Fromtheheart of thebusinessworld

NorthWest Dec/ Jan2024/25

NorthWest Dec/ Jan2024/25

FEATUREBankruptcy and bouncing back

Behavioural Finance :understanding the psychology behind investment decisions

Retirement planning - why its never too early

REGIONALFirst ever plan for male victims of gender based violence

The share buy back debate: exploring its role in corporate strategy and market implications 4 8 10 18 22 26 30 38 44 50 54 60

Weight loss jabs pose pose potential risk in the workplace, experts reveal.

FEATURELosing it all : Bankruptcy and bouncing back

Four ways businesses can attract and retain a multi-generational workforce

How the Trump presidency might change the global economy

Is franchising your business finacially viable? Key considerations and what it entails

Four ways to optimise your supply chain and help minimise business disruption

Behavioural finance: Understanding the psychology behind investment decisions

Retirement planning, why its never too early

C-Suite burnout : Is your business encouraging sabbaticals?

Covid lockdowns affected adolescents' brain structures, says research

Greater Manchester hasbecome the first place in the UK to have a dedicated plan for tackling gender-based violence against men and boys.

Co-authoredby Professor DavidGadd (University of Manchester)andDuncan CraigOBE(Chief ExecutiveOfficer of We AreSurvivors),alongsidetheMayor (Andy Burnham)and Deputy Mayor (KateGreen) of Greater Manchester,theplansetsout how thecity regionwill:

- Tackledomesticabuseandsexual violencetowardsmenandboys

- Raiseawarenessof support services andreportingmechanismsfor male victims/survivors,withafocuson servicesfor menfromminoritised communities

- Expandtrauma- informed and trauma-responsivetrainingfor Greater Manchester Police,teachers, social workersandprofessionalsto improverecognitionand responseto malegender-basedviolence, including'socalled' honour based abuse

Inthedevelopment of theplan,partners already deliveringwork that meetsthe needsof menandboysinGreater Manchester,weengaged andsupportedthe work;alongsidethecollectionand analysis of datawhichevidenced1 in5 recorded offencesof rapewereagainst malevictims, comparedtothenational dataof 1 in10.

Duncan Craig OBE, founder and Chief Executive of We Are Survivors ? a Greater Manchester based charity supporting male victims/survivorsof sexual abuse, rape and sexual exploitation ? and a survivor of sexual abuse, rape and sexual exploitation himself ? said: ?Intheabsenceofacoherent nationalstrategy that tacklesgender-basedviolenceagainst men andboys,GreaterManchesterisleadingthe wayinlaunchingourownplan,which addressesthefullrangeofviolence,abuseand exploitationinwhichmenorboysarevictims, andinwhichtheirgender,sexualityorintimate relationshipsaremotivatingorprevailing factorsintheirsuffering.

?Victimsofgender-basedviolenceface numerousbarrierstoreportingandseeking support,includingfearofdisbelief,social ostracism,andlackofawarenessabout availablehelp.Formalevictims,thereare additionalchallengessuchassocietal expectationsaboutmasculinity,fearof homophobicreactions,andconcernsaboutthe consequencesofdisclosure.

?It iscrucialtorecognisethecomplexpower dynamicsinabusiverelationshipsandprioritise support forallvictims,addressingtheirspecific needs.Developingcomprehensivesupport for malevictimsisessential,ifwearetotruly tacklegender-basedviolence.?

InJanuary2020,Britain?smost prolific rapist ReynardSinagawassentencedin Manchester CrownCourt toaminimumof 30 yearsfor committing136 rapesagainst 48 men,withGreater Manchester Police holdingevidencethat over a30-month period,Sinagarapedover 200 men?the majority of whomidentified as?straight?The caseshoneaspotlight ontheconsiderable

barriersmenfaceinreportingexperiences of victimisationandisnow thebiggest rape caseinBritishlegal history.

Kate Green, Greater Manchester?sDeputy Mayor for Safer and Stronger Communities said:

?Ourplanaimstoreducegender-based violenceagainst menandboys,encourage themtoseekhelpandlivewell,andensure high-quality,accessibleservicesacrossGreater Manchester.Wearecommittedtoa trauma-informedandresponsive,inclusive approachthat addressesthespecificneedsof malevictimsandrecognisesthecomplexpower dynamicsandintersectionalchallengesthey face.

?Last year,malevictimsaccountedforonein fivereportsofrapeandsexualassault offences toGreaterManchesterPoliceandsadly,we

"Last year,male victims accounted forone in five reports of rape and sexual assault offencesto GreaterManchester Police..."

knowtheactualcasesofgender-basedabuse andviolenceaffectingmenandboysismuch higherastheyarelesslikelytoreport casesto thepolice.

?Thisiswhyit?ssoimportant tohaveabespoke planformalevictimsthat ensurestheright support andservicesareavailableandthat professionalsunderstandthedistinct needsof malevictims,particularlythosefrom minoritisedcommunities.

?Weareverygratefultoourpartnersandthe expertsthat havehelpedtodevelopthisplanas anextensionofour10-yearstrategyandour unwaveringcommitment tomakingour communitiessaferandstronger.?

Statisticsshow that intheyear endingJune 2024,Greater Manchester Police(GMP) recorded9,904 offencesof rapeand sexual assault,of which1,836 (oneinfive)related tomalevictims.

InGreater Manchester,theaveragetime takenby malevictimstoreport sexual assault topoliceisfour yearsandlessthan

four percent of reportsresult inacharge.

Theplanwill seetheextension of the trailblazinghousingreciprocal tomale victimsof domesticabuseandviolence The reciprocal isanarrangement acrossall 10 boroughsof Greater Manchester which ensuresthat victimscanberehomedin suitablehousinginany borough.Previously victimsof domesticabusecouldonly be rehomedwithintheir borough,whichoften ledtofurther traumaor abuse

Asset out intheplan,Greater Manchester will invest inIndependent Domestic ViolenceAdvisorstospecialisein supportingmenand boysand support ambitionstobeatrauma-responsive city-region,andestablishaMaleVictims ServiceCoordinator role,tohelpenhance therapeuticandadviceservices.

Theplanwill alsoseethecreationof pathwaysfor victimsat risk of committing sexual offencesor causingharm,including throughwork withtheViolenceReduction Unit

The National Institute for Health and Care Excellence (NICE) final draft guidance on the weight loss jab Mounjaro has recommended it being given from March, however, it could take 12 years for everyone to receive it, the NHSdrugs advisory body says.

