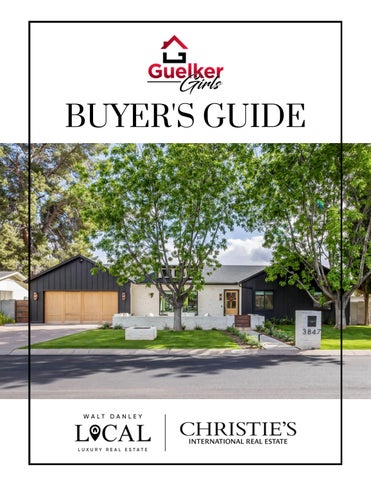

BUYER'S GUIDE

MEET YOUR GUELKER GIRLS

Meet Ali and Suzie Guelker, a dynamic real estate team with deep roots in the Valley and a passion for helping clients find their perfect home Ali lives in Arcadia, while Suzie resides in Scottsdale, and together they bring a unique blend of local expertise, experience, and dedication to their work

Born and raised in Phoenix, Ali has an innate love for the Valley and its vibrant community. A proud University of Arizona graduate and licensed real estate agent since 2004, Ali pairs her extensive knowledge of the area with a commitment to exceptional service. When she’s not helping clients, Ali enjoys traveling, trying new restaurants, spending time with her two rescue dogs, and exploring all the Valley has to offer

Suzie, originally from St Louis and raised in Scottsdale, has witnessed the growth and transformation of the Valley over the years. With a 30-year career in advertising sales, Suzie seamlessly transitioned her skills into real estate, offering creative solutions and expert guidance to her clients.

With over 30 years of combined real estate experience, Ali and Suzie take pride in their attention to detail, personalized service, and willingness to go above and beyond

Whether you ’ re buying, selling, or looking for your dream home, Ali and Suzie are here to help make your real estate journey a success

Step #1: Hire a Realtor

How We Provide Value:

Explainstepsandprocessinadvance.

1. Guidanceandsupportthroughouttheentireprocess.

2. Helpwiththesearchforyourhome:Immediateauto-emailsof newlyavailableproperties,MLSsearches,extensivecontactliststo

3. Findoff-marketedproperties,andmore!

4. Adviseyouonmarketconditions,pricing,negotiatingtips, financing,etc.

5. AdvocateforyoubynegotiatingwithSellers,Lenders,Appraisers, Inspectors,Contractors,Insurers,TitleandCompany,

6. PaperworkandLegalities:Realestatetransactionsinvolve extensivepaperworkandlegaldocumentation.Realtorsare familiarwiththenecessarycontracts,disclosures,andlocal regulations.

7. Manageyourtransaction-mortgage,insurances,inspections, repairs,warranties,andotherimportantdetails.

8. TimeandConvenience:Buyingorsellingapropertycanbeatimeconsumingprocess.Wecansaveyoutimebyhandlingtaskssuchas propertysearches,schedulingshowings,coordinatinginspections, andmanagingcommunicationwithotherpartiesinvolved.

9. Extensivelistofcontractorstoreferasneeded. 10. Attendfinalinspectionandclosingtorepresentyourinterests. 11.

Step #2: Finances

Evaluateyourcurrentincome,expenses,andexistingdebts.Understand your cash flow and how much you can comfortably allocate towards homeownership.

Considerfactorssuchasyourmonthlyincome,savings,investments,and anypotentialfuturefinancialchanges.

Determinehowmuchyoucanaffordtoputdownasadownpayment. Rememberthatalargerdownpaymentmayresultinlowermonthly mortgagepaymentsandpotentiallybetterloanterms.

Beyondthepurchasepriceanddownpayment,considerothercosts associatedwithbuyingahome.Thesemayincludeclosingcosts,home inspections,propertytaxes,homeownersinsurance,andpotential renovationsorrepairs.

ConsiderMortgageAffordability:

Useonlinemortgagecalculatorsorconsultwithamortgageprofessional toestimatehowmuchyoucanborrowandwhatyourmonthlymortgage paymentsmightbe.

Takeintoaccountfactorssuchasinterestrates,loanterms,andany potentialchangesinyourfinancialsituation.

Consultingwithafinancialadvisorormortgagespecialistcanprovide valuableinsightsandhelpyoudetermineabudgetthatalignswithyour financialgoalsandcircumstances.

The Importance of Pre-Qualification

Apre-qualificationhelpsyoudeterminethemaximumloanamountyoucan qualifyfor,givingyouaclearunderstandingofyourbudget Thisallowsyouto focusyourhomesearchonpropertieswithinyourpricerange,savingtimeand effortbyavoidinghomesthatareoutsideofyourfinancialcapabilities.

Sellersoftenprioritizeoffersfromprequalifiedbuyersbecausethey demonstratefinancialreadinessandseriousness.Havingaprequalgivesyoua competitiveedgeinacompetitiverealestatemarket,increasingyourchances ofhavingyourofferaccepted.

