfacility1 Commercialbillfacility2 Commercialbillfacility3 Commercialbillfacility4 Commercialbillfacility5 Businesscard Asset/equipmentfinancefacility1 Asset/equipmentfinancefacility2 Insurancepremiumfunding LetterofCreditI GuaranteeFacility Facilities utilised atreportingdate: Commercialbillfacility1 Commercialbillfacility2 Commercialbillfacility3 Commercialbillfacility4 Commercialbillfacility5 Asset/equipmentfinancefacilities Insurancepremiumfunding 2023 2022 $ $ 40,945,380 43,945,380 9,250,000 3,000,000 3,000,000 31,700,000 3,840,000 100,000 100,000 4,000,000 4,000,000 2,143,000 2,143,000 1,233,515 1,233,515 1,085,000 1,085,000 61,756,895 91,046,895 2023 2022 $ $ 40,695,380 43,695,380 5,888,736 2,477,605 2,477,605 20,684,877 3,580,000 2,527,807 2,922,913 971,662 986,812 52,561,190 74,347,587

30

Notesto the consolidated financial statements

Fortheyear ended 30 June 2023

14. Interest-bearing loans and borrowings (continued)

The insurance premium funding is based on an interest rate of 2.24% and paid monthly until 23 February 2024,whenthe debtwillbefullyrepaid.

Security

The commercial bill facilities are secured over:

(a) First RegisteredMortgageregistrationnumberAG49452dated1 February 2011,beingtheproperty at 77 Castle Street, Castle Hill, New South Wales, being the land described in Certificate of Title Folio Identifier 1/1080161

(b) Registered Charge (Mortgage Debenture) dated 1 February 2011, all present and future undertakings (including goodwill) and unpaid or uncalled capital of the Castle Hill RSL Club Ltd ACN 001 043 910

(c) Tripartite Agreement dated 1 February 2011, being the liquor license and poker machine entitlements for the property situated at 77 Castle Street, Castle Hill, New South Wales

(d) All present andafter acquiredproperty of Castle Hill RSL Club LtdACN001 043 910 as described in the GeneralSecurityAgreement

(e) First Registered Mortgage for the property at 2 Macquarie Street, Parramatta, New South Wales being the land described in the Certificate of Title Folio Identifier 362/752058

(f) Builder's Side Deed, being the agreements between the agreements between financiers and building contractors in relation to construction loans in order to ensure their contractual responsibilitiesare met; and

(g) Liquor Licence Side Deed for Licence Number LIQC300226425 being the liquor license for the property situated at 2 Macquarie Street, Parramatta, NewSouth Wales

The carrying amount of the pledged assetsis asfollows:

TheClubhasleasecontractsforvariousitemsofequipmentandotherequipmentusedinitsoperations. Leases of equipmentgenerally have lease terms between 3and 5 years. The Club's obligations under its leases are secured by the lessor's title to the leased assets. Generally, the Club is restricted from assigning and subleasing the leased assets and some contracts require the Club to maintain certain financial ratios. There are several lease contracts that include extension and termination options and variable lease payments,which are further discussed below.

The Club also has certain leases of machinery with lease terms of 12 months or less and leases of office equipmentwithlowvalue. The Club appliesthe 'short-termlease' and 'lease oflow-valueassets' recognition exemptionsfor theseleases.

Freehold land Buildings Total pledged assets 15. Leases Club as alessee 2023 $ 20,150,000 111,822,785 131,972,785 2022 $ 13,650,000 82,860,274 96,510,274

31

Notesto the consolidated financial statements

Forthe year ended30 June2023

15. Leases (continued)

Set out below are the carrying amounts ofright-of-useassetsrecognised and themovementsduring the period:

at1 July 2022

at30 June 2023

Set out below are the carrying amounts of lease liabilitiesand the movements

at 1 July 2022

The following are theamounts recognised in profit or loss: Depreciation expense of right-of-useassets

Interest expense on lease liabilities

Expenserelating to short-termleases

Expenserelating to leases of low-value assets

Totalamount recognised in profit or loss

The Club had total cash outflows for leases of $80,726 in 2023 (2022: $98,679) and total expense relatingtoshort-termleasesandleasesoflowvalueassetsrecognisedduringtheyearended30June 2023 of $105,065 (2022: $91,410). The Club also had non-cash additions to right-of-use assets and lease liabilitiesof $61,213 in 2023 (2022: $34,670).

Additions Depreciation expense As

As

As

Additions Accretion of interest Payments At

Current Non-current

30 June2023

Equipment $ 155,555 61,213 (75,203) 141,565 2023 $ 159,250 61,213 4,147 (80,726) 143,884 73,120 70,764 75,203 4,147 91,574 13,491 184,415

32

Notesto the consolidated financial statements

For the year ended 30 June2023

16. Otherliabilities

17.

Thecapitalprofits reserve represents realisedcapital profiton sale offreehold property in prior years

Amalgamation reserve

The amalgamation reserve is used to record differences between the fair value of net asset acquired through amalgamation and consideration paid.