In October, Health Secretary Wes Streeting announced that trials of the weight loss jabMounjarowill take place in Greater Manchester to reduce worklessness.Streeting shared that people with illnesses caused by obesity are taking an extra four sick days off a year or are simply being forced out of work.

Mounjaro is the brand name of the drug Tirzepatide, which is approved to treat type 2 diabetes and can also trigger insulin creation and feelings of fullness.

Ozempic is the brand name of the drug Semaglutide, which is also approved to treat type 2 diabetes However, Wegovy is the only Semaglutide drug that is approved for use in weight management. Mounjaro and Ozempic are different drugs but work in a similar way.

Personal injury experts at Claims co uk reveal the potential risks that weight loss jabs pose to the workplace:

?While the proposal of weight lossjabsto get people living with obesityback to work seemslike the ideal solution, it isimportant to acknowledge the potential risksof this both to employeesand employers.

?With the rise in the use of Ozempicin the US, there have been manylawsuitsagainst the drug, with some patientsallegedly suffering from gastroparesis, which is stomach paralysis, sudden vision lossand an oesophageal injuryrequiring surgery. Furthermore, common side effectsof the weight lossdrug include muscle lossand nausea.

?These long and short-term impactsof the weight lossjab could not onlylead to sick daysfrom the workplace but also necessary adjustments, such asshorter hours The common side effectscould also significantly hinder the efficiencyof work or limit workers to veryspecificindustries

?It istherefore crucial to recognise that weight lossjabsneed to be met with caution and not asa ?quick fix?to get people living with obesityback to work, asthismayhave the opposite effect?

Credit to source: Claimsco uk

Facing bankruptcy can feel like the end of the road, but for many, it?s the beginning of a powerful comeback story In this feature article, Craig Sergeant of Advance Copy Ltd, dives into bankruptcy, the stigma, overcoming the 'failure' of your business and bouncing back

It can feel like a slow, steady suffocation

Sales may start to dwindle. Debts might surge. A global market crash could happen. A whole host of factors can converge, leaving you looking deep into the void of business and financial oblivion

Everything you?ve worked hard for, everything you care about, it slowly slips away... then it?s gone.

And that might seem like the end of your business career. But is that really the case?

Way back in the first series of Dragon'sDen, there was a contestant called Rachel Lowe

Though she had no joy on the show, Lowe?s first venture, a board game series that included Destination London, became a roaring success

At least, that was until a new product missed its launch date ahead of a vital Christmas period

The business had staked everything on that product, and now there wasn? t enough cash flowing in Lowe hoped her bank would help her find the way out, but it was too soon after the 2008 crisis, so they refused all support.

The administrators were called in, Lowe was bankrupt, and her house was taken away.

Looking back, Lowe tells theGuardian it was her ?lowest point.?She believed that her career was over with her ?reputation irreversibly damaged ?

While it wouldn? t be the last the business world would see of Lowe, her reflections reveal two interesting aspects of entrepreneurialism in the UK.

The first is how British society itself views failure (more on that shortly), and the second is its devastating psychological effect.

Healt h im pact

Research by Mental Health UK reveals that 80%of small business owners report symptoms of poor mental health. Split by gender, that?s 77%of male entrepreneurs and 86%female.

But the most concerning part is that despite most active business owners admitting that they suffer, less than half of them (44%) have tried to get any sort of mental health support

Could this be a result of the insidious ?grind culture?we see in films and on social media? Is it even possible to work to excessive levels while displaying constant positivity, resilience, and perfectionism?Especially when success is never a guarantee?

And combined with this country?s social pressures and taboos around failure, it?s understandable that people in business feel the strain.

In the UK, there are around 5 5 million small businesses, most of which have the owner as the sole employee.

The cold fact is that 20% of SMEs fail in the first year, with 60% doing so within three years That means that at any given moment, millions bear the extreme stresses of struggling finances Take ex-bookkeeping

business owner Victoria Pullen, for example

Writing on her blog, Pullen recalls when her small business finally hit the wall

She?d spent the previous eighteen months besieged by at least thirty calls a day from debt collectors She was also too terrified to open her front door in case bailiffs were there, ready to recoup her debts of £45,000 by any means necessary

While declaring herself bankrupt helped move her beyond such immediate fears, Pullen admits that it ?felt like the end?and like ?I?d be getting a massive ?You are a failure?sign tattooed on my forehead ?

Pullen paints a picture that perfectly encapsulates the UK?s stigma around failure And it highlights that change needs to happen. But where can we start?

Well, there might be some lessons to learn from our cousins across the Atlantic

The Am erican w ay

There?s anecdotal evidence that people in the USare more likely than Brits to view failed ventures as valuable learning experiences

On the surface, it seems a reasonable assumption, perhaps as a by-product of the concept of the American Dream ? the idea that anyone can make it.

For example, the phrase "Fail fast, fail often," generally attributed to the tech unicorn companies of Silicon Valley in California, promotes experimentation and risk-taking to drive innovation

Basically, make mistakes, learn from them, go again, and repeat until you reach your goal

"Success is not final, failure is not fatal:it is the courage to continue that counts."

WinstonChurchill

As the billionaire founder of Amazon, Jeff Bezos, says: "Failure and invention are inseparable twins To invent, you have to experiment, and if you know in advance that it's going to work, it's not an experiment "

Granted, American bankruptcy laws allow ailing businesses to reorganise and continue operating, so failure as an option is ingrained in their system. That?s in stark contrast to the more punishment-led approach of the UK?s corporate laws

So, it?s no wonder that Rami Cassis, founder and CEO of Parabellum Investments, recognises that British investors tend to be cautious, aiming to minimise risk. Meanwhile, Americans typically enter negotiations with optimism, eager to find reasons to do a deal

Cassis also says that USinvestors are also more willing to back entrepreneurs with a

history of failure, recognising the value of hard-earned experience Needless to say, on these shores, that would be more likely to set alarm bells ringing

St art again

Bankruptcy has affected some of the biggest names in the world But their public financial fiascos can be useful for business owners to observe and draw lessons from

Here in the UK and Ireland, people as different as George Best (footballer), Christopher Biggins (actor) and Peter Stringfellow (?nightclub?owner) ran up exorbitant debts ? whether through overspending, bad investments or trusting the wrong people

But the important point is that they all managed to rebuild In fact, Stringfellow?s empire was reportedly worth £30 million at the time of his death.

Plus, those lenient USbankruptcy laws have been used by none other than the actual current President of the United States of America, Donald Trump Not only that, but he?s also done it a whopping sixtimes

?I do play with the bankruptcy laws,?says Trump ?They're very good for me ?

Like him or not, there?s something to take from that

To fail in business isn? t fatal Yes, it hurts And while it?s happening, it may seem impossible to come out of it on the other side But it?s not the end.

Most entrepreneurs who?ve been through a business failure and bankruptcy will admit that it was terrible to experience. But they tend to look back on it as one of the best things that happened to them

They learned from their mistakes and channelled their experiences into innovation and reinvention

Just like Rachel Lowe from earlier, the former Dragon'sDen contestant After her board game business collapsed, she returned with a lifestyle company, SheWho Dares, followed by another games company. She was even awarded an MBE.

So, what?s Lowe?s advice on bouncing back?

?Giving up completely is where you'd be failing,?she says. ?Be realistic about the situation [...] try to ride the wave and don't expect recovery to come overnight Also, keep sight of what's most important in life ?

Business is business, and bankruptcy is not a reflection of you and your personal worth

So, if you face a setback, remember that a fall isn? t a failure so long as you rise again.

Credit to source: Greater Manchester Chamber of Commerce

Greater Manchester is launching a pioneering Electrotechnical Training and Careers Alliance

The regional Alliance, the first of its kind in the UK, comprises electrical businesses, education providers, the Electrical Contractor?s Association (ECA), Greater Manchester Chamber of Commerce, the Greater Manchester Combined Authority and GM Colleges The aim of the Alliance is to take meaningful action to strengthen local electrotechnical skills development and careers provision within the region

Andrew Eldred, Chief Operating Officer at ECA, which has led on the initiative for local employers, said: ?We and our members are delighted to be working in partnership with the Greater Manchester Combined Authority, Greater Manchester Chamber of Commerce, education providers of all kinds, and other electrical industry organisations Together we can deliver for the region, for local people, and for business?

Chris Fletcher, Policy Director at Greater Manchester Chamber, added: ?ECAdid a lot of research and work with the Local Skills

Improvement Plan which is helping us identify the key areas that need addressing, especially where there is no provision currently in place

?An Electrotechnical Training and Careers Alliance has not been tried before; Greater Manchester is leading the way We hope the Alliance will become a model of how organisations can work together to tackle skills gaps in this sector?

The Chamber of Commerce has led the development of the Local Skills Improvement Plan (LSIP) for Greater Manchester. The Department for Education introduced LSIPs with the aim of giving employers a stronger voice in shaping local skills provision.

The launch of the Electrotechnical Training and Careers Alliance was held on 27th November in Elliot House, Manchester, the headquarters of the Chamber The event, which was chaired by Chris Fletcher and Andrew Eldred, discussed the practicalities of the Alliance

For more information about the event, email chrisfletcher@gmchamber co uk

Credit to source: Leisure Lake Bikes

Today?s workforce is the mostage-diverse ever witnessed, with four, sometimes five, generations working side by side, ranging from Baby Boomers to Gen Z. While the diversity in people's backgrounds and skills can be really valuable, it also presents challenges for businesses looking to attract, engage, and retain talent across different age groups.

In an era of ongoing talent shortages, companies that effectively foster an inclusive environment for employees at all stages of their careers will thrive But how do you create an employee experience that works for everyone?

Here, we?ll look at ways businesses can attract and retain multi-generational workforce

When it comes to attracting talent, businesses need to adopt targeted recruitment strategies that appeal to different generations

For younger generations, job searching starts online, and they often rely on platforms like LinkedIn, Glassdoor, and even TikTok Companies should invest in a strong online presence, highlighting their culture and values through social media, employee testimonials, and videos that show what life is like inside the company

To engage Gen Z, emphasise career growth and development opportunities Highlight mentorship programmes, training and development, and lateral career paths that offer variety and challenge.

For older generations, focus on job stability, retirement benefits, and opportunities to mentor younger employees. Many Baby Boomers want to stay active in the workforce, but they may be more selective about where they choose to work based on the company?s culture and respect for their expertise.

Inclusivity is a fundamental part of retaining a multi-generational workforce, with employees being more engaged and satisfied when they feel seen and valued.

By encouraging collaboration between generations businesses can break down stereotypes and allow employees to learn from each other Initiatives like cross-generational mentorship programmes or project teams that mix experience with fresh perspectives can foster a more cohesive workplace.

By offering flexibility, businesses can attract and retain a broader talent pool. Gen Zand Millennials might want remote work options or non-traditional hours, while Baby Boomers might value phased retirement plans or reduced hours

"Different

have different strengths.By combining them,we can achieve more than we ever could alone."

Anne Mulcahy

While Millennials and Gen Zvalue continuous feedback and recognition, older generations appreciate structured performance reviews. Having a blend of informal check-ins and more formal evaluation methods ensures everyone feels supported

Employees expect companies to care about their mental, physical, and emotional health. However, different generations have different wellness needs, so companies need to offer a range of wellness programmes that cater to this

Ben Mercer of Leisure Lakes Bikes, the UK's leading mountain bike supplier, says: ?One great way to promote wellness for employees of all ages is the Cycle to Work scheme. Not only does it encourage people to stay active but also helps the environment and allows for tax-free savings on bikes and accessories, meaning younger employees can save money and help the environment, while older employees can benefit from staying active?

Continuous learning is essential to keeping employees engaged and motivated, regardless of age Baby Boomers and Gen X, for example, may want to keep their skills relevant as the workforce evolves, while Millennials and Gen Zare eager to learn and advance in their careers.

Also, mentorship programmes, pairing younger employees with seasoned professionals, can create a culture of learning and knowledge transfer Younger generations benefit from the wisdom of experience, while older employees stay connected to the fast-changing work landscape.

In today?s talent-short market, it?s not just about hiring people? it?s about creating an environment where everyone can thrive, no matter what stage of life they?re in By offering tailored recruitment strategies, cross-generational collaboration, wellness initiatives, and continuous learning opportunities, businesses can engage employees at every stage of their careers

Donald Trump?s victory in the 2024 election ? and his threat to impose tariffs on all imports to the United States ? highlights an important problem for the global economy.

The USis a technological powerhouse, spending more than any other country on research and development and winning more Nobel prizes in the last five years than every other country combined Its inventions and economic successes are the envy of the globe. But the rest of the world needs to do everything in its power to avoid being too dependent on it

And this situation would not have been much different had Harris won.

The ?America first?approach of Donald Trump has actually been a bipartisan policy. At least since previous president Barack Obama?s policy of energy independence, the UShas been on a mostly inward-looking quest of maintaining technological supremacy while ending the offshoring of industrial jobs.

One of the major choices Trump made in his first term was to accept higher prices for US consumers in order to protect national producers by slapping high tariffs on almost every trading partner

For instance, Trump?s 2018 tariffs on washing machines from all over the world mean US consumers have been paying 12% more for these products

President Joe Biden ? in certainly a more polite way ? then increased some of the Trump tariffs: up to 100% on electric vehicles, 50% on solar cells and 25%on batteries from China.

Renaud Foucart Senior Lecturer in Economics, Lancaster University Management School, Lancaster University

At a time of climate emergency, this was a clear choice to slow down the energy transition in order to protect US manufacturing.

While Biden signed a truce with Europe on tariffs, it started a perhaps even more damaging battle by launching a subsidy race.

The USInflation Reduction Act for instance contains US$369 billion (£286 billion) of subsidies in areas such as electric vehicles or renewable energy. And the Chips Act committed US$52billion to subsidise the production of semiconductors and computer chips.

This USindustrial policy might have been inward-looking, but it has clear consequences for the rest of the world China, after decades of mostly export-based growth, must now deal with massive problems of industrial overcapacity.

The country is now trying to encourage more domestic consumption and to diversify its trading partners

Europe, despite a very tight budget constraint, spends a lot of money in the subsidy race Germany, a country facing sluggish growth and big doubts on its industrial model, is committed to matching USsubsidies, offering for instance ?900 million(£750 million) to Swedish battery makers Northvolt to continue producing in the country.

All those subsidies are hurting the world economy and could have easily financed urgent needs such as the electrification of the entire African continent with solar panels and batteries Meanwhile, China has replaced the USand Europe as the largest investor in Africa, following its own interest for natural resources.

The incoming Trump mandate might be a chance to fix ideas

One might, for instance, argue that the full-scale invasion of Ukraine, and the thousands of deaths and the energy crisis that followed, could have been avoided had the Biden administration been clearer to Russian president Vladimir Putin about the consequences of an invasion, and provided modern weapons to Kyiv before the war

But the blame is mostly on Europe. Credit where it?s due, the strategic problem of becoming too dependent on Russian gas is something Trump had clearly warned Germany about during his first mandate.

There is a clear path forward: Europe could help China fix its overcapacity problems by negotiating an end to its own tariff war on Chinese technology such a solar panels and electric cars

In exchange, Europe would regain some sovereignty by producing more of its own clean energy instead of importing record amounts of liquid gas from the US It could also learn a few things from producing with Chinese companies, and China could use its immense leverage on Russia to end the invasion of Ukraine

The European Union could also work harder on what it does best: signing trade deals, and using them as a way to reduce carbon emissions around the world

This is not only about Europe and China

The number of people facing hunger is increasing, taking us back to the levels of 2008-9. War is raging in Gaza, Sudan, Myanmar, Syria, and now Lebanon The world had not seen as many civilian casualties since 2010

For better or worse, it is unlikely that a Trump administration will reverse the path of lower USinterventionism It is also unlikely to lead any major initiative on peace, climate change or on the liberalisation of trade.

The world is alone, and America will not come to save it.

We do not know what will happen to the US Maybe the return of Trump will mostly be a continuation of the last ten years. Maybe prohibitive tariffs or destroying the institutions that made the USsuch an economic powerhouse will make the US economy less relevant But this is something Americans have chosen, and something the rest of the world simply has to live with.

After decades of continuous improvement on all major dimensions of human life, the world is moving backwards.

In the meantime, the only thing the world can do is learn how to better work together, without becoming too dependent on each other

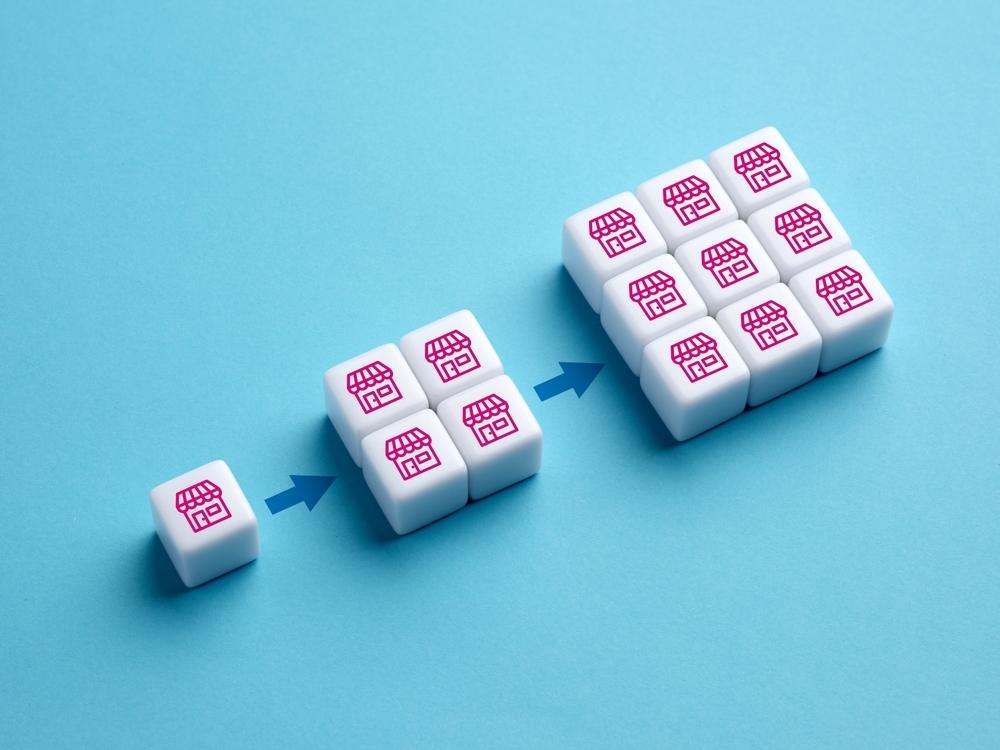

Expanding a business through franchising can be a powerful growth strategy, enabling you to replicate success in multiple locations while leveraging the investment and energy of franchisees However, franchising requires careful financial evaluation and planning to determine if it is a viable option. Understanding what franchising involves and assessing its financial feasibility is crucial before making the leap

Franchising involves granting the right to operate a business under your brand name, using your established systems, products, and services. In return, franchisees typically pay an initial franchise fee and ongoing royalties based on their revenue As the franchisor, you provide training, support, and brand standards to help franchisees succeed

while maintaining consistency across locations.

Franchising allows for rapid expansion with less financial burden compared to opening company-owned outlets. However, it also requires strong operational systems, a scalable business model, and a significant upfront investment in legal, marketing, and operational frameworks

Determining whether franchising is financially viable involves assessing both your current business model and the costs of setting up a franchise operation. Here are the key factors to consider:

The foundation of a successful franchise is a strong, scalable business model

Assess whether your business is ready for replication:

Profitability:Is your current business consistently profitable?Franchisees will expect a proven track record of success.

Demand: Is there sufficient market demand for your product or service in multiple regions?

Scalability: Can your business systems, supply chains, and operational procedures scale efficiently?

Unique Value Proposition: Does your business offer something distinctive that attracts customers and gives you an edge over competitors?

If your business has a clear roadmap for success and strong appeal to franchisees

and consumers, it may be ready for franchising.

Franchising requires a significant investment to set up the necessary frameworks. Common costs include:

Legal Fees:Drafting franchise agreements and disclosure documents to comply with regulations.

Operational Systems:Developing training materials, manuals, and operational guidelines for franchisees.

Marketing Expenses:Creating promotional campaigns to attract potential franchisees.

Support Infrastructure:Building teams to provide training, marketing, and operational support.

"The strength of the franchise is in the network, not in the

Michael H.

Seid

Estimate these costs carefully and compare them against potential franchise revenues to determine whether the model is financially sustainable

3. Evaluate Revenue Potential

The financial success of franchising depends on the revenues generated by franchise fees and royalties Consider:

Initial Franchise Fee: This should reflect the value of your brand and the resources provided to franchisees

Ongoing Royalties:Typically a percentage of franchisees?gross revenue, royalties provide ongoing income for the franchisor

Franchisee Success:Your revenue depends on franchisees thriving, so the potential profitability of their operations is crucial

Create a detailed financial forecast to project how long it will take to recoup your initial investment and achieve profitability

4 Understand the Risks

Franchising carries risks that can affect its financial viability. These include:

Brand Reputation:Poorly performing franchisees can damage your brand image.

Legal Liability:Non-compliance with franchise laws can lead to costly legal disputes.

Operational Challenges:Supporting multiple franchisees across locations requires robust systems and resources.

Be prepared to manage these risks effectively to protect your investment and brand.

If your business is profitable, scalable, and in demand, and you have the resources to set up a franchise framework, franchising can be a lucrative growth strategy However, it requires a significant upfront investment and ongoing effort to support franchisees Carefully weigh the costs, risks, and rewards before deciding.

Franchising is not a decision to take lightly It demands financial readiness, operational excellence, and a commitment to maintaining your brand?s standards across locations By evaluating your business model, forecasting costs and revenues, and preparing for the challenges ahead, you can make an informed decision about whether franchising is the right path for your business growth Done well, franchising can unlock exponential opportunities and create a legacy of success.

credit to source: Cleveland Containers

From global shortages of materials to transport delays and lack of personnel, supply chains in the UKhave experienced several issues in recent years, with at least 20% of businesses experiencing some sort of disruption

93% of companies expect the pressure on supply chains in our country to persist throughout 2024, meaning their operations might suffer as a result But the good news is that, even if most organisations have made necessary adaptions to limit problems with their supply chain, further steps can be taken to enhance and refine the process

Cleveland Containers, a leading supplier of 40 ft shipping containers in the UK, offers expert insight on the best ways to optimise your supply chain, from investing in the right technology to fostering collaboration.

First things first, planning ahead and carefully is arguably one of the most critical segments to ensure a smooth supply chain process

Hayley Hedley, Head of Commercial at Cleveland Containers, said: ?Planning in a timely fashion is crucial, especially when it comes to order fulfilment.

?This is because it will allow you to prevent potential issues with your logistics chain and avoid delays that could leave you without the raw materials and products you need to seamlessly carry out your operations

"What?s more, if you fail to plan your orders early, you may end up in a situation where you?ll have to ask for urgent deliveries ? and added costs can rack up pretty quickly

?Planning carefully includes looking at any potential process change, evaluating how it might impact the flow of your supply chain and whether it might affect your bottom-line gains

?This gives you the opportunity to prepare and account for worst-case contingencies Hopefully, they will never happen ? but if they do, you will have a plan of action to tackle them effectively and with confidence.?

Promote communication and collaboration

Communication and collaboration are the lifeblood of any organisation, as they create an environment where expectations are clear and everyone rows in the same direction

In addition to fostering cooperation among various departments within your business, it

is important to extend a culture of open communication with your suppliers and logistics providers. In fact, this can promote a stronger sense of trust, improve responsiveness to changes, eliminate confusion, and lead to a more fruitful relationship overall.

If you are using more than one supplier, communication and collaboration become even more essential. By staying in constant touch with all your suppliers, you can keep everything ticking as it should without the risk of delays or misunderstandings

Harnessing the power of data analytics is another great way to optimise your supply chain and give your business a competitive edge

For example, analytical tools allow you to evaluate your sales figures, understand customer preferences, and predict future demands

Based on the data, you can then make more conscious and confident business decisions, such as forecasting demand and recalculating inventory levels to suit both your business and customers?needs

In short, analytics tools allow you to monitor customer behaviour, keep your stock at appropriate levels, and contact your supplier with more accurate orders and requests.

Technology can act as a much-loved friend in terms of streamlining processes and optimising supply chains

Interestingly, almost half of UKbusinesses (46%) are not yet relying on modern tech, such as AI, robotics, machine learning, and augmented reality, in their day-to-day activities.

However, embracing innovations can have a wide range of benefits when it comes to improving speed and accuracy. For example, blockchain technology can automate repetitive and physically draining processes, increase visibility, and enhance decision-making within the supply chain.

What?s more, implementing specific software can aid inventory management, allowing to track locations in real-time and facilitate operations within the warehouse.

From planning in advance to promoting collaboration, there are many steps you can take to optimise your supply chain and ensure your business is operating constantly at its best

So, despite the challenges of recent times, having a few handy tips can make the all-important difference between struggling with disruptions and maintaining efficiency at prime levels.

The 2024 UKGovernment Cybersecurity Breaches Survey revealed that 50% of businesses had suffered a cyber-attack or security breach in the previous 12 months This cybersecurity awareness month, cyber protection experts from e-commerce hosting provider Hypernode have highlighted the importance of cyber hygiene for UK businesses and revealed their key practices for staying safe online as a business.

Cyber hygiene can be explained as a set of practices to maintain system health and security in relation to a business's online activities Like physical hygiene, maintaining cyber hygiene entails a set of regular preventative measures.

5 Key practices

Antivirus and antimalware softwareInstalling antivirus and antimalware is an obvious place to start for protecting against cyber threats. These tools help detect malicious programs that can compromise data Viruses and malware are constantly evolving, so it is crucial to also keep this protective software up to date

Credit to source: Hypernode

Be cautious of phishing- Phishing is a common cyber-attack in which criminals use deceptive emails, messages, or websites to trick individuals into providing sensitive information It is by far the most common type of cybercrime, with 90% of businesses that have experienced at least one type of cybercrime falling victim to phishing Awareness and caution around possible phishing scams is crucial within all businesses.

Back up and encrypt data- Backing up important data and storing it securely will be helpful in the event of a data loss or ransomware attack. Particularly sensitive data, meanwhile, ought to be encrypted to ensure it can only be accessed by authorised parties

Secure Wi-Fi, strong passwords, and MFAWhile seemingly obvious, these three simple steps, which are often neglected, are absolutely key to good cyber hygiene. Unsecured Wi-Fi networks are vulnerable to attack from cybercriminals who may intercept data or gain access to internal systems. Similarly, weak passwords are susceptible to being hacked. Strong, unique passwords that are different for each online account should be used MFA(Multi-factor authentication) adds a layer of security to

data and internal systems, keeping out anyone who should not be able to access them

Educating all employees- Perhaps the most important point is that a business?s security is only as strong as its weakest link, and a cyber-attack can target any employee Providing cybersecurity training to all employees is crucial to ensuring the security of a business as a whole.

Milan Bosman, Commercial Director of Hypernode, spoke regarding the tips: ?Warningsfrom experts, who have predicted the rise in cybercrime in the UK, have certainlybeen proven valid. Globally, cybercrime isexpected to surge 15% throughout 2024, and 2023government statisticsalreadystate that 32%of UK businessesexperienced cyber-attacksat least once a week. With this, the importance of maintaining cyber hygiene continuesto grow.

?With October being cybersecurityawareness month, it?scertainlya good time for businesseswhose regulationsare not up to date to reviewthem and to ensure all staff are adequatelyeducated around threatsto avoid breachesin security.?

£ £ ££ £ ££

Behavioral finance, a rapidly growing field within finance, examines the psychological influences that shape investors?decisions, often leading to irrational financial choices. Traditional finance theories, such as the Efficient Market Hypothesis, assume that investors are rational and markets are efficient However, behavioral finance challenges this notion by highlighting cognitive biases and emotional influences that often drive investors?behavior away from rationality

One of the key concepts in behavioral finance is loss aversion This principle, identified by psychologists Daniel Kahneman and Amos Tversky, suggests that people feel the pain of losses more acutely than the pleasure of equivalent gains For example, losing £100 feels more painful than the pleasure derived from gaining £100 This aversion to loss can lead investors to hold onto losing stocks longer than advisable, hoping they will rebound, instead of cutting losses and reallocating their funds This behavior, known as the disposition effect, often results in significant financial setbacks as investors wait for an unrealistic recovery.

Warren Buffett

Another crucial bias in behavioral finance is overconfidence Many investors believe they can consistently beat the market due to their research, intuition, or skill, even though evidence suggests that consistently outperforming the market is extremely difficult This overconfidence often leads investors to make overly risky bets, engage in excessive trading, or ignore diversification principles, ultimately exposing them to significant losses Overconfident investors may also downplay the risks associated with volatile assets, leading to a portfolio that is more fragile during market downturns.

Herd behavior is another phenomenon in behavioral finance where investors follow the actions of the majority, even if those

actions are not aligned with their individual analysis or goals For example, during market bubbles, such as the dot-com bubble or the more recent cryptocurrency surge, investors tend to follow the crowd, assuming that if everyone else is investing, they must be making a sound decision However, this herd mentality often leads to overpriced assets and significant losses when the bubble bursts. Herding can be highly detrimental as it leads to volatile markets and can cause individuals to invest based on hype rather than fundamentals.

In addition to these biases, anchoring plays a significant role in shaping financial decisions. Anchoring occurs when investors fixate on an arbitrary reference point, such

as a stock?s historical high price, and make decisions based on that reference rather than the current market context. For instance, if an investor sees a stock that was once valued at £100 but has since dropped to £50, they may view the lower price as a "bargain," even if the stock?s fundamentals do not justify a recovery. This reliance on an arbitrary anchor often clouds objective analysis, leading to misguided investments.

Behavioral finance not only helps explain why investors sometimes make irrational decisions but also provides tools and strategies to counter these tendencies By becoming aware of biases like loss aversion, overconfidence, herd behavior, and anchoring, investors can approach their

decisions more objectively Many financial advisors now incorporate principles of behavioral finance to help clients avoid these pitfalls, encouraging strategies like diversification, long-term planning, and regular portfolio reviews

Understanding behavioral finance can empower investors to make better financial decisions by acknowledging and managing their psychological influences Awareness of these biases allows investors to recognize emotional triggers and, ideally, make more rational, informed decisions aligned with their financial goals, reducing the likelihood of costly mistakes

For business owners, retirement planning often takes a backseat to the daily demands of running a company Many entrepreneurs invest most of their time, energy, and finances into growing their business, often neglecting their future financial security

However, starting your retirement plan early is not just prudent? it?s essential. Here's why retirement planning is crucial for business owners and how to get started, no matter the stage of your career

Unlike traditional employees who may have workplace pensions or employer-matched contributions, business owners bear full responsibility for funding their retirement This independence comes with its challenges:

Irregular Income:Entrepreneurs often experience fluctuating income, making it difficult to commit to regular savings.

Business as a Retirement Plan:Many assume they will sell their business to fund retirement, but this plan is risky as market conditions, valuations, or buyer interest may not align with their timeline

Lack of Diversification: Business owners tend to reinvest their profits back into the business, leaving little for personal savings or retirement accounts

These factors make it even more critical for business owners to develop a proactive retirement strategy

The earlier you start saving for retirement, the more secure your future will be Starting early provides the following benefits:

Investing early allows your savings to grow exponentially through compound interest Even small, consistent contributions over

decades can accumulate into significant wealth. For example, £10,000 invested at an annual return of 6% grows to over £57,000 in 30 years, without any additional contributions

Starting early gives you flexibility to adjust your savings rate or investment strategy as your business evolves If one year is financially challenging, you have time to make up for it later without derailing your long-term goals.

Early planning prevents the need for drastic savings measures later in life By spreading your contributions over decades, you reduce the financial strain compared to catching up in your 50s or 60s.

While your business is a valuable asset, relying solely on its sale for retirement funding is risky. Diversify your investments to reduce risk and ensure financial security, regardless of your business?s performance Options include:

Stocks and Bonds:Create a balanced investment portfolio to grow wealth over time.

Property:Invest in rental properties or other real estate to generate passive income

ISAs (Individual Savings Accounts): Use tax-free ISAs to save for retirement and benefit from growth without tax liabilities

In the UK, business owners can benefit from tax-advantaged pension schemes Consider the following options:

(SIPP):Offers flexibility in investment choices and is particularly suited for entrepreneurs. Contributions are tax-deductible, providing immediate savings on your taxable income

Pension for Employees (and Yourself):If you employ staff, you may already contribute to a workplace pension scheme Include yourself as an employee and make regular contributions to build your retirement fund.

Lifetime Allowance Awareness:Ensure your pension savings don? t exceed the lifetime allowance (£1,073,100 in 2023/ 24) to avoid additional tax charges.

If your business forms a key part of your retirement strategy, a succession plan is vital Decide whether you?ll sell the business, pass it to a family member, or hire a successor to manage operations while you step back Having a clear exit strategy ensures your business retains value when it?s time to retire

The UKtax system provides several incentives for retirement savings:

Employer Contributions:Contributions made through your company are deductible for corporation tax purposes

Tax-Free Lump Sum:When you retire, you can withdraw up to 25% of your pension pot tax-free

Annual Allowance:Maximise your annual pension contribution allowance (£60,000 for 2023/ 24), which includes tax relief

Passive income ensures financial stability even if your business doesn? t sell for the expected value. Options include:

- Dividend-paying stocks.

- Rental income from properties

- Royalties from intellectual property or product licensing.

Unexpected events like illness, disability, or economic downturns can derail your retirement plans. Protect your assets and income with the following:

Income Protection Insurance:Replaces your income if you?re unable to work due to illness or injury.

Key Person Insurance: Covers the financial impact on your business if a key individual, including yourself, becomes unable to work

Critical Illness Cover:Provides a lump sum payout if you?re diagnosed with a serious illness

5 Monitor and Adjust Your Plan

Retirement planning is not a one-and-done activity. Regularly review your financial goals, contributions, and investment performance to ensure you remain on track Major life events like marriage, children, or changes in your business may require adjustments to your strategy.

6 Seek Professional Advice

Retirement planning for business owners involves navigating complex tax laws,

investment options, and succession planning Working with a financial advisor or pension specialist can help you craft a personalised plan that aligns with your financial goals and business strategy.

Retirement planning is essential for business owners, and it?s never too early to start By diversifying investments, leveraging tax benefits, and setting up a robust pension scheme, you can secure financial stability for your post-work years Remember, the earlier you begin, the more options you?ll have to create a comfortable retirement Take action today and ensure that your entrepreneurial journey leads to a well-deserved and worry-free retirement

In today?s fast-paced corporate world, the wellbeing of C-Suite employees is increasingly under threat

According to a landmark study by Deloitte, 70% of C-Suite executives interviewed were at risk of burnout and considered moving to organisations that offer better workplace cultures

This alarming statistic raises fresh questions about how businesses can improve their wellbeing support to help retain staff and precent burnout.

David Banaghan, Interim CEOat recruitment software experts: Occupop said: ?With 20% to 50% of employee turnover a result of burnout, burnout is a pressing concern for businesses and HRdepartments in particular.

?One option to combat this could be the use of sabbaticals which can have restorative health benefits while improving your internal staff retention statistics?

We explore how businesses can enhance their wellbeing initiatives, with a particular focus on the benefits of sabbaticals.

David Banaghan Co-Founder and InterimCEOat Occupop

As the highest management level in any given organisation, C-Suite executives are often the driving force behind a company?s strategic vision and long-term success.

Despite this, C-Suite wellbeing can often be overlooked with 73% of C-Suite reporting they don? t feel able to take time off work and fully disconnect.

While 20% of UKworkers experience burnout, it can be particularly detrimental at executive level because it affects not just the individual, but also the entire organisation.

Stressed and overworked leaders may consequently struggle to make clear decisions, foster innovation and effectively guide their teams Over time, this can erode company culture and employee morale, leading to higher turnover rates and a decrease in overall performance.

To mitigate these risks, businesses need to take proactive steps to support the wellbeing of their executives. By doing so, they can retain top talent, ensure long-term leadership stability and create a more resilient organisation

One of the most effective ways to support the wellbeing of C-Suite executives is through sabbaticals Areported 90,000 UK professionals are estimated to take a career break each year with a further 62% saying they?d take one if it were an option

Historically, sabbaticals have been rare outside of academic professions, yet businesses are starting to embrace their benefits: affording executives the opportunity to recharge and return with renewed energy and a greater sense of perspective.

The benefits of sabbaticals are well-documented. In the UK, 50% of respondents who took sabbaticals did so relieve stress: 43% of which reported improved mental health as a result

For executives, a sabbatical offers a rare chance to reflect on their personal and professional goals, explore new ideas and gain fresh perspectives This period of reflection can lead to greater clarity in decision-making, improved leadership skills and a deeper commitment to their role

"

level affectsnot just the individual but also the entire organisation."

Despite some clear benefits, many executives may ? understandably ? be hesitant to take sabbaticals. When asked why C-Suite executives were reluctant to take time off, 24%reported having too much work to do while 22%questioned whether others would be able to cover for them while away

Businesses can play a crucial role in encouraging sabbatical uptake by addressing these concerns and fostering a culture that values and supports employee wellbeing at all levels.

Here are some practical tips to encourage uptake:

If you are considering employing a sabbatical policy, be clear around what expectations are Having a clear and well-communicated sabbatical policy is the first step in encouraging executives to take time off.

The policy should outline the eligibility criteria, duration of the sabbatical, and any expectations around communication and workload management during the break

By providing a structured framework, companies can make it easier for executives to plan their sabbatical and feel confident that their absence will not negatively impact the business.

Businesses can promote the mental and physical health benefits of taking an extended break through internal communications, wellness programs and workshops.

By highlighting the positive impact that a sabbatical can have on stress levels, companies can make a case for why executives (who may be silently suffering) should open-up and prioritise their wellbeing

Clearly, not all businesses will be set up to allow for sabbaticals and this may only be done in exceptional circumstances One of the main concerns around sabbaticals will be how responsibilities are managed in an employee?s absence.

To address this, businesses can provide support in the form of succession planning, cross-training or interim leadership appointments.

By ensuring that there is a clear plan in place for managing the executive?s duties,

companies can help alleviate the anxiety around taking a sabbatical

In an era where nearly 70%of C-suite executives are considering leaving their organisations for better wellbeing support, businesses cannot afford to ignore the importance of executive health

Asabbatical may be an effective means of addressing this and is not just beneficial for the individual ? but your organisation as a whole

Arecent study reported the somewhat alarming observation that the social disruptions of COVIDlockdowns caused significant changes in teenagers?brains.

Using MRI data, researchers at the University of Washington in Seattle showed that the usual, age-related thinning of the cortex ? the folded surface ? of the adolescent brain accelerated after the lockdowns and the effect was greater in the female brain than the male

What are we to make of these findings?

Science shows the critical importance of adolescence for the brain. The notoriously different behaviour of teenagers is due to a large degree to the immaturity of their brain cortex During adolescence, substantial

changes take place to enable the brain to reach maturity One of these very important changes is the thinning of the cortex

Abreakthrough paper in 2022 delivered the first evidence that, in adolescence, there is a critical period of brain ?plasticity? (malleability) in the frontal brain region ? the area of the brain responsible for thinking, decision-making, short-term memory and control of social behaviour

Given the evidence of this sensitivity of brain development in adolescence, is it possible that the pandemic lockdowns really did accelerate harmful brain ageing in teenagers?And how strong is the evidence that it was due to the lockdowns and not something else?

James Goodwin

Professor in the Physiology of Ageing, Loughborough University

To answer the first question, we have to realise that ageing and development are two sides of the same coin. They are inextricably linked On the one hand, biological ageing is the progressive decline in the function of the body?s cells, tissues and systems On the other, development is the process by which we reach maturity.

Adverse conditions at critical periods of our life, especially adolescence, are very likely to influence our ageing trajectory. It is therefore plausible that the ?accelerated maturation? of the teenage brain cortex is an age-related change that will affect the rate of brain ageing throughout life.

So it seems there is an unpalatable and much more serious conclusion: the reported accelerated maturation ? though serious enough ? is not a one-off detriment It may well set a trajectory of adverse brain ageing way beyond adolescence

Now to the second question: the role, if any, of the lockdowns One of the central pillars of brain health is ?social cognition?: the capacity of the brain to interact socially with others. It has been embedded in our brains for15 million years It is not an optional add-on It is fundamentally important Interfere with it and potentially devastating health consequences result, particularly in

adolescents who depend on social interaction for normal cognitive development.

At the same time, adolescence is also a period of the emergence of many neuropsychiatric disorders, including anxiety and depression, with younger females at a higher risk of developing anxiety and mood disorders than males

Devastating consequences

The socially restrictive lockdown measures appear to have had a substantial negative effect on the mental health of teenagers, especially girls, and the new study provides a potential underlying cause

There is little doubt that the pandemic lockdowns resulted in devastating health consequences for many people. To the litany of evidence, we may now add a particularly grim finding ? that the developmental brain biology of our precious teenage population has been damaged by these measures.

But perhaps the main message is that the wider effects of single-issue health policies should be considered more carefully. In the case of the known damaging effects of social isolation and loneliness on brain health, it?s not as if the evidence wasn? t there

In recent years, share buybacks have become a prominent feature of corporate strategy, with companies using them as a tool to manage their capital and reward shareholders While they offer clear benefits, they have also sparked considerable debate about their impact on long-term value creation, market dynamics, and economic inequality

Share buybacks, or stock repurchases, occur when a company buys back its own shares from the open market or directly from shareholders. This reduces the number of outstanding shares, often leading to an increase in earnings per share (EPS) and potentially boosting the stock price. Companies typically execute buybacks when they believe their stock is undervalued or as a way to return excess cash to shareholders

Proponents of share buybacks argue that they are an efficient way to deploy surplus cash, especially when other investment opportunities such as acquisitions or expansions are unattractive. By reducing the number of shares, buybacks improve financial ratios like EPSand return on equity (ROE), enhancing the company's appeal to investors.

Buybacks also provide flexibility compared to dividends, as companies can adjust their timing or scale without committing to ongoing payouts. In a market where investors value consistency, this can be a strategic advantage Moreover, buybacks signal confidence from management, implying that the company?s stock is

undervalued and its financial health is robust

Critics, however, contend that share buybacks often prioritize short-term gains at the expense of long-term growth Instead of reinvesting profits in innovation, research, or workforce development, companies may allocate substantial funds to repurchase shares. This can undermine their competitive position and resilience in the face of future challenges

Another concern is that buybacks can artificially inflate stock prices, benefiting executives whose compensation is tied to share performance. This raises ethical questions, particularly when companies engage in buybacks while cutting costs or

laying off employees Furthermore, critics argue that the emphasis on returning capital to shareholders exacerbates income inequality, as wealthier individuals disproportionately benefit from rising stock prices

On a broader scale, buybacks influence market behavior and liquidity. By reducing the supply of shares, they can create upward pressure on stock prices, contributing to market valuations that some experts believe are disconnected from underlying economic fundamentals.

During economic downturns, companies that over-leverage themselves to finance buybacks may find themselves vulnerable, with reduced cash reserves to weather crises For instance, during the COVID-19 pandemic, several firms that had aggressively pursued buybacks faced criticism for requesting government bailouts shortly thereafter.

The share buyback debate underscores the need for balance While buybacks can be a legitimate and effective tool for capital allocation, they should not come at the expense of long-term strategic investments. Policymakers have also weighed in, with proposals to regulate or tax buybacks to ensure they align with broader economic goals.

Ultimately, companies must carefully assess their use of buybacks, considering both immediate shareholder returns and sustainable growth. Investors, too, should scrutinize buyback policies to understand their implications for long-term value creation As this debate evolves, it continues to shape the landscape of corporate finance and investor expectations.