3.EARLYIDENTIFICATIONOFISSUES

Duringtheprequalificationprocess,thelenderreviewsyourfinancial informationandcredithistory.Ifthereareanyredflagsorissuesthatcould impactyourabilitytosecurealoan,theycanbeidentifiedearlyon.This givesyouanopportunitytoaddressanyproblems,improveyourcreditscore, ormakenecessaryfinancialadjustmentsbeforeproceedingwithahome purchase.

A mortgage prequalification is a process where a lender evaluates your financial information to determine the maximum loan amount you can borrow and the interest rate you may qualify for. It provides you with an estimate of how much you can afford to spend on a home and demonstratestosellersthatyouareaseriousbuyer.

Step #3: Exploring the Market

Identifyyourwants,needs, andspecificationsinahome.

Onceweidentifyyourhome wantsandneeds,wewillsend youhomesthatfitthecriteria.

Schedule time to tour homes andneighborhoods.

Besuretodoyourresearchon localcrime,schooldistricts, demographicsandotherlocal detailsthatmaybeimportant toyou.ARealtorisprohibited fromgivingpersonalopinions onthesetopics.

Findingtherighthomeis important.Wewillalwaysask forhonestfeedbackafter everyhometourtoensurewe findtherightfit.

Step #4

Negotiating Your Terms

SubmittingAnOffer

Whenyoufindahomeyouwantto purchase,you'llworkwithusto submitanoffertotheseller.The sellerwillreviewyourofferandmay acceptit,rejectit,orcounteroffer. Negotiationsmaytakeplaceuntil bothpartiesagreeonthetermsofthe purchase.

PositionofStrength

Factorsweconsiderwhenwritinganoffer:

MultipleOfferStrategy

Step #5: Inspections

Wehighlyrecommendthatyouhaveaprofessionalhomeinspectorconducta thoroughinspection-resaleornewconstruction.Theinspectionisintendedto beinformationaltothebuyersandprovidereportonmajordamageorserious problemsthatrequirerepairifapplicable.

THEINSPECTIONWILLINCLUDETHEFOLLOWING

Structuralcomponents:Foundation,roof,walls,floor,andceilings

Exteriorfeatures:Sidingandexteriorfinishes,windowsanddoors, drivewayandwalkways

Appliances

PlumbingSystem

ElectricalSystem

HVACSystems:Heating/CoolingSystemsandVentilation

RoofandAttic(ifaccessible)

Basementandcrawlspaces(ifapplicable)

Estimated Costs

StandardHomeInspection

Startingat$500

Dependingonsizeandage

HVACInspection125 SewerScope$150

SepticInspection$530 MoldInspection$200

Notallitemsarenecessarilyrequired. Pricesmayvarybycontractor

Step #6 Submit Loan to Lender

Whenyousubmitaloantoyourlender, it'sknownasunderwriting.

Thelender'sunderwritingteamreviews theloanapplication,supporting documentation,andappraisalreportto assesstheborrower'squalificationsand determinewhethertoapproveordeny theloan.Theyevaluatefactorssuchas creditworthiness,income,debt-toincomeratio,propertyvalue,and compliancewithlendingguidelines.

Basedontheunderwriter'sevaluation andreview,adecisionismadetoeither approveordenytheloan.Ifapproved, theborrowerwillreceiveaformalloan commitmentletteroutliningtheterms andconditionsoftheloan.Ifdenied, theborrowerwillbenotifiedofthe reasonsforthedenial.

Step #7 Appraisal

An appraisal is a professional assessment of a property's value conducted by a licensed appraiser. It is an important step in various real estate transactions, including home purchases, refinancing, and property tax assessments. The purpose of an appraisal is to provide an unbiased and expert opinion of the property's worth based on various factors. During an appraisal, the appraiser will typically consider severalkeyelementstodeterminetheproperty'svalue:

PropertyInspection

ComparativeMarketAnalysis

PropertyCharacteristics

Location

MarketConditions

AdditionalFactorsuniquetotheproperty(i.eeasementsand encroachments).

Step #8: Prepare to Close

LoanCommitment

Afterafilehasbeenfullyunderwritten andalloftheconditionsare satisfactorilymet,afinalloanapproval willbeissued.Thisisknownas"Clear toClose."

HomeownersInsurance

Competitiverates

Impactsyourmonthlypayment

TitleCompany/EscrowOfficer

Managesallpartiesinatransaction

Leverageforgettingproblemsolved

Closingontime

Protectingyourinterests

Clearingthetitleandtransferring ownershipofpropertytoyou.

TheFinalDetails

Alldocumentstothelenderinatimely manner

Appraisal

Lenderrepairswhereapplicable

Closing&Settlementreview

Transferofutilities

Movingintoyournewhome

Step #9 Closing Day!

Congratulations!You'veworkedsohardto gettothisday...CLOSINGDAY!Closing dayisasignificantmilestoneinthe processofbuyingorsellingaproperty.It isthedaywhenthelegalownershipofthe propertyistransferredfromthesellerto thebuyer,andtheagreed-upontermsand conditionsofthesalearefinalized.Here's abreakdownofwhattypicallyhappenson justbeforesettlementday:

FINALWALKTHROUGH

Afinalwalkthroughisacrucialstepthat typicallyoccursjustbeforetheclosing. Itprovidesthebuyerwithanopportunity toinspectthepropertybeforetaking ownership.Thepurposeofthefinal walkthroughistoensurethatthe property'sconditionalignswiththe agreed-upontermsofthepurchase.

WHOWILLBETHERE?

You,thebuyer(s) Seller(s) Buyer'sagent Listingagent

EscrowOfficer-thepersonrepresentingthe titlecompanyandresponsibleforensuring thetitleistransferredtoyou.

WHATWILLYOUNEED?

AvalidgovernmentissuedIDandasecond formofID

Wireclosingfunds24hourspriortoclosing. Yourmortgageofficerwilltellyouthefinal amountthreedayspriortoclosing.

Upfront Costs

Earnestmoneydeposit:1%-2%ofpurchaseprice

HomeInspection:$500+

Appraisal:$550+

ClosingCosts:2-5%ofpurchaseprice

DownPayment:TBD,basedontypeofloanandfinances

Earnest Money Deposit

Anearnestmoneydeposit,alsoknownasagoodfaithdepositisasumofmoney providedbyabuyertodemonstratetheirseriousintentandcommitmentto purchaseaproperty.Itispaidatthebeginningofarealestatetransaction,often whenthebuyersubmitsanoffertotheseller.

Theprimarypurposeofanearnestmoneydepositistoshowthesellerthatthebuyer iscommittedtomovingforwardwiththepurchase.

Theamountoftheearnestmoneydepositisusuallyapercentageofthepurchase price,anditcanvarybasedonlocalcustoms,marketconditions,andthespecific termsnegotiatedbetweenthebuyerandseller.Itusuallyrangesbetween1%to3% ofthepurchaseprice,butitcanbehigherorlowerdependingonthecircumstances.

What are Closing Costs?

Thedown-paymentamountisthedifferencebetweenthesellingpriceofthepropertyandthe amountofmoneyborrowedtopurchasetheproperty.Thedepositprovidedwithheofferis deductedfromthedown-payment Example:Sellingpriceis$300,000 Depositwithofferis$3,000 Mortgageloanisfor$270,000.Remainingdownpaymentwillbe$27,000 *Basedona10%down-payment

PrepaidUtilities

Thebuyerisresponsibleforpayingutilitiesasoftheclosingdateandmayalsoneedtoreimburse thesellerforprepaidutilities.

PrepaidPropertyTaxes

Propertytaxesarecalculatedbasedonthevalueoftheproperty.Ifthesellerhasprepaidthe propertytaxesfortheyear,thebuyermayberequiredtoreimbursetheseller.

InterestAdjustment

Theinterestadjustmentistheamountofinterestaccruedbetweentheclosingdateandthedateof thefirstmortgagepayment.

Escrow/TitleFees

EscrowandTitlefeesincludeconductingatitlesearchontheproperty,puttingtitle insuranceinplace,registeringthehomeinthehomebuyer'sname,andfacilitating disbursementsuponclosing(transfertaxes,land,estate,etc.).

LenderFees

ThesefeesgenerallyincludeOriginationFees,Appraisal,CreditReport,andPoints(moneyyou paytogetalowerrate).

TaxandHomeownersInsuranceEscrow

Somelendersrequireprepayingtaxesandonefullyearofhomeownersinsuranceatclosing. Theseupfrontcostsareplacedinanescrowaccountsothemoneyisalwaystherewhenneeded. Thisaccountismaintainedinyourmonthlymortgagepayment.

Closing Checklist

Thischecklistoffersastep-by-stepguideonimportantmilestonesand whattoexpectwhenclosingonahouseasabuyer

Inspecttheproperty

ProvidetheLenderalldocumentsandinformationneededontime

GetHomeownersInsurance.Makesureyoushoprates!

ProvideinsurancetoLender

Review Closing Disclosure (3 Days Prior to Closing)

ConductFinalWalkThrough

RequestClosingFundsfromFinancialInstitution DONOTWIREANYTHINGWITHOUTGETTINGDIRECTWIRING INFORMATIONFROMTHEESCROWOFFICER.

Transferutilitiesintoyournameeffectiveclosingday

Getthekeysandenjoyyournewhome!WOHOO!! BringaGovernmentIDandSecondaryFormofID

Networks & Awards

MASTER’S CIRCLE