18. Auditors' remuneration

Amounts received or due and receivable by Ernst & Young Australia for: An auditor review ofthe financialreport of the Club Feesforpreparation ofthe financialreport of the Club Totalauditors' remuneration

19. Commitments Hire purchase commitments

Within one year After oneyear but not more than fiveyears

Current Income

Non-current Income

received in advance

received in advance

Reserves Capital profit reserve Amalgamation reserve Capitalprofits reserve 2023 $ 677,921 129,059 19,127,467 12,001,709 31,129,176 2022 $ 2,779,503 260,630 19,127,467 5,156,519 24,283,986

Futurefinance charges Hire purchase liability Comprises: Current liability Non-current liability 96,495 6,206 102,701 1,130,271 1,636,995 2,767,266 (239,459) 2,527,807 1,017,609 1,510,198 2,527,807 80,000 5,800 85,800 1,028,630 1,989,503 3,018,133 (95,220) 2,922,913 971,770 1,951,143 2,922,913 33

Total minimum lease payments

Notestotheconsolidatedfinancialstatements

Fortheyearended30June2023

20.Commitments(continued)

The Group hiresproperty,plant and equipment under hire purchase agreementsexpiringfromoneto five years. Atthe endofthe hire purchasetermthe consolidated entity hasthe option topurchasethe equipment. The hire purchasefacilityissecuredagainsttheassetspurchasedunderthisfacility.

Capitalcommitments

Capital expenditure of $1,793,883 (2022: $17,615,455) has been contracted at balance date but not provided in the financial statements.

21.Contingentliabilities

22.Keymanagementpersonneldetails

(a)Directors

Thefollowing persons were non-executive directors of the Groupduring the financial year:

John Richard Payne (President)

MichaelYeo (Vice-President)

RickAnthony Cumming

David Bruce Wood

Annemarie Kate Christie

John Hopwood

John James Mason

Shubhada Gandhi

David William Hand (Appointed: 25 October 2022)

Robert Bruce Duncan (Resigned: 25 October 2022)

(b)Otherkeymanagementpersonnel

The following persons also had authority and responsibility for planning, directing and controlling the activitiesof the Group,directlyorindirectlyduring the financialyear:

Name

David O'Neil

AndriannaAbeyaratne

NadeemAli

Allan DePaoli

Position Group Chief Executive Officer Group Chief Operating Officer Group Chief Financial Officer Executive Manager - Group Assets and Projects Headof Hospitality

2023 2022 $ $ Bankguarantees 1,017,000 1,017,000

DenisSullivan 34

Notestotheconsolidatedfinancialstatements

Fortheyear ended30 June 2023

22. Key Management Personnel (continued)

(c) Keymanagementpersonnelcompensation

Benefits and payments made to the directors and other key managementpersonnel

(d) Transactionswithrelatedparties

From time to time, directors of the Group, or their director-related entities, may purchase goods from the Group. These purchases are on the same terms and conditions as those entered into by other companyemployeesor customers.

Apart from the details disclosed in this note, no director has entered into a material contract with the Group since the end of the previous financial year and there were no material contracts involving directors' interests existing at year end.

23. Relatedparties

Key managementpersonnel

Disclosures relating to key management personnelare set out in Note 22

Receivable fromandpayable torelatedparties

There were no trade receivables from or trade payables to related parties at the current and previous reportingdate.

24. Events afterthereporting period

Therewereno significant eventsoccurring after the reportingperiodwhich may affect either the Club's operations orresults of those operations or the Club's state of affairs.

2023 2022 $ $ 1,985,991 1,665,543

35

Notestotheconsolidatedfinancialstatements

Fortheyearended30June2023

24.Parententitydisclosure

Assets Currentassets Non-currentassets Totalassets Liabilities Currentliabilities Non-currentliabilities Totalliabilities Members'funds Reserves Retainedearnings Totalmembers'funds Netprofitafterincometaxexpense Othercomprehensiveincome Totalcomprehensiveincomefortheyear Contingentliabilities 2023 2022 $ $ 19,435,408 32,519,974 172,899,623 155,570,512 192,335,031 188,090,486 16,787,514 40,166,759 47,053,447 47,652,969 63,840,961 87,819,728 31,129,176 24,283,986 97,364,894 75,986,772 128,494,070 100,270,758 21,378,122 4,006,039 6,845,190 28,223,312 4,006,039 1,017,000 1,017,000 36

Directors' declaration

InaccordancewitharesolutionofthedirectorsofCastle Hill RSLClub Limited, westatethat: Intheopinion of the directors:

(a) theconsolidatedfinancialstatementsand notesofthe consolidated entity arein accordancewiththe Corporations Act2001, including:

(i) giving a true and fair view of the consolidated entity's financial position as at 30 June 2023 and its performance forthe year endedon thatdate; and

(ii) complying with Australian Accounting Standards- Simplified Disclosures and the Corporations Regulations 2001;

(b) there are reasonable grounds to believe that the Company will be able to pay its debts asand when theybecome due andpayable.

On behalf of the board

Director Castle Hill, 27 September2023

Director Castle Hill, 27 September 2023